Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - Solaris Power Cells, Inc. | ex31_1.htm |

| EX-31.2 - EXHIBIT 31.2 - Solaris Power Cells, Inc. | ex31_2.htm |

| EX-32.1 - EXHIBIT 32.1 - Solaris Power Cells, Inc. | ex32_1.htm |

| EXCEL - IDEA: XBRL DOCUMENT - Solaris Power Cells, Inc. | Financial_Report.xls |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-Q

| [X] | Quarterly Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| For the quarterly period ended October 31, 2012 | |

| [ ] | Transition Report pursuant to 13 or 15(d) of the Securities Exchange Act of 1934 |

| For the transition period from to __________ | |

| Commission File Number: 000-53982 |

Rolling Technologies, Inc.

(Exact name of registrant as specified in its charter)

| Nevada | TBA |

| (State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

| Penthouse, Menara Antara No. 11, Jalan Bukit Ceylong, Kuala Lumpur 50200 |

| (Address of principal executive offices) |

| 012-377-0130 |

| (Registrant’s telephone number) |

|

_______________________________________________________________ |

| (Former name, former address and former fiscal year, if changed since last report) |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days [X] Yes [ ] No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). [ ] Yes [X] No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

| [ ] Large accelerated filer Accelerated filer | [ ] Non-accelerated filer |

| [X] Smaller reporting company |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). [X] Yes [ ] No

State the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date: 2,150,000 common shares as of November 26, 2012.

| 1 |

| 2 |

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements

Our financial statements included in this Form 10-Q are as follows:

These financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America for interim financial information and the SEC instructions to Form 10-Q. In the opinion of management, all adjustments considered necessary for a fair presentation have been included. Operating results for the interim period ended October 31, 2012 are not necessarily indicative of the results that can be expected for the full year.

| 3 |

ROLLING TECHNOLOGIES, INC.

(A DEVELOPMENT STAGE COMPANY)

AS OF OCTOBER 31, 2012 AND JULY 31, 2012

| October 31, 2012 | July 31, 2012 | |||||||

| ASSETS | ||||||||

| Current Assets | ||||||||

| Cash and equivalents | $ | 0 | $ | 0 | ||||

| Prepaid expenses | 0 | 0 | ||||||

| TOTAL ASSETS | $ | 0 | $ | 0 | ||||

| LIABILITIES AND STOCKHOLDERS’ DEFICIT | ||||||||

| Liabilities | ||||||||

| Current Liabilities | ||||||||

| Accrued expenses | $ | 4,394 | $ | 4,394 | ||||

| Loan payable – related party | 72,291 | 70,291 | ||||||

| Total Liabilities | 76,685 | 74,685 | ||||||

| Stockholders’ Deficit | ||||||||

| Common Stock, $.001 par value, 100,000,000 shares authorized, 2,150,000 shares issued and outstanding | 2,150 | 2,150 | ||||||

| Additional paid-in capital | 40,850 | 40,850 | ||||||

| Deficit accumulated during the development stage | (119,685 | ) | (117,685 | ) | ||||

| Total Stockholders’ Deficit | (76,685 | ) | (74,685 | ) | ||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ DEFICIT | $ | 0 | $ | 0 | ||||

See accompanying notes to financial statements.

| F-1 |

ROLLING TECHNOLOGIES, INC.

(A DEVELOPMENT STAGE COMPANY)

STATEMENTS OF OPERATIONS (unaudited)

FOR THE THREE MONTHS ENDED OCTOBER 31, 2012 AND 2011

FOR THE PERIOD FROM JULY 27, 2007 (INCEPTION) TO OCTOBER 31, 2012

| Three months ended October 31, 2012 | Three months ended October 31, 2011 | Period from July 27, 2007 (Inception) to October 31, 2012 | ||||||||||

| REVENUES | $ | 0 | $ | 0 | $ | 0 | ||||||

| EXPENSES | ||||||||||||

| Professional fees | 2,000 | 2,000 | 119,685 | |||||||||

| LOSS FROM OPERATIONS | (2,000 | ) | (2,000 | ) | (119,685 | ) | ||||||

| PROVISION FOR INCOME TAXES | 0 | 0 | 0 | |||||||||

| NET LOSS | $ | (2,000 | ) | $ | (2,000 | ) | $ | (119,685 | ) | |||

| NET LOSS PER SHARE: BASIC AND DILUTED | $ | (0.00 | ) | $ | (0.00 | ) | ||||||

| WEIGHTED AVERAGE NUMBER OF SHARES OUTSTANDING: BASIC AND DILUTED | 2,150,000 | 2,150,000 | ||||||||||

See accompanying notes to financial statements.

| F-2 |

ROLLING TECHNOLOGIES, INC.

(A DEVELOPMENT STAGE COMPANY)

STATEMENTS OF CASH FLOWS (unaudited)

FOR THE THREE MONTHS ENDED OCTOBER 31, 2012 AND 2011

FOR THE PERIOD FROM JULY 27, 2007 (INCEPTION) TO OCTOBER 31, 2012

| Three months ended October 31, 2012 | Three months ended October 31, 2011 | Period from July 27, 2007 (Inception) to October 31, 2012 | ||||||||||

| CASH FLOWS FROM OPERATING ACTIVITIES | ||||||||||||

| Net loss for the period | $ | (2,000 | ) | $ | (2,000 | ) | $ | (119,685 | ) | |||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||||||

| Changes in assets and liabilities: | ||||||||||||

| (Increase) decrease in prepaid expenses | 0 | 0 | 0 | |||||||||

| Increase (decrease) in accrued expenses | 0 | 0 | 4,394 | |||||||||

| Net Cash Used by Operating Activities | (2,000 | ) | (2,000 | ) | (115,291 | ) | ||||||

| CASH FLOWS FROM FINANCING ACTIVITIES | ||||||||||||

| Proceeds from issuance of common stock | 0 | 0 | 43,000 | |||||||||

| Loan received from related party | 2,000 | 2,000 | 72,291 | |||||||||

| Net Cash Provided by Financing Activities | 2,000 | 2,000 | 115,291 | |||||||||

| NET INCREASE (DECREASE) IN CASH | 0 | 0 | 0 | |||||||||

| Cash, beginning of period | 0 | 0 | 0 | |||||||||

| Cash, end of period | $ | 0 | $ | 0 | $ | 0 | ||||||

| SUPPLEMENTAL CASH FLOW INFORMATION: | ||||||||||||

| Interest paid | $ | 0 | $ | 0 | $ | 0 | ||||||

| Income taxes paid | $ | 0 | $ | 0 | $ | 0 | ||||||

See accompanying notes to financial statements.

| F-3 |

ROLLING TECHNOLOGIES, INC.

(A DEVELOPMENT STAGE COMPANY)

NOTES TO THE FINANCIAL STATEMENTS

OCTOBER 31, 2012

NOTE 1 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Nature of Business

Rolling Technologies, Inc. (“Rolling” and the “Company”) was incorporated in Nevada on July 27, 2007. The Company is in the process of developing a portable, light-weight car-top carrier that combines the strength of a box carrier with the convenience of a bag carrier for a retail price of under $50.

Development Stage Company

The accompanying financial statements have been prepared in accordance with generally accepted accounting principles related to development-stage companies. A development-stage company is one in which planned principal operations have not commenced or if its operations have commenced, there has been no significant revenues there from.

Basis of Presentation

The financial statements of the Company have been prepared in accordance with generally accepted accounting principles in the United States of America and are presented in US dollars.

Accounting Basis

The Company uses the accrual basis of accounting and accounting principles generally accepted in the United States of America (“GAAP” accounting). The Company has adopted a July 31 fiscal year end.

Cash and Cash Equivalents

Rolling considers all highly liquid investments with maturities of six months or less to be cash equivalents. At October 31, 2012 and July 31, 2012, the Company had $0 of cash.

Fair Value of Financial Instruments

The Company’s financial instruments consist of cash and cash equivalents, prepaid expenses, accrued expenses and loans payable to a related party. The carrying amount of these financial instruments approximates fair value due either to length of maturity or interest rates that approximate prevailing market rates unless otherwise disclosed in these financial statements.

Income Taxes

Income taxes are computed using the asset and liability method. Under the asset and liability method, deferred income tax assets and liabilities are determined based on the differences between the financial reporting and tax bases of assets and liabilities and are measured using the currently enacted tax rates and laws. A valuation allowance is provided for the amount of deferred tax assets that, based on available evidence, are not expected to be realized.

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date the financial statements and the reported amount of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Revenue Recognition

The Company recognizes revenue when products are fully delivered or services have been provided and collection is reasonably assured.

| F-4 |

ROLLING TECHNOLOGIES, INC.

(A DEVELOPMENT STAGE COMPANY)

NOTES TO THE FINANCIAL STATEMENTS

OCTOBER 31, 2012

NOTE 1 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Basic Income (Loss) Per Share

Basic income (loss) per share is calculated by dividing the Company’s net loss applicable to common shareholders by the weighted average number of common shares during the period. Diluted earnings per share is calculated by dividing the Company’s net income available to common shareholders by the diluted weighted average number of shares outstanding during the year. The diluted weighted average number of shares outstanding is the basic weighted number of shares adjusted for any potentially dilutive debt or equity. There are no such common stock equivalents outstanding as of October 31, 2012.

Stock-Based Compensation

Stock-based compensation is accounted for at fair value in accordance with ASC 718. To date, the Company has not adopted a stock option plan and has not granted any stock options. As of October 31, 2012, the Company has not issued any stock-based payments to its employees.

Recent Accounting Pronouncements

Rolling does not expect the adoption of recently issued accounting pronouncements to have a significant impact on the Company’s results of operations, financial position or cash flow.

NOTE 2 – PREPAID EXPENSES

Prepaid expenses totaled $0 as of October 31, 2012 and July 31, 2012.

NOTE 3 – ACCRUED EXPENSES

Accrued expenses at July 31, 2012 consisted of amounts owed to the Company’s attorneys and stock transfer agent. Accrued expenses totaled $4,394 as of October 31, 2012 and July 31, 2012.

NOTE 4 – LOAN PAYABLE – RELATED PARTY

The Company has received loans from a related party to be used for working capital. The loans are unsecured, non-interest bearing, and due on demand. The balance due to the shareholder was $72,291 and $70,291 as of October 31, 2012 and July 31, 2012, respectively.

NOTE 5 – STOCKHOLDERS’ DEFICIT

The Company has 100,000,000 shares of $0.001 par value common stock authorized. There were no shares of common stock issued during the three months ended October 31, 2012. As of October 31, 2012, Rolling had 2,150,000 shares of common stock issued and outstanding.

NOTE 6 – COMMITMENTS AND CONTINGENCIES

Rolling neither owns nor leases any real or personal property. An office has provided office services without charge. There is no obligation for this arrangement to continue. Such costs are immaterial to the financial statements and accordingly are not reflected herein. The officers and directors are involved in other business activities and most likely will become involved in other business activities in the future.

| F-5 |

ROLLING TECHNOLOGIES, INC.

(A DEVELOPMENT STAGE COMPANY)

NOTES TO THE FINANCIAL STATEMENTS

OCTOBER 31, 2012

NOTE 7 – INCOME TAXES

As of July 31, 2012, the Company had net operating loss carry forwards of approximately $120,000 that may be available to reduce future years’ taxable income through 2032. Future tax benefits which may arise as a result of these losses have not been recognized in these financial statements, as their realization is determined not likely to occur and accordingly, the Company has recorded a valuation allowance for the deferred tax asset relating to these tax loss carry-forwards.

The provision for Federal income tax consists of the following for the three months ended October 31, 2012 and 2011:

| 2012 | 2011 | |||||||

| Federal income tax benefit attributable to: | ||||||||

| Current operations | $ | 680 | $ | 680 | ||||

| Less: valuation allowance | (680 | ) | (680 | ) | ||||

| Net provision for Federal income taxes | $ | 0 | $ | 0 | ||||

The cumulative tax effect at the expected rate of 34% of significant items comprising our net deferred tax amount is as follows as of October 31, 2012 and July 31, 2012:

| October 31, 2012 | July 31, 2012 | |||||||

| Deferred tax asset attributable to: | ||||||||

| Net operating loss carryover | $ | 40,692 | $ | 40,012 | ||||

| Less: valuation allowance | (40,692 | ) | (40,012 | ) | ||||

| Net deferred tax asset | $ | 0 | $ | 0 | ||||

Due to the change in ownership provisions of the Tax Reform Act of 1986, net operating loss carry forwards of $119,685 for Federal income tax reporting purposes are subject to annual limitations. Should a change in ownership occur net operating loss carry forwards may be limited as to use in future years.

NOTE 8 – LIQUIDITY AND GOING CONCERN

Rolling has negative working capital, has incurred losses since inception, and has not yet received revenues from sales of products or services. These factors create substantial doubt about the Company’s ability to continue as a going concern. The financial statements do not include any adjustment that might be necessary if the Company is unable to continue as a going concern.

The ability of Rolling to continue as a going concern is dependent on the Company generating cash from the sale of its common stock and/or obtaining debt financing and attaining future profitable operations. Management’s plans include selling its equity securities and obtaining debt financing to fund its capital requirement and ongoing operations; however, there can be no assurance the Company will be successful in these efforts.

NOTE 9 – SUBSEQUENT EVENTS

In accordance with ASC 855-10, the Company has analyzed its operations subsequent to October 31, 2012 to the date these financial statements were issued, and has determined that it does not have any material subsequent events to disclose in these financial statements.

| F-6 |

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Forward-Looking Statements

Certain statements, other than purely historical information, including estimates, projections, statements relating to our business plans, objectives, and expected operating results, and the assumptions upon which those statements are based, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements generally are identified by the words “believes,” “project,” “expects,” “anticipates,” “estimates,” “intends,” “strategy,” “plan,” “may,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. We intend such forward-looking statements to be covered by the safe-harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995, and are including this statement for purposes of complying with those safe-harbor provisions. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking statements. Our ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse affect on our operations and future prospects on a consolidated basis include, but are not limited to: changes in economic conditions, legislative/regulatory changes, availability of capital, interest rates, competition, and generally accepted accounting principles. These risks and uncertainties should also be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise. Further information concerning our business, including additional factors that could materially affect our financial results, is included herein and in our other filings with the SEC.

Overview

We were formed as a Nevada corporation, “Rolling Technologies Inc.,” on July 27, 2007. Our operations office in Malaysia is located at Penthouse, Menara Antara, No. 11, Jalan Bukit Ceylong, Kuala Lumpur 50200, Kuala Lumpur Malaysia. Our phone number is (012) 377-0130.

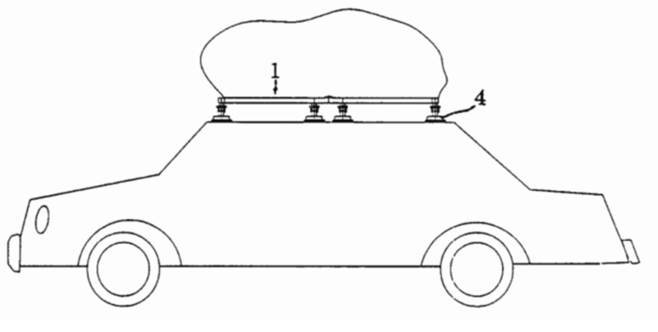

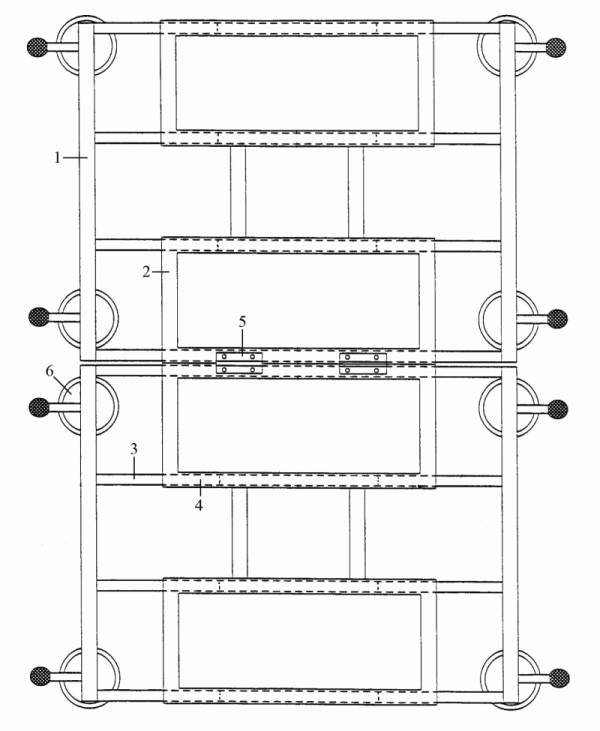

We are a development stage company and have not generated any sales to date. We are in the process of developing a portable, light-weight car-top carrier (our “Product”) that combines the strength of a box carrier with the convenience of a bag carrier (See Figure 1) for a retail price of under $50. Our current Product has two support frames (See Figure 2), an outer (1) and an inner frame (2), to provide the structure and strength of a traditional box carrier. The outer frame has several cross-bars (3) and the inner frame has several bushings (4), which fit together upon assembly and installation. This combines the structural support of the inner and outer frames to provide for maximum strength and weight-bearing ability. The entire unit is attached to the car top by strong magnets (6), which are connected to the outer frame. Ease of storage is enhanced by hinges in the middle of the frame (5), allowing users to fold the entire unit in half lengthwise in lieu of, or in addition to, removing the outer frame cross-bars from the inner frame bushings. Upon disassembly, which we anticipate will be quick, easy, and require no technical or mechanical sophistication, the Product can then be transported or stored in the accompanying luggage bag, requiring very little space.

Our Product is being designed specifically for the Asian market. One of the variables influential in the development of our Product is the fact that very few cars in Asia are equipped with roof racks by the manufacturer, so we needed to design our Product for easily installation in the absence of a roof rack. Thus, our Product can be attached to a vehicle using strong magnets, so no roof rack is necessary. We have not yet determined whether we will use permanent magnets or electromagnets for this purpose, nor have we determined the magnetic field strength required to safely and securely keep our Product attached to a car top while experiencing the drag associated with speeds up to 200 kph. These variables are being addressed as we continue to develop the final model of our Product.

| 4 |

Also, because our Product doesn’t rest directly on the roof of the vehicle and the weight is distributed across several contact points, it can withstand a greater amount of weight than traditional carriers that apply the force of their weight to the luggage rack, which determines the maximum load. Our current research and development efforts include maximizing the carrying load of our Product. Another factor in the weight load is the material used for the inner and outer frames. We are experimenting with different alloys and plastics to find the best combination of strength and cost-effectiveness for our Product. Final Product weight will also be a factor in determining the material we use for the Product frame.

Figure 1

| 5 |

Figure 2

| 6 |

Results of Operations for the three months ended October 31, 2012 and 2011 and for the Period from July 27, 2007 (Date of Inception) until October 31, 2012

We generated no revenues since our inception. We do not anticipate earning revenues until we procure additional financing to manufacture and market our products. There is no assurance that we will earn any revenues or in amounts that will enable us to continue as a going concern.

We incurred $2,000 in operating expenses for the three months ended October 31, 2012, as compared with $2,000 in operating expenses for the same period ended October 31, 2011. Our operating expenses for the three months ended October 31, 2012 and 2011 consisted of professional fees. Our operating expenses from July 27, 2007 (Date of Inception) until October 31, 2012 were $119,685.

We expect that our operating expenses will increase as we are able to locate funds and pursue business operations. Until then, our operating expenses will include general and administrative expenses for accounting fees, legal costs and other miscellaneous items.

We had a net loss of $2,000 for the three months ended October 31, 2012, as compared with a net loss of $2,000 for the same period ended October 31, 2011. We have an accumulated net loss of $119,685 from July 27, 2007 (Date of Inception) until October 31, 2012.

Liquidity and Capital Resources

As of October 31, 2012, we had $0 in current assets. Our total current liabilities as of October 31, 2012 were $76,685. Thus, we have a working capital deficit of $76,685, as of October 31, 2012.

Operating Activities used $115,291 in net cash for the period from July 27, 2007 (Date of Inception) until October 31, 2012. Our net loss of $119,685 was the primary component of our negative operating cash flow. Financing Activities generated $115,291 in cash during the period from July 27, 2007 (Date of Inception) until October 31, 2012, as a result of a private offering of equity securities raising $43,000 and related party loans of $72,291.

Based upon our current financial condition, we do not have sufficient cash to operate our business at the current level for the next twelve months. We intend to fund operations through increased sales and debt and/or equity financing arrangements, which may be insufficient to fund expenditures or other cash requirements. We plan to seek additional financing in a private equity offering to secure funding for operations. There can be no assurance that we will be successful in raising additional funding. If we are not able to secure additional funding, the implementation of our business plan will be impaired. There can be no assurance that such additional financing will be available to us on acceptable terms or at all.

Off Balance Sheet Arrangements

As of October 31, 2012, there were no off balance sheet arrangements.

Going Concern

We have negative working capital, have incurred losses since inception, and have not yet received revenues from sales of products or services. These factors create substantial doubt about our ability to continue as a going concern. The financial statements do not include any adjustment that might be necessary if we are unable to continue as a going concern.

| 7 |

Our ability to continue as a going concern is dependent on our generating cash from the sale of our common stock and/or obtaining debt financing and attaining future profitable operations. Management’s plans include selling our equity securities and obtaining debt financing to fund our capital requirement and ongoing operations; however, there can be no assurance we will be successful in these efforts.

Critical Accounting Policies

In December 2001, the SEC requested that all registrants list their most “critical accounting polices” in the Management Discussion and Analysis. The SEC indicated that a “critical accounting policy” is one which is both important to the portrayal of a company’s financial condition and results, and requires management’s most difficult, subjective or complex judgments, often as a result of the need to make estimates about the effect of matters that are inherently uncertain. We do not believe that any accounting policies currently fit this definition.

Recently Issued Accounting Pronouncements

We do not expect the adoption of recently issued accounting pronouncements to have a significant impact on our results of operations, financial position or cash flow.

Item 3. Quantitative and Qualitative Disclosures About Market Risk

A smaller reporting company is not required to provide the information required by this Item.

Item 4. Controls and Procedures

We carried out an evaluation of the effectiveness of the design and operation of our disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) as of October 31, 2011. This evaluation was carried out under the supervision and with the participation of our Chief Executive Officer and our Chief Financial Officer, Mr. Tee Kai Shen. Based upon that evaluation, our Chief Executive Officer and Chief Financial Officer concluded that, as of October 31, 2012, our disclosure controls and procedures are effective. There have been no changes in our internal controls over financial reporting during the quarter ended October 31, 2012.

Disclosure controls and procedures are controls and other procedures that are designed to ensure that information required to be disclosed in our reports filed or submitted under the Exchange Act are recorded, processed, summarized and reported, within the time periods specified in the SEC's rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed in our reports filed under the Exchange Act is accumulated and communicated to management, including our Chief Executive Officer and Chief Financial Officer, to allow timely decisions regarding required disclosure.

Limitations on the Effectiveness of Internal Controls

Our management does not expect that our disclosure controls and procedures or our internal control over financial reporting will necessarily prevent all fraud and material error. Our disclosure controls and procedures are designed to provide reasonable assurance of achieving our objectives and our Chief Executive Officer and Chief Financial Officer concluded that our disclosure controls and procedures are effective at that reasonable assurance level. Further, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, within the Company have been detected. These inherent limitations include the realities that judgments in decision-making can be faulty, and that breakdowns can occur because of simple error or mistake. Additionally, controls can be circumvented by the individual acts of some persons, by collusion of two or more people, or by management override of the internal control. The design of any system of controls also is based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions. Over time, control may become inadequate because of changes in conditions, or the degree of compliance with the policies or procedures may deteriorate.

| 8 |

PART II – OTHER INFORMATION

Item 1. Legal Proceedings

We are not a party to any pending legal proceeding. We are not aware of any pending legal proceeding to which any of our officers, directors, or any beneficial holders of 5% or more of our voting securities are adverse to us or have a material interest adverse to us.

Item 1A: Risk Factors

A smaller reporting company is not required to provide the information required by this Item.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds

None

Item 3. Defaults upon Senior Securities

None

Item 4. Mine Safety Disclosure

Not applicable

Item 5. Other Information

None

Item 6. Exhibits

| Exhibit Number | Description of Exhibit |

| 31.1 | Certification of Chief Executive Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

| 31.2 | Certification of Chief Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

| 32.1 | Certification of Chief Executive Officer and Chief Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

| 101** | The following materials from the Company’s Quarterly Report on Form 10-Q for the quarter ended October 31, 2012 formatted in Extensible Business Reporting Language (XBRL). |

**Provided herewith

| 9 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| Rolling Technologies, Inc. | |

| Date: | November 28, 2012 |

| By: | /s/ Tee Kai Shen |

| Tee Kai Shen | |

| Title: | Chief Executive Officer and Director |

| 10 |