Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Artisanal Brands, Inc. | Financial_Report.xls |

| EX-32.1 - EXHIBIT 32.1 - Artisanal Brands, Inc. | ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Artisanal Brands, Inc. | ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - Artisanal Brands, Inc. | ex31-1.htm |

| EX-32.2 - EXHIBIT 32.2 - Artisanal Brands, Inc. | ex32-2.htm |

| EX-21.1 - EXHIBIT 21.1 - Artisanal Brands, Inc. | ex21-1.htm |

| EX-10.39 - EXHIBIT 10.39 - Artisanal Brands, Inc. | ex10-39.htm |

| EX-10.40 - EXHIBIT 10.40 - Artisanal Brands, Inc. | ex10-40.htm |

| EX-10.41 - EXHIBIT 10.41 - Artisanal Brands, Inc. | ex10-41.htm |

| EX-10.38 - EXHIBIT 10.38 - Artisanal Brands, Inc. | ex10-38.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(x) ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended May 31, 2012.

( ) TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to .

Commission File No. 0-26112

ARTISANAL BRANDS, INC.

(Exact name of registrant as specified in its charter)

| New York | 41-1759882 |

| (State of Jurisdiction) | (IRS Employer I.D. No.) |

| 483 Tenth Avenue, New York, New York | 10018 |

| (Address of Principal Executive offices) | (Zip Code) |

Registrant’s telephone number, including area code 212-871-3150

Securities registered pursuant to Section 12(g) of the Act:

Title of each class

Common Stock, $.001 par value per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No X

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes No X

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to filing requirements for the past 90 days. Yes X No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if the disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12-2 of the Exchange Act.

| Large accelerated filer. o | Accelerated filer. o |

| Non-accelerated filer. o | Smaller reporting company. x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). . Yes No X

Based on the closing sale price of $.05 on May 31, 2012, the aggregate market value of the voting stock held by non-affiliates of the registrant was approximately $1,318,517. The Company had 28,093,982 shares of its $.001 par value common stock and 6,514,154 shares of its $.001 par value preferred stock issued and outstanding on May 31, 2012.

DOCUMENTS INCORPORATED BY REFERENCE

| Location in Form 10-K | Incorporated Document |

| None |

ARTISANAL BRANDS, INC.

Table of Contents

| Page No. | ||

|

Part I

|

||

|

Item 1

|

Business

|

2

|

|

Item 2

|

Description of Property

|

9

|

|

Item 3

|

Legal Proceedings

|

10

|

|

Item 4

|

(Removed and Reserved)

|

10

|

|

Part II

|

||

|

Item 5

|

Market for Registrant’s Common Equity and Related Stockholder Matters and Issuer Purchases of Equity Securities

|

10

|

|

Item 6

|

Selected Financial Data

|

12

|

|

Item 7

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

12

|

|

Item 8

|

Financial Statements and Supplementary Data

|

19

|

|

Item 9

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

20

|

|

Item 9A

|

Controls and Procedures

|

20

|

|

Part III

|

||

|

Item 10

|

Directors, Executive Officers, and Corporate Governance

|

22

|

|

Item 11

|

Executive Compensation

|

24

|

|

Item 12

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

25

|

|

Item 13

|

Certain Relationships and Related Transactions, and Director Independence

|

27

|

|

Item 14

|

Principal Accounting Fees and Services

|

27

|

|

Part IV

|

||

|

Item 15

|

Exhibits, Financial Statement Schedules

|

28

|

PART I

Item 1 DESCRIPTION OF BUSINESS

General

Artisanal Cheese, LLC was originally founded in 2003 by an American born, French-trained chef that started selling artisan, handcrafted cheeses in his restaurant in 1993. The interest in cheese at this restaurant led to the development of our company which consists of five state of the art cheese aging caves, a classroom to host consumer events for thematic cheese tastings with wines and beers, a call center to service customers and general administrative offices.

Since 2003 the company has offered consumer tasting events, selling aged cheeses to restaurants and hotels and marketing its full line of 150-250 cheeses through our website www.artisanalcheese.com.

The Original Acquisition

In August 2007, Artisanal Brands, Inc. (then known as American Home Food Products), acquired 100% of the memberships interests of Artisanal Cheese, LLC in exchange for $4.0 million in cash and $500,000 in sellers' notes. The founding chef remained as a consultant for one year after the closing and has since moved his business of managing two restaurants to another location.

August 2007 to December 2010

In this period, as the new owners and management team, we began the work to mobilize Artisanal from a highly-specialized cheese aging facility into one that could develop and manage a strategy to expand the business behind the unified brand – Artisanal Premium Cheese. Our management team has evolved through employee turnover.

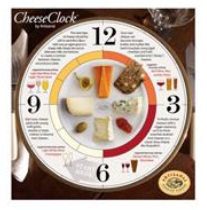

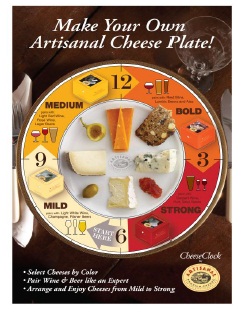

During this time we developed the CheeseClock™ , a concept to help online consumers select cheeses in the same fashion that a professional chef would offer them in the finest dining rooms, from mild to strong. The coding of cheeses into 4 categories – Mild, Medium, Bold, Strong – provide a basic structure for consumers to follow to select cheeses from a wide assortment. From there we developed a 4-color-coded packaging system that corresponds to the 4-colored quarters of the CheeseClock™ to further assist consumers in selecting cheeses in a retail environment. We then added to the program color-coded bottle hang tags that could be placed over the neck of a wine or beer bottle to coordinate purchases of Artisanal cheeses with beverages that fit the taste profile of the selected cheese.

The most recent step in the development of the retail program has been the design of two distinct customized refrigeration units (large and small) to facilitate a retailer's display of Artisanal cheeses along with our similarly color-coded chutneys in locations where wines and beers can be cross-promoted near the cheeses for consumer convenience.

January 2011 to Present

In January 2011 we entered into negotiations with KeHE, Inc. whereby KeHE would become a semi-exclusive distributor of the Artisanal CheeseClock™ program. In February we entered into a marketing and distribution agreement with KeHE that restricted us from offering the Artisanal CheeseClock™ program to KeHE’s top national distribution competitors in exchange for which KeHE agreed to provide Artisanal with: (a) working capital assistance, (b) a dedicated person at KeHE to manage the growth of the Artisanal brand, (c) a marketing allowance to cover the cost of promoting Artisanal branded products and the CheeseClock™ program at four major trade shows and several regional trade shows annually, (d) funding of the first $100,000 of in-store demonstrations to promote the new Artisanal CheeseClock™ program, and (e) access to KeHE’s national sales force to reach independent, regional and national retailers that already conduct business with KeHE.

2

During this period, we attended along with KeHE two of KeHE's own selling tradeshows--one held in January in Dallas and the other in June in Chicago, We also attended three major industry shows--the Winter Fancy Food Show in San Francisco held in January, the International Deli-Dairy -Bakery Association Tradeshow held in June and the Summer Fancy Food Show held in Washington, D.C. in July. We also attended several regional customer appreciation weekends(CAWs) hosted by KeHE which are attended by its largest customers. Our management has also made various headquarter calls to several regional and national supermarket chains resulting in approximately 100 stores stocking our cheeses and setting the groundwork for 2012.

Artisanal and Its Industry

The specialty retail cheese business has been stated by recent industry reporting sources to be a $3.4 billion category measured in retail dollars in the United States.1 The foodservice business for specialty cheese includes another $1.4 billion in sales and we are part of the online food gift business although specialty cheese sales in this category are not tracked by any reliable source.

The Market for Specialty, Artisan and Farmstead Cheese

The term “Specialty Cheese” refers to cheese products produced in a specialized manner (i.e. production method, aging or treatment). Even though some cheeses in this category are made in large quantities in commercial operations, like the well-known Italian Parmaggiano or Pecorino-Romano cheeses, they have specialized production requirements under laws that give the finished product a unique taste and texture. The phrase “Artisan Cheese” refers to cheeses produced in smaller quantities and generally by hand or with little reliance on mechanical equipment or other commercial processes. “Farmstead Cheeses” are artisan cheeses, but are made only from the milk produced by animals that graze on the same property as the cheese production facility.

Traditional Retail Outlets

The largest channel of distribution is the retail sector consisting of major national premium retail supermarkets, mass merchandisers that offer premium cheese products, gourmet stores and wine stores.

Foodservice Distribution

This channel of distribution includes restaurants, caterers, hotels, private clubs, private and commercial aircraft, cruise ships and other similar venues.

E-Commerce

The E-Commerce sector consists of sales through our website www.artisanalcheese.com and website of other online retailers that market our products.

Cheese Center

Located within our Manhattan property is a revenue-generating classroom facility known internally as the Cheese Center. At this modern facility of approximately 1,000 square feet is a dedicated working kitchen, classroom and presentation area with two large flat-screen television panels and seating for up to 50 individuals. Historically, we have offered wine and cheese education courses to the general public for a per person price of approximately $75 which is paid at the time of booking. The Cheese Center is also rented by third parties for a site fee of $3,000-$5,000 per day for organizations wanting a personalized event at the Cheese Center, independent photo shoots, and classroom instruction.

3

Suppliers

We do not produce the cheeses we market. We work with approximately 100 producers, distributors and importers of hand-crafted cheeses to develop our product line. No single supplier provides a significant portion of our cheese inventory. There are approximately 400 artisan cheese makers in the United States alone2 and hundreds more in the world market at any given time. Therefore, we anticipate having a sufficient supply of quality, hand-crafted cheeses to fulfill our demand for the foreseeable future.

Location

We are located at 483 Tenth Avenue, New York, New York 10018 (corner of West 37th Street & 10th Avenue) where we lease approximately 10,000 square feet on the second floor. At this location are all of our executive and sales offices, five cheese-aging caves, a packaging and shipping facility, customer call center and the Cheese Center (see above). The current lease payment is approximately $28,000 per month, subject to a rent increase of approximately ten percent per year. Although the lease terminates in August 2012, we have extended the lease to February 2013 with the option to extend to May 31, 2013.

We believe that our facilities are adequately covered by insurance and are suitable and adequate for our current business operations.

Our Competitors

We have substantial competition in each of the three market segments. The cheese industry is already a $6 billion category when considering the specialty retailers, foodservice, online and catalogue offerings of cheese3 There is no shortage of cheese available worldwide. Where many of our competitors offer a limited number of cheeses under multiple brand names, we try to differentiate ourselves by using an umbrella brand for a wide range of cheeses and related products, our trademarked logo as well as our new CheeseClock™ to help consumers shop for cheese. While these items help us to compete, other cheese companies have advertising budgets and other types of marketing and merchandising concepts that compete with our efforts.

We are not aware of any other competitor that is creating a national brand consisting of a highly-specialized and wide selection of domestic and imported artisan cheeses. Several Internet sites can be found for gourmet food products and many include cheese offerings. Other importers and cheese and specialty food distributors also compete in some of the same channels of distribution served by us. Other competitors include small farms or artisan cheese producers that have launched websites to sell cheese direct to consumers.

Seasonality

While there are a few artisan cheeses made on a seasonal basis, most of our cheeses are available all year as Artisanal specializes primarily in aged cheeses.

2 Rubiner, Matthew, “The Big Cheese”, The American, November/December 2007, 21 Aug. 2008 <http://www.american.com/archive/2007/november-december-magazine-contents/the-big-cheese>

4

We are not dependent upon any one customer. None of our customers provide us with more than 5% of our annual sales.

|

Intellectual Property Rights

|

|

Our Logo

We own the above trademark and logo, and all derivations thereof, except that we have assigned to Artisanal's founder the logo which specifically bears the name “Fromagerie & Bistro” where the words “Premium Cheese” appear in our logo. His use of that logo is restricted to the restaurant that now bears the name “Artisanal Fromagerie. Wine Bar & Bistro” and in any restaurant/retail establishment that he may open in the future.

We also own the registered trademark CheeseClock by Artisanal™ (Serial No. 77,632,254 and the corresponding image:

Artisanal CheeseClock ™

as well as the closely-related color-coded image of the CheeseClock by ArtisanalTM below (Serial No. 77,900,866), which corresponds to our new 4-color-coded packaging of 16 cheeses being sold to various retailers across the country:

Artisanal CheeseClock ™

5

We have since developed a newly trademarked retail merchandising packaging plan called the Artisanal CheeseClock™ to market 16 Artisanal Premium Cheeses in a color-coded manner that offers consumers a visual guide to understand how to select cheeses and pair them with wines and beers.

Artisanal CheeseClock ™

The CheeseClock™ was derived from our early heritage. The Artisanal Premium Cheese brand began in a restaurant and we continue to sell cheeses to professional chefs in over 300 restaurants and hotels. In a formal restaurant setting a professional chef will offer cheeses starting at the 6 o’clock position of a plate and then place the remaining cheeses in clockwise order progressing from the mildest to the strongest in taste. This format enables a person to enjoy the subtle nuances of a mild cheese before consuming the robust characteristics of a stronger cheese. Our 4-color packaging system was designed to help consumers purchase cheese from mild to strong.

In retail stores that stock our cheeses, consumers can reference the different colored boxes of cheeses from Mild (beige box), Medium (yellow box), Bold (Orange box), Strong (red box) to select different cheeses that complement one another and receive guidance as to beverage pairings. The corresponding colored bottle hang tags can be used by retailers to offer guidance on which wines and beers should be paired with the different cheeses.

6

Artisanal CheeseClock™ customize display case

As the above retail setting shows, consumers can visually pair wines and beers with our cheeses. All of this advice is presented on the CheeseClock™ displayed nearby and on the label of each of the individually-packaged cheeses.

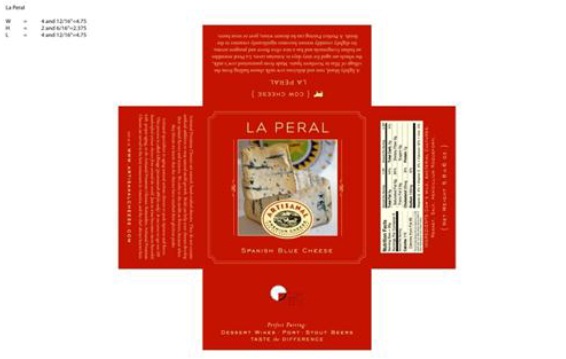

Sample of our La Peral cheese box

On each box of cheese we market for sale, we share our knowledge with consumers. We tell them on the cover what type of cheese they are buying, for instance, a Spanish Blue Cheese. We use one side panel to them about the cheese, another side panel addresses how we age cheese, and another panel reminds the consumer where the cheese belongs on the CheeseClock and, therefore, on their a Cheese Platter based on its strength from Mild to Strong. On the fourth panel we include nutritional information about the cheese within the box.

7

Image of Artisanal Premium Cheese display tags

Inside each of our boxes is a pre-printed cheese display tag that states the name of the cheese and its milk type. These display tags enable us to present the Artisanal Premium Cheese brand at the time of consumption. While the cheeses are being enjoyed, the host or hostess have already secured a considerable amount of information about each cheese from its packaging and has received guidance on selecting wines and beers to pair with our cheeses.

We are now offering the Artisanal CheeseClock ™ program to retailers from traditional supermarket and gourmet stores to wine stores. In retail stores that can market food and alcoholic beverages together, we provide our matching bottle hang tags (see below) and suggestions on the types of wines and beer that would be best paired with our cheeses, to further assist the average customers in making a purchase decision.

Backorders

We periodically have backorders due to transportation delays for foreign-made cheeses. The backorders are generally fulfilled within days of the official backorder date.

Financial Information About Foreign and Domestic Operations and Export Sales

We do not believe we have any material risks attendant with foreign operations or export sales as our primary dependence is on the U.S. market. As part of our inventory of foreign-produced cheeses, we are subject to fluctuations in exchange rates. At present, we maintain an inventory of approximately $300,000 most of which represents domestic product so our exposure at any one time to currency risks is not material to our immediate working capital requirements.

8

Regulation

We and our distributors are subject to regulation by federal, state and local authorities that affects our business. All of our cheese products and packaging materials are subject to regulations administered by the Food and Drug Administration (FDA) and the U.S. Department of Agriculture (USDA). Under the Federal Food, Drug and Cosmetic Act of 1938, as amended, the FDA prescribes the requirements and establishes the standards for quality, purity and labeling. Among other things, the FDA enforces statutory prohibitions against misbranded and adulterated foods, establishes safety standards for food processing, establishes ingredients and manufacturing procedures for certain foods, establishes standards of identity for certain foods, and establishes labeling standards and nutrition labeling requirements for food products.

New government laws and regulations may be introduced in the future that could result in additional compliance costs, seizures, confiscations, recalls, or monetary fines, any of which could prevent or inhibit the development, distribution, and sale of our products. If we fail to comply with applicable laws and regulations, we may be subject to civil remedies, including fines, injunctions, recalls, or seizures, as well as potential criminal sanctions, which could have a material adverse effect on our business, results of operations, and financial condition. We have not experienced any material regulatory problems in the past and have not been subject to any fines or penalties.

Research and Development Activities

We will continue our past practice of identifying the best-tasting specialty, artisan and farmstead cheese products available worldwide and bringing them to market through our multi-channel distribution system. We will also continue to work closely with leading cheese makers to develop new types of cheeses that will be proprietary to Artisanal, if not by ownership of the recipe, then through exclusive distribution and marketing rights for these products. As of the date of this filing Artisanal has developed seven such cheeses—Laurier, North Country Blue, Terraluna, Royale, Grassias, Geit-in-Stadt and Tomme Fermier D'Alsace. We are also working closely with an industry-renowned chef to develop a line of four refrigerated products all bearing the Artisanal Premium Cheese logo. We have no budget for research and development as all costs are nominal inasmuch as they require the intellectual work of our employees or cheese makers that offer samples of new products.

Employees

As of May 31, 2012, we had 26 full-time employees and 8 part-time employees. We believe the relationship we have with our employees is good.

Item 2 DESCRIPTION OF PROPERTY

We are located at 483 Tenth Avenue, New York, New York 10018 (corner of West 37th Street & 10th Avenue) where we lease approximately 10,000 square feet on the second floor. The leased space consists of all executive and sales offices, five cheese-aging caves, a packaging and shipping facility, a customer call center and a 1,000 square foot cheese center consisting of a fully-equipped kitchen, classroom and presentation area with two large flat-screen television panels used for conducting cheese education courses and third-party special events. From this facility the business distributes its line of Artisanal Premium Cheese products to fine food wholesalers, specialty food outlets, restaurants and to consumers through its catalogue and internet site. The current lease payment is approximately $28,000 per month, subject to a rent increase of approximately ten percent per year. Although the lease terminates in August 2012, we have extended the lease to February 2013 with the option to extend to May 31, 2013.

We believe that our facilities are adequately covered by insurance and are suitable and adequate for our current business operations.

9

Item 3 LEGAL PROCEEDINGS

There are currently no legal matters against the Company that are of a material nature or that could adversely impact the Company's business.

Item 4 (Removed and Reserved).

PART II

Item 5 MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Common Stock

As of May 31, 2012, we had 28,093,982 shares of our $.001 par value common stock outstanding. The Company’s common stock, $.001 par value, is traded "Over the Counter" (OTC) Bulletin Board operated by the National Association of Securities Dealers and are quoted on the OTCQB Market Tier under the ticker symbol "AHFP". The Company’s common stock became actively traded in July, 1995.

The following table shows the range of high and low bid information for our common shares for each quarter (except as indicated) within the last two fiscal years:

|

Closing Bid

|

||||||||

|

High

|

Low

|

|||||||

|

Fiscal Year 2011

|

||||||||

|

Quarter Ended August 31, 2010

|

$

|

0.08

|

$

|

0.08

|

||||

|

Quarter Ended November 30, 2010

|

$

|

0.09

|

$

|

0.09

|

||||

|

Quarter Ended February 29, 2011

|

$

|

0.11

|

$

|

0.11

|

||||

|

Quarter Ended May 31, 2011

|

$

|

0.17

|

$

|

0.17

|

||||

|

Fiscal Year 2012

|

||||||||

|

Quarter Ended August 31, 2011

|

$

|

0.45

|

$

|

0.45

|

||||

|

Quarter Ended November 30, 2011

|

$

|

0.45

|

$

|

0.45

|

||||

|

Quarter Ended February 29, 2012

|

$

|

0.15

|

$

|

0.09

|

||||

|

Quarter Ended May 31, 2012

|

$

|

0.05

|

$

|

0.05

|

||||

The quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions.

The approximate number of common stockholders of record at May 31, 2012, was approximately 200. The number of stockholders of record does not include beneficial owners of our common stock, whose shares are held in the names of various dealers, clearing agencies, banks, brokers and other fiduciaries, which is estimated to be 500 shareholders.

We may, but have not yet, entered into any agreements with market makers to make a market in our common stock. In addition, any market making activity would be subject to the limits imposed by the Securities Act, and the Exchange Act, as amended. For example, federal regulations under the Exchange Act regulate the trading of so-called "penny stocks" (the "Penny Stock Rules"), which are generally defined as any security not listed on a national securities exchange or NASDAQ, priced at less than $5.00 per share, and offered by an issuer with limited net tangible assets and revenues. In addition, equity securities listed on NASDAQ that are priced at less than $5.00 per share are deemed penny stocks for the limited purpose of Section 15(b)(6) of the Exchange Act. Therefore, during the time which the common stock is quoted on the NASDAQ OTC Bulletin Board at a price below $5.00 per share, trading of the common stock will be subject to the full range of the Penny Stock Rules. Under these rules, broker dealers must take certain steps before selling a "penny stock," which steps include: (i) obtain financial and investment information from the investor; (ii) obtain a written suitability questionnaire and purchase agreement signed by the investor; and (iii) provide the investor a written identification of the shares being offered and in what quantity. If the Penny Stock Rules are not followed by the broker-dealer, the investor has no obligation to purchase the shares. Given the application of the comprehensive Penny Stock Rules it may be more difficult for broker-dealers to sell the common stock.

10

Accordingly, no assurance can be given that an active market will always be available for the common stock, or as to the liquidity of the trading market for the common stock. If a trading market is not maintained, holders of the common stock may experience difficulty in reselling them or may be unable to resell them at all. In addition, there is no assurance that the price of the common stock in the market will be equal to or greater than the offering price when a particular offer of securities is made by or on behalf of a selling security holder, whether or not we employ market makers to make a market in our stock.

Our Series A Redeemable Convertible Preferred Stock

As of May 31, 2012, we had 6,514,154 shares of preferred stock outstanding. The preferred stock has a face value of $1.00 per share and is convertible at $.30 per share into $.001 par value common stock of Company. In the event of a liquidation, the preferred stockholders shall receive a cash payment of $1.20 per preferred share.

When first issued, dividends were to be paid (a) at an annual rate of 12% of the face value in each of the first two years ending August 14, 2008 and 2009, and were to be paid in preferred shares and (b) after the first two years, at a rate of 12% of the face value if paid in cash or at a rate of 15% of the face value if paid in preferred shares, at the election of Artisanal. On or about June 2009, the certificate of designation was amended to extend the 12% in kind dividend for another year, i.e. to August 2010. In February 2010, the preferred shareholders agreed to terminate the preferred dividend altogether as of December 1, 2009. Like the preferred shares, the preferred share dividends will convert into common stock at $.30 per share. The monthly accrual for preferred share dividends paid in preferred shares through November 30, 2009 (when the dividend was terminated) was an average of 53,000 shares.

The redemption provisions of these redeemable preferred shares were at Artisanal's option of and has since expired. So long as over $1,500,000 of the preferred stock is issued and outstanding we will require the prior written consent of holders representing two-thirds of the preferred stock issued and outstanding to (a) sell, merge with, acquire or consolidate with another business entity, (b) incur additional leverage beyond the leverage we contemplated upon acquiring Artisanal Cheese, LLC, or (c) issue any new shares of common stock or securities convertible or exercisable into common stock in excess of 2% of the shares of common stock issued and outstanding on a fully diluted basis as of August 14, 2007. At no time shall any securities be sold or granted at a price less than the thirty cents ($.30) per share conversion price.

Our Common Stock Options

As of May 31, 2012, we had 5,430,000 common stock options issued and outstanding.

On or about February 11, 2011, Artisanal entered a marketing and distribution agreement with KeHE Distributors pursuant to which the we were obligated to issue up to 4,880,000 stock options in specified tranches subject to KeHE achieving certain purchase thresholds. During May 2011, we amended the vesting terms of these options, whereby 440,000 of the options were vested and the remainder vested after our fiscal year end. The respective stock options have an exercise period of three years from the date of issuance and an exercise price of $.30 per share.

At a board meeting on September 13, 2011, our directors authorized a total of 550,000 stock options to board members to replace three-year options that had expired in February 2011. The stock options have an exercise period of three years from the date of issuance and an exercise price of $.30 per share.

11

Dilution

The conversion price of the Series A shares and exercise price of the stock options and the number of shares issuable upon conversion/exercise of the respective shares and options are subject to adjustments for common stock dividends, stock splits, combinations, reclassification or similar event. Therefore, any Series A preferred shares converted or stock options exercised after such event shall be entitled to receive the aggregate number and kind of common stock and/or capital stock which, if such Series A shares had been converted or stock options exercised immediately prior to such event, Series A or stock options would have owned upon such conversion/exercise (and, in the case of a reclassification, would have retained after giving effect to such reclassification) and been entitled to receive by virtue of such dividend, subdivision, combination or reclassification.

As of May 31, 2012, we had 5,430,000 stock options and 6,514,154 preferred shares outstanding. If all of the options and preferred shares outstanding as of May 31, 2012 were exercised and converted, as the case may be, the number of common shares would increase by 27,143,847 shares, to a total of 55,237,829 shares representing a 49% dilution to existing 28,093,982 common shares.

Item 6 SELECTED FINANCIAL DATA

As a smaller reporting company, this Item has been omitted pursuant to 17 CFR 229.301(c).

|

Item 7

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION

|

Results of Operations

Year ended May 31, 2012 (Fiscal 2012) as compared to May 31, 2011 (Fiscal 2011)

In the year ending May 31, 2012, we recorded sales of $3,563,144 versus $4,634,359 in the year before. The sales reduction was due in part to our decision to limit the number of Costco road shows in favor of focusing our limited sales staff on the expansion of our retail program into traditional retailers that will stock our entire Artisanal CheeseClock™ retail program 52 weeks a year.

In the latter part of 2011, Costco implemented new road shows rules that required all vendors to have two people in attendance during store hours, one of whom had to be a full-time employee of the vendor. Prior to this rule change we often had temporary workers that resided within the vicinity of the Costco location to conduct the road shows on our behalf to minimize travel costs and allow our full-time staff to spend more time opening new retail stores. The 4-day road shows that run from Thursday to Sunday consume close to 40 work hours. Under the new policy, we would have had to use our limited in-house retail staff for the roadshows and then allow them time off during the work week to compensate for the weekend hours they work at Costco. This significantly limits their ability to build a territory of regularly stocking retailers. Additionally, the road shows required new travel expenses when locations were beyond 30 miles from our offices. Coupled with the already substantial costs of cheese samples and supplies associated with the road shows, these added costs caused a marked increase in our selling, general and administrative expenses and made resulted in operating losses at Costco road shows. Repetitive road shows in the same Costco locations also tend to result in lower daily sales as the surprise element of the road show that generates the impulse-sales that road shows were created becomes routine and revenues and margins begin to drop. We will continue to do Costco road shows in new regions as it presents a great opportunity to market our brand via sampling done by our trained sales staff and to explain the principles of the CheeseClock™ and how it enables consumers to more readily select cheeses and pair them with wines and beers. For instance, earlier this year we moved outside of the north east region and conducted road shows in North Carolina, Florida, Atlanta and Puerto Rico. We now alert traditional retailers in these markets of our brand building through the Costco road shows which encourages the retailer to stock our products knowing that consumers are now familiar with Artisanal Premium Cheeses in their local markets. Looking long-term and being realistic about the best use of our limited personnel resources, we think this is the better strategy. In making this shift, we expect a reduction in monthly sales of approximately $100,000, over the next few months. However, as we bring on additional retail stores, we expect new sales to make up the difference. We will need to bring on roughly 125 to 150 traditional retail stores to replace the Costco business. With added personnel, we are increasing the number of retail stores that are stocking the Artisanal CheeseClock ™ retail concept.

12

Furthermore, we have focused less on selling the larger stationary cases and more on the smaller mobile cases as we found during the January trade shows that our lower cost mobile unit was gaining more interest than the more expensive units KeHE originally sought to purchase from Artisanal to place with retailers in exchange for a minimum amount of monthly deli sales volume. KeHE is still interested in purchasing the larger refrigeration units and placing them into retailers free of charge where sales volume to KeHE merits such treatment, but the shift to the smaller units is likely to gain more market acceptance. We continue to make progress with the various initiatives we put into play as far back as two years ago to make us less dependent on low volume orders from restaurants in our foodservice business.

During this period we developed new strategic plans with our distributor KeHE, Inc. and have since expanded into several locations managed by the 110-store Spec’s Wine chain in Texas. We also received a commitment from the Texas supermarket chain, HEB, to stock our brand, although the timetable has been elongated. This is not unusual in the supermarket trade. By the end of the calendar year, we expect to have close to 100 retailers stocking Artisanal Premium Cheeses in Texas. Our original goal is to reach this level of penetration in 10 states to hit our 1,000 store projection in calendar year 2012 will be lower as we spend more time now in the Tri-State New York area closing independent stores due to the unreliable commitment cycles of supermarkets and our own internal timetable to become cash flow positive. We also received approval from the St. Louis supermarket chain, Schnuck’s, to expand our program beyond the 10 stores we currently stock. As we begin to expand into these regional chains, local independent-operated stores are starting to stock our products and large scale chains are meeting with us to learn about our program. As of this filing we have met with Kroger’s, Total Wines, Jewel, Supervalu, and Super Targets.

Notwithstanding the progress we are making with KeHE, our growth is still hampered by our need to complete a capital plan (described below) that will enable us to recruit new regional sales personnel to work with KeHE, Inc.’s national sales team to accelerate placement of our Artisanal CheeseClock™ retail program in stores located throughout the country.

This spring the State of Connecticut passed new legislation allowing for wine retailers to operate under new rules that now allow for the sale of packaged food items in wine stores previously barred from selling food items. We have concentrated our focus on selling our Artisanal CheeseClock™ retail program in the state. Since the passage of the law, as of this filing we have successfully secured placement of our new retail program in xx stores. The Connecticut laws now track the laws of New Jersey where we are also concentrating on selling our program. In New York State, the third state in the Tri-state region, wine stores are prohibited from selling food items. In New York, we look to partner with beer marketers that are interested in cross-merchandising of their products with our new retail concept. (see pages 7-8 on how our products are cross-merchandised with wines and beers using the 4-color scheme of the Artisanal CheeseClock™.)

Our E-commerce division can be our fastest growing business short-term and the one that drives the highest margin. To achieve this potential, we need a deeper bench of more experienced personnel that can design a stronger customer acquisition plan and increase our daily online customer conversion rate. We are also looking to partner with much larger e-commerce businesses in wine and food that don’t directly compete with our company but can see the benefit of combining their marketing expertise with our brand, uniqueness and cheese quality. We believe our fullest potential will be achieved through hiring one senior manager to drive sales online and through our affiliated marketing programs with major online and catalogue retailers. Over time we would like to hire approximately 8 new junior staff additions to increase the number of third party affiliates we can service, improve on SEO and SEM, customer acquisition and retention and higher annual sales per customer for existing online customers.

13

We also recently filled one senior position in our foodservice business. When we acquired the business in 2007 close to 80% of our sales were derived from the foodservice sector which was hit very hard by the national recession. While the industry sector is regaining strength, we have, in addition to our core restaurant sales, an added focus to corporate executive dining with national on-premise service providers. In March 2012 we were approved by the national foodservice company, Aramark, to install our Artisanal CheeseClock™ customized retail refrigeration units into large scale corporate cafeterias. We have already placed units in select locations operated by Aramark and another major foodservice operator, Compass Foods. This is a whole new market for the Artisanal CheeseClock™ retail concept. Corporate cafeterias that have branched into much higher quality and healthier food offerings, like salad bars, meat carving stations, sushi, premium coffee stations, will now have a premium cheese and cracker alternative that is fully branded Artisanal Premium Cheese, from the exterior of our refrigeration cases to the individual cheese and cracker packages. Since all of our cheeses are pre-cut and wrapped, the elimination of labor is a great selling point to such retailers versus the other food offerings mentioned above that require a fair amount of labor to operate. In the hospitality sector, we work closely with Hyatt, Four Season, Ritz Carlton and other premium hotel accounts where banquet business offers much larger order volume and consistency.

Our cost of goods sold for the year was $2,816,209 versus $3,369,178 for the prior year. Our cost of goods sold increased this year partly because of higher costs from fuel charges that impact prices on packaging, cheese transportation and surcharges from overnight carriers on home deliveries as well as higher fuel surcharges per delivery. With lower sales, our fixed overhead represents a greater percentage of total sales. As a result our gross margin for the twelve month period was 21% down from 27% from the prior year. We are still looking at competing shipping companies to control shipping costs better, assuming the new providers can offer more competitive rates. With the planned completion of our capital plans we will be able to make greater use of ocean carrier versus the more expensive airfreight which affords us some benefits and reduces the amount of capital tied up in inventory.

In this fiscal year, we recorded a net loss of $4,310,109, versus a net loss of $2,539,667 in 2011. Of this amount, $2,234,773 was for non-cash expenses resulting in an operating cash loss of $2,075,376. Non-cash charges related to the vesting of 550,000 common stock option issued to board members in January 2012, and $1,037,685 is attributable to non-cash stock compensation expense relating to the vesting in August 2011 of 4,440,000 common stock options that had been granted to KeHE Distributors in connection with the marketing and distribution agreement entered in February 2011 and amended in May 2011, amortization and depreciation of $151,820, accrued interest of $636,555, amortization of debt discount of $230,108, common stock issued for services $178,365. Management determined that it was in our best interest to accelerate the vesting of these options during the first fiscal quarter and realize the expense to income immediately, rather than over the three-year term of the agreement when the expense would increase with each potential uptick in our stock price. The $636,555 in interest charges, is attributable primarily to interest on the term loan, the bridge loan and long-term debt. In August 2011, we paid off all interest on the long-term debt with shares of Series A preferred stock which helped us address this issue without the use of cash. In December 2011,we paid off a short-term bridge loan of $150,00 plus interest.

Our selling, general and administrative expenses increased significantly during this fiscal year due to the new personnel we hired to increase sales, the higher number of industry trade shows we attended with KeHE to prospect for new large scale retail chains and the 3-5 day road shows we ran with Costco in the south east division that required more travel expenses than local road shows in the north east. These are examples of how our expenses in the short-term increased to contribute to operating losses that will expect will reverse themselves as new revenues materialize from these efforts in subsequent periods. We also plan to increase our ranks of regional sales representatives which will reduce the higher travel expenses incurred by home office personnel traveling extensively by air with overnight lodging needs to meet with regional buyers for targeted retailers as well as the Costco road shows.

14

As of May 31, 2012, we had $536,871 in current liquid assets, which consisted primarily of cash of $43,016, inventory of $297,300 and accounts receivable of $173,496. This is against $596,636 in accounts payable. We had leasehold improvements and equipment of $500,583 and intangibles of $3,468,179 net of amortization.

Year ended May 31, 2011 (Fiscal 2011) as compared to May 31, 2010 (Fiscal 2010)

In the year ending May 31, 2011 (Fiscal 2011), we had net sales of $4,634,359. The cost of goods sold was $3,369,178 representing a gross margin of approximately 27%. Selling, general and administrative costs totaled $3,083,952 and are predominantly comprised of employee related expenses. Net sales increased 11% over the prior year reflecting additional new revenues from our retail expansion plans.

For the year ending May 31, 2011, we recorded a net loss from operations of $2,539,667 versus $2,291,614 for the same period in 2010. The net loss to common shareholders during the year ending May 31, 2011 was $2,539,667 versus a net loss of $2,559,550 in 2010. No dividends were paid to preferred shareholders during Fiscal 2011. We incurred $84,000 of amortization charges and depreciation of $144,639.

On May 31, 2011, we had $764,258 in current assets, which consisted primarily of net accounts receivable of $317,751, inventory of $374,116 and prepaid expenses of $28,844. Our leaseholds and equipment were $546,746 and intangibles were $3,552,179 net of amortization, which represents the goodwill and other intangibles.

Liquidity and Financial Resources at May 31, 2012

As of May 31, 2012, we had $3,750,113 in current liabilities, which includes $1,234,000 in notes payable and current portion of long-term debt. We had accounts payable of $596,636, accrued taxes of $1,093,483, and accrued expenses and other current liabilities totaling $767,216. Our current liabilities also include outstanding prepaid gift certificates and other deferred revenue totaling $58,778. Our accounts receivable are lower in part because of the shorter payment terms we have with KeHE and Costco. This allows us to carry a higher inventory balance which reduces inventory imbalances and lost selling opportunities to being out-of-stock with various items.

On or about February 22, 2010, we entered a loan agreement with one of our preferred shareholders and term loan participants (the "Lender") for a loan of $2.5 million. On specified dates since then, the Long Term Loan has been increased by a total of $1,382,000. The original loan was conditional upon the Lender obtaining a first security position on all of our assets. The loan was also conditional upon our repurchase from Lender and its affiliate 500,000 shares of redeemable convertible preferred stock they held collectively, repayment to the Lender of amounts Lender had previously advanced to Borrower under the Term Loan agreement and issuance to Lender of 9,275,000 shares of our common stock representing approximately twenty percent of our outstanding common stock on a fully-diluted basis. As of May 31, 2012, the total amount due under the Long Term Loan including interest is $4,144,873.

15

A year later, Artisanal entered into a three-year marketing and distribution agreement granting KeHE Distributors LLC the exclusive rights to distribute into retail outlets all Artisanal products with primary focus on our 16-cheese CheeseClockTM program. KeHE's exclusivity is dependent upon KeHE meeting specific minimum annual sales. Under the agreement, KeHE earns a commission of five percent (5%) on all net sales to accounts serviced by KeHE and could also earn up to 4,880,000 of common stock options upon meeting specified sales thresholds over the term of the agreement The agreement further provided that KeHE would loan Artisanal up to $520,000 to facilitate the purchase of inventory required for the KeHE accounts and that KeHE would advance up to an additional $100,000 of marketing funds to be used for in-store demonstrations and related marketing costs. The loan bears interest at a rate of 3-Month LIBOR plus 5% to be paid quarterly and is secured by our accounts receivable and inventory

In May 2011, we borrowed an additional $250,000 from KeHE to be repaid within 60 days. For this reason, $250,000 of the KeHE loan is reported under Notes Payable. As an inducement for making this additional loan, we modified the vesting terms of KeHE’s 4,880,000 options, which were to be earned based on certain product purchase thresholds. Upon the execution on May 9, 2011, of the amended Marketing and Distribution Agreement, KeHE became fully vested in 440,000 three year options exercisable at $.30 a share. The remaining 4,440,000 of options were to become fully vested on August 22, 2011, if the $250,000 was not repaid. As the additional funds were not repaid on that date, the remaining options vested. As of May 31, 2012, the total amount due under the KeHE Agreement, as amended, including interest is $818,194.

Over the last few months, we have raised additional sums of capital from our current lender and shareholders in the form of additions to the Long Term Loan (as described above) and the sale of the final outstanding 1,135,000 shares of Series A Preferred Stock that the board had authorized in 2007 in connection with the acquisition of Artisanal's operations but that were not sold at that time.

In June 2012, we filed with the Securities and Exchange Commission a registration statement with the purpose of raising as much as $8,000,000 to pay down debts and afford our company greater working capital to build out our sales organization. Our planned use of proceeds will be to retire the shareholders loans of approximately $1.1 million and pay off all accrued taxes leaving approximately $6 million in working capital. This level of working capital will help us make senior and junior hires to accelerate our growth plans in the 3 business lines – retail, foodservice, E-commerce and lower our cost of goods sold by purchasing more merchandise in larger quantities and relying less on air freight for international shipments of cheese.

We generate cash from the sales of our products. Wholesale and retail customers purchasing on an open account basis have 30-day payment terms. All others sales pertaining to cheese and related items from our print catalog or website or sales relating to classes at the cheese center are paid through credit card which generally settle within three days of purchase. While we believe our cash flow will be sufficient to meet our fixed monthly expenses, the Offering described above is critical to advancing our business plan as stated above.

As long as more than $1,500,000 of the Preferred Stock is issued and outstanding, we will need the prior written consent of holders representing two-thirds of the Preferred stock issued and outstanding to (a) sell, merge with, acquire or consolidate with another business entity, (b) incur additional leverage beyond the leverage we contemplated upon acquiring Artisanal Cheese, LLC in 2007, or (c) issue any new shares of common stock or securities convertible or exercisable into common stock in excess of 2% of the shares of common stock issued and outstanding on a fully diluted basis as of August 14, 2007. If we cannot obtain the requisite two-thirds approval for any future transaction, these restrictions may affect our liquidity and our ability to execute our business plan.

Inflation and Changing Prices

We do not foresee any risks associated with inflation or substantial price increases in the near future. In addition, the cheeses that we select for our affinage process are often available from various sources. As such, while we have exposure to inflation, we do not believe that inflation will have any materially significant impact on our operations in the near future.

16

We do not foresee any increase in costs that cannot be passed on to our customer in the ordinary course of business. We adjust our wholesale and online prices throughout the year to reflect increase costs attributable to increases in energy prices. Under very limited circumstances, Artisanal has entered into agreements with certain customers for which we provide third-party drop-ship fulfillment with contracted pricing for various cheese collections. We, in turn, usually have a corresponding agreement with the cheese suppliers whose products are incorporated into these collections for fixed prices to ensure that we achieve our anticipated gross margin.

Critical Accounting Policies

The discussion and analysis of our financial condition and results of operations are based upon our financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States of America. The preparation of these financial statements requires us to make estimates and judgments that affect the reported amount of assets and liabilities, revenues and expenses, and related disclosure on contingent assets and liabilities at the date of our financial statements. Actual results may differ from these estimates under different assumptions and conditions.

Critical accounting policies are defined as those that are reflective of significant judgments and uncertainties, and potentially result in materially different results under different assumptions and conditions. We believe that our critical accounting policies are limited to those described below. For a detailed discussion on the application of these and other accounting policies see Note 2 to our Financial Statements.

Long-Lived Assets (including Tangible and Intangible Assets)

We acquired businesses in recent years, which resulted in intangible assets being recorded. The determination of the value of such intangible assets requires management to make estimates and assumptions that affect our consolidated financial statements. We assess potential impairment to the intangible and tangible assets on a quarterly basis or when evidence of events or changes in circumstances indicate that the carrying amount of an asset may not be recovered. Our judgments regarding the existence of impairment indicators, if any, and future cash flows related to these assets are based on operational performance of our business, market conditions and other factors.

Accounting for Income Taxes

As part of the process of preparing our financial statements we are required to estimate our income taxes. Management judgment is required in determining our provision of our deferred tax asset. We recorded a valuation for the full deferred tax asset from our net operating losses carried forward due to the Company not demonstrating any consistent profitable operations. In the event that the actual results may differ from these estimates or we adjust these estimates in future periods we may need to adjust such valuation recorded.

17

Equity-Based Compensation

The Company accounts for equity-based compensation in accordance with guidance issued by the FASB, Share-Based Payment. The Company records compensation expense using a fair-value-based measurement method for all awards granted. In computing the impact, the fair value of each option is estimated on the date of grant based on the Black-Scholes options-pricing model utilizing certain assumptions for a risk free interest rate; volatility; and expected remaining lives of the awards. The assumptions used in calculating the fair value of share-based payment awards represent management’s best estimates, but these estimates involve inherent uncertainties and the application of management judgment. As a result, if factors change and the Company uses different assumptions, the Company’s equity-based compensation expense could be materially different in the future. In addition, the Company is required to estimate the expected forfeiture rate and only recognize expense for those shares expected to vest. In estimating the Company’s forfeiture rate, the Company analyzed its historical forfeiture rate, the remaining lives of unvested options, and the amount of vested options as a percentage of total options outstanding. If the Company’s actual forfeiture rate is materially different from its estimate, or if the Company reevaluates the forfeiture rate in the future, the equity-based compensation expense could be significantly different from what we have recorded in the current period.

18

Item 8 FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

ARTISANAL BRANDS, INC.

Consolidated Financial Statements

|

Report of Independent Registered Public Accounting Firm

|

F-1

|

|

Financial Statements:

|

|

|

Balance Sheets at May 31, 2012 and May 31, 2011

|

F-2

|

|

Statement of Operations for Years ended May 31, 2012 and May 31, 2011

|

F-3

|

|

Statement of Changes in Shareholders' Equity (Deficiency) for the Years ended May 31, 2012 and May 31, 2011

|

F-4

|

|

Statement of Cash Flows for the Years ended May 31, 2012 and May 31, 2011

|

F-5

|

|

Notes to Financial Statements for the Years ended May 31, 2012 and May 31, 2011

|

F-6

|

19

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Shareholders and Directors

Artisanal Brands, Inc.

New York, New York

We have audited the accompanying consolidated balance sheets of Artisanal Brands, Inc. as of May 31, 2012 and 2011, and the related consolidated statements of operations, shareholders’ deficit and cash flows for each of the years then ended May 31, 2012 and 2011. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. We were not engaged to perform an audit of the Company’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting.An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Artisanal Brands, Inc. as of May 31, 2012 and 2011, and the results of its operations and its cash flows for each of the years then ended May 31, 2012 and 2011, in conformity with accounting principles generally accepted in the United States.

/s/ Sherb & Co., LLP

New York, NY

November 21, 2012

F-1

ARTISANAL BRANDS, INC.

CONSOLIDATED BALANCE SHEETS

|

May 31,

|

May 31,

|

|||||||

|

2012

|

2011

|

|||||||

| ASSETS | ||||||||

| CURRENT ASSETS: | ||||||||

|

Cash

|

$ | 43,016 | $ | 43,547 | ||||

|

Accounts receivable, net

|

173,496 | 317,751 | ||||||

|

Inventories

|

297,300 | 374,116 | ||||||

|

Prepaid expenses and other current assets

|

23,059 | 28,844 | ||||||

|

Total Current Assets

|

536,871 | 764,258 | ||||||

|

FIXED ASSETS, net

|

500,583 | 546,746 | ||||||

|

OTHER ASSETS

|

31,514 | 33,085 | ||||||

|

INTANGIBLES - at cost, net

|

3,468,179 | 3,552,179 | ||||||

|

Total Assets

|

$ | 4,537,147 | $ | 4,896,268 | ||||

|

LIABILITIES AND SHAREHOLDERS' DEFICIT

|

||||||||

|

CURRENT LIABILITIES:

|

||||||||

|

Accounts payable

|

$ | 596,636 | $ | 719,798 | ||||

|

Note payable and current portion of long term debt

|

1,234,000 | 1,246,256 | ||||||

|

Prepaid gift certificates and other deferred revenue

|

58,778 | 51,296 | ||||||

|

Accrued expenses and other current liabilities

|

767,216 | 517,618 | ||||||

|

Accrued payroll taxes

|

1,093,483 | 622,570 | ||||||

|

Total Current Liabilities

|

3,750,113 | 3,157,538 | ||||||

|

LONG TERM DEBT, net of current portion

|

4,302,488 | 3,288,124 | ||||||

|

COMMITMENTS AND CONTINGENCY

|

||||||||

|

SHAREHOLDERS' DEFICIT

|

||||||||

|

Preferred stock - $0.001 par value, 10,000,000 shares authorized, 6,514,154 and 6,405,660 shares issued and outstanding, respectively

|

6,514 | 6,405 | ||||||

|

Common stock - $0.001 par value, 100,000,000 shares authorized 28,093,982 and 24,200,316 shares issued and outstanding, respectively

|

28,094 | 24,200 | ||||||

|

Additional paid-in capital

|

19,368,435 | 17,028,389 | ||||||

|

Accumulated deficit

|

(22,918,497 | ) | (18,608,388 | ) | ||||

|

Total shareholders' deficit

|

(3,515,454 | ) | (1,549,394 | ) | ||||

|

Total Liabilities & Shareholders' Deficit

|

$ | 4,537,147 | $ | 4,896,268 | ||||

See notes to the consolidated financial statements.

F-2

ARTISANAL BRANDS, Inc.

CONSOLIDATED STATEMENTS OF OPERATIONS

|

Year Ended May 31,

|

||||||||

|

2012

|

2011

|

|||||||

|

SALES

|

$ | 3,563,144 | $ | 4,634,359 | ||||

|

COST OF GOODS SOLD

|

2,816,209 | 3,369,178 | ||||||

|

GROSS PROFIT

|

746,935 | 1,265,181 | ||||||

|

SELLING, GENERAL AND ADMINISTRATIVE

|

3,292,041 | 3,083,952 | ||||||

|

ONE-TIME OPTION EXPENSE

|

976,628 | - | ||||||

|

DEPRECIATION AND AMORTIZATION

|

151,820 | 228,639 | ||||||

|

LOSS FROM OPERATIONS BEFORE INCOME TAXES AND INTEREST

|

(3,673,554 | ) | (2,047,410 | ) | ||||

|

OTHER INCOME( EXPENSES):

|

||||||||

|

Interest income (expense) and other income

|

(636,555 | ) | (492,257 | ) | ||||

|

LOSS FROM OPERATIONS BEFORE INCOME TAXES

|

(4,310,109 | ) | (2,539,667 | ) | ||||

|

INCOME TAXES

|

- | - | ||||||

|

NET LOSS

|

(4,310,109 | ) | (2,539,667 | ) | ||||

|

LESS PREFERRED STOCK DIVIDEND

|

- | - | ||||||

|

NET LOSS APPLICABLE TO COMMON SHARES

|

$ | (4,310,109 | ) | $ | (2,539,667 | ) | ||

|

LOSS APPLICABLE PER COMMON SHARE

|

||||||||

|

Basic

|

(0.17 | ) | (0.11 | ) | ||||

|

Diluted

|

(0.17 | ) | (0.11 | ) | ||||

|

WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING:

|

||||||||

|

basic

|

25,140,116 | 24,022,649 | ||||||

|

diluted

|

25,140,116 | 24,022,649 | ||||||

See notes to the consolidated financial statements.

F-3

ARTISANAL BRANDS, Inc.

CONSOLIDATED STATEMENT OF CHANGES IN SHAREHOLDERS' EQUITY/(DEFICIT)

YEARS ENDED MAY 31, 2011 and 2012

|

Preferred Stock

|

Common Stock

|

Additional

Paid-in |

Accumulated

|

|||||||||||||||||||||||||

|

Shares

|

Amount

|

Shares

|

Amount

|

Capital

|

Deficit

|

Total

|

||||||||||||||||||||||

|

BALANCE, May 31, 2010

|

6,419,160 | $ | 6,419 | 23,765,316 | $ | 23,765 | $ | 16,820,913 | $ | (16,068,721 | ) | $ | 782,376 | |||||||||||||||

|

Equity Based rights issued to lender

|

75,386 | 75,386 | ||||||||||||||||||||||||||

|

Conversion of preferred stock by investors

|

(13,500 | ) | (14 | ) | 45,000 | 45 | (31 | ) | 0 | |||||||||||||||||||

|

Equity-based compensation

|

390,000 | 390 | 132,121 | 132,511 | ||||||||||||||||||||||||

|

Net loss

|

(2,539,667 | ) | (2,539,667 | ) | ||||||||||||||||||||||||

|

BALANCE, May 31, 2011

|

6,405,660 | $ | 6,405 | 24,200,316 | $ | 24,200 | $ | 17,028,389 | $ | (18,608,388 | ) | $ | (1,549,394 | ) | ||||||||||||||

|

Issuance of common stock to lender

|

341,000 | 341 | 23,669 | 24,010 | ||||||||||||||||||||||||

|

Conversion of preferred stock by lenders

|

(1,019,000 | ) | (1,019 | ) | 3,397,666 | 3,398 | (2,379 | ) | - | |||||||||||||||||||

|

Issuance of preferred stock to lenders

|

50,000 | 50 | 49,950 | 50,000 | ||||||||||||||||||||||||

|

Issuance of preferred stock to investors

|

800,250 | 800 | 799,450 | 800,250 | ||||||||||||||||||||||||

|

Issuance of preferred stock representing interest

|

277,544 | 278 | 277,266 | 277,544 | ||||||||||||||||||||||||

|

Equity-based compensation

|

155,000 | 155 | 1,192,090 | 1,192,245 | ||||||||||||||||||||||||

|

Net loss

|

(4,310,109 | ) | (4,310,109 | ) | ||||||||||||||||||||||||

|

BALANCE, May 31, 2012

|

6,514,454 | $ | 6,514 | 28,093,982 | $ | 28,094 | $ | 19,368,435 | $ | (22,918,497 | ) | $ | (3,515,454 | ) | ||||||||||||||

See notes to the consolidated financial statements.

F-4

ARTISANAL BRANDS, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

|

Year Ended May 31,

|

||||||||

|

2012

|

2011

|

|||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES:

|

||||||||

| Net loss | $ | (4,310,109 | ) | $ | (2,539,667 | ) | ||

|

Adjustments to reconcile loss to net cash used in operating activities:

|

||||||||

|

Depreciation

|

67,820 | 144,639 | ||||||

|

Amortization of intangibles

|

84,000 | 84,000 | ||||||

|

Amortization of debt discount

|

230,108 | 159,734 | ||||||

|

Equity based compensation

|

61,257 | |||||||

|

One-time option expense

|

976,628 | |||||||

|

Common stock issued for services

|

178,365 | 132,511 | ||||||

|

Changes in assets and liabilities

|

||||||||

|

Accounts receivable

|

144,255 | (28,748 | ) | |||||

|

Inventory

|

76,816 | (4,214 | ) | |||||

|

Prepaid expenses and other assets

|

5,785 | 24,404 | ||||||

|

Accounts payable

|

154,382 | 207,990 | ||||||

|

Accrued expenses and other current liabilities

|

727,998 | 367,697 | ||||||

|

NET CASH USED IN OPERATING ACTIVITIES

|

(1,602,695 | ) | (1,451,654 | ) | ||||

|

CASH FLOWS FROM INVESTING ACTIVITIES:

|

||||||||

|

Sale/(Purchase) of fixed assets

|

(21,657 | ) | (74,948 | ) | ||||

|

Increase in security deposit

|

1,571 | - | ||||||

|

NET CASH USED IN INVESTING ACTIVITIES:

|

(20,086 | ) | (74,948 | ) | ||||

|

CASH FLOWS PROVIDED BY FINANCING ACTIVITIES:

|

||||||||

|

Increase/(Decrease) in notes payable

|

582,000 | 770,000 | ||||||

|

Sale of preferred stock

|

800,250 | (84,849 | ) | |||||

|

Proceeds/(Payment) of term loan

|

(60,000 | ) | - | |||||

|

Payment of long term debt

|

- | - | ||||||

|

Proceeds from Shareholder loan

|

300,000 | 500,000 | ||||||

|

NET CASH PROVIDED BY FINANCING ACTIVITIES

|

1,622,250 | 1,185,151 | ||||||

|

NET DECREASE IN CASH

|

(531 | ) | (341,451 | ) | ||||

|

CASH AT BEGINNING OF PERIOD

|

43,547 | 384,998 | ||||||

|

CASH AT END OF PERIOD

|

$ | 43,016 | $ | 43,547 | ||||

|

SUPPLEMENTAL CASH FLOW INFORMATION:

|

||||||||

|

Cash paid during the period for:

|

||||||||

|

Interest

|

$ | 2,920 | $ | 8,007 | ||||

|

Income taxes

|

- | - | ||||||

|

Non-cash financing activies:

|

||||||||

|

Conversion of Preferred Shares to Common Shares

|

$ | 1,019,300 | - | |||||

|

Preferred shares issued for interest

|

$ | 277,544 | - | |||||

See notes to the consolidated financial statements.

F-5

ARTISANAL BRANDS, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

YEARS ENDED MAY 31, 2012 AND 2011

1. DESCRIPTION OF BUSINESS

Artisanal Brands, Inc. (the “Company”) markets and distributes a wide line of specialty, artisanal and farmstead cheese products and other related specialty food products under its own brand “Artisanal Premium Cheese” to food wholesalers and retailers and directly to consumers through its catalog and website www.artisanalcheese.com.

2. SUMMARY OF SIGNIFICANT ACCOUNTING PRINCIPLES

a. Basis of Presentation - The accompanying audited consolidated financial statements of Artisanal Brands, Inc. (the “Company”) have been prepared in accordance with generally accepted accounting principles for financial information and with the instructions to Form 10-K and Regulation SX. In the opinion of management, all adjustments considered necessary for a fair presentation (consisting of normal recurring accruals) have been included.

b. Principles of Consolidation - The consolidated financial statements include the accounts of the Company and its majority-owned subsidiaries. All material intercompany accounts and transactions have been eliminated on consolidation.

c. Cash and Cash Equivalents - The Company considers all highly liquid investments with an original maturity of three months or less to be cash equivalents. Cash equivalents include investments in money market funds and are stated at cost, which approximates market value. Cash at times may exceed FDIC insurable limits.

d. Trade Accounts Receivable and Other Receivables, Net - The Company's accounts receivable consist primarily of amounts due from customers for the sale of its products. The Company records an allowance for doubtful accounts based on management's estimate of collectability of such trade and notes receivables outstanding. The allowance for doubtful accounts represents an amount considered by management to be adequate to cover potential losses, if any. The recorded allowance at May 31, 2012 and 2011 was $20,000 and $15,000, respectively.

e. Inventories – Inventories are stated at the lower of cost or market. Cost is determined using first-in, first-out (FIFO) method for cheese, accessories and packing materials, all finished goods.

f. Property and Equipment - Property and equipment acquired in the Artisanal acquisition is carried at net book value which approximates fair market value at the date of the acquisition. Amounts incurred for repairs and maintenance are charged to operations in the period incurred. Depreciation is calculated on a straight-line basis over the following useful lives:

|

Equipment (years)

|

3 | - | 5 | |||

|

Furniture and fixtures (years)

|

5 | - | 7 | |||

|

Leasehold improvements (years)

|

5 | - | 10 | |||

|

Software (years)

|

2 | - | 5 |

F-6

g. Goodwill and Intangible Assets - Intangible assets at May 31, 2012 relates to the assets acquired by the Company in August 2007.

The Company reviews long-lived assets, certain identifiable assets and any impairment related to those assets at least annually or whenever circumstances and situations change such that there is an indication that the carrying amounts may not be recoverable.

h. Fair Value of Financial Instruments - The accounting guidance establishes a fair value hierarchy based on whether the market participant assumptions used in determining fair value are obtained from independent sources (observable inputs) or reflect the Company's own assumptions of market participant valuation (unobservable inputs). A financial instrument's categorization within the fair value hierarchy is based upon the lowest level of input that is significant to the fair value measurement. The accounting guidance establishes three levels of inputs that may be used to measure fair value:

Level 1—Quoted prices in active markets that are unadjusted and accessible at the measurement date for identical, unrestricted assets or liabilities;

Level 2—Quoted prices for identical assets and liabilities in markets that are inactive; quoted prices for similar assets and liabilities in active markets or financial instruments for which significant inputs are observable, either directly or indirectly; or

Level 3—Prices or valuations that require inputs that are both unobservable and significant to the fair value measurement.

The Company considers an active market to be one in which transactions for the asset or liability occur with sufficient frequency and volume to provide pricing information on an ongoing basis, and views an inactive market as one in which there are few transactions for the asset or liability, the prices are not current, or price quotations vary substantially either over time or among market makers. Where appropriate the Company's or the counterparty's non-performance risk is considered in determining the fair values of liabilities and assets, respectively.

i. Revenue Recognition – The Company recognizes revenues associated with the sale of its products at the time of delivery to customers, when the price is fixed or determinable, persuasive evidence of an arrangement exists and collectability of the resulting receivable is reasonably assured.

In the current fiscal year the Company with its largest distributor, began to purchase from a foreign manufacturer and resell coolers for product displays. The sale of the coolers are recorded once delivery is tendered to the distributor.

j. Shipping and Handling Costs – Shipping and handling costs are included in cost of sales.

k. Advertising Costs – All advertising costs are expensed as incurred. Advertising expenses charged to operations for the years ended May 31, 2012 and 2011 amounted to approximately $128,567 and $297,691, respectively.

l. Interest Income/(Expense) - Interest expense relates to interest owed on the Company's debt. Interest expense is recognized over the period the debt is outstanding at the stated interest rates.

m. Income Taxes - Income taxes have been provided using the liability method. Deferred tax assets and liabilities are determined based on differences between the financial reporting and tax basis of assets and liabilities and are measured by applying estimated tax rates and laws to taxable years in which such differences are expected to reverse. The deferred tax asset attributed to the net operating losses has been fully reserved, since the Company has yet to achieve recurring income from operations.