Attached files

| file | filename |

|---|---|

| 8-K - 8-K - EQUITY ONE, INC. | d436475d8k.htm |

Investor Presentation

November 2012

Exhibit 99.1 |

1

Forward Looking Statements

Certain matters discussed by Equity One in this presentation constitute forward-looking statements

within the meaning of the federal securities laws. Although Equity One believes that the

expectations reflected in such forward-looking statements are based upon reasonable

assumptions, it can give no assurance that these expectations will be achieved. Factors that

could cause actual results to differ materially from current expectations include volatility of

the capital markets, changes in macro-economic conditions and the demand for retail space

in the states in which Equity One owns properties; the continuing financial success of Equity

One’s current and prospective tenants; the risks that Equity One may not be able to proceed with

or obtain necessary approvals for development or redevelopment projects or that it may take

more time to complete such projects or incur costs greater than anticipated; the availability

of properties for acquisition; the ability to sell non-core assets at favorable pricing;

the extent to which continuing supply constraints occur in geographic markets where Equity One

owns properties; the success of its efforts to lease up vacant space; the effects of natural

and other disasters; the ability of Equity One to successfully integrate the operations and systems of

acquired companies and properties; changes in Equity One’s credit ratings; and other risks, which

are described in Equity One’s filings with the Securities and Exchange Commission.

This presentation also contains non-GAAP financial measures, including Funds from Operations, or

FFO. Reconciliations of these non-GAAP financial measures to the most directly

comparable GAAP measures can be found in Equity One’s quarterly supplemental information

package and in filings made with the SEC which are available on its website at

www.equityone.net |

Mission Statement

2

Improving retail real estate in urban communities |

Corporate Overview

3

•

Equity One specializes in the acquisition, asset management, development and

redevelopment of quality retail properties primarily located in the coastal

markets of the United States •

We own

160

operating

properties

in

13

states

(1)

•

Our largest markets as measured by approximate fair market values are: South

Florida (27%), Northeast (27%),

California

(21%),

North

Florida

(10%),

and

Atlanta

(8%)

(2)

•

Total equity capitalization / total enterprise value as of 09/30/12: $2.7 billion /

$4.2 billion •

Investment

grade

credit

ratings

of

Baa3

(positive)

from

Moody’s

and

BBB-

(stable)

from

S&P

•

Management and board have substantial ownership stake and experience:

–

Beneficial ownership: 50.1%

(3)

–

Management team has over 80 years of collective experience

(1)

Includes acquisitions & dispositions under contract as of 09/30/2012. Excludes land and

non-core assets not associated with retail centers. Additionally, we have joint venture

interests in nineteen retail properties and two office buildings totaling approximately 2.8 million square feet.

(2)

Based on total estimated fair value as of 09/30/12, inclusive of all acquisitions and dispositions

under contract as of 09/30/2012 and excludes land. Does not include unconsolidated JV

properties. (3)

Beneficial ownership of current executive officers and directors as of 09/30/12 in accordance with

rules of the SEC and including options exercisable within 60 days. Beneficial ownership:

Chaim Katzman 46.5%, Jeff Olson 2.0% and Nathan Hetz 0.5% on a fully diluted basis. |

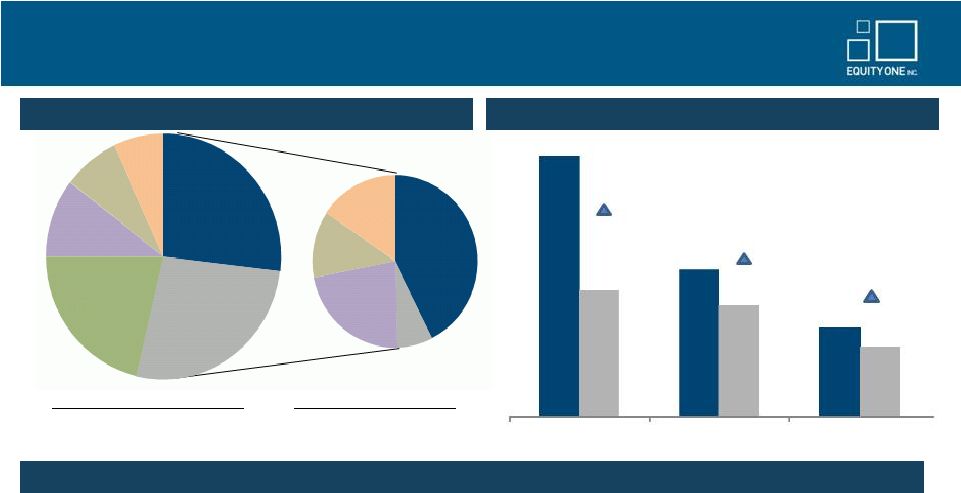

Equity

One is on the move… Then vs. Now

4

Asset Composition by Region

•

Approximately

$2

billion

of

acquisitions

completed

since

2009

in

our

target

markets

(3):

–

Approximately $780 million of assets in West Coast markets

–

Approximately $950 million of premium quality assets in Northeast portfolio

–

Completed The Gallery at Westbury Plaza in Nassau County, NY

•

Sold approximately $800 million of non-strategic/non-core assets since

2009, the most prominent being: –

$473 million sale of 36 non-strategic retail assets to Blackstone

–

$191 million asset dispositions related to non-retail CapCo assets

Portfolio

Quality

Metrics

in

2012

vs.

2008

(2)

Dec

2008

Portfolio

$2,365 MM

Sept 2012 Portfolio

(1)

$3,690 MM

Significant Investment Activity has Transformed the Portfolio

(1)

Data includes acquisitions & dispositions under contract as of 09/30/12. Excludes land and

non-core assets not associated with retail centers. Based on IFRS fair market values as of

09/30/12. (2)

Demographic data based on weighted estimated fair market value of assets. Source: Sites USA.

(3)

As of Sept 30, 2012, includes assets under contract as of Sept 30, 2012 and joint venture properties.

Figures are computed based on weighted average estimated fair values. South

Florida 27%

Northeast

27%

California

21%

Central/

North Florida

10%

Atlanta

8%

Other

7%

South Florida

43%

Northeast

7%

Central/

North Florida

22%

Atlanta

12%

Other

16%

169,017

$95,702

82,368

$72,878

3-mile population

3-mile avg. HH income

$522

$406

Grocery sales per sq.ft

108%

30%

33% |

5

Portfolio Metrics

(1)

New York occupancy rate would be 98% excluding The Gallery at Westbury Plaza, which

is currently 73% leased. (2)

Excludes land and non-core assets not associated with retail centers. Includes

acquisitions and dispositions under contract as of 09/30/12. (3)

Fair value of Westwood Center in Bethesda, MD is based on purchase price when

property is ultimately acquired. (4)

Includes Lake Mary, Sunlake, Pablo and South Beach Regional.

(1)

(3)

(4)

# of

centers

3Q12 Fair

Value

($M)

GLA

3Q12

Occ.

All

Anchor

Shop

Pop.

Avg HH

Income

Grocer

Sales

Balance

Interest Years to

Rate

Maturity

Core Markets

Northeast

Connecticut

7

$252.3

867,764

98.0%

$22.66

$13.27

$31.15

37,706

$140,202

$843

$82.7

5.6%

5.2

Maryland

1

$140.0

466,910

97.8%

$13.84

N/A

N/A

139,570

$200,005

$847

$0.0

0.0%

0.0

Massachusetts

7

$139.7

600,879

99.1%

$18.80

$18.96

$17.47

185,947

$84,412

$347

$7.1

8.1%

11.9

New York

7

$465.1

950,727

86.9%

$32.67

$29.38

$55.71

481,966

$104,881

$1,391

$7.1

7.0%

6.6

Northeast Total

22

$997.2

2,886,280

94.5%

$22.84

$21.20

$31.79

280,001

$124,307

$669

$96.9

5.9%

5.8

Southeast

North and Central Florida

7

$176.8

1,212,742

88.8%

$14.82

$11.27

$21.15

49,068

$91,351

$420

$23.3

5.8%

2.7

Atlanta (Core)

6

$178.7

821,321

95.8%

$16.45

$12.77

$24.70

92,868

$111,775

$571

$39.6

7.0%

4.4

Broward/Miami-

Dade/Palm Beach Counties

40

$914.5

4,826,944

92.2%

$15.07

$10.37

$23.38

130,518

$76,458

$618

$87.6

6.3%

5.4

Florida Treasure/Northeast Coast

6

$73.5

504,568

92.3%

$12.11

$8.35

$19.62

39,678

$70,858

$630

$7.0

5.7%

1.8

Southeast Total

59

$1,343.5

7,365,575

92.1%

$14.98

$10.66

$22.92

109,822

$82,809

$609

$157.5

6.3%

4.6

West Coast

Arizona

1

$26.7

210,396

64.4%

$19.26

$12.54

$26.09

35,703

$74,853

$0

$0.0

0.0%

0.0

Los Angeles

4

$194.5

489,239

98.0%

$20.58

$13.57

$34.69

263,644

$93,587

$508

$74.9

5.5%

6.3

San Francisco

5

$587.9

1,564,570

98.2%

$28.61

$20.80

$39.69

217,182

$95,412

$817

$71.6

6.0%

3.7

West Coast Total

10

$809.1

2,264,205

95.0%

$25.92

$18.23

$37.95

222,360

$94,295

$647

$146.5

5.7%

5.0

Total

91

$3,149.8

12,516,060

93.2%

$18.66

$14.64

$26.87

192,606

$98,897

$630

$400.9

6.0%

5.0

Non-core Markets

Atlanta

13

$103.6

1,042,475

88.4%

$10.40

$7.86

$15.61

49,254

$78,135

$396

$16.5

6.9%

8.7

Tampa/St. Petersburg/Venice/Cape Coral/Naples

10

$87.0

984,807

73.2%

$10.59

$7.63

$17.06

39,344

$83,294

$416

$0.0

0.0%

0.0

Louisiana

12

$101.6

1,311,385

95.4%

$8.59

$6.80

$13.03

58,017

$76,794

$235

$3.1

6.5%

11.4

Jacksonville/North Florida

9

$67.6

819,879

90.2%

$10.22

$8.45

$16.14

43,528

$62,772

$474

$0.0

0.0%

0.0

Orlando/Central Florida

6

$52.9

555,044

85.0%

$11.63

$6.46

$20.25

85,262

$59,855

$365

$0.0

0.0%

0.0

North Carolina

9

$59.2

921,216

74.4%

$8.03

$6.39

$11.96

29,774

$63,967

$289

$6.6

6.3%

0.8

Central/ South Georgia

4

$35.2

624,662

79.6%

$8.10

$6.17

$12.06

60,007

$48,571

$443

$3.1

6.5%

11.4

AL/MS/VA

3

$18.1

258,535

97.9%

$7.27

$5.49

$13.44

21,816

$69,354

$395

$2.8

6.5%

11.4

South Carolina

3

$14.8

196,876

89.3%

$8.24

$7.00

$14.32

30,589

$82,603

$489

$0.0

0.0%

0.0

Total

69

$539.9

6,714,879

85.1%

$9.41

$7.10

$14.91

49,250

$71,348

$396

$32.1

6.7%

7.8

Grand Total

(2)

160

$3,689.7

19,230,939

90.4%

$15.48

$11.97

$22.86

171,628

$94,866

$540

$433.0

6.1%

5.2

In-Place Debt (9/30/12)

Base Rent ($/sf) |

Concentration of Assets As of September 30, 2012

(1)

6

Region

$(M)

%

South Florida

$988

27%

Northeast

$997

27%

California

$782

21%

Central/North Florida

$384

10%

Atlanta

$282

8%

Other

$257

7%

Total

$3,690

100%

(1)

Data includes acquisitions & dispositions under contract as of 09/30/12.

Excludes land and non-core assets not associated with retail centers. IFRS fair market

values are as of 09/30/12.

Estimated FMV:

$588M

% of FV: 16%

Estimated FMV:

$194M

% of FV: 5%

Estimated FMV:

$997M

% of FV: 27%

Estimated FMV:

$29M

% of FV: 1%

Estimated FMV:

$282M

% of FV: 8%

Estimated FMV:

$988M

% of FV: 27%

Estimated FMV:

$384M

% of FV: 10% |

2012

Strategic Goals 7

Meet or exceed fundamental operating goals:

•

FFO per share

•

SS NOI growth

•

SS Occupancy

Continue to upgrade portfolio quality and demographic profile through strategic

transactions:

•

Expected to close $280M in acquisitions in 2012 with a focus on the Northeast and

West Coast

•

Identified $215M of non-core assets for dispostion

Maintain low leverage (~40%) and abundant liquidity

Maintain investment grade ratings and improve credit metrics

Upgrade information technology systems –

implement IT strategic plan that is aligned

with our operational strategy

OPERATING

FUNDAMENTALS

PORTFOLIO QUALITY

VALUE CREATION

BALANCE SHEET

MANAGEMENT

OPERATIONS

Continue to strengthen development and redevelopment pipeline:

•

Focus on the remaining lease up of The Gallery at Westbury (targeting 80% lease

rate by 12/31/12)

•

Establish redevelopment and densification plans at Serramonte Center in Daly City,

CA –

Signed lease with Dick’s Sporting Goods (83K sf) at a cost of $18M

•

Finalize development plan and budget for new site in the Bronx (133,000 sf)

–

Work on phase I plan to add entertainment wing |

Our

Path to Sustained NOI Growth 8

Contractual rent steps

Below market

leases

–

recent

acquisitions

provide

opportunity

to

capture

market

rents

in

coming years

Increase

in

percentage

rent

–

higher

quality

assets

in

more

productive

markets

provide

greater upside

Increase occupancy with an emphasis on small shop space

Expense control and implementation of cost control initiatives within property

operations Reduce concentration of assets in secondary and non-core

markets Expand tenant relations and marketing efforts with national and

regional retailers |

Enhancing Portfolio Value by Improving Portfolio Quality

9

•

We plan to further diversify our portfolio into supply constrained, urban

markets •

Recent

acquisitions

in

California

and

New

York

highlight

our

focused

approach

on

properties

which

meet

the

following key criteria aimed at enhancing the quality and performance of our

overall portfolio: –

Strong demographics

–

average

3-mile

populations

of

nearly

200,000

as

compared

to

EQY’s

historical

portfolio average of approximately 80,000

–

Strong barriers to entry due to scarcity of land and strict zoning

restrictions –

Highly productive anchor sales volumes

–

Below market anchor rents

–

Redevelopment and densification opportunities

•

These

acquisitions

have

enabled

us

to

diversify

our

portfolio

into

higher

quality

centers

in

major

MSAs

which

will ultimately result in greater stability and higher internal growth

|

Enhancing Portfolio Value through Development and Redevelopment

10

Our redevelopment strategy is based on a careful assessment of risk:

•

Projects undertaken in select target markets where management has extensive

knowledge •

Majority

of

new

leases

related

to

development

space

signed

prior

to

construction

•

Development

skill

set

greatly

enhanced

with

new

senior

executive

team

members:

•

Michael

Berfield

–

Northeast

•

Jeff

Mooallem

–

West

Coast

•

New ground up development projects limited to urban locations sought after by big

box retail •

Redevelopment projects provide growth in asset value while minimizing risk of in

place income •

Recent track record demonstrates successful execution by narrowing focus to a

select few projects

•

Targeted level of development/redevelopment projects (approx. 10% of total asset

value) is reasonable and appropriate given lower risk profile of selected

opportunities in urban markets |

Development / Redevelopment Update

11

•

The Gallery at Westbury Plaza

•

Recent activity at The Gallery at Westbury includes signed leases with Starbucks,

Red Mango, Jenna & Molly, Banana Republic Outlet, GAP Outlet, Lane

Bryant, Bank of America, Noodles & Co., and GNC

•

Stores

now

open

include

The

Container

Store,

Trader

Joe’s,

Saks

Off

5

th

,

Ulta,

Bloomingdale’s,

Nordstrom Rack, SA Elite and Verizon

•

Old Navy and Shake Shack will open in November

•

Serramonte

•

Multi-phased expansion, development and re-tenanting to begin with the

construction of a new two level Dick’s

Sporting

Goods –

their

largest

one

in

California

and

flagship

San

Francisco store

•

Actively discussing

new

tenanting

options

–

big

box

retail,

entertainment, value/convenience retail

•

Future phases will

explore

250,000

sf

of

additional

retail

space

plus

a

residential

component

•

Boca Village / Pine Ridge

•

Addresses layout / structural design weakness

•

Reduces shop tenant exposure

•

Target stabilization late 2013 / early 2014

•

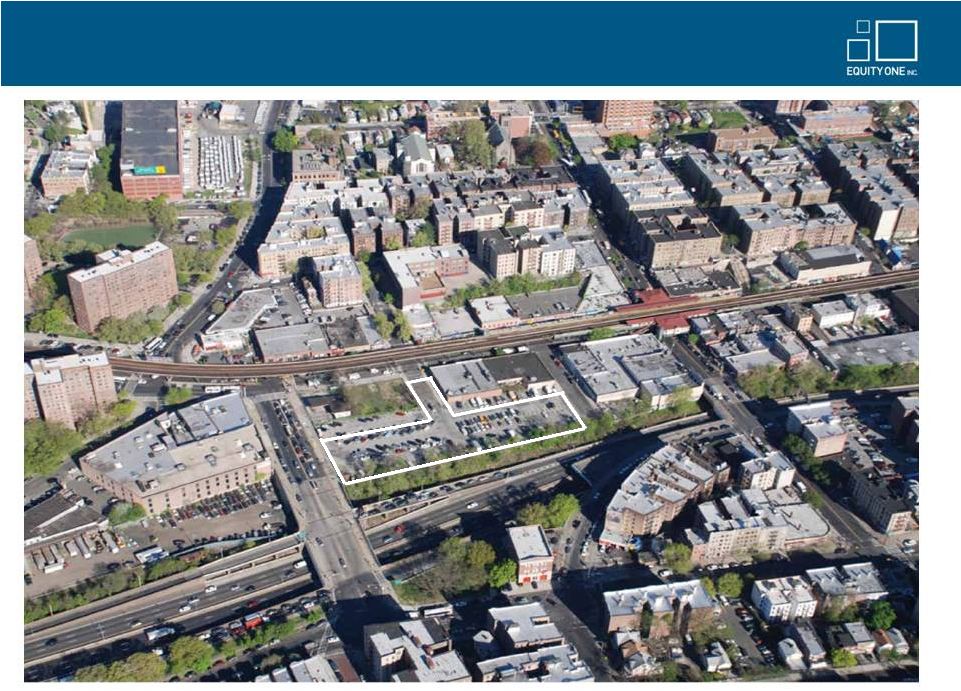

Bronx site

•

Acquired 80,000

sf

land

parcel

located

at

the

intersection

of

230

street

and

the

Broadway near

Kingsbridge in the Bronx

•

Expected to construct a new 133,000-square-foot, two-story

multi-tenant retail development •

Expected to start construction in early 2013 with a targeted stabilization date in

2015 th |

Disciplined Growth While Improving Leverage Metrics

12

Gross Assets

(1)

Equity Raised

Fixed Charge Coverage

(4)

Total Debt to Gross Real Estate

(5)

Secured Debt to Gross Real Estate

(5)

(1)

Gross Assets represents Total Assets plus Accumulated Depreciation.

(2)

Represents 866,373 shares issued to DIM Vastgoed at closing price of $14.12 on

1/9/09 and 536,601 at a closing price of $18.36 on 2/19/10. (3)

Based on total capitalization of $600 million for Capital & Counties less $327

million of debt. (4)

Represents adjusted EBITDA to fixed charges. Adjusted EBITDA excludes gains/losses

on property sales, debt extinguishment, impairments, and other non-recurring items.

(5)

Gross Real Estate represents Total Real Estate Assets plus Accumulated

Depreciation. (2)

(3)

(2) |

Balance Sheet Discipline –

Demonstrated Via Modest Leverage

13

•

Key leverage ratios as of 9/30/12:

–

Net Debt to Total Market Cap: 34.0%

–

Net Debt to Gross Real Estate: 42.4%

–

Net

Debt

to

Adjusted

EBITDA

(1)

:

6.8x

–

Adjusted EBITDA to interest expense coverage: 2.8x

–

Adjusted EBITDA to fixed charges: 2.6x

–

Weighted

average

term

to

maturity

for

our

total

debt

years:

5.8

years

(2)

Source: Company filings and SNL financial. Credit ratings from S&P and Moody's

as of 9/30/12. 30.0%

35.0%

40.0%

45.0%

50.0%

55.0%

EQY (BBB-/Baa3)

KIM (BBB+/Baa1)

FRT (BBB+/Baa1)

REG (BBB/NR)

WRI (BBB/Baa2)

Q3

2012 Leverage (Total Debt + Preferred / Gross Assets)

(1)

Based on Net Debt as of 9/30/12 and Adjusted EBITDA (excluding gains/losses on property sales, debt

extinguishment, impairments, and other non-recurring items) calculated by annualizing 3Q12

adjusted EBITDA as reported in the 9/30/12 Supplement. (2)

Based on the pro-forma term to maturity including the effect of the October $300M bond offering

and pending redemption of the 2014 bonds. |

Current Liquidity Position

14

•

Cash and cash equivalents amounted to $28.9 million as of September 30, 2012

•

New upsized revolving credit facility has capacity of $575 million and matures

September 30, 2015 with a one year extension option

•

We maintain a manageable debt maturity schedule with maturities through 2017:

Note: Cash includes $2.3M in Escrow account. Debt maturity schedule as of 9/30/12.

Includes scheduled principal amortization. Credit facilities are shown as due on

the

initial

maturity

dates,

though

certain

extension

options

may

be

available.

Debt maturity schedule presents pro-forma effect of the $300M bonds issued in

October 2012 and the corresponding redemption of the 2014 bonds. •

Strong lending relationships with both traditional banks and life insurance

companies •

Demonstrated access to the public markets

Debt Maturity Schedule (includes amortization)

$3

$55

$15

$233

$220

$289

$63

$273

$344

$0

$50

$100

$150

$200

$250

$300

$350

2012

2013

2014

2015

2016

2017

2018

2019

Thereafter

Secured Debt

Senior Notes

Term Loan

Credit Facility |

Investment Thesis

15

Well-located, high quality, and productive grocery-anchored shopping

centers with an intensive focus on asset management

Investment strategy focused on identified core markets leading to an upgrade in

portfolio quality and further geographic diversity

A healthy financial structure including a strong balance sheet, modest leverage

and ample liquidity

We are a premier operator positioned for growth

A management team who has proven to execute a stated strategy of significant

portfolio improvement while maintaining financial discipline

|

Appendix

–

Recent

Acquisitions

•

Westwood Complex

•

Clocktower

•

2 Avenue

•

Darinor Plaza

•

Broadway Plaza

•

Potrero

•

Serramonte Shopping Center

•

The Gallery at Westbury Plaza and Westbury Plaza

nd

16 |

Westwood Complex, Bethesda, MD

17 |

Westwood

Complex

–

Competition

Map

18 |

Clocktower –

Queens, NY

19 |

2 Avenue between 64 & 65 Street

20

nd

th

th |

Darinor Plaza, Connecticut

21 |

Broadway Plaza, Bronx, NY

22 |

Broadway Plaza, Bronx, NY

23 |

Development Option -

Broadway Plaza, Bronx, NY

24 |

Schematic -

Broadway Plaza, Bronx, NY

25 |

Potrero Center, San Francisco, CA

26 |

Serramonte Shopping Center

27 |

The

Gallery at Westbury Plaza and Westbury Plaza 28

|

The

Gallery at Westbury Plaza 29 |