Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - GreenHunter Resources, Inc. | d442686d8k.htm |

Exhibit 99.1

|

|

GREENHUNTER ENERGY REPORTS FINANCIAL RESULTS FOR

THE THIRD QUARTER AND NINE MONTHS ENDED SEPTEMBER 30, 2012

Nine months revenues up to $11.3 million

Nine months adjusted EBITDA up to $2.0 million

Volume of water handled increased 129% from prior quarter

GRAPEVINE, TEXAS, NOVEMBER 19, 2012—GreenHunter Energy, Inc. (NYSE MKT: GRH) (NYSE MKT: GRH.PRC), a diversified water resource, waste management and environmental services company specializing in the unconventional oil and natural gas shale resource plays, announced today financial and operating results for the three and nine months ended September 30, 2012.

FINANCIAL RESULTS FOR THE THREE MONTHS ENDED SEPTEMBER 30, 2012

Revenues for the three months ended September 30, 2012 were $4.9 million, compared to revenues of $230 thousand during the third quarter of 2011. The significant increase in revenues was due to the strategic shift in the Company’s business plan to our water management products and services business activities which were initiated in late 2011. The operating loss for the three months ended September 30, 2012 was $12.9 million, compared to an operating loss of $686 thousand during the third quarter of 2011. Net loss to common shareholders was $15.5 million, ($(0.52) loss per common share basic and diluted) for the three months ended September 30, 2012 compared to a net loss of $1.0 million, ($(0.04) loss per common share basic and diluted), during the third quarter of 2011. During the 2012 third quarter, we recorded an impairment of asset value (non-cash) for the Mesquite Lake Biomass Project of $12.9 million ($(0.44) per common share basic and diluted.) We also recorded a net deemed dividend (non-cash) of $1.6 million ($(0.06) per common share basic and diluted) during the third quarter of 2012 from the conversion of our Series A and B Preferred stock into a combination of shares in Series C Preferred stock and common stock.

For the three months ended September 30, 2012, GreenHunter Energy’s adjusted Earnings Before Interest, Income Taxes, Depreciation and Amortization (“Adjusted EBITDA”) was $1.2 million. This represents a 107% increase over the Adjusted EBITDA of $573 thousand for the three months ended June 30, 2012. Adjusted EBITDA for the three months ended September 30, 2011 was a loss of $455 thousand (a reconciliation of adjusted EBITDA to net loss is included in the tables attached). Third quarter financial numbers reflect revenues from the newly acquired Oklahoma facilities, a newly refurbished barge and transloading terminal near New Matamoras, Ohio, a newly completed Class II SWD facility in Ritchie County, West Virginia and additional rolling stock added to the fleet. Improvements in operational efficiencies, equipment utilization and revenue mix resulted in a 597 basis point sequential improvement in gross margins during the third quarter to 49.4% as compared to what was realized in the second quarter of 2012.

FINANCIAL RESULTS FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2012

Revenues for the nine months ended September 30, 2012 were $11.3 million, compared to revenues of $230 thousand during the first three quarters of 2011. The operating loss for the nine months ended September 30, 2012 was $13.7 million, compared to an operating loss of $2.9 million during the first three quarters of 2011. Net loss to common shareholders was $17.3 million, ($(0.61) loss per common share basic and diluted) for the nine months ended September 30, 2012 compared to a net loss of $4.2 million, ($(0.17) loss per common share basic and diluted), during the first three quarters of 2011. The effect of the non-cash impairment charge and deemed dividend on basic and diluted earnings per share in the nine month period of 2012 was $(0.46) and $(0.06), respectively.

For the nine months ended September 30, 2012, GreenHunter Energy’s adjusted Earnings Before Interest, Income Taxes, Depreciation and Amortization’ (“Adjusted EBITDA”) was $2.0 million. This compares to Adjusted EBITDA of negative ($2.4 million) for the nine months ended September 30, 2011.

OPERATIONAL UPDATE

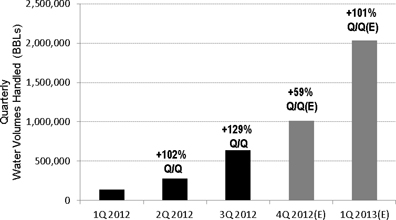

Total volumes of water handled companywide increased 129% for the three months ended September 30, 2012 to 636,240 barrels (“BBL”) or an average of 6,916 barrels of produced and flowback water per day (“BBL/D”) as compared to the 277,479 BBL or 3,049 BBL/D handled for the three months ended June 30, 2012. As of September 30, 2012, GreenHunter Water owned and/or operated nine (9) Class II SWD wells with a cumulative daily injection capacity of 25,000 BBL/D. At the end of the quarter, GreenHunter Water owned and operated 29 vacuum trailers, 2 winch trucks and had a frac tank rental fleet of 68 units. During the quarter, the Appalachia operating team achieved its 12,500 BBL/D total injection capacity target for year-end in the Marcellus and Utica Shale. Operations at our Ohio River bulk water storage facility together with increased disposal capacity at our Ritchie County, West Virginia Class II SWD, helped significantly improve asset utilization which resulted in the excellent gross margin improvement during the quarter. Management also made progress during this period in the Oklahoma (Mississippian Lime) Division on (i) the operating condition (ii) efficiency of existing wells and (iii) the marketing front. In the Eagle Ford Shale in South Texas, management has increased its target for the end of 2012 to 30,000 BBL/D of commercial SWD capacity (up from 10,000 BBL/D previously) due to three new disposal facilities going operational prior to year-end.

GREENHUNTER WATER VOLUMES HANDLED (PROJECTED)

MANAGEMENT COMMENTS

Commenting on GreenHunter Energy’s financial and operating results for the three and nine months ended September 30, 2012, Mr. Jonathan D. Hoopes, GreenHunter Energy’s President and COO, stated, “During the quarter, we commenced operations and quickly achieved maximum capacity utilization at our Ohio River barge transloading and bulk water storage facility that augmented disposal activities at our newly commissioned salt water disposal (SWD) facility in Ritchie County, West Virginia. We have identified and are working on additional terminal transactions with riverside facilities to further increase our barge capabilities to help reduce costs for our customers and eliminate a good portion of truck traffic with its associated adverse effects in this region. Net proceeds of $7.9 million from our Series C Perpetual Preferred stock (non-convertible) offering in July helped us to shore up the balance sheet and regain full listing compliance with the NYSE MKT. Our capital structure was significantly simplified during the quarter by the conversion and exchange of the Series A and Series B Convertible Preferred stock which improves our flexibility to finance our future growth. Additionally, we received cash proceeds of $2.9 million in October from the prior sale of a California wind project. The first Eagle Ford SWD well that we spud during the quarter began to generate revenues in early October and we will be bringing more capacity online in this exciting play in South Texas with two additional wells before the end of the year. During the remainder of the fourth quarter, management is staying focused on growth by both organic means (leasing, permitting, drilling and outfitting) and by acquisition of strategically located assets in the unconventional shale resource plays. We expect to deploy our first MAG Tank™ during the month of December and we are most anxious to add this unique product to our Total Water Management Solutions™ line up during 2013.”

About GreenHunter Water, LLC (a wholly owned subsidiary or GreenHunter Energy, Inc.)

GreenHunter Water, LLC provides Total Water Management Solutions™ in the oilfield. An understanding that there is no single solution to E&P fluids management shapes GreenHunter’s technology-agnostic approach to services. In addition to licensing of and joint ventures with manufacturers of mobile water treatment systems (Frac-Cycle™), GreenHunter Water is expanding capacity of salt water disposal facilities, next-generation modular above-ground storage tanks (MAG Tank™), advanced hauling and fresh water logistics services—including 21st Century tracking technologies (RAMCAT™) that allow Shale producers to optimize the efficiency of their water resource management and planning while complying with emerging regulations and reducing cost.

Additional information about GreenHunter Water may be found at www.GreenHunterWater.com

About Non-GAAP Financial Measures

This press release contains non-GAAP financial measures as defined by the rules and regulations of the United States Securities and Exchange Commission. A non-GAAP financial measure is a numerical measure of a company’s historical or future financial performance, financial position or cash flows that excludes amounts, or is subject to adjustments that have the effect of excluding amounts, that are included in the most directly comparable measure calculated and presented in accordance with GAAP in the statements of operations, balance sheets, or statements of cash flows of the Company; or includes amounts, or is subject to adjustments that have the effect of including amounts, that are excluded from the most directly comparable measure so calculated and presented. Reconciliations of these non-GAAP financial measures to their comparable GAAP financial measures are included in the attached financial tables.

These non-GAAP financial measures are provided because management of the Company uses these financial measures in maintaining and evaluating the Company’s ongoing financial results and trends. Management uses this non-GAAP information as an indicator of business performance, and evaluates overall management with respect to such indicators. Management believes that excluding items such as stock-based compensation and unrealized loss on convertible securities that are determined pursuant to complex formulas that incorporate factors such as market volatility that are beyond our control (as with stock-based compensation), for purposes of calculating these non-GAAP financial measures facilitates a more meaningful evaluation of the Company’s current operating performance and comparisons to the past and future operating performance. The Company believes that providing non-GAAP financial measures such as EBITDA and adjusted EBITDA, in addition to related GAAP financial measures, provides investors with greater transparency to the information used by the Company’s management in its financial and operational decision-making. These non-GAAP measures should be considered in addition to, but not as a substitute for, measures of financial performance prepared in accordance with GAAP.

Forward-Looking Statements

Any statements in this press release about future expectations and prospects for GreenHunter Energy and its business and other statements containing the words “believes,” “anticipates,” “plans,” “expects,” “will,” “could,” “should,” “budget,” “continue,” and similar expressions constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements in the press release include, without limitation forecasts of growth, revenues, adjusted EBITDA and SWD well and rolling stock expansion. Actual results may differ materially from those indicated by such forward-looking statements as a result of various important factors, including the substantial capital expenditures required to fund its operations, the ability of the Company to fund and implement its business plan, government regulation and competition. Additional risks and uncertainties are set forth in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2011, as well as the Company’s other reports filed with the United States Securities and Exchange Commission and are available at http://www.sec.gov/ as well as the Company’s website at http://greenhunterenergy.com/. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. All forward-looking statements are qualified in their entirety by this cautionary statement. GreenHunter Energy undertakes no obligation to update these forward-looking statements in the future.

GREENHUNTER ENERGY, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

| For the Three Months

Ended September 30, |

For the Nine Months

Ended September 30, |

|||||||||||||||

| 2012 | 2011 | 2012 | 2011 | |||||||||||||

| REVENUES: |

||||||||||||||||

| Water disposal revenue |

$ | 2,396,745 | $ | — | $ | 4,747,771 | $ | — | ||||||||

| Transportation revenue |

2,087,993 | — | 5,408,380 | — | ||||||||||||

| Storage rental revenue and other |

386,045 | 229,800 | 1,159,910 | 229,800 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total revenues |

4,870,783 | 229,800 | 11,316,061 | 229,800 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| COST OF SERVICES PROVIDED: |

||||||||||||||||

| Cost of services provided |

2,463,448 | 206,613 | 6,151,684 | 206,816 | ||||||||||||

| Depreciation and accretion expense |

635,423 | 47,762 | 1,100,188 | 142,242 | ||||||||||||

| Impairment of asset value, biomass project |

12,873,013 | — | 12,873,013 | — | ||||||||||||

| Selling, general and administrative |

1,753,472 | 661,686 | 4,922,209 | 2,777,681 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total costs and expenses |

17,725,356 | 916,061 | 25,047,094 | 3,126,739 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| OPERATING LOSS |

(12,854,573 | ) | (686,261 | ) | (13,731,033 | ) | (2,896,939 | ) | ||||||||

| OTHER INCOME (EXPENSE): |

||||||||||||||||

| Interest and other income |

— | 6 | — | 4,866 | ||||||||||||

| Interest, amortization and other expense |

(343,460 | ) | (193,051 | ) | (821,305 | ) | (566,345 | ) | ||||||||

| Unrealized gain (loss) on convertible securities |

23,857 | 12,965 | 23,857 | (185,944 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total other income (expense) |

(319,603 | ) | (180,080 | ) | (797,488 | ) | (747,423 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss |

(13,174,176 | ) | (866,341 | ) | (14,528,481 | ) | (3,644,362 | ) | ||||||||

| Preferred stock dividends |

(631,699 | ) | (159,997 | ) | (1,130,844 | ) | (510,645 | ) | ||||||||

| Deemed dividend on preferred stock conversion |

(1,649,460 | ) | — | (1,649,460 | ) | — | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss to common stockholders |

(15,455,335 | ) | (1,026,338 | ) | (17,308,785 | ) | (4,155,007 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted average shares outstanding, basic and diluted |

29,561,614 | 25,886,392 | 28,243,394 | 24,237,641 | ||||||||||||

| Basic and diluted loss per share: |

||||||||||||||||

| Net loss per share |

$ | (0.52 | ) | $ | (0.04 | ) | $ | (0.61 | ) | $ | (0.17 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

GREENHUNTER ENERGY, INC. AND SUBSIDIARIES

SELECTED BALANCE SHEET DATA

| September 30, 2012 | December 31, 2011 | |||||||

| Cash and cash equivalents |

$ | 1,499,163 | $ | 84,823 | ||||

| Total current assets |

4,868,451 | 570,991 | ||||||

| Net fixed assets |

31,867,504 | 20,892,668 | ||||||

| Total assets |

36,758,936 | 23,166,080 | ||||||

| Total current liabilities |

14,476,810 | 14,272,630 | ||||||

| Total long-term liabilities |

7,733,404 | 2,076,119 | ||||||

| Total stockholders’ equity |

$ | 14,548,722 | $ | 6,817,331 | ||||

GREENHUNTER ENERGY, INC. AND SUBSIDIARIES

ADJUSTED EBITDA

| Three Months Ended | Nine Months Ended | |||||||||||||||

| September 30, | September 30, | |||||||||||||||

| 2012 | 2011 | 2012 | 2011 | |||||||||||||

| Calculation of Adjusted EBITDA: |

||||||||||||||||

| Net loss |

$ | (13,174,176 | ) | $ | (866,341 | ) | $ | (14,528,481 | ) | $ | (3,644,362 | ) | ||||

| Interest expense, net |

343,460 | 193,045 | 821,305 | 561,479 | ||||||||||||

| Unrealized (gain) loss on convertible securities |

(23,857 | ) | (12,965 | ) | (23,857 | ) | 185,944 | |||||||||

| Depreciation |

635,423 | 47,762 | 1,100,188 | 142,242 | ||||||||||||

| Impairment of asset value, biomass project |

12,873,013 | — | 12,873,013 | — | ||||||||||||

| Stock-based compensation |

529,601 | 183,303 | $ | 1,754,147 | 345,059 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Adjusted EBITDA |

$ | 1,183,463 | $ | (455,196 | ) | $ | 1,996,315 | $ | (2,409,638 | ) | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

Contact:

GreenHunter Energy, Inc.

Jonathan D. Hoopes

President & COO

1048 Texan Trail

Grapevine, TX 76051

Tel: (972) 410-1044

jhoopes@greenhunterenergy.com