Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CVR PARTNERS, LP | d438608d8k.htm |

Investor Presentation

November 2012

Exhibit 99.1 |

2

Safe Harbor

The following information contains forward-looking statements based

on management’s current expectations and beliefs, as well

as a number of assumptions concerning future events. These

statements are subject to risks, uncertainties, assumptions and

other important factors. You are cautioned not to put

undue reliance on such forward-looking statements (including forecasts

and projections regarding our future performance) because actual

results may vary materially from those expressed or implied as a

result of various factors, including those noted in the

Company’s filings with the Securities and Exchange

Commission. CVR Partners, LP assumes no obligation to, and

expressly disclaims any obligation to, update or revise any

forward-looking statements, whether as a result of new

information, future events or otherwise. |

3

Key Strategic Drivers

•

Experienced management team

•

Fully utilized capacity

•

High run time rates

•

Strategically located assets

•

Solid market fundamentals supports

future growth

•

Growth oriented partnership formed by CVR Energy, Inc. in June 2007,

with IPO in April 2011 •

Manufacturing facility produces ammonia and Urea Ammonium Nitrate

(UAN) •

Facility

located

in

Coffeyville,

Kansas

and

produces

5%

of

total

UAN

demand

in

United

States |

Experienced Management

4 |

5

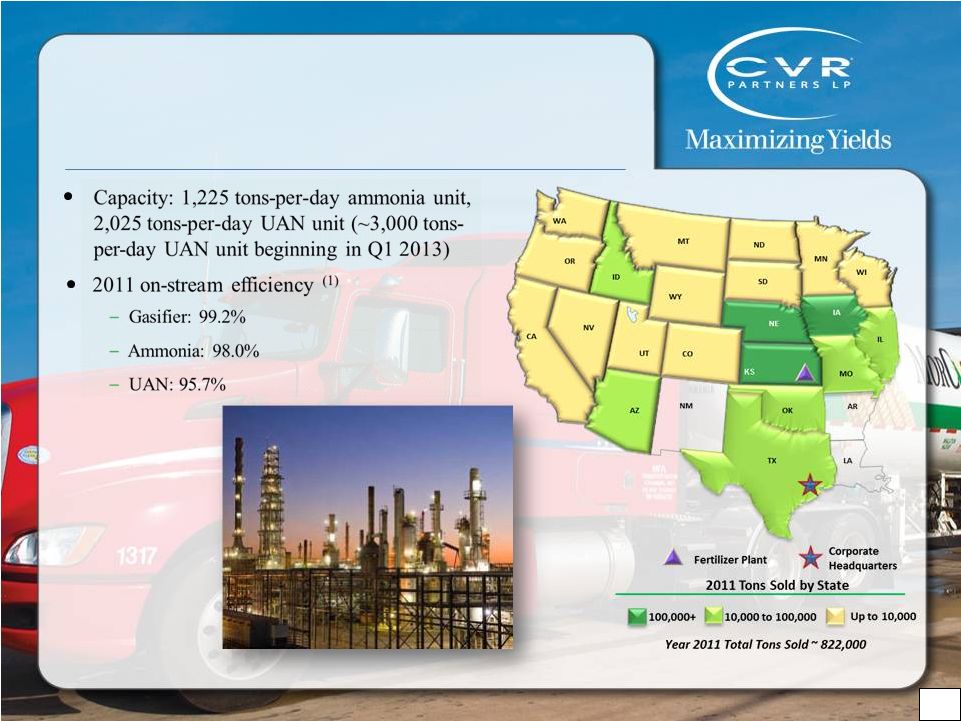

Fully Utilized Capacity &

High Run Rates

(1) Adjusted for third-party outage.

|

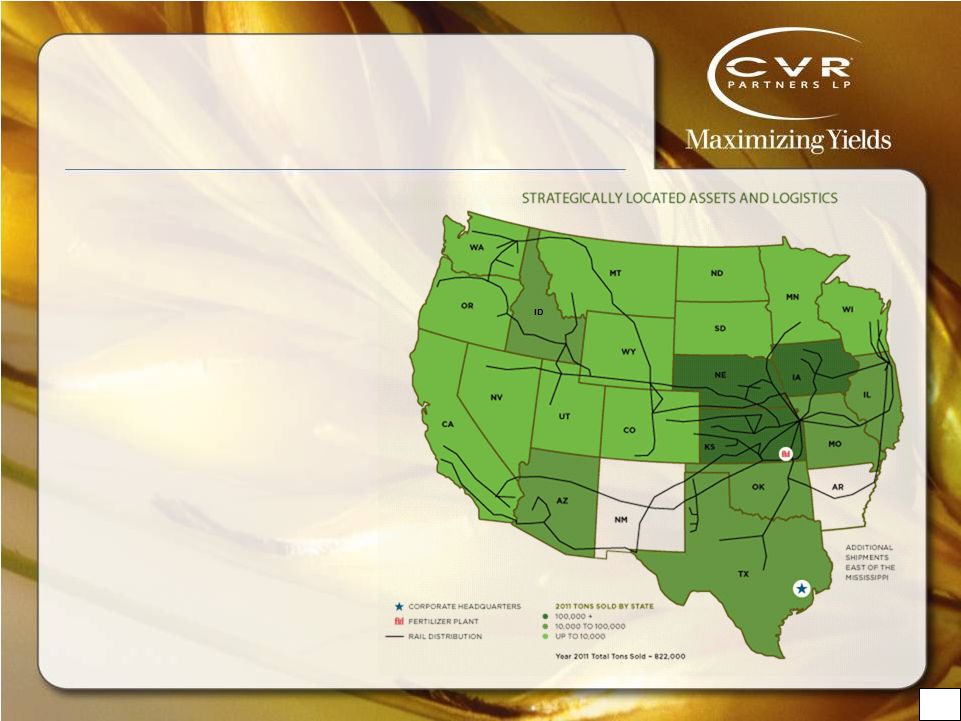

Strategically Located Assets

•

Located in corn belt

•

56% of corn planted in 2011

was within $40/UAN ton

freight rate of plant

•

$25/ton transportation

advantage to corn belt vs.

U.S. Gulf Coast

•

No intermediate transfer,

storage, barge freight or

pipeline freight charges

6 |

7

Solid Market Fundamentals

Key Demand Drivers |

8

Solid Market Fundamentals

Consistent Fertilizer Demand Growth

•

Nitrogen represents ~63%

of fertilizer consumption

(1)

•

Nitrogen based fertilizers

have most stable demand

because must be applied

annually

–

Primary determinant of crop yield

(1) Per the International Fertilizer Industry Association.

|

9

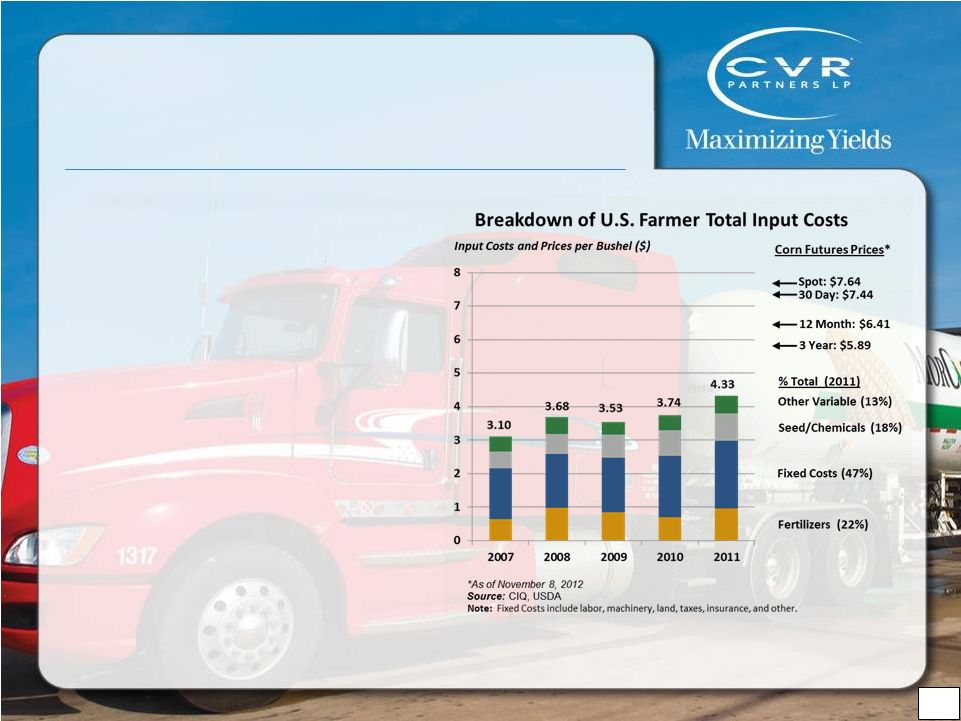

Solid Market Fundamentals

Farmer Profitability Supports Fertilizer Price

•

Corn consumes the largest

amount of nitrogen fertilizer

•

Farmers are expected to generate

substantial proceeds at currently

forecasted corn prices

•

Farmer incentivized to use

nitrogen at corn price much lower

than current spot

•

Nitrogen fertilizer represents

small portion of farmer’s total

input costs |

10

Solid Market Fundamentals

Supply/Demand Supports Increased Planting

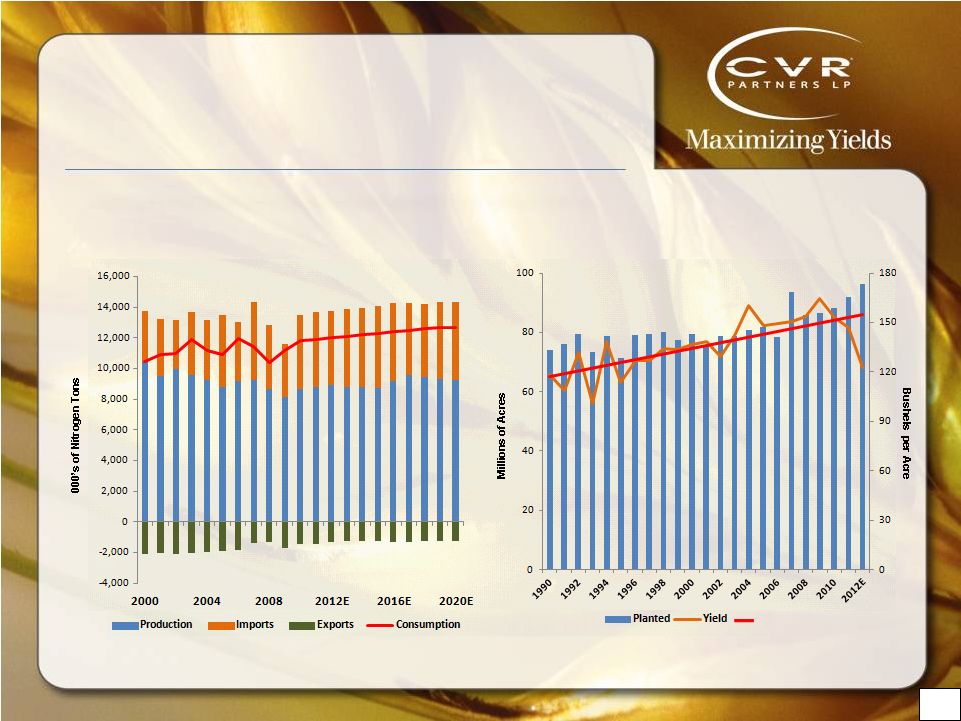

U.S. Nitrogen Production & Consumption

Source:

Fertecon.

U.S. Corn Planted & Yields

Source:

USDA.

Yield Trendline |

11

Country

2007

2008

2009

2010

2011

Trinidad & Tobago

0

0

0

777

1,010

Russia

749

953

658

749

674

Canada

685

487

427

437

617

Romania

472

185

29

254

487

Egypt

176

174

0

123

117

Lithuania

514

431

69

79

489

Ukraine

344

173

0

73

30

Poland

142

123

0

0

0

Estonia

0

13

30

117

92

Netherlands

18

28

0

44

144

Bulgaria

58

58

0

33

21

Germany

55

13

69

30

153

Belarus

96

0

0

0

0

Rest of world

38

3

3

2

29

Total

3,347

2,641

1,285

2,718

3,853

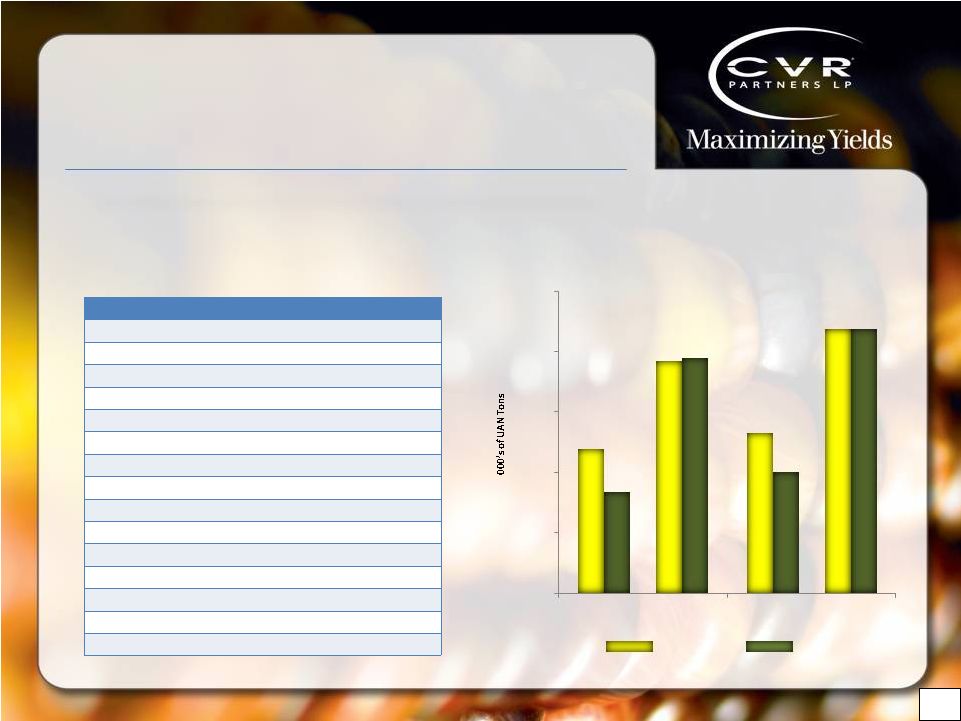

U.S. Imports of UAN

(000’s of UAN Tons)

Source:

USDA.

Source:

Fertecon.

U.S.

World

2011

Demand

Supply

0

5,000

10,000

15,000

20,000

25,000

U.S.

World

2020E

Source:

Fertecon.

U.S. imports for UAN expected to be ~26% of total demand in 2020

Solid Market Fundamentals

UAN Demand & U.S.

Imports

UAN Demand/Supply |

12

Growth Strategies

Current

12-24

Months

3-5

Years

•

Operational efficiency

•

Plant expansion

•

Specialty products

•

Distribution

•

Mergers and acquisitions

•

Plant development |

13

UAN Expansion

•

Overview

–

Increase exposure to strong UAN market

dynamics

–

Expand UAN capacity by 330K tons

per year (~50%) to ~1MM tons/year

–

Upgrade 100% of ammonia to UAN

–

On-line at beginning of 2013

•

Total cost of $125MM-$130MM

–

$93MM spent through 09/30/12

•

Annualized incremental impact

–

EBITDA: ~$20MM

–

Available for distribution: ~$0.25/unit

UAN Price Premium

to Ammonia

Note: UAN Mid Corn Belt to Ammonia Southern Plains. |

14

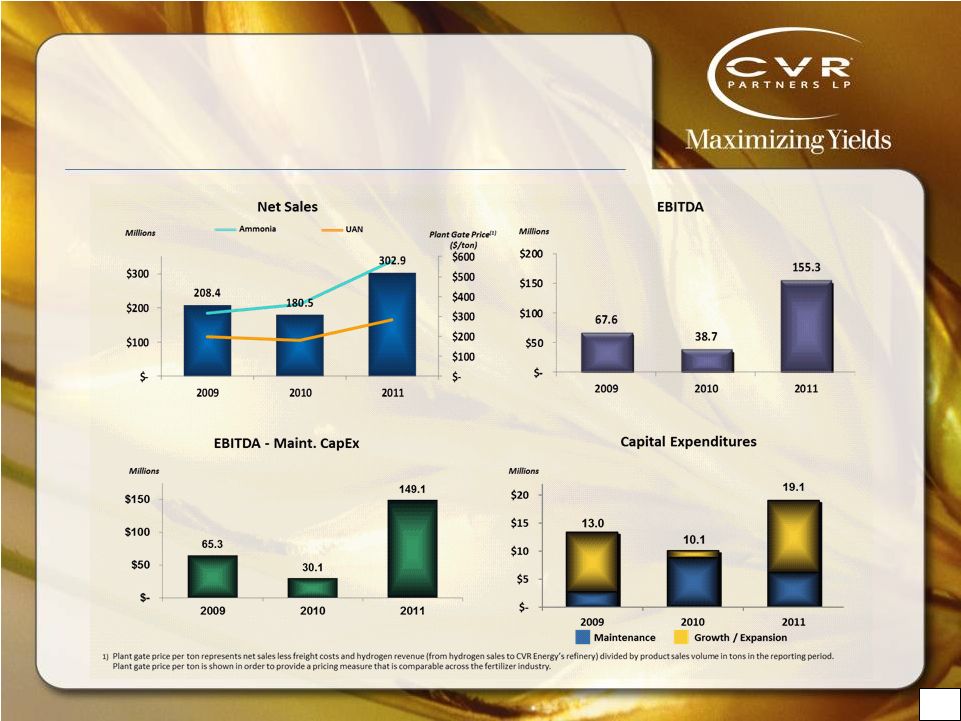

Financial Statistics

See page 21 for a reconciliation of net income to EBITDA.

See page 21 for a reconciliation of net income to EBITDA less maintenance capital.

|

15

Continued Success in 2012

YTD 9/30/12

YTD 9/30/11

Change

Sales

$234.7

$215.3

9.0%

EBITDA

(1)

$115.7

$107.6

7.5%

Adjusted

EBITDA

(2)

$121.1

$114.0

6.2%

Operating Income

$99.8

$93.6

6.6%

Distributable Cash

Flow (DCF)

(3)

$118.2

$71.5

n/a

DCF/Unit

(3)

$1.62

$0.98

n/a

$US millions, except per unit data

Expect DCF/Unit of $1.70 to $1.80 for 2012 Full Year

~

Benefit to 2013 Cash Available for Distribution of

~$0.50/Unit from UAN Expansion and No Turnaround ~

(1) See page 21 for a reconciliation of net income to EBITDA.

(2) See page 21 for reconciliation of EBITDA to Adjusted

EBITDA. (3) Reflects post IPO for 2011 (April 13 –

September 30). |

16

Strong Financial Profile

(US$ in millions)

Capitalization

As of 9/30/12

Cash & Equivalents

$180.3

Credit Facility due April 2016:

Term Loan

125.0

$25 million Revolver

–-

Total Debt

$125.0

Partners' Equity

465.9

Total Capitalization

$590.9

LTM EBITDA

(1)

$163.4

LTM Interest Expense

(1)

4.5

Key Credit Statistics

Total Debt / LTM EBITDA

0.8x

LTM EBITDA / Interest Expense

36.3x

Total Debt / Book Cap.

21.2%

Liquidity

As of 9/30/12

Cash & Equivalents

$180.3

$25 million Revolver

25.0

Less: Drawn Amount

–-

Less: Letters of Credit

Total Liquidity

$205.3

Financial Flexibility to

Support Growth Initiatives

(1)

See page 21 for a reconciliation of LTM 09/30/12 EBITDA and interest expense.

–-

As of 9/30/12 |

17

A Bright Outlook

•

Strong industry fundamentals

•

High-quality & strategically-located

assets

•

Premium product focus

•

Attractive growth opportunities

•

Pay out 100% of available cash

each quarter

•

No IDR’s

•

Experienced management team |

Appendix |

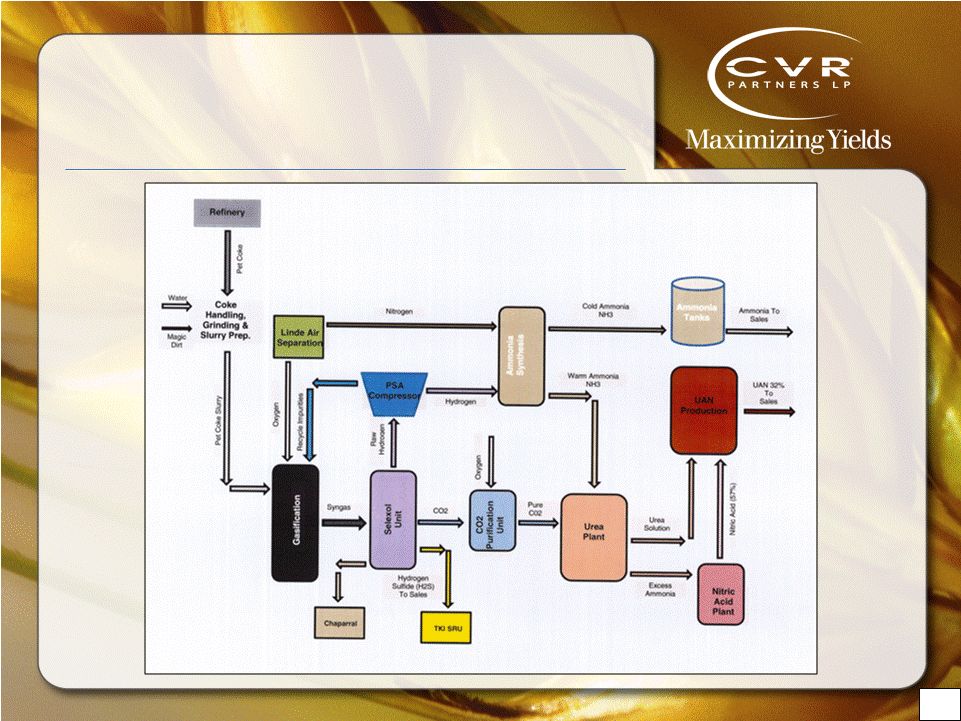

19

Fertilizer Plant Schematic |

Non-GAAP Financial Measures

To supplement the actual results in accordance with U.S. generally

accepted accounting principles (GAAP), for the applicable

periods, the Company also uses certain non-GAAP financial

measures as discussed below, which are adjusted for

GAAP-based results. The use of non-GAAP adjustments are

not in accordance with or an alternative for GAAP. The adjustments are

provided to enhance the overall understanding of the Company’s

financial performance for the applicable periods and are also

indicators that management utilizes for planning and forecasting

future periods. The non-GAAP measures utilized by the Company

are not necessarily comparable to similarly titled measures of

other companies. The Company believes that the presentation of non-GAAP financial

measures provides useful information to investors regarding the

Company’s financial condition and results of operations

because these measures, when used in conjunction with related GAAP

financial measures (i) together provide a more comprehensive

view of the Company’s core operations and ability to

generate cash flow, (ii) provide investors with the financial

analytical framework upon which management bases financial and

operational planning decisions, and (iii) presents measurements

that investors and rating agencies have indicated to management are

useful to them in assessing the Company and its results of

operations. 20

|

21

Non-GAAP Reconciliation

EBITDA: Represents net income before the effect of interest expense,

interest income, income tax expense (benefit) and depreciation and amortization.

EBITDA is not a calculation based upon GAAP; however, the amounts

included in EBITDA are derived from amounts included in the consolidated

statement of operations of the Company.

See below for reconciliation of net income to EBITDA, EBITDA to

Adjusted EBITDA, & EBITDA less maintenance capital

See below for reconciliation of net income to EBITDA &

EBITDA to Adjusted EBITDA

Adjusted EBITDA: Represents EBITDA adjusted for the impact of

share-based compensation, and, where applicable, major scheduled turnaround expense

and loss on disposition of assets. We present Adjusted EBITDA because

it is a key measure used in material covenants in our credit facility. Adjusted

EBITDA is not a recognized term under GAAP and should not be

substituted for net income as a measure of our liquidity. Management believes that

Adjusted EBITDA enables investors and analysts to better understand our

liquidity and our compliance with the covenants contained in our credit facility.

See below for reconciliation of LTM 09/30/12 EBITDA & Interest

Expense (in $US millions)

For the Fiscal Years

2009

2010

2011

Net income

57.9

$

33.3

$

132.4

$

Interest expense

-

-

4.0

Interest (income)

(9.0)

(13.1)

-

Depreciation and amortization

18.7

18.5

18.9

Income tax expense

-

-

-

EBITDA

67.6

$

38.7

$

155.3

$

Loss on disposition of assets

-

1.4

-

Turnaround

-

3.5

-

Share-based compensation

3.2

9.0

7.3

Adjusted EBITDA

70.8

$

52.6

$

162.6

$

EBITDA

67.6

$

38.7

$

155.3

$

Maintenance capital

2.3

8.6

6.2

EBITDA less maintenance capital

65.3

$

30.1

$

149.1

$

(in $US millions)

2011

2012

Net income

91.2

$

96.9

$

Interest expense, net

2.6

3.1

Interest (income)

(0.1)

(0.2)

Depreciation and amortization

13.9

15.8

Income tax expense

-

0.1

EBITDA

107.6

$

115.7

$

Major turnaround expense

-

0.2

Share-based compensation

6.4

5.2

Adjusted EBITDA

114.0

$

121.1

$

Nine Months Ended

September 30,

(in $US millions)

Interest

EBITDA

Expense

9 months ended 9/30/12

115.7

$

3.1

$

12 months ended 12/31/11

155.3

4.0

Less: 9 months ended 9/30/11

107.6

2.6

LTM 9/30/12

163.4

$

4.5

$ |