Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the fiscal year ended August 31, 2012

|

||

|

OR

|

||

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the transition period from to

Commission file number: 000-53482

TEXAS RARE EARTH RESOURCES CORP.

(Exact Name of Registrant as Specified in its Charter)

|

Delaware

|

87-0294969

|

|

(State of other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

539 El Paso Avenue

|

|

|

Sierra Blanca, Texas

|

79851

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

(915) 369-2133

(Registrant’s Telephone Number, including Area Code)

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT: None

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: Common Stock, par value $0.01

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d)

of the Act. Yes o Nox

Indicate by checkmark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by checkmark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to the Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

Large Accelerated Filer o Accelerated Filer o Non-Accelerated Filer o Smaller Reporting Company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o Nox

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: As of February 28, 2012 the aggregate market value of the registrant’s voting common stock held by non-affiliates of the registrant was $21,250,572 based upon the closing sale price of the common stock as reported by the OTCQX Premier.

The number of shares of the Registrant’s common stock outstanding as of November 1, 2012 was 36,550,009

DOCUMENTS INCORPORATED BY REFERENCE

Portions of our Definitive Proxy Statement to be filed with the Securities and Exchange Commission pursuant to Regulation 14A in connection with the 2012 Annual General Meeting of Shareholders are incorporated by reference to Part III of this Annual Report on Form 10-K.

TABLE OF CONTENTS

|

Page

|

||

|

Glossary of Terms

|

4

|

|

|

Cautionary Notice Regarding Forward-Looking Statements

|

6

|

|

|

Part I

|

||

|

Item 1

|

Business

|

7

|

|

Item 1A

|

Risk Factors

|

13

|

|

Item 1B

|

Unresolved Staff Comments

|

23

|

|

Item 2

|

Properties

|

23

|

|

Item 3

|

Legal Proceedings

|

28

|

|

Item 4

|

Mine Safety Disclosure

|

28

|

|

Part II

|

||

|

Item 5

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

28

|

|

Item 6

|

Selected Financial Data

|

29

|

|

Item 7

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

29

|

|

Item 7A

|

Quantitative and Qualitative Disclosures About Market Risk

|

35

|

|

Item 8

|

Financial Statements and Supplementary Data

|

F-1

|

|

Item 9

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

|

36

|

|

Item 9A

|

Controls and Procedures

|

36

|

|

Item 9B

|

Other Information

|

36

|

|

Part III

|

||

|

Item 10

|

Directors, Executive Officers and Corporate Governance

|

36

|

|

Item 11

|

Executive Compensation

|

36

|

|

Item 12

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

36

|

|

Item 13

|

Certain Relationships and Related Transactions and Director Independence

|

37

|

|

Item 14

|

Principal Accountant Fees and Services

|

37

|

|

Item 15

|

Exhibits, Financial Statement Schedules

|

37

|

|

Signatures

|

39

|

|

PRELIMINARY NOTES

As used in this Annual Report on Form 10-K (“Annual Report”), references to “Texas Rare Earth”, “the Company,” “we,” “our,” or “us” mean Texas Rare Earth Resources Corp. and its predecessors, as the context requires.

|

GLOSSARY OF TERMS

|

|

|

Alteration

|

Any physical or chemical change in a rock or mineral subsequent to its formation.

|

|

Breccia

|

A rock in which angular fragments are surrounded by a mass of fine-grained minerals.

|

|

Concession

|

A grant of a tract of land made by a government or other controlling authority in return for stipulated services or a promise that the land will be used for a specific purpose.

|

|

Core

|

The long cylindrical piece of a rock, about an inch in diameter, brought to the surface by diamond drilling.

|

|

Diamond drilling

|

A drilling method in which the cutting is done by abrasion using diamonds embedded in a matrix rather than by percussion. The drill cuts a core of rock, which is recovered in long cylindrical sections.

|

|

Drift

|

A horizontal underground opening that follows along the length of a vein or rock formation as opposed to a cross-cut which crosses the rock formation.

|

|

Exploration

|

Work involved in searching for ore, usually by drilling or driving a drift.

|

|

Exploration expenditures

|

Costs incurred in identifying areas that may warrant examination and in examining specific areas that are considered to have prospects that may contain mineral deposit reserves.

|

|

Grade

|

The average assay of a ton of ore, reflecting metal content.

|

|

Host rock

|

The rock surrounding an ore deposit.

|

|

Intrusive

|

A body of igneous rock formed by the consolidation of magma intruded into other rocks, in contrast to lavas, which are extruded upon the surface.

|

|

Lode

|

A mineral deposit in solid rock.

|

|

Ore

|

The naturally occurring material from which a mineral or minerals of economic value can be extracted profitably or to satisfy social or political objectives. The term is generally but not always used to refer to metalliferous material, and is often modified by the names of the valuable constituent; e.g., iron ore.

|

|

Ore body

|

A continuous, well-defined mass of material of sufficient ore content to make extraction economically feasible.

|

|

Mine development

|

The work carried out for the purpose of opening up a mineral deposit and making the actual ore extraction possible.

|

|

Mineral

|

A naturally occurring homogeneous substance having definite physical properties and chemical composition, and if formed under favorable conditions, a definite crystal forms.

|

|

Mineralization

|

The presence of minerals in a specific area or geological formation.

|

-4-

|

Mineral reserve

|

That part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. Reserves are customarily stated in terms of “Ore” when dealing with metalliferous minerals.

|

|

Probable (Indicated) reserves

|

Reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling, and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven (measured) reserves, is high enough to assume continuity between points of observation.

|

|

Prospect

Proven (Measured) reserves

|

A mining property, the value of which has not been determined by exploration.

Reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well-established.

|

|

Tonne

|

A metric ton which is equivalent to 2,200 pounds.

|

|

Trend

|

A general term for the direction or bearing of the outcrop of a geological feature of any dimension, such as a layer, vein, ore body, or fold.

|

|

Unpatented mining claim

|

A parcel of property located on federal lands pursuant to the General Mining Law and the requirements of the state in which the unpatented claim is located, the paramount title of which remains with the federal government. The holder of a valid, unpatented lode-mining claim is granted certain rights including the right to explore and mine such claim.

|

|

Vein

|

A mineralized zone having a more or less regular development in length, width, and depth, which clearly separates it from neighboring rock.

|

-5-

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report contains “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 (collectively, “forward-looking statements”). Such forward-looking statements concern our anticipated results and developments in our operations in future periods, planned exploration and development of its properties, plans related to its business and other matters that may occur in the future. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management.

Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects” or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “estimates” or “intends”, or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements in this prospectus include, but are not limited to:

|

·

|

the progress, potential and uncertainties of our 2012-2013 rare-earth exploration program at our Round Top Project (the “Round Top Project”);

|

|

·

|

the success of getting the necessary permits for future drill programs and future project exploration;

|

|

·

|

expectations regarding the ability to raise capital and to continue our exploration plans on its properties; and

|

|

·

|

plans regarding anticipated expenditures at the Round Top Project.

|

Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results to differ from those expressed or implied by the forward-looking statements, including, without limitation:

|

·

|

risks associated with our history of losses and need for additional financing;

|

|

·

|

risks associated with our limited operating history;

|

|

·

|

risks associated with our properties all being in the exploration stage;

|

|

·

|

risks associated with our lack of history in producing metals from our properties;

|

|

·

|

risks associated with a shortage of equipment and supplies;

|

|

·

|

risks associated with our need for additional financing to develop a producing mine, if warranted;

|

|

·

|

risks associated with our exploration activities not being commercially successful;

|

|

·

|

risks associated with ownership of surface rights at our Round Top Project;

|

|

·

|

risks associated with increased costs affecting our financial condition;

|

|

·

|

risks associated with a shortage of equipment and supplies adversely affecting our ability to operate;

|

|

·

|

risks associated with mining and mineral exploration being inherently dangerous;

|

|

·

|

risks associated with mineralization estimates;

|

|

·

|

risks associated with changes in mineralization estimates affecting the economic viability of our properties;

|

|

·

|

risks associated with uninsured risks;

|

|

·

|

risks associated with mineral operations being subject to market forces beyond our control;

|

|

·

|

risks associated with fluctuations in commodity prices;

|

|

·

|

risks associated with permitting, licenses and approval processes;

|

|

·

|

risks associated with the governmental and environmental regulations;

|

|

·

|

risks associated with future legislation regarding the mining industry and climate change;

|

|

·

|

risks associated with potential environmental lawsuits;

|

|

·

|

risks associated with our land reclamation requirements;

|

|

·

|

risks associated with rare earth and beryllium mining presenting potential health risks;

|

|

·

|

risks related to title in our properties

|

|

·

|

risks related to competition in the mining and rare earth elements industries;

|

|

·

|

risks related to economic conditions;

|

|

·

|

risks related to our ability to manage growth;

|

|

·

|

risks related to the potential difficulty of attracting and retaining qualified personnel;

|

|

·

|

risks related to our dependence on key personnel;

|

|

·

|

risks related to our United States Securities and Exchange Commission (the “SEC”) filing history; and

|

|

·

|

risks related to our securities.

|

This list is not exhaustive of the factors that may affect our forward-looking statements. Some of the important risks and uncertainties that could affect forward-looking statements are described further under the section headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this prospectus. Although we have attempted to identify important factors that could cause actual results to differ materially from those described in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, believed, estimated or expected. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. Except as required by law, we disclaim any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. We qualify all the forward-looking statements contained in this Annual Report by the foregoing cautionary statements.

-6-

PART I

ITEM 1. BUSINESS

Corporate Organization and History

We were incorporated in the State of Nevada in 1970 as Standard Silver Corporation. In July 2004, our Articles of Incorporation were amended and restated to increase the number of shares of common stock to 25,000,000, and in March 2007, we effected a 1 for 2 reverse stock split. In September 2008, we amended and restated our Articles of Incorporation to: (i) increase of the number of shares of common stock from 25,000,000 to 100,000,000; and to (ii) authorize an additional 10,000,000 shares of preferred stock, to be issued at management’s discretion. In September 2010, we amended our Amended and Restated Articles of Incorporation to change our name from Standard Silver Corporation to Texas Rare Earth Resources Corp.

On August 24, 2012, we changed our state of incorporation from the State of Nevada to the State of Delaware (the “Reincorporation”) pursuant to a plan of conversion dated August 24, 2012. The Reincorporation was previously submitted to a vote of, and approved by, our stockholders at a special meeting of the stockholders held on April 25, 2012.

Our common stock is traded on the OTCQX U.S. operated by OTC Markets Group Inc. under the symbol “TRER.” The market for our common stock on the OTCQX U.S. is extremely limited, sporadic and highly volatile.

Our fiscal year-end is August 31.

Narrative Description of Business

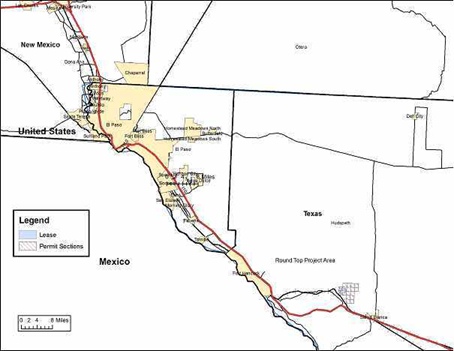

We are a mining company engaged in the business of the acquisition, exploration and development of mineral properties. We currently hold two nineteen year leases, executed in September 2011 and November 2011 respectively, to explore and develop a 950 acre rare earths project located in Hudspeth County, Texas known as the Round Top Project. We are also prospecting permits covering 9,345 acres adjacent to the Round Top Project. We also own unpatented mining claims in New Mexico. Our principal focus is on developing a metallurgical process to concentrate or otherwise extract the metals from the Round Top rhyolite, although we will continue to examine other opportunities in the region as they develop. We currently have limited operations and have not established that any of our projects or properties contain any proven or probable reserves under SEC Industry Guide 7 (“Guide 7”).

On November 8, 2011, we announced that our supplementary operating plan to expand exploration activities at our Round Top Project had been approved by the Texas General Land Office (GLO); the expanded development and exploration drill plan called for an additional 40 drill holes and 4 diamond core holes for an estimated planned drilled footage of 20,000 feet. The program included 4,000 feet of Core drilling to establish a high level of confidence in the resource, provide physical engineering data and additional metallurgical sample.

On March 20, 2012, we submitted for approval an updated plan of operations. The updated plan of operations consisted of the reclassification of the drilling program through the Feasibility Study into three phases. Phase 1 consists of 25 drill locations, phase 2 consists of 41 drill locations and phase 3 consists of 27 drill locations all located on the Round Top Project. The plan of operations also included two locations for 100 ton bulk sample collection for additional metallurgical tests. We have suspended this phase of physical exploration and development at the Round Top Project pending development of a metallurgical process to extract the potentially marketable metals.

In addition to the Round Top Project, we also own title to 12 unpatented mining claims, the Macho group, comprising 240 acres covering the Old Dude Mine, located in Sierra County, New Mexico. The Old Dude Mine has a production history of silver, lead, zinc and gold dating from the 1890s. We also own another 18 unpatented mining claims and fractional claims, the HA group, comprising 274 acres covering an andesite hosted vein system similar to and 10 miles to the southwest of the Macho District. These claims surround another historic producer, the Graphic Mine. The geologic setting at the HA property is the same as the Macho. We do not intend to schedule any physical exploration such as drilling or geophysics at these properties but will actively seek joint development or sale of them.

On June 22, 2012, we filed our Preliminary Economic Assessment for our Round Top Project, entitled “NI 43-101 Preliminary Economic Assessment Round Top Project, Sierra Blanca, Texas,” dated June 22, 2012, effective as of May 15, 2012 (the “Report”), with securities regulatory authorities in Canada. On June 26, 2012, the Report was furnished to, not filed with, the SEC on a current report on Form 8-K to satisfy our “public disclosure” obligations under Regulation FD of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Cautionary Note to Investors: The mineral estimates in the Preliminary Economic Assessment have been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of the securities laws of the United States. The terms “mineral reserve”, “proven mineral reserve” and “probable mineral reserve” are Canadian mining terms as defined in accordance with Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) - CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended. These definitions differ from the definitions in SEC Industry Guide 7 under the United States Securities Act of 1933, as amended (the “Securities Act”). Under Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority. In addition, the terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC Industry Guide 7 standards as in place tonnage and grade without reference to unit measures. Accordingly, information in the Preliminary Economic Assessment contains descriptions of our mineral deposits that may not be comparable to similar information made public by United States companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder. Our Round Top Project as described in the Preliminary Economic Assessment currently does not contain any known proven or probable ore reserves under SEC Industry Guide 7 reporting standards. U.S. investors are urged to consider closely the disclosure in the Registrant’s latest reports and registration statements filed with the SEC. You can review and obtain copies of these filings at http://www.sec.gov/edgar.shtml.

-7-

U.S. Investors are cautioned not to assume that any defined resources in these categories will ever be converted into SEC Guide 7 compliant reserves.

On October 3, 2012, our management released updated economic projections related to various revisions to the proposed mine plan presented in the Preliminary Economic Assessment.

Current and Planned Exploration Activities

In April 2011, the Texas General Land Office approved our operation plan for the Round Top Project. The plan calls for the completion of approximately 50 drill holes totaling at least 12,000 feet of reverse circulation drilling. We began exploratory drilling on the 50 drill whole sites in July 2011. We expect the drill program to span the next three to six months while concurrent testing activities will be ongoing.

On November 8, 2011, we announced that our supplementary operating plan to expand exploration activities at our Round Top Project had been approved by the Texas General Land Office (GLO); the expanded development and exploration drill plan now calls for an additional 40 drill holes and 4 diamond core holes for an estimated planned drilled footage of 20,000 feet. The program included 4,000 feet of Core drilling to establish a high level of confidence in the resource, to provide physical engineering data and to provide an additional metallurgical sample.

On March 20, 2012, we submitted for approval an updated plan of operations. The updated plan of operations consisted of the reclassification of the drilling program through the Feasibility Study into three phases. Phase 1 consists of 25 drill locations, phase 2 consists of 41 drill locations and phase 3 consists of 27 drill locations all located on the Round Top Project. The plan of operations also included two locations for 100 ton bulk sample collection for additional metallurgical tests.

Drilling on the Round Top Project was planned to twin certain of the historic drill holes, infill drill between existing holes and step out drill beyond the known area to better define the margins of the deposit. Coverage is planned to be adequate to begin block modeling of the deposit. A geologic model of the Round Top Project was developed by TRER and Gustavson as of March 20, 2012 and provided the basis for the PEA that was issued in Q2 2012. We have designated the sites for several holes on the adjacent Little Round Top Mountain, and several additional holes are planned to test the deeper potential. This drilling was expected to produce at least 150 tonnes of sample, all of which were to be stored and used for metallurgical testing.

We have suspended this phase of physical exploration and development at the Round Top Project pending development of a metallurgical process to extract the potentially marketable metals.

As announced on October 3, 2012, we intend to engage our independent experts to prepare twin updated studies on the project, including refinements to the Preliminary Economic Assessment 80,000 tonnes per day mine plan and a smaller “enhanced vat acid leach” at a staged ramp-up from 10,000 tonnes per day. While such a “twin study” may be presented as one document, it may include many dozens of refinements, new ideas, empirical tests or scientific experiments as we expect to challenge and retest many more items than the eleven changes discussed earlier to the 80,000 tonne per day economic model that we call a “first pass.” We estimate our independent experts will require a similar time frame to prepare an updated study of up to one year.

-8-

Trends – Rare-Earth Market

Rare earth elements (or “REEs”) are a group of chemically similar elements that usually are found together in nature; they are referred to as the “lanthanide series.” These individual elements have a variety of characteristics that are important in a wide range of technologies, products, and applications and are critical inputs in existing and emerging applications including: computer hard drives, cell phones, clean energy technologies, such as hybrid and electric vehicles and wind power turbines; multiple high-tech uses, including fiber optics, lasers and hard disk drives; numerous defense applications, such as guidance and control systems and global positioning systems; and advanced water treatment technology for use in industrial, military and outdoor recreation applications. As a result, global demand for REE is projected to steadily increase due to continuing growth in existing applications and increased innovation and development of new end uses. Interest in developing resources domestically has become a strategic necessity as there is limited production of these elements outside of China. Our ability to raise additional funds in order to complete our plan of development at the Round Top Project may be impacted by future prices for REEs.

Sources and Availability of Raw Materials

We are currently in the exploration stage and as such we do not require any significant raw materials in order to carry out our primary operating activities. Our primary operating objective is to explore and develop the Round Top Project. For at least the next year, we expect to continue to require the use of contract drilling services in order to obtain additional geological information. In the past year we have been able to secure contract drilling services without excessive delay and costs. We except the contract drilling services will continue to be available over the next year.

The raw materials that our current operations rely on are gasoline and diesel fuel for the exploration vehicles and for the heavy equipment required to build roads and conduct drilling operations. Water is provided per service contract by Eagle Mountain Gang which is used for the drilling operations.

Seasonality

Seasonality in the State of Texas is not a material factor to our operations for our project.

Competition

The mining industry is highly competitive. We will be competing with numerous companies, substantially all with greater financial resources available to them. We therefore will be at a significant disadvantage in the course of acquiring mining properties and obtaining materials, supplies, labor, and equipment. Additionally, we are and will continue to be an insignificant participant in the business of exploration and mineral property development. A large number of established and well-financed companies are active in the mining industry and will have an advantage over us if they are competing for the same properties. Nearly all such entities have greater financial resources, technical expertise and managerial capabilities than ourselves and, consequently, we will be at a competitive disadvantage in identifying possible mining properties and procuring the same.

China accounts for the vast majority of rare earth element production. While rare earth element projects exist outside of China, very few are in actual production. Further, given the timeline for current exploration projects to come into production, if at all, it is likely that the Chinese will be able to dominate the market for rare earth elements into the future. This gives the Chinese a competitive advantage in controlling the supply of rare earth elements and engaging in competitive price reductions to discourage competition. Any increase in the amount of rare earth elements exported from other nations, and increased competition, may result in price reductions, reduced margins and loss of potential market share, any of which could materially adversely affect our profitability. As a result of these factors, we may not be able to compete effectively against current and future competitors.

Government Approvals

The exploration, drilling and mining industries operate in a legal environment that requires permits to conduct virtually all operations. Thus permits are required by local, state and federal government agencies. Local authorities, usually counties, also have control over mining activity. The various permits address such issues as prospecting, development, production, labor standards, taxes, occupational health and safety, toxic substances, air quality, water use, water discharge, water quality, noise, dust, wildlife impacts, as well as other environmental and socioeconomic issues.

Prior to receiving the necessary permits to explore or mine, the operator must comply with all regulatory requirements imposed by all governmental authorities having jurisdiction over the project area. Very often, in order to obtain the requisite permits, the operator must have its land reclamation, restoration or replacement plans pre-approved. Specifically, the operator must present its plan as to how it intends to restore or replace the affected area. Often all or any of these requirements can cause delays or involve costly studies or alterations of the proposed activity or time frame of operations, in order to mitigate impacts. All of these factors make it more difficult and costly to operate and have a negative and sometimes fatal impact on the viability of the exploration or mining operation. Finally, it is possible that future changes in these laws or regulations could have a significant impact on our business, causing those activities to be economically reevaluated at that time.

-9-

Effect of Existing or Probable Government and Environmental Regulations

Mineral exploration, including mining operations are subject to governmental regulation. Our operations may be affected in varying degrees by government regulation such as restrictions on production, price controls, tax increases, expropriation of property, environmental and pollution controls or changes in conditions under which minerals may be marketed. An excess supply of certain minerals may exist from time to time due to lack of markets, restrictions on exports, and numerous factors beyond our control. These factors include market fluctuations and government regulations relating to prices, taxes, royalties, allowable production and importing and exporting minerals. The effect of these factors cannot be accurately determined, and we are not aware of any probable government regulations that would impact the Company. This section is intended as a brief overview of the laws and regulations described herein and is not intended to be a comprehensive treatment of the subject matter.

Overview. Like all other mining companies doing business in the United States, we are subject to a variety of federal, state and local statutes, rules and regulations designed to protect the quality of the air and water, and threatened or endangered species, in the vicinity of its operations. These include “permitting” or pre-operating approval requirements designed to ensure the environmental integrity of a proposed mining facility, operating requirements designed to mitigate the effects of discharges into the environment during exploration, mining operations, and reclamation or post-operation requirements designed to remediate the lands affected by a mining facility once commercial mining operations have ceased.

Federal legislation in the United States and implementing regulations adopted and administered by the Environmental Protection Agency, the Forest Service, the Bureau of Land Management, the Fish and Wildlife Service, the Army Corps of Engineers and other agencies—in particular, legislation such as the federal Clean Water Act, the Clean Air Act, the National Environmental Policy Act, the Endangered Species Act, the National Forest Management Act, the Wilderness Act, and the Comprehensive Environmental Response, Compensation and Liability Act—have a direct bearing on domestic mining operations. These federal initiatives are often administered and enforced through state agencies operating under parallel state statutes and regulations.

The Clean Water Act. The federal Clean Water Act is the principal federal environmental protection law regulating mining operations in the United States as it pertains to water quality.

At the state level, water quality is regulated by the Environment Department, Water and Waste Management Division under the Water Quality Act (state). If our exploration or any future development activities might affect a ground water aquifer, it will have to apply for a Ground Water Discharge Permit from the Ground Water Quality Bureau in compliance with the Groundwater Regulations. If exploration affects surface water, then compliance with the Surface Water Regulations is required.

The Clean Air Act. The federal Clean Air Act establishes ambient air quality standards, limits the discharges of new sources and hazardous air pollutants and establishes a federal air quality permitting program for such discharges. Hazardous materials are defined in the federal Clean Air Act and enabling regulations adopted under the federal Clean Air Act to include various metals. The federal Clean Air Act also imposes limitations on the level of particulate matter generated from mining operations.

National Environmental Policy Act (NEPA). NEPA requires all governmental agencies to consider the impact on the human environment of major federal actions as therein defined.

Endangered Species Act (ESA). The ESA requires federal agencies to ensure that any action authorized, funded or carried out by such agency is not likely to jeopardize the continued existence of any endangered or threatened species or result in the destruction or adverse modification of their critical habitat. In order to facilitate the conservation of imperiled species, the ESA establishes an interagency consultation process. When a federal agency proposes an action that “may affect” a listed species, it must consult with the USFWS and must prepare a “biological assessment” of the effects of a major construction activity if the USFWS advises that a threatened species may be present in the area of the activity.

National Forest Management Act. The National Forest Management Act, as implemented through title 36 of the Code of Federal Regulations, provides a planning framework for lands and resource management of the National Forests. The planning framework seeks to manage the National Forest System resources in a combination that best serves the public interest without impairment of the productivity of the land, consistent with the Multiple Use Sustained Yield Act of 1960.

Wilderness Act. The Wilderness Act of 1964 created a National Wilderness Preservation System composed of federally owned areas designated by Congress as “wilderness areas” to be preserved for future use and enjoyment.

The Comprehensive Environmental Response, Compensation and Liability Act (CERCLA). CERCLA imposes clean-up and reclamation responsibilities with respect to discharges into the environment, and establishes significant criminal and civil penalties against those persons who are primarily responsible for such discharges.

The Resource Conservation and Recovery Act (RCRA). RCRA was designed and implemented to regulate the disposal of solid and hazardous wastes. It restricts solid waste disposal practices and the management, reuse or recovery of solid wastes and imposes substantial additional requirements on the subcategory of solid wastes that are determined to be hazardous. Like the Clean Water Act, RCRA provides for citizens’ suits to enforce the provisions of the law.

-10-

National Historic Preservation Act. The National Historic Preservation Act was designed and implemented to protect historic and cultural properties. Compliance with the Act is necessary where federal properties or federal actions are undertaken, such as mineral exploration on federal land, which may impact historic or traditional cultural properties, including native or Indian cultural sites.

In the fiscal year ended August 31, 2012, we incurred minimal costs in complying with environmental laws and regulations in relation to our operating activities. Costs in the fiscal year ended August 31, 2013 will be substantially similar, but slightly lower due to our anticipated decreased drilling activities at our Round Top Project.

Employees

Including our executive officers, we currently have three employees. We also retain qualified technical contractors through a third party administrator and utilize the services of qualified consultants with geological and mineralogical expertise.

Recent Corporate Developments

On October 27, 2011, we announced favorable results of our Phase I metallurgical testing and characterization that reconfirmed that the rare earth minerals are finely disseminated throughout the rhyolite host rock at our Round Top Project.

On November 8, 2011, we announced that our supplementary operating plan to expand exploration activities at our Round Top Project had been approved by the Texas General Land Office (GLO); the expanded development and exploration drill plan now calls for an additional 40 drill holes and 4 diamond core holes for an estimated planned drilled footage of 20,000 feet.

On November 10, 2011, we announced that Gustavson Associates, LLC, a subsidiary of Walsh Environmental Scientists and Engineers and its parent company, Ecology and Environment, Inc. (NASDAQ: EEI) had been contracted to perform the scoping study at the Round Top Project.

On December 31, 2011, Daniel Gorski retired as Chief Operating Officer of the Company.

On February 1, 2012, we entered into a Director Appointment Agreement, effective January 25, 2012 , with Highline Capital Partners, L.P. and several of its affiliates pursuant to which we granted Highline Capital the right to instruct our board of directors to appoint one nominee to our board of directors during the term of the agreement. That agreement has now expired pursuant to its terms without Highline exercising its right to appoint a director.

On February 12, 2012, our common stock began trading on the OTCQX U.S. Premier, the most prestigious tier of the over-the-counter marketplace for broker-dealers operated by OTC Markets Group Inc., under the symbol “TRER”.

On February 15, 2012, our stockholders approved an increase to the number of shares of common stock available under our Amended and Restated 2008 Stock Option Plan.

On March 29, 2012, we entered into an amended 19 year mining lease agreement (M-11317) with the GLO, thereby removing Restrictions on Development with the exception of No Hunting.

On May 16, 2012, we received a notice from OTC Markets, Inc. regarding its determination that the bid price of our shares of common stock, as quoted on the OTCQX U.S. Premier, has closed below $1.00 for more than 30 consecutive trading days and no longer met the Standards for Continued Qualification for the OTCQX U.S. Premier tier. Pursuant to Section 3.2(c) of the OTCQX Rules for U.S. Companies, we had a 180 calendar day grace period to regain compliance. Compliance can be regained by having the minimum bid price of our shares of common stock at the close of business be at least $1.00 for ten consecutive trading days. As of November 8, 2012, we had not regained compliance and as a result the quotations for our shares of common stock moved from the OTCQX U.S. Premier to the OTCQX U.S. for continued quotation.

On June 12, 2012, three of our shareholders filed a Schedule 13D with the SEC to act together to explore their options concerning proposing and voting as a group on candidates for our board of directors, including potentially for the purpose of changing control of the Company.

On June 12, 2012, we announced that since March of 2012, the Corporate Governance and Nominating Committee (the “Committee”) of our board of directors (the “Board”), which is composed entirely of independent directors, with the assistance of independent special counsel to the Committee, has been conducting an internal review and investigation of certain matters of corporate governance and compliance with federal securities laws (the “Internal Review”). As a result of the recent report of the independent counsel on such counsel’s findings of the Internal Review and a further review of the recommendations of independent counsel by the Committee and the Board, at the direction of the Board, the Company contacted the SEC on June 8, 2012, to report our findings.

On June 13, 2012, we announced that effective June 7, 2012, Mr. Anthony Marchese had stepped down as our non-executive Chairman of the Board, and that effective June 8, 2012, the Board has appointed Mr. James Graham, an independent director of the board of directors, as interim non-executive Chairman of the Board, to run our board of directors operations while the board of directors searches for a permanent non-executive Chairman of the Board. On June 15, 2012, we issued a press release regarding the results of our Preliminary Economic Assessment.

-11-

On June 22, 2012, we filed our Preliminary Economic Assessment for our Round Top Project, entitled “NI 43-101 Preliminary Economic Assessment Round Top Project, Sierra Blanca, Texas,” dated June 22, 2012, effective as of May 15, 2012 (the “Report”), with securities regulatory authorities in Canada. On June 26, 2012, the Report was furnished to, not filed with, the SEC on a current report on Form 8-K to satisfy our “public disclosure” obligations under Regulation FD of the Exchange Act.

On July 5, 2012, the three shareholders who had filed a Schedule 13D on June 12, 2012 ( “Gorski Group”), filed a preliminary Schedule 14A with the SEC, regarding the solicitation of consents to four separate proposals to the shareholders: (i) to repeal any provision of our bylaws in effect on that date the proposal was adopted and that was not in the Amended and Restated Bylaws of Standard Silver Corporation (now known as Texas Rare Earth Resource Corporation) that became effective by written consent of the board of directors on September 8, 2008; (ii) to remove without cause the following directorships of: James Graham; Graham Karklin; Gregory Martin; and Marc LeVier; (iii) to amend section 4.06 of the Amended and Restated Bylaws to provide that any vacancies on the Board resulting from the removal of directors by the shareholders of the Company pursuant to the solicited consents be filled exclusively by the shareholders of the Company; and (iv) elect Dr. Philip Goodell, Dr. Nicholas Pingitore, John Tumazos, Cecil C. Wall and Dr. James R. Wolfe to serve as directors of the Company.

The Gorski Group stated that its reasons for seeking control of the Company included: (i) dissatisfaction with the progress on developing cost-effective metallurgical extraction process for our Round Top Project; (ii) the focus of current management on a mine project that would cost in excess of $2 billion ($3 billion life of mine capital costs) and would take six years to bring to production rather than focusing on a smaller mining project and advanced metallurgical testing; (iii) denying our directors access to technical data; (iv) declining market performance due to management’s failure to properly prioritize the work on the Round Top Project; (v) the failure of the Board to take action after Mr. Marc LeVier received only 31.2% of shareholder votes in his favor at the February 15, 2012 Annual General Meeting of Shareholders; and (vi) concern in relation to control of overhead costs.

As a result, on July 18, 2012, James Graham, Graham Karklin and Gregory Martin resigned from the Board. In addition, on July 24, 2012, Marc LeVier resigned from the Board and Marc LeVier resigned as Chief Executive Officer. The resigning directors disagreed with the assessment of the Gorski Group made in our current report on Form 8-K dated June 12, 2012. In addition, the resigning directors also disagreed with the Gorski Group’s statements regarding the proper course of the Company as detailed in the preliminary Schedule 14A filed by the Gorski Group on July 5, 2012.

Pursuant to the terms of their resignation, Messrs. Graham, Karklin and Martin retained their options in the Company and entered into resignation and release agreements which contain mutual releases of claims between the Company and the directors.

On July 24, 2012, we entered into a Separation Agreement and Release (“Separation Agreement”) with Mr. Marc LeVier regarding his voluntary resignation from the Board and as our Chief Executive Officer. Pursuant to the terms of the Separation Agreement, we agreed to pay Mr. LeVier the following consideration: (i) Mr. LeVier’s base salary through to the date of the Separation Agreement; (ii) a lump sum payment of $225,000 as a separation payment; and (iii) an additional amount of four weeks base salary, reflecting accrued but unpaid vacation pay. Pursuant to the Separation Agreement, Mr. LeVier surrendered all of his 2,500,000 stock options. The Separation Agreement also contains a mutual waiver and release of claims and a mutual non-disparagement agreement.

On July 30, 2012, Mr. Cecil C. Wall, Dr. Philip Goodell, Dr. Nicholas Pingitore, and Mr. James R. Wolfe were appointed to serve as directors. On August 2, 2012, Mr. John Tumazos was appointed to serve as a director. Mr. Tumazos was also appointed as non-executive Chairman of the Board. We and Mr. Gorski have not entered into a formal written employment agreement in relation to Mr. Gorski’s compensation and employment terms as Chief Executive Officer.

In relation to Mr. Tumazos’ appointment as a director, we granted Mr. Tumazos two five-year options, each vesting 1/36 at the end of each month over a 36 month period, to purchase: (i) 1,000,000 of our shares of common, at an exercise price of $0.50 per share; and (ii) 900,000 of our shares of common stock, at an exercise price of $1.00 per share.

On July 30, 2012, Mr. Daniel Gorski was appointed to serve as our Chief Executive Officer. Mr. Gorski was previously our Interim Chief Executive Officer. On August 16, 2012, we agreed to pay compensation to Mr. Gorski, in the amount of $120,000 annually.

On August 24, 2012, we changed our state of incorporation from the State of Nevada to the State of Delaware (the “Reincorporation”) pursuant to a plan of conversion dated August 24, 2012. The Reincorporation was previously submitted to a vote of, and approved by, our stockholders at a special meeting of the stockholders held on April 25, 2012.

On August 24, 2012, we and Mr. Garcia mutually agreed upon the resignation of Mr. Garcia as our Senior Vice President of Project Development and Engineering effective August 31, 2012. In connection with Mr. Garcia’s resignation we entered into a Confidential Severance, Waiver and Release Agreement with Mr. Garcia, dated September 14, 2012, to be retroactive effective August 31, 2012, whereby in exchange for a full general release and waiver of any obligations owed by us to Mr. Garcia, Mr. Garcia is entitled to receive: (i) continuation of his current salary of $200,000, as of the time of termination, for a period of twelve months (minus applicable withholding), paid through our payroll practices; and (ii) continuation of health benefits through our payment of his COBRA premiums, if elected within the time period required by law, during the period from September 1, 2012 through February 28, 2013 (or such shorter period as Mr. Garcia is entitled to COBRA continuation coverage under the terms our insurance policies or plans).

-12-

In August 2012, we entered into a non-binding letter of intent with the Texas General Land Office to negotiate agreements for the following:

|

·

|

potential ground water supply on GLO land in Red Light Draw;

|

|

·

|

associated easements for the project;

|

|

·

|

additional leasing of land as maybe reasonably necessary for the development of leased minerals; and

|

|

·

|

use of an existing railroad spur.

|

On October 3, 2012, we announced a potential dividend of our Texas gold and silver properties. We own two potentially higher grade properties. These include the beryllium-uranium “contact zone” at the base of Round Top mountain for which Cyprus Minerals prepared a historic feasibility study in 1988 posted on our web site, which is not complaint with Canadian NI 43-101standards or SEC Guide 7 standards. It contains a usable decline built to facilitate a bulk metallurgical sample, which has in place all the services necessary to resume work. We intend to contemplate the possibility of selling sell this project within our company to: (i) utilize existing tax losses; and (ii) retain cash to develop gold and silver properties. We also own the “Macho” silver-lead-zinc property in New Mexico, which was our principal asset prior to the acquisition of the Round Top deposit. A one kilometer host structure contains galena veins, and historic shafts to 100, 300 and 525 feet from prior operations before the Second World War were filled. Management believes Macho is an exploration stage project. There may be other opportunities to obtain small deposits suitable for 100 tonne per day mines, low cap ex, and simpler permitting that can earn favorable returns at recent gold and silver prices. Any potential dividend of these assets to shareholders is subject to final board approval after consideration of the requirements of Delaware law for approval of dividends, completing necessary accounting and tax reviews and obtaining all necessary regulatory approvals.

Closure of Colorado Office and Reduction Of Expenses

We do not believe we can attract investor financing to maintain a large corporate staff during a lengthy pre-revenue period where most metallurgical, design, feasibility study, engineering and permitting activities will be led by outside consultants.

Further, our management policy is to shorten lines of communication, improve oversight and reduce travel expenses by moving our corporate headquarters to Sierra Blanca, Texas. Two of our directors are faculty at the University of Texas at El Paso, where we have in the past employed geology students to staff the drilling program. We expect our streamlined organization will be more effective.

Effective August 31, 2012, our offices at 304 Inverness Way South, Suite 365, Englewood, CO are to be phased out. Our Sierra Blanca, Texas office at 539 El Paso Street, Sierra Blanca, TX 79851 will become our official address and our principal operational office where Jamie May will continue as office manager. Our principal daytime contact number will be (915) 369- 2133. The El Paso warehouse located at 11459 Pellicano Dr., El Paso, Texas will also be phased out. We anticipate moving our accounting functions to our former office in Tyler, Texas under the supervision of our largest current shareholder and former CFO, G. W. McDonald. Our primary investor contacts are our chairman, John Tumazos at (732) 444-1083, and our President and CEO, Dan Gorski at (361) 790-5831.

The current management is shareholder-centric, and receives either no cash compensation or much less than previous management. We look to the share price to rise as the principal mechanism for wealth creation. We will require definitive scientific documentation, rigorous economic studies, consideration of a wide range of alternatives and meticulous oversight of any cash outlays of shareholder funds.

ITEM 1A. RISK FACTORS

This investment has a high degree of risk. Before you invest you should carefully consider the risks and uncertainties described below and the other information in this prospectus. If any of the following risks actually occur, our business, operating results and financial condition could be harmed and the value of our stock could go down. This means you could lose all or a part of your investment.

Risk Related to Our Business

We have a history of losses and will require additional financing to fund exploration and, if warranted, development and production of our properties. Failure to obtain additional financing could have a material adverse affect on our financial condition and results of operation and could cast uncertainty on our ability to continue as a going concern.

We had no revenues during the fiscal year ended August 31, 2012. For the fiscal year ended August 31, 2012, our net loss was approximately $14,375,000. Our accumulated deficit at August 31, 2012 was approximately $22,817,000. At August 31, 2012, our cash position was approximately $6,518,000 and our working capital was approximately $6,114,000. We have not commenced commercial production on any of our mineral properties. We have no revenues from operations and anticipate we will have no operating revenues until we place one or more of our properties into production. All of our properties are in the exploration stage.

We will need to raise additional funding to implement our business strategy. Our management believes that based on our current working capital, we will be able to continue operations through the end of calendar year 2014 without raising additional capital. During our fiscal year ending August 31, 2013, we plan to spend approximately $1,500,000 for metallurgical testing and flow sheet development, additional geologic and resource modeling and compliance costs associated with state governmental agencies and appropriate staff and consulting expenses. The timing of these expenditures is dependent upon a number of factors, including the availability of drilling contractors. We estimate that general and administrative expenses during fiscal year ending August 31, 2013 will be approximately $1,900,000 to include payroll, investor relations, professional services, travel, and other expenses necessary to conduct our operations. We have reduced our staff, closed the Denver office and plan to reduce all other costs possible in order to accomplish our objectives without the necessity of raising additional capital.

-13-

We currently do not have sufficient funds to fully complete exploration and development work on any of our properties, which means that we will be required to raise additional capital, enter into joint venture relationships or find alternative means to finance placing one or more of our properties into commercial production, if warranted. Failure to obtain sufficient financing may result in the delay or indefinite postponement of exploration and development or production on one or more of our properties and any properties we may acquire in the future or even a loss of property interests. This includes our leases over claims covering the principal deposits on our properties, which may expire unless we expend minimum levels of expenditures over the terms of such leases. We cannot be certain that additional capital or other types of financing will be available if needed or that, if available, the terms of such financing will be favorable or acceptable to us. Our ability to arrange additional financing in the future will depend, in part, on the prevailing capital market conditions as well as our business performance.

The most likely source of future financing presently available to us is through the sale of our securities. Any sale of common shares will result in dilution of equity ownership to existing shareholders. This means that if we sell common shares, more common shares will be outstanding and each existing shareholder will own a smaller percentage of the shares then outstanding. Alternatively, we may rely on debt financing and assume debt obligations that require us to make substantial interest and capital payments. Also, we may issue or grant warrants or options in the future pursuant to which additional common shares may be issued. Exercise of such warrants or options will result in dilution of equity ownership to our existing shareholders.

We have a limited operating history on which to base an evaluation of our business and properties.

Any investment in the Company should be considered a high-risk investment because investors will be placing funds at risk in an early stage business with unforeseen costs, expenses, competition, a history of operating losses and other problems to which start-up ventures are often subject. Investors should not invest in the Company unless they can afford to lose their entire investment. Your investment must be considered in light of the risks, expenses, and difficulties encountered in establishing a new business in a highly competitive and mature industry. Our operating history has been restricted to the acquisition and sampling of our Round Top Project and this does not provide a meaningful basis for an evaluation of our Round Top Project. Other than through conventional and typical exploration methods and procedures, we have no additional way to evaluate the likelihood of whether our Round Top Project or our other mineral properties contain commercial quantities of mineral reserves or, if they do, that they will be operated successfully. We anticipate that we will continue to incur operating costs without realizing any revenues during the period when we are exploring our properties.

All of our properties are in the exploration stage. There is no assurance that we can establish the existence of any mineral reserve on any of our properties in commercially exploitable quantities. Until we can do so, we cannot earn any revenues from these properties, and our business could fail.

We have not established that any of our properties contain any mineral reserve, nor can there be any assurance that we will be able to do so. The probability of an individual prospect ever having a mineral reserve that meets the requirements of the SEC is extremely remote. Even if we do eventually discover a mineral reserve on one or more of our properties, there can be no assurance that they can be developed into producing mines and extract those minerals. Both mineral exploration and development involve a high degree of risk and few properties, which are explored, are ultimately developed into producing mines.

The commercial viability of an established mineral deposit will depend on a number of factors including, by way of example, the size, grade and other attributes of the mineral deposit, the proximity of the deposit to infrastructure such as a smelter, roads and a point for shipping, government regulation and market prices. Most of these factors will be beyond our control, and any of them could increase costs and make extraction of any identified mineral deposit unprofitable.

Even if commercial viability of a mineral deposit is established, it may take several years in the initial phases of drilling until production is possible, during which time the economic feasibility of production may change. Substantial expenditures are required to establish proven and probable reserves through drilling and bulk sampling, to determine the optimal metallurgical process to extract the metals from the ore and, in the case of new properties, to construct mining and processing facilities. Because of these uncertainties, no assurance can be given that our exploration programs will result in the establishment or expansion of a mineral deposit or reserves.

-14-

We have no history of producing metals from our mineral properties.

We have no history of producing metals from any of our properties. Our properties are all exploration stage properties in various stages of exploration and evaluation. Our Round Top Project is an early exploration stage project, and our New Mexico properties are each early stage exploration projects that management does not consider material to our operations. Advancing properties from exploration into the development stage requires significant capital and time, and successful commercial production from a property, if any, will be subject to completing feasibility studies, permitting and construction of the mine, processing plants, roads, and other related works and infrastructure. As a result, we are subject to all of the risks associated with developing and establishing new mining operations and business enterprises including:

· completion of feasibility studies to verify reserves and commercial viability, including the ability to find sufficient REE or gold reserves to support a commercial mining operation;

· the timing and cost, which can be considerable, of further exploration, preparing feasibility studies, permitting and construction of infrastructure, mining and processing facilities;

· the availability and costs of drill equipment, exploration personnel, skilled labor and mining and processing equipment, if required;

· the availability and cost of appropriate smelting and/or refining arrangements, if required, and securing a commercially viable sales outlet for our products;

· compliance with environmental and other governmental approval and permit requirements;

· the availability of funds to finance exploration, development and construction activities, as warranted;

· potential opposition from non-governmental organizations, environmental groups, local groups or local inhabitants which may delay or prevent development activities;

· potential increases in exploration, construction and operating costs due to changes in the cost of fuel, power, materials and supplies; and

· potential shortages of mineral processing, construction and other facilities related supplies.

The costs, timing and complexities of exploration, development and construction activities may be increased by the location of our properties and demand by other mineral exploration and mining companies. It is common in exploration programs to experience unexpected problems and delays during drill programs and, if warranted, development, construction and mine start-up. Accordingly, our activities may not result in profitable mining operations and we may not succeed in establishing mining operations or profitably producing metals at any of our properties.

If we establish the existence of a mineral reserve on any of our properties in a commercially exploitable quantity, we will require additional capital in order to develop the property into a producing mine. If we cannot raise this additional capital, we will not be able to exploit the reserve, and our business could fail.

If we do discover mineral reserves in commercially exploitable quantities on any of our properties, we will be required to expend substantial sums of money to establish the extent of the reserve, develop processes to extract it and develop extraction and processing facilities and infrastructure. We do not have adequate capital to develop necessary facilities and infrastructure and will need to raise additional funds. Although we may derive substantial benefits from the discovery of a major mineral deposit, there can be no assurance that such a deposit will be large enough to justify commercial operations, nor can there be any assurance that we will be able to raise the funds required for development on a timely basis. If we cannot raise the necessary capital or complete the necessary facilities and infrastructure, our business may fail.

Our exploration activities may not be commercially successful.

Our long-term success depends on our ability to identify mineral deposits on our existing properties and other properties we may acquire, if any, that we can then develop into commercially viable mining operations. Our belief that our properties contain commercially exploitable minerals has been based solely on preliminary tests that we have conducted and data provided by third parties, including the data published in various third party reports, including but not limited to the GSA, Geological Society of America, Special Paper 246, 1990. There can be no assurance that the tests and data upon which we have relied is correct or accurate. Moreover, mineral exploration is highly speculative in nature, involves many risks and is frequently non-productive. Unusual or unexpected geologic formations and the inability to obtain suitable or adequate machinery, equipment or labor are risks involved in the conduct of exploration programs. The success of mineral exploration and development is determined in part by the following factors:

· the identification of potential mineralization based on analysis;

· the availability of exploration permits;

· the quality of our management and our geological and technical expertise; and

· the capital available for exploration.

Substantial expenditures and time are required to establish existing proven and probable reserves through drilling and analysis, to develop metallurgical processes to extract metal, and to develop the mining and processing facilities and infrastructure at any site chosen for mining. Whether a mineral deposit will be commercially viable depends on a number of factors, which include, without limitation, the particular attributes of the deposit, such as size, grade and proximity to infrastructure; metal prices, which fluctuate widely; and government regulations, including, without limitation, regulations relating to prices, taxes, royalties, land tenure, land use, allowable production, importing and exporting of minerals and environmental protection. Any one or a combination of these factors may result in us not receiving an adequate return on our investment capital. The decision to abandon a project may have an adverse effect on the market value of our securities and our ability to raise future financing.

-15-

We do not hold the surface rights adjacent to our Round Top Project and may experience difficulties in asserting our mining rights at the Round Top Project in utilizing the surface space to build our facilities.

We do not currently hold surface rights to the adjacent surfaces at our Round Top Project. GLO currently has adjacent properties under long-term lease agreements. While the GLO, which owns both the surface and the mineral rights at the Round Top Project, has the overriding right to mine the minerals on the property and we believe that we will have the right to construct surface facilities pursuant to our rights under the leases we hold over the Round Top Project granted by the GLO, we and the GLO may experience difficulties in dealing with the current lease and private surface owners in enforcing our rights and developing the Round Top Project. Currently, the surface owners hold rights pursuant to two leases with the GLO which cover areas on the east and west sides of the Round Top Project. There can be no assurance that we will be able to resolve these potential issues and uncertainty may remain regarding our ability to develop and mine the Round Top Project. If we are unable to resolve these potential issues, we may be unable to proceed with the development of a mine at the Round Top Project without becoming involved in a dispute with the holders of the surface rights, which may result in a substantial delay of the development of the Round Top Project or may prevent its development altogether.

Increased costs could affect our financial condition.

We anticipate that costs at our projects that we may explore or develop, will frequently be subject to variation from one year to the next due to a number of factors, such as changing ore grade, metallurgy and revisions to mine plans, if any, in response to the physical shape and location of the ore body. In addition, costs are affected by the price of commodities such as fuel, rubber, and electricity. Such commodities are at times subject to volatile price movements, including increases that could make production at certain operations less profitable. A material increase in costs at any significant location could have a significant effect on our profitability.

A shortage of equipment and supplies could adversely affect our ability to operate our business.

We are dependent on various supplies and equipment to carry out our mining exploration and, if warranted, development operations. The shortage of such supplies, equipment and parts could have a material adverse effect on our ability to carry out our operations and therefore limit or increase the cost of production.

Mining and mineral exploration is inherently dangerous and subject to conditions or events beyond our control, which could have a material adverse effect on our business and plans.

Mining and mineral exploration involves various types of risks and hazards, including:

· environmental hazards;

· power outages;

· metallurgical and other processing problems;

· unusual or unexpected geological formations;

· personal injury, flooding, fire, explosions, cave-ins, landslides and rock-bursts;

· inability to obtain suitable or adequate machinery, equipment, or labor;

· metals losses;

· fluctuations in exploration, development and production costs;

· labor disputes;

· unanticipated variations in grade;

· mechanical equipment failure; and

· periodic interruptions due to inclement or hazardous weather conditions.

These risks could result in damage to, or destruction of, mineral properties, production facilities or other properties, personal injury, environmental damage, delays in mining, increased production costs, monetary losses and possible legal liability. We may not be able to obtain insurance to cover these risks at economically feasible premiums. Insurance against certain environmental risks, including potential liability for pollution or other hazards as a result of the disposal of waste products occurring from production, may be prohibitively expensive. We may suffer a material adverse effect on our business if we incur losses related to any significant events that are not covered by our insurance policies.

-16-

The figures for our mineralization are estimates based on interpretation and assumptions and may yield less mineral production under actual conditions than is currently estimated.

Unless otherwise indicated, mineralization figures presented in this Annual Report and in our filings with securities regulatory authorities, press releases and other public statements that may be made from time to time are based upon estimates made by independent geologists and our internal geologists. When making determinations about whether to advance any of our projects to development, we must rely upon such estimated calculations as to the mineral reserves and grades of mineralization on our properties. Until ore is actually mined and processed, mineral reserves and grades of mineralization must be considered as estimates only.

Estimates can be imprecise and depend upon geological interpretation and statistical inferences drawn from drilling and sampling analysis, which may prove to be unreliable. We cannot assure you that:

· these interpretations and inferences will be accurate;

· mineralization estimates will be accurate; or

· this mineralization can be mined or processed profitably.

Any material changes in mineralization estimates and grades of mineralization will affect the economic viability of placing a property into production and a property's return on capital.

Because we have not completed feasibility studies on any of our properties and have not commenced actual production, mineralization estimates for our properties may require adjustments or downward revisions. In addition, the grade of ore ultimately mined, if any, may differ from that indicated by our feasibility studies and drill results. Minerals recovered in small scale tests may not be duplicated in large scale tests under on-site conditions or in production scale.

The mineralization estimates contained in this Annual Report have been determined and valued based on assumed future prices, cut-off grades and operating costs that may prove to be inaccurate. But where done in accordance to Ni-43-101 standards. Extended declines in market prices for rare earth minerals may render portions of our mineralization estimates uneconomic and result in reduced reported mineralization or adversely affect the commercial viability determinations we reach. Any material reductions in estimates of mineralization, or of our ability to extract this mineralization, could have a material adverse effect on our share price and the value of our properties.