Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - C&J Energy Services, Inc. | d446249d8k.htm |

| EX-99.1 - PRESS RELEASE DATED NOVEMBER 29, 2012 - C&J Energy Services, Inc. | d446249dex991.htm |

C&J Energy

Services, Inc. JP Morgan Oil and Gas

Corporate Access Day

November 2012

Exhibit 99.2 |

C&J Energy

Services, Inc. Disclaimer

Forward-Looking

Statements

Certain

statements

and

information

in

this

presentation

may

constitute

“forward-looking

statements”

within

the

meaning

of

Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange

Act of 1934, as amended, and

the

Private

Securities

Litigation

Reform

Act

of

1995.

The

words

“believe,”

“expect,”

“anticipate,”

“plan,”

“intend,”

“foresee,”

“should,”

“would,”

“could”

or other similar expressions are intended to identify forward-looking statements, which

are generally not historical in nature. These forward-looking statements are based

on our current expectations and beliefs concerning

future

developments

and

their

potential

effect

on

us.

While

management

believes

that

these

forward-looking

statements are reasonable as and when made, there can be no assurance that future developments

affecting us will be those that we anticipate. All comments concerning our expectations

for future revenues and operating results are based on our

forecasts

for

our

existing

operations

and

do

not

include

the

potential

impact

of

any

future

acquisitions.

Our

forward-

looking statements involve significant risks and uncertainties (some of which are beyond our

control) and assumptions that could cause actual results to differ materially from our

historical experience and our present expectations or projections. Known material

factors that could cause our actual results to differ from our projected results are described in our filings

with the Securities and Exchange Commission (“SEC”), including but not limited to

our Annual Report on Form 10-K for the fiscal year

ended December 31, 2011 and subsequent Quarterly Reports on Form 10-Q and the Current Reports on Form 8-K. All readers are

cautioned not to place undue reliance on forward-looking statements, which speak only as of the date hereof.

We undertake no obligation to publicly update or revise any forward-looking statements

after the date they are made, whether as a result of new information, future events or

otherwise. Non-GAAP

Financial

Measures

We use both GAAP and certain non-GAAP financial measures to assess performance. Generally,

a non-GAAP financial measure is a numerical measure of a company's performance,

financial position or cash flows that either excludes or includes amounts that are not

normally excluded or included in the most directly comparable measure calculated and

presented in accordance with GAAP. C&J management believes that these non-GAAP

measures provide useful supplemental information to investors in order that they may

evaluate our financial performance using the same measures as management.

These

non-GAAP

financial

measures

should

not

be

considered

as

a

substitute

for,

or

superior

to,

measures

of

financial performance prepared in accordance with GAAP. In evaluating these measures,

investors should consider that the methodology applied in calculating such measures may

differ among companies and analysts. Reconciliation of non-GAAP results to GAAP

results for historical periods can be found on slide 23 of this presentation and in our filings with the SEC,

as applicable. |

PAGE

3

Focus on the most complex projects in the most challenging basins

C&J Energy Services Profile

Demonstrated efficiencies allow for premium pricing

Engineering staff offers extensive front-end technical

evaluation

Hydraulic

Fracturing

Ability to handle heavy-duty jobs across a wide spectrum of

environments

Leverage to expand into additional fracturing opportunities

Coiled

Tubing

Wireline

and related

services

Casedhole provides wireline perforation, logging, pressure

pumping, and pipe recovery services as well as wellsite

makeup and pressure testing in most of the major US basins

Diversified provider of premium, technologically-advanced completion services |

PAGE

4

Efficiencies Provide Cost Savings for Customers, Favorable Margins for C&J

In-house

Manufacturing

Enhances product development and R&D activities

Mitigates supply constraints, reduces manufacturing and repair

costs

Operational Model Drives

Best-In-Class Performance

Experience &

Expertise

Maintenance

Logistics

Management with in-depth, basin-level expertise gained

through decades of field experience

Empowering employees and promoting best practices produces

a proud and highly motivated workforce

Extensive front-end technical planning and active management

of raw materials, equipment and spare parts drives efficiency

Dedicated logistics team for each fracturing fleet

Regimented fleet maintenance program

Real-time monitoring of critical equipment components, on-site

pump unit maintenance and proactive replacement of wear items

New, high performance equipment enables us to perform the

most demanding, technically complex completions

Focus on long lateral segments and multiple fracturing stages

Modern,

High-Spec

Fleet |

PAGE

5

Equipment Overview

Our 7 premium hydraulic fracturing fleets have a total capacity of over

240,000 HP

We will take delivery of 2 new fleets with combined capacity of 64,000

HP by first quarter 2013

18 coiled tubing units, majority with 2-inch dimension. Additional six

new coiled tubing units scheduled for deployment to new basins by

first quarter 2013

33 pressure pumping units, primarily double pump

Casedhole acquisition added 58 wireline units and 15 pumpdown units

with 7 additional wireline units scheduled to be deployed by first

quarter 2013

Almost all equipment built within the past 5 years

Vertical integration of Total’s manufacturing capabilities

Invested in Modern, High-Spec Equipment to Grow |

PAGE

6

Strategy for Continued Growth

Broaden geographic presence

•

Focus on emerging domestic developments and building customer

relationships

•

Evaluate opportunities to expand internationally and build

infrastructure to capitalize on growth in Middle East

•

Leverage reputation for excellence

•

Demonstrate superior execution with new customers in the spot

market

Emphasize R&D across service lines and in manufacturing

Grow completion service offerings

Generate cost efficiencies through further vertical integration and

supply chain extension

•

Significant manufacturing savings (~20%) from Total

•

Expansion into drilling, completion and production fluids

Expand customer base |

PAGE

7

Hydraulic Fracturing: Expanding our

Customer Base

Contracted

Spot

Over 120,000 HP currently on

“take-or-pay”

contracts with

high minimum hours

Enhances visibility, margins

and revenue

Currently working in the Eagle

Ford and Permian

Contracts with leading

providers:

Demonstrates our significant

efficiencies to new customers

History of successfully

converting spot customers to

contracted customers

Generates opportunities to

expand our customer base

Currently operating in the

Eagle Ford and Permian

New fleets to be to deployed

to the Bakken and to Western

Oklahoma |

PAGE

8

A leading multi-regional provider of a broad range of high quality

casedhole wireline services with superior track record for efficiency

New, custom-built equipment, including 58 wireline units and

15 pumpdown units

Industry leading EBITDA margins and will be accretive to C&J’s year-

end 2012 earnings and cash flow

Generated third quarter of 2012 revenue of $61.6 million

Acquisition closed June 7, 2012 for a total consideration of ~$273

million

Complementary services, similar operating model and growth

strategy make Casedhole an excellent fit for C&J

Expansion into Wireline Services

with Casedhole Acquisition |

PAGE

9

Operational Overview

Casedhole Provides Significant Geographic Expansion

C&J leveraging Casedhole’s

foothold in the

most active U.S. shale plays and basins |

PAGE

10

Capitalizing on Casedhole Acquisition

In addition to providing entry into key target plays (Bakken, Utica)

and strengthening C&J’s position in current operating areas, the

acquisition has had a number of other positive impacts:

•

Wireline services are an important addition for competing with larger

firms

•

Casedhole sales team has extensive domestic and international

experience

•

Bundled completion services have been well-received across our

combined customer base

Enhances product bundling, cross-selling and geographic

expansion opportunities |

PAGE

11

Relationships with Industry Leaders

Service Offerings

Customer

Stand Alone

Pressure Pumping

Coiled Tubing

Hydraulic

Fracturing

Wireline

Large operators have embraced C&J’s

technical capabilities |

PAGE

12

Demonstrated shorter time per completion permits negotiation of

premium rates with customers

Complex projects with demanding wells drive higher hourly rates

and increased revenues from fluids and proppants

More frac stages per well keep fleets onsite longer, allowing more

pumping hours per month

Less redundant pumping capacity boosts utilization

ROCE

of

42%

in

2010,

57%

in

2011

and

48%

TTM

Q3

2012

(1)

Operating efficiencies generate

higher revenues per unit of horsepower

Operational Strategy Drives Strong

Financial Performance

(1)

TTM Q3 2012 ROCE does not include Casedhole |

PAGE

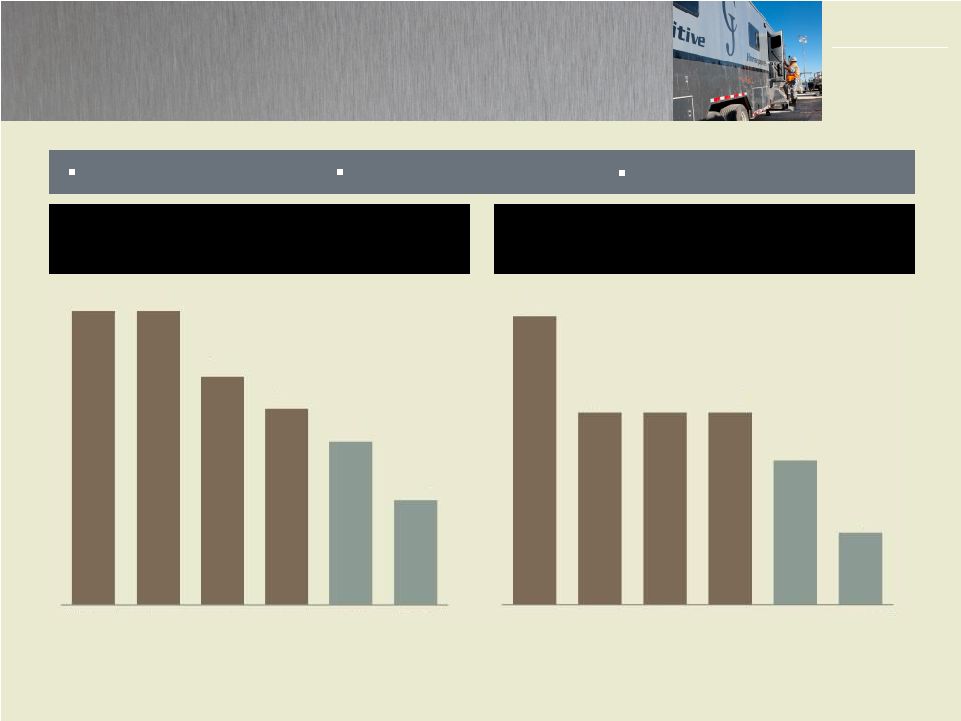

13

Advances in Completion Techniques

Driving Demand

Source: Goldman Sachs Equity Research

Approximate Horsepower Per Job

(000s of HP)

Typical Number of Fracturing

Stages Per Well

24

16

16

16

12

6

Bakken

Eagle Ford

Granite

Wash

Permian

Other

Unconvent.

Conventional

45

45

35

30

25

16

Eagle Ford

Granite

Wash

Bakken

Permian

Other

Unconvent.

Conventional

Longer laterals

More frac stages

Higher pressure wells |

PAGE

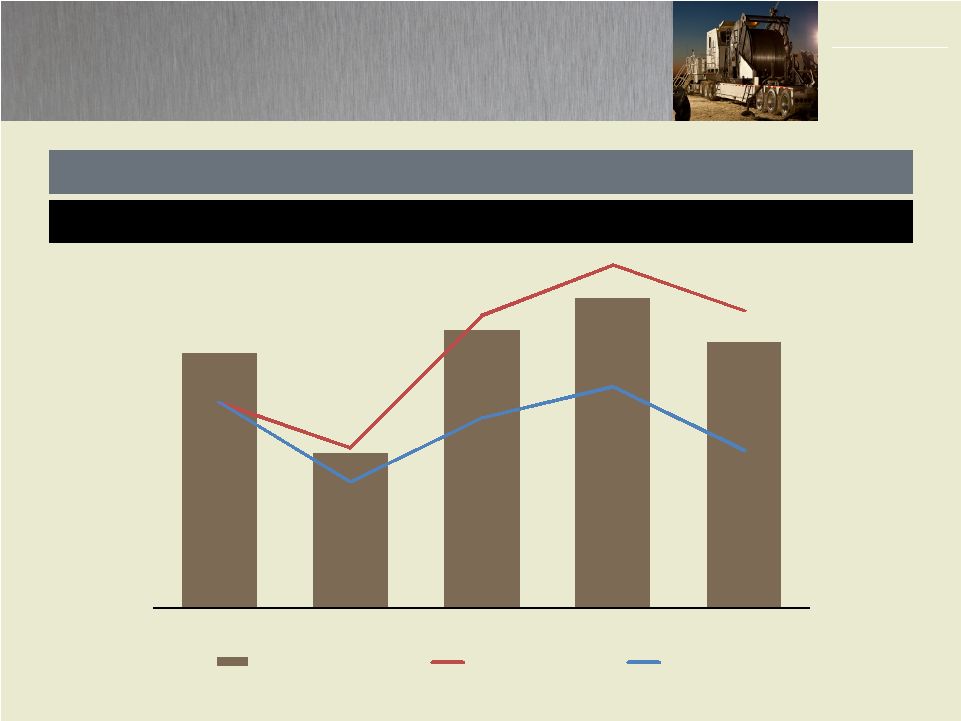

14

Margins driven by superior execution & utilization, not price

Leading Margin Profile

Adjusted EBITDA Margin

31%

19%

34%

38%

32%

2008

2009

2010

2011

YTD 9/30/12

Adjusted EBITDA

Frac Utilization

Frac Pricing

(2)

(1)

(1)

Average utilization figures indexed for presentation purposes; 2008 reflects Q4

annualized (2)

Reflects an index of selected jobs that management believes are representative of historical

market contract pricing |

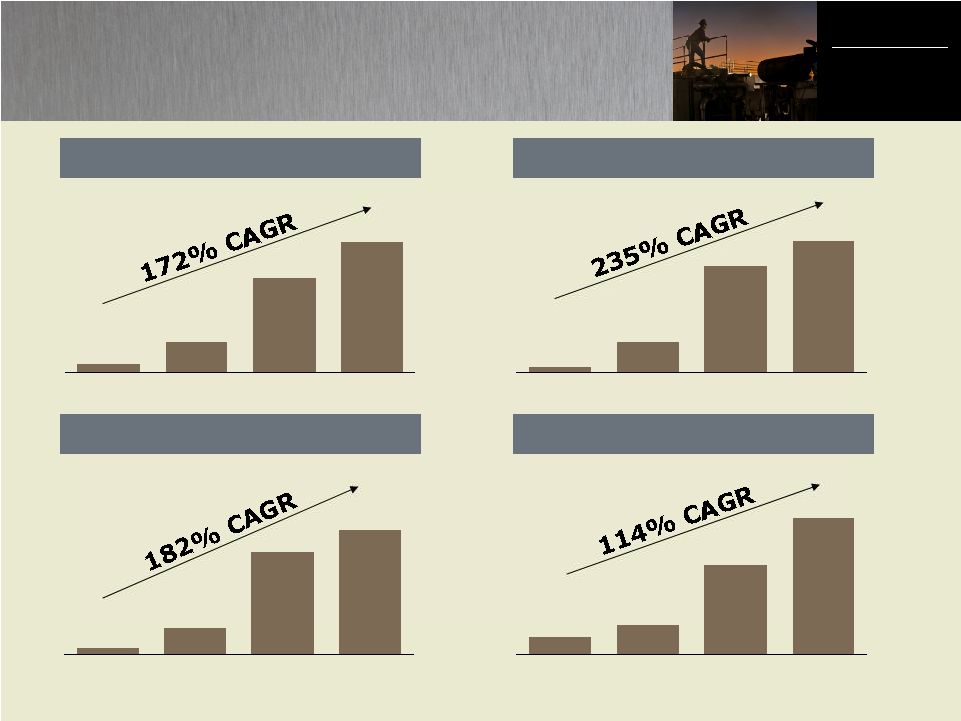

PAGE

15

$12.1

$44.7

$171.7

$207.9

2009

2010

2011

TTM Q3

34,000

58,000

178,000

274,000

2009

2010

2011

2012E

$67.0

$244.2

$758.5

$1,045.3

2009

2010

2011

TTM Q3

Significant Historical Growth

Growth in HHP

Operating Cash Flow ($MM)

Adjusted EBITDA ($MM)

Revenue ($MM)

$12.6

$82.3

$285.4

$352.0

2009

2010

2011

TTM Q3 |

PAGE

16

Strong Cash Flow Generation,

Flexible Balance Sheet

$400 million revolving credit facility recently expanded from $200

million with $100 million accordion

$220 million drawn to partially fund Casedhole acquisition

% Growth

Revenue

$758,454

$1,045,288

38%

Adjusted EBITDA

285,388

352,028

23%

Operating Cash Flow

$171,702

$207,863

21%

12/31/2011

6/30/2012

9/30/2012

Cash and Cash Equivalents

$ 46,780

$ 8,278

$ 14,102

Long Term Debt and Capital Lease Obligations

-

224,765

204,225

Shareholder Equity

395,055

505,623

561,059

Total Capitalization

$ 395,055

$ 730,388

$ 765,284

Conservative Balance Sheet

($ in thousands)

Cash Flow Generation

($ in thousands)

Q3 TTM

12/31/2011 |

PAGE

17

Strategic Overview

Broaden Geographic Presence

Expand Customer Base

Increase Service Offerings

Focus on Research and Technological Developments

Vertical Integration around In-house Manufacturing

and Fluids Development

Generate High Financial Returns for Shareholders |

C&J Energy

Services, Inc. Appendix |

PAGE

19

Detailed Historical Financials –

Income Statement

YTD

($ in thousands, except per share amounts)

2008

2009

2010

2011

9/30/2012

Statement of Operations Data

(Unaudited)

Revenue

$62,441

$67,030

$244,157

$758,454

$825,237

Cost of sales

42,401

54,242

154,297

443,556

523,196

Gross profit

20,040

12,788

89,860

314,898

302,041

Selling, general and admin. expenses

8,950

9,533

17,998

52,737

68,467

Loss (gain) on disposal of assets

397

920

1,571

(25)

623

Operating income

10,693

2,335

70,291

262,186

232,951

Other income (expense):

Interest expense, net

(7,419)

(5,099)

(17,663)

(4,221)

(3,191)

Loss on early extinguishment of debt

–

–

–

(7,605)

–

Other income (expense)

(68)

(52)

13

(40)

(120)

Total other expense

(7,487)

(5,151)

(17,650)

(11,866)

(3,311)

Income (loss) before income tax

3,206

(2,816)

52,641

250,320

229,640

Provision (benefit) for income tax

2,085

(386)

20,369

88,341

77,720

Net income (loss)

$1,121

($2,430)

$32,272

$161,979

$151,920

Basic net income (loss) per share

$0.02

-$0.05

$0.70

$3.28

$2.92

Diluted net income (loss) per share

$0.02

-$0.05

$0.67

$3.19

$2.82

Year Ended December 31, |

PAGE

20

Detailed Historical Financials –

Cash Flow

($ in thousands)

2007

2008

2009

2010

2011

YTD

9/30/12

(Unaudited)

Capital expenditures

$30,152

$21,526

$4,301

$44,473

$140,723

$135,887

Cash flow provided by (used in)

Operating activities

8,377

8,611

12,056

44,723

171,702

177,351

Investing activities

(30,054)

(20,673)

(4,254)

(43,818)

(165,545)

(408,854)

Financing activities

$21,305

$11,921

($6,733)

$734

$37,806

$198,825

Year Ended December 31, |

PAGE

21

Detailed Historical Financials –

Balance Sheet

($ in thousands)

2007

2008

2009

2010

2011

9/30/12

(Unaudited)

Cash and Cash Equivalents

$250

$109

$1,178

$2,817

$46,780

$14,102

Accounts Receivable, Net

4,409

13,362

12,668

44,354

122,169

189,284

Inventories, Net

581

861

2,463

8,182

45,440

73,587

Property Plant and Equipment, Net

57,991

71,441

65,404

88,395

213,697

398,884

Total Assets

$133,711

$155,212

$150,231

$266,088

$537,849

$1,020,798

Accounts Payable

1,705

6,519

10,598

13,084

57,564

90,604

Long-term Debt and Capital Lease

Obligations

56,773

25,041

60,668

44,817

–

204,225

Total

Stockholders’

Equity

$66,767

$68,099

$65,799

$109,446

$395,055

$561,059

Year Ended December 31, |

PAGE

22

Adjusted EBITDA Reconciliation

Note: EBITDA and Adjusted EBITDA are

non-GAAP financial measures, and when analyzing C&J’s operating performance,

investors should use EBITDA and Adjusted EBITDA in addition to, and not as an alternative for,

operating income and net income (loss)(each as determined in accordance with GAAP).

C&J uses EBITDA and Adjusted EBITDA as supplemental financial

measures

because

we

believe

they

are

useful

indicators

of

our

performance.

EBITDA

is

defined

as

net

income

(loss)

before interest expense (net), income taxes, depreciation and amortization. Adjusted EBITDA is

EBITDA further adjusted for certain other items which are not indicative of future

performance or cash flow, including loss on early extinguishment of debt and loss

(gain) on sale/disposal of property, plant and equipment. EBITDA and Adjusted EBITDA, as used and defined

by C&J, may not be comparable to similarly titled measures employed by other companies and

are not measures of performance calculated in accordance with GAAP.

($ in thousands)

2008

2009

2010

2011

(Unaudited)

Net income (loss)

$1,121

($2,430)

$32,272

$161,979

$151,920

Interest expense, net

6,908

4,708

17,341

4,221

3,191

Provision (benefit) for income tax

2,085

(386)

20,369

88,341

77,720

Depreciation and amortization

8,836

9,828

10,711

22,919

31,517

EBITDA

$18,950

$11,720

$80,693

$277,460

$264,348

Adjustment to EBITDA

Loss on early extinguishment of debt

–

–

–

7,605

–

Loss (gain) on disposal of assets

397

920

1,571

(25)

623

Cost of Acquisitions

–

–

–

348

853

Adjusted EBITDA

$19,347

$12,640

$82,264

$285,388

$265,824

Year Ended December 31,

YTD

9/30/12 |