Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Northern Tier Energy LP | d441162d8k.htm |

Third Quarter

2012 Earnings Conference Call and Webcast

November 13, 2012

Exhibit 99.1 |

Forward Looking

Statements 1

The following information contains forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. These forward- looking

statements are based on management’s current expectations and beliefs, as well as a number of assumptions concerning future events. You can

identify forward-looking statements by words such as “anticipate,”

“believe,” “estimate,” “forecast,” “project,” “could,” “may,” “should,” “would,” “will or

other similar expression that convey the uncertainty of future events or outcomes. These

forward-looking statements are based on our current expectations and beliefs

concerning future developments and their potential effect on us. While management believes that these forward-looking statements are

reasonable as and when made, there can be no assurance that future developments affecting us

will be those that we anticipate. All comments concerning our expectations for

future revenues and operating results are based on our forecasts for our existing operations and do not include the potential impact of

any future acquisitions. Our forward-looking statements involve significant risks

and uncertainties (some of which are beyond our control) and assumptions that could

cause actual results to differ materially from our historical experience and our present expectations or projections. Important factors that could

cause actual results to differ materially from those in the forward-looking statements

include, but are not limited to, the overall demand for hydrocarbon products, fuels and

other refined products; our ability to produce products and fuels that meet our customers’ unique and precise specifications; the impact

of fluctuations and rapid increases or decreases in crude oil, refined products, fuel and

utility services prices and crack spreads, including the impact of these factors on our

liquidity; fluctuations in refinery capacity; accidents or other unscheduled shutdowns or disruptions affecting our refinery, machinery, or

equipment, or those of our suppliers or customers; changes in the cost or availability of

transportation for feedstocks and refined products; the results of our hedging and other

risk management activities; our ability to comply with covenants contained in our debt instruments; labor relations; relationships with our

partners and franchisees; successful integration and future performance of acquired assets,

businesses or third-party product supply and processing relationships; our access

to capital to fund expansions, acquisitions and our working capital needs and our ability to obtain debt or equity financing on

satisfactory terms; currently unknown liabilities in connection with the Marathon Acquisition

(as defined herein); environmental liabilities or events that are not covered by an

indemnity, insurance or existing reserves; dependence on one principal supplier for merchandise; maintenance of our credit ratings and

ability to receive open credit lines from our suppliers; the effects of competition; continued

creditworthiness of, and performance by, counterparties; the impact of current and

future laws, rulings and governmental regulations, including guidance related to the Dodd-Frank Wall Street Reform and Consumer

Protection Act; shortages or cost increases of power supplies, natural gas, materials or

labor; weather interference with business operations; seasonal trends in the industries

in which we operate; fluctuations in the debt markets; potential product liability claims and other litigation; and changes in economic

conditions, generally, and in the markets we serve, consumer behavior, and travel and tourism

trends. For additional information regarding known material factors that could cause

our actual results to differ from our projected results, please see (1) Part II, “Item 1A. Risk Factors” and elsewhere in our form 10-Q,

dated November 13, 2012 (File No. 001-35612) and (2) “Risk Factors” in our final

prospectus, dated July 25, 2012 (the “Prospectus),” included in our

Registration Statement on Form S-1 (File No. 001-35612). The

presentation also includes non-GAAP measures. We believe that these non-GAAP financial measures provide useful information about our operating

performance and should not be viewed in isolation or considered as alternatives to comparable

GAAP measures. Our non-GAAP financial measures may also differ from similarly

names measures used by other companies. See the disclosures in the “Management’s Discussion and Analysis of Financial Condition

and Results of Operations” included in our quarterly financial statements for the three

and nine months ended September 30, 2012 for additional information on the non

–GAAP measures used in this presentation and reconciliations to the most directly comparable GAAP measures. |

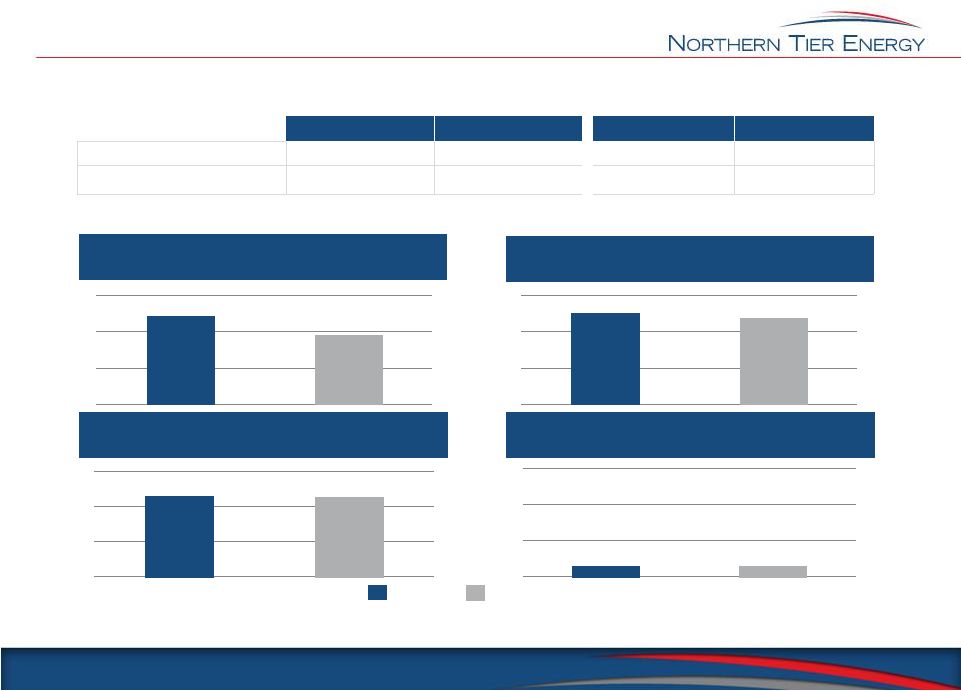

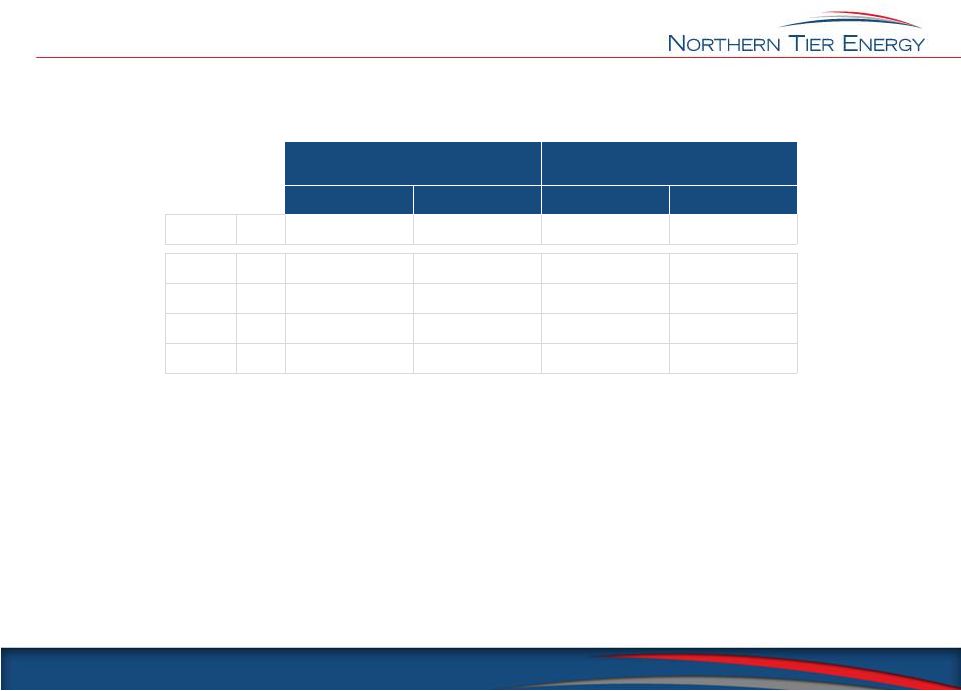

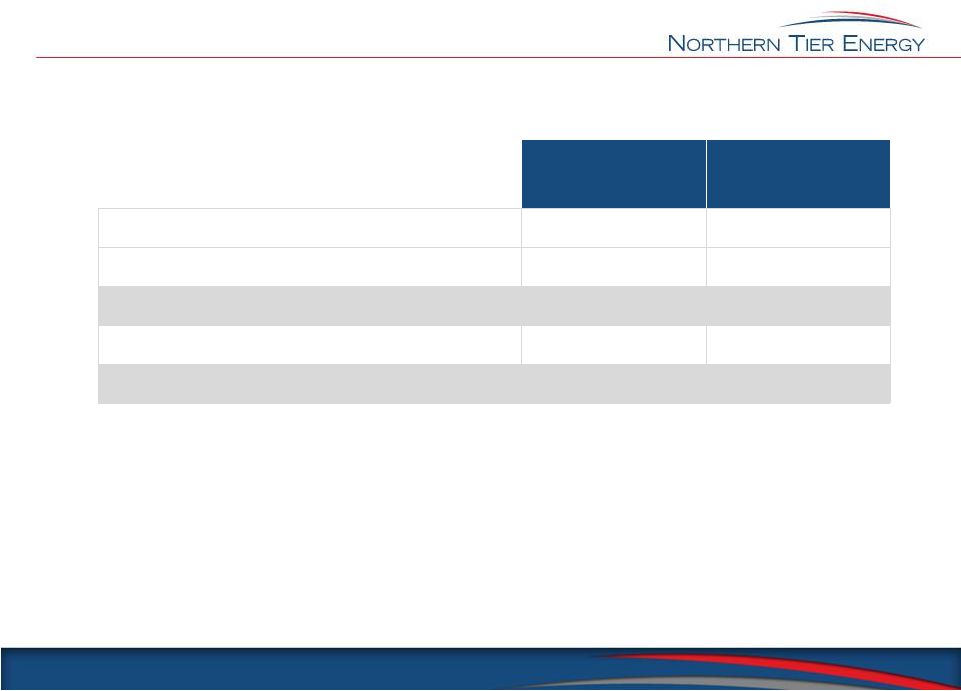

$36.69

$28.54

$4.54

$4.36

8.0

7.8

$34.36

$34.08

Direct Operating Expenses

3

($ per throughput barrel)

Q3 2012 Financial Results and Key Refining

Performance Metrics

2

Q3 2012

Q3 YTD 2012

Q3 2011

Q3 YTD 2011

Net Income

$61.1

$113.1

$2.2

($264.4)

Adjusted

EBITDA

1

249.5

577.3

179.5

364.2

Consolidated Financial Results

Key Refining Performance Metrics

1

See Appendix for reconciliation of Net Income to Adjusted EBITDA.

2

3

Direct operating expenses per barrel is calculated by dividing direct operating expenses by

the total barrels of throughput for the respective periods presented. ($ in

millions) Gross Margin

2

($ per throughput barrel)

Group 3 3-2-1

Benchmark Crack Spread

Throughput

(millions of barrels)

Q3 2012

Q3 2011

See Appendix for each of the components used in this calculation (revenue and cost of sales).

|

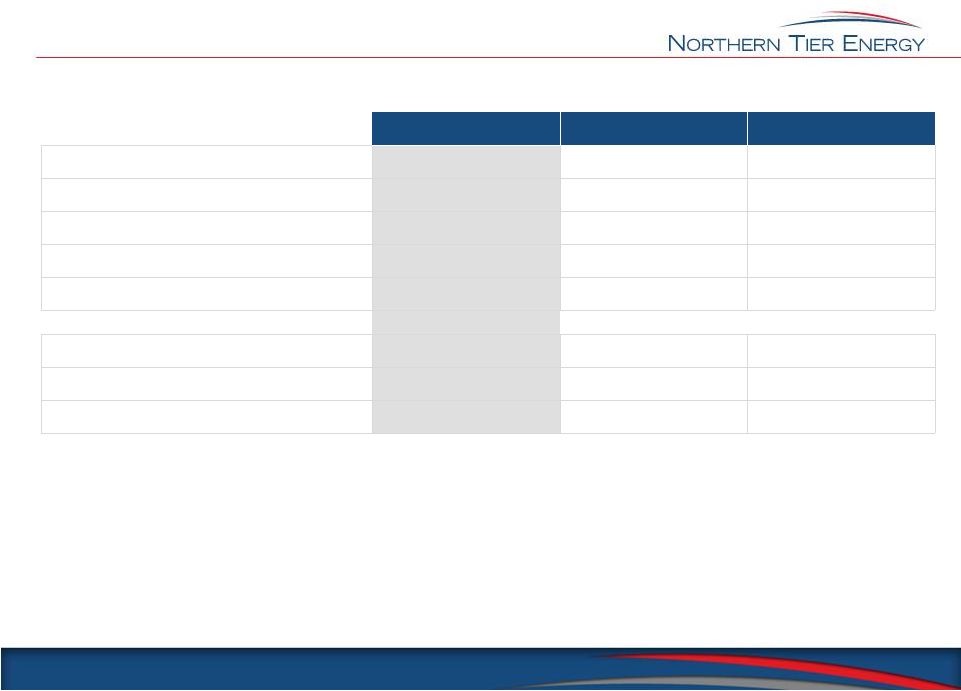

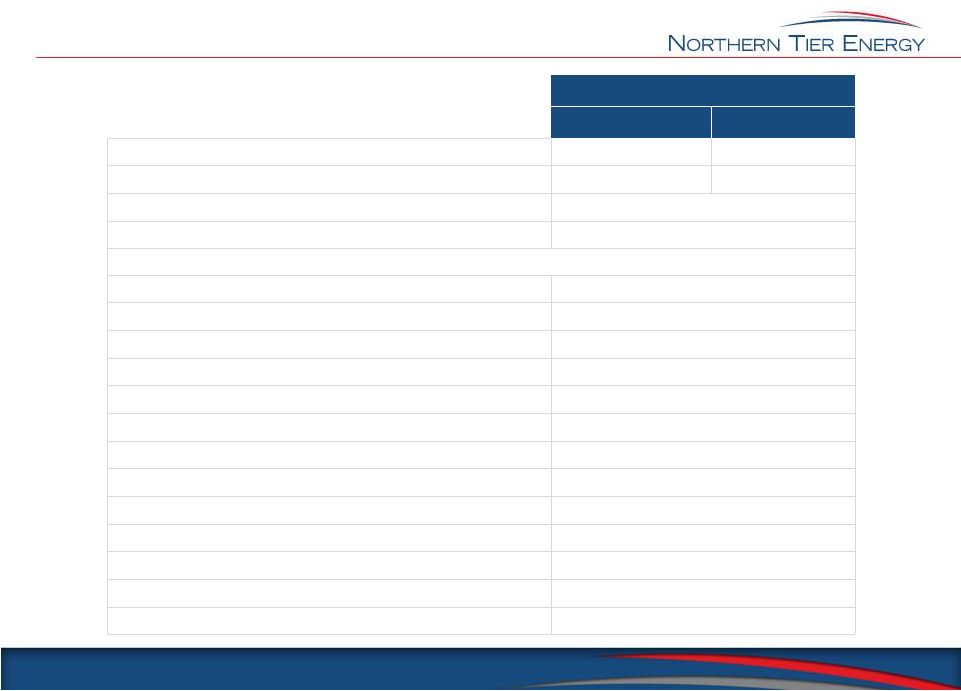

Select Balance

Sheet & Cash Flow Data 3

Q3 2012

Q2 2012

Q1 2012

Cash and Cash Equivalents

$323.5

$171.0

$64.1

Total Debt

268.5

302.7

301.9

Equity

537.9

326.1

119.0

Last Twelve Months (LTM) Adjusted EBITDA

643.8

573.8

429.0

Net Debt to LTM Adjusted EBITDA

NM

0.2x

0.6x

Cash Flow from Operations

(1)

$80.0

$149.6

($54.8)

Cash Available for Distribution

(2)

136.1

NA

NA

Distribution per Unit

$1.48

NA

NA

($ in millions)

1

Includes $132 million of cash payments related to the execution of the IPO

2

See Appendix for reconciliation of Net Income to Cash Available for Distribution

|

Hedge

Positions 4

Volume Hedged

(000 barrels)

NTI Strike Price

Gasoline

Diesel

Gasoline

Distillate

2012

Q4

2,340

1,380

$17.10

$28.21

2013¹

Q1

504

761

$16.08

$21.40

Q2

504

761

16.08

21.40

Q3

504

761

16.08

21.40

Q4

504

761

16.08

21.40

1

30,000 barrels of gasoline per quarter and 15,000 barrels of diesel per quarter are hedged at

cracks against WCS, while the remaining barrels are hedged at cracks against WTI. |

Q4

Guidance 5

Q4 2012

Low

High

Refinery Statistics:

Total throughput (bpd)

80,000

85,000

Direct opex ex. turnaround ($/throughput bbl)

$4.75

Turnaround reserve ($ in mm)

$10.0

Retail Statistics:

Forecasted gallons (mm)

79

Retail fuel margin ($/gallon)

$0.19

Merchandise sales ($ in mm)

$90.0

Merchandise gross margin (%)

25.5%

Direct operating expense ($ in mm)

$29.0

Other Guidance ($ in mm):

SG&A

$23.0

Depreciation & amortization

9.0

Cash interest expense

6.7

Capital expenditure

11.0

Taxes

1.1 |

APPENDIX

|

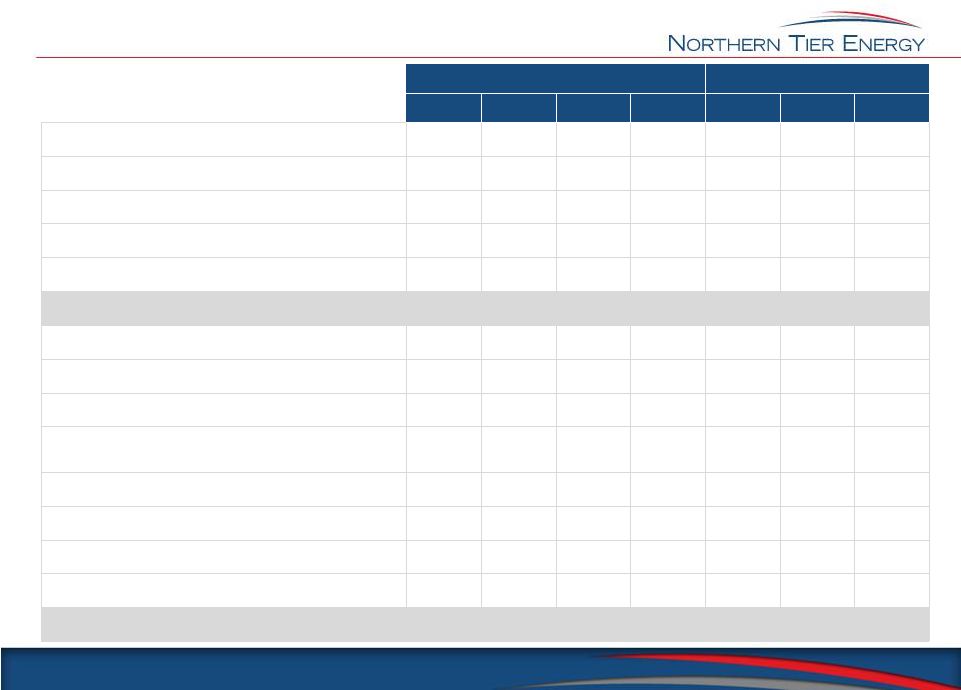

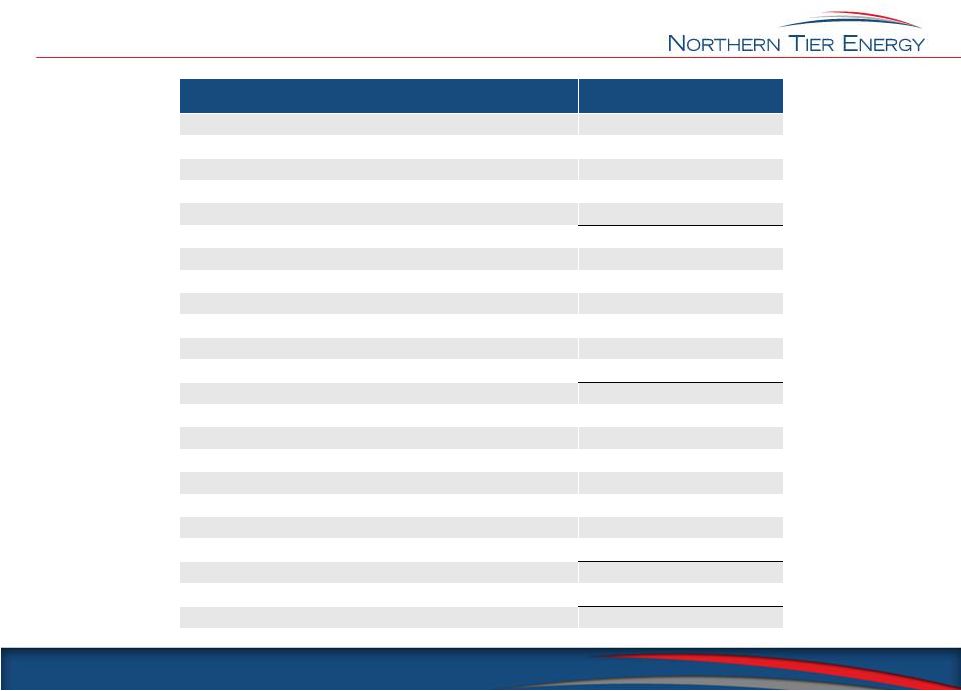

Adjusted EBITDA

Reconciliation 7

2011

2012

1Q

2Q

3Q

4Q

1Q

2Q

3Q

Net Income (Loss)

$(224.5)

$(42.1)

$2.2

$292.7

$(193.6)

$246.6

$61.1

Adjustments:

Interest Expense

10.0

10.2

10.4

11.5

10.4

10.7

15.6

Income Tax Provision

0.1

(0.1)

-

-

-

0.1

7.7

Depreciation and Amortization

7.3

7.6

7.4

7.2

8.5

7.8

8.3

EBITDA Subtotal

$(207.1)

$(24.4)

$20.0

$311.4

$(174.7)

$265.2

$92.7

Minnesota Pipe Line Proportionate EBITDA

0.9

0.9

0.9

0.1

0.7

0.7

0.7

Turnaround and Related Expenses

3.3

19.2

-

0.1

3.5

11.5

2.1

Equity-based Compensation Expense

0.3

0.4

0.4

0.5

0.4

0.5

0.5

Unrealized (Gains) / Losses on Derivative

Activities

262.9

31.0

40.6

(292.6)

88.4

(191.3)

70.3

Contingent Consideration (Income) / Loss

(31.8)

(9.2)

3.4

(18.2)

65.7

0.1

38.5

Formation Costs

2.5

1.9

1.7

1.3

-

-

-

Loss on Early Extinguishment of Derivatives

-

-

-

-

44.6

92.2

-

Realized losses on derivative activities

52.2

81.7

112.5

63.9

52.9

67.4

44.7

Adjusted EBITDA

$83.2

$101.5

$179.5

$66.5

$81.5

$246.3

$249.5

($ in millions) |

Refining Gross

Product Margin Per Barrel of Throughput Reconciliation

8

Q3 2012

Q3 2011

Refinery Revenue

$1,151.1

$1,034.0

Refinery Costs of Sales

855.8

812.2

Refinery Gross Product Margin

$295.3

$221.8

Total Refinery Throughput (bpd)

87,476

84,485

Refinery Gross Product Margin Per Barrel of

Throughput

$36.69

$28.54

($ in millions, unless otherwise indicated) |

Cash Available

for Distribution Reconciliation For the 3 months ending

9/30/12

Net income

$61.1

Adjustments:

Interest expense

15.6

Income tax provision

7.7

Depreciation and amortization

8.3

EBITDA subtotal

92.7

Minnesota Pipe Line proportionate EBITDA

0.7

Turnaround and related expenses

2.1

Equity-based compensation

0.5

Unrealized gains on derivative activities

70.3

Contingent consideration loss

38.5

Realized losses on derivative activities

44.7

Adjusted EBITDA

249.5

Cash interest expense

(9.9)

Current tax provision

(0.1)

Minnesota Pipe Line proportionate EBITDA

(0.7)

Realized losses on derivative activities

(44.7)

Capital expenditures

(6.3)

Reserve for turnaround and related expenses

(10.0)

Working capital impacts

19.9

Cash Available for Distribution

197.7

Adjustment for period prior to initial public offering

(61.6)

Cash Available for Distribution subsequent to initial public offering

$136.1

($ in millions)

9 |