Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HEALTHCARE TRUST OF AMERICA, INC. | investorpresentation.htm |

November 2012 Company Presentation Exhibit 99.1

Leading owner of Medical Office Buildings Forward looking statements This document contains both historical and forward-looking statements. Forward-looking statements are based on current expectations, plans, estimates, assumptions and beliefs, including expectations, plans, estimates, assumptions and beliefs about our company, the real estate industry and the debt and equity capital markets. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include information concerning possible or assumed future results of operations of our company. The forward-looking statements included in this document are subject to numerous risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the forward-looking statements. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond our control. Although we believe that the expectations reflected in such forward-looking statements are based on reasonable assumptions, our actual results and performance could differ materially from those set forth in the forward-looking statements. Factors which could have a material adverse effect on our operations and future prospects include, but are not limited to: changes in economic conditions affecting the healthcare property sector, the commercial real estate market and the credit market; competition for acquisition of medical office buildings and other facilities that serve the healthcare industry; economic fluctuations in certain states in which our property investments are geographically concentrated; retention of our senior management team; financial stability and solvency of our tenants; supply and demand for operating properties in the market areas in which we operate; our ability to acquire properties, and to successfully operate those properties once acquired; changes in property taxes; legislative and regulatory changes, including changes to laws governing the taxation of REITs and changes to laws governing the healthcare industry; fluctuations in reimbursements from third party payors such as Medicare and Medicaid; changes in interest rates; the availability of capital and financing; restrictive covenants in our credit facilities; changes in our credit ratings; our ability to remain qualified as a REIT; and the risk factors set forth in our 2011 Annual Report on Form 10-K and our quarterly report on Form 10-Q for the quarter ended September 30, 2012. Forward-looking statements speak only as of the date made. Except as otherwise required by the federal securities laws, we undertake no obligation to update any forward-looking statements to reflect the events or circumstances arising after the date as of which they are made. As a result of these risks and uncertainties, readers are cautioned not to place undue reliance on the forward looking statements included in this document or that may be made elsewhere from time to time by, or on behalf of, us. 1

Company Profile Focused Medical Office Building REIT Investment Grade Growing Sector, Defensive Asset Class ¹ HTA’s enterprise value as of November 23, 2012 2 As of 9/30/12. On-campus refers to a property that is located on or adjacent to (within ¼ mile) a healthcare system. Aligned refers to properties leased 50% or more to a healthcare system. • HTA is a self managed $3.3 billion¹ healthcare REIT focused on medical office buildings (MOBs) • NYSE listed since June 6, 2012 (Ticker: HTA) - Addition to MSCI US REIT Index (RMZ) announced in November 2012 • Investment grade company (BBB- / Baa3) • Annualized distribution of $0.575 per share • Defensive healthcare sector with strong growth fundamentals o Affordable Care Act adding 30 to 40 million insured o Aging population increasing healthcare expenditures o Patient care shifting to cost-efficient settings: MOBs o MOBs on or affiliated with health system campuses = core, critical real estate • 96% of portfolio is on-campus or affiliated with leading healthcare systems2 • Experienced management team in place since 2009, executing on high quality acquisitions with significant healthcare systems Healthcare Trust of America, Inc. A Leading Owner of Medical Office Buildings 2

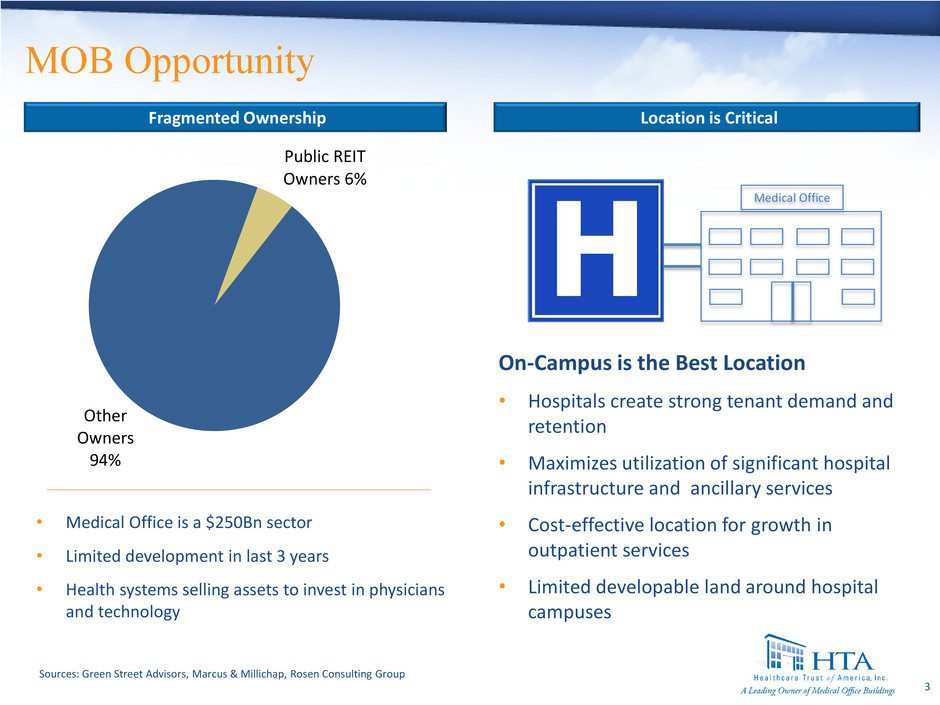

MOB Opportunity Sources: Green Street Advisors, Marcus & Millichap, Rosen Consulting Group 3 Public REIT Owners 6% Other Owners 94% Fragmented Ownership On-Campus is the Best Location • Hospitals create strong tenant demand and retention • Maximizes utilization of significant hospital infrastructure and ancillary services • Cost-effective location for growth in outpatient services • Limited developable land around hospital campuses • Medical Office is a $250Bn sector • Limited development in last 3 years • Health systems selling assets to invest in physicians and technology Location is Critical Medical Office

$0 $1 $2 $3 $4 $5 Trillions Macroeconomic and Regulatory Trends 4 MOB’s Positioned to Benefit from Demographics and Affordable Care Act Outpatient Trend Annual Healthcare Expenditures 1,000 1,200 1,400 1,600 1,800 2,000 2,200 110 112 114 116 118 120 122 124 126 128 1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 OutpatientInpatient Inpatient Admissions/1000 Persons Outpatient Visits/1000 Persons U.S. Residents with Insurance Coverage in 2021 Aging Population 10% 12% 14% 16% 18% 20% 22% 0 20 40 60 80 100 1980 1990 2000 2010 2020f 2030f 2040f 2050f % of PopulationMillions 65+ Population 65+ Population As a % of Total U.S. Population Sources: U.S. Census Bureau, U.S. Centers for Disease Control and Prevention, Congressional Budget Office Rosen Consulting Group, 223 253 200 210 220 230 240 250 260 '21Before ACA After ACA

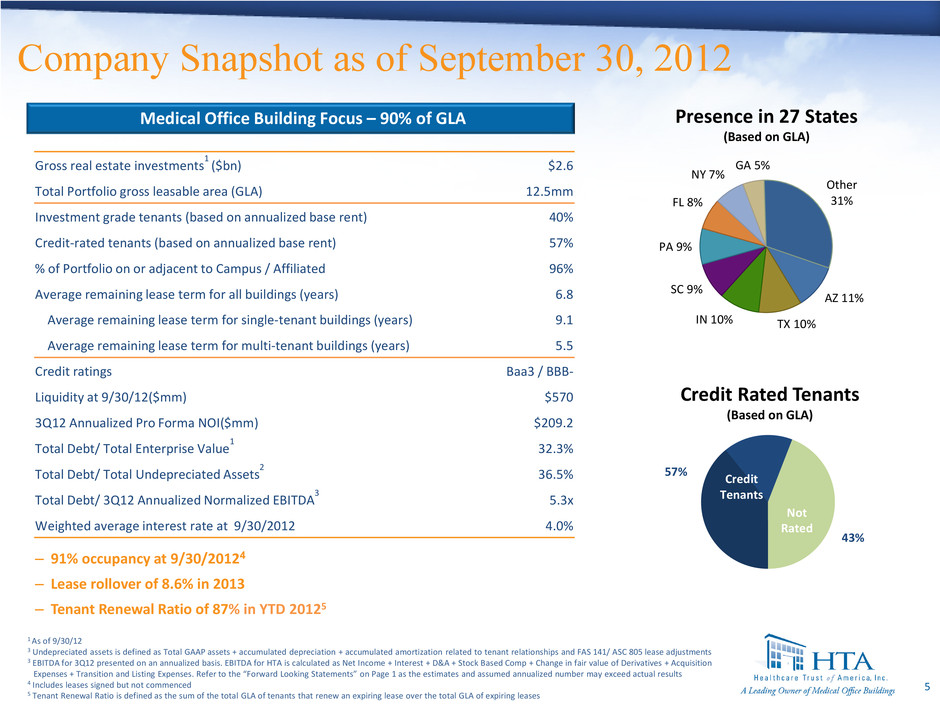

Leading owner of Medical Office Buildings 1 As of 9/30/12 3 Undepreciated assets is defined as Total GAAP assets + accumulated depreciation + accumulated amortization related to tenant relationships and FAS 141/ ASC 805 lease adjustments 3 EBITDA for 3Q12 presented on an annualized basis. EBITDA for HTA is calculated as Net Income + Interest + D&A + Stock Based Comp + Change in fair value of Derivatives + Acquisition Expenses + Transition and Listing Expenses. Refer to the “Forward Looking Statements” on Page 1 as the estimates and assumed annualized number may exceed actual results 4 Includes leases signed but not commenced 5 Tenant Renewal Ratio is defined as the sum of the total GLA of tenants that renew an expiring lease over the total GLA of expiring leases 43% Credit Tenants Not Rated Credit Rated Tenants (Based on GLA) Company Snapshot as of September 30, 2012 Gross real estate investments 1 ($bn) $2.6 Total Portfolio gross leasable area (GLA) 12.5mm Investment grade tenants (based on annualized base rent) 40% Credit-rated tenants (based on annualized base rent) 57% % of Portfolio on or adjacent to Campus / Affiliated 96% Average remaining lease term for all buildings (years) 6.8 Average remaining lease term for single-tenant buildings (years) 9.1 Average remaining lease term for multi-tenant buildings (years) 5.5 Credit ratings Baa3 / BBB- Liquidity at 9/30/12($mm) $570 3Q12 Annualized Pro Forma NOI($mm) $209.2 Total Debt/ Total Enterprise Value 1 32.3% Total Debt/ Total Undepreciated Assets 2 36.5% Total Debt/ 3Q12 Annualized Normalized EBITDA 3 5.3x Weighted average interest rate at 9/30/2012 4.0% Presence in 27 States (Based on GLA) AZ 11% TX 10% IN 10% SC 9% PA 9% FL 8% NY 7% GA 5% Other 31% 5 57% – 91% occupancy at 9/30/20124 – Lease rollover of 8.6% in 2013 – Tenant Renewal Ratio of 87% in YTD 20125 Medical Office Building Focus – 90% of GLA

Leading owner of Medical Office Buildings 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% 70.0% 80.0% 12/31/2010 12/31/2011 9/30/2012 2012 (Year End) In-House Property Management Fully Integrated Asset Management Platform National Portfolio, Regionally Focused Midwest Indianapolis, IN GLA: 2.5 M sf % GLA: 20% East Charleston, SC and Atlanta, GA GLA: 6.1 M sf % GLA: 49% South/Southwest Scottsdale, AZ GLA: 3.9 M sf % GLA: 31% • 4 Regional Offices: Charleston, SC; Atlanta, GA; Indianapolis, IN; and Scottsdale, AZ • All offer full service asset management, property management, construction management, accounting and leasing capabilities • Integrated accounting, budgeting and property management systems Key Market GLA % of Portfolio Phoenix, AZ 1,152 9.2% Pittsburgh, PA 978 7.8% Greenville, SC 965 7.7% Indianapolis, IN 820 6.5% Albany, NY 741 5.9% Houston, TX 692 5.5% Atlanta, GA 574 4.6% Dallas, TX 393 3.1% Boston, MA 372 3.0% Raleigh, NC 244 2.0% Oklahoma City, OK 186 1.5% 6

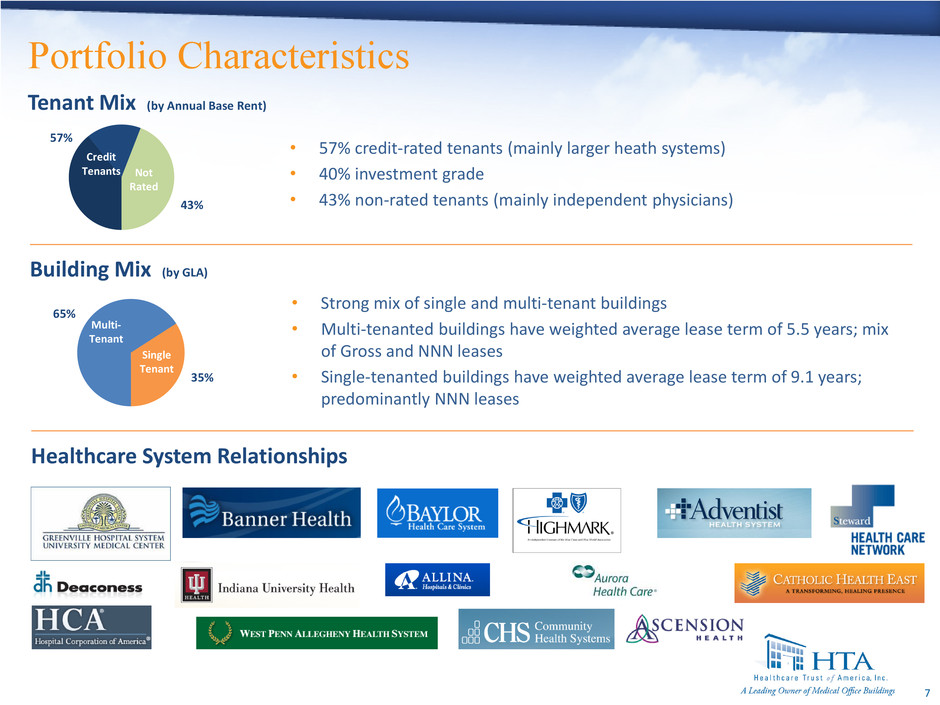

Portfolio Characteristics Tenant Mix (by Annual Base Rent) 57% 43% Credit Tenants Not Rated • Strong mix of single and multi-tenant buildings • Multi-tenanted buildings have weighted average lease term of 5.5 years; mix of Gross and NNN leases • Single-tenanted buildings have weighted average lease term of 9.1 years; predominantly NNN leases 65% 35% Multi- Tenant Single Tenant • 57% credit-rated tenants (mainly larger heath systems) • 40% investment grade • 43% non-rated tenants (mainly independent physicians) 7 Healthcare System Relationships Building Mix (by GLA)

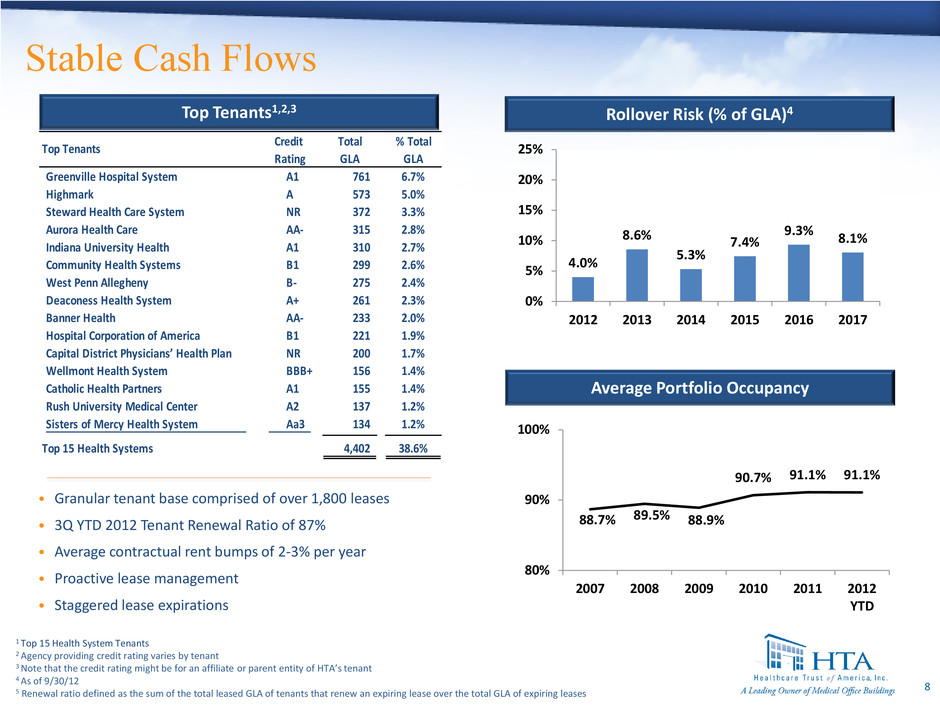

Leading owner of Medical Office Buildings Stable Cash Flows 1 Top 15 Health System Tenants 2 Agency providing credit rating varies by tenant 3 Note that the credit rating might be for an affiliate or parent entity of HTA’s tenant 4 As of 9/30/12 5 Renewal ratio defined as the sum of the total leased GLA of tenants that renew an expiring lease over the total GLA of expiring leases Top Tenants1,2,3 Rollover Risk (% of GLA)4 Average Portfolio Occupancy 8 4.0% 8.6% 5.3% 7.4% 9.3% 8.1% 0% 5% 10% 15% 20% 25% 2012 2013 2014 2015 2016 2017 88.7% 89.5% 88.9% 90.7% 91.1% 91.1% 80% 90% 100% 2007 2008 2009 2010 2011 2012 YTD Credit Total % Total Rating GLA GLA Greenville Hospital System A1 761 6.7% Highmark A 573 5.0% Steward Health Care System NR 372 3.3% Aurora Health Care AA- 315 2.8% Indiana University Health A1 310 2.7% Community Health Systems B1 299 2.6% West Penn Allegheny B- 275 2.4% Deaconess Health System A+ 261 2.3% Banner Health AA- 233 2.0% Hospital Corporation of America B1 221 1.9% Capital District Physicians’ Health Plan NR 200 1.7% Wellmont Health System BBB+ 156 1.4% Catholic Health Partners A1 155 1.4% Rush University Medical Center A2 137 1.2% Sisters of Mercy Health System Aa3 134 1.2% Top 15 Health Systems 4,402 38.6% Top Tenants • Granular tenant base comprised of over 1,800 leases • 3Q YTD 2012 Tenant Renewal Ratio of 87% • Average contractual rent bumps of 2-3% per year • Proactive lease management • Staggered lease expirations

Leading owner of Medical Office Buildings Greenville, SC Key Strategic Investments in Economic Downturn • 964k SF / 17 buildings • Major Tenant: Greenville Hospital System (Moody’s: A1) • Key Acquisition: GHS / $163mm / September 2009 Pittsburgh, PA Phoenix, AZ Albany, NY Boston, MA • 1.2mm SF / 32 buildings • Major Tenant: Banner Health (Fitch: AA-) • Key Acquisition: Banner Sun City / $107mm / December 2009 • 956k SF / 9 buildings • Multi-Tenanted Buildings • Acquired: $197mm / November 2010 • 978k SF / 3 buildings • Major Tenant: Highmark (S&P: A) and its affiliates • Acquired: $133.5mm / 2010-2012 • 372k SF / 13 buildings • Major Tenant: 100% NNN to Steward Healthcare • Acquired: $100mm / March 2012 9 Indianapolis, IN • 820k SF / 32 buildings • Major Tenant: Indiana Univ. Health (A1) • Key Acquisition: IU Health / $90mm / June 2008

Leading owner of Medical Office Buildings • HTA has developed and maintains extensive industry relationships • Dedicated buyer focused only on MOB space • Acquired $1.8 Bn of properties in 2008- 2010 o HTA was a cash buyer during the economic recession o Limited competition o Attractive pricing • Developers and Health Systems are primary source of acquisition opportunities o ~69% of transactions1 2009-present sourced through these relationships Acquisition Sourcing Acquisition Strategy 10 1 Transactions measured by acquisition price Acquisition Criteria • On-Campus MOBs – core, critical real estate • Affiliated with dominant health system • Significant ongoing investment by health system in the adjacent campus • Ability to service with HTA’s in-house property management platform • Stabilized occupancy • Generally $25 to $75 million in size – meaningful to HTA • Accretive to cost of capital

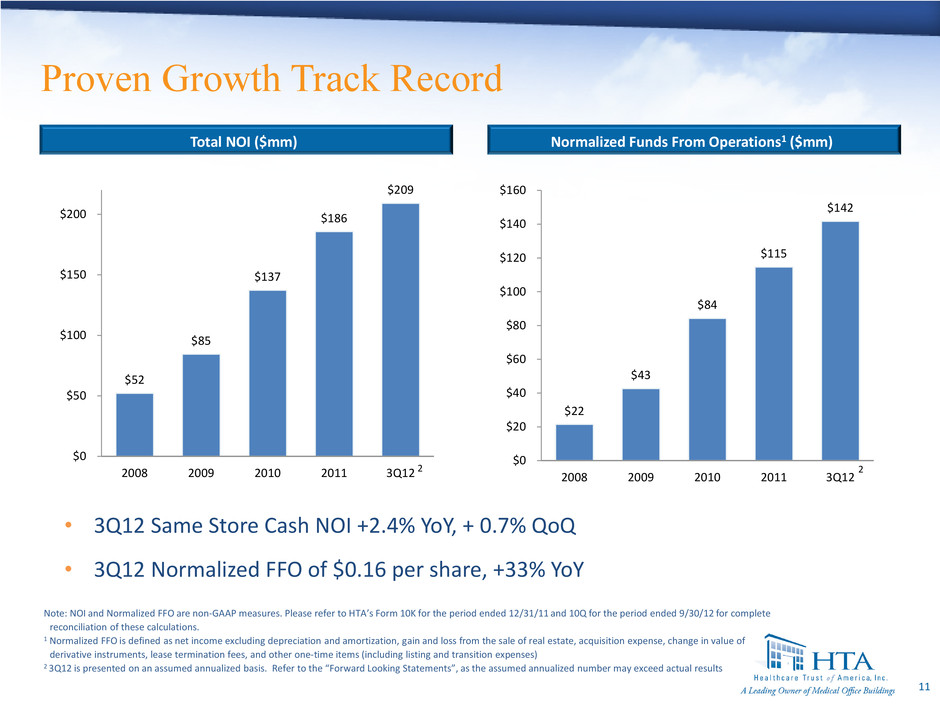

Leading owner of Medical Office Buildings Proven Growth Track Record Total NOI ($mm) Normalized Funds From Operations1 ($mm) $52 $85 $137 $186 $209 $0 $50 $100 $150 $200 2008 2009 2010 2011 3Q12 $22 $43 $84 $115 $142 $0 $20 $40 $60 $80 $100 $120 $140 $160 2008 2009 2010 2011 3Q12 • 3Q12 Same Store Cash NOI +2.4% YoY, + 0.7% QoQ • 3Q12 Normalized FFO of $0.16 per share, +33% YoY 11 Note: NOI and Normalized FFO are non-GAAP measures. Please refer to HTA’s Form 10K for the period ended 12/31/11 and 10Q for the period ended 9/30/12 for complete reconciliation of these calculations. 1 Normalized FFO is defined as net income excluding depreciation and amortization, gain and loss from the sale of real estate, acquisition expense, change in value of derivative instruments, lease termination fees, and other one-time items (including listing and transition expenses) 2 3Q12 is presented on an assumed annualized basis. Refer to the “Forward Looking Statements”, as the assumed annualized number may exceed actual results 2 2

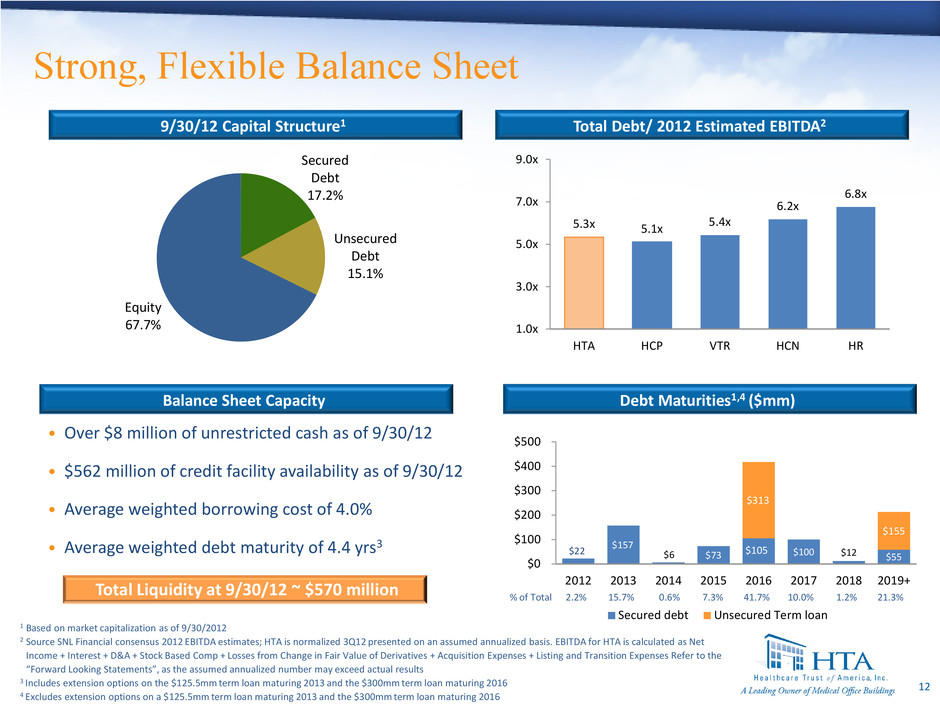

• Over $8 million of unrestricted cash as of 9/30/12 • $562 million of credit facility availability as of 9/30/12 • Average weighted borrowing cost of 4.0% • Average weighted debt maturity of 4.4 yrs3 Strong, Flexible Balance Sheet 5.3x 5.1x 5.4x 6.2x 6.8x 1.0x 3.0x 5.0x 7.0x 9.0x HTA HCP VTR HCN HR Total Debt/ 2012 Estimated EBITDA2 9/30/12 Capital Structure1 1 Based on market capitalization as of 9/30/2012 2 Source SNL Financial consensus 2012 EBITDA estimates; HTA is normalized 3Q12 presented on an assumed annualized basis. EBITDA for HTA is calculated as Net Income + Interest + D&A + Stock Based Comp + Losses from Change in Fair Value of Derivatives + Acquisition Expenses + Listing and Transition Expenses Refer to the “Forward Looking Statements”, as the assumed annualized number may exceed actual results 3 Includes extension options on the $125.5mm term loan maturing 2013 and the $300mm term loan maturing 2016 4 Excludes extension options on a $125.5mm term loan maturing 2013 and the $300mm term loan maturing 2016 Balance Sheet Capacity 12 Secured Debt 17.2% Unsecured Debt 15.1% Equity 67.7% Total Liquidity at 9/30/12 ~ $570 million Debt Maturities1,4 ($mm) $22 $157 $6 $73 $100 $12 $55 $313 $155 $0 $100 $200 $300 $400 $500 2012 2013 2014 2015 2016 2017 2018 2019+ Secured debt Unsecured Term loan % of Total 2.2% 15.7% 0.6% 7.3% 41.7% 10.0% 1.2% 21.3% $105

Experienced Management Team Scott Peters Chairman, CEO, and President • Co-Founded HTA in 2006 • CEO of Grubb & Ellis (NYSE), ‘07-’08 • CEO of NNN Realty Advisors, ‘06-’08 • EVP, CFO, Triple Net Properties, Inc., ‘04-’06 • Co-Founder, CFO of Golf Trust of America, Inc. (AMEX), ’97-’07 • EVP, Pacific Holding Company/LSR, ‘92-’96 • EVP, CFO, Castle & Cooke Properties, Inc. (Dole Food Co.), ‘88-’92 Mark Engstrom, EVP - Acquisitions • CEO, InSite Medical Properties, ‘06–’09 • Mgr. of Real Estate Services, Hammes Company, ‘01–’05 • Vice President, PM Realty Group, ‘98–’01 • Founder/Principal–Pacific Health Properties, ‘95–’98 • Hospital Administrator, Good Samaritan Health System, ‘87–’95 Amanda Houghton, EVP - Asset Management • Manager of Joint Ventures, Glenborough LLC, ‘06–’09 • Senior Analyst, ING Clarion, ‘05 –’06 • Senior Analyst, Weyerhauser Realty Investors, ‘04–’05 • RSM EquiCo and Bernstein, Conklin, & Balcombe, ‘01-’03 • Member of the CFA Institute and CREW • Appointed to the NAIOP Medical & Life Sciences Forum Kellie Pruitt, EVP - Chief Financial Officer • VP of Financial Reporting and Compliance, Fender Musical Instruments Corporation, ‘07-’08 • Senior Manager, Real Estate and Public Companies, Deloitte and Touche, LLP, ’95-’07 • Certified Public Accountant, Texas and Arizona 13

Key Investment Highlights Dividend of $0.575 per share Medical Office Building Specialist 91% Occupancy in Defensive Asset Class Investment Grade Balance Sheet Strong Industry and Macroeconomic Trends Greenville Life Center (Greenville, SC) Desert Ridge (Phoenix, AZ) 14 Healthcare REITs at Significant Premiums