Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - JetPay Corp | v328938_8k.htm |

| EX-2.1 - SECOND AMENDMENT TO AGREEMENT AND PLAN OF MERGER - JetPay Corp | v328938_ex2-1.htm |

UNIVERSAL BUSINESS PAYMENTS SOLUTIONS ACQUISITION CORP. $179 Million Business Combination with Electronic Merchant Systems JetPay LLC AD Computer Investor Update Presentation – November 2012

2 UNIVERSAL BUSINESS PAYMENT SOLUTIONS ACQUISITION CORPORATION Disclaimer This presentation is being presented by Universal Business Payment Solutions Acquisition Corporation (“UBPS”) . Neither UBPS nor any of its respective affiliates makes any representation or warranty as to the accuracy or completeness of the information contained in this presentation . The sole purpose of the presentation is to assist persons in deciding whether they wish to proceed with a further review of the proposed transaction discussed herein and is not intended to be all - inclusive or to contain all the information that a person may desire in considering the proposed transaction discussed herein . It is not intended to form the basis of any investment decision or any other decision in respect of the proposed transaction . This presentation shall not constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed transactions . This presentation shall also not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdictions in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction . No offering of securities shall be made except by means of a prospectus meeting the requirements of section 10 of the Securities Act of 1933 , as amended .

3 UNIVERSAL BUSINESS PAYMENT SOLUTIONS ACQUISITION CORPORATION Forward Looking Statements This presentation includes “forward - looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995 . UBPS’s actual results may differ from its expectations, estimates and projections and consequently, you should not rely on these forward looking statements as predictions of future events . Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward - looking statements . These forward - looking statements include, without limitation, UBPS’s expectations with respect to future performance and anticipated financial impacts of the proposed transaction, the satisfaction of the closing conditions to the proposed transaction, and the timing of the completion of the proposed transaction . These forward - looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results . Most of these factors are outside UBPS’s control and are difficult to predict . Factors that may cause such differences include, but are not limited to, those described under the heading “Risk Factors” in UBPS’s final prospectus, dated May 9 , 2011 . Other factors include the possibility that the transactions contemplated by a potential transaction agreement do not close, including due to the failure of certain closing conditions . UBPS cautions that the foregoing list of factors is not exclusive . Additional information concerning these and other risk factors is contained in UBPS’s most recent filings with the Securities and Exchange Commission . All subsequent written and oral forward - looking statements concerning UBPS, a potential transaction agreement, the related transactions, or other matters and attributable to UBPS or any person acting on its behalf, are expressly qualified in their entirety by the cautionary statements above . UBPS cautions readers not to place undue reliance upon any forward - looking statements, which speak only as of the date made . UBPS does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward - looking statements to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based .

4 UNIVERSAL BUSINESS PAYMENT SOLUTIONS ACQUISITION CORPORATION Transaction Overview UBPS will acquire three operating companies – Transaction consideration consists of: – $104mm in cash – 6.3mm UBPS shares ($38mm valuation @ $6 per share) – Future guarantee payments totaling $12mm ($10mm due on 18 month anniversary of closing and $2mm due on two year anniversary) Compelling transaction valuation – 6.7x 2013E EBITDA and 9.7x 2013E net income versus comps of 8.6x and 16.5x ▪ Represents discount of 23% to EBITDA multiple and 41% to net income multiple Superior growth to peers and natural inflation hedge – $55mm float and merchant pricing based on transaction size will increase revenues Recent transactions show value of platforms – Vantiv acquisition of Litle at 6.0x revenues, Cielo acquisition of Merchant e - Solutions at 5.4x revenues Expected to result in a well capitalized company poised to grow and consolidate fragmented industry

5 UNIVERSAL BUSINESS PAYMENT SOLUTIONS ACQUISITION CORPORATION Transaction Update Anticipated Sources of Funds UBPS anticipates the cash sources of funds totaling $120mm to close its pending business combination will be approximately as follows: – Bank financing – term loans totaling $44mm from individual targets at weighted average interest rate of approximately 4.6% – Issuance of $40mm of convertible preferred stock to Abry Partners ▪ $6.90 conversion price ▪ 12% PIK dividend – Trust Proceeds - $36mm Warrant Exchange In conjunction with the closing, UBPS is exchanging 1 share of its common stock for every 7.5 warrants outstanding – Eliminates warrant overhang of 19mm warrants – 2.5mm shares of common stock to be issued

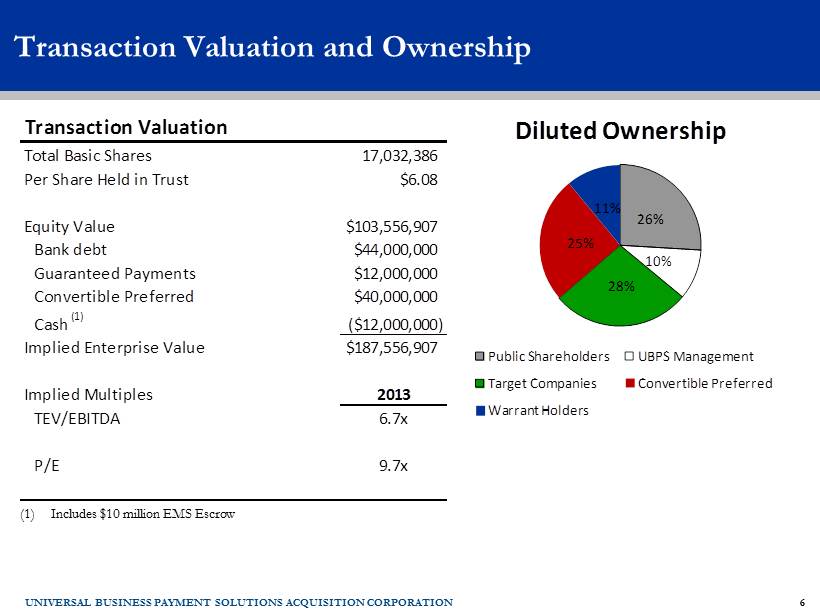

6 UNIVERSAL BUSINESS PAYMENT SOLUTIONS ACQUISITION CORPORATION Transaction Valuation and Ownership (1) Includes $10 million EMS Escrow 26% 10% 28% 25% 11% Diluted Ownership Public Shareholders UBPS Management Target Companies Convertible Preferred Warrant Holders Transaction Valuation Total Basic Shares 17,032,386 Per Share Held in Trust $6.08 Equity Value $103,556,907 Bank debt $44,000,000 Guaranteed Payments $12,000,000 Convertible Preferred $40,000,000 Cash (1) ($12,000,000) Implied Enterprise Value $187,556,907 Implied Multiples 2013 TEV/EBITDA 6.7x P/E 9.7x

7 UNIVERSAL BUSINESS PAYMENT SOLUTIONS ACQUISITION CORPORATION Comparable Companies EBITDA and Price to Earnings Multiples Note: All data as of November 12, 2012 Source: CapitalIQ ▪ Other publicly traded companies in the business processing industry include: ― Automatic Data Processing, Inc. (ADP) ― Global Payments Inc. (GPN) ― Heartland Payment Systems, Inc. (HPY) ― Paychex, Inc. (PAYX) ― Total System Services, Inc. (TSS) ― Vantiv , Inc. (VNTV) ▪ 6.7x 2013 EBITDA and 9.7x 2013E net income versus comps of 8.6x and 16.5x 6.7x 11.6x 6.5x 6.9x 11.6x 7.7x 7.4x 0.0x 2.0x 4.0x 6.0x 8.0x 10.0x 12.0x 14.0x UBPS ADP GPN HPY PAYX TSS VNTV TEV/EBITDA 2013E 9.7x 19.9x 12.1x 14.3x 20.9x 17.1x 14.5x 0.0x 5.0x 10.0x 15.0x 20.0x 25.0x 30.0x UBPS ADP GPN HPY PAYX TSS VNTV P/E 2013E

8 UNIVERSAL BUSINESS PAYMENT SOLUTIONS ACQUISITION CORPORATION Comparable Companies EBITDA Metrics Note: All data as of November 12, 2012 Source: CapitalIQ (1) UBPS EBITDA data is actual full year 2011 24.3% 22.3% 22.8% 5.7% 42.6% 25.0% 27.0% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% 40.0% 45.0% UBPS (1) ADP GPN HPY PAYX TSS VNTV LTM EBITDA Margins 28.3% - 0.4% 2.3% 10.6% 2.1% 11.1% 3.2% - 5.0% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% UBPS (1) ADP GPN HPY PAYX TSS VNTV EBITDA CAGR (LTM - 2013E) 6.7x 2013E EBITDA versus comps of 8.6x 6.7x 11.6x 6.5x 6.9x 11.6x 7.7x 7.4x 0.0x 2.0x 4.0x 6.0x 8.0x 10.0x 12.0x 14.0x UBPS ADP GPN HPY PAYX TSS VNTV TEV/EBITDA 2013E

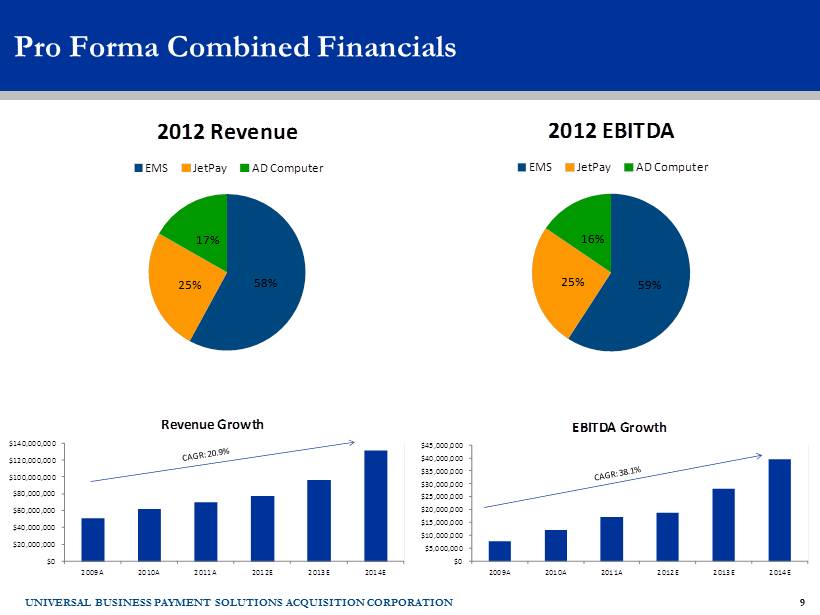

9 UNIVERSAL BUSINESS PAYMENT SOLUTIONS ACQUISITION CORPORATION Pro Forma Combined Financials 58% 25% 17% 2012 Revenue EMS JetPay AD Computer 59% 25% 16% 2012 EBITDA EMS JetPay AD Computer $0 $20,000,000 $40,000,000 $60,000,000 $80,000,000 $100,000,000 $120,000,000 $140,000,000 2009A 2010A 2011A 2012E 2013E 2014E Revenue Growth $0 $5,000,000 $10,000,000 $15,000,000 $20,000,000 $25,000,000 $30,000,000 $35,000,000 $40,000,000 $45,000,000 2009A 2010A 2011A 2012E 2013E 2014E EBITDA Growth

10 UNIVERSAL BUSINESS PAYMENT SOLUTIONS ACQUISITION CORPORATION Historical Financial Summary Financial Summary ($ in thousands) 2009A 2010A 2011A 2012E 2013E 2014E Revenue (1) $50,742 $61,708 $70,058 $77,388 $96,150 $131,225 % Growth - 21.6% 13.5% 10.5% 24.2% 36.5% Gross Profit $35,177 $41,870 $47,270 $51,470 $61,747 $76,676 % Margin 69.3% 67.9% 67.5% 66.5% 64.2% 58.4% EBITDA (2) $7,861 $12,025 $17,059 $18,645 $28,134 $39,541 % Margin 15.5% 19.5% 24.3% 24.1% 29.3% 30.1% Net Income $4,387 $7,068 $10,204 $8,220 $14,724 $22,301 % Margin 8.6% 11.5% 14.6% 10.6% 15.3% 17.0% Plus: After Tax Savings from New Credit Facility $715 $715 Less: PIK (Non-Cash Dividend) $4,800 $5,376 Pro Forma Net Income $10,639 $17,640 % Margin 11.1% 13.4% (1) Cumulative revenue projections from add-on acquisitions in 2013 and 2014 are $6.0 million and $24.2 million, respectively (2) Cumulative EBITDA projections from add-on acquisitions in 2013 and 2014 are $1.8 million and $7.6 million, respectively

11 UNIVERSAL BUSINESS PAYMENT SOLUTIONS ACQUISITION CORPORATION Sources and Uses of Capital Cash Sources and Uses at Closing ($ in thousands) Cash Sources Cash Held in Trust $36,000 Convertible Preferred $40,000 Term Loan $44,000 Total Cash Sources $120,000 Cash Uses AD Computer Acquisition $16,000 EMS Acquisition $60,000 JetPay Acquisition $28,000 EMS Escrow $10,000 Estimated Fees and Expenses $4,000 Working Capital $2,000 Total Cash Uses $120,000