Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Car Monkeys Group | Financial_Report.xls |

| EX-32.2 - CERTIFICATION - Car Monkeys Group | dlne_ex322.htm |

| EX-31.1 - CERTIFICATION - Car Monkeys Group | dlne_ex311.htm |

| EX-31.2 - CERTIFICATION - Car Monkeys Group | dlne_ex312.htm |

| EX-32.1 - CERTIFICATION - Car Monkeys Group | dlne_ex321.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2012

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number 333-171861

DELAINE CORPORATION

(Exact name of registrant as specified in its charter)

Nevada

(State or other jurisdiction of incorporation or organization)

393 Crescent Ave

Wyckoff, NJ 07481

(Address of principal executive offices, including zip code)

(862) 251-5912

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $0.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a small reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “small reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | o | Accelerated filer | o |

| Non-accelerated filer | o | Smaller reporting company | x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. $0.00

As of November 15, 2012, there are 45,980,000 shares of common stock outstanding.

All references in this Report on Form 10-K to the terms “we”, “our”, “us”, the “Company”, “Delaine” and the “Registrant” refer to Delaine Corporation unless the context indicates another meaning.

TABLE OF CONTENTS

|

Page Number

|

|||||

| Special Note Regarding Forward Looking Statements | 3 | ||||

| PART I | |||||

| Item 1. |

Business

|

4 | |||

| Item 1A. |

Risk Factors

|

15 | |||

| Item 1B. |

Unresolved Staff Comments

|

15 | |||

| Item 2. |

Properties

|

15 | |||

| Item 3. |

Legal Proceedings

|

15 | |||

| Item 4. |

Mine Safety Disclosures

|

15 | |||

| PART II | |||||

| Item 5. |

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

16 | |||

| Item 6. |

Selected Financial Data

|

17 | |||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

17 | |||

| Item 7A. |

Quantitative and Qualitative Disclosures about Market Risk

|

20 | |||

| Item 8. |

Financial Statements and Supplementary Data

|

21 | |||

| Item 9. |

Changes In and Disagreements With Accountants on Accounting and Financial Disclosure

|

35 | |||

| Item 9A. |

Controls and Procedures

|

36 | |||

|

PART III

|

|||||

| Item 10. |

Directors, Executive Officers and Corporate Governance

|

37 | |||

| Item 11. |

Executive Compensation

|

41 | |||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

43 | |||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence

|

44 | |||

| Item 14. |

Principal Accounting Fees and Services

|

44 | |||

| Part IV | |||||

|

Item 15.

|

Exhibits, Financial Statement Schedules and Signatures

|

45

|

|||

2

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements that involve assumptions, and describe our future plans, strategies, and expectations. Such statements are generally identifiable by use of the words “may,” “will,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “intend,” or “project” or the negative of these words of other variations on these words or comparable terminology. These statements are expressed in good faith and based upon a reasonable basis when made, but there can be no assurance that these expectations will be achieved or accomplished.

Such forward-looking statements include statements regarding, among other things, (a) the potential markets for our products, our potential profitability, and cash flows (b) our growth strategies, (c) anticipated trends in our industry, (d) our future financing plans and (e) our anticipated needs for working capital. This information may involve known and unknown risks, uncertainties, and other factors that may cause our actual results, performance, or achievements to be materially different from the future results, performance, or achievements expressed or implied by any forward-looking statements. These statements may be found under "Item 1. Business" and "Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations," as well as in this Annual Report on Form 10-K generally. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors as described in this Annual Report on Form 10-K generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this Annual Report on Form 10-K will in fact occur. In addition to the information expressly required to be included in this filing, we will provide such further material information, if any, as may be necessary to ensure that the required statements, in light of the circumstances under which they are made, are not misleading.

Although forward-looking statements in this Annual Report on Form 10-K reflect the good faith judgment of our management, forward-looking statements are inherently subject to known and unknown risks, business, economic and other risks and uncertainties that may cause actual results to be materially different from those discussed in these forward-looking statements. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this Annual Report on Form 10-K. We assume no obligation to update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this report, other than as may be required by applicable law or regulation. Readers are urged to carefully review and consider the various disclosures made by us in our reports filed with the Securities and Exchange Commission which attempt to advise interested parties of the risks and factors that may affect our business, financial condition, results of operation and cash flows. If one or more of these risks or uncertainties materialize, or if the underlying assumptions prove incorrect, our actual results may vary materially from those expected or projected.

All references in this Annual Report on Form 10-K to the terms “we”, “our”, “us”, “Delaine” and “the Company” refer to Delaine Corporation.

3

PART I

ITEM 1. Business.

Organizational History

Delaine Corporation (“We” the “Registrant,” or the “Company”) was incorporated on June 23, 2010 in the State of Nevada. We maintain our statutory registered agent's office at 5348 Vegas Drive, Las Vegas, NV 89108, and our business office is located at 393 Crescent Ave, Wyckoff, NJ 07481. We have not been subject to any bankruptcy, receivership, or similar proceeding, or any material reclassification or consolidation.

On June 13, 2012, the Company entered into an agreement (the “Agreement”) with Mariusz Girt (“Girt”), whereby Girt granted to the Company sole and exclusive license to certain proprietary technology relating to online procurement of goods (the “Technology”). Prior to the Agreement there was no material relationship between the Registrant and Girt.

Pursuant to the Agreement, Girt received consideration of: (a) 576,160 restricted shares of the Company’s common stock, par value $0.001; and (b) 400,000 shares of the Company’s Class A Preferred Stock (the “Preferred Stock”). The issuance of common and Preferred Stock to Mr. Girt pursuant to the Agreement will result in a Change of voting control of the Registrant to Mr. Girt.

On June 14, 2012, Mr. Timothy Moore resigned from all executive positions and as director of the Registrant. Mr. Moore’s resignation was not due to any disagreement with the Registrant on any matter relating to the Registrant’s operations, policies or practices. Also on June 14, 2012, Mariusz Girt was appointed as the Company’s president and sole director. Mr. Girt will also act as the company’s principal financial officer, principal accounting officer, and principal operating officer until such positions are otherwise filled.

On June 28, 2012, the Company amended its articles of incorporation to increase its authorized common shares to 100,000,000 with a par value of $0.001 and to increase its authorized preferred shares to 10,000,000 shares with a par value of $0.001. On June 29, 2012, the Company designated the Class A Preferred Shares.

On July 6, 2012, the Company issued a stock dividend whereby each holder of 1 share of the Company’s capital stock would receive 5 additional shares of the Company’s common stock, par value $0.001.

Primary Business

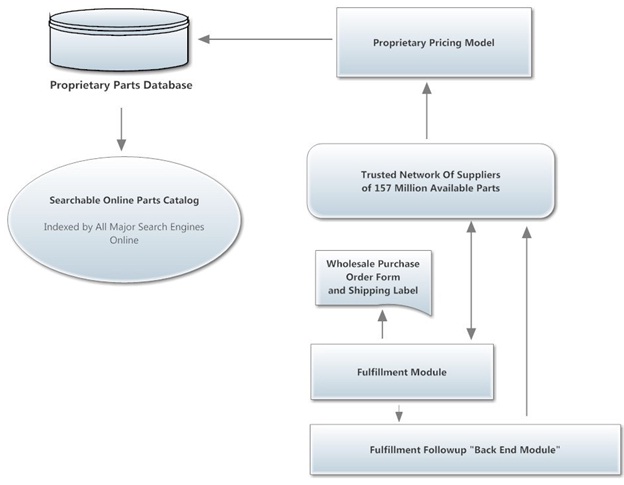

Delaine Corporation is an online retailer of used auto parts under the brand name Car Monkeys. The Company utilizes proprietary algorithms developed in 2008 by Mariusz Girt, the Company’s president. The Company’s proprietary search and consolidation algorithm allows us to show our customers all parts that meet their specific needs. Far more sophisticated than normal search engines, this technology understands and accounts for the fact that many identical parts and assemblies are shared across multiple models, model years, and even across brands. Most owners are completely unaware that parts from a completely different vehicle may be an exact fit for their application. Ordinary search engines do not account for this interchangeability, and as a result, severely limit the customer’s range of choices. This first component of our technology lays the groundwork by providing us with an enhanced field of possibilities for subsequent data mining.

4

Working from this expanded field of prospects, a second proprietary component of our technology applies advanced AI techniques to perform a complex analysis to identify parts that are simultaneously competitively priced as well as of verifiable quality. This component allows us to assess all resultant prospects, and display those that simultaneously represent the best value to our customers, a reasonable profit margin, and, most importantly, a predictive quality metric that allows us to offer a 5-year unlimited-mileage warranty on used parts purchased from us.

This pricing model applies state-of-the-art actuarial models in order to quantify our exposure based on dynamic statistical data. This takes into account the predicted service life of critical parts, the likely duration of ownership by the purchaser, and, critically, a quantitative ‘trust index’ of the part suppliers who constitute our nationwide trusted network of automotive recyclers. This model is based on an already established database of reliable automotive recyclers, compiled by Mr. Girt over years of first-hand experience. Additional mechanisms ensure that this database is updated with every transaction. Far beyond the obvious benefit of offering the unlimited mileage warranty on parts purchased through our online retail channel, it will provide a critical incentive when establishing the network of trusted installers.

Many mechanics are reluctant to install used parts for their customers, or, indeed, even new parts obtained by the customer from external discount sources. The reason for this attitude is understandable: if the part fails, or the customer is dissatisfied for any reason whatsoever, the mechanic is left in the uncomfortable position of having to resolve the issue at his or her own expense, or else, risk losing the customer by refusing to remedy the problem. By dealing with Delaine Corporation, selected shops will be able to expand their customer base with no risk to themselves. Behind the scenes, our advanced decision support software empowers us to search real-time inventory of more than 157 million parts from our trusted network of suppliers, create a purchase order, and activate the entire wholesale purchase order process, right down to production of a shipping label ready to be transmitted to a particular recycler for fulfillment. This entire process is fully automated and very straightforward to use, with minimal training required.

In order to ensure complete customer satisfaction, our software infrastructure includes a sophisticated, proactive fulfillment facility. This automated process tracks shipments, comparing progress against predicted positioning and flagging potential deviations for timely human intervention, when necessary. Timing is critical both to customers who do their own work as well to professionals who must efficiently control their shop schedules. Once fully staffed, our combination of automation and human control will allow us to guarantee shipment of each order within 24-48 hours. Here again, the result is to instill confidence in our customers that Delaine is the safest, most reliable, and most predictable source for all their part, tool, and service requirements.

The combination of these unique proprietary AI algorithms, along with innovative integration of well supported off the shelf software, sets Delaine apart from a disparate field of narrow-focus, highly commercialized retailers. Our deep and extensive understanding of a broad array of technologies is designed to make us an essential first-stop for anyone involved in automobile maintenance. Our interface design, coupled with a comprehensive offering of free and competitively priced resources, will ensure that once they arrive, our visitors will have no reason to leave. Our primary focus is to build customer loyalty through exemplary service, before as well as after a sale has been made. Stated differently, visitors will be encouraged to fully experience our service philosophy in order to thoroughly convince themselves that we deserve and value their business.

5

6

Industry

The United States represents the largest passenger vehicle market of any country in the world. Overall, there were an estimated 254.4 million registered passenger vehicles in the United States according to a 2007 DOT study. This number, along with the average age of vehicles, has increased steadily since 1960, indicating a growing number of vehicles per capita, but also, an increasing percentage of older vehicles being kept in service for longer periods of time.

In March 2009, RL Polk released a study conducted between 2007 to 2008, which indicated that the median age of passenger cars in operation in the US increased to 9.4 years, and that the median age for light trucks increased from 7.1 years in 2007 to 7.5 years in 2008. This represents a significant increase over 1990, when the median age of vehicles in operation in the US was 6.5 years, and 1969 when the mean age for automobiles was 5.1 years.

In a 2001 study, the National Automobile Dealers Association found that the majority of vehicles, 60.6%, were more than seven years old. This relatively high age of automobiles in the U.S. might be explained by unaffordable prices for comparable replacement vehicles, and has only increased since that time, as indicated by numerous recent studies. For example, according to data provided by the Automotive Aftermarket Industry Association, as of December 2011, the average age of vehicles on the road is 10.8 years as compared to 8.3 years as of 1996. This number is the highest since 1948.

Most older automobiles are not covered by warranties, and increased maintenance is required to keep the vehicle operating. As the number of five year old or older vehicles on the road increases, we expect a steady increase in demand for our products and services.

Many consumers have been reluctant to choose recycled automobile parts, for three understandable reasons:

|

1.

|

When buying parts from a salvage facility, particularly one in a geographically distant locale, the buyer must accept on faith that they will be sent the correct part, and that the part will be in the condition represented by the seller.

|

|

2.

|

If the part turns out to be an improper fit, or in unacceptable condition, the buyer is usually stuck paying for expensive shipping of heavy parts.

|

|

3.

|

Even when the seller offers an airtight warranty, installation of major assemblies often represents an even greater expenditure than the parts themselves, and these costs are rarely covered. (Moreover, once the faulty part is installed, the buyer is then faced with the labor inherent in removing that part, and then reinstalling the replacement.)

|

Delaine’s unprecedented no-risk warranty program will mean that our customers can reduce their repair costs by using eco-friendly recycled parts, while simultaneously benefitting from a warranty program superior to that from any other sources of new or recycled parts. Thus, buying from Delaine becomes a true ‘no-brainer’.

7

Environmental Impact

There is more to the recycled parts story than saving money on auto repairs. The salvage industry consolidates and recycles damaged, abandoned, and inoperable vehicles, making our remaining countryside, streets, and neighborhoods safer and more pleasant places in which to live. By recycling automotive parts, we save the natural ores, resources, and energy needed to manufacture new automotive parts.

Each automotive part that is resold and reused represents massive energy savings compared to the manufacturing of new replacement parts. Saving this energy reduces air pollution, as well as our nation’s dependence on foreign oil.

Automotive part recycling has a major impact on resource conservation, but the story doesn’t end there. Recycling benefits us all in some way. It reduces pollution, reduces the need to harvest natural resources, saves landfill space, creates jobs, and can save consumers money. By choosing to recycle, the astute consumer improves their environment today; and in addition, helps to ensure that future generations have clean air to breathe, water to drink, ample natural resources, and more land for parks and playgrounds (by reducing the need for landfills). According to Environmental Systems of America, the five most important advantages of auto part recycling are:

|

1.

|

Recycling saves energy and natural resources by reducing the need to drill for oil and dig for minerals.

|

|

2.

|

Recycling helps keep the air and water cleaner. Making products from recycled materials typically creates less air and water pollution than making products from virgin materials.

|

|

3.

|

Recycling saves landfill space by reusing products that would otherwise have gone to a landfill or been incinerated.

|

|

4.

|

Recycling saves money and creates jobs. The recycling process creates more jobs than landfills or incinerators, and the cost of recycling is usually lower than, or about the same as, other forms of waste management.

|

|

5.

|

Recycling automotive parts also helps keep vehicle insurance costs affordable. Often an automotive recycler will pay an insurance company thousands of dollars for a damaged late model vehicle, reducing the insurance company’s total claim costs. This means lower vehicle insurance premiums for consumers.

|

Delaine’s web presence will position us as far more than just another purveyor of parts for purchase.

Our site will be a central repository and gathering point for those seeking resources for maintaining their vehicles while minimizing cost to themselves and impact to the environment.

8

Expansion Through Vertical Integration

Delaine has developed a comprehensive expansion strategy to vertically grow its operations and to substantially increase profitability. Key elements of our vertical growth strategy are as follows:

Addition Of Aftermarket Collision Repair Parts

The Company will negotiate agreements with local aftermarket wholesale parts suppliers in all major markets of the United States. Each one of those suppliers has already well established delivery routes in their local markets, with their own delivery fleet and drivers typically delivering orders placed before 11 a.m. by 4 p.m. the same day, and orders placed after 11 a.m. delivered early the next morning.

By placing inventory of the new aftermarket collision repairs parts on our websites we’ll be able to accept orders for those parts and in turn order them for same or next day delivery from the local wholesale parts suppliers.

Addition Of New OEM (Original Equipment Manufacturer)Parts

The Company has recently been approached by a local new car dealership’s owner of a major American car brand, who proposed to sell new OEM hard parts and accessories to us at wholesale prices, for which our Company could develop the market. Delaine will approach local dealers of all domestic and foreign automobiles, in any location that would be willing to supply us with the new OEM parts that we will add to our online inventory.

Creation Of Prepaid Installation Network

Delaine will establish a program to partner with ASE-certified mechanic shops in order to create our own proprietary database of installation costs for engines, transmissions, transfer cases, and rear ends, for each year, make, and model for every market in the United States. We will pre-negotiate those rates, and then offer them at our online stores at a modest mark up.

Addition Of Labor Warranty

Once the Company builds the installation network and database of installation pricing, we will be able to properly calculate (by the use of statistical models) a profitable Labor Warranty Program. At that point, the installation warranty will be offered at an additional cost to every purchaser of one of our ‘heavy’ parts. The Company will also launch a Prepaid No Hassle Installation Service that will be independent of our stores, in order to drive traffic to our online merchandise.

9

Expansion Through Horizontal Integration

Key elements of our horizontal growth strategy are as follows:

Competition Buyout Or Takeover

With the completion of the vertical business integration models, Delaine will commence a process to identify candidates for a buyout or takeover. The good candidate will be identified from a list of existing used or aftermarket parts e-retailers. The newly acquired competitor will bring significant growth of online traffic and number of customers. At this point our Company will implement the previously created vertical business strategy models to the newly purchased online stores.

Addition Of New Online Stores For International Markets

The Company has identified one African country (Nigeria) as a major market for used automotive parts. In 2008 alone, that country imported over $400,000,000 worth of used auto parts from United States. Delaine plans to launch a Nigerian version of our online store with direct shipping of all of our auto parts to that sub-Saharan Nation.

Another enormous market that Delaine has identified is Latin America. The Company will concentrate on Spanish speaking countries and launch a Spanish version of our online store.

Once implementation of these first two international stores is completed, Delaine will continue to identify future international markets.

Inclusion Of Our Online Inventory On Amazon.com

The Company will prepare our product database for Amazon integration. Once completed all of our inventory will be available for purchase through the Amazon.com website with its millions of customers per month. The terms of such partnership have already been investigated.

Make Our Inventory Available To National Brick And Mortar Parts Retailers

Delaine will develop partnerships with popular brick-and-mortar retailers. Our president has pre-existing relationships with individual branches of a nationwide parts retailer. We are working on creating software modules that will reside on the company’s Point of Sale system. This will allow our inventory to display seamlessly in response to parts queries from retail chains, including our price for the part, labor warranty, and prepaid installation cost for their local market. Our pricing structure will allow us to offer our parts at an attractive discount, while still generating significant sales at a profitable margin. In addition, we expect further revenue to be realized from selling our labor warranty and prepaid installations.

10

Technology

Background

When Delaine’s president, Mariusz Girt, began exploring the used auto parts business in 2008, product returns on recycled automobile part sales was as high as 25%. Given the freight charges associated with heavy parts, this was clearly unacceptable. He began investigating the sources of this issue and researching possible solutions, developing a deep understanding of the entire supply-chain. What he discovered was a problem domain of significant complexity, but one that could be broken down into three primary components:

|

1.

|

While most operators of salvage facilities competent, ethical business people, many are otherwise. A good supplier has a clear idea of the condition of each vehicle taken into their inventory, and scrupulously represents the nature of the parts they sell. High mileage or poorly maintained vehicles are sold for scrap metal, and are not parted out. Moreover, an experienced automobile dismantler is well versed in vehicle compatibility for all parts they sell. Less conscientious suppliers will ship heavily worn parts, or the wrong parts altogether. For example, the 258 cubic inch, inline six-cylinder engine found in many jeeps is virtually identical to the engine used in the same years of AMC Eagle . . . except for one critical difference: The Eagle variation has castin bosses for mounting the front differential of the Eagle’s independent front end. This distinction is subtle, and easily overlooked. Worse still, it is an incompatibility that is typically not discovered until after the engine is installed, and the final re-assembly is being completed, at which point, the mechanic discovers there is no way to mount the front wheel drive!

|

|

2.

|

Part interchangeability within models, model years, or even between manufacturers is complex, and can confuse professional mechanics and ‘do-it-yourselfers’ alike. An example cited earlier is of a buyer who mistakenly assumes that the window glass from a 2-door model will fit in a 4-door vehicle of the same make, model, and year. It is not uncommon for manufacturers to make subtle or significant changes to the same part, within a single model year. Conversely, multiple manufacturers may outsource components from the same supplier, with the result that a part removed from a Dodge may fit perfectly in a GMC!

|

|

3.

|

Component interdependencies: With the increasing reliance on computer control since the late 1970s, even when a part fits, proper operation may entail replacement of various sensors, modules, computer boards, and so forth. Everything bolts up just fine, but afterwards, the vehicle runs poorly or not at all, and the customer concludes that he or she was sold a faulty part.

|

Proprietary Database

To resolve the above problems, the Company employs an interlocking system of databases and advanced, knowledge- based search and evaluation algorithms.

To address the part compatibility questions, the Company’s database contains well over one million carefully cataloged parts, along with an intelligent query system that allows identification of compatible parts based on the exact year, make and model. This system ‘understands’ that it is not enough to simply match the query target vehicle, and actually recognizes compatibilities between models, years, and even different makes of vehicle. This is a capability that no simple search engine can achieve, and results in a far more comprehensive catalog from which our customers can choose.

11

The second component of our proprietary decision-support system addresses the quantitative assessment of supplier quality, performance, and reliability. Far more than just a simple list of ‘preferred dealers’, this system, layered on data collected over four years, provides in-depth analyses with sufficient depth and scope to permit pricing and risk analysis based on several dimensions of performance criteria. Thus, while one supplier may, for example, have an exemplary record with Honda 4-cylinder engines, that same supplier might have an entirely different profile when fulfilling orders for domestic light truck transfer cases.

At this juncture, we have established a database populated with the nation’s most reliable and trustworthy suppliers, complete with detailed ranking algorithms that facilitate setting a sale price that is competitive while offering a desirable profit margin, and also covering the statistical exposure inherent in our warranty program.

This latter capability is the critical differentiator that allows us to offer an unprecedented free 5-year unlimited mileage warranty on our recycled parts—a feature no would-be competitor is likely to challenge.

While this may seem risky at first glance, we have determined that it is safe, predictable, and predicated upon quantitative actuarial mathematics proven repeatedly through years of insurance underwriting. Hence, for example, if the same part is available at the same cost from two different sources, one of which has a higher confidence rating for this particular class of part, our quoted price is adjusted to reflect and ameliorate additional risk incurred.

Together, these systems comprise our proprietary artificial intelligence Component Location and Ranking Architecture.

The next component of our proprietary software system is the ‘Fulfillment Module,’ which allows our customers to access the knowledge components in real time, searching for parts using flexible, natural- language queries, and returning appropriately adjusted pricing, as described above. With the press of a button, the item is ordered, wholesale purchase documentation is generated and transmitted, and shipping labels are prepared and transmitted to the selected supplier for fulfillment.

The final element in our system is the Fulfillment Follow-Up Module. This automated process scrutinizes shipment movement against expected progress, flagging potential problems for timely intervention. This component ensures delivery within our guaranteed 24 to 48 hours.

Each stage in the fulfillment process captures, evaluates, and integrates performance data back into the underlying Expert System, allowing the entire network to learn from experience. In practical terms, it expands the entire Supply Chain paradigm from a tactical logistics-control system, into an intelligent predictive system for strategic planning and risk management.

12

Technological Differentiators

Technology plays a critical role in all modern enterprises, and this is particularly true in our business model. Critical areas of focus include:

|

1.

|

Web presence. Our goal is to offer an exemplary web experience. We want visitors to bookmark our page within the first few minutes of their arrival, and plan to engage the best available design experts to ensure this is the case.

|

|

2.

|

Inter-enterprise connectivity—A critical component of our operating model is our ability to seamlessly merge our internal data model with the software infrastructures of our supply-chain partners. We must be able to pull inventory information from all of our sources in real time, and must simultaneously be able to allow our consumers, including auto shops, brick-and-mortar resellers, and the customers themselves, to query our consolidated data, including our calculated pricing structures. These are challenging requirements, requiring a robust logical data model, multi- tiered architectures, real-time transaction processing components, and sophisticated, standards- based, integration layers. Delaine’s current and prospective management team embody the technological backgrounds and skill sets to address these requirements. Of course, no individual can be expert in every area of today’s multifaceted technology environment, which is why our business plan includes provisions for retaining experts in specific areas, as required.

|

|

3.

|

Proprietary software—As described throughout this document, several key areas of our operational model are predicated upon unique software algorithms of our own design. Nevertheless, as experienced IT professionals, the Company’s president and prospective management team are well aware of the costs associated with the maintenance and enhancement of proprietary software components. Businesses that fail to anticipate this overhead frequently find themselves brought to a virtual standstill by the burgeoning expense of spiraling development costs. We will address these potential pitfalls from several directions:

|

|

a)

|

First, as experienced IT professionals we are well aware of the real costs of software maintenance, and have ensuring that these are explicitly anticipated in our operating plan.

|

|

b)

|

We will favor off-the-shelf, well-supported software components, from established sources, wherever possible.

|

|

c)

|

For those areas where proprietary software is required, we will strictly adhere to software ‘best practices’, as described by SEI/CMM (Software Engineering Institute’s Capability Maturity Model), and ISO procedures, to ensure our software can be economically maintained and enhanced.

|

|

4.

|

Mathematical and Statistical Modeling—In a very real sense, the critical success factor of our business model involves our ability to quickly apply statistical predictors to our pricing structure. Some parts, some suppliers, some makes, models or model years will entail a higher likelihood of future warranty claims than others, and anticipating these factors is crucial to our long-term profitability. Nevertheless, these techniques are well understood, and have been employed, and constantly refined, by insurers for many years. Our innovation is not in the underlying science, but rather, in our model that allows application of these proven techniques to the field of automobile parts and repair services.

|

13

Marketing Plan

Our marketing will focus on a two-pronged approach, targeting both the ultimate customer (DIY mechanics, ‘Brick and Mortar’ retailers, and so forth), as well as enlisting the participation of critical intermediaries, such as certified repair shops, OEM parts producers, distributors, body shops, and even insurance companies, who will be highly motivated to specify our parts both in terms of initial repair cost and our iron-clad warranty of both parts and installation services.

The central component of our marketing strategy is establishing and promoting our new Car Monkeys brand identity.

Our strategy is to position ourselves as more than just another company out to sell something. To this end, we have carefully analyzed a wide cross-section of popular web communities, including Facebook.com, HarmonyCentral.com, CraigsList.com, AngiesList.com, LinkedIn.com, Tubecad.com, Duncanamps.com, and many others.

Promotion

We anticipate a significant portion of our income over the course of the next twelve months going toward engaging a reputable public relations firm to help define, consolidate, and solidify our corporate image.

Central to our strategy is a rich and extensive web presence that will attract a relevant audience of prospective customers, whether or not they are actually ready to make a purchase, retain their interest, and cultivate their loyalty and confidence so when they are ready to buy, they won’t even consider looking elsewhere.

Regardless of specific content, the key to attracting and retaining users is an exemplary user interface. We will test and refine our site through the use of scientific usability testing. In a typical usability lab, representative users are observed and recorded as they utilize our site, either executing a predetermined list of tasks, or simply exploring ad hoc topics. Their body language is subsequently analyzed by experts in cognitive psychology to identify areas of confusion, frustration, and so forth. This is a critical step rarely employed by web designers or even software application developers. The result, however, is an environment in which people enjoy spending their time.

There are numerous sites dedicated to evaluating exemplary web designs, and many awards for such sites. Submitting our portal for consideration will be an active priority and an additional source of recognition, publicity, and ultimately, traffic and revenue.

While website content (in addition to parts finder and related commercial components) will be finalized in consultation with marketing experts, some possibilities under consideration include:

|

•

|

Moderated user forums on relevant topics,

|

|

•

|

Libraries of manuals, repair guides, and related materials,

|

|

•

|

Embedded how-to videos from YouTube and other sources,

|

|

•

|

Customer evaluations of, and experience with, our parts, service, and installation partners,

|

|

•

|

Geographically organized networking pages (along the lines of Craigslist), were customers can arrange to share use of specialty tools, arrange mutual help, and so forth. (No ‘for-sale’ advertisements).

|

|

•

|

Personalized answers from our support staff.

|

14

Employees

As of June 30, 2012 we have one employee, our president Mariusz Girt.

We believe that our future success will depend in part on our continued ability to attract, hire and retain qualified personnel. We have negotiated contracts with several qualified individuals whom we have nominated as prospective management candidates, to be hired as funding allows.

ITEM 1A. Risk Factors.

As a “smaller reporting company” as defined by Item 10 of Regulation S-K, the Company is not required to provide the information required by this Item.

ITEM 1B. Unresolved Staff Comments.

None.

ITEM 2. Properties.

We maintain our principal executive offices at 393 Crescent Avenue, Wyckoff, NJ 07481. The Company does not own or lease any properties at this time.

ITEM 3. Legal Proceedings.

Currently we are not involved in any pending litigation or legal proceeding.

ITEM 4. Mine Safety Disclosures.

None.

15

PART II

ITEM 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Only a limited market exists for our securities. There is no assurance that a regular trading market will develop, or if developed, that it will be sustained. Therefore, a shareholder in all likelihood will be unable to resell his securities in our company. Furthermore, it is unlikely that a lending institution will accept our securities as pledged collateral for loans unless a regular trading market develops.

Our company's securities are traded on the Over-The-Counter Bulletin Board (“OTCBB”) operated by the Financial Industry Regulatory Authority (FINRA) under the symbol “DEPN”.

|

Fiscal Quarter

|

High Bid

|

Low Bid

|

||||||

|

2012

|

||||||||

|

Fourth Quarter 04-01-12 to 06-30-12

|

$ | 0.00 | $ | 0.00 | ||||

|

Third Quarter 01-01-12 to 03-31-12

|

$ | 0.00 | $ | 0.00 | ||||

|

Second Quarter 10-01-11 to 12-31-11

|

$ | 0.00 | $ | 0.00 | ||||

|

First Quarter 07-01-11 to 09-30-11

|

$ | 0.00 | $ | 0.00 | ||||

|

Fiscal Quarter

|

High Bid

|

Low Bid

|

||||||

|

2011

|

||||||||

|

Fourth Quarter 04-01-11 to 06-30-11

|

$ | 0.00 | $ | 0.00 | ||||

|

Third Quarter 01-01-11 to 03-31-11

|

$ | 0.00 | $ | 0.00 | ||||

|

Second Quarter 10-01-10 to 12-31-10

|

$ | 0.00 | $ | 0.00 | ||||

|

First Quarter 07-01-10 to 09-30-10

|

$ | 0.00 | $ | 0.00 | ||||

Shareholders

As of June 30, 2012, we had 41 shareholders of record of our common stock. We have no outstanding warrants or other agreements to issue any shares.

Dividend Policy

We have not declared any cash dividends. We do not intend to pay dividends in the foreseeable future, but rather to reinvest earnings, if any, in our business operations.

16

Section 15(g) of the Securities Exchange Act of 1934

Our shares are covered by section 15(g) of the Securities Exchange Act of 1934, as amended, that imposes additional sales practice requirements on broker/dealers who sell such securities to persons other than established customers and accredited investors (generally institutions with assets in excess of $5,000,000 or individuals with net worth in excess of $1,000,000 or annual income exceeding $200,000 in each of the two most recent years or joint income with a spouse exceeding $300,000 for those years). For transactions covered by the Rule, the broker/dealer must make a special suitability determination for the purchase and have received the purchaser's written agreement to the transaction prior to the sale. Consequently, the Rule may affect the ability of broker/dealers to sell our securities and also may affect your ability to sell your shares in the secondary market.

Section 15(g) also imposes additional sales practice requirements on broker/dealers who sell penny securities. These rules require a one-page summary of certain essential items. The items include the risk of investing in penny stocks in both public offerings and secondary marketing; terms important to in understanding of the function of the penny stock market, such as “bid” and “offer” quotes, a dealers “spread” and broker/dealer compensation; the broker/dealer compensation, the broker/dealers duties to its customers, including the disclosures required by any other penny stock disclosure rules; the customers rights and remedies in causes of fraud in penny stock transactions; and, the FINRA's toll free telephone number and the central number of the North American Administrators Association, for information on the disciplinary history of broker/dealers and their associated persons.

Securities authorized for issuance under equity compensation plans

We have no equity compensation plans and accordingly we have no shares authorized for issuance under an equity compensation plan.

ITEM 6. Selected Financial Data.

As a “smaller reporting company” as defined by Item 10 of Regulation S-K, the Company is not required to provide the information required by this Item.

ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion is an overview of the important factors that management focuses on in evaluating our business; financial condition and operating performance should be read in conjunction with the financial statements included in this Annual Report on Form 10-K. This discussion contains forward-looking statements that involve risks and uncertainties. Actual results could differ materially from those anticipated in these forward-looking statements as a result of any number of factors, including those set forth in the Company’s reports filed with the SEC on Form 10-K, 10-Q and 8-K as well as in this Annual Report on Form 10-K. Given the uncertainties that surround such statements, you are cautioned not to place undue reliance on such forward-looking statements.

17

Our Company

Delaine Corporation (the “Company”) was incorporated on June 23, 2010 in the State of Nevada. The Company’s accounting and reporting policies conform to accounting principles generally accepted in the United States of America, and the Company’s fiscal year end is June 30. The Company’s operations are to provide online sales of recycled automotive parts. We have established a web site to help introduce our product line to the marketplace. To date, the Company’s activities have been limited to its formation, offering products for sale on our website, and the raising of equity capital.

Results of Operations

Due to a lack of funds, our ability to promote our products has been limited. To date, our efforts have been devoted primarily to raising capital, borrowing funds and establishing our online catalog and the CarMonkeys brand name. Accordingly, the Company has realized $5,414 in revenue from June 23, 2010 (Inception) through June 30, 2012, and inflation and changing prices have had no impact on the Registrant's revenues or income from continuing operations.

The following table sets forth a summary, for the periods indicated, our consolidated results of operations. Our historical results presented below are not necessarily indicative of future operating results.

|

Year Ended June 30,

|

||||||||

|

2012

|

2011

|

|||||||

|

Net Revenue

|

- | 5,414 | ||||||

|

Operating expenses:

|

||||||||

|

Selling, general and administrative

|

$ | 71,272 | $ | 12,048 | ||||

|

Operating loss before income taxes

|

(71,272 | ) | (6,634 | ) | ||||

|

Other income

|

- | - | ||||||

|

Income tax (expense) benefit

|

- | - | ||||||

|

Net loss

|

$ | (71,272 | ) | $ | (6,634 | ) | ||

18

Year Ended June 30, 2012 Compared to Year Ended June 30, 2011.

Selling, General and Administrative Expenses:

Selling, general and administrative expenses primarily consist of legal, accounting, transfer agent fees and EDGAR filing fees incurred. During the year ended June 30, 2012, the Company incurred $71,272 of expense, compared to $12,048 for the year ended June 30, 2011, representing an increase of $59,224, or 491.6%. This increase is primarily due to legal fees, audit fees, EDGAR filing fees and transfer agent fees incurred during the year ended June 30, 2012, which fees were not similarly incurred during the corresponding period in the prior year.

Liquidity and Capital Resources

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern, which contemplates, among other things, the realization of assets and satisfaction of liabilities in the normal course of business. As of June 30, 2012 and June 30, 2011, the Company has a working capital of $182,058 and negative $12,263, respectively, and an accumulated deficit of $78,550 and $7,278, respectively.

Since we initiated our business operations, we have been funded by the private sale of equity to thirty-nine investors.

In June, 2010, the Company issued 300,000 common shares to its Director at $0.00167 per share, in exchange for $500.

Also, in November, 2010, the Company’s president contributed $1,000 for no further consideration. The $1,000 is considered a capital contribution, and there is no debt payable to Mr. Moore in conjunction with the contribution.

In July, 2010, the Company issued 30,000,000 common shares at $0.001 per share to its Director in exchange for all title, rights and interest in an invention (see Note 4).

In October, 2011, the Company issued 2,370,000 common shares at $0.00167 per share to twelve individuals, in exchange for $3,950.

In November, 2011, the Company issued 3,570,000 common shares at $0.00167 per share to eighteen individuals, in exchange for $5,950.

In January, 2012, the Company issued 240,000 common shares at $0.00167 per share to one individual, in exchange for $400.

In May and June, 2012, the Company issued 4,043,040 common shares at $0.0603 per share in exchange for $243,808. The securities were sold to accredited investors pursuant to Rule 506 of Regulation D.

In May, 2012, the Company’s president contributed $5,000 for no further consideration. The $5,000 is considered a capital contribution, and there is no debt payable to Mr. Moore in conjunction with the contribution.

19

As of June 30, 2012 and June 30, 2011, accounts payable totaled $4,544 and $15,960, respectively.

We currently have very little cash on hand and no other liquid assets. Therefore, in order to carry on our business, we must obtain additional capital. The Company intends to fund continuing operations through equity financing arrangements; however, we have no current prospects for any equity financing arrangements. Therefore, available capital may be insufficient to fund capital expenditures, required working capital, and other cash requirements for the next twelve months.

The successful execution of our business plan requires significant cash resources. Because of our limited operating history, equity or debt financing arrangements may not be available in amounts and on terms acceptable to us, if at all. Additionally, because we intend to rely upon the sale of additional equity securities, there is a risk that your shares will suffer additional dilution. Furthermore, if we incur additional indebtedness there is a risk that increased debt service obligations will restrict our operations. To the extent that additional capital is raised through the sale of equity or convertible debt securities, the issuance of these securities could result in further dilution to our stockholders.

As of June 30, 2012 and June 30, 2011, we had no material commitments for capital expenditures.

ITEM 7A. Quantitative and Qualitative Disclosures About Market Risk.

As a “smaller reporting company” as defined by Item 10 of Regulation S-K, the Company is not required to provide the information required by this Item.

20

ITEM 8. Financial Statements and Supplementary Data.

Delaine Corporation

(A Development Stage Company)

Audited Financial Statements

June 30, 2012

June 30, 2011

21

Delaine Corporation

(A Development Stage Company)

Index to the Audited Financial Statements

For the Period from June 23, 2010 (Inception) to

June 30, 2012

|

Report of Independent Registered Public Accounting Firm

|

||||

|

Report of Former Independent Registered Public Accounting Firm

|

||||

|

Balance Sheets as of June 30, 2012 and June 30, 2011

|

23 | |||

|

Statements of Operations for the years ended June 30, 2012 and 2011, and for the period from June 23, 2010 (Inception) to June 30, 2012

|

24 | |||

|

Statement of Changes of Stockholder’s Equity (Deficit) for the period from June 23, 2010 (Inception) to June 30, 2012

|

25 | |||

|

Statements of Cash Flows for the years ended June 30, 2012 and 2011, and for the period from June 23, 2010 (Inception) to June 30, 2012

|

26 | |||

|

Notes to the Audited Financial Statements

|

27 |

22

Delaine Corporation

(A Development Stage Company)

Balance Sheets

|

June 30, 2012

|

June 30, 2011

|

|||||||

|

ASSETS

|

||||||||

|

Current assets:

|

||||||||

|

Cash

|

$ | 186,602 | $ | 3,697 | ||||

|

Total current assets

|

$ | 186,602 | $ | 3,697 | ||||

|

Intangible assets

|

353,194 | 6,485 | ||||||

|

Total assets

|

$ | 539,796 | $ | 10,182 | ||||

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

||||||||

|

Current liabilities:

|

||||||||

|

Accounts payable

|

$ | 4,544 | $ | 15,960 | ||||

|

Total current liabilities

|

4,544 | 15,960 | ||||||

|

Stockholder's Equity (Deficit)

|

||||||||

|

Preferred stock, par value $0.001, 10,000,000 shares authorized, 400,000 and zero shares issued

and outstanding as of June 30, 2012 and June 30, 2011, respectively

|

400 | - | ||||||

|

Common stock, par value $0.001, 100,000,000 shares authorized, 45,980,000 and 30,300,000 issued and

outstanding as of June 30, 2012 and June 30, 2011, respectively

|

45,980 | 30,300 | ||||||

|

Additional paid-in capital

|

567,422 | (28,800 | ) | |||||

|

Deficit accumulated during the development stage

|

(78,550 | ) | (7,278 | ) | ||||

|

Total stockholder's equity (deficit)

|

535,252 | (5,778 | ) | |||||

|

Total liabilities and stockholder's equity (deficit)

|

$ | 539,796 | $ | 10,182 | ||||

See accompanying notes to the audited financial statements.

23

Delaine Corporation

(A Development Stage Company)

Statements of Operations

|

For the Year Ended June 30, 2012

|

For the Year Ended June 30, 2011

|

From Inception

(June 23, 2010)

Through June 30, 2012

|

||||||||||

|

Net Revenue

|

$ | - | $ | 5,414 | $ | 5,414 | ||||||

|

Operating expenses:

|

||||||||||||

|

Selling, general and administrative

|

71,272 | 12,048 | 83,964 | |||||||||

|

Operating loss before income taxes

|

(71,272 | ) | (6,634 | ) | (78,550 | ) | ||||||

|

Other income

|

- | - | - | |||||||||

|

Income tax (expense) benefit

|

- | - | - | |||||||||

|

Net loss

|

$ | (71,272 | ) | $ | (6,634 | ) | $ | (78,550 | ) | |||

|

Basic and diluted loss per common share

|

$ | (0.00 | ) | $ | (0.00 | ) | ||||||

|

Weighted average shares outstanding

|

37,522,651 | 27,834,246 | ||||||||||

See accompanying notes to the audited financial statements.

24

Delaine Corporation

(A Development Stage Company)

Statement of Changes of Stockholder’s Equity (Deficit)

|

Preferred Stock

|

Common Stock

|

Additional

Paid-In

Capital

|

Deficit Accumulated During the Development Stage

|

Total Stockholders' Deficit

|

||||||||||||||||||||||||

|

Shares

|

Amount

|

Shares

|

Amount

|

|||||||||||||||||||||||||

|

Balance, June 23, 2010 (Inception)

|

- | $ | - | - | $ | - | $ | - | $ | - | $ | - | ||||||||||||||||

|

Common stock issued for cash at $0.00167 per share

|

- | - | 300,000 | 300 | 200 | - | 500 | |||||||||||||||||||||

|

Net loss for the year ended June 30, 2010

|

- | - | - | - | - | (644 | ) | (644 | ) | |||||||||||||||||||

|

Balance, June 30, 2010

|

- | - | 300,000 | 300 | 200 | (644 | ) | (144 | ) | |||||||||||||||||||

|

Common stock issued for patent rights at $0.001 per share

|

- | - | 30,000,000 | 30,000 | (30,000 | ) | - | - | ||||||||||||||||||||

|

Contributed capital

|

- | - | - | - | 1,000 | - | 1,000 | |||||||||||||||||||||

|

Net loss for the year ended June 30, 2011

|

- | - | - | - | - | (6,634 | ) | (6,634 | ) | |||||||||||||||||||

|

Balance, June 30, 2011

|

- | - | 30,300,000 | 30,300 | (28,800 | ) | (7,278 | ) | (5,778 | ) | ||||||||||||||||||

|

Common stock issued for cash at $0.00167 per share

|

- | - | 6,180,000 | 6,180 | 4,120 | - | 10,300 | |||||||||||||||||||||

|

Common stock issued for cash at $0.06030 per share

|

- | - | 4,043,040 | 4,043 | 239,765 | - | 243,808 | |||||||||||||||||||||

|

Preferred stock issued for proprietary technology at $0.001 per share

|

400,000 | 400 | - | - | 144,328 | - | 144,728 | |||||||||||||||||||||

|

Common stock issued for proprietary technology at $0.06030 per share

|

- | - | 3,456,960 | 3,457 | 205,009 | - | 208,466 | |||||||||||||||||||||

|

Common stock issued for preferred stock dividend at $0.001 per share

|

- | - | 2,000,000 | 2,000 | (2,000 | ) | - | - | ||||||||||||||||||||

|

Contributed capital

|

- | - | - | - | 5,000 | - | 5,000 | |||||||||||||||||||||

|

Net loss for the year ended June 30, 2012

|

- | - | - | - | - | (71,272 | ) | (71,272 | ) | |||||||||||||||||||

|

Balance, June 30, 2012

|

400,000 | $ | 400 | 45,980,000 | $ | 45,980 | $ | 567,422 | $ | (78,550 | ) | $ | 535,252 | |||||||||||||||

See accompanying notes to the audited financial statements.

25

Delaine Corporation

(A Development Stage Company)

Statements of Cash Flows

|

For the Year Ended June 30, 2012

|

For the Year Ended June 30, 2011

|

From Inception

(June 23, 2010)

Through June 30, 2012

|

||||||||||

|

Cash flows from operating activities:

|

||||||||||||

|

Net loss

|

$ | (71,272 | ) | $ | (6,634 | ) | $ | (78,550 | ) | |||

|

Loss on asset disposition

|

6,485 | - | 6,485 | |||||||||

|

Adjustments to reconcile net loss to net cash used in operating activities:

|

||||||||||||

|

Accounts payable

|

(11,416 | ) | 15,316 | 4,544 | ||||||||

|

Net cash used in operating activities

|

(76,203 | ) | 8,682 | (67,521 | ) | |||||||

|

Cash flows from investing activities:

|

- | (6,485 | ) | (6,485 | ) | |||||||

|

Net cash used in investing activities

|

- | (6,485 | ) | (6,485 | ) | |||||||

|

Cash flows from financing activities:

|

||||||||||||

|

Contributed capital

|

5,000 | 1,000 | 6,000 | |||||||||

|

Issuance of common stock for cash

|

254,108 | - | 254,608 | |||||||||

|

Net cash provided by financing activities

|

259,108 | 1,000 | 260,608 | |||||||||

|

Net increase in cash

|

182,905 | 3,197 | 186,602 | |||||||||

|

Cash at beginning of period

|

3,697 | 500 | - | |||||||||

|

Cash at end of period

|

$ | 186,602 | $ | 3,697 | $ | 186,602 | ||||||

|

Supplemental Information and Non-Monetary Transactions:

|

||||||||||||

|

Cash paid for interest

|

$ | - | $ | - | $ | - | ||||||

|

Cash paid for income taxes

|

$ | - | $ | - | $ | - | ||||||

|

3,456,960 common shares issued for proprietary technology

|

$ | 208,466 | $ | - | $ | 208,466 | ||||||

|

400,000 preferred shares issued for proprietary technology

|

$ | 144,728 | $ | - | $ | 144,728 | ||||||

See accompanying notes to the audited financial statements.

26

Delaine Corporation

(A Development Stage Company)

Notes to the Audited Financial Statements

|

1)

|

ORGANIZATION

|

Delaine Corporation (the “Company”) was incorporated on June 23, 2010 in the State of Nevada. The Company’s accounting and reporting policies conform to accounting principles generally accepted in the United States of America, and the Company’s fiscal year end is June 30.

The Company’s intended operations are to provide cost effective solutions for everyday problems encountered by homeowners as well as maintenance and construction professionals. Our initial product line comprises name brand and generic homeowner and contractor tools. We also intend to develop and manufacture our own proprietary products, and to wholesale our proprietary products to resellers, as well as directly to the public. Our proprietary products are in the development stage, and currently all of our sales are of products developed and manufactured by third party companies. We are currently planning to establish a web site to help introduce our product line to the marketplace. To date, the Company’s activities have been limited to its formation, minimal operations, and the raising of equity capital.

DEVELOPMENT STAGE COMPANY

The Company is considered to be in the development stage as defined in ASC 915 “Development Stage Entities.” The Company’s efforts have been devoted primarily to raising capital, borrowing funds and attempting to implement its planned, principal activities.

|

2)

|

SIGNIFICANT ACCOUNTING POLICIES

|

USE OF ESTIMATES

The preparation of the Company’s financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amount of revenues and expenses during the reporting period. Actual results could differ from those estimates. The Company’s periodic filings with the Securities and Exchange Commission include, where applicable, disclosures of estimates, assumptions, uncertainties and markets that could affect the financial statements and future operations of the Company.

27

Delaine Corporation

(A Development Stage Company)

Notes to the Audited Financial Statements

|

2)

|

SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

|

CASH AND CASH EQUIVALENTS

Cash and cash equivalents include cash in banks, money market funds, and certificates of term deposits with maturities of less than three months from inception, which are readily convertible to known amounts of cash and which, in the opinion of management, are subject to an insignificant risk of loss in value. The Company had $186,602 and $3,697 in cash and cash equivalents as of June 30, 2012 and June 30, 2011, respectively.

INTANGIBLE ASSETS

Identifiable intangible assets have been capitalized as per SC 350-35 “General Intangibles Other than Goodwill.” In July, 2010, the Company entered into an assignment agreement with its Director, whereby the Company’s Director assigned to the Company all title, right, and interest in and to the Lighted Ratcheting Wrench invention in exchange for 30,000,000 shares of the Company’s common stock, par value $0.001 (see Note 3). During the year ended June 30, 2012, the Company elected to suspend its pursuit of the patent protection of the Lighted Ratcheting Wrench. Accordingly, previously capitalized patent costs, totaling $6,485 have been written off and recorded in sales, general and administrative expense, totaling $71,272 for the year ended June 30, 2012.

Identifiable intangible assets also consist of proprietary technology relating to the online procurement of certain goods, which technology was acquired by the Company in June, 2012 in exchange for 3,456,960 restricted shares of common stock, par value $0.001, and 400,000 shares of preferred stock, par value $0.001 (see Note 3).

REVENUE RECOGNITION

The Company recognizes revenue under ASC 605 “Revenue Recognition.” Under ASC 605-45, the Company determined that revenues should be recognized on the net revenue reporting method, where the Company only reports the net revenues from the drop shipped transactions. Revenue is recognized when revenues have been collected and the product has been shipped FOB shipper.

INCOME TAXES

The Company accounts for income taxes under FASB ASC 740 "Income Taxes." Under the asset and liability method of FASB ASC 740, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statements carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. Under FASB ASC 740, the effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period the enactment occurs. A valuation allowance is provided for certain deferred tax assets if it is more likely than not that the Company will not realize tax assets through future operations.

28

Delaine Corporation

(A Development Stage Company)

Notes to the Audited Financial Statements

|

2)

|

SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

|

FAIR VALUE OF FINANCIAL INSTRUMENTS

The Company's financial instruments as defined by FASB ASC 825-10-50 include cash, trade accounts receivable, and accounts payable and accrued expenses. All instruments are accounted for on a historical cost basis, which, due to the short maturity of these financial instruments, approximates fair value at June 30, 2012, and June 30, 2011.

FASB ASC 820 defines fair value, establishes a framework for measuring fair value in accordance with generally accepted accounting principles, and expands disclosures about fair value measurements. FASB ASC 820 establishes a three-tier fair value hierarchy, which prioritizes the inputs used in measuring fair value as follows:

Level 1. Observable inputs such as quoted prices in active markets;

Level 2. Inputs, other than the quoted prices in active markets, that are observable either directly or indirectly; and

Level 3. Unobservable inputs in which there is little or no market data, which requires the reporting entity to develop its own assumptions.

The Company does not have any assets or liabilities measured at fair value on a recurring basis at June 30, 2012 and June 30, 2011. The Company did not have any fair value adjustments for assets and liabilities measured at fair value on a nonrecurring basis at June 30, 2012 and June 30, 2011.

SHARE BASED EXPENSES

FASB ASC 718 "Compensation - Stock Compensation" prescribes accounting and reporting standards for all stock-based payments award to employees, including employee stock options, restricted stock, employee stock purchase plans and stock appreciation rights, may be classified as either equity or liabilities. The Company should determine if a present obligation to settle the share-based payment transaction in cash or other assets exists. A present obligation to settle in cash or other assets exists if: (a) the option to settle by issuing equity instruments lacks commercial substance or (b) the present obligation is implied because of an entity's past practices or stated policies. If a present obligation exists, the transaction should be recognized as a liability; otherwise, the transaction should be recognized as equity.

29

Delaine Corporation

(A Development Stage Company)

Notes to the Audited Financial Statements

|

2)

|

SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

|

SHARE BASED EXPENSES (CONTINUED)

The Company accounts for stock-based compensation issued to non-employees and consultants in accordance with the provisions of FASB ASC 505-50 "Equity - Based Payments to Non-Employees." Measurement of share-based payment transactions with non-employees shall be based on the fair value of whichever is more reliably measurable: (a) the goods or services received; or (b) the equity instruments issued. The fair value of the share-based payment transaction should be determined at the earlier of performance commitment date or performance completion date.

NET INCOME OR (LOSS) PER SHARE OF COMMON STOCK

The Company has adopted ASC 260 “Earnings per Share,” (“EPS”) which requires presentation of basic and diluted EPS on the face of the income statement for all entities with complex capital structures and requires a reconciliation of the numerator and denominator of the basic EPS computation to the numerator and denominator of the diluted EPS computation. In the accompanying financial statements, basic earnings (loss) per share is computed by dividing net loss by the weighted average number of shares of common stock outstanding during the period.

The Company has no potentially dilutive securities, such as options or warrants, currently issued and outstanding.

CONCENTRATIONS OF CREDIT RISK

The Company’s financial instruments that are exposed to concentrations of credit risk primarily consist of its cash and cash equivalents and related party payables it will likely incur in the near future. The Company places its cash and cash equivalents with financial institutions of high credit worthiness. At times, its cash and cash equivalents with a particular financial institution may exceed any applicable government insurance limits. The Company’s management plans to assess the financial strength and credit worthiness of any parties to which it extends funds, and as such, it believes that any associated credit risk exposures are limited.

30

Delaine Corporation

(A Development Stage Company)

Notes to the Audited Financial Statements

|

2)

|

SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

|

RECENTLY ISSUED ACCOUNTING PRONOUNCEMENTS

Management believes recently issued accounting pronouncements will have no impact on the financial statements of Delaine Corporation.

|

3)

|

STOCKHOLDERS’ EQUITY

|

AUTHORIZED STOCK

The Company has authorized 100,000,000 of common shares with a par value of $0.001 per share. Each share entitles the holder to one vote, in person or proxy, on any matter on which action of the shareholder of the Company is sought. The Company has also authorized 10,000,000 of preferred shares with a par value of $0.001 per share.

SHARE ISSUANCES

In June, 2010, the Company issued 300,000 common shares to its Director at $0.00167 per share, in exchange for $500.

In July, 2010, the Company issued 30,000,000 common shares at $0.001 per share to its Director in exchange for all title, rights and interest in an invention (see Note 4).

In October, 2011, the Company issued 2,370,000 common shares at $0.00167 per share to twelve individuals, in exchange for $3,950.

In November, 2011, the Company issued 3,570,000 common shares at $0.00167 per share to eighteen individuals, in exchange for $5,950.

In January, 2012, the Company issued 240,000 common shares at $0.00167 per share to one individual, in exchange for $400.

In May and June, 2012, the Company issued 4,043,040 common shares at $0.0603 per share in exchange for $243,808. The securities were sold to accredited investors pursuant to Rule 506 of Regulation D.

31

Delaine Corporation

(A Development Stage Company)

Notes to the Audited Financial Statements

|

3)

|

STOCKHOLDERS’ EQUITY (CONTINUED)

|

SHARE ISSUANCES (CONTINUED)

In June, 2012, the Company issued 3,456,960 common shares at $0.06030 per share and 400,000 preferred shares at $0.001 per share to one individual in exchange for the sole and exclusive license to proprietary technology relating to online procurement of certain goods (see Note 5).

In June, 2012, the Company’s shareholders approved a stock dividend of 5 shares of the Company’s common stock, par value $0.001, for each 1 share of the Company’s common stock held as of July 6, 2012, and 5 shares of common stock for each 1 share of preferred stock held as of July 6, 2012. As a result of the stock dividend, the Company’s common shares issued and outstanding increased to 45,980,000 as of June, 2012. These increased amounts have been retrospectively applied to the Company’s financial statements and notes thereto for the years ended June 30, 2012 and 2011.

|

4)

|

ASSIGNMENT OF INVENTIONS

|

In July, 2010, the Company entered into an assignment agreement with its Director, whereby the Company’s Director assigned to the Company all title, right, and interest in and to the Lighted Ratcheting Wrench invention in exchange for 30,000,000 shares of the Company’s common stock, par value $0.001 (see Note 3).

As neither the common stock issued by the Company, nor the inventions assigned by its Director, are objectively measureable, the Company has offset the $30,000 in par value by a corresponding amount recorded in additional paid in capital, resulting in a net transaction value of $0.

Costs incurred to develop further the concept of the assigned inventions and filing for the patent protection of those inventions will be capitalized as intangible assets. During the year ended June 30, 2012, the Company elected to suspend its pursuit of the patent protection of the Lighted Ratcheting Wrench. Accordingly, previously capitalized patent costs, totaling $6,485 have been written off and recorded in sales, general and administrative expense, totaling $71,272 for the year ended June 30, 2012.

|

5)

|

PROPRIETARY TECHNOLOGY ACQUISITION/CHANGE IN CONTROL

|

In June, 2012, the Company entered into an agreement with an individual and acquired a sole and exclusive license in and to certain proprietary technology relating to online procurement of certain goods in exchange for the issuance of 5,456,960 shares of common stock, par value $0.001, and 400,000 shares of preferred stock, par value $0.001, to the Company’s president and sole director. The common shares have been valued at $0.06030 per share, whereas the preferred shares have been valued at $0.36182 per share. The proprietary technology has been recorded as an intangible asset totaling $353,194 as of June 30, 2012.

32

Delaine Corporation

(A Development Stage Company)

Notes to the Audited Financial Statements

|

5)

|

PROPRIETARY TECHNOLOGY ACQUISITION/CHANGE IN CONTROL (CONTINUED)

|

The proprietary technology consists of internet search algorithms tailored to searching, cross referencing, and pricing used auto parts. The search algorithms enable a vast and detailed online catalog of used auto parts, which surpasses what is currently available from any other source. Together with the pricing algorithms, the technology provides the display of product information, together with a price that is both competitive and offers a good profit margin for an online retail entity utilizing the technology. This pricing model is based on availability and wholesale cost of each particular part from a trusted network of automotive recyclers nationwide.

|

6)

|

PROVISION FOR INCOME TAXES

|

We did not provide any current or deferred U.S. federal income tax provision or benefit for any of the periods presented because we have experienced operating losses since inception. When it is more likely than not that a tax asset cannot be realized through future income the Company must allow for this future tax benefit. We provided a full valuation allowance on the net deferred tax asset, consisting of net operating loss carryforwards, because management has determined that it is more likely than not that we will not earn income sufficient to realize the deferred tax assets during the carryforward period.