Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): November 27, 2012

NYC Moda Inc.

(Exact Name of Registrant as Specified in Its Charter)

Nevada

(State or Other Jurisdiction of Incorporation)

|

333-175483

|

99-0364975

|

|

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

C214. Fitting Integreation Building, Fazhan Road to Sugian Gate Section

Jiangsu Province, China

(Address of Principal Executive Offices)

86-527-84370508

(Registrant's Telephone Number, Including Area Code)

547 N. Yale Avenue

Villa Park, IL

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

This Current Report on Form 8-K is being filed in connection with a series of transactions consummated by NYC Moda Inc. (the “Company”), and with certain events and actions taken by the Company.

This Current Report on Form 8-K includes the following items on Form 8-K:

1

|

Item 1.01

|

Entry into a Material Definitive Agreement

|

|

Item 2.01

|

Completion of Acquisition or Disposition of Assets

|

|

Item 4.01

|

Change in Registrant’s Certifying Accountant

|

|

Item 5.01

|

Changes in Control of Registrant

|

|

Item 5.02

|

Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers; Compensatory Arrangements of Certain Officers

|

|

Item 5.03

|

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year

|

|

Item 5.06

|

Change in Shell Company Status

|

| Item 5.07 | Submission of Matters to a Vote of Security Holders |

|

Item 9.01

|

Financial Statements and Exhibits

|

EMERGING GROWTH COMPANY DISCLOSURE

We are an "emerging growth company" under the federal securities laws and, as such, may elect to comply with certain reduced public company reporting requirements for future filings. Investing in our common stock involves a high degree of risk. Before buying any shares, you should carefully read the discussion of material risks of investing in our common stock in "Risk Factors".

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This document contains forward-looking statements which reflect our views with respect to future events and financial performance. These forward-looking statements are subject to uncertainties and other factors that could cause actual results to differ materially from the views expressed in these statements. Forward-looking statements are sometimes identified by, among other things, the words "anticipates", "believes", "estimates", "expects", "plans", "projects", "targets" and similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statement was made. Except to the extent required by applicable

securities laws, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. These forward-looking statements include, among other things, statements relating to:

|

●

|

our ability to increase our sales and revenue;

|

|

●

|

our ability to contain sourcing and labor costs;

|

|

●

|

our ability to attract and retain key technology and management personnel;

|

|

●

|

our ability to improve our existing technology and remain competitive in the electronics industry;

|

|

●

|

our ability to obtain additional capital in future years to fund our planned expansion; and

|

|

●

|

economic, political, regulatory, legal and foreign exchange risks associated with our operations.

|

2

USE OF DEFINED TERMS; CONVENTIONS

Except where the context otherwise requires and for the purposes of this report only:

|

●

|

"we," "us," "our company," "our" “Company” and "NYC Moda Inc." refer to the combined business of NYC Moda Inc and its consolidated subsidiaries and its consolidated affiliate, as the case may be;

|

|

●

|

"Inclusion" refers to Inclusion Business Limited (BVI), our direct, wholly-owned subsidiary, a BVI corporation;

|

|

●

|

"Lotus International" refers to Lotus International Holdings Limited (Hong Kong), our indirect, wholly-owned subsidiary, a Hong Kong corporation;

|

|

●

|

"Baichuang Consulting" refers to Baichuang Information Consulting (Shenzhen) Co., Ltd., our indirect, wholly-owned subsidiary, a Chinese corporation;

|

|

●

|

“Jiangsu Xuefeng” refers to Jiangsu Xuefeng Environmental Protection Science and Technology Co., Ltd., our indirect, consolidated affiliate, a Chinese corporation;

|

|

●

|

"SEC" refers to the United States Securities and Exchange Commission;

|

|

●

|

"China," "Chinese" and "PRC," refer to the People's Republic of China, excluding Hong Kong, Macao and Taiwan;

|

|

●

|

"Renminbi" and "RMB" and “Yuan” refer to the legal currency of China;

|

|

●

|

"U.S. dollars," "dollars" and "$" refer to the legal currency of the United States;

|

|

●

|

"Securities Act" refers to the United States Securities Act of 1933, as amended; and

|

|

●

|

"Exchange Act" refers to the United States Securities Exchange Act of 1934, as amended.

|

Solely for the convenience of the reader, this report contains conversions of certain Renminbi amounts into U.S. dollars at specified rates. Except as otherwise indicated, all conversions from Renminbi to U.S. dollars were made based on the Exchange Rate on May 31, 2012 which was RMB 6.36 and the Exchange Rate on August 31, 2012 which was RMB 6.33. No representation is made that the Renminbi or U.S. dollar amounts referred to in this prospectus could have been or could be converted into U.S. dollars or Renminbi, as the case may be, at any particular rate or at all. See “Risk Factors—Risks Related to Our Business— Fluctuations in exchange rates could adversely affect our

business and the value of our securities” for a discussion of the effects on the Jiangsu Xuefeng of fluctuating exchange rates.

In this report we refer to information and statistics regarding our industry and the overall economy in China that we obtained from various government and institute research publications. Much of this information is publicly available and has not been specifically prepared for our use or incorporation in this current report on Form 8-K. We have no reason to believe that the information and statistics that we refer to from such reports is not accurate.

On November 27, 2012, we entered into and closed an exchange agreement with Inclusion Business Limited (BVI), or “Inclusion”, all of the shareholders of Inclusion (the “Inclusion Shareholders”), and Mr. Zhenxing Liu, the majority shareholder of the Company (the "Exchange Agreement"), pursuant to which we acquired all of the outstanding shares of Inclusion (the “Inclusion Shares”) from the Inclusion Shareholders in exchange for an issuance of 7,895,000 shares of our common stock

which was surrendered by Zhenxing LIU, our Majority Shareholder (the “Share Exchange”), representing approximately 76.65% of our outstanding shares of common stock. (the “Inclusion Acquisition”). We currently have 10,300,000 shares of common stock issued and outstanding.

3

Pursuant to the Share Exchange Agreement, the Company acquired Inclusion and its indirect, controlled affiliate Jiangsu Xuefeng, a company that is primarily engaged in providing improvement and upgrading services of garbage recycling processing technology and equipment. On November 27, 2012, pursuant to the terms of the Share Exchange Agreement, the Company acquired all of the outstanding equity securities of Inclusion (the “Inclusion Shares”) from Inclusion Shareholders, and Inclusion Shareholders transferred and contributed all of its Inclusion Shares to the Company. In addition, pursuant to the terms of the Share Exchange Agreement, we agreed to change our

name to China Xuefeng Environmental Engineering Inc. and to effect a 4 for 1 forward stock split of our shares of common stock. to modify the Company’s capital structure to accommodate the transactions contemplated by the Share Exchange and to put in place an appropriate capital structure for the Company following the closing of the Share Exchange. Such securities were not registered under the Securities Act. These securities qualified for exemption under Section 4(2) of the Securities Act since the issuance of securities by us did not involve a public offering.

The foregoing description of the terms of the Exchange Agreement is qualified in its entirety by reference to the provisions of those documents filed as Exhibit 2.1, to this report, which are incorporated by reference herein.

ITEM 2.01 COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS

On November 27, 2012 (the "Closing Date"), we completed the Inclusion Acquisition pursuant to the Exchange Agreement. The Inclusion Acquisition was accounted for as a "reverse acquisition" effected as a recapitalization effected by a share exchange, wherein Inclusion is considered the acquirer for accounting and financial reporting purposes. The assets and liabilities of the acquired entity have been brought forward at their book value and no goodwill has been recognized.

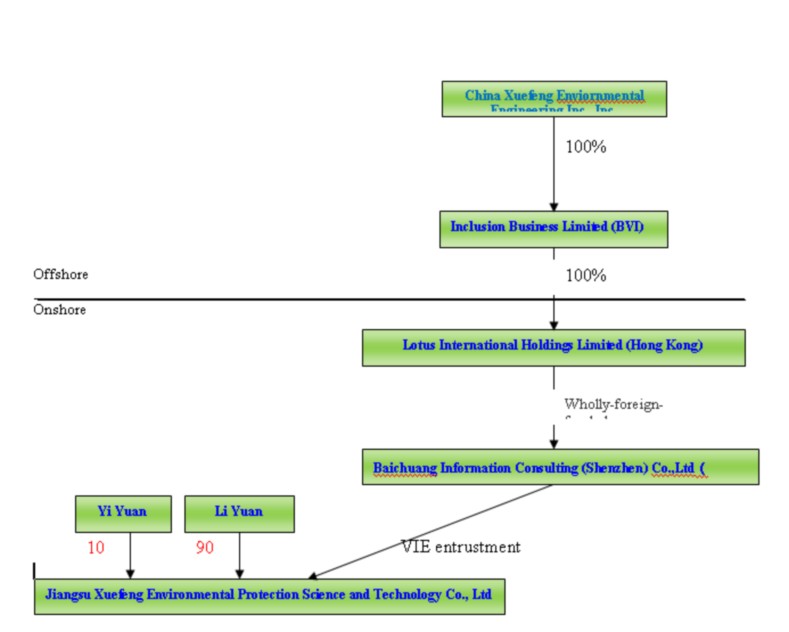

As a result of the Inclusion Acquisition, our consolidated subsidiaries include Inclusion Business Limited (BVI) or “Inclusion”, our wholly-owned subsidiary which is incorporated under the laws of the British Virgin Islands, Lotus International Holdings Limited (Hong Kong) or “Lotus”, a wholly-owned subsidiary of Inclusion which is incorporated under the laws of Hong Kong, Baichuang Information Consulting (Shenzhen) Co., Ltd., or “Baichuang Consulting”, a wholly-owned subsidiary of Lotus which

is incorporated under the laws of the PRC, and Jiangsu Xuefeng Environmental Protection Science and Technology Co., Ltd., or “Jiangsu Xuefeng”, a limited liability company incorporated under the laws of the PRC which is effectively and substantially controlled by Baichuang Consulting through a series of captive agreements, discussed below.

On October 17, 2012, prior to the reverse acquisition transaction, Baichuang Consulting and Jiangsu Xuefeng and its shareholders Li YUAN and Yi YUAN entered into a series of agreements, including an Exclusive Technical Service and Business Consulting Agreement, a Call Option Agreement, Proxy Agreement and Share Pledge Agreement, collectively referred to in this report as variable interest agreements, or “VIE Agreements,” pursuant to which Jiangsu Xuefeng became Baichuang Consulting’s contractually controlled affiliate. The use of VIE agreements is a common structure used to acquire PRC corporations, particularly in certain industries in which foreign investment is

restricted or forbidden by the PRC government. As a result of the VIE Agreements described above, we have consolidated Jiangsu Xuefeng’s historical financial results in our financial statements as a variable interest entity pursuant to Accounting Principles Generally Accepted in the United States of America following the date of the agreements and combined such results prior to the date of the agreements. The VIE Agreements with our Chinese affiliate and its shareholders, which relate to critical aspects of our operations, may not be as effective in providing operational control as direct ownership. In addition, these arrangements may be difficult and costly to enforce under PRC law. See “Risk Factors - Risks Relating to the VIE Agreements.”

The foregoing descriptions of the VIE Agreements and the transactions contemplated thereby, are subject to the more detailed provisions set forth in the VIE Agreements, which are attached as Exhibits 10.1, 10.2, 10.3, and 10.4 to this Current Report on Form 8-K and which are incorporated herein by reference. Please also see “Related Party Transactions” and “Form 10 Disclosure” for further information on our contractual arrangements with these parties.

We have included the information that would be required if the registrant were filing a general form for registration of securities on Form 10, including a complete description of the business and operations of Inclusion and its operating subsidiaries in Item 5.06 below, which is incorporated herein by reference.

4

ITEM 4.01 CHANGES IN REGISTRANT’S CERTIFYING ACCOUNTANT

Dismissal of Previous Independent Registered Public Accounting Firm

Effective November 26, 2012, upon the approval of the board of directors of the Company, the Company dismissed Ronald R. Chadwick, P.C., as the Company’s independent registered public accountant.

Although the report of Ronald R. Chadwick, P.C. on the Company’s financial statements for the fiscal year ended April 30, 2012 and 2011 included an explanatory paragraph that noted substantial doubt about the Company’s ability to continue as a going concern. They did not contain any adverse opinion or a disclaimer of opinion, nor were they modified as to uncertainty, audit scope or accounting principles.

During the fiscal years ended April 30, 2012 and 2011 as well as the subsequent interim period preceding our decision to dismiss Ronald R. Chadwick, P.C., there have been no disagreements (as defined in Item 304(a)(1)(iv) of Regulation S-K) between the Company and Ronald R. Chadwick, P.C. on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of Ronald R. Chadwick, P.C., would have caused them to make reference thereto in their report on financial statements for such years.

On November 30, 2012, the Company provided Ronald R. Chadwick, P.C. with a copy of the foregoing disclosures it is making in response to Item 4.01 on this Form 8-K, and requested Ronald R. Chadwick, P.C. to furnish it with a letter addressed to the Securities and Exchange Commission stating whether or not it agrees with the above statements in response to Item 304(a) of Regulation S-K and, if not, stating the respect in which it does not agree. We have not received any response letter from Ronald R. Chadwick, P.C. yet.

Engagement of New Independent Registered Public Accounting Firm

On November 26, 2012, upon the approval of the board of directors of the Company, the Company engaged Wei Wei & Co., LLP (“Wei & Wei”) as the independent registered public accounting firm for the Company. Wei Wei served as the independent registered public accounting firm for Jiangsu Xuefeng prior to our acquisition of Jiangsu Xuefeng pursuant to the transactions set forth in the Exchange Agreement. During the Company’s fiscal years ended April 30, 2012 and 2011 as well as the subsequent interim period preceding our decision to retain Wei & Wei, the Company did not consult with Wei Wei regarding any of the matters or events set

forth in Item 304(a)(2) of Regulation S-K.

ITEM 5.01 CHANGES IN CONTROL OF REGISTRANT

Prior to the closing of the Share Exchange, Mr. Zhenxing LIU, the Company’s sole director and officer and owner of 8,145,000 shares of common stock, representing approximately 79.08% of the outstanding shares of common stock, surrendered 7,895,000 shares of common stock to the Company as a capital contribution in contemplation of the consummation of the Share Exchange .Upon the closing of Share Exchange, the Company acquired 100% of the outstanding shares of Inclusion from the Inclusion Shareholders in exchange for 7,895,000 shares of the Company’s common stock (the “Exchange”). In addition, as of the

Closing, Mr. Li YUAN has been appointed as the Chairman of the Board and Chief Executive Officer of the Company effective on November 27, 2012 pursuant to the Share Exchange Agreement and board resolutions and majority shareholder's consent.

As a result of the closing of the Exchange Agreement, the former shareholders of Inclusion now own 76.65% of the total outstanding shares of our common stock.

See Item 1.01 above and Item 5.06 below of this Current Report on Form 8-K, each of which is incorporated herein by reference.

5

|

ITEM 5.02

|

DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS

|

On November 27, 2012, Zhenxing LIU, the sole member of our board of directors and our President, Secretary and Treasurer, submitted a letter of resignation pursuant to which he resigned immediately from his position as our sole director and officer. The resignation of Mr. LIU is not in connection with any known disagreement with us on any matter.

Immediately prior to his resignation, (a) Mr. Liu appointed Li YUAN Yi YUAN and Xiaojun ZHUANG as members of our board of directors; Li YUAN was appointed to serve as our Chief Executive Officer and Kuanfu FAN as our Chief Financial Officer, Secretary and Treasurer.

For certain biographical and other information regarding the newly appointed officers and directors, see the “Form 10 Disclosure” included in this report under the headings “Directors and Executive Officers” and “Certain Relationships and Related Transactions”, which disclosure is incorporated herein by reference.

|

ITEM 5.03

|

AMENDMENTS TO ARTICLES OF INCORPORATION OR BYLAWS; CHANGE IN FISCAL YEAR

|

On November 26, 2012, the Board of Directors of the Company approved changing the fiscal year-end of the Company from April 30 to May 31 as a result of the Inclusion Acquisition.

On November 27, 2012, the Company filed a Certificate of Amendment to its Articles of Incorporation (the “Amendment”) with the Office of the Secretary of State of Nevada to change its name from “NYC Moda Inc.” to “China Xuefeng Environmental Engineering Inc.” (the “Name Change”) and to effect a 4-for-1 forward split of the Company’s outstanding shares of common stock (the “Forward Split”). The effective date of the Name Change and the Forward Split, subject to approval by the Financial Industry Regulatory Authority (“FINRA”),is expected to be December 12, 2012.

|

ITEM 5.06

|

CHANGE IN SHELL COMPANY STATUS

|

On November 27, 2012, the Company acquired Inclusion in a reverse acquisition transaction. Prior to the transactions contemplated by the Exchange Agreement, the Company was a shell company as defined in Rule 12b-2 under the Exchange Act. As a result of the transactions under the Exchange Agreement, the Company is no longer a shell company. The information with respect to the transactions set forth in Item 2.01 is incorporated herein by reference.

| ITEM 5.07 |

SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

|

On November 26, 2012, the Company received a written consent signed by Zhenxing LIU the record owner of approximately 79.08% of theoutstanding shares of common stock approving the Name Change and the Forward Split. Upon the effectiveness of the Forward Split, the Company’s outstanding shares of common stock will increase from 10,300,000 to 41,200,000 shares.

6

FORM 10 DISCLOSURE

We are providing below the information that would be included in a Form 10 if we were to file a Form 10. Please note that the information provided below relates to the combined enterprises after the acquisition of Inclusion, except that information relating to periods prior to the date of the reverse acquisition only relate to Inclusion and its subsidiaries and controlled consolidated affiliate unless otherwise specifically indicated.

DESCRIPTION OF BUSINESS

We conduct our operations through our controlled consolidated affiliate Jiangsu Xuefeng Environmental Protection Science and Technology Co., Ltd. (hereinafter referred to as “Jiangsu Xuefeng”). Jiangsu Xuefeng, founded on December 14th, 2007, is primarily engaged in providing improvement and upgrading services of garbage recycling processing technology and equipment.

OUR CORPORATE HISTORY AND BACKGROUND

The Company was incorporated in the state of Nevada on March 30, 2011. The Company was initially created to engage in the business of clothing distribution. Since its inception and until the acquisition of Inclusion, the Company was a development stage company without signigicant assets or any revenue.

On November 27, 2012, the Company filed a certificate of amendment to its articles of incorporation to change its name from “NYC Moda Inc” to “China Xuefeng Environmental Engineering Inc” (the “Name Change”) and to effect a 4-for-1 forward stock split (the “Forward Split”) of its outstanding shares of common stock. The effective date of the Name Change and the Forward Split, subject to approval by the Financial Industry Regulatory Authority (“FINRA”), is expected to be December 12, 2012. Upon the effectiveness of the Forward Split, the number of outstanding shares of the Company’s common stock will increase from 10,300,000 to

41,200,000 shares. The number of authorized shares of common stock will continue to be 75,000,000 shares.

Acquisition of Inclusion

On November 27, 2012, we completed a reverse acquisition transaction through a share exchange with the Inclusion Shareholders, whereby we acquired 100% of the outstanding shares of Inclusion in exchange for a total of 7,895,000 shares of our common stock, representing 76.65% of our issued and outstanding shares of common stock. As a result of the reverse acquisition, Inclusion became our wholly-owned subsidiary and the former Inclusion Shareholders became our controlling stockholders. The share exchange transaction was treated as a reverse acquisition, with Inclusion as the acquirer and the Company as the acquired party for accounting purposes. Unless the context suggests otherwise, when

we refer in this report to business and financial information for periods prior to the consummation of the reverse acquisition, we are referring to the business and financial information of Inclusion and its consolidated subsidiaries and variable interest entity.

Immediately prior to the Share Exchange, the common stock of Inclusion was owned by the following persons in the indicated percentages: Li YUAN (10%); Yi YUAN (8%); Bangmin ZHEN (4.9%); Changyung LIU (4.9%); Meilling CHEN (4.9%); Zibo LIU (4.9%); Wei SONG (4.9%); Xinyan SHAN (4.8%); Yongzhu WEI (4.7%); Houquan WU (4.7%); Xianqing QU (4.7%); Jinli YUAN (4.6%); Li LI (4.6%); Chun LI (4.5%); Baosheng ZHOU (4.5%); Heng SHI (4.4%); Qiaoyan ZHANG (4.1%); Wei LIU (4%); Yang LIU (4%); and Guangjing SONG (3.9%);

As a result of our acquisition of Inclusion, we now own all of the issued and outstanding capital stock of Lotus, which in turn owns all of the issued and outstanding capital stock Baichuang Consulting. In addition, we effectively and substantially control Jiangsu Xuefeng through a series of captive agreements with Baichuang Consulting.

Subsequent to the closing of the Exchange Agreement, we conduct our operations through our controlled consolidated affiliate Jiangsu Xuefeng. Jiangsu Xuefeng is primarily engaged in providing improvement and upgrading services of garbage recycling processing technology and equipment.

The Company is located in C214, Fitting Integration Building, Fazhan Road to Suqian Gate Section. Our telephone number is +86 527-84370508.

Contractual Arrangements with our Controlled Consolidated Affiliate and its Shareholders

On October 17, 2012, prior to the reverse acquisition transaction, Baichuang Consulting and Jiangsu Xuefeng and its shareholders Li YUAN and Yi YUAN entered into a series of agreements known as variable interest agreements (the “VIE Agreements”) pursuant to which Jiangsu Xuefeng became Baichuang Consulting’s contractually controlled affiliate. The VIE Agreements included:

7

|

(1)

|

an Exclusive Technical Service and Business Consulting Agreement between Baichuang Consulting and Jiangsu Xuefeng pursuant to which Baichuang Consulting is to provide technical support and consulting services to Jiangsu Xuefeng in exchange for (i) 95% of the total annual net profit of Jiangsu Xuefeng plus (ii) RMB100,000 per month (U.S.$15,873).

|

|

|

(2)

|

a Call Option Agreement among Li YUAN and Yi YUAN (together referred to as “Jiangsu Xuefeng Shareholders”), and Baichuang Consulting under which the Jiangsu Xuefeng Shareholders have granted to Baichuang Consulting the irrevocable right and option to acquire all of the equity interests in Jiangsu Xuefeng to the extent permitted by PRC law. If PRC law limits the percentage of Jiangsu Xuefeng that Baichuang Consulting may purchase at any time, then Baichuang Consulting may repeatedly exercise its option in such increments as may be allowed by PRC law. The exercise price of the option is RMB1.00($0.16) or any lower price permitted by PRC law. The Jiangsu Xuefeng

Shareholders agreed to refrain from taking certain actions which might harm the value of Jiangsu Xuefeng or Baichuang Consulting’s option;

|

|

|

(3)

|

a Proxy Agreement by Li YUAN and Yi YUAN pursuant to which they each authorize Baichuang Consulting to designate someone to exercise all of their shareholder decision rights with respect to Jiangsu Xuefeng; and

|

|

|

(4)

|

a Share Pledge Agreement among Li YUAN and Yi YUAN, Jiangsu Xuefeng, and Baichuang Consulting under which the Jiangsu Xuefeng Shareholders agree to pledge all of their equity in Jiangsu Xuefeng to Baichuang Consulting to guarantee Jiangsu Xuefeng’s and its shareholders’ performance of their obligations under the Exclusive Technical Service and Business Consulting Agreement, the Call Option Agreement and the Proxy Agreement.

|

The VIE Agreements with our Chinese affiliate and its shareholders, which relate to critical aspects of our operations, may not be as effective in providing operational control as direct ownership. In addition, these arrangements may be difficult and costly to enforce under PRC law. See “Risk Factors - Risks Relating to the VIE Agreements.”

The foregoing description of the terms of the Exclusive Technical Service and Business Consulting Agreement, the Call Option Agreement, the Proxy Agreement and the Share Pledge Agreement is qualified in its entirety by reference to the provisions of the agreements filed as Exhibits 10.1, 10.2, 10.3 and 10.4 to this report, respectively, which are incorporated by reference herein.

See “Related Party Transactions” for further information on our contractual arrangements with these parties.

8

After the exchange, our current organizational structure after giving effect to the name changeis as follows:

Inclusion was established in the British Virgin Islands on August 9, 2012. Lotus was established in Hong Kong on May 2, 2012 to serve as an intermediate holding company with an authorized shares of 10,000 at HK$1.00 per share. Baichuang Consulting was established by Lotus as a wholly foreign owned enterprise (the “WFOE”) in the PRC on September 5, 2012. Jiangsu Xuefeng, our operating consolidated affiliate, was established in the PRC on December 14, 2007. The local government of the PRC issued a certificate of approval regarding the foreign ownership of Baichuang Consulting by Lotus, a Hong

Kong entity on September 5, 2012.

Mr. Li YUAN is the sole director and officer of Inclusion who owns 10% of outstanding shares of Inclusion. Mr. Yisha Yang GAO was the founder of Lotus and Mr. Xiaoran Zhang was the sole director of Lotus. Mr. Yisha Yang GAO transferred the 10,000 issued shares of Lotus to Mr. Li YUAN on September 28, 2012.

OVERVIEW

Jiangsu Xuefeng Environmental Protection Science & Technology Co., Ltd (hereinafter referred to as “Jiangsu Xuefeng”), founded in December 14th,2007, is primarily engaged in providing improvement and upgrading services of garbage recycling processing technology and equipment.

The Company is located at C214, Fitting Integration Building, Fazhan Road to Suqian Gate Section.

There are two shareholders in Jiangsu Xuefeng: 90% of the shares are owned by Li YUAN, and the remaining 10% of the shares are owned by Yi YUAN. Li YUAN is the chief executive officer and chairman of the company and Yi YUAN is the director of the company.

9

Jiangsu Xuefeng is primarily engaged in providing improvement and upgrading services of garbage recycling processing technology and equipment.

Until August 31, the main revenue of Jiangsu Xuefeng was generated from providing improvement and upgrading services to garbage recycling processing plants. On August 5, 2012, Jiangsu Xuefeng entered into a lease agreement with Li Yuan, one of its stockholders for the use of a patent on garbage recycling processing technology, a Utility Model Patent of Comprehensive and Harmless Garbage Processing Equipment, issued by the State Intellectual Property Office (SIPO) on July 7, 2010 and valid for ten years (Patent Number: ZL 2009 2 0232893.7)

owned by the CEO of the Company, Mr. Li Yuan,. The lease commenced on September 1, 2012 and expires in July 2017. Jiangsu Xuefeng expanded its business model from the sole service of providing upgrading to waste processing plants to also providing patent licensing based on its newly acquired use right of the patent technology. Under the new business model, Jiangsu Xuefeng could get revenues from two sources: first from improvement and upgrading services of garbage processing equipment; second from patent licensing for the use of the upgraded technology. License agreements will be offered to clients for a limited period of three to five years, within which period, the client shall pay patent royalties yearly to Jiangsu XuefengJiangsu Xuefeng for their use of the equipment containing the patent technology.

PRODUCTS AND FACILITIES

Jiangsu Xuefeng’s main business is currently providing equipment upgrading service for other garbage processing plants. Jiangsu Xuefeng plans to construct its own garbage processing plant to process various environmental wastes. Currently Jiangsu Xuefeng’s main focus is to use its patented technology to update others’ equipment, and develop a patent licensing service for the use of that technology.

For the three months ended August 31, 2012, Jiangsu Xuefeng’s revenue was $632,000, and for the twelve months ended May 31, 2012, the revenue was $314,248, all from updating other companies’ equipment. Revenue from patent licensing agreements should supplement.

CUSTOMERS

On April 4, 2012, Jiangsu Xuefeng entered into a technical service agreement with Maoshan Diversification Garbage Processing Plant (“Maoshan”), according to which, by April 20, 2012, Jiangsu Xuefeng would finish the upgrading and improvement of Maoshan’s major garbage preprocessing equipment with the following improvements: 1. The equipment processing ability was to be upgraded from 140 cubic meters per hour to 220 cubic meters per hour; 2. The sediments in sorting the waste

plastics was to drop from 40% to below 28%. Jiangsu Xuefeng charged a fee of 2 million RMB(approximately $314,200) for the service and was paid in one lump sum at the completion of the service.

On June 2 2012, Jiangsu Xuefeng entered into another technical service agreement with Xuzhou Zhongze Oasis Garbage Processing Co, Ltd (“Zhongze”), according to which, by June 20, 2012, Jiangsu Xuefeng would finish the upgrading and improvement of Zhongze’s major garbage preprocessing equipment with the following improvements: 1. The house garbage processing ability of one machine was to be upgraded from 300 tons a day to 500-550 tons a day; 2. Little sediments in sorting the plastics with a economic

indicator of 80% to 90%. Jiangsu Xuefeng charged a fee of 1 million RMB(approximately $158,000) for the service and it was paid in one lump sum at the completion of the service.

On August 4, 2012, Jiangsu Xuefeng entered into another technology licensing agreement with Suzhou Zhonghe Solid Waste Recovery Processing Co., Ltd. (“Zhonghe”), according to which, by August 20, 2012, Jiangsu Xuefeng would finish upgrading and improvement of Zhonghe’s major garbage processing equipment. Jiangsu Xuefeng charged a fee of 3 million RMB ($474,684) for the service and it was paid in one lump sum within ten days upon signing of the contract. Jiangsu Xuefeng also licensed its technology to Zhonghe upon

completion of the upgrading for five years at a royalty fee of 1.8 million RMB ($284,400) per year.

OUR INDUSTRY

10

In the description below we rely on certain information and statistics regarding our industry and the economy in China from the reports published by National Bureau of Statistics of China and the PRC Ministry of Environmental Protection. We have no reason to believe that the information and statistics we cite are not accurate.

The Chinese industry of garbage processing is highly fragmented and in a very early-stage of development. Benefiting from a series of encouraging and supportive policies on garbage processing formulated by the Chinese government, the urban garbage processing industry has been in rapid development. The current market is primarily dominated by small regional companies, like Jiangsu Xuefeng, which account for approximately 90% of all environmental protection enterprises in China.

The volume of solid waste generated by industrial companies is directly correlates to the industrial rate of utilization of natural resources and is expected to grow by over 10% per year according to the National Bureau of Statistics of China. In addition, according to estimates from the PRC Ministry of Environmental Protection, the production of industrial waste was approximately 1.34 billion tons in 2010, excluding approximately 13 million tons of hazardous industrial waste.

According to the Opinions on Further the Municipal Solid Waste Processing Service issued by the Chinese government, the harmless garbage processing rate will reach over 80% by 2015. This anticipated increase creates a strong incentive for companies to improve their garbage processing capability. Thus the Chinese garbage processing industry has significant potential room for growth both in areas of equipment marketing and equipment upgrading and improvement.

Nationwide Innocuous Disposal Facilities MSW Facilities Construction Planning (2011-2015) (“Planning”), recently passed by the Chinese government, has gone into the implementation phase. In accordance with the Planning, the aggregate investment in the items of the Planning will reach RMB 260Billion Yuan ($41.08 billion).

According to the Environmental Protection Equipment “Twelfth Five-Year” Development Planning, the yearly growth rate of environmental protection industry gross output during the Twelfth Five-Year period is 20% and will reach 500 billion yuan ($79 billion)by 2015.

The “Twelfth Five-Year” Energy Saving and Environmental Protection Industry Development Program recently issued by the Chinese government will provide support for the energy saving and environmental protection industry in finance, tax and many other aspects and will also provide directional guidance to the industry’s development. Based on the “three years exemptions and three years reductions” tax preference that the energy saving and environmental protection enterprises have already acquired, and the tax applied to high and new tech enterprises enjoying special support from the government, the income tax

rate that energy saving and environmental protection enterprises are subjected to is 15% lower than the customary tax of 25%.

Thus, recently issued policies reducing the cost of Jiangsu Xuefeng operations, and anticipated future industrial policies of the Chinese government show the Chinese government’s encouragement and support for the long term development of the environment waste processing industry, setting the stage for a larger market place for the environmental protection equipment upgrading and improvement business.

COMPETITION

Competitive Advantages

Jiangsu Xuefeng’s experience and technology combine to provide several competitive advantages:

|

1.

|

Jiangsu Xuefeng mainly specializes in the upgrading and improvement of environmental protection equipment. The Chinese environmental protection equipment upgrading and improvement industry being in its early stage, there is a lot of development space for the company.

|

11

|

2.

|

Since Jiangsu Xuefeng has already successfully upgraded the garbage processing equipment for Yangzhou Maoshan Diversified Garbage Processing Plant, Xuzhou Zhongze Oasis Garbage Processing Co, Ltd, and Suzhou Zhonghe Solid Waste Recovery Processing Co., Ltd., Jiangsu Xuefeng has specialized experience in equipment upgrading. In the developing environmental protection industry, such specialization should position Jiangsu Xuefeng at the cutting edge of the field. Jiangsu Xuefeng believes it is uniquely positioned to take advantage of industry growth opportunities.

|

Competitive Disadvantages

With the increasing development of Chinese science and technology and the government attention paid to independent innovation, the rising environmental protection industry has huge room for development. The rapid development of China’s environmental protection industry can be attributed to government initiative and encouragement, yearly increasing investment in environmental protection programs, and the realization of the potential demand of the environmental protection market.

The future development of Jiangsu Xuefeng will bear the following operating risks:

|

1.

|

The issue of environmental protection is increasingly emphasized by the Chinese government. In light of this rapid growth, the Chinese government may formulate strictly uniform standards governing technology and equipment. Jiangsu Xuefeng may have to commit more R&D funds and other expenses to conform to the regulations and rules implemented by the Chinese government.

|

|

2.

|

If the cost of Jiangsu Xuefeng’s garbage processing equipment upgrading is too high, it will limit the profit level of Jiangsu Xuefeng and further limit its sustainable development.

|

OUR GROWTH STRATEGY

As industrial development continues its rapid increase in growth, the demand for the Company should also increase rapidly. The Company hopes to seize the opportunity to use industrial growth of both large and medium-size enterprises, establishing cooperative relationships with high-quality customers by fully using its advantages in waste processing technology providing customers with improved environmental solutions and larger scale processing capability.

The Company will further perfect the equipment upgrading business

Jiangsu Xuefeng will make the best use of patented technology of comprehensive and harmless garbage processing equipment to carry on the improvement and upgrading service for Chinese clients and generate steady service revenue. In addition, patent license agreements will be offered to clients for a limited period of three to five years, within which period, the client shall pay patent royalties yearly to Jiangsu Xuefeng for their use of the equipment containing the patent technology thus providing the Company with an additional source of revenue.

The Company will establish an equipment manufacturing and sales center.

While continuing to provide equipment upgrading services, Jiangsu Xuefeng intends to establish a garbage processing equipment manufacturing and sales center to meet the anticipated market needs for Chinese garbage processing equipment, gradually branching further into the Chinese garbage processing equipment market and improving the Company’s revenue.

The Company plans to also undertake technical cooperation with key domestic and foreign R&D institutions and industry partners. Keeping abreast of domestic and foreign technical developments, the Company plans to make use of international and domestic newly advanced technology in comprehensive garbage processing with high daily processing capacity. The Company plans to constantly expand marketing channels and increase its market shares.

MARKETS, SALES AND DISTRIBUTION

12

Jiangsu Xuefeng markets its products through improving the processing efficiency and range of garbage processing equipment for its customers by signing technology service contracts with new customers advertising through its successful current cooperation with existing clients.

INTELLECTUAL PROPERTY

The Company acquired the use right of the “patent technology of comprehensive and harmless garbage processing equipment” that passed the ISO9001:2008 International Quality Management System Certification through the Patent Licensing Service Agreement signed with one of our shareholders, Li Yuan. The Licensing Agreement commenced on September 1, 2012 with a monthly payment from the Jiangsu Xuefeng to Li YUAN of approximately $12,600 (RMB 80,000). The Licensing Agreement expires in July 2017.

Comprehensive and Harmless Garbage Processing Equipment is a Utility Model Patent issued by the State Intellectual Property Office (SIPO) on July 7, 2010 and valid for ten years (Patent Number: ZL 2009 2 0232893.7). It is owned by the Chairman and shareholder Li Yuan, who licensed this patent to Jiangsu Xuefeng on August 5, 2012. This patented technology is for the treatment of complex municipal solid waste including sorting and classification, leaving no pollution and no residue.

PROPERTIES

Jiangsu Xuefeng leases office space under a one-year operating lease from an unrelated third party, expiring March 31, 2013. The lease requires Jiangsu Xuefeng to prepay the one year rental of $7,044 (RMB44,664). The related prepayments of $4,109 and $5,870 are included in the prepaid expenses on the balance sheets as of August 31, 2012 and May 31, 2012, respectively. The lease provides for renewal options. Rent expense charged to operations for the three months ended August 31, 2012 and 2011 was $1,764 and $1,732, respectively.

On March 23, 2012, Jiangsu Xuefeng entered into an agreement with an independent third party to acquire a 50-year land use right for construction of a factory facility for cash consideration of US$851,580, equivalent to RMB 5,400,000, of which US$788,500, equivalent to RMB 5,000,000 was paid before August 31, 2012. As of August 31, 2012, the land used right had not been obtained and no certificate for the use of land had been issued to Jiangsu Xuefeng.

The agreement provides terms that under certain circumstances, such as delay in construction, Jiangsu Xuefeng may be subject to a penalty of up to 20% of the payment for the land use right, or forfeiture of the land use right.

REGULATION

Because our operating affiliate Jiangsu Xuefeng is located in the PRC, our business is regulated by the national and local laws of the PRC. We believe our conduct of business complies with existing PRC laws, rules and regulations.

Environmental Law

Jiangsu Xuefeng is subject to China’s national Environmental Protection Law, which was enacted on December 26, 1989, as well as a number of other national and local laws and regulations governing landfills, air, water, and noise pollution and establishing pollutant discharge standards for wastewater.

On July 1, 2004, the PRC central government adopted the Measures for the Administration of Permit for Operation of Dangerous Wastes (the “Measures”). The Measures are intended to strengthen supervision and administration of activities relating to the collection, storage and disposal of dangerous wastes, and preventing dangerous wastes from polluting the environment.

Both the PRC Ministry of Environment Protection and local bureaus of environmental protection, license and regulate companies engaged in waste disposal and treatment in China. The requirements for licensing have become more stringent, with applicants having to demonstrate a sufficient operating history and a number of professional technicians, as well as comply with national and local environmental standards. The licensing process is also very time consuming and requires lengthy lead times.

13

General Regulation of Businesses

We believe we are in material compliance with all applicable labor and safety laws and regulations in the PRC, including the PRC Labor Contract Law, the PRC Production Safety Law, the PRC Regulation for Insurance for Labor Injury, the PRC Unemployment Insurance Law, the PRC Provisional Insurance Measures for Maternity of Employees, PRC Interim Provisions on Registration of Social Insurance, PRC Interim Regulation on the Collection and Payment of Social Insurance Premiums and other related regulations, rules and provisions issued by the relevant governmental authorities from time to time, for our operations in the PRC.

According to the PRC Labor Contract Law, we are required to enter into labor contracts with our employees. We are required to pay no less than local minimum wages to our employees. We are also required to provide employees with labor safety and sanitation conditions meeting PRC government laws and regulations and carry out regular health examinations of our employees engaged in hazardous occupations.

Foreign Currency Exchange

The principal regulation governing foreign currency exchange in China is the Foreign Currency Administration Rules (1996), as amended (2008). Under these Rules, RMB is freely convertible for current account items, such as trade and service-related foreign exchange transactions, but not for capital account items, such as direct investment, loan or investment in securities outside China unless the prior approval of, and/or registration with, the State Administration of Foreign Exchange of the People’s Republic of China, or SAFE, or its local counterparts (as the case may be) is obtained.

Pursuant to the Foreign Currency Administration Rules, foreign invested enterprises, or FIEs, in China may purchase foreign currency without the approval of SAFE for trade and service-related foreign exchange transactions by providing commercial documents evidencing these transactions. They may also retain foreign exchange (subject to a cap approved by SAFE) to satisfy foreign exchange liabilities or to pay dividends. In addition, if a foreign company acquires a company in China, the acquired company will also become an FIE. However, the relevant PRC government authorities may limit or eliminate the

ability of FIEs to purchase and retain foreign currencies in the future. In addition, foreign exchange transactions for direct investment, loan and investment in securities outside China are still subject to limitations and require approvals from, and/or registration with, SAFE.

14

Regulation of Income Taxes

On March 16, 2007, the National People’s Congress of China passed the Enterprise Income Tax Law, or the EIT Law, and its implementing rules, both of which became effective on January 1, 2008. The EIT Law and its implementing rules impose a unified EIT rate of 25.0% on all domestic-invested enterprises and FIEs, unless they qualify under certain limited exceptions.

Under the EIT Law, companies designated as High- and New-Technology Enterprises may enjoy a reduced national EIT rate of 15%. The Administrative Measures for Assessment of High-New Tech Enterprises and Catalogue of High/New Tech Domains Strongly Supported by the State (2008), jointly issued by the Ministry of Science and Technology and the Ministry of Finance and State Administration of Taxation set forth general guidelines regarding criteria as well as application procedures for qualification as a High- and New-Tech Enterprise under the EIT Law.

In addition to the changes to the current tax structure, under the EIT Law, an enterprise established outside of China with “de facto management bodies” within China is considered a resident enterprise and will normally be subject to an EIT of 25% on its global income. The implementing rules define the term “de facto management bodies” as “an establishment that exercises, in substance, overall management and control over the production, business, personnel, accounting, etc., of a Chinese enterprise.” If the PRC tax authorities subsequently determine that we should be classified as a resident enterprise, then our organization’s global income will be

subject to PRC income tax of 25%. For detailed discussion of PRC tax issues related to resident enterprise status, see “Risk Factors – Risks Related to Our Business – Under the EIT Law, we may be classified as a ‘resident enterprise’ of China. Such classification will likely result in unfavorable tax consequences to us and our non-PRC stockholders.”

Our future effective income tax rate depends on various factors, such as tax legislation, the geographic composition of our pre-tax income and non-tax deductible expenses incurred. Our management carefully monitors these legal developments and will timely adjust our effective income tax rate when necessary.

Dividend Distribution

Under applicable PRC regulations, FIEs in China may pay dividends only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, a FIE in China is required to set aside at least 10.0% of its after-tax profit based on PRC accounting standards each year to its general reserves until the cumulative amount of such reserves reach 50.0% of its registered capital. These reserves are not distributable as cash dividends. The board of directors of a FIE has the discretion to allocate a portion of its after-tax profits to staff welfare and bonus funds, which may not be distributed to equity owners except in the event of

liquidation.

The EIT Law and its implementing rules generally provide that a 10% withholding tax applies to China-sourced income derived by non-resident enterprises for PRC enterprise income tax purposes unless the jurisdiction of incorporation of such enterprises’ shareholder has a tax treaty with China that provides for a different withholding arrangement. Baichuang Consulting is considered a FIE and is directly held by our subsidiary in Hong Kong, Lotus. According to a 2006 tax treaty between the Mainland and Hong Kong, dividends payable by an FIE in China to the company in Hong Kong who directly holds at least 25% of the equity interests in the FIE will be subject to a no more than 5%

withholding tax. We expect that such 5% withholding tax will apply to dividends paid to Lotus by Baichuang Consulting, but this treatment will depend on our status as a non-resident enterprise.

15

PRC M&A Rule, Circular 75 and Circular 638

On August 8, 2006, six Chinese government agencies, namely, the Ministry of Commerce, or MOFCOM, the State Administration for Industry and Commerce, or SAIC, the China Securities Regulatory Commission, or CSRC, the State Administration of Foreign Exchange, or SAFE, the State Assets Supervision and Administration Commission, or SASAC, and the State Administration for Taxation, or SAT, jointly issued the Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors, referred to as the “New M&A Rules”, which became effective on September 8, 2006. The New M&A Rules purport, among other things, to require offshore “special purpose vehicles,”

that are (1) formed for the purpose of overseas listing of the equity interests of Chinese companies via acquisition and (2) are controlled directly or indirectly by Chinese companies and/or Chinese individuals, to obtain the approval of the CSRC prior to the listing and trading of their securities on overseas stock exchanges. Based on our understanding of current Chinese Laws and pursuant to a legal opinion issued by Jinlin Changchun Law Firm dated October 17, 2012, (i) Baichuang Consulting was incorporated by a foreign investor and therefore has no Chinese shareholders; (ii) the share exchange between Inclusion and the Company, is between two offshore companies and is not deemed as a transaction to acquire equity or assets of a “Chinese domestic company” as defined under the New M&A Rules and (ii) no provision in the New M&A Rules clearly classifies

the contractual arrangements between Baichuang Consulting and Jiangsu Xuefeng as a type of transaction falling within the New M&A Rules.

The SAFE issued a public notice in October 2005, or the Circular 75, requiring Chinese residents to register with the local SAFE branch before establishing or controlling any company outside of China for the purpose of capital financing with assets or equities of Chinese companies, referred to in the Circular 75 as special purpose vehicles, or SPVs. Chinese residents who are shareholders of SPVs established before November 1, 2005 were required to register with the local SAFE branch before June 30, 2006. Further, Chinese residents are required to file amendments to their registrations with the local SAFE branch if their SPVs undergo a material event involving changes in capital, such as

changes in share capital, mergers and acquisitions, share transfers or exchanges, spin-off transactions or long-term equity or debt investments.

Pursuant to the Circular 698, where a foreign investor transfers the equity interests of a Chinese resident enterprise indirectly via disposing of the equity interests of an overseas holding company, which we refer to as an Indirect Transfer, and such overseas holding company is located in a tax jurisdiction that: (i) has an effective tax rate less than 12.5% or (ii) does not tax foreign income of its residents, the foreign investor shall report such Indirect Transfer to the competent tax authority of the Chinese resident enterprise. The Chinese tax authority will examine the true nature of the Indirect Transfer, and if the tax authority considers that the foreign investor has adopted an

abusive arrangement in order to avoid Chinese tax, they will disregard the existence of the overseas holding company and re-characterize the Indirect Transfer and as a result, gains derived from such Indirect Transfer may be subject to Chinese withholding tax at the rate of up to 10%. Circular 698 also provides that, where a non-Chinese resident enterprise transfers its equity interests in a Chinese resident enterprise to its related parties at a price lower than the fair market value, the competent tax authority has the power to make a reasonable adjustment to the taxable income of the transaction.

INSURANCE

Insurance companies in China offer limited business insurance products. While business interruption insurance is available to a limited extent in China, we have determined that the risks of interruption, cost of such insurance and the difficulties associated with acquiring such insurance on commercially reasonable terms make it impractical for us to have such insurance. As a result, we could face liability from the interruption of our business as summarized under “Risk Factors – Risks Related to Our Business – We do not carry business interruption insurance so we could incur unrecoverable losses if our business is interrupted.”

OUR EMPLOYEES

As of August 31, 2012, we had a total of 32 employees. The Company employs a highly qualified team of technically trained personnel. Among the Company’s employees, 11 have environmental assessment engineer degrees and 10 have ecological and environmental protection planning qualifications. This team provides support for clients when the Company upgrades waste management systems with our new patented technology.

16

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this report, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment. You should read the section entitled "Special Notes Regarding Forward-Looking Statements" immediately following these risk factors for a discussion of what types of statements are forward-looking statements, as

well as the significance of such statements in the context of this report.

Risks Related to our Business

We are an emerging growth company and as such must comply with certain reporting standards.

We will be required to disclose changes made in our internal controls and procedures on a quarterly basis and our management will be required to assess the effectiveness of these controls annually. However, for as long as we are an "emerging growth company" under the JOBS Act, our independent registered public accounting firm will not be required to attest to the effectiveness of our internal controls over financial reporting pursuant to Section 404. We could be an emerging growth company for up to five years. An independent assessment of the effectiveness of our internal controls could detect problems that our management's assessment might not. Undetected material weaknesses in our

internal controls could lead to financial statement restatements and require us to incur the expense of remediation.

We will incur increased costs as a result of operating as a public company, and our management will be required to devote substantial time to new compliance initiatives.

As a public company, we will incur significant legal, accounting and other expenses that we did not incur as a private company. We will be subject to the reporting and other requirements of the Securities Exchange Act of 1934, as amended, or the Exchange Act, the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, and the Dodd-Frank Wall Street Reform and Protection Act. These rules and regulations will require, among other things, that we file annual, quarterly and current reports with respect to our business and financial condition and establish and maintain effective disclosure and financial controls and corporate governance practices. We expect these rules and regulations to

substantially increase our legal and financial compliance costs and to make some activities more time-consuming and costly, particularly after we are no longer an "emerging growth company" as defined in the recently enacted Jumpstart Our Business Startups Act of 2012, or the JOBS Act. Our management and other personnel will need to devote a substantial amount of time to these compliance initiatives.

If we take advantage of specified reduced disclosure requirements applicable to an "emerging growth company" under the JOBS Act, the information that we provide to stockholders may be different than they might receive from other public companies.

As a company with less than $1 billion in revenue during our last fiscal year, we qualify as an "emerging growth company" under the JOBS Act. As an emerging growth company, we may take advantage of specified reduced disclosure and other requirements that are otherwise applicable generally to public companies. These provisions include:

|

·

|

Only two years of audited financial statements in addition to any required unaudited interim financial statements with correspondingly reduced "Management's Discussion and Analysis of Financial Condition and Results of Operations" disclosure.

|

|

|

·

|

Reduced disclosure about our executive compensation arrangements.

|

|

·

|

No non-binding advisory votes on executive compensation or golden parachute arrangements.

|

|

|

·

|

Exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting.

|

17

We may take advantage of these exemptions for up to five years or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company if we have more than $1 billion in annual revenues, we have more than $700 million in market value of our stock held by non-affiliates, or we issue more than $1 billion of non-convertible debt over a three-year period. We may choose to take advantage of some but not all of these reduced burdens. We have not taken advantage of any of these reduced reporting burdens in this prospectus, although we may choose to do so in future filings. If we do, the information that we provide stockholders may be

different than you might get from other public companies in which you hold stock.

We are an “emerging growth company” and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors.

The JOBS Act permits "emerging growth companies" like us to rely on some of the reduced disclosure requirements that are already available to companies having a public float of less than $75 million, for as long as we qualify as an emerging growth company or smaller reporting company. As long as we are qualified as “emerging growth company” or “smaller reporting company”, we are permitted to omit the auditor's attestation on internal control over financial reporting that would otherwise be required by the Sarbanes-Oxley Act. Companies with a public float of $75 million or more must otherwise procure such an attestation beginning with their second

annual report after their initial public offering. For as long as we qualify as an emerging growth company, we are also excluded from the requirement to submit "say-on-pay", "say-on-pay frequency" and "say-on-parachute" votes to our stockholders and may avail ourselves of reduced executive compensation disclosure compared to larger companies.

In addition, Section 107 of the JOBS Act also provides that, as an emerging growth company, we can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. We can therefore delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of the benefits of this extended transition period. Our financial statements may therefore not be comparable to those of companies that comply with such new or revised accounting standards. Please refer to "Management's Discussion and Analysis of

Financial Condition and Results of Operations — Critical Accounting Policies and Estimates" for further discussion of the extended transition period for complying with new or revised accounting standards.

Until we cease to be an emerging growth company, we cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

Our failure to effectively compete in the waste processing market may have a material adverse effect on our growth prospects and our ability to generate revenue.

We currently compete primarily on the basis of our ability to secure contracts with waste processing companies, and local government entities in Jiangsu Province, China and surrounding areas for the updating of waste processing equipment. The Company is embarking on a new area of growth in licensing the use of our patented technology used in these updates and in beginning to establish our own waste processing centers. There can be no absolute assurance that we will be able to complete such expansion without losses or that our competitors will not develop at a faster rate and offer more favorable arrangements to our current and future customers. We

expect that we will be required to continue to invest in research and development and building waste treatment and disposal infrastructure.

Our competitors include both domestic companies and international companies operating in the waste processing industry in China. Some of these competitors have significantly greater financial and marketing resources and name recognition than that of our company at this point. As the Chinese government continues to support and encourage the development of the environmentally sound waste processing industry, more domestic and international competitors may enter the market. We believe that the Chinese market for our services is subject to intense regional competition, with a relatively limited number of large competitors. While the Company effectively competes in our current

focus of updating waste processing equipment for centers in our primary regional market of Jiangsu Province and surrounding areas, our reach outside this primary market and beyond our current focus has yet to be tested and we will necessarily face new competitors in the other geographic markets into which we plan to expand. If the Chinese government continues to emphasize the spending on environmental protection and continues to allocate funds to our industry, the number of our competitors throughout China, both domestic and foreign companies, will likely increase, so we cannot assure you that we will be able to compete successfully against any new or existing competitors, or against any new technologies our competitors may develop or implement. All of these competitive factors could have a material

adverse effect on our revenues, profitability and growth prospects.

18

The waste processing industry is highly regulated and our business depends on governmental permits and certifications to operate our business, the loss of any of which would have a material adverse impact on our business.

Only those companies that have been granted operating licenses issued by the PRC central and local governments are permitted to engage in the industrial waste treatment and disposal business in China. Our company is currently fully licensed to carry out our core business of updating and improving waste processing equipment, however, expansion into our own waste processing center in the future will require new licenses for which we will apply. The central and local governments of the PRC impose strict requirements on companies regarding the technology which must be employed and the qualifications and training of management employees which must be maintained. While we possess the

necessary permits and certifications to operate our business, our regulatory approvals authorizing our operations and activities are subject to periodic review, reassessment and renewal by Chinese authorities. Standards of compliance necessary to pass such reviews change from time to time and differ from jurisdiction to jurisdiction, leading to a degree of uncertainty. If our licenses and permits are revoked, substantially modified or not renewed or if additional permits, business licenses or approvals that may become necessary in connection with our business are not granted or are delayed, we may suffer adverse consequences. As a result, the termination or suspension of our licenses to operate would have a material adverse impact on our revenue and business.

If we fail to introduce new products or services or our existing products and services do not meet the requirements of our customers, we may not gain or may lose market share.

Our continued growth is dependent upon our ability to generate increased revenue from our existing customers, obtain new customers and raise capital from outside sources. While our current technology is at the forefront of industry developments, in order to maintain that advantage we will need to continue to pursue innovative solutions to meet our customers’ needs. We believe that in order to continue to capture additional market share and generate additional revenue, we will have to raise more capital to fund the construction and installation of new facilities and to obtain additional equipment to collect, process and dispose of industrial waste and recycle waste for our existing and

future customers. We anticipate that such funding will be provided through a variety of sources including bank loans, equity financing and net cash flow generated from operations.

In the future we may be unable to obtain the necessary financing for our capital requirements on a timely basis or on acceptable terms, which may prevent or delay the planned expansion of our service offerings. Our failure to provide new products or services may prevent us from retaining customers or gaining new customers, which may adversely affect our financial position, competitive position, growth and profitability. Our ability to obtain acceptable financing at any time may depend on a number of factors, including, our financial condition and results of operations; the condition of the PRC economy and the industrial waste treatment industry in the PRC, and conditions in relevant

financial markets in the United States, PRC and elsewhere in the world.

The rapid expansion of our business could strain our resources and adversely affect our ability to effectively control and manage our growth.

If our business and markets grow and develop as planned, it will be necessary for us to finance and manage expansion in an efficient mannor. We may face challenges in managing our waste processing equipment updating business over an expanded geographical area as well as managing expanded service offerings, including, among other things, waste processing services and patent licensing. Such eventualities will increase demands on our existing management, workforce and facilities. Failure to satisfy such increased demands could interrupt or adversely affect our operations and cause administrative inefficiencies.

19

Waste processing operations can be hazardous and may subject us to civil liabilities as a result of hazards posed by such operations.

Waste processing operations are subject to potential hazards incident to the gathering, processing and storage of industrial hazardous waste such as explosions, product spills, leaks, emissions and fires. These hazards can cause personal injury and loss of life, severe damage to and destruction of property and equipment, and pollution or other environmental damage, and may result in the curtailment or suspension of operations at the affected facility. Consequently, we may face civil liabilities in the ordinary course of our business as we update the equipment which performs this process at clients’ waste processing plants and as we branch into our own waste processing business. As the

environmental protection industry in China is in its developing stage, there is no comprehensive insurance available to cover environmental liabilities. Although we have not faced any civil liabilities in the ordinary course of our waste processing equipment updating operations, there is no assurance that we will not face such liabilities in the future. If such liabilities occur in the future, they may have a material adverse effect on our results of operations, financial condition and business prospects.

Our success depends on our management team and other key personnel, the loss of any of whom could disrupt our business operations and have a material adverse effect on our financial condition, operating results and growth prospects.

Our success to date has been largely due to the contributions of our current management team, especially Chairman Li Yuan. The continued success of our business is very much dependent on the experience of the members of our management team and the goodwill that they have developed in the industry to date. As a result, our continued success is dependent, to a large extent, on our ability to retain the services of our management team and key personnel. The loss of the services of any of our management team or key personnel due to resignation, retirement, illness or otherwise without suitable replacement or the inability to attract and retain qualified personnel would have a material adverse

effect on our operations and may reduce our profitability and the return on your investment. We do not currently maintain key man insurance covering our key personnel.

If we fail to adequately protect or enforce our intellectual property rights, we may be exposed to intellectual property infringement and the value of our intellectual property rights could diminish.

If we need to initiate litigation or administrative proceedings to enforce or protect our intellectual property rights, such actions may be costly and may divert management attention as well as expend other resources which could otherwise have been devoted to our business. An adverse determination in any such litigation could impair our intellectual property rights and may harm our business, prospects and reputation. In addition, historically, implementation of PRC intellectual property-related laws has been lacking, primarily because of ambiguities in the PRC laws and difficulties in enforcement. Accordingly, intellectual property rights and confidentiality protections in China may not be

as effective as in the United States or other countries, which increases the risk that we may not be able to adequately protect our intellectual property. Given the relative unpredictability of China’s legal system and potential difficulties enforcing a court judgment in China, there is no guarantee that we would be able to halt any unauthorized use of our intellectual property through litigation which may cause us to lose our competitive advantage and adversely affect our business and profitability.

We may face claims for infringement of third-party intellectual property rights.

We may face claims from third parties in respect of the infringement of any intellectual property rights owned by such third parties. There is no assurance that third parties will not assert claims to our processes, technologies and systems. In such an event, we may need to acquire licenses to, or to contest the validity of, issued or pending patents or claims of third parties. There can be no assurance that any license acquired under such patents would be made available to us on acceptable terms, if at all, or that we would prevail in any such contest. In addition, we would incur substantial costs and spend substantial amounts of time in defending ourselves in or contesting suits brought

against us for alleged infringement of another party’s patent rights. As such, our operations and business may be adversely affected by such civil actions. We rely on trade secrets, technology and know-how. There can be no assurance that other parties may not obtain knowledge of our trade secrets and processes, technology and systems. Should these events occur, our business would be affected and our profitability reduced.

20

A significant portion of our revenue is dependent on the performance of the customers of our waste processing equipment updating business. If we were to become over dependent on only a few customers rather than growing our customer bases, such dependency could have a material adverse effect on our business, operating results and financial condition.

Our equipment upgrading business relies on the continued development of the waste treatment industry in China and the ability of our customer base to continue to meet those growing needs and realize a need for the increased processing capabilities of our technology. As a result, our waste processing equipment upgrading business is influenced by the volume of waste processed by our customers. Should any of our current customers cease to require the use of our technology, and if we are unable to grow our customer base on a timely basis, our operations, revenue and profitability could be materially and adversely affected.

BOT (Build-Operate-Transfer) projects that we may be awarded could be adversely affected by cost overruns, project delays and/or incorrect estimation of project costs.

The company plans to establish its own waste processing centers as an extension of its current business. However, any future BOT projects we may be awarded will require us to incur high up-front expenditures. Therefore, it is important that we manage such projects efficiently in terms of time, procurement of materials and allocation of resources. If our initial cost estimates are incorrect or delays occur in a project resulting in cost overruns, the profitability of that project could be adversely affected. Cost overruns due to additional rectification work and delays in completion of projects or delivery of waste to our new processing center would adversely affect our

profitability. We may also face potential liability from legal suits brought against us by our government customers for causing loss due to any delay in completing a project. In addition, we may also face potential liability from legal suits brought against us by our customers who have suffered loss due to such mismanagement or mistakes. This would also adversely affect our profitability and financial position.