Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM - HUMANIGEN, INC | d412134dex231.htm |

Table of Contents

As filed with the Securities and Exchange Commission on November 16, 2012

Registration No. 333-184299

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

To

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

KALOBIOS PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 2834 | 77-0557236 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary standard industrial classification code number) |

(I.R.S. employer identification no.) |

260 East Grand Avenue

South San Francisco, CA 94080

(650) 243–3100

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

David Pritchard

Chief Executive Officer

KaloBios Pharmaceuticals, Inc.

260 East Grand Avenue

South San Francisco, CA 94080

(650) 243–3100

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Bennett L. Yee, Esq. David T. Young, Esq. |

Alan C. Mendelson, Esq. Patrick A. Pohlen, Esq. |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||||

| Non-accelerated filer | ¨ | (Do not check if a smaller reporting company) | Smaller reporting company | x | ||||

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION

DATED NOVEMBER 16, 2012

Shares

Common Stock

KaloBios Pharmaceuticals, Inc. is offering shares of common stock. This is our initial public offering, and no public market currently exists for our common stock. We anticipate that the initial public offering price will be between $ and $ per share.

We have applied to list our common stock on The NASDAQ Global Market under the symbol “KBIO.”

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discount and commissions |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

We have granted the underwriters an option for a period of up to 30 days to purchase up to additional shares of common stock to cover over-allotments.

We are an “emerging growth company” under applicable Securities and Exchange Commission rules and will be eligible for reduced public company reporting requirements. Investing in our common stock involves risks. See “Risk Factors” beginning on page 11.

The underwriters expect to deliver the shares on or about , 2012.

| Leerink Swann | ||||

| Sole Book-Running Manager | ||||

| William Blair | ||||

| Lead Manager | ||||

| Needham & Company | ||||

| Co-Manager | ||||

The date of this prospectus is , 2012.

Table of Contents

| Page | ||||

| 1 | ||||

| 11 | ||||

| 42 | ||||

| 44 | ||||

| 44 | ||||

| 45 | ||||

| 47 | ||||

| 49 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

51 | |||

| 67 | ||||

| 98 | ||||

| 105 | ||||

| 113 | ||||

| 115 | ||||

| 119 | ||||

| 123 | ||||

| 125 | ||||

| 130 | ||||

| 136 | ||||

| 136 | ||||

| 136 | ||||

| F-1 | ||||

No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus.

You should rely only on the information contained in this prospectus and any free writing prospectus prepared by or on behalf of us. This prospectus is an offer to sell only the shares offered hereby but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date, regardless of the time of delivery of this prospectus or any sale of shares of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

Through and including (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus.

The market data and certain other statistical information used throughout this prospectus are based on independent industry publications, governmental publications, reports by market research firms or other independent sources. Some data are also based on our good faith estimates. Although we believe these third-party sources are reliable, we have not independently verified the information attributed to these third-party sources and cannot guarantee its accuracy and completeness.

KaloBios Pharmaceuticals, KaloBios, and Humaneered® are our registered trademarks. Any other trademarks appearing in this prospectus are the property of their respective holders.

i

Table of Contents

This summary highlights selected information contained elsewhere in this prospectus. Because this is only a summary, it does not contain all of the information you should consider before investing in our common stock. You should carefully read the entire prospectus, especially the risks set forth under the heading “Risk Factors” and our consolidated financial statements and related notes included elsewhere in this prospectus, before making an investment decision. References in this prospectus to “KaloBios,” “our company,” “we,” “us” and “our” and other similar references refer to KaloBios Pharmaceuticals, Inc. and its consolidated subsidiaries during the periods presented unless the context requires otherwise.

KALOBIOS PHARMACEUTICALS, INC.

Overview

We are a biopharmaceutical company focused on the development of monoclonal antibody therapeutics for diseases that represent a significant burden to society and to patients and their families. Using our proprietary and patented Humaneered® antibody technology, we have produced a portfolio of patient-targeted, first-in-class, antibodies to treat serious medical conditions with a primary clinical focus on respiratory diseases and cancer. By focusing on disease-specific targets and patient selection criteria in developing these drugs, we aim to provide patients with medicines that are safe and effective and offer innovative approaches compared to current treatments. We believe that antibodies produced with our Humaneered® technology offer important clinical and economic advantages over antibodies generated by other methods, including enhanced binding activity to target epitopes and minimal immunogenicity (undesired immune response), making our antibodies potentially more suitable for chronic treatment. We seek to identify and develop products that may treat multiple indications through proof-of-concept studies, and then secure development partnerships with large pharmaceutical and biotechnology companies who will further develop and commercialize our products while we retain rights in specialty or orphan indications. We have partnered with Sanofi Pasteur (Sanofi), the vaccines division of the Sanofi Group, to develop, manufacture, and commercialize KB001-A, one of our lead antibodies, for all human diseases and conditions caused by Pseudomonas aeruginosa (Pa).

We currently have three monoclonal antibodies at the clinical development stage (Figure 1). For each program, we have created a Humaneered® antibody from a mouse or chimeric (mouse-human) antibody, and customized the development candidate for specific applications:

| • | Our first antibody, KB001-A (a Humaneered®, recombinant, PEGylated, anti-PcrV of Pseudomonas Fab’ antibody), is scheduled to enter a Phase 2 clinical trial, conducted by us, in cystic fibrosis (CF) patients with chronic Pa lung colonization by early 2013. Clinical data are expected by mid-2014. Our partner, Sanofi, has an option to assume primary responsibility for developing and promoting KB001-A for Pa in CF or bronchiectasis patients after the completion of this Phase 2 clinical trial. We understand that, as part of Sanofi’s clinical development plan for ventilator associated pneumonia (VAP) caused by Pa (Pa VAP), Sanofi is planning to conduct a Phase 1 clinical study in healthy volunteers in early 2013 to evaluate higher doses than those that we previously tested. The Phase 1 study will be followed, after completion of manufacturing process development and scale-up, by a Phase 2b intravenous study in late 2014 to determine the safety and efficacy of KB001-A in preventing Pa VAP and then Sanofi plans a subsequent Phase 3 study. We understand that the Phase 2b and Phase 3 trials are being designed as pivotal studies and are intended to serve as a basis for registration of KB001-A in the prevention of Pa VAP. |

| • | Our second antibody, KB003 (a Humaneered®, recombinant, anti-granulocyte macrophage colony-stimulating factor (anti-GM-CSF) monoclonal antibody), is in a Phase 2 clinical trial in severe asthma patients inadequately controlled by corticosteroids. We plan to report data from this trial by early 2014. |

1

Table of Contents

| • | Our third antibody, KB004 (a Humaneered®, recombinant anti-EphA3 receptor tyrosine kinase monoclonal antibody) is in the dose escalation portion of a Phase 1 clinical trial in patients with hematologic malignancies. |

Clinical trials in Pa VAP and CF patients infected with Pa were completed with a precursor molecule, KB001, that showed activity in Phase 1/2 clinical studies with a single dose for both indications. KB001-A differs from KB001 by a single amino acid substitution per chain. This amino acid change is not within the antigen binding site and does not affect antigen binding. The change has been made to facilitate the PEGylation step of the production process. Similarly, KB002, the chimeric precursor molecule to KB003, showed activity with a single dose in a Phase 1/2 clinical study in persistent asthma and in a Phase 1 clinical study in rheumatoid arthritis (RA). KB003 targets the same binding site as KB002 and has been shown to be functionally similar and generally safe in our early clinical trials. In this prospectus, we refer to Phase 1b and Phase 2a trials collectively as Phase 1/2 trials.

We take a patient-targeted approach with each of our antibody programs by developing or utilizing an existing screen or diagnostic method that we believe may identify those individuals most likely to benefit from our therapies. We believe this targeted approach could result in an enhanced treatment benefit, reduce the overall risk associated with clinical development, enable our trials to be conducted with a smaller number of patients, and ultimately provide therapies that are more effective than current treatments. Our Humaneered® antibodies have been tested clinically in over 90 patients with no evidence of immunogenicity.

Figure 1

KaloBios Patient-Targeted Product Candidates

| Program | Status | Expected Next Step(s) |

Screen | Responsible Party | ||||

| KB001-A (Anti-PcrV of Pa) |

||||||||

| Pneumonia Prevention of VAP Caused by Pa |

Phase 1/2 complete with KB001 |

• Sanofi to initiate high dose Phase 1 in 2013 • Sanofi to initiate Phase 2b post-CMC development in late 2014 |

Pa colonization |

Sanofi | ||||

| CF Patients Infected with Pa |

Phase 1/2 complete with KB001 |

• Initiate Phase 2 by early 2013 • Phase 2 data expected by mid-2014 |

Pa infection | KaloBios subject to Sanofi option | ||||

| KB003 (Anti-GM-CSF) |

||||||||

| Severe Asthma |

Phase 1/2 complete with KB002; Phase 2 with KB003 ongoing |

• Phase 2 data expected by early 2014 |

Reversibility | KaloBios | ||||

| KB004 (Anti-EphA3) |

||||||||

| Hematologic Malignancies |

Phase 1 ongoing |

• Initiate expansion phase in mid-2013 |

EphA3 expression |

KaloBios | ||||

2

Table of Contents

The growth of recombinant biologic therapeutic drugs over the last 20 years has had a dramatic impact on many areas of medicine, including infectious, inflammatory, autoimmune, and respiratory diseases, as well as hematology and oncology. The efficacy and safety of such biologic drugs have driven impressive market growth, with worldwide sales in 2011 of $140 billion according to data from the IMS Institute for Healthcare Informatics. Data from EvaluatePharma, an industry research firm, indicate that therapeutic monoclonal antibody products represent approximately 35% of the biopharmaceuticals market with 2011 global sales of greater than $48 billion and expected 2018 global sales approaching $75 billion. At least 30 antibody products have been approved by the U.S. Food and Drug Administration (FDA) and international regulatory authorities, and more than 300 monoclonal antibodies are in various stages of clinical development. According to a 2010 statistical analysis by Tufts University, antibody products have shown a 2.5 times higher probability of successful clinical development as compared to small-molecule drugs.

While antibody therapeutics have been highly successful, current approaches to developing antibodies have faced challenges. These challenges include immunogenicity concerns and activity levels based on target epitope selection, which can affect the antibody product’s safety and efficacy profile, particularly in treating chronic illnesses. Our Humaneered® technology platform is designed to produce optimized antibodies by selecting targets specific to diseased cells, improving antibody affinity for such targets, reducing immunogenicity of such antibodies, and addressing downstream processing issues such as antibody solubility, expression, stability, and aggregation.

Our Product Candidates

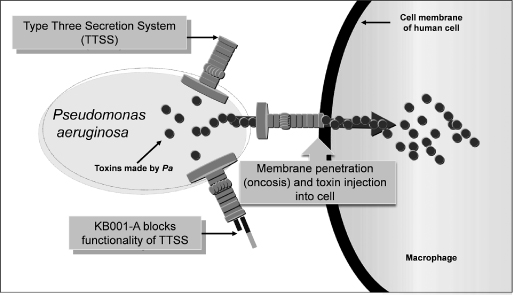

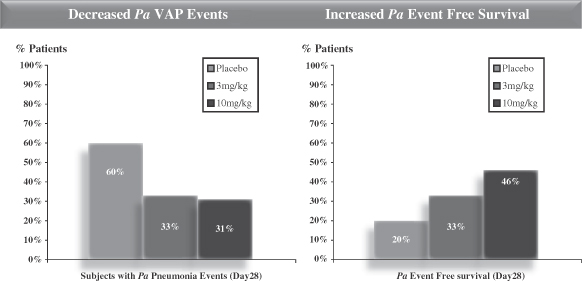

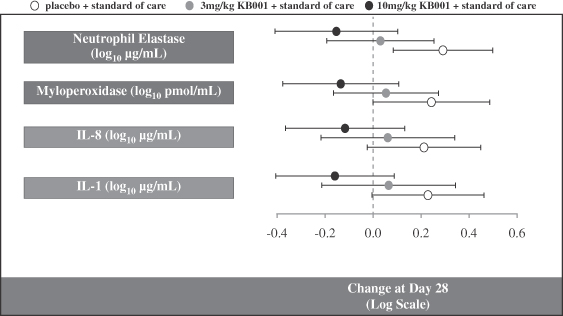

KB001-A in Development for the Prevention and Treatment of Pa VAP and Pa Infection in CF Patients

KB001-A is in development for the prevention and treatment of infections caused by Pa, a gram-negative bacteria that can cause pneumonia in mechanically ventilated patients and chronic respiratory infections in individuals with CF. Both of these indications represent a significant market opportunity for KB001-A. Mechanical ventilation is the fifth most common procedure in the United States and patients with Pa VAP have a high mortality rate, with greater hospital utilization costs than mechanically ventilated patients without pneumonia. In individuals with CF, chronic pulmonary infection by Pa is a leading contributor to respiratory deterioration that ultimately leads to respiratory failure and death.

The only currently approved treatments for Pa infections are antibiotics, and while antibiotics may be effective, mortality and morbidity remain high due to Pa antibiotic resistance. Unlike antibiotics that attack and kill Pa, KB001-A is designed to neutralize Pa pathogenicity allowing the body’s natural immune system to kill and clear the bacteria. As a result, we believe this novel approach to preventing and treating Pa infections is not subject to the drug resistance mechanisms that affect antibiotics. KB001-A is being developed for hospitalized patients on mechanical ventilation susceptible to Pa (>48 hours on mechanical ventilation) as a single intravenous dose of KB001-A to prevent Pa VAP, as well as for CF patients infected with Pa as a subcutaneous dose of KB001-A suitable for chronic use.

In October 2012, we filed an investigational new drug (IND) amendment with the FDA. As a result, we are preparing to launch a 180 patient, 16-week, randomized, placebo-controlled, repeat-dose, intravenous Phase 2 clinical trial for the treatment of Pa in CF patients with chronic Pa infections, to investigate the efficacy and safety of intravenous KB001-A, by early 2013 with data expected by mid-2014. The primary endpoint will be time to need for antibiotics to treat worsening of respiratory tract signs and symptoms, with secondary endpoints of changes in inflammatory markers, respiratory symptoms, subject-reported outcomes, changes in Forced Expiratory Volume in 1 second (FEV1, a measure of lung function), pharmacokinetics (PK), safety, and tolerability. We plan to use this trial to support pivotal trials of a subcutaneous formulation of KB001-A. We believe that a subcutaneous formulation will be commercially more attractive and convenient for the patient in the chronic setting. We anticipate that two Phase 3 trials as well as a subcutaneous bridging study will be required for registration of KB001-A in Pa-infected CF patients. We expect that the pivotal program would be dose ranging in nature and designed to support the approval of subcutaneous KB001-A for the management of

3

Table of Contents

respiratory Pa infection, either as a monotherapy or in combination with inhaled antibiotics. We anticipate that exacerbation will be the primary endpoint for these studies; however, the design of these studies is dependent on discussions with the FDA and other regulatory authorities.

Our Partnership with Sanofi

In January 2010, we entered into an agreement with Sanofi pursuant to which we granted to Sanofi an exclusive worldwide license to develop, manufacture, and commercialize antibodies directed against the PcrV protein of Pa (including KB001-A) for all indications. As part of this agreement, we have retained responsibility for developing and promoting the product for the diagnosis, treatment, and/or prevention of Pa in patients with CF or bronchiectasis. Subject to the terms of the agreement, Sanofi has an option to assume primary responsibility for developing and promoting KB001-A for Pa infection in CF or bronchiectasis patients upon the completion of our Phase 2 clinical trial.

We understand that our partner, Sanofi, plans to continue the development of KB001-A in Pa VAP with a Phase 1 intravenous pharmacokinetic and safety clinical trial in healthy volunteers to evaluate dose levels higher than previously studied in KB001. The Phase 1 study will be followed, after completion of manufacturing process development and scale-up, by a Phase 2b intravenous study in late 2014 to determine the safety and efficacy of KB001-A in preventing Pa VAP and then Sanofi plans a subsequent Phase 3 study. We understand that the Phase 2b and Phase 3 trials are being designed as pivotal studies and are intended to serve as a basis for registration of KB001-A in the prevention of Pa VAP. Because Sanofi has exclusive rights for the development of KB001-A for the prevention of Pa VAP, we do not have control over the conduct or timing of the studies for this indication.

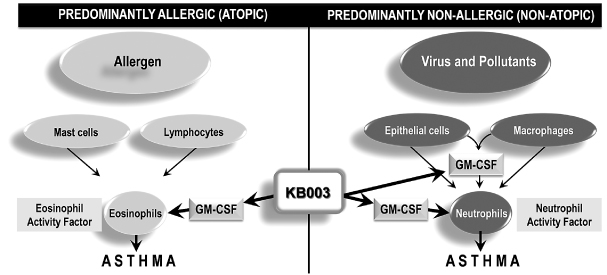

KB003 in Development for Treatment of Severe Asthma

We are developing our second antibody, KB003, for the treatment of severe asthma inadequately controlled by corticosteroids, an indication that currently has limited treatment options. We are targeting the severe asthma population, which represents approximately 5% to 10% of the total asthma population of approximately 300 million people worldwide. Severe asthma is associated with more frequent exacerbations than mild to moderate asthma and is responsible for approximately 50% of the economic costs associated with asthma. In addition, KB003 may provide a clinical and commercial advantage by treating the two forms of asthma: allergic and non-allergic.

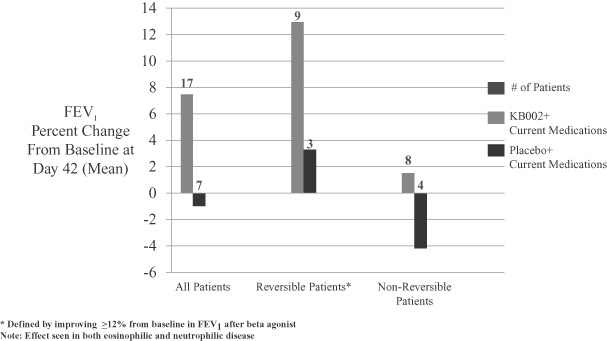

In August 2012, we initiated a 150 patient, randomized, double-blind, placebo-controlled, monthly-dose, intravenous Phase 2 clinical trial in adults with severe asthma inadequately controlled by corticosteroids. Subjects are being pre-screened for “reversibility”, or a demonstrated FEV1 bronchodilator response of ³12% from baseline, as this patient segment showed a positive trend in responding to our precursor antibody in our Phase 1/2 clinical study for persistent asthma. The primary endpoint will be change in FEV1. Secondary endpoints include exacerbation, effect on asthma control, asthma symptoms, use of rescue therapy, and safety. We anticipate reporting data from this trial by early 2014. We plan to conduct a bridging study to switch from an intravenous formulation to a subcutaneous formulation in parallel with our Phase 2 clinical study. We believe that a subcutaneous formulation will be commercially more attractive and convenient for the patient. After successful completion of these studies, we plan to conduct two Phase 2/3 trials with the subcutaneous formulation of KB003 that will be designed to support regulatory approval for the treatment of severe asthma inadequately controlled by corticosteroids. We expect these studies to be dose-ranging in design. We anticipate that exacerbation will be the primary endpoint for these studies; however, the design of these studies is dependent upon future discussions with the FDA and other regulatory authorities.

4

Table of Contents

KB004 in Development for Treatment of Hematologic Malignancies

Our third antibody, KB004, is directed against EphA3 receptor tyrosine kinase, an oncofetal antigen involved in the positioning of cells during fetal development and re-expressed on the surface of hematologic and solid tumor cells and the stem cell microenvironment, but not on normal cells. As a result, KB004 may have the potential to kill cancer cells and disrupt the stem cell microenvironment, providing for long-term responses while sparing normal cells. Thus, we believe KB004 represents a novel approach to treating both hematologic malignancies and solid tumors. Cancer is among the leading causes of death worldwide and the second leading cause of death in the United States. The National Institutes of Health estimates that the annual cost of medical treatment for cancer will be over $155 billion in the year 2020.

We are currently conducting the dose escalation portion of a Phase 1 clinical trial in hematologic malignancies for KB004. The study is designed to be composed of subjects with hematologic malignancies, including subjects with acute myelogenous leukemia (AML), chronic myelogenous leukemia (CML), myelodysplastic syndromes (MDS), myeloproliferative neoplasms (MPN), multiple myeloma (MM), chronic lymphocytic leukemia (CLL) or acute lymphoblastic leukemia (ALL) unresponsive to standard of care or unsuitable for such treatment, and is designed as a dose-escalation study to determine a maximum tolerated dose (MTD), and the safety and PK profile for KB004. Doses will be escalated until a MTD is determined, defined as a dose level with < 33% of subjects experiencing a dose limiting toxicity (DLT). Bleeding is typical in late-stage AML patients, and intracranial hemorrhages are the second leading cause of death in these patients. Serious bleeding events have occurred with KB004 in patients with late-stage AML. We amended the study to enroll lower-risk patients and implement a coagulation monitoring plan, and we have not had any incidences of bleeding since the study was amended.

We are currently in the fourth level dose cohort, and the MTD has not yet been reached. We continue to enroll patients in our dose escalation study and hope to initiate the expansion portion of this trial, which will pre-screen subjects for EphA3 expression and assess the activity of KB004, in mid-2013.

Our Technology Platform

Our Humaneered® technology platform addresses issues of therapeutic antibody engineering (e.g., specificity, affinity, immunogenicity) and equally important down-stream processing issues (e.g., antibody solubility, expression, stability, aggregation). Our Humaneered® technology is a method for converting antibodies (typically mouse) into engineered, high-affinity human antibodies designed for therapeutic use, particularly for chronic conditions. The technology is designed to produce optimized antibodies that have high specificity and high affinity for their target antigen, low propensity for aggregation, and excellent long-term stability. Because their sequences are very close to those of human germ-line antibody gene sequences, we believe Humaneered® antibodies will produce fewer immunological adverse side effects in patients than chimeric or conventionally humanized antibodies. The selection process for Humaneered® antibodies is also designed to provide high-expressing v-region portions of the antibody and high-affinity antibodies.

Our Strategy

Our goal is to become a leading biopharmaceutical company focused on the development and commercialization of first-in-class, patient-targeted, monoclonal antibody therapeutics that address serious medical needs. Key elements of our strategy are to:

| • | Advance the clinical development of our lead product candidates, KB001-A for the treatment of Pa-infected patients with CF, KB003 for the treatment of severe asthma, and KB004 for the treatment of cancer; |

| • | Focus on indications where patient selection is guided by tests, such as clinical measures or a companion diagnostic, that we believe will prospectively indicate which patient segments are likely to respond |

5

Table of Contents

| positively to our drug, thereby potentially reducing clinical trial costs and increasing the likelihood of regulatory approval and reimbursement; |

| • | Enter into partnership arrangements with leading pharmaceutical and biotechnology companies while retaining rights to specialty or orphan indications, which can be addressed by a focused sales force; and |

| • | Collaborate with Sanofi on the clinical development and commercialization of KB001-A. |

Risks Related to Our Business

Our business is subject to numerous risks and uncertainties, including those highlighted in the section titled “Risk Factors” immediately following this prospectus summary. These risks represent challenges to the successful implementation of our strategy and to the growth and future profitability of our business. Some of these risks include the following:

| • | we have a limited operating history developing clinical-stage antibodies; |

| • | we will require substantial additional capital to develop and commercialize our product candidates; |

| • | our product candidates are at an early stage of development and may not be successfully developed or commercialized; |

| • | any of our product candidates may cause unacceptable adverse events or have other properties that may delay, limit, or prevent its regulatory approval or commercialization; |

| • | we depend on Sanofi for the development, manufacture, and commercialization of KB001-A for human diseases and conditions caused by Pa; |

| • | we, Sanofi, and any of our future collaborators are subject to regulatory approval processes that are lengthy, time consuming, and unpredictable; |

| • | we, Sanofi, and any of our future collaborators may not obtain approval for our product candidates from the FDA or other regulatory authorities; |

| • | we face substantial competition, which may result in others discovering, developing, or commercializing products before, or more successfully, than we do; |

| • | we may not be able to successfully develop and manufacture a subcutaneous formulation of KB001-A or KB003; |

| • | we have incurred significant operating losses to date and expect to continue to incur losses, and may never become profitable; and |

| • | it is difficult and costly to protect our intellectual property rights. |

Our Corporate Information

Our principal offices are located at 260 East Grand Avenue, South San Francisco, CA, 94080, and our telephone number is (650) 243-3100. Our website address is www.kalobios.com. Our website and the information contained on, or that can be accessed through, the website will not be deemed to be incorporated by reference in, and are not considered part of, this prospectus. You should not rely on any such information in making your decision whether to purchase our common stock.

Implications of Being an Emerging Growth Company

As a company with less than $1.0 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (JOBS Act). An emerging

6

Table of Contents

growth company may take advantage of specified reduced reporting and other burdens that are otherwise applicable generally to public companies. These provisions include:

| • | a requirement to have only two years of audited financial statements and only two years of related management’s discussion and analysis; |

| • | exemption from the auditor attestation requirement on the effectiveness of our internal controls over financial reporting; |

| • | reduced disclosure about the company’s executive compensation arrangements; and |

| • | no non-binding advisory votes on executive compensation or golden parachute arrangements. |

We may take advantage of these provisions for up to five years or until such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company if we have more than $1.0 billion in annual revenue, have more than $700 million in market value of our capital stock held by non-affiliates, or issue more than $1.0 billion of non-convertible debt over a three-year period. We may choose to take advantage of some but not all of these reduced burdens. We have not taken advantage of any of these reduced reporting burdens in this prospectus, although we may choose to do so in future filings and if we do, the information that we provide stockholders may be different than you may receive from other public companies in which you hold equity interests.

Although we have not taken advantage of the reduced reporting burdens available to emerging growth companies, as a smaller reporting company we have taken advantage of certain reduced reporting obligations available to smaller reporting companies.

7

Table of Contents

THE OFFERING

| Common stock offered by us |

Shares |

| Common stock to be outstanding after this offering |

Shares |

| Over-allotment option of common stock offered by us |

Shares |

| Use of proceeds |

We intend to use the net proceeds of this offering primarily to develop and advance our product candidates through clinical trials, as well as for working capital and general corporate purposes. See “Use of Proceeds.” |

| Dividend policy |

We do not currently intend to declare dividends on shares of our common stock. See “Dividend Policy.” |

| Risk factors |

You should read the “Risk Factors” section of this prospectus for a discussion of factors that you should consider carefully before deciding to invest in shares of our common stock. |

| Proposed NASDAQ Global Market symbol |

“KBIO” |

The number of shares of common stock to be outstanding after this offering is based on 51,628,725 shares outstanding as of September 30, 2012, and excludes:

| • | 3,766,322 shares issuable upon the exercise of stock options outstanding as of September 30, 2012 with a weighted average exercise price of $0.67 per share; |

| • | 197,712 shares issuable upon the exercise of warrants outstanding as of September 30, 2012 with a weighted average exercise price of $2.02 per share; |

| • | 7,557,567 shares of common stock reserved for issuance as of September 30, 2012 under our 2012 Equity Incentive Plan; and |

| • | 600,000 shares of common stock reserved for issuance as of September 30, 2012 under our 2012 Employee Stock Purchase Plan, which will go into effect upon the closing of this offering. |

Except as otherwise indicated, all information in this prospectus assumes:

| • | a -for- reverse stock split effected on ; |

| • | the automatic conversion of all outstanding shares of our convertible preferred stock into 43,910,723 shares of our common stock effective upon the completion of this offering; |

| • | the filing of our amended and restated certificate of incorporation and effectiveness of our amended and restated bylaws, which will occur immediately prior to the completion of this offering; and |

| • | no exercise by the underwriters of their option to purchase from us up to an additional shares of our common stock in this offering. |

8

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL DATA

The following table summarizes our consolidated financial data as of, and for the periods ended on, the dates indicated. We have derived the following consolidated statements of operations data for the years ended December 31, 2009, 2010 and 2011 from our audited consolidated financial statement included elsewhere in this prospectus. The consolidated statement of operations data for the nine months ended September 30, 2011 and 2012 and the actual and pro forma consolidated balance sheet data as of September 30, 2012 are derived from our unaudited consolidated financial statements included elsewhere in this prospectus. Our historical results are not necessarily indicative of the results that may be expected in the future. The following summary consolidated financial data should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes included elsewhere in this prospectus.

| Year Ended December 31, | Nine Months Ended September 30, |

|||||||||||||||||||

| 2009 | 2010 | 2011 | 2011 | 2012 | ||||||||||||||||

| (in thousands, except share and per share information) | (unaudited) | |||||||||||||||||||

| Consolidated Statement of Operations Data: |

||||||||||||||||||||

| Contract revenue |

$ | 589 | $ | 17,712 | $ | 20,255 | $ | 14,386 | $ | 6,080 | ||||||||||

| Operating expenses: |

||||||||||||||||||||

| Research and development |

22,862 | 18,893 | 18,512 | 15,070 | 14,238 | |||||||||||||||

| General and administrative |

5,190 | 4,942 | 4,010 | 3,203 | 3,392 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating expenses |

28,052 | 23,835 | 22,522 | 18,273 | 17,630 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loss from operations |

(27,463 | ) | (6,123 | ) | (2,267 | ) | (3,887 | ) | (11,550 | ) | ||||||||||

| Other income (expense): |

||||||||||||||||||||

| Interest income, net |

291 | 108 | 43 | 36 | 35 | |||||||||||||||

| Other income (expense), net |

348 | 915 | (8 | ) | (43 | ) | (297 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loss before benefit for income taxes |

(26,824 | ) | (5,100 | ) | (2,232 | ) | (3,894 | ) | (11,812 | ) | ||||||||||

| Benefit for income taxes |

(19 | ) | — | — | — | — | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss |

$ | (26,805 | ) | $ | (5,100 | ) | $ | (2,232 | ) | $ | (3,894 | ) | $ | (11,812 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Basic and diluted net loss per common share (1) |

$ | (5.30 | ) | $ | (0.85 | ) | $ | (0.32 | ) | $ | (0.57 | ) | $ | (1.60 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Weighted average common shares outstanding used to calculate basic and diluted net loss per common share (1) |

5,053,962 | 6,018,507 | 6,886,716 | 6,844,098 | 7,372,439 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Pro forma basic and diluted net loss per common share (unaudited) (1) |

$ | (0.05 | ) | $ | (0.24 | ) | ||||||||||||||

|

|

|

|

|

|||||||||||||||||

| Weighted average common shares outstanding used to calculate pro forma basic and diluted net loss per common share (unaudited) (1) |

44,841,558 | 48,410,685 | ||||||||||||||||||

|

|

|

|

|

|||||||||||||||||

| (1) | See Note 2 to our consolidated financial statements for an explanation of the method used to calculate basic and diluted net loss per common share, the unaudited pro forma basic and diluted net loss per common share and the weighted average common shares outstanding used to calculate the per share amounts. |

9

Table of Contents

| As of September 30, 2012 | ||||||||||

| Actual | Pro Forma(1) |

Pro Forma as Adjusted(2)(3) | ||||||||

| (in thousands) | (unaudited) | |||||||||

| Consolidated Balance Sheet Data: |

||||||||||

| Cash, cash equivalents and marketable securities |

$ | 24,739 | $ | 24,739 | ||||||

| Working capital |

21,658 | 21,658 | ||||||||

| Total assets |

28,278 | 28,278 | ||||||||

| Notes payable |

4,815 | 4,815 | ||||||||

| Convertible preferred stock |

102,023 | — | ||||||||

| Accumulated deficit |

(86,570 | ) | (86,570 | ) | ||||||

| Total stockholders’ (deficit) equity |

(83,474 | ) | 18,549 | |||||||

| (1) | The unaudited pro forma column in the balance sheet data above gives effect to the automatic conversion of all outstanding shares of our convertible preferred stock into an aggregate of 43,910,723 shares of common stock as if it had occurred as of September 30, 2012. |

| (2) | The unaudited pro forma as adjusted column in the balance sheet data above gives further effect to the sale of shares of common stock in this offering at an assumed initial public offering price of $ per share, the midpoint of the price range set forth on the cover page of this prospectus, after deducting the estimated underwriting discounts and commissions and the estimated offering expenses payable by us, as if the sale of the shares in this offering had occurred as of September 30, 2012. |

| (3) | Each $1.00 increase or decrease in the assumed initial public offering price of $ per share, the midpoint of the price range set forth on the cover page of this prospectus, would increase or decrease, as applicable, each of cash, cash equivalents and marketable securities, working capital, total assets, and total stockholders’ (deficit) equity by $ million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. We may also increase or decrease the number of shares we are offering. Each increase or decrease of 1.0 million shares in the number of shares offered by us would increase or decrease, as applicable, each of cash, cash equivalents, and marketable securities, working capital, total assets, and total stockholders’ (deficit) equity by $ million, assuming that the assumed initial public offering price remains the same, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. The pro forma as adjusted information discussed above is illustrative only and will adjust based on the actual initial public offering price, the number of shares offered by us, and other terms of this offering determined at pricing. |

10

Table of Contents

Risk Related to Our Business and the Development, Regulatory Approval, and Commercialization of Our Product Candidates

We have a history of operating losses, we expect to continue to incur losses, and we may never become profitable.

As of September 30, 2012, we had an accumulated deficit of $86.6 million, and for the nine months ended September 30, 2012, we incurred a net loss of $11.8 million. We have incurred net losses each year since our inception except for the year ended December 31, 2007, including net operating losses of $2.3 million for the year ended December 31, 2011, $6.1 million for the year ended December 31, 2010, and $27.5 million for the year ended December 31, 2009. To date, we have only recognized revenue from payments for funded research and development and for license or collaboration fees. We expect to make substantial expenditures and incur additional operating losses in the future to further develop and commercialize our product candidates. Our accumulated deficit is expected to increase significantly as we expand our development and clinical trial efforts. Our ability to achieve and sustain profitability depends on obtaining regulatory approvals for and successfully commercializing our lead product candidates, either alone or with third parties. We do not currently have the required approvals to market any of our product candidates and we may never receive them. We may not be profitable even if we, Sanofi, or any of our future development partners succeed in commercializing any of our product candidates. Because of the numerous risks and uncertainties associated with developing and commercializing our product candidates, we are unable to predict the extent of any future losses or when we will become profitable, if at all.

We have limited sources of revenue, and we will need substantial additional capital to develop and commercialize our product candidates, and we may be unable to raise additional capital when needed, or at all, which would force us to reduce or discontinue operations.

As of September 30, 2012, we had $24.7 million in cash, cash equivalents, and marketable securities. Our contract revenue for the three and nine months ended September 30, 2012 were $0.1 million and $6.1 million, respectively. We consumed a net $15.3 million of cash in operating activities during the nine months ended September 30, 2012, or an average of $1.7 million per month. Our monthly spending levels vary based on new and ongoing development and corporate activities. As a result, our cash used in operating activities will also fluctuate from period to period. We have not sold any product candidates, and we do not expect to sell any product candidates or derive royalty revenue from product candidate sales for the foreseeable future, if ever. In order to develop and bring product candidates through clinical trials, we must commit substantial resources to costly and time-consuming clinical trials. As such, we anticipate that we will need to raise substantial additional capital, the requirements of which will depend on many factors, including:

| • | the type, number, costs, and results of the product candidate development programs which we are pursuing or may choose to pursue in the future; |

| • | the scope, progress, expansion, costs, and results of our clinical trials; |

| • | the timing of and costs involved in obtaining regulatory approvals; |

| • | our ability to establish and maintain development partnering arrangements; |

| • | the timing, receipt and amount of contingent, royalty, and other payments from Sanofi or any of our future development partners; |

| • | the emergence of competing technologies and other adverse market developments; |

| • | the costs of maintaining, expanding, and protecting our intellectual property portfolio, including potential litigation costs and liabilities; |

| • | the resources we devote to marketing, and, if approved, commercializing our product candidates; |

11

Table of Contents

| • | the scope, progress, expansion, and costs of manufacturing our product candidates; |

| • | our ability to draw funds from our loan and security agreement; |

| • | the amount of funds we receive in this offering; and |

| • | the costs associated with being a public company. |

Since our inception, we have been financing our operations primarily through private placements of our equity securities, interest income earned on cash, cash equivalents, and marketable securities, lines of credit, and payments under agreements with Sanofi and Novartis International Pharmaceutical Ltd. (together with its affiliates, Novartis), a licensee of our Humaneered® technology. In order to fund our future needs, we may seek additional funding through equity or debt financings, development partnering arrangements, lines of credit, or other sources. We believe our cash on hand, together with our access to funds through our existing credit facility, will be sufficient to fund our operations for the next 12 months. Our expectations are based on management’s current assumptions and clinical development plans, which may prove to be wrong, and we could spend our available financial resources much faster than we currently expect. We will require substantial additional capital to support clinical trials, regulatory approvals, and, if approved, the potential commercialization of our product candidates. Additional funding may not be available to us on a timely basis or at acceptable terms, or at all.

If we are unable to raise additional funds when needed, we may be required to delay, reduce, or terminate some or all of our development programs and clinical trials. We may also be required to sell or license to others our technologies, product candidates, or development programs that we would have preferred to develop and commercialize ourselves.

Because we have a short operating history developing clinical-stage antibodies, there is a limited amount of information about us upon which you can evaluate our product candidates and business prospects.

We commenced our first clinical trial in 2006, and we have a limited operating history developing clinical-stage antibodies upon which you can evaluate our business and prospects. In addition, as an early-stage clinical development company, we have limited experience in conducting clinical trials, and we have never conducted clinical trials of a size required for regulatory approvals. Further, we have not yet demonstrated an ability to successfully overcome many of the risks and uncertainties frequently encountered by companies in new and rapidly evolving fields, particularly in the biopharmaceutical area. For example, to execute our business plan we will need to successfully:

| • | execute our product candidate development activities, including successfully completing our clinical trial programs; |

| • | obtain required regulatory approvals for the development and commercialization of our product candidates; |

| • | manage our spending as costs and expenses increase due to clinical trials, regulatory approvals, manufacturing and commercialization; |

| • | secure substantial additional funding; |

| • | develop and maintain successful strategic relationships; |

| • | build and maintain a strong intellectual property portfolio; |

| • | build and maintain appropriate clinical, sales, distribution, and marketing capabilities on our own or through third parties; and |

| • | gain broad market acceptance for our product candidates. |

If we are unsuccessful in accomplishing these objectives, we may not be able to develop product candidates, raise capital, expand our business, or continue our operations.

12

Table of Contents

Our product candidates are at an early stage of development and may not be successfully developed or commercialized.

Our product candidates are in the early stage of development and will require substantial clinical development, testing, and regulatory approval prior to commercialization. We currently only have one product candidate in Phase 2 clinical trials, one product candidate scheduled to enter Phase 2 clinical trials by early 2013, and one product candidate in Phase 1 clinical trials. None of our product candidates have advanced into a pivotal study and it may be years before such study is initiated, if at all. Of the large number of drugs in development, only a small percentage successfully complete the FDA regulatory approval process and are commercialized. Accordingly, even if we are able to obtain the requisite financing to continue to fund our development programs, we cannot assure you that our product candidates will be successfully developed or commercialized. If we, Sanofi, or any of our future development partners are unable to develop, or obtain regulatory approval for or, if approved, successfully commercialize, one or more of our product candidates, we may not be able to generate sufficient revenue to continue our business.

Our product candidates are subject to extensive regulation, compliance with which is costly and time consuming, may cause unanticipated delays, or prevent the receipt of the required approvals to commercialize our product candidates.

The clinical development, manufacturing, labeling, storage, record-keeping, advertising, promotion, import, export, marketing, and distribution of our product candidates are subject to extensive regulation by the FDA in the United States and by comparable authorities in foreign markets. In the United States, we are not permitted to market our product candidates until we receive regulatory approval from the FDA. The process of obtaining regulatory approval is expensive, often takes many years, and can vary substantially based upon the type, complexity, and novelty of the products involved, as well as the target indications. Approval policies or regulations may change and the FDA has substantial discretion in the drug approval process, including the ability to delay, limit, or deny approval of a product candidate for many reasons. Despite the time and expense invested in clinical development of product candidates, regulatory approval is never guaranteed.

The FDA or other comparable foreign regulatory authorities can delay, limit, or deny approval of a product candidate for many reasons, including:

| • | such authorities may disagree with the design or implementation of our, Sanofi’s, or any of our future development partners’ clinical trials; |

| • | we, Sanofi, or any of our future development partners may be unable to demonstrate to the satisfaction of the FDA or other regulatory authorities that a product candidate is safe and effective for any indication; |

| • | such authorities may not accept clinical data from trials which are conducted at clinical facilities or in countries where the standard of care is potentially different from the United States; |

| • | the results of clinical trials may not demonstrate the safety or efficacy required by such authorities for approval; |

| • | we, Sanofi, or any of our future development partners may be unable to demonstrate that a product candidate’s clinical and other benefits outweigh its safety risks; |

| • | such authorities may disagree with our interpretation of data from preclinical studies or clinical trials or the use of results from antibody studies that served as precursors to our current drug candidates; |

| • | such authorities may find deficiencies in the manufacturing processes or facilities of third-party manufacturers with which we, Sanofi, or any of our future development partners contract for clinical and commercial supplies; |

| • | we may not be successful in developing any companion diagnostic necessary to demonstrate efficacy in our desired target populations for KB004; |

13

Table of Contents

| • | such authorities may delay approval or clearance of any companion diagnostic for KB004; or |

| • | the approval policies or regulations of such authorities may significantly change in a manner rendering our, Sanofi’s, or any of our future development partners’ clinical data insufficient for approval. |

With respect to foreign markets, approval procedures vary among countries and, in addition to the aforementioned risks, can involve additional product testing, administrative review periods, and agreements with pricing authorities. In addition, events raising questions about the safety of certain marketed pharmaceuticals may result in increased cautiousness by the FDA and comparable foreign regulatory authorities in reviewing new drugs based on safety, efficacy or other regulatory considerations and may result in significant delays in obtaining regulatory approvals. Any delay in obtaining, or inability to obtain, applicable regulatory approvals would prevent us, Sanofi, or any of our future development partners from commercializing our product candidates.

The results of preclinical studies and early clinical trials are not always predictive of future results. Any product candidate we, Sanofi, or any of our future development partners advance into clinical trials may not have favorable results in later clinical trials, if any, or receive regulatory approval.

Drug development has inherent risk. We, Sanofi, or any of our future development partners will be required to demonstrate through adequate and well-controlled clinical trials that our product candidates are effective, with a favorable benefit-risk profile, for use in their target indications before we can seek regulatory approvals for their commercial sale. Drug development is a long, expensive and uncertain process, and delay or failure can occur at any stage of development, including after commencement of any of our clinical trials. In addition, success in early clinical trials does not mean that later clinical trials will be successful because product candidates in later-stage clinical trials may fail to demonstrate sufficient safety or efficacy despite having progressed through initial clinical testing. Furthermore, our future trials will need to demonstrate sufficient safety and efficacy for approval by regulatory authorities in larger patient populations. Companies frequently suffer significant setbacks in advanced clinical trials, even after earlier clinical trials have shown promising results. In addition, only a small percentage of drugs under development result in the submission of a New Drug Application (NDA) or Biologic Licensing Application (BLA) to the FDA and even fewer are approved for commercialization.

Although we have completed two Phase 1/2 clinical studies of KB001, the precursor molecule to KB001-A, we understand that Sanofi has determined that it will commence a Phase 1 clinical study of KB001-A in healthy volunteers to evaluate higher doses than those that we previously tested and planned for in our Phase 2 CF development program. The results of Sanofi’s Phase 1 clinical study could delay or adversely impact our KB001-A development program.

Furthermore, the efficacy or safety data demonstrated with KB001 and KB002, the precursor molecules to KB001-A and KB003, respectively, and intravenous formulation of KB001-A and KB003 may not be reproduced in KB001-A and KB003. Similarly, the subcutaneous formulations of KB001-A and KB003 may not produce any efficacy observed with intravenous formulations. We may need to conduct additional preclinical and clinical testing to confirm such data in the successor molecules and reformulations. We are still developing a subcutaneous formulation for KB001-A and need to further evaluate the subcutaneous formulation for KB003. We have yet to reach the stage at which we will inform the FDA that we intend to switch dosage forms from intravenous to subcutaneous formulations. Also, our current development timelines for KB001-A are based on demonstrating to the FDA that KB001-A is comparable to KB001 and that data obtained with intravenous KB001-A and KB003 can be bridged to the development of subcutaneous formulations of these product candidates. In addition, we do not currently plan to test different dose levels of drug until we conduct our pivotal trials. Because we will be testing different dose levels as part of our pivotal trials, the trials will be larger than the standard pivotal trial. In addition, testing dose levels at a later stage in development increases the risk that we will not successfully identify a dose with an acceptable safety and efficacy profile.

14

Table of Contents

Any product candidate we, Sanofi, or any of our future development partners advance into clinical trials may cause unacceptable adverse events or have other properties that may delay or prevent its regulatory approval or commercialization or limit its commercial potential.

Unacceptable adverse events caused by any of our product candidates that we advance into clinical trials could cause us or regulatory authorities to interrupt, delay, or halt clinical trials and could result in the denial of regulatory approval by the FDA or other regulatory authorities for any or all targeted indications and markets. This in turn could prevent us from completing development or commercializing the affected product candidate and generating revenue from its sale. For example, we observed fatal intracranial hemorrhages in two subjects deemed possibly related to the study drug by the study investigator in our KB004 Phase 1 clinical trial and, as a result, we amended our clinical protocol, which caused a delay in our program.

We and Sanofi have not yet completed testing of any of our product candidates for the treatment of the indications for which we intend to seek approval in humans, and we currently do not know the extent of adverse events, if any, that will be observed in individuals who receive any of our product candidates. If any of our product candidates cause unacceptable adverse events in clinical trials, we and Sanofi, as applicable, may not be able to obtain regulatory approval or commercialize such product candidate.

Anti-GM-CSF antibodies, including KB003, may contribute to the development of pulmonary alveolar proteinosis (PAP), in which case we may need to delay, redesign or terminate our clinical trials of KB003.

PAP is a very uncommon lung disease which is associated with the presence of high concentrations of anti-GM-CSF antibody, but such antibodies alone may not be sufficient to cause disease. PAP is characterized by excessive accumulation of the normal alveolar lining fluid (surfactant) within the lung. The clinical course of PAP is variable, ranging from spontaneous remission to respiratory failure. The estimated incidence of the disorder is 0.36 per 1 million people per year. Although PAP is associated with anti-GM-CSF antibodies, it is unclear if these antibodies are the sole cause of surfactant accumulation. For example, blood donors and cancer patients who have measurable anti-GM-CSF antibodies do not develop signs or symptoms of PAP. Natural neutralizing anti-GM-CSF antibodies have been reported in 0.3% of healthy populations. While we believe the risk for development of PAP with KB003 is low, in the event that KB003 is linked to the development of PAP, we may need to delay, redesign, or terminate our clinical trials of KB003.

We may experience delays in commencing or conducting our clinical trials or in receiving data from third parties or in the completion of clinical testing, which could result in increased costs to us and delay our ability to generate product candidate revenue.

Before we can initiate clinical trials in the United States for our product candidates, we need to submit the results of preclinical testing to the FDA as part of an IND application, along with other information including information about product candidate chemistry, manufacturing, and controls and our proposed clinical trial protocol. We rely in part on preclinical, clinical, and quality data generated by Sanofi and other third parties for regulatory submissions for KB001-A. If Sanofi does not make timely regulatory submissions for KB001-A, it will delay our plans for our clinical trials for CF. If those third parties do not make this data available to us, we will likely have to develop all necessary preclinical and clinical data on our own, which will lead to significant delays and increase development costs of the product candidate. In addition, the FDA may require us to conduct additional preclinical testing for any product candidate before it allows us to initiate clinical testing under any IND, which may lead to additional delays and increase the costs of our preclinical development. Despite the presence of an active IND for a product candidate, clinical trials can be delayed for a variety of reasons including delays in:

| • | identifying, recruiting, and training suitable clinical investigators; |

| • | reaching agreement on acceptable terms with prospective contract research organizations (CROs) and trial sites, the terms of which can be subject to extensive negotiation, may be subject to modification from time to time, and may vary significantly among different CROs and trial sites; |

15

Table of Contents

| • | obtaining sufficient quantities of a product candidate for use in clinical trials, including as a result of transferring the manufacturing of a product candidate to another site or manufacturer; |

| • | obtaining and maintaining institutional review board (IRB) or ethics committee approval to conduct a clinical trial at an existing or prospective site; |

| • | identifying, recruiting, and enrolling subjects to participate in a clinical trial; |

| • | retaining or replacing participants who have initiated a clinical trial but may withdraw due to adverse events from the therapy, insufficient efficacy, fatigue with the clinical trial process, or personal issues; and |

| • | readiness of any companion diagnostic necessary to ensure that the study enrolls the target population. |

The FDA may also put a clinical trial on clinical hold at any time during product candidate development.

Once a clinical trial has begun, recruitment and enrollment of subjects may be slower than we anticipate. Clinical trials may also be delayed as a result of ambiguous or negative interim results. Further, a clinical trial may be suspended or terminated by us, an IRB, an ethics committee, or a data safety monitoring committee overseeing the clinical trial, any of our clinical trial sites with respect to that site or the FDA or other regulatory authorities due to a number of factors, including:

| • | failure to conduct the clinical trial in accordance with regulatory requirements or our clinical protocols; |

| • | inspection of the clinical trial operations or clinical trial site by the FDA or other regulatory authorities; |

| • | unforeseen safety issues, known safety issues that occur at a greater frequency or severity than we anticipate, or any determination that the clinical trial presents unacceptable health risks; or |

| • | lack of adequate funding to continue the clinical trial. |

Additionally, under the terms of our license and collaboration agreement with Sanofi, Sanofi has the exclusive right to develop and commercialize KB001, KB001-A and other antibodies directed against the PcrV protein or Pa for all indications. Although this agreement requires Sanofi to use commercially reasonable efforts to engage in certain product development activities, Sanofi may decide to amend, suspend or terminate the clinical trials related to these licensed product candidates. Further, if Sanofi or any of our future development partners do not develop the licensed product candidates in the manner that we expect, or at all, the clinical development efforts related to these licensed product candidates could be delayed or terminated.

Any delays in the commencement of our clinical trials, including any delays by Sanofi attributed to terminating or switching any subcontractors for the manufacture of the KB001-A drug substance, will delay our ability to pursue regulatory approval for our product candidates. Changes in U.S. and foreign regulatory requirements and guidance also may occur and we may need to amend clinical trial protocols to reflect these changes. Amendments may require us to resubmit our clinical trial protocols to IRBs for re-examination, which may affect the costs, timing, and likelihood of a successful completion of a clinical trial. If we, Sanofi, or any of our future development partners experience delays in the completion of, or if we, Sanofi, or any of our future development partners must terminate, any clinical trial of any product candidate our ability to obtain regulatory approval for that product candidate will be delayed and the commercial prospects, if any, for the product candidate may suffer as a result. In addition, many of these factors may also ultimately lead to the denial of regulatory approval of a product candidate.

If we pursue development of a companion diagnostic intended to identify patients who are likely to benefit from KB004, failure to obtain approval for the diagnostic may prevent or delay approval of KB004.

We are in the initial phases of developing a companion diagnostic which is intended to identify patients who are likely to derive the most benefit from KB004. If we are able to develop this companion diagnostic, we intend to amend our Phase 1 protocol prior to initiating the expansion phase to include EphA3 positive status as an inclusion criterion.

16

Table of Contents

The FDA regulates companion diagnostics, or in-vitro diagnostics, such as the one we are developing, as medical devices. FDA regulations pertaining to medical devices govern, among other things, the research, design, development, pre-clinical and clinical testing, manufacture, safety, efficacy, storage, record-keeping, packaging, labeling, adverse event reporting, advertising, promotion, marketing, distribution, and import and export of medical devices. Pursuant to the Federal Food, Drug, and Cosmetic Act (FDC Act), medical devices are subject to varying degrees of regulatory control and are classified in one of three classes depending on the controls the FDA determines necessary to reasonably ensure their safety and efficacy. In July 2011, the FDA issued draft guidance that stated that if safe and effective use of a therapeutic depends on an in vitro diagnostic, then the FDA generally will not approve the therapeutic until it is ready to approve or clear this in vitro companion diagnostic device. While this guidance is still in draft form, we believe that it states the FDA’s current position and that KB004 may not be approved until the FDA has sufficient information to also approve or clear our companion device. Moreover, the FDA’s expectations for in vitro companion diagnostics are evolving and some aspects of the FDA’s regulatory approach remain unclear. The FDA’s developing expectations will affect, among other things, the development, testing and review of our in vitro companion diagnostics.

Because our companion diagnostic candidate is at an early stage of development, we have yet to seek a meeting with the FDA to discuss our companion diagnostic test in development and therefore cannot yet know what the FDA will require for this test. We may not be able to develop or obtain approval or clearance for the companion diagnostic, and any failure to obtain regulatory approval or clearance could delay development or prevent approval of KB004.

If our competitors develop treatments for the target indications of our product candidates that are approved more quickly, marketed more successfully or demonstrated to be safer or more effective than our product candidates, our commercial opportunity will be reduced or eliminated.

We operate in highly competitive segments of the biotechnology and biopharmaceutical markets. We face competition from many different sources, including commercial pharmaceutical and biotechnology enterprises, academic institutions, government agencies, and private and public research institutions. Our product candidates, if successfully developed and approved, will compete with established therapies as well as with new treatments that may be introduced by our competitors. Many of our competitors have significantly greater financial, product candidate development, manufacturing, and marketing resources than we do. Large pharmaceutical and biotechnology companies have extensive experience in clinical testing and obtaining regulatory approval for drugs. In addition, many universities and private and public research institutes are active in cancer research, some in direct competition with us. We also may compete with these organizations to recruit management, scientists, and clinical development personnel. Smaller or early-stage companies may also prove to be significant competitors, particularly through collaborative arrangements with large and established companies. New developments, including the development of other pharmaceutical technologies and methods of treating disease, occur in the pharmaceutical and life sciences industries at a rapid pace. Developments by competitors may render our product candidates obsolete or noncompetitive. We will also face competition from these third parties in recruiting and retaining qualified personnel, establishing clinical trial sites, and registering subjects for clinical trials, and in identifying and in-licensing new product candidates.

There are several companies treating Pa using antibiotics or alternative approaches. For example, Intercell AG has a fusion protein vaccine program in Phase 2/3 for the prevention of Pa in mechanically ventilated intensive care unit patients and Kenta Biotech Ltd. is conducting a Phase 2 trial for KBPA101, a monoclonal antibody against a specific Pa serotype. There are two inhaled antibiotics (Tobi® and Cayston®) that have been approved for Pa to treat CF. We are also aware of one biologic drug (Pulmozyme®) that is approved in the United States to treat respiratory problems in CF patients. KALYDECO®, a small-molecule drug that potentiates the form of the defective protein that causes CF, was recently approved by the FDA. VX-809 is a compound being developed by Vertex Pharmaceuticals, Inc. in Phase 2 clinical trials for CF.

Several companies are also working on anti-GM-CSF antibodies: Morphosys recently announced results of a Phase 1/2 trial in RA and is conducting a Phase 1 trial in multiple sclerosis (MS); Micromet (now part of Amgen)

17

Table of Contents

has partnered with Nycomed (now part of Takeda) in a Phase 1 trial in RA; and MedImmune is conducting a Phase 2 trial in RA with an antibody against the GM-CSF receptor. Although we are no longer pursuing the RA indication, these competitors could nonetheless affect our market for an anti-GM-CSF antibody for severe asthma. Many companies are developing drugs for asthma. Monoclonal antibody drug development has primarily focused on allergic asthma. Xolair®, which is co-developed by Genentech and Novartis, is currently the only monoclonal antibody that we are aware of that is approved for the treatment of severe asthma. Genentech (Roche), MedImmune, Novartis and Pfizer each has an anti-IL-13 antibody program in Phase 2 or Phase 3 testing for asthma. Other monoclonal antibodies in development target cytokines such as IL-4, IL-5, and IL-9 or their receptors. Although these drugs function differently, if successfully developed these drugs will compete in the asthma market.

Competition in cancer drug development is intense, with more than 250 compounds in clinical trials by large pharmaceutical and biotechnology companies. Many of these companies are focused on targeted therapies. We anticipate that we will face intense and increasing competition as new treatments enter the market and advanced technologies become available.

We are subject to a multitude of manufacturing risks, any of which could substantially increase our costs and limit supply of our products.

The process of manufacturing our products is complex, highly regulated and subject to several risks, including:

| • | The process of manufacturing biologics, such as KB001-A, KB003, and KB004, is extremely susceptible to product loss due to contamination, equipment failure or improper installation or operation of equipment, or vendor or operator error. Even minor deviations from normal manufacturing processes could result in reduced production yields, product defects and other supply disruptions. If microbial, viral or other contaminations are discovered in our products or in the manufacturing facilities in which our products are made, such manufacturing facilities may need to be closed for an extended period of time to investigate and remedy the contamination. |

| • | The manufacturing facilities in which our products are made could be adversely affected by equipment failures, labor shortages, natural disasters, power failures and numerous other factors. |

| • | We and our contract manufacturers must comply with the FDA’s current Good Manufacturing Practice (cGMP) regulations and guidelines. We and our contract manufacturers may encounter difficulties in achieving quality control and quality assurance and may experience shortages in qualified personnel. We and our contract manufacturers are subject to inspections by the FDA and comparable agencies in other jurisdictions to confirm compliance with applicable regulatory requirements. Any failure to follow cGMP or other regulatory requirements or delay, interruption or other issues that arise in the manufacture, fill-finish, packaging, or storage of our products as a result of a failure of our facilities or the facilities or operations of third parties to comply with regulatory requirements or pass any regulatory authority inspection could significantly impair our ability to develop and commercialize our products, including leading to significant delays in the availability of products for our clinical studies or the termination or hold on a clinical study, or the delay or prevention of a filing or approval of marketing applications for our product candidates. Significant noncompliance could also result in the imposition of sanctions, including fines, injunctions, civil penalties, failure of regulatory authorities to grant marketing approvals for our product candidates, delays, suspension or withdrawal of approvals, license revocation, seizures or recalls of products, operating restrictions and criminal prosecutions, any of which could damage our reputation. If we are not able to maintain regulatory compliance, we may not be permitted to market our products and/or may be subject to product recalls, seizures, injunctions, or criminal prosecution. |

| • | Any adverse developments affecting manufacturing operations for our products may result in shipment delays, inventory shortages, lot failures, product withdrawals or recalls, or other interruptions in the supply of our products. We may also have to take inventory write-offs and incur other charges and expenses for products that fail to meet specifications, undertake costly remediation efforts or seek more costly manufacturing alternatives. |

18

Table of Contents

We may not be able to successfully develop and manufacture a subcutaneous formulation of KB001-A or KB003.