Attached files

| file | filename |

|---|---|

| 8-K - 8-K - International Safety Group, Inc. | v328295_8k.htm |

| EX-2.1 - EX-2.1 - International Safety Group, Inc. | v328295_ex2-1.htm |

| EX-3.1 - EX-3.1 - International Safety Group, Inc. | v328295_ex3-1.htm |

| EX-16.1 - EX-16.1 - International Safety Group, Inc. | v328295_ex16-1.htm |

| EX-10.1 - EX-10.1 - International Safety Group, Inc. | v328295_ex10-1.htm |

(Continuation Pages)

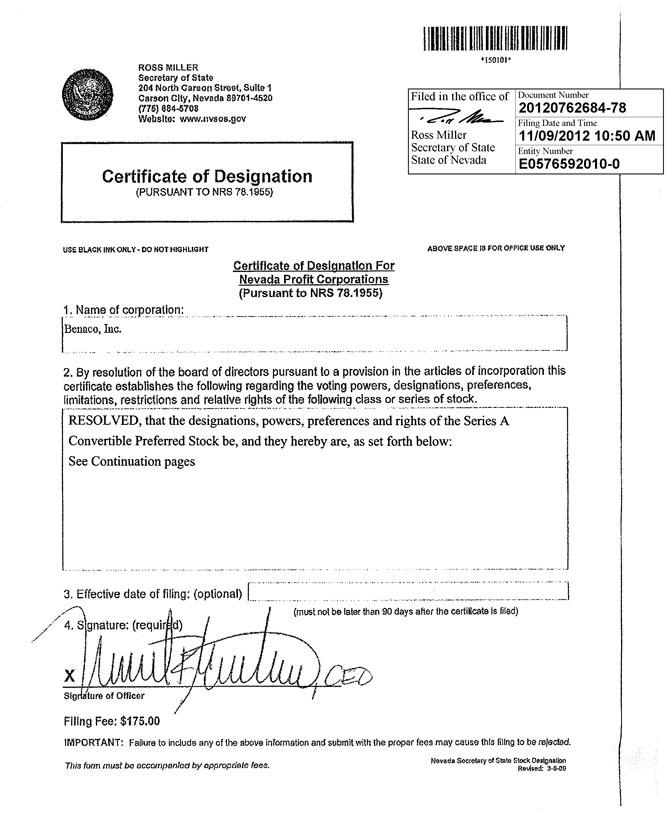

CERTIFICATE OF DESIGNATIONS. PREFERENCES AND RIGHTS OF

SERIES A CONVERTIBLE PREFERRED STOCK

OF

BENACO, INC.

Benaco, Inc. (the “Corporation”), a corporation organized and existing under the laws of the State of Nevada, does hereby certify, that, pursuant to authority conferred upon the Board of Directors by the Corporation’s Articles of Incorporation and pursuant to Section 78.1955 of the Nevada Revised Statutes, the Board of Directors duly adopted resolutions:

RESOLVED, that the designations, powers, preferences and rights of the Series A Convertible Preferred Stock be, and they hereby are, as set forth below:

| 1. | Designation; Ranking. A series of preferred stock is hereby designated as Series A Convertible Preferred Stock (the “Series A Preferred Stock”). |

| 2. | Number. The number of shares constituting Series A Preferred Stock is fixed at 10 shares, par value $.001 per share, and such amount may not be increased or decreased, except with the written consent of the holders of 100% of the issued and outstanding Series A Preferred Stock. |

| 3. | Dividends. The holders of the Series A Preferred Stock shall not be entitled to dividends, except that in the event that a dividend is declared on the Corporation’s Common Stock, par value $.001 per share (“Common Stock”), the holders of the Series A Preferred Stock shall receive the dividends that would be payable if all then outstanding shares were converted into Common Stock immediately prior to the declaration of the dividend. |

| 4. | Liquidation. In the event of the liquidation, dissolution or winding up of the Corporation, the holders of Series A Preferred Stock shall not be entitled to a liquidation preference over the holders of the Common Stock, but the holders of the Series A Preferred shall share pro rata with the holders of Common Stock, as if all then outstanding shares of Series A Preferred Stock were converted into Common Stock, in any assets of the Corporation available therefor after the payment of all sums to which the holders of other classes of outstanding Preferred Stock, if any, having a preference over the Series A Preferred Stock, are entitled. |

| 5. | Voting. Except as otherwise provided herein or by law and in addition to any right to vote as a separate class as provided by law, the holders of the Series A Preferred Stock shall have full voting rights and powers equal to the voting rights and powers of holders of Common Stock and shall be entitled to notice of any stockholders meeting in accordance with the By-laws of the Corporation, and shall be entitled to vote, with respect to any question upon which holders of Common Stock have the right to vote, including, without limitation, the right to vote for the election of directors, voting together with the holders of Common Stock as one class. For so long as Series A Preferred Stock is issued and outstanding, the holders of Series A Preferred Stock shall vote together as a single class with the holders of the Corporation’s Common Stock, and the holders of any other class or series of shares entitled to vote with the Common Stock, with the holders of Series A Preferred Stock being entitled to 67% of the total votes on all such matters regardless of the actual number of shares of Series A Preferred Stock then outstanding, and the holders of Common Stock and any other shares entitled to vote being entitled to their proportional share of the remaining 33% of the total votes based on their respective voting power. The vote of 100% of the outstanding Series A Preferred Stock shall determine the vote of the Series A Preferred Stock as a class. If the holders of Series A Preferred Stock cannot unanimously agree on how to vote on a particular matter or matters, then the holders shall submit such matter or matters for a determination by a majority of the directors of the Board of Directors of the Corporation (including, for such purpose directors who are holders of Series A Preferred Stock) and the holders shall be deemed to have voted all of their shares of Series A Preferred Stock in accordance with the determination of the Board of Directors. |

| 6. | Action By Written Consent. Whenever holders of Series A Preferred Stock are required or permitted to take any action by vote, such action may be taken without a meeting on written consent, setting forth the action so taken and signed by the holders of the outstanding Series A Preferred Stock of the Corporation having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted. |

| 7. | Conversion. |

| (a) | Automatic Conversion. All or any portion of the outstanding shares of Series A Preferred Stock may upon at least ten (10) days prior written notice to the Corporation be converted into Common Stock at the then effective Conversion Ratio, as defined below. At any time, each share of Series A Preferred Stock shall be convertible into one (1) share of Common Stock (the “Conversion Ratio”). |

| (b) | Delivery of Certificates Upon Conversion. The Corporation shall deliver to the holder promptly following the Conversion Date (which date shall be ten (10) days after the Conversion Notice is delivered to the Corporation together with the certificate or certificates representing the number of shares of Series A Preferred Stock being converted and a duly executed assignment or stock power) a certificate or certificates for the number of shares of Common Stock being acquired upon the conversion of shares of Series A Preferred Stock. |

| (c) | Reservation of Shares Issuable Upon Conversion. The Corporation covenants that it will at all times reserve and keep available out of its authorized and unissued shares of Common Stock solely for the purpose of issuance on conversion of the Series A Preferred Stock, not less than such number of shares of Common Stock as shall be issuable upon the conversion of all outstanding shares of Series Preferred Stock. |

| (d) | Transfer Taxes. The issuance of certificates for shares of the Common Stock on conversion of the Series A Preferred Stock shall be made without charge to the holders thereof for any documentary stamp or similar taxes that may be payable in respect of the issue or delivery of such certificate, provided that the Corporation shall not be required to pay any tax that may be payable in respect of any transfer involved in the issuance and delivery of any such certificate upon conversion in a name other than that of the holder of such shares of Series A Preferred Stock so converted and the Corporation shall not be required to issue or deliver such certificates unless or until the person or persons requesting the issuance thereof shall have paid to the Corporation the amount of such tax or shall have established to the satisfaction of the Corporation that such tax has been paid. |

| 8. | Limitations Upon Disposition. The Series A Preferred Stock issuable pursuant to this Certificate and the shares of Common Stock issuable on conversion of the Series A Preferred Stock (collectively the “Securities”), if not registered by the Corporation under the Securities Act of 1933, as amended, may not be sold or offered for sale in the absence of an effective registration statement as to the Securities under the Securities Act, or an opinion of counsel satisfactory to the Corporation that such registration statement is not required. The above restrictions in this Section 9 shall be contained in a legend to be placed on each of the Series A Preferred Stock certificates at the time of issuance of the shares and a stop transfer order may be placed on such shares by the Corporation. In addition, the following language shall appear on the back of each of the Series A Preferred Stock certificates: |

ANY TRANSFEREE OF THIS CERTIFICATE SHOULD CAREFULLY REVIEW THE TERMS OF THE COMPANY’S CERTIFICATE OF DESIGNATIONS, PREFERENCES AND RIGHTS OF THE PREFERRED SHARES REPRESENTED BY THIS CERTIFICATE

| 9. | Additional Rights. So long as any shares of Series A Preferred Stock remain outstanding, the Corporation shall not, without first obtaining the approval by vote or written consent of all the outstanding shares of Series A Preferred Stock, (i) alter or change the powers, preferences, privileges, or rights of the Series A Preferred Stock, or (ii) amend the provisions of this Section 9 or any other provision of this Certificate of Designation. |

| 10. | Replacement. Upon receipt by the Corporation of evidence reasonably satisfactory to it of the ownership of and the loss, theft, destruction or mutilation of any certificate evidencing one or more shares of Series A Preferred Stock, and in the case of loss, theft or destruction, of any indemnification undertaking by the holder to the Corporation in customary form and, in the case of mutilation, upon surrender and cancellation of such certificate, the Corporation at its expense will execute and deliver in lieu of such certificate, a new certificate of like kind, representing the number of shares of Series A Preferred Stock which shall have been represented by such lost, stolen, destroyed, or mutilated certificate. |

| 11. | Notice. Whenever notice is required to be given pursuant to this Certificate of Designation, unless otherwise provided herein, such notice shall be given at the address then set forth in the Corporation’s records. |