Attached files

| file | filename |

|---|---|

| EX-10.2 - EXHIBIT 10.2 - Enertopia Corp. | exhibit10-2.htm |

| EX-10.3 - EXHIBIT 10.3 - Enertopia Corp. | exhibit10-3.htm |

| 8-K - FORM 8-K - Enertopia Corp. | form8k.htm |

| EX-99.1 - EXHIBIT 99.1 - Enertopia Corp. | exhibit99-1.htm |

NOTE REGARDING FORWARD LOOKING STATEMENTS

Certain information in this Offering Memorandum is “forward looking information” within the meaning of applicable securities laws. Forward looking information is frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate” or other similar words, or statements that certain events or conditions “may” or “will” occur. Forward looking information involves significant known and unknown risks and uncertainties. A number of factors, many of which are beyond the control of the Issuer, could cause actual results to differ materially from the results discussed in the forward looking information. Although the forward looking information contained in this Offering Memorandum is based upon assumptions which management of the Issuer believes to be reasonable, the Issuer cannot assure investors that actual results will be consistent with this forward looking information. Because of the risks, uncertainties and assumptions inherent in forward looking information, prospective investors in the Issuer’s securities should not place undue reliance on this forward looking information.

In particular, this Offering Memorandum contains forward looking information pertaining to business development plans, mineral exploration and other expectations, beliefs, plans, goals, objectives, assumptions, information. Undue reliance should not be placed on forward-looking information. Forward-looking information is based on current expectations, estimates and projections that involve a number of risks which could cause actual results to vary and, in some instances to differ materially from those anticipated by the Issuer and described in the forward-looking information contained in this Offering Memorandum.

Some but not all of the factors affecting forward-looking statements include: the speculative nature of mining exploration, production and development activities; changes in reserve estimates; the productivity of the Issuer's proposed properties; changes in the operating costs; changes in economic conditions and conditions in the resource, foreign exchange and other financial markets; changes of the interest rates on borrowings; hedging activities; changes in commodity prices; changes in the investments and exploration expenditure levels; litigation; legislation; environmental, judicial, regulatory, political and competitive developments in areas in which the Issuer operates; technological, and mechanical and operational difficulties encountered in connection with the Issuer's exploration and development activities. The foregoing list of risk factors is not exhaustive. Prospective investors should refer to the risk disclosures set out in the periodic reports and other disclosure documents filed by the Issuer from time to time with regulatory authorities.

Forward-looking information is based on the estimates and opinions of the Issuer at the time the information is presented. The Issuer assumes no obligation to update forward-looking information should circumstances or the Issuer’s estimates or opinions change, except as required by law.

PROSPECTIVE INVESTORS SHOULD THOROUGHLY REVIEW THIS OFFERING MEMORANDUM AND ARE ADVISED TO CONSULT WITH THEIR OWN LEGAL AND TAX ADVISORS CONCERNING THIS INVESTMENT.

2

ENERTOPIA CORPORATION

OFFERING MEMORANDUM

Form 45-10GF3

July 16, 2012

Form 45-106F3 – Offering Memorandum for Qualifying Issuers

| Date: |

July 16, 2012. |

| The Issuer: |

|

| Name: |

Enertopia Corp. (the "Issuer" or the “Company”) |

| Head

Office: |

950 – 1130 West Pender

Street |

| Issuer’s Solicitors: |

Macdonald Tuskey, Corporate and Securities Lawyers 4th Floor - 570 Granville Street, Vancouver BC V6C 3P1 |

| Phone Number: |

604-602-1033 |

| E-mail address: |

kameo300@gmail.com |

| Fax Number: |

604-685-1602 |

| Current

Listing and/or |

The Issuer is quoted for trading on the Over-the-Counter Bulletin Board and listed for trading on the Canadian National Stock Exchange. |

| Reporting Jurisdictions: |

The Issuer is reporting in the Provinces of British Columbia and Ontario and in the United States. |

| The Offering: |

|

| Securities Offered: |

Up to 20,000,000 units (the "Units"), each Unit to consist of one common share of the Issuer (each, a “Share”) and one Share purchase warrant (each, a “Warrant”). Each Warrant will be exercisable into one further Share (a “Warrant Share”) at a price of US$0.10 per Warrant Share for a period of twelve (12) months following closing; or at a price of US$0.20 per warrant share for a period that is twelve months and one day to thirty-six (36) months following closing. See Item 5. |

| Price per Security: |

US$0.05 per Unit. |

| Maximum Offering |

The offering of Units is subject to a maximum overall subscription of 20,000,000 Units for gross proceeds of US$1,000,000 (the “Maximum Subscription”). |

| Funds available under the offering may not be sufficient to accomplish our proposed objectives. |

|

| Minimum

Subscription |

Each investor must invest a minimum of US$1,000. |

| Payment terms: |

The subscription proceeds must accompany the form of subscription agreement attached to and forming a part of this Offering Memorandum, and shall be paid by immediately available good funds in either Canadian or US currency, drawn on a Canadian, or other chartered bank reasonably acceptable to the Issuer, made payable by certified cheque and/or bank draft and made payable and delivered to the Issuer’s Solicitors, Macdonald Tuskey, Corporate and Securities Lawyers, at 4th Floor - 570 Granville Street, Vancouver BC V6C 3P1. Alternatively, payment of the subscription proceeds can be made by wire transfer of funds to a bank account of the Issuer, the particulars of which will be provided to investors. |

| Proposed Closing Date: |

Closings will occur periodically on a "first come, first served" basis. See Item 5. |

| Income Tax Consequences: |

There are important tax consequences to these securities. See item 6. |

| Selling Agent: |

Yes. See item 7. |

| Resale Restrictions: |

You will be restricted from selling your securities for 4 months and a day. See item 10. There are also United States resale restrictions on the securities. |

| Purchaser’s Rights: |

You have two business days to cancel your agreement to purchase these securities. If there is a misrepresentation in this Offering Memorandum, you have the right to sue either for damages or to cancel the agreement. See item 11. |

No securities regulatory authority or regulator has assessed the merits of these securities or reviewed this Offering Memorandum. Any representation to the contrary is an offence. This is a risky investment. See item 8.

Currency

In this Offering Memorandum, unless otherwise noted, all dollar amounts are expressed in US dollars. An exchange rate of 1.00 is used in this Offering Memorandum when discussing the conversion of United States dollars to Canadian dollars and an exchange rate of 1.00 is used for conversion of Canadian dollars to United States dollars.

ITEM 1: USE OF AVAILABLE FUNDS

Available Funds

Upon completion of the Offering, the Issuer anticipates that the following funds will be available to it for the next twelve mon1th period:

| Assuming max. Offering | ||

| A | Amount to be raised by this offering | $1,000,000 |

| B | Selling commissions and fees | $100,000 |

| C | Estimated offering costs (e.g., legal, accounting, audit) | $25,000 |

| D | Available funds: D = A – (B + C) | $875,000 |

| E | Additional sources of funding required | $0 |

| F | Working capital deficiency (May 31, 2012) | ($149,070) |

| G | Total: G = (D + E) – F | $725,930 |

Use of Available Funds

The Issuer anticipates that up to $875,000 will be available to it upon conclusion of the Maximum Subscription. The principal purposes for which these funds will be used over the next twelve months are as follows:

| Description | Amount |

| Maximum

PP | |

| Property Payments (US $120,000) (1) | $120,000 |

| Phase IA Drilling Copper Hills (US $300,000) (1) | $300,000 |

| Surface Exploration Mildred Peak (US$50,000) (1) | $50,000 |

| General and administrative expenses |

$155,000 |

| As a reserve for unallocated working capital | $250,000 |

| Total: | $875,000 |

Note:

(1) Based upon an exchange rate of 1.0.

Reallocation

We intend to spend the available funds as stated. We will reallocate funds only for sound business reasons.

Insufficient Funds

The funds available as a result of the Offering may not be sufficient to accomplish the Issuer’s proposed objectives and there is no assurance that alternative financing will be available.

ITEM 2: INFORMATION ABOUT THE ISSUER

General

The Issuer is a mineral resource and renewable energy company that is pursuing business opportunities in mineral resource exploration and several clean technology sectors.

Reference is made to Item 1. (Business) in the Issuer’s Form 10-K (Annual Information Form), filed on SEDAR on November 29, 2011, for disclosure relating to the Issuer’s business history and current business.

Mineral Resource Division

The Issuer’s mineral resource properties are currently in the exploration stage. The Issuer holds the rights, through two separate mineral property option agreements, to acquire the rights to two properties, known as the Copper Hills Project in New Mexico and the Mildred Peak Project in Arizona.

The Issuer has and intends to conduct exploration activities on its Copper Hills Project in New Mexico in the search for base metals, specifically copper and silver.

Project Description and Location:

The following information with respect to the Copper Hills Project is derived from a National Instrument 43-101 compliant report entitled "Technical Repot on the Copper Hills Property Cat Mountain Mining District, Socorra County, New Mexico, USA". The full text of the Technical Report is available for review at the office of the Company at 950 – 1130 West Pender Street, Vancouver, British Columbia, Canada V6E 4A4 and may also be accessed online, under the Company's SEDAR profile at www.sedar.com.

Property Description and Location

Location

The Copper Hills property is located in Socorro County, New Mexico, approximately 15 km west of the village of Magdalena. The Copper Hills property consists of a group of 76 contiguous unpatented lode mining claims. Access is via US Hwy 60 from the city of Socorro, some 60 km to the east. The property straddles two United States Geological Survey 7.5’ quadrangle map sheets (Tres Montosas, New Mexico [west] and Arroyo Landavaso, New Mexico [east]). The claims cover parts of: Meridian 23 Township 3S Range 5W Sections 6, 7 Meridian 23 Township 3S Range 6W Sections 1,12

Property Description

The Copper Hills property consists of 76 contiguous unpatented lode mining claims (COPPER HILLS #1, Wildhorse 1-15; 21-24; 30-75 and Timberwolf 16-20; 25-29). All of the claims are owned or controlled by Wildhorse Copper (AZ), Inc., an Arizona corporation. Wildhorse Copper (AZ), Inc. is a wholly owned subsidiary of Wildhorse Copper, Inc., a British Columbia, Canada corporation. The combined area of the landholdings represents approximately 603 hectares (~1,550 acres). The property has not been legally surveyed.

The Bureau of Land Management (United States Federal government) holds the surface rights. There is no privately held land on the Copper Hills property.

The 66 Wildhorse claims and 10 Timber Wolf claims were located with the use of a global positioning system (“GPS”) and tied to section corners and geodetic control points. The claim staking work was carried out on behalf of Wildhorse by Environmental Field Services, LLC, of Oracle, Arizona, a firm specializing in land surveying and claim staking. This work was completed between February 28 and October 1, 2011.

A yearly maintenance fee of US$140 per claim must be paid to the Bureau of Land Management on or before September 1 of each year to maintain the title to the claims in good standing. In addition an annual “Notice of Intent to Hold“ for each claim must be filed with the Socorro County Recorder. The county recordation filing fee per claim is $9.00 per document page plus $2.00 per each additional page.

Maintenance and recordation fees through the 2011 maintenance year have been paid to the Bureau of Land Management and the Socorro County Recorder's office.

To the author's knowledge the property interest is subject only to the normal environmental regulations and liabilities as stipulated under the laws of New Mexico and the United States of America and the sufficiency of rights for exploration and mining operations on the property is subject only to the normal procedures and permits under the laws of the United States of America.

Prior to the commencement of any activity that may produce a disturbance to the surface (i.e. drilling), Enertopia will need to provide the Bureau of Land Management a financial guarantee under an approved "Plan of Operations". The "bond" amount must cover the estimated cost to contract a third party to reclaim the disturbance due to operations. The Bureau of Land Management State office will authorize and maintain the bond instrument. Permits will then be needed to required construct drill sites and drainage sumps.

At the time of this report Enertopia had not made application for any permits nor had posted a financial assurance bond. Reclamation of some disturbances by previous owners has occurred. The author understands that the Bureau of Land Management covered and secured at least one site (a shallow shaft) on the property in late 2007.

Enertopia Corporation has entered into a definitive mineral property option agreement dated April 11, 2011 with Wildhorse Copper Inc. and its wholly owned subsidiary Wildhorse Copper (AZ) Inc. respecting an option to earn a 100% interest, subject to a 1% NSR capped to a maximum of $2,000,000 on one claim, in the Copper Hills property. The Copper Hills property is comprised of 56 located mining claims covering a total of 1,150 acres (468 hectares) located in Socorro County, New Mexico, USA. Wildhorse Copper Inc. holds the Copper Hills property directly and indirectly through property purchase agreements between Wildhorse Copper (AZ) Inc. and third parties (collectively, the "Indirect Agreements"). Pursuant to the option agreement between Enertopia Corporation and Wildhorse Copper Inc., Wildhorse has assigned the Indirect Agreements to Enertopia Corporation.

In order to earn the interest in the Copper Hills property, Enertopia Corporation is required to make aggregate cash payments of $591,650 over an eight year period and issue an aggregate of 1,000,000 shares of its common stock over a three year period. As of April 11, 2011, Enertopia Corporation has made aggregate cash payments of $69,150 to the respective claim owners and issued 650,000 shares to Wildhorse Copper Inc. 150,000 of the securities issued in the acquisition are subject to a hold period in Canada expiring on July 30, 2012. These securities are also restricted for United States securities laws purposes and are subject to the applicable hold periods.

Geological Setting

The property is located within the physiographic province known as the Datil-Mogollon Section, locally characterized by volcanic highlands.

The geology of the project area was described by Wilkinson (1976). A northerly trending fault separates volcanic rocks to the west from younger piedmont gravels, alluvium and basalt to the east. Volcanic rocks are dominantly Oligocene 'spears Formation" andesitic volcaniclastics. The important "Nipple Mountain" tuff member is an interbedded lithic and variably welded tuff with deposition controlled by northeast and east-northeast trending, partly fault bounded paleovalleys. The overlying "Hells Mesa Formation" and the "A-L Peak Tuff" represents a change to ash flow volcanism related to the Mt. Withington caldera collapse. The caldera margin is situated 7 ½ km south of the Copper Hills prospect.

Structurally the property is situated within a north-northwest trending uplifted block bounded to the east by the "Mulligan Gulch" graben. Three major structural trends are present at Copper Hills. The west-northwest trending "Capitan" lineament is a pre-volcanic feature that was reactivated in the Oligocene. The northeast to east-northeast trending "Morenci-Magdalena" lineament is also a basement feature that in part controlled deposition of the Nipple Mountain tuff. The north to 335° trend reflects the monoclinal eastern edge of the uplifted block and controlled the emplacement of intrusive stocks and later Basin and Range faulting. Convergence of the three structural trends in the vicinity of the Copper Hills prospect resulted in an intense shattering of the rocks.

Mineralization

Mineralization at Copper Hills includes fracture controlled and disseminated copper oxides (plus silver) at the Copper Hills prospect and epithermal gold-silver veins. Wilkinson (1976) describes previous work conducted on the property. Various stakeholders held mining claims in the area almost continuously between 1950 and 2007. During the 1950's minor copper oxide production from the Copper Hills main outcrop took place and five short holes were drilled. In 1968 the Banner Mining Company reportedly drilled a deeper hole to 1,622 ft (494.5 m) and intersected pervasive propylitic alteration with abundant fresh and oxidized pyrite throughout the hole. Samples taken from the last 100 ft reportedly contained small amounts of pyrite plus chalcopyrite, sphalerite and galena. Numerous other prospecting pits and shafts are found on the property and most appear to be related to exploration and minor extraction of minerals associated with epithermal vein type systems. The Banner hole is on the eastern edge of a strong IP-chargeability anomaly defined by the IP survey completed by Wright geophysics, on behalf of the Company in August, 2011.

The deposit model being investigated by Enertopia for economic potential at the Copper Hills project is that of epigenetic supergene Cu-Ag deposits, with potential for deeper porphyry-style mineralization.

The most recent exploration work done at Copper Hills was by Coyote Copper in the early part of 2008 which included a ground magnetics geophysical survey, followed by a reconnaissance and field verification mapping and rock chip sampling program and a soil sampling geochemical survey. Enertopia engaged Wright geophysical to manage an IP geophysical survey conducted in August, 2011. Wright also interpreted the results and provided a technical report. The original author of this report (Wiese) visited the Copper Hills project in early February, 2008 on behalf of Coyote Copper. The present author (Cleary) visited the property on August 31, 2011, on behalf of Enertopia Corp.

Compilation of historical information on the Copper Hills prospect combined with the outcome of the above mentioned exploration work, as carried out by Coyote Copper and its consultants, have herein resulted in a recommendation for further work to be performed by Enertopia Corporation.

This report has been prepared in accordance with Canadian National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”). The original report was prepared in April, 2011 by Claus Wiese, P.Eng., of Tucson, Arizona, USA, an independent Qualified Person (as defined within the connotation of NI 43-101). This subsequent update to the report was prepared in September, 2011 by John G. Cleary, CPG & RG of Reno, Nevada, USA, also an independent Qualified Person (as defined within the connotation of NI 43-101). The material change to the project during that time interval was the completion of the ground IP-Resistivity survey, which Wiese recommended in the original report.

Accessibility, Climate, Local Resources, Infrastructure and Physiography

The Copper Hills project area is located within Socorro County, New Mexico, approximately 15 km west of the village of Magdalena (pop. 900). The City of Socorro (pop. 9,000) located about 60 km west of the

property offers a broad range of services. Albuquerque, New Mexico (pop.+500,000) is approximately 150 km north-northeast of the property, and is a major center for equipment, supplies, labor, logistics and services.

There is easy access to the property from Socorro (through Magdalena) along US Hwy 60, which crosses the property. Electric power and fiber optic telecommunications parallel Hwy 60. There are numerous unimproved ranch roads and trails that provide good access to the remainder of the area.

The property is located within the physiographic province known as the Datil-Mogollon Section, locally characterized by volcanic highlands (Hawley, 1986). The claim group is situated between the Gallinas Mountains to the north and the San Mateo Mountains in the south. Local terrain is flat to rolling hills with elevations between 2,125 m (6,970 ft) and 2,260 m (7,410 ft). The area is part of New Mexico's woodland rangelands; vegetation is classified as belonging to the Juniper Savanna ecotone. Juniper, cedar and some pinon bushes are common atop grassy surface growth.

The climate is considered semi-arid with precipitation between 1-2 cm per month and 5 cm per month average during summer monsoon season (July - September). The temperature is mild to moderate. Ambient temperatures for this region range from -5°C to +10°C (fall/winter) and +5°C to +30°C (spring/summer).

The physiography and climate pose no significant difficulties to exploration and mining activities in the area. The property has ample room for potential mine and mill operations and facilities.

History

Mining History - Socorro County

The following mining history for the area is summarized from Padilla (2001).

In 1866 lead was discovered in the Magdalena district, and in 1867 silver was found in the Socorro Peak district. By the 1880's, the mining boom in Socorro County was in full swing, with crowded camps and tent cities dotting the land. In a six-month period in 1880-81, nearly 3,000 different mineral deposits were located and dozens of new towns developed including Kelly (population 5,000) and Magdalena, the two principal boom towns in Socorro County. Magdalena, which had begun as a collection of tents, grew substantially with the development of a railroad line from Socorro. A smelting plant erected in 1881 near Socorro treated ore from the Kelly and other mines until 1893. In 1896, a new smelter was constructed in Magdalena which then became the smelting town for the mine operations in both Magdalena and Kelly districts.

In a forty-year period, from the 1880's to the 1920's, Magdalena district production was valued at some $60 million. In addition, coal mines were opened near Carthage between 1880 and 1885 to supply fuel for locomotives, mills, and smelters. This further increased the mineral production level during Socorro County's boom years.

In the early 1900's, as lead and silver were being mined, a zinc carbonate mineral, smithsonite, was discovered at Kelly. Smithsonite was previously discarded as waste rock.. Kelly's second wind of prosperity started as smithsonite was recovered from tailings piles and other leased properties. The mines of the Kelly area became New Mexico's leading zinc producers and were known for the high quality smithsonite mined from the area. By 1931 the smithsonite deposits were exhausted and mining throughout the district decreased.

Previous Work

Prior to Coyote acquiring its land position in the Copper Hills area, various stake holders had actively held mining claims there continuously between 1950 and 2007. The most active period occurred between 1950 and 1995 in which a core part of the property was held by a consortium of partners for as many as 45 years.

Previous work in and surrounding the Copper Hills project area was focused on the epithermal gold-silver vein mineralization in the Cat Mountain Mining district and disseminated copper (+/- silver) mineralization at the Copper Hills prospect. Wilkinson (1976) provides an overview of known historical work and previous operators.

Cat Mountain

The Cat Mountain gold mining district, 1.5 miles (2.4 km) south of the Copper Hills property, was active around 1900. A 20-stamp amalgamating mill was erected in 1902. The mill operated for a short time until 1903 when it was closed down. It was reported (Jones, 1904) that the gold mineralization at Cat Mountain was mainly refractory in nature. Hence, recovery was poor owing to the technology of the time. Production figures are not documented. The author is not aware of any other particulars including names of the operators.

Copper Hills prospect

The Copper Hills prospect is located in Township 3S, Range 5W and Section 6, approximately 1600 ft (about 490 m) south of US Hwy 60. It is an oxide copper body with mineralization disseminated in a highly silicified and fractured Tertiary volcanic tuff unit. Workings consist of a shaft and several excavations, one of which is 130 m in length. It is thought this work was carried out in the early 1950's, but details are not confirmed at this time. The author is not specifically aware of who all the individual operators were and has relied on Wilkinson's (1976) report for these descriptions. Total production was said to be 356 tons which averaged 3.01 oz. silver per ton and 0.81% copper. Trace amounts of gold and up to 1.33% lead have also been reported.

Historic Drilling

On the ridge above the excavation at the Copper Hills prospect, 5 short drill holes were completed, oriented along a northeast-southwest line. It is thought this drilling was done during the early 1950's. Wilkinson (1976) reports that the drill holes, apparently completed during the 1950's, all intersected copper mineralization.

In 1968, Banner Mining Company drilled a vertical diamond drill hole to 1,622 ft. (494.5 m.). It was located approximately 10 m south of the Copper Hills prospect. Copper, lead and zinc sulphide mineralization was encountered towards the bottom of the hole. The author has not seen the original report by Banner and has relied on Wilkinson (1976).

Sampling and Security

Mayor undertook to sample selected mineralized outcrops. A total of 55 samples were collected as follows: 21 from the Copper Hills prospect, 18 from vein prospects and 16 of the Nipple Mountain tuff. The material was broken using a rock hammer and the pieces were packed in heavy cloth sample bags, tied with cloth laces, and marked with a unique sample identification number. The sample location was taken using a handheld GPS device (setup in UTM Zone 13N coordinates and using the NAD27 datum). The sample was geologically described and together with the location information recorded into a field book. Sample weights ranged from 1.5 to 6 kg.

All samples were taken back to Tucson, Arizona by Mayor from where he shipped them to ALS Chemex Laboratories in Elko, Nevada for preparation and subsequent analysis in Vancouver, Canada.

Other Work

Numerous prospecting pits and shafts are found on the property north of Hwy. US 60. Most appear to be related to exploration and extraction of minerals associated with epithermal vein type systems. It is unclear when, or over what period of time this work was carried out, or by whom.

Mineral Resource and Mineral Reserves

NONE

Mining Operations

NONE

Exploration Proposal

A two phase exploration program has been proposed. Phase 1A & 1B would commence with 3 core drill holes to an average depth of 550 meters designed to test the strong IP-chargeability anomalies defined by the geophysical survey completed in August, 2011. In addition, reverse circulation drilling will be undertaken to verify the grade and extent of the copper (+silver) mineralization as documented by previous operators, within and peripheral to the Copper Hills Prospect. This is will require about 750 m of drilling in 10 reverse circulation holes each about 75 m in depth spaced on a 50 m x 50 m grid. This phase 1A is estimated to consist of 10 to 15 shallow RC or Diamond drill holes depending on rig availability under our proposed budget estimate of $300,000.The total Phase 1 program will cost $720,000. Contingent upon Phase 1 providing positive results it is recommended for Phase 2 that additional drilling be undertaken to add to the grade and extent of the copper (+silver) mineralization as documented by previous operators, within and peripheral to the Copper Hills Prospect. This is will require about 1,500 m of drilling in 20 reverse circulation holes each about 75 m in depth designed to extend the a 50 m x 50 m grid.

An additional 2,500 m of core drilling is recommended to offset the two core holes into the IP anomaly. Other facets of a Phase 2 program include conducting additional geological mapping, prospecting and sampling of priority targets based on geophysical and geochemical survey interpretations. The cost of Phase 2 will be about $1,210,000. The total for both phases is US$1,930,000.

Additionally, the Issuer intends to conduct exploration activities on its Mildred Peak Project in Arizona in the search for precious metals, specifically gold and silver.

Reference is made to Item 1. (Business) in the Issuer's Form 10-K (Annual Information Form), filed on SEDAR on November 29, 2011, for disclosure relating to the mineral property agreements for each of the Copper Hills Project and the Mildred Peak Project.

Reference is made to the Issuer's Technical Report (NI 43-101), filed on SEDAR on November 2, 2011, for disclosure relating to the Copper Hills Project.

Clean Technology Division

The Issuer is currently involved in the following clean technology sectors, Solar Thermal (Hot Water), Energy Retrofits and Recovery and Solar powered Filtered Drinking Water.

The Issuer's involvement in the clean technology sector is indirect through equity holdings in companies that are involved in each respective sector.

The Issuer currently owns an 8.25% equity investment into Pro Eco Energy USA Ltd., a clean tech energy company involved in designing, developing and installing solar energy solutions for commercial and residential customers.

Additionally, the Issuer, as of November 30, 2011, held an 8.56% interest in Global Solar Water Power Systems Inc., (“GSWPS”) a private company beneficially owned by Mark Snyder, our company's Chief Technical Officer. GSWPS owns certain technology invented and developed by Mark Snyder for the design and manufacture of certain water filtration equipment, and is pursuing other clean energy opportunities. Current products offered by GSWPS include a portable solar powered trailer mounted water purification unit that can be delivered and operated nearly anywhere in the world and can provide a village, resort, or remote work-camps with all their drinking water and domestic water requirements.

Reference is made to Item 1. (Business) in the Issuer's Form 10-K (Annual Information Form), filed on SEDAR on November 29, 2011, for disclosure relating to the Issuer's clean technology division.

Existing Documents Incorporated by Reference

Information has been incorporated by reference into this Offering Memorandum from documents listed in the table below, which have been filed with securities regulatory authorities or regulators in Canada. The documents incorporated by reference are available for viewing on the SEDAR website at www.sedar.com. In addition, copies of the documents may be obtained on request without charge from the Issuer, c/o Macdonald Tuskey Corporate and Securities Lawyers, Suite 400-570 Granville Street, Vancouver, BC V6C 3P1 Attention: William L. Macdonald.

Documents listed in the table and information provided in those documents are not incorporated by reference to the extent that their contents are modified or superseded by a statement in this Offering Memorandum or in any other subsequently filed document that is also incorporated by reference in this Offering Memorandum.

Description of Document |

Date of Document and/or SEDAR Filing |

| Interim Financial Statements (Form 10-Q) (includes May 31, 2012 Financial Statements and MD&A) | July 10, 2012 |

| News Release of the Issuer, announcing Mildred Peak and Copper Hills update | June 12, 2012 |

| News Release of the Issuer, Announcing $1,000,000 giveaway | June 7, 2012 |

| News Release of the Issuer, announcing Mildred Peak drilling update | May 24, 2012 |

| News Release of the Issuer, announcing terms of the Offering | May 14, 2012 |

| Material Change Report relating to the dissemination of the Presidents Report | April 23, 2012 |

| Interim Financial Statements (Form 10-Q) (includes February 29, 2012 Financial Statements and MD&A) | April 16, 2012 |

| Material Change Report relating to the closing of a $208,000 first tranche of a equity financing | April 16, 2012 |

| Material Change Report relating to the dissemination of news regarding shareholder votes cast at the recent Annual General Meeting | April 16, 2012 |

| Material Change Report relating to the settlement of debt for equity | April 11, 2012 |

| Notice of Annual General Meeting | April 11, 2012 |

| News Release of the Issuer, Mildred Peak ROFR property to be diamond- drilled | April 4, 2012 |

| Material Change Report relating to annual property payment | March 30, 2012 |

| Material Change Report relating to entry into agreement with Coal Harbor Communications | March 27, 2012 |

| Material Change Report relating to one new Director and two new Advisors | March 19, 2012 |

| Amended Form 10-K (includes August 31, 2011 Financial Statements & MD&A) | March 14, 2012 |

| News Release of the Issuer, announcing terms of the Offering | February10, 2012 |

| News Release of the Issuer, announcing terms of the Director’s Loan | February 9, 2012 |

| News Release, staking of additional claims Copper Hills | February 2, 2012 |

Description of Document |

Date of Document and/or SEDAR Filing |

| Interim Financial Statements (Form 10-Q) (includes November 30, 2011 Financial Statements and MD&A) | January 17, 2012 |

| Annual Information Form (Form 10-K) (includes August 31, 2011 Financial Statements & MD&A) | November 29, 2011 |

| Material Change Report relating to entry into agreement with Trident Financial | November 15, 2011 |

| News Release of the Issuer, Copper Hills 43-101 | November 2, 2011 |

| News Release of the Issuer, Mildred Peak Aquisition | October 11, 2011 |

| Material Change Report relating to Mildred Peak Aquisition | October 11, 2011 |

| Material Change Report relating to entry into agreement with Peter Grandich | October 3, 2011 |

| News Release of the Issuer, IP/Res Survey Copper Hills | September 12, 2011 |

Existing Documents Not Incorporated by Reference

Other documents available on the SEDAR website (for example, most press releases, take-over bid circulars, prospectuses and rights offering circulars) are not incorporated by reference into this Offering Memorandum unless they are specifically referenced in the table above. Your rights as described in Item 11 of this Offering Memorandum apply only in respect of information contained in this Offering Memorandum and documents or information incorporated by reference.

Future Documents Not Incorporated by Reference

Documents filed after the date of this Offering Memorandum are not deemed to be incorporated into this Offering Memorandum. However, if you subscribe for securities and an event occurs, or there is a change in the Issuer's business or affairs, that makes the Certificate to this Offering Memorandum no longer true, the Issuer will provide you with an update of this Offering Memorandum, including a newly dated and signed Certificate, and will not accept your subscription until you have re-signed the subscription agreement.

ITEM 3: INTERESTS OF DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND PRINCIPAL HOLDERS

To the knowledge of the Issuer, the following persons or company beneficially owns, directly or indirectly, or exercises control or direction over, Common Shares carrying more than 10% of the voting rights attached to the outstanding Common Shares of the Issuer.

Name and Address of Beneficial Owner |

Position with the Issuer |

Amount and Nature of Beneficial Ownership |

Percentage of Class |

| Chris Bunka Kelowna, British Columbia, Canada |

Chairman, Director and Chief Executive Officer |

4,238,833(1) |

15.26% |

| Robert McAllister Kelowna, British Columbia, Canada |

President and Director |

3,587,000(2) |

12.92% |

| Bal Bhullar Vancouver, British Columbia, Canada |

Chief Financial Officer |

501,000(3) |

1.82% |

| Mark Snyder San Diego, California, USA |

Chief Technical Officer |

700,000(4) |

2.57% |

| Donald Findlay Calgary, Alberta, Canada |

Director |

202,000(5) |

0.74% |

| Greg Dawson Vancouver, British Columbia, Canada |

Director |

250,000(6) |

0.92% |

| Tom Ihrke Charleston, South Carolina, USA |

Senior Vice President |

290,625(7) |

1.07% |

| John Thomas Vancouver, British Columbia, Canada |

Director |

250,000(8) |

0 92% |

Notes: (1) Consists of beneficial ownership of an aggregate of 4,238,833 shares of common stock of the Issuer broken down as follows: (i) 999,500 shares of common stock held directly by Mr. Bunka, (ii) 705,000 shares of common stock acquirable on exercise of outstanding stock options within 60 days of the date hereof; (iii) 200,000 shares of common stock registered in the name of Kelowna Resource Group Ltd., Mr. Bunka beneficially owns all of the voting shares of Kelowna Resource Group Ltd.; and (iv) 2,334,333 shares of common stock registered in the name of C.A.B. Financial Service Ltd., Mr. Bunka beneficially owns all of the voting shares of C.A.B. Financial Service Ltd.

(2) Consists of beneficial ownership of an aggregate of 3,587,000 shares of common stock of the Issuer broken down as follows: (i) 2,882,000 shares of common stock held directly by Mr. McAllister, and (ii) 705,000 shares of common stock acquirable on exercise of outstanding stock options within 60 days of the date hereof.

(3) Consists of beneficial ownership of an aggregate of 501,000 shares of common stock of the Issuer broken down as follows: (i) 1,000 shares of common stock held directly by Ms. Bal Bhullar, and (ii) 500,000 shares of common stock acquirable on exercise of outstanding stock options within 60 days hereof.

(4) Consists of beneficial ownership of an aggregate of 700,000 shares of common stock of the Issuer broken down as follows: (i) 500,000 shares of common stock held directly by Mr. Mark Snyder; (ii) 200,000 shares of common stock acquirable on exercise of outstanding stock options within 60 days hereof.

(5) Consists of beneficial ownership of an aggregate of 202,000 shares of common stock of the Issuer broken down as follows: (i) 1,000 shares of common stock held directly by Mr. Donald Findlay; (ii) 1,000 shares of common stock acquirable on the exercise of outstanding warrants within 60 days of the date hereof; (iii) 200,000 shares of common stock acquirable on exercise of outstanding stock options within 60 days hereof.

(6) Consists of beneficial ownership of an aggregate of 250,000 shares of common stock of the Issuer broken down as follows: (i) 250,000 shares of common stock acquirable on exercise of outstanding stock options within 60 days hereof.

(7) Consists of beneficial ownership of an aggregate of 290,625 shares of common stock of the Issuer broken down as follows: (i) 140,625 shares of common stock held directly by Mr. Tom Ihrke; and (ii) 150,000 shares of common stock acquirable on the exercise f outstanding stock option within 60 days of the date hereof.

(8) Consists of beneficial ownership of an aggregate of 250,000 shares of common stock of the Issuer broken down as follows: (i) 250,000 shares of common stock acquirable on exercise of outstanding stock options within 60 days hereof.

You can obtain further information about directors and executive officers from the Issuer’s Form 10-K (Annual Information Form) filed on SEDAR on November 29, 2011.

Current information regarding the securities held by directors, executive officers and principal holders can be obtained from the SEDI website at www.sedi.ca and from the U.S. Securities and Exchange Commission’s EDGAR system at www.sec.gov. The Issuer cannot guarantee the accuracy of this information.

Loans

A loan exists in the form of a CDN $50,000 non secured loan bearing 10%, repayable at any time by the Company and currently on a month to month basis. The lender is President and a Director of the Company.

ITEM 4: CAPITAL STRUCTURE

Description of security |

Number authorized to be issued |

Price per security |

Number outstanding as at July 16, 2012 |

Number outstanding after max. offering |

| Common Shares | 200,000,000 | N/A(1) | 27,067,615 | 47,067,615 |

| Offering Warrants(2) | 22,000,000 | US$0.10 – US$0.20 | 0 | 22,000,000 |

| Warrants(3) | 11,442,500 | CDN $0.20 - US$0.30 | 11,442,500 | 11,442,500 |

| Options(4) | 4,225,000 | US$0.10 – US$0.25 | 4,225,000 | 4,225,000 |

| TOTAL | 42,735,115 | 84,735,115 |

Notes:

| (1) |

Common shares of the Issuer have been issued from treasury at prices ranging from US$0.02 per share to US$0.50 per Share. |

| (2) |

Represents the Warrants to be issued under this Offering (including broker warrants), exercisable to acquire common shares at an exercise price of US $0.10 per common share for a |

|

period of twelve months from the date of issuance and at an exercise price of US $0.20 thereafter for a period of 36 months from the date of issuance. | |

| (3) |

Represents an aggregate of 9,218,300 warrants exercisable at the price of CDN $0.20 until March 3, 2013, and an aggregate of 2,224,200 warrants exercisable at the price of US $0.15 until April 16, 2013 and US $0.20 from April 17 until April 16, 2014. |

| (4) |

Represents incentive stock options granted pursuant to the Issuer’s former and current equity compensation and stock option plans. |

ITEM 5: SECURITIES OFFERED

Terms of Securities

The Issuer is offering for sale by way of private placement (the "Offering") up to 20,000,000 units (the "Units"), each Unit to consist of one common share (each, a “Share”) of the Issuer and one Share purchase warrant (each, a “Warrant”). Each Warrant will be exercisable into one further Share (a “Warrant Share”) at a price of US$0.10 per Warrant Share for a period of twelve (12) months following closing; or at a price of US$0.20 per warrant share for a period that is twelve months and one day to thirty-six (36) months following closing.

The holders of common shares are entitled to one vote at meetings of shareholders for each share held and all common shares rank equally with respect to the payment of dividends and on any distribution of the assets of the Issuer on dissolution or winding up.

Reference is also made to Item 7 (Compensation Paid to Sellers and Finders) below for particulars with respect to commissions and finders' fees payable in connection with the Offering.

Subscription Procedure

In order to subscribe for the Units, purchasers will be required to complete and deliver the following documents to the Issuer or its legal counsel on or before August 15 2012, or such other date as the Issuer may determine.

| 1. |

a completed subscription agreement in the form attached hereto as Schedule "A", with such subscription agreement containing, among other things, representations by the subscriber that it is duly authorized to purchase the Units, that it is purchasing the Units for investment and not with a view for resale, and as to its status to purchase the Units on a private placement basis; |

| 2. |

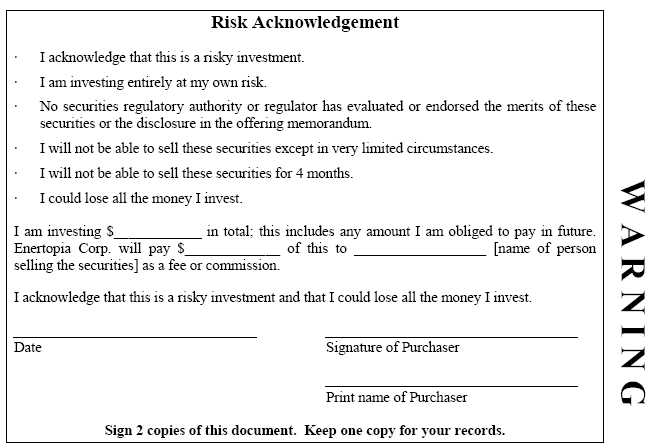

a completed copy of a Risk Acknowledgment (Form 45-106F4) in the form attached hereto as Schedule "B"; and |

| 3. |

cash, solicitor's trust cheque, certified cheque, bank draft, money order in the amount of your investment payable to "Enertopia Corporation". |

Your subscription funds will be held in trust until midnight on the second business day after the day on which the Issuer or its legal counsel received your signed subscription agreement and if the closing is after this time, the Issuer and/or its legal counsel will hold the funds in trust pending closing. We expect to close the first tranche of this Offering on or before August 15 2012.

The Issuer reserves the right to accept or reject subscriptions in whole or in part at its discretion and to close the subscription books at any time without notice. Any subscription funds or subscriptions that the Issuer does not accept will be returned promptly after it has been determined not to accept the funds.

At the closing of the Offering, or as soon as practicable thereafter, you will receive certificates representing the Shares and certificates representing the Warrants, provided that the subscription price has been paid in full.

ITEM 6: INCOME TAX CONSEQUENCES AND RRSP ELIGIBILITY

The Issuer has not undertaken a study of potential income tax consequences to investors.

You should consult your own professional advisers to obtain advice on the income tax consequences that apply to you.

Not all securities are eligible for investment in a registered retirement savings plan (“RRSP”) . You should consult your own professional advisers to obtain advice on the RRSP eligibility of these securities.

ITEM 7: COMPENSATION PAID TO SELLERS AND FINDERS

The Issuer may pay finder's fees to certain arm's length parties (the "Finders") in connection with the completion of the Offering equal to 10% of the aggregate subscription proceeds realized from the sale of the Units by the respective Finder, payable in cash or Shares, and Broker’s Warrants equal to 10% of the aggregate subscription proceeds. Each Broker’s Warrant will be exercisable into one further Share (a “Warrant Share”) at a price of US$0.10 per Warrant Share for a period of twelve (12) months following closing; or at a price of US$0.20 per warrant share for a period of thirty-six (36) months following closing.

ITEM 8: RISK FACTORS

Investment in the Units should only be made after consulting with independent and qualified sources of investment and tax advice. Investment in the Units at this time is highly speculative due to the stage of the Issuer’s development and requirement to raise additional financing to carry out the long-term business objectives of the Issuer. Any investment in the Issuer at this stage involves a high degree of risk.

Reference is made to Item 1A. (Risk Factors) in the Issuer’s Form 10-K/A (Annual Information Form), filed on SEDAR on March 14, 2012, for a discussion of the risks and uncertainties that the Issuer believes to be material.

Additional risk factors relating to the Offering include:

| 1. |

Purchasers of the Units will not have the benefit of a review of this Offering Memorandum by any regulatory authority. |

| 2. |

Purchasers of Units have no individual legal representation in connection with the Offering. Accordingly, purchasers should consult with their own counsel prior to purchasing Units. |

| 3. |

Purchasers of the Units offered hereby will experience an immediate and substantial dilution in the net tangible book value of the Units from the Offering Price of this Offering. |

| 4. |

Purchasers of the Units must be aware of the long-term nature of their investment and be able to bear the economic risks of their investment. The right of any purchaser to sell, transfer, pledge or otherwise dispose of the Shares or the Warrant Shares will be limited by applicable legislation, including a number of resale restrictions, including a restriction on trading. Until the restriction on trading expires, you will not be able to trade the Securities unless you comply with an exemption from prospectus and registration requirements under applicable securities legislation. The restriction on trading may be indefinite depending on the holder's jurisdiction of residence. Consequently, a holder of the Units may not be able to readily liquidate his/her/its investment. Prospective purchasers should be able to afford the entire loss of their investment in the Issuer. |

| 5. |

Publicly quoted securities are subject to a relatively high degree of price volatility. It may be anticipated that the quoted market for the Shares of the Issuer will be subject to market trends generally, notwithstanding any potential success of the Issuer in creating revenue. |

| 6. |

Shareholders of the Issuer may be unable to sell significant quantities of Shares into the public trading markets without a significant reduction in the price of their Shares, if at all. There can be no assurance that the Issuer will continue to meet the listing requirements of the Canadian National Stock Exchange, the Over-The-Counter Bulletin Board or achieve listing on any other public listing exchange. |

ITEM 9: REPORTING OBLIGATIONS

Other than notices of annual and special meetings of the shareholders, and related information circulars, form of proxies, and financial statement request forms, the Issuer does not provide documents to its shareholders on an annual or ongoing basis.

The Issuer is a reporting issuer (or equivalent) in British Columbia, Ontario and in the United States. You can obtain corporate and securities information about the Issuer from the SEDAR website at www.sedar.com, the SEDI website at www.sedi.ca, and from the U.S. Securities and Exchange Commission's EDGAR system at www.sec.gov. The Issuer cannot guarantee the accuracy of this information. Additionally, you can obtain quotations for the Issuer's shares of common stock, under the symbol TOP, from the Canadian National Stock Exchange and/or under the symbol ENRT, from OTC Markets at www.otcmarkets.com.

ITEM 10: RESALE RESTRICTIONS

Canadian Resale Restrictions

These securities will be subject to a number of resale restrictions, including a restriction on trading. Until the restriction on trading expires, you will not be able to trade the securities unless you comply with an exemption from the prospectus and registration requirements under securities legislation.

Unless permitted under securities legislation, you cannot trade the securities before the date that is 4 months and a day after the distribution date.

United States Resale Restrictions

The Shares and Warrants to be issued to security holders will not be registered under the U.S. Securities Act or applicable state securities laws. Such securities will be issued in reliance upon the exemption from registration provided by Regulation S of the U.S. Securities Act and pursuant to exemptions from applicable state securities laws.

Likewise, the Warrant Shares will not be registered under the U.S. Securities Act or applicable states securities laws, and accordingly may not be issued to U.S. Persons or persons in the United States, unless an exemption from registration under the U.S. Securities Act and applicable states securities laws is available.

In addition, the Shares, the Warrants and the Warrant Shares issuable upon the exercise of the Warrants will be "restricted securities" within the meaning of Rule 144 under the U.S. Securities Act, certificates representing such securities will bear a legend to that effect, and such securities may be resold only pursuant to an exemption from the registration requirements of the U.S. Securities Act and all applicable state securities laws. Subject to certain limitations, such securities may be resold outside the United States without registration under the U.S. Securities Act pursuant to Regulation S under the U.S. Securities Act.

Moreover, the Warrants may be exercised only pursuant to an exemption from the registration requirements of the U.S. Securities Act and applicable state securities laws. As a result, the Warrants may only be exercised by a holder who represents that, at the time of exercise, the holder is not then located in the United States, is not a "U.S. person", as defined in Rule 902 of Regulation S under the U.S. Securities Act (a "U.S. Person"), and is not exercising the Warrants for the account or benefit of a U.S. Person or a person in the United States, unless the holder provides a legal opinion or other evidence reasonably satisfactory to the Company to the effect that the exercise of the Warrants does not require registration under the U.S. Securities Act or applicable state securities laws, or any other such documents that the Company may deem necessary.

The foregoing discussion is only a general overview of certain requirements of United States securities laws applicable to the securities received upon completion of the Private Placement. All holders of such securities are urged to consult with counsel to ensure that the resale of their securities complies with applicable securities legislation.

ITEM 11: PURCHASERS' RIGHTS

If you purchase these securities you will have certain rights, some of which are described below. For information about your rights you should consult a lawyer.

Two-Day Cancellation Right

You can cancel your agreement to purchase these securities. To do so, you must send a notice to the Issuer by midnight on the 2nd business day after you sign the subscription agreement to buy the securities.

Statutory Rights of Action in the Event of a Misrepresentation

If there is a misrepresentation in this Offering Memorandum, you have a statutory right to sue:

| (a) |

the Issuer to cancel your agreement to buy these securities, or |

| (b) |

for damages against the Issuer, every person who was a director of the Issuer at the date of this Offering Memorandum, and every other person who signed this Offering Memorandum. |

This statutory right to sue is available to you whether or not you relied on the misrepresentation. However, there are various defences available to the persons or companies that you have a right to sue. In particular, they have a defence if you knew of the misrepresentation when you purchased the securities.

If you intend to rely on the rights described in (a) or (b) above, you must do so within strict time limitations. You must commence your action to cancel the agreement within180 days after you signed the subscription agreement to purchase the securities. You must commence your action for damages within the earlier of 180 days after learning of the misrepresentation and three years after you signed the subscription agreement to purchase the securities.

ITEM 12: DATE AND CERTIFICATE

Dated this 16th day of July, 2012.

This Offering Memorandum does not contain a misrepresentation.

ENERTOPIA CORP.

| Robert McAllister | Bal Bhullar | |

| President | Chief Financial Officer | |

| ON BEHALF OF THE BOARD OF DIRECTORS | ||

| Chris Bunka | Donald Findlay | |

| Director, Promoter | Director | |

| Greg Dawson | John Thomas | |

| Director | Director |

Form 45-106F4

You have 2 business days to cancel your purchase. To do so, send a notice to Enertopia Corporation stating that you want to cancel your purchase. You must send the notice before midnight on the 2nd business day after you sign the agreement to purchase the securities. You can send the notice by fax or email or deliver it in person to Enertopia Corporation at its business address. Keep a copy of the notice for your records.

Issuer Name and Address:

Enertopia Corporation.

Suite 950 1150 West Pender

Vancouver, British Columbia

Canada, V6E 4A4

Phone: 604-602-1675

Fax: 604-685-1602

E-mail: bbspa@hotmail.com

You are buying Exempt Market Securities

They are called exempt market securities because two parts of securities law do not apply to them. If an issuer wants to sell exempt market securities to you:

-

the issuer does not have to give you a prospectus (a document that describes the investment in detail and gives you some legal protections), and

-

the securities do not have to be sold by an investment dealer registered with a securities regulatory authority or regulator.

There are restrictions on your ability to resell exempt market securities. Exempt market securities are more risky than other securities.

You will receive an offering memorandum. Read the offering memorandum carefully because it has important information about the issuer and its securities. Keep the offering memorandum because you have rights based on it. Talk to a lawyer for details about these rights.

For more information on the exempt market, call your local securities regulatory authority or regulator.

British Columbia Securities Commission

P.O. Box

10142, Pacific Centre

701 West Georgia Street

Vancouver, British

Columbia V7Y 1L2

Telephone: (604) 899-6500

Toll free in British Columbia

and Alberta 1-800-373-6393

Facsimile: (604) 899-6506

Alberta Securities Commission

4th Floor, 300 – 5th

Avenue SW

Calgary, Alberta T2P 3C4

Telephone: (403) 297-6454

Facsimile: (403) 297-6156