Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Apollo Global Management, Inc. | d438863d8k.htm |

Bank of America Merrill Lynch Banking and Financial Services

Conference: Josh Harris –Managing Partner

November 13, 2012

Not

for

distribution

in

whole

or

in

part

without

the

express

consent

of

Apollo

Global

Management,

LLC.

It

should

not

be

assumed

that

investment

made

in

the

future

will

be

profitable

or

will equal the performance of the investments in this

document. Exhibit 99.1 |

1

1

1

1

Forward Looking Statements and Other Important

Disclosures

This presentation may contain forward looking statements that are

within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934. These statements include, but

are not limited to, discussions related to Apollo Global Management, LLC’s and its subsidiaries’

(collectively “Apollo”) expectations regarding the

performance of its business, its liquidity and capital resources and the other non-historical statements. These

forward-looking statements are based on management’s

beliefs, as well as assumptions made by, and information currently available to, management. When

used

in

this

presentation,

the

words

“believe,”

“anticipate,”

“estimate,”

“expect,”

“intend”

and

similar

expressions

are

intended

to

identify

forward-looking

statements. Although management believes that the expectations

reflected in these forward-looking statements are reasonable, it can give no assurance that

these

expectations

will

prove

to

have

been

correct.

These

statements

are

subject

to

certain

risks,

uncertainties

and

assumptions.

We

believe

these

factors

include

but

are

not

limited

to

those

described

under

the

section

entitled

“Risk

Factors”

in

the

Company’s

Annual

Report

on

Form

10-K

for

the

year

ended

December 31, 2011 filed with the Securities and Exchange Commission

(“SEC”) on March 9, 2012, as such factors may be updated from time to time in our

periodic filings with the SEC, which are accessible on the SEC’s

website at www.sec.gov. These factors should not be construed as exhaustive and should be read

in

conjunction

with

the

other

cautionary

statements

that

are

included

in

this

presentation

in

other

SEC

filings.

We

undertake

no

obligation

to

publicly

update

or

review any forward-looking statements, whether as a result of new

information, future developments or otherwise. “Gross

IRR” of a fund represents the cumulative

investment-related cash flows for all of the investors in the fund on the basis of the actual timing of investment

inflows

and

outflows

(for

unrealized

investment

assuming

disposition

of

the

respective

“as

of”

dates

referenced)

aggregated

on

a

gross

basis

quarterly,

and

the

return

is

annualized

and

compounded

before

management

fees,

carried

interest

and

certain

other

fund

expenses

(including

interest

incurred

by

the

fund

itself)

and measures the returns on the fund’s investments as a whole

without regard to whether all of the returns would, if distributed, be payable to the fund’s

investors.

“Net IRR”

of a fund means the gross IRR applicable to all investors, including

related parties which may not pay fees, net of management fees,

organizational

expenses,

transaction

costs,

and

certain

other

fund

expenses

(including

interest

incurred

by

the

fund

itself)

and

realized

carried

interest

all

offset

to the extent of interest income, and measures returns based on

amounts that, if distributed, would be paid to investors of the fund; to the extent that an Apollo

private

equity

fund

exceeds

all

requirements

detailed

within

the

applicable

fund

agreement,

the

estimated

unrealized

value

is

adjusted

such

that

a

percentage

of

up to 20.0% of the unrealized gain is allocated to the general

partner, thereby reducing the balance attributable to fund investors.

This presentation is for informational purposes only and does not

constitute an offer to sell, or the solicitation of an offer to buy, any security, product, service of

Apollo

as

well

as

any

Apollo

sponsored

investment

fund,

whether

an

existing

or

contemplated

fund

(“Apollo

Fund”),

for

which

an

offer

can

be

made

only

by

such

fund's

Confidential

Private

Placement

Memorandum

and

in

compliance

with

applicable

law.

It should not be assumed that investments made in the future will be

profitable or will equal the performance of investments in this document. |

2

Apollo Global Management, LLC

Apollo Global Management, LLC is a leading

global alternative investment manager in

private equity, credit and real estate

Ticker (NYSE):

APO

Market Capitalization

(1)

$5.5 billion

Total Assets Under Management

(2)

$110 billion

L12M Dividend Yield

(3)

9.5%

2013E PE Multiple

(4)

4.9x

AUM CAGR (2004 –

9/30/12)

34%

1.

As of November 12, 2012.

2.

As of September 30, 2012.

3.

Based

on

closing

price

on

November

12,

2012

and

LTM

dividends

as

of

and

for

the

period

ended

September

30,

2012.

4.

Based on mean First Call estimate as of November 9, 2012.

|

3

Agenda

1.

Overview of Apollo

2.

Market Overview

3.

Selected Opportunities Across Apollo’s Integrated Platform

|

4

Apollo’s Integrated Global Platform

Private Equity

$39bn

AUM

Credit

(2)

$60bn

AUM

Principal Investment Businesses

(1)

Real Estate

$8bn

AUM

Los Angeles

New York

London

Singapore

Frankfurt

Luxembourg

Mumbai

Hong Kong

Houston

Firm Profile

(1)

Founded:

1990

AUM:

$110 bn

Employees:

624

Inv. Prof.:

250

Global Footprint

Investment Approach

Value-oriented

Contrarian

Opportunistic across

market cycles and capital

structures

Integrated platform across

asset classes and

geographies

Deep industry knowledge

1.

As of September 30, 2012.

2.

Includes three funds that are denominated in Euros and translated into

U.S. dollars at an exchange rate of €1.00 to $1.29 as of September 30, 2012. |

5

Apollo’s Total AUM Has Grown By More Than 10x Over the Last

Decade $495

$6,469

$7,971

$8,129

$2,483

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

Sept 2012

Unallocated Strategic Account AUM

Real Estate AUM

Capital Markets AUM

Private Equity AUM

1990-2002:

PE Only

Significant Growth and Diversification

($ in millions)

Apollo AUM CAGR: 34%

Total

AUM:

$110

bn

(1)

$8,163

$9,200

$9,765

$18,734

$20,186

$30,237

$29,094

$34,002

$38,799

$35,384

$38,983

$529

$1,557

$2,463

$4,392

$10,533

$15,108

$19,112

$22,283

$31,867

$60,107

1.

AUM as of September 30, 2012 includes the acquisitions of Stone Tower

Capital LLC and its related management companies ($18bn of AUM) and Gulf Stream Asset Management. LLC ($3bn of AUM). |

6

Secular Tailwinds Favor Alternatives

6

1.

Source: Towers Watson Global Pension Assets Study 2012.

Portfolio Allocations to Alternatives Have

Quadrupled

Since

1995

(1)

49%

51%

41%

46%

37%

39%

5%

12%

20%

0%

10%

20%

30%

40%

50%

60%

1995

2003

2011E

Equities

Alternatives

Fixed Income / Cash

“Cash-strapped US Pension Funds Ditch

Stocks For Alternatives”

—

Reuters (8/18/12)

“Alternatives Becoming Mainstream”

—

Asset Allocation News (7/27/12)

“In Search of Diversification and Alpha,

Investors Seek Alts…”

—

Asset International (6/19/12)

“Alts Poised to Gain Significant Market

Share…”

—

Fundfire (5/7/12) |

7

Consistent, Simple Strategy

Every strategy across our platform

is about one thing only:

“VALUE”

Note: As of September 30, 2012. Past performance is not indicative of

future results. (1) Apollo creation multiples may incorporate pro

forma or other adjustments based on investment teams’ estimates and/or calculations. “Industry average” is based on S&P LCD data as of September 30, 2012.

Over

the

last

decade

we

have

created

our

investments

at

almost

2

turns

below

the

industry

average

(1) |

8

(2)

(3)

(5)

(5)

(1)

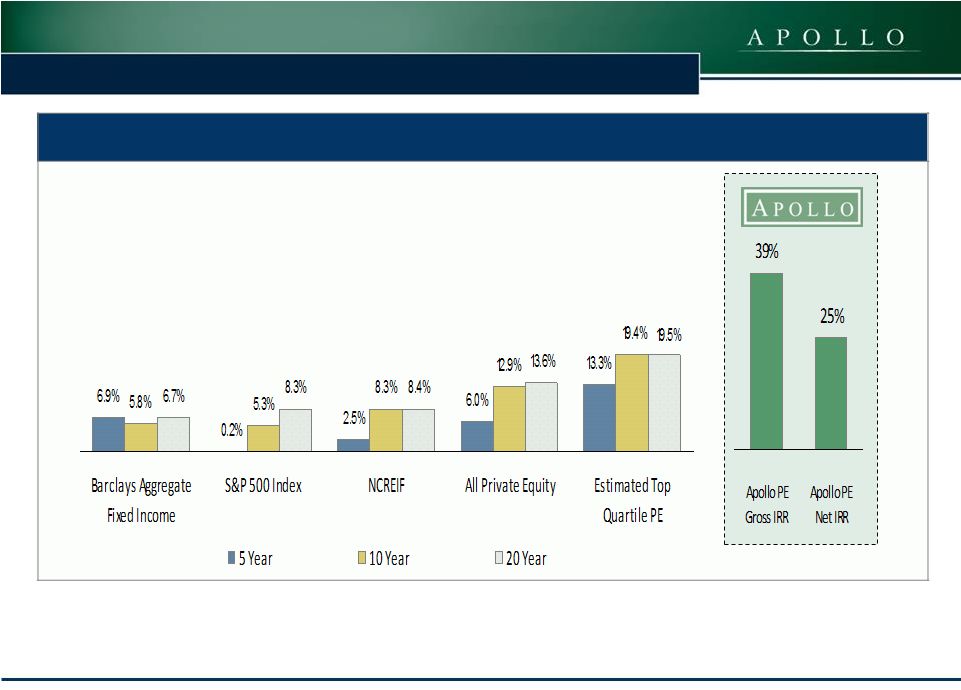

Long Track Record of Success in Private Equity

(1)

(4)

8

Apollo’s Private Equity Funds: 39% Gross & 25% Net IRR Since

Inception Note: Past performance is not indicative nor a

guarantee of future results. See the last page for an “Important Note Regarding the Use of Index Comparisons.” (1) Data as of June 30, 2012. (2) National Council of

Real Estate Investment Fiduciaries (“NCREIF”) as of June 30,

2012. (3) Cambridge Associates LLC U.S. Private Equity Index and Benchmark Statistics, June 30, 2012, the most recent data available. Returns

represent End-to-End Pooled Mean Net to Limited Partners (net

of fees, expenses and carried interest) for all U.S. Private Equity. (4) Cambridge Associates LLC U.S. Private Equity Index and Benchmark Statistics,

June 30, 2012, the most recent data available. Estimated Top Quartile

PE numbers are calculated by taking the 5 year, 10 year and 20 year return metrics as described above and adding the average of the delta

between Top Quartile IRRs and the Pooled Mean Net to Limited Partners

for each vintage year in the selected timeframe. (5) Represents returns of all Apollo Private Equity funds since inception in 1990 through

September 30, 2012.

|

9

European

Principal Finance

Fund I

Structured Credit:

Structured

Credit

Recovery

Fund

I

(5)

Opportunistic:

Credit

Strategies

Fund

(2,3)

Net IRR Since Inception

Annualized Net Return

Performing US Credit:

Credit

Opportunity

Funds

I

&

II

(1)

Dedicated Europe:

AIE II

(6,8)

& EPF I

(7,8)

Subordinated Credit:

Apollo

Investment

Corporation

(AINV)

(4)

Weighted Average Yield

Net IRR

Note: Past performance is not indicative nor a guarantee of future

results. See second to last slide for a full listing of Apollo’s Credit Funds, which may have different or worse performance than the Funds illustrated on this slide. See last slide for an “Important Note Regarding

the Use of Indices in this Presentation.”

(1) Since inception of COF I & II in April 2008 through

September 30, 2012. (2) Since inception in February 2011 through September 30, 2012 (note February 2011 was a partial month of performance). (3) Track record was

accumulated by the investment committee, of which two members are no

longer at the firm as of June 30, 2012. (4) Weighted average yield as of September 30, 2012, excludes non-accrual and non-yielding equity investments. AINV annualized net NAV return of 4.83% since

inception in 2004 through September 30, 2012. (5) Since inception in

October 2008 through June 30, 2012. Fund is currently liquidating. (6) Net IRR for Apollo Investment Europe II (“AIE II”) from inception in June 2008 through September 30, 2012. Prospective investors

should be aware that AP Investment Europe Limited (“AIE I”),

which was managed from inception through April 2009 by a portfolio manager who is no longer associated or affiliated with Apollo or AIE I, experienced significant losses. AIE I was formed on July 2, 2006 and was

designed to invest in subordinated credit, employing the use of leverage

in these investments. (7) Net IRR for European Principal Finance Fund, L.P. (EPF) from inception in 2007 through June 30, 2012. (8) Fund is denominated in Euros and translated into U.S. dollars at an

exchange rate of €1.00 to $1.29 as of September 30, 2012.

Net IRR

27.2%

11.7%

6.4%

Credit

Opportunity

Fund I

Credit

Opportunity

Fund II

CS Leveraged

Loan Index

24.6%

14.7%

Structured Credit

Recovery Fund I

Merril Lynch High

Yield II Index

10.1%

8.0%

Credit Strategies Fund

Merril Lynch High Yield

II Index

15.5%

5.0%

Apollo

Investment

Europe II

CS Western

European

Leveraged Loan

Index

11.9%

Apollo Investment Corporation (AINV)

EPF

11.2%

Strong Credit Performance Across Asset Classes |

10

Significant Progress Since Our IPO

10

10

Increased

total AUM by over 55%

from $70 billion to $110 billion

Raised

$11.1 billion

of third party capital across the Apollo platform

Deployed

$5.3 billion

of private equity capital

Distributed $2.01 per share

of cash to our shareholders

Acquired two alternative credit managers

(Stone Tower, Gulf Stream) with

approximately $21 billion of assets under management

Since its IPO in March, 2011, Apollo has continued to execute against

its growth plan |

11

Delivering Cash Distributions to Shareholders

Since the beginning of 2011, Apollo has distributed an average

quarterly cash distribution of $0.29 per share

(1)

Industry-leading

dividend

yield

of

9.5%

versus

4.4%

peer

average

(2)

3

2

1

Average Cash Distribution

Comprises 3 Components

$0.14 from one-

time realizations

$0.08 from interest

and dividends

$0.07 regular

distribution

1.

Past performance is not indicative of future results.

2.

Based on LTM dividend yield for publicly traded alternative asset

managers (BX, KKR, CG, OAK, OZM, FIG) whose yields range from 2.5% to 5.8% based on closing stock prices as of 11/9/12 and LTM dividends

as of and for the quarter ended September 30, 2012.

|

12

Attractive Growth Strategies

12

12

Scale Existing Businesses

New Product Development

Geographic Expansion

Expand Distribution Channels

Strategic Acquisitions and Alliances

Apollo will continue to identify opportunities to leverage its

existing platform and expand into areas with meaningful

synergies with our core business |

13

Agenda

1.

Overview of Apollo

2.

Market Overview

3.

Selected Opportunities Across Apollo’s Integrated Platform

|

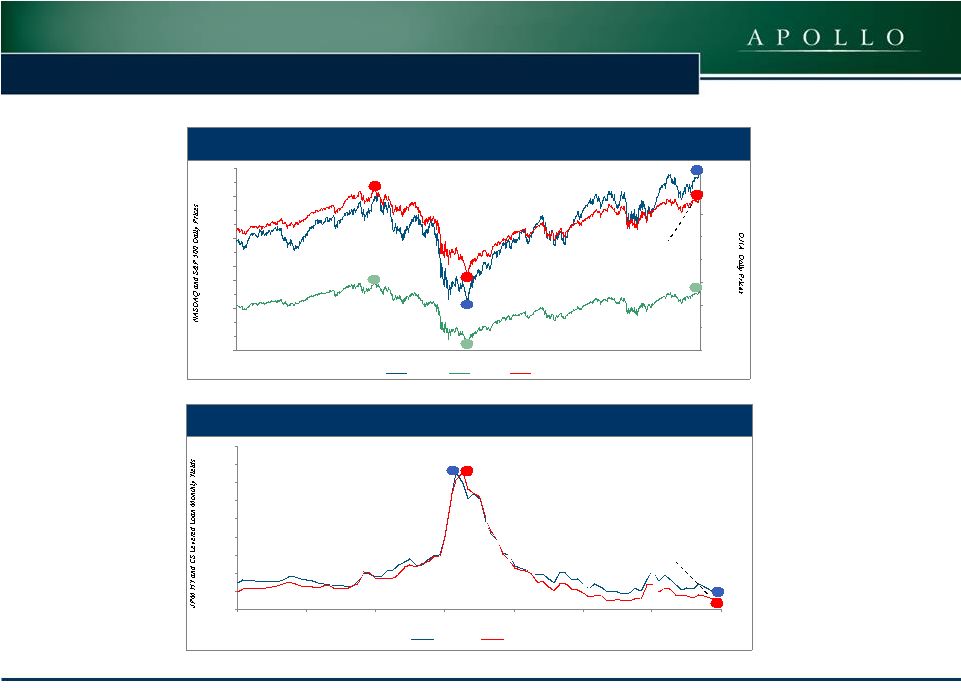

14

600

800

1,000

1,200

1,400

1,600

1,800

2,000

2,200

2,400

2,600

2,800

3,000

3,200

Sep-05

Sep-06

Sep-07

Sep-08

Sep-09

Sep-10

Sep-11

Sep-12

0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

NASDAQ

S&P 500

DOW

(1)

Source: Yahoo Finance. As of September 17, 2012.

(2)

Source: Bloomberg. As of September 13, 2012.

Stock Markets are Close to All-Time Highs;

Levered Credit at All-Time Low Yields

High

Yield

Bond

and

Leveraged

Loan

Yields

NASDAQ,

S&P

500

and

Dow

5%

7%

9%

11%

13%

15%

17%

19%

21%

23%

Sep-05

Sep-06

Sep-07

Sep-08

Sep-09

Sep-10

Sep-11

Sep-12

JPMHY

CSLevLoan

Peak 10/9/07: 1,565.2

Peak 9/14/12: 3,184.0

Trough 3/9/09:

NASDAQ: 1,268.6

S&P: 676.5

Dow: 6,547.1

9/17/12: 1,461.2

Trough 9/13/12:

JPMHY: 6.55%; CSLevLoan: 6.00%

Peak 11/28/2008: 20.15%

Peak 12/31/2008: 20.27%

Peak 10/9/07: 14,164.5

9/17/12: 13,553.1

(2)

(1) |

15

General Consensus Is That Growth Will Be Muted

United States

Euro Area

Emerging Markets

Sources: Bloomberg and International Monetary Fund. As of November 9,

2012. Developed economies continue to experience low growth

rates, while growth in the emerging markets has softened Forecast

GDP Forecast GDP

Global

Forecast GDP

Forecast GDP

2.7%

1.9%

-0.3%

-3.1%

2.4%

1.8%

2.1%

2.0%

-8%

-6%

-4%

-2%

0%

2%

4%

6%

8%

10%

12%

14%

16%

2006

2007

2008

2009

2010

2011

2012

2013

3.2%

2.9%

0.4%

-4.4%

2.0%

1.4%

-0.5%

0.3%

-8%

-6%

-4%

-2%

0%

2%

4%

6%

8%

10%

12%

14%

16%

2006

2007

2008

2009

2010

2011

2012

2013

-8%

-6%

-4%

-2%

0%

2%

4%

6%

8%

10%

12%

14%

16%

2006

2007

2008

2009

2010

2011

2012

2013

Brazil

Russia

India

China

Developing Asia

4.0%

4.0%

1.5%

-2.4%

4.0%

2.9%

2.2%

2.6%

-8%

-6%

-4%

-2%

0%

2%

4%

6%

8%

10%

12%

14%

16%

2006

2007

2008

2009

2010

2011

2012

2013 |

16

16

Significant Tail Risk Remains

Bank deleveraging

Fiscal cliff

Geopolitical tension

Europe in crisis

Oil price volatility

Slower growth in China |

17

17

Source: JPMorgan. FRB, BEA, ECB, Eurostat, BoE, UK Office for

National Statistics, BoJ, Japan Cabinet Office. Monetary Policy is Driving

Global Recovery Efforts U.S.

18%

U.K.

25%

Japan

32%

ECB

33%

•

TARP

•

QE1

•

Fannie/Freddie

•

AIG

•

Bear Stearns

•

EFSF / EU / IMF

Bailout

•

LTRO

•

TWIST

•

MBS Reinvestment

Program

•

QE3

•

TWIST

Extension

•

QE2

Key Monetary Policy Actions:

Global Governments Continue to Print Money to Stimulate Economies

5%

10%

15%

20%

25%

30%

35%

2007

2008

2009

2010

2011

2012 |

18

-150

-100

-50

0

50

100

150

Jan-09

Jul-09

Jan-10

Jul-10

Jan-11

Jul-11

Jan-12

Jul-12

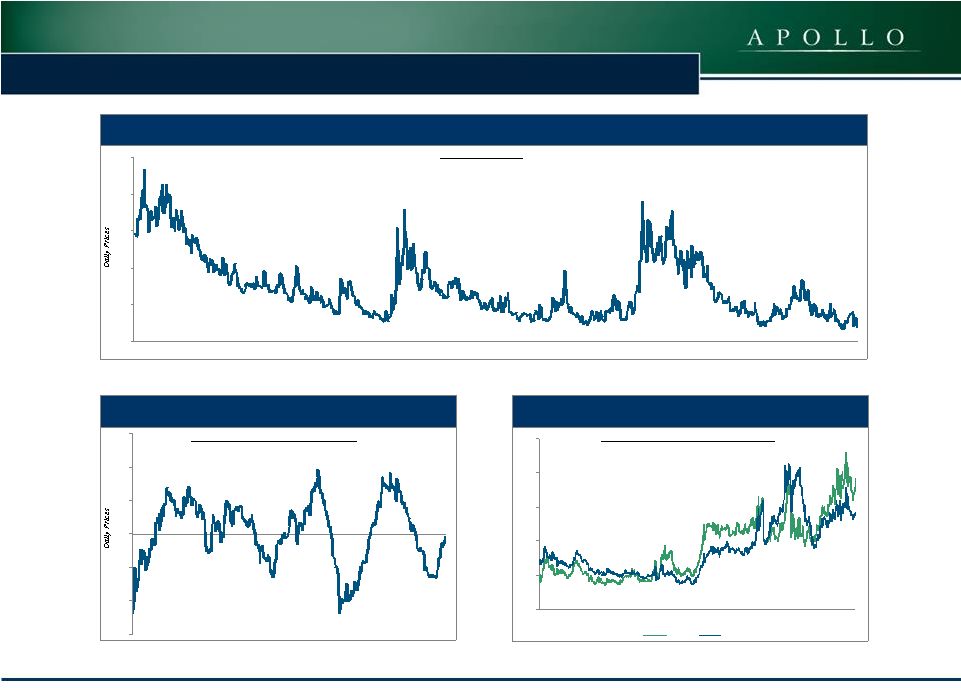

(1)

Source: Yahoo Finance. As of September 14, 2012.

(2)

Source: Bloomberg. As of August 31, 2012.

Volatility Comes and Goes…

Citi

U.S.

Economic

Surprise

Index

(2)

VIX

(1)

European

Sovereign

Risk

(2)

Spanish and Italian 10 Yr. Govt. Bond Yields

Standard Deviation of Economic Surprises

Volatility of S&P 500

3%

4%

5%

6%

7%

8%

Jan-09

Jul-09

Jan-10

Jul-10

Jan-11

Jul-11

Jan-12

Jul-12

Spain

Italy

10

20

30

40

50

60

Jan-09

Jul-09

Jan-10

Jul-10

Jan-11

Jul-11

Jan-12

Jul-12 |

19

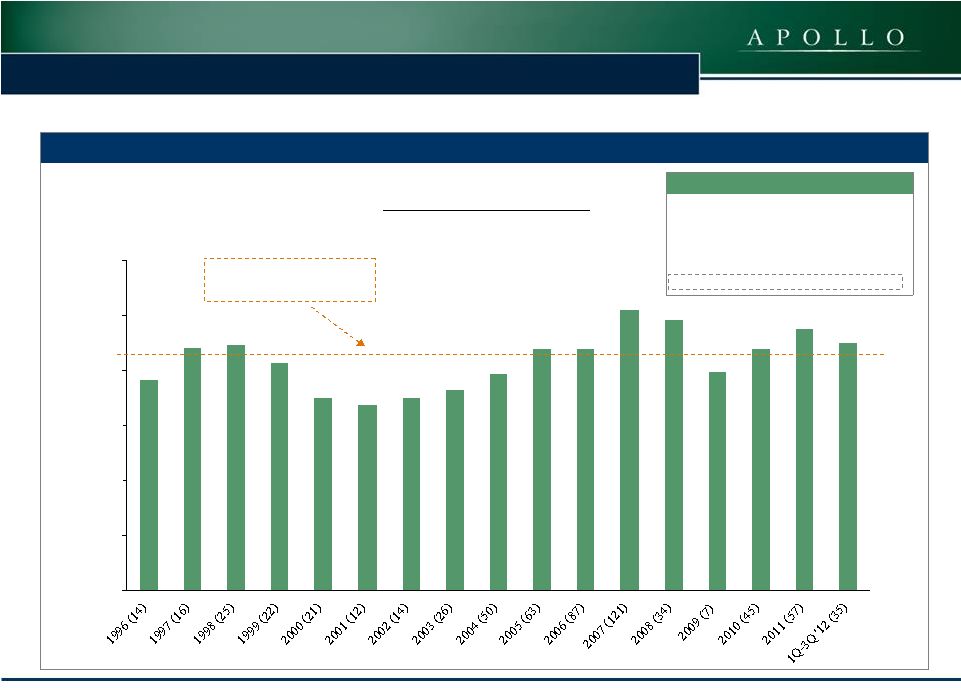

Private Equity Valuations are Fully Priced

Private Equity Valuations Remain High Despite Underlying

Uncertainty 7.7x

8.8x

8.9x

8.3x

7.0x

6.7x

7.0x

7.3x

7.9x

8.8x

8.8x

10.2x

9.8x

8.0x

8.8x

9.5x

9.0x

0x

2x

4x

6x

8x

10x

12x

LBO

Purchase

Price

Multiples

(1)

Transactions over $500 million

Average purchase price:

8.5x

Recent

Transactions

(2)

JDA Software Group

10.5x

Ancestry.com

11.2x

Apex Tool Group

7.1x

Samson

8.0x

EP Energy

5.6x

(1)

Source:

Standard

&

Poor’s

LCD’s

Leveraged

Buyout

Review

–

3Q

12.

(2)

Source: Preqin. Most recent buyout deals announced or closed with

publicly available transaction multiples as of November 1, 2012 as well as Apollo estimates for Samson, EP Energy’s closest comparable transaction. |

20

Agenda

1.

Overview of Apollo

2.

Market Overview

3.

Selected Opportunities Across Apollo’s Integrated Platform

|

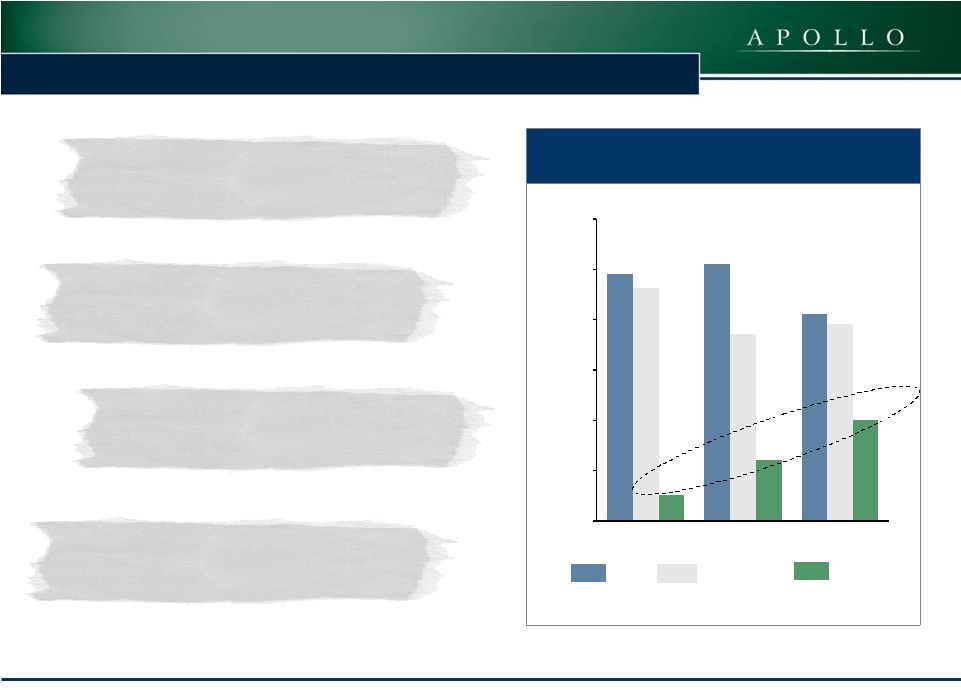

Apollo PE Fund VI

Apollo PE Fund VII

Apollo PE Fund V

Value-Oriented Philosophy

Vintage:

2001

Total Commitments:

$3.7 bn

Apollo

Entry Multiple

Industry Entry

Multiple

Composition

Apollo

Entry Multiple

(1) (3)

Industry Entry

Multiple

Composition

Apollo

Entry Multiple

Industry Entry

Multiple

Vintage:

2006

Total Commitments:

$10.1 bn

Vintage:

2008

Total Commitments:

$14.7 bn

(2)

(2)

(2)

Creation Multiple

Creation Multiple

Creation Multiple

Distressed

27%

Opportunistic

Buyouts

42%

Opportunistic

Buyouts

51%

Distressed

23%

Opportunistic

Buyouts

27%

Distressed

62%

Corporate

Carve-outs

11%

Corporate

Carve-outs

26%

Corporate

Carve-outs

31%

(1)

(1)

6.6x

7.7x

7.7x

9.6x

6.2x

9.0x

Note: As of September 30, 2012. Composition of pie charts is based on

Total Invested Capital as per Apollo’s initial investment strategy at time of acquisition. Distressed investments include Credit and Distressed Buyouts. Past

performance is not indicative of future results.

(1) Creation multiples may incorporate pro forma or other adjustments

based on investment team’s estimates and/or calculations.

(2) Source: S&P LCD database.

(3) Where Fund VI invested in the equity and debt of a portfolio

company, a capital weighted average creation multiple was used.

21

Composition |

22

Longstanding Expertise in Distressed Investing

As of 9/30/12

$ in millions

# of

Companies

Total Capital

Invested

Total

Value

MOIC

(2)

Gross

IRR

(2)

Apollo’s Distressed Investments Since Inception

Distressed Buyouts (obtained control)

14

$5,059

$14,149

2.8x

28.9%

Did Not Obtain Control

233

$5,954

$7,936

1.3x

73.2%

Total Distressed Investments

247

$11,013

$22,085

2.0x

49.1%

Apollo’s Distressed Investing Expertise

Distressed

Investments

Include

:

(3)

(1)

(1) Private Equity investment examples selected based on

non-performance criteria. Information for Apollo’s distressed investment experience is provided to illustrate the Firm’s experience making distressed investments since the Firm’s inception. While Apollo

believes the performance represents all such distressed investments,

there can be no assurance as to the validity of such methodology or determination. (2) Gross IRRs and MOIC are computed prior to management fees, incentive compensation, certain expenses and

taxes, which, if given effect to, would reduce such returns and, in the

aggregate, are expected to be substantial. Gross IRRs are based on actual cash flows to and from the respective Apollo fund in accordance with the applicable provisions within the partnership

agreement of the relevant Apollo fund, as well as the valuations for

unrealized investments as of September 30, 2012. (3) Contains companies which are not currently held in any Apollo portfolio. (4) Based on dollars invested in non-control and control positions acros

all Apollo private equity funds where MOIC as of June 30, 2012 is

<1.0x, exclusive of unrealized investments where we are actively accumulating positions.

|

23

Fund VII

Fund VI

Fund V

Apollo is a Market Leader in Corporate Carve-Outs

Apollo has a history of completing complex carve-outs from leading

global corporations, which are designed to achieve mutual

objectives for both parties Creation

Multiple

Creation

Multiple

Creation

Multiple

5.2x

2.9x

5.6x

7.5x

6.7x

4.1x

8.4x

6.5x

7.1x

7.7x

5.0x

5.7x

7.6x

4.8x

Apollo Portfolio

Company

Parent

Company

Apollo Portfolio

Company

Parent

Company

Apollo Portfolio

Company

Parent

Company

Average

Creation

Multiple:

6.1x

(1)

Average

Creation

Multiple:

6.1x

(1)

6.7x

Note: Investment examples selected based on non-performance

criteria. Investment examples are included as they are the “Carve-Outs” that Apollo has previously completed within its private equity Funds VII, VI and V. Past

performance is not indicative of future results. Listed companies

are not representative of all companies recommended for advisory clients. It should not be assumed investment in such companies was or will be profitable. It

contains companies which are not currently held in any Apollo portfolio.

There can be no guarantees that any similar investment opportunities will be available or pursued by Apollo in the future. Creation multiples may

incorporate pro forma or other adjustments based on investment

team’s estimates and/or calculations. (1) Average creation multiple for investment examples in Funds V, VI,

VII represents arithmetic mean. (2) The acquisition of Borden Chemical was a part of the formation of Momentive but not specifically a carve-out.

|

24

24

Opportunistic

Buyouts: Physical Asset Acquisitions

Examples of Apollo’s

Physical Asset Acquisitions:

# of

Companies

Average

Purchase

Multiple

Total Capital

Invested

Average

Life

5

5.4x

$2,186.2

1.4 yrs

Acquire physical assets at

discounts to financial

market prices

Lock-in value arbitrage through

hedging programs

Upside through operational

enhancements at asset level

Benefits of Physical Asset Acquisitions

Note: Examples represent all past investments in natural

resources-related companies made by Apollo within its private equity funds V, VI and VII that are of the respective transaction type (i.e., corporate carve-outs,

distressed investments, build-up and asset acquisitions) and

includes companies which are not currently held in any Apollo portfolio. Apollo believes the categorization of each investment example to be accurate, but

there can be no assurance as to the accuracy of such classifications nor

the methodology with which Apollo made such categorization determinations.

|

25

Apollo’s Broad Credit Capabilities

(1) As of September 30, 2012.

Performing US

Credit

Structured

Credit

Private

Credit

Opportunistic

Dedicated

Europe

Senior Loans

High Yield

Private Market

Debt

Asia Private Credit

Event Driven

Long/Short Credit

Distressed

Corporate Credit

Sub-

& Non-

Performing Loans

CLOs

RMBS, CMBS, ABS

Multi-Asset

Longevity

Broad platform, adaptable to evolving market conditions and different

risk tolerances Corporate Credit

•$41.3 bn in AUM

(1)

•90 Inv. Professionals

•~900 credits

Structured Credit

•$18.8 bn in AUM

(1)

•45 Inv. Professionals

•~2,650 credits

Broad, Customized Managed Accounts |

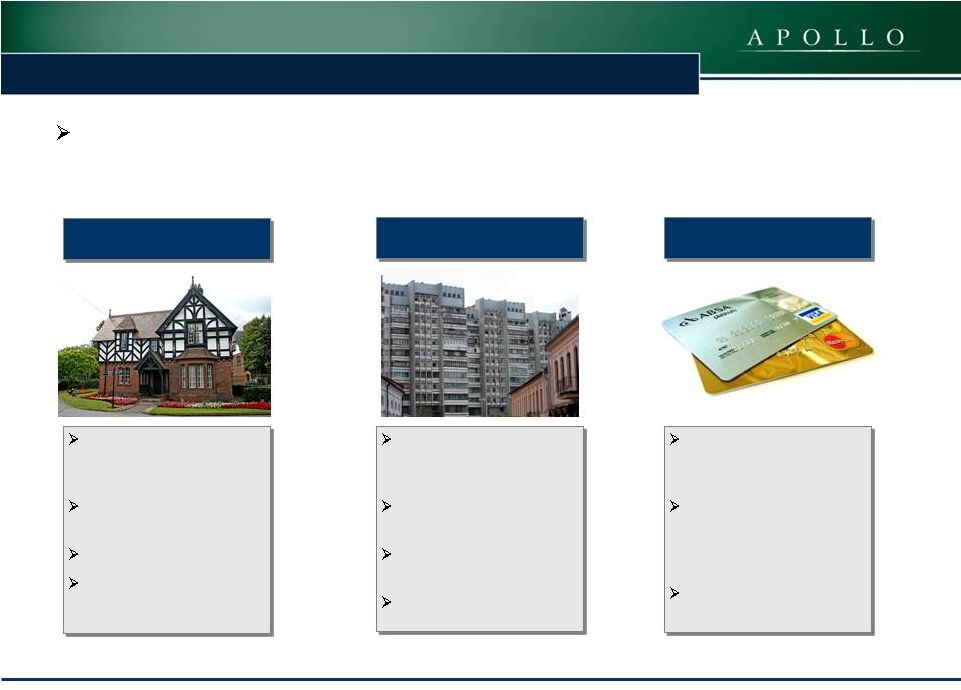

26

26

26

Apollo

leverages

its

integrated

platform

to

pursue

opportunities

that

may

be

less

traditional

and have less competition as a result

–

Select examples include:

Residential Loans

NPLs

Credit Card

Receivables

Portfolio

of

11,000

loans

secured by residential

properties in the U.K.

Average purchase price of

57% of par

Attractive seller financing

Target ~25% gross IRR

€2.4 billion portfolio of

European commercial real

estate loans

Purchase price of less than

€1 billion

Preferred return structure

mitigates downside risk

Target ~30% gross IRR

Irish credit card platform

of major U.S. bank with

250+ employees

Live portfolio with over

200,000 customer accounts

and €650 million of

receivables

Target ~20% gross IRR

Case Study: European Non-Performing & Performing Loans

The target return is based upon estimates and assumptions that a

potential investment will yield a return equal or greater than the target. There can be no assurance that Apollo's projections will be realized or that Apollo will be successful in finding investment

opportunities that meet these anticipated return parameters.

Apollo’s estimate of potential return from a potential investment is not a guarantee as to the quality of the investment or a representation as to the adequacy of Apollo’s methodology for estimating returns.

The target return information is presented gross and does not reflect

the effect of management fees, incentive compensation, certain expenses and taxes.

|

27 |

28

Appendix: Capital Markets’

Fund Summary

Apollo / Artus Investors 2007 –

1

2007

Apollo Asia Opportunity Fund

2007

Apollo Asia Private Credit Fund

2012

Apollo Credit Liquidity Fund

2007

Apollo Credit Opportunity Fund I

2008

Apollo Credit Opportunity Fund II

2008

Apollo Senior Loan Fund

2010

Apollo European Principal Finance

2007

Apollo Investment Corporation (NASDAQ: AINV)

2004

AP Investment Europe Limited

(1)

2006

Apollo Investment Europe II

2008

Apollo European Credit Fund

2011

Apollo Residential Mortgage, Inc. (NYSE: AMTG)

2011

Apollo Senior Floating Rate Fund Inc (NYSE: AFT)

2011

Apollo Strategic Value Fund

2006

Apollo Value Investment Fund

2003

Credit Fund

(2)

2005

Credit Strategies Fund

(2)

2011

Structured Credit Recovery Fund I

2008

Structured Credit Recovery Fund II

2012

Credit Solutions Fund

2011

ALM I

2010

ALM III

2010

ALM IV

2011

ALM V

2012

ALM VI

2012

Compass 2002

2002

Compass 2003

(1)

2003

Compass 2004

2004

Compass 2005-I

2005

Compass 2005-II

2006

Compass 2007

2007

Cornerstone CLO

2007

Granite Ventures I

2005

Granite Ventures II

2005

Granite Ventures III

2006

Neptune

2008

Rampart CLO 2006-I

2006

Rampart CLO 2007-I

2007

Rashinban

2006

Sextant 2006

2006

Sextant 2007

2007

Stone Tower CLO

2003

Stone Tower CLO II

(1)

2004

Stone Tower CLO III

2005

Stone Tower CLO IV

2006

Stone Tower CLO V

2006

Stone Tower CLO VI

2007

Stone Tower CLO VII

2007

It should not be assumed that future Capital Markets funds or CLOs will

equal the performance of the funds and CLOs on this list, nor should it be assumed that the past performance of the funds and CLOs on this list are indicative or a guarantee of future performance of such

funds and CLOs. Note that performance information is not being provided

due to potential issues relating to Regulation FD with respect to Apollo Global Management (NYSE:APO). (1) Fund is currently winding down. (2) Track record was accumulated by the investment

committee, of which two members are no longer at the firm as of June 30,

2012. Apollo Fund

Year of Inception |

29

Risk Factors and Definitions |