Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| x | PART I. ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended August 31, 2012

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-35566

STREAM EXCHANGE TRADED TRUST

STREAM S&P DYNAMIC ROLL GLOBAL COMMODITIES FUND

(A Series of STREAM Exchange Traded Trust)

(Exact name of Registrant as specified in its charter)

| Delaware | 27-6620981 45-3262464 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) | |

| c/o STREAM Exchange Traded Trust 787 Seventh Avenue New York, New York |

10019 | |

| (Address of Principal Executive Offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (212) 841-2000

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Common Units of Beneficial Interest | NYSE Arca, Inc. |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes ¨ No x

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “accelerated filer,” “large accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large Accelerated Filer | ¨ | Accelerated Filer | ¨ | |||

| Non-Accelerated Filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x | |||

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

State the market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the Registrant’s most recently completed second fiscal quarter. Not Applicable

Number of Common Units of Beneficial Interest outstanding as of November 28, 2012: 604,000

Table of Contents

| PART I. | ||||||

| ITEM 1. | BUSINESS | 1 | ||||

| ITEM 2. | PROPERTIES | 10 | ||||

| ITEM 3. | LEGAL PROCEEDINGS | 10 | ||||

| ITEM 4. | MINE SAFETY DISCLOSURES | 10 | ||||

| PART II. | ||||||

| ITEM 5. | 11 | |||||

| ITEM 6. | SELECTED FINANCIAL DATA | 11 | ||||

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

12 | ||||

| ITEM 8. | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | 24 | ||||

| ITEM 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

45 | ||||

| PART III. | ||||||

| ITEM 10. | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | 45 | ||||

| ITEM 11. | EXECUTIVE COMPENSATION | 48 | ||||

| ITEM 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

49 | ||||

| ITEM 13. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

49 | ||||

| ITEM 14. | PRINCIPAL ACCOUNTING FEES AND SERVICES | 49 | ||||

| PART IV. | ||||||

| ITEM 15. | EXHIBITS, FINANCIAL STATEMENT SCHEDULES | 50 | ||||

i

Table of Contents

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING INFORMATION

This report includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that involve substantial risks and uncertainties. These forward-looking statements are based on the registrant’s current expectations, estimates and projections about the registrant’s business and industry and its beliefs and assumptions about future events. These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions about the registrant that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. In some cases, investors can identify forward-looking statements by terminology such as “may,” “should,” “could,” “would,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “continue,” or the negative of such terms or other similar expressions. Factors that might cause or contribute to such a discrepancy include, but are not limited to, those described in this report and our other Securities and Exchange Commission (the “SEC”) filings.

ii

Table of Contents

| ITEM 1. | BUSINESS |

Organization

STREAM S&P Dynamic Roll Global Commodities Fund (the “Fund”), a separate series of STREAM Exchange Traded Trust (the “Trust”), a Delaware statutory trust organized in two separate series, was formed on April 30, 2010. STREAM Enhanced Volatility Fund is the other series of the Trust, which is not currently offered to the public. The Fund offers common units of beneficial interest (the “Shares”) only to certain eligible financial institutions (the “Authorized Participants”) in one or more blocks of 40,000 Shares (a “Basket”). BNP Paribas Quantitative Strategies, LLC (the “Managing Owner”), a Delaware limited liability company, serves as the managing owner and commodity pool operator of the Fund. BNP Paribas Securities Corp (“BNPPSC”), acting as agent for BNP Paribas Arbitrage SNC (“Arbitrage”), which is a related party, seeded the Fund with a capital contribution of $100,000 in exchange for 4,000 Shares at the initial issuance price of $25.00 per share on September 22, 2011. Additionally, BNPPSC, acting as agent for Arbitrage seeded the STREAM Enhanced Volatility Fund with a capital contribution of $100,000 in exchange for 4,000 Shares at the initial issuance price of $25.00 per Share on September 22, 2011.

The Fund commenced investment operations on June 1, 2012 (commencement of investment operations). The Fund Shares commenced trading on the NYSE Arca, Inc. (the “NYSE Arca”) on June 6, 2012 and trades under the symbol “BNPC.” The fiscal year end of the Fund is August 31st.

Fund Objective and Index

The Fund seeks to track changes, whether positive or negative, in the level of the S&P GSCI® Dynamic Roll Excess Return Index (the “Index”), over time, plus the excess, if any of the Fund’s interest from its holdings of cash, U.S. Treasury bonds, U.S. Treasury bills, U.S. government securities and related securities (the “Cash Instruments”) over the expenses of the Fund.

The Fund seeks to achieve its investment objective by investing in exchange-traded futures on the index commodities comprising the Index (the “Index Commodities”), with a view to tracking the Index over time. The Index aims to reflect the return of an investment in a world production-weighted portfolio comprised of the principal physical commodities that are the subject of active, liquid futures markets. The Index employs a flexible and systematic futures contract rolling methodology which seeks to maximize yield from rolling long futures contracts in certain markets (backwardated markets) and minimize roll loss from rolling long futures contracts in certain markets (contangoed markets).

The Fund does not intend to outperform the Index. The Managing Owner seeks to cause the net asset value of the Fund to track the Index during periods in which the Index is flat or declining as well as when the Index is rising.

The CFTC and commodity exchange rules impose speculative position limits and other position limitations, as applicable, on market participants trading in the Index Commodities. Because the Fund is subject to these position limits, the Fund’s ability to issue new Baskets or to reinvest income in additional exchange-traded futures corresponding to the Index Commodities (the “Designated Contracts”) may be limited to the extent that these activities would cause the Fund to exceed the applicable position limits (or if a price limit is in effect on a Designated Contract during the last 30 minutes of its regular trading session). If the Managing Owner determines in its commercially reasonable judgment that it has become impractical or inefficient for any reason for the Fund to gain full or partial exposure to a Designated Contract, the Fund may first trade Cleared Swaps, and then, if applicable, Substitute Contracts and/or Alternative Financial Instruments (each as more fully described in the Fund’s Prospectus) in addition to and as a proxy for the Designated Contracts on the Index Commodities. These limitations and the use of first Cleared Swaps, and then, if applicable, Substitute Contracts and/or Alternative Financial Instruments in addition to and as a proxy for the Designated Contracts on the Index Commodities may affect the correlation between changes in the Net Asset Value per Share and changes in the level of the Index, and the correlation between the market price per Share on NYSE Arca and the Net Asset Value per Share.

1

Table of Contents

The Fund does not employ leverage. As of August 31, 2012, the Fund had $1,741,963 (or 9.97%), of its holdings of Cash Instruments and unrealized appreciation/depreciation of futures contracts on deposit with its Commodity Brokers. Of this, $1,020,767 is required to be deposited as margin in support of the Fund’s long futures positions as of August 31, 2012. For additional information, please see the audited Schedule of Investments as of August 31, 2012 for details of the Fund’s portfolio holdings.

“S&P®” and “Standard & Poor’s” are registered trademarks of Standard & Poor’s Financial Services LLC. “S&P GSCI®” is a registered service mark and trademark of S&P.

The Managing Owner has entered into an agreement with S&P, the Index Sponsor, that provides the Fund and its affiliates with a non-transferable, limited, nonexclusive (except as provided below) and worldwide license, for a fee, with the right to use the S&P GSCI® Dynamic Roll Excess Return Index in connection with certain securities.

Net Asset Value

The net asset value (the “NAV”) of the Fund means the total assets of the Fund including, but not limited to, all cash and cash equivalents or other debt securities less total liabilities of the Fund, determined on the basis of generally accepted accounting principles in the United States, consistently applied under the accrual method of accounting.

The Fund’s NAV is calculated as of the close of the NYSE Arca Core Trading Session, or the last to close of the Futures Exchanges on which the Fund’s Designated Contracts or Substitute Contracts (which are listed on futures exchanges other than the Futures Exchanges) are traded, whichever is later.

2

Table of Contents

Overview of the Index

General

The Index was developed by the Index Sponsor and is an index on a world production-weighted basket of principal physical commodities that satisfy specified criteria. The Index reflects the level of commodity prices at a given time and is designed to be a measure of the return over time of the markets for these commodities. The commodities represented in the Index, each an Index Commodity, are those physical commodities on which active and liquid contracts are traded on trading facilities in major industrialized countries. The Index Commodities are weighted, on a production basis, to reflect the relative significance (in the view of the Index Sponsor) of those Index Commodities to the world economy. The fluctuations in the level of the Index are intended generally to correlate with changes in the prices of those physical Index Commodities in global markets.

The methodology underlying the Index is based on the same methodology as the S&P GSCI Commodity Index (the “S&P GSCI”), except with respect to rolling the Designated Contracts. (For the avoidance of doubt, the Index is calculated on an excess return basis and the S&P GSCI is calculated on a total return basis.) The Index, which is an expansion of the S&P GSCI, is comprised of the same Index Commodities as the S&P GSCI and uses the same world production weighting methodology. The Index includes Index Commodities from the following five sectors: energy, agriculture, industrial metals, precious metals, and livestock.

The Index, denominated in USD, is currently composed of long positions in the Designated Contracts on the 24 underlying Index Commodities (as set forth in Table 1 below) diversified across the commodity universe. There is no limit on the number of Designated Contracts that may be included in the Index. Any contract satisfying the eligibility criteria will become a Designated Contract and will be included in the Index.

The Index reflects the return associated with the change in prices of the underlying Designated Contracts on the Index Commodities together with the “roll yield” associated with these Designated Contracts (the price changes of the Designated Contracts and roll yield, taken together, constitute the “excess return” reflected by the Index).

The Designated Contracts currently included in the Index, the Futures Exchanges on which they are traded, their trading symbols, trading times and their percentage dollar weights are as follows:

Table 1

| Futures Exchange1 |

Index Commodity |

Trading Symbol2 |

Trading Times (Eastern Time) |

Dollar Weight August 31, 20123 |

||||||

| CBOT |

Chicago Wheat | W | 10:30-15:00 | 3.74 | % | |||||

| KBT |

Kansas City Wheat | KW | 10:30-15:00 | 1.05 | % | |||||

| CBOT |

Corn | C | 10:30-15:00 | 5.48 | % | |||||

| CBOT |

Soybeans | S | 10:30-15:00 | 3.26 | % | |||||

| ICE-US |

Coffee | KC | 03:30-14:00 | 0.66 | % | |||||

| ICE-US |

Sugar #11 | SB | 02:30-14:00 | 1.57 | % | |||||

| ICE-US |

Cocoa | CC | 04:00-14:00 | 0.25 | % | |||||

| ICE-US |

Cotton #2 | CT | 21:00-14:30 | 0.95 | % | |||||

| CME |

Lean Hogs | LH | 10:05-14:00 | 1.25 | % | |||||

| CME |

Live Cattle | LC | 10:05-14:00 | 2.69 | % | |||||

3

Table of Contents

| Futures Exchange1 |

Index Commodity |

Trading Symbol2 |

Trading Times (Eastern Time) |

Dollar Weight August 31, 20123 |

||||||

| CME |

Feeder Cattle | FC | 10:05-14:00 | 0.46 | % | |||||

| NYM/ICE-US |

Crude Oil | CL | 09:00-14:30 | 30.20 | % | |||||

| NYM |

Heating Oil | HO | 09:00-14:30 | 5.26 | % | |||||

| NYM |

RBOB Gasoline | RB | 09:00-14:30 | 5.06 | % | |||||

| ICE-UK |

Brent Crude Oil | LCO | 20:00-18:00 | 18.33 | % | |||||

| ICE-UK |

Gasoil | LGO | 20:00-18:00 | 8.25 | % | |||||

| NYM/ICE-US |

Natural Gas | NG | 09:00-14:30 | 1.87 | % | |||||

| LME |

Aluminum | MAL | 06:55-07:00 07:55-08:00 08:20-09:45 10:15-10:20 10:55-11:00 11:15-12:00 |

1.85 | % | |||||

| LME |

Copper | MCU | 07:00-07:05 07:30-07:35 08:20-09:45 10:10-10:15 10:50-10:55 11:15-11:55 |

3.01 | % | |||||

| LME |

Lead | MPB | 07:05-07:10 07:45-07:50 08:20-09:45 10:00-10:05 10:40-10:45 11:15-11:40 |

0.36 | % | |||||

| LME |

Nickel | MNI | 07:15-07:20 08:00-08:05 08:20-09:45 10:25-10:30 11:05-11:10 11:15-11:45 |

0.50 | % | |||||

| LME |

Zinc | MZN | 07:10-07:15 07:50-07:55 08:20-09:45 10:05-10:10 10:45-10:50 11:15-11:50 |

0.47 | % | |||||

| CMX |

Gold | GC | 08:20-13:30 | 2.98 | % | |||||

| CMX |

Silver | SI | 08:25-13:25 | 0.48 | % | |||||

| 1 Legend: “CBOT” means the Chicago Board of Trade. “KBT” means the Kansas City Board of Trade. “ICE-US” means ICE Futures U.S. “CME” means the Chicago Mercantile Exchange. “NYM” means the New York Mercantile Exchange, Inc. “ICE-UK” means ICE Futures Europe. “LME” means the London Metal Exchange. “CMX” means the COMEX Division of the New York Mercantile Exchange, Inc.. |

We refer to the futures exchanges on which the Designated Contracts trade, CBOT, KBT, ICE-US, CME, NYM, ICE-UK, LME, and CMX, collectively as the Futures Exchanges 2 Tickers are Reuters RIC Codes. 3 The futures contracts included in the S&P GSCITM and their percentage dollar weights, among other matters, may change. Source: S&P. Used with permission. |

The holding of long positions involves establishing commodity futures contracts, which means that the investor’s portfolio will benefit if the prices of such Index Commodities rise and will be negatively affected if the prices of such Index Commodities decline. The Index is a synthetic portfolio or basket of Index Commodities (and in turn, a reflection of the change in market value of these Index Commodities) because there is no actual portfolio of assets to which any person is entitled or in which any person has any ownership interest.

4

Table of Contents

No assurance can be given that the Index will achieve its goals or that the Index results will surpass any alternative basket or strategy that might be constructed from the Index Commodities.

The steps and calculations that govern the determination of the weighting for the Index Commodities and the selection of the Designated Contracts, and therefore, the results of the Index, were developed by the Index Sponsor.

The closing levels of the Index are published under the symbol “SPDYCIP.” The Index Sponsor provides the closing levels of the Index for each Index Business Day to market data vendors. The Index Sponsor began calculating the level of the Index on January 27, 2011 (the “Launch Date”). January 16, 1995 is the base date, or Base Date on which the initial level of the Index was 100. Values of the Index Commodities are required prior to and after the Launch Date to determine the Index levels for the Index.

The Index was developed by the Index Sponsor and the S&P GSCI® Dynamic Index Methodology is provided by the Index Sponsor on its website at http://us.spindices.com and the closing levels are published by market data vendors.

The Dynamic Roll Process

The Index was established in January 2011 and reflects the returns that are potentially available through rolling uncollateralized Designated Contracts on the Index Commodities comprising the Index. Because futures contracts have scheduled expirations, or delivery months, as one contract nears expiration it becomes necessary to close out the position in that delivery month and to establish a position in a futures contract with a future expiration date. This process is referred to as “rolling” the position forward. An index that is designed to reflect the return from rolling each contract included in the index as it nears expiration into the next nearby most active delivery month is said to follow a standard roll, or Standard Roll, methodology. This is accomplished by selling the position in the first delivery month and purchasing a position of equivalent value in the second delivery month. If the price of the second contract is lower than the price of the first contract, the “rolling” process results in a greater quantity of the second contract being acquired for the same value and the market is described as being “backwardated.” Conversely, if the price of the second contract is higher than the price of the first contract, the “rolling” process results in a smaller quantity of the second contract being acquired for the same value and the market is described as being in “contango.”

An index that employs the Standard Roll schedule may sometimes diminish total returns due to periodic rolling expenses. Although the first nearby contracts are generally the most liquid, based on open interest, they may also become the most expensive (resulting in lower total returns) when the commodities market is in contango (when further out futures contracts trade at a premium). Conversely, when commodity markets are in backwardation (when further out futures contracts trade at a discount), indices that employ a Standard Roll strategy generally boast higher total returns.

The Index is a commodity index that utilizes the S&P GSCI® Dynamic Roll Index Methodology, a monthly futures contract rolling methodology that determines the new futures contract months for the underlying commodities. The S&P GSCI® Dynamic Roll Index Methodology is a more flexible methodology than the Standard Roll methodology. The dynamic roll algorithms measure the current shape of the forward curves of the eligible futures contract prices for each Index Commodity. The contract rolling strategy is optimized based on implied roll yield and the Dynamic Roll Parity Principle. The Index optimizes rolling by using a systematic methodology to search for the optimal contract months along the curve to roll into, subject to using only the most liquid of all available contracts of a given commodity.

5

Table of Contents

When the futures curve for a given commodity is in a general state of contango, the S&P GSCI Dynamic Roll methodology uses futures contracts months that are further out on the futures curve, with the intention of minimizing the effects of negative roll yields. When the futures curve for a given commodity is in a general state of backwardation, the S&P GSCI Dynamic Roll methodology generally uses nearby futures contracts with the intention of maximizing the potential effects of positive roll yields from backwardation.

The Trustee

Wilmington Trust Company (the “Trustee”), a Delaware banking corporation, is the sole trustee of the Fund. The Trustee has only nominal duties and liabilities to the Fund.

Under the Declaration of Trust, the Managing Owner has the exclusive management and control of all aspects of the business of the Trust and the Fund. The Trustee does not have any duty to supervise or monitor the performance of the Managing Owner, nor does the Trustee have any liability for the acts or omissions of the Managing Owner.

The Managing Owner

BNP Paribas Quantitative Strategies, LLC, a Delaware limited liability company, was formed on April 30, 2010 and serves as Managing Owner of the Fund (the “Managing Owner”). The Managing Owner will also manage the Fund portfolio. The Managing Owner is a subsidiary of Paribas North America, Inc., which is a subsidiary of BNP Paribas (“BNPP”). The Managing Owner has been registered as a commodity pool operator with the CFTC and has been a member of the National Futures Association (the “NFA”) since July 27, 2010. The Managing Owner has been registered as a commodity trading advisor with the NFA since June 11, 2012. During the period from April-July, 2010, the Managing Owner was engaged in fund structuring activities in connection with futures-based exchange traded funds. As a registered commodity pool operator of the Trust and the Fund, the Managing Owner must comply with various regulatory requirements under the Commodity Exchange Act, which we refer to as the CEAct, and the rules and regulations of the CFTC and the NFA, including investor protection requirements, antifraud prohibitions, disclosure requirements, and reporting and recordkeeping requirements. The Managing Owner is also subject to periodic inspections and audits by the CFTC and NFA.

The Fund pays the Managing Owner a Management Fee, monthly in arrears, in an amount equal to 0.65% per annum of the daily Net Asset Value of the Fund.

The Declaration of Trust provides that the Managing Owner and its affiliates (“Covered Person”), will have no liability to the Trust and each Fund or to any Shareholder for any loss suffered by the Trust and each Fund arising out of any action or inaction of the Covered Person if the Covered Person, in good faith, determined that such course of conduct was in the best interests of the Trust or the applicable Fund and such course of conduct did not constitute fraud, gross negligence, bad faith, or willful misconduct by the Covered Person. The Trust and each Fund have agreed to indemnify the Covered Person against any losses, judgments, liabilities, expenses and amounts paid in settlement of any claims sustained by it in connection with the Covered Person’s activities for the Trust and each Fund, provided that the Covered Person was acting on behalf of or performing services for the Trust and each Fund and has determined, in good faith, that such course of conduct was in the best interests of the applicable Fund and such liability or loss was not the result of fraud, gross negligence, bad faith, willful misconduct, or a material breach of the Declaration of Trust on the part of the Managing Owner and any such indemnification will only be recoverable from the applicable Fund estate.

6

Table of Contents

The Commodity Broker

A variety of executing brokers execute futures transactions on behalf of the Fund. Such executing brokers give-up all such transactions to BNP Paribas Prime Brokerage, Inc., a Delaware corporation, which serves as the Fund’s executing and clearing broker (“PBI”). PBI is an affiliate of the Managing Owner and is a BNPP Affiliated Entity. In its capacity as executing and clearing broker, PBI executes and clears each of the Fund’s futures transactions (except for transactions on the London Metal Exchange) and performs certain administrative services for the Fund. PBI has been registered with the CFTC as a futures commission merchant since August 19, 2011 and has been a member of the NFA in such capacity since August 19, 2011.

BNP Paribas Commodity Futures Limited, a limited company registered in England and Wales serves as the Fund’s executing and clearing broker (“CFL”), with respect to all transactions on the London Metal Exchange. CFL is an affiliate of the BNPP Affiliated Entities and the Managing Owner. CFL is a member of the Financial Services Authority and as such is regulated by the Financial Services Authority in the conduct of its business in the United Kingdom.

We may refer to PBI and/or CFL as a Commodity Broker individually, or the Commodity Brokers collectively.

The Fund will pay to the Commodity Brokers all brokerage commissions, including applicable exchange fees, NFA fees, give-up fees, pit brokerage fees and other transaction related fees and expenses charged in connection with trading activities. On average, total charges paid to the Commodity Brokers were less than $6.00 per round-turn trade, even though the Commodity Brokers’ brokerage commissions and trading fees are determined on a contract-by-contract basis. The Managing Owner expects that the brokerage commissions and fees may equal to approximately 0.05% of the Net Asset Value of the Fund in any year, although the actual amount of brokerage commissions and fees in any year or any part of any year may be greater.

A round-turn trade is a completed transaction involving both a purchase and a liquidating sale, or a sale followed by a covering purchase.

The Administrator, Transfer Agent and Custodian

The Managing Owner, on behalf of the Fund, has appointed The Bank of New York Mellon as the administrator (the “Administrator”), the transfer agent (the “Transfer Agent”) and the custodian (the “Custodian”) of the Fund and has entered into an Administration Agreement, a Transfer Agency and Service Agreement and a Custodian Agreement in connection therewith, respectively.

The Bank of New York Mellon, a banking corporation organized under the laws of the State of New York with trust powers, has an office at 2 Hanson Place, 12th Floor, Brooklyn, N.Y. 11217. The Bank of New York Mellon is subject to supervision by the New York State Banking Department and the Board of Governors of the Federal Reserve System.

Pursuant to the Administration Agreement, the Administrator performs or supervises the performance of services necessary for the operation and administration of the Fund (other than making investment decisions), including receiving and processing orders from Authorized Participants to create and redeem Baskets, Net Asset Value calculations, accounting and other fund administrative services. The Administrator will maintain certain financial books and records, including: Basket creation and redemption books and records, Fund accounting records, ledgers with respect to assets, liabilities, capital, income and expenses, the registrar, transfer journals and related details and trading and related documents received from futures commission merchants.

7

Table of Contents

The Administrator’s monthly fees are paid on behalf of the Fund by the Managing Owner out of the Management Fee.

The Transfer Agent will also receive a transaction processing fee in connection with orders from Authorized Participants to create or redeem Baskets in the amount of $500 per order. These transaction processing fees are paid by the Authorized Participants and not by the Fund.

The Marketing Agent

The Managing Owner, on behalf of the Fund, has appointed ALPS Distributors, Inc. as the marketing agent (the “Marketing Agent”) for the Fund and has entered into a Marketing Agent Agreement in connection therewith. Pursuant to the Marketing Agent Agreement, the Marketing Agent assists the Managing Owner and the Administrator with certain functions and duties relating to distribution and marketing, including reviewing and approving marketing materials. The Marketing Agent does not open or maintain customer accounts or solicit, receive, execute, clear, settle or otherwise handle any orders to purchase or redeem Shares.

The Managing Owner, out of the Management Fee, pays the Marketing Agent for performing its duties on behalf of the Fund.

Tax Reporting

The Fund has retained the services of PricewaterhouseCoopers LLP to assist with certain tax reporting requirements of the Fund and its Shareholders.

Regulation

Futures exchanges in the United States are subject to regulation under the CEAct by the CFTC, the governmental agency having responsibility for regulation of futures exchanges and trading on those exchanges. No U.S. governmental agency regulates the over-the-counter (the “OTC”) foreign exchange markets.

The CEAct and the CFTC also regulate the activities of “commodity trading advisors” and “commodity pool operators” and the CFTC has adopted regulations with respect to certain of such persons’ activities. Pursuant to its authority, the CFTC requires a commodity pool operator (such as the Managing Owner) to keep accurate, current and orderly records with respect to each pool it operates. The CFTC may suspend the registration of a commodity pool operator if the CFTC finds that the operator has violated the CEAct or regulations thereunder and in certain other circumstances. Suspension, restriction or termination of the Managing Owner’s registration as a commodity pool operator would prevent it, until such time (if any) as such registration were to be reinstated, from managing, and might result in the termination of, the Fund. The CEAct gives the CFTC similar authority with respect to the activities of commodity trading advisors. If the registration of the Managing Owner as a commodity pool operator were to be terminated, restricted or suspended, the Managing Owner would be unable, until such time (if any) as such registration were to be reinstated, to render trading advice to the Fund. The Fund itself is not registered with the CFTC in any capacity.

The CEAct requires all “futures commission merchants,” such as PBI, to meet and maintain specified fitness and financial requirements, segregate customer funds from proprietary funds and account separately for all customers’ funds and positions, and to maintain specified books and records open to inspection by the staff of the CFTC.

8

Table of Contents

The CEAct also gives the states certain powers to enforce its provisions and the regulations of the CFTC.

Shareholders are afforded certain rights for reparations under the CEAct. Shareholders may also be able to maintain a private right of action for certain violations of the CEAct. The CFTC has adopted rules implementing the reparation provisions of the CEAct which provide that any person may file a complaint for a reparations award with the CFTC for violation of the CEAct against a floor broker, futures commission merchant, introducing broker, commodity trading advisor, commodity pool operator, and their respective associated persons.

Pursuant to authority in the CEAct, the NFA has been formed and registered with the CFTC as a “registered futures association.” At the present time, the NFA is the only non-exchange self-regulatory organization for commodities professionals. NFA members are subject to NFA standards relating to fair trade practices, financial condition, and consumer protection. As the self-regulatory body of the commodities industry, the NFA promulgates rules governing the conduct of commodity professionals and disciplines those professionals who do not comply with such standards. The CFTC has delegated to the NFA responsibility for the registration of commodity trading advisors, commodity pool operators, futures commission merchants, introducing brokers and their respective associated persons and floor brokers. BPI and the Managing Owner are members of the NFA (the Fund itself is not required to become a member of the NFA).

The CFTC has no authority to regulate trading on foreign commodity exchanges and markets.

Regulatory reform, by its nature, is unpredictable, and may be detrimental to the Fund and the Net Asset Value or the market price, as applicable, of your Shares. Under the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Reform Act”), the CFTC is required, among other things, to establish speculative position limits on exchange listed futures and options on physical commodities (including certain energy, metals and agricultural products) and economically equivalent over-the-counter derivatives. The Reform Act also requires the CFTC to establish aggregate position limits for contracts based on the same underlying commodity, including certain contracts traded on non-U.S. exchanges. Depending on the outcome of any future CFTC or futures exchanges rulemaking, as applicable, the rules concerning position limits or other position limitations, as applicable, may be amended in a manner that is detrimental to the Fund.

Employees

The Fund has no employees.

Reports to Shareholders and Available Information

The Fund files with or submits to the SEC annual, quarterly and current reports and other information meeting the informational requirements of the Exchange Act. The Managing Owner’s website at www.stream.bnpparibas.com includes a link to these reports. Investors may also inspect and copy these reports, proxy statements and other information, and related exhibits and schedules, at the Public Reference Room of the SEC at 100 F Street, NE, Washington, D.C. 20549, on official business days during the hours of 10 a.m. to 3 p.m. Investors may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet site that contains reports, proxy and information statements and other information filed electronically by us with the SEC which are available on the SEC’s Internet site at http://www.sec.gov.

9

Table of Contents

The Fund also posts monthly performance reports and its annual report, as required by the CFTC, on the Managing Owner’s website at the address listed above.

| ITEM 1A. | RISK FACTORS |

Not required.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

| ITEM 2. | PROPERTIES |

Not applicable.

| ITEM 3. | LEGAL PROCEEDINGS |

None.

| ITEM 4. | MINE SAFETY DISCLOSURES |

Not applicable.

10

Table of Contents

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Market Information

The Shares of the Fund have been trading on the NYSE Arca since June 6, 2012 under the symbol “BNPC.”

The following table sets forth, for the quarter indicated, the high and low closing sales prices per Share, as reported on the applicable exchange.

| Shares | ||||||||

| Quarter ended |

High | Low | ||||||

| August 31, 2012* |

$ | 28.72 | $ | 24.51 | ||||

| * | Commencing from June 6, 2012 (commencement of trading on NYSE Arca) |

Holders

As of August 31, 2012, the Fund had 11 holders of record of its Shares.

Distributions

The Managing Owner has sole discretion in determining what distributions, if any, the Fund makes to Shareholders.

The Fund paid no distributions for the Year Ended August 31, 2012.

Recent Sales of Unregistered Securities; Use of Proceeds from Registered Securities

The following table summarizes the redemptions by Authorized Participants for the period from June 1, 2012 through August 31, 2012:

| Period of Redemption |

Total Number

of Shares Redeemed |

Average Price Paid per Share |

||||||

| Period from June 1, 2012 through August 31, 2012: |

0 | $ | N/A | |||||

| ITEM 6. | SELECTED FINANCIAL DATA |

Not required.

11

Table of Contents

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

This information should be read in conjunction with the financial statements and notes included in Item 8 of Part II of this Annual Report (the “Report”). The discussion and analysis which follows may contain trend analysis and other forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”) which reflect our current views with respect to future events and financial results. Words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “seek,” “outlook” and “estimate,” as well as similar words and phrases, signify forward-looking statements. STREAM S&P Dynamic Roll Global Commodities Fund’s forward-looking statements are not guarantees of future results and conditions and important factors, risks and uncertainties may cause our actual results to differ materially from those expressed in our forward-looking statements.

You should not place undue reliance on any forward-looking statements. Except as expressly required by the Federal securities laws, BNP Paribas Quantitative Strategies, LLC (the “Managing Owner”), undertakes no obligation to publicly update or revise any forward-looking statements or the risks, uncertainties or other factors described in this Report, as a result of new information, future events or changed circumstances or for any other reason after the date of this Report.

Overview/Introduction

Fund Objective and Index

As described in Part I above, the Fund seeks to track changes, whether positive or negative, in the level of the S&P GSCI® Dynamic Roll Excess Return Index (the “Index”), over time, plus the excess, if any of the Fund’s interest from its holdings of cash, U.S. Treasury bonds, U.S. Treasury bills, U.S. government securities and related securities (the “Cash Instruments”) over the expenses of the Fund.

The Fund seeks to achieve its investment objective by investing in exchange-traded futures on the index commodities comprising the Index (the “Index Commodities”), with a view to tracking the Index over time. The Index aims to reflect the return of an investment in a world production-weighted portfolio comprised of the principal physical commodities that are the subject of active, liquid futures markets. The Index employs a flexible and systematic futures contract rolling methodology which seeks to maximize yield from rolling long futures contracts in certain markets (backwardated markets) and minimize roll loss from rolling long futures contracts in certain markets (contangoed markets).

The Fund does not intend to outperform the Index. The Managing Owner seeks to cause the net asset value of the Fund to track the Index during periods in which the Index is flat or declining as well as when the Index is rising.

Performance Summary

This Report covers the three months ended August 31, 2012. The Fund commenced investment operations on June 1, 2012 and Fund Shares commenced trading on the NYSE Arca, Inc. (the “NYSE Arca”) on June 6, 2012 under the symbol “BNPC”.

Performance of the Fund and the exchange traded Shares are detailed below in “Results of Operations.” Past performance of the Fund is not necessarily indicative of future performance.

12

Table of Contents

S&P GSCI® Dynamic Roll Excess Return Index (the “Index”) aims to reflect the return of an investment in a world production-weighted portfolio comprised of the principal physical commodities that are the subject of active, liquid futures markets. The Index employs a flexible and systematic futures contract rolling methodology which seeks to maximize yield from rolling long futures contracts in certain markets (backwardated markets) and minimize roll loss from rolling long futures contracts in certain markets (contangoed markets).

The section “Summary of S&P GSCI® Dynamic Roll Excess Return Index and the Underlying Designated Contracts Returns for the Three Months Ended August 31, 2012” below provides the changes in the closing levels of S&P GSCI® Dynamic Roll Excess Return Index by disclosing the percentage change of each of the Index Commodities as reflected by each corresponding underlying Designated Contract. Please note that the Fund’s objective is to track the Index and the Fund does not attempt to outperform or underperform the Index.

Summary of S&P GSCI® Dynamic Roll Excess Return Index and Underlying Designated Contracts Returns for the

Three Months Ended August 31, 2012

| Underlying Designated Contracts |

Returns for the Three Months Ended August 31, 2012 | |

| Chicago Wheat |

23.03% | |

| Kansas City Wheat |

34.05% | |

| Corn |

56.56% | |

| Soybeans |

39.63% | |

| Coffee |

1.14% | |

| Sugar #11 |

3.85% | |

| Cocoa |

25.70% | |

| Cotton #2 |

14.27% | |

| Lean Hogs |

-10.58% | |

| Live Cattle |

0.67% | |

| Feeder Cattle |

-10.24% | |

| Crude Oil |

12.71% | |

| Heating Oil |

17.04% | |

| RBOB Gasoline |

24.02% | |

| Brent Crude Oil |

18.39% | |

| Gasoil |

15.11% | |

| Natural Gas |

3.72% | |

| Aluminum |

-4.98% |

13

Table of Contents

| Underlying Designated Contracts |

Returns for the Three Months Ended August 31, 2012 | |

| Copper |

3.60% | |

| Lead |

2.89% | |

| Nickel |

-1.24% | |

| Zinc |

-3.13% | |

| Gold |

3.75% | |

| Silver |

9.90% | |

| AGGREGATE RETURN OF INDEX: |

15.17% |

Pursuant to the rules and regulations of the Exchange Act, the above table discloses the change in levels of the Index for the period covered by this Report. If the Fund’s interest income from its holdings of fixed-income securities exceeds the Fund’s fees and expenses, then the amount of such excess is expected to be distributed periodically. The market price of the Shares is expected to closely track the Index. The aggregate return on an investment in the Fund over any period is the sum of the capital appreciation or depreciation of the Shares over the period, plus the amount of any distributions during the period.

Net Asset Value

Net Asset Value means the total assets of the Fund including, but not limited to, all cash and cash equivalents or other debt securities less total liabilities of the Fund, each determined on the basis of generally accepted accounting principles. In particular, Net Asset Value includes any unrealized profit or loss on open Designated Contracts, Cleared Swaps, Substitute Contracts, Alternative Financial Instruments (if any) and any other credit or debit accruing to the Fund but unpaid or not received by the Fund. All open commodity futures contracts traded on a U.S. or non-U.S. exchange will be calculated at their then current market value, which will be based upon the settlement price for that particular commodity futures contract traded on the applicable U.S. or non-U.S. exchange on the date with respect to which Net Asset Value is being determined; provided, that if a commodity futures contract traded on a U.S. or on a non-U.S. exchange could not be liquidated on such day, due to the operation of daily limits (if applicable) or other rules of the exchange upon which that position is traded or otherwise, the settlement price on the most recent day on which the position could have been liquidated will be the basis for determining the market value of such position for such day. The Managing Owner may in its discretion (and under extraordinary circumstances, including, but not limited to, periods during which a settlement price of a futures contract is not available due to exchange limit orders or force majeure type events such as systems failure, natural or man-made disaster, act of God, armed conflict, act of terrorism, riot or labor disruption or any similar intervening circumstance) value any asset of the Fund pursuant to such other principles as the Managing Owner deems fair and equitable so long as such principles are consistent with normal industry standards. Interest earned on the Fund’s commodity brokerage accounts is expected to accrue at least monthly. The amount of any distribution will be a liability of the Fund from the day when the distribution is declared until it is paid.

The value of Cleared Swaps is determined based on the value of the Designated Contract underlying the Index Commodity in connection with each specific Cleared Swap.

14

Table of Contents

In calculating the Net Asset Value of the Fund, the settlement value of a Cleared Swap (if any) and an Alternative Financial Instrument (if any) is determined by either applying the then-current disseminated value for the Designated Contracts or the terms as provided under the applicable Cleared Swap or Alternative Financial Instrument, as applicable. However, in the event that the Designated Contracts are not trading due to the operation of daily limits or otherwise, the Managing Owner may in its sole discretion choose to value the Fund’s Cleared Swap or Alternative Financial Instrument (if any) on a fair value basis in order to calculate the Fund’s Net Asset Value.

Net Asset Value per Share is the Net Asset Value of the Fund divided by the number of its outstanding Shares.

Critical Accounting Policies

The Fund’s critical accounting policies are as follows:

Preparation of the financial statements and related disclosures in accordance with U.S. generally accepted accounting principles requires the application of appropriate accounting rules and guidance, as well as the use of estimates. The Fund’s application of these policies involves judgments and the use of estimates. Actual results may differ from the estimates used and such differences could be material. The Fund will hold a significant portion of its assets in futures contracts and Cash Instruments, each of which, as applicable, will be held at fair value. The Fund may also invest in Cleared Swaps, Substitute Contracts and/or Alternative Financial Instruments.

Fair Value - Definition and Hierarchy

In accordance with U.S. GAAP, fair value is defined as the price that would be received to sell an asset or paid to transfer a liability (i.e., the “exit price”) in an orderly transaction between market participants at the measurement date.

In determining fair value, the Fund uses various valuation approaches. In accordance with U.S. GAAP, a fair value hierarchy for inputs is used in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs by requiring that the most observable inputs be used when available. Observable inputs are those that market participants would use in pricing the asset or liability based on market data obtained from sources independent of the Fund. Unobservable inputs reflect the Fund’s assumptions about the inputs market participants would use in pricing the asset or liability developed based on the best information available in the circumstances. The fair value hierarchy is categorized into three levels based on the inputs as follows:

Level 1 - Valuations based on unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access. Valuation adjustments and block discounts are not applied to Level 1 securities. Since valuations are based on quoted prices that are readily and regularly available in an active market, valuation of these securities does not entail a significant degree of judgment.

Level 2 - Valuations based on quoted prices in markets that are not active or for which all significant inputs are observable, either directly or indirectly.

Level 3 - Valuations based on inputs that are unobservable and significant to the overall fair value measurement.

15

Table of Contents

The availability of valuation techniques and observable inputs can vary from security to security and is affected by a wide variety of factors including the type of security, whether the security is new and not yet established in the marketplace, and other characteristics particular to the transaction. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Those estimated values do not necessarily represent the amounts that may be ultimately realized due to the occurrence of future circumstances that cannot be reasonably determined. Because of the inherent uncertainty of valuation, those estimated values may be materially higher or lower than the values that would have been used had a ready market for the securities existed. Accordingly, the degree of judgment exercised by the Fund in determining fair value is greatest for securities categorized in Level 3. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy, within which the fair value measurement in its entirety falls, is determined based on the lowest level input that is significant to the fair value measurement.

Fair value is a market-based measure considered from the perspective of a market participant rather than an entity-specific measure. Therefore, even when market assumptions are not readily available, the Fund’s own assumptions are set to reflect those that market participants would use in pricing the asset or liability at the measurement date. The Fund uses prices and inputs that are current as of the measurement date, including during periods of market dislocation. In periods of market dislocation, the observability of prices and inputs may be reduced for many securities. This condition could cause a security to be reclassified to a lower level within the fair value hierarchy. For instance, when Corn Futures Contracts on the Chicago Board of Trade (“CBOT”) are not actively trading due to a “limit-up” or limit-down” condition, meaning that the change in the Corn Futures Contracts has exceeded the limits established, the Trust and the Fund will revert to alternative verifiable sources of valuation of its assets. When such a situation exists on a quarter close, the Managing Owner will calculate the NAV on a particular day using the Level 1 valuation, but will later recalculate the NAV for the impacted Fund based upon the valuation inputs from these alternative verifiable sources (Level 2 or Level 3) and will report such NAV in its applicable financial statements and reports.

The Fund records its derivative activities at fair value. Profits and losses from derivative contracts are included in the Statement of Operations. Derivative contracts include futures contracts related to commodity prices. Futures, which are listed on a national securities exchange, such as the CBOT or the New York Mercantile Exchange (“NYMEX”), or reported on another national market, are generally categorized in Level 1 of the fair value hierarchy. The Fund also trades futures contracts on the London Metals Exchange (LME). The valuation pricing for LME contracts is based on action of a committee that incorporates prices from the most liquid trading sessions of the day and can also rely on other inputs such as supply and demand factors and bid and asks from open outcry sessions. These are considered to be level 2 positions. OTC derivatives contracts (such as forward and swap contracts) which may be valued using models, depending on whether significant inputs are observable or unobservable, are categorized in Levels 2 or 3 of the fair value hierarchy.

Liquidity and Capital Resources

All of the Fund’s capital is derived from the Fund’s offering of Shares to Authorized Participants. The Fund in turn allocates its net assets to commodities trading. A significant portion of the net asset value is held in Cash Instruments, which may be used as margin for the Fund’s trading in commodities. The percentage that Cash Instruments bear to the total net assets will vary from period to period as the market values of the Fund’s commodity interests change. The balance of the net assets is held in the Fund’s commodity trading account. Interest earned on the Fund’s interest-bearing balances are paid to the Fund.

16

Table of Contents

If the Fund invests in Cleared Swaps and/or Alternative Financial Instruments, a portion of its proceeds of the offering may be used to collateralize the Cleared Swaps and/or Alternative Financial Instruments, as applicable, in accordance with normal market practices.

Although the following percentages may vary substantially over time, as of the date of this report, the Fund estimates that up to approximately 10% of its Net Asset Value will be placed in segregated accounts (pursuant to the rules of the CFTC) in the name of the Fund with PBI and CFL (or another eligible financial institution, as applicable) in the form of Cash Instruments and unrealized appreciation/depreciation of futures contracts to margin positions of all futures contracts combined. The Fund maintains approximately 90% of its Net Asset Value in Cash Instruments over and above that which is needed to post as collateral for trading. The percentage that the Fund’s Cash Instruments will bear to the total net assets will vary from period to period as the market values of commodity interests change. The balance of the net assets will be held in the Fund’s segregated and custodial account with the Custodian or Commodity Broker.

“Initial” or “original” margin is the minimum amount of funds that must be deposited by a futures trader with his commodity broker in order to initiate futures trading or to maintain an open position in futures contracts. “Maintenance” margin is the amount (generally less than initial margin) to which a trader’s account may decline before he must deliver additional margin. Margin requirements are computed each day by a commodity broker. When the market value of a particular open futures position changes to a point where the margin on deposit does not satisfy maintenance margin requirements, a margin call is made by the commodity broker. The Fund will meet a margin call by either liquidating an appropriate amount of Cash Instruments, as applicable, or satisfies the margin call with cash. If the Fund does not have a sufficient amount of Cash Instruments to satisfy the margin call, the Fund will be required to liquidate its holdings of futures contracts, Cleared Swaps or Alternative Financial Instruments (if any). If the margin call is not met within the required time, the broker may close out the Fund’s position.

The amount of margin that is required to establish and maintain a Cleared Swap is determined by the exchange which clears the applicable Cleared Swap. Additionally, the requirements and the logistics related to margin with respect to Cleared Swaps is substantially similar to futures contracts.

The Fund’s commodity futures contracts may be subject to periods of illiquidity because of market conditions, regulatory considerations and other reasons. For example, commodity exchanges limit fluctuations in certain commodity futures contract prices during a single day by regulations referred to as “daily limits.” During a single day, no trades may be executed at prices beyond the daily limit. Once the price of a futures contract for a particular commodity has increased or decreased by an amount equal to the daily limit, positions in the commodity futures contracts can neither be taken nor liquidated unless the traders are willing to effect trades at or within the limit. Commodity futures prices have occasionally moved the daily limit for several consecutive days with little or no trading. Such market conditions could prevent the Fund from promptly liquidating its commodity futures positions.

The Fund’s Cleared Swaps and Alternative Financial Instruments, if any, may also be subject to periods of illiquidity because of market conditions, regulatory considerations and other reasons. For example, the Alternative Financial Instruments are not traded on an exchange, do not have uniform terms and conditions, and in general are not transferable without the consent of the counterparty. Entry into Alternative Financial Instruments (if any) may further impact liquidity because these contractual agreements are executed “off-exchange” between private parties and, therefore, the time required to offset or “unwind” these positions may be greater than that for exchange-traded instruments. This potential delay could be exacerbated to the extent a counterparty is not a U.S. person.

17

Table of Contents

Because the Fund trades futures contracts, its capital is at risk due to changes in the market price of these contracts (market risk) or the inability of counterparties to perform under the terms of the contracts (credit risk). The Fund’s capital would be at risk in connection with its cleared swaps due to changes in the value of these cleared swaps (market risk) or the inability of counterparties to perform under the terms of the contracts (credit risk). Additionally, if the Fund invested in Alternative Financial Instruments, its capital would be at risk due to changes in the value of these Alternative Financial Instruments (market risk) or the inability of counterparties to perform under the terms of the Alternative Financial Instruments (credit risk).

Authorized Participants may also redeem Baskets of Shares. On any business day, an Authorized Participant may place an order with the Managing Owner to redeem one or more Baskets. Redemption orders must be placed by 10:00 a.m., New York time. The day on which the Managing Owner receives a valid redemption order is the redemption order date. Redemption orders are irrevocable. The redemption procedures allow only Authorized Participants to redeem Baskets. Individual Shareholders may not redeem directly from the Fund. By placing a redemption order, an Authorized Participant agrees to deliver the Baskets to be redeemed through DTC’s book-entry system to the Fund not later than noon, New York time, on the business day immediately following the redemption order date. By placing a redemption order, and prior to receipt of the redemption proceeds, an Authorized Participant’s DTC account is charged the non-refundable transaction fee due for the redemption order.

Market risk

Trading in futures contracts, Cleared Swaps and Alternative Financial Instruments (if any) involves the Fund entering into contractual commitments to purchase or sell a particular commodity at a specified date and price. The market risk associated with the Fund’s commitments to purchase commodities are limited to the gross or face amount of the futures contracts, the Cleared Swaps or the Alternative Financial Instruments (if any) held.

The Fund’s exposure to market risk is influenced by a number of factors including the volatility of interest rates and foreign currency exchange rates, the liquidity of the markets associated with the contracts and the relationships among the contracts held. The inherent uncertainty of the Fund’s trading as well as the development of drastic market occurrences could ultimately lead to a loss of all or substantially all of investors’ capital.

Credit risk

When the Fund enters into futures contracts, Cleared Swaps or Alternative Financial Instruments (if any), the Fund is exposed to credit risk that the counterparty to the contract will not meet its obligations.

The counterparty for futures contracts traded on U.S. and on most foreign futures exchanges is the clearing house associated with the particular exchange. In general, clearing houses are backed by their corporate members who may be required to share in the financial burden resulting from the nonperformance by one of their members and, as such, should significantly reduce this credit risk. In cases where the clearing house is not backed by the clearing members (i.e., some foreign exchanges), it may be backed by a consortium of banks or other financial institutions.

When the Fund enters into Cleared Swaps, the Fund will be exposed to credit risk that the clearinghouse for the Cleared Swaps will not meet its obligations. However, the Fund will not be subject to individual dealer counterparty risk that exists in over the counter swaps that are not cleared through a clearinghouse.

18

Table of Contents

There can be no assurance that any counterparty, clearing member or clearing house will meet its obligations to the Fund.

Cleared Swaps may not generally involve the delivery of the underlying assets either at the outset of a transaction or upon settlement. Because Cleared Swaps are cleared by a clearinghouse, the Fund is not subject to the counterparty risks associated with a swap agreement as described in the next paragraph. However, the Fund is subject to the risk that the clearinghouse may fail to clear the Cleared Swap and therefore may suffer a full loss.

Swap agreements do not generally involve the delivery of the underlying assets either at the outset of a transaction or upon settlement. Accordingly, if the counterparty to a swap agreement defaults, the Fund’s risk of loss consists of the net amount of payments that the Fund is contractually entitled to receive, if any. Swap counterparty risk is generally limited to the amount of any unrealized gains, although in the event of a counterparty bankruptcy, there could be delays and costs associated with recovery of collateral posted in segregated tri-party accounts at the Fund’s custodian bank.

Forward agreements do not involve the delivery of the underlying assets at the onset of a transaction, but may be settled physically in the underlying asset if such contracts are held to expiration. Thus, prior to settlement, if the counterparty to a forward contract defaults, the Fund’s risk of loss consists of the net amount of payments that the Fund is contractually entitled to receive, if any. However, if physically settled forwards are held until expiration (presently, there is no plan to do this), at the time of settlement, the Fund may be at risk for the full notional value of the forward contracts depending on the type of settlement procedures used.

The Managing Owner attempts to minimize these market and credit risks by requiring the Fund to abide by various trading limitations and policies, which include limiting margin accounts and trading only in liquid markets. The Managing Owner implemented procedures which include, but are not be limited to:

| • | executing and clearing trades with creditworthy counterparties; |

| • | limiting the amount of margin or premium required for any one futures contract or all futures contracts combined; and |

| • | generally limiting transactions to futures contracts which will be traded in sufficient volume to permit the taking and liquidating of positions. |

The Fund will enter into Alternative Financial Instruments (if any) with counterparties selected by the Managing Owner. The Managing Owner will select Alternative Financial Instrument (if any) counterparties giving due consideration to such factors as it deems appropriate, including, without limitation, creditworthiness, familiarity with the Index, and price. Under no circumstances will the Fund enter into an Alternative Financial Instrument (if any) with any counterparty whose credit rating is lower than investment-grade at the time a contract is entered into.

PBI, when acting as the Fund’s futures commission merchant in accepting orders for the purchase or sale of domestic futures contracts, will be required by CFTC regulations to separately account for and segregate as belonging to the Fund, all assets of the Fund held at PBI relating to domestic futures trading and PBI will not be allowed to commingle such assets with other assets of PBI. In addition, CFTC regulations will also require PBI to hold in a secure account assets of the Fund related to foreign futures trading.

CFL is subject to the rules and regulations of the Financial Services Authority.

19

Table of Contents

Concentration

At August 31, 2012, Arbitrage, which is a related party, continued to be a majority shareholder and owned approximately 99% of the outstanding units. If it decided to redeem, it would substantially impact the Fund’s ability to operate.

Cash Flows

The primary cash flow activity of the Fund originates from Authorized Participants through the issuance of Shares of the Fund. This cash may be invested into the Fund where it is used to invest in Cash Instruments and to meet margin requirements as a result of the positions taken in futures contracts to match the fluctuations of the Index that the Fund is attempting to track.

Operating Activities

Net cash flow used in operating activities was $14,967,011 for the three months ended August 31, 2012. This amount includes an increase in collateral due from brokers of $402,501 as reflected in the Statement of Financial Condition.

During the three months ended August 31, 2012, $29,095,260 was paid to purchase Cash Instruments and $13,500,000 was received from maturing Cash Instruments.

Financing Activities

The Fund’s net cash flow provided by financing activities was $15,000,000 for the three months ended August 31, 2012, consisting of $15,000,000 from the sale of Shares to Authorized Participants and $0 paid on the redemption of Shares by Authorized Participants.

Results of Operations

The Fund commenced investment operations on June 1, 2012 at $25.00 per Share. The Shares have been trading on the NYSE Arca since June 6, 2012 under the symbol “BNPC”.

The Fund seeks to achieve its investment objective by investing in exchange-traded futures on the index commodities comprising the S&P GSCI® Dynamic Roll Excess Return Index (the “Index”), with a view to tracking the Index over time.

The Index is a set of rules applied to a body of data and does not represent the results of actual investment or trading. The Index is frictionless, in that it does not take into account fees or expenses associated with investing in the Fund. Also, because it does not represent actual futures positions, the Index is not subject to, and does not take into account the impact of, speculative position limits or certain other similar limitations on the ability of the Fund to trade the Index Commodities. The Fund, by contrast, invests actual money and trades actual futures contracts. As a result, the performance of the Fund involves friction, in that fees and expenses impose a drag on performance. The Fund may be subject to speculative position limits and certain other limitations on its ability to trade the Index Commodities, which may compel the Fund to trade Cleared Swaps, Substitute Contracts, or Alternative Financial Instruments, as applicable, as proxies for the Index Commodities. All of these factors can contribute to discrepancies between changes in net asset value per Share and changes in the level of the Index over any period of time. Fees and expenses always will tend to cause changes in the net asset value per Share to underperform changes in the value of the Index over any given period, all other things being equal.

20

Table of Contents

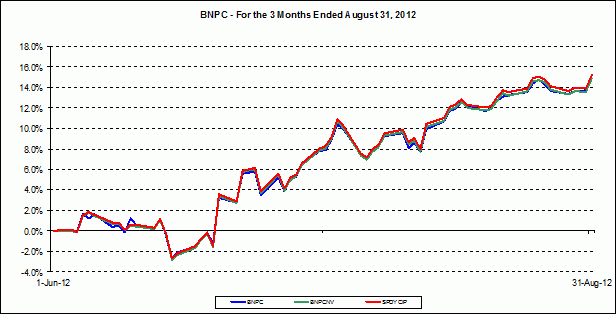

The following graph illustrates changes in the price of the Shares, Share net asset value and the Index for the three months ended August 31, 2012.

COMPARISON OF BNPC, BNPC NAV AND THE INDEX FOR

THE THREE MONTHS ENDED AUGUST 31, 2012

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND

CHANGES, POSITIVE OR NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S

FUTURE PERFORMANCE.

See Additional Legend below.

21

Table of Contents

Additional Legends

The Index does not reflect (i) actual trading and (ii) any fees or expenses.

With respect to Index data, no representation is being made that the Index will or is likely to achieve annual or cumulative closing levels consistent with or similar to those set forth in the graph above. Similarly, no representation is being made that the Fund will generate profits or losses similar to the Fund’s past performance or the historical annual or cumulative changes in the Index closing levels. In fact, there are frequently sharp differences between hypothetical results and the actual results subsequently achieved by investment methodologies, whether active or passive.

No hypothetical record can completely account for the impact of financial risk in actual trading. For example, there are numerous factors, including those described in the “Risk Factors” set forth in the Fund’s Prospectus dated June 1, 2012, related to the relevant market segments in general or to the implementation of the Fund’s efforts to track the Index over time which cannot be, and have not been, accounted for in the preparation of the Index information set forth on the graph above, all of which can adversely affect actual performance results for the Fund. Furthermore, the Index information does not involve financial risk or account for the impact of fees and costs associated with the Fund.

The Managing Owner commenced operations on April 30, 2010. As managing owner, the Managing Owner and its trading principals have been managing the day-to-day operations for the Fund and, if applicable, related products and managing futures accounts. Because there are limited actual trading results to compare to the Index closing levels set forth above, current and prospective investors should be particularly wary of placing undue reliance on the cumulative Index results as reflected in the graph above.

FOR THE PERIOD FROM JUNE 1, 2012 TO AUGUST 31, 2012

Fund Share Price Performance

During the period from June 6, 2012 (commencement of Shares trading on the NYSE Arca) to August 31, 2012, the NYSE Arca market value of each Share increased 12.89% from $25.44 per Share, representing the initial trade on June 6, 2012 to $28.72 per Share, representing the closing price on August 31, 2012. The closing Share price high and low for the period June 6, 2012 to August 31, 2012 and related change from the initial Share price on June 6, 2012 was as follows: Shares traded from a high of $28.72 per Share (+12.89%) on August 21, 2012 to a low of $24.51 per Share (-3.66%) on June 22, 2012.

22

Table of Contents

Fund Share Net Asset Value Performance

For the period from June 1, 2012 (commencement of investment operations) to August 31, 2012, the net asset value of each Share increased 14.84% from $25.00 per Share to $28.71 per Share (NAV calculation methodology as described in the notes to the financials). Appreciation in futures contracts prices for Crude Oil, Brent Crude Oil, Heating Oil, RBOB Gasoline, Gasoil, Natural Gas, Live cattle, Chicago Wheat, Kansas City Wheat, Corn, Soybeans, Coffee, Sugar #11, Cocoa, Cotton #2, Gold, Silver, Copper and Lead during the period from June 1, 2012 to August 31, 2012 more than offset falling prices for Feeder Cattle, Lean Hogs, Aluminum, Nickel and Zinc during that same period, contributing to an overall 15.17% increase in the level of the Index. No distributions were paid to Shareholders during the period ended August 31, 2012. Therefore, the total return for the Fund on a net asset value basis was 14.84%.

Net income for the period from June 1, 2012 to August 31, 2012, was $2,240,138, resulting from $2,054 of interest income, net realized gain on investments and futures contracts of $933,091, net unrealized gain on futures contracts of $1,339,462, net unrealized gain on US Treasury obligations of $15 and net operating expenses of $34,484.

Off-Balance Sheet Arrangements and Contractual Obligations

In the normal course of its business, the Fund is party to financial instruments with off-balance sheet risk. The term “off-balance sheet risk” refers to an unrecorded potential liability that, even though it does not appear on the Statement of Financial Condition, may result in a future obligation or loss. The instruments used by the Fund are futures contracts, whose values are based upon an underlying asset and generally represent future commitments which have a reasonable possibility to be settled in cash or through physical delivery. The instruments are traded on an exchange and are standardized contracts.

The Fund has not utilized, nor does it expect to utilize in the future, special purpose entities to facilitate off-balance sheet financing arrangements and have no loan guarantee arrangements or off-balance sheet arrangements of any kind, other than agreements entered into in the normal course of business noted above, which may include indemnification provisions related to certain risks service providers undertake in performing services which are in the best interests of the Fund. While the Fund’s exposure under such indemnification provisions cannot be estimated, these general business indemnifications are not expected to have a material impact on the Fund’s financial position.

The Fund’s contractual obligations are with the Managing Owner and the Commodity Brokers. Management Fee payments made to the Managing Owner are calculated as a fixed percentage of the Fund’s net asset value, net of any applicable waivers. Commission payments to the Commodity Brokers are on a contract-by-contract, or round-turn, basis. As such, the Managing Owner cannot anticipate the amount of payments that will be required under these arrangements for future periods as net asset values are not known until a future date. These agreements are effective for one-year terms, renewable automatically for additional one-year terms unless terminated. Additionally, these agreements may be terminated by either party for various reasons.

| ITEM 7A. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK. |

Not required.

23

Table of Contents

| ITEM 8. | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA |

Report of Independent Registered Public Accounting Firm

To the Board of Managers of BNP Paribas Quantitative Strategies, LLC and the Shareholders of STREAM Exchange Traded Trust: