Attached files

EXHIBIT 99.2

Helix Energy Solutions Group Dynamically Positioned November 2012

* Forward-Looking Statements This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All such statements, other than statements of historical fact, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including, without limitation, any projections of financial items; the timing of the closing of our pipelay vessel sales; projections of contracting services activity; future production volumes, results of exploration, exploitation, development, acquisition and operations expenditures, and prospective reserve levels of properties or wells; projections of utilization; any statements of the plans, strategies and objectives of management for future operations; any statements concerning developments; any statements regarding future economic conditions or performance; any statements of expectation or belief; and any statements of assumptions underlying any of the foregoing. These statements involve certain assumptions we made based on our experience and perception of historical trends, current conditions, expected future developments and other factors we believe are reasonable and appropriate under the circumstances. The forward-looking statements are subject to a number of known and unknown risks, uncertainties and other factors that could cause our actual results to differ materially. The risks, uncertainties and assumptions referred to above include the performance of contracts by suppliers, customers and partners; delays, costs and difficulties related to the pipelay vessel sale; actions by governmental and regulatory authorities; operating hazards and delays; employee management issues; local, national and worldwide economic conditions; uncertainties inherent in the exploration for and development of oil and gas and in estimating reserves; complexities of global political and economic developments; geologic risks, volatility of oil and gas prices and other risks described from time to time in our reports filed with the Securities and Exchange Commission (“SEC”), including the Company’s most recently filed Annual Report on Form 10-K and in the Company’s other filings with the SEC. Free copies of the reports can be found at the SEC’s website, www.SEC.gov. You should not place undue reliance on these forward-looking statements which speak only as of the date of this presentation and the associated press release. We assume no obligation or duty and do not intend to update these forward-looking statements except as required by the securities laws. References to quantities of oil or gas include amounts we believe will ultimately be produced, and may include “proved reserves” and quantities of oil or gas that are not yet classified as “proved reserves” under SEC definitions. Statements of oil and gas reserves are estimates based on assumptions and may be imprecise. Investors are urged to consider closely the disclosure regarding reserves in our most recently filed Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q.

* Who We Are Helix is a specialty deepwater service provider to the offshore energy industry, focused on expanding our subsea infrastructure services in Well Intervention and Robotics. Our entire vessel fleet is dynamically positioned. We utilize free cash flow from our Oil and Gas business to support expansion in the Well Intervention and Robotics business units.

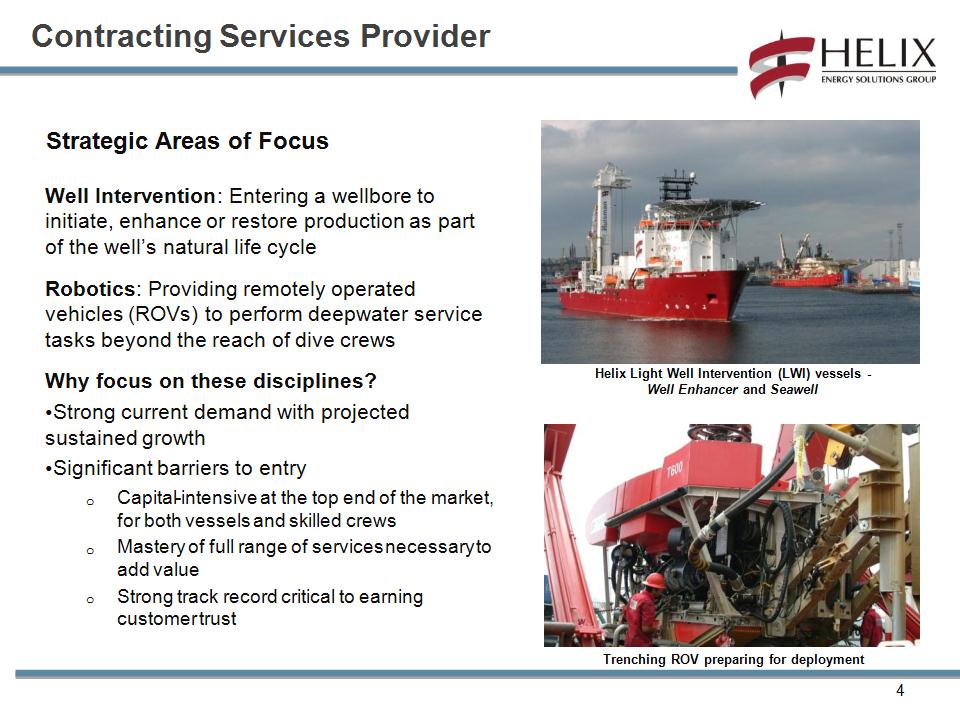

Contracting Services Provider Strategic Areas of Focus Well Intervention: Entering a wellbore to initiate, enhance or restore production as part of the well’s natural life cycle Robotics: Providing remotely operated vehicles (ROVs) to perform deepwater service tasks beyond the reach of dive crews Why focus on these disciplines? Strong current demand with projected sustained growth Significant barriers to entry Capital-intensive at the top end of the market, for both vessels and skilled crews Mastery of full range of services necessary to add value Strong track record critical to earning customer trust * Trenching ROV preparing for deployment Helix Light Well Intervention (LWI) vessels – Well Enhancer and Seawell

* WELL INTERVENTION Dynamically Positioned for Growth

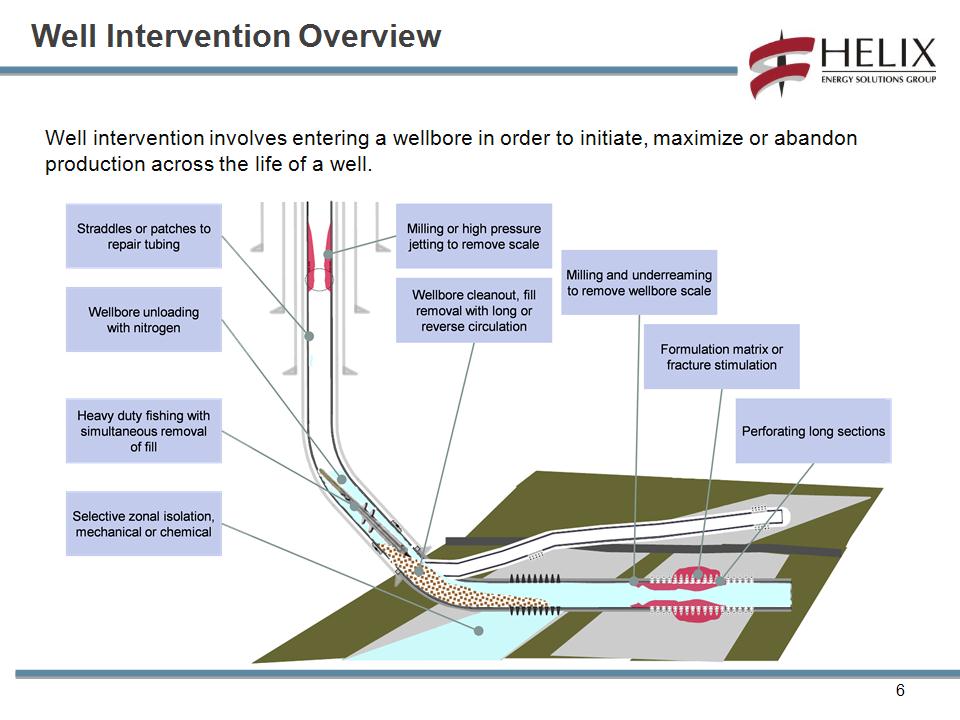

Well Intervention Overview Well intervention involves entering a wellbore in order to initiate, maximize or abandon production across the life of a well. *

Well Intervention Assets * Helix 534 Skandi Constructor (chartered vessel) Q5000 Well Enhancer Q4000 Seawell

What Sets Helix Apart in Well Intervention The Helix fleet pioneered modern deepwater well intervention techniques MSV Seawell, the industry’s first dedicated monohull light well intervention vessel MODU Q4000, the industry’s first semi-submersible vessel dedicated to riser-deployed well intervention MSV Well Enhancer, the industry’s first LWI monohull to deploy coiled tubing for well intervention Subsea Intervention Lubricators (SILs) make intervention possible for a broad range of applications, including connecting to the Macondo well in 2010 Only intervention company with expertise in all intervention asset categories A significant track record of global intervention successes Primary operations in the U.S. Gulf of Mexico, North Sea, and Southeast Asia Further growth potential in emerging global markets, including West Africa, Asia Pacific, and Brazil *

* ROBOTICS Expanding the Fleet to Meet Growing Demand

Robotics Overview Helix provides ROVs and crews to perform subsea tasks, including: Umbilical and flowline trenching services Geotechnical coring Comprehensive workclass ROV services Dynamically positioned ROV support vessels Tooling and intervention services Technical manpower and project management services As drilling operations move into deeper waters, more powerful, specialized ROVs will be required to perform subsea tasks * State-of-the-art ROVs entering Robotics fleet in 2012

Robotics Assets 47 Work-class ROVs – the backbone of the fleet, capable of performing a broad array of subsea construction and well intervention tasks 4 Trenching ROVs – key to pipeline installation in heavily-trafficked waters 2 Coring ROVs (ROVDrills) – provide seabed composition intelligence for subsea construction and subsea mining operations 4 Chartered vessels – multifunctional dynamically positioned support vessels used to deploy assets and services; spot vessels utilized as the market demands * Triton XLS Work-class ROV iTrencher Seabed Trenching ROV ROVDrill Seabed Coring ROV

What Sets Helix Apart in Robotics Helix charters its ROV support vessels, ensuring a modern fleet that can expand and contract based on regional requirements A fleet of advanced vehicles, including several units custom-built to our specifications The industry leader in subsea trenching and coring capabilities Provide trenching, cable burial and ROV support for offshore wind farm development Current focus on export lines (field to shore) Future opportunities in-field (inter-array cable installation) * Grand Canyon vessels are designed with large reinforced decks to accommodate a broad array of installation support equipment.

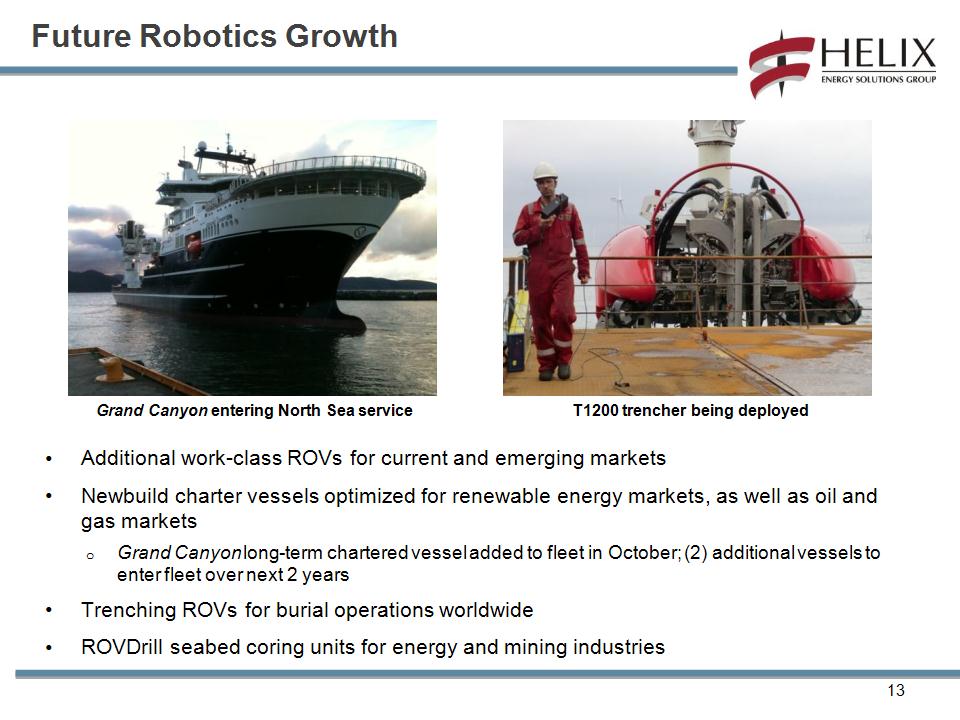

Future Robotics Growth Additional work-class ROVs for current and emerging markets Newbuild charter vessels optimized for renewable energy markets, as well as oil and gas markets Grand Canyon long-term chartered vessel added to fleet in October; (2) additional vessels to enter fleet over next 2 years Trenching ROVs for burial operations worldwide ROVDrill seabed coring units for energy and mining industries * T1200 trencher being deployed Grand Canyon entering North Sea service

* SUBSEA CONSTRUCTION

Subsea Construction Helix’s full-service shore base facility designed to fabricate various subsea equipment As of October 2012, Helix has reached agreements to sale all 3 of its pipelay vessels for a combined selling price of $253 million The Intrepid was sold in September In October an agreement was reached to sell the Express, Caesar and related equipment Closings after vessels complete contracted backlog (estimated in February 2013 for Express and July 2013 for Caesar) * Ingleside Spoolbase Facilities

* PRODUCTION FACILITIES

* Independence Hub Semi (20%) Location: Mississippi Canyon 920 Depth: 8,000 ft. Production capacity: 1 BCFD Marco Polo TLP (50%) Location: Green Canyon 608 Depth: 4,300 ft. Production capacity: 120,000 BOPD 300 MMCFD Helix Producer I FPU Location: Helix’s Phoenix field (GC 237) Production capacity: 45,000 BOPD 55,000 BLPD 80 MMCFD A component of the well containment system, along with the Q4000 Production Facilities Helix Producer I preparing to re-enter service following Macondo well containment response

* OIL & GAS Gulf of Mexico Oil and Gas Producer

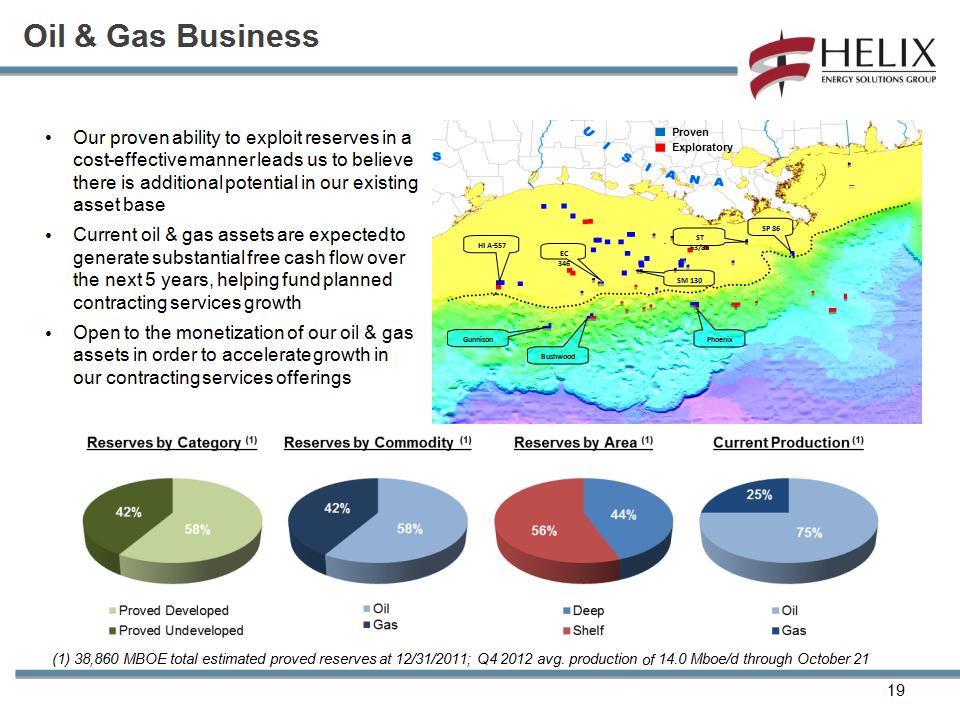

Oil & Gas Business * Our proven ability to exploit reserves in a cost-effective manner leads us to believe there is additional potential in our existing asset base Current oil & gas assets are expected to generate substantial free cash flow over the next 5 years, helping fund planned contracting services growth Open to the monetization of our oil & gas assets in order to accelerate growth in our contracting services offerings (1) 38,860 MBOE total estimated proved reserves at 12/31/2011; Q4 2012 avg. production of 14.0 Mboe/d through October 21 Proven Exploratory EC 346 HI A-557 ST 63/86 SM 130 SP 86 Gunnison Bushwood Phoenix

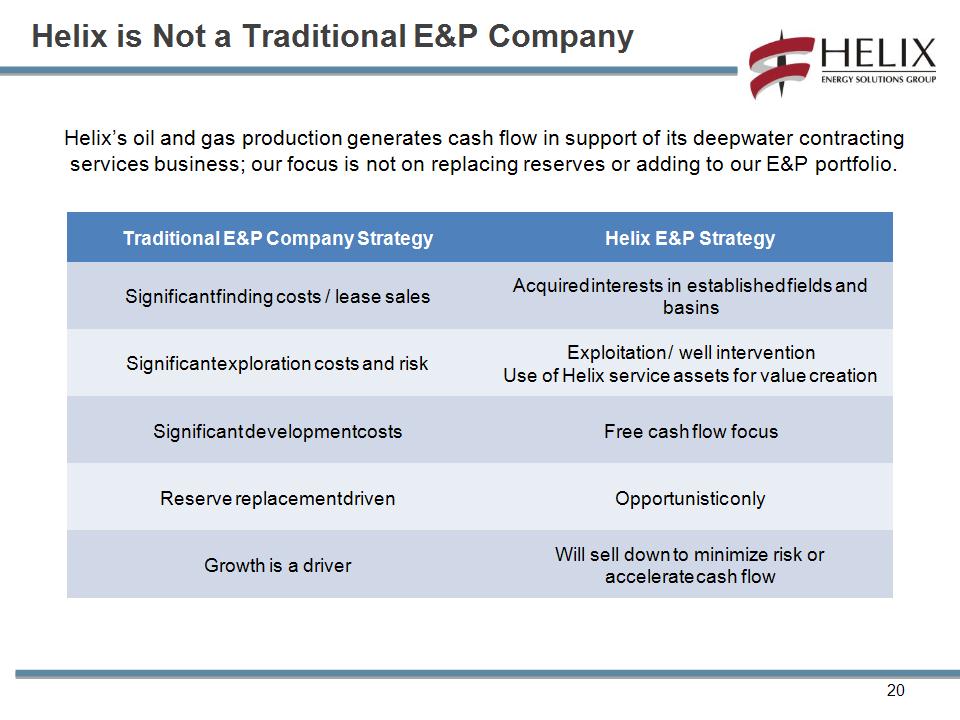

Helix is Not a Traditional E&P Company * Traditional E&P Company Strategy Helix E&P Strategy Significant finding costs / lease sales Acquired interests in established fields and basins Significant exploration costs and risk Exploitation / well intervention Use of Helix service assets for value creation Significant development costs Free cash flow focus Reserve replacement driven Opportunistic only Growth is a driver Will sell down to minimize risk or accelerate cash flow Helix’s oil and gas production generates cash flow in support of its deepwater contracting services business; our focus is not on replacing reserves or adding to our E&P portfolio.

* Convertible Notes Term Loans / Revolver Senior Unsecured Notes MARAD Debt DEBT & LIQUIDITY / 2012 OUTLOOK *

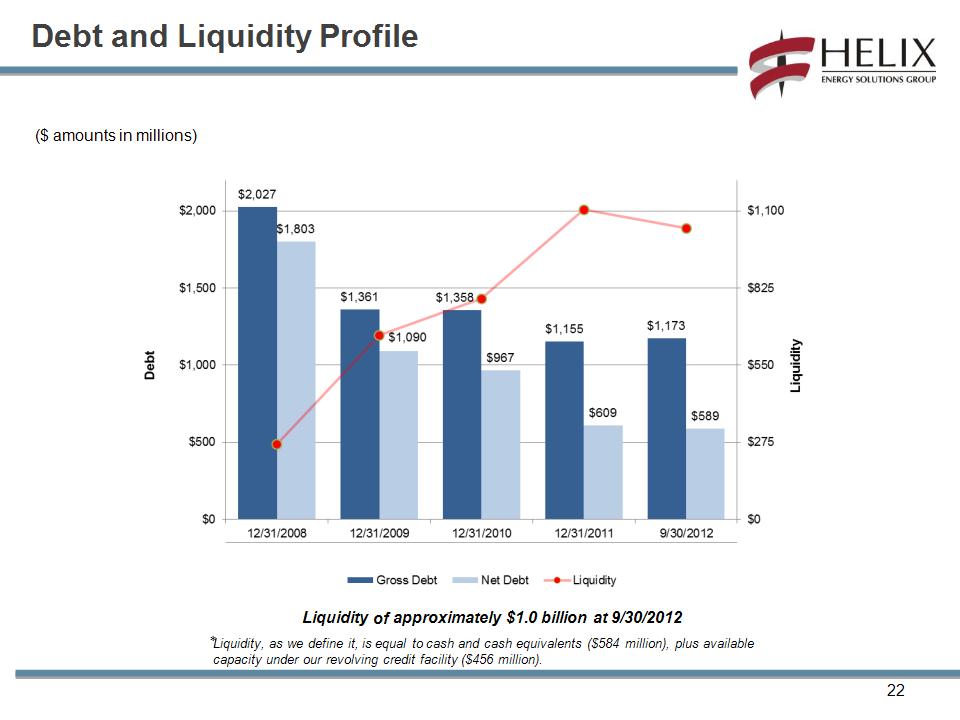

* Liquidity of approximately $1.0 billion at 9/30/2012 Liquidity, as we define it, is equal to cash and cash equivalents ($584 million), plus available capacity under our revolving credit facility ($456 million). ($ amounts in millions) Debt and Liquidity Profile

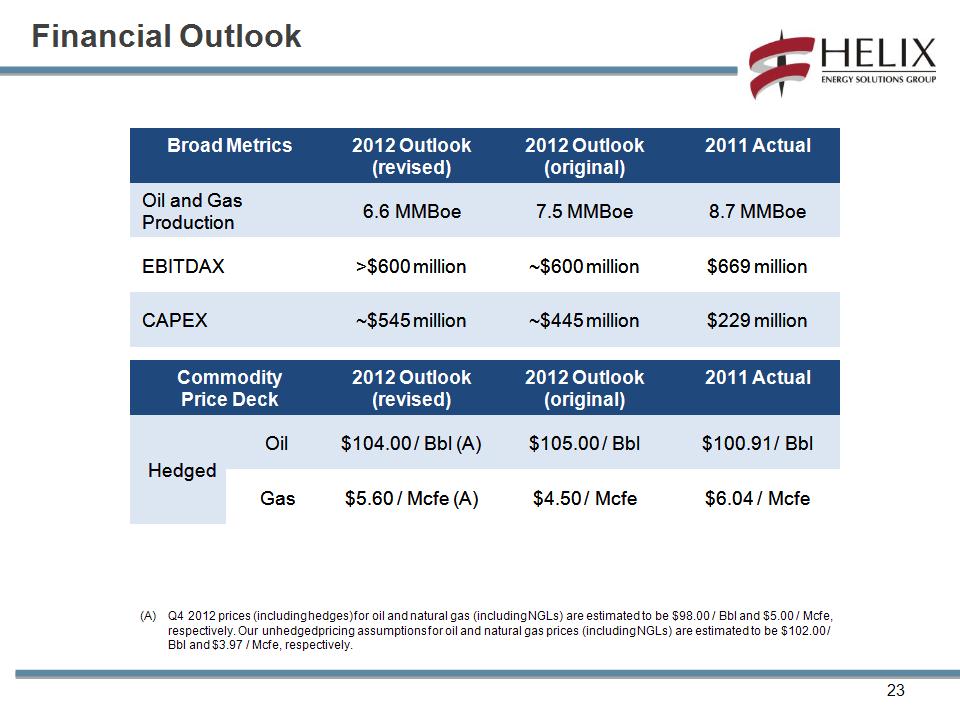

Financial Outlook * Broad Metrics 2012 Outlook (revised) 2012 Outlook (original) 2011 Actual Oil and Gas Production 6.6 MMBoe 7.5 MMBoe 8.7 MMBoe EBITDAX >$600 million ~$600 million $669 million CAPEX ~$545 million ~$445 million $229 million Commodity Price Deck Commodity Price Deck 2012 Outlook (revised) 2012 Outlook (original) 2011 Actual Hedged Oil $104.00 / Bbl (A) $105.00 / Bbl $100.91 / Bbl Hedged Gas $5.60 / Mcfe (A) $4.50 / Mcfe $6.04 / Mcfe Q4 2012 prices (including hedges) for oil and natural gas (including NGLs) are estimated to be $98.00 / Bbl and $5.00 / Mcfe, respectively. Our unhedged pricing assumptions for oil and natural gas prices (including NGLs) are estimated to be $102.00 / Bbl and $3.97 / Mcfe, respectively.

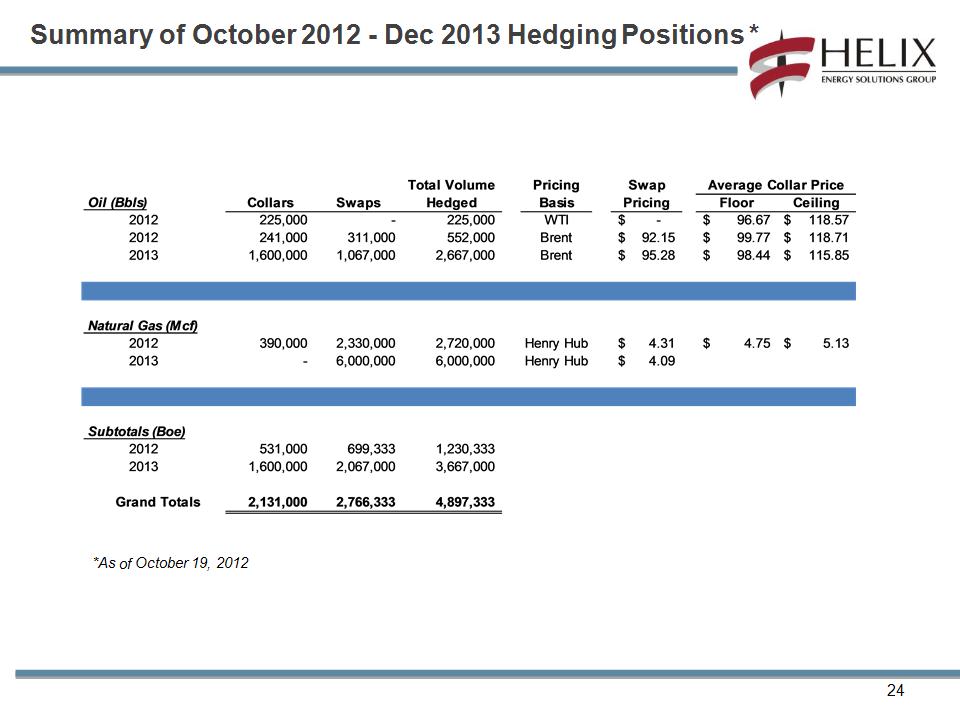

* Summary of October 2012 – Dec 2013 Hedging Positions * *As of October 19, 2012

* 2012 Outlook Contracting Services Significant backlog totaling $700 million at the end of Q3 ($175 million expected to be completed in Q4 2012) Full backlog for the Q4000, Well Enhancer and Seawell through 2013 Q4000 full backlog thru 2014, with strong customer interest beyond Significant customer interest in Helix 534 for scope of work in Gulf of Mexico beginning mid-2013 Express working in the Gulf of Mexico in Q4 on contracted backlog Caesar accommodations project offshore Mexico continues through July 2013 On October 15, 2012, agreed to sell the Express, Caesar and related equipment for $238.3 million (fourth quarter 2012 impairment charge of approximately $160 million pre-tax, $100 million after tax, for Caesar and related equipment, and approximately $14 million pre-tax gain, $9 million after tax, related to the sale of the Express in first quarter 2013). Closings to occur once vessels complete contracted backlog (February 2013 for Express and July 2013 for Caesar) Continue to add ROV systems to support commercial growth in our Robotics business in 2012 and beyond

* 2012 Outlook Oil and Gas Forecasted 2012 overall production of approximately 6.6 MMboe Nancy gas well (Bushwood field) now completed and expected to commence production in 1H 2013 Wang well (Phoenix field) expected to commence drilling in November Rig mobilized If successful, production forecasted for Q2 2013 Approximately 90% of 2012 revenues from oil and NGLs Anticipated 72% of production volume is oil and 68% of total production from deepwater 78% hedged for the year (80% of estimated PDP production)

* 2012 Outlook - Capex Capital Expenditures Contracting Services (~$370 million) Q5000 new build (approximately $130 million of capex in 2012) Approximately $65 million incurred thru Q3 Newly acquired Helix 534 continues conversion into a well intervention vessel in Singapore Estimated $180 million for vessel, conversion and intervention riser system (approximately $125 million to be incurred in 2012) Expect to deploy vessel to Gulf of Mexico in mid 2013 Completed regulatory dry docks for four vessels Continued incremental investment in Robotics business, with a focus on adding trenching spread capacity Oil and Gas (~$175 million) Two major deepwater well projects planned this year Danny II – drilled in Q2/Q3, producing as of October 25th Wang – expect to spud early November ; Q1 completion and production in Q2 2013

* Follow Helix ESG on Twitter: www.twitter.com/Helix_ESG Join the discussion on LinkedIn: www.linkedin.com/company/helix