Attached files

| file | filename |

|---|---|

| 8-K - SUCAMPO PHARMACEUTICALS, INC. 8-K - Sucampo Pharmaceuticals, Inc. | a50494264.htm |

| EX-99.2 - EXHIBIT 99.2 - Sucampo Pharmaceuticals, Inc. | a50494264ex99_2.htm |

Exhibit 99.1

Corporate Update Cary J. Claiborne, CFO Stanley G. Miele, SVP, Sales & Marketing Silvia Taylor, SVP, IR, PR & Corporate Communications December 4-5, 2012

Forward-Looking Statements This presentation contains “forward-looking statements” as that term is defined in the Private Securities Litigation Reform Act of 1995. These statements are based on management’s current expectations and involve risks and uncertainties which may cause results to differ materially from uncertainties, those set forth in the statements. The forward-looking statements may include statements regarding product development, product potential, future financial and operating results, and other statements that are not historical facts. The following factors, among others, could cause actual results to differ from those set forth in the forward-looking statements: the impact of pharmaceutical industry regulation and health care legislation; Sucampo’s ability to accurately predict future market conditions; dependence on the effectiveness of Sucampo’s patents and other protections for innovative products; the risk of new and changing regulation and health policies in the US and internationally, and the exposure to litigation and/or regulatory actions. No forward-looking statement can be guaranteed and actual results may differ materially from those projected. Sucampo undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events, or otherwise. Forward-looking statements in this presentation should be evaluated together with the many uncertainties that affect Sucampo’s business, particularly those mentioned in the risk factors and cautionary statements in Sucampo’s Form 10-K for the year ended Dec. 31, 2011, which the Company incorporates by reference. 2

Sucampo Snapshot: Prostone Pioneers Sucampo Mission To develop and commercialize prostone-based medicines to meet the major unmet medical needs of patients on a global basis Commercial-stage, global biopharmaceutical company 2 FDA-approved drugs based on our proprietary prostone technology AMITIZA® ( lubiprostone) in gastroenterology market RESCULA® (unoprostone isopropyl) in ophthalmology market Prostone pioneers Therapeutic potential 1st identified by Sucampo’s founders, Drs Ryuji Ueno and Sachiko Kuno ® Registered trademark of Sucampo 3

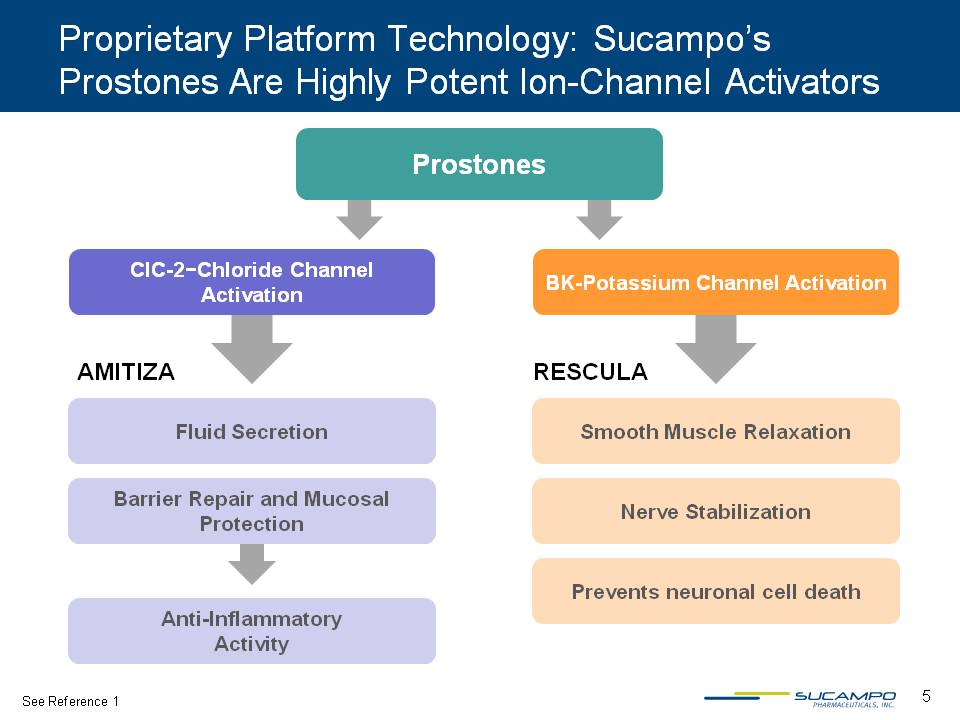

Sucampo Has Pioneered the Field of Prostones Prostones: Functional fatty acids naturally occuring in the human body Selective ion-channel activators Physiological mediators of restoration of cellular homeostasis and tissue regeneration Clinical safety profile of prostones is excellent, as demonstrated by the clinical safety record of AMITIZA in GI and RESCULA in ophthalmology Clinical potential of prostones is broad and applicable to various therapeutic fields beyond GI and ophthalmology Sucampo is the only company developing and commercializing prostone compounds globally See Reference 1 4

Proprietary Platform Technology: Sucampo’s Prostones Are Highly Potent Ion-Channel Activators Prostones ClC-2−Chloride Channel Activation AMITIZA Fluid Secretion Barrier Repair and Mucosal Protection Anti-Inflammatory Activity BK-Potassium Channel Activation RESCULA Smooth Muscle Relaxation Nerve Stabilization Prevents neuronal cell death See Reference 1 5

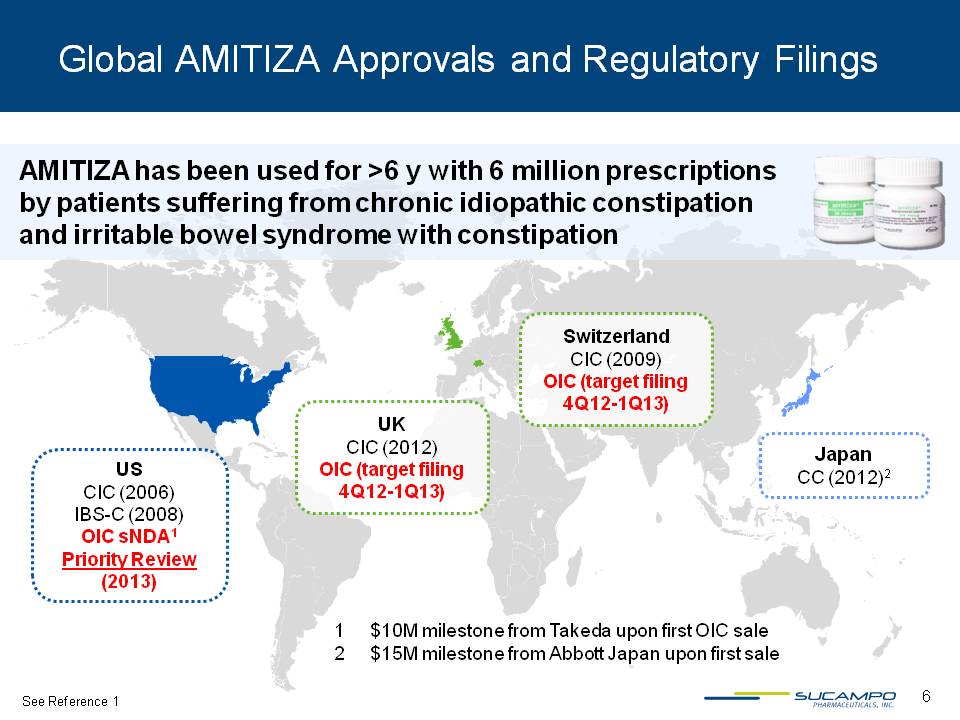

Global AMITIZA Approvals and Regulatory Filings AMITIZA has been used for >6 y with 6 million prescriptions by patients suffering from chronic idiopathic constipation and irritable bowel syndrome with constipation Switzerland CIC (2009) OIC (target filing 4Q12-1Q13) Japan CC (2012)2 UK CIC (2012) OIC (target filing 4Q12-1Q13) US CIC (2006) IBS-C (2008) OIC sNDA1 Priority Review (2013) 1 $10M milestone from Takeda upon first OIC sale 2 $15M milestone from Abbott Japan upon first sale See Reference 1 6

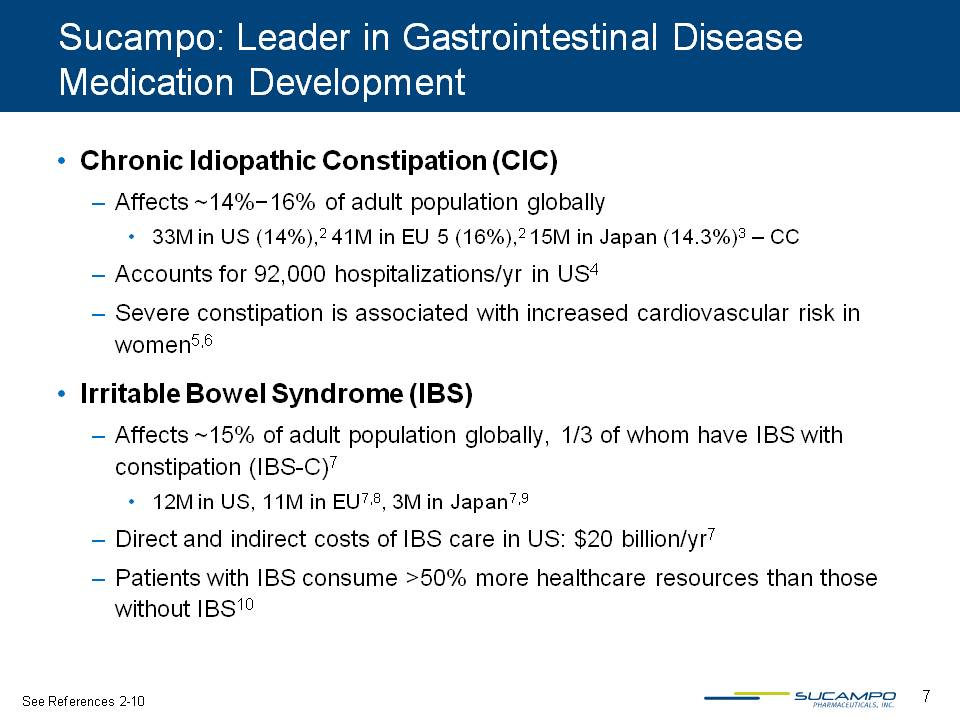

Sucampo: Leader in Gastrointestinal Disease Medication Development Chronic Idiopathic Constipation (CIC) Affects ~14%−16% of adult population globally 33M in US (14%),2 41M in EU 5 (16%),2 15M in Japan (14.3%)3 – CC Accounts for 92,000 hospitalizations/yr in US4 Severe constipation is associated with increased cardiovascular risk in women5,6 Irritable Bowel Syndrome (IBS) Affects ~15% of adult population globally, 1/3 of whom have IBS with constipation (IBS-C)7 12M in US, 11M in EU7,8, 3M in Japan7,9 Direct and indirect costs of IBS care in US: $20 billion/yr7 Patients with IBS consume >50% more healthcare resources than those without IBS10 See References 2-10 7

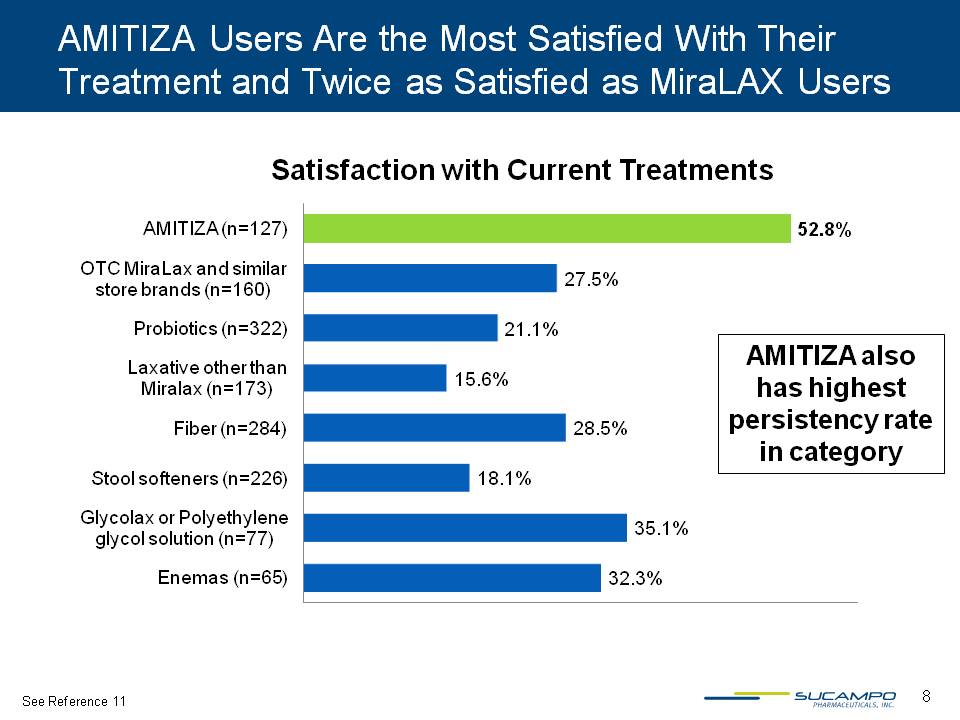

AMITIZA Users Are the Most Satisfied With Their Treatment and Twice as Satisfied as MiraLAX Users Satisfaction with Current Treatments AMITIZA (n=127) 52.8% OTC MiraLax and similar store brands (n=160) 27.5% Probiotics (n=322) 21.1% Laxative other than Miralax (n=173) 15.6% Fiber (n=284) 28.5% Stool softeners (n=226) 18.1% Glycolax or Polyethylene glycol solution (n=77) 35.1% Enemas (n=65) 32.3% AMITIZA also has highest persistency rate in category See Reference 11 8

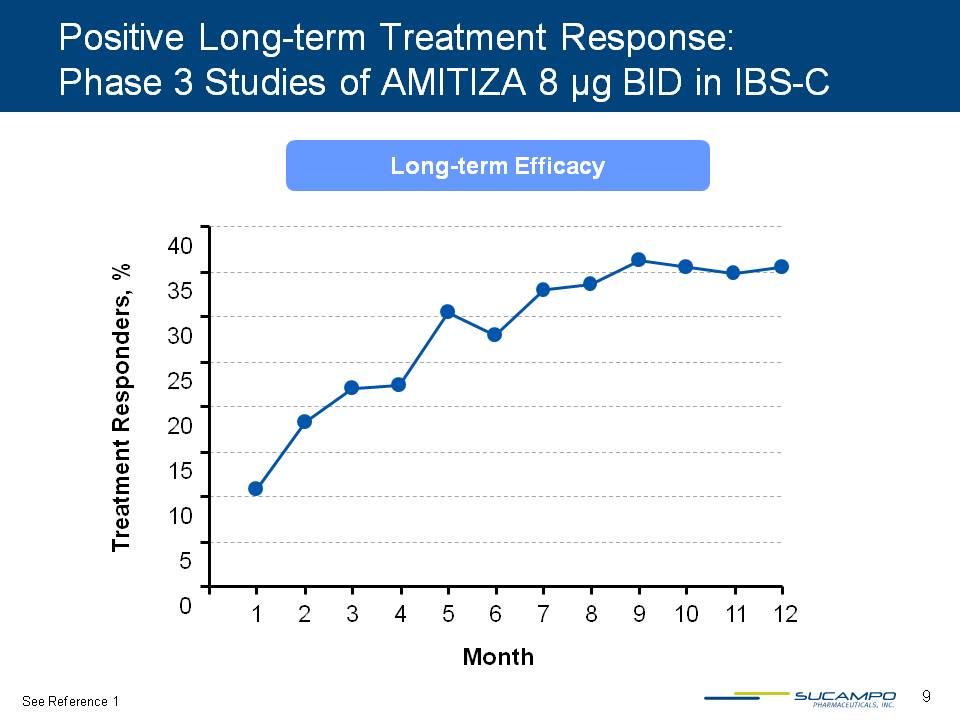

Positive Long-term Treatment Response: Phase 3 Studies of AMITIZA 8 µg BID in IBS-C Long-term Efficacy See Reference 1 9

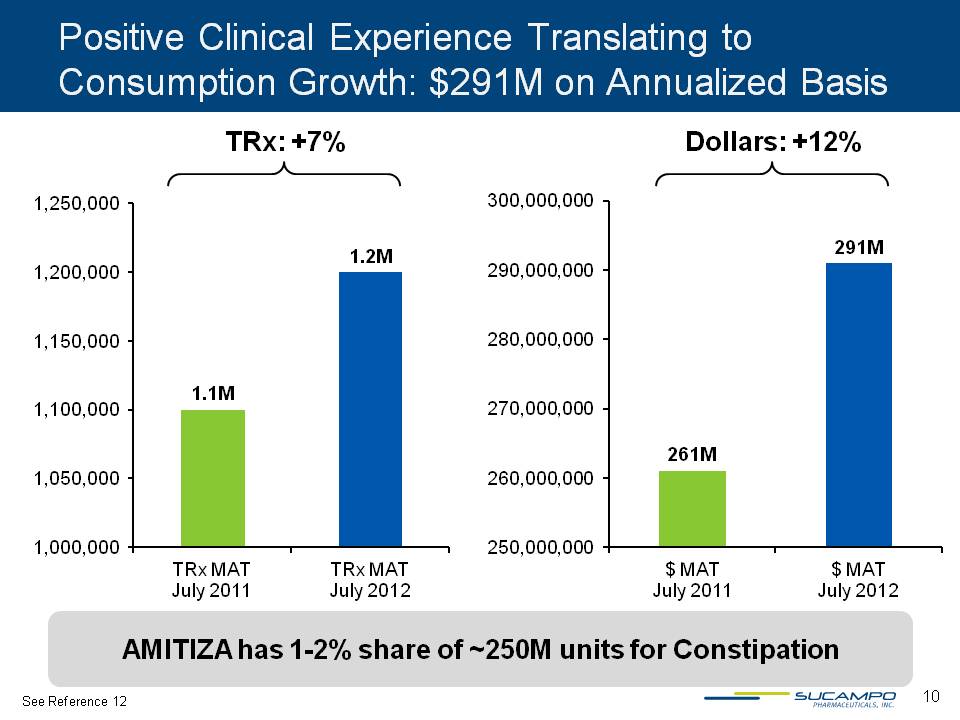

Positive Clinical Experience Translating to Consumption Growth: $291M on Annualized Basis TRx: +7% 1.1M 1.2M TRx MAT July 2011 TRx MAT July 2012 Dollars: +12% 261M 291M $ MAT July 2011 $ MAT July 2012 AMITIZA has 1-2% share of ~250M units for Constipation See Reference 12 10

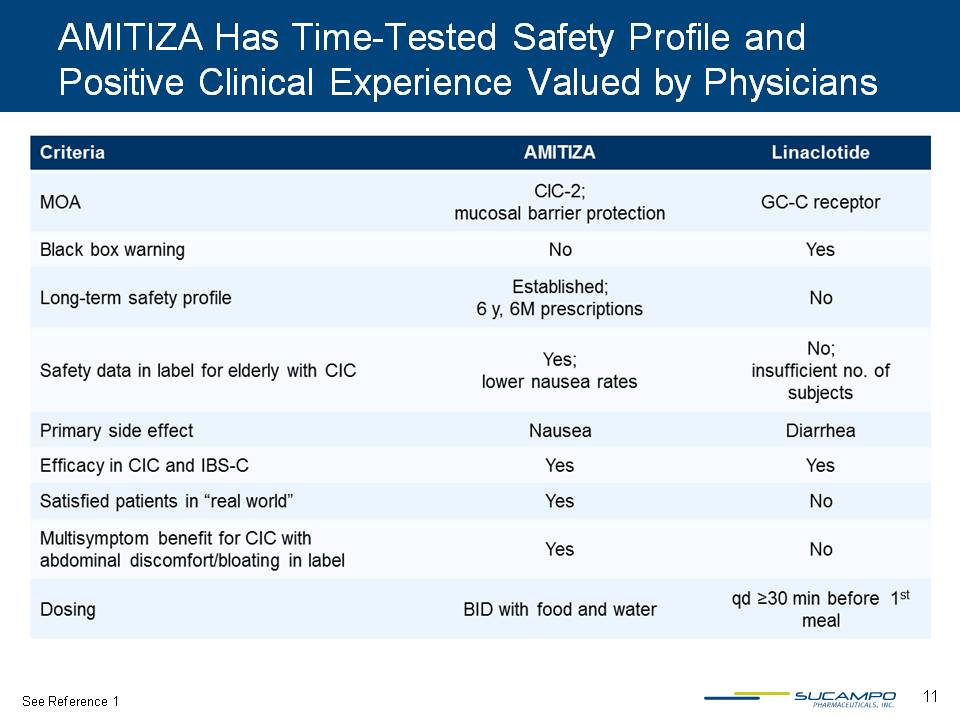

AMITIZA Has Time-Tested Safety Profile and Positive Clinical Experience Valued by Physicians Criteria AMITIZA Linaclotide MOA CIC-2; mucosal barrier protection GC-C receptor Black box warning No Yes Long-term safety profile Established; 6y, 6M prescriptions No Safety data in label for elderly with CIC Yes; lower nausea rates No; insufficient no. of subjects Primary side effect Nausea Diarrhea Efficacy in CIC and IBS-C Yes Yes Satisfied patients in “real world” Yes No Multisymptom benefit for CIC with abdominal discomfort/bloating in label Yes No Dosing BID with food and water qd ≥ 30 min before 1st meal See Reference 1 11

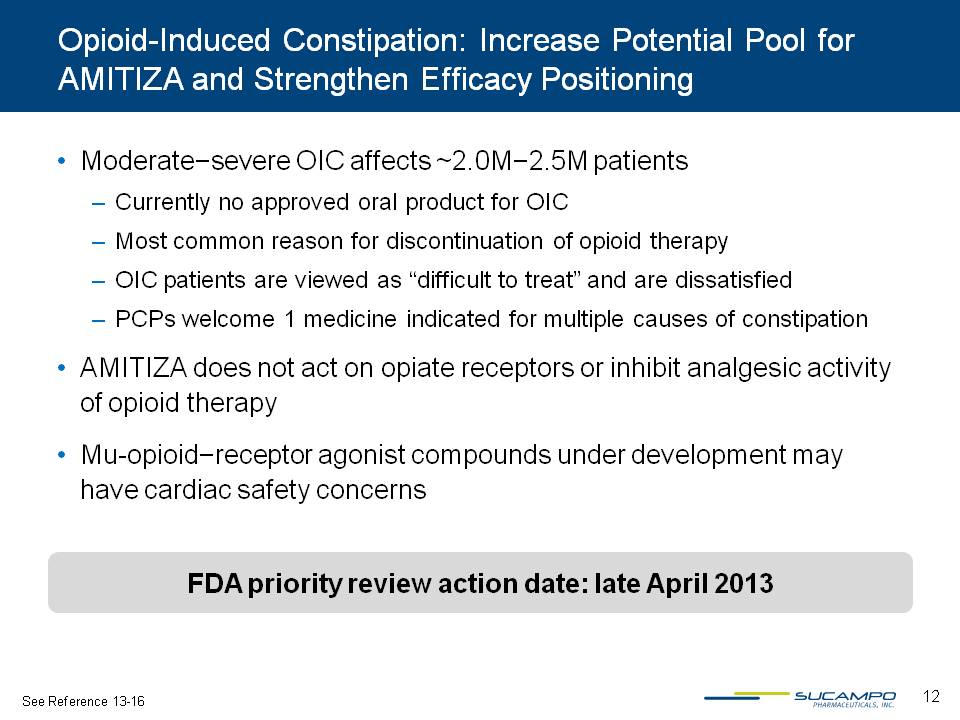

Opioid-Induced Constipation: Increase Potential Pool for AMITIZA and Strengthen Efficacy Positioning Moderate−severe OIC affects ~2.0M−2.5M patients Currently no approved oral product for OIC Most common reason for discontinuation of opioid therapy OIC patients are viewed as “difficult to treat” and are dissatisfied PCPs welcome 1 medicine indicated for multiple causes of constipation AMITIZA does not act on opiate receptors or inhibit analgesic activity of opioid therapy Mu-opioid−receptor agonist compounds under development may have cardiac safety concerns FDA priority review action date: late April 2013 See Reference 13-16 12

Summary and Outlook for AMITIZA Well positioned to serve expanding population of patients with CIC and IBS-C Continue growth in US: over 6 million prescriptions used over past 6 yrs, with favorable benefit-risk profile Near-term goals Seek approval for OIC indication in US and submit labeling applications for OIC abroad Expand global approvals and launches for AMITIZA worldwide Develop and seek approval for AMITIZA in pediatric constipation Currently unmet medical need; no approved prescription medications Develop liquid formulation of AMITIZA for long-term care market Evaluate potential of AMITIZA for new indications, such as mixed irritable bowel syndrome 13

Sucampo Is an Emerging Player in Ophthalmology: RESCULA Ophthalmology Glaucoma is a group of ocular diseases with various causes that ultimately are associated with a progressive optic neuropathy leading to loss of vision Age-related disease: Second leading cause of bilateral blindness worldwide Will affect an estimated 79.6 million people worldwide by 202018 Reduction in intra-ocular pressure (IOP) is currently the only modifiable risk factor for patients with glaucoma and ocular hypertension See Reference 17-18 14

US Glaucoma Market Overview The US glaucoma market is 29.2M TRx’s22 4-5M potential patients21,22,24 67% of the market is generic22 80% of TRx’s are by eye specialists22 ~$3B: US sales volume (2012) ~$1B: Japan sales volume (2011) Compliance and adherence are unmet needs 50% of new patients drop off therapy within one year of initiation Prostaglandins are inflammatory agents which depolarize cell membranes #1 reason for discontinuation of prostaglandins is hyperemia20,23,24 See Reference 19-24 15

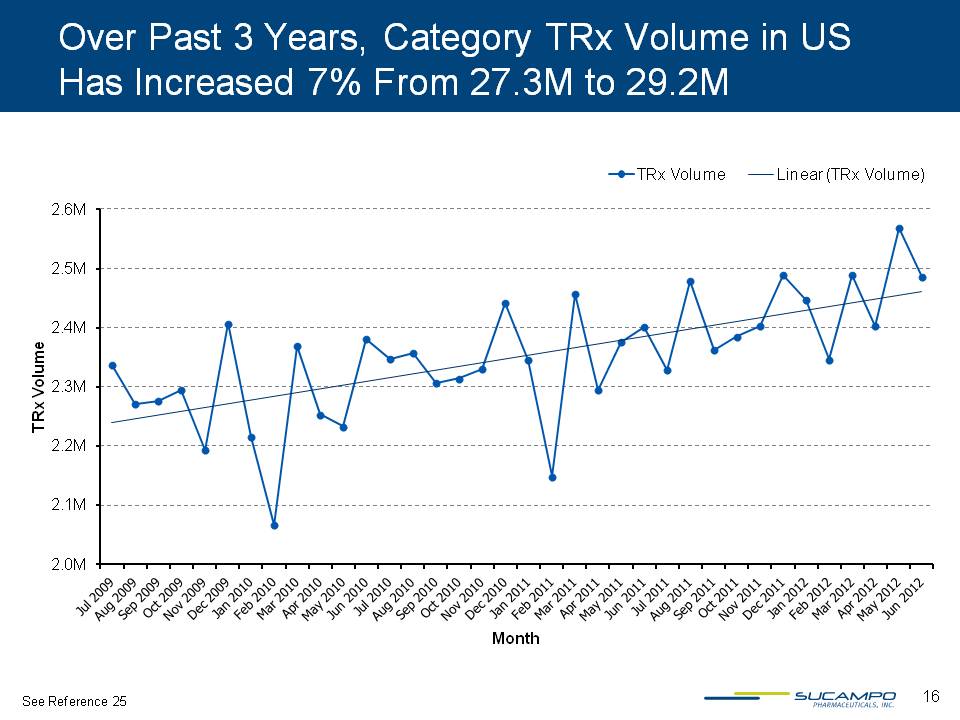

Over Past 3 Years, Category TRx Volume in US Has Increased 7% From 27.3M to 29.2M TRx Volume Linear (TRx Volume) See Reference 25 16

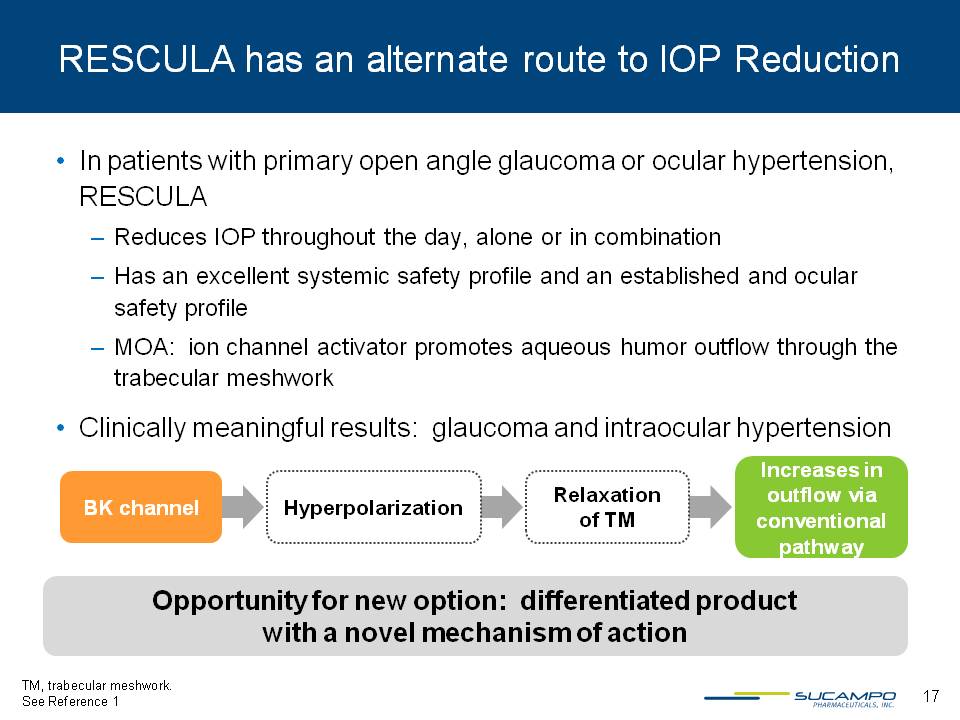

RESCULA has an alternate route to IOP Reduction In patients with primary open angle glaucoma or ocular hypertension, RESCULA Reduces IOP throughout the day, alone or in combination Has an excellent systemic safety profile and an established and ocular safety profile MOA: ion channel activator promotes aqueous humor outflow through the trabecular meshwork Clinically meaningful results: glaucoma and intraocular hypertension BK channel Hyperpolarization Relaxation of TM Increases in outflow via conventional pathway Opportunity for new option: differentiated product with a novel mechanism of action TM, trabecular meshwork. See Reference 1 17

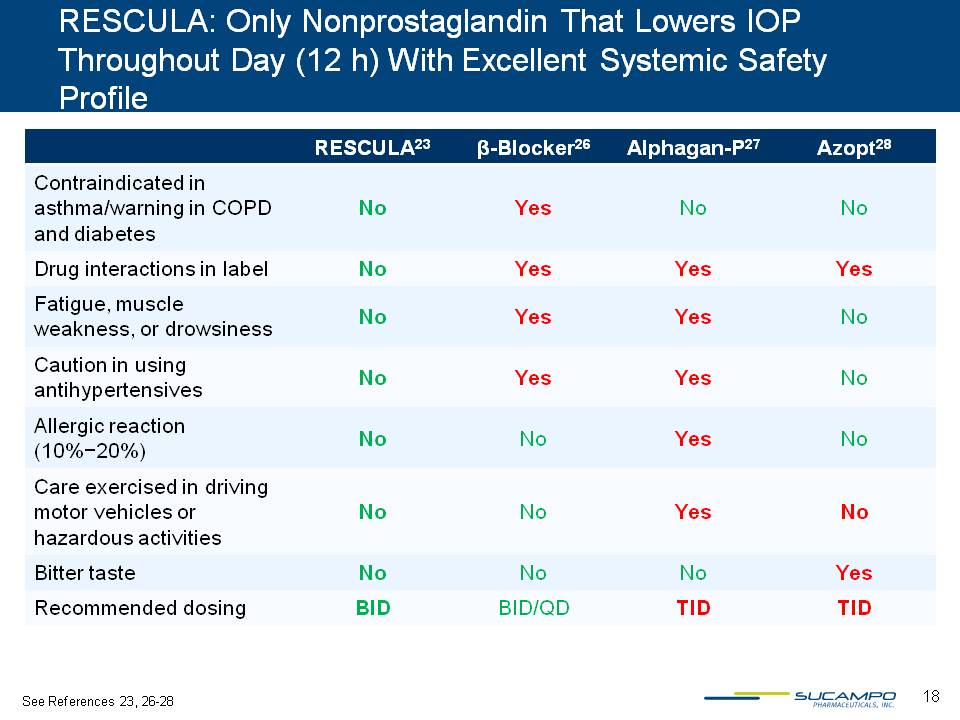

RESCULA: Only Nonprostaglandin That Lowers IOP Throughout Day (12 h) With Excellent Systemic Safety Profile RESCULA23 β-Blocker26 Alphagan-P27 Azopt28 Contraindicated in asthma/warning in COPD and diabetes No Yes No No Drug interactions in label No Yes Yes Yes Fatigue, muscle weakness, or drowsiness No Yes Yes No Caution in using antihypertensives No Yes Yes No Allergic reaction (10%−20%) No No Yes No Care exercised in driving motor vehicles or hazardous activities No No Yes No Bitter taste No No No Yes Recommended dosing BID BID/QD TID TID See References 23, 26-28 18

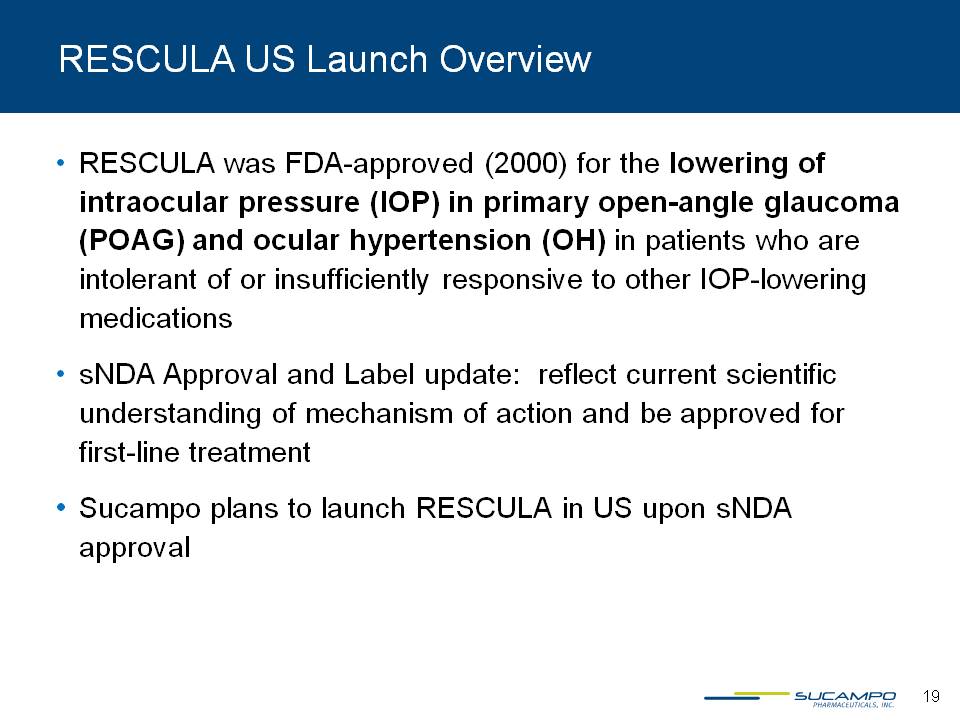

RESCULA US Launch Overview RESCULA was FDA-approved (2000) for the lowering of intraocular pressure (IOP) in primary open-angle glaucoma (POAG) and ocular hypertension (OH) in patients who are intolerant of or insufficiently responsive to other IOP-lowering medications sNDA Approval and Label update: reflect current scientific understanding of mechanism of action and be approved for first-line treatment Sucampo plans to launch RESCULA in US upon sNDA approval 19

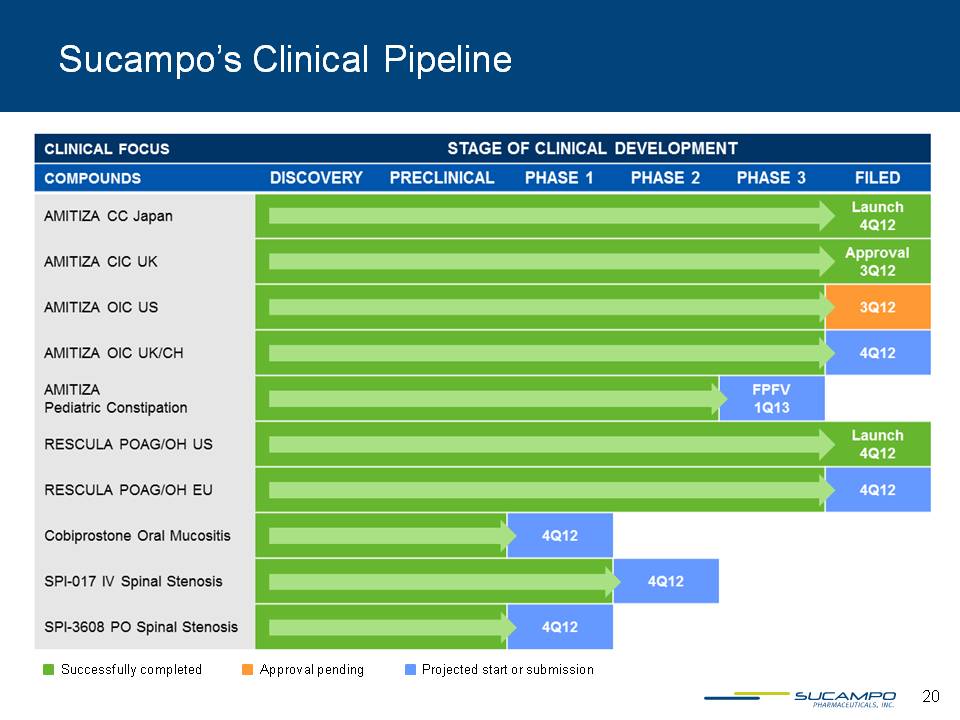

Sucampo’s Clinical Pipeline CLINICAL FOCUS STAGE OF CLINICAL DEVELOPMENT COMPOUNDS DISCOVERY PRECLINICAL PHASE 1 PHASE 2 PHASE 3 FILED AMITIZA CC Japan Launch 4Q12 AMITIZA CIC UK Approval 3Q12 AMITIZA OIC US 3Q12 AMITIZA OIC UK/CH 4Q12 AMITIZA Pediatric Constipation FPFV 1Q13 RESCULA POAG/OH US Launch 4Q12 RESCULA POAG/OH EU 4Q12 Cobiprostone Oral Mucositis 4Q12 SPI-017 IV Spinal Stenosis 4Q 12 SPI-3608 PO Spinal Stenosis 4Q 12 Successfully completed Approval pending Projected start or submission 20

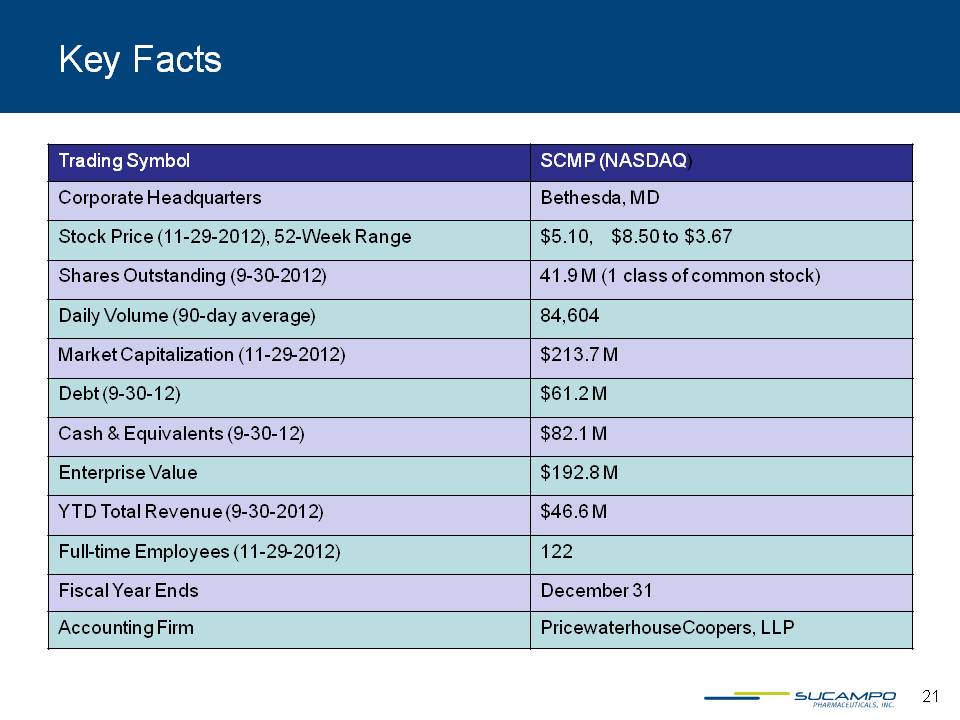

Key Facts Trading Symbol SCMP (NASDAQ) Corporate Headquarters Bethesda, MD Stock Price (11-29-2012), 52-Week Range $5.10, $8.50 to $3.67 Shares Outstanding (9-30-2012) 41.9 M (1 class of common stock) Daily Volume (90-day average) 84,604 Market Capitalization (11-29-2012) $213.7 M Debt (9-30-12) $61.2 M Cash & Equivalents (9-30-12) $82.1 M Enterprise Value $192.8 M YTD Total Revenue (9-30-2012) $46.6 M Full-time Employees (11-29-2012) 122 Fiscal Year Ends December 31 Accounting Firm PricewaterhouseCoopers, LLP 21

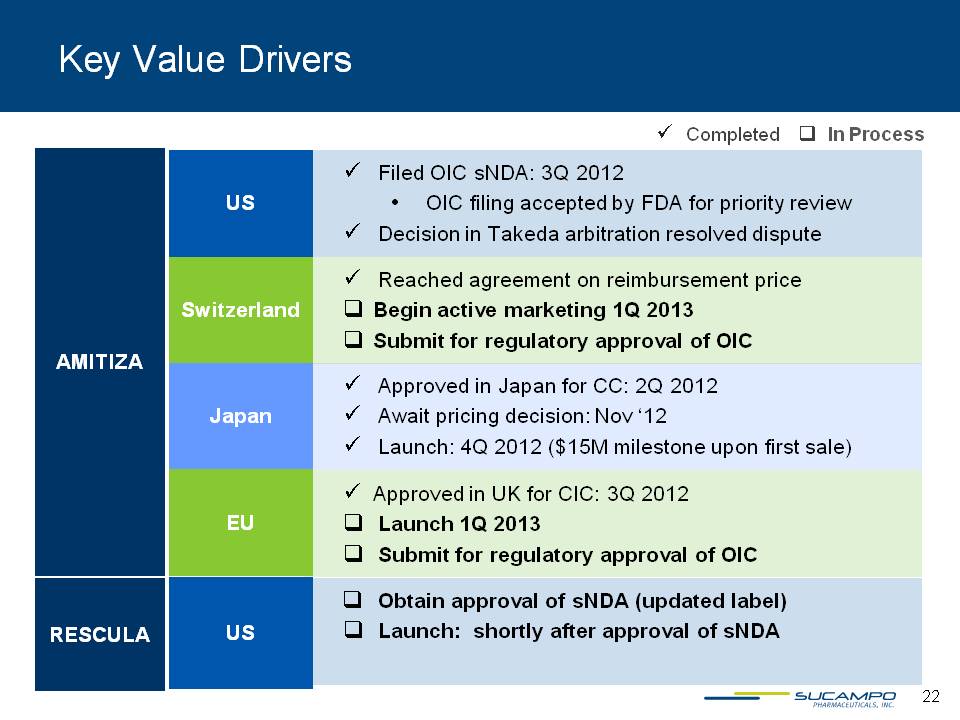

Key Value Drivers Completed In Process AMITIZA US Filed OIC sNDA: 3Q 2012 OIC filing accepted by FDA for priority review Decision in Takeda arbitration resolved dispute Switzerland Reached agreement on reimbursement price Begin active marketing 1Q 2013 Submit for regulatory approval of OIC Japan Approved in Japan for CC: 2Q 2012 Await pricing decision: Nov ‘12 Launch: 4Q 2012 ($15M milestone upon first sale) EU Approved in UK for CIC: 3Q 2012 Launch 1Q 2013 Submit for regulatory approval of OIC RESCULA US Obtain approval of sNDA (updated label) Launch: shortly after approval of sNDA 22

Appendix

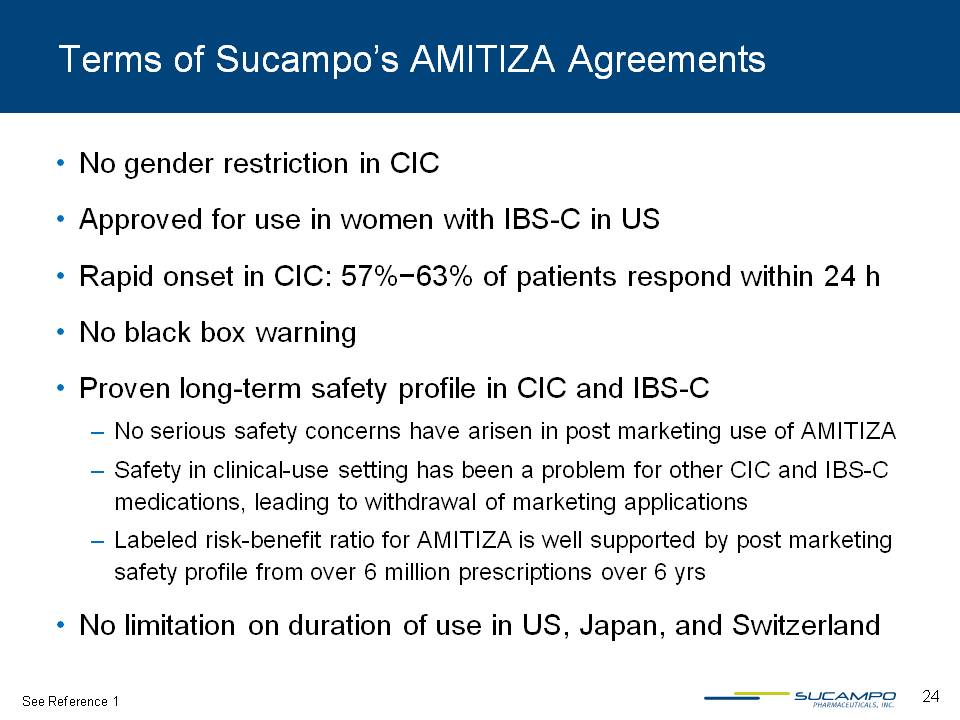

Terms of Sucampo’s AMITIZA Agreements No gender restriction in CIC Approved for use in women with IBS-C in US Rapid onset in CIC: 57%−63% of patients respond within 24 h No black box warning Proven long-term safety profile in CIC and IBS-C No serious safety concerns have arisen in post marketing use of AMITIZA Safety in clinical-use setting has been a problem for other CIC and IBS-C medications, leading to withdrawal of marketing applications Labeled risk-benefit ratio for AMITIZA is well supported by post marketing safety profile from over 6 million prescriptions over 6 yrs No limitation on duration of use in US, Japan, and Switzerland See Reference 1 24

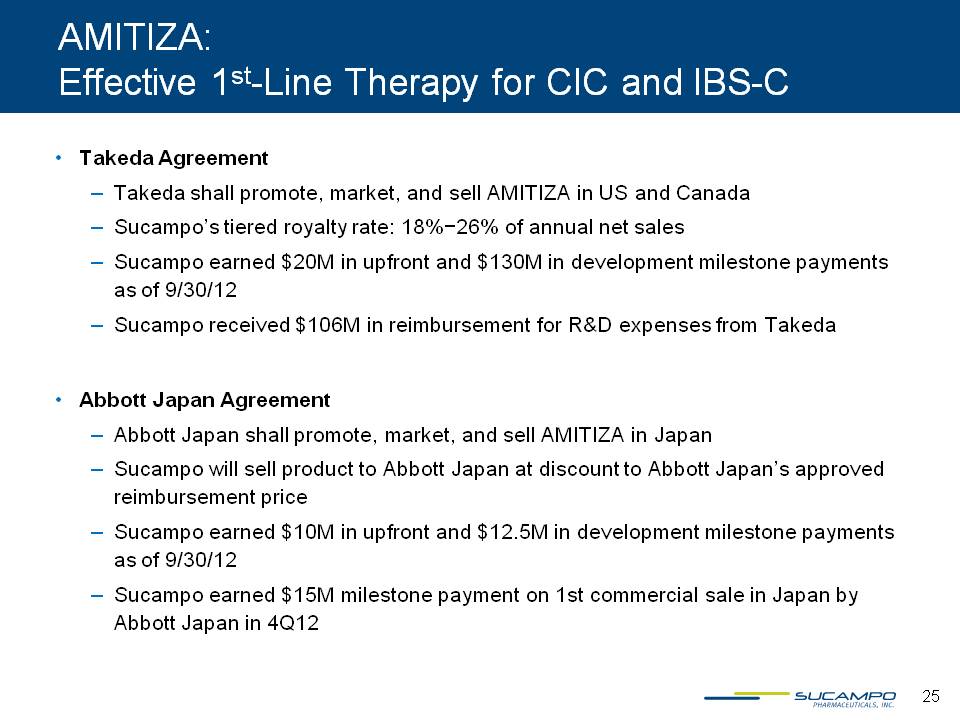

AMITIZA: Effective 1st-Line Therapy for CIC and IBS-C Takeda Agreement Takeda shall promote, market, and sell AMITIZA in US and Canada Sucampo’s tiered royalty rate: 18%−26% of annual net sales Sucampo earned $20M in upfront and $130M in development milestone payments as of 9/30/12 Sucampo received $106M in reimbursement for R&D expenses from Takeda Abbott Japan Agreement Abbott Japan shall promote, market, and sell AMITIZA in Japan Sucampo will sell product to Abbott Japan at discount to Abbott Japan’s approved reimbursement price Sucampo earned $10M in upfront and $12.5M in development milestone payments as of 9/30/12 Sucampo earned $15M milestone payment on 1st commercial sale in Japan by Abbott Japan in 4Q12 25

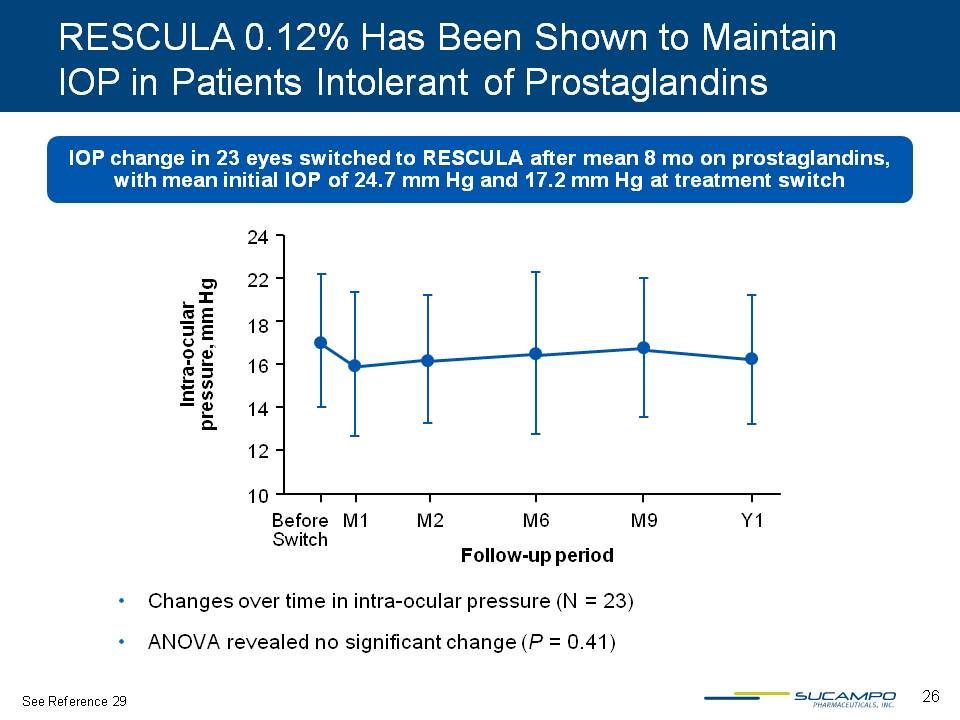

RESCULA 0.12% Has Been Shown to Maintain IOP in Patients Intolerant of Prostaglandins IOP change in 23 eyes switched to RESCULA after mean 8 mo on prostaglandins, with mean initial IOP of 24.7 mm Hg and 17.2 mm Hg at treatment switch Changes over time in intra-ocular pressure (N = 23) ANOVA revealed no significant change (P = 0.41) See Reference 29 26

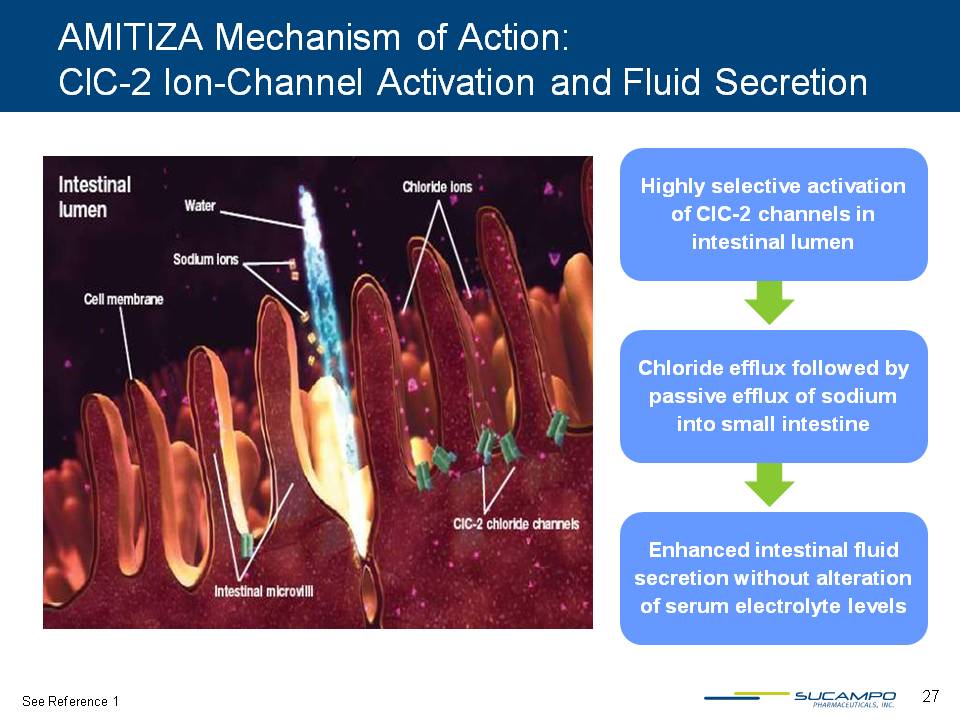

AMITIZA Mechanism of Action: ClC-2 Ion-Channel Activation and Fluid Secretion Highly selective activation of ClC-2 channels in intestinal lumen Chloride efflux followed by passive efflux of sodium into small intestine Enhanced intestinal fluid secretion without alteration of serum electrolyte levels See Reference 1 27

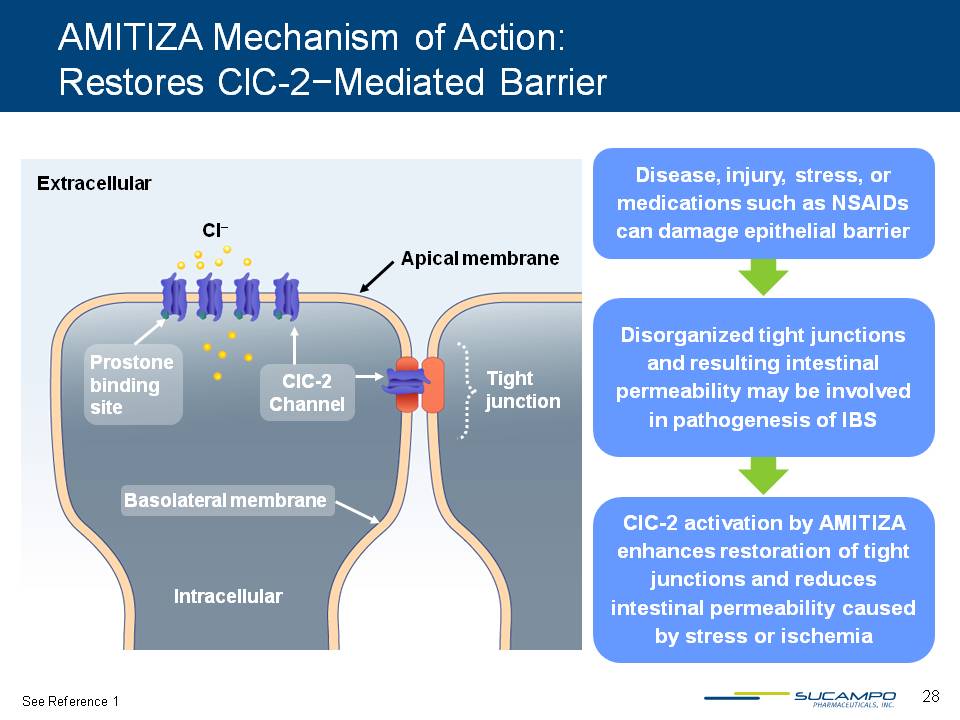

AMITIZA Mechanism of Action: Restores ClC-2−Mediated Barrier Disease, injury, stress, or medications such as NSAIDs can damage epithelial barrier Disorganized tight junctions and resulting intestinal permeability may be involved in pathogenesis of IBS ClC-2 activation by AMITIZA enhances restoration of tight junctions and reduces intestinal permeability caused by stress or ischemia See Reference 1 28

AMITIZA Safety Profile: Clinical Trials in Patients With CIC or IBS-C Nausea rated as mild−moderate by 89% and 96% of CIC and IBS-C patients, respectively, who experienced nausea >93% of patients reporting nausea experienced only 1 event over course of treatment with AMITIZA In placebo-controlled, 12-wk IBS-C trials, diarrhea reported by 7% of AMITIZA patients vs 4% of placebo patients In IBS-C exposure up to 1 yr, dropout due to diarrhea accounted for <2% of patients AMITIZA has excellent tolerability and safety profile as demonstrated in clinical studies See References 1, 30 29

AMITIZA Postmarketing Safety No serious safety concerns have arisen in postmarketing use of AMITIZA Safety in clinical-use setting has been a problem for other CIC and IBS-C medications, leading to withdrawal of marketing applications Labeled risk benefit ratio for AMITIZA is well risk-supported by postmarketing safety profile from 6 million prescriptions over 6 yr See Reference 1 30

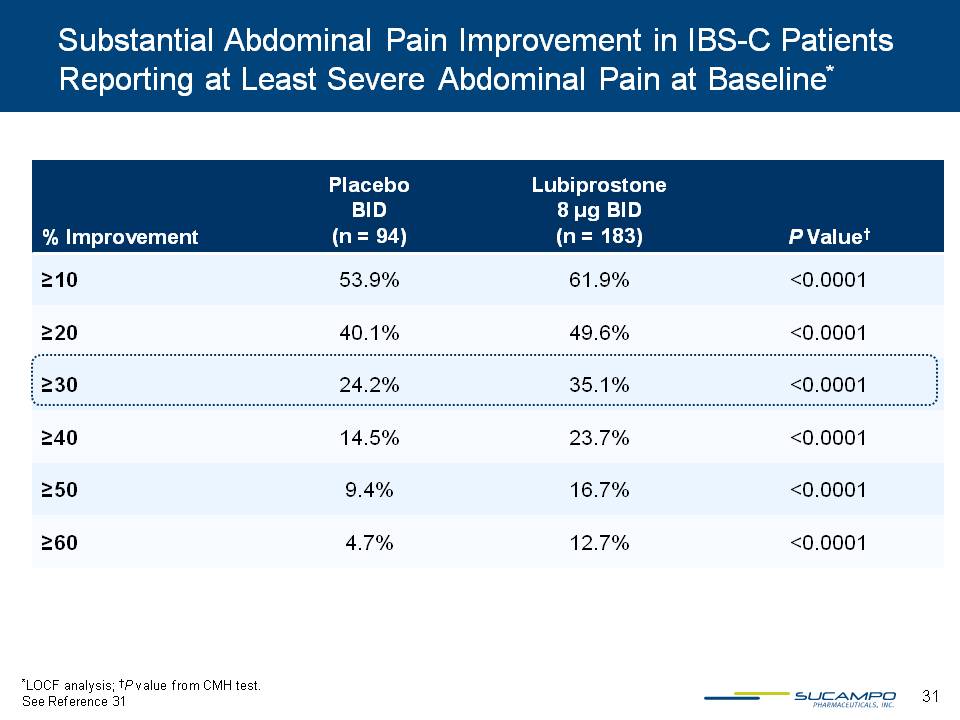

Substantial Abdominal Pain Improvement in IBS-C Patients Reporting at Least Severe Abdominal Pain at Baseline % Improvement Placebo BID (n = 94) Lubiprostone 8 µg BID (n = 183) P Value ≥10 53.9% 61.9% <0.0001 ≥20 40.1% 49.6% <0.0001 ≥30 24.2% 35.1% <0.0001 ≥40 14.5% 23.7% <0.0001 ≥50 9.4% 16.7% <0.0001 ≥60 4.7% 12.7% <0.0001 LOCF analysis; P value from CMH test. See Reference 31 31

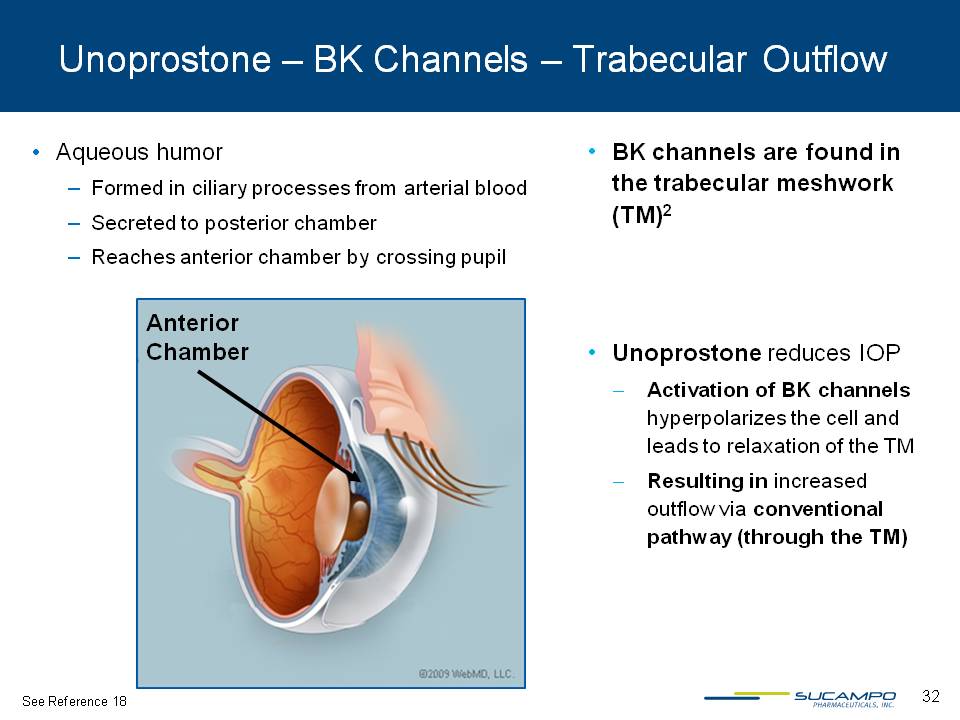

Unoprostone – BK Channels – Trabecular Outflow Aqueous humor Formed in ciliary processes from arterial blood Secreted to posterior chamber Reaches anterior chamber by crossing pupil BK channels are found in the trabecular meshwork (TM)2 Unoprostone reduces IOP Activation of BK channels hyperpolarizes the cell and leads to relaxation of the TM Resulting in increased outflow via conventional pathway (through the TM) See Reference 18 32

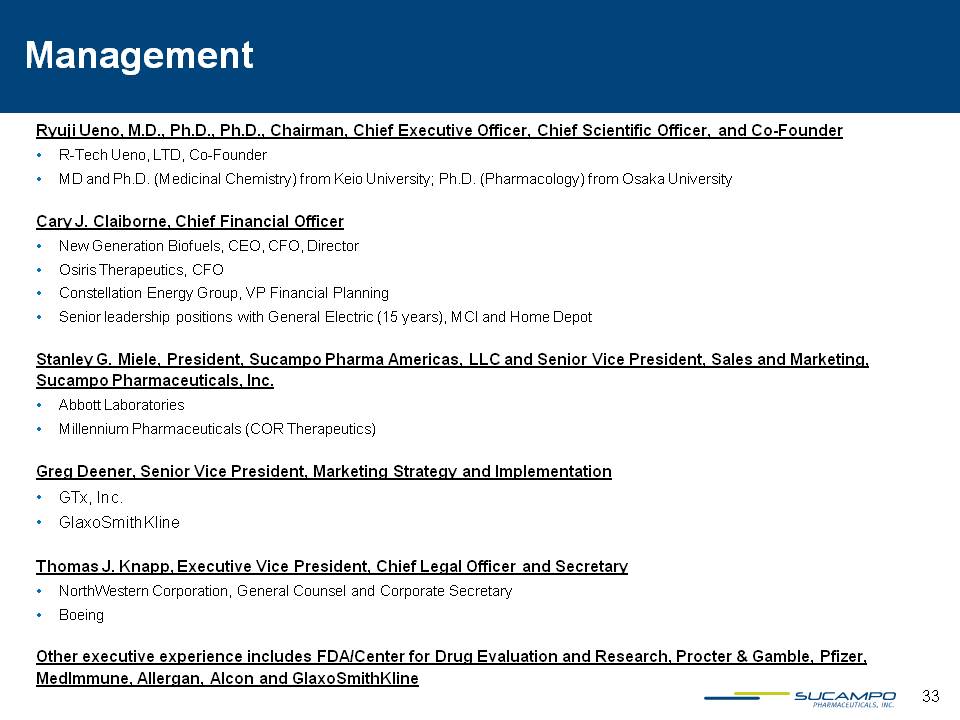

Management Ryuji Ueno, M.D., Ph.D., Ph.D., Chairman, Chief Executive Officer, Chief Scientific Officer, and Co-Founder R-Tech Ueno, LTD, Co-Founder MD and Ph.D. (Medicinal Chemistry) from Keio University; Ph.D. (Pharmacology) from Osaka University Cary J. Claiborne, Chief Financial Officer New Generation Biofuels, CEO, CFO, Director Osiris Therapeutics, CFO Constellation Energy Group, VP Financial Planning Senior leadership positions with General Electric (15 years), MCI and Home Depot Stanley G. Miele, President, Sucampo Pharma Americas, LLC and Senior Vice President, Sales and Marketing, Sucampo Pharmaceuticals, Inc. Abbott Laboratories Millennium Pharmaceuticals (COR Therapeutics) Greg Deener, Senior Vice President, Marketing Strategy and Implementation GTx, Inc. GlaxoSmithKline Thomas J. Knapp, Executive Vice President, Chief Legal Officer and Secretary NorthWestern Corporation, General Counsel and Corporate Secretary Boeing Other executive experience includes FDA/Center for Drug Evaluation and Research, Procter & Gamble, Pfizer, MedImmune, Allergan, Alcon and GlaxoSmithKline 33

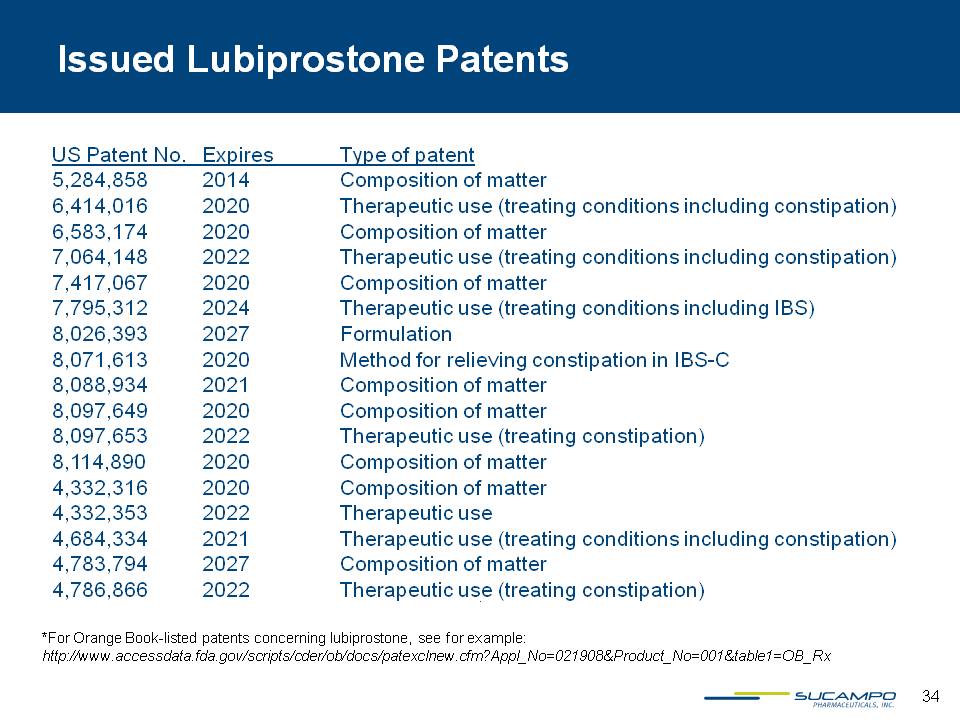

Issued Lubiprostone Patents US Patent No. Expires Type of patent 5,284,858 2014 Composition of matter 6,414,016 2020 Therapeutic use (treating conditions including constipation) 6,583,174 2020 Composition of matter 7,064,148 2022 Therapeutic use (treating conditions including constipation) 7,417,067 2020 Composition of matter 7,795,312 2024 Therapeutic use (treating conditions including IBS) 8,026,393 2027 Formulation 8,071,613 2020 Method for relieving constipation in IBS-C 8,088,934 2021 Composition of matter 8,097,649 2020 Composition of matter 8,097,653 2022 Therapeutic use (treating constipation) 8,114,890 2020 Composition of matter 4,332,316 2020 Composition of matter 4,332,353 2022 Therapeutic use 4,684,334 2021 Therapeutic use (treating conditions including constipation) 4,783,794 2027 Composition of matter 4,786,866 2022 Therapeutic use (treating constipation) *For Orange Book-listed patents concerning lubiprostone, see for example: http://www.accessdata.fda.gov/scripts/cder/ob/docs/patexclnew.cfm?Appl_No=021908&Product_No=001&table1=OB_Rx 34

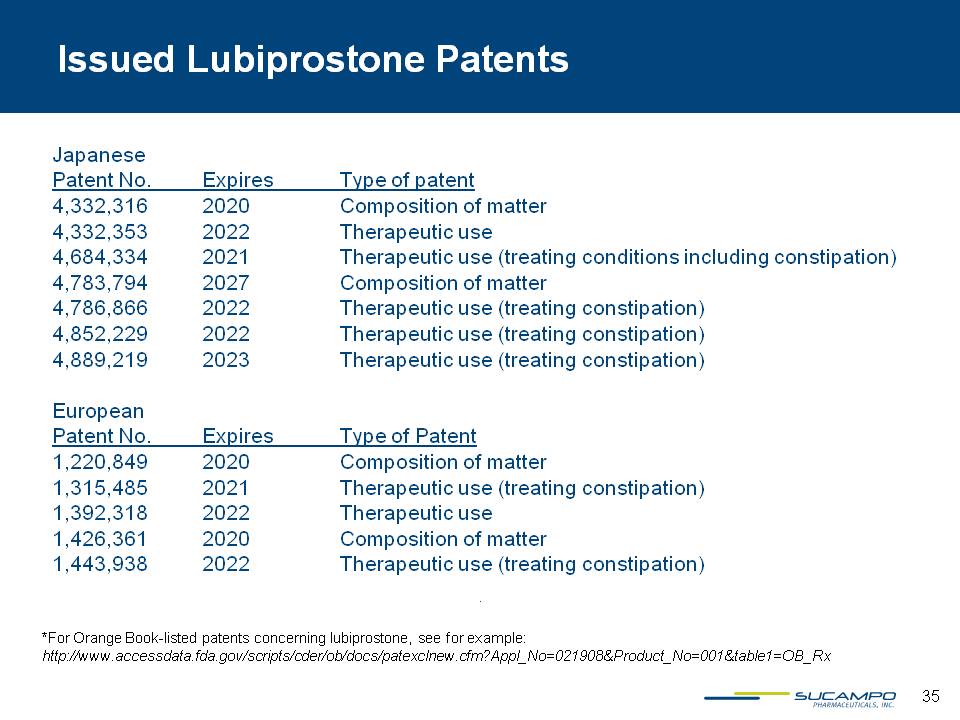

Issued Lubiprostone Patents Japanese Patent No. Expires Type of patent 4,332,316 2020 Composition of matter 4,332,353 2022 Therapeutic use 4,684,334 2021 Therapeutic use (treating conditions including constipation) 4,783,794 2027 Composition of matter 4,786,866 2022 Therapeutic use (treating constipation) 4,852,229 2022 Therapeutic use (treating constipation) 4,889,219 2023 Therapeutic use (treating constipation) European Patent No. Expires Type of Patent 1,220,849 2020 Composition of matter 1,315,485 2021 Therapeutic use (treating constipation) 1,392,318 2022 Therapeutic use 1,426,361 2020 Composition of matter 1,443,938 2022 Therapeutic use (treating constipation) *For Orange Book-listed patents concerning lubiprostone, see for example: http://www.accessdata.fda.gov/scripts/cder/ob/docs/patexclnew.cfm?Appl_No=021908&Product_No=001&table1=OB_Rx 35

References 1. Sucampo data on file. 2. Suares et al. Am J Gastroenterol. 2011 3. Kantar Health Epi database http://epidb.khapps.jp 4. Lembo et al. Sleisenger and Fordtran’s Gastrointestinal and Liver Disease. 2010 5. Salmoirago-Blotcher et al. Am J Med. 2011 6. Talley et al. Am J Gastroenterol. 2001 7. Saito et al. Am J Gastroenterol. 2002 8. Muller-Lissner S et al. Digestion. 2001 9. Kubo et al. Neurogastroenterol Motil. 2011 10. Hulisz D. J Manag Care Pharm. 2004 11. Sucampo data on file – Physician ATU 12. IMS MAT July 2012 compared with MAT July 2011 13. IMS Health 14. Verispan PDDA 15. Physician Interviews 16. ClearView Analysis 17. RESCULA Package Insert 18. Quigley et al. Br J Ophthalmol 2006 Mar;90(3):252-7 36

References Cont. 19. American Academy of Ophthalmology 20. Friedman et al. Prevalence of Open-Angle Glaucoma Among Adults in the United States. Arch Ophthalmol. 2004 Apr;122(4):532-8 21. July 2011-June 2012 MATTY IMS NPS Data 22. July 2011-June 2012 MATTY IMS NPA Data 23. Catalina Presentation 2011 24. Input from KOLs 25. IMS NPA data, MATTY June 2009 to MATTY June 2012 26. Timoptic Prescribing Information; 2005. Merck & Co. Inc., Whitehouse Station, NJ 27. Alphagan-P Prescribing Information. 2005. Allergan Inc, Irvine, CA 28. Azopt Prescribing information. 2000–2009. Alcon Laboratories Inc, Fort Worth, TX 29. Goseki T et al. Jpn. J Clin Ophthalmol. 2006;60:1227-30 30. AMITIZA Package Inserts (US and UK) 31. Joswick et al. Digestive Disease Week, 2012 37

Corporate Update Cary J. Claiborne, CFO Stanley G. Miele, SVP, Sales & Marketing Silvia Taylor, SVP, IR, PR & Corporate Communications December 4-5, 2012