Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PATHEON INC | d438034d8k.htm |

Patheon

Lender Information

November 13, 2012

Exhibit 99.1 |

1

Forward Looking Statements

•

This presentation contains forward-looking statements or information which reflect Patheon

Inc.’s (“Patheon,” the

“Company,”

“we,”

“us,”

or “our”) expectations regarding possible events, conditions, our future

growth, results of

operations, performance, and business prospects and opportunities. All statements, other than

statements of historical fact, are forward-looking statements. Forward-looking

statements necessarily involve significant known and unknown risks, assumptions and

uncertainties that may cause our actual results in future periods to differ materially from those

expressed or implied by such forward-looking statements, including risks related to our

ability to complete the proposed acquisition of Sobel USA and Banner Europe (together

“Banner Pharmacaps” or “Banner”) and the related equity and

debt financings; integration of and achievement of our intended objectives with respect to our

acquisition of Banner; and compliance with our debt covenants and our debt service

obligations. For additional information regarding risks and uncertainties that could

affect our business, please see our 2011 Form 10-K and our subsequent filings with the U.S.

Securities and Exchange Commission and the Canadian Securities Administrators. Accordingly, you

are cautioned not to place undue reliance on forward-looking statements.

•

These forward-looking statements are made as of the date hereof, and except as

required by law, we assume no

obligation to update or revise them to reflect new events or circumstances.

|

2

Use of Non-GAAP Measures

•

This presentation includes certain financial measures that have not been prepared in accordance

with accounting principles generally accepted in the United States

(“GAAP”). These measures include Adjusted EBITDA, Pro Forma (“PF”) Adjusted EBITDA, PF Adjusted EBITDA less Maintenance

Capex, PF Revenues, PF Gross Profit and Free Cash Flow. Certain of these measures

are presented both for the Company on a standalone basis an on a combined basis with the

estimated results of Banner. •

References in this presentation to “Adjusted EBITDA” are to income (loss) before

discontinued operations before repositioning expenses, interest expense, net, foreign

exchange losses reclassified from other comprehensive income, refinancing expenses, gains and losses on sale of fixed assets,

gain on extinguishment of debt, income taxes, asset impairment charge, depreciation and

amortization and other income and expenses. •

References in this presentation to “PF Adjusted EBITDA ” are to Adjusted EBITDA

adjusted for certain non-cash or other costs, including stock-based compensation

expenses, consulting fees and executive severance, and cost savings/revenue enhancements, on a pro forma basis, from

transformational initiatives implemented by management.

•

References in this presentation to “PF Adjusted EBITDA less Maintenance Capex” are to

PF Adjusted EBITDA less capital expenditures to maintain the Company’s facilities

instead of grow the Company’s revenue. •

References in this presentation to “PF Revenues” and “PF Gross Profit” are

to revenues and gross profit, respectively, adjusted for costs associated with a product

recall by a customer and cost savings/revenue enhancements, on a pro forma basis, from transformational initiatives implemented by

management.

•

References in this presentation to “Total PF Adjusted EBITDA,” “Total PF

Adjusted EBITDA less Maintenance Capex,” “Total PF Revenues” and “Total

PF Gross Profit” are to the corresponding non-GAAP measures presented on an uncombined

basis as adjusted for the estimated pro forma adjusted EBITDA, revenue or gross profit,

as applicable, for Banner and expected synergies from the Banner acquisition.

•

References in this presentation to “Free Cash Flow” are to net cash flows from

operating activities, less purchase of property, plant and equipment, and changes in

accrued expenses related to capital expenditures. •

Since non-GAAP measures, including the measures referenced above and in the presentation,

do not have a standardized meaning, they may not be comparable to similar measures

presented by other issuers. Readers are cautioned that these non-GAAP measures are not based on any

comprehensive set of accounting rules or principles and that they should be considered only in

conjunction with, and not as a substitute for, or superior to, income (loss) before

discontinued operations determined in accordance with GAAP as indicators of performance and not as a substitute

for, or superior to, operating cash flow as an indicator of liquidity, as applicable. These

non-GAAP measures are subject to inherent limitations because (i) they do not

reflect all of the expenses and cash flow associated with income (loss) before discontinued operations and operating cash

flow, respectively, determined in accordance with GAAP and (ii) the composition of these

non-GAAP measures involved the exercise of judgment by management. •

Reconciliations of the non-GAAP measures used in this presentation to their closest U.S.

GAAP measures are included in the appendix to this presentation.

|

Financial

Information on a GAAP and Non-GAAP Basis US $ millions

2009

2010

2011

2012E

Revenue

655.1

671.2

700

740.9

Gross Profit

144.1

134.4

131.8

157.2

Income (loss) before disc.

operations

1.1

(2.9)

(15.8)

(102.6)

Cash provided by operating

activities

39.1

50.0

22.9

31.5

Cash used in investing activities

(49.3)

(50.0)

(47.4)

(49.3)

Cash provided by financing

activities

13.6

31.6

2.7

26.0

•

Certain non-GAAP information relating to the preliminary results of Patheon for fiscal 2012

and additional non-GAAP information about other completed fiscal years are being

disclosed in this presentation. •

Presented in the table below is certain selected financial information of Patheon, including

the most directly comparable GAAP measures to certain financial measures that are

included in this presentation that have not been prepared in accordance with GAAP.

3 |

4

Outline

•

Introductions

•

Transaction Summary

•

Executive Summary

•

Patheon Update

•

Acquisition Summary

•

Key Credit Strengths

•

Historical Financial Review |

5

Introductions |

6

Presenters Overview

Stuart Grant

Executive Vice President, Chief Financial Officer, Patheon

James Mullen

Chief Executive Officer, Patheon

Michael Lytton

Executive Vice President, Corporate Development and Strategy, and General Counsel,

Patheon |

7

Patheon Leadership

James Mullen

CEO

•

Mr. Mullen joined Patheon in 2011 as CEO

•

Prior to joining Patheon, he served as CEO

and President at Biogen Idec Inc. from 2003

to 2010, one of the world's largest

biotechnology companies

•

Mr. Mullen was responsible for merger of

Biogen and Idec Pharmaceuticals, serving as

CEO and President of Biogen from 2000 to

2002, and Chairman, CEO and President of

Biogen until merger was complete in 2003

•

Additionally, Mr. Mullen held various operating

positions at Biogen prior to becoming CEO,

including Vice President, Operations, and

several manufacturing and engineering

positions over a nine-year period at

SmithKline Beckman

•

Mr. Mullen possesses over 30 years of

industry experience, ranging from

biotechnology, pharmaceuticals to specialty

chemicals, as well as extensive expertise in

pharmaceutical and biotech manufacturing,

engineering, sales, marketing, M&A

•

Mr. Mullen holds a Bachelor of Science in

chemical engineering from Rensselaer

Polytechnic Institute, and a Master of

Business Administration from Villanova

Stuart Grant

CFO

•

Mr. Grant joined Patheon in 2012 as CFO

•

Prior to joining Patheon, he served as Senior

Vice President and Chief Financial Officer of

BioCryst Pharmaceuticals, Inc., a small molecule

biotech company focused on infectious and

inflammatory disease and cancer

•

Mr. Grant was a key player in the creation and

execution of a company-wide strategy that

stabilized, funded and enabled

commercialization activities

•

Prior to BioCryst was Group Chief Financial

Officer for Serono SA, a global biotechnology

company

•

Additionally, Mr. Grant served in various senior

operating and financial roles, including Finance

Director for Swiss Manufacturing Operations and

then General Manager of the company's

Manufacturing Laboratories over 12 years

•

Mr. Grant spent 15 years in finance at Digital

Equipment Corporation, and several years

working as a tax consultant and senior auditor

for Price Waterhouse in Glasgow, Scotland

•

Mr. Lytton joined Patheon in 2011 as EVP,

Corporate Development

•

Prior to joining Patheon, he served as Executive

Vice President, Corporate and Business

Development of Biogen Idec from 2008-2011

•

Mr. Lytton was General Partner with Oxford

Bioscience Partners, a venture capital firm

investing in therapeutic, diagnostic and life

science tool companies from 2001 to 2008

•

Additionally, Mr. Lytton practiced law from

1984-2000 and specialized in representing

biomedical companies; he was Partner and a

member of the Executive Committee of law firm

Edwards Wildman Palmer and was Partner of

law firm Wilmer Hale

•

Mr. Lytton holds an undergraduate degree from

Princeton University, a Master of Science degree

in epidemiology from the London School of

Hygiene and Tropical Medicine at the University

of London, U.K., where he was a Fulbright

Scholar; he also has a Juris Doctor degree from

Harvard Law School

Michael Lytton

EVP Corporate Development |

8

•

Strong market position and brand

•

Further strengthened with increased

customer focus

•

$650MM underlying revenue

–

Excludes one-time contract cancellation

benefit of $50MM

•

Increased PF revenue to

approximately $744MM

–

No single customer more than 11%

•

$33MM PF Adjusted EBITDA

excluding the contract cancellation

benefit

–

Weak base of earnings

–

Inefficient facility operations

•

Approximately $102MM in PF Adjusted

EBITDA

•

Improved profitability for all sites and major products

2011

2012

•

No free cash flow

•

Second half free cash flow estimated

to be $20MM

Patheon Transformation |

9

Transaction Summary |

10

Transaction Summary

•

On October 29 2012, Patheon, a leading provider of commercial manufacturing and

pharmaceutical development services of branded and generic prescription drugs to the

international pharmaceutical industry, entered into a definitive agreement to purchase

Banner Pharmacaps (the “Acquisition”) for $255 million –

Banner Pharmacaps is a gelatin-based (soft-gel / soft-caps) drug delivery and

specialty pharma company with operations in Europe and the Americas

–

Purchase price implies multiple of 10.2x Banner’s LTM PF Adjusted EBITDA, or 6.8x

including estimated synergies of $12.5 million

–

The Acquisition is expected to close in the fourth calendar quarter of 2012

•

Concurrent with the Transaction, Patheon is seeking to realign its balance sheet with its

strategy –

Transaction will refinance existing funded debt of $280 million principal value and $75

million Revolving Credit Facility (the “Refinancing”)

•

The Acquisition and the Refinancing (together the “Transaction”) will be supported by

(i) a new $565 million Term Loan B, as described in the debt commitment letter, and (ii)

an equity commitment letter from JLL of up to $30 million, and will also include (iii)

an $85 million Revolving Credit Facility expected to be undrawn at closing The combined

company would have generated ~$1 billion in revenue and ~$140 million in Total PF

Adjusted EBITDA in the LTM (net debt¹

would have been 3.9x Total PF Adjusted EBITDA)

•

¹

Total debt less cash and cash equivalents

th |

11

Sources & Uses and Pro Forma Capitalization

Adjusted Capitalization

($MM)

Pro Forma Amount

x 10/31/2012

PF Adjusted EBITDA

% of Capitalization

Cash

$27.4

Revolver ($85.0)

(1)

$0.0

0.0x

0.0%

Term Loan B

$565.0

4.0x

52.3%

Short Term & Other Borrowings

$1.6

0.0x

0.1%

Total Debt

$566.6

4.1x

52.4%

Market Value of Patheon Equity

(3)

$514.0

3.7x

47.6%

Total Capitalization

$1,080.6

7.7x

100.0%

Total PF Adj. LTM EBITDA

$139.7

Bank Debt / PF Adj. EBITDA

4.0x

Total Debt / PF Adj. EBITDA

4.1x

Net Debt / PF Adj. EBITDA

3.9x

PF Adj. EBITDA / Net Interest Expense

4.1x

(PF

Adj.

EBITDA

–

Maintenance

Capex)

/

Net

Interest

Expense

3.3x

Sources

($MM)

(%)

Revolver ($85.0)

(1)

$0.0

0.0%

Term Loan B

$565.0

91.3%

Additional Cash Equity

$30.0

4.8%

Cash from Patheon

$24.0

3.9%

Total Sources

$619.0

100.0%

Uses

($MM)

(%)

Banner Purchase Price

$255.0

41.2%

Refi. Existing Patheon Bonds

$280.0

45.2%

Breakage Costs of Bonds

(2)

$25.0

4.0%

Refi. Existing ABL

$30.0

4.8%

Total Fees and Expenses

$29.0

4.7%

Uses

$619.0

100.0%

(1)

Assumes no amount drawn at transaction close

(2)

Estimated breakage costs at transaction close

(3)

Based on shares outstanding multiplied by share price of $3.75 as of 11/01/12 and

includes $30MM of additional cash equity; converts CAD/USD at 1.0 |

12

Executive Summary |

13

Executive Summary

•

Patheon is a leading Contract Development and Manufacturing Organization (“CDMO”)

with global reach and

long-standing

client

relationships

–

In 2011, the Board strengthened the management team with senior leaders from biopharma

industry –

Management refocused the Company on efficiency, delivery and quality by implementing

strategies to improve operations, procurement and pricing

•

Patheon transformation initiatives are moving along very well and will result in an estimated

$40 million in Adjusted EBITDA impact in FY 2012, before consulting fees.

•

Industry dynamics are strong in both PDS and CMO market segments, and Patheon believes it is

well positioned for continued growth in the future

•

Banner Pharmacaps acquisition is an opportunity for Patheon to deepen its presence in oral

dosage manufacturing and own products and proprietary technologies, as well as enter

Latin America •

Combined entity with over $1 billion in estimated revenue and $140 million in combined PF

Adjusted EBITDA will enhance our position as a leading CDMO with a stronger brand name,

more diversified customer and product base, and a healthy balance sheet that we believe

will de-lever quickly over time |

14

Patheon Update |

15

Patheon Overview

•

Market leading CDMO with global footprint in growing industry

of pharmaceutical outsourcing

•

2012 estimated PF Revenues of $744 million and PF Adjusted

EBITDA of approximately $102 million, respectively

•

Operates in two distinct yet synergistic segments

•

Commercial Manufacturing Outsourcing

(“CMO”)

–

~$605 million 2012 revenue (82% of Revenue)

–

Long-cycle, diversified, sticky customer base

•

Pharmaceutical Development Services (“PDS”)

–

~$139 million 2012 revenue (18% of Revenue)

–

Short-cycle, helps to fuel CMO segment

•

Core dosage form expertise in solids and steriles

•

Over 4,000 employees across 11 facilities

•

Listed on the Toronto Stock Exchange (Ticker: PTI)

PDS

CMO

•

Research Triangle Park, USA

•

San Francisco, USA

•

Cincinnati, USA

•

Manati, Puerto Rico

•

Whitby, Canada

•

Toronto, Canada

•

Bourgoin, France

•

Swindon, England

•

Milton Park, England

•

Monza, Italty

•

Ferento, Italty

Patheon’s Global Network |

16

CMO and PDS are distinct businesses with PDS originating 25% of CMO business

CMO –

$605MM

•

~ 5-year contract duration

•

Size $100K –

$50MM+

•

Longer cycle

•

Diversified

•

High barrier to switch

PDS –

$139MM

•

6 –

12 contract month duration

•

Size $100K –

$1MM

•

Shorter cycle with initial project typically

generating 2.5x revenue over time

•

Fuels CMO business with 25% of CMO revenue

starting in PDS

Patheon Participates in Two Business Segments Across

a Broadly Diversified Customer Base

Top 20 PDS Clients

(1)

Top 20 CMO Clients

(1)

All Others

All Others

Top Client Y

Top Client X

Top 5 CMO clients do not overlap with Top 5 PDS clients

(1)

YTD 2012 |

17

Patheon is the Only Company with a Leadership Position in

both CMO and PDS Markets

CMO

PDS

$12.3Bn Market Size

(1)

(+5% Growth Rate)

$1.4Bn Market Size

(1)

(+7% Growth Rate)

•

Healthy growth (5%) expected in simple oral,

but much higher in steriles (10%+)

•

Patheon is vendor of choice since it can take

products from development into

manufacturing

•

Higher growth rates at 7%

•

Patheon is a leader in the PDS market

segment and well regarded for its scientific

expertise

Catalent

Patheon

Famar

Baxter

FAREVA

Holdings

Vetter

Haupt

Aenova

All Other

Catalent

100+

Others

Patheon

Almac

Lancaster

Labs

SGS

PPD

Aptuit

AAIPharma

(1)

Market size as of 2011 |

18

Source: EvaluatePharma®

(1)

Only those companies that publicly disclose sales are included

(2)

Novartis and Sanofi are not counted among the Generics companies

Patheon Serves Each of the Four Major Customer

Segments and Each is Growing Rapidly

520

437

18

152

194

12

22

77

110

81

1,000+

66

•

Most receptive to outsource partners that

can supply complex products

•

10% of Patheon revenues in 2011

•

Outsourcing

rate

varies

(10

–

20%)

Generics

(2)

Emerging Pharma

< $500MM in Sales

Mid-size/Specialty

$500MM to $8Bn

in Sales

Large

Pharma / Biotech

> $8Bn in Sales

Pharma / Biotech

Market Segments

(1)

Number of

companies

Profile Attributes

Total Drug Sales ($MM)

2010

2016

•

Hold majority of commercial products

•

51% of Patheon revenues in 2011

•

Outsourcing

rate

is

low

10

–

20%

•

Hundreds of companies. Most drug

development begins here

•

12% of Patheon revenues in 2011

•

Outsourcing rate is high ~75%

•

Interest in end-to-end solutions

•

Smaller number of companies but

very receptive outsourcing partners

•

Want to deal with fewer service providers

•

26% of Patheon revenues in 2011

•

Outsourcing

rate

is

moderate

40

–

50%

•

Need to outsource driven by lack of capacity

16

23

263

16

Patheon

customers |

19

Patheon has been Delivering against First Two Elements of Strategy

since Early 2011 and is now Moving Towards Later Elements

•

Benchmarking proved

Patheon lagged comps

in operations (per

production unit basis)

•

Transformation project

–

operations,

procurement, pricing,

G&A –

paid for itself in

one year

•

Network rationalization

•

Commercial team to

focus on key accounts

•

Executive insights -

solicit key customer

feedback for business

positives and key

improvements

•

Banner acquisition will

bring proprietary

products (Aleve,

Zyrtec, ibuprofen) and

soft-gel technologies

•

Gain direct exposure

to emerging markets

(Latin America)

•

Top 10 CMOs are less than 50%

of market with remaining share

divided amongst 400 companies

•

Potentially 1/3 of companies could

exit; which we believe will help

with long-term pricing power

Strengthen

core operations

Sell business

differently

Enter logical

adjacencies

Drive industry

consolidation |

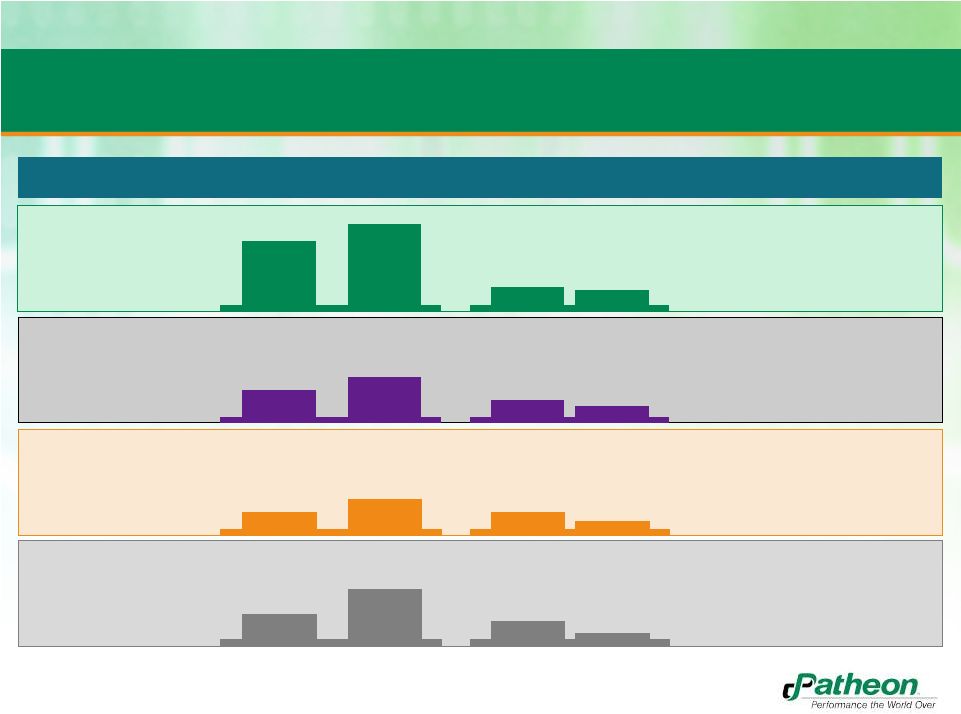

20

Global support function simplification

Contract compliance

Pricing process: opportunity filter and standard costing

Global spending policies and discipline

Focused direct and indirect cost categories

Site OE transformations for both CMO and PDS

Capacity release of bottlenecks enables quick revenue gains

2012 Impact

($MM)

~8.7

~1.6

~1.8

Operational

Transformation

is

estimated

to

have

increased

Adjusted

EBITDA

by

approx.

$40

million

in

Fiscal

Year

2012

~28.0

Achieved Cost Savings & Pricing Initiatives

Operational

Excellence

Procurement

G&A

Pricing

Strengthen

core operations

1

2

3

4

5

6

7

Patheon set out to achieve $37MM in Adjusted EBITDA impact in 2012

|

21

Solution and “targeted”

selling builds on our

strengths in PDS and CMO within solids and

sterile injectables

Recent major multi-year contract win with

Boehringer Ingelheim is an example of solution

selling to an important customer

Other examples include SoluPath™, P-Gels™, Quick to Clinic™, and

Sterile Backup Supply We have also been Selling the Business Differently by Offering

Integrated Solutions to Our Customers

Sell business

differently |

22

Acquisition Summary |

23

Banner Overview

Banner Company Overview

Banner Customers

•

#2 leading manufacturer of gelatin-based (soft-gel/gelcaps)

drug delivery and specialty pharmaceuticals

•

Owns IP related to 7 different technologies for:

–

Controlled release (time and target)

–

Absorption enhancement

–

Safety and compliance

•

Owns IP for 16 proprietary products currently in market and

owns IP for another 15+ proprietary products in the pipeline

•

Operates in 3 market segments: OTC, Rx and Nutritional and

sells direct to market for private label and OTC

•

1,284 employees worldwide

•

Headquartered in High Point, NC with additional facilities in

Alberta, Mexico City, and The Netherlands

Proprietary

Technology

•

Major Consumer Health Companies

Selling OTC

•

Leading Private Label Resellers

•

Consumer Buying Clubs

•

Major Generics Companies

•

Pharmacy Chains |

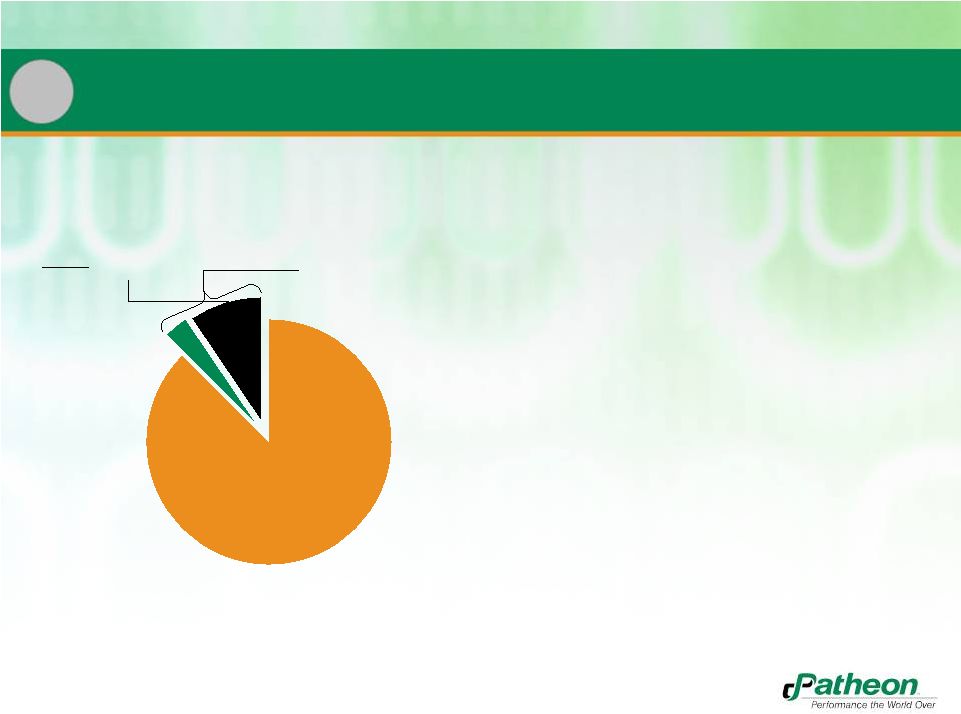

24

Current Revenues are Generated Primarily in North

America and from a Portfolio of Proprietary Products

Europe

14%

Latin

America

16%

U.S. +

Canada

70%

CMO

38%

Proprietary

Products

62%

Sales by Geography

(1)

Sales by Segment

(1)

•

Expands Patheon’s presence in US, EU, and parts of Latin America

•

Patheon will continue to invest in proprietary products business, which should drive

margin expansion

(1)

LTM sales as of 9/30/2012 |

25

Acquisition Rationale

•

Increases Size and Scale

in attractive CDMO market

–

Diversifies top line customers and channels

–

Allows for increase in capacity utilization and efficiency gains

•

Gives Patheon access to New Customer Segments (end-sellers, buying clubs, and broad

range of generics partnerships)

•

Adds Proprietary Technologies and Products

–

Gives Patheon proprietary products in attractive soft-gel market

•

Broadens combined company Geographic Footprint

–

Patheon gains greater access to Emerging Markets

–

Banner penetrates more deeply into Europe

•

Provides opportunity to Cross-sell Patheon and Banner Services

•

Allows Patheon to drive Operational Excellence across Banner network

•

Operational

synergies

of

approximately

$12.5

million

expected

to

be

delivered |

26

Key Credit Strengths |

27

Summary of Credit Highlights

Increased Diversity of Revenue and Profitability

1

Leading Positions in Large and Attractive Markets

3

Global and Diversified Manufacturing Network

5

Recurring Revenue Model with High Visibility

2

Best in Class Management Team

6

Industry Leading Quality Record

4 |

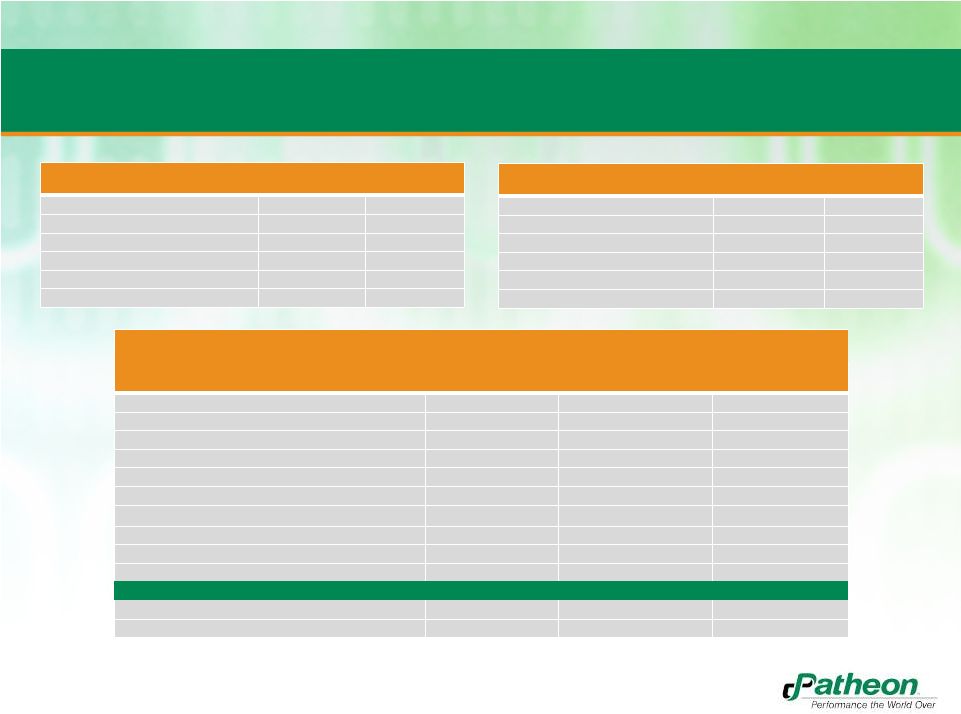

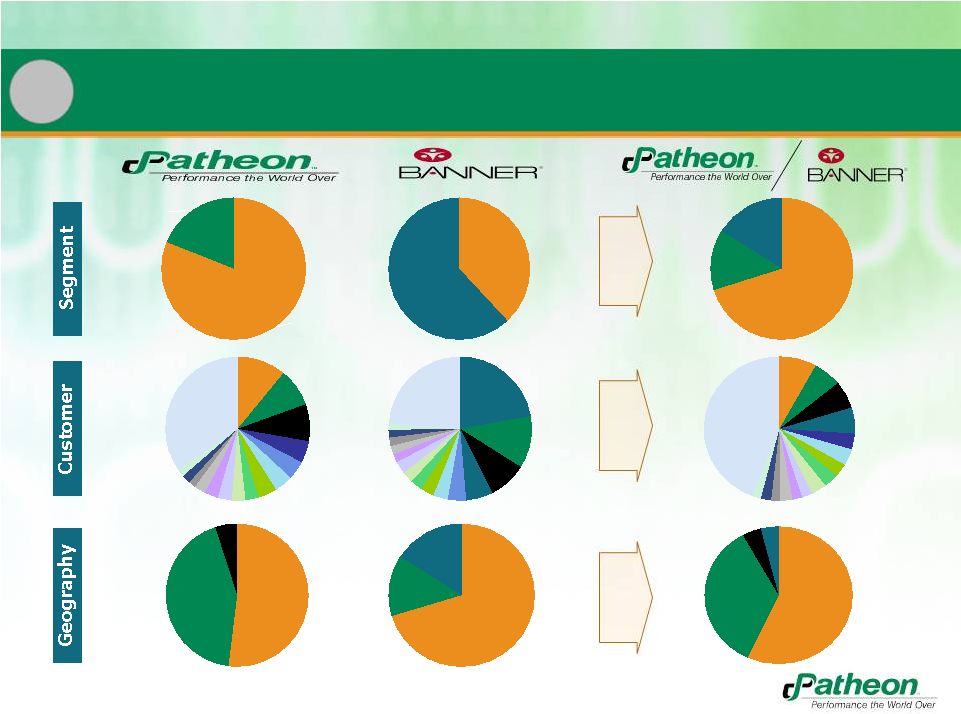

28

CMO

81%

PDS

19%

CMO

38%

Proprietary

62%

EUR

43%

NA

52%

NA

70%

EUR

14%

LatAm

16%

1

Increased Diversity of Revenue and Profitability

$139MM

$167MM

$605MM

$104MM

$709MM

$139MM

$167MM

Rest 35%

#P1_11%

Other

5%

Other

4%

LatAM

4%

Rest 24%

Rest 44%

#P2_9%

#P3_8%

#B1_22%

#B2_12%

#B3_9%

#P1_8%

#P2_6%

#P3_6%

Note: Only one customer is a Top 15 customer for both Patheon (#7) and Banner (#12)

#P4_5%

#P5_4%

#B4_6%

#B5_4%

#B1_6%

#P4_4%

$320MM

$387MM

$37MM

$190MM

$38MM

$43MM

$577MM

$358MM

$43MM

$37MM

CMO

70%

PDS

14%

Proprietary

16%

NA

57%

EUR

35% |

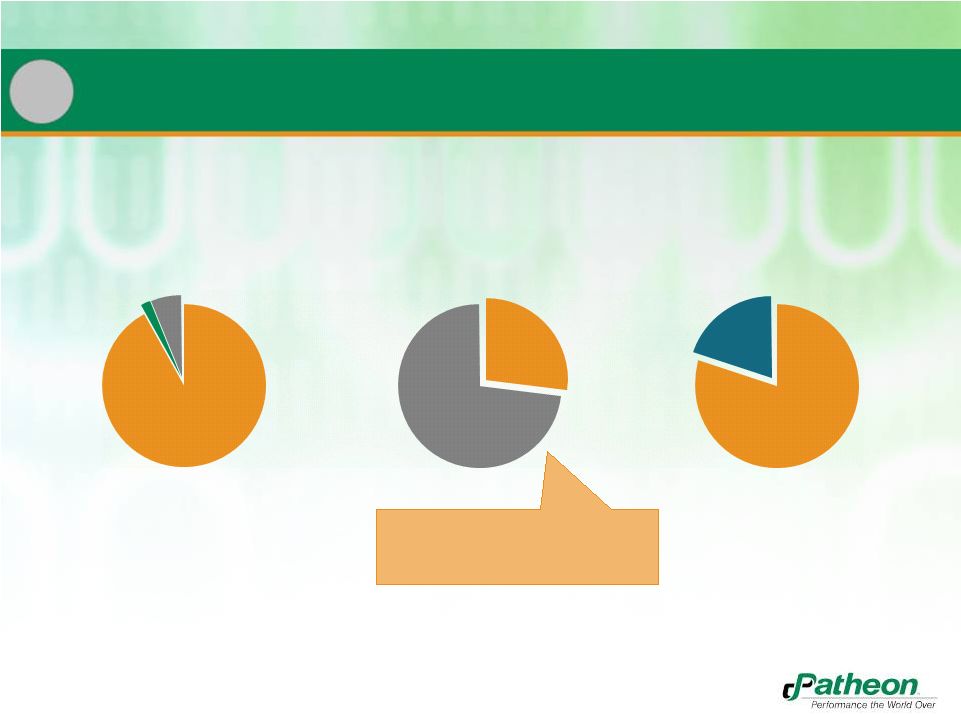

29

Under Contract

New Sales

New Sales

Recurring Revenue Model with High Visibility

Patheon CMO

Patheon PDS

Banner

Under Contract

Under Contract

New

Product

Launches

Other

•

PDS business under contract has

historically resulted in 2.5x initial

revenue over lifetime

92%

6%

2%

27%

73%

20%

80%

2 |

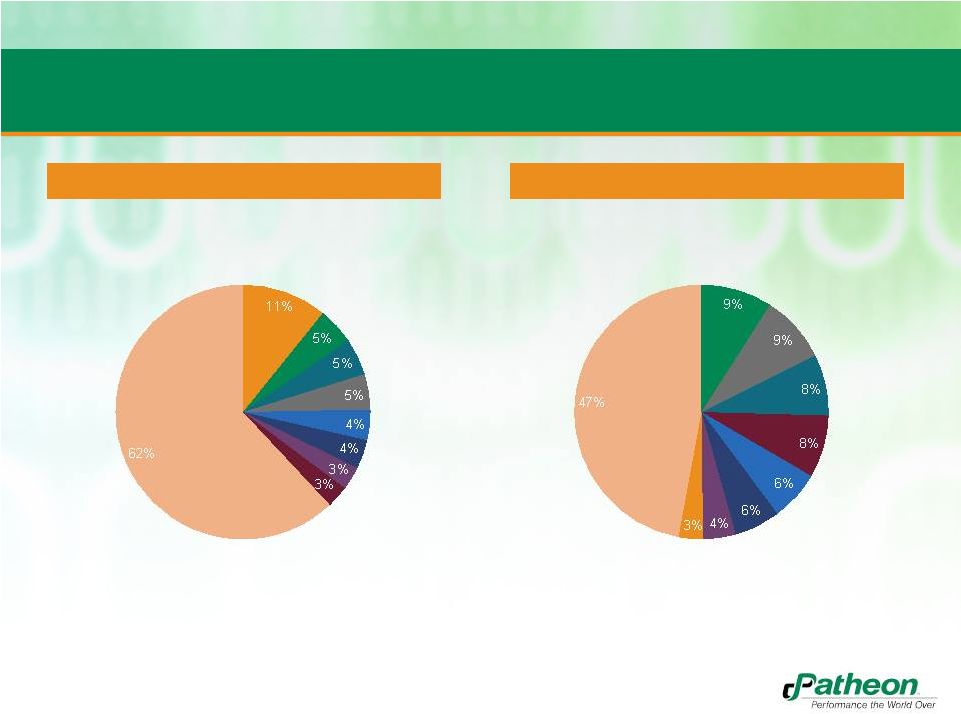

30

$12.3Bn market size

(% Market Share)

Catalent

PF Patheon

Strides

Accucaps

Aenova

ProBio

Capsugel

All Others

$1.7Bn market size

(% Market Share)

Soft-gel

PF Patheon

Almac

Lancaster Labs

SGS

Aptuit

AAIPharma

Catalent

PPD

All Others

Hospira

Famar

Corden Pharma

LTS

All Others

Baxter

FAREVA Holdings

Vetter

Haupt

Aenova

Recipharm

Catalent

PF Patheon

$1.4Bn market size

(% Market Share)

PDS

#1

Market

Share

#2

Market

Share

Leading Positions in Large and Attractive Markets

CMO

#2

Market

Share

11%

6%

5%

5%

4%

4%

3%

3%

2%

2%

2%

2%

51%

32%

16%

11%

7%

4%

4%

3%

23%

9%

9%

8%

8%

6%

6%

4%

3%

47%

3 |

31

•

Neither Patheon nor Banner has had

any warning letters in last 5 years

•

4.2 inspections / audits per week

•

Nearly 1 in every 3 inspections

resulted in zero observations

•

19 pre-approval inspections waived

•

Thorough understanding of

worldwide compliance issues gained

through global reach

Regulatory Scrutiny Continues to Increase

Source: Data from November 2006 through July 2011

102

Regulatory

Agency Inspections

30

Agency

Inspections with

ZERO

Observations

Inspections and Audits,

2007 to 2011

934

934

Customer Audits

Customer Audits

1,036

Total

4

Industry Leading Quality Record |

32

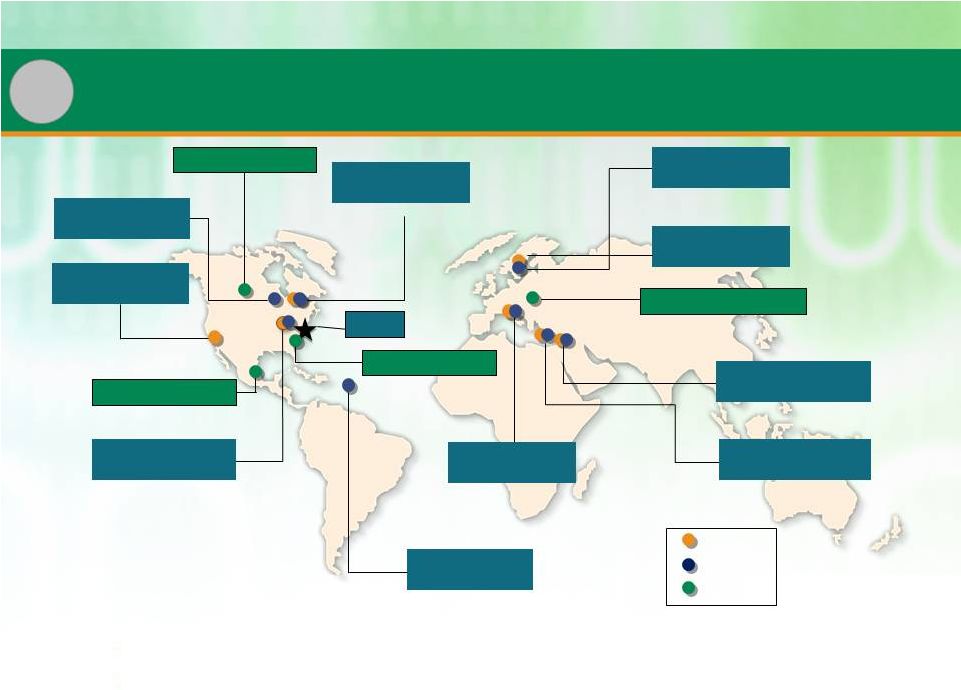

Global and Diversified Manufacturing Network

PDS

CMO

Banner

•

Global facility base diversifies supply chain and reduces risk of disruption

•

Patheon customers can typically optimize location

Cincinnati, USA

(PDS, CMO solid/sterile)

Mexico City, Mexico

San Francisco, USA

(PDS development)

Toronto, Canada

(PDS, CMO solids)

Alberta, Canada

Whitby, Canada

(PDS, CMO solids)

Swindon, England

(PDS, CMO sterile)

HQ

High Point, NC

Bourgoin, France

(PDS, CMO solids)

Manatí, Puerto Rico

(CMO solids)

Ferentino, Italy

(PDS, CMO sterile)

Monza, Italy

(PDS, CMO solid/sterile)

Tilburg, Netherlands

Milton Park, England

(PDS development)

5 |

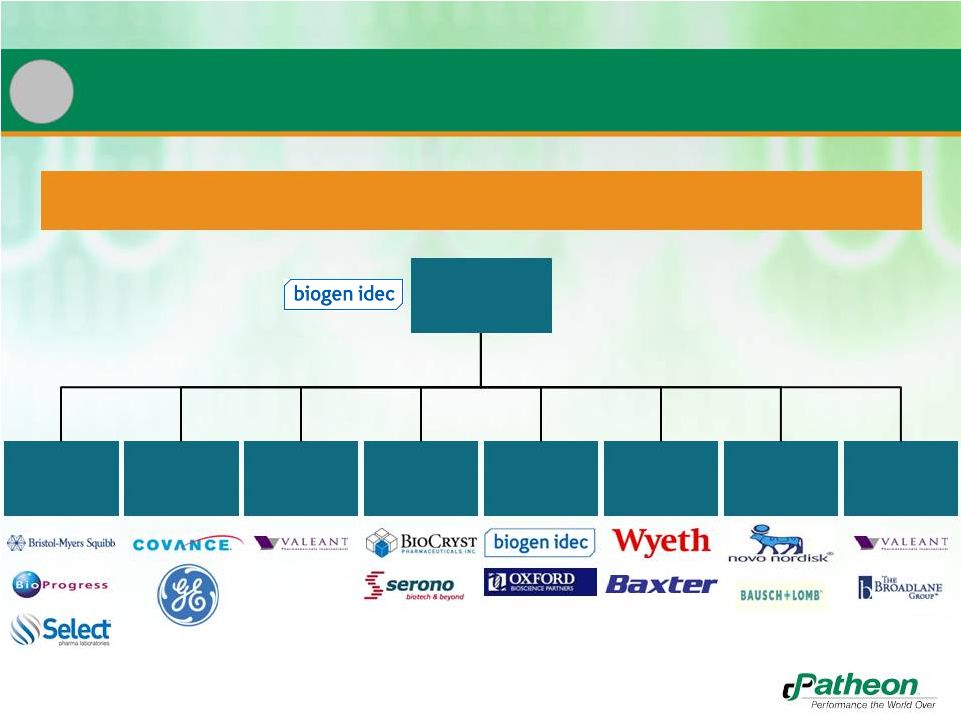

33

Proven ability to drive value through growing core business, expanding into

ancillary markets and integrating complementary acquisitions

James Mullen

Chief Executive

Officer (CEO)

6

Best in Class Management Team

Antonella Mancuso

Global Commercial

Operations and Chief

Manufacturing Officer

Michael Lehmann

Global PDS

President

Geoffrey Glass

Global Sales and

Marketing

Stuart Grant

Chief Financial Officer

Michael Lytton

Development &

Strategy, General

Counsel

Harry Gill

Quality and

Continuous

Improvement

Rebecca

HollandNew

Human Resources

Paul Garofolo

Global PDS

Operations |

34

Historical Financial Review |

35

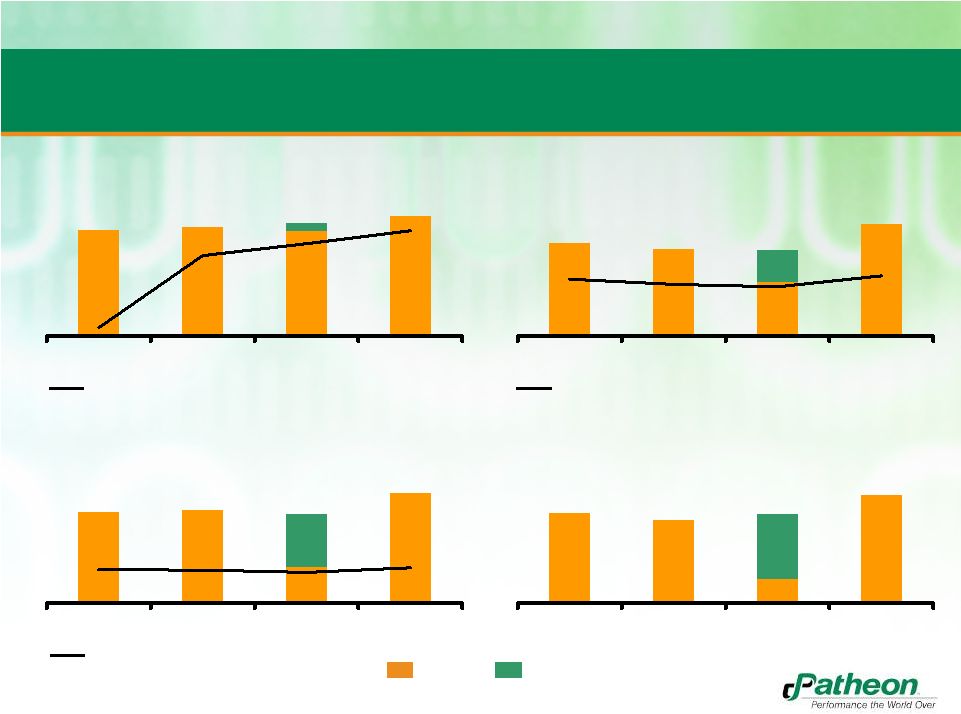

Patheon Standalone Historical Financial Performance

PF Revenue

($MM)

PF Gross Profit

($MM)

% Growth

% Margin

PF Adjusted EBITDA

($MM)

PF Adjusted EBITDA less Maintenance Capex

($MM)

% Margin

650

50

4.3%

2.5%

6.3%

2009

2010

2011

2012E

144

134

84

173

50

22.0%

20.0%

23.3%

19.1%

2009

2010

2011

2012E

134

70

65

19

84

50

2009

2010

2011

2012E

69

85

86

33

102

50

12.9%

12.8%

13.7%

11.9%

2009

2010

2011

2012E

83

Patheon

Benefit of contract cancellation

655

671

700

744

(8.7%) |

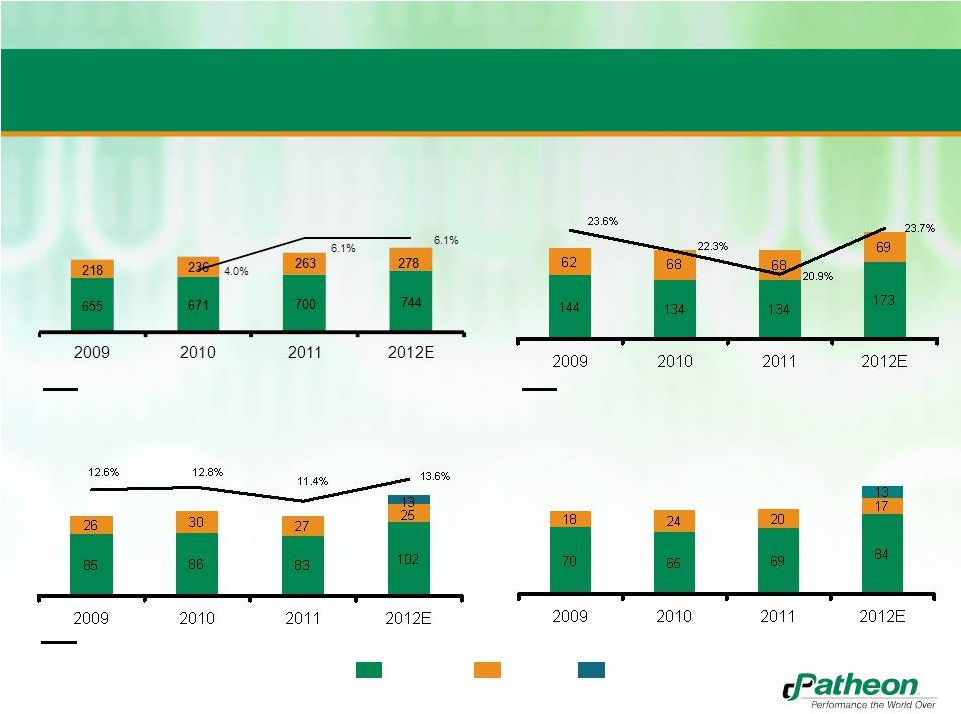

Combined

Historical and Pro Forma Financial Performance Total PF Adj. EBITDA

($MM)

Total PF Adj. EBITDA less Maint. Capex

($MM)

PF Revenue

($MM)

Total PF Gross Profit

($MM)

Patheon

Banner

Run Rate Synergies

% Growth

% Margin

% Margin

873

907

963

1,022

206

202

242

202

111

116

110

140

88

89

89

114

36 |

37

Credit Facilities Overview |

38

Summary of Key Terms

Borrower

Patheon Inc.

Guarantors

Material wholly-owned subsidiaries (excluding certain subsidiaries in jurisdictions where

security interests are difficult to perfect or enforce)

Security

First

priority

lien

on

all

tangible

and

intangible

assets

of

the

Borrower

and

Guarantors

Purpose

To fund the acquisition of Banner and refinance existing debt

Lead Arrangers and

Bookrunners

Morgan Stanley Senior Funding, Inc., UBS Securities LLC, Credit Suisse Securities (USA) LLC,

KeyBank National Association

Administrative Agent

Morgan Stanley Senior Funding, Inc.

Facility and Pricing

Tranche

Amount

Maturity

Revolver

$85 million

5 Years

Term Loan B

$565 million

7 Years

Accordion

$140 million, plus unlimited amounts subject to pro forma First Lien Net Leverage of 4.0x (50

bps MFN applicable during first 18 months of facility)

Amortization

Revolver: None

Term Loan B: 1% per annum

Optional Redemption

101 soft call for first year, prepayable at par thereafter

Mandatory

Repayments

50% excess cash flow sweep with leveraged based step-downs based on net total leverage,

100% of asset sale proceeds, 100% of debt issuance proceeds

Financial Covenants

Revolver:

1st

lien

leverage

covenant

when

>

20%

of

RC

used

with

cushions

set

30%

with

step-downs

to

4.25x

Term Loan B: None

Other Covenants

Customary and standard affirmative and negative covenants, including: limitations on

indebtedness, limitations on liens,

limitations

on

dispositions,

restrictions

on

transactions

with

affiliates,

limitations

on

investments

and

acquisitions |

39

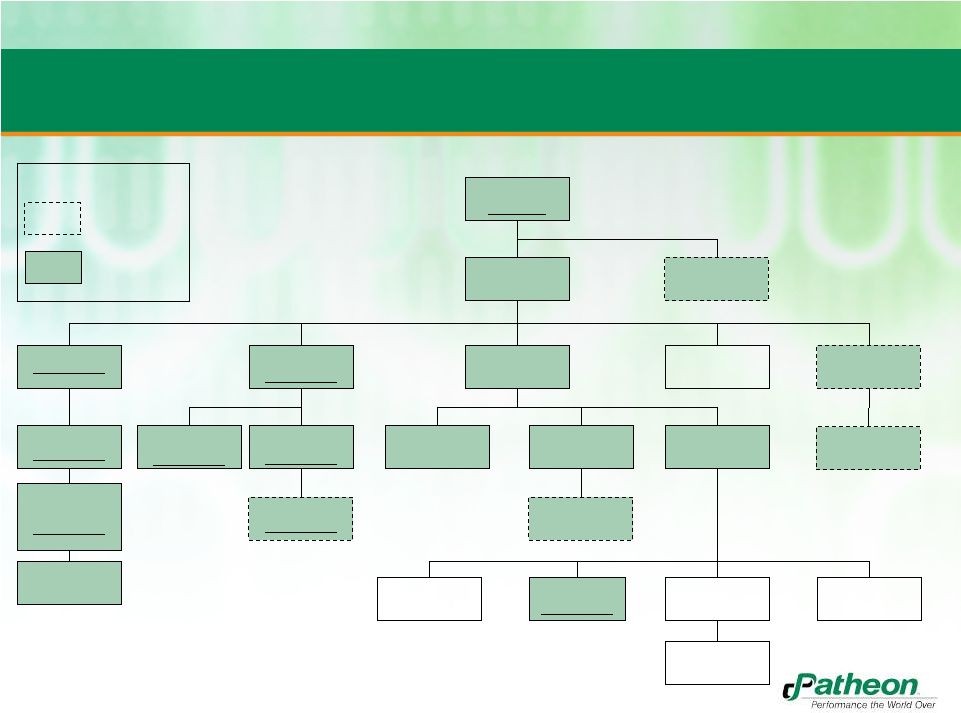

Patheon Finance

LLC

(US)

Patheon, Inc.

(CAN)

Parent Borrower

Patheon (UK) Ltd

(UK)

Subsidiary Borrower

Patheon B.V.

(NL)

Patheon

International AG

(CH)

Patheon

International Inc

(CAN)

Patheon

Holdings SAS

(FR)

Patheon Italia SpA

(IT)

Patheon US

Holdings LLC

(US)

Patheon

France SAS

(FR)

Patheon KK

(Japan)

Patheon US

Holdings Inc. (US)

Subsidiary Borrower

Patheon

Pharmaceuticals, Inc.

(US)

Subsidiary Borrower

Patheon

Pharmaceuticals

Services Inc. (US)

Subsidiary Borrower

Patheon PR LLC (US)

Subsidiary Borrower

Patheon Puerto Rico

Inc. (PR)

Subsidiary Borrower

Patheon PR

Acquisitions

Corporation

(PR)

Subsidiary Borrower

CEPH International

Corporation

(US)

Pharmacaps Mexicana

S.A. de C.V.

(MEX)

Gelcaps Exportadora

de Mexico S.A. de C.V.

(MEX)

Pro Forma Organizational Structure

Loan parties represent 81% of each of combined revenues and assets

Banner Pharmacaps,

LLC (US)

Subsidiary Borrower

Banner Pharamcaps

Europe B.V.

(NL)

Banner Pharamcaps

Europe Holding Coop

(NL)

Legend

Banner entities

Banner Pharmacaps

Ltd.

(CAN)

Loan parties |

40

Summary of Credit Highlights

Increased Diversity of Revenue and Profitability

1

Leading Positions in Large and Attractive Markets

3

Global and Diversified Manufacturing Network

5

Recurring Revenue Model with High Visibility

2

Best in Class Management Team

6

Industry Leading Quality Record

4 |

41

Appendix |

42

(1) Represents amortization of stock-based compensation

and non-cash foreign exchange gains and losses.

(2) Represents

consulting

fees

related

to

Patheon's

operational

excellence

program

recorded

in

the

12

months

ended

October

31,

2012.

(3) Represents expenses related to a 2011 product recall by one

of Patheon's customers for product returns recorded in the second quarter of fiscal

2012 and executive severance paid to the company's former CFO in the

first quarter of fiscal 2012. (4)

Represents additional estimated savings/revenues from operational

excellence projects and Puerto Rico overhead savings that Patheon estimates

it would have recognized in fiscal 2012 had all such projects been

completed and fully implemented as of November 1, 2011. 2012 Quarterly PF

Adjusted and Adjusted EBITDA Bridges (unaudited)

Q1 2012

Q2 2012

Q3 2012

Q4 2012

Full Year

PF Adjusted EBITDA

6.0

24.6

36.6

35.0

102.2

Non-cash items (1)

(0.7)

(1.3)

(0.4)

(0.9)

(3.3)

Consulting fees (2)

(6.3)

(6.0)

(1.0)

-

(13.3)

Other items (3)

(0.4)

(2.4)

-

-

(2.8)

Pro forma cost savings (4)

(7.8)

(5.2)

(0.6)

(0.2)

(13.8)

Adjusted EBITDA

(9.2)

9.7

34.6

33.9

69.0

Depreciation and amortization

(10.6)

(10.8)

(9.3)

(9.9)

(40.6)

Repositioning expenses

(0.8)

(6.0)

(0.1)

1.7

(5.2)

Interest expense, net

(6.5)

(6.5)

(6.8)

(6.6)

(26.4)

Impairment charge

-

(57.9)

-

-

(57.9)

Loss on sale of capital assets

-

-

-

(0.6)

(0.6)

Benefit (provision) for income taxes

7.7

(8.0)

(3.3)

(38.3)

(41.9)

Miscellaneous

0.1

(0.1)

0.4

0.6

1.0

(Loss) income before discontinued operations

(19.3)

(79.6)

15.5

(19.2)

(102.6)

Actuals

Estimate |

43

2009-2012 Annual PF Adjusted and Adjusted EBITDA Bridges

(unaudited)

2009

2010

2011

2012 Est.

$

$

$

$

Income (loss) before discontinued operations

1.1

(2.9)

(15.8)

(102.6)

Add (deduct):

Provision for (benefit from) income taxes

12.6

(13.8)

1.1

41.9

Loss on sale of capital assets

-

0.2

0.2

0.6

Refinancing expenses

-

12.2

-

-

Interest expense, net

15.4

19.6

25.6

26.4

Repositioning expenses

2.1

6.8

7.0

5.2

Depreciation and amortization

42.4

55.6

53.2

40.6

Asset impairment charge

-

3.6

-

57.9

Other

0.4

(0.4)

(4.9)

(1.0)

Adjusted EBITDA

74.0

80.9

66.4

69.0

Non-cash items (1)

1.0

2.3

3.5

3.3

Consulting fees

-

-

10.0

13.3

Special Committee costs

8.0

3.0

-

-

Other (2)

2.0

-

3.2

2.8

Pro forma cost savings/revenue (3)

-

-

-

13.8

PF Adjusted EBITDA

85.0

86.2

83.1

102.2

Banner Adjusted EBITDA (4)

25.5

30.4

27.1

25.0

Synergies (5)

12.5

Total PF Adjusted EBITDA

110.5

116.6

110.2

139.7

Years ended October

31,

(1)

Primarily stock-based compensation expenses.

(2)

Represents costs related to a recall by one of Patheon’s

customers (FY 2011 and FY 2012) and executive relocation and severance (FY 2009, 2011 and 2012).

(3)

Represents additional estimated savings/revenue from operational

excellence projects and Puerto Rico overhead savings that Patheon estimates it would have recognize

in fiscal 2012 had all such projects been completed and fully

implemented as of November 1, 2011. (4)

Represents LTM 10/31 Banner Pharmacaps estimated earnings before

interest expense, income tax expense, depreciation and amortization, foreign exchange gains and

losses, management fees, other income and expense, and pricing

allowance adjustments in FY 2011 and FY 2012.

(5)

Represents estimated annual synergies for FY 2012 resulting from

Patheon's expected acquisition of Banner Pharmacaps assuming completion of integration activities. |

Total PF Revenue and Gross Profit Bridges

(unaudited)

Represents

estimated

revenue/gross

profit

for

Banner

for

the

12

months

ended

October

31

each

year.

Represents costs related to a recall by one of Patheon’s

customers. Represents

additional

estimated

savings/revenue

from

operational

excellence

projects

and

Puerto

Rico

overhead

savings

that

Patheon

expects

it

would have

recognized in fiscal 2012 had all such projects been completed and

fully implemented as of November 1, 2011. Revenue

2009

2010

2011

2012 Est.

$

$

$

$

Total PF revenue

872.8

907.5

963.0

1,022.2

Banner revenue (1)

217.7

236.3

263.0

278.4

PF revenue

655.1

671.2

700.0

743.8

Product recall costs (2)

1.7

2.4

Pro forma revenue (3)

0.5

Revenue

655.1

671.2

698.3

740.9

Gross profit

Total PF gross profit

205.7

202.3

201.5

242.4

Banner gross profit (1)

61.6

67.9

68.0

69.0

PF gross profit

144.1

134.4

133.5

173.4

Product recall costs (2)

1.7

2.4

Pro forma cost savings/revenue (3)

13.8

Gross Profit

144.1

134.4

131.8

157.2

Years ended October 31,

(1)

(2)

(3)

44

st |

Bridges to

Cash Provided by Operating Activities (unaudited)

45

2009

2010

2011

2012 Est

Total PF Adjusted EBITDA

139.7

Total maintenance capex

Total PF Adjusted EBITDA less maintenance capex

87.9

88.6

89

Estimated Banner Adjusted EBITDA less maintenance capex (1)

17.5

24

20.2

17.6

Synergies

(2)

12.5

PF Adjusted EBITDA less maintenance capex

70.4

64.6

68.8

83.7

Maintenance capex

14.6

21.6

14.3

18.5

PF Adjusted EBITDA

85

86.2

83.1

102.2

Non-cash items

(3)

(1.0)

(2.3)

(3.5)

(3.3)

Consulting fees

(4)

(8.0)

(3.0)

(10.0)

(13.3)

Other items

(5)

(2.0)

(3.2)

(2.8)

Pro forma cost savings

(6)

-

-

-

(13.8)

Depreciation and amortization

(42.4)

(55.6)

(53.2)

(40.6)

Repositioning expenses

(2.1)

(6.8)

(7.0)

(5.2)

Interest expense, net

(15.4)

(19.6)

(25.6)

(26.4)

Impairment charge

(3.6)

(57.9)

Refinancing expenses

-

(12.2)

-

-

Benefit (provision) for income taxes

(12.6)

13.8

(1.1)

(41.9)

Miscellaneous

(0.4)

0.2

4.7

0.4

Income (loss) before discontinued operations

1.1

(2.9)

(15.8)

(102.6)

Depreciation and amortization

42.4

55.6

53.2

40.6

Stock-based compensation expense

1.1

2.3

3.5

3.4

Impairment charge

3.6

57.9

Loss on sale of capital assets

-

0.2

0.2

0.6

Deferred revenue amortization

(1.0)

(37.4)

(45.0)

(11.7)

Deferred financing charge amortization

0.6

2.5

1.1

1.1

Working capital changes

(10.8)

(2.6)

1.0

(8.6)

Change in other long term assets/liabilities

3.7

(17.5)

(4.6)

27.0

Change in deferred revenue

10.5

47.4

30.4

25.3

Miscellaneous

0.4

(0.5)

(0.1)

(1.1)

Cash used in discontinued operations

(8.9)

(0.7)

(1.0)

(0.4)

Cash provided by operating activities

39.1

50.0

22.9

31.5

Cash used in investing activities

(49.3)

(50.0)

(47.4)

(49.3)

Cash provided by financing activities

13.6

31.6

2.7

26.0

Represents LTM 10/31 Banner Pharmacaps estimated earnings before

interest expense, income tax expense, depreciation and amortization, foreign exchange gains and losses, management fees, other income and

expense, and FY 2011 and FY 2012 pricing allowance adjustments

reduced by estimated Maintenance Capex. Represents

estimated annual synergies for FY 2012 resulting from Patheon's expected acquisition of Banner Pharmacaps assuming completion of integration activities.

Primarily stock-based compensation expenses.

Represents consulting fees related to Patheon's operational excellence

program recorded in the 12 months ended October 31, 2012 and expenses associated with the Special Committee in 2009 and 2010 and SEC

registration in 2011.

Represents costs related to a recall by one of Patheon’s

customers (FY 2011 and FY 2012) and executive relocation and severance (FY 2009, 2011 and 2012).

Represents additional estimated savings/revenue from operational

excellence projects and Puerto Rico overhead savings that Patheon expects it would have

recognized in fiscal 2012 had all such projects been completed and

fully implemented as of November 1, 2011. (1)

(2)

(3)

(4)

(5)

(6)

113.8

25.9 |

46

Maintenance Capex and Free Cash Flow Bridges

(unaudited)

Maintenance Capex

2009

2010

2011

2012 Est.

Maintenance capital expenditures

14.6

21.6

14.3

18.5

Project capital expenditures

34.5

27.1

33.5

32.4

Total Capital expenditures

49.1

48.7

47.8

50.9

Free cash flow

1st half

2nd half

2012 Est.

Cash flow (used in) provided by operating activities

(22.9)

54.4

31.5

Capital expenditures

(17.6)

(33.3)

(50.9)

Free cash flow

(40.5)

21.1

(19.4)

Cash flow used in investing activities

(17.5)

(31.8)

(49.3)

Cash flow provided by financing activities

27.7

(1.7)

26.0

Fiscal year 2012

Years ended October

31, |