Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ENDO HEALTH SOLUTIONS INC. | d438461d8k.htm |

Exhibit 99.1

2012 Annual Credit Suisse Healthcare Conference November 15, 2012 1 (c) 2012 Endo Pharmaceuticals Inc. All rights reserved

2 Forward Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Statements including words such as “believes,” “expects,” “anticipates,” “intends,” “estimates,” “plan,” “will,” “may,” “look forward,” “intend,” “guidance,” “future” or similar expressions are forward-looking statements. Because these statements reflect our current views, expectations and beliefs concerning future events, these forward-looking statements involve risks and uncertainties. Investors should note that many factors, as more fully described under the caption “Risk Factors” in our Form 10-K, Form 10-Q and Form 8-K filings with the Securities and Exchange Commission and as otherwise enumerated herein or therein, could affect our future financial results and could cause our actual results to differ materially from those expressed in forward-looking statements contained in our Annual Report on Form 10-K. The forward-looking statements in this presentation are qualified by these risk factors. These are factors that, individually or in the aggregate, could cause our actual results to differ materially from expected and historical results. We assume no obligation to publicly update any forward-looking statements, whether as a result of new information, future developments or otherwise.

|

3 Non-GAAP Financial Measures; Trademarks This presentation may refer to non-GAAP financial measures that are not prepared in accordance with accounting principles generally accepted in the United States and that may be different from non-GAAP financial measures used by other companies. Investors are encouraged to review Endo’s current report on Form 8-K filed with the SEC for Endo’s reasons for including those non- GAAP financial measures in this presentation. Reconciliations of certain non-GAAP financial measures to the most directly comparable GAAP financial measures are provided at the end of this presentation. All product and service names appearing in a typeface different from that of the surrounding text or with a trademark symbol, including the Endo and product logos, are trademarks and/or service marks owned by or licensed to Endo, its subsidiaries or its affiliates other than Voltaren(r), which is a registered trademark of Novartis Corporation, BEMA(r), which is a registered trademark of BioDelivery Sciences International, Inc., and Lidoderm(r), which is a registered trademark of Hind Health Care, Inc.

Endo Health Solutions Today Has Track record of revenue growth and profitability Durable cash flow Organic and long-term growth across business segments Disciplined capital allocation International capabilities Diversified pipeline 4 (c) 2012 Endo Pharmaceuticals Inc. All rights reserved

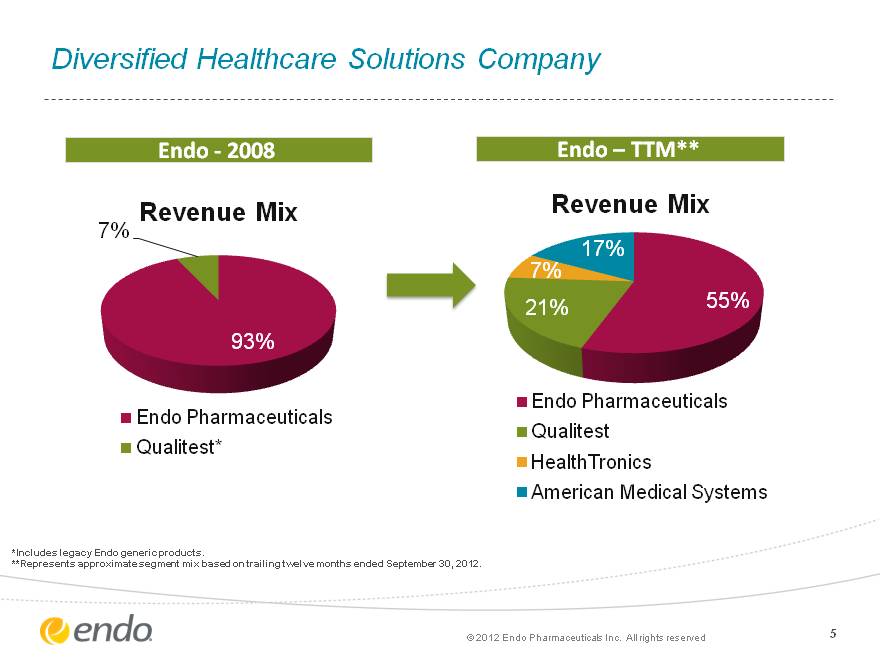

5 Diversified Healthcare Solutions Company Diversified Healthcare Solutions Company Endo—2008 Endo—TTM** *Includes legacy Endo generic products. **Represents approximate segment mix based on trailing twelve months ended September 30, 2012. (c) 2012 Endo Pharmaceuticals Inc. All rights reserved

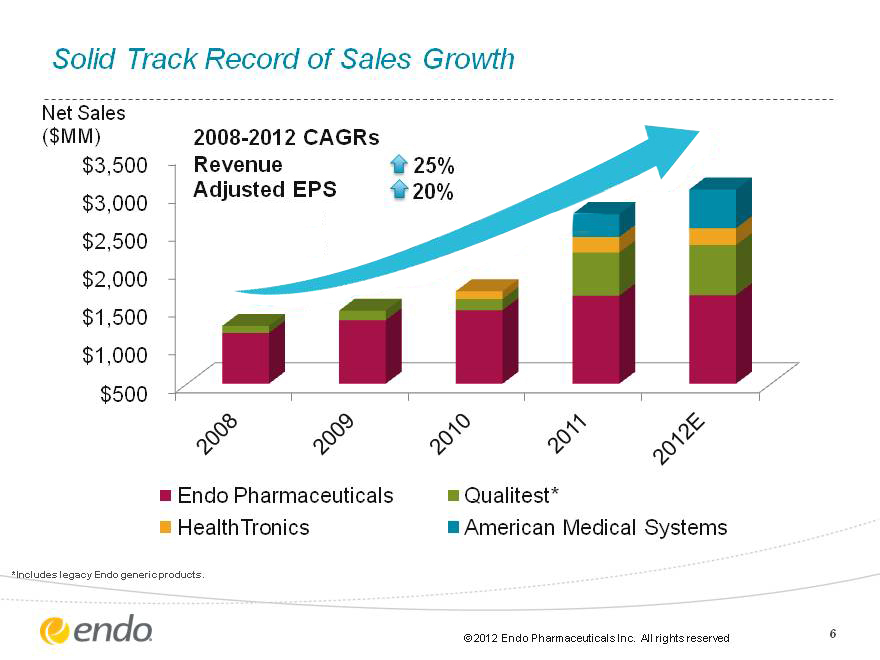

6 2011 |Endo collaborates with Orion Corporation for assets in Oncology. Endo Launches FORTESTA(tm) (Testosterone) Gel. Endo Pharmaceuticals acquires American Medical Systems (CHART) Solid Track Record of Sales Growth 2008-2012 CAGRs Revenue 25% Adjusted EPS 20% Net Sales ($MM) *Includes legacy Endo generic products.

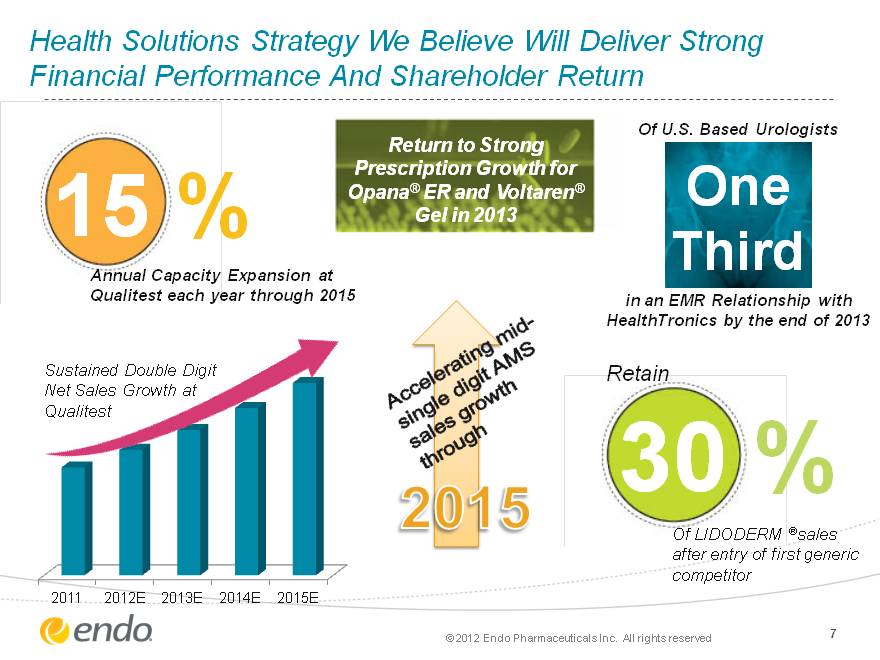

Health Solutions Strategy We Believe Will Deliver Strong Financial Performance And Shareholder Return 7 15 % Annual Capacity Expansion at Qualitest each year through 2015 One Third Of U.S. Based Urologists in an EMR Relationship with HealthTronics by the end of 2013 30 % Of LIDODERM (r)sales after entry of first generic competitor Retain Return to Strong Prescription Growth for Opana(r) ER and Voltaren(r) Gel in 2013 (CHART) Sustained Double Digit Net Sales Growth at Qualitest 2015 Accelerating mid- single digit AMS sales growth through (c) 2012 Endo Pharmaceuticals Inc. All rights reserved

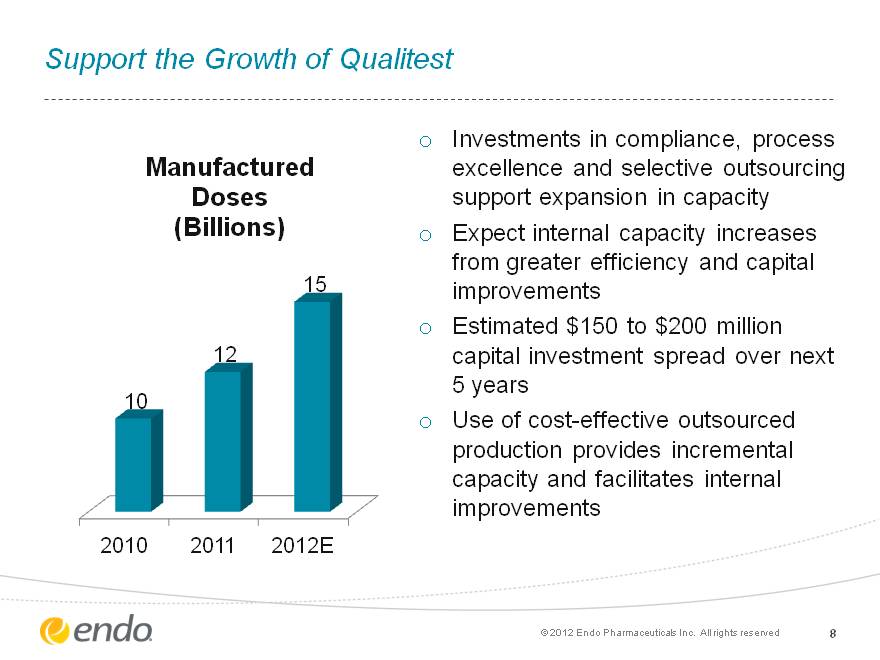

Support the Growth of Qualitest Investments in compliance, process excellence and selective outsourcing support expansion in capacity Expect internal capacity increases from greater efficiency and capital improvements Estimated $150 to $200 million capital investment spread over next 5 years Use of cost-effective outsourced production provides incremental capacity and facilitates internal improvements 8 8 (c) 2012 Endo Pharmaceuticals Inc. All rights reserved

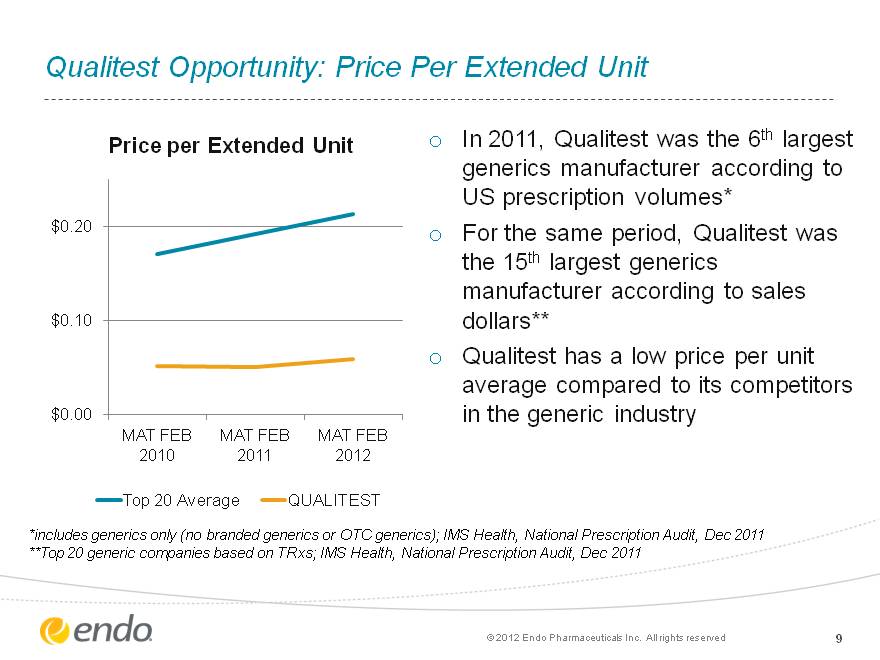

Qualitest Opportunity: Price Per Extended Unit Qualitest Opportunity: Price Per Extended Unit 9 In 2011, Qualitest was the 6th largest generics manufacturer according to US prescription volumes* For the same period, Qualitest was the 15th largest generics manufacturer according to sales dollars** Qualitest has a low price per unit average compared to its competitors in the generic industry *includes generics only (no branded generics or OTC generics); IMS Health, National Prescription Audit, Dec 2011 **Top 20 generic companies based on TRxs; IMS Health, National Prescription Audit, Dec 2011 (c) 2012 Endo Pharmaceuticals Inc. All rights reserved

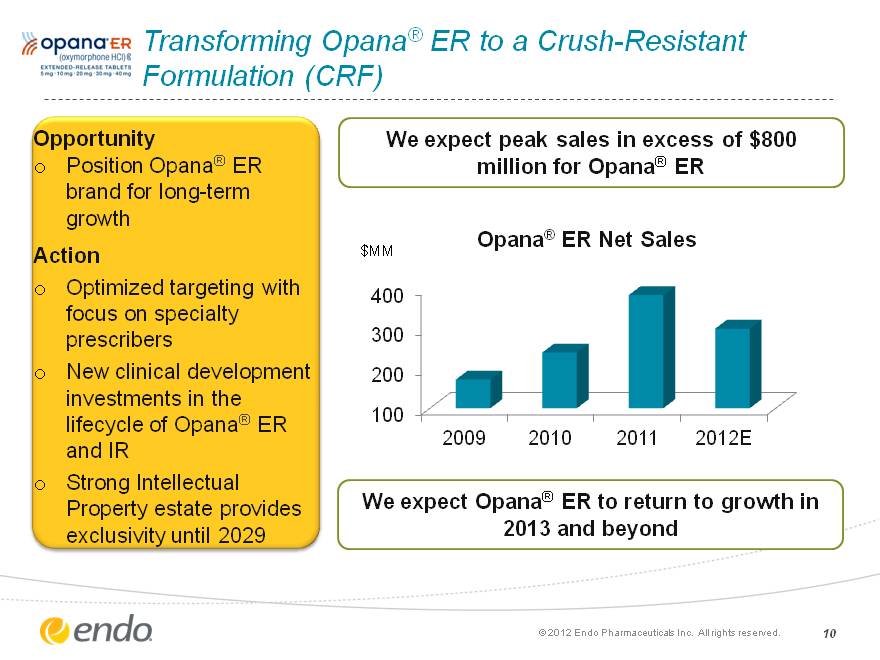

Transforming Opana(r) ER to a Crush-Resistant Formulation (CRF) Opportunity Position Opana(r) ER brand for long-term growth Action Optimized targeting with focus on specialty prescribers New clinical development investments in the lifecycle of Opana(r) ER and IR Strong Intellectual Property estate provides exclusivity until 2029 We expect peak sales in excess of $800 million for Opana(r) ER (c) 2012 Endo Pharmaceuticals Inc. All rights reserved. 10 (CHART) We expect Opana(r) ER to return to growth in 2013 and beyond

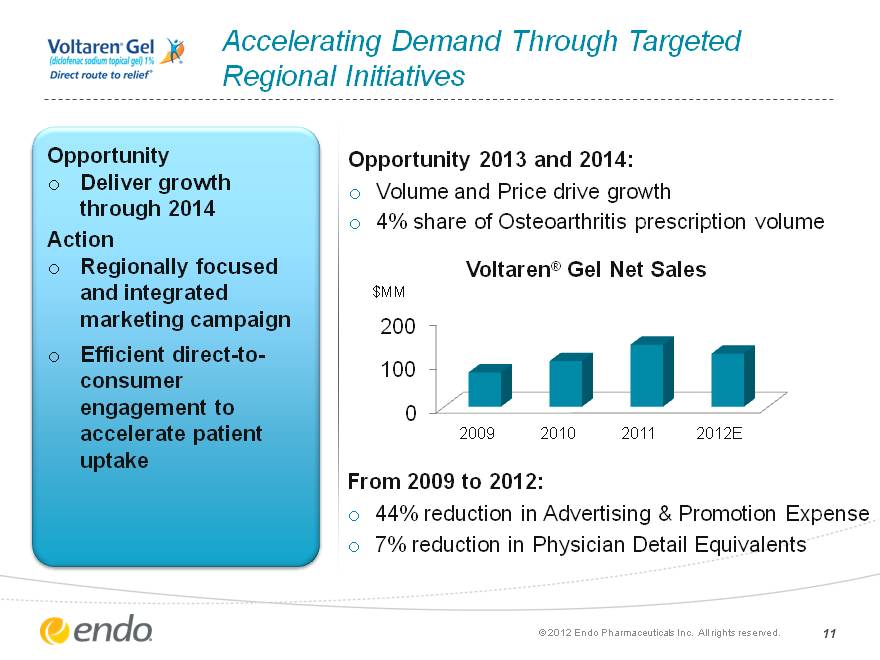

Accelerating Demand Through Targeted Regional Initiatives Opportunity Deliver growth through 2014 Action Regionally focused and integrated marketing campaign Efficient direct-to- consumer engagement to accelerate patient uptake From 2009 to 2012: 44% reduction in Advertising & Promotion Expense 7% reduction in Physician Detail Equivalents (c) 2012 Endo Pharmaceuticals Inc. All rights reserved. 11 (CHART) Opportunity 2013 and 2014: Volume and Price drive growth 4% share of Osteoarthritis prescription volume

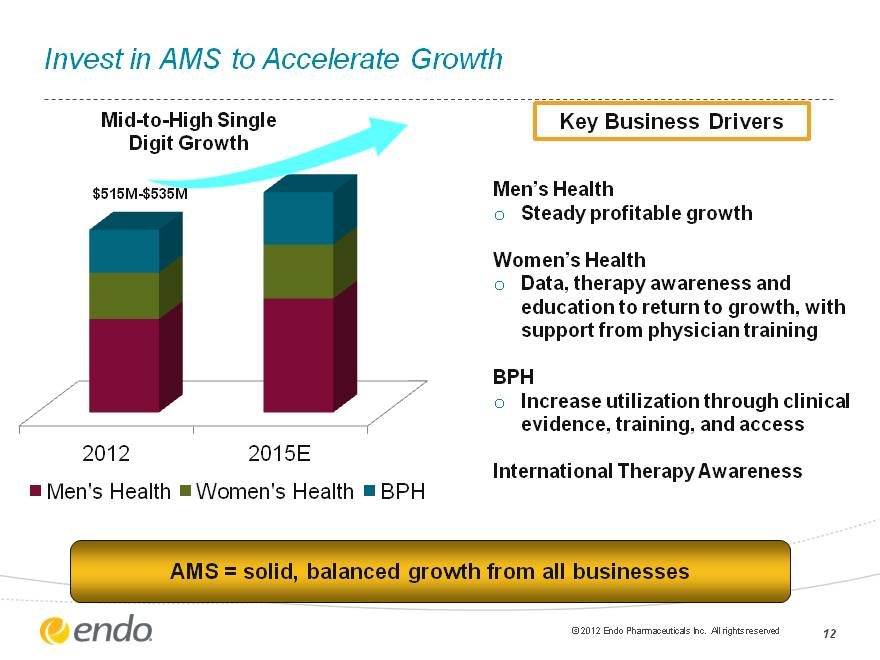

Invest in AMS to Accelerate Growth Men’s Health Steady profitable growth Women’s Health Data, therapy awareness and education to return to growth, with support from physician training BPH Increase utilization through clinical evidence, training, and access International Therapy Awareness AMS = solid, balanced growth from all businesses (CHART) $515M-$535M Mid-to-High Single Digit Growth Key Business Drivers (c) 2012 Endo Pharmaceuticals Inc. All rights reserved 12

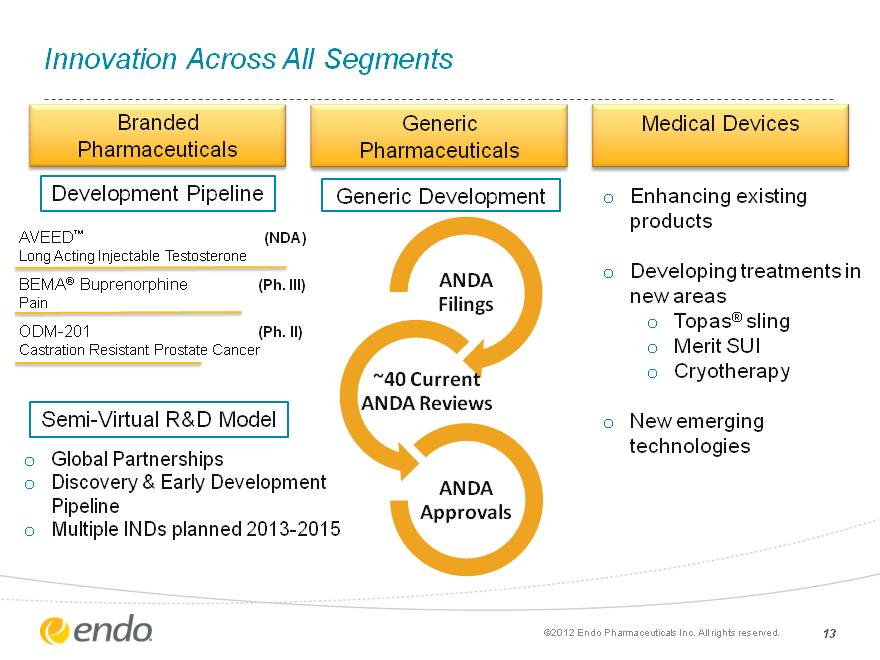

Innovation Across All Segments 13 Branded Pharmaceuticals Medical Devices Generic Pharmaceuticals Generic Development Enhancing existing products Developing treatments in new areas Topas(r) sling Merit SUI Cryotherapy New emerging technologies Global Partnerships Discovery & Early Development Pipeline Multiple INDs planned 2013-2015 AVEED(tm) (NDA) Long Acting Injectable Testosterone BEMA(r) Buprenorphine (Ph. III) Pain ODM-201 (Ph. II) Castration Resistant Prostate Cancer Development Pipeline Semi-Virtual R&D Model (c)2012 Endo Pharmaceuticals Inc. All rights reserved.

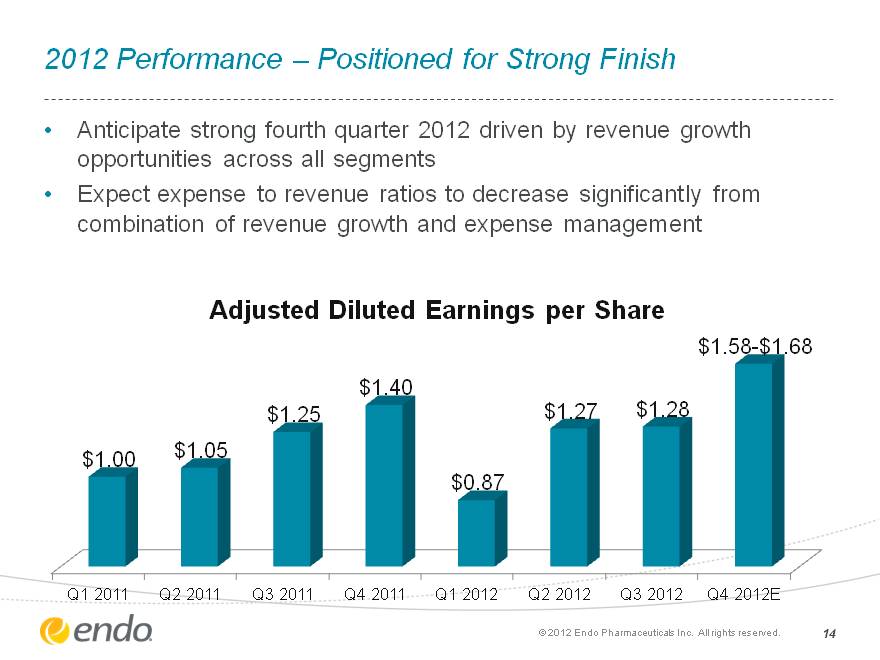

2012 Performance—Positioned for Strong Finish Anticipate strong fourth quarter 2012 driven by revenue growth opportunities across all segments Expect expense to revenue ratios to decrease significantly from combination of revenue growth and expense management (c) 2012 Endo Pharmaceuticals Inc. All rights reserved. 14 (CHART)

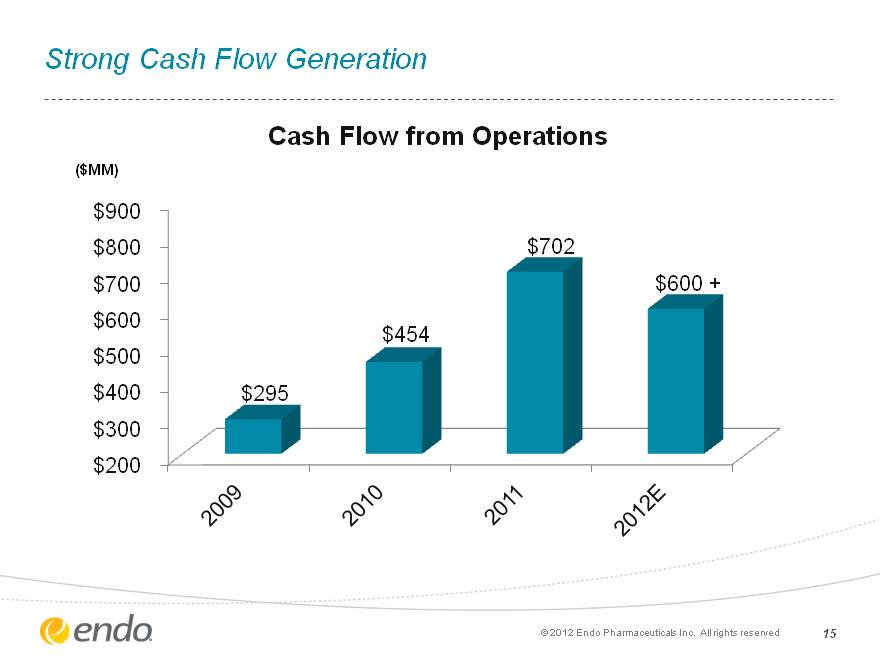

15 Strong Cash Flow Generation (c) 2012 Endo Pharmaceuticals Inc. All rights reserved

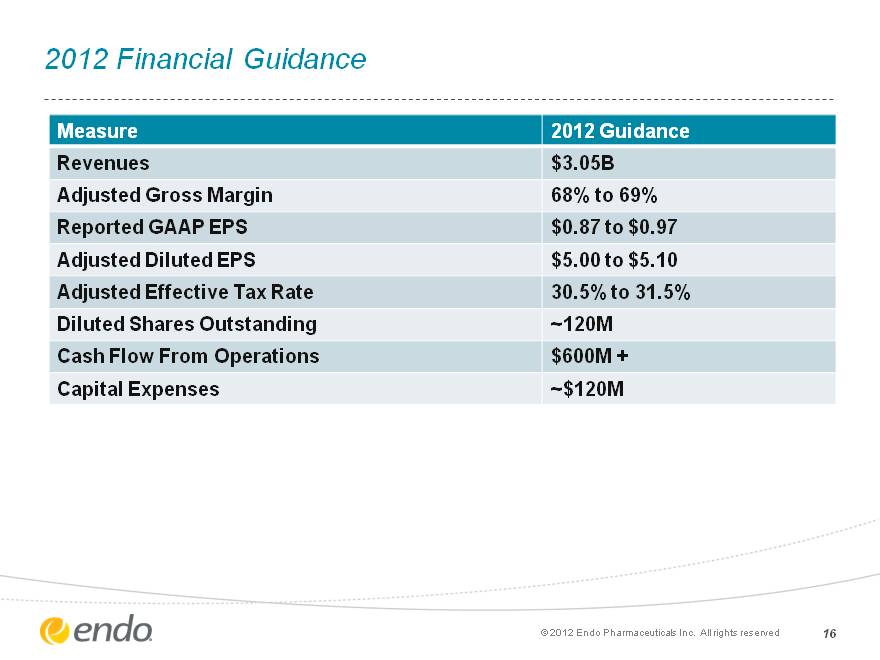

2012 Financial Guidance 16 Measure 2012 Guidance Revenues $3.05B Adjusted Gross Margin 68% to 69% Reported GAAP EPS $0.87 to $0.97 Adjusted Diluted EPS $5.00 to $5.10 Adjusted Effective Tax Rate 30.5% to 31.5% Diluted Shares Outstanding ~120M Cash Flow From Operations $600M + Capital Expenses ~$120M (c) 2012 Endo Pharmaceuticals Inc. All rights reserved

17

Supplementary Financial Data 18 (c) 2012 Endo Pharmaceuticals Inc. All rights reserved

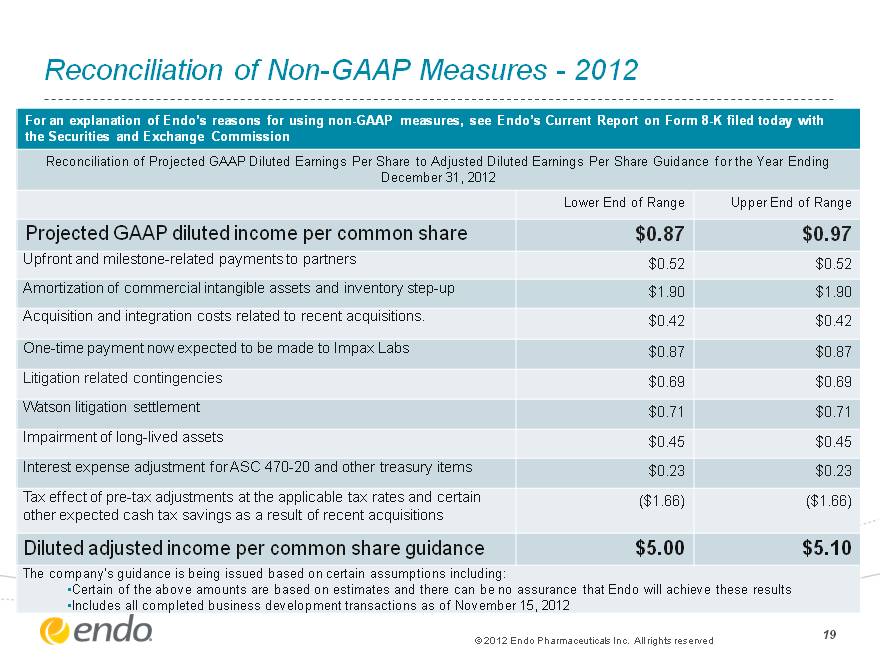

19 Reconciliation of Non-GAAP Measures—2012 For an explanation of Endo’s reasons for using non-GAAP measures, see Endo’s Current Report on Form 8-K filed today with the Securities and Exchange Commission For an explanation of Endo’s reasons for using non-GAAP measures, see Endo’s Current Report on Form 8-K filed today with the Securities and Exchange Commission For an explanation of Endo’s reasons for using non-GAAP measures, see Endo’s Current Report on Form 8-K filed today with the Securities and Exchange Commission Reconciliation of Projected GAAP Diluted Earnings Per Share to Adjusted Diluted Earnings Per Share Guidance for the Year Ending December 31, 2012 Reconciliation of Projected GAAP Diluted Earnings Per Share to Adjusted Diluted Earnings Per Share Guidance for the Year Ending December 31, 2012 Reconciliation of Projected GAAP Diluted Earnings Per Share to Adjusted Diluted Earnings Per Share Guidance for the Year Ending December 31, 2012 Lower End of Range Upper End of Range Projected GAAP diluted income per common share $0.87 $0.97 Upfront and milestone-related payments to partners $0.52 $0.52 Amortization of commercial intangible assets and inventory step-up $1.90 $1.90 Acquisition and integration costs related to recent acquisitions. $0.42 $0.42 One-time payment now expected to be made to Impax Labs $0.87 $0.87 Litigation related contingencies $0.69 $0.69 Watson litigation settlement $0.71 $0.71 Impairment of long-lived assets $0.45 $0.45 Interest expense adjustment for ASC 470-20 and other treasury items $0.23 $0.23 Tax effect of pre-tax adjustments at the applicable tax rates and certain other expected cash tax savings as a result of recent acquisitions ($1.66) ($1.66) Diluted adjusted income per common share guidance $5.00 $5.10 The company’s guidance is being issued based on certain assumptions including: Certain of the above amounts are based on estimates and there can be no assurance that Endo will achieve these results Includes all completed business development transactions as of November 15, 2012 The company’s guidance is being issued based on certain assumptions including: Certain of the above amounts are based on estimates and there can be no assurance that Endo will achieve these results Includes all completed business development transactions as of November 15, 2012 The company’s guidance is being issued based on certain assumptions including: Certain of the above amounts are based on estimates and there can be no assurance that Endo will achieve these results Includes all completed business development transactions as of November 15, 2012 (c) 2012 Endo Pharmaceuticals Inc. All rights reserved

2012 Annual Credit Suisse Healthcare Conference November 15, 2012 20 (c) 2012 Endo Pharmaceuticals Inc. All rights reserved