Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Blue Water Petroleum Corp. | Financial_Report.xls |

| EX-32 - SOX SECTION 906 CERTIFICATION OF THE CEO - Blue Water Petroleum Corp. | degaro-section906certificati.htm |

| EX-31 - SOX SECTION 302(A) CERTIFICATION OF THE CEO - Blue Water Petroleum Corp. | degaro-section302certificati.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

[X] |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

|

For the fiscal year ended |

July 31, 2012 | |

|

[ ] |

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

|

For the transition period from |

[ ] to [ ] | |

|

Commission file number |

333-169770 | |

|

DEGARO INNOVATIONS CORP. |

|

(Exact name of registrant as specified in its charter) |

|

Nevada |

|

N/A |

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

Lot 107, Roaring River, Steer Town PO, St. Ann, Jamaica |

|

N/A |

|

(Address of principal executive offices) |

|

(Zip Code) |

|

Registrant's telephone number, including area code: |

|

(876) 347-9493 |

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class |

|

Name of Each Exchange On Which Registered |

|

N/A |

|

N/A |

Securities registered pursuant to Section 12(g) of the Act:

|

None. | |

|

(Title of class) | |

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 the Securities Act. | |

|

|

Yes ¨ No x |

|

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act | |

| Yes ¨ No x | |

|

|

| ||||||

|

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the last 90 days. | |||||||

|

|

Yes x No ¨ | ||||||

|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-K (§229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). |

| ||||||

|

|

Yes x No ¨ |

| |||||

|

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. | |||||||

|

|

Yes ¨ No x | ||||||

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| |||||||

|

Large accelerated filer |

¨ |

Accelerated filer |

¨ |

| |||

|

Non-accelerated filer |

¨ |

Smaller reporting company |

x |

| |||

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). | |||||||

|

|

Yes ¨ No x | ||||||

|

The aggregate market value of Common Stock held by non-affiliates of the Registrant on January 31, 2012 was $Nil based on a $Nil average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. | |||||||

|

Indicate the number of shares outstanding of each of the registrant’s classes of common stock as of the latest practicable date. 51,155,000 common shares as of November 13, 2012. |

DOCUMENTS INCORPORATED BY REFERENCE

None.

2

TABLE OF CONTENTS

|

Item 1. Business |

4 |

|

Item 1A. Risk Factors |

20 |

|

Item 1B. Unresolved Staff Comments |

20 |

|

Item 2. Properties |

20 |

|

Item 3. Legal Proceedings |

20 |

|

Item 4. Mine Safety Disclosures |

20 |

|

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

21 |

|

Item 6. Selected Financial Data |

22 |

|

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations |

22 |

|

Item 7A. Quantitative and Qualitative Disclosures About Market Risk |

26 |

|

Item 8. Financial Statements and Supplementary Data |

26 |

|

Item 9. Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

27 |

|

Item 9A. Controls and Procedures |

27 |

|

Item 9B. Other Information |

27 |

|

Item 10. Directors, Executive Officers and Corporate Governance |

28 |

|

Item 11. Executive Compensation |

31 |

|

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

33 |

|

Item 13. Certain Relationships and Related Transactions, and Director Independence |

34 |

|

Item 14. Principal Accounting Fees and Services |

34 |

|

Item 15. Exhibits, Financial Statement Schedules |

35 |

3

PART I

Item 1. Business

This annual report contains forward-looking statements. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors”, that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our financial statements are stated in United States Dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles.

In this annual report, unless otherwise specified, all dollar amounts are expressed in United States dollars and all references to “common shares” refer to the common shares in our capital stock.

As used in this annual report, the terms we", "us", "our" and "our company" mean Degaro Innovations Corp. and our wholly owned subsidiary, Degaro Limited, a Jamaica corporation, unless otherwise indicated.

General Overview

We were incorporated on December 8, 2009 under the laws of the State of Nevada. At incorporation, our authorized capital consisted of 100,000,000 shares of common stock with a par value of $0.001 and 100,000,000 shares of preferred stock with a par value of $0.001. Effective January 29, 2010, we amended our articles of incorporation to change the par value of shares of our common stock to $0.0001. As a result, effective January 29, 2010, our authorized capital consisted of 100,000,000 shares of common stock with a par value of $0.0001 and 100,000,000 shares of preferred stock with a par value of $0.001.

We have a wholly-owned subsidiary, Degaro Limited, incorporated under the laws of Jamaica on July 26, 2010. Our principal executive offices are located at Lot 107, Roaring River, Steer Town PO, St. Ann, Jamaica. Our telephone number is (876) 347-9493. Our fiscal year end is July 31.

We are development stage company. We have only recently begun operations, have minimal sales and revenues, and therefore rely upon the sale of our securities to fund our operations. We have a going concern uncertainty as of the date of our most recent financial statements.

From inception, our management has devoted a significant amount of time to the development of our business. In furtherance of our planned business, our management investigated the market demand for solar power in the Jamaican and Caribbean markets, raised seed capital, investigated various suppliers of solar power equipment, decided on a supplier of solar power equipment and most recently purchased a complete 1.5KW solar system for demonstration purposes.

4

Our Current Business

We intend to market and distribute solar panel power generation systems for household application in the Jamaican and Caribbean market. We anticipate that our products will be designed and assembled in Pingshan District in Shenzhen, Guangdong Province, China by Shenzhen Commonpraise Solar Co., Ltd. where various types of solar products, including solar water heaters, residential and commercial powered-systems, LED products, and solar powered streetlights are manufactured. However, we are continuously seeking other manufacturers and suppliers of solar panel power generation systems in order to offer our customers the most current technology at the most competitive prices.

On January 6, 2011, we entered into an exclusive distribution agreement with Shenzhen Commonpraise Solar Co., Ltd. for the distribution of Shenzhen Commonpraise products in Jamaica. Pursuant to the agreement, we were to purchase not less than 10 industrial or commercial solar energy systems from Shenzhen Commonpraise within a six month period following the date of the agreement. Exclusivity under the agreement would be effective for the initial 6 months period following our purchase of a solar energy system of not less than 2 KW. If we were successful in meeting the 10 system quota, the exclusive distribution arrangement would be extended for an additional 12 month period. If we are not successful, we would revert back to a non-exclusive distribution arrangement with Shenzhen Commonpraise. On July 6, 2011, our company had not purchased 10 systems and the exclusive agreement was voided. Our company will continue to act as a distributor of systems on a non-exclusive basis.

Prior to the distribution agreement we purchased a 1.5KW system from Shenzhen Commonpraise for testing, marketing and display purposes. The specifications and manufacturer estimated capacities of the 1.5KW system are as follows:

|

1.5KW System | ||||

|

Items |

Rated Watt |

Quantity |

Working Time |

Consumption |

|

Light |

11 |

6 |

4 |

264 |

|

computer |

100 |

1 |

5 |

500 |

|

printer |

30 |

1 |

1 |

30 |

|

fax |

150 |

1 |

1 |

150 |

|

Refrigerator |

100 |

1 |

24 |

2400 |

|

TV receiver |

25 |

1 |

6 |

150 |

|

TV (21") |

70 |

1 |

6 |

420 |

|

water pump |

200 |

1 |

0.5 |

100 |

|

Total |

741 |

13 |

|

4014 |

|

system components | ||||

|

Items |

Total capacity |

Model |

Power |

Quantity (PCS) |

|

Polycrystalline solar panels |

1440WP |

PS180-24P |

180W |

8 |

|

Lead-acid battery |

1000AH/24V |

GP1000 |

1000AH/2V |

12 |

|

Controller |

50A/24V |

PC5024 |

1200W/24V |

1 |

|

Inverter |

1KW |

PN10220C |

1KW/220V |

1 |

|

Brackets and cable |

|

|

|

|

|

| ||||

|

Certificates |

CE&RHOS | |||

|

Quality Assurance |

Solar panels:20 years; Battery: 1years,Controller and inverter:1 years | |||

5

Once this unit is installed and fully functioning, we anticipate that we will engage two sales staff to aid with establishing relationships with retailers and distributors. Once we finished the installation process and we plan to hire the required staff by the end of November of 2012 , but this is dependent on financial resources available to us. There can be no assurance that we will be able to raise sufficient capital to be able to hire any employees. We anticipate that these individuals will be trained to target and market solar systems to developers of industrial, commercial and residential developments.

In connection with our proposed installation business, we intend to concentrate on serving the solar power needs of residential and small commercial customers who may or may not desire to be tied to the electric power grid. We believe the solar power industry is at an early stage of its growth and is highly fragmented with many smaller companies. The prospects for long-term worldwide demand for solar power have attracted a multitude of design/integration companies in our market segment. We expect consolidation in the design/integration segment of the industry based mostly on branding, development of new technology and business process improvements. Our principal objective is to be among the leaders in the marketing, sales, and distribution of solar panels.

Accordingly, we anticipate that our growth strategy will primarily include:

- Providing solutions for solar rooftop installations of solar panels for residential facilities;

- Commercializing solar module installation technology optimized for residential markets;

- Reducing installation costs and improving the aesthetics of solar systems compared to standard commercially available solar equipment;

- Promoting and enhancing brand name and reputation;

- Developing and utilizing a process-driven approach to sell and install solar power systems in the Jamaican market; and

- Capitalizing on the fact we are not a manufacturer, but rather a supplier of solutions using the best technology available given our finances. By consistently reappraising the markets and supplying state of the art solar cell technology, we expect that we will be able to select the best solution for any particular project.

6

On March 18, 2011, we entered into a purchase and sale agreement with N.A.T. Enterprise whereby N.A.T. has agreed to acquire three of our 750W and one of our 2.0KW solar power systems for a total purchase price of $36,238.50. Pursuant to the agreement, N.A.T. paid 10% of the purchase price within 45 days of the execution of the agreement and will pay the remaining 90% within 30 days after delivery of the ordered equipment. On May 20, 2011, we received 10% of the purchase price from N.A.T. pursuant to the purchase and sale agreement. As of July 31, 2012, the solar equipment has not been delivered due to the changing requirements by the purchaser and due to the purchaser’s technical specification requirements which may not be able to be achieved by this particular supplier. We sourced the products we are selling to N.A.T. from Shenzhen Commonpraise Solar Co. In addition, we have sourced an alternative solar system equipment provider: US Solar Institute, a US company located in Fort Lauderdale, Florida. As of October 28, 2011, we purchased from US Solar Institute a 2,500W grid solar system which includes, an inverter with internal DC disconnect, and panels. It is anticipated that we will take delivery of this system by the end of November 2012. The delay in delivery is a result of not receiving some key components for parts manufactured in Europe and the customer continues to change its requirements. Once these parts are received by our supplier we should then receive our 2,500W grid solar system if these parts continue to have delays we will seek a refund and seek alternative solar system suppliers.

Background to Solar Power

Solar power is the generation of electricity by sunlight. It has the potential to provide 1,000 times the Earth’s current demand for electricity, but currently only has the capacity to provide 0.02% of the Earth’s actual electricity (1998). However, roughly every two years, the usage of solar energy has doubled. If it continues to stay on that scale, it would become the dominant source of energy in the 21st century.

(source: http://www.researchandmarkets.com/research/6d59cc/the_solar_power_generation_technologies_market (last verified June 9, 2011)).

There are two main types of solar energy. One is photovoltaic energy, which directly converts the sun’s heat into energy. The other type is concentrating solar power (CSP), which focuses the sun’s energy into boiling water, which is then used to provide power to practical applications. Photovoltaics were commonly used to power small and medium sized devices, such as solar calculators, for many years. Today, it is common to see water heaters in homes powered by independent solar panels, located on a house’s roof. Residential solar powered systems, which provide full electricity to a residence, are also becoming more common.

In residential applications, solar energy could be provided by on-grid or off-grid systems. On-grid systems are generally used to work with a city or town’s power grid. Sunlight can be used as electricity during the day, and at night, when no solar energy is being produced, the grid system is switched on. Off-grid systems, also known as independent solar systems, completely use the power of the sun to provide electricity to a residence. These systems use a battery to store energy when the sun is not generating electricity. In order to capture enough sunlight to generate electricity, these systems are typically very large, and are able to produce and store enough wattage to power a home in times without a lot of sunlight. Hybrid systems combine the two systems, and would be very useful if one would never want to risk losing electricity due to lack of sunlight. With hybrid systems, a battery would be used to store electricity when there is no sunlight, but if there is no sunlight for extended periods of time, and the battery would be used up, the grid system would be tapped into, and electricity from that medium would be used until the sunlight can produce electricity for the home again.

Solar Cells

Solar Cells, also known as photovoltaic cells, are used commonly in new technologies to provide electricity and other types of power to residential and commercial applications. In solar panels, solar cells are combined to harness the energy of the sun, and redirect it into energy for daily use. Currently, solar technology is limited in capability. A single solar panel can only produce a limited amount of power, because each panel can only hold a certain amount of cells. When installations of solar panels occur, several panels are installed, known as a photovoltaic array. Installing a number of panels would make it more likely that the solar cells would be fit for normal usage.

7

A simple explanation of how sunlight is converted to energy is as follows:

- Photons in sunlight hit the solar panel and are absorbed by semiconducting materials, such as silicon.

- Electrons (negatively charged) are knocked loose from their atoms, allowing them to flow through the material to produce electricity. Due to the special composition of solar cells, the electrons are only allowed to move in a single direction.

- An array of solar cells converts solar energy into a usable amount of direct current (DC) electricity.

Solar cells use photons, also known as light energy, to generate electricity. This is known as the photovoltaic effect. Solar cells themselves are made up of modules made mostly of a wafer-based silicon. Crystalline Silicon, which is commonly used in the wafer-form in photovoltaic modules (PV modules), is derived from silicon, a commonly used semi-conductor.

Solar cells use light-absorbing materials contained within the cell structure to absorb photons and generate electrons through the photovoltaic effect. These materials have the capability of absorbing the wavelengths of solar light that reach the earth’s surface. Some are also optimized to take advantage of solar light beyond the earth’s atmosphere. Light absorbing materials can often be used in multiple physical configurations to take advantage of different light absorption and charge separation mechanisms.

Currently, the most widely used bulk material for solar cells is crystalline silicon (c-Si), also known as solar grade silicon. Crystalline silicon is broken down into two main categories: monocrystalline silicon and polycrystalline silicon. Monocrystalline (single crystal wafer cells) is the most expensive because they are the most efficient type of silicon for solar cells. Polycrystalline cells are more common and are cheaper.

When solar cells are used in practical applications, they must be connected to one another and to the entire system, both by structural links and parallel links. Since wafer-based silicon cells are brittle, they must be protected from damage during all stages of its life, including manufacturing, transport, installation, and use. Since solar panels are very fragile, they always must be handled with extreme care. Additionally, the cells cannot come in contact with moisture, or else extreme damage may be caused and may deem the cells ineffective or useless.

Advantages and Disadvantages of Solar Energy

Solar energy generated through PV systems has several advantages compared to conventional and other renewable sources of electricity including security, system reliability, low maintenance, modularity and flexibility of design, as well as significant environmental benefits. PV systems also support the trend toward distributed (point-of-use) power generation. Capacity constraints, increased demand for power reliability, and the challenges of building new centralized power plants will increase the demand for distributed power generation.

Solar energy generated through PV systems also has certain disadvantages. Perhaps the most significant drawback of PV systems is the high initial cost of individual systems. Solar power can cost twice as much as grid power. This is due almost entirely to the high cost of PV cells, which depend upon the cost and availability of semiconductor grade silicon. While technical developments are underway in thin film, membrane and other non-crystalline based materials, over 90% of the industry currently relies upon crystalline silicon cells.

Challenges Facing Solar Power

Decrease Per Kilowatt-hour Cost to Customer. In most cases, the current cost of solar electricity is greater than the cost of retail electricity from the utility network. While government programs and consumer preference have accelerated the use of solar power for on-grid applications, product cost remains one of the largest impediments to growth. To provide an economically attractive alternative to conventional electricity network power, the solar power industry must continually reduce manufacturing and installation costs.

8

Achieve Higher Conversion Efficiencies. Increasing the conversion efficiency of solar cells reduces the material and assembly costs required to build a solar panel with a given generation capacity. Increased conversion efficiency also reduces the amount of rooftop space required for a solar power system, thus lowering the cost of installation per consumer.

Improve Product Appearance. Many believe that aesthetics are a barrier to wider adoption of solar power products particularly among residential consumers. Historically, residential and commercial customers have resisted solar power products, in part, because most solar panels are perceived as unattractive.

Efficiently Use Polysilicon. There is currently an industry-wide shortage of polysilicon, an essential raw material in the production of solar cells. Given this demand and supply imbalance, we believe that the efficient use of polysilicon, for example through the reduction of wafer thickness, will be critical for the continued growth of the solar power industry.

(source: http://apps1.eere.energy.gov/solar/cfm/faqs/third_level.cfm/name=Photovoltaics/cat=The%20Basics; see also: http://www.epia.org/solar-pv/the-sun.html (last verified on June 9, 2011))

Government and Economic Incentives and Education Initiatives in Jamaica

Activities of the Petroleum Corporation of Jamaica

The Petroleum Corporation of Jamaica (PCJ) is a state owned corporation with the exclusive right to explore for oil, to develop Jamaica's petroleum resources and to enter all stages of the petroleum industry. In 1995 PCJ was mandated to develop indigenous renewable energy resources, to prevent adverse effects on the environment and to assist the government in realizing the goals of the Jamaica Energy Sector Policy.

PCJ acknowledges the economic burden of imported petroleum, and that, given an infant renewable energy market, improving energy efficiency and conservation at all levels of the economy presents the most cost-effective and quick treatment to the problem. (see “Opening Remarks by Dr. Ruth Potopsingh Group Managing Director of the Petroleum Corporation of Jamaica, April 16, 2008 at the Seminar entitled “Building Human Resource Capacities for Renewable Energy Development”).

(source: http://www.pcj.com/dnn/Portals/0/Documents/Speech%20MexicoJamaica%20-%20April%2016.pdf (last verified June 9, 2011))

Accordingly, PCJ has promoted energy efficiency and conservation practices as an integral part of its mission. PCJ’s mission focuses on public education initiatives supplemented by the import and installation of compact florescent lamps, solar water heaters, energy audits in public sector agencies and a comprehensive hospitals energy efficiency program. These activities have been funded by the Government of Jamaica and the United Nations Development Program (Jamaica). PCJ has further stimulated the local solar power market by founding the Jamaica Solar Energy Association, a non-governmental organization made up of manufacturers, retailers, marketers, installers and providers of solar energy, and academics. The Jamaica Solar Energy Association holds regular seminars on energy conservation and advocates on behalf of the industry, generally.

(source: http://www.pcj.com/dnn/RenewalEnergy/tabid/69/Default.aspx.(last verified June 9, 2011))

PCJ also operates an Energy Efficiency Unit that regularly installs solar PV systems (lighting and water heaters) at key infrastructure locations, namely hospitals and public spaces. Most recently, in addition to numerous solar power research and planning initiatives, PCJ has secured preliminary approval for funding through the PETROCARIBE for the development of a number of solar projects including.

9

· Grid-Tie PV systems for Portmore communities

· Stand alone PV systems for rural communities that are off the electrical grid

· A solar PV and solar water heater manufacturing facility

· Solar design and technologies capacity training

· Solar PV systems for schools in Jamaica

(source: http://www.pcj.com/dnn/RenewalEnergy/Solar/tabid/113/Default.aspx. (last verified June 9, 2011))

Our management believes that the public awareness and power grid infrastructure improvements resulting from the activities of PCJ provide invaluable support for the private market for solar energy products in Jamaica, generally.

National Housing Trust of Jamaica Loan Programs

The National Housing Trust of Jamaica Loan Programs (NHT) is a statutory body mandated to increase and enhance the stock of available housing in Jamaica as well as to financial assistance to its contributors who wish to build, to buy or to repair their homes. NHT generates funding for the housing construction sector and promotes improved building systems and greater efficiency within the industry. NHT is primarily funded by deductions from employers and the self-employed as well as from employees and voluntary contributors.

Solar Water Heater Loans

NHT administers a loan program for its contributors to facilitate the purchase and installation of solar water heating systems. Eligible homeowners may access loan facilities of up to $250,000 (Jamaican Dollars) carrying an interest rate of three percent repayable with five years. A five percent service charge is applicable. Over 1,300 homeowners have benefited from the program since its inception in 2006.

(source: http://www.nht.gov.jm/media-room/media-queries/performance-solar-water-heater-loan) (last verified June 9, 2011))

Solar Panel Loans

NHT also administers a loan program for homeowners and recognized institutions for buying and installing solar electricity panels. The solar panel loan program is accessible by any NHT contributor who has not previously received an NHT loan and offers financing of up to $1.2 million (Jamaican Dollars) for sole applicants and $2.4 million (Jamaican Dollars) for joint-applicants. Interest rate range from 2% to 8% over a maximum loan term of 15 years. Financed solar panel systems do not have to be installed on the property that is being used as security.

(source: http://www.nht.gov.jm/loans/need-a-loan/solar-panel. (last verified June 9, 2011))

Jamaica National Building Society Loan Program

In June, 2009 the Jamaica National Building Society, a private financial institution, launched a loan program under accessible by homeowners to make their homes greener. The program covers the purchase and installation of photovoltaic systems to produce solar electricity as well as energy efficient fixtures, windows and roofing.

(source: http://www.jnbs.com/dynaweb.dti?dynasection=news&dynapage=news_media&id=1035. (last verified June 9, 2011) ).

10

Caribbean Regional Initiatives

In April, 2010, the Inter-American Development Bank (IDB), the leading source of long-term lending for Latin America and the Caribbean, announced its intention to increase its financing for renewable energy and climate-related projects to $3 billion a year by 2012. According to the IDB, the expanded lending will allow the bank to focus on four broad areas: stepping up renewable energy investments in its poorest member countries; fostering energy integration throughout Latin America and the Caribbean; promoting energy efficiency measures across the region and helping governments establish climate change mitigation and adaptation frameworks. IDB lending for energy-related projects was estimated at $1.5 billion in 2010, up from $457million approved in 2008.

(source: http://www.iadb.org/news-releases/2010-04/english/idb-to-expand-lending-for-renewable-energy-and-climaterelated-projects-in-latin-6982.html. (last verified June 9, 2011))

The IDB has supported a wide range of renewable energy development programs across the Caribbean, including numerous solar energy studies and installations. Our management believes that the IDB will continue to be an invaluable source of financing for projects that result in open procurement tenders across the Caribbean, in turn providing sales opportunities for distributors and installers of renewable energy technology.

The initiatives of the Caribbean Renewable Energy Fund (CREF) also promise to create tender opportunities for the supply of renewable energy technologies in the Caribbean. Administered by The Caribbean Community (CARICOM), an organization of 15 Caribbean nations and dependencies including Jamaica. CREF seeks to provide equity and debt financing to renewable energy projects, often co-investing with regional financial institutions. CREDP eligible projects include solar water heating and photovoltaics for off-grid rural electrification.

Principal Products

Initially we intend to market and distribute solar home systems within the range of 750W to 4KW. These products have a wide range of power and can be used to power all electrical products in the home, depending on the devices used and amount of time the devices are used.

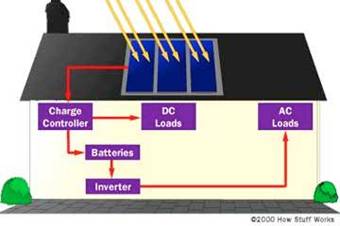

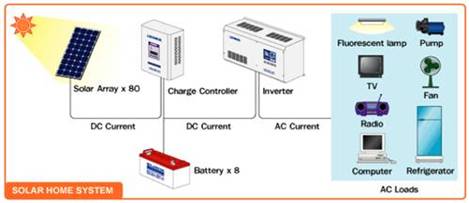

Our typical solar home system can be illustrated by the pictures below. When there is enough sunlight that reaches the solar panels, the solar cells will convert that to energy in the form of a DC current. The charge then travels to the charge controller, which ensures the entire system works correctly. It will help keep the charge flowing toward the battery, while not allowing any flow of energy to travel backwards. The voltage of the controller should always be higher than the voltage of any other component, in order to prevent short circuits. Additionally, the controller prevents the battery from overcharging after the battery reaches maximum capacity. It also prevents the battery from draining too much power, and is preset to do so. Both of these will help maintain the battery throughout its entire lifespan.

After the flow of energy leaves the controller, it travels to the battery, where it is stored. With systems with batteries, energy can be stored for times when the sun isn’t available. The bigger the battery is, the more energy that can be stored. All solar systems such as these use lead-acid batteries, which are extremely heavy and are not for use with other types of applications.

After the energy reaches the battery, it then travels to the inverter, which converts DC power into AC power, which is used by common electrical devices.

11

We expect that all of our systems will include all parts for installation, including solar panels, batteries, controller, inverter, and cables.

Below are the components for each of our proposed systems. Also noted are manufacturer examples of common electrical devices supported by our proposed systems and manufacturer estimates of how long each device can be used in one day (watt hours = total watts x total hours used) with a particular system.

Some notes to consider regarding solar systems:

- Kilowatt hours (kwh) is amount of kilowatts used by a certain device multiplied by amount of hours used multiplied by 1000

- The amount of time it takes to charge a battery from empty to capacity varies greatly on factors such as amount of direct sunlight, strength of sunlight, amount of panels used, and capacity of battery

- The larger the battery, the more kilowatt hours it can store, but it will take more time to charge the battery to capacity

- The charge controller doesn’t allow the battery to run to empty. It typically will only allow it to run to 30% of capacity before shutting down the system. This helps greatly prolong battery lifespan

- For a two kilowatt system using 12 lead acid batteries at 1500 amp hours, it typically takes 10 hours of direct strong sunlight to charge from 30% capacity to 100% capacity

- Different devices use different amounts of watt hours. Typically an air conditioner uses the most energy in the house of any common appliance.

- Each lead acid battery can typically hold 3 kilowatt hours (3000 watt hours) of energy. A system that uses 12 lead acid batteries can hold 36 kilowatt hours of energy. However, due to the fact that the batteries will not run completely dry, only about 70% of that can be used before the controller shuts down the batteries for further use.

12

|

750W System |

|

|

|

|

|

Items |

Rated Watt |

Quantity |

Working Time |

Consumption |

|

Light |

11 |

6 |

4 |

264 |

|

Computer |

100 |

1 |

5 |

500 |

|

Printer |

30 |

1 |

1 |

30 |

|

Fax |

150 |

1 |

1 |

150 |

|

TV receiver |

25 |

1 |

6 |

150 |

|

TV (21") |

70 |

1 |

6 |

420 |

|

water pump |

200 |

1 |

0.5 |

100 |

|

Total |

641 |

12 |

|

1614 |

|

System components |

|

|

| |

|

Items |

Total capacity |

Model |

Power |

Quantity (PCS) |

|

Polycrystalline solar panels |

720WP |

PS180-24P |

180W |

4 |

|

Lead-acid battery |

400AH/24V |

GP200 |

200AH/12V |

4 |

|

Controller/Inverter |

750W |

PCN751024D |

750W/24V |

1 |

|

Brackets and cables |

|

|

|

1 set |

|

Certificates |

CE&RHOS |

|

|

|

|

Quality Assurance |

Solar panels:20 years; Battery: 1year,Inverter:1 year | |||

|

2KW System |

|

|

|

|

|

Items |

Rated Watt (W) |

Quantity (pcs) |

Working Time (hour) |

Consumption (wh) |

|

Light |

11 |

6 |

4 |

264 |

|

Computer |

100 |

1 |

5 |

500 |

|

Printer |

30 |

1 |

1 |

30 |

|

Fax |

150 |

1 |

1 |

150 |

|

Refrigerator |

100 |

1 |

24 |

2400 |

13

|

Washing machine |

300 |

1 |

1 |

300 |

|

Microwave oven |

1000 |

1 |

1 |

1000 |

|

TV receiver |

25 |

1 |

6 |

150 |

|

TV (21") |

70 |

1 |

6 |

420 |

|

water pump |

200 |

1 |

0.5 |

100 |

|

Total |

2041 |

15 |

|

5314 |

|

System components |

|

|

|

|

|

Items |

Total capacity |

Model |

Power |

Quantity (PCS) |

|

Pollycrystalline Solar panels |

2160WP |

PS180-24P |

180W |

12 |

|

Storage battery |

1500AH/24V |

GP1500 |

1500AH/24V |

12 |

|

Controller |

100A/24V |

PC10024 |

2400W/24V |

1 |

|

Inverter |

2KW |

PN50220C |

2KW/220V |

1 |

|

Brackets and cables |

|

|

|

1 Set |

|

Certificates |

CE&RHOS |

|

|

|

|

Quality Assurance |

Solar panels: 20 years; Battery: 1 year,Controller and inverter: 1 year | |||

|

3KW System |

|

|

|

|

|

Items |

Rated Watt (W) |

Quantity (pcs) |

Working Time (hour) |

Consumption (wh) |

|

Light |

11 |

8 |

6 |

528 |

|

Computer |

100 |

2 |

5 |

1000 |

|

Printer |

250 |

1 |

1 |

250 |

|

Fax |

150 |

1 |

2 |

300 |

|

Refrigerator |

100 |

1 |

24 |

2400 |

|

Washing machine |

300 |

1 |

1 |

300 |

|

Microwave oven |

1000 |

1 |

1 |

1000 |

|

TV receiver |

25 |

1 |

6 |

150 |

14

|

TV (21") |

95 |

1 |

6 |

570 |

|

water pump |

400 |

1 |

1 |

400 |

|

Total |

2508 |

18 |

|

6898 |

|

System components |

|

|

|

|

|

Items |

Total capacity |

Model |

Power |

Quantity (PCS) |

|

Pollycrystalline Solar panels |

2600WP |

260-24 |

210W |

10 |

|

Storage battery |

1500AH/24V |

SB1500 |

1500AH/24V |

12 |

|

Controller |

100A/24V |

CT10024 |

2400W/24V |

1 |

|

Inverter |

3000KW |

In302048 |

2KW/220V |

1 |

|

Brackets and cables |

|

|

|

1 Set |

|

Certificates |

CE&RHOS |

|

|

|

|

Quality Assurance |

Solar panels: 20 years; Battery: 1 year,Controller and inverter: 1 year | |||

|

4KW System |

|

|

|

|

|

Items |

Rated Watt (W) |

Quantity (pcs) |

Working Time (hour) |

Consumption (wh) |

|

Light |

11 |

8 |

6 |

528 |

|

Computer |

100 |

2 |

5 |

1000 |

|

Printer |

250 |

1 |

1 |

250 |

|

Fax |

150 |

1 |

1 |

150 |

|

Refrigerator |

100 |

1 |

24 |

2400 |

|

Washing machine |

300 |

1 |

1 |

300 |

|

Microwave oven |

1000 |

1 |

1 |

1000 |

|

air conditioner |

1200 |

1 |

5 |

3000 |

|

TV receiver |

25 |

1 |

6 |

150 |

|

TV (21") |

95 |

1 |

6 |

570 |

|

water pump |

400 |

1 |

1 |

400 |

|

Total |

3708 |

19 |

|

9748 |

|

System components |

|

|

|

|

|

Items |

Total Capacity |

Model |

Power |

Quantity (PCS) |

|

Pollycrystalline solar panels |

3960WP |

PS180-24P |

180W |

22 |

|

Lead-acid battery |

1500AH/48V |

GP1500 |

1500AH/2V |

24 |

|

Controller |

100A/48V |

PC10048 |

4800W/48V |

1 |

|

Inverter |

3KW |

PN15220C |

3KW/220V |

1 |

|

Brackets and cables |

|

|

|

1 Set |

|

|

|

|

| |

|

Certificated |

CE&RHOS |

|

|

|

|

Quality Assurance |

Solar panels: 20 years; Battery: 1 year,Controller and inverter: 1 year | |||

15

We anticipate that each of our proposed systems can be independent systems (off-grid) or can be hybrid systems. Our proposed hybrid systems would allow for the solar panel to connect to a grid, but still use the power from the solar panels. When the battery runs dry from the energy from the solar cells, the residence can tap into grid system for alternative power. This way, the home will always have the use of electricity even when there may be no sun for longs periods of time. The cost of converting an independent system into a hybrid system is minimal.

Markets, Customers and Distribution

We plan on testing the market first with the two kilowatt series of products as they offer the Jamaican market the most competitively priced product. Conducting a test and market analysis will allow us to better understand our target market and to better outline our marketing plan and sales strategies. Our initial plan and offering will be to market to residents, businesses, governments, contractors, builders, and related supply stores. This will also allow us to market and target a larger audience and thus eliminating any dependence on one or a few major customers.

In marketing our products we anticipate relying on the following channels:

- Trade Shows – We expect that participating in trade shows will allow us to showcase our products, make contact with industry leaders, and keep abreast with the changes and advancements in product selection, manufacturing, and delivery.

- Telephone solicitations – We anticipate hiring in-house sales representatives who will contact potential clients directly through the telephone. Our management believes that telephone solicitation will be an effective marketing tool in Jamaica for direct sales of our products.

- Direct mail – We anticipate also contacting potential customers through direct mail with advertising in the form of brochures and information leaflets. We may include coupons, direct sales offers, selecting the audience by name, and set whatever distribution schedule is most desirable, without being constrained by the publication or broadcast schedules of the major media.

- Personal visits from sales representatives – We anticipate also contacting potential customers through direct visits from our sales representatives. We believe that the benefits provided by personal visits will allow for efficiency, smooth operation, and put us in direct contact with the clients and major decision-makers.

- Website – We expect to develop a website to act as a major source of information and sales. Use of the Internet is growing in Jamaica and more and more people are using it in place of the traditional methods to look for services and even to do their shopping.

- Traditional Advertising – Magazine and newspaper advertising is an effective way of reaching an audience that is interested in solar energy products.

- Distribution Channels – We will attempt to enter into agreements with existing Jamaican retailers who have already established a clientele. Complementary product channels will be targeted such as home improvement stores and environmentally conscious stores.

16

We intend to provide a competitive warranty replacement and repair service for our products. Typically, solar panels can run for 20 to 30 years before they wear out. Currently, our manufacturer guarantees the solar panels for 20 years. Other parts, such as the battery, controller, and inverter are guaranteed for one year. However, limited quality assurance provisions apply only to the original owners, as the warranties being offered will be non-transferable to third parties. The warranty service will require the need to provide proof of purchase of all products. Our warranty will apply to the normal operating state of the hardware. If we are obligated to repair or replace any of our products our operating costs could increase if the actual costs differ materially from our estimates, which could prevent us from becoming profitable.

Suppliers

The products that we intend to offer are designed and assembled in Pingshan District in Shenzhen, Guangdong Province, China by Shenzhen Commonpraise Solar Co., Ltd. where various types of solar products, including solar water heaters, residential and commercial powered-systems, LED products, and solar powered streetlights are manufactured. Shenzhen Commonpraise’s main products are flat panel solar collectors, stainless steel water tanks, enamel water tanks, split solar water heaters, heat pumps, and solar air collectors. With more than ten years of experience in the solar field, Shenzhen Commonpraise provides Original Equipment Manufacturer and Original Design Manufacturer service for its clients.

On January 6, 2011 we entered into an exclusive distribution agreement with Shenzhen Commonpraise for the distribution of Shenzhen Commonpraise products in Jamaica. Pursuant to the agreement, we were to purchase not less than 10 industrial or commercial solar energy systems from Shenzhen Commonpraise within a six month period following the date of the agreement. Exclusivity under the agreement would be effective for the initial 6 months period following our purchase of a solar energy system of not less than 2 KW. If we were successful in meeting the 10 system quota, the exclusive distribution arrangement would be extended for an additional 12 month period. If we are not successful, we would revert back to a non-exclusive distribution arrangement with Shenzhen Commonpraise. On July 6, 2011, our company had not purchased 10 systems and the exclusive agreement was voided. Our company will continue to act as a distributor of systems on a non-exclusive basis.

Pursuant to our arrangement with Shenzhen Commonpraise, Shenzhen Commonpraise will supply us with private label branded products (products bearing our name or trademarks) on an as needed basis. We believe that our anticipated ability to sell products branded with our name or trademark will serve as a valuable marketing tool that will distinguish us from competing distributors and re-sellers. To date, we have purchased a 1.5KW system from Shenzhen Commonpraise Solar Co., Ltd. for testing, marketing and display purposes.

In addition, we have also identified an alternative solar equipment provider: US Solar Institute, based in Fort Lauderdale, Florida. As of October 28, 2011, we have purchased a 2,500 watt Grid system from them. Having access to two suppliers now allows us to be in a better position to offer our customers with up to date solar equipment at competitive prices. However, we continue to seek out new suppliers with new technology and competitive pricing.

Although we anticipate that Shenzhen Commonpraise will provide us with a reliable product supply, and although we have now identified a comparable alternative supplier who may agree to provide us with products should we be unable to maintain our relationship with Shenzhen Commonpraise, but there is no guarantee that we will be successful in obtaining or maintaining an adequate supply of products, which could harm our business and decrease our ability to operate profitably.

17

Competition and Barriers to Entry

We face competition from various companies focusing on the residential home solar system market in Jamaica. Currently the primary market of solar systems in Jamaica lies in water heating, rather than powering the entire home with electricity. We face competition from domestic and international companies actively engaged in the manufacturing and distribution of solar PV systems, as well as from emerging technology companies that may become viable in the next several years.

Currently, the competition in the Jamaican Solar PV market includes organizations such as Isratech Jamaica Ltd., Sky Energy, S.A., Sun Source Technologies, A To B Industries, Alternative Energy Plus, Alternative Power Sources, Ltd., Alternex Energy Systems, Automatic Control Engineering Ltd., Caribbean Solar Engineering Co. Ltd., Energy Sources Jamaica, Gensol Energy Systems, and Solar and Fire Protection Services Ltd. Many of these companies have been in business for several years and are experienced in all types of renewable energy platforms.

Many of our competitors have longer operating histories, better brand recognition and greater financial resources than we do. In order for us to successfully compete in our industry we will need to:

- establish our products’ competitive advantage with retailers and customers;

- develop a comprehensive marketing system; and

- increase our financial resources.

However, there can be no assurance that even if we do these things we will be able to compete effectively with the other companies in our industry.

We believe that we will be able to compete effectively in our industry because of a competitive advantage offered by our products. We believe that our proposed residential-integrated solar roofing products have advantages over most other PV product offerings. In certain cases, competitors produce modules that are installed incorrectly, with inferior materials, creating potential damage to the structure, generating maintenance problems and detracting from their visual appearance. Our proposed PV product offerings differ in this respect because they maximize power output using the latest generation PV cells in an innovative design that incorporates ultra-thin, invisible connectors between cells. This new connector design reduces power losses and increases efficiency. We will attempt to inform our potential customers of these competitive advantages and establish a developed distribution network based on various marketing techniques and positive word of mouth advertising.

However, as we are a newly-established company, we face the same problems as other new companies starting up in an industry, such as lack of available funds. Our competitors may be substantially larger and better funded than us, and have significantly longer histories of research, operation and development than us. In addition, they may be able to provide more competitive products than we can and generally be able to respond more quickly to new or emerging technologies and changes in legislation and regulations relating to the industry. Additionally, our competitors may devote greater resources to the development, promotion and sale of their products or services than we do. Increased competition could also result in loss of key personnel, reduced margins or loss of market share, any of which could harm our business.

Barriers to entering the solar PV module include the technical know-how required to produce solar cells that maintain acceptable efficiency rates at competitive production, marketing, and distribution costs. In addition, any new PV solar technology would require successful demonstration of reliability testing prior to widespread market acceptance. The principal competitive factors in the market for solar electric power products are: price per watt, long-term stability and reliability, conversion efficiency and other inherent performance measures, ease of handling and installation, product quality, reputation, and environmental factors.

18

Intellectual Property

We have not filed for any protection of our trademark, and other than copyright in the contents of our website, www.degaroinnovations.com, we do not own any intellectual property. Over the next 12 months, we intend to trademark our company name and logo for the Jamaican and Caribbean markets.

Purchase of Significant Equipment

We do not intend to purchase any significant equipment over the twelve months ending July 31, 2013.

Research and Development

We have not incurred any research and development expenses for our past two fiscal years.

Government Regulations

We are not aware of any government regulations which will have a material impact on our operations.

Environmental Regulations

We are not aware of any material violations of environmental permits, licenses or approvals that have been issued with respect to our operations. We expect to comply with all applicable laws, rules and regulations relating to our business, and at this time, we do not anticipate incurring any material capital expenditures to comply with any environmental regulations or other requirements.

While our intended projects and business activities do not currently violate any laws, any regulatory changes that impose additional restrictions or requirements on us or on our potential customers could adversely affect us by increasing our operating costs or decreasing demand for our products or services, which could have a material adverse effect on our results of operations.

Employees

As of November 13, 2012, we did not have any full-time or part-time employees. Our sole director and officers works as part-time consultants in the areas of business development and management and contributes approximately 30% of their time to us.

We plan to engage either employees or independent contractors in the areas of marketing and sales including at least 2 part time consultants who will each focus on sales, marketing, and installation.

19

REPORTS TO SECURITY HOLDERS

We are required to file annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission and our filings are available to the public over the internet at the Securities and Exchange Commission’s website at http://www.sec.gov. The public may read and copy any materials filed by us with the Securities and Exchange Commission at the Securities and Exchange Commission’s Public Reference Room at 100 F Street N.E. Washington D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the Securities and Exchange Commission at 1-800-732-0330. The SEC also maintains an Internet site that contains reports, proxy and formation statements, and other information regarding issuers that file electronically with the SEC, at http://www.sec.gov.

Item 1A. Risk Factors

As a “smaller reporting company”, we are not required to provide the information required by this Item.

Item 1B. Unresolved Staff Comments

As a “smaller reporting company”, we are not required to provide the information required by this Item.

Item 2. Properties

Our executive office is located at Lot 107 Roaring River Steer Town P.O St. Ann J.W., Jamaica. This office is approximately 400 square feet in size and is provided to us free of charge by our sole director. As of

November 13, 2012, we had not entered into any lease agreement for the office. We do not plan to recognize any rent expenses for this office.

Item 3. Legal Proceedings

We know of no material, existing or pending legal proceedings against our company, nor are we involved as a plaintiff in any material proceeding or pending litigation. There are no proceedings in which any of our directors, officers or affiliates, or any registered or beneficial stockholder, is an adverse party or has a material interest adverse to our interest.

Item 4. Mine Safety Disclosures

Not applicable.

20

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Our common stock is not traded on any exchange. We intend to engage a market maker to apply to have our common stock quoted on the OTC Bulletin Board once this Registration Statement has been declared effective by the SEC; however, there is no guarantee that we will obtain a listing.

There is currently no trading market for our common stock and there is no assurance that a regular trading market will ever develop. OTC Bulletin Board securities are not listed and traded on the floor of an organized national or regional stock exchange. Instead, OTC Bulletin Board securities transactions are conducted through a telephone and computer network connecting dealers. OTC Bulletin Board issuers are traditionally smaller companies that do not meet the financial and other listing requirements of a regional or national stock exchange.

To have our common stock listed on any of the public trading markets, including the OTC Bulletin Board, we will require a market maker to sponsor our securities. We have not yet engaged any market maker to sponsor our securities and there is no guarantee that our securities will meet the requirements for quotation or that our securities will be accepted for listing on the OTC Bulletin Board. This could prevent us from developing a trading market for our common stock.

As of November 13, 2012, there were approximately 45 holders of record of our common stock. As of such date, 51,155,000 common shares were issued and outstanding.

Dividend Policy

We have not paid any cash dividends on our common stock and have no present intention of paying any dividends on the shares of our common stock. Our current policy is to retain earnings, if any, for use in our operations and in the development of our business. Our future dividend policy will be determined from time to time by our board of directors.

Recent Sales of Unregistered Securities; Use of Proceeds from Registered Securities

We did not sell any equity securities which were not registered under the Securities Act during the year ended

July 31, 2012 that were not otherwise disclosed on our quarterly reports on Form 10-Q or our current reports on Form 8-K filed during the year ended July 31, 2012.

Equity Compensation Plan Information

Except as disclosed herein, we do not have a stock option plan in favor of any director, officer, consultant or employee of our company.

Convertible Securities

Except as disclosed herein, we do not have any outstanding convertible securities.

Purchase of Equity Securities by the Issuer and Affiliated Purchasers

We did not purchase any of our shares of common stock or other securities during our fourth quarter of our fiscal year ended July 31, 2012.

21

Item 6. Selected Financial Data

As a “smaller reporting company”, we are not required to provide the information required by this Item.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion should be read in conjunction with our audited financial statements and the related notes for the years ended July 31, 2012 and July 31, 2011 that appear elsewhere in this annual report. The following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward looking statements. Factors that could cause or contribute to such differences include, but are not limited to those discussed below and elsewhere in this annual report.

Our audited financial statements are stated in United States Dollars and are prepared in accordance with United States Generally Accepted Accounting Principles.

Purchase of Significant Equipment

We do not intend to any significant equipment over the next twelve months.

Results of Operations

For the Years Ended July 31, 2012 and 2011 are outlined in the table below:

|

|

Year Ended |

|

Year Ended July 31, 2011 | ||

|

Revenue |

$ |

Nil |

|

$ |

Nil |

|

Operating expenses |

$ |

43,914 |

|

$ |

58,446 |

|

Interest expense |

$ |

4,258 |

$ |

- | |

|

Net loss |

$ |

(48,172) |

|

$ |

(58,446) |

Revenue

We have earned no revenue since our inception.

Expenses

Our operating expenses for the years ended July 31, 2012 and 2011 are outlined in the table below:

|

|

Year Ended |

|

Year Ended July 31, 2011 | ||

|

General and administrative |

$ |

12,023 |

|

$ |

11,554 |

|

Depreciation expense |

$ |

1,690 |

|

$ |

773 |

|

Professional fees |

$ |

30,201 |

|

$ |

46,119 |

Operating expenses for year ended July 31, 2012 decreased by $14,532 as compared to the comparative period in 2011 primarily as a result of a decrease in professional fees.

Equity Compensation

As at July 31, 2012, we did not have any stock option or equity compensation plans or arrangements.

22

Liquidity and Financial Condition

|

Working Capital |

|

|

|

|

|

|

|

|

At |

|

At | |

|

Current Assets |

$ |

1,572 |

|

$ |

4,387 |

|

Current Liabilities |

$ |

77,280 |

|

$ |

31,936 |

|

Working Capital (Deficit) |

$ |

(75,708) |

|

$ |

(27,549) |

|

Cash Flows |

|

|

|

|

|

|

|

|

Year Ended July 31, 2012 |

|

|

Year Ended July 31, 2011 |

|

Net Cash used in Operating Activities |

$ |

(40,242) |

|

$ |

(45,800) |

|

Net Cash used in Investing Activities |

$ |

(5,935) |

|

$ |

(12,370) |

|

Net Cash Provided by Financing Activities |

$ |

43,362 |

|

$ |

19,213 |

|

Increase (Decrease) in Cash During the Period |

$ |

(2,815) |

|

$ |

(38,957) |

We estimate that our expenses over the next 12 months will be approximately $215,000 as described in the table below. These estimates may change significantly depending on the performance of our products in the marketplace and our ability to raise capital from shareholders or other sources.

|

Description |

Estimated Completion Date |

Estimated Expenses |

|

Legal and accounting fees |

12 months |

45,000 |

|

Product acquisition, testing and servicing costs |

12 months |

45,000 |

|

Marketing and advertising |

12 months |

30,000 |

|

Investor relations and capital raising |

12 months |

10,000 |

|

Management and operating costs |

12 months |

15,000 |

|

Salaries and consulting fees |

12 months |

15,000 |

|

Fixed asset purchases for distribution centers |

12 months |

20,000 |

|

General and administrative expenses |

12 months |

20,000 |

|

Total |

|

215,000 |

We intend to meet our cash requirements for the next 12 months through a combination of debt financing and equity financing by way of private placements. We currently do not have any arrangements in place to complete any private placement financings and there is no assurance that we will be successful in completing any private placement financings on terms that will be acceptable to us. We may not raise sufficient funds to fully carry out our business plan.

Future Financings

We will require additional financing in order to enable us to proceed with our plan of operations, as discussed above, including approximately $215,000 over the next 12 months to pay for our ongoing expenses. These expenses include legal, accounting and audit fees as well as general and administrative expenses. These cash requirements are in excess of our current cash and working capital resources. Accordingly, we will require additional financing in order to continue operations and to repay our liabilities. There is no assurance that any party will advance additional funds to us in order to enable us to sustain our plan of operations or to repay our liabilities.

23

We anticipate continuing to rely on equity sales of our common stock in order to continue to fund our business operations. Issuances of additional shares will result in dilution to our existing stockholders. There is no assurance that we will achieve any additional sales of our equity securities or arrange for debt or other financing to fund our planned business activities.

We presently do not have any arrangements for additional financing for the expansion of our exploration operations, and no potential lines of credit or sources of financing are currently available for the purpose of proceeding with our plan of operations.

Contractual Obligations

As a “smaller reporting company”, we are not required to provide tabular disclosure obligations.

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to stockholders.

Critical Accounting Policies

We have implemented all new accounting pronouncements that are in effect and that may impact our consolidated financial statements and we do not believe that there are any other new accounting pronouncements that have been issued that might have a material impact on our financial position or results of operations.

Use of Estimates

The preparation of consolidated financial statements in conformity with United States generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. Our company regularly evaluates estimates and assumptions related to useful life of long-lived assets and deferred income tax asset valuation allowances. Our company bases its estimates and assumptions on current facts, historical experience and various other factors that it believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities and the accrual of costs and expenses that are not readily apparent from other sources. The actual results experienced by our company may differ materially and adversely from our company’s estimates. To the extent there are material differences between the estimates and the actual results, future results of operations will be affected.

Property and Equipment

Property and equipment are recorded at cost. Depreciation is provided over the estimated useful lives of the related assets using the straight-line method for financial statement purposes. Our company uses other depreciation methods (generally, accelerated depreciation methods) for tax purposes where appropriate. Repairs and maintenance are expensed as incurred. Expenditures that increase the value or productive capacity of assets are capitalized. When property and equipment are retired, sold, or otherwise disposed of, the asset’s carrying amount and related accumulated depreciation are removed from the accounts and any gain or loss is included in operations. Our company reviews the carrying value of property, plant, and equipment for impairment whenever events and circumstances indicate that the carrying value of an asset may not be recoverable from the estimated future cash flows expected to result from its use and eventual disposition. In cases where undiscounted expected future cash flows are less than the carrying value, an impairment loss is recognized equal to an amount by which the carrying value exceeds the fair value of assets. The factors considered by management in performing this assessment include current operating results, trends, and prospects, as well as the effects of obsolescence, demand, competition, and other economic factors.

24

The estimated service lives of property and equipment are principally as follows:

Equipment 10 years

Revenue Recognition

Sales are recorded when products are shipped to customers. Provisions for discounts and rebates to customers, estimated returns and allowances, and other adjustments are provided for in the same period the related sales are recorded. No provision for discounts or rebates to customers, estimated returns and allowances or other adjustments were recognized during the periods ended July 31, 2012 and 2011. In instances where products are configured to customer requirements, revenue is recorded upon the successful completion of our company’s final test procedures and the customer’s acceptance. Revenues of $3,624 were deferred as the products were not shipped to the customers as at July 31, 2012 and 2011.

Recent Accounting Pronouncements

Our company has implemented all new accounting pronouncements that are in effect and that may impact its consolidated financial statements and does not believe that there are any other new accounting pronouncements that have been issued that might have a material impact on its financial position or results of operations.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

As a “smaller reporting company”, we are not required to provide the information required by this Item.

Item 8. Financial Statements and Supplementary Data

25

Degaro Innovations Corp.

(A Development Stage Company)

For the years ended July 31, 2012 and 2011

Index

Report of Independent Registered Public Accounting Firm ............................................................................................... F–1

Consolidated Balance Sheets................................................................................................................................................... F–2

Consolidated Statements of Operations................................................................................................................................. F–3

Consolidated Statement of Stockholders’ Deficit................................................................................................................. F–4

Consolidated Statements of Cash Flows................................................................................................................................ F–5

Notes to the Consolidated Financial Statements.................................................................................................................. F–6

26

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors

Degaro Innovations Corp.

(A Development Stage Company)

Steer Town PO, St. Ann, Jamaica

We have audited the accompanying consolidated balance sheets of Degaro Innovations Corp. (the “Company”) as of July 31, 2012 and 2011 and the related consolidated statements of operations, stockholders' deficit, and cash flows for the years then ended and the period from December 8, 2009 (inception) to July 31, 2012. These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the consolidated financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall consolidated financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of the Company as of July 31, 2012 and 2011, and the results of its operations and its cash flows for the years then ended and the period from December 8, 2009 (inception) to July 31, 2012 in conformity with accounting principles generally accepted in the United States of America.

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 1 to the consolidated financial statements, the Company has incurred losses since inception, and has not yet generated any revenue from operations, which raise substantial doubt about the Company’s ability to continue as a going concern. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ GBH CPAs, PC

GBH CPAs, PC

www.gbhcpas.com

Houston, Texas

November 13, 2012

27

Degaro Innovations Corp.

(A Development Stage Company)

Consolidated Balance Sheets

(Expressed in US Dollars)

|

|

July 31, 2012 |

July 31, 2011 | |

|

ASSETS |

|

| |

|

|

|

| |

|

Current Assets |

|

| |

|

Cash |

$ 1,572 |

$ 4,387 | |

|

|

|

|

|

|

Total Current Assets |

1,572 |

4,387 | |

|

Property and equipment, net |

15,842 |

11,597 | |

|

|

|

| |

|

Total Assets |

$ 17,414 |

$ 15,984 | |

|

|

|

| |

|

LIABILITIES AND STOCKHOLDERS’ DEFICIT |

|

| |

|

Current Liabilities |

|

| |

|

|

|

| |

|

Accounts payable and accrued liabilities |

$ 10,231 |

$ 8,249 | |

|

Related party payables |

20,874 |

7,716 | |

|

Loan payable |

42,551 |

12,347 | |

|

Deferred revenue |

3,624 |

3,624 | |

|

|

|

| |

|

Total Liabilities |

77,280 |

31,936 | |

|

|

|

| |

|

Contingencies and Commitments |

|

| |

|

Stockholders’ Deficit |

|

| |

|

|

|

| |

|

Preferred stock, 100,000,000 shares authorized, $0.001 par value; no share issued and outstanding |

– |

– | |

|

Common stock, 100,000,000 shares authorized, $0.0001 par value; 51,155,000 shares issued and outstanding |

5,116 |

5,116 | |

|

Additional paid-in capital |

47,452 |

43,194 | |

|

Deficit accumulated during the development stage |

(112,434) |

(64,262) | |

|

|

|

| |

|

Total Stockholders’ Deficit |

(59,866) |

(15,952) | |

|

|

|