Attached files

| file | filename |

|---|---|

| EX-5.1 - EX-5.1 - BOISE CASCADE Co | a2211705zex-5_1.htm |

| EX-21.1 - EX-21.1 - BOISE CASCADE Co | a2211705zex-21_1.htm |

| EX-23.1 - EX-23.1 - BOISE CASCADE Co | a2211705zex-23_1.htm |

As filed with the Securities and Exchange Commission on November 15, 2012

No. 333-

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Boise Cascade, L.L.C.*

(Exact name of registrant as specified in its charter)

| Delaware | 5110 | 20-2807265 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

||

1111 West Jefferson Street, Suite 300 Boise, Idaho 83702-5389 (208) 384-6161 (Address, including zip code and telephone number, including area code, of registrant's principal executive offices) |

||||

John T. Sahlberg

Senior Vice President, Human Resources and General Counsel

Boise Cascade, L.L.C.

1111 West Jefferson Street, Suite 300

Boise, Idaho 83702-5389

(208) 384-6161

(Name, address, including zip code and telephone number, including area code, of agent for service)

Copies of all communications, including communications sent to agent for service, should be sent to:

| Dennis M. Myers, P.C. Carol Anne Huff Kirkland & Ellis LLP 300 North LaSalle Chicago, Illinois 60654 (312) 862-2000 |

James J. Junewicz Winston & Strawn LLP 35 W. Wacker Drive Chicago, Illinois 60601 (312) 558-5600 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act (Check one):

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

|

||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum Offering Price(1)(2) |

Amount of Registration Fee(3) |

||

|---|---|---|---|---|

Common Stock, $0.01 par value per share |

$200,000,000 | $27,280 | ||

|

||||

- (1)

- Includes

the offering price of the shares of common stock that may be sold if the option to purchase additional shares granted by us to the underwriters is

exercised in full.

- (2)

- Estimated

solely for purposes of calculating the registration fee pursuant to Rule 457(o) of the Securities Act of 1933, as amended.

- (3)

- Calculated by multiplying 0.00013640 by the proposed maximum offering price.

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

* Boise Cascade, L.L.C., the registrant whose name appears on the cover of this registration statement, is a Delaware limited liability company. Prior to the effectiveness of this registration statement, Boise Cascade, L.L.C. will be converted into a Delaware corporation and renamed Boise Cascade Company. Shares of the common stock of Boise Cascade Company are being offered by the prospectus. Except as disclosed in the prospectus, the consolidated financial statements and selected historical consolidated financial data and other financial information included in this registration statement are those of Boise Cascade, L.L.C. and its subsidiaries and do not give effect to the corporate conversion.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. The prospectus is not an offer to sell these securities nor a solicitation of an offer to buy these securities in any jurisdiction where the offer and sale is not permitted.

Subject to Completion

Preliminary Prospectus dated November 15, 2012

P R O S P E C T U S

Shares

Common Stock

This is the initial public offering of shares of common stock of Boise Cascade Company.

We are selling shares of our common stock.

We expect the public offering price to be between $ and $ per share. Currently, no public market exists for the shares. After pricing of the offering, we expect that the shares will trade on the New York Stock Exchange under the symbol "BCC."

Investing in our common stock involves risks that are described in the "Risk Factors" section beginning on page 15 of this prospectus.

| |

Per Share | Total | |||||

|---|---|---|---|---|---|---|---|

Public offering price |

$ | $ | |||||

Underwriting discounts |

$ | $ | |||||

Proceeds, before expenses, to us |

$ | $ | |||||

The underwriters may also exercise their option to purchase up to additional shares from us at the initial public offering price, less the underwriting discount, for a period of 30 days after the date of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The shares will be ready for delivery on or about , 2013.

Joint Book-Running Managers

| BofA Merrill Lynch | Goldman, Sachs & Co. |

| Deutsche Bank Securities | J.P. Morgan | Wells Fargo Securities |

The date of this prospectus is , 2013.

TABLE OF CONTENTS

We have not and the underwriters have not authorized anyone to provide you with any information other than that contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where such offers and sales are permitted. The information in this prospectus or any free writing prospectus is accurate only as of its date, regardless of its time of delivery or the time of any sale of shares of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

i

The following is a summary of material information discussed in this prospectus. This summary may not contain all the details concerning our business, our common stock or other information that may be important to you. You should carefully review this entire prospectus, including the "Risk Factors" section and our consolidated financial statements and the notes thereto included elsewhere in this prospectus, before making an investment decision.

As used in this prospectus, unless the context otherwise indicates, the references to "Boise Cascade," "we," "our," or "us" refer to Boise Cascade, L.L.C., together with its subsidiaries, prior to our conversion to a Delaware corporation and Boise Cascade Company and its consolidated subsidiaries on or after such conversion. Unless otherwise indicated or the context otherwise requires, financial and operating data in this prospectus reflects the consolidated business and operations of Boise Cascade, L.L.C. and its wholly-owned subsidiaries prior to the conversion of Boise Cascade, L.L.C. into a corporation and Boise Cascade Company and its wholly-owned subsidiaries on and after such conversion. For a definition of EBITDA, see Note 6 to "—Summary Historical Consolidated Financial Data." In addition, for a definition of segment income (loss) and a reconciliation of segment income (loss) to EBITDA for the twelve months ended September 30, 2012 ("LTM" or the "LTM period"), see "Business—Wood Products" and "—Building Materials Distribution," as applicable.

We are a large, vertically-integrated wood products manufacturer and building materials distributor with widespread operations throughout the United States and Canada. We are the second largest manufacturer of laminated veneer lumber ("LVL"), I-joists (together "engineered wood products" or "EWP") and plywood in North America. We are also one of the largest stocking wholesale distributors of building products in the United States. Our broad line of products is used primarily in new residential construction, residential repair and remodeling projects, light commercial construction and industrial applications. We believe our large, vertically-integrated operations provide us with significant advantages over less integrated competitors and position us to optimally serve our customers. We have a broad base of more than 4,500 customers, which includes a diverse mix of leading wholesalers, home improvement centers, retail lumberyards and industrial converters. In the LTM period, no single customer represented more than 11% of sales and our top ten customers represented less than 31% of sales. For the LTM period, we generated sales of $2,631.9 million, income before interest and taxes of $45.7 million and EBITDA of $80.1 million.

We supply our customers through 49 strategically located facilities (consisting of 18 manufacturing facilities and 31 distribution facilities). In addition to the vertical integration between our manufacturing and distribution operations, our EWP manufacturing facilities are closely integrated with our nearby plywood operations, which allows us to optimize both production processes. Throughout the housing downturn, we have continued to make strategic capital investments to increase our manufacturing capacity and expand our building materials distribution network. We believe that our scale, closely integrated businesses and significant capital investments throughout the downturn provide us with substantial operating leverage to benefit from a recovery in the U.S. housing market.

1

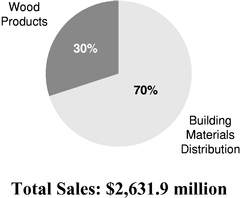

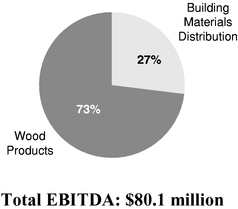

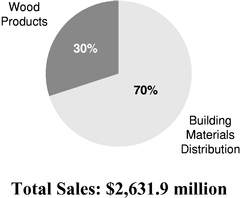

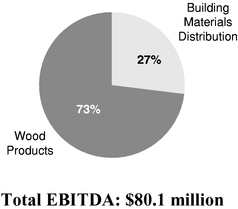

We operate our company through two primary segments: our Wood Products segment and our Building Materials Distribution segment. The charts below summarize the breakdown of our business for the LTM period.

LTM SALES BY SEGMENT(1)(2)

|

LTM EBITDA BY SEGMENT(1)(3)

|

|

|---|---|---|

|

|

- (1)

- Financial data for the LTM period presented in this prospectus is derived by adding financial data for the year

ended December 31, 2011 to financial data for the nine months ended September 30, 2012 and subtracting financial data for the nine months ended September 30, 2011.

- (2)

- Segment

percentages are calculated before intersegment eliminations.

- (3)

- Segment percentages exclude Corporate and Other segment expenses.

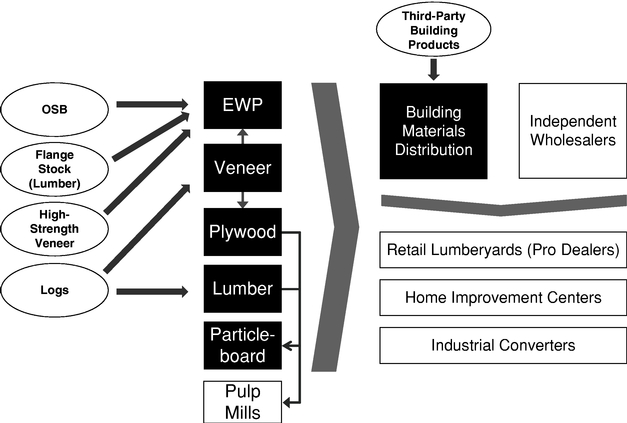

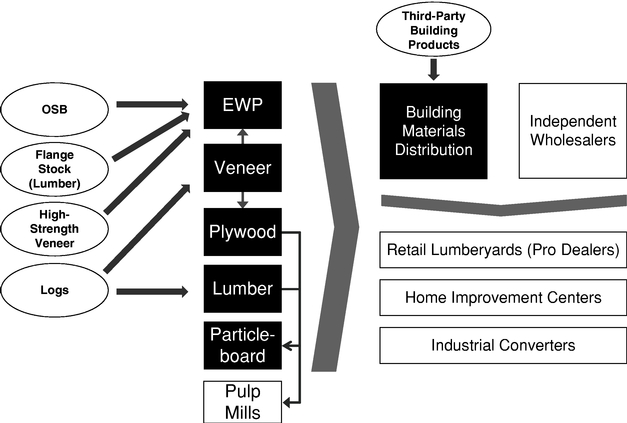

Wood Products ($69.2 million, or 73%, of LTM EBITDA). Our Wood Products segment is the second largest manufacturer of EWP and plywood in North America, with a highly integrated national network of 17 manufacturing facilities. Our wood products are used primarily in new residential construction, residential repair and remodeling projects and light commercial construction. We are focused on profitably gaining EWP market share and maintaining a strong market presence in plywood and pine lumber by providing superior customer service and distribution support. We manufacture LVL, I-joists and laminated beams, which are high-grade, value-added structural products used in applications where additional strength and consistent quality are required. LVL is also used in the manufacture of engineered I-joists, which are assembled by combining a vertical web of oriented strand board ("OSB") with top and bottom LVL or solid wood flanges. We also produce plywood, studs, particleboard and ponderosa pine lumber, a premium lumber grade sold primarily to manufacturers of specialty wood windows, moldings and doors. We enjoy the benefit of long-term wood supply agreements put in place in 2005 following the sale of our timberlands, under which we purchase timber at market-based prices. Approximately 40% of our log consumption is typically supplied through these agreements, giving us access to timberlands near our manufacturing operations.

Our EWP manufacturing facilities are closely integrated with our nearby plywood operations to optimize our veneer utilization by enabling us to dedicate higher quality veneers to higher margin applications and lower quality veneers to plywood products, giving us an advantage over our less integrated competitors. For the LTM period, EWP, plywood and lumber accounted for 35%, 44% and 9%, respectively, of our Wood Products sales. Most of our wood products are sold to leading wholesalers (including our Building Materials Distribution segment), home improvement centers, retail lumberyards and industrial converters. In the LTM period, approximately 37% of our Wood Products sales, including approximately 71% of our EWP sales, were to our Building Materials Distribution segment. For the LTM period, our Wood Products segment generated sales, income before interest and taxes and EBITDA of $893.0 million, $43.7 million and $69.2 million, respectively.

2

Building Materials Distribution ($26.2 million, or 27%, of LTM EBITDA). We are one of the largest national stocking wholesale distributors of building materials in the United States. Our nationwide network of 31 strategically-located distribution facilities sells a broad line of building materials, including EWP, OSB, plywood, lumber and general line items such as framing accessories, composite decking, roofing, siding and insulation. We also operate a truss manufacturing plant located in Maine. Our products are used in the construction of new residential housing, including single-family, multi-family and manufactured homes, repair and remodeling projects and the construction of light industrial and commercial buildings. Except for EWP, we purchase most of these building materials from more than 1,000 third-party suppliers ranging from large manufacturers, such as James Hardie Building Products, Trex Company, Louisiana-Pacific and Georgia-Pacific, to small regional producers.

We market our products primarily to retail lumberyards and home improvement centers that then sell the products to end customers, who are typically professional builders, independent contractors and homeowners engaged in residential construction projects. We also market our products to industrial converters, which use our products to assemble windows, doors, agricultural bins and other value-added products used in industrial and repair and remodel applications. We believe that we are attractive to customers in our Building Materials Distribution segment because we provide a high level of customer service and a broad line of products from a large number of quality manufacturers. The majority of our competitors in this segment are specialized, local or regional distributors focused primarily on a narrow range of products. We also compete against other national wholesalers. Unlike many of our competitors who focus primarily on a narrow range of products, we are a one-stop resource for our customers' building materials needs, which allows for more cost-efficient ordering, delivery and receiving. Furthermore, we believe that our national presence and long-standing relationships with many of our key suppliers allow us to obtain favorable price and term arrangements and offer excellent customer service on top brands in the building materials industry. We have expertise in special-order sourcing and merchandising support, which is a key service for our home improvement center customers that choose not to stock certain items in inventory. Our highly efficient logistics system allows us to deliver superior customer service and assist our customers in optimizing their working capital, which we believe has led to increased market share during the housing downturn. For the LTM period, our Building Materials Distribution segment generated sales, income before interest and taxes and EBITDA of $2,066.6 million, $17.4 million and $26.2 million, respectively.

3

The following diagram illustrates our value chain:

BOISE CASCADE VALUE CHAIN

The building products manufacturing and distribution industry in North America is highly competitive, with a number of producers manufacturing and selling a broad range of products. Demand for our products is principally influenced by new residential construction, light commercial construction and repair and remodeling activity in the United States. Drivers of new residential construction, light commercial construction and repair and remodeling activity include new household formation, the age of the housing stock, availability of credit and other macroeconomic factors, such as GDP growth, population growth, migration, interest rates, employment and consumer sentiment. Purchasing decisions made by the customers who buy our wood products are generally based on price, quality and, particularly with respect to EWP, customer service and product support.

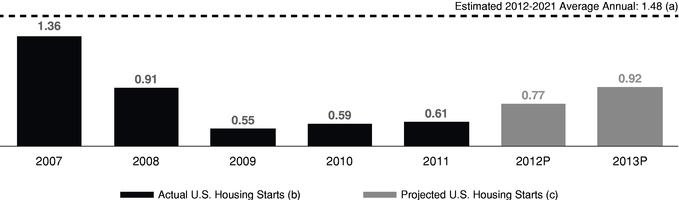

From 2005 to 2011, total housing starts in the United States declined by more than 70%. The significant drop in new residential construction has created challenging conditions for building products manufacturers and distributors, with substantial reductions in manufacturing and distribution capacity occurring since late 2008 as companies adjusted to lower industry demand. According to the U.S. Census Bureau, total housing starts in the United States were 0.59 million in 2010 and 0.61 million in 2011, modest increases over the 2009 level of 0.55 million (the lowest year on record) but significantly less than the 50-year average rate of 1.5 million. Prior to 2008, the housing market had not experienced a year with total housing starts below 1.0 million since the U.S. Census Bureau began its annual recordkeeping in 1959.

In the U.S., single- and multi-family housing starts were 0.87 million in September 2012 on a seasonally adjusted annual rate basis, an increase of 35% from September 2011. In November 2012, the Blue Chip Economic Indicators median consensus forecast of single- and multi-family housing starts in

4

the U.S. was approximately 0.77 million units for 2012 and approximately 0.92 million units for 2013, which represent annual increases of 26% and 19%, respectively. We believe that over the long-term, there is considerable growth potential in the U.S. housing sector. In November 2012, IHS Global Insight estimates that total U.S. single- and multi-family housing starts will average 1.48 million units per year from 2012 through 2021, levels that are in line with the 50-year historical average.

During the housing downturn, demand for EWP declined less than demand for many products dependent on new residential construction. According to APA—The Engineered Wood Association, LVL production volumes in North America increased 27% from 32.7 million cubic feet in 2009 to 41.6 million cubic feet in 2011 and I-joist production volumes in North America increased 20% from 380.1 million linear feet in 2009 to 456.9 million linear feet in 2011. Longer-term demand trends are expected to improve further. Resource Information Systems, Inc. ("RISI") forecasts that I-joist demand in North America will increase 15% and LVL billet demand in North America will increase 21% in 2012, followed by further demand increases in 2013 through 2015. RISI expects the I-joist and LVL billet demand to reach 1,013 million linear feet and 98.5 million cubic feet, respectively, by 2017.

Our products are not only used in new residential construction, but also in residential repair and remodeling projects, light commercial construction and industrial applications. We believe this diversification by product end use provides us some protection from declines in the new residential construction market. Residential repair and remodeling spending increased significantly over the past 15 years. According to the Home Improvement Research Institute ("HIRI"), the U.S. repair and remodel market increased 81.5% from $165 billion in 1996 to a peak of $300 billion in 2006 and declined approximately 10.2% to $269 billion in 2011. In addition, the overall age of the U.S. housing stock, increased focus on making homes more energy efficient, rising home prices and availability of consumer capital at low interest rates are expected to drive long-term growth in repair and remodeling expenditures. HIRI estimates that total U.S. sales of home maintenance, repair and improvement products will grow at a compounded annual rate of 5.1% from 2011 through 2016.

We believe the following key competitive strengths have contributed to our success and will enable us to execute our growth strategy:

Leadership Positions in Wood Products Manufacturing and Building Materials Distribution on a National Scale

We are one of the leading manufacturers in the North American wood products industry. We are the second largest producer of EWP and plywood in North America and we are the largest producer of plywood in the Western United States. From 2005 to 2011, our sales of LVL and I-joist per North American housing start increased by 65% and 30%, respectively. We have positioned ourselves to take advantage of improving demand in our core markets by expanding our EWP and plywood capacity through capital investments in low-cost, internal veneer manufacturing. Our Wood Products segment operates a highly-integrated national network of 17 manufacturing facilities that are well-maintained and cost-efficient as a result of continued capital improvements. We believe we are better able to serve our customers because our Wood Products business is vertically-integrated with our Building Materials Distribution business.

We are one of the largest national stocking wholesale distributors of building materials in the United States and we believe we offer one of the broadest product lines in the industry. From 2005 to 2011, we nearly doubled our sales per U.S. housing start in our Building Materials Distribution segment. We have a national platform of 31 strategically-located distribution facilities, which supply products to all major markets in the United States and provide us with significant scale and capacity relative to most of our competitors. We also have one truss manufacturing plant in Maine. Our broad geographic presence reduces our exposure to market factors in any single region. We have developed

5

and maintain long-standing relationships with our customer segments, including retail lumberyards, home improvement centers and industrial converters. We believe that our strong and diverse customer relationships and support from leading industry manufacturers will enable us to capture additional market share as demand for building products improves.

Strongly Situated to Serve our Customers with Vertically-Integrated Manufacturing and Distribution Operations

We believe that we are the only large-scale manufacturer of plywood and EWP in North America that is vertically-integrated from log procurement through distribution. The integration of our manufacturing and distribution operations allows us to make procurement, manufacturing, veneer merchandising and marketing decisions that reduce our manufacturing and supply chain costs and allow us to more effectively control quality and working capital. Furthermore, our vertically-integrated operations combined with our national distribution network significantly enhance our ability to assure product supply for our end customers. We believe our vertical integration was an important factor in our ability to increase market share during the recent housing downturn.

Low-Cost Manufacturing and Distribution Footprint Supported by Significant Capital Investments

We believe that we have a highly competitive asset base across both of our operating segments, in part because we continued to strategically invest through the housing downturn. We operate the two largest EWP facilities in North America. Our large-scale EWP production facilities are integrated with our nearby plywood operations to optimize our veneer utilization, which we believe helps position us as a competitive manufacturer in the growing EWP business. In the past three years, we completed a number of initiatives in our Wood Products segment that strengthened our asset base and enhanced our operating performance. In our plywood and veneer operations, we reduced costs by reducing headcount and closing three facilities in Western Oregon. At the same time, we installed two new large-scale, state-of-the-art dryers at our Medford, Oregon plywood facility. In our EWP operations, we executed significant operational improvements to take advantage of additional low-cost, internal veneer production at our plywood facilities.

We believe that our plywood facilities in Kettle Falls, Washington and Elgin, Oregon are among the lowest cost Douglas fir plywood producers in North America. In the active timberland markets in which we operate, our manufacturing facilities are clustered to enable us to efficiently utilize fiber resources and to shift production depending on demand. We believe we are the only manufacturer in the inland Pacific Northwest with the integrated primary and secondary facilities necessary to process all softwood species.

We have continued to execute our strategic growth initiatives in our Building Materials Distribution segment, opportunistically acquiring facilities, starting a new facility in South Florida and significantly expanding six of our existing facilities. Since 2005, we have increased our covered warehouse space by over 65% and have more than doubled our outdoor storage acreage.

Well-Positioned for Growth as the Housing Market Recovers

Our vertically-integrated operations are well-positioned to serve our customers and take advantage of the recovery that we believe is underway in the U.S. housing market. From 2005 to 2011, we invested $270 million (excluding acquisitions) to upgrade and maintain our facilities. We expect to make further capital investments in cost and operational improvements, primarily related to internal veneer production, which will further leverage our competitive position and allow us to capture growth opportunities. Additionally we have substantial unused capacity in our EWP operations. For the LTM period, we operated our EWP facilities at approximately 50% of LVL press capacity.

We believe that our Building Materials Distribution facilities enable us to support a considerable ramp-up in housing starts with no significant requirement for new capacity and will allow

6

us to double our sales without increasing our existing footprint. Our excess capacity will provide us with substantial operating leverage as demand recovers.

Additionally, our strong balance sheet, significant liquidity and our access to the capital markets as a public company will provide us ample flexibility to take advantage of future market opportunities. As of September 30, 2012, we had total liquidity of $483.8 million, consisting of $224.4 million of cash and cash equivalents and $259.4 million of availability under our revolving credit facility.

Experienced Management Team and Principal Equityholder

Madison Dearborn Partners, LLC ("Madison Dearborn") has a long and successful track record of investing in manufacturing and distribution businesses. Our senior management team has a track record of financial and operational excellence in the forest products industry in both favorable and challenging market conditions. Our senior management team has an average of approximately 30 years of experience in forest products manufacturing and building materials distribution. We will establish a new management equity incentive plan so that we can align management's compensation with our financial performance. See "Executive Compensation—2013 Equity Incentive Plan."

We intend to capitalize on our strong market position in wood products manufacturing and building materials distribution to increase revenues and profits and maximize cash flow as the U.S. housing market recovers. We seek to achieve this objective by executing on the following strategies:

Grow our Wood Products Segment Operations with a Focus on Expanding our Market Position in EWP

From 2005 to 2011, despite experiencing a significant downturn in the U.S. housing sector, we increased our LVL and I-joist sales-per-housing start in North America by 65% and 30%, respectively. We will further expand our market position in EWP by continuing to focus on our large-scale manufacturing position, comprehensive customer service, design support capabilities and efficient distribution network. We have positioned ourselves to take advantage of expected increases in the demand for EWP per housing start by expanding our capacity through capital investments in low-cost, internal veneer manufacturing. We have also developed strategic relationships with third-party veneer suppliers to support additional EWP production as needed. Additionally, we intend to grow our Wood Products business through strategic acquisitions that are a compelling fit with our existing operations.

Grow Market Share in our Building Materials Distribution Segment

We intend to grow our Building Materials Distribution business in existing markets by adding products and services to better serve our customers. For example, we have added cedar board inventory and door shops in additional locations. We also plan to opportunistically expand our Building Materials Distribution business into adjacent geographies that we currently serve using off-site storage arrangements or longer truck routes. Sales in our Building Materials Distribution segment are strongly correlated with new residential construction in the United States. Measured on a sales-per-housing-start basis, our Building Materials Distribution business has grown significantly from 2005 to 2011, with penetration increasing from $1,476 to $2,923, or approximately 98%, per U.S. housing start. In the future, we will continue to grow our Building Materials Distribution business by opportunistically acquiring facilities, adding new products, opening new locations, relocating and expanding capacity at existing facilities and capturing local market share through our superior supply chain capabilities and customer service.

7

Further Differentiate our Products and Services to Capture Market Share

We seek to continue to differentiate ourselves from our competitors by providing a broad line of high-quality products and superior customer service. Throughout the housing downturn, we believe we have grown market share by strengthening relationships with our customers by stocking sufficient inventory and retaining our primary sales team. Our Building Materials Distribution segment's highly efficient logistics system allows us to deliver superior customer service and assist our customers in optimizing their working capital. Our national distribution and manufacturing integration system differentiates us from most of our competitors and is critical to servicing leading wholesalers, home improvement centers, retail lumberyards and industrial converters. Additionally, this system allows us to procure product more efficiently and to develop and maintain stronger relationships with our vendors. Because of these relationships and our national presence, many of our vendors have offered us favorable pricing and provide us with enhanced product introductions and ongoing marketing support.

Continue to Improve our Competitiveness through Operational Excellence

We use a disciplined cost management approach to maximize our competitiveness without sacrificing our ability to react to future growth opportunities. Additionally, we have made capital investments and process improvements in certain facilities, which have enabled us to close or divest five manufacturing facilities during the housing downturn without any adverse impact on our production capacity. These capital investments and process improvements have decreased our production costs and allowed us to produce lower-cost, higher-quality veneers. Beginning in 2009, we adopted a data-driven process improvement program to further strengthen our manufacturing operations. Because of the significant gains we continue to see from this program, we believe there are opportunities to apply similar techniques and methods to different functional areas (including sales and marketing) to realize efficiencies in those areas.

On October 15, 2012, we redeemed $75.0 million of our senior subordinated notes. On October 22, 2012, we issued $250.0 million of 63/8% senior notes due 2020 and used a portion of the proceeds from such offering to fund the redemption of the remaining $144.6 million of our senior subordinated notes.

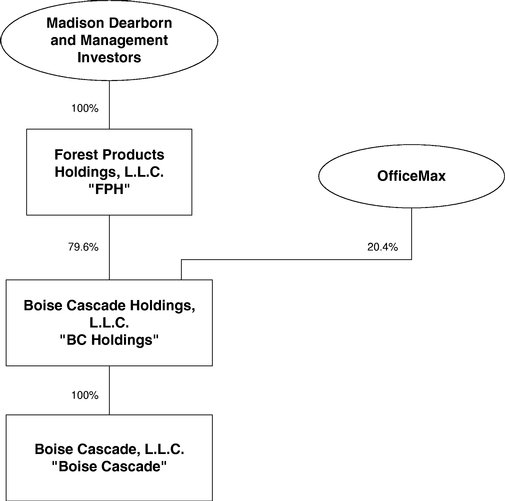

Our direct parent company, Boise Cascade Holdings, L.L.C. ("BC Holdings"), is controlled by Forest Products Holdings, L.L.C. ("FPH"), an entity controlled by an investment fund managed by Madison Dearborn. Madison Dearborn, based in Chicago, is an experienced private equity investment firm that has raised over $18 billion of capital. Since its formation in 1992, Madison Dearborn's investment funds have invested in approximately 125 companies across a broad spectrum of industries, including basic industries; business and government services; consumer; financial services; healthcare; and telecom, media and technology services. Madison Dearborn's objective is to invest in companies with strong competitive characteristics that it believes have the potential for significant long-term equity appreciation. To achieve this objective, Madison Dearborn seeks to partner with outstanding management teams that have a solid understanding of their businesses as well as track records of building stockholder value.

Conversion into a Delaware Corporation

Prior to the consummation of this offering, we will convert from a Delaware limited liability company into a Delaware corporation by filing a certificate of conversion in Delaware.

8

We were formed under the name Boise Cascade, L.L.C., a Delaware limited liability company, in October 2004 in connection with our acquisition of OfficeMax's forest products and paper assets. Prior to the consummation of the offering, we will effect our conversion into a Delaware corporation and become Boise Cascade Company. Our principal executive offices are located at 1111 West Jefferson Street, Suite 300, Boise, Idaho 83702. Our telephone number at that location is (208) 384-6161. Our website address is www.bc.com. The reference to our website is a textual reference only. We do not incorporate the information on our website into this prospectus and you should not consider any information on, or that can be accessed through, our website as part of this prospectus.

Our key registered trademarks include BOISE CASCADE® and the TREE-IN-A-CIRCLE® logo. This prospectus also refers to the products or services of other companies by the trademarks and trade names used and owned by those companies.

Investing in our common stock involves substantial risk. You should carefully consider all of the information in this prospectus prior to investing in our common stock, including the information described under "Risk Factors" elsewhere in this prospectus. Among these important risks are the following:

- •

- the commodity nature of our products and their price movements, which are driven largely by capacity utilization rates and

industry cycles that affect supply and demand;

- •

- general economic conditions, including but not limited to housing starts, repair and remodel activity and light commercial

construction, inventory levels of new and existing homes for sale, foreclosure rates, interest rates, unemployment rates, relative currency values, mortgage availability and pricing, as well as other

consumer financing mechanisms, that ultimately affect demand for our products;

- •

- availability and affordability of raw materials, including wood fiber, glues and resins and energy; and

- •

- the impact of actuarial assumptions and regulatory activity on pension costs and pension funding requirements.

9

| Common stock offered | shares | |

Common stock to be outstanding immediately after this offering |

shares |

|

Option to purchase additional shares |

We have agreed to allow the underwriters to purchase up to an additional shares from us, at the public offering price, less the underwriting discount, within 30 days of the date of this prospectus. |

|

Use of proceeds |

We estimate that the net proceeds from this offering will be approximately $ million, or approximately $ million if the underwriters exercise their option to purchase additional shares in full, assuming an initial public offering price of $ per share, which is the midpoint of the price range set forth on the cover of this prospectus, after deducting underwriting discounts and commissions and estimated offering expenses payable by us. We expect to use substantially all of the net proceeds from this offering for general corporate purposes. We have not allocated the net proceeds from this offering for any specific purpose at this time. See "Use of Proceeds." |

|

Dividend policy |

Boise Cascade does not plan to pay dividends on its common stock. The declaration and payment of all future dividends, if any, will be at the discretion of our board of directors and will depend upon our financial condition, earnings, contractual conditions, restrictions imposed by our revolving credit facility and the indenture governing our senior notes or applicable laws and other factors that our board of directors may deem relevant. See "Dividend Policy." |

|

Proposed New York Stock Exchange symbol |

We intend to apply to list our common stock on the New York Stock Exchange ("NYSE") under the symbol "BCC." |

Unless otherwise indicated, all information in this prospectus relating to the number of shares of common stock to be outstanding immediately after this offering:

- •

- gives effect to the completion of the conversion of Boise Cascade, L.L.C. into Boise Cascade Company prior to the

completion of this offering as described in "—Conversion into a Delaware Corporation;"

- •

- assumes the effectiveness of our Delaware amended and restated certificate of incorporation, which we will adopt in

connection with the conversion discussed in the immediately prior bullet point;

- •

- assumes (i) no exercise by the underwriters of their option to purchase up

to additional shares

from us; and (ii) an initial public offering price of $ per share, the midpoint of the initial public offering price range indicated on the cover of this prospectus; and

- •

- excludes an aggregate of shares of our common stock reserved for issuance under the new management equity incentive plan we intend to adopt in connection with this offering (the "2013 Equity Incentive Plan").

10

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL DATA

The following tables set forth our summary consolidated historical and pro forma financial data. You should read the information set forth below in conjunction with "Use of Proceeds," "Capitalization," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated historical financial statements and notes thereto included elsewhere in this prospectus. The statement of income (loss) data for each of the years ended December 31, 2009, 2010 and 2011 and the balance sheet data as of December 31, 2010 and 2011 set forth below are derived from our audited consolidated financial statements included elsewhere in this prospectus. The statements of income (loss) data for each of the nine-month periods ended September 30, 2011 and 2012 and the balance sheet data as of September 30, 2012 set forth below are derived from our unaudited quarterly consolidated financial statements included elsewhere in this prospectus and contain all adjustments, consisting of normal recurring adjustments, that management considers necessary for a fair presentation of our financial position and results of operations for the periods presented. Operating results for the nine-month periods are not necessarily indicative of results for a full financial year, or any other periods. See "Index to Consolidated Financial Statements."

| |

Year Ended December 31 | Nine Months Ended September 30 |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2009 | 2010 | 2011 | 2011 | 2012 | |||||||||||

| |

(in thousands, except per share data) |

|||||||||||||||

Statement of Income (Loss) Data: |

||||||||||||||||

Sales |

$ | 1,973,250 | $ | 2,240,591 | $ | 2,248,088 | $ | 1,700,646 | $ | 2,084,482 | ||||||

Costs and expenses(1) |

2,056,699 | 2,253,753 | 2,275,134 | 1,718,616 | 2,029,956 | |||||||||||

Income (loss) from operations |

(83,449 | ) | (13,162 | ) | (27,046 | ) | (17,970 | ) | 54,526 | |||||||

Foreign exchange gain (loss) |

1,025 | 352 | (497 | ) | (596 | ) | 125 | |||||||||

Change in fair value of contingent value rights(2) |

194 | — | — | — | — | |||||||||||

Gain on repurchase of long-term debt(3) |

6,026 | 28 | — | — | — | |||||||||||

Interest expense |

(22,520 | ) | (21,005 | ) | (18,987 | ) | (14,174 | ) | (14,471 | ) | ||||||

Interest income |

886 | 790 | 407 | 314 | 281 | |||||||||||

|

(14,389 | ) | (19,835 | ) | (19,077 | ) | (14,456 | ) | (14,065 | ) | ||||||

Income (loss) before income taxes |

(97,838 | ) | (32,997 | ) | (46,123 | ) | (32,426 | ) | 40,461 | |||||||

Income tax provision |

(660 | ) | (300 | ) | (240 | ) | (146 | ) | (243 | ) | ||||||

Net income (loss) |

$ | (98,498 | ) | $ | (33,297 | ) | $ | (46,363 | ) | $ | (32,572 | ) | $ | 40,218 | ||

Pro forma net income (loss) per share(4) |

$ | $ | ||||||||||||||

Pro forma weighted average shares outstanding(4) |

||||||||||||||||

| |

Year Ended December 31 | Nine Months Ended September 30 |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2009 | 2010 | 2011 | 2011 | 2012 | |||||||||||

| |

(in thousands) |

|||||||||||||||

Other Financial Data: |

||||||||||||||||

Depreciation and amortization |

$ | 40,874 | $ | 34,899 | $ | 37,022 | $ | 27,500 | $ | 24,918 | ||||||

Capital expenditures(5) |

21,404 | 35,751 | 39,319 | 31,081 | 20,037 | |||||||||||

EBITDA(6) |

(35,330 | ) | 22,117 | 9,479 | 8,934 | 79,569 | ||||||||||

Adjusted EBITDA(6) |

(41,550 | ) | 17,476 | 9,479 | 8,934 | 79,569 | ||||||||||

11

| |

September 30, 2012 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

Actual | As Adjusted(7) | As Further Adjusted(8) |

|||||||

| |

(in thousands) |

|||||||||

Balance Sheet Data: |

||||||||||

Cash and cash equivalents |

$ | 224,418 | $ | 45,656 | $ | |||||

Total current assets |

729,143 | 550,381 | ||||||||

Property and equipment, net |

263,671 | 263,671 | ||||||||

Total assets |

1,031,470 | 856,641 | ||||||||

Total debt |

219,560 | 275,000 | ||||||||

Total capital |

326,210 | 98,613 | ||||||||

- (1)

- In

2009, costs and expenses include $8.9 million of expenses related to a facility closure, of which $3.7 million was included in EBITDA and

$5.2 million was accelerated depreciation recorded in depreciation and amortization. In 2010, costs and expenses include $4.6 million of income associated with receiving proceeds from a

litigation settlement related to vendor product pricing. In 2011, costs and expenses include $3.8 million of expense related to the closure of a laminated beam plant and noncash asset

write-downs, of which $2.9 million was included in the first nine months of 2011.

- (2)

- Represents

the change in fair value of contingent value rights issued in connection with the sale of our Paper and Packaging & Newsprint assets in

2008.

- (3)

- Represents

gain on the repurchase of $11.9 million and $8.6 million of our senior subordinated notes in 2009 and 2010, respectively.

- (4)

- Both

pro forma net income (loss) per share and pro forma weighted shares outstanding give effect to our conversion from a limited liability company to a

corporation and to the issuance of shares in this offering. The pro forma results of our being treated as a corporation had no impact on net income (loss) for the pro forma nine months ended

September 30, 2012 and the pro forma year ended December 31, 2011, primarily as a result of placing a full valuation allowance on the tax benefits associated with the 2011 net operating

losses. The pretax income for the nine months ended September 30, 2012 would not have resulted in an adjustment to our income tax provision due to the utilization of the net operating losses

carried forward from 2011. In addition, due to its non-recurring nature, the pro forma presentation does not reflect the recognition of a net deferred tax liability of approximately

$4.0 million, net of deferred tax assets and related valuation allowances, related to our tax status conversion from a limited liability company to a corporation prior to the consummation of

this offering. Following the offering, our effective tax rate is expected to be higher than in historical periods based on U.S. federal and state income tax rates applicable to a corporation and

because we will not be able to utilize the net operating losses incurred while we were a limited liability company. See "Management's Discussion and Analysis of Financial Condition and Results of

Operations—Taxation." Earnings per common share is not applicable to historical periods, as there were no shares of common stock outstanding during these periods.

- (5)

- For

2009, includes $0.9 million of cash paid for the purchase of a truss assembly operation and EWP sales office in Saco and Biddeford, Maine,

respectively, and $3.7 million of cash paid for the purchase of a sawmill in Pilot Rock, Oregon. For 2011, includes $5.8 million of cash paid for the acquisition of a laminated beam and

decking manufacturing plant in Homedale, Idaho. For the first nine months of 2012, includes $2.4 million of cash paid for the February 2012 acquisition of a sawmill in Arden, Washington.

- (6)

- EBITDA is defined as income (loss) before interest (interest expense and interest income), income taxes and depreciation and amortization. EBITDA is the primary measure used by our

12

chief

operating decision maker to evaluate segment operating performance and to decide how to allocate resources to segments. We believe EBITDA is useful to investors because it provides a means to

evaluate the operating performance of our segments and our company on an ongoing basis using criteria that are used by our internal decision makers and because it is frequently used by investors and

other interested parties when comparing companies in our industry that have different financing and capital structures and/or tax rates. We believe EBITDA is a meaningful measure because it presents a

transparent view of our recurring operating performance and allows management to readily view operating trends, perform analytical comparisons and identify strategies to improve operating performance.

EBITDA, however, is not a measure of our liquidity or financial performance under generally accepted accounting principles ("GAAP") and should not be considered as an alternative to net income (loss),

income (loss) from operations, or any other performance measure derived in accordance with GAAP or as an alternative to cash flow from operating activities as a measure of our liquidity. The use of

EBITDA instead of net income (loss) or segment income (loss) has limitations as an analytical tool, including the inability to determine profitability; the exclusion of interest expense, interest

income and associated significant cash requirements; and the exclusion of depreciation and amortization, which represent unavoidable operating costs. Management compensates for the

limitations of EBITDA by relying on our GAAP results. Our measure of EBITDA is not necessarily comparable to other similarly titled captions of other companies due to potential inconsistencies in the

methods of calculation.

Adjusted EBITDA is defined as EBITDA before unusual items, including the change in fair value of contingent value rights issued in connection with the sale of our Paper and Packaging &

Newsprint assets, a gain on the repurchase of long-term debt and a litigation gain.

The following is a reconciliation of net income (loss) to EBITDA and Adjusted EBITDA:

| |

Year Ended December 31 | Nine Months Ended September 30 |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2009 | 2010 | 2011 | 2011 | 2012 | |||||||||||

| |

(in millions) |

|||||||||||||||

Net income (loss) |

$ | (98.5 | ) | $ | (33.3 | ) | $ | (46.4 | ) | $ | (32.6 | ) | $ | 40.2 | ||

Interest expense |

22.5 | 21.0 | 19.0 | 14.2 | 14.5 | |||||||||||

Interest income |

(0.9 | ) | (0.8 | ) | (0.4 | ) | (0.3 | ) | (0.3 | ) | ||||||

Income tax provision |

0.7 | 0.3 | 0.2 | 0.1 | 0.2 | |||||||||||

Depreciation and amortization |

40.9 | 34.9 | 37.0 | 27.5 | 24.9 | |||||||||||

EBITDA |

$ | (35.3 | ) | $ | 22.1 | $ | 9.5 | $ | 8.9 | $ | 79.6 | |||||

Change in fair value of contingent value rights(a) |

(0.2 | ) | — | — | — | — | ||||||||||

Gain on repurchase of long-term debt(b) |

(6.0 | ) | (0.0 | ) | — | — | — | |||||||||

Litigation gain(c) |

— | (4.6 | ) | — | — | — | ||||||||||

Adjusted EBITDA |

$ | (41.6 | ) | $ | 17.5 | $ | 9.5 | $ | 8.9 | $ | 79.6 | |||||

- (a)

- See

Note (2) above.

- (b)

- See

Note (3) above.

- (c)

- See Note (1) above.

13

- (7)

- The

balance sheet data, as adjusted, gives effect to (i) our redemption of $75.0 million of our senior subordinated notes on

October 15, 2012; (ii) our issuance of $250.0 million of senior notes on October 22, 2012 and our redemption of our remaining $144.6 million of senior subordinated

notes with a portion of the related proceeds; and (iii) our payment of a $225.0 million cash distribution to BC Holdings prior to the consummation of this offering and a

$25.0 million repayment on our revolving credit facility, which we anticipate will be required to comply with the related covenant in the indenture governing our senior notes in connection with

making the distribution. In addition, the balance sheet data, as adjusted, gives effect to the write-off of deferred financing costs of $1.5 million and payment of $3.7 million of

interest related to the redemption of our senior subordinated notes, as well as the deferral of $5.5 million in financing costs on the offering of our senior notes.

- (8)

- The balance sheet data, as further adjusted, gives further effect to our conversion from a limited liability company to a corporation and our issuance and sale of shares of common stock in this offering at an assumed initial public offering price of $ per share, which is the midpoint of the price range listed on the cover page of this prospectus, after deducting underwriting discounts and commissions and estimated offering expenses payable by us.

14

RISK FACTORS

Investing in our common stock involves a high degree of risk. You should carefully consider the risk factors set forth below as well as the other information contained in this prospectus before investing in our common stock. Any of the following risks could materially and adversely affect our business, financial condition and results of operations. In such case, you may lose all or part of your original investment.

Risks Relating to Our Business

Many of the products we manufacture or purchase and resell are commodities whose price is determined by the market's supply and demand for such products, and the markets in which we operate are cyclical and competitive. The depressed state of the housing, construction and home improvement markets could continue to adversely affect demand and pricing for our products.

Many of the building products we produce or distribute, including OSB, plywood, lumber and particleboard, are commodities that are widely available from other manufacturers or distributors with prices and volumes determined frequently in an auction market based on participants' perceptions of short-term supply and demand factors. At times, the price for any one or more of the products we produce may fall below our cash production costs, requiring us to either incur short-term losses on product sales or cease production at one or more of our manufacturing facilities. Therefore, our profitability with respect to these commodity products depends, in significant part, on managing our cost structure, particularly raw materials and labor, which represent the largest components of our operating costs. Commodity wood product prices could be volatile in response to operating rates and inventory levels in various distribution channels. Commodity price volatility affects our distribution business, with falling price environments generally causing reduced revenues and margins, resulting in substantial declines in profitability and possible net losses.

Historically, demand for the products we manufacture, as well as the products we purchase and distribute, has been closely correlated with new residential construction in the United States and, to a lesser extent, light commercial construction and residential repair and remodeling activity. New residential construction activity remained substantially below average historical levels during the first nine months of 2012 and so did demand for the products we manufacture and distribute. There is significant uncertainty regarding the timing and extent of any recovery in such construction activity and resulting product demand levels. Demand for new residential construction is influenced by seasonal weather factors, mortgage availability and rates, unemployment levels, household formation rates, domestic population growth, immigration rates, residential vacancy and foreclosure rates, demand for second homes, existing home prices, consumer confidence and other general economic factors.

Wood products industry supply is influenced primarily by price-induced changes in the operating rates of existing facilities but is also influenced over time by the introduction of new product technologies, capacity additions and closures, restart of idled capacity and log availability. The balance of wood products supply and demand in the United States is also heavily influenced by imported products, principally from Canada.

We have very limited control of the foregoing and as a result, our profitability and cash flow may fluctuate materially in response to changes in the supply and demand balance for our primary products.

Our industry is highly competitive. If we are unable to compete effectively, our sales, operating results and growth strategies could be negatively affected.

The building products distribution industry that our Building Materials Distribution segment competes in is highly fragmented and competitive and the barriers to entry for local competitors are relatively low. Competitive factors in our industry include pricing and availability of product, service

15

and delivery capabilities, ability to assist customers with problem solving, customer relationships, geographic coverage and breadth of product offerings. Also, financial stability is important to suppliers and customers in choosing distributors and allows for more favorable terms on which to obtain products from suppliers and sell products to customers. If our financial condition deteriorates in the future, our support from suppliers may be negatively impacted.

The markets for the products we manufacture in our Wood Products segment are also highly competitive. Our competitors range from very large, fully integrated forest and building products firms to smaller firms that may manufacture only one or a few types of products. We also compete less directly with firms that manufacture substitutes for wood building products. Certain mills operated by our competitors may be lower-cost manufacturers than the mills operated by us.

Some of our competitors are larger companies and, therefore, have access to greater financial and other resources than we do. These resources may afford those competitors greater purchasing power, increased financial flexibility and more capital resources for expansion and improvement, which may enable those competitors to compete more effectively than we can.

Our manufacturing businesses may have difficulty obtaining logs and fiber at favorable prices or at all.

Wood fiber is our principal raw material, which accounted for approximately 38% of the aggregate amount of materials, labor and other operating expenses, including from related parties, for our Wood Products segment in 2011. Wood fiber is a commodity and prices have been cyclical historically in response to changes in domestic and foreign demand and supply. Foreign demand for log exports, particularly from China, increased log costs in the western U.S. in 2010 and 2011 and negatively affected wood products manufacturers in the region. Sustained periods of high log costs may impair the cost competitiveness of our manufacturing facilities. Availability of residual wood fiber for our particleboard operation has been negatively affected by significant mill closures and curtailments that have occurred among solid-wood product manufacturers. Future development of wood cellulose biofuel or other new sources of wood fiber demand could interfere with our ability to source wood fiber or significantly raise our costs.

Future domestic or foreign legislation and litigation concerning the use of timberlands, timber harvest methodologies, forest road construction and maintenance, the protection of endangered species, forest-based carbon sequestration, the promotion of forest health and the response to and prevention of catastrophic wildfires can also affect log and fiber supply from government and private lands. Availability of harvested logs and fiber may be further limited by fire, insect infestation, disease, ice storms, windstorms, hurricanes, flooding and other natural and man-made causes, thereby reducing supply and increasing prices.

Significant changes in discount rates, actual investment return on pension assets and other factors could affect our earnings, equity and pension contributions in future periods.

Our earnings may be negatively affected by the amount of income or expense we record for our pension plans. GAAP requires that we calculate income or expense for the plans using actuarial valuations. These valuations reflect assumptions relating to financial market and other economic conditions. Changes in key economic indicators can change the assumptions. The most significant year-end assumptions used to estimate pension expense are the discount rate and the expected long-term rate of return on plan assets. In addition, we are required to make an annual measurement of plan assets and liabilities, which may result in a significant change to equity through a reduction or increase to "Accumulated other comprehensive income (loss)." A decline in the market value of the pension assets will increase our funding requirements. Our pension plan liabilities are sensitive to changes in interest rates. As interest rates decrease, the liabilities increase, potentially increasing benefit costs and funding requirements. Changes in demographics, including increased numbers of

16

retirements or changes in life expectancy assumptions, may also increase the funding requirements of the obligations related to the pension plans. At December 31, 2011, the net underfunded status of our defined benefit pension plans was $187.9 million. If the status of our defined benefit plans continues to be underfunded, we anticipate significant future funding obligations, reducing the cash available for our business. For more discussion regarding how our financial statements can be affected by pension plan estimates, see "Management's Discussion and Analysis of Financial Condition and Results of Operations—Critical Accounting Estimates—Pensions."

A material disruption at one of our manufacturing facilities could prevent us from meeting customer demand, reduce our sales and/or negatively affect our financial results.

Any of our manufacturing facilities, or any of our machines within an otherwise operational facility, could cease operations unexpectedly due to a number of events, including but not limited to:

- •

- equipment failure, particularly a press at one of our major EWP production facilities;

- •

- fires, floods, earthquakes, hurricanes or other catastrophes;

- •

- unscheduled maintenance outages;

- •

- utility and transportation infrastructure disruptions;

- •

- labor difficulties;

- •

- other operational problems; or

- •

- ecoterrorism or threats of ecoterrorism.

Any downtime or facility damage could prevent us from meeting customer demand for our products and/or require us to make unplanned capital expenditures. If our machines or facilities were to incur significant downtime, our ability to satisfy customer requirements would be impaired, resulting in lower sales and net income.

In addition, a number of our suppliers are subject to the manufacturing facility disruption risks noted above. Our suppliers' inability to produce the necessary raw materials for our manufacturing processes or supply the finished goods that we distribute through our Building Materials Distribution segment may adversely impact our results of operations, cash flows and financial position.

Adverse conditions may increase the credit risk from our customers.

Our Building Materials Distribution and Wood Products segments extend credit to numerous customers who are heavily exposed to the effects of downturns in the housing market. Unfavorable housing market conditions could result in financial failures of one or more of our significant customers, which could impair our ability to fully collect receivables from such customers and negatively affect our operating results, cash flow and liquidity.

A significant portion of our sales are concentrated with a relatively small number of customers.

For the LTM period, our top ten customers represented approximately 31% of sales, with one customer accounting for approximately 11% of sales during such period. Although we believe that our relationships with our customers are strong, the loss of one or more of these customers could have a material adverse effect on our operating results, cash flow and liquidity.

Our ability to service our indebtedness or to fund our other liquidity needs is subject to various risks.

Our ability to make scheduled payments on our indebtedness and fund other liquidity needs depends on and is subject to our financial and operating performance, which in turn is affected by general and regional economic, financial, competitive, business and other factors, including the

17

availability of financing in the banking and capital markets as well as the other risks described herein. In particular, demand for our products correlates to a significant degree to the level of residential construction activity in North America, which historically has been characterized by significant cyclicality. Over the last several years, housing starts remained below historical levels. This reduced level of building was caused, in part, by an increase in the inventory of homes for sale, a more restrictive mortgage market and a slowed economy. There can be no assurance as to when or if the housing market will rebound to historical levels. We have experienced significant losses from operations and used significant cash for operating activities in recent periods.

We cannot assure you that our business will generate sufficient cash flows from operations or that future borrowings will be available to us in an amount sufficient to enable us to service our debt or to fund our other liquidity needs. If we are unable to service our debt obligations or to fund our other liquidity needs, we could be forced to curtail our operations, reorganize our capital structure, or liquidate some or all of our assets.

We are subject to environmental regulation and environmental compliance expenditures, as well as other potential environmental liabilities.

Our businesses are subject to a wide range of general and industry-specific environmental laws and regulations, particularly with respect to air emissions, wastewater discharges, solid and hazardous waste management and site remediation. Enactment of new environmental laws or regulations, including those aimed at addressing greenhouse gas emissions, or changes in existing laws or regulations might require significant expenditures or restrict operations.

The Environmental Protection Agency (the "EPA") has recently promulgated a series of four regulations commonly referred to collectively as Boiler MACT, which are intended to regulate the emission of hazardous air pollutants from industrial boilers. At the time it announced the final promulgation of the regulations, the EPA also announced that it planned to reconsider portions of the regulations and has recently taken steps to initiate such reconsideration. In December 2011, the EPA published its re-proposed rules and we are currently evaluating the potential impact of the re-proposed rules on our business. If the Boiler MACT rules are finalized as re-proposed, we believe the new rules would be less costly for us to implement than the current rules. The EPA has yet to finalize the new Boiler MACT rules. Once final, considerable uncertainty will still exist, as there will likely be legal challenges to the final rules from industry and/or environmental organizations. Notwithstanding that uncertainty, we are proceeding with efforts to analyze the applicability and requirements of the regulations, as recently re-proposed and the likely capital and operating costs required to comply. At this time, we cannot accurately forecast the capital or operating cost changes that may result from compliance with the regulations.

As an owner and operator of real estate, we may be liable under environmental laws for the cleanup of past and present spills and releases of hazardous or toxic substances on or from our properties and operations. We could be found liable under these laws whether or not we knew of, or were responsible for, the presence of such substances. In some cases, this liability may exceed the value of the property itself.

We may be unable to generate funds or other sources of liquidity and capital to fund unforeseen environmental liabilities or expenditures. For additional information on how environmental regulation and compliance affects our business, see "Management's Discussion and Analysis of Financial Condition and Results of Operations—Environmental."

Labor disruptions or increased labor costs could adversely affect our business.

As of September 30, 2012, we had approximately 4,470 employees. Approximately 30% of these employees work pursuant to collective bargaining agreements. As of September 30, 2012, we had ten

18

collective bargaining agreements. One agreement, covering 359 employees at our facility in Florien, Louisiana and 262 employees at our facility in Oakdale, Louisiana, is set to expire on July 15, 2013. If these agreements are not renewed or extended upon their expiration, we could experience a material labor disruption or significantly increased labor costs, which could prevent us from meeting customer demand or reduce our sales and profitability.

Should the markets for our products deteriorate or should we decide to invest capital differently or should other cash flow assumptions change, it is possible that we will be required to record noncash impairment charges in the future that could have a material impact on our results of operations.

We review the carrying value of long-lived assets for impairment when events or changes in circumstances indicate that the carrying amount of the assets may not be recoverable. Should the markets for our products deteriorate or should we decide to invest capital differently or should other cash flow assumptions change, it is possible that we will be required to record noncash impairment charges in the future that could have a material impact on our results of operations.

The terms of our revolving credit facility and the indenture governing our senior notes restrict, and covenants contained in agreements governing indebtedness in the future may restrict, our ability to operate our business and to pursue our business strategies.

Our revolving credit facility and the indenture governing our senior notes contain, and any future indebtedness of ours may contain, a number of restrictive covenants that impose customary operating and financial restrictions on us. Our revolving credit facility and the indenture governing our senior notes limit our ability and the ability of our restricted subsidiaries, among other things, to:

- •

- incur additional debt;

- •

- declare or pay dividends, redeem stock or make other distributions to stockholders;

- •

- make investments;

- •

- create liens or use assets as security in other transactions;

- •

- merger or consolidate, or sell, transfer, lease or dispose of substantially all of our assets;

- •

- enter into transactions with affiliates;

- •

- sell or transfer certain assets; and

- •

- make prepayments on our senior notes and subordinated indebtedness.

In addition, our revolving credit facility provides that if an event of default occurs or excess availability under our revolving credit facility drops below a threshold amount equal to the greater of 12.5% of the aggregate commitments under our revolving credit facility and $31.25 million (and until such time as excess availability for two consecutive fiscal months exceeds that threshold amount and no event of default has occurred and is continuing), we will be required to maintain a monthly minimum fixed coverage charge ratio of 1.0:1.0, determined on a trailing twelve-months' basis.

Our failure to comply with any of these covenants could result in an event of default which, if not cured or waived, could result in the acceleration of all of our indebtedness.

We may be unable to attract and retain key management and other key employees.

Our employees, particularly our key management, are vital to our success and difficult to replace. We may be unable to retain them or to attract other highly qualified employees, particularly if we do not offer employment terms competitive with the rest of the market. Failure to attract and retain highly qualified employees, or failure to develop and implement a viable succession plan, could result in inadequate depth of institutional knowledge or skill sets, adversely affecting our business.

19

As a result of the sale of our Paper and Packaging & Newsprint assets, we now rely on Boise Inc. for many of our administrative services.

In conjunction with the sale of our Paper and Packaging & Newsprint assets in 2008, we entered into an Outsourcing Services Agreement under which Boise Inc. provides a number of corporate staff services to us at cost. These services include information technology, accounting and human resource transactional services. Most of the Boise Inc. staff that provides these services are providing the same services they provided when they were our employees. Nevertheless, we cannot be assured that these employees will remain with Boise Inc. or that there will not be a disruption in the continuity or level of service provided. If Boise Inc. is unwilling or unable to provide services at the same quality levels as those services have been provided in the past, our business and compliance activities and results of operations could be substantially and negatively affected.

Risks Relating to Ownership of Our Common Stock

There is no existing market for our common stock, and we do not know if one will develop to provide you with adequate liquidity to sell our common stock at prices equal to or greater than the price you paid in this offering.

Prior to this offering, there has not been a public market for our common stock. We cannot predict the extent to which investor interest in our company will lead to the development of an active trading market on the NYSE or otherwise or how liquid that market might become. If an active trading market does not develop, you may have difficulty selling any of our common stock that you buy. The initial public offering price for the common stock will be determined by negotiations between us and the representatives of the underwriters and may not be indicative of prices that will prevail in the open market following this offering. Consequently, you may not be able to sell our common stock at prices equal to or greater than the price you paid in this offering, or at all.

The price of our common stock may fluctuate significantly, and you could lose all or part of your investment.

Volatility in the market price of our common stock may prevent you from being able to sell your shares at or above the price you paid for them. The market price for our common stock could fluctuate significantly for various reasons, including:

- •

- our operating and financial performance and prospects;

- •

- our quarterly or annual earnings or those of other companies in our industry;

- •

- the public's reaction to our press releases, our other public announcements and our filings with the SEC;

- •

- changes in, or failure to meet, earnings estimates or recommendations by research analysts who track our common stock or

the stock of other companies in our industry;

- •

- the failure of research analysts to cover our common stock;

- •

- general economic, industry and market conditions;

- •

- strategic actions by us, our customers or our competitors, such as acquisitions or restructurings;

- •

- new laws or regulations or new interpretations of existing laws or regulations applicable to our business;

- •

- changes in accounting standards, policies, guidance, interpretations or principles;

- •

- material litigation or government investigations;

20

- •

- changes in general conditions in the U.S. and global economies or financial markets, including those resulting from war,

incidents of terrorism or responses to such events;

- •

- changes in key personnel;

- •

- sales of common stock by us, our principal stockholder or members of our management team;

- •

- termination of lock-up agreements with our management team and principal stockholder;

- •

- the granting or exercise of employee stock options;

- •

- volume of trading in our common stock; and

- •

- the impact of the facts described elsewhere in "Risk Factors."

In addition, in recent years, the stock market has regularly experienced significant price and volume fluctuations. This volatility has had a significant impact on the market price of securities issued by many companies, including companies in our industry. The changes frequently appear to occur without regard to the operating performance of the affected companies. Hence, the price of our common stock could fluctuate based upon factors that have little or nothing to do with us and these fluctuations could materially reduce our share price.

The requirements of being a public company will increase certain of our costs and require significant management focus.