Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ERICKSON INC. | a12-27791_18k.htm |

Exhibit 99.1

|

|

November 2012 Investor Presentation |

|

|

Disclaimer This presentation may contain forward-looking statements that involve substantial risks and uncertainties. All statements other than statements of historical fact, such as statements regarding our growth opportunities, our potential acquisitions, our future operations, financial position and revenues, other financial guidance, and our other prospects, plans and management objectives, are forward-looking statements. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. There are a number of important factors that could cause our actual results to differ materially from those indicated by these forward-looking statements. We disclose many of these risk factors in our most recent quarterly report on Form 10-Q and our the registration statement we filed with the Securities and Exchange Commission. All of the information provided in this presentation is as of today’s date and we undertake no duty to update this information. |

|

|

Company Overview 18 Aircrane fleet is the world’s largest, and we are deployed globally Specifically focused on firefighting, oil & gas, construction and timber Innovative engineering, excellent crews with deep experience and expertise in rotorcraft Firefighting Timber Harvesting Manufacturing MRO 2011 Revenue = $138.6 million 2010 Revenue = $105.7 million 2011 Revenue = $14.1 million 2010 Revenue = $12.5 million Crewing Construction Aerial Services Manufacturing / MRO Leading Provider of Heavy-Lift Helicopter Solutions Provides Value for a Diverse Range of End-Markets Vertical Operations: Design, Manufacture, Operate and Service |

|

|

Industry Leading Heavy-Lift Helicopter Solutions Continuous innovation maintains S-64’s leadership position 350+ design improvements, including many Supplemental Type Certificates State-of-the-art avionics Fully modern “glass” cockpit Automatic Flight Control System (AFCS) Fuel measurement systems Health measurement systems Design changes approved by FAA, ENAC (Italy), EASA (EU) and Transport Canada S-64 Helicopter Design Improvements & Innovation Our S-64 is the only commercial helicopter built as a flying crane with a rear load-facing cockpit Six Blade Fully Articulated Main Rotor System Two Pilots & Observer Station Automatic Flight Control System Avionics Bay Includes Comm/NAV/GPS Primary, Secondary and Auxiliary Hydraulic System Optional “Sea Snorkel” Attachment Optional “Pond Snorkel” Hover Fill Capability Twin Pratt & Whitney JFTD-12 Turbine Jet Engines (4,500 shaft HP per engine) 1,300 Gallon Fuel Capacity Four Blade Tail Rotor System Wheeled Landing Gear Optional Full Length Microprocessor Controlled Tank Doors Rear Cockpit Fire Tank and Pond Snorkel Fire Tank and Sea Snorkel Foam Cannon Hydromulch Loading Manifold "Heli Harvester" Hydraulic Grapple Long-Line Shock and Pendant Anti-Rotation Device and Hoist Material Transport Bucket |

|

|

Equity Snapshot Price (11/15/2012): $7.50 2012 Guidance (as of 11/07/12) Revenue: $177-$181 million Adj. EBITDA: $42.0-$44.0 million Pro Forma EPS(2): $1.34-$1.55 Adjusted EBITDA is a non-GAAP financial measure. In addition to adjusting net income (loss) to exclude interest expense, net, provision for (benefit from) income taxes, and depreciation and amortization, Adjusted EBITDA also adjusts net income by excluding non cash mark-to-market foreign exchange gains (losses), specified litigation and settlement expenses, certain management fees, gains from sale of equipment, non-cash charges arising from awards to employees relating to equity interests, non-cash charges relating to financings, IPO related non-capitalized expenses, and extraordinary, non-recurring non cash costs. Pro forma EPS assumes the IPO and recapitalization took place on Jan 1, 2012 and assumes 9.8 million basic and fully diluted shares Ticker: NASDAQ: EAC Market Cap (11/15/2012): $72.0 million Adjusted EBITDA(1) (LTM 9/30): $38.2 million EV (11/15/2012) / Adj. EBITDA (LTM 9/30): 4.2x |

|

|

Key Investment Highlights Experienced Management Superior Operating Profitability Strong Balance Sheet Numerous Growth Opportunities Increasing Diversification Adjusted EBITDA is a non-GAAP financial measure. In addition to adjusting net income (loss) to exclude interest expense, net, provision for (benefit from) income taxes, and depreciation and amortization, Adjusted EBITDA also adjusts net income by excluding non cash mark-to-market foreign exchange gains (losses), specified litigation and settlement expenses, certain management fees, gains from sale of equipment, non-cash charges arising from awards to employees relating to equity interests, non-cash charges relating to financings, IPO related non-capitalized expenses, and extraordinary, non-recurring non cash costs. Adjusted EBITDA Margin is Adjusted EBITDA divided by sales. Fair value of the net assets of the Company predominantly determined by an independent appraisal in September 2012 of 19 owned aircraft and our parts inventory. Expect organic growth across major end markets Announced non-binding LOI for acquisition in Brazil Pursuing Aircrane sales Increase utilization of manufacturing / MRO capabilities 20+ years average aerospace, military experience FY 2012 Adjusted EBITDA(1) margin of ~20% Growth focused in non-seasonal venues Leverage ratio < 2.3x at 9/30/12 Estimated fair value of net assets in excess of $800 million(2) Improving mix across end markets, oil and gas New market development in South America Balanced presence on five continents |

|

|

Aircranes In Action Firefighting Timber Harvesting Infrastructure Construction Oil & Gas 2,650 gallon tank refills in under 45 seconds from any water source deeper than 18” One Aircrane replaces up to 50 ground vehicles Up to 25,000 pounds of lift Proprietary precision heavy-lift solutions: Rear, load-facing cockpit; Anti-rotation hoist Owner, operator, and manufacturer of the S-64 Aircrane, the most versatile and powerful heavy-lift helicopter in the world |

|

|

Aerial Services Overview Revenue Flight Hours 2011 Revenue by Key Market Highly versatile, airborne heavy-lift platform Precise and efficient aerial firefighting solution Pioneer of aerial timber harvesting Diverse range of infrastructure construction applications All contracts are wet leases – we supply aircraft, pilots, mechanics and support crews Many contracts include both fixed (daily) and variable (flight hour-based) revenue Significant revenue not correlated to economic activity 18 Aircranes: Largest commercial helicopter fleet capable of carrying loads up to 25,000 lbs. 8,130 7,250 10,650 11,850 0 2,000 4,000 6,000 8,000 10,000 12,000 14,000 2009 2010 2011 LTM 9/30/12 Firefighting Timber Harvesting Construction Crewing |

|

|

Manufacturing / MRO Overview Type and Production certificate holder Manufactured 33 S-64s to date Full service hangar: can produce four S-64s per year Manufacture rotor blades Fabricate hard-to-locate and out of production parts FAA and EASA certified MRO services Airframe, component and engine overhaul Full MRO services for S-64 platform (internal and third-party) MRO services for non-S-64 aircraft platforms and components Manufacturing MRO Vertically integrated manufacturing and MRO operations |

|

|

Potential Acquisition of a Brazilian Aerial Services Operation Providing dedicated helicopter services to support HRT Oil & Gas operational requirements in the Amazon Basin 101 full time dedicated employees, pilots, mechanics, ground support Significant unused capacity of medium- and light-helicopters will allow expansion to additional customers Potentially materially accretive transaction planned for completion in 2H 2013 7 Sikorsky S-61 5 Bell 212 2 AS 350 - Astar |

|

|

Established International Presence Geographically distributed fleet and employees “on the ground” Minimizes fleet mobilization costs and response times Broadens client base and increases the number of business opportunities Maximizes use of fleet for seasonal aerial services across hemispheres Significant competitive advantages Operating experience in 18 countries across five continents Local permits and regulatory authorization Recent U.S. State Department “ITAR” exemption allows expanded global footprint 56% of business in North America, 44% International (2011) Corporate headquarters Operating subsidiaries Current and past operating presence Canadian Air-Crane Delta, British Columbia, Canada European Air-Crane SRL Florence, Italy Erickson Air-Crane, Malaysia SDN. BHD Miri, Malaysia Erickson Air-Crane Inc. Manufacturing, Logistics, and MRO Facilities: Central Point, Oregon, U.S.A Erickson Air-Crane Inc. Global Headquarters: Portland, Oregon, U.S.A. Agents / Representatives Principal Operating Facilities |

|

|

Management Team 3 years 3 years 4 years 4 years 2 years 2 years 4 years 4 years 3 years 8 years 6 years 5 years 3 years 4 years 8 years 3 years 27 years 7 years 3 years 1 year 9 years <1 year Name & Position Years Experience Selected Background (Years) Udo Rieder President & CEO 25 Chuck Ryan Senior Vice President & CFO 33 Gary Zamieroski Vice President & CMO 27 Mac McClaren Vice President, Global Aerial Services 35 Ed Rizzuti Vice President & General Counsel 14 |

|

|

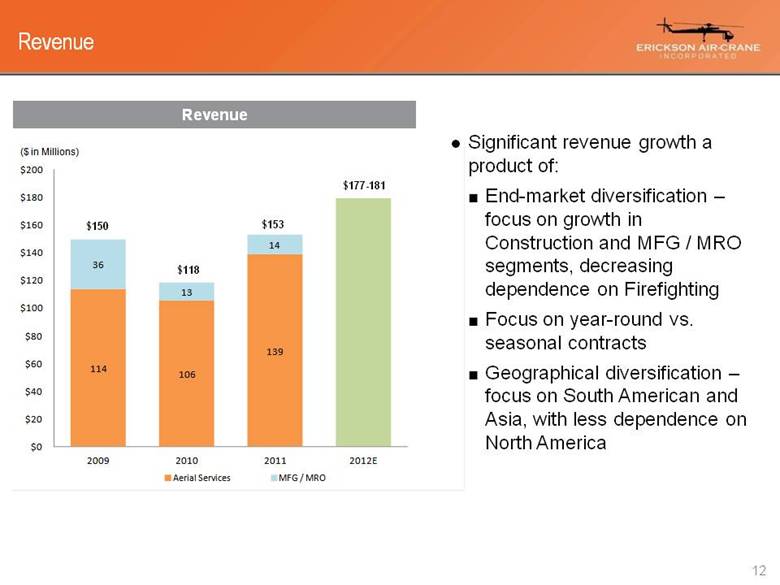

Revenue Revenue $150 $118 $153 $177-181 Significant revenue growth a product of: End-market diversification – focus on growth in Construction and MFG / MRO segments, decreasing dependence on Firefighting Focus on year-round vs. seasonal contracts Geographical diversification – focus on South American and Asia, with less dependence on North America 114 106 139 36 13 14 $0 $20 $40 $60 $80 $100 $120 $140 $160 $180 $200 2009 2010 2011 2012E Aerial Services MFG / MRO ($ in Millions) |

|

|

Increasing Diversification of Revenue Sources Increasing End-Market Diversity 2007 2012E 2016 Projection Increasing Geographic Diversity 2007 2012E 2016 Projection Firefighting Timber Harvesting Firefighting Timber Harvesting Construction Crewing MFG / MRO North America Europe Asia South America North America Europe Asia South America North America Europe Asia |

|

|

EBITDA Adjusted EBITDA(1) EBITDA margins normalize to 20% returns 2009 included an Aircrane sale 2010 included an accident 2011 included non-recurring expenses Continued progression toward end-market diversification and converting seasonal to year-round contracts will enhance returns Acquisition strategy will enhance returns and provide a more diverse product offering Rev. ($mm) $150 $118 $153 $177-181 (1) Adjusted EBITDA is a non-GAAP financial measure. In addition to adjusting net income (loss) to exclude interest expense, net, provision for (benefit from) income taxes, and depreciation and amortization, Adjusted EBITDA also adjusts net income by excluding non cash mark-to-market foreign exchange gains (losses), specified litigation and settlement expenses, certain management fees, gains from sale of equipment, non-cash charges arising from awards to employees relating to equity interests, non-cash charges relating to financings, IPO related non-capitalized expenses, and extraordinary, non-recurring non cash costs. 32 12 25 $42-44 21% 10% 16% 23-24% 0% 5% 10% 15% 20% 25% 30% $0 $5 $10 $15 $20 $25 $30 $35 $40 $45 $50 2009 2010 2011 2012E Adjusted Ebitda Margin ($ in Millions) (% Margin) |

|

|

Well Positioned For Growth Aerial Services New end markets/geographies in infrastructure construction, especially South American oil-and-gas support Expansion in Asia, especially India and China Acquisitive growth focused on complementary aircraft serving our target markets (such as the potential Brazilian acquisition) MRO Significant global market demand for heavy-lift aircraft Go-to-market strategy focused on growth in S-64 install base, through both fleet additions and Aircrane sales Third-party platforms – supporting other OEMs and existing non-S-64 fleets Acquisitive growth focused on supplementing and leveraging our existing capabilities |

|

|

Key Investment Highlights Experienced Management Superior Operating Profitability Strong Balance Sheet Numerous Growth Opportunities Increasing Diversification Adjusted EBITDA is a non-GAAP financial measure. In addition to adjusting net income (loss) to exclude interest expense, net, provision for (benefit from) income taxes, and depreciation and amortization, Adjusted EBITDA also adjusts net income by excluding non cash mark-to-market foreign exchange gains (losses), specified litigation and settlement expenses, certain management fees, gains from sale of equipment, non-cash charges arising from awards to employees relating to equity interests, non-cash charges relating to financings, IPO related non-capitalized expenses, and extraordinary, non-recurring non cash costs. Adjusted EBITDA Margin is Adjusted EBITDA divided by sales. Fair value of the net assets of the Company predominantly determined by an independent appraisal in September 2012 of 19 owned aircraft and our parts inventory. Expect organic growth across major end markets Announced non-binding LOI for acquisition in Brazil Pursuing Aircrane sales Increase utilization of manufacturing / MRO capabilities 20+ years average aerospace, military experience FY2012 Adjusted EBITDA(1) margin of >20% Growth focused in non-seasonal venues Leverage ratio < 2.3x at 9/30/12 Estimated fair value of net assets in excess of $800 million(2) Improving mix across end markets, oil and gas New market development in South America Balanced presence on five continents |

|

|

Appendix |

|

|

Erickson is the only manufacturer and operator of a commercial heavy-lift helicopter in production that has a payload capacity of up to 25,000 lbs and does not have geographic or category restrictions Commercial Heavy-Lift Helicopter Alternatives Note: Data not provided by manufacturer based on estimates. All performance data based on sea level assumption. Sources: (1) TransGlobal Aviation, www.transglobalaviation.net. (2) Evergreen Helicopters, Inc., www.evergreenaviation.com. (3) Columbia Helicopters, www.colheli.com. (4) Kamov Helicopters, www.kamov.net. (5) FAS Military Analysis Network, www.fas.org. (6) Category restrictions include not being authorized to fly over populated areas, carry passengers, and operate in multiple countries. (7) PRWeb, www.prweb.com. (8) 102 standard and 47 restricted S-61s in operation. Columbia Columbia S-64E/S-64F CH-54A/CH-54B S-61 (1)(2) 234 (3) 107 (3) KA-32 (4) MIL 26 (5) Manufacturer Erickson Sikorsky Sikorsky Boeing Boeing Kamov MIL Original Production 1962 1962 1959 1962 1964 1980 1977 Country of Origin U.S. U.S. U.S. U.S. U.S. Russia Russia Payload Capacity (lbs) 20,000 / 20,000 / 10,000 26,000 10,000 11,000 44,000 25,000 25,000 Range (nautical miles) 245/227 245/227 470/408 240 207 605 497 Max Speed (knots) 115/104 115/104 165/143 170 143 166 183 Primary Civilian - Firefighting - Firefighting - Firefighting - Firefighting - Firefighting - Firefighting - Firefighting Activities - Timber - Timber - Timber - Timber - Timber - Timber - Timber Harvesting Harvesting Harvesting Harvesting Harvesting Harvesting Harvesting - Construction - Construction - Construction - Construction - Construction - Construction - Passenger - Passenger - Passenger - Passenger - Passenger Transport Transport Transport Transport Transport U.S. and U.S. and Country Country Specific Specific Depends on Configuration In Production Yes No No No No Unknown No Approximate Number in Operation 29 11 102/47 (8) 7 (7) 14 (7) Unknown Unknown Standard Standard Restricted Restricted None Country Specific None None None Geographic Category (6) Operating Restrictions Standard Restricted |