Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FULTON FINANCIAL CORP | d444527d8k.htm |

Investor Presentation

Data as of September 30, 2012

Ticker Symbol: FULT (NASDAQ)

Exhibit 99.1 |

Forward-Looking Statements

2

This presentation may contain forward-looking statements with respect to Fulton Financial

Corporation’s financial condition, results of operations and business. Do not

unduly rely on forward-looking statements. Forward-looking statements can be

identified by the use of words such as “may,” “should,” “will,” “could,” “estimates,” “predicts,”

“potential,” “continue,” “anticipates,” “believes,”

“plans,” “expects,” “future,” “intends” and similar expressions which

are intended to identify forward-looking statements.

Forward-looking statements are not guarantees of future performance and are subject to risks and

uncertainties, some of which are beyond the Corporation’s control and ability to predict,

that could cause actual results to differ materially from those expressed in the

forward-looking statements. The Corporation undertakes no obligation, other than as

required by law, to update or revise any forward-looking statements whether as a result of new information,

future events or otherwise. Many

factors could affect future financial results including, without limitation: the impact of adverse changes in the

economy and real estate markets; increases in non-performing assets which may reduce the level of

earning assets and require the Corporation to increase the allowance for credit losses,

charge-off loans and incur elevated collection and carrying costs related to such

non-performing assets; acquisition and growth strategies; market risk; changes or adverse

developments in political or regulatory conditions; a disruption in, or abnormal functioning of, credit and other

markets, including the lack of or reduced access to markets for mortgages and other asset-backed

securities and for commercial paper and other short-term borrowings; changes in the levels

of, or methodology for determining, FDIC deposit insurance premiums and assessments; the

effect of competition and interest rates on net interest margin and net interest income;

investment strategy and other income growth; investment securities gains and losses; declines

in the value of securities which may result in charges to earnings; changes in rates of deposit and

loan growth or a decline in loans originated; relative balances of rate-sensitive assets

to rate-sensitive liabilities; salaries and employee benefits and other expenses;

amortization of intangible assets; goodwill impairment; capital and liquidity strategies; and

other financial and business matters for future periods.

For a more complete discussion of certain risks and uncertainties affecting the Corporation, please

see the sections entitled “Risk Factors” and “Management’s Discussion and

Analysis of Financial Condition and Results of Operations” set forth in the

Corporation’s filings with the Securities and Exchange Commission.

|

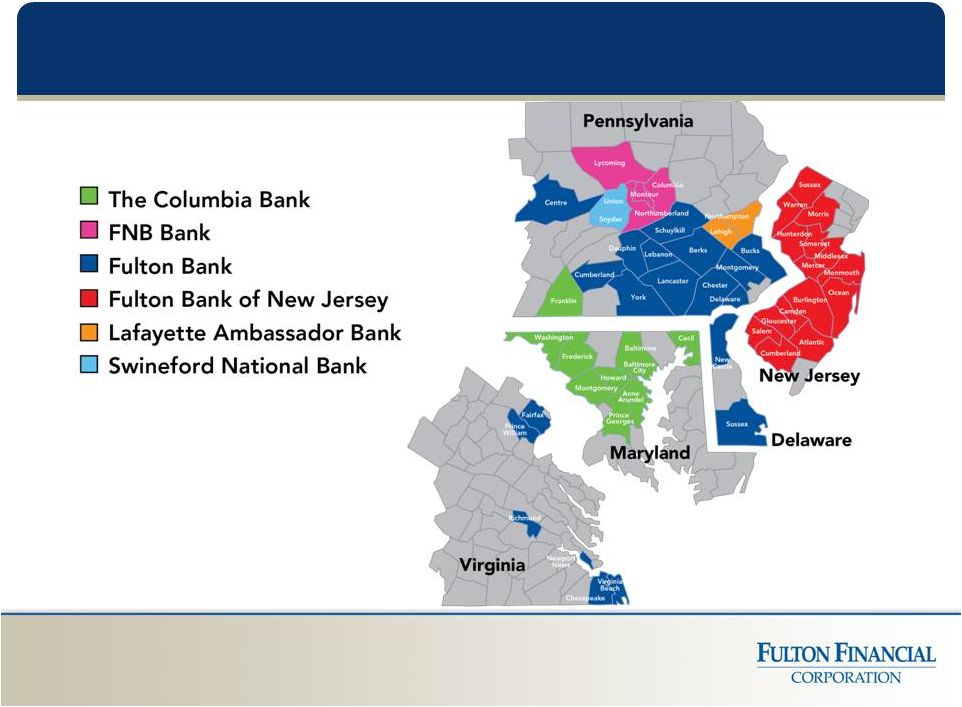

About

Us

Mid-Atlantic financial holding company

6 community banks / 5 states

Fulton Financial Advisors

Fulton Mortgage Company

270 community banking offices

Asset size: $16.3 billion

3,800 team members

Market capitalization: $ 2.0 billion

Book value per common share: $ 10.36

Tangible book value per common share: $ 7.63

Shares outstanding: 199 million

3 |

1.

EPS Growth 2. ROA Improvement

3. Spread Management /Net Interest Margin

4. Improve Asset Quality

5. Deploy Capital Prudently

6. Leverage Market Opportunities

7. Profitable Organic / Acquisitive Growth

Corporate Goals and Priorities

4 |

Goals

and Priorities 1. Earnings per Share Growth

Q3/12 Diluted EPS: 21 cents

Up 5.0% linked quarter (20 cents)

Up 5.0% year over year (20 cents)

5 |

Income

Statement Summary 6

Q3 2012

Q2 2012

$

%

(dollars in thousands, except per-share data)

Net Interest Income

135,881

$

137,530

$

(1,649)

$

-1%

Loan Loss Provision

(23,000)

(25,500)

2,500

-10%

Non-Interest Income

51,962

51,826

136

0%

Securities Gains

42

1,538

(1,496)

-97%

Non-Interest Expenses

(110,043)

(112,143)

2,100

-2%

Income Taxes

(13,260)

(13,360)

100

-1%

Net Income

41,582

$

39,891

$

1,691

$

4%

Per Share (Diluted)

0.21

$

0.20

$

0.01

$

5% |

Income

Statement Summary (Nine Months Ended September 30

th

)

7

2012

2011

$

%

(dollars in thousands, except per-share data)

Net Interest Income

412,106

$

421,701

$

(9,595)

$

-2%

Loan Loss Provision

(76,500)

(105,000)

28,500

-27%

Non-Interest Income

154,217

137,872

16,345

12%

Securities Gains

2,831

1,507

1,324

88%

Non-Interest Expenses

(332,897)

(307,616)

(25,281)

8%

Income Taxes

(40,152)

(38,970)

(1,182)

3%

Net Income

119,605

$

109,494

$

10,111

$

9%

Per Share (Diluted)

0.60

$

0.55

$

0.05

$

9% |

Ending

Loans 8

Q3 2012

Q3 2011

$

%

(dollars in millions)

Comm'l Mort

4,633

$

4,491

$

142

$

3%

Commercial

3,508

3,690

(182)

-5%

Home Equity

1,603

1,631

(28)

-2%

Resid Mort

1,214

1,041

173

17%

Construction

597

648

(51)

-8%

Consumer/Other

378

394

(16)

-4%

Total Loans

11,933

$

11,895

$

38

$

0% |

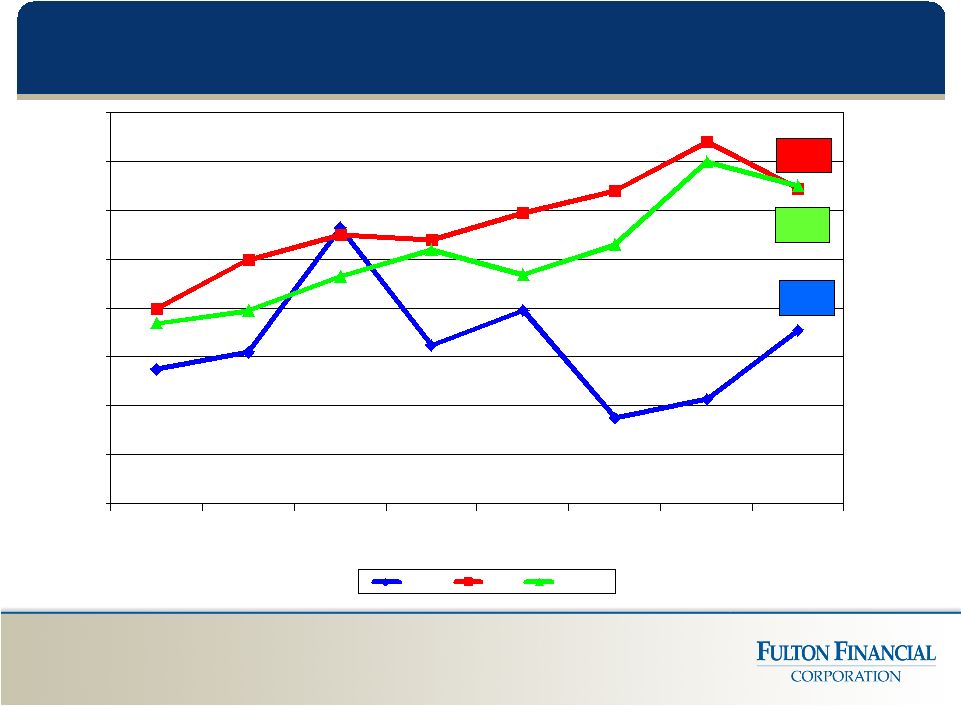

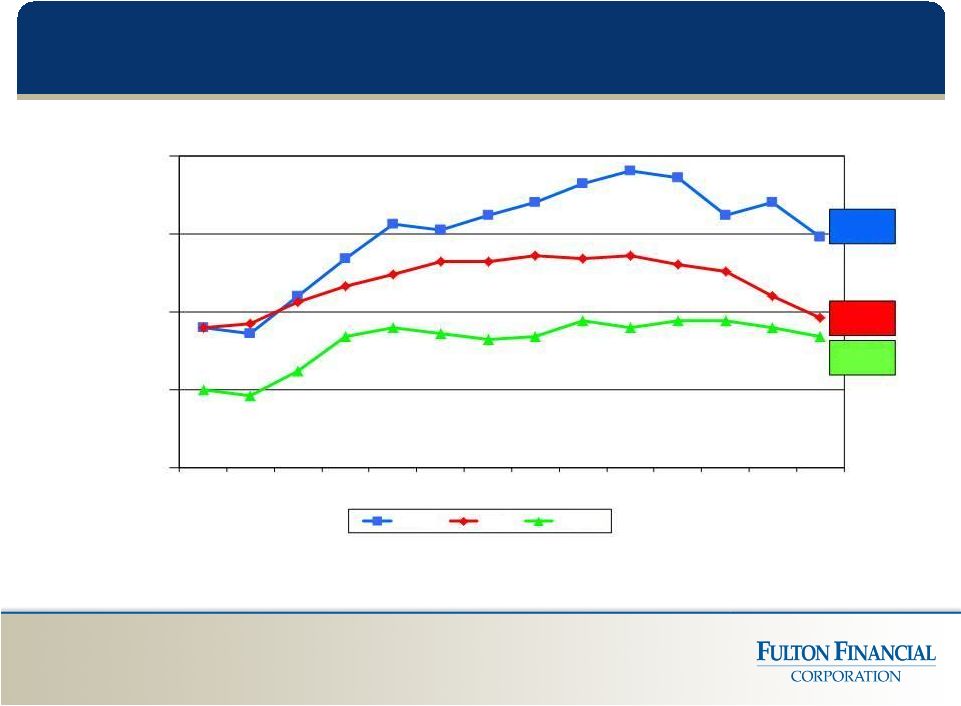

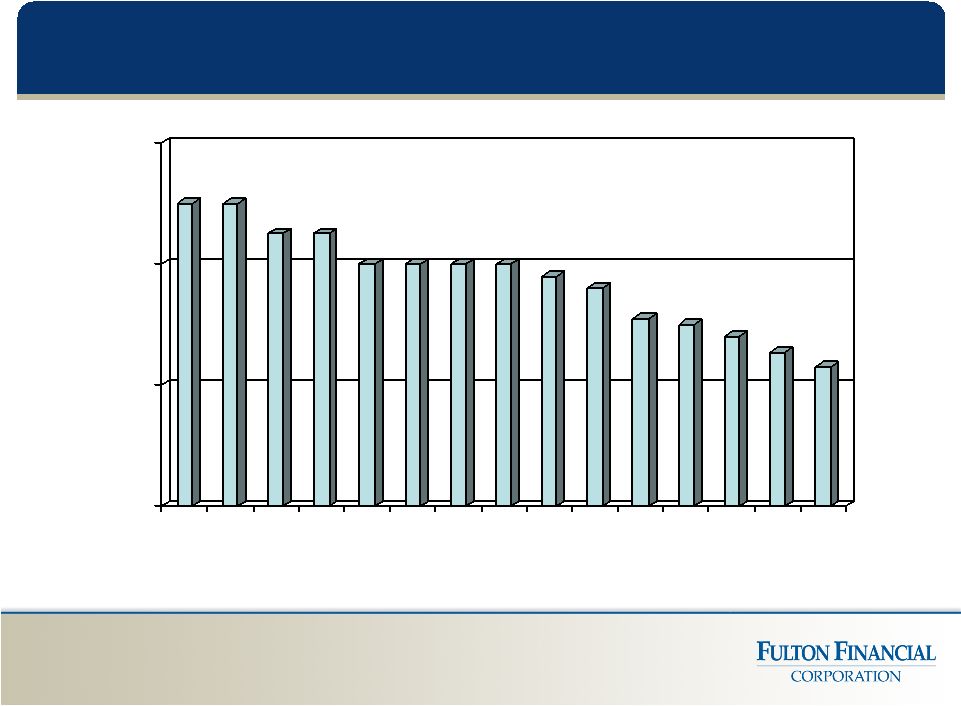

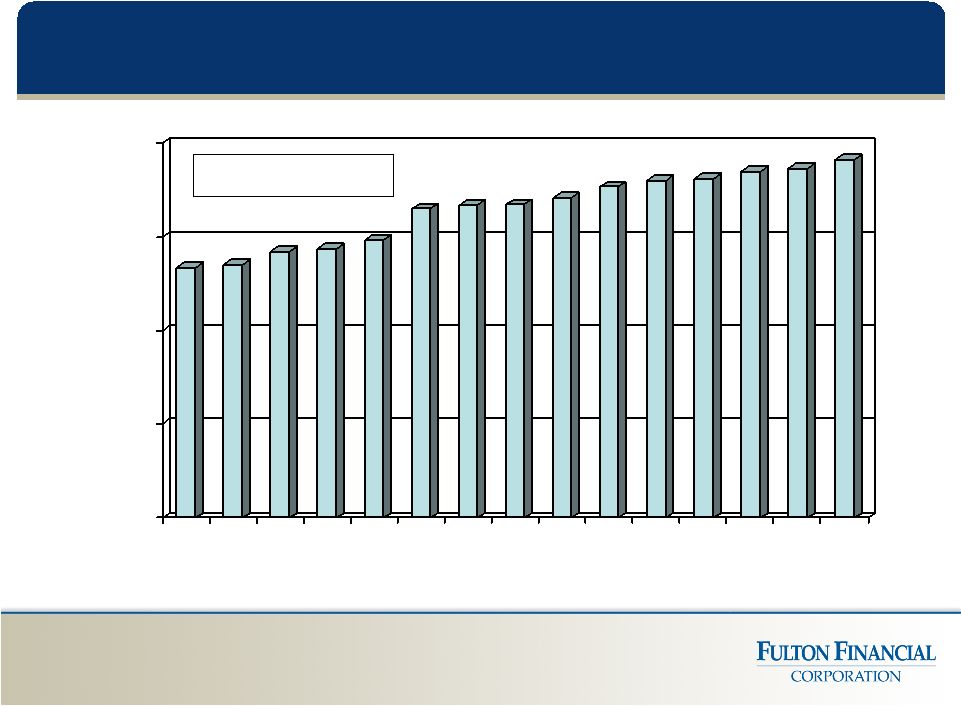

Diluted

EPS 9

$0.00

$0.05

$0.10

$0.15

$0.20

$0.25

Q1

09

Q2

09

Q3

09

Q4

09

Q1

10

Q2

10

Q3

10

Q4

10

Q1

11

Q2

11

Q3

11

Q4

11

Q1

12

Q2

12

Q3

12 |

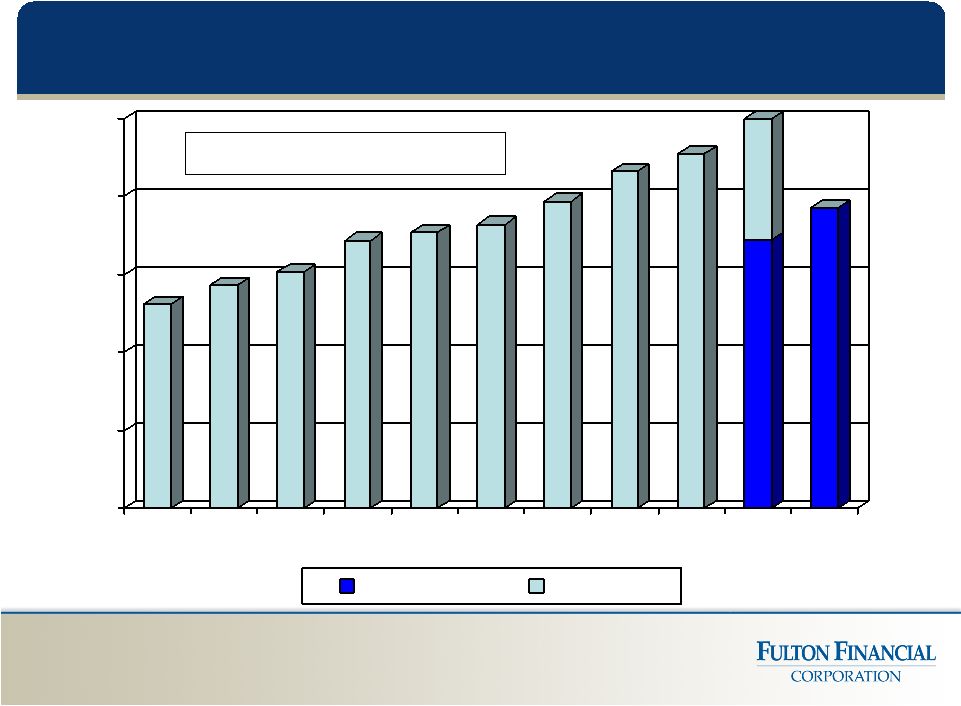

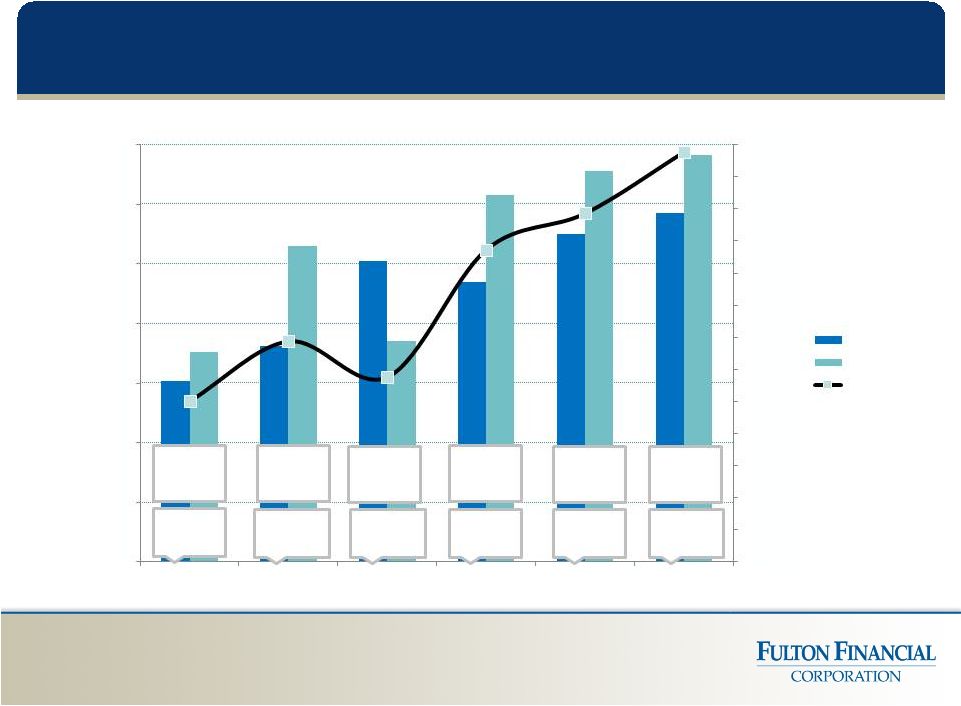

Non-Interest Income (in millions)

$-

$40

$80

$120

$160

$200

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

YTD Sep

YTD Dec

10

CAGR = 6.4% (2002-2011) |

Non-Interest Income

Q3 2012

Q2 2012

$

%

(dollars in thousands)

Mort. Banking Income

10,594

$

11,143

$

(549)

$

-5%

Invt Mgt & Trust

9,429

9,822

(393)

-4%

Overdraft & NSF Fees

8,552

8,095

457

6%

Service Charges

4,340

4,456

(116)

-3%

Merchant Fees

3,128

3,376

(248)

-7%

Cash Mgt Fees

2,759

2,816

(57)

-2%

Debit Card Fees

2,145

2,209

(64)

-3%

Other

11,015

9,909

1,106

11%

51,962

$

51,826

$

136

$

0%

11 |

2012

2011

$

%

(dollars in thousands)

Mort. Banking Income

31,787

$

19,454

$

12,333

$

63%

Invt Mgt & Trust

28,628

27,756

872

3%

Overdraft & NSF Fees

24,612

23,988

624

3%

Service Charges

13,060

10,880

2,180

20%

Merchant Fees

9,363

7,124

2,239

31%

Cash Mgt Fees

8,188

7,933

255

3%

Debit Card Fees

6,455

13,352

(6,897)

-52%

Other

32,124

27,385

4,739

17%

154,217

$

137,872

$

16,345

$

12%

12

Non-Interest Income

(Nine Months Ended September 30

th

) |

Non-Interest Income Growth

Fulton Mortgage Company

Significant Contributor to Non-interest Income

Steady Pipeline with Low Rate Environment

Leverage our Market Reputation and Brand

Expanded Origination Staff

Fulton Financial Advisors

($4.0 billion A.U.M.)

Brokerage Production Mix (non-recurring / recurring)

Referrals from Commercial Bank

Team Market Development

13 |

Fulton

Mortgage Company Applications up linked quarter: $850

million from $824 million

Pipeline $535 million vs. $520 million

(End Q3/12 vs. end Q2/12)

40% purchase / 60% refinancing

(Q3/12)

Sales gains up linked quarter offset by

decreased MSR income

14 |

Non-Interest Expenses

Q3 2012

Q2 2012

$

%

(dollars in thousands)

Salaries & Benefits

62,162

$

60,091

$

2,071

$

3%

Occupancy & Equip.

14,977

14,390

587

4%

Data Proc. & Software

6,287

6,031

256

4%

Outside Services

4,996

4,476

520

12%

FDIC Insurance

3,029

3,002

27

1%

Professional Fees

2,729

2,984

(255)

-9%

Supplies & Postage

2,232

2,399

(167)

-7%

OREO & Repo Expense

2,096

2,823

(727)

-26%

Telecommunications

1,764

1,478

286

19%

Operating Risk Loss

1,404

2,055

(651)

-32%

Marketing

648

2,583

(1,935)

-75%

Other Expenses

7,719

9,831

(2,112)

-21%

110,043

$

112,143

$

(2,100)

$

-2%

15 |

Asset Quality Improvement

Core Platform Conversion

Enterprise-wide Risk Management

and Compliance

Priority Resource Commitments

16 |

International Bancshares Corp.

People’s United Financial, Inc.

Susquehanna Bancshares, Inc.

Synovus Financial Corporation

TCF Financial Corporation

UMB Financial Corporation

Valley National Bancorp

Webster Financial Corporation

*Fulton’s peer group as of September 30, 2012

Associated Banc-Corp

BancorpSouth, Inc.

BOK Financial Corporation

City National Corporation

Commerce Bancshares, Inc.

Cullen / Frost Bankers, Inc.

First Horizon National

Corporation

FirstMerit Corporation

First Niagara Financial Group, Inc.

Peer Group*

17 |

More

Efficient Than Peers 57.1

62.9

63.0

50.0

52.0

54.0

56.0

58.0

60.0

62.0

64.0

66.0

2005

2006

2007

2008

2009

2010

2011

YTD

09/12

FULT

Peer

Top 50*

18

* Comprised of the 50 largest publicly traded domestic banks/thrifts in asset size as

of December 31, 2011. Excludes credit card companies. Source :

SNL.com |

2.

Improve Our Return on Assets Q3/12: 1.02%

YTD 9/30/12: 0.98%

Goals and Priorities

19 |

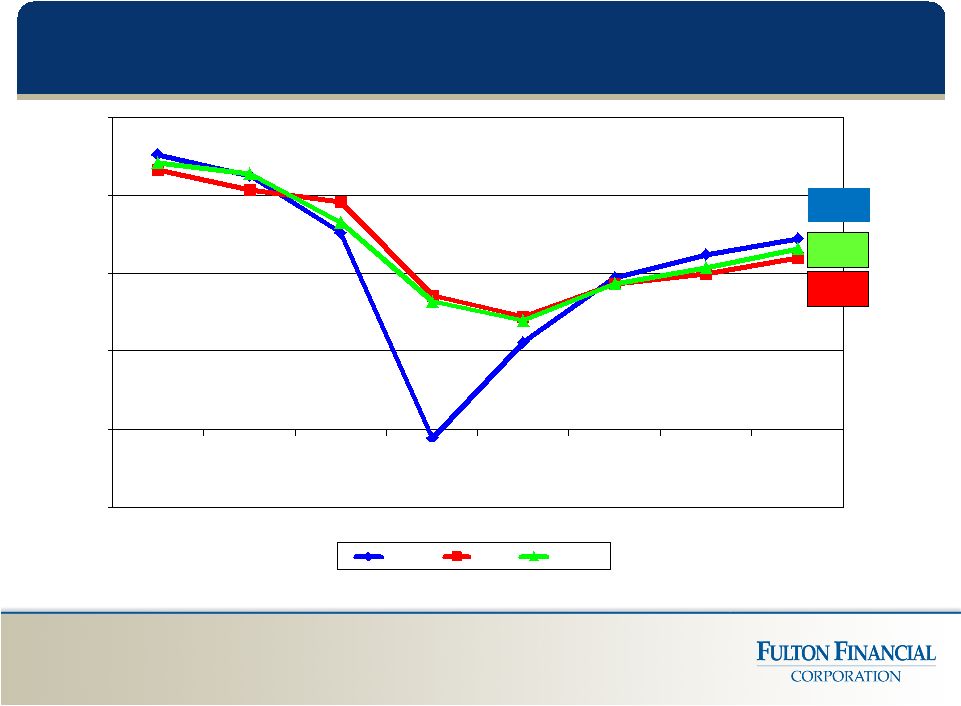

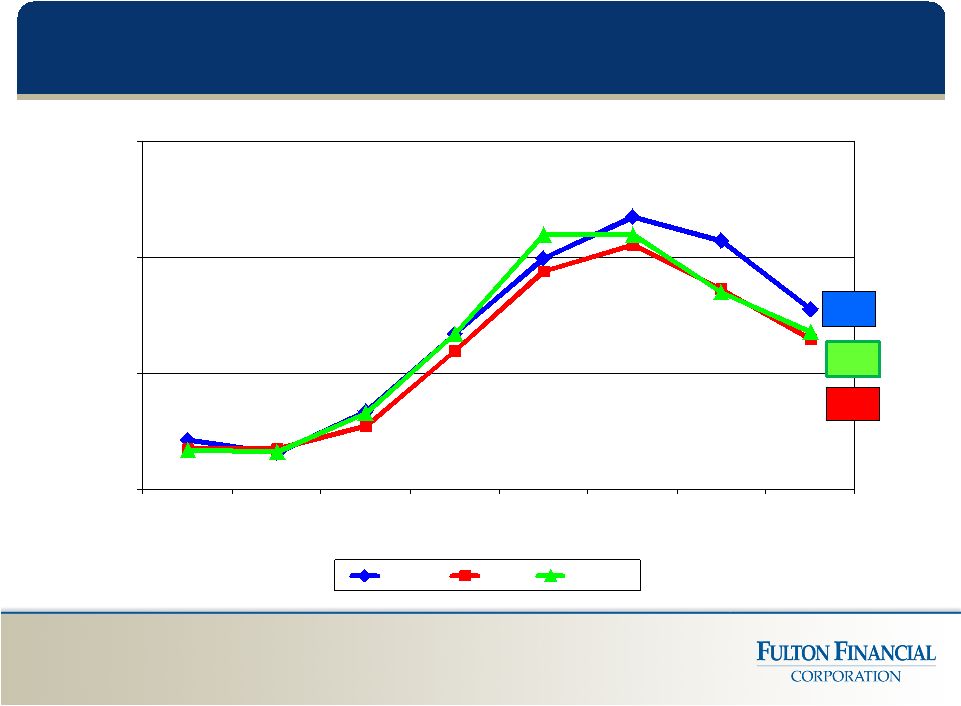

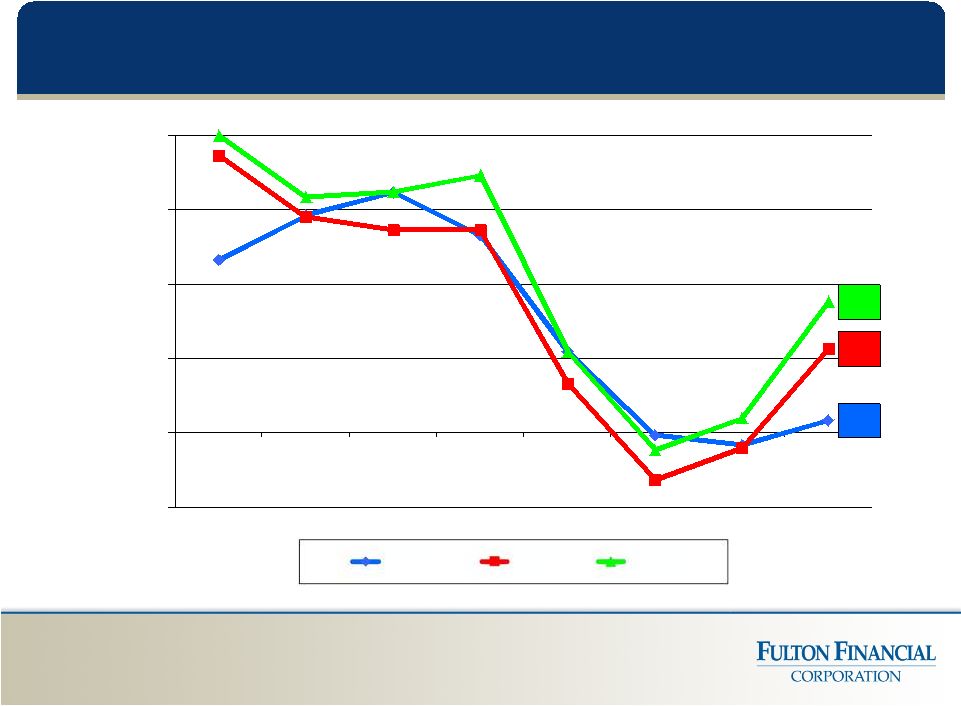

ROA

Growth 0.98

0.88

0.93

-0.40

0.00

0.40

0.80

1.20

1.60

2005

2006

2007

2008

2009

2010

2011

YTD

09/12

FULT

Peer

Top 50

20 |

ROA and

Assets, by Bank 21

Return on Average Assets

Assets

9Months

Year

($ Millions)

09/30/12

2011

Lafayette Ambassador Bank

1,406

$

1.56%

1.48%

FNB Bank, NA

371

1.24%

1.46%

Fulton Bank, NA

9,041

1.29%

1.40%

Swineford National Bank

287

1.25%

1.60%

The Columbia Bank

2,025

0.92%

0.75%

Fulton Bank of New Jersey

3,334

0.44%

-0.10%

Fulton Financial Corporation

16,273

$

0.98%

0.90% |

3.

Spread Management / Net Interest Margin

Q3/12: 3.74%

Cost of interest bearing liabilities: 0.90%

Yield on earning assets: 4.42%

Goals and Priorities

22 |

Net

Interest Margin 23

3.74

3.48

3.42

3.00

3.25

3.50

3.75

4.00

Q1 09

Q2 09

Q3 09

Q4 09

Q1 10

Q2 10

Q3 10

Q4 10

Q1 11

Q2 11

Q3 11

Q4 11

Q1 12

Q3 12

FULT

Peer

Top 50 |

6 month

cumulative gap: 1.15 Interest Rate

Shocks (9/30/12)

Rate Change

NII Change (Annual)

% Change

+400 bp

+ $ 80.4 million

+ 15.3%

+300 bp

+ $ 57.4 million

+ 11.0 %

+200 bp

+ $ 34.5 million

+ 6.6%

+100 bp

+ $ 11.9 million

+ 2.3%

-

100 bp

-

$ 20.5 million

-

3.9%

24 |

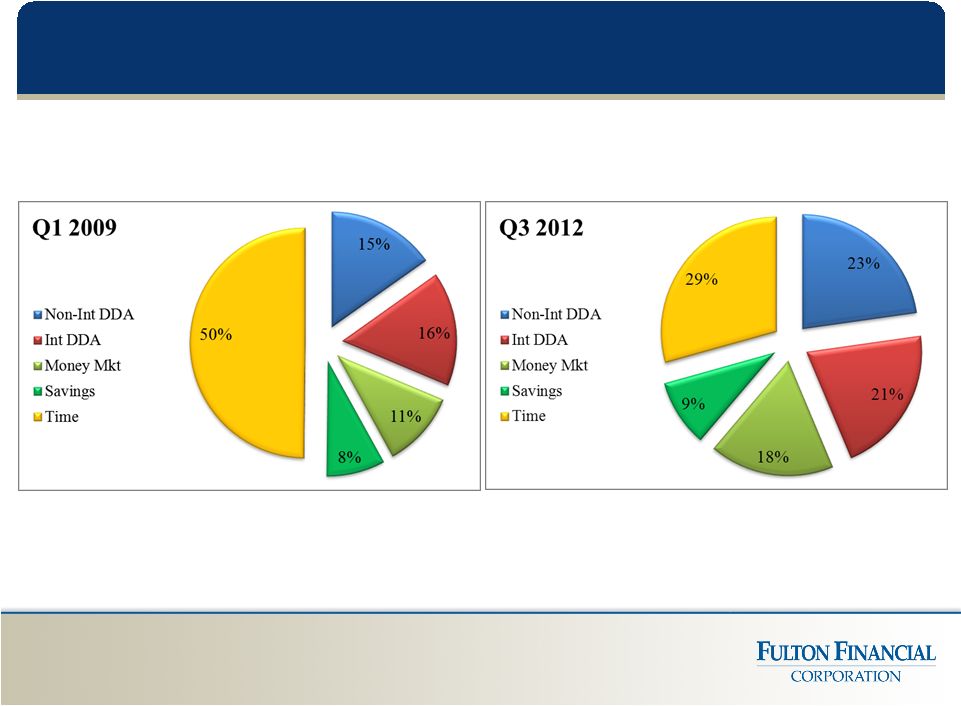

Deposit

Composition 25 |

4.

Improve Asset Quality Goals and Priorities

26 |

Non-accrual Loans to Loans

1.56

1.30

1.36

0.00

1.00

2.00

3.00

2005

2006

2007

2008

2009

2010

2011

Q3 12

FULT

Peer

Top 50

27 |

Allowance for Loan Losses to Loans

1.96

1.65

1.72

0.80

1.10

1.40

1.70

2.00

2.30

2.60

2005

2006

2007

2008

2009

2010

2011

Q3 12

FULT

Peer

Top 50

28 |

Non-performing Loans* (9/30/12) Comm'l

Comm'l

Mortgage

Constr.

Res. Mtg.

Other

Total

(in thousands)

Pennsylvania

50,294

$

18,451

$

9,706

$

8,078

$

6,237

$

92,766

$

Maryland

4,845

12,198

9,510

1,687

1,718

29,958

New Jersey

14,147

26,013

10,172

6,633

7,233

64,198

Virginia

4,553

6,762

3,354

6,908

711

22,288

Delaware

40

1,185

-

1,604

787

3,616

73,879

$

64,609

$

32,742

$

24,910

$

16,686

$

212,826

$

Ending Loans

3,507,846

4,632,509

597,358

1,213,831

1,981,457

11,933,001

NPL% (Sep-12)

2.11%

1.39%

5.48%

2.05%

0.84%

1.78%

NPL% (Jun-12)

1.92%

1.77%

6.96%

2.14%

0.77%

1.95%

* Includes loans > 90 days past due and accruing.

29 |

Loan

Delinquency 30

90 Days

Total

90 Days

Total

Commercial Mortgage

1.39%

1.85%

1.78%

2.19%

Commercial Loans

2.11%

2.56%

1.91%

2.57%

Construction Loans

5.48%

6.43%

6.96%

7.91%

Residential Mortgage

2.05%

4.71%

2.15%

5.09%

Home Equity

0.78%

1.63%

0.71%

1.54%

Consumer, leasing and other

1.07%

2.92%

0.99%

2.60%

Total

1.78%

2.58%

1.95%

2.81%

June 30, 2012

September 30, 2012 |

Construction Exposure

Construction Loans /

Total Loans

10.5%

8.2%

6.7%

5.1%

5.0%

31 |

32

50

50

45

45

40

40

40

40

38

36

31

30

28

25.5

23

$0

$20

$40

$60

Q1

09

Q2

09

Q3

09

Q4

09

Q1

10

Q2

10

Q3

10

Q4

10

Q1

11

Q2

11

Q3

11

Q4

11

Q1

12

Q2

12

Q3

12

Provision for Credit Losses |

5.

Deploy Capital Prudently Goals and Priorities

33 |

Total

Risk-Based Capital Ratio 34

11.0%

12.0%

13.0%

14.0%

15.0%

16.0%

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

Q3 12 |

Capital

Adequacy (9/30/12

-

estimate)

Well-

FULT

Capitalized

Total Risk-Based Capital Ratio

15.40%

10.00%

Tier 1 Risk-Based Capital Ratio

13.20%

6.00%

Leverage Capital Ratio

10.70%

5.00%

35 |

Capital

Adequacy vs. Basel III

36

FULT (1)

Basel III (2)

Total Risk-Based Capital Ratio

14.60%

10.50%

Tier 1 Risk-Based Capital Ratio

11.30%

8.50%

Leverage Capital Ratio

9.50%

6.50%

Common Equity Tier 1 Ratio

11.30%

7.00%

(1) Estimates

-

based

on

proposed

rules.

Final

rules,

when

issued,

may

differ

from proposed. Application of the Basel III rules are also subject

to further interpretation and clarification, which could result in

changes to the estimates shown above.

(2) Fully-phased in requirements, with 2.50% conservation

buffer. |

Tangible Book Value Per Share

37

$0.00

$2.00

$4.00

$6.00

$8.00

Q1

09

Q2

09

Q3

09

Q4

09

Q1

10

Q2

10

Q3

10

Q4

10

Q1

11

Q2

11

Q3

11

Q4

11

Q1

12

Q2

12

Q3

12

CAGR = 10.8% |

Price

Multiple vs. Peer Group 38

Note:

Peer Tangible Book Value and LTM EPS data as of 6/30/2012 .

FULT Tangible Book Value and LTM EPS data as of 9/30/2012 .

|

Deploying Capital

Current Uses

Support organic growth

Increase our cash dividend

Stock repurchase

Potential Uses

Acquisitions with right opportunities

39 |

FULT

– Cash Dividend and Yield

40

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

$-

$0.01

$0.02

$0.03

$0.04

$0.05

$0.06

$0.07

$0.08

$0.09

Q1 09

Q2 09

Q3 09

Q4 09

Q1 10

Q2 10

Q3 10

Q4 10

Q1 11

Q2 11

Q3 11

Q4 11

Q1 12

Q2 12

Q3 12

Cash Dividend per Share

Yield

CAGR (cash dividend) = 32.3% |

Program authorized: June 2012

Purchase of up to 5 million shares

through 12/31/12

About 2.5% of outstanding shares

Shares repurchased as of September

30, 2012: 2,115,000

Average purchase price: $ 9.63

Stock Repurchase Program

41 |

6.

Leverage Market Opportunities Goals and Priorities

42 |

Superior

Customer Experience CARE,

LISTEN,

UNDERSTAND

and

DELIVER

43 |

Top

3 Box Satisfaction: 84%

Delivery

on our Promise:

Top 3 Box

85%

*Survey Sample Size: 4,897 customers

Retail Customer Satisfaction*

44 |

Commercial Households:

Up 1.9% YTD (2.5% annualized)

Retail Households

Up 1.7% YTD (2.3% annualized)

Net Household Lift:

Up 1.7% YTD (2.3% annualized)

New Household Growth YTD

45 |

Counties ranked #1 in deposit market share

Lebanon, PA (Fulton Bank 30.2%)

Salem, NJ (Fulton Bank of New Jersey 26.0%)

Counties ranked #2 in deposit market share

Lancaster, PA (Fulton Bank 24.3%)

Montour, PA (FNB Bank 27.7%)

Gloucester, NJ (Fulton Bank of New Jersey 13.4%)

Snyder, PA (Swineford National Bank 28.0%)

Washington, MD (The Columbia Bank 19.2%)

Counties ranked #3 in deposit market share

Northampton, PA (Lafayette Ambassador Bank 14.0%)

Top

County

Market

Share

(6/30/12)

46 |

7.

Profitable Organic / Acquisitive Growth

Goals and Priorities

47 |

A

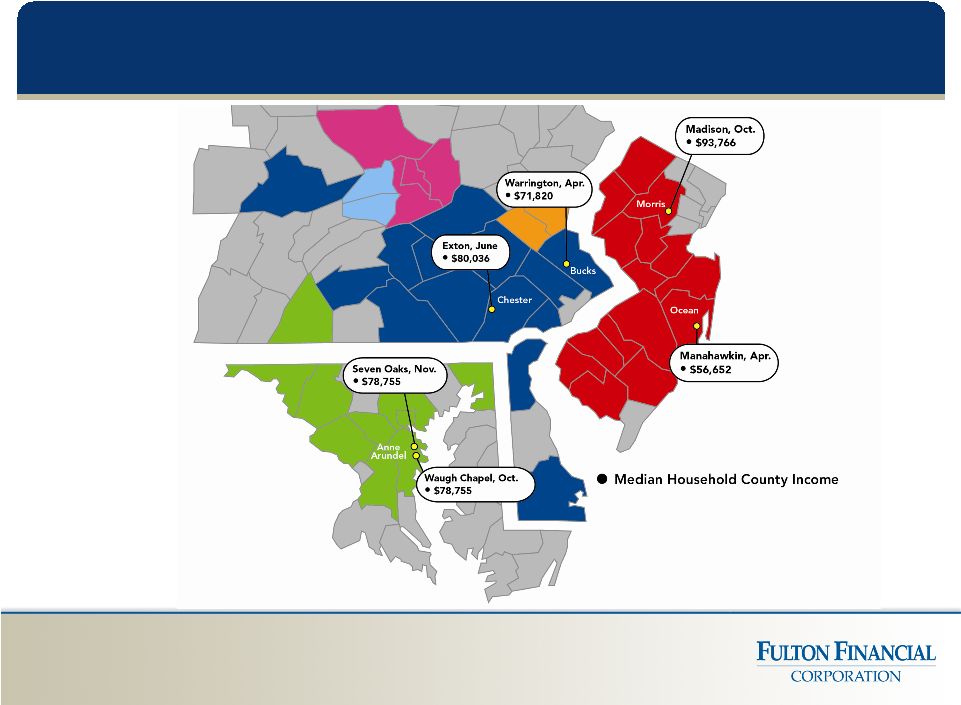

Valuable Franchise 48 |

2012

Branch Expansion 49 |

Optimal asset size: $ 300 million to

$2.5 billion (102 banks in footprint)

Good fit geographically

Earnings accretive /reasonable

tangible book dilution

Culturally compatible

Acceptable risk profile

Meaningful existing market share

Acquisitive Growth

50 |

Fulton

Financial Corporation One Penn Square

Lancaster, PA 17602

www.fult.com

Version 2012-11-26 |

Supplemental Information |

Average

Deposits Q3 2012

Q2 2012

$

%

(dollars in millions)

Nonint DDA

2,836

$

2,669

$

167

$

6%

Int DDA

2,608

2,485

123

5%

Savings/MMDA

3,364

3,293

71

2%

Total Core Deposits

8,808

8,447

361

4%

CD's

3,658

3,791

(133)

-4%

Cash Management

338

372

(34)

-9%

Total Deposits

12,804

$

12,610

$

194

$

2%

53 |

Interest

Rates 54

Q3 2012

Q2 2012

Change

%

Net Interest Margin

3.74%

3.78%

-0.04%

-1%

Yield on Earning Assets

4.42%

4.48%

-0.06%

-1%

Cost of Funds

0.72%

0.75%

-0.03%

-4%

Fed Funds

0.25%

0.25%

-

- |

Projected CD Maturities

55 |

Average

Loans 56

Q3 2012

Q2 2012

$

%

(dollars in millions)

Comm'l Mort

4,603

$

4,634

$

(31)

$

-1%

Commercial

3,530

3,530

-

0%

Home Equity

1,597

1,600

(3)

0%

Resid Mort

1,201

1,180

21

2%

Construction

606

640

(34)

-5%

Consumer/Other

383

382

1

0%

Total Loans

11,920

$

11,966

$

(46)

$

0% |

56

relationships with commitments to lend $20 million or more

Maximum individual commitment: $39 million

Maximum commitment to any builder/developer:

$28 million

Maximum commitment to any one development project:

$15 million

Average commercial lending relationship size is

$469,332

Loans and corresponding relationships are within

Fulton’s geographic market area

Summary of Larger Loans (9/30/12)

57 |

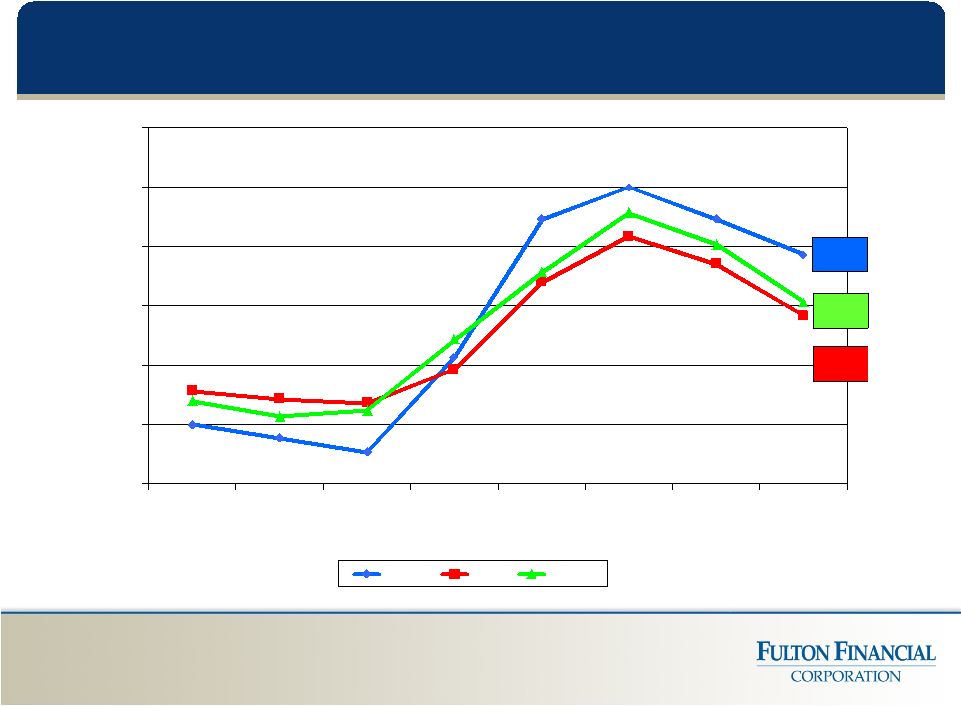

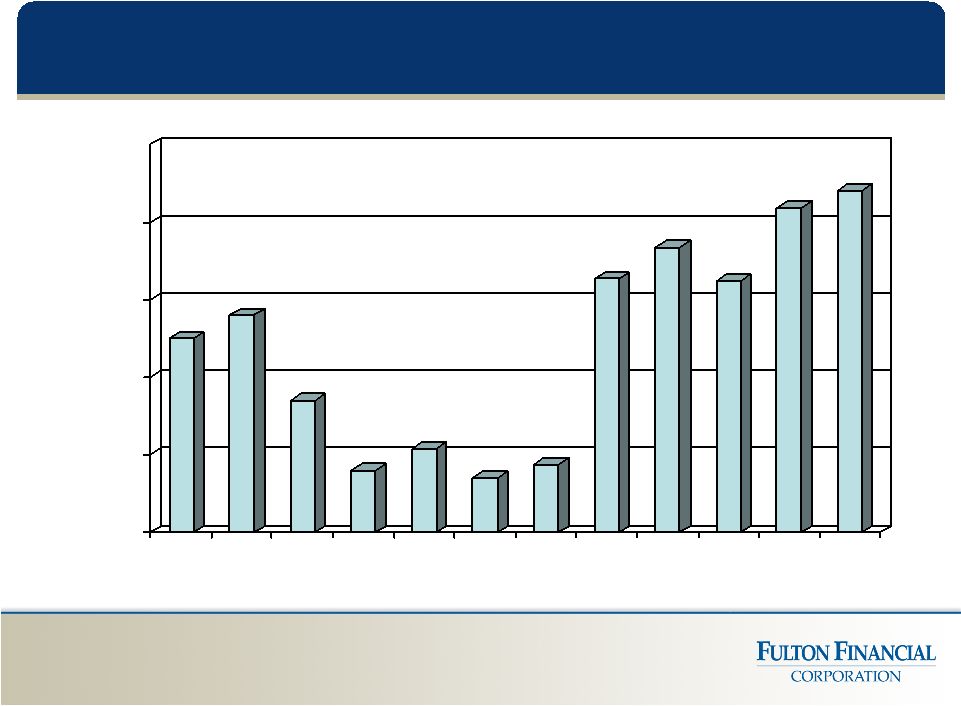

Average

Loan Growth (vs. prior year period)

58

0.5

3.4

5.3

-3.0

0.0

3.0

6.0

9.0

12.0

2005

2006

2007

2008

2009

2010

2011

YTD 09/12

FULT

Peer

Top 50 |

Net

Charge-offs (YTD September 2012)

Comm'l

Comm'l

Mortgage

Constr.

Res. Mtg.

Other

Total

(in thousands)

Pennsylvania

13,480

$

14,808

$

4,979

$

282

$

2,976

$

36,525

$

Maryland

2,333

3,333

2,451

648

1,772

10,537

New Jersey

9,192

17,059

7,353

684

2,043

36,331

Virginia

978

3,698

7,925

1,015

709

14,325

Delaware

128

869

26

211

457

1,691

26,111

$

39,767

$

22,734

$

2,840

$

7,957

$

99,409

$

Avg Loans

3,548,332

4,618,389

629,170

1,172,732

1,986,207

11,954,830

NCO %

0.98%

1.15%

4.82%

0.32%

0.53%

1.11%

59 |

Net

Charge-Offs To Average Loans 60

1.11

0.57

0.57

0.00

0.50

1.00

1.50

2005

2006

2007

2008

2009

2010

2011

YTD 09/12

FULT

Peer

Top 50 |

Allowance for Loan Losses to Non-accrual Loans

61

125.9

109.9

118.0

50.0

100.0

150.0

200.0

250.0

300.0

350.0

2005

2006

2007

2008

2009

2010

2011

Q3 12

FULT

Peer

Top 50 |

Commercial Loans by Industry

62

Industry

%

Services

17.7

Manufacturing

15.8

Construction

11.9

Wholesale

9.9

Retail

8.5

Other

8.0

Health Care

7.5

Real Estate

7.4

Agriculture

5.5

Transportation

3.0

Arts & Entertainment

2.5

Financial Services

2.3

Total

100.0 |

Loan

Distribution by State (9/30/12)

Ending

% of

Variance to 9/30/11

Balance

Total

$

%

(dollars in thousands)

Pennsylvania

7,124,012

$

59.6%

211,197

$

3%

New Jersey

2,297,259

19.3%

(100,791)

-4%

Maryland

1,201,613

10.1%

(51,509)

-4%

Virginia

931,105

7.8%

(36,117)

-4%

Delaware

379,012

3.2%

14,565

4%

11,933,001

$

63 |

Residential Mortgages (9/30/12) Ending

% of

NPL

Allowance

Balance

Total

Balance

Allocations

(dollars in thousands)

Pennsylvania

605,947

$

50.0%

8,078

$

6,819

$

Virginia

225,863

18.6%

6,908

12,695

New Jersey

166,398

13.7%

6,633

4,889

Maryland

137,730

11.3%

1,687

2,500

Delaware

77,893

6.4%

1,604

1,953

1,213,831

$

24,910

$

28,856

$

64 |

Fulton

Mortgage Company ($ in thousands)

65

$-

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

$8,000

$9,000

$10,000

$11,000

$12,000

$13,000

$-

$100,000

$200,000

$300,000

$400,000

$500,000

$600,000

$700,000

Q2 2011

Q3 2011

Q4 2011

Q1 2012

Q2 2012

Q3 2012

Originations

Rate Locks

Gain On Sale

1.42%

GOS

Spread

1.30%

GOS

Spread

1.55%

GOS

Spread

1.58%

GOS

Spread

1.87%

76%

Available

for Sale

69%

Available

for Sale

88%

Available

for Sale

GOS

Spread

1.66%

86%

Available

for Sale

70%

Available

for Sale

73%

Available

for Sale

GOS

Spread |

Residential Mortgage Repurchase Activity

Year to date through Q3 2012:

2012 –

Servicing Retained

Repurchased

$ 3,550,000.

2012 –

Servicing Released

Repurchased

$ 610,000.

66 |

C&I

Loans (9/30/12)

Ending

% of

NPL

Allowance

Balance

Total

Balance

Allocations

(dollars in thousands)

Pennsylvania

2,497,526

$

71.2%

50,294

$

34,332

$

New Jersey

508,297

14.5%

14,147

24,361

Maryland

296,225

8.4%

4,845

5,066

Virginia

165,220

4.7%

4,553

3,221

Delaware

40,578

1.2%

40

894

3,507,846

$

73,879

$

67,874

$

67 |

Commercial Real Estate Loans

(9/30/12) Ending

% of

NPL

Allowance

Balance

Total

Balance

Allocations

(dollars in thousands)

Pennsylvania

2,517,564

$

54.3%

18,451

$

24,759

$

New Jersey

1,202,520

26.0%

26,013

33,932

Maryland

409,443

8.8%

12,198

6,438

Virginia

345,895

7.5%

6,762

4,253

Delaware

157,087

3.4%

1,185

2,787

4,632,509

$

64,609

$

72,169

$

68 |

Construction

Loans (9/30/12)

Ending

% of

NPL

Allowance

Balance

Total

Balance

Allocations

(dollars in thousands)

Pennsylvania

310,893

$

52.1%

9,706

$

5,398

$

Virginia

122,441

20.5%

3,354

3,692

New Jersey

77,523

13.0%

10,172

5,892

Maryland

72,573

12.1%

9,510

6,174

Delaware

13,928

2.3%

-

972

597,358

$

32,742

$

22,128

$

69 |

Construction Loans by Type (9/30/12)

Ending

% of

Balance

Total

(dollars in thousands)

Commercial Residential

312,658

$

52.4%

Commercial

218,828

36.6%

Other

65,872

11.0%

597,358

$

70 |

Shared

National Credits (9/30/12)

Ending

Balance

(dollars in thousands)

Commercial

83,565

$

Commercial Real Estate

63,386

Total Outstanding

146,951

$

Delinquency: 2.6%

71 |

Troubled

Debt Restructurings 09/30/12

12/31/11

(in thousands)

Residential Mtg

36,946

$

32,330

$

C&I/Comm'l Mtg

36,993

26,010

Construction

10,525

7,650

Consumer/other

755

190

85,219

$

66,180

$

72

Note: Excludes non-accrual TDRs |

Investment Portfolio

(09-30-12)

73

Book Yield (monthly) 3.49%

ENDING

WEIGHTED

BALANCE

AVG. LIFE

(in millions)

Agency mortgage-backed securities

1,022.2

$

2.93

Agency collateralized mortgage obligations

1,014.8

1.95

Municipal bonds

293.2

6.25

Auction rate securities

188.4

4.92

Corporate & trust preferred securities

106.0

13.56

U.S. Treasuries and agencies

2.3

0.44

FHLB & FRB stock

73.2

NA

Bank stocks

34.3

NA

Other investments

10.9

NA

Net unrealized gain / (loss)

44.9

NA

Total Investments

2,790.1

$

3.50 |

Projected Investment Security Cash Flows

74 |

Investment MBS & CMO Cash Flows

(2011-2012)

75

Book Price

$101.51

Book Price

$101.87

Book Price

$102.12

$112,300,966

$181,596,288

$157,060,613

$163,241,031

$179,433,591

$1,927,653

$4,883,560

$4,074,329

$3,998,272

$4,591,601

$0

$1,000,000

$2,000,000

$3,000,000

$4,000,000

$5,000,000

$6,000,000

$7,000,000

$8,000,000

$0

$20,000,000

$40,000,000

$60,000,000

$80,000,000

$100,000,000

$120,000,000

$140,000,000

$160,000,000

$180,000,000

$200,000,000

3Q 2011

4Q 2011

1Q 2012

2Q 2012

3Q 2012

E

x

p

e

n

s

e

C

a

s

h

F

l

o

w

MBS & CMO Cash Flow

Net Amortization Expense

Book Price

$102.14

Book Price

$102.00 |

Investment

Portfolio

–

Transactions

(3

Quarter

2012)

($ in Thousands)

76

Purchases

Amount

Yield

Weighted

Avg. Life

US Treasury

326

$

0.17%

0.66

MBS

10,678

1.56%

3.75

CMO -

Agency

135,465

1.44%

3.41

Municipal Bans

6,453

1.45%

0.51

Municipal Bonds

14,942

3.57%

4.90

Corporate / Trust Preferred

1,000

5.38%

9.96

Other

-

-

168,865

$

1.66%

3.49

Sales

Amount

Book

Yield

Gain /

(Loss)

US Treasury

Corporate / Trust Preferred

1,965

$

8.31%

66

$

Other

1,965

$

8.31%

66

$

Total

Total

RD |

Projected FHLB Advance Maturities

77 |

Fulton

Financial Corporation One Penn Square

Lancaster, PA 17602

www.fult.com

Version 2012-11-26 |