Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ATP OIL & GAS CORP | d445842d8k.htm |

Exhibit 99.1

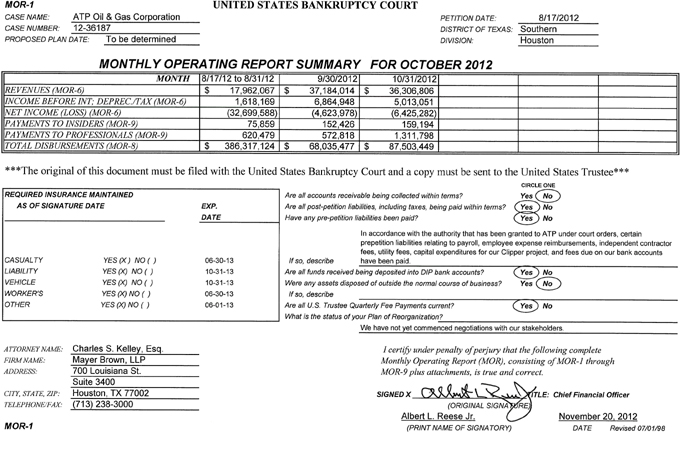

MOR-1 case name: ATP Oil & Gas Corporation UNITED STATES BANKRUPTCY COURT PETITION DATE: DISTRICT OF TEXAS: DIVISION: 8/17/2012 CASE NUMBER: 12-36187 Southern proposed plan date: To be determined Houston MONTHLY OPERATING REPORT SUMMARY FOR OCTOBER 2012 MONTH 8/1 7/12 to 8/31/1 2 9/30/2012 10/31/2012 REVENUES (MOR-6) $ 17,962,067 $ 37,184,014 $ 36,306,806 INCOME BEFORE INT; DEPREC./TAX (MOR-6) 1,618,169 6,864,948 5,013,051 NET INCOME (LOSS) (MOR-6) (32,699,588) (4,623,978) (6,425,282) PAYMENTS TO INSIDERS (MOR-9) 75,859 152,426 159,194 PAYMENTS TO PROFESSIONALS (MOR-9) 620,479 572,818 1,311,798 TOTAL DISHVRSEMENTS (MOR-8) $ 386,317,124 $ 66,035,477 $ 87,503,449 ***The original of this document must be filed with the United States Bankruptcy Court and a copy must be sent to the United States Trustee***

REQUIRED INSURANCE MAINTAINED AS OF SIGNATURE DATE EXP. DATE CASUALTY YES(X) NO( ) 06-30-13 LIABILITY YES (X) NO ( ) 10-31-13 VEHICLE YES (X) NO ( ) 10-31-13 WORKER’S yes (X) no ( ) 06-30-13 OTHER YES (X) NO ( ) 06-01-13 Are ail accounts receivable being collected within terms? Are all post-petition liabilities, including taxes, being paid within terms? Have any pre-petitiori liabilities been paid? CIRCLE ONE Yes No yes no Yes No if so, describe In accordance with the authority that has been granted to ATP under court orders, certain prepetition liabilities relating to payroll, employee expense reimbursements, independent contractor fees, utility fees, capital expenditures for our Clipper project, and fees due on our bank accounts have bean paid Are all funds received being deposited into DIP bank accounts? Were any assets disposed of outside the normal course of business? If so, describe Yes No Yes No Are all U.S. Trustee Quarterly Fee Payments current? What is the status of your Plan of Reorganization? Yes No

ATTORNEY NAME: FIRM NAME: ADDRESS: CITY. STATE, ZIP: TELEPHONE/FAX: Charles S. Kelley, Esq. Mayer Brown, LLP 700 Louisiana St. Suite 3400 Houston, TX 77002 (713)238-3000 We have not yet commenced negotiations with our stakeholders. / certify under penalty of perjury that the following complete Monthly Operating Report (MOR), consisting of MOR-1 through MOR-9 plus attachments, is true and correct. SIGHED X TITLE: Chief Financial Officer (ORIGINAL SIGNATURE) Albert L Reese Jr. November 20, 2012 (PRINT NAME OF SIGNATORY) DATE Revised 07/01/98

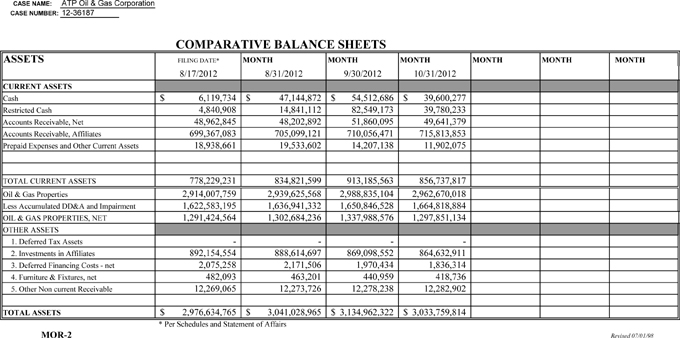

CASE NA ME: ATP Oil & Gas Corporation CASE NUMBER: 12-36187 COMPARATIVE BALANCE SHEETS ASSETS FILING DATE* MONTH MONTH MONTH MONTH MONTH MONTH 8/17/2012 8/31/2012 9/30/2012 10/31/2012 CURRENT ASSETS Cash $ 6,119,734 $ 47,144,872 $ 54,512,686 $ 39,600,277 Restricted Cash 4,840,908 14,841,112 82,549,173 39,780,233 Accounts Receivable, Net 48,962,845 48,202,892 51,860,095 49,641,379 Accounts Receivable, Affiliates 699,367,083 705,099,121 710,056,471 715,813,853 Prepaid Expenses and Other Current Assets 18,938,661 19,533,602 14,207,138 11,902,075 TOTAL CURRENT ASSETS 778,229,231 834,821,599 913,185,563 856,737,817 Oil & Gas Properties 2,914,007,759 2,939,625,568 2,988,835,104 2,962,670,018 Less Accumulated DD&A and Impairment 1,622,583,195 1,636,941,332 1,650,846,528 1,664,818,884 OIL & GAS PROPERTIES, NET 1,291,424,564 1,302,684,236 1,337,988,576 1,297,851,134 OTHER ASSETS 1. Deferred Tax Assets - - - - 2. Investments in Affiliates 892,154,554 888,614,697 869,098,552 864,632,911 3. Deferred Financing Costs - net 2,075,258 2,171,506 1,970,434 1,836,314 4. Furniture & Fixtures, net 482,093 463,201 440,959 418,736 5. Other Non current Receivable 12,269,065 12,273,726 12,278,238 12,282,902 TOTAL ASSETS $ 2,976,634,765 $ 3,041,028,965 $ 3,134,962,322 $ 3,033,759,814 * Per Schedules and Statement of Affairs MOR-2 Revised 07/01/98

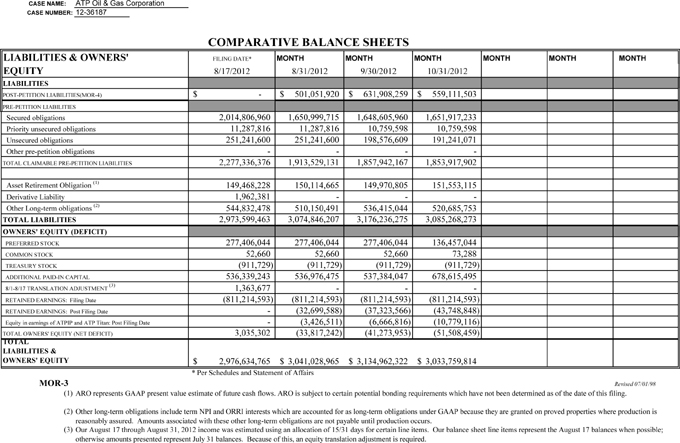

CASE NAME: ATP Oil & Gas Corporation CASE NUMBER: 12-36187 COMPARATIVE BALANCE SHEETS LIABILITIES & OWNERS’ FILING DATE* MONTH MONTH MONTH MONTH MONTH MONTH EQUITY 8/17/2012 8/31/2012 9/30/2012 10/31/2012 LIABILITIES POST-PETITION LIABILITIES(MOR-4) $ - $ 501,051,920 $ 631,908,259 $ 559,111,503 PRE-PETITION LIABILITIES Secured obligations 2,014,806,960 1,650,999,715 1,648,605,960 1,651,917,233 Priorityunsecured obligations 11,287,816 11,287,816 10,759,598 10,759,598 Unsecured obligations 251,241,600 251,241,600 198,576,609 191,241,071 Other pre-petition obligations - - - - TOTAL CLAIMABLE PRE-PETITION LIABILITIES 2,277,336,376 1,913,529,131 1,857,942,167 1,853,917,902 (1) Asset Retirement Obligation 149,468,228 150,114,665 149,970,805 151,553,115 Derivative Liability 1,962,381 - - - (2) Other Long-term obligations 544,832,478 510,150,491 536,415,044 520,685,753 TOTAL LIABILITIES 2,973,599,463 3,074,846,207 3,176,236,275 3,085,268,273 OWNERS’ EQUITY (DEFICIT) PREFERRED STOCK 277,406,044 277,406,044 277,406,044 136,457,044 COMMON STOCK 52,660 52,660 52,660 73,288 TREASURY STOCK (911,729) (911,729) (911,729) (911,729) ADDITIONAL PAID-IN CAPITAL 536,339,243 536,976,475 537,384,047 678,615,495 (3) 8/1-8/17 TRANSLATION ADJUSTMENT 1,363,677 - - - RETAINED EARNINGS: Filing Date (811,214,593) (811,214,593) (811,214,593) (811,214,593) RETAINED EARNINGS: Post Filing Date - (32,699,588) (37,323,566) (43,748,848) Equity in earnings of ATPIP and ATP Titan: Post Filing Date - (3,426,511) (6,666,816) (10,779,116) TOTAL OWNERS’ EQUITY (NET DEFICIT) 3,035,302 (33,817,242) (41,273,953) (51,508,459) TOTAL LIABILITIES & OWNERS’ EQUITY $ 2,976,634,765 $ 3,041,028,965 $ 3,134,962,322 $ 3,033,759,814 * Per Schedules and Statement of Affairs MOR-3 Revised 07/01/98 (1) ARO represents GAAP present value estimate of future cash flows. ARO is subject to certain potential bonding requirements which have not been determined as of the date of this filing. (2) Other long-term obligations include term NPI and ORRI interests which are accounted for as long-term obligations under GAAP because they are granted on proved properties where production is reasonably assured. Amounts associated with these other long-term obligations are not pay able until production occurs. (3) Our August 17 through August 31, 2012 income was estimated using an allocation of 15/31 day s for certain line items. Our balance sheet line items represent the August 17 balances when possible; otherwise amounts presented represent July 31 balances. Because of this, an equity translation adjustment is required.

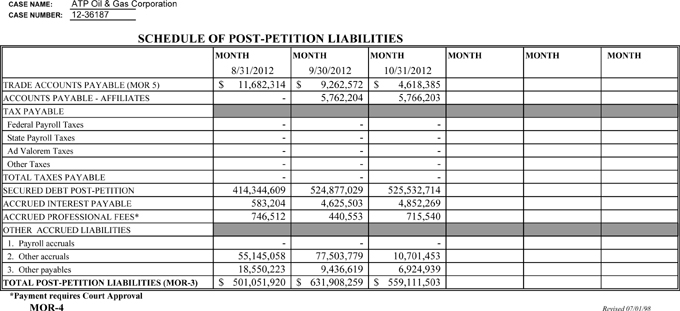

CASE NAME: ATP Oil & Gas Corporation CASE NUMBER: 12-36187 SCHEDULE OF POST-PETITION LIABILITIES MONTH MONTH MONTH MONTH MONTH MONTH 8/31/2012 9/30/2012 10/31/2012 TRADE ACCOUNTS PAYABLE (MOR 5) $ 11,682,314 $ 9,262,572 $ 4,618,385 ACCOUNTS PAYABLE - AFFILIATES - 5,762,204 5,766,203 TAX PAYABLE Federal Payroll Taxes - - - State Payroll Taxes - - - Ad Valorem Taxes - - - Other Taxes - - - TOTAL TAXES PAYABLE - - - SECURED DEBT POST-PETITION 414,344,609 524,877,029 525,532,714 ACCRUED INTEREST PAYABLE 583,204 4,625,503 4,852,269 ACCRUED PROFESSIONAL FEES* 746,512 440,553 715,540 OTHER ACCRUED LIABILITIES 1. Payroll accruals - - - 2. Other accruals 55,145,058 77,503,779 10,701,453 3. Other payables 18,550,223 9,436,619 6,924,939 TOTAL POST-PETITION LIABILITIES (MOR-3) $ 501,051,920 $ 631,908,259 $ 559,111,503 *Payment requires Court Approval MOR-4 Revised 07/01/98

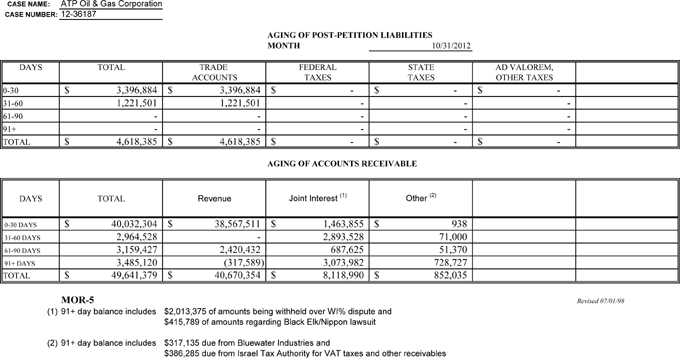

CASE NA ME: ATP Oil & Gas Corporation CASE NUMBER: 12-36187 AGING OF POST-PETITION LIABILITIES MONTH 10/31/2012 DAYS TOTAL TRADE FEDERAL STATE AD VALOREM, ACCOUNTS TAXES TAXES OTHER TAXES 0-30 $ 3,396,884 $ 3,396,884 $ - $ - $ - 31-60 1,221,501 1,221,501 - - - 61-90 - - - - - 91+ - - - - - TOTAL $ 4,618,385 $ 4,618,385 $ - $ - $ - AGING OF ACCOUNTS RECEIVABLE AGING OF ACCOUNTS RECEIVABLE (1) (2) DAYS TOTAL Revenue Joint Interest Other 0-30 DAYS $ 40,032,304 $ 38,567,511 $ 1,463,855 $ 938 31-60 DAYS 2,964,528 - 2,893,528 71,000 61-90 DAYS 3,159,427 2,420,432 687,625 51,370 91+ DAYS 3,485,120 (317,589) 3,073,982 728,727 TOTAL $ 49,641,379 $ 40,670,354 $ 8,118,990 $ 852,035 MOR-5 Revised 07/01/98 (1) 91+ day balance includes $2,013,375 of amounts being withheld over W I% dispute and $415,789 of amounts regarding Black Elk/Nippon lawsuit (2) 91+ day balance includes $317,135 due from Bluewater Industries and $386,285 due from Israel Tax Authority for VAT taxes and other receivables

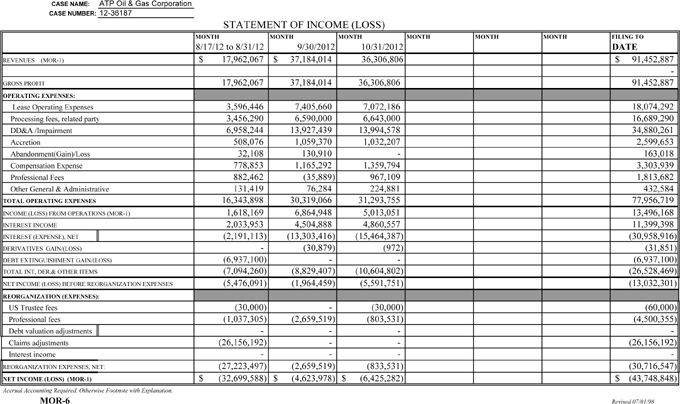

CASE NAME: ATP Oil & Gas Corporation CASE NUMBER: 12-36187 CASE NUMBER: 12-36187 STATEMENT OF I NCOME (LOSS) MONTH MONTH MONTH MONTH MONTH MONTH FILING TO 8/17/12 to 8/31/12 9/30/2012 10/31/2012 DATE REVENUES (MOR-1) $ 17,962,067 $ 37,184,014 36,306,806 $ 91,452,887 - GROSS PROFIT 17,962,067 37,184,014 36,306,806 91,452,887 OPERATING EXPENSES: Lease Operating Expenses 3,596,446 7,405,660 7,072,186 18,074,292 Processing fees, related party 3,456,290 6,590,000 6,643,000 16,689,290 DD&A /Impairment 6,958,244 13,927,439 13,994,578 34,880,261 Accretion 508,076 1,059,370 1,032,207 2,599,653 Abandonment(Gain)/Loss 32,108 130,910 - 163,018 Compensation Expense 778,853 1,165,292 1,359,794 3,303,939 Professional Fees 882,462 (35,889) 967,109 1,813,682 Other General & Administrative 131,419 76,284 224,881 432,584 TOTAL OPERATING EXPENSES 16,343,898 30,319,066 31,293,755 77,956,719 INCOME (LOSS) FROM OPERATIONS (MOR-1) 1,618,169 6,864,948 5,013,051 13,496,168 INTEREST INCOME 2,033,953 4,504,888 4,860,557 11,399,398 INTEREST (EXPENSE), NET (2,191,113) (13,303,416) (15,464,387) (30,958,916) DERIVATIVES GAIN/(LOSS) - (30,879) (972) (31,851) DEBT EXTINGUISHMENT GAIN/(LOSS) (6,937,100) - - (6,937,100) TOTAL INT, DER.& OTHER ITEMS (7,094,260) (8,829,407) (10,604,802) (26,528,469) NET INCOME (LOSS) BEFORE REORGANIZATION EXPENSES (5,476,091) (1,964,459) (5,591,751) (13,032,301) REORGANIZATION (EXPENSES): US Trustee fees (30,000) - (30,000) (60,000) Professional fees (1,037,305) (2,659,519) (803,531) (4,500,355) Debt valuation adjustments - - - - Claims adjustments (26,156,192) - - (26,156,192) Interest income - - - - REORGANIZATION EXPENSES, NET: (27,223,497) (2,659,519) (833,531) (30,716,547) NET INCOME (LOSS) (MOR-1) $ (32,699,588) $ (4,623,978) $ (6,425,282) $ (43,748,848) Accrual Accounting Required, Otherw ise Footnote w ith Explanation. MOR-6 Revised 07/01/98

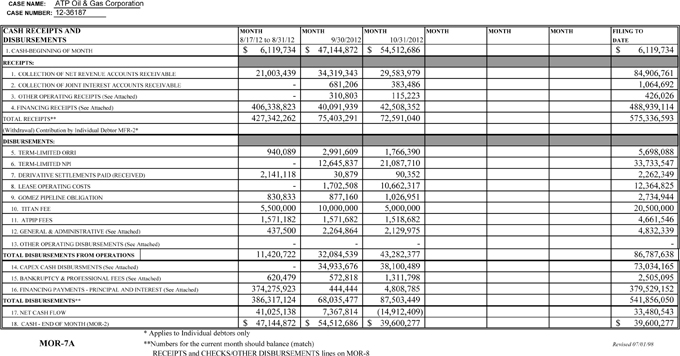

CASE NAME: ATP Oil & Gas Corporation CASE NUMBER: 12-36187 CASH RECEIPTS AND MONTH MONTH MONTH MONTH MONTH MONTH FILING TO DISBURSEMENTS 8/17/12 to 8/31/12 9/30/2012 10/31/2012 c DATE 1. CASH-BEGINNING OF MONTH $ 6,119,734 $ 47,144,872 $ 54,512,686 $ 6,119,734 RECEIPTS: 1. COLLECTION OF NET REVENUE ACCOUNTS RECEIVABLE 21,003,439 34,319,343 29,583,979 84,906,761 2. COLLECTION OF JOINT INTEREST ACCOUNTS RECEIVABLE - 681,206 383,486 1,064,692 3. OTHER OPERATING RECEIPTS (See Attached) - 310,803 115,223 426,026 4. FINANCING RECEIPTS (See Attached) 406,338,823 40,091,939 42,508,352 488,939,114 TOTAL RECEIPTS** 427,342,262 75,403,291 72,591,040 575,336,593 (Withdrawal) Contribution by Individual Debtor MFR-2* DISBURSEMENTS: 5. TERM-LIMITED ORRI 940,089 2,991,609 1,766,390 5,698,088 6. TERM-LIMITED NPI - 12,645,837 21,087,710 33,733,547 7. DERIVATIVE SETTLEMENTS PAID (RECEIVED) 2,141,118 30,879 90,352 2,262,349 8. LEASE OPERATING COSTS - 1,702,508 10,662,317 12,364,825 9. GOMEZ PIPELINE OBLIGATION 830,833 877,160 1,026,951 2,734,944 10. TITAN FEE 5,500,000 10,000,000 5,000,000 20,500,000 11. ATPIP FEES 1,571,182 1,571,682 1,518,682 4,661,546 12. GENERAL & ADMINISTRATIVE (See Attached) 437,500 2,264,864 2,129,975 4,832,339 13. OTHER OPERATING DISBURSEMENTS (See Attached) - - - - TOTAL DISBURSEMENTS FROM OPERATIONS 11,420,722 32,084,539 43,282,377 86,787,638 14. CAPEX CASH DISBURSMENTS (See Attached) - 34,933,676 38,100,489 73,034,165 15. BANKRUPTCY & PROFESSIONAL FEES (See Attached) 620,479 572,818 1,311,798 2,505,095 16. FINANCING PAYMENTS - PRINCIPAL AND INTEREST (See Attached) 374,275,923 444,444 4,808,785 379,529,152 TOTAL DISBURSEMENTS** 386,317,124 68,035,477 87,503,449 541,856,050 17. NET CASH FLOW 41,025,138 7,367,814 (14,912,409) 33,480,543 18. CASH - END OF MONTH (MOR-2) $ 47,144,872 $ 54,512,686 $ 39,600,277 $ 39,600,277 Revised 07/01/98 * Applies to Individual debtors only MOR-7A **N umbers for the current month should balance (match) RECEIPTS and CHECKS/OTHER DISBURSEMENTS lines on MOR-8 CASE NAME: ATP Oil & Gas Corporation CASE NUMBER: 12-36187

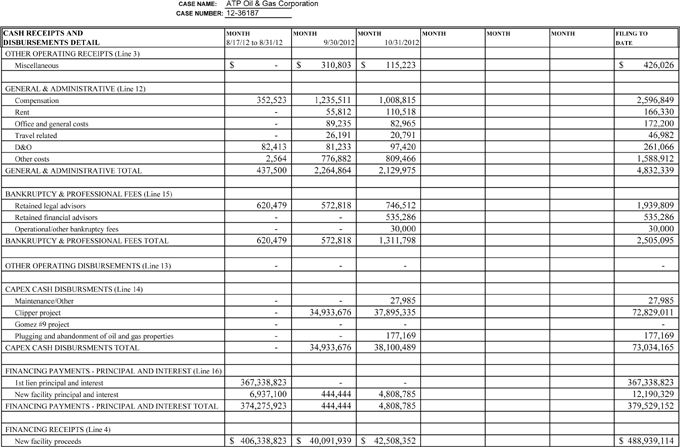

CASE NUMBER: 12-36187 CASH RECEIPTS AND MONTH MONTH MONTH MONTH MONTH MONTH FILING TO DISBURSEMENTS DETAIL 8/17/12 to 8/31/12 9/30/2012 10/31/2012 DATE OTHER OPERATING RECEIPTS (Line 3) Miscellaneous $ - $ 310,803 $ 115,223 $ 426,026 GENERAL & ADMINISTRATIVE (Line 12) Compensation 352,523 1,235,511 1,008,815 2,596,849 Rent - 55,812 110,518 166,330 Office and general costs - 89,235 82,965 172,200 Travel related - 26,191 20,791 46,982 D&O 82,413 81,233 97,420 261,066 Other costs 2,564 776,882 809,466 1,588,912 GENERAL & ADMINISTRATIVE TOTAL 437,500 2,264,864 2,129,975 4,832,339 BANKRUPTCY & PROFESSIONAL FEES (Line 15) Retained legal advisors 620,479 572,818 746,512 1,939,809 Retained financial advisors - - 535,286 535,286 Operational/other bankruptcy fees - - 30,000 30,000 BANKRUPTCY & PROFESSIONAL FEES TOTAL 620,479 572,818 1,311,798 2,505,095 OTHER OPERATING DISBURSEMENTS (Line 13) - - - - CAPEX CASH DISBURSMENTS (Line 14) Maintenance/Other - - 27,985 27,985 Clipper project - 34,933,676 37,895,335 72,829,011 Gomez #9 project - - - - Plugging and abandonment of oil and gas properties - - 177,169 177,169 CAPEX CASH DISBURSMENTS TOTAL - 34,933,676 38,100,489 73,034,165 FINANCING PAYMENTS - PRINCIPAL AND INTEREST (Line 16) 1st lien principal and interest 367,338,823 - - 367,338,823 New facility principal and interest 6,937,100 444,444 4,808,785 12,190,329 FINANCING PAYMENTS - PRINCIPAL AND INTEREST TOTAL 374,275,923 444,444 4,808,785 379,529,152 FINANCING RECEIPTS (Line 4) New facility proceeds $ 406,338,823 $ 40,091,939 $ 42,508,352 $ 488,939,114

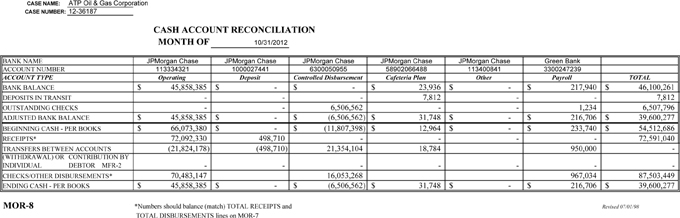

CASE NAME: ATP Oil & Gas Corporation CASE NUMBER: 12-36187 CASH ACCOUNT RECONCILIATION MONTH OF 10/31/2012 BANK NAME JPMorgan Chase JPMorgan Chase JPMorgan Chase JPMorgan Chase JPMorgan Chase Green Bank ACCOUNT NUMBER 113334321 1000027441 6300050955 58902066488 113400841 3300247239 ACCOUNT TYPE Operating Deposit Controlled Disbursement Cafeteria Plan Other Payroll TOTAL BANK BALANCE $ 45,858,385 $ - $ - $ 23,936 $ - $ 217,940 $ 46,100,261 DEPOSITS IN TRANSIT - - - 7,812 - - 7,812 OUTSTANDING CHECKS - - 6,506,562 - - 1,234 6,507,796 ADJUSTED BANK BALANCE $ 45,858,385 $ - $ (6,506,562) $ 31,748 $ - $ 216,706 $ 39,600,277 BEGINNING CASH - PER BOOKS $ 66,073,380 $ - $ (11,807,398) $ 12,964 $ - $ 233,740 $ 54,512,686 RECEIPTS* 72,092,330 498,710 - - - - 72,591,040 TRANSFERS BETWEEN ACCOUNTS (21,824,178) (498,710) 21,354,104 18,784 950,000 - (WITHDRAWAL) OR CONTRIBUTION BY INDIVIDUAL DEBTOR MFR-2 - - - - - - - CHECKS/OTHER DISBURSEMENTS* 70,483,147 16,053,268 967,034 87,503,449 ENDING CASH - PER BOOKS $ 45,858,385 $ - $ (6,506,562) $ 31,748 $ - $ 216,706 $ 39,600,277 Revised 07/01/98 MOR-8 *Numbers should balance (match) TOTAL RECEIPTS and TOTAL DISBURSEMENTS lines on MOR-7

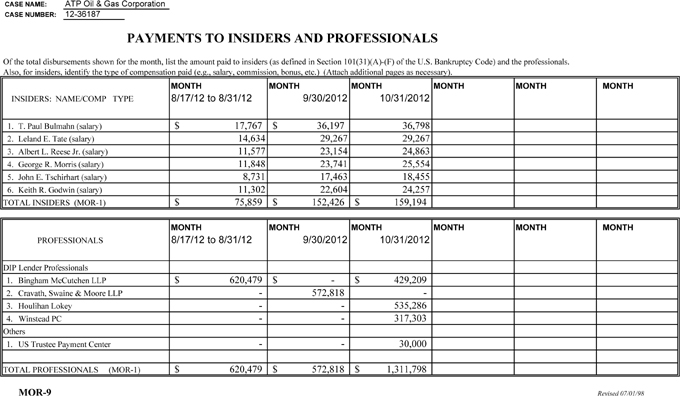

CASE NAME: ATP Oil & Gas Corporation CASE NUMBER: 12-36187 PAYMENTS TO INSIDERS AND PROFESSIONALS Of the total disbursements shown for the month, list the amount paid to insiders (as defined in Section 101(31)(A)-(F) of the U.S. Bankruptcy Code) and the professionals. Also, for insiders, identify the type of compensation paid (e.g., salary, commission, bonus, etc.) (Attach additional pages as necessary). MONTH MONTH MONTH MONTH MONTH MONTH INSIDERS: NAME/COMP TYPE 8/17/12 to 8/31/12 9/30/2012 10/31/2012 1. T. Paul Bulmahn (salary) $ 17,767 $ 36,197 36,798 2. Leland E. Tate (salary) 14,634 29,267 29,267 3. Albert L. Reese Jr. (salary) 11,577 23,154 24,863 4. George R. Morris (salary) 11,848 23,741 25,554 5. John E. Tschirhart (salary) 8,731 17,463 18,455 6. Keith R. G odwin (salary) 11,302 22,604 24,257 TOTAL INSIDERS (MOR-1) $ 75,859 $ 152,426 $ 159,194 MONTH MONTH MONTH MONTH MONTH MONTH PROFESSIONALS 8/17/12 to 8/31/12 9/30/2012 10/31/2012 DIP Lender Professionals 1. Bingham McCutchen LLP $ 620,479 $ - $ 429,209 2. Cravath, Swaine & Moore LLP - 572,818 - 3. Houlihan Lokey - - 535,286 4. Winstead PC - - 317,303 Others 1. US Trustee Payment Center - - 30,000 TOTAL PROFESSIONALS (MOR-1) $ 620,479 $ 572,818 $ 1,311,798 More-9 Revised 07/01/98