Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Green Innovations Ltd. | green_8k.htm |

EXHIBIT 10.1

ASSET PURCHASE AGREEMENT

THIS ASSET PURCHASE AGREEMENT (the “Agreement”) is made and entered into this 19th day of November, 2012, by and between Sensational Brands, Inc., a Florida corporation (the “Purchaser,” “SBI-FL,” or the “Company”) and Sensational Brands, Inc., a Texas corporation (the “Seller,” “SBI-TX”).

WHEREAS, the Purchaser agrees to buy certain Sensational brand related assets owned by the Seller, as described in Schedule A, and operate as Sensational Brands, Inc., a Florida corporation which is wholly-owned by Green Hygienics, Inc. (“GHI”), a Florida corporation. This Agreement is for the purchase price of five hundred thousand (500,000) warrants for common stock of Green Innovations Ltd. (OTCBB: GNIN), the parent company of GHI, with an exercise price of $0.01 per share (see Schedule D).

NOW THEREFORE BE IT RESOLVED, in consideration of the mutual covenants, promises, warranties and other good and valuable consideration set forth herein, the Parties agree as follows:

1. Assets. Upon the closing of this Agreement (the “Closing”), Seller shall transfer and convey, and Purchaser shall acquire, all of Seller’s right, title and interest in the assets listed in Schedule A, free and clear of any liens, encumbrances or liabilities.

2. Liabilities. Purchaser is acquiring no liabilities of SBI-TX.

3. No Undisclosed Liabilities. Seller does not have any liability, indebtedness, obligation, expense, claim, deficiency, guaranty or endorsement of any type, in regards to the assets being acquired, whether accrued, absolute, contingent, matured, unmatured or other (whether or not required to be reflected in financial statements in accordance with GAAP).

4. Seller’s Representations and Warranties. Seller represents and warrants as follows:

a) Seller has clear and marketable title to all of the Assets, and there are no liens, liabilities or encumbrances attached to or otherwise encumbering the Assets, nor will Seller take any action that may result in the encumbering of any Asset prior to Closing.

b) Seller has the legal authority and power to sell the Assets to the Purchaser, and no consent is required from any other person or entity to authorize the sale of the Assets.

c) There is no litigation, arbitration, or other legal proceeding currently ongoing, pending, or threatened against Seller in regards to the certain assets being acquired, nor does Seller have any reason to believe that any such proceeding will be brought or threatened in the future.

d) Seller has all permits, licenses, rights, registrations, and other approvals (the “Approvals”) necessary to operate its business as it is currently operated. All Approvals are current and in full effect, and Seller is in compliance with the terms and conditions imposed by all such Approvals.

e) Seller’s business is currently in material compliance with all laws, rules, regulations and ordinances to which it is subject.

f) the Assets do not constitute all of the assets of the Seller and the Seller is able to carry on its business after the sale of the Assets.

1

5. Indemnification. Seller shall indemnify Purchaser and hold harmless Purchaser from any claim, damage, lawsuit, action, complaint, or other costs arising out of any breach of Seller warranties set forth in this Agreement, or of any other representation or warranty contained within this Agreement.

6. Contracts. Seller warrants that they are not a party to any contract, lease, agreement, or other commitment relating to Seller’s business or to the Assets.

7. Not used.

8. Not used.

9. Arm’s-Length Transactions. This transaction, even though between related parties as the principal of SBI-TX is an employee of Green Hygienics, Inc., shall be considered an arm’s-length transaction as all parties agree to the terms and conditions of the Agreement. Future transactions shall be governed by normal and customary arm’s-length specifications, if deemed necessary.

10. Risk of Loss or Damage. Seller assumes the risk of any loss of or damage to the Assets from the date of this Agreement through the Closing Date. After the Closing, the risk of loss shall be borne by the Purchaser thereafter.

11. Further Actions. Seller agrees to execute any further documents and to perform any further actions necessary to perfect Purchaser’s ownership of all right, title and interest to the Assets.

12. Assignment. Neither Party may assign their respective rights or obligations under this Agreement without prior written consent from the other Party.

13. Closing Deliveries. At the Closing, Seller and Purchaser shall deliver, or cause to be delivered, to the other party:

a) A fully executed Bill of Sale and Assignment and Assumption in the form of Exhibit C to this Agreement (the “Bill of Sale”) conveying to Purchaser all personal property to be acquired by Purchaser pursuant to this Agreement and providing for (i) the assignment to Purchaser of the contract rights, and all other intangible personal property included in the Purchased Assets and (ii) Purchaser’s assumption of the Assumed Liabilities;

b) A Certificate of an officer of Seller (i) certifying to the attached resolutions of the board of directors and shareholders, if the board of directors deems it necessary, of Seller authorizing this transaction, and (ii) attesting to the incumbency of the authorized officers of Seller executing this Agreement and the Seller’s closing documents;

c) A duly authorized and executed Release Agreement required by required by Schedule D;

d) A Certificate of an authorized officer of the each party certifying as to the accuracy of their respective representations and warranties under Section 6;

2

e) All Consents necessary to permit Seller to transfer the Purchased Assets to Purchaser; and

f) To the Purchaser, all of the books and records of Seller.

14. Additional Covenants: Release of Purchaser and Seller. At Closing, Purchaser and Seller shall enter into a release agreement (the “Release Agreement”) in the form of Schedule D attached hereto.

15. Governing Law. This Agreement shall be construed in accordance with, and governed in all respects by, the laws of the State of Florida, without regard to conflicts of law principles.

16. Counterparts. This Agreement may be executed in several counterparts, each of which shall constitute an original and all of which, when taken together, shall constitute one agreement.

17. Severability. If any part or parts of this Agreement shall be held unenforceable for any reason, the remainder of this Agreement shall continue in full force and effect. If any provision of this Agreement is deemed invalid or unenforceable by any court of competent jurisdiction, and if limiting such provision would make the provision valid, then such provision shall be deemed to be construed as so limited.

18. Notice. Any notice required or otherwise given pursuant to this Agreement shall be in writing and mailed certified return receipt requested, postage prepaid, or delivered by overnight delivery service, addressed as follows:

|

If to Seller:

|

Sensational Brands, Inc., a Texas corporation

|

|

| Tray Harrison | ||

|

2807 Allen Street #657

|

||

|

|

Dallas, Texas 75204 | |

|

If to Purchaser:

|

Sensational Brands, Inc., a Florida corporation

|

|

| Attn: Bruce Harmon | ||

|

|

1222 SE 47th Street | |

|

|

Cape Coral, Florida 33904 |

19. Headings. The headings for section herein are for convenience only and shall not affect the meaning of the provisions of this Agreement.

20. Entire Agreement. This Agreement constitutes the entire agreement between the Seller and the transferee, and supersedes any prior understanding or representation of any kind preceding the date of this Agreement. There are no other promises, conditions, understandings or other agreements, whether oral or written, relating to the subject matter of this Agreement.

21. Seller Business Activities through Closing. Seller promises and hereby agrees to maintain its current business activities, including all ongoing relationships with customers, clients, suppliers, contractors, or other related parties, until the Closing is complete. Seller further promises that it shall continue to operate its business in the ordinary course, and shall make no sale of assets prior to the completion of the Closing other than those within the ordinary course of business, save for the asset sale pursuant to this Agreement.

22. Closing. The Closing shall take place at 1222 SE 47th Street, Cape Coral, Florida 33904 on November 19, 2012, (the “Closing Date”), unless the Parties agree to another location, date and/or time in writing.

3

IN WITNESS WHEREOF, the parties have caused this Agreement to be executed the day and year first above written.

|

SENSATIONAL BRANDS, INC.,

a Texas corporation

|

SENSATIONAL BRANDS, INC.,

a Florida corporation

|

|||

| SELLER | PURCHASER | |||

|

/s/ Tray Harrison

|

/s/ Bruce Harmon

|

|||

|

Signature

|

Signature

|

|||

| Tray Harrison | Bruce Harmon | |||

|

Print Name

|

Print Name

|

|||

| President | Chief Executive Officer | |||

| Title | Title |

4

SCHEDULE A

Assets to be Purchased

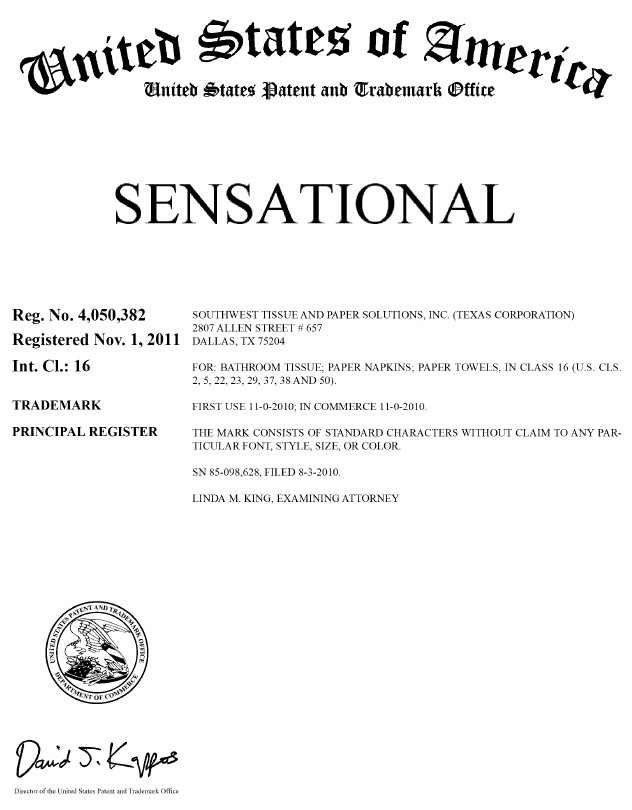

Trademark: SENSATIONAL, Reg. No. 4,050,382, registered November 1, 2011 (see attached), as assigned from Southwest Tissue and Paper Solutions, Inc., a Texas corporation, to Sensational Brands, Inc., a Texas corporation (see attached).

5

SENSATIONAL designs, art work and plates.

6

SCHEDULE B

BILL OF SALE

AND

ASSIGNMENT AND ASSUMPTION

This Bill of Sale and Assignment and Assumption Agreement (this “Bill of Sale”), dated as of November 19, 2012 (the “Effective Date”), by and between Sensational Brands, Inc., a Texas corporation (“SBI-TX” or “Seller”), and Sensational Brands, Inc., a Florida corporation (“SBI-FL” or “Purchaser”).

Recitals:

A. SBI-TX and SBI-FL entered into that certain Asset Purchase Agreement, November _, 2012 (the “Agreement”), which provides, on the terms and conditions set forth therein, for the transfer by Seller and purchase by Purchaser of certain assets of Seller as set forth in the Agreement. Capitalized terms used herein without definition shall have the meanings ascribed to them in the Agreement.

B. The assets being sold by Seller and purchased by Purchaser are certain of Seller’s tangible and intangible property (the “Purchased Assets”) as set forth in the Agreement.

C. Purchaser desires to obtain all right, title and interest in and to any and all of the Purchased Assets.

D. This Bill of Sale is being executed and delivered in order to effect the transfer of the Purchased Assets to Purchaser, as provided in the Agreement.

NOW THEREFORE, for valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Seller agree as follows:

1. Assignment. Seller hereby sells, grants, conveys, bargains, transfers, assigns and delivers to Purchaser, and to Purchaser’s successors and assigns, all of Seller’s rights, titles and interests, legal and equitable, throughout the world, in and to the Purchased Assets, to have and to hold the same forever. This is a transfer and conveyance by Seller to Purchaser of good and marketable title to the Purchased Assets, free and clear of all encumbrances except as provided in the Agreement or on the Schedules thereto. Subject to the conditions and limitations contained in the Agreement, Seller hereby covenants and agrees to warrant and defend title to the Purchased Assets against any and all claims whatsoever to the extent represented and warranted to in the Agreement.

2. Not Used.

7

3. Further Assurances. Seller agrees that it will, at Purchaser’s request at any time and from time to time after the date hereof and without further consideration, do, execute, acknowledge and deliver or will cause to be done, executed, acknowledged and delivered all such further acts, deeds, assignments, transfers, conveyances, powers of attorney and other instruments and assurances as may be considered by Purchaser, its successors and assigns, to be necessary or proper to better effect the sale, conveyance, transfer, assignment, assurance, confirmation and delivery of ownership of the Purchased Assets to Purchaser, or to aid and assist in collecting and reducing to the possession of Purchaser, any and all Purchased Assets.

4. Amendment or Termination; Successors and Assigns. This Bill of Sale may not be amended or terminated except by a written instrument duly signed by each of the parties hereto. This Bill of Sale shall inure to the benefit of, and be binding upon, each of the parties hereto and their respective successors and assigns.

5. No Third Parties. Nothing in this Bill of Sale, expressed or implied, is intended or shall be construed to confer upon or give to any person, firm or corporation other than Purchaser and Seller, their successors and assigns, any remedy or claim under or by reason of this instrument or any term, covenant or condition hereof, and all of the terms, covenants, conditions, promises and agreements contained in this instrument shall be for the sole and exclusive benefit of the Purchaser and Seller, their successors and assigns.

6. Construction. This Bill of Sale, being further documentation of a portion of the conveyances, transfers and assignments provided for in and by the Agreement, neither supersedes, amends, or modifies any of the terms or provisions of the Agreement nor does it expand upon or limit the rights, obligations or warranties of the parties under the Agreement. In the event of a conflict or ambiguity between the provisions of this Bill of Sale and the Agreement, the provisions of the Agreement will be controlling.

7. Governing Law. The rights and obligations of the parties under this Bill of Sale will be construed under and governed by the internal laws of the State of Florida (regardless of its or any other jurisdiction’s conflict-of-law provisions).

8. Counterparts. This Bill of Sale may be executed by facsimile in one or more counterparts and by facsimile, each of which shall be deemed an original and all of which taken together shall constitute one and the same instrument.

8

IN WITNESS WHEREOF, the parties have executed this Bill of Sale as of the Effective Date.

|

SENSATIONAL BRANDS, INC.

a Texas corporation

|

|||

| SELLER: | |||

|

|

By:

|

/s/ Tray Harrison | |

| Name: | Tray Harrison | ||

| Its: | President | ||

| PURCHASER: |

SENSATIONAL BRANDS, INC.

a Florida corporation

|

||

|

By:

|

/s/ Bruce Harmon | ||

| Name: | Bruce Harmon | ||

| Its: | Chief Executive Officer | ||

9

SCHEDULE C

MUTUAL RELEASE AGREEMENT

This Mutual Release Agreement (this “Release Agreement”), dated as of November 19, 2012 (the “Effective Date”), by and between Sensational Brands, Inc., a Texas corporation (“SBI-TX”) and Sensational Brands, Inc., a Florida corporation (“SBI-FL”).

RECITALS

WHEREAS, SBI-TX and SBI-FL are parties to that certain Asset Purchase Agreement, dated November __, 2012 (the “Asset Purchase Agreement”), and this Release Agreement is that certain Release Agreement as that term is defined in the Asset Purchase Agreement; and

WHEREAS, SBI-TX and SBI-FL now wish to enter into this Release Agreement with respect to the consummation of the Asset Purchase Agreement.

AGREEMENT

NOW, THEREFORE, in consideration of the mutual covenants and agreements contained in this Agreement, the receipt and sufficiency of which are hereby acknowledged, the parties do hereby agree as follows:

1. Definitions. Any capitalized term used in this Release Agreement without definition shall have the meaning given to such term in the Asset Purchase Agreement.

2. Release by SBI-TX. SBI-TX hereby fully, forever, irrevocably, and unconditionally releases and discharges SBI-FL, including, as applicable, all past and present officers, directors, stockholders, affiliates (including, but not limited to, parent, subsidiary and affiliated corporations), agents, employees, representatives, lawyers, administrators, spouses, and all persons acting by, through, under, or in concert with them, from any and all claims, damages or other sums, including attorneys' fees and costs, which CardWeb may have against them, or any of them, which could have arisen out of any act or omission occurring from the beginning of time to the effective date of this Agreement, whether now known or unknown, and whether asserted or unasserted.

3. Release by SBI-FL. SBI-FL hereby fully, forever, irrevocably, and unconditionally releases and discharges SBI-TX, including, as applicable, all past and present officers, directors, stockholders, affiliates (including, but not limited to, parent, subsidiary and affiliated corporations), agents, employees, representatives, lawyers, administrators, spouses, and all persons acting by, through, under, or in concert with them, from any and all claims, damages or other sums, including attorneys' fees and costs, which SBI-TX may have against them, or any of them, which could have arisen out of any act or omission occurring from the beginning of time to the effective date of this Agreement, whether now known or unknown, and whether asserted or unasserted.

10

4. Miscellaneous.

4.1 Severability. The invalidity of all or any part of this Release Agreement shall not render invalid the remainder of this Release Agreement. In the event a court of competent jurisdiction should decline to enforce any provision of this Release Agreement, such provision shall be reformed to the extent necessary in the judgment of such court to make such provision enforceable to the maximum extent that the court shall find enforceable.

4.2 Notices. Any notice hereunder shall be sufficient if in writing and telefaxed to the party or sent by certified mail, return receipt requested and addressed as follows:

|

If to SBI-TX:

|

Sensational Brands, Inc.

|

| Attn: Tray Harrison | |

| 2807 Allen Street #657 | |

| Dallas, TX 75204 | |

|

If to SBI-FL:

|

Green Innovations Ltd.

|

| Attn: Bruce Harmon | |

| 80 SW 8th Street, Suite 2000 | |

| Miami, FL 33130 |

4.3 Governing Law. This Agreement is made and shall be construed and performed in accordance with the laws of the State of Florida.

4.4 Waiver of Agreement. Any term or condition of this Release Agreement may be waived at any time by the party that is entitled to the benefit thereof, but no such waiver shall be effective unless set forth in a written instrument duly executed by or on behalf of the party waiving such term or condition. No waiver by any party of any term or condition of this Release Agreement, in any one or more instance, shall be deemed to be or construed as a waiver of the same or any other term or condition of this Release Agreement on any future occasion. All remedies, either under this Release Agreement, by law or otherwise, will be cumulative and not alternative.

4.5 Headings. The headings of the sections of this Release Agreement are for convenience and reference only and are not to be used to interpret or define the provisions hereof.

4.6 Counterparts. This Release Agreement may be executed by facsimile and in two (2) or more counterparts, each of which shall be deemed an original and all of which shall constitute one (1) instrument.

[SIGNATURE PAGE FOLLOWS]

11

IN WITNESS WHEREOF, each of the parties has caused this Release Agreement to be executed as of the Effective Date.

| SBI-TX: |

SENSATIONAL BRANDS, INC.

a Texas corporation

|

||

|

|

By:

|

/s/ Tray Harrison | |

| Name: | Tray Harrison | ||

| Its: | President | ||

| SBI - FL: |

Sensational Brands, Inc.,

a Florida corporation

|

||

|

By:

|

/s/ Bruce Harmon | ||

| Name: | Bruce Harmon | ||

| Its: | Chief Executive Officer | ||

12

SCHEDULE D

WARRANT FOR COMMON STOCK OF

GREEN INNOVATIONS LTD.

WARRANT NO. 1

THIS WARRANT HAS NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “ACT”), AND MAY NOT BE SOLD, OFFERED FOR SALE, PLEDGED OR HYPOTHECATED IN THE ABSENCE OF SUCH REGISTRATION OR AN EXEMPTION UNDER THE ACT.

WARRANT TO PURCHASE SHARES OF COMMON STOCK

of

Green Innovations Ltd.

This certifies that, for value received, Tray Harrison or its assignees (the “Holder”) is entitled, subject to the terms set forth below, to purchase from Green Innovations Ltd., a Nevada corporation (the “Company”), five hundred thousand (500,000) shares of Common Stock of the Company, $0.0001 par value per share (the “Warrant Shares”), as constituted on the date hereof (the “Warrant Issue Date”), upon surrender hereof, at the principal office of the Company referred to below, with the subscription form attached hereto duly executed, and simultaneous payment therefor in lawful money of the United States or otherwise as hereinafter provided, at the exercise price as set forth in Section 2 below (the “Exercise Price”). The number, character and Exercise Price of the Warrant Shares is subject to adjustment as provided below. The term “Warrant” as used herein shall include this Warrant and any warrants delivered in substitution or exchange therefor as provided herein.

This Warrant is dated November 19, 2012.

1. Term of Warrant. The purchase right represented by this Warrant shall terminate on or before 5:30 p.m., Eastern Standard Time, on the fifth (5th) anniversary of the date of this Warrant (the “Expiration Date”).

2. Exercise Price. The Exercise Price at which this Warrant may be exercised shall be no Dollars and one Cent ($0.01) per share of Common Stock, as adjusted from time to time pursuant to Section 11 hereof.

3. Exercise of Warrant. There is no obligation to exercise all or any portion of the Warrant. The Warrant (or any portion thereof) may be exercised at any time after the date hereof only by delivery to the Company of:

(a) Written notice of exercise in form and substance identical to Exhibit “A” attached to this Warrant; and

(b) Payment of the Exercise Price of the Warrant Shares being purchased, may be made by (1) cash or by check, (2) cancellation of indebtedness of the Company to the Holder equal to the Exercise Price, (3) cashless exercise procedure whereby the Warrant Shares issued upon exercise of this Warrant will be sold with the Holder receiving the difference between the Exercise Price and the sale price, in cash, and the Company receiving the Exercise Price for the Warrant Shares, in cash, (4) cashless exercise procedure whereby warrants having a Market Value (as defined) equal to the Exercise Price for such Warrant Shares are surrendered to the Company, or (5) any combination of the foregoing. For purposes of computing Market Value, Warrants shall be valued at the difference between the Exercise Price therefore and the value of the underlying security, which: (x) if is a publicly traded security shall be valued at the average of its closing price (as reported in The Wall Street Journal) for the five trading days prior to the closing of the transaction, and otherwise shall be (y) valued at the fair market value thereof on the day prior to closing as determined in good faith by the Company’s board of directors.

13

4. No Fractional Shares or Scrip. No fractional shares or scrip representing fractional shares shall be issued upon the exercise of this Warrant. In lieu of any fractional share to which the Holder would otherwise be entitled, the Company shall make a cash payment equal to the Exercise Price multiplied by such fraction.

5. Replacement of Warrant. On receipt of evidence reasonably satisfactory to the Company of the loss, theft, destruction or mutilation of this Warrant and, in the case of loss, theft or destruction, on delivery of an indemnity agreement reasonably satisfactory in form and substance to the Company or, in the case of mutilation, on surrender and cancellation of this Warrant, the Company at its expense shall execute and deliver, in lieu of this Warrant, a new warrant of like tenor and amount.

6. Rights of Shareholders. Except as otherwise provided herein, this Warrant shall not entitle its Holder to any of the rights of a shareholder of the Company.

7. Transfer of Warrant.

(a) Restrictions on transfer of Warrant. This Warrant may not be transferred or assigned in whole or in part, except that the Warrant may be transferred in whole or in part to an employee, affiliate or person controlling or controlled by or under the common control with the original Holder or by operation of law as the result of the death or divorce of any transferee to whom the Warrants may have been transferred.

(b) Exchange of Warrant Upon a Transfer. On surrender of this Warrant for exchange and subject to the provisions of this Warrant with respect to compliance with the limitations on transfers contained in this Section 7, the Company at its expense shall issue to or on the order of the Holder a new warrant or warrants of like tenor, in such names as the Holder may direct, for the number of shares issuable upon exercise hereof.

8. Reservation of Stock. The Company covenants that during the term this Warrant is exercisable, the Company will reserve from its authorized and unissued Common Stock a sufficient number of shares to provide for the issuance of Common Stock upon the exercise of this Warrant and, from time to time, will take all steps necessary to amend its Amended and Restated Articles of Incorporation (the “Articles”) to provide sufficient reserves of shares of Common Stock issuable upon exercise of the Warrant. The Company further covenants that all shares that may be issued upon the exercise of rights represented by this Warrant and payment of the Exercise Price, all as set forth herein, will be free from all taxes, liens and charges in respect of the issue thereof (other than taxes in respect of any transfer occurring contemporaneously or otherwise specified herein). The Company agrees that its issuance of this Warrant shall constitute full authority to its officers who are charged with the duty of executing stock certificates to execute and issue the necessary certificates for shares of Common Stock upon the exercise of this Warrant, and that such certificates shall be issued in the names of, or in such names as may be directed by, the Holder.

14

9. Notices.

(a) Whenever the Exercise Price or number of shares purchasable hereunder shall be adjusted pursuant to Section 11 hereof, the Company shall issue a certificate signed by its Chief Financial Officer setting forth, in reasonable detail, the event requiring the adjustment, the amount of the adjustment, the method by which such adjustment was calculated, and the Exercise Price and number of shares purchasable hereunder after giving effect to such adjustment, and shall cause a copy of such certificate to be delivered to the Holder of this Warrant.

(b) In case:

(i) the Company shall take a record of the holders of its Common Stock (or other stock or securities at the time receivable upon the exercise of this Warrant) for the purpose of entitling them to receive any dividend or other distribution, or any right to subscribe for or purchase any shares of stock of any class or any other securities, or to receive any other right, or

(ii) of any capital reorganization of the Company, any reclassification of the capital stock of the Company, any consolidation or merger of the Company with or into another corporation, or any conveyance of all or substantially all of the assets of the Company to another corporation, or

(iii) of any voluntary dissolution, liquidation or winding-up of the Company, then, and in each such case, the Company will deliver or cause to be delivered to the Holder or Holders a notice specifying, as the case may be, (A) the date on which a record is to be taken for the purpose of such dividend, distribution or right, and stating the amount and character of such dividend, distribution or right, or (B) the date on which such reorganization, reclassification, consolidation, merger, conveyance, dissolution, liquidation or winding-up is to take place, and the time, if any is to be fixed, as of which the holders of record of Common Stock (or such other stock or securities at the time receivable upon the exercise of this Warrant) shall be entitled to exchange their shares of Common Stock (or such other stock or securities) for securities or other property deliverable upon such reorganization, reclassification, consolidation, merger, conveyance, dissolution, liquidation or winding-up. Such notice shall be delivered at least 15 days prior to the date therein specified.

10. Amendments.

(a) Any term of this Warrant may be amended with the written consent of the Company and the holders of warrants representing not less than fifty percent (50%) of the shares of Common Stock issuable upon exercise of any and all outstanding Warrants. Any amendment effected in accordance with this Section 10 shall be binding upon each holder of any of the Warrants, each future holder of all such Warrants, and the Company; provided, however, that no special consideration or inducement may be given to any such holder in connection with such consent that is not given ratably to all such holders, and that such amendment must apply to all such holders equally and ratably in accordance with the number of shares of Common Stock issuable upon exercise of their Warrants. The Company shall promptly give notice to all holders of Warrants of any amendment effected in accordance with this Section 10.

15

(b) No waivers of, or exceptions to, any term, condition or provision of this Warrant, in any one or more instances, shall be deemed to be, or construed as, a further or continuing waiver of any such term, condition or provision.

11. Adjustments. Prior to the Expiration Date, the Exercise Price and the number of Warrant Shares purchasable upon the exercise of each Warrant are subject to adjustment from time to time upon the occurrence of any of the events enumerated in this Section 11.

(a) In the event that the Company shall at any time after the date of this Warrant (i) declare a dividend on Common Stock in shares or other securities of the Company, (ii) split or subdivide the outstanding Common Stock, (iii) combine the outstanding Common Stock into a smaller number of shares, or (iv) issue by reclassification of its Common Stock any shares or other securities of the Company, then, in each such event, the Exercise Price in effect at the time shall be adjusted so that the holder shall be entitled to receive the kind and number of such shares or other securities of the Company which the holder would have owned or have been entitled to receive after the happening of any of the events described above had such Warrant been exercised immediately prior to the happening of such event (or any record date with respect thereto). Such adjustment shall be made whenever any of the events listed above shall occur. An adjustment made pursuant to this paragraph (a) shall become effective immediately after the effective date of the event retroactive to the record date, if any, for the event.

(b) No adjustment in the number of Warrant Shares shall be required unless such adjustment would require an increase or decrease of at least 0.1% in the aggregate number of Warrant Shares purchasable upon exercise of all Warrants; provided that any adjustments which by reason of this Section 11(c) are not required to be made shall be carried forward and taken into account in any subsequent adjustment; provided, however, that notwithstanding the foregoing, all such adjustments shall be made no later than three years from the date of the first event that would have required an adjustment but for this paragraph. All calculations under this Section 11 shall be made to the nearest cent or to the nearest hundredth of a share, as the case may be.

(c) Whenever the Exercise Price payable upon exercise of each Warrant is adjusted pursuant to this Section 11, the Warrant Shares shall be adjusted by multiplying the number of Warrant Shares immediately prior to such adjustment by a fraction, the numerator of which shall be the Exercise Price in effect immediately prior to such adjustment, and the denominator of which shall be the Exercise Price as adjusted.

(d) Irrespective of any adjustments in the Exercise Price or the number or kind of shares purchasable upon exercise of the Warrants, Warrant Certificates theretofore or thereafter issued may continue to express the same Exercise Price per share and number and kind of shares as are stated on the Warrant Certificates initially issuable pursuant to this Warrant.

16

13. Miscellaneous.

(a) All notices shall be in writing and shall be delivered personally, electronically, or by express, certified or registered mail or by private overnight express mail service. Delivery shall be deemed conclusively made (i) at the time of delivery if personally delivered, (ii) immediately in the event notice is delivered by confirmed facsimile, (iii) twenty-four (24) hours after delivery to the carrier if served by any private, overnight express mail service, (iv) twenty-four (24) hours after deposit thereof in the United States mail, properly addressed and postage prepaid, return receipt requested, if served by express mail, or (v) five (5) days after deposit thereof in the United States mail, properly addressed and postage prepaid, return receipt requested, if served by certified or registered mail.

Any notice to the Company shall be given to:

Green Innovations Ltd.

80 SW 8th Street

Suite 2000

Miami, FL 33130

Attn: Chief Executive Officer

Any notice or demand to Holder shall be given to:

Tray Harrison

2807 Allen Street #657

Dallas, TX 75204

Any party may, by virtue of written notice in compliance with this paragraph, alter or change the address or the identity of the person to whom any notice, or copy thereof, is to be delivered.

17

(b) The Company and Holder shall each execute and deliver all such further instruments, documents and papers, and shall perform any and all acts necessary, to give full force and effect to all of the terms and provisions of this Warrant.

(c) This Warrant shall inure to the benefit of and be binding upon the parties hereto, and their successors in interest.

(d) This Warrant incorporates the entire understanding of the parties and supersedes all previous agreements relating to the subject matter hereof should they exist. This Warrant and any issue arising out of or relating to the parties’ relationship hereunder shall be governed by, and construed in accordance with, the laws of the State of New York, without regard to principles of conflicts of law. In all matters of interpretation, whenever necessary to give effect to any provision of this Warrant, each gender shall include the others, the singular shall include the plural, and the plural shall include the singular. The titles of the paragraphs of this Warrant are for convenience only and shall not in any way affect the interpretation of any provision or condition of this Warrant.

(e) In the event of any litigation or arbitration between the parties hereto respecting or arising out of this Warrant, the prevailing party shall be entitled to recover reasonable legal fees, whether or not such litigation or arbitration proceeds to final judgment or determination.

(f) Jurisdiction, Venue and Governing Law. Each party hereto consents specifically to the exclusive jurisdiction of the federal courts of the United States in Nevada, or if such federal court declines to exercise jurisdiction over any action filed pursuant to this Warrant, the courts of the Nevada sitting in the County of _____, and any court to which an appeal may be taken in connection with any action filed pursuant to this Warrant, for the purposes of all legal proceedings arising out of or relating to this Warrant. In connection with the foregoing consent, each party irrevocably waives, to the fullest extent permitted by law, any objection which it may now or hereafter have to the court's exercise of personal jurisdiction over each party to this Warrant or the laying of venue of any such proceeding brought in such a court and any claim that any such proceeding brought in such a court has been brought in an inconvenient forum. Each party further irrevocably waives its right to a trial by jury and consents that service of process may be effected in any manner permitted under the laws of the State of Nevada. This Warrant shall be deemed to be a contract made under the laws of the State of Nevada and for all purposes shall be governed by and construed and enforced in accordance with the internal laws of Nevada without regard to Nevada’s principles of conflict of laws.

(g) If any clause or provision of this Warrant is illegal, invalid or unenforceable under present or future laws effective during the term of this Warrant, then and, in that event, the remainder of this Warrant shall not be affected thereby, and in lieu of each clause or provision of this Warrant that is illegal, invalid or unenforceable, there shall be added a clause or provision as similar in terms and in amount to such illegal, invalid or unenforceable clause or provision as may be possible and be legal, valid and enforceable, as long as it does not otherwise frustrate the principal purposes of this Warrant.

18

IN WITNESS WHEREOF, Green Innovations Ltd. has caused this Warrant to be executed by its officers thereunto duly authorized.

| Green Innovations Ltd. | |||

|

Dated: November 19, 2012

|

By:

|

/s/ Bruce Harmon | |

| Printed Name: Bruce Harmon | |||

| Its: Chief Executive Officer | |||

19

EXHIBIT “A”

NOTICE OF EXERCISE

(To be signed only upon exercise of the Warrant)

TO: Green Innovations Ltd.

The undersigned, hereby irrevocably elects to exercise the purchase rights represented by the Warrant granted to the undersigned on ______________ and to purchase thereunder __________ shares of Common Stock of Green Innovations Ltd., (the “Company”) and herewith encloses either payment of $____________ or instructions regarding the manner of exercise permitted under Section 3(b) of the Warrant, in full payment of the purchase price of such shares being purchased.

Dated: ________________

| (Signature must conform in all respects to name

of holder as specified on the face of the Warrant)

|

|

| (Please Print Name) | |

| (Address) |

19