Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NEW JERSEY RESOURCES CORP | d446119d8k.htm |

| EX-99.1 - EXHIBIT 99.1 - NEW JERSEY RESOURCES CORP | d446119dex991.htm |

New Jersey

Resources 4

th

Quarter Fiscal 2012 Update

November 29,2012

Exhibit 99.2 |

Regarding

Forward-Looking Statements Certain statements contained in this presentation are

forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-

looking

statements

can

also

be

identified

by

the

use

of

forward-looking

terminology

such

as

“may,”

"will",

“intend,”

“expect,”

"believe,"

or

“continue”

or

comparable

terminology and are made based upon management’s current expectations and beliefs as of

this date concerning future developments and their potential effect upon New

Jersey

Resources

(NJR

or

the

Company).

There

can

be

no

assurance

that

future

developments

will

be

in

accordance

with

management’s

expectations

or

that

the

effect

of

future developments on the Company will be those anticipated by management. NJR cautions

persons reading or hearing this presentation that the assumptions that form the

basis

for

forward-looking

statements

regarding

expected

contribution

by

new

customers

of

New

Jersey

Natural

Gas

Company

(NJNG)

to

utility

gross

margin,

expected

number of new customers of NJNG, the completion of NJRCEV's planned solar projects in fiscal

2013, estimated capital expenditures in fiscal 2013, by NJNG and NJRCEV, and

the

potential

impact

of

post-tropical

cyclone

Sandy,

(commonly

referred

to

as

“Hurricane”

or

“Superstorm”

Sandy)

The

factors

that

could

cause

actual

results

to

differ

materially

from

NJR’s

expectations

include,

but

are

not

limited

to,

weather

and

economic

conditions;

demographic

changes

in

the

NJNG

service

territory

and

their

effect

on

NJNG's

customer

growth;

volatility

of

natural

gas

and

other

commodity

prices

and

their

impact

on

NJNG

customer

usage, NJNG's Basic Gas Supply Service incentive programs, NJRES' operations and on the

Company's risk management efforts; changes in rating agency requirements and/or credit

ratings and their effect on availability and cost of capital to the Company; the impact of volatility in the credit markets; the ability to comply with debt

covenants;

the

impact

to

the

asset

values

and

resulting

higher

costs

and

funding

obligations

of

NJR's

pension

and

postemployment

benefit

plans

as

a

result

of

downturns

in

the financial markets, a lower discount rate, and impacts associated with the Patient

Protection and Affordable Care Act; accounting effects and other risks associated with

hedging activities and use of derivatives contracts; commercial and wholesale credit risks,

including the availability of creditworthy customers and counterparties and

liquidity

in

the

wholesale

energy

trading

market;

the

ability

to

obtain

governmental

approvals

and/or

financing

for

the

construction,

development

and

operation

of

certain

non-regulated energy investments; risks associated with the management of the Company's

joint ventures and partnerships; risks associated with our investments in renewable

energy projects and our investment in an on-shore wind developer, including the availability of regulatory and tax incentives, logistical risks and potential delays

related

to

construction,

permitting,

regulatory

approvals

and

electric

grid

interconnection,

the

availability

of

viable

projects

and

NJR's

eligibility

for

federal

investment

tax

credits

(ITC),

the

future

market

for

Solar

Renewable

Energy

Certificates,

the

potential

expiration

of

the

federal

Production

Tax

Credit

(PTC)

and

operational

risks

related

to

projects

in

service;

timing

of

qualifying

for

ITCs

due

to

delays

or

failures

to

complete

planned

solar

energy

projects

and

the

resulting

effect

on

our

effective

tax

rate

and

earnings;

the

level

and

rate

at

which

NJNG's

costs

and

expenses

are

incurred

and

the

extent

to

which

they

are

allowed

to

be

recovered

from

customers

through

the

regulatory process; access to adequate supplies of natural gas and dependence on

third-party storage and transportation facilities for natural gas supply; operating risks

incidental

to

handling,

storing,

transporting

and

providing

customers

with

natural

gas;

risks

related

to

our

employee

workforce,

including

a

work

stoppage;

the

regulatory

and pricing policies of federal and state regulatory agencies; the possible expiration of the

NJNG Conservation Incentive Program (CIP), the costs of compliance with the proposed

regulatory framework for over-the-counter derivatives; the costs of compliance with present and future environmental laws, including potential climate change-

related legislation; risks related to changes in accounting standards; the disallowance of

recovery of environmental-related expenditures and other regulatory changes;

environmental-related and other litigation and other uncertainties; and the impact of

natural disasters, terrorist activities, and other extreme events on our operations and

customers,

including

the

impacts

associated

with

Superstorm

Sandy.

The

aforementioned

factors

are

detailed

in

the

“Risk

Factors”

sections

of

our

Annual

Report

on

Form

10-K

filed

on

November

28,

2012,

as

filed

with

the

Securities

and

Exchange

Commission

(SEC)

and

which

is

available

on

the

SEC’s

website

at

sec.gov.

NJR

disclaims any obligation to update and revise statements contained in these materials

based on new information or otherwise. 2 |

Disclaimer

Regarding Non-GAAP Financial Measures 3

This presentation includes the non-GAAP measures net financial earnings (losses), financial

margin and utility gross margin. As an indicator of

the

company’s

operating

performance,

these

measures

should

not

be

considered

an

alternative

to,

or

more

meaningful

than,

GAAP

measures such as cash flow, net income, operating income or earnings per share. Net financial

earnings (losses) and financial margin exclude unrealized gains or losses on derivative

instruments related to the company’s unregulated subsidiaries and certain realized gains and losses

on derivative instruments related to natural gas that has been placed into storage at NJRES.

Volatility associated with the change in value of these financial and physical commodity

contracts is reported in the income statement in the current period. In order to manage its business,

NJR views its results without the impacts of the unrealized gains and losses, and certain

realized gains and losses, caused by changes in value

of

these

financial

instruments

and

physical

commodity

contracts

prior

to

the

completion

of

the

planned

transaction

because

it

shows

changes in value currently as opposed to when the planned transaction ultimately is settled.

NJNG’s utility gross margin represents the results

of

revenues

less

natural

gas

costs,

sales

and

other

taxes

and

regulatory

rider

expenses,

which

are

key

components

of

the

company’s

operations that move in relation to each other.

Management uses net financial earnings (NFE), financial margin and utility gross margin as

supplemental measures to other GAAP results to provide a more complete understanding of

the company’s performance. Management believes these non-GAAP measures are more

reflective of the company’s business model, provide transparency to investors and

enable period-to-period comparability of financial performance.

For

a

full

discussion

of

our

non-GAAP

financial

measures,

please

see

Item

7

of

our

Annual

Report

on

Form

10-K

for

the

fiscal

year

ended

September

30,

2012,

filed

on

November

28,

2012. |

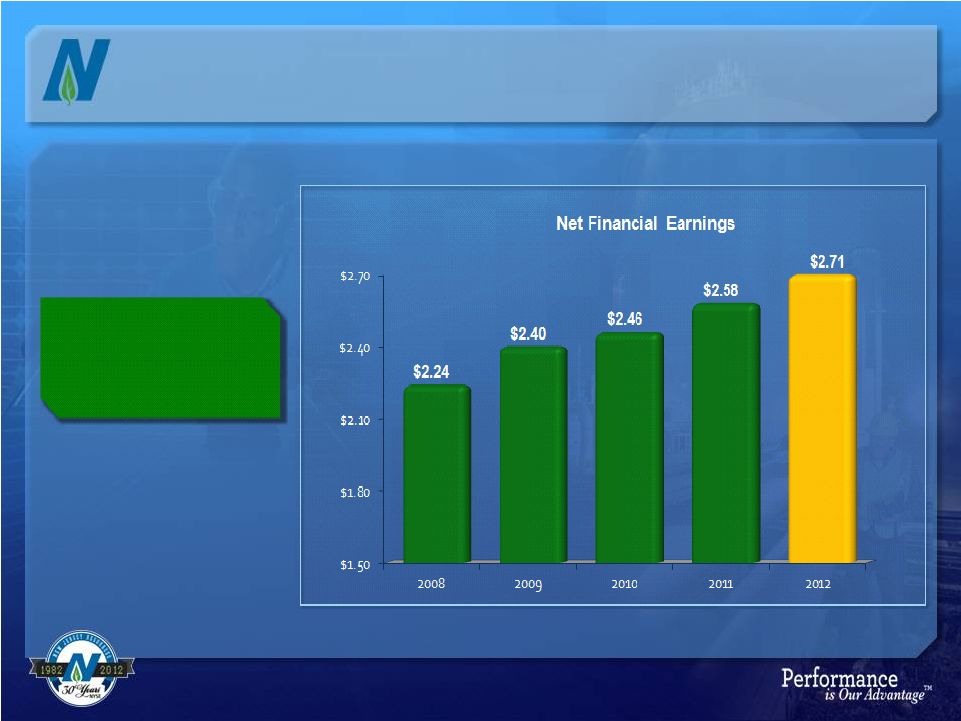

Delivering

Results 4

($MM)

Company

2012

2011

Change

New Jersey Natural Gas

$73.2

$71.3

$1.9

NJR Clean Energy

19.5

6.8

12.7

NJR Energy Services

10.8

18.6

(7.8)

NJR Energy Holdings

6.7

6.8

(0.1)

NJR Home Services

2.5

2.4

0.1

Other

(0.3)

0.6

(0.9)

Total

$112.4

$106.5

$5.9

NFE per basic share

$2.71

$2.58

$.13

September 30, |

Consistent

Performance 5

Five year CAGR of

5.1 percent |

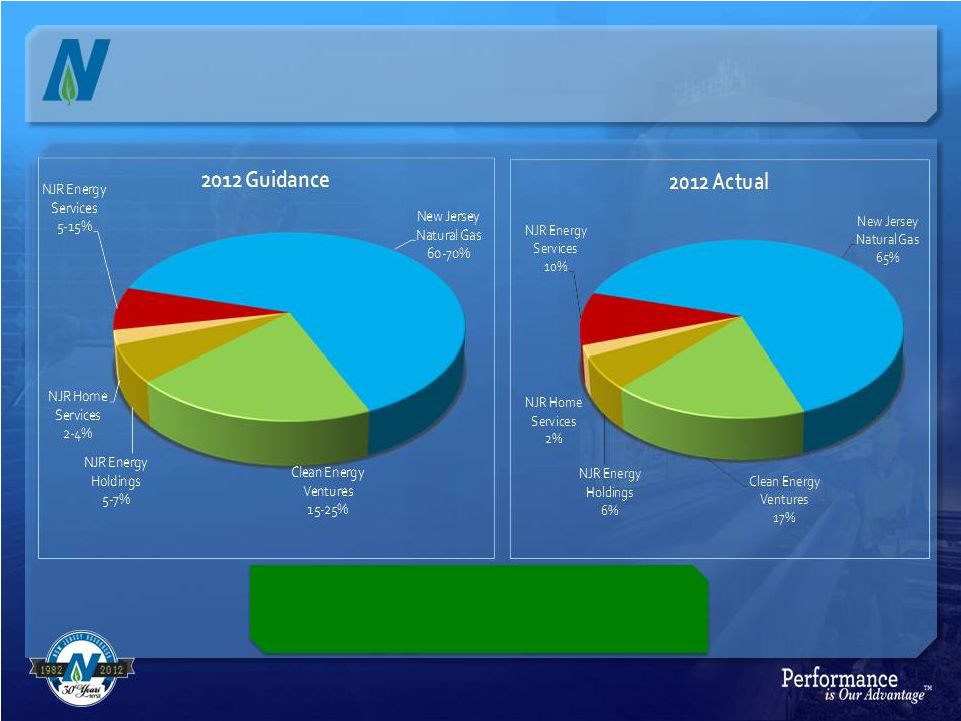

Fiscal 2012

Earnings: Comparison to Guidance 6

Infrastructure-based businesses contributed

90 percent of fiscal 2012 NFE |

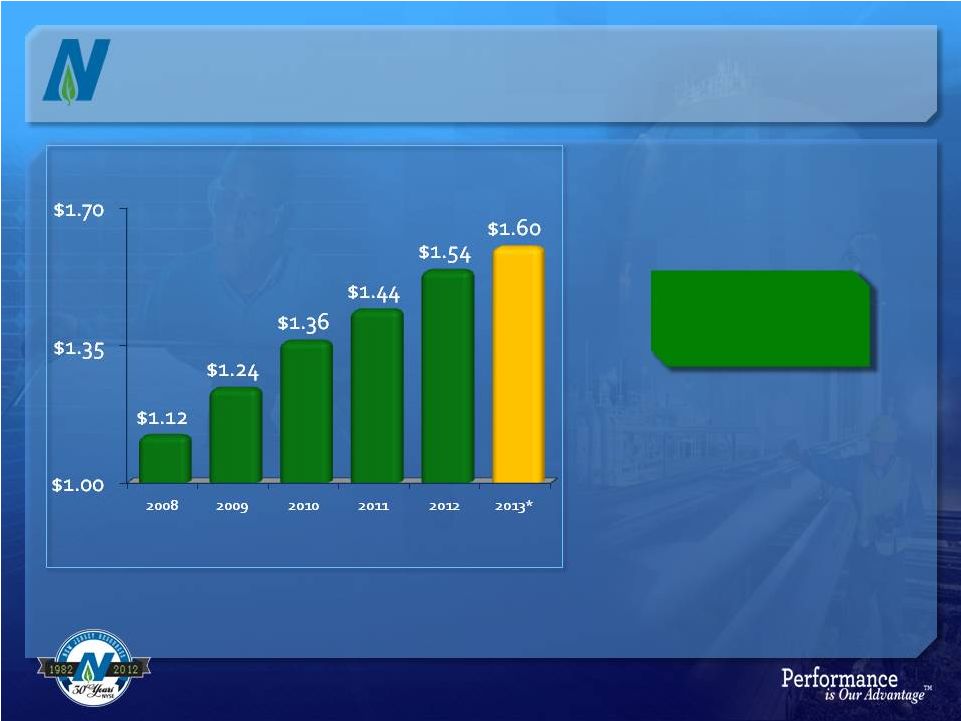

Dividend

Growth 19 dividend

increase in 17 years

* Current annual rate

7

th |

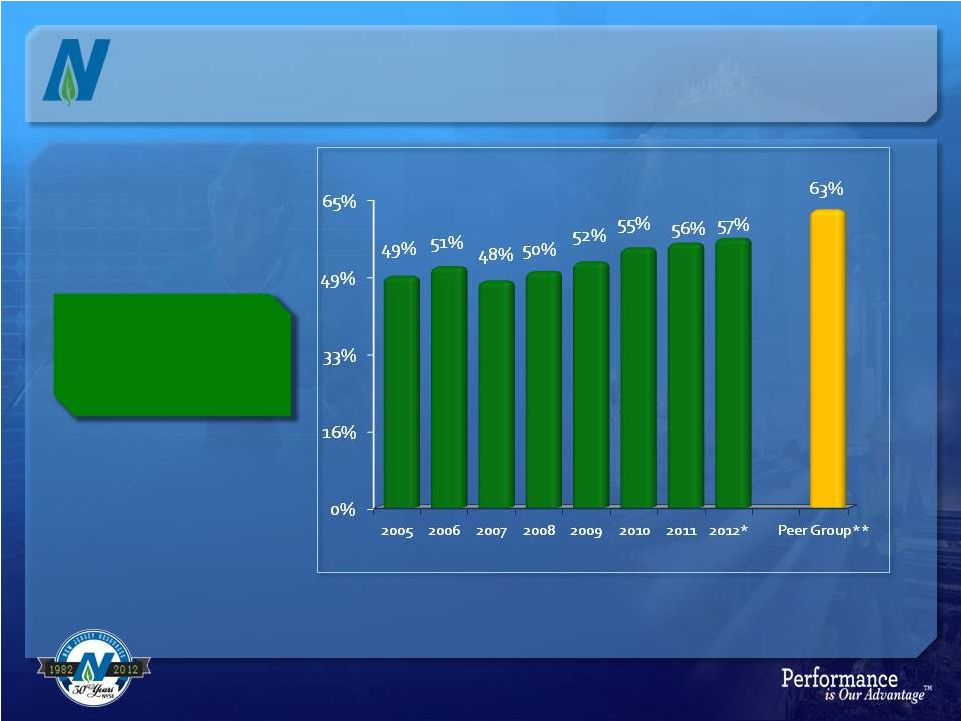

Payout

Ratio* Strong reinvestment to

support future NFE

growth

* Based on NJR Net Financial Earnings

** Peer group average based on 2012 earnings estimates and indicated

dividend from Bloomberg. Peer group: ATO, GAS, LG, NWN,

PNY, SJI, SWX, VVC and WGL 8 |

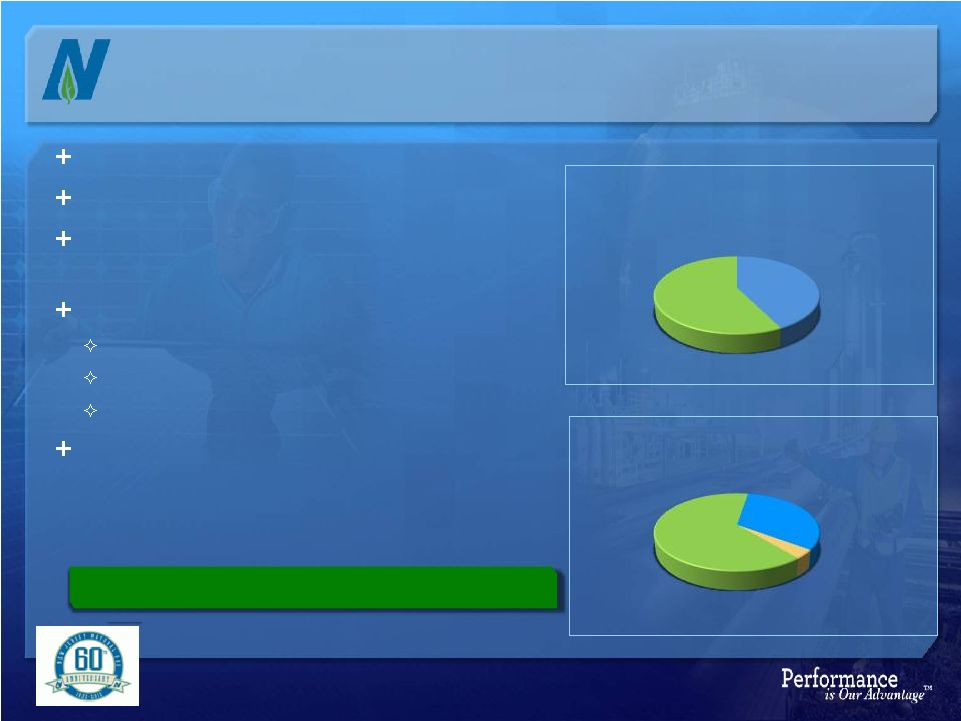

Strong Customer

Growth Strong demographics to support customer growth

9

6,704 new customers in fiscal 2012

539 existing customer heat conversions

Customer growth expected to add about $3.7

million of utility gross margin annually

Conversion breakdown:

65 percent oil

23 percent electric

12 percent propane

Estimate 12,000 to 14,000 new customers over the

next two years

New Customer

Breakdown

Gross Margin

Contribution

Conversions

57%

New

Construction

43%

Commercial

32%

Existing

4%

Residential

64% |

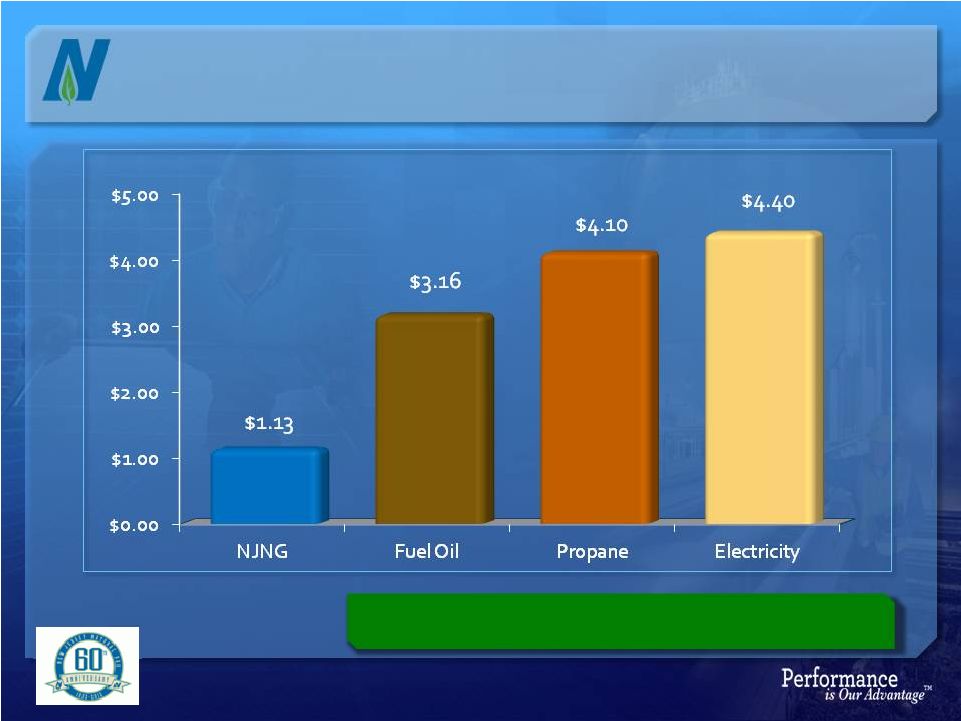

Value for

Customers Source: US Energy Information Administration

Data as of October 2012. Based on 100,000 comparable

BTUs

10

We have a strong price advantage in our service territory |

Approved by

the BPU on October 23, 2012 Four-year program -

$130 million

Replace approximately 276 miles of unprotected steel and cast iron distribution

main

Cost recovery at a weighted average cost of capital of 6.9 percent

Common Equity component 9.75 percent with a 53.5 percent equity ratio

Should create approximately 1,325 jobs*

Infrastructure Investment Opportunities

NJNG will file a rate case no later than November 2015 for

recovery of revenue

11

* According to a study by the Rutgers Bloutstein School of Planning and

Public Policy Safety Acceleration and Facility Enhancement (SAFE) Program

|

Off-system

sales and capacity release In place since 1992

Optimization of capacity and supply contracts

Sharing formula of 85 percent customer; 15 percent

NJNG

Storage Incentive (SI)

In place since 2004

Promotes long-term price stability

Promotes efficient contract utilization

Sharing formula of 80 percent customer; 20 percent

NJNG

Financial Risk Management (FRM)

In place since 1997

Promote application of risk management tools

Sharing formula of 85 percent customer; 15 percent

NJNG

Regulatory Incentives

Since inception customers have saved nearly $600

million with total earnings of $1.90 per share,

an average of $.09 annually

Incentive programs in place

through October 2015

12 |

NJR Clean

Energy Ventures New legislation signed by

Governor Christie in July

13

Clean energy investments contributed $19.5 million to NFE in fiscal 2012

35.7MW of installed capacity; over 45,000 SRECs generated annually

Meaningful earnings growth opportunities

Competitively-priced electricity for customers

Strong legislative commitment to solar in NJ |

Fiscal

2012 results: 778 homes added in fiscal 2012

Average size: 7.5 kilowatts

$20.5 million of capital deployed

Customers are expected to save

over $630,000 in electric costs

after lease payments annually at

current electric rates

The Sunlight Advantage®

1,000

th

customer signed in

August 2012

14 |

The

Commercial Sunlight Advantage Completed projects in place totaling 27.6MW

Capital of more than $127 million

Fiscal 2013 projects:

•

Ground-mounted system

•

$20 million; 6.7 MW project

•

In-service as of October 15, 2012

•

Rooftop system

•

$6.9 million; 2.4 MW project

•

In-service date planned for Q1 fiscal 2013

15

Medford

Wakefern |

OwnEnergy

Investment 16

Announced on September 11, 2012

$8.8 million investment to acquire an approximate 20 percent equity interest

OwnEnergy manages the process for on-shore wind projects to make them

“shovel-ready” Provides NJR Clean Energy Ventures (CEV) with effective,

first-hand knowledge of the wind energy business

The potential opportunity to invest capital in a viable renewable long-term earnings

stream CEV has the option, but not the obligation, to purchase shovel-ready projects

for development CEV’s potential investments would:

Diversify its renewable energy portfolio and risk profile

Reduce reliance on New Jersey Solar Renewable Energy Certificates and

investment tax credits |

NJR Energy

Services contributed $10.8 million to NFE in fiscal 2012 Focusing on long-option

strategy and disciplined risk management Providing customized energy solutions to its

customers Producers, Utilities, Power Generators, Pipelines and Industrials

Holds 1.1 Bcf/day of firm transportation and over 33 Bcf of storage diversified throughout

North America

Other Non-Regulated Businesses

17

NJR Energy Holdings

NJR Energy Services

Contributed $6.7 million to NFE in fiscal 2012

Steckman Ridge

Iroquois

50 percent joint venture with Spectra Energy

Contributed $4.3 million to 2012 NFE

5.53 percent ownership in pipeline from Canada to the northeast

Contributed $2.4 million to 2012 NFE |

Contributed

$2.5 million to NFE in fiscal 2012

Pursuing geographic expansion

Currently marketing in Sussex, Warren and

Hunterdon counties

Expanded services now offered

Whole house electric and plumbing contracts

Standby generator contracts

18

NJR Home Services |

19

Superstorm Sandy

Facts:

Landfall just south of Atlantic City, NJ

Same time as high tide and a full moon

Added an additional six feet to the storm surge

Winds: 90+ miles per hour

970 miles wide. By contrast:

Andrew 180 miles wide

Katrina 460 miles wide

Irene 520 miles wide

943mb –

lowest pressure ever recorded at NJ latitudes

24 states affected by the storm |

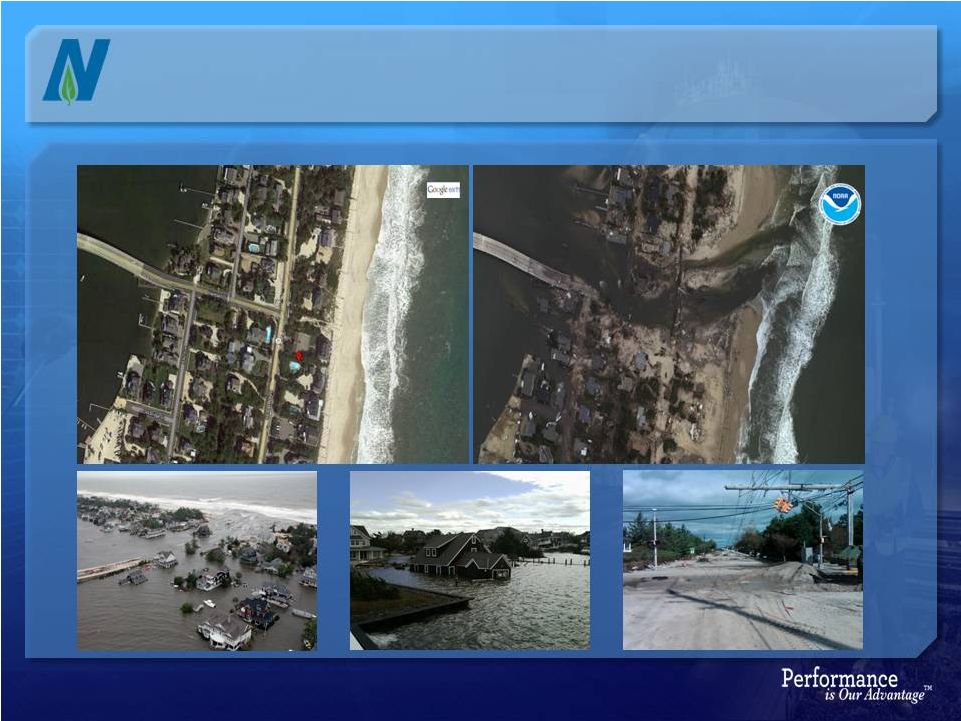

20

Mantoloking, NJ (Seaside Peninsula)

Before

After |

NJNG Natural

Gas Exposed Main, Route 35 Mantoloking, NJ

21 |

22

Seaside Heights, NJ (Seaside Peninsula)

Before

After |

Manasquan, NJ

(Monmouth County Mainland) |

In the first

three days following the storm, NJNG crews responded to over 1,300 leaks and made them

all safe Over 400 individuals on the ground in affected areas

Crews from other east coast utilities worked alongside NJNG

personnel

Safety #1 Priority

Decision made to shut down system on the Seaside peninsula and all

of Long Beach Island

Approximately 30,000 customers affected

Expected water to infiltrate pipes due to no pressure

Other

mainland

towns

such

as

Sea

Bright

and

Manasquan

also

shut

down

24

Superstorm Sandy –

Initial Assessment |

25

Superstorm Sandy –

Scope of Curtailments

Area

Miles of

Pipe

Curtailed

Number of

Customers

Affected

Seaside Peninsula

116

15,207

Long Beach Island

150

13,756

Other affected areas

6

1,104

Total

272

30,067 |

Long

Beach Island Assessment of pipe revealed less damage than expected (no

water)

Majority of main and services salvageable

Restoration Plan implemented in three phases

Reintroduce natural gas into the main

Repair

and

replace

meters

to

bring

natural

gas

to

the

meter

with

leak

surveys done at incremental pressure levels to ensure safety

Customer becomes “gas ready”

and gets turned on following

certification from qualified technician

As of November 26, natural gas currently available to all accessible

meters except those with the most severe damage

26

Superstorm Sandy –

Restoration Plans |

Seaside

Peninsula More debris than LBI which has slowed assessments

Assessment of pipe revealed more damage than LBI (but again, no water)

Much of main salvageable

Expect to begin restoration process by December 3, 2012

NJNG

is

installing

approximately

one

mile

of

12

inch

main

-

the

backbone

of

the system that serves the Seaside peninsula, due to three breeches in

Mantoloking

Restoration similar to LBI, Plan includes three phases

Reintroduce natural gas into the main

Repair

and

replace

meters

to

bring

natural

gas

to

the

meter

with

leak

surveys

done

at incremental pressure levels to ensure safety

Customer becomes “gas ready”

and gets turned on following certification from

qualified technician

Currently expect natural gas to all meters that can take gas safely by

December 31, 2012

27

Superstorm Sandy –

Restoration Plans |

28

Superstorm Sandy –

Restoration Summary

Area

Miles of

Pipe

Curtailed

Number of

Customers

Affected

Pct. of

Customers

with Gas

Available*

Seaside Peninsula

116

15,207

-

Long Beach Island

150

13,756

99%

Other

6

1,104

98%

Total

272

30,067

* As of November 26 |

NJNG Capital

Spending Currently estimated at $40-$60 million*

Mains, services and predominately meter assemblies at

customer’s premise

As with normal operations, storm-related capital costs will be

treated as additions to rate base

Options

Seek regulatory approval to use a portion of SAFE monies for storm-

related capital costs

Re-evaluate our normal budgets, both utility and non-utility

File base rate case before required by SAFE settlement

29

Superstorm Sandy –

Financial Impacts

* Preliminary and subject to change |

Incremental

O&M Costs Currently estimated at $$12-$20 million*

Assessment, leak survey and leak repair

Petition filed with the NJ BPU seeking deferred accounting

treatment for incremental storm-related costs

Precedent exists in New Jersey for incremental O&M costs to be

deferred and recovered subsequently in a base rate case

30

Superstorm Sandy –

Financial Impacts

* Preliminary and subject to change |

Lost Utility

Gross Margin Lost gross margin is estimated at about $1.5 -$2 million per month

during the winter*

Total utility gross margin in fiscal 2012 was nearly $276 million

Expect all customers who can have service safely restored to be

completed by December 31

Some customers with severe damage may be lost for an extended

period of time

For every 1,000 residential and 50 small commercial customers lost as

a

result

of

the

storm,

through

total

loss

or

condemnation,

the

annual

loss

in utility gross margin would be $407,000 and $32,000,

respectively

31

Superstorm Sandy –

Financial Impacts

* Monthly impact is seasonal |

NJNG has

adequate liquidity to cover storm expenses $200 million syndicated credit facility in

place Accordion feature of $50 million has been exercised

Long-term debt

BPU approval in place for up to $200 million

2013 plan included $50 million, but may be upsized, if needed

Additional lines have been offered by lenders, if needed

Re-evaluate normal capital budgets

Flexibility with DRP/Repurchase Plan

32

Superstorm Sandy –

Liquidity |

Earnings

guidance will be given as usual with our first quarter fiscal 2013 earnings

We will continue to provide updates on our system restoration

progress

http://www.njng.com/safety/hurricane-sandy-updates/index.asp

33

As We Look Ahead |

New Jersey

Resources 4

th

Quarter Fiscal 2012 Update

November 29,2012 |