Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TTM TECHNOLOGIES INC | d440522d8k.htm |

Exhibit 99.1

| TTM Technologies Investor Presentation UBS Global Technology Conference November 15, 2012 |

| Safe Harbor During the course of this presentation, the company will make forward- looking statements subject to known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. Such risks and uncertainties include, but are not limited to, fluctuations in quarterly and annual operating results, the volatility and cyclicality of various industries that the company serves and other risks described in TTM's most recent SEC filings. The company assumes no obligation to update the information provided in this presentation. The company also will present non-GAAP financial information in this presentation. For a reconciliation of TTM's non-GAAP financial information to the equivalent measures under GAAP, please refer to the company's press release, which was filed with the SEC and which is posted on TTM's website. |

| Company Overview |

| Global Leader in PCB Manufacturing Leading global PCB manufacturer - $1.4 billion in revenue* 15 specialized factories located in U.S. and China Over 16,000 employees worldwide Focused on advanced technology products Total customer solution: prototype through production Technology development coordinated with customers' needs Diversified end markets with broad customer base * Based on 2011 sales |

| Historical Pro Forma Sales* AP: 21% CAGR NA: 15% CAGR Total: 19% CAGR * AP includes Meadville pro forma sales |

| Current Global Ranking Top 10 World PCB Makers 2011 Represents approximately 30% of 2011 total world PCB output $ millions Core supplier to wide range of high-end networking products addressing increasing bandwidth demands Key supplier in rapidly growing touch screen tablet market Expanding position in smartphones Leadership position in strategic North America Aerospace & Defense industry Leading Position in Growing Market Segments Source: Prismark, PCB Report - February 2012 |

| Regional PCB Company Ranking 2011 Rank Company Revenue est. 1 TTM North America $508 2 DDI $263 3 Viasystems $145 4 Sanmina-SCI $138 5 Endicott Interconnect $90 Top 5 Total Top 5 Total $1,144 Rank Company Revenue est. 1 Zheng Ding (Foxconn) $1,510 2 KB Group $1,400 3 HannStar $1,314 4 Tripod $1,270 5 TTM Asia Pacific $870 Top 5 Total Top 5 Total $6,364 Top 5 American PCB Makers Top 5 Chinese PCB Makers Source: NT Information, Global PCB Output Report, May 2012 $ in millions USD $ in millions USD Represents approximately 36% of 2011 total Americas PCB output Represents approximately 25% of 2011 total Chinese PCB output Source: NT Information, Global PCB Output Report, May 2012 |

| Specialized Facilities Provide Optimal Growth Integrated manufacturing platform enables TTM to execute a global facility specialization strategy Focused Assembly 8 Shanghai, China 1 Stafford, CT 3 San Diego, CA Aerospace/Defense 5 High Tech/Quick-Turn/High Mix 4 Chippewa Falls, WI 2 Santa Clara, CA Santa Ana, CA 6 Logan, UT 9 Stafford Springs, CT China Volume Production 10 Dongguan - DMC 11 Dongguan - SYE 12 Guangzhou - GME 13 Shanghai - SME 14 Suzhou - MAS Substrate 15 Shanghai - SMST 7 Hong Kong - OPCM 1 9 2 5 3 4 6 United States 7 10 11 12 13 15 8 14 |

| Industry & Market Overview |

| World PCB Outlook The worldwide PCB market is expected to grow at nearly 6 percent through 2014 with the majority of growth occurring in Asia 60% of the world PCB production will be generated from the Greater China region in 2014 PCB production in the Americas is expected to deliver moderate growth and remains significant to TTM Region 2010 $B 2014 $B 10 /14 CAGR China / HK / Taiwan $29.3 $42.2 8.8% Japan $9.9 $7.6 -7.0% SE Asia, Korea, Others $9.7 $13.3 7.9% Americas $3.4 $3.7 2.6% EU $2.8 $3.2 2.5% World $55.1 $70.0 5.8% Source: N.T. Information Ltd. April 2012 |

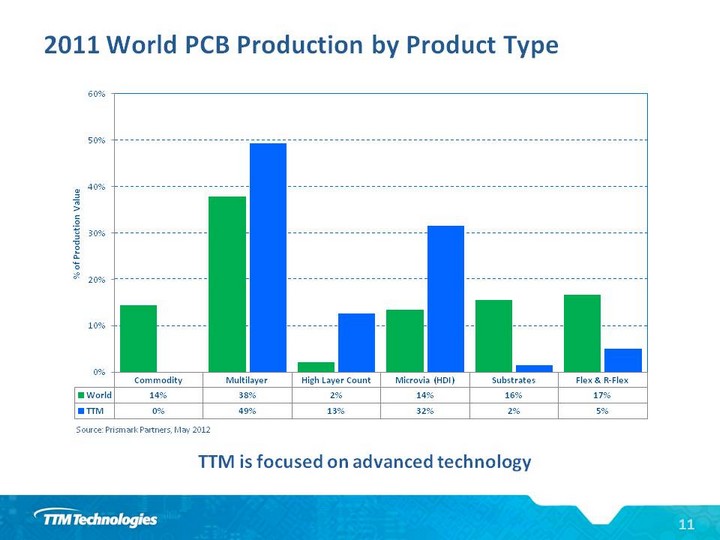

| 2011 World PCB Production by Product Type TTM is focused on advanced technology Source: Prismark Partners, May 2012 |

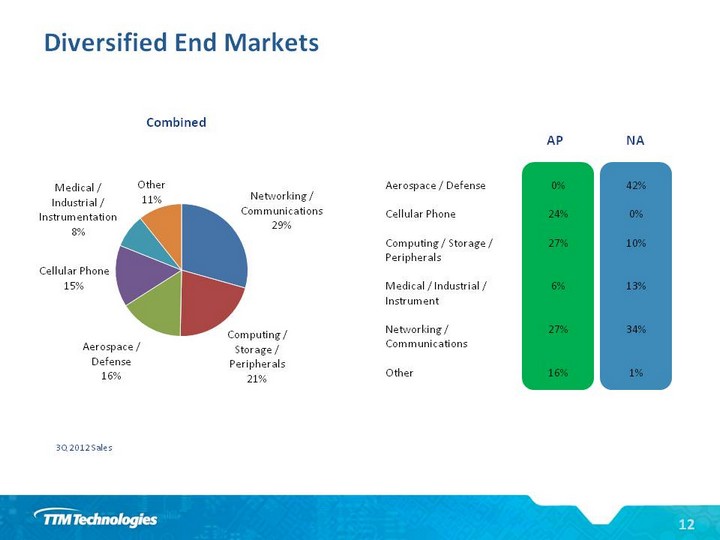

| Diversified End Markets AP Combined NA Aerospace / Defense Cellular Phone Computing / Storage / Peripherals Medical / Industrial / Instrument Networking / Communications Other 0% 24% 27% 6% 27% 16% 42% 0% 10% 13% 34% 1% 3Q 2012 Sales |

| Future Plans & Strategies |

| Positioned for Revolutionary Growth Advanced PCB and Semiconductor Technology Expansion in Communication, Networking & Storage Infrastructure Proliferation of "Converged Mobile Devices" Explosion of Network Applications & Cloud Computing Consumer Demand for Advanced Printed Circuit Board Technology Business |

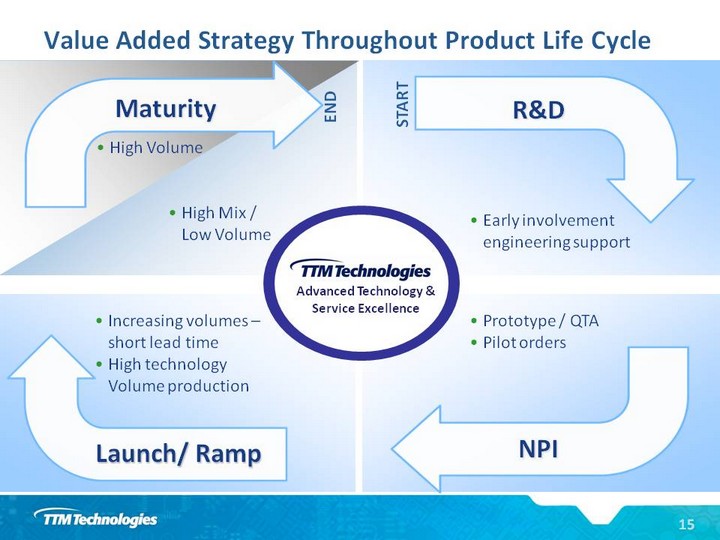

| Value Added Strategy Throughout Product Life Cycle Advanced Technology & Service Excellence Early involvement engineering support Prototype / QTA Pilot orders Increasing volumes - short lead time High technology Volume production High Mix / Low Volume High Volume R&D STAR T END Maturity NPI Launch/ Ramp |

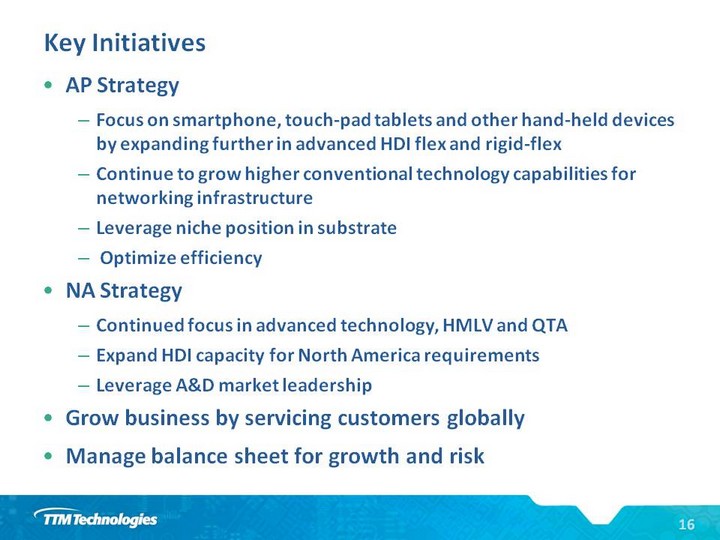

| Key Initiatives AP Strategy Focus on smartphone, touch-pad tablets and other hand- held devices by expanding further in advanced HDI flex and rigid-flex Continue to grow higher conventional technology capabilities for networking infrastructure Leverage niche position in substrate Optimize efficiency NA Strategy Continued focus in advanced technology, HMLV and QTA Expand HDI capacity for North America requirements Leverage A&D market leadership Grow business by servicing customers globally Manage balance sheet for growth and risk |

| Financial Overview |

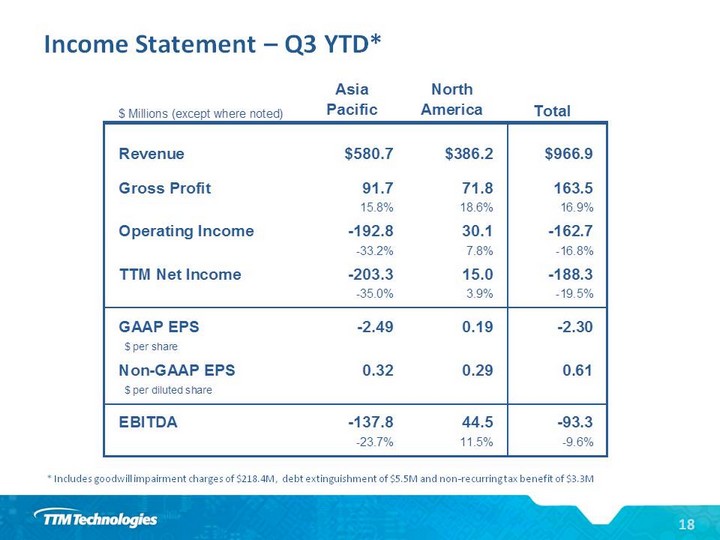

| Income Statement - Q3 YTD* * Includes goodwill impairment charges of $218.4M, debt extinguishment of $5.5M and non-recurring tax benefit of $3.3M |

| Target Model * Excludes goodwill impairment charges of $218.4M, debt extinguishment of $5.5M and non-recurring tax benefit of $3.3M |

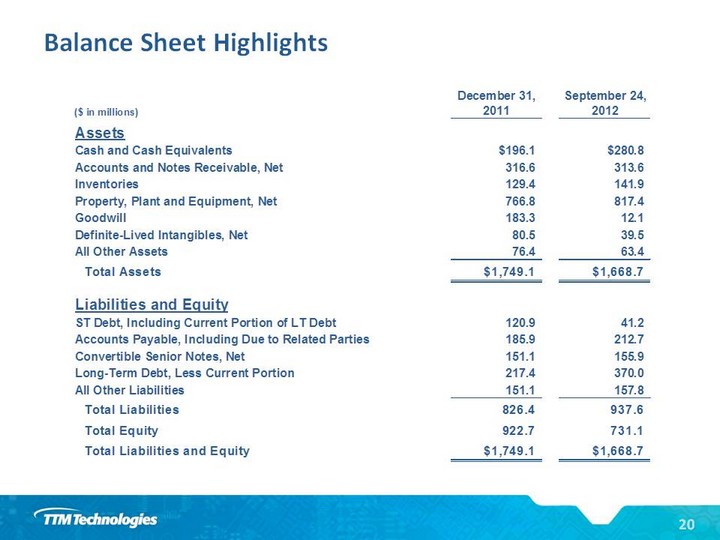

| Balance Sheet Highlights |

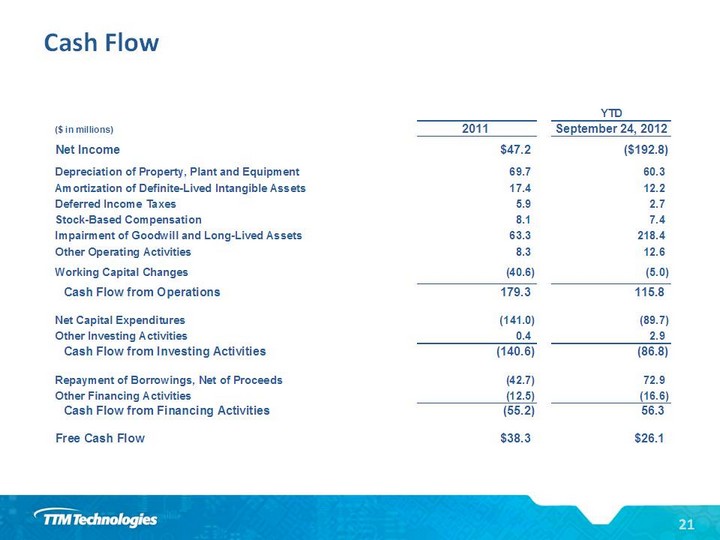

| Cash Flow |

| Investment Highlights Market leader in advanced technology PCBs globally Strong track record of operating performance Emphasis on customer service with facilities tailored to meet customer needs now and in the future Focused on growth through organic opportunities as well as strategic acquisitions Healthy balance sheet and solid cash flow funding growth |

| Appendix |

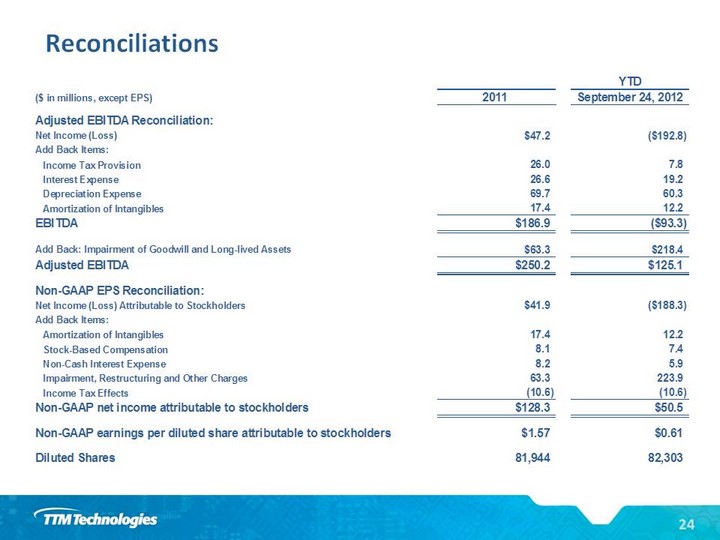

| Reconciliations |

| IR Contacts Asia Pacific Audrey Sim VP, Investor Relations & Marketing e-mail: audrey.sim@ttmtech.com.hk Corporate Steve Richards CFO & Investor Relations e-mail: steve.richards@ttmtech.com |