Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Ameris Bancorp | d440604d8k.htm |

Third Quarter 2012

Investor Presentation

Exhibit 99.1 |

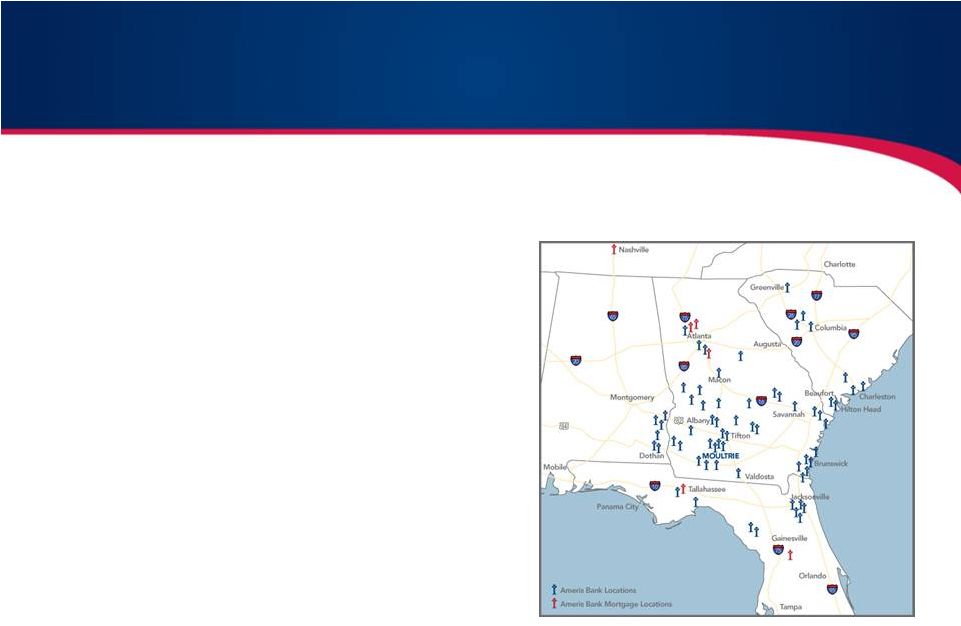

Corporate

Profile •

Headquartered in Moultrie, Georgia

•

Founded in 1971 as American Banking

Company

•

Historically grown through acquisitions of

smaller banks in areas close to existing

operations

•

Recent growth through de novo expansion

strategy and 10 FDIC-assisted transactions

•

Four state footprint with 66 offices

•

Approximately 872 FTEs managing 200,000

core customer accounts

•

Assets –

$2.9 billion

Loans –

$2.0 billion

Deposits –

$2.6 billion

2 |

Realize the

positive impacts of our Earnings Strategies •

Design and implement strategies to build more efficient banking platform. Rationalize

branch network and position Bank for faster growth in assets.

•

Continue to drive double digit growth in loans and low-cost/no-cost funding.

•

Build

additional

non-interest

income

lines

of

businesses

to

drive

revenue

towards

the

top

quartile of our peer group. Leverage premier mortgage platform for better

profitability. •

Recognize a reduction in credit related expenses commensurate with the significant reduction

in classified and non-accrual assets.

Position Ameris Bank as a Consolidator in our 4 Southeastern States

•

FDIC

Assisted

acquisitions

–

Slowing

pipeline

of

opportunities

but

our

markets

still

have

majority

of

potential

deals.

Interest

in

both

Strategic

(builds

market

share)

and

Financial

(builds excess TCE and T1 capital).

•

Traditional

M&A

–

Early

stages

of

a

growing

pipeline

of

opportunities

in

our

footprint

on

larger, thinly capitalized institutions.

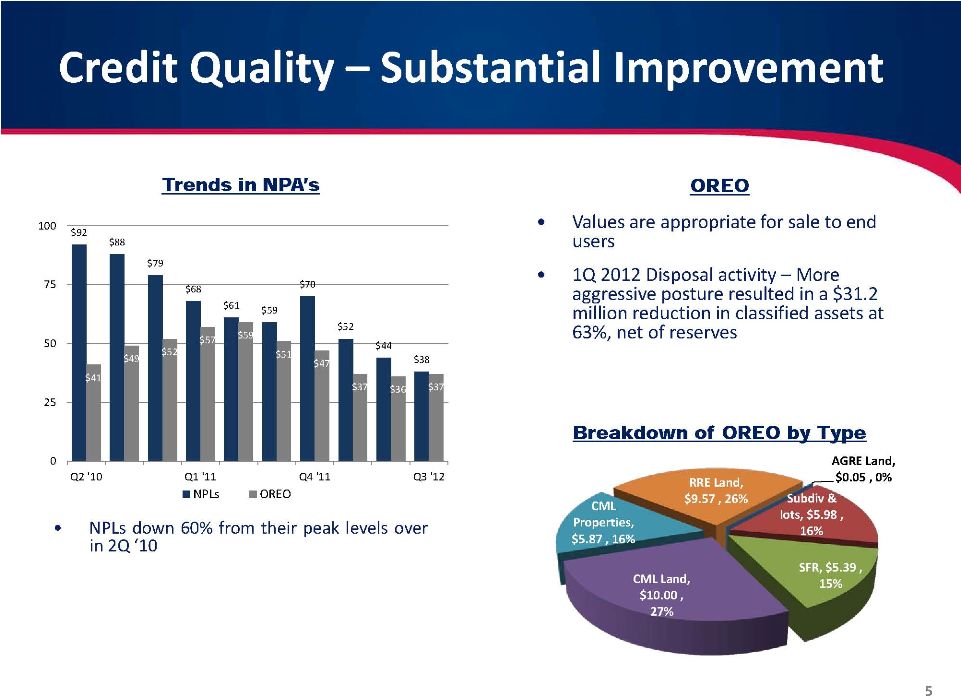

Continue Improving Credit Quality

•

Continue to manage strategies that restore historic quality to our Balance Sheet.

•

Reduce credit-related operating expenses incrementally throughout 2012.

3

Current Focus |

•

Diversified loan portfolio across five regions

–

Inland Georgia –

51%

–

Coastal Georgia –

15%

–

Alabama –

9%

•

In-house lending limit of $7.5 million versus $75 million legal limit

–

5 loans greater than $5 million

•

Loan participations less than 1.00% of total loans

•

Aggressive management of concentrations of credit

•

Top

25

relationships

are

only

10.3%

of

total

loans

4

–

South Carolina –

13%

–

Florida –

12%

Loan Type

Average Loan

Size

Average Rate

Commercial R/E

$ 347,487

5.42 %

C&D

108,514

5.39

Residential

72,066

5.74

C&I

59,831

5.03

Consumer

6,970

6.53

Agriculture

118,634

5.83

Total

$ 81,632

5.55 %

Loan Portfolio Detail

Loan Portfolio Detail –

9/30/12

Agriculture

9%

Construction

6%

owner

occupied CRE

15%

Owner

Occupied CRE

15%

Consumer

Installment &

Residential

20%

Covered

28%

C&I

7%

Non

- |

|

•

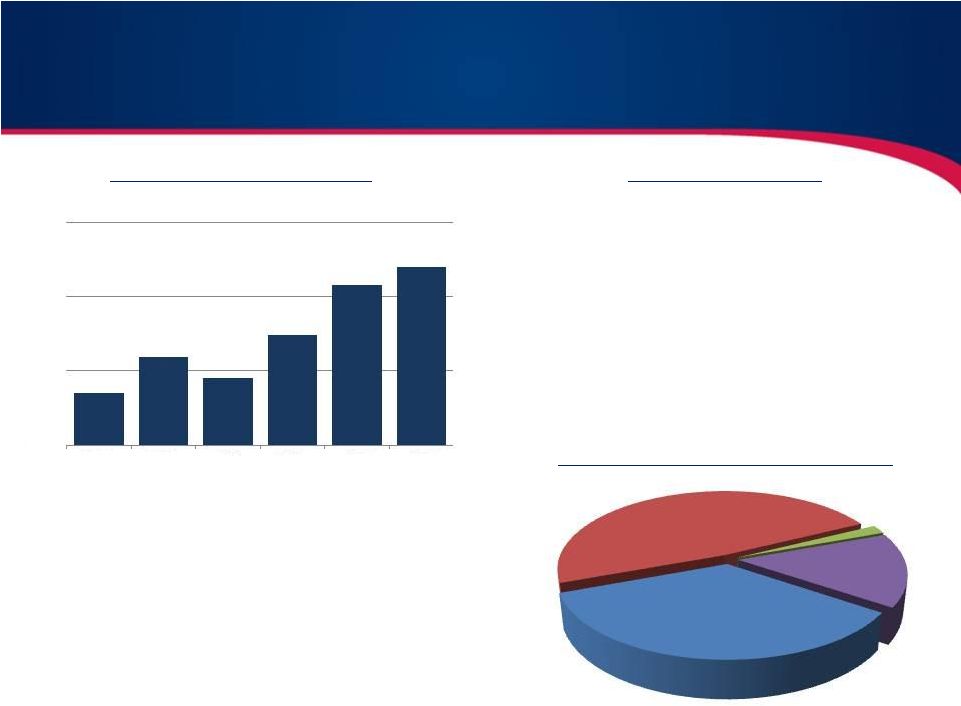

Leveraging presence in new markets (top five markets

account for 70% of pipeline: Atlanta, Jacksonville,

Columbia, Savannah, Charleston

•

Upgrading production positions in key markets: limited

changes to expense base but higher levels of quality

production

•

Expanding Mortgage Strategy: Jumbo mortgages,

wholesale, warehouse LOC

•

Leveraging Agricultural expertise: better yields than in

CRE due to limited competition

•

Specialty lines of business that would diversify loan

portfolio

•

Yields on current production approximately

5.25%

•

2/3

rds

of production is with existing customers –

higher rates (40bps-50bps from relationships)

•

Diversified loan types –

not solely chasing CRE

or competing with low rates that do not

compensate for term or quality

6

Loan Growth Opportunity

Growth in Loan Pipelines

Lending Strategies

Portfolio Diversification by Type

Comm'l, Finc'l

& Agriculture,

34.9%

Commercial

R/E, 48.3%

Construction,

1.8%

Residential

R/E, 15.0%

$120.4

$168.1

$139.7

$197.5

$264.9

$289.1

$50.0

$150.0

$250.0

$350.0

2Q 11

3Q 11

4Q 11

1Q 12

2Q 12

3Q 12

Loan Pipeline EOQ

(in millions) |

7

(1)

Excludes covered assets, where applicable

dollars in millions, except per share data

Q3 '11

Q4 '11

Q1 '12

Q2 '12

Q3 '12

YTD Change

BALANCE SHEET

Assets

$3,010

$2,994

$3,043

$2,920

$2,949

(2.03)

%

Loans, net

1,929

1,868

1,949

1,941

2,015

4.46

Tang Common Equity / Assets

7.96%

7.96%

7.95%

8.41%

8.27%

3.89

Tangible Book Value

$10.08

$10.06

$10.15

$10.29

$10.23

1.49

PERFORMANCE

Pre-tax, pre-credit earnings

$15,433

$15,030

$13,634

$14,700

$13,728

(11.05)

%

as a percentage of average assets

2.01%

2.01%

1.84%

1.99%

1.86%

Revenue (ex acquisition gains)

$34,880

$35,259

$34,954

$37,756

$38,069

9.14

as a percentage of average assets

4.64%

4.71%

4.59%

5.17%

5.16%

OPEX (ex credit costs)

$20,501

$20,926

$21,507

$23,200

$25,104

22.45

as a percentage of average assets

2.72%

2.80%

2.83%

3.18%

3.41%

Diluted earnings per share

0.66

0.01

0.19

0.07

0.04

(93.94)

Net interest margin (TE)

4.44 %

5.21 %

4.48 %

4.66 %

4.52 %

1.80

Efficiency ratio (ex credit costs)

58.78%

59.35%

61.53%

61.45%

75.68%

28.76

CREDIT QUALITY

(1)

NPAs / Assets

3.77%

4.05%

3.03%

2.89%

2.58%

(31.56)

%

Classified Assets / Capital

41.78

43.93

35.07

32.05

31.44

(24.75)

Reserves / Loans

2.57

2.64

2.17

1.92

1.80

(29.96)

Reserves / NPLs

59.66

49.64

54.90

58.98

67.76

13.58

Third Quarter Update |

Short-term

plan to convert low yielding assets into traditional earning asset mix Pickup in net

interest income from the strategy is approximately $24.6 million

•

•

•

•

8

Balance

Type

75,961

Legacy NPAs

88,895

Covered OREO

198,440

Covered OREO

123,448

Covered NPLs

111,251

S/T assets

597,995

Total Low Yielding Assets

Balance

Type

448,496

Loans

(75% weighting, 5.00% yields)

119,599

Investments

(20% weight, 2.00% yields)

29,900

S/T assets

(5% weighting, 0.25% yields)

597,995

Traditional E/A mix

•

Majority of the conversion of low yielding assets expected

inside of 2 years

•

Cash flows here do not factor in “growth”; Management

believes growth is possible and costs of new deposits in

3Q 2012 was approximately 0.40%

Earnings Growth –

Expansion/Remix of Earning Assets

Reshuffling asset mix is 100% incremental to ROA

After tax pickup of $0.68 per share and 54bps improvement in

ROA

Loan generation engine in place, focused on lending niches,

larger relationships in growth markets, existing customers

Some loan growth may come from additional FDIC

transactions where assets have higher yields than calculated

here |

9

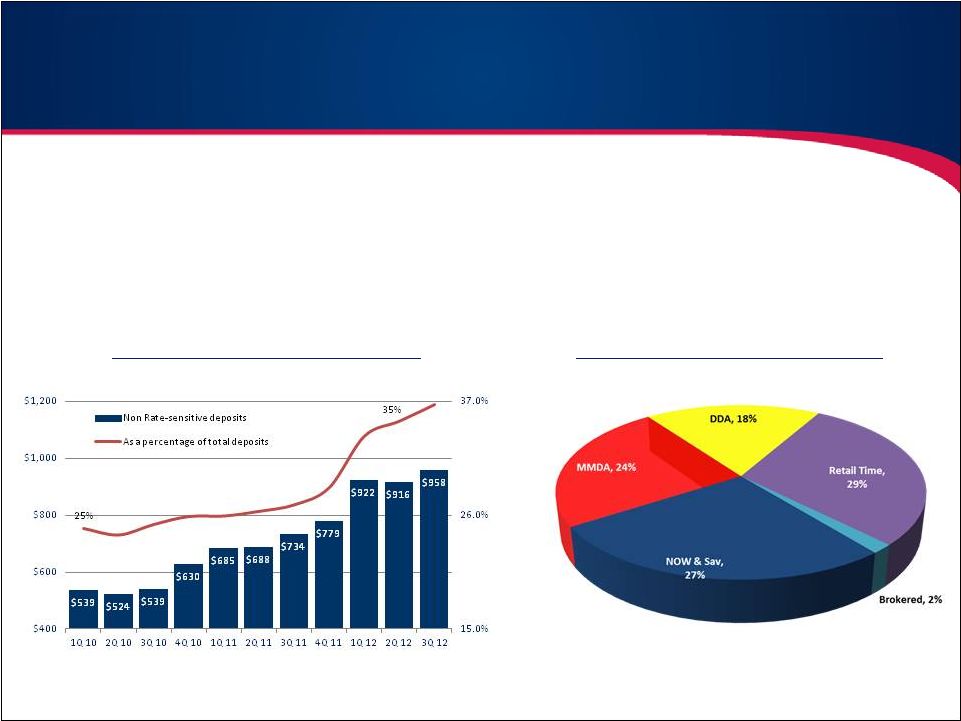

•

31.1%

-

Growth rate in Non-interest Bearing Demand during last 12 months

•

61.0%

-

Percentage of deposits in retail oriented transaction style accounts

•

98.0%

-

Percentage

of

Bank’s

total

funding

through

deposits

that

“walks

through

our

front

doors”

(2Q

‘12)

“Zero”

cost deposits include non-interest bearing checking, NOW accounts and Savings accounts that

cost less than 0.25% and are deemed to have very little sensitivity to changing interest

rates.. Local Deposit Customers

Drive Profitability & Long Term Franchise Value

“Zero”

Cost

Deposits

–

9/30/12

Deposit

Composition

–

9/30/12 |

10

(1)

Maturity and Repricing Opportunity are amounts and yields maturing in the designated

quarter (2)

Ameris Bank net interest margin on a fully taxable-equivalent basis, excludes H/C level

TRUPs .

Loans

CDs

Quarter

Yield

Quarter

Yield

Q3 '11

5.62%

Q3 '11

0.96%

Q4 '11

5.38%

Q4 '11

0.67%

Q1 '12

5.48%

Q1 '12

0.65%

Q2 '12

5.45%

Q2 '12

0.54%

Q3 '12

5.28%

Q3 '12

0.51%

Upcoming

Maturities

and

Expected

Renewals:

Quarter

Loans -

Balance

Maturing

Yield

Quarter

CDs -

Balance

Maturing

Cost

Q3 '12

$ 144,165

5.82%

Q3 '12

$ 232,812

1.05%

Q4 '12

$ 123,207

5.98%

Q4 '12

$ 186,914

0.89%

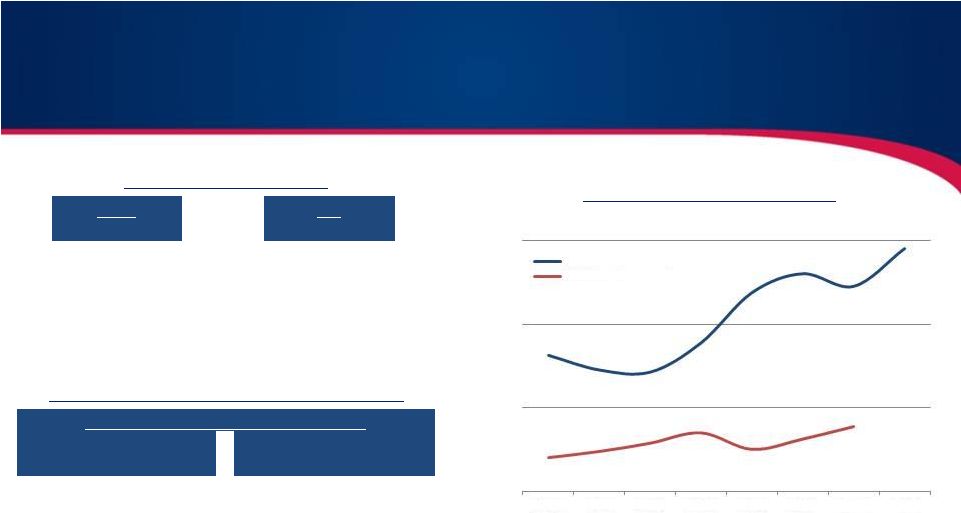

•

Maturing

Balances

and

yields

relative

to

“Acquisition

Yields”

are

still

in

Ameris

Bank’s

favor

•

53.5% -

Increase in new loan volume in Q2 2012 vs. Q3 2011

Net Interest Margin

Net

Interest

Margin

(2)

(%)

Maturity

&

Repricing

Opportunity

(1)

“Acquisition Yields”

3.50

3.90

4.30

4.70

Q3 '10

Q4 '10

Q1 '11

Q2 '11

Q3 '11

Q4 '11

Q1 '12

Q2 '12

ABCB Net Interest Margin

UBPR Peer Group

4.15

4.07

4.45

4.66 |

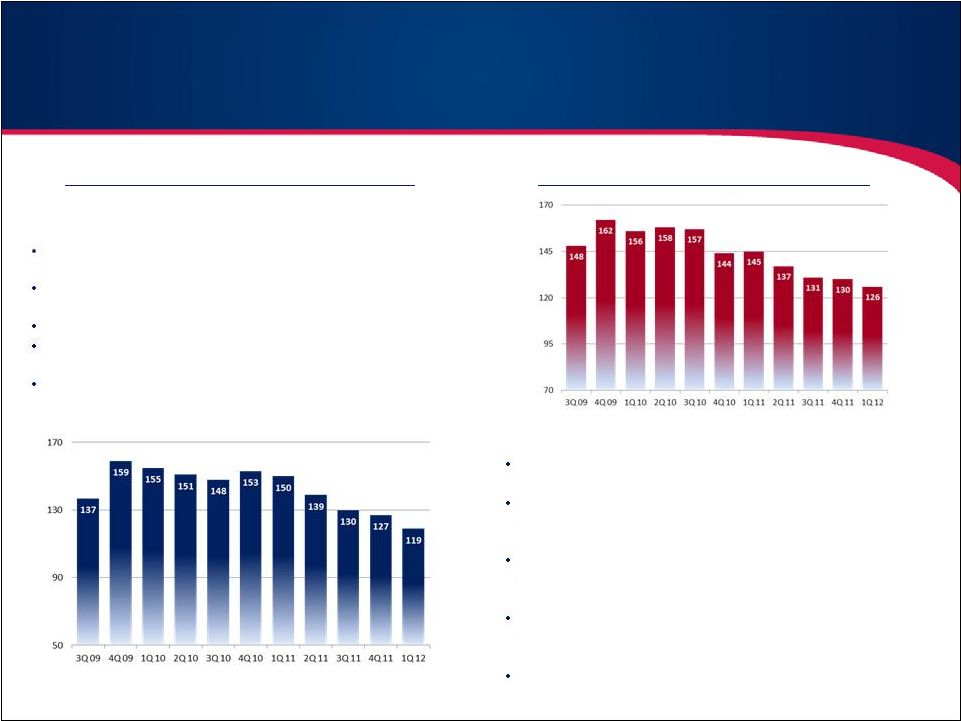

Significant

growth

in

mortgage

revenue

–

currently

all

from

retail

activities

•

Still hiring highly experienced, high volume teams

•

Current retail production is $30mm per month, potential

and platform to double in 12-18 months

Started wholesale activities in 2Q 2012

•

Hiring experienced relationship managers from large

wholesale players

•

Larger volume opportunity in wholesale relative to retail

activities

11

Serious about building strength and diversification in non-

interest income sources

•

Moving away from deposit charges

•

Researching unique lines of business

•

Momentum in our numbers coming from mortgage

revenue; we believe we can duplicate that strategy

with other LOBs by hiring expertise

Peer group comparison are banks greater than $3 billion

•

BOLI transaction in the 3Q will increase annual

revenue by $2.6 million and NII/Assets by 0.05%

Earnings Growth –

Non-Interest Income

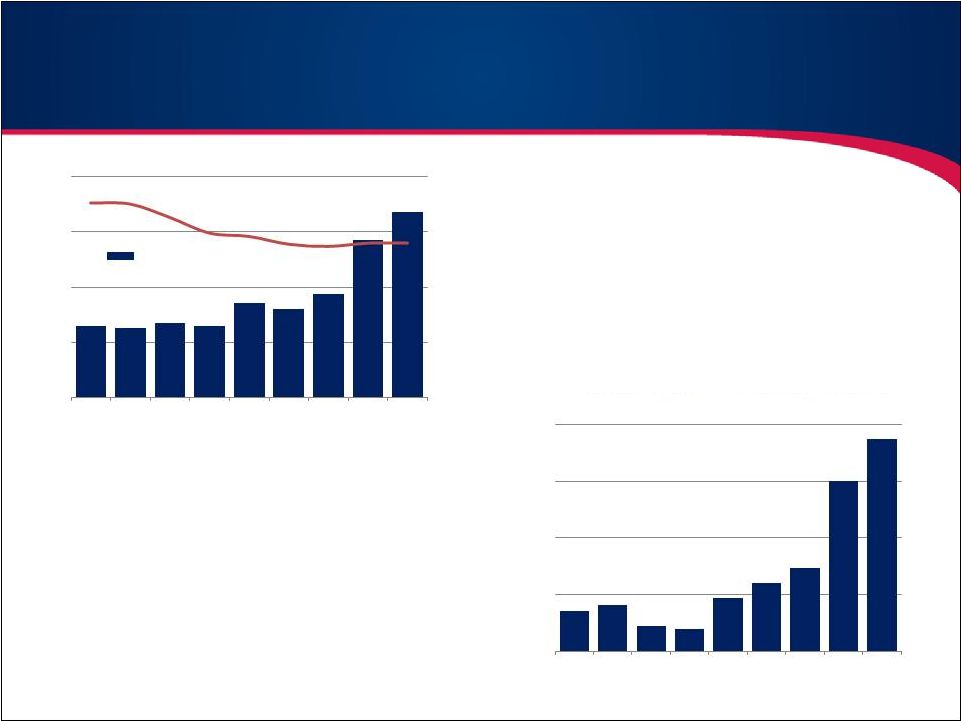

0.82%

0.82%

0.84%

0.82%

0.93%

0.90%

0.97%

1.21%

1.34%

0.50%

0.75%

1.00%

1.25%

1.50%

3Q 10

4Q 10

1Q 11

2Q 11

3Q 11

4Q 11

1Q 12

2Q 12

3Q 12

Non-Interest Income to Assets

ABCB

713

806

450

382

930

1,209

1,475

3,001

3,740

0

1,000

2,000

3,000

4,000

3Q 10

4Q 10

1Q 11

2Q 11

3Q 11

4Q 11

1Q 12

2Q 12

3Q 12

Mortgage Revenue |

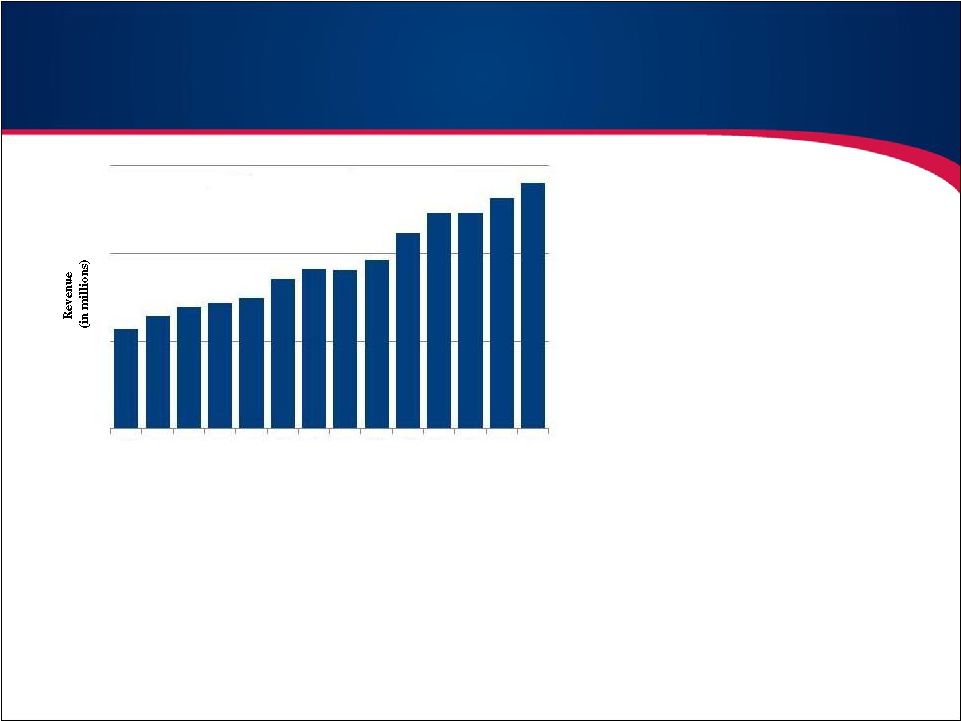

•15.0%

compounded annual growth rate in total revenue over the last three years

•Revenue has grown twice as fast as earning assets

•Significant amount of assets that will be deployed

over the next 3 years that will significantly boost

revenue and earnings

•

27.4% -

CGR for mortgage related

revenue

•

23.6% -

CGR for debit interchange

fees

•

7.8% -

CGR for analysis and

overdraft fees

•

2011 revenue gains boosted by improved net interest margins from

deployment of short-term assets

•

2012-2015 strategy demands:

•

Diversification of revenue with more emphasis on highly profitable

non-interest income LOB’s that enhance ROA and reduce burden on

capital leverage

•

Protect our advantage from strong net interest margins with emphasis on

creating a highly favorable funding mix

12

Earnings Growth

–

Continued Growth in Revenue

$21.4

$23.9

$25.0

$28.3

$29.3

$34.6

$38.1

$10.0

$20.0

$30.0

$40.0

2Q

2009

3Q

2009

4Q

2009

1Q

2010

2Q

2010

3Q

2010

4Q

2010

1Q

2011

2Q

2011

3Q

2011

4Q

2011

1Q

2012

2Q

2012

3Q

2012

Recurring Quarterly Revenue

(in millions)

Revenue growth through this cycle with

opportunistic strategies: |

13

Significant Leverage Opportunities in Operating Expense

Current Efficiency Projects and Branch Rationalization -

•

Branch structure being critically analyzed to determine most efficient operating style.

5 branches already decided with several more being decided during fourth

quarter. Annualized potential savings in excess of $5.0 million.

•

Bank operations and corporate support being realigned to be more

efficient and to bring assets/employees in line

with peers. Annualized savings of over $5.0 million by end of 2013.

FDIC Insurance is going to decrease substantially

•

$3.0 million reduction in FDIC insurance starting in January 2013 when the prepaid assessment

is fully amortized. M&A opportunities exist where primary catalyst for the deal is

operating leverage •

Our M&A strategy is building in existing markets where we can leverage current management

and facilities. •

Our core processor contract allows for 50% reduction in processing costs.

•

Believe we can integrate targets with less than 2.00% incremental opex/assets.

Non-provision credit costs are moderating quickly

•

$3.7 million in 3Q 2012 and $3.4 million in 2Q 2012 vs. $9.0 million and $7.8 million in same

quarters in 2011. Expect moderation in these costs in 4Q 2012 and into 2013 as credit

quality has improved to peer level. Earnings Growth

–

Operating Expense Leverage |

(1)

Banks in Ga, Fl, Al and SC with Texas Ratio over 50% but below 100%. Total assets under

$2 billion. Excludes banks with covered assets (2)

Banks in Ga, Fl, Al and SC with Texas Ratio over 100%. Total assets under $2

billion. Excludes banks with covered assets 14

“Traditional”

M&A

20% of all banks under $2 billion in our four states have Tx

ratio between 50% and 100%

Some improvement in number of “problem”

banks, but

almost always from deleveraging vs. new capital or earnings

growth

Credit marks in purchase transaction are very punitive given

levels of classified assets and limit acquirers ability to

maintain TBV levels in recapitalization

These banks are receiving significant pressure from regulatory

agencies to strategically develop sources of capital and a rapid

path to profitability

Similar in average assets to “loss share”

M&A opportunities

“Loss-Share”

M&A

20% of all banks

under $2 billion in our four states have Tx ratio over 100%

Majority remaining are smaller banks where consolidation

opportunities would favor Ameris Bank

Average assets of approximately $250 million

Regulatory pressure to “make something happen”

on capital

levels and problem assets

Average Tier 1 leverage (incl h/c debt) of approximately 5.00%

Potential Consolidation Opportunities

(Data for Banks in our 4-State Footprint)

Traditional M&A Opportunities

(1)

“Loss-Share”

M&A

Opportunities

(2) |

|