Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MidWestOne Financial Group, Inc. | a2012sandlerfallpresentati.htm |

| EX-99.1 - EXHIBIT 99.1 - MidWestOne Financial Group, Inc. | exhibit9912012sandlerfallp.htm |

11/6/2012 MidWestOne Financial Group, Inc. s 102 South Clinton Street s Iowa City, Iowa 52240 s 800.247.4418 s MidWestOne.com NASDAQ: MOFG Investor Presentation November 2012

11/6/2012 2 Forward-Looking Statements This presentation contains forward-looking statements relating to the financial condition, results of operations and business of MidWestOne Financial Group, Inc. Forward-looking statements generally include words such as believes, expects, anticipates and other similar expressions. Actual results could differ materially from those indicated. Among the important factors that could cause actual results to differ materially are interest rates, changes in the mix of the company’s business, competitive pressures, general economic conditions and the risk factors detailed in the company’s periodic reports and registration statements filed with the Securities and Exchange Commission. MidWestOne Financial Group, Inc. undertakes no obligation to publicly revise or update these forward-looking statements to reflect events or circumstances after the date of this presentation.

11/6/2012 1 = As of September 30, 2012; 2 = As of October 25, 2012 3 MidWestOne Overview Symbol: MOFG on NASDAQ Global Select Headquarters: Iowa City, Iowa Assets: $1.72 Billion 1 4th Largest Based in Iowa Market Cap: $171.9 Million 2 Total Employees: 379 FTE Employees 1 Recent Price: $20.24 2 52 Week Range: $13.75 - $23.25 2 Tangible Common Equity: $19.07 Per Share 1 Price/Tangible Book: 113% 1 Average Shares Outstanding: 8.5 Million Cash Dividend Trailing 12 Months: 32.5 Cents Current Dividend Yield : 1.88% 2

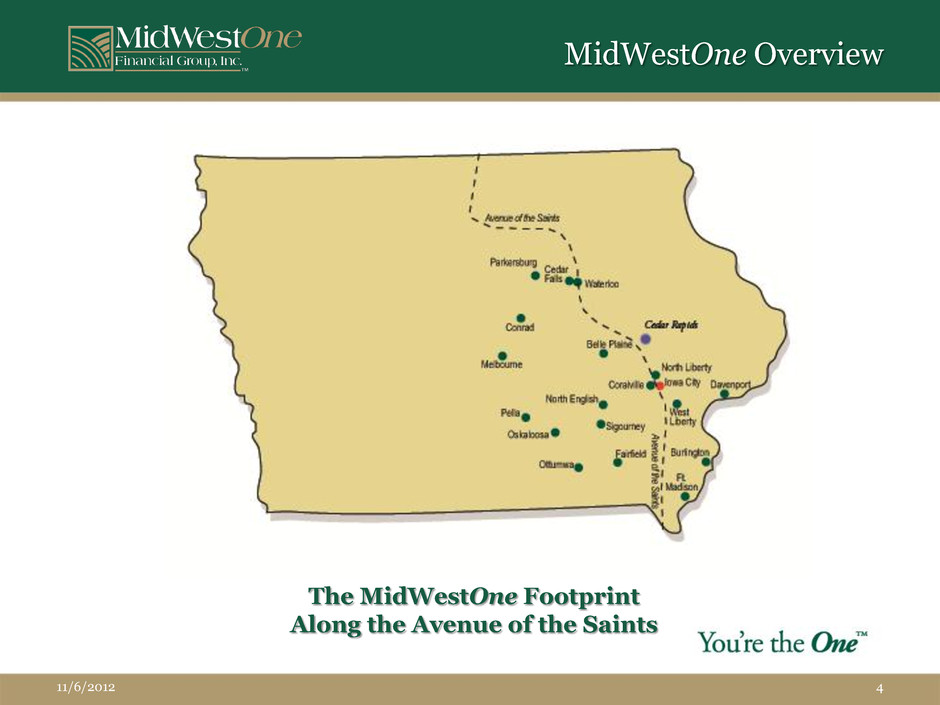

11/6/2012 4 MidWestOne Overview The MidWestOne Footprint Along the Avenue of the Saints

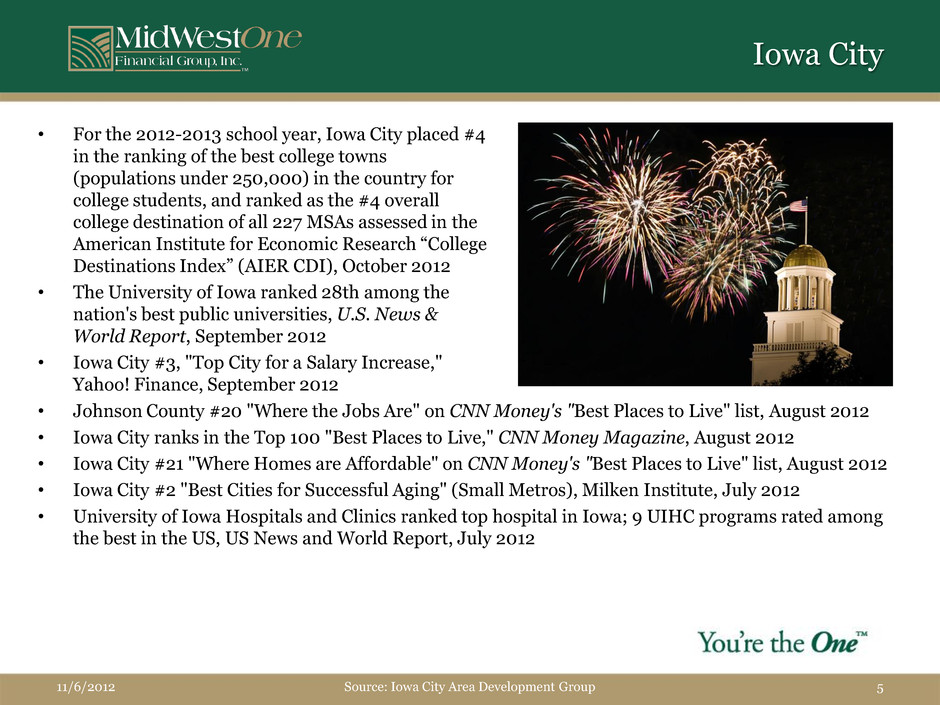

• For the 2012-2013 school year, Iowa City placed #4 in the ranking of the best college towns (populations under 250,000) in the country for college students, and ranked as the #4 overall college destination of all 227 MSAs assessed in the American Institute for Economic Research “College Destinations Index” (AIER CDI), October 2012 • The University of Iowa ranked 28th among the nation's best public universities, U.S. News & World Report, September 2012 • Iowa City #3, "Top City for a Salary Increase," Yahoo! Finance, September 2012 11/6/2012 Source: Iowa City Area Development Group 5 Iowa City • Johnson County #20 "Where the Jobs Are" on CNN Money's "Best Places to Live" list, August 2012 • Iowa City ranks in the Top 100 "Best Places to Live," CNN Money Magazine, August 2012 • Iowa City #21 "Where Homes are Affordable" on CNN Money's "Best Places to Live" list, August 2012 • Iowa City #2 "Best Cities for Successful Aging" (Small Metros), Milken Institute, July 2012 • University of Iowa Hospitals and Clinics ranked top hospital in Iowa; 9 UIHC programs rated among the best in the US, US News and World Report, July 2012

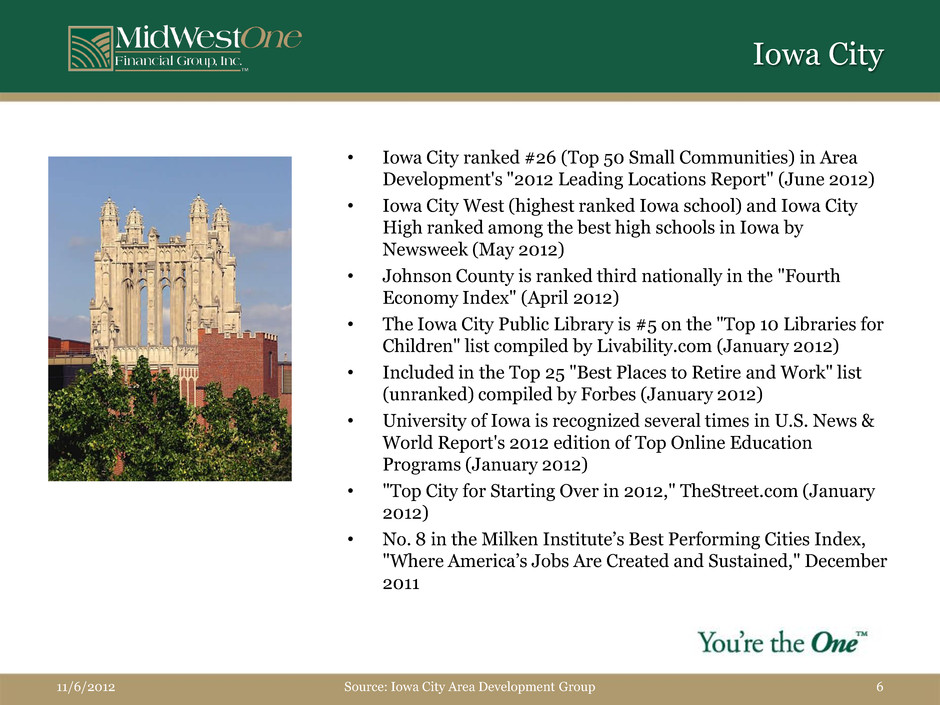

11/6/2012 Source: Iowa City Area Development Group 6 Iowa City • Iowa City ranked #26 (Top 50 Small Communities) in Area Development's "2012 Leading Locations Report" (June 2012) • Iowa City West (highest ranked Iowa school) and Iowa City High ranked among the best high schools in Iowa by Newsweek (May 2012) • Johnson County is ranked third nationally in the "Fourth Economy Index" (April 2012) • The Iowa City Public Library is #5 on the "Top 10 Libraries for Children" list compiled by Livability.com (January 2012) • Included in the Top 25 "Best Places to Retire and Work" list (unranked) compiled by Forbes (January 2012) • University of Iowa is recognized several times in U.S. News & World Report's 2012 edition of Top Online Education Programs (January 2012) • "Top City for Starting Over in 2012," TheStreet.com (January 2012) • No. 8 in the Milken Institute’s Best Performing Cities Index, "Where America’s Jobs Are Created and Sustained," December 2011

11/6/2012 Unemployment rates as of September 2012 from the Bureau of Labor Statistics 7 The Iowa Market Low Unemployment • Iowa is ranked 4th nationally with a 5.2% unemployment rate. The national average is 7.8%. • Johnson County (Iowa City) has a 3.20% unemployment rate. • According to the Federal Housing Finance Agency, Johnson County ranked #16 out of 306 MSAs for home price appreciation. • Over the past 5 years national home prices fell 19.16 % while Johnson County home prices are up 3.04%. Overbanked • 340 banks chartered in Iowa • 4th highest number of bank charters in the country • For example, by comparison, New Jersey has 110 bank charters, Utah has 56, and Arizona has 30. • Consolidation due in Iowa

11/6/2012 8 Executive Management Team Name Position Banking Experience Years with MidWestOne Charles N. Funk President & CEO 33 Years 12 Years Susan R. Evans Chief Operating Officer 36 Years 11 Years Kent L. Jehle EVP, Chief Credit Officer 31 Years 26 Years Gary J. Ortale EVP, Chief Financial Officer 34 Years 25 Years Douglas L. Benjamin SVP, Regional President 24 Years 8 Years James M. Cantrell SVP, Chief Risk Officer 26 Years 3 Years Barbara A. Finney SVP, Regional President 20 Years 15 Years Sondra J. Harney SVP, Director of Human Resources 33 Years 33 Years John J. Henk SVP, Chief Information Officer 25 Years 6 Years Steven P. Hicks SVP, Regional Credit Manager 24 Years 21 Years Pamela S. Pothoven SVP, Regional President 29 Years 6 Years Gregory W. Turner SVP, Wealth Management 15 Years 4 Years

11/6/2012 2000-2007 As Reported by SNL Financial, 2008-2012 As Reported by the Company 9 Asset Quality 1.14% (0.50) 0.00 0.50 1.00 1.50 2.00 2.50 2000 FY 2001 FY 2002 FY 2003 FY 2004 FY 2005 FY 2006 FY 2007 FY 2008 FY 2009 FY 2010 FY 2011 FY NCOs/ Avg Loans (%) NPLs/ Loans (%) 0.21% 2012 FYTD As of 09/30/12

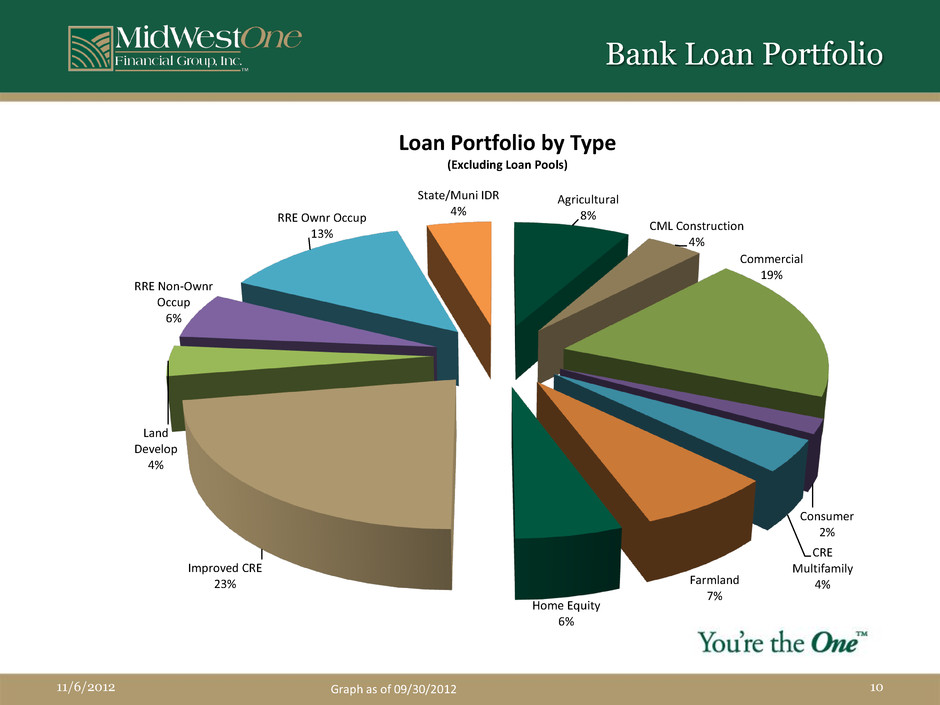

11/6/2012 10 Bank Loan Portfolio Graph as of 09/30/2012 Agricultural 8% CML Construction 4% Commercial 19% Consumer 2% CRE Multifamily 4% Farmland 7% Home Equity 6% Improved CRE 23% Land Develop 4% RRE Non-Ownr Occup 6% RRE Ownr Occup 13% State/Muni IDR 4% Loan Portfolio by Type (Excluding Loan Pools)

11/6/2012 As of 09/30/2012 11 Bank Loan Portfolio $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 M ill io n s Loan Portfolio by Market (Excluding Loan Pools)

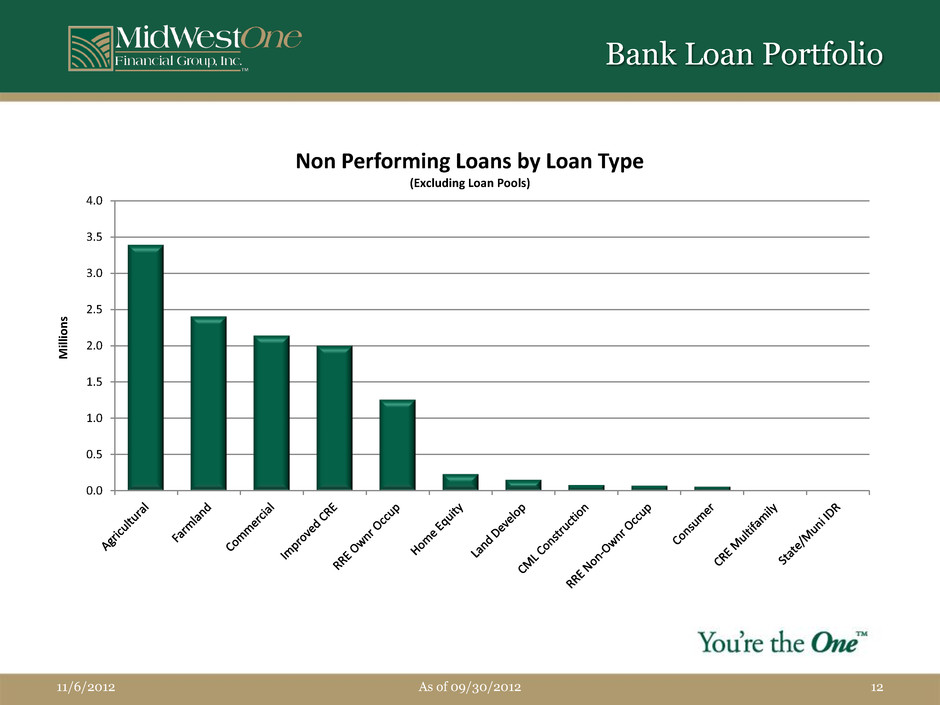

11/6/2012 As of 09/30/2012 12 Bank Loan Portfolio 0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 M ill io n s Non Performing Loans by Loan Type (Excluding Loan Pools)

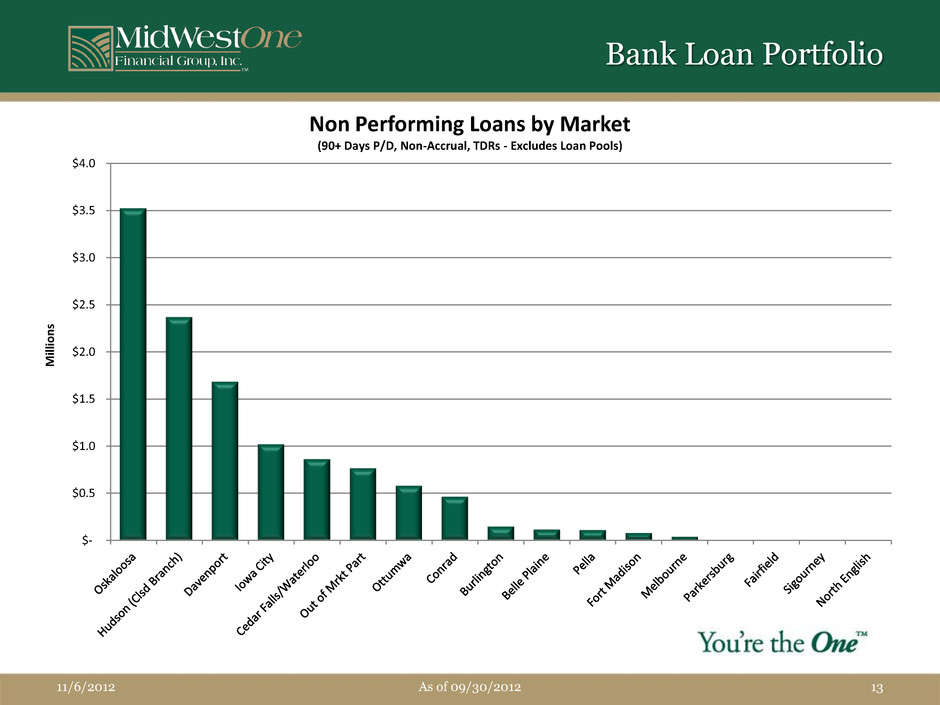

11/6/2012 As of 09/30/2012 13 Bank Loan Portfolio $- $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 $3.5 $4.0 M ill io n s Non Performing Loans by Market (90+ Days P/D, Non-Accrual, TDRs - Excludes Loan Pools)

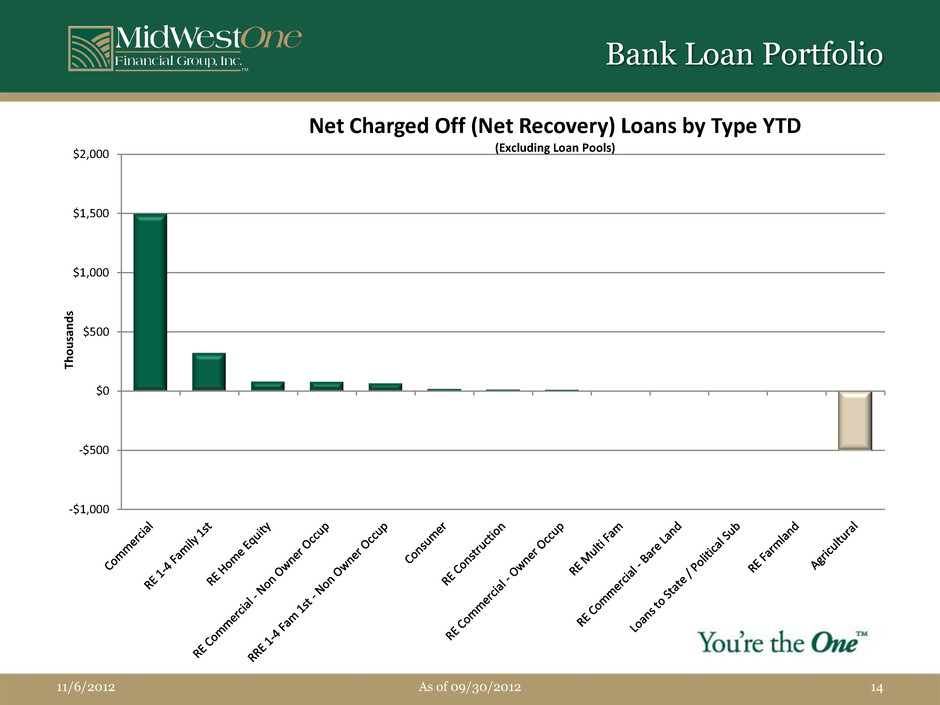

11/6/2012 As of 09/30/2012 14 Bank Loan Portfolio -$1,000 -$500 $0 $500 $1,000 $1,500 $2,000 Th o u sa n d s Net Charged Off (Net Recovery) Loans by Type YTD (Excluding Loan Pools)

11/6/2012 15 Loan Pool Participations At September 30, 2012, our loan pool investment was $40.00 million. As of September 30, 2012, approximately 2.50% of our earning assets were invested in loan pools, and approximately 3.40% of our total revenue was derived from loan pools. The Company entered into this business upon consummation of its merger with the former MidWestOne in March 2008, and decided to exit this line of business as current balances pay down. These loan pool participations are pools of performing, sub-performing and nonperforming loans purchased at varying discounts from the aggregate outstanding principal amount of the underlying loans. Our basis across the total loan pool portfolio is approximately $0.35 per $1.00 of loan face value as of September 30, 2012, and they represent 2.20% of total assets. Loan pools are held and serviced by a third-party independent servicing corporation working in cooperation with MOFG management. The Company has very minimal exposure in loan pools to consumer real estate, subprime credit or to construction and real estate development loans.

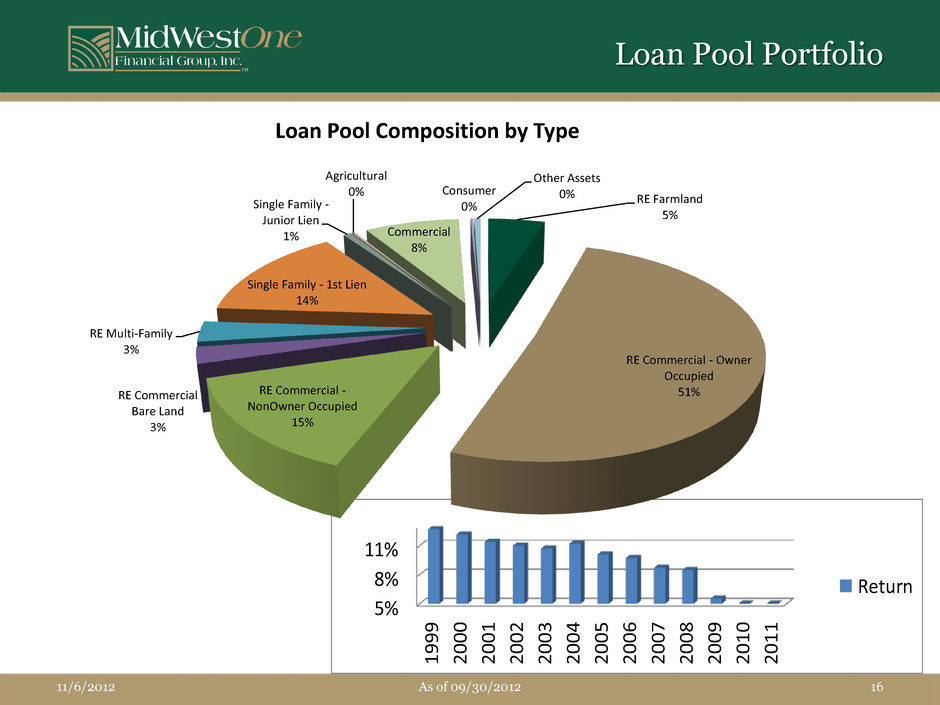

5% 8% 11% 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 Return 11/6/2012 As of 09/30/2012 16 Loan Pool Portfolio RE Farmland 5% RE Commercial - Owner Occupied 51% RE Commercial - NonOwner Occupied 15% RE Commercial Bare Land 3% RE Multi-Family 3% Single Family - 1st Lien 14% Single Family - Junior Lien 1% Agricultural 0% Commercial 8% Consumer 0% Other Assets 0% Loan Pool Composition by Type

11/6/2012 Real Estate loans include all 1-4 Family 1st Mortgages and Commercial 1-4 Family RE loans 17 Keys to MOFG Non-Interest Income Growth • Wealth Management • Trust – Opportunity to expand trust services to locations within the company previously without those services • Investor Center – Strong brokerage presence in 4 markets with potential to expand • Home Mortgage • Economies of scale through utilizing a central hub for Real Estate lending • $163,527,267 in real estate loans closed in 2012 as of 09/30/12 • $169,654,069 in real estate loans closed in 2011 • MidWestOne Insurance Services • In process of building this phase of business in selected MidWestOne communities and we expect that insurance will become a greater contributor to non-interest income over the next five years • Strategic planning goal is to increase non-interest income to 30% of revenues

11/6/2012 *Regulatory Guidelines for a Well-Capitalized Bank 18 Capital MidWestOne Bank 09/30/2012 Regulatory Guidelines* Risk Based Capital/ Risk Weighted Assets 12.89% 10.00% Tier 1 Capital/ Risk Weighted Assets 11.64% 6.00% Leverage Ratio 8.88% 5.00% MidWestOne Financial Group, Inc. 09/30/2012 Internal Guidelines Tangible Common Equity/ Tangible Assets 9.45% 7.50- 9.00% Tier 1 Capital/ Total Assets 9.98% 7.50- 9.50%

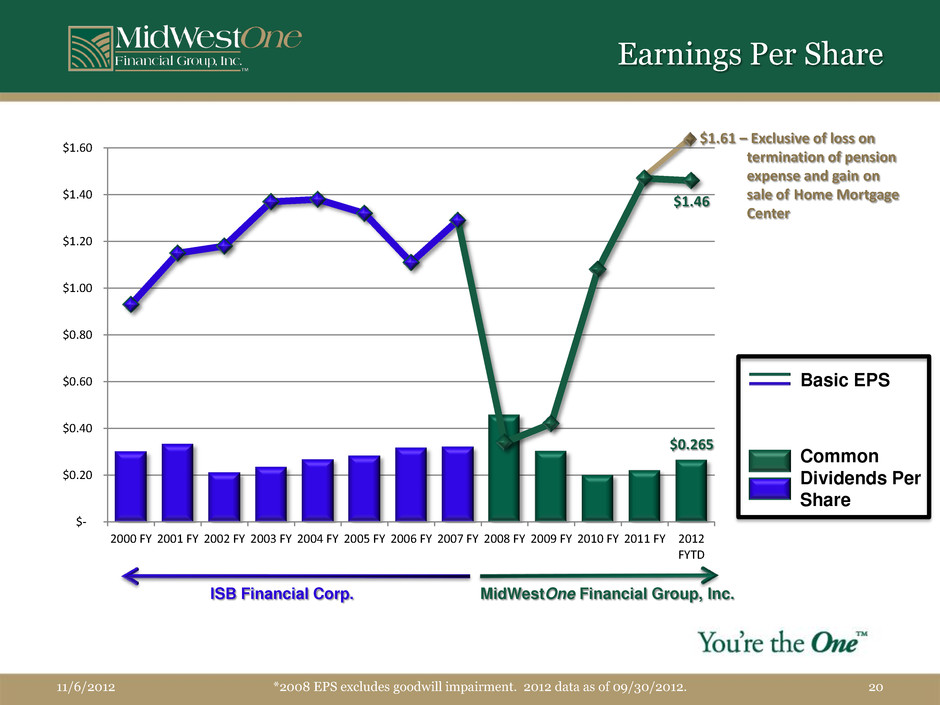

• In October, 2012, declared a fourth quarter cash dividend of $0.095 per common share. • In July, 2012, increased quarterly dividend from $0.085 per share to $0.095 per share • In January, 2012, increased quarterly dividend from $0.06 per share to $0.085 per share • In October 2011 announced a $5 million share repurchase program – 188,273 shares repurchased at an average cost of $15.63 per share, $2,942,230 total 11/6/2012 19 Capital

11/6/2012 *2008 EPS excludes goodwill impairment. 2012 data as of 09/30/2012. 20 Earnings Per Share ISB Financial Corp. MidWestOne Financial Group, Inc. Common Dividends Per Share Basic EPS $1.46 $0.265 $- $0.20 $0.40 $0.60 $0.80 $1.00 $1.20 $1.40 $1.60 2000 FY 2001 FY 2002 FY 2003 FY 2004 FY 2005 FY 2006 FY 2007 FY 2008 FY 2009 FY 2010 FY 2011 FY 2012 FYTD $1.61 – Exclusive of loss on termination of pension expense and gain on sale of Home Mortgage Center

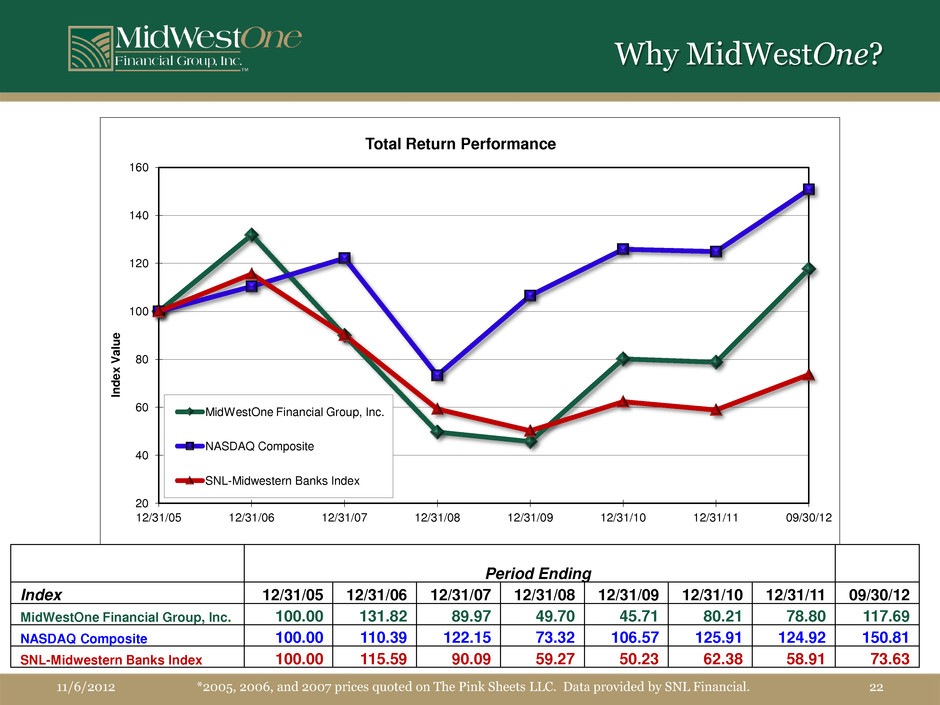

11/6/2012 21 Why MidWestOne? • Strong capital position • Ample liquidity • High credit and loan quality • NPAs are traditionally better than peer group • Excellent historical track record • Diversified portfolio • Company has strategic plan to grow • Commitment to our shareholders – we make long-term decisions • People; including a strong and experienced management team • The Iowa economy has outperformed the national economy for many years • Community focus is very positive for our brand promise • Our employees give an average of 4,131 hours of their own time to volunteerism each month (9.72 hours per month per employee) • Over $450,000 in community support was given by the Bank and Bank Foundation in 2009, approximately $500,000 in each 2010 and 2011.

11/6/2012 *2005, 2006, and 2007 prices quoted on The Pink Sheets LLC. Data provided by SNL Financial. 22 Why MidWestOne? 20 40 60 80 100 120 140 160 12/31/05 12/31/06 12/31/07 12/31/08 12/31/09 12/31/10 12/31/11 09/30/12 In d e x V a lu e Total Return Performance MidWestOne Financial Group, Inc. NASDAQ Composite SNL-Midwestern Banks Index Period Ending Index 12/31/05 12/31/06 12/31/07 12/31/08 12/31/09 12/31/10 12/31/11 09/30/12 MidWestOne Financial Group, Inc. 100.00 131.82 89.97 49.70 45.71 80.21 78.80 117.69 NASDAQ Composite 100.00 110.39 122.15 73.32 106.57 125.91 124.92 150.81 SNL-Midwestern Banks Index 100.00 115.59 90.09 59.27 50.23 62.38 58.91 73.63

11/6/2012 23 Analysts That Cover Our Company Sandler O’Neill + Partners, LLC • Rating = Buy Raymond James Financial, Inc. • Rating = Outperform 2 FIG Partners • Rating = Outperform

11/6/2012 MidWestOne Financial Group, Inc. 102 South Clinton Street s Iowa City, Iowa 52240 319.356.5800 www.MidWestOne.com