Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Jefferies Financial Group Inc. | d438671d8k.htm |

| EX-99.2 - MEMO OF TERMS - Jefferies Financial Group Inc. | d438671dex992.htm |

Exhibit 99.3

Leucadia – Jefferies

A Unique Combination

November 12, 2012

|

|

|

Note on Forward Looking Statements

This document contains “forward looking statements” within the meaning of the safe harbor provisions of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward looking statements include statements about Jefferies’ and Leucadia’s future and statements that are not historical facts. These forward looking statements are usually preceded by the words “expect,” “intend,” “may,” “will,” or similar expressions. All information and estimates relating to the merger of Leucadia and Jefferies and the combination of our businesses constitute forward looking statements. Forward looking statements may contain expectations regarding post-merger activities, financial strength, operations, synergies, and other results, and may include statements of future performance, plans, and objectives. Forward looking statements also include (i) statements pertaining to our strategies for the future development of our businesses, (ii) the spin-out of Leucadia’s Crimson Wine Group, and (iii) Jefferies’ intention to remain subject to the filing requirements under the Securities Exchange Act of 1934. Forward looking statements represent only our belief regarding future events, many of which by their nature are inherently uncertain or subject to change. It is possible that the actual results may differ, possibly materially, from the anticipated results indicated in these forward-looking statements. Information regarding important factors that could cause actual results to differ, perhaps materially, from those in our forward looking statements is contained in reports we file and will file with the SEC. You should read and interpret any forward looking statement together with such reports.

|

i |

|

Important Information for Investors and Shareholders

Leucadia National Corporation (Leucadia) plans to file with the SEC a Registration Statement on Form S-4 in connection with the proposed transaction, and Leucadia and Jefferies Group, Inc. (Jefferies) plan to file with the SEC and mail to their respective shareholders a Joint Proxy/Prospectus in connection with the proposed transaction. THE REGISTRATION STATEMENT AND THE JOINT PROXY/PROSPECTUS WILL CONTAIN IMPORTANT INFORMATION ABOUT LEUCADIA, JEFFERIES, THE PROPOSED TRANSACTION AND RELATED MATTERS. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT AND THE JOINT PROXY/PROSPECTUS CAREFULLY WHEN THEY BECOME AVAILABLE. Investors and security holders will be able to obtain free copies of the Registration Statement and the Joint Proxy/Prospectus and other documents filed with the SEC by Leucadia and Jefferies through the web site maintained by the SEC at www.sec.gov. In addition, investors and security holders will be able to obtain free copies of the Registration Statement and the Joint Proxy/Prospectus by phone, e-mail or written request by contacting the investor relations department of Jefferies and Leucadia at the following:

| Jefferies | Leucadia | |

| 520 Madison Avenue, New York, NY 10022 | 315 Park Avenue South, New York, NY 10010 | |

| Attn: Investor Relations | Attn: Investor Relations | |

| 203-708-5975 | 212-460-1900 | |

| info@jefferies.com |

Participants in the Solicitation

Leucadia and Jefferies, and their respective directors and executive officers, may be deemed to be participants in the solicitation of proxies in respect of the proposed transactions contemplated by the merger agreement. Information regarding Leucadia’s directors and executive officers is contained in Leucadia’s proxy statement dated April 13, 2012, which has been filed with the SEC. Information regarding Jefferies’ directors and executive officers is contained in Jefferies’ proxy statement dated March 28, 2012, which has been filed with the SEC. A more complete description will be available in the Registration Statement and the Joint Proxy/Prospectus.

|

ii |

|

Note on Financial Presentation and Assumptions

This document presents financial information of Leucadia and Jefferies on a combined basis. The presentation makes certain stated assumptions including (i) the spin-out of Leucadia’s Crimson Wine Group, (ii) the assumptions made pertaining to the financial reporting of the redemption of the Fortescue note and Pershing Square interest held by Leucadia and Leucadia’s sale of Keen Energy, and (iii) the increase in Jefferies’ book value calculated using the exchange ratio in the proposed transaction. These as well as other assumptions are made for presentation purposes only and may differ materially from actual results.

The combined presentation does not conform to or apply all of the requirements of acquisition method of accounting under FASB Accounting Standards Codification (ASC) 805, Business Combinations. Under the acquisition method of accounting, the acquirer recognizes, separately from goodwill, any identifiable assets acquired, including intangible assets, liabilities assumed and any noncontrolling interests in the acquiree at their fair values. To the extent the acquisition consideration exceeds or is less than the net fair value of the identifiable assets acquired and liabilities assumed, goodwill or a bargain purchase gain, respectively, is recognized.

The financial information presented herein will be superseded by financial information to be contained in Leucadia’s Registration Statement and Leucadia’s and Jefferies’ Joint Proxy/Prospectus.

|

iii |

|

Merger Overview

|

1 |

|

Press Release – November 12, 2012

LEUCADIA NATIONAL CORPORATION AND JEFFERIES GROUP, INC. TO MERGE

Strategic Combination, With Over $9 Billion in Shareholders’ Equity, Supports Long-Term Value Creation

| • | Leucadia, with its 35-year track record as one of the world’s leading long-term investors, will continue to acquire and own businesses and investments that will leverage the knowledge base, opportunity flow and execution capabilities of both the Leucadia and Jefferies management teams and operating businesses. Leucadia’s existing businesses and investments have strong inherent value-creation potential. |

| • | Jefferies will continue its over 50-year focus in investment banking and the capital markets, and continue to maintain a highly liquid, client-focused balance sheet. Jefferies has grown rapidly over the past two decades and is well-positioned to continue this growth with Leucadia’s support. As a subsidiary of Leucadia, Jefferies will have greater balance sheet resilience and flexibility to guard against, and take advantage of, market dislocations and opportunities. Jefferies currently pays substantial Federal income taxes and thus its expected ongoing pre-tax earnings will materially accelerate utilization of Leucadia’s net operating losses, creating incremental value for all shareholders. |

| • | Combined company will be well-positioned to capitalize on Leucadia’s investment expertise and Jefferies’ investment banking and capital markets platform, including opportunities for enhanced growth, diversification and profitability that are expected to result from the combined management structure and increased business interaction. |

|

2 |

|

Press Release – November 12, 2012 (continued)

NEW YORK, NEW YORK, NOVEMBER 12, 2012 – Leucadia National Corporation (NYSE: LUK) and Jefferies Group, Inc. (NYSE: JEF) today announced that the Boards of Directors of both companies have approved a definitive merger agreement under which Jefferies’ shareholders (other than Leucadia, which currently owns approximately 28.6% of the Jefferies outstanding shares) will receive 0.81 of a share of Leucadia common stock for each share of Jefferies common stock they hold. This exchange is intended to be tax-free to Jefferies’ shareholders. The merger, which is expected to close during the first quarter of 2013, is subject to customary closing conditions, including approval to effect the merger by both Leucadia and Jefferies shareholders. In order to avert the possibility that the transaction would result in the application of tax law limitations to the use of certain of Leucadia’s tax attributes, the merger agreement limits the amount of Leucadia shares that can be issued to certain persons that would otherwise become holders of 5% of the combined Leucadia’s common shares by reason of the merger.

Concurrently with the execution of the merger agreement, Leucadia, Richard Handler, Chief Executive Officer and Chairman of Jefferies, and Brian Friedman, Chairman of the Executive Committee of Jefferies and one of its Directors, have each agreed pursuant to separate voting agreements, among other things, to vote their respective shares in favor of the transaction; and lan Cumming, Leucadia’s Chief Executive Officer and Chairman, and Joseph Steinberg, Leucadia’s President and one of its Directors, have each agreed pursuant to separate voting agreements, among other things, to vote their respective shares in favor of the transaction. These voting agreements represent approximately 18.3% and 31.5% of the outstanding shares of Leucadia and Jefferies, respectively.

|

3 |

|

Press Release – November 12, 2012 (continued)

Upon the closing of the merger, Mr. Handler will become the Chief Executive Officer of Leucadia, as well as one of its Directors, and also remain Jefferies’ Chief Executive Officer and Chairman; Mr. Friedman will become Leucadia’s President and one of its Directors, and also remain Chairman of the Executive Committee of Jefferies; and Mr. Steinberg will become Chairman of the Board of Leucadia and will continue to work full time as an executive of Leucadia. Mr. Cumming will retire as Chairman of the Board and Chief Executive Officer of Leucadia upon the closing of the transaction and remain a Leucadia Director. The other Leucadia officers will continue in their present positions. In addition, upon the closing of the transaction, the four independent members of the Board of Directors of Jefferies also will join the Leucadia Board of Directors; the size of the Leucadia Board of Directors will be increased to fourteen.

Leucadia will continue to operate in its current form, except that the merger agreement contemplates that Leucadia’s Crimson Wine Group, with a book value of $197 million, will be spun out in a distribution that is intended to be tax-free to current Leucadia shareholders prior to the completion of the merger.

Jefferies, which will be the largest business of Leucadia, will continue to operate as a full-service global investment banking firm in its current form. Jefferies will retain a credit rating that is separate from Leucadia’s. Jefferies’ existing long-term debt will remain outstanding and Jefferies intends to remain an SEC reporting company, regularly filing annual, quarterly, and periodic financial reports.

Following the transaction, 35.3% of Leucadia’s common stock will be owned by Jefferies’ shareholders (excluding the Jefferies shares owned today by Leucadia and including Jefferies vested restricted stock units). Leucadia’s Board of Directors has approved a new share repurchase program authorizing the repurchase from time to time of up to an aggregate of 25 million Leucadia common shares, inclusive of prior authorizations. Leucadia’s Board also has indicated its intention to continue to pay dividends at the annual rate of $0.25 per common share, but on a quarterly basis following the merger.

|

4 |

|

Press Release – November 12, 2012 (continued)

Mr. Cumming observed: “Joe and I have been partners for 34 years. He will be Chairman of the Board of the combined enterprise. His role as Chairman of the Board, along with other Leucadia and Jefferies Directors, will ensure continuity and propel our continued success. Rich and Brian managing the company will bring to fruition the abundant and profitable opportunities that will be realized by this merger. My relationship with Rich and Brian, both as advisors and, more recently, as business partners and Jefferies Directors, showed me they can manage Leucadia profitably long into the future. Their ability to manage and grow Jefferies through the elongated financial bubble, successfully navigate the crises that followed where others could not, and protect the firm from the attacks based on false information exactly one year ago with deftness and grace, should comfort all!”

Mr. Steinberg stated: “I am absolutely thrilled that Rich and Brian will be joining me as we move forward with our combined company. Ian and I have enjoyed working together for 34 years. He invited me into Leucadia and to be his partner. I am forever grateful for that opportunity. Our partnership produced great returns for shareholders and we have had a lot of fun. I expect that Rich and Brian will continue on the same track and intend to help in every way.”

Mr. Handler stated: “Having known Joe and Ian for over two decades, this transaction represents the realization of a personal dream for me. Brian and I look forward to leading Leucadia, while continuing to serve as the hands-on management of Jefferies, which will become Leucadia’s largest operating company. This merger will allow us to continue to create long-term value for all of our clients, shareholders, employee-partners and bondholders. I am honored with the trust and confidence Ian and Joe are demonstrating by allowing us to carry on their life’s work.”

Mr. Friedman said: “This merger will allow us to operate from a position of even greater strength, take advantage of opportunities that arise in and around the business of Jefferies, and continue Leucadia’s longstanding practice of smart value acquisitions and investments. Our substantial combined equity base, ample liquidity and long-term focus will all support meaningful long-term value creation for Leucadia and Jefferies’ shareholders. We also view with great enthusiasm the opportunity to work with Leucadia management, who have been instrumental in helping Ian and Joe achieve Leucadia’s exceptional track record, as well as the management teams of each of the companies in which Leucadia is invested.”

|

5 |

|

Press Release – November 12, 2012 (continued)

Jefferies & Company, Inc. acted as financial advisors to Jefferies. Citigroup Global Markets Inc. acted as financial advisors and provided a fairness opinion to the Transaction Committee of the Jefferies Board of Directors (“Transaction Committee”), and J.P. Morgan acted as financial advisors to Jefferies. Morgan, Lewis & Bockius acted as legal advisors to Jefferies, and Wachtell, Lipton, Rosen & Katz acted as legal advisors to the Transaction Committee. Rothschild acted as financial advisors to Leucadia, and UBS Investment Bank acted as financial advisors and provided a fairness opinion to the Leucadia Board of Directors. Weil Gotshal & Manges acted as legal advisors to Leucadia, and Proskauer Rose LLP acted as legal advisors to the Leucadia Board of Directors.

Conference Call

A conference call is scheduled for November 12, 2012, at 9:00 a.m. to discuss the transaction. Investors and securities industry professionals may access the management discussion by calling (877) 710-9938 or (702) 928-7183. A one-week replay of the call will also be available at (855) 859-2056 or (404) 537-3406 (conference ID #70517742). Presentation slides will be used during this call and can be accessed at the Leucadia website (www.leucadia.com) and Jefferies website (www.jefferies.com).

About Jefferies

Jefferies Group, Inc. (NYSE: JEF) is a global investment banking firm focused on serving clients for over 50 years. The firm is a leader in providing insight, expertise and execution to investors, companies and governments, and provides a full range of investment banking, sales, trading, research and strategy across the spectrum of equities, fixed income and commodities, in the U.S., Europe and Asia.

About Leucadia

Leucadia National Corporation (NYSE: LUK) is a diversified holding company engaged through its consolidated subsidiaries in a variety of businesses, including beef processing, manufacturing, gaming entertainment, real estate activities, medical product development and winery operations. Leucadia also has a significant equity interest in Jefferies Group, Inc., and owns equity interests in operating businesses including a commercial mortgage origination and servicing business.

|

6 |

|

Press Release – November 12, 2012 (continued)

For further information, please contact:

Peregrine Broadbent

Chief Financial Officer

Jefferies Group, Inc.

(212) 284-2338

or

Laura Ulbrandt

Corporate Secretary

Leucadia National Corporation

(212) 460-1900

|

7 |

|

Leucadia – Jefferies

Leucadia – Jefferies merger creates a unique combination

| • | Leucadia will be in the business of merchant investing and owning Jefferies, an investment banking firm |

| • | Jefferies will continue its over 50-year focus in the capital markets and maintain a highly liquid balance sheet |

| • | Future acquisitions and investments will leverage the knowledge base, opportunity flow and execution capabilities of Leucadia and Jefferies’ management team and businesses |

|

8 |

|

Merger Considerations

A merger of Leucadia and Jefferies should generate significant value for shareholders

| • | Jefferies has grown rapidly over the past two decades and is well-positioned to continue this growth with Leucadia’s support |

| • | Jefferies’ capabilities, personnel, financial position and client momentum have never been stronger |

| • | Investments over the past five years in additional capabilities and personnel provide ongoing operating leverage |

| • | Significant market share is available as competitors confront regulatory, operational and market pressures |

| • | As a subsidiary of Leucadia, Jefferies will have greater balance sheet resilience and flexibility to guard against, and take advantage of, market dislocations and other opportunities |

| • | Leucadia’s existing businesses have inherent value creation potential |

| • | National Beef has a best-in-class management team, first quartile assets, margin-enhancing value-added programs and a strong presence in export markets that position it to capitalize on global protein trends |

| • | Inmet is a high-quality company with a strong portfolio of current and future mining projects |

| • | Garcadia, Berkadia and Premier produce stable cash flows and strong returns |

| • | Significant realizable enterprise value and cash-flow generation from Conwed and ldaho Timber |

| • | Jefferies’ recurring pre-tax earnings will materially accelerate NOL utilization, creating incremental value for all shareholders |

| • | Earnings of Jefferies, National Beef, Berkadia and other holdings will convert the Leucadia deferred tax asset into cash |

| • | A number of the portfolio companies are platforms that we believe will provide attractive opportunities to deploy additional capital over time |

| • | Jefferies management will lead the combined company; merger facilitates Leucadia’s management succession, while preserving significant employee and strategic continuity |

|

9 |

|

Leucadia Investments

Following the merger, new acquisitions and investments will leverage the knowledge base, opportunity flow and execution capabilities of Leucadia and Jefferies’ management team and operating businesses

| • | Leucadia’s investment and operating team will continue to source and analyze investment opportunities that leverage the broader Leucadia platform |

| • | Core operating team (Joe Steinberg, Justin Wheeler, Tom Mara and Joe Orlando) will remain with Leucadia post-merger |

| • | Jefferies’ investment banking and trading platforms periodically originate investment opportunities that offer the opportunity to earn outsized returns over the medium horizon |

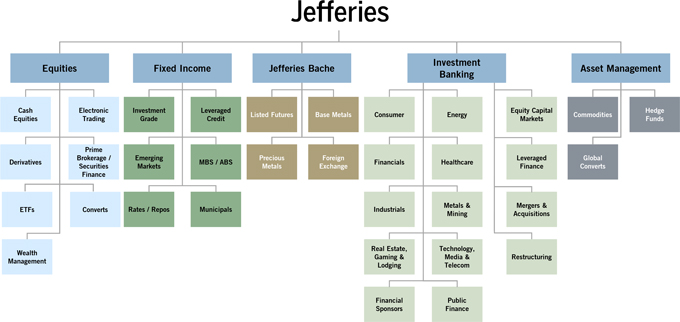

| • | Leucadia will leverage Jefferies’ 700 investment bankers across 8 industry verticals in offices worldwide, as well as Jefferies’ research and trading platforms |

| • | For example, Leucadia’s investment in Fortescue emanated from a Jefferies introduction |

| • | Opportunistic intermediate term (six months to two+ years) marketable securities investments emanating from Jefferies’ trading flow and market knowledge (such as recent investment in Knight Capital) |

| • | Leucadia may make strategic investments in business opportunities that are complementary and synergistic to Jefferies’ platform but, by their nature, require longer-term commitments |

|

10 |

|

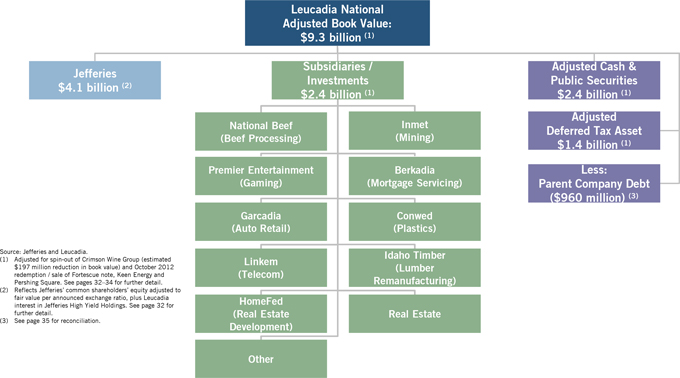

Balance Sheet Strength and Scale

Merger will enhance both Leucadia and Jefferies’ liquidity, scale and overall financial strength

| • | Combined balance sheet: |

| • | Total Assets: $42.1 billion (1) |

| • | Total Shareholders’ Equity: $9.3 billion (1) |

| • | Leucadia Book Value per Share, Adjusted for Merger: $24.69 (1) |

| • | Jefferies will retain a credit rating that is separate from Leucadia’s, and intends to remain an SEC reporting company for the foreseeable future, regularly filing annual (10-K), quarterly (10-Q) and periodic (8-K) public financial reports |

Source: Jefferies and Leucadia.

| (1) | Adjusted for spin-out of Crimson Wine Group (estimated $197 million reduction in assets and book value) and October 2012 redemption / sale of Fortescue note and Keen Energy. See pages 32 and 34 for further detail. |

|

11 |

|

Long-Term Leadership Stability and Strategic Continuity

| • | Richard Handler, Jefferies’ CEO, and Brian Friedman, Executive Committee Chairman, will serve as Leucadia’s new CEO and President, respectively, while continuing as hands-on leaders of Jefferies |

| • | Joe Steinberg, Leucadia’s current President, will serve as Chairman of the Board of Leucadia |

| • | Leucadia’s senior operating team, including Justin Wheeler, Chief Operating Officer, Tom Mara, Executive Vice President and Joe Orlando, Chief Financial Officer, will remain in their roles and manage Leucadia’s existing assets under the leadership of the new CEO and President from Jefferies |

|

12 |

|

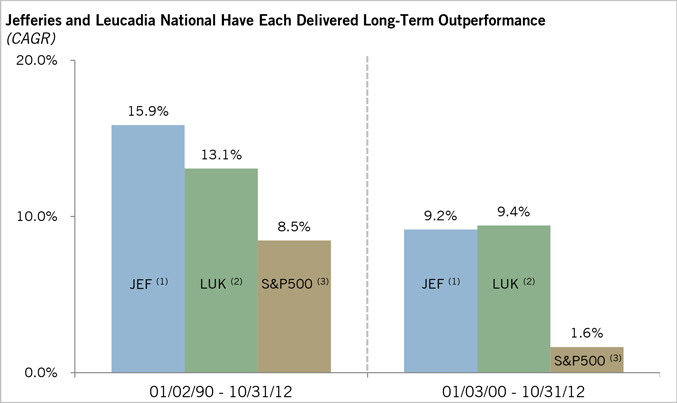

Both Jefferies and Leucadia Have Long-Term, Value-Oriented Cultures

Jefferies and Leucadia’s relationship has been built over twenty years

| • | Jefferies and Leucadia have worked together and partnered on countless financings and strategic transactions, including Jefferies High Yield Funds (2000 – 2007), Jefferies High Yield Holdings joint venture (2007 – ongoing) and the Fortescue investment (2006 – 2012) |

| • | Both Jefferies and Leucadia have consistently prioritized the long-term, both in our relationships with partners / clients and in creating shareholder value |

Source: Bloomberg and public company filings.

| (1) | Includes all split-adjusted regular dividends, as well as split-adjusted Jefferies 1999 special cash dividend and shares from ITG spin-out. |

| (2) | Includes all split-adjusted regular dividends, as well as split-adjusted Leucadia 1999 special cash dividend. |

| (3) | Reflects SPXT total return index. |

|

13 |

|

Jefferies Group

|

14 |

|

Key Jefferies Strengths

| Committed, Aligned, Highly Experienced Leadership Team |

• Richard Handler and Brian Friedman, with almost 60 years of combined experience (more than half at Jefferies), have led Jefferies for over 11 years

• Active and empowered Executive Committee comprised of 15 members of senior management, including the CEO and the Chairman of the Executive Committee

• These 15 members have a combined industry experience of 413 years, with 153 years (average over 10 years) at Jefferies

• Long-term partnership with Leucadia – our largest shareholder (29% owner) and engaged Board of Directors participants

• Strongly aligned with long-term success – total inside ownership of 54%, including senior management, Board, employees and our strategic partners, Leucadia and MassMutual

• Executive management team is battle tested | |

| Client Focused, Liquid & Straight-Forward Business Model |

• Consistent business model

• Trading is focused on clients

• Fee and flow based businesses represent preponderance of net revenues – limited capital risk

• Highly liquid trading inventory, 97% of our inventory is Level 1 or Level 2

• All funding is secured, and readily and consistently available through clearing houses, or fixed for periods of time that exceed the expected tenure of the inventory it is funding

• No material exposure to highly structured derivatives or difficult-to-price securities | |

| Diversified Across Products |

• Well-balanced business mix (LTM 08/31/12):

• Investment Banking (40%)

• Equities (21%)

• Fixed Income (38%) | |

| Consistently Profitable |

• Jefferies has been profitable for every quarter for over 20 years, with the exception of the financial crisis in 2007-2008 when the Firm incurred operating losses, which were more than mitigated by our $434 million cash equity raise | |

Source: Jefferies.

|

15 |

|

Key Jefferies Strengths (continued)

| Strong Financial Profile |

• Nine months 2012 adjusted net revenue: $2.22 billion (1)

• Cumulative adjusted pre-tax earnings of $1.73 billion since 2009 (1)

• Average quarterly adjusted pre-tax margin of 18.1% since 2009 (1) | |

| Favorable Industry Trends |

• Significant market share available due to regulatory pressures and deleveraging at peers

• Non-US competitors are retreating to their domestic markets and traditional lending activities

• Reduced capacity will drive improved pricing and lower compensation costs over the medium horizon | |

| Strong Capital Structure and Ample Liquidity |

• Investment grade since 1994

• Long-term capital of $8.6 billion, including $4.5 billion of long-term debt with a weighted average maturity of 8.3 years

• Strong liquidity framework calibrated to cover remote contingencies

• 90% of Jefferies’ assets financed through repos are eligible collateral for central clearing. Remaining 10% of assets financed through repos are financed for a weighted average term of approximately 47 days | |

| Rigorous and Proven Risk Management |

• Proven risk management framework

• Monitoring of P&L at multiple levels of granularity

• Rigorous balance sheet and cash usage limits applied to business units and monitored continuously

• Fully transparent with Executive Committee, Board, firm-wide leaders, shareholders and rating agencies | |

Source: Jefferies.

| (1) | Adjusted to exclude debt extinguishment gains, amortization of debt discounts and certain historical acquisition items. See pages 36–39 for further detail. |

|

16 |

|

Core Principles

| • | Jefferies is focused on the following core principles to manage risk and deliver across-the-cycle revenue and earnings growth: |

| • | Consistent Profitability |

| • | Jefferies has remained solidly profitable despite the volatile trading environment in global markets since 2009 |

| • | Driving Productivity and Margin Improvement |

| • | Following two years of significant investment, Jefferies continues to rapidly increase investment banker productivity |

| • | Recent hires have begun reaching targeted productivity levels |

| • | Aside from recent hires, investment banker productivity continues to materially improve due to Jefferies’ increasingly prominent market presence |

| • | Taking Market Share |

| • | Since 2008, Jefferies has materially grown market share by: |

| • | Taking advantage of market dislocation and our competitors’ ongoing struggles to enter new business and regions and expand existing capabilities |

| • | Delivering broader and better capabilities to our clients |

| • | Cross-selling across our firm, ensuring that we maximize client penetration across all products |

| • | Culture |

| • | Jefferies is transparent, humble, client focused, and shareholder and bondholder friendly |

| • | Strong Liquidity |

| • | Jefferies’ maintains a very liquid, financeable and low-risk balance sheet |

| • | Limited Leverage |

| • | Jefferies maintains a consistent, carefully managed leverage ratio, and has demonstrated the operational and financial flexibility to reduce leverage in times of stress |

|

17 |

|

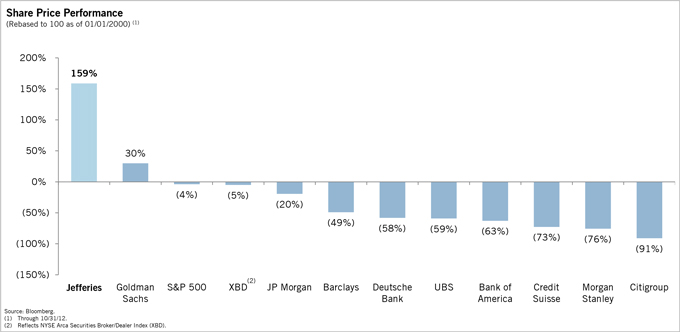

Share Price Performance Since 2000

| • | Since 2000, Jefferies has significantly outperformed its peers |

| • | Total return of 27.9x since 1990, representing a compound annual growth rate of 15.9% |

|

18 |

|

Jefferies – A Full-Service Investment Bank

| • | Jefferies offers clients advice and execution across all major products and markets globally |

|

19 |

|

Jefferies – Financial Performance

| Financial Summary | ||||||||

| ($ Millions) |

Fiscal Year 2011 |

Nine Months 2012 |

||||||

| Equities |

$ | 594 | $ | 466 | ||||

| Fixed Income |

715 | 897 | ||||||

|

|

|

|

|

|||||

| Sales & Trading |

1,309 | 1,363 | ||||||

| Other |

74 | 13 | ||||||

| Equity |

187 | 141 | ||||||

| Debt |

385 | 310 | ||||||

|

|

|

|

|

|||||

| Capital Markets |

572 | 451 | ||||||

| Advisory |

550 | 392 | ||||||

|

|

|

|

|

|||||

| Investment Banking |

1,123 | 843 | ||||||

| Asset Management Fees and Investment Income |

44 | 11 | ||||||

|

|

|

|

|

|||||

| Net Revenues |

$ | 2,549 | $ | 2,230 | ||||

| Adjusted Net Revenues (1) |

2,476 | 2,220 | ||||||

| Adjusted Operating Earnings (1) |

366 | 395 | ||||||

| Adjusted Net Income (1) |

$ | 232 | $ | 221 | ||||

Source: Jefferies.

| (1) | Adjusted net revenues, adjusted operating earnings and adjusted net income for the year ended November 30, 2011 and the nine months ended August 31, 2012 are non-GAAP measures, which exclude the effects of purchases and sales of Jefferies debt in November and December 2011, certain items identified and recognized in connection with the acquisition of Hoare Govett on February 1, 2012 and the Global Commodities Group from Prudential Financial, Inc. on July 1, 2011 and the impairment of certain intangible assets. These measures provide meaningful information to shareholders as they provide comparability for the results of operations across the presented periods. Please see pages 36 and 38 for a reconciliation of GAAP to non-GAAP financial measures. |

|

20 |

|

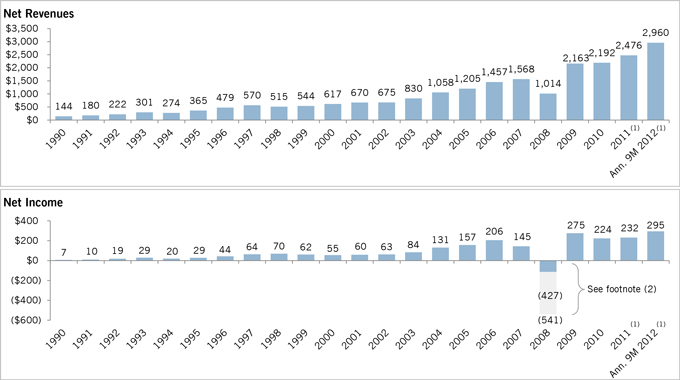

Jefferies Revenues & Net Income – Since 1990

($ Millions)

| • | With the exception the global financial crisis in 2007-2008, Jefferies has not had a single loss quarter dating back to 1990 |

| • | Jefferies raised $433 million of equity from Leucadia in 2008, more than mitigating the impact of our operating loss |

Source: Jefferies.

| (1) | Adjusted to exclude debt extinguishment gains, amortization of debt discounts and certain historical acquisition items. See pages 36 and 38 for further detail. |

| (2) | Loss was partly related to the modification during the fourth quarter to the terms of our employee stock awards, such that previously granted awards were written-off and current year employee stock compensation awards were expensed in the year in which service was provided. These charges totaled $427 million for the year on a post-tax basis. |

|

21 |

|

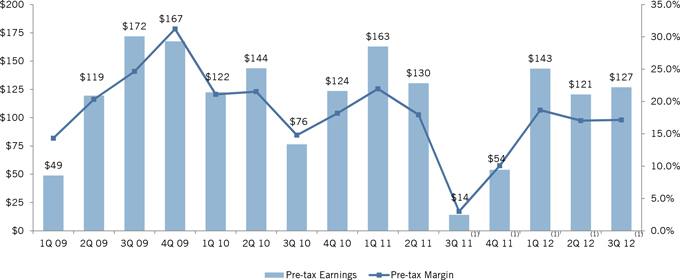

Consistent Profitability Across the Cycle

($Millions)

| • | Jefferies has generated pre-tax earnings of $1.7 billion since 2009 |

| • | Average pre-tax margin of 18.1% |

Source: Jefferies.

| (1) | Adjusted to exclude debt extinguishment gains, amortization of debt discounts and certain historical acquisition items. See pages 36–39 for further detail. |

|

22 |

|

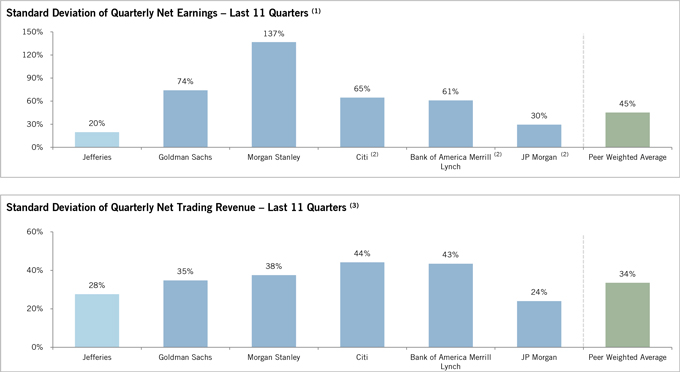

Jefferies Profitability and Trading Income Much More Stable Than Peers

Source: Public filings.

| (1) | Calculated as standard deviation of net earnings to common over the past 11 quarters (Q1 2010 to Q3 2012), divided by average net earnings to common over the same time period. |

| (2) | For Citi, Bank of America Merrill Lynch and JP Morgan, net earnings to common include investment banking and sales & trading divisions only. |

| (3) | Calculated as standard deviation of net sales & trading revenue (excluding DVA) over the past 11 quarters (Q1 2010 to Q3 2012), divided by average net sales & trading revenue (excluding DVA) over the same time period. |

|

23 |

|

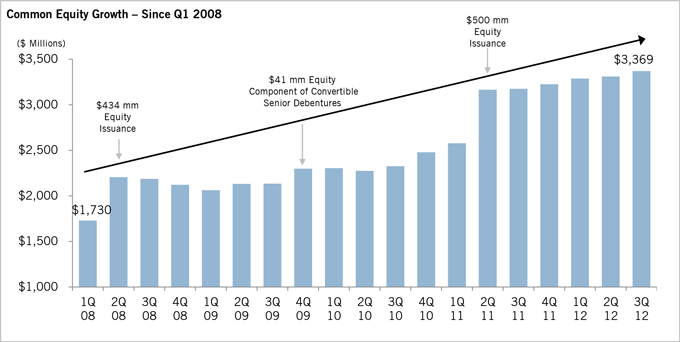

Consistent Common Equity Growth

| • | Jefferies has grown common equity by $1.6 billion, or 95%, since the financial crisis began in Q1 2008 |

| • | Jefferies’ proactive equity capital raises have helped the firm navigate the global financial crisis and capitalize on growth opportunities |

Source: Jefferies.

|

24 |

|

Leucadia National

|

25 |

|

Leucadia Overview

| Key Points | From Leucadia’s 2011 Annual Report: | |||||||||||||||||||||||||||||||||

| Leucadia National Scorecard |

||||||||||||||||||||||||||||||||||

| • Publicly Listed: LUK (NYSE)

• Market Cap: $5.3 billion (11/09/12)

• Total Assets: $9,068 MM (1) |

|

Book Value Per Share |

|

|

Book Value % Change |

|

|

% Change in S&P 500 with Dividends Included |

|

|

Market Price Per Share |

|

|

Market Price % Change |

|

|

Shareholders’ Equity |

|

|

Net Income (Loss) |

|

|

Return on Average Share- holders’ Equity |

| ||||||||||

|

• Total Common Equity: $6,534 MM(1)

• Book Value per Share: 18.5% CAGR since 1979 (2) |

(Dollars in thousands, except per share amounts) | |||||||||||||||||||||||||||||||||

| 1978 | ($ | 0.04 | ) | NA | NA | $ | 0.01 | NA | ($ | 7,657 | ) | ($ | 2,225 | ) | NA | |||||||||||||||||||

| 1979 | 0.11 | NM | 18.2 | % | 0.07 | 600.0 | % | 22,945 | 19,058 | 249.3 | % | |||||||||||||||||||||||

| 1980 | 0.12 | 9.1 | % | 32.3 | % | 0.05 | (28.6 | %) | 24,917 | 1,879 | 7.9 | % | ||||||||||||||||||||||

| 1981 | 0.14 | 16.7 | % | (5.0 | %) | 0.11 | 120.0 | % | 23,997 | 7,519 | 30.7 | % | ||||||||||||||||||||||

| 1982 | 0.36 | 157.1 | % | 21.4 | % | 0.19 | 72.7 | % | 61,178 | 36,866 | 86.6 | % | ||||||||||||||||||||||

| 1983 | 0.43 | 19.4 | % | 22.4 | % | 0.28 | 47.4 | % | 73,498 | 18,009 | 26.7 | % | ||||||||||||||||||||||

| 1984 | 0.74 | 72.1 | % | 6.1 | % | 0.46 | 64.3 | % | 126,097 | 60,891 | 61.0 | % | ||||||||||||||||||||||

| 1985 | 0.83 | 12.2 | % | 31.6 | % | 0.56 | 21.7 | % | 151,033 | 23,503 | 17.0 | % | ||||||||||||||||||||||

| 1986 | 1.27 | 53.0 | % | 18.6 | % | 0.82 | 46.4 | % | 214,587 | 78,151 | 42.7 | % | ||||||||||||||||||||||

| 1987 | 1.12 | (11.8 | %) | 5.1 | % | 0.47 | (42.7 | %) | 180,408 | (18,144 | ) | (9.2 | %) | |||||||||||||||||||||

| 1988 | 1.28 | 14.3 | % | 16.6 | % | 0.70 | 48.9 | % | 206,912 | 21,333 | 11.0 | % | ||||||||||||||||||||||

| 1989 | 1.64 | 28.1 | % | 31.7 | % | 1.04 | 48.6 | % | 257,735 | 64,311 | 27.7 | % | ||||||||||||||||||||||

| 1990 | 1.97 | 20.1 | % | (3.1 | %) | 1.10 | 5.8 | % | 268,567 | 47,340 | 18.0 | % | ||||||||||||||||||||||

| 1991 | 2.65 | 34.5 | % | 30.5 | % | 1.79 | 62.7 | % | 365,495 | 94,830 | 29.9 | % | ||||||||||||||||||||||

| 1992 | 3.69 | 39.2 | % | 7.6 | % | 3.83 | 114.0 | % | 618,161 | 130,607 | 26.6 | % | ||||||||||||||||||||||

| 1993 | 5.43 | 47.2 | % | 10.1 | % | 3.97 | 3.7 | % | 907,856 | 245,454 | 32.2 | % | ||||||||||||||||||||||

| 1994 | 5.24 | (3.5 | %) | 1.3 | % | 4.31 | 8.6 | % | 881,815 | 70,836 | 7.9 | % | ||||||||||||||||||||||

| 1995 | 6.16 | 17.6 | % | 37.6 | % | 4.84 | 12.3 | % | 1,111,491 | 107,503 | 10.8 | % | ||||||||||||||||||||||

| 1996 | 6.17 | 0.2 | % | 23.0 | % | 5.18 | 7.0 | % | 1,118,107 | 48,677 | 4.4 | % | ||||||||||||||||||||||

| 1997 | 9.73 | 57.7 | % | 33.4 | % | 6.68 | 29.0 | % | 1,863,531 | 661,815 | 44.4 | % | ||||||||||||||||||||||

| 1998 | 9.97 | 2.5 | % | 28.6 | % | 6.10 | (8.7 | %) | 1,853,159 | 54,343 | 2.9 | % | ||||||||||||||||||||||

| 1999 | 6.59 | (b) | (33.9 | %) | 21.0 | % | 7.71 | 26.4 | % | 1,121,988 | (b) | 215,042 | 14.5 | % | ||||||||||||||||||||

| 2000 | 7.26 | 10.2 | % | (9.1 | %) | 11.81 | 53.2 | % | 1,204,241 | 116,008 | 10.0 | % | ||||||||||||||||||||||

| 2001 | 7.21 | (0.7 | %) | (11.9 | %) | 9.62 | (18.5 | %) | 1,195,453 | (7,508 | ) | (0.6 | %) | |||||||||||||||||||||

| 2002 | 8.58 | 19.0 | % | (22.1 | %) | 12.44 | 29.3 | % | 1,534,525 | 161,623 | 11.8 | % | ||||||||||||||||||||||

| 2003 | 10.05 | 17.1 | % | 28.7 | % | 15.37 | 23.6 | % | 2,134,161 | 97,054 | 5.3 | % | ||||||||||||||||||||||

| 2004 | 10.50 | 4.5 | % | 10.9 | % | 23.16 | 50.7 | % | 2,258,653 | 145,500 | 6.6 | % | ||||||||||||||||||||||

| 2005 | 16.95 | (c) | 61.4 | % | 4.9 | % | 23.73 | 2.5 | % | 3,661,914 | (c) | 1,636,041 | 55.3 | % | ||||||||||||||||||||

| 2006 | 18.00 | 6.2 | % | 15.8 | % | 28.20 | 18.8 | % | 3,893,275 | 189,399 | 5.0 | % | ||||||||||||||||||||||

| 2007 | 25.03 | (d) | 39.1 | % | 5.5 | % | 47.10 | 67.0 | % | 5,570,492 | (d) | 484,294 | 10.2 | % | ||||||||||||||||||||

| 2008 | 11.22 | (e) | (55.2 | %) | (37.0 | %) | 19.80 | (58.0 | %) | 2,676,797 | (e) | (2,535,425 | ) | (61.5 | %) | |||||||||||||||||||

| 2009 | 17.93 | 59.8 | % | 26.5 | % | 23.79 | 20.2 | % | 4,361,647 | 550,280 | 15.6 | % | ||||||||||||||||||||||

| 2010 | 28.53 | (f) | 59.1 | % | 15.1 | % | 29.18 | 22.7 | % | 6,956,758 | (f) | 1,939,312 | 34.3 | % | ||||||||||||||||||||

| 2011 | 25.24 | (11.5 | %) | 2.1 | % | 22.74 | (22.1 | %) | 6,174,396 | 25,231 | 0.4 | % | ||||||||||||||||||||||

| CAGR | ||||||||||||||||||||||||||||||||||

| (1978-2011)(a) | 11.1 | % | 26.4 | % | ||||||||||||||||||||||||||||||

| CAGR | ||||||||||||||||||||||||||||||||||

| (1979-2011)(a) | 18.5 | % | 10.9 | % | 19.8 | % | 19.1 | % | ||||||||||||||||||||||||||

| (a) | A negative number cannot be compounded; therefore, we have used 1979. |

| (b) | Reflects a reduction resulting from dividend payments in 1999 totaling $811.9 million or $4.53 per share. |

Leucadia’s CAGRs do not reflect the benefit of annual dividends or the special 1999 dividend.

| (c) | Reflects the recognition of $1,135.1 million of the deferred tax asset or $5.26 per share. |

| (d) | Reflects the recognition of $542.7 million of the deferred tax asset or $2.44 per share. |

| (e) | Reflects the write-off of $1,672.1 million of the deferred tax asset or $7.01 per share. |

| (f) | Reflects the recognition of $1,157.1 million of the deferred tax asset or $4.75 per share. |

Source: Leucadia.

| (1) | Adjusted for October 2012 completed redemption / sale of Fortescue note and Keen Energy. See pages 32 and 34 for further detail. |

| (2) | As of 12/31/11. |

|

26 |

|

Leucadia – Subsidiaries and Investments

| • | National Beef |

| • | 4th largest beef processor in the US, with significant operations in hide tanning, direct-to-consumer beef sales, retail package preparation and logistics |

| • | Major exporter to foreign markets, including Asia and the Middle East |

| • | Inmet Mining |

| • | Publicly listed – TSX: IMN |

| • | Global exploration, development and mining of base and precious metals. Copper mine development currently underway in Panama |

| • | Premier Entertainment (Hard Rock Hotel & Casino Biloxi) |

| • | 325 room hotel with 50,000 square feet of gaming |

| • | Currently constructing a 154-room tower addition to hotel |

| • | Berkadia |

| • | One of the largest non-bank owned commercial mortgage servicing and origination platforms |

| • | 50/50 joint venture with Berkshire Hathaway |

| • | Garcadia |

| • | Acquires and operates auto dealerships, with current operations in lowa, Texas and California |

| • | Joint venture with Garff Enterprises |

Source: Leucadia.

|

27 |

|

Leucadia – Subsidiaries and Investments

| • | Conwed |

| • | Market leader in lightweight oriented and extruded plastic netting |

| • | Partners with customers to customize core technology into innovative solutions |

| • | Linkem |

| • | Start-up wireless broadband services provider in Italy |

| • | Idaho Timber |

| • | Wood product manufacture and distribution |

| • | Operations in primary milling, clear boards and dimensional lumber remanufacturing |

| • | HomeFed |

| • | Developer of residential real estate projects |

Source: Leucadia.

|

28 |

|

Leucadia – Recent Liquidity Events

Leucadia recently completed three major realizations, generating an aggregate of over $1.2 billion of incremental cash

| • | Fortescue Royalty Note: |

| • | On October 18, 2012, Fortescue redeemed Leucadia’s 2006 Royalty Note for $715 MM in cash, or a pre-tax gain of $526 MM, and all litigation has been settled |

| • | Mueller Industries: |

| • | On September 26, 2012, Leucadia sold its entire 27.3% stake in Mueller back to Mueller for net cash consideration to Leucadia of $426 MM |

| • | Keen Energy: |

| • | On October 17, 2012, Leucadia sold Keen Energy |

| • | Sale price consists of: |

| • | Cash: $100 MM + ~$40 MM in retained working capital |

| • | Seller Note: $40 MM (valued at $37.5 MM) |

Source: Leucadia.

|

29 |

|

Leucadia – Post-Merger Balance Sheet Parameters

| • | Post-merger, Leucadia will target specific concentration, leverage and liquidity principles |

| • | Concentration: Leucadia’s single largest equity investment (excluding Jefferies) will be no greater than 20% of book value (currently, National Beef), with no other individual investment greater than 10% of book value at time of investment |

| • | Leverage: Leucadia will target a maximum parent debt / equity ratio <0.5x in a stressed scenario |

| • | Stressed scenario assumes total impairment of Leucadia’s two largest investments (excluding Jefferies) |

| ($ Millions) | Adjusted |

|||

| Adjusted Book Value (excl. Jefferies) (1) |

5,201.6 | |||

| Less: National Beef |

(878.4 | ) | ||

| Less: Inmet Mining |

(524.6 | ) | ||

|

|

|

|||

| Stressed Book Value (excl. Jefferies) |

$ | 3,798.6 | ||

| Less: Adjusted Deferred Tax Asset (2) |

(1,386.4 | ) | ||

|

|

|

|||

| Stressed Book Value (excl. DTA) |

$ | 2,412.3 | ||

| Parent Company Debt |

959.5 | |||

| Parent Company Debt / Book Value (excl. Jefferies) |

0.18x | |||

| Parent Company Debt / Stressed Book Value |

0.25x | |||

| Parent Company Debt / Stressed Book Value (excl. DTA) |

0.40x | |||

| • | Liquidity: Leucadia will target (i) a minimum liquid assets / parent debt ratio >1.0x (current ratio of 3.0x) and (ii) minimum cash and cash equivalents equal to 10% of book value (excluding Jefferies) |

Source: Leucadia.

| (1) | See page 32 for further detail. |

| (2) | See page 33 for further detail. |

|

30 |

|

Appendix

|

31 |

|

Reconciliations

|

32 |

|

Reconciliations

|

33 |

|

Reconciliations

|

34 |

|

Reconciliations

Leucadia Parent Company Debt Reconciliation

| Leucadia Parent Company Debt Reconciliation |

||||

| ($ Millions) | 09/30/12 | |||

| Debt Due Within 1 Year (1) |

445.4 | |||

| Long-term Debt (1) |

911.8 | |||

|

|

|

|||

| Consolidated Long-term Debt, including Current Portion |

$ | 1,357.2 | ||

| Parent Company Debt, including Current Portion |

959.5 | |||

| Long-term Debt of Consolidated Subsidiaries, including Current Portion |

397.7 | |||

|

|

|

|||

| Consolidated Long-term Debt, including Current Portion |

$ | 1,357.2 | ||

Source: Leucadia.

| (1) | Per Leucadia 10-Q as of 09/30/12. |

|

35 |

|

Jefferies – Reconciliation of GAAP to non-GAAP Financial Measures

Three and Nine Months Ended August 31, 2012

(Amounts in Thousands)

| Three

Months Ended August 31, 2012 |

Amortization of Debt Discount and Certain Acquisition Items |

Three Months Ended August 31, 2012 (Excluding Amortization of Debt Discount and Certain Acquisition Items) |

Nine

Months Ended August 31, 2012 |

Debt

Accounting Gain and Amortization of Debt Discount, Impairment Charge and Certain Acquisition Items |

Nine Months Ended August 31, 2012 (Excluding Debt Accounting Gain and Amortization of Debt Discount, Impairment Charge and Certain Acquisition Items) |

|||||||||||||||||||

| Net revenues |

$ | 738,938 | $ | (1,223 | )(1) | $ | 740,161 | $ | 2,229,935 | $ | 9,661 | (5) | $ | 2,220,274 | ||||||||||

| Compensation and benefits |

440,391 | 2,615 | (2) | $ | 437,776 | 1,310,394 | 22,179 | (6) | 1,288,215 | |||||||||||||||

| Noncompensation expenses |

167,874 | 714 | (3) | $ | 167,160 | 507,117 | 4,996 | (7) | 502,121 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total non-interest expenses |

608,265 | 3,329 | 604,936 | 1,817,511 | 27,175 | 1,790,336 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Earnings before income taxes |

122,369 | (4,552 | ) | 126,921 | 377,820 | (17,514 | ) | 395,334 | ||||||||||||||||

| Income tax expense (benefit) |

44,048 | (1,755 | )(4) | 45,803 | 134,403 | (7,236 | )(4) | 141,639 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net earnings |

78,321 | (2,797 | ) | 81,118 | 243,417 | (10,278 | ) | 253,695 | ||||||||||||||||

| Net earnings to common shareholders |

$ | 70,171 | $ | (2,797 | ) | $ | 72,968 | $ | 210,805 | $ | (10,278 | ) | $ | 221,083 | ||||||||||

Source: Jefferies 8-K filed September 20, 2012.

| (1) | Net revenues in the third quarter of 2012 includes additional interest expense of $1.2 million from the amortization of discounts on long-term debt reissued in November and December 2011 in connection with trading activities in our debt. |

| (2) | Compensation expense for the three months ended August 31, 2012 includes expense related to the amortization of retention and stock replacement awards granted in connection with the acquisition of the Bache entities and Hoare Govett. |

| (3) | Reflects amortization of intangible assets recognized in connection with the acquisitions of Hoare Govett and the Bache entities. |

| (4) | For the three months ended August 31, 2012, reflects the tax benefit on the additional interest expense, Hoare Govett and Bache related expense items at a domestic and foreign marginal tax rate of 41.5% and 24.3%, respectively. The domestic and foreign marginal tax rate for the nine months ended August 31, 2012, on the additional interest expense, Hoare Govett and Bache related expense items and the impairment charge is 41.5% and 24.3%, respectively. |

| (5) | Includes a gain on debt extinguishment of $9.9 million relating to trading activities in our own debt and a bargain purchase gain of $3.4 million resulting from the acquisition of Hoare Govett recorded in Other revenues, partially offset by additional interest expense of $3.6 million from subsequent amortization of debt discounts upon reissuance of our long-term debt. |

| (6) | Includes compensation expense related to the amortization of retention and stock replacement awards granted in connection with the acquisition of the Bache entities and Hoare Govett and bonus costs for employees as a result of the completion of the Hoare Govett acquisition. |

| (7) | Reflects an impairment charge of $2.9 million on indefinite-lived intangible assets and amortization of intangible assets recognized in connection with the acquisitions of Hoare Govett and the Bache entities. |

|

36 |

|

Jefferies – Reconciliation of GAAP to non-GAAP Financial Measures

Three Months Ended February 29, 2012 and Three Months Ended May 31, 2012

(Amounts in Thousands)

| Three Months Ended Feb 29, 2012 |

Debt Accounting Gain and Certain Acquisition Items |

Three Months Ended (Excluding Debt Accounting Gain and Certain Acquisition Items) Feb 29, 2012 |

Three Months Ended May 31, 2012 |

Amortization of

Debt Discount, Impairment Charge and Certain Acquisition Items |

Three Months Ended May 31, 2012 (Excluding Amortization of Debt Discount, Impairment Charge and Certain Acquisition Items) |

|||||||||||||||||||

| Net revenues |

$ | 779,966 | $ | 12,085 | (1) | $ | 767,881 | $ | 711,031 | $ | (1,201 | ) (5) | $ | 712,232 | ||||||||||

| Compensation and benefits |

446,462 | 5,821 | (2) | $ | 440,641 | 423,541 | 9,214 | (6) | $ | 414,327 | ||||||||||||||

| Noncompensation expenses |

162,791 | 701 | (3) | $ | 162,090 | 176,452 | 3,581 | (7) | $ | 172,871 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total non-interest expenses |

609,253 | 6,522 | 602,731 | 599,993 | 12,795 | 587,198 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Earnings before income taxes |

148,869 | 5,563 | 143,306 | 106,582 | (13,996 | ) | 120,578 | |||||||||||||||||

| Income tax expense (benefit) |

52,152 | 2,041 | (4) | 50,111 | 38,203 | (5,650 | ) (4) | 43,853 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net earnings |

96,717 | 3,522 | 93,195 | 68,379 | (8,346 | ) | 76,725 | |||||||||||||||||

| Net earnings to common shareholders |

$ | 77,136 | $ | 3,522 | $ | 73,614 | $ | 63,498 | $ | (8,346 | ) | $ | 71,844 | |||||||||||

Source: Jefferies 8-K filed March 20, 2012 and 8-K filed June 19, 2012.

| (1) | Within Total revenues in the first quarter of 2012, we recognized Other revenues of $13.2 million comprised primarily of a gain on debt extinguishment of $9.9 million relating to trading activities in our own debt and a bargain purchase gain of $3.4 million resulting from the acquisition of Hoare Govett. This is offset within Net Revenues by additional interest expense of $1.2 million from subsequent amortization of debt discounts upon reissuance of our long-term debt. |

| (2) | The three months ended February 29, 2012 is comprised of compensation expense related to the amortization of retention and stock replacement awards granted in connection with the acquisition of the Bache entities, amortization of retention awards granted in connection with the acquisition of Hoare Govett and bonus costs for employees as a result of the completion of the Hoare Govett acquisition. |

| (3) | Reflects the amortization of intangible assets recognized in connection with the acquisition of Hoare Govett and the Bache entities for the three months ended February 29, 2012. |

| (4) | Reflects the net tax expense on the debt accounting gain, Hoare Govett bargain purchase gain and Hoare Govett and Bache related expense items taxed at a domestic and foreign marginal tax rate of 41.4% and 25.3%, respectively. |

| (5) | Net revenues in the second quarter of 2012 include additional interest expense of $1.2 million from the amortization of discounts on long-term debt reissued in November and December 2011 in connection with trading activities in our debt. |

| (6) | Compensation expense for the three months ended May 31, 2012 includes expense related to the amortization of retention and stock replacement awards granted in connection with the acquisition of the Bache entities and Hoare Govett. |

| (7) | Reflects an impairment charge of $2.9 million on indefinite-lived intangible assets and amortization of intangible assets recognized in connection with the acquisitions of Hoare Govett and the Bache entities. |

|

37 |

|

Jefferies – Reconciliation of GAAP to non-GAAP Financial Measures

Three and Twelve Months Ended November 30, 2011

(Amounts in Thousands)

| Three Months Ended Nov 30, 2011 |

Debt Accounting Gain and Certain Acquisition Items |

Three Months Ended (Excluding Debt Accounting Gain and Certain Acquisition Items) Nov 30, 2011 |

Twelve Months Ended Nov 30, 2011 |

Debt Accounting Gain and Certain Acquisition Items |

Twelve Months Ended (Excluding Debt Accounting Gain and Certain Acquisition Items) Nov 30, 2011 |

|||||||||||||||||||

| Net revenues |

$ | 553,983 | $ | 20,175 | (1) | $ | 533,808 | $ | 2,548,813 | $ | 72,684 | (5) | $ | 2,476,129 | ||||||||||

| Compensation and benefits |

308,137 | 2,721 | (2) | 305,416 | 1,482,604 | 11,785 | (6) | 1,470,819 | ||||||||||||||||

| Noncompensation expenses |

177,727 | 704 | (3) | 177,023 | 643,253 | 7,826 | (7) | 635,427 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total non-interest expenses |

485,864 | 3,425 | 482,439 | 2,125,857 | 19,611 | 2,106,246 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Earnings before income taxes |

70,680 | 16,750 | 53,930 | 419,334 | 53,073 | 366,261 | ||||||||||||||||||

| Income tax expense |

25,066 | 6,985 | (4) | 18,081 | 132,966 | 235 | (4) | 132,731 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net earnings |

45,614 | 9,765 | 35,849 | 286,368 | 52,838 | 233,530 | ||||||||||||||||||

| Net earnings to common shareholders |

$ | 48,386 | $ | 9,765 | $ | 38,621 | $ | 284,618 | $ | 52,838 | $ | 231,780 | ||||||||||||

Source: Jefferies 8-K filed December 20, 2011.

| (1) | In accordance with Debt Extinguishment Accounting under ASC 405 and 470, we recorded a gain on debt extinguishment of $20.2 million in Other revenues relating to trading activities in our own long term debt, specifically our 5.125% Senior Notes due 2018 and our 3.875% Convertible Senior Debentures due 2029. |

| (2) | The three months ended November 30, 2011 is comprised of amortization of retention and stock replacement awards granted in connection with the acquisition of the Bache entities. |

| (3) | Reflects the amortization of intangible assets recognized in connection with the acquisition of the Bache entities for the three months ended November 30, 2011. |

| (4) | Reflects the net tax expense on the debt accounting gain and Bache related expense items taxed at the total domestic marginal tax rate of 41.7%. The bargain purchase gain of $52.5 million on the acquisition of the Global Commodities Group recognized in the three months ended August 31, 2011, is not a taxable item. |

| (5) | Includes a gain on debt extinguishment of $20.2 million in the fourth quarter of 2011 and a bargain purchase gain of $52.5 million resulting from the acquisition of the Global Commodities Group from Prudential recorded in Other revenues in the third quarter of 2011. |

| (6) | Includes compensation expense recognized in connection with the acquisition of the Global Commodities Group related to 1) severance costs for certain employees of the acquired Bache entities that were terminated subsequent to the acquisition, 2) the amortization of stock awards granted to former Bache employees as replacement awards for previous Prudential stock awards that were forfeited in the acquisition, 3) bonus costs for employees as a result of the completion of the acquisition and 4) the amortization of retention awards. |

| (7) | Includes the amortization of intangible assets of $0.7 million recognized during the three months ended November 30, 2011 in connection with the acquisition of the Bache entities as well as expenses (primarily professional fees) totaling $7.1 million related to the acquisition and/or integration of the Bache entities within the Jefferies Group, Inc. recorded during the nine months ended August 31, 2011. |

|

38 |

|

Jefferies – Reconciliation of GAAP to non-GAAP Financial Measures

Three Months Ended August 31, 2011

(Amounts in Thousands)

| Three Months Ended August 31, 2011 |

Certain Bache Acquisition Items |

Three Months Ended August 31, 2011 (Excluding Certain Bache Acquisition Items) |

||||||||||

| Net revenues |

$ | 509,282 | $ | 52,509 | (1) | $ | 456,773 | |||||

| Compensation and benefits |

299,640 | 9,064 | (2) | $ | 290,576 | |||||||

| Noncompensation expenses |

169,075 | 2,333 | (3) | $ | 166,742 | |||||||

|

|

|

|

|

|

|

|||||||

| Total non-interest expenses |

468,715 | 11,397 | 457,318 | |||||||||

|

|

|

|

|

|

|

|||||||

| Earnings before income taxes |

55,238 | 41,112 | 14,126 | |||||||||

| Income tax expense (benefit) |

1,228 | (4,268 | ) (4) | 5,496 | ||||||||

|

|

|

|

|

|

|

|||||||

| Net earnings |

54,010 | 45,380 | 8,630 | |||||||||

| Net earnings to common shareholders |

$ | 68,275 | $ | 45,380 | $ | 22,895 | ||||||

Source: Jefferies 8-K filed September 20, 2011.

| (1) | Net revenues in the third quarter of 2011 include $52.5 million recorded in Other revenues resulting from the acquisition of the Bache entities from Prudential, as the fair value of the assets acquired and liabilities assumed exceeded the purchase price. |

| (2) | In connection with the acquisition of the Bache entities, compensation expense of $9.1 million was recognized for the three month period ended August 31, 2011 related to 1) severance costs for certain employees of the acquired Bache entities that were terminated subsequent to the acquisition, 2) the amortization of stock awards granted to former Bache employees as replacement awards for previous Prudential stock awards that were forfeited in the acquisition and 3) bonus costs for employees as a result of the completion of the acquisition. |

| (3) | In connection with the acquisition of the Bache entities, expenses (primarily professional fees) were recognized during the three months ended August 31, 2011 directly related to the acquisition and/or integration of the acquired entities within Jefferies Group, Inc. |

| (4) | Reflects the tax benefit associated with deducting total non-interest expenses during the three months ended August 31, 2011 attributed to the acquisition of the Bache entities at an effective tax rate of 37%, which reflects our estimate of our full year tax rate. The bargain purchase gain is not a taxable item. |

|

39 |

|