Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - UNIVERSAL POWER GROUP INC. | Financial_Report.xls |

| 10-Q - FORM 10-Q - UNIVERSAL POWER GROUP INC. | t74942_10q.htm |

| EX-31.1 - EXHIBIT 31.1 - UNIVERSAL POWER GROUP INC. | ex31-1.htm |

| EX-31.2 - EXHIBIT 31.2 - UNIVERSAL POWER GROUP INC. | ex31-2.htm |

| EX-32.1 - EXHIBIT 32.1 - UNIVERSAL POWER GROUP INC. | ex32-1.htm |

EXHIBIT 10.15

INDUSTRIAL REAL ESTATE LEASE

Multi-Tenant Net Form

Landlord: Cabot II - TX1B02, L.P.

Tenant: Universal Power Group, Inc.

Property Address: 488 S. Royal Lane, Coppell, TX 75019

Building: 488 S. Royal Lane

table of contents

|

ARTICLE ONE - BASIC TERMS

|

1

|

|

ARTICLE TWO - PREMISES

|

3

|

|

ARTICLE THREE - LEASE TERM

|

3

|

|

ARTICLE FOUR - RENT

|

4

|

|

ARTICLE FIVE - PROPERTY TAXES

|

5

|

|

ARTICLE SIX - UTILITIES

|

6

|

|

ARTICLE SEVEN - INSURANCE

|

6

|

|

ARTICLE EIGHT - OUTSIDE AREAS

|

9

|

|

ARTICLE NINE - USE OF PREMISES

|

11

|

|

ARTICLE TEN - CONDITION AND MAINTENANCE OF PREMISES

|

13

|

|

ARTICLE ELEVEN - DAMAGE OR DESTRUCTION

|

16

|

|

ARTICLE TWELVE - CONDEMNATION

|

17

|

|

ARTICLE THIRTEEN - ASSIGNMENT AND SUBLETTING

|

17

|

|

ARTICLE FOURTEEN - DEFAULTS AND REMEDIES

|

19

|

|

ARTICLE FIFTEEN - PROTECTION OF LENDERS

|

22

|

|

ARTICLE SIXTEEN - LEGAL COSTS

|

24

|

|

ARTICLE SEVENTEEN - MISCELLANEOUS PROVISIONS

|

24

|

|

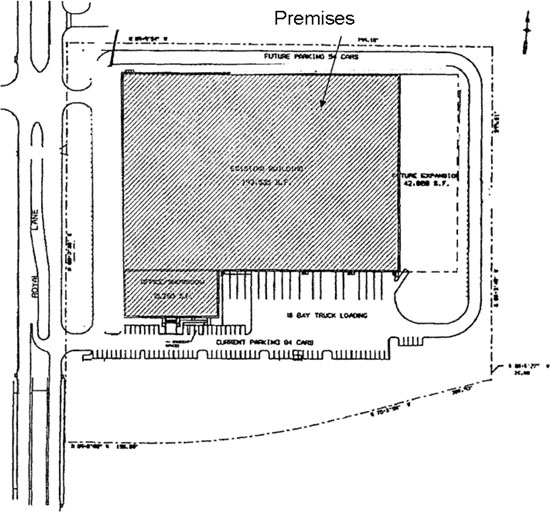

EXHIBIT A - THE PROPERTY

|

|

|

EXHIBIT B - THE PREMISES

|

|

|

EXHIBIT C - RULES AND REGULATIONS

|

|

|

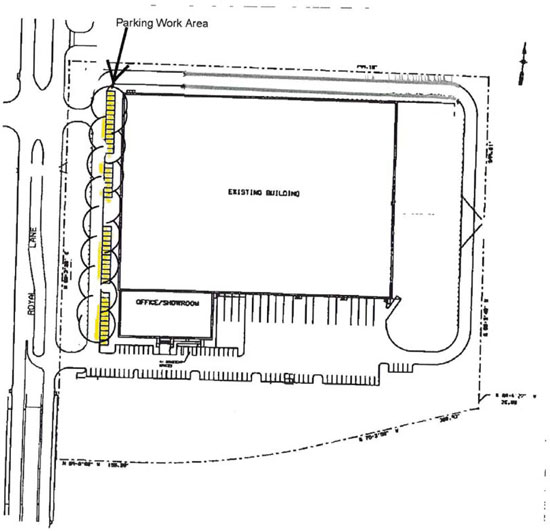

EXHIBIT D - WORK LETTER

|

|

|

EXHIBIT E - SUMMARY OF INSURANCE REQUIREMENTS

|

|

|

EXHIBIT F - RENEWAL OPTION

|

|

|

EXHIBIT G - MEMORANDUM OF ACCEPTANCE OF PREMISES

|

|

|

EXHIBIT H - FORM OF SNDA

|

|

|

EXHIBIT I - FORM OF TENANT ESTOPPEL CERTIFICATE

|

ARTICLE ONE - BASIC TERMS

The following terms used in this Lease shall have the meanings set forth below.

1.01 Date of Lease: October 31, 2012

1.02 Landlord (legal entity): Cabot II - TX1B02, L.P., a Delaware limited partnership

1.03 Tenant (legal entity): Universal Power Group, Inc., a Texas corporation

1.04 Tenant’s Guarantor: None

1.05 Property: 488 S. Royal Lane, Coppell, Texas 75019 Building: 488 S. Royal Lane, Coppell, Texas 75019

1.06 Property Rentable Area: Approximately 208,800 rentable square feet

1.07 Premises Rentable Area: Approximately 208,800 rentable square feet being the entire rentable area of the building located at 488 S. Royal Lane, Coppell, Texas 75019

1.08 Tenant’s Initial Pro Rata Share: 100%

1.09 Lease Term: Beginning on the Lease Commencement Date and ending on the last day of the 127th full calendar month thereafter, unless sooner terminated or extended pursuant to the terms and provisions of this Lease.

1.10 Lease Commencement Date: The earliest of (a) the date Tenant occupies any portion of the Premises and begins conducting business therein, (b) the later of (i) the date on which Landlord achieves substantial completion (as defined in the Work Letter attached hereto as Exhibit D (the “Work Letter”)) of the Initial Improvements, the Roofing Work and the Parking Work, and (ii) March 1, 2013, or (c) the later of (i) the date Landlord would have achieved substantial completion but for a Tenant Delay (as defined in the Work Letter)., and (ii) March 1, 2013.

1.11 Permitted Uses: Warehouse and related office uses

1.12 Broker(s): Stream Realty Partners – DFW, L.P., representing Tenant, and Binswanger, representing Landlord

1.13 Initial Security Deposit: $78,822.00

1.14 Parking Spaces Allocated to Tenant: Prior to completion of the Parking Work (as defined in Exhibit D attached hereto): 84 unreserved spaces. After completion of the Parking Work: 127 unreserved spaces

1.15 Base Rent:

|

Period

|

Annual Base Rent

|

Monthly Installments

of Base Rent |

||

|

Lease Months 1 – 7

|

$0.00

|

$0.00

|

||

|

Lease Months 8 – 12

|

$563,760.00

|

$46,980.00

|

||

|

Lease Months 13 – 30

|

$584,640.00

|

$48,720.00

|

||

|

Lease Months 31 – 54

|

$626,400.00

|

$52,200.00

|

||

|

Lease Months 55 – 78

|

$657,720.00

|

$54,810.00

|

||

|

Lease Months 79 – 12

|

$689,040.00

|

$57,420.00

|

||

|

Lease Months 103 – 127

|

$730,800.00

|

$60,900.00

|

As used herein, a “Lease Month” means a period of time commencing on the same numeric day as the Lease Commencement Date and ending on (but not including) the day in the next calendar month that is the same numeric date as the Lease Commencement Date; provided, however, that if the Lease Commencement Date does not occur on the first day of a calendar month, then the eighth (8th) Lease Month shall be extended to end on the last day of the eighth (8th) full calendar month following the Lease Commencement Date, Tenant shall pay Base Rent during the resulting partial calendar month at the same rate payable for the eighth (8th) Lease Month (prorated based on the number of days in such partial calendar month), and the succeeding Lease Months shall commence on the first day of each calendar month thereafter.

1.16 Other Charges Payable by Tenant:

(i) Taxes (Article Five);

(ii) Utilities (Article Six);

(iii) Insurance Premiums (Article Seven);

(iv) Outside Maintenance Expenses (Article Eight);

1.17 Address of Landlord for Notices:

c/o Cabot Properties

One Beacon Street, Suite 1700

Boston, MA 02108

Attn: Asset Management

Address of Landlord for Rent Payments:

Cabot Industrial Value Fund II, OP PTNSH

Dept. 81402

P.O. Box 201814

Dallas, TX 75320-1814

1.18 Address of Tenant for Notices:

Universal Power Group, Inc.

488 S. Royal Lane

Coppell, TX 75019

Attn: ______________

|

1.19

|

Fiscal Year:

|

January - December

|

|

1.20

|

Mortgagee:

|

JP Morgan Chase Bank, N.A.

|

1.21 Exhibits:

Exhibit A – Legal Description of the Land

Exhibit B – The Premises

Exhibit C – Rules & Regulations

Exhibit D – Work Letter

Exhibit E – Summary of Insurance Coverages

Exhibit F – Renewal Option

Exhibit G – Memorandum of Acceptance of Premises

Exhibit H – Form of SNDA

Exhibit I – Form of Tenant Estoppel Certificate

2

ARTICLE TWO - PREMISES

2.01 Premises. The Premises are shown on Exhibit B and are a part of the Property (hereinafter defined). The Property includes all of the land described on Exhibit A attached hereto, the building(s) and all other improvements located thereon, including the Outside Areas as defined in Article Eight.

ARTICLE THREE - LEASE TERM

3.01 Lease of Premises for Lease Term. Landlord leases the Premises to Tenant and Tenant leases the Premises from Landlord for the Lease Term. Tenant shall have the exclusive right to use the Outside Areas as provided in Section 8.02 below. The Lease Term shall begin on the Lease Commencement Date.

3.02 Commencement. Landlord shall not be liable to Tenant for any delay in the Lease Commencement Date. Following the determination of the actual Lease Commencement Date, Landlord and Tenant shall enter into a Memorandum of Acceptance of Premises in the form set forth in Exhibit G to this Lease setting forth the Lease Commencement Date and expiration date of this Lease. Failure to execute such memorandum shall not affect the Lease Commencement Date and expiration date of this Lease. Notwithstanding to the contrary set forth in this Lease, so long as the scope of the Initial Improvements does not materially change from the description of the Initial Improvements set forth in Schedule D-1 to the Work Letter, if the Lease Commencement Date has not occurred on or before the date which is one hundred twenty (120) days after the later of (i) Tenant’s approval of the cost of the Initial Improvements and (ii) Landlord’s receipt of a building permit for the Initial Improvements (the “Required Completion Date”), Tenant, as its sole and exclusive remedy other than postponement of the Lease Commencement Date, shall be entitled to one (1) day of abatement of Base Rent (based on Base Rent payable during Month 8) following the Lease Commencement Date for every day in the period beginning on the Required Completion Date and ending on the Lease Commencement Date. Landlord agrees to submit for a building permit for the Initial Improvements and the Parking Work within three (3) business days after approval of the Plans by Landlord and Tenant and to submit for a building permit for the Roofing Work on or before November 15, 2012, and to thereafter diligently pursue obtaining such permit(s). Landlord and Tenant acknowledge and agree that: (i) the determination of the Lease Commencement Date shall take into consideration the effect of any Tenant Delays (as defined in the Work Letter); and (ii) the Required Completion Date shall be postponed by the number of days the Lease Commencement Date is delayed due to events of force majeure.

3.03 Early Occupancy. Approximately thirty (30) days prior to the Lease Commencement Date, Tenant may take possession of the Premises for purposes of installing furniture, fixtures, and other personal property of Tenant; provided that such possession shall not interfere with Landlord’s construction of the Initial Improvements and shall be coordinated with Landlord’s general contractor. Tenant’s occupancy of the Premises prior to the Lease Commencement Date shall be subject to all of the provisions of this Lease except the requirement to pay Base Rent and Additional Rent. Tenant shall, however, be liable for the cost of any utilities or other services that are provided to Tenant or the Premises during the period of Tenant’s possession prior to the Lease Commencement Date. Early occupancy of the Premises for such purpose shall not constitute Tenant’s conduct of business in the Premises and shall not advance the expiration date of this Lease.

3

3.04 Holding Over. Tenant shall vacate the Premises upon the expiration or earlier termination of this Lease. Tenant shall reimburse Landlord for and indemnify Landlord against all damages, costs, liabilities and expenses, including attorneys’ fees, which Landlord shall incur on account of Tenant’s delay in so vacating the Premises. If Tenant shall not vacate the Premises upon the expiration or earlier termination of this Lease, the Base Rent shall be increased to 150% of the Base Rent then in effect and Tenant’s obligation to pay Additional Rent shall continue, but nothing herein shall limit any of Landlord’s rights or Tenant’s obligations arising from Tenant’s failure to vacate the Premises, including, without limitation, Landlord’s right to repossess the Premises and remove Tenant therefrom at any time after the expiration or earlier termination of this Lease and Tenant’s obligation to reimburse and indemnify Landlord as provided in the preceding sentence. No holding over by Tenant, whether with or without consent of Landlord, shall operate to extend this Lease.

ARTICLE FOUR - RENT

4.01 Base Rent. The monthly installment of Base Rent due for the period of Lease Month 8 of the Lease Term shall be due and payable by Tenant upon the execution of this Lease and the remaining installments of Base Rent shall be due and payable on the first day of each calendar month during the Lease Term after Lease Month 8. Tenant shall pay to Landlord the Base Rent in lawful money of the United States, in advance and without offset, deduction, or prior demand, expect as otherwise expressly provided herein). The Base Rent shall be payable at Landlord’s address or at such other place or to such other person as Landlord may designate in writing from time to time.

4.02 Additional Rent. All sums payable by Tenant under this Lease other than Base Rent shall be deemed “Additional Rent;” the term “Rent” shall mean Base Rent and Additional Rent. Landlord shall estimate in advance and charge to Tenant its Pro Rata Share of the following costs, to be paid on the same date Base Rent is payable on a monthly basis throughout the Lease Term (including during the period of Lease Months 1 – 7): (i) all Taxes for which Tenant is liable under Section 5.01 and 5.02 of the Lease, (ii) all utility costs (if utilities are not separately metered) for which Tenant is liable under Section 6.01 of the Lease, (iii) all insurance premiums for which Tenant is liable under Sections 7.01 and 7.06 of the Lease and (iv) all Outside Maintenance Expenses for which Tenant is liable under Section 8.04 of the Lease. Collectively, the aforementioned Taxes, insurance, utility, and Outside Maintenance Expenses shall be referred to as the “Total Operating Costs”. Landlord may adjust its estimates of Total Operating Costs at any time based upon Landlord’s experience and reasonable anticipation of costs. Such adjustments shall be effective as of the next Rent payment date after notice to Tenant. Within one hundred twenty (120) days after the end of each Fiscal Year during the Lease Term, Landlord shall deliver to Tenant a statement prepared in accordance with generally accepted accounting principles setting forth, in reasonable detail, the Total Operating Costs paid or incurred by Landlord during the preceding Fiscal Year and Tenant’s Pro Rata Share of such expenses. Within thirty (30) days after Tenant’s receipt of such statement, there shall be an adjustment between Landlord and Tenant, with payment to or credit given by Landlord (as the case may be) in order that Landlord shall receive the entire amount of Tenant’s share of such costs and expenses for such period. In addition to its obligation to pay Base Rent and its Pro Rata Share of Total Operating Costs, Tenant is required hereunder to pay directly to suppliers, vendors, carriers, contractors, etc. certain insurance premiums, utility costs, personal property taxes, maintenance and repair costs and other expenses to the extent provided in this Lease, collectively “Additional Expenses.” If Landlord pays for any Additional Expenses in accordance with the terms of this Lease, Tenant’s obligation to reimburse such costs shall be an Additional Rent obligation payable in full with the next monthly Rent payment. Unless this Lease provides otherwise, Tenant shall pay all Additional Rent then due with the next monthly installment of Base Rent. If Tenant’s payment by check for Rent is returned for non-sufficient funds or for any other reason, Landlord at its sole option may require all future payments of Rent to be made by cashier’s or certified check, money order, or wire transfer, and the delivery of Tenant’s personal or corporate check shall no longer constitute payment thereof.

4

4.03 Late Charge. Tenant hereby acknowledges that late payment by Tenant to Landlord of Rent and other amounts due hereunder will cause Landlord to incur costs not contemplated by this Lease, the exact amount of which will be extremely difficult to ascertain. Such costs include, but are not limited to, processing and accounting charges, and late charges which may be imposed on Landlord by the terms of any loan secured by the Property. Accordingly, if any installment of Rent or any other sums due from Tenant shall not be received by Landlord within five (5) days following the due date, Tenant shall pay to Landlord a late charge equal to two and one-half percent (2.5%) of such overdue amount. The parties hereby agree that such late charge represents a fair and reasonable estimate of the costs Landlord will incur by reason of late payment by Tenant. Acceptance of such late charge by Landlord shall in no event constitute a waiver of Tenant’s default with respect to such overdue amount, nor prevent Landlord from exercising any of the other rights and remedies granted hereunder.

4.04 Interest. Any Rent or other amount due to Landlord, if not paid when due, shall bear interest from the date due until paid at the rate of fifteen percent (15%) per annum or, if a higher rate is legally permissible, at the highest rate legally permitted, provided that interest shall not be payable on late charges incurred by Tenant nor on any amounts upon which late charges are paid by Tenant to the extent such interest would cause the total interest to be in excess of that legally permitted. Payment of interest shall not excuse or cure any default hereunder by Tenant.

4.05 Tenant’s Pro Rata Share. Tenant’s Pro Rata Share shall be calculated by dividing the Premises Rentable Area by the Property Rentable Area, which is leased or held for lease by tenants, as of the date on which the computation shall be made. Tenant’s Initial Pro Rata Share is set forth in Section 1.08 and is subject to adjustment based on the aforementioned formula.

ARTICLE FIVE - PROPERTY TAXES

5.01 Taxes. Tenant shall pay Tenant’s Pro Rata Share of Taxes (as defined below) payable during the Lease Term. Tenant shall make such payments in accordance with Section 4.02. If Landlord shall receive a refund of any Taxes with respect to which Tenant shall have paid Tenant’s Pro Rata Share, Landlord shall refund to Tenant Tenant’s Pro Rata Share of such refund after deducting therefrom the costs and expenses incurred in connection therewith.

5.02 Definition of “Taxes”. “Taxes” shall mean real estate taxes, assessments (special, betterment, or otherwise), levies, fees, rent taxes, excises, impositions, charges, water and sewer rents and charges, and all other government levies and charges, general and special, ordinary and extraordinary, foreseen and unforeseen, which are imposed or levied upon or assessed against the Property or any Rent or other sums payable by any tenants or occupants thereof. Taxes shall include Landlord’s costs and expenses of contesting any Taxes. If at any time during the term the present system of ad valorem taxation of real property shall be changed so that in lieu of the whole or any part of the ad valorem tax on real property, or in lieu of increases therein, there shall be assessed on Landlord a capital levy or other tax on the gross rents received with respect to the Property or a federal, state, county, municipal, or other local income, franchise, excise or similar tax, assessment, levy, or charge (distinct from any now in effect) measured by or based, in whole or in part, upon gross rents, then all of such taxes, assessments, levies, or charges, to the extent so measured or based, shall be deemed to be Taxes. Taxes shall also include fees payable to tax consultants and attorneys for consultation and contesting Taxes.

5

5.03 Personal Property Taxes. Tenant shall pay directly all taxes charged against trade fixtures, furnishings, equipment, inventory, or any other personal property belonging to Tenant. Tenant shall use its best efforts to have personal property taxed separately from the Property. If any of Tenant’s personal property shall be taxed with the Property, Tenant shall pay Landlord the taxes for such personal property within fifteen (15) days after Tenant receives a written statement from Landlord for such personal property taxes.

ARTICLE SIX - UTILITIES

6.01 Utilities. Tenant shall promptly pay, directly to the appropriate supplier, the cost of all natural gas, heat, cooling, energy, light, power, sewer service, telephone, water, refuse disposal and other utilities and services supplied to the Premises, allocable to the period from the time Tenant shall first enter the Premises, throughout the Lease Term and thereafter as long Tenant shall remain in the Premises (collectively, “the Occupancy Period”), together with any related installation or connection charges or deposits (collectively “Utility Costs”). If any services or utilities are jointly metered with other premises, Landlord shall make a reasonable determination of Tenant’s proportionate share of such Utility Costs and Tenant shall pay such share to Landlord in accordance with Section 4.02. Landlord shall not be liable for damages, consequential or otherwise, nor shall there be any rent abatement arising out of any curtailment or interruption whatsoever in utility services. Utilities serving the Outside Areas (as defined in Article Eight) exclusively shall be accounted for as described in Article Eight. Notwithstanding the foregoing, if: (i) Landlord is the sole and direct cause of an interruption in the foregoing described utilities to the Premises for a period in excess of two (2) consecutive business days after Tenant notifies Landlord of such cessation (the “Interruption Notice”); (ii) such cessation is not caused by a fire or other casualty (in which case Article 11 shall control); and (iii) as a result of such cessation, the Premises, or a material portion thereof, is rendered untenantable and Tenant in fact ceases to use the Premises, or material portion thereof, then Tenant, as its sole remedy, shall be entitled to receive an abatement of Base Rent and Tenant’s Pro Rata Share of Total Operating Costs payable hereunder during the period beginning on the third (3rd) consecutive business day following Landlord’s receipt of the Interruption Notice and ending on the day when the utility in question has been restored. In the event the entire Premises has not been rendered untenantable by the cessation in utility service, the amount of abatement that Tenant is entitled to receive shall be prorated based upon the percentage of the Premises so rendered untenantable and not used by Tenant.

ARTICLE SEVEN - INSURANCE

7.01. Liability Insurance. During the Occupancy Period, Tenant shall maintain in effect Commercial General Liability insurance insuring Tenant against liability for bodily injury, property damage and personal injury at the Premises, including contractual liability insuring the indemnification provisions contained in this Lease. Such insurance shall name Landlord, its property manager, any mortgagee, Cabot Industrial Value Fund II, OP, L.P., Cabot Properties, Inc., and such other parties as Landlord may designate, as additional insureds on a form that does not limit the coverage provided under such policy to any additional insured (i) by reason of such additional insured’s negligent acts or omissions (sole or otherwise), (ii) by reason of other insurance available to such additional insured, or (iii) to claims for which a primary insured has agreed to indemnify the additional insured. Such insurance shall be for a limit of not less than One Million Dollars ($1,000,000) per occurrence and Two Million Dollars ($2,000,000) annual aggregate. Coverage shall also be included for fire damage (damage to rented premises) for a limit of $300,000 any one fire, and medical expense coverage in the amount of $10,000 any one person. The liability insurance obtained by Tenant under this Section 7.01 and Section 7.04 shall (i) be primary and (ii) insure Tenant’s obligations to Landlord under Section 7.09. The amount and coverage of such insurance shall not limit Tenant’s liability nor relieve Tenant of any other obligation under this Lease. Landlord may also obtain commercial general liability insurance in an amount and with coverage determined by Landlord insuring Landlord against liability with respect to the Premises and the Property. The policy obtained by Landlord shall not provide primary insurance, shall not be contributory and shall be excess over any insurance maintained by Tenant.

6

7.02 Worker’s Compensation Insurance. During the Occupancy Period, Tenant shall maintain in effect Worker’s Compensation Insurance (including Employers’ Liability Insurance) in the statutory amount covering all employees of Tenant employed or performing services at the Premises, in order to provide the statutory benefits required by the laws of the state in which the Premises are located, or non-subscriber’s insurance providing coverage for claims that would have been covered by Worker’s Compensation Insurance. Employer’s Liability Insurance in the amount of $1,000,000 each accident/$1,000,000 disease-policy limit/$1,000,000 disease-each employee shall also be maintained.

7.03 Automobile Liability Insurance. During the Occupancy Period, Tenant shall maintain in effect Automobile Liability Insurance, including but not limited to, passenger liability, on all owned, non-owned, and hired vehicles used in connection with the Premises, with a combined single limit per occurrence of not less than One Million Dollars ($1,000,000) for Bodily Injury and Property Damage.

7.04 Umbrella Liability Insurance. The initial mount of such insurance shall be Five Million Dollars ($5,000,000) per occurrence and Five Million Dollars ($5,000,000) annual aggregate and shall be subject to periodic increases specified by Landlord based upon inflation, increased liability awards, recommendation of Landlord’s professional insurance advisers, and other relevant factors. Such insurance shall name Landlord, its property manager, any mortgagee and Cabot Industrial Properties, L.P., as additional insureds.

At all times when any work is in process in connection with any change or alteration being made by Tenant, Tenant shall require all contractors and subcontractors to maintain the insurance described in Sections 7.01, 7.02, 7.03 and 7.04.

7.05 Causes of Loss – Special Form Property Insurance. During the Occupancy Period, Tenant shall maintain in effect causes of loss – special form property insurance covering leasehold improvements paid for by Tenant and Tenant’s personal property and fixtures from time to time in, on, or at the premises, in an amount not less than 100% of the full replacement cost, without deduction for depreciation, providing protection against events protected under “Special Risk Coverage,” as well as against sprinkler damage, vandalism, and malicious mischief. Any proceeds from the causes of loss – special form property insurance shall be used for the repair or replacement of the property damaged or destroyed, unless this Lease is terminated under an applicable provision herein. If the Premises are not repaired or restored following damage or destruction in accordance with other provisions herein, Landlord shall receive any proceeds from the causes of loss – special form property insurance allocable to Tenant’s leasehold improvements.

7.06 Business Interruption Insurance. Intentionally omitted.

7.07 Landlord’s Property and Rental Income Insurance. During the Lease Term, Landlord shall maintain in effect causes of loss – special form property insurance covering loss of or damage to the Property in the amount of its replacement value with such endorsements and deductibles as Landlord shall determine from time to time. Landlord shall have the right to obtain flood, earthquake, and such other insurance as Landlord shall determine from time to time or shall be required by any lender holding a security interest in the Property. Landlord shall not obtain insurance for Tenant’s fixtures or equipment or building improvements installed by Tenant. During the Lease Term, Landlord shall also maintain a rental income insurance policy, with loss payable to Landlord, in an amount equal to one (1) year’s Base Rent, plus estimated Taxes, Outside Maintenance Expenses, Utility Costs and insurance premiums for one (1) year. Tenant shall be liable for the payment of any deductible amount under Landlord’s insurance maintained pursuant to this Article Seven, in an amount not to exceed Twelve Thousand Five Hundred Dollars ($12,500) per occurrence. Tenant shall not do or permit anything to be done which shall invalidate any such insurance. Any increase in the cost of Landlord’s insurance due to Tenant’s use or activities at the Premises shall be paid by Tenant to Landlord as Additional Rent hereunder.

7

Exhibit F attached hereto is a summary of the insurance coverages required by this Article Seven.

7.08 Payment of Insurance Premiums. Landlord shall pay the premiums of the insurance policies maintained by Landlord under Section 7.07 and Section 7.01 (if applicable), and Tenant shall reimburse Landlord for Tenant’s Pro Rata Share of such premiums in accordance with Section 4.02. Tenant shall pay directly the premiums of the insurance policies maintained by Tenant under Sections 7.01, 7.02, 7.03, 7.04, 7.05 and 7.06.

7.09 General Insurance Provisions.

7.09 (a) Prior to the earlier of Tenant’s entry into the Premises or the Lease Commencement Date and prior to the expiration of any policy, Tenant shall furnish Landlord certificates evidencing that all required insurance is in force and providing that such insurance may not be cancelled or changed without at least thirty (30) days prior written notice to Landlord and Tenant (unless such cancellation is due to nonpayment of premiums, in which event ten (10) days’ prior notice shall be provided). If Tenant shall fail to deliver any certificate or renewal certificate to Landlord required under this Lease within the prescribed time period or if any such policy shall be canceled or modified during the Lease Term without Landlord’s consent, Landlord may obtain such insurance, in which case Tenant shall reimburse Landlord, as Additional Rent, for 110% of the cost of such insurance within ten (10) days after receipt of a statement of the cost of such insurance.

7.09 (b) Tenant shall maintain all insurance required under this Lease with insurers having a Best’s Insurance Reports rating of A- X or better.

7.09 (c) Notwithstanding anything to the contrary set forth herein, Landlord and Tenant, on behalf of themselves and their insurers, each hereby waive any and all rights of recovery against the other, the officers, members, partners, employees, agents, or representatives of the other and the officers, members, partners, employees, agents or representatives of each of the foregoing, for loss of or damage to its property or the property of others under its control, if such loss or damage shall be covered by any insurance policy in force (whether or not described in this Lease) at the time of such loss or damage, or required to be carried under this Article Seven, EVEN IF SUCH LOSS OR DAMAGE IS CAUSED BY THE NEGLIGENCE OF THE RELEASED PARTY. Landlord and its agents, employees and contractors shall not be liable for, and Tenant hereby waives all claims against such parties for, business interruption and losses occasioned thereby sustained by Tenant or any person claiming through Tenant resulting from any accident or occurrence in or upon the Premises or the Property from any cause whatsoever, INCLUDING WITHOUT LIMITATION, DAMAGE CAUSED IN BY THE CONCURRENT NEGLIGENCE (BUT NOT THE SOLE NEGLIGENCE, GROSS NEGLIGENCE OR WILLFUL MISCONDUCT) OF LANDLORD OR ITS AGENTS, EMPLOYEES OR CONTRACTORS. All property insurance carried by either party shall contain a waiver of subrogation against the other party to the extent such right shall have been waived by the insured party prior to the occurrence of loss or injury.

8

7.09 (d) Tenant shall comply with all applicable laws and ordinances, all orders and decrees of court and all requirements of other governmental authority and shall not directly or indirectly make any use of the Premises which may thereby be prohibited or be dangerous to person or property or which may jeopardize any insurance coverage, or may increase the cost of insurance or require additional insurance coverage.

7.10 Indemnity. To the fullest extent permitted by law, Tenant hereby waives all claims against Landlord, its agents, advisors, employees, members, officers, directors, partners, trustees, beneficiaries and shareholders (each a “Landlord Party”) and the agents, advisors, employees, members, officers, directors, partners, trustees, beneficiaries and shareholders of each Landlord Party (collectively “the Indemnitees”) for damage to any property or injury to or death of any person in, upon or about the Premises or the Property arising at any time and from any cause, and Tenant shall hold Indemnitees harmless from and defend Indemnitees from and against all claims, liabilities, judgments, demands, causes of action, losses, damages, costs and expenses including reasonable attorney’s fees for damage to any property or injury to or death of any person arising in or from (i) the use or occupancy of the Premises by Tenant or persons claiming under Tenant, EVEN IF CAUSED BY THE CONCURRENT NEGLIGENCE (BUT NOT THE SOLE NEGLIGENCE, GROSS NEGLIGENCE OR WILLFUL MISCONDUCT) OF LANDLORD, ITS AGENTS, EMPLOYEES OR CONTRACTORS, or (ii) arising from the negligence or willful misconduct of Tenant, its employees, agents, contractors, or invitees in, upon or about the Property, or (iii) arising out of any breach or default by Tenant under this Lease. The foregoing shall include investigation costs and expenses incurred by Landlord in connection with any claim or demand made under this Section. The provisions of this Section 7.10 shall survive the expiration or termination of this Lease with respect to any damage, injury, or death occurring prior to such time.

ARTICLE EIGHT - OUTSIDE AREAS

8.01 Outside Areas. As used in this Lease, “Outside Areas” shall mean all areas within the Property which are outside the building envelope, including, but not limited to, parking areas, driveways, sidewalks, access roads, landscaping, and planted areas.

8.02 Use of Outside Areas. Tenant shall have the exclusive right to use the Outside Areas for the purposes intended, subject to such reasonable rules and regulations (“Rules and Regulations”) as Landlord may establish or modify from time to time and as initially set forth in Exhibit C. Tenant shall abide by all such Rules and Regulations and shall use its best efforts to cause others who use the Outside Areas with Tenant’s express or implied permission to abide by Landlord’s Rules and Regulations. At any time, Landlord may close any Outside Areas to perform any acts in the Outside Areas as, in Landlord’s reasonable judgment, are desirable to maintain or improve the Property and during any such closure, Landlord shall use commercially reasonable efforts not to materially interfere with Tenant’s business operations.

8.03 Vehicle Parking. Tenant shall be entitled to use the Parking Spaces Allocated to Tenant without paying any additional Rent. Tenant’s parking shall not be reserved and shall be limited to vehicles no larger than standard size automobiles or pickup utility vehicles. Tenant shall not cause large trucks or other large vehicles to be parked within the Property or on the adjacent public streets except in accordance with the Rules and Regulations. Parking shall be at Tenant’s risk and Landlord shall not be responsible for any damage or theft to vehicles parking at the Property. Landlord shall not be responsible for policing the parking areas. Vehicles shall be parked only in striped parking spaces and not in driveways or other locations not specifically designated for parking. Handicapped spaces shall only be used by those legally permitted to use them. Tenant shall not park at any time more vehicles in the parking area than the number of Parking Spaces Allocated to Tenant.

9

8.04 Outside Area Maintenance. Subject to Articles Eleven and Twelve, Landlord shall maintain the Outside Areas in good order, condition, and repair. Outside Area Maintenance expenses (“Outside Maintenance Expenses”) are all costs and expenses associated with the operation and maintenance of the Outside Areas and the repair and maintenance of the heating, ventilation, air conditioning, plumbing, electrical, utility, and safety systems (to the extent not performed by Tenant), including, but not limited to, the following: gardening and landscaping; snow removal; utility, water and sewage services for the Outside Areas; maintenance of signs (other than tenants’ signs); worker’s compensation insurance; personal property taxes; rentals or lease payments paid by Landlord for rented or leased personal property used in the operation or maintenance of the Outside Areas; fees for required licenses and permits; routine maintenance and repair of roof membrane, flashings, gutters, downspouts, roof drains, skylights and waterproofing; maintenance of paving (including sweeping, striping, repairing, resurfacing, and repaving); amounts paid pursuant to covenants, declarations, restrictions or easement agreements; general maintenance; painting; lighting; cleaning; refuse removal; security and similar items; exterior painting and a property management fee (not to exceed two percent (2%) of the gross revenues of the Property for the calendar year). Landlord may cause any or all of such services to be provided by third parties and the cost of such services shall be included in Outside Maintenance Expenses. With respect to any Outside Maintenance Expenses which are included for the benefit of the Property and other property, Landlord shall make a reasonable allocation of such cost between the Property and such other property. Outside Maintenance Expenses shall not include: (a) the cost of capital repairs and replacements, provided, however, that the annual depreciation (based on the useful life of the item under generally accepted accounting principles) of any such capital repair or replacement to the Outside Areas or the heating, ventilating, air-conditioning, plumbing, electrical, utility and safety systems serving the Property shall be included in the Outside Maintenance Expenses each year during the term of this Lease; (b) the cost of capital improvements, provided, however, that the annual depreciation (based on the useful life of the item under generally accepted accounting principles) of any capital improvement undertaken to reduce Outside Maintenance Expenses (provided such inclusion within Outside Maintenance Expenses shall be limited to the amount of savings actually realized) or made in order to comply with legal requirements enacted or becoming applicable to the Building or the Property after the execution of this Lease shall be included in Outside Maintenance Expenses each year during the term of this Lease, (c) depreciation or amortization except as permitted herein; (d) loan payments; (e) advertising and promotional costs; (f) costs incurred in connection with the original construction of the Building or Premises and accompanying site improvements; (g) expenses resulting from the gross negligence of Landlord, its agents, servants or employees; (h) legal fees, space planners’ fees, real estate brokers’ leasing commissions, advertising expenses, marketing expenses and promotional expenses incurred in connection with the Building; (i) costs for which Landlord is reimbursed from any source other than Tenant; (j) any reserves; (k) Landlord’s general, administrative and overhead expenses, as the same are distinguished from the costs of operation of the Premises, the Building or the Property, including company accounting and legal matters; (l) costs of selling, syndicating, financing, mortgaging or hypothecating any of Landlord’s interest in the Property; (m) costs (including attorney’s fees and costs of settlement judgments and payments in lieu thereof) arising from claims, disputes or potential disputes in connection with potential or actual claims, litigation or arbitrations regarding Landlord and/or the Building; (n) the wages and benefits of any employee who does not devote substantially all of his or her time to the Property, unless such wages and benefits are allocated to reflect the actual time spent on operating and managing the Property vis-à-vis time spent on matters unrelated to operating and managing the Property; (o) amounts paid as ground rental by Landlord; (p) costs incurred by Landlord due solely to the violation by Landlord or any law; (q) repairs or other work needed because of fire, windstorm, or other casualty or cause insured against by Landlord, except for a commercially reasonable deductible; (r) except for any such costs related to general maintenance and repair of the Property, any costs incurred to test, survey, cleanup, contain, abate, remove or otherwise remedy hazardous wastes (including asbestos-containing materials) from the Building to the extent such costs do not result from Tenant’s use or occupancy of the Premises; (s) penalties, fines, late payment charges, or interest incurred as a result of the late payment of any property tax, operating expense or other cost or expense related to the ownership or operation of the Building, including mortgages, and (t) any income, franchise, ad valorem or other taxes imposed on Landlord or the Property.

10

8.05 Tenant’s Payment of Outside Maintenance Expenses. Tenant shall pay Tenant’s Pro Rata Share of all Outside Maintenance Expenses in accordance with Section 4.02. Notwithstanding the foregoing, during the initial Lease Term, for purposes of computing Tenant’s Pro Rata Share of Outside Maintenance Expenses, commencing with Fiscal Year 2015, the Controllable Outside Maintenance Expenses (hereinafter defined) shall not increase by more than 7% per Fiscal Year on a compounding and cumulative basis over the course of the Lease Term. In other words, Controllable Outside Maintenance Expenses for calendar year 2015 shall not exceed 107% of the Controllable Outside Maintenance Expenses for calendar year 2014. Controllable Outside Maintenance Expenses for calendar year 2016 shall not exceed 107% of the limit on Controllable Outside Maintenance Expenses for calendar year 2015, etc. By way of illustration, if Controllable Outside Maintenance Expenses were $1.00 per square foot for calendar year 2014, then Controllable Outside Maintenance Expenses for calendar year 2015 shall not exceed $1.07 per square foot, and Controllable Outside Maintenance Expenses for calendar year 2016 shall not exceed $1.1449 per square foot. “Controllable Outside Maintenance Expenses” shall mean all Outside Maintenance Expenses exclusive of the cost of taxes, insurance, utilities, employment costs based upon the minimum wage (including benefits), the property management fee (not to exceed two percent (2%) of gross revenues of the Property for the calendar year), any costs Landlord is required to incur to comply with any rule, code, law, regulation, or ordinance adopted or promulgated after the Lease Commencement Date (or new or different interpretations of any of the foregoing adopted or promulgated after the Lease Commencement Date) of any governmental authority or agency with jurisdiction over the Property, or any expense increase arising from the unionization of any service rendered to the Property.

ARTICLE NINE - USE OF PREMISES

9.01 Permitted Uses. Tenant may use the Premises only for the Permitted Uses.

9.02 Manner of Use. Tenant shall not cause or permit the Premises to be used in any way which shall constitute a violation of any law, ordinance, restrictive covenants, governmental regulation or order or which shall constitute a nuisance or waste. Tenant shall obtain and pay for all permits (excluding a certificate of occupancy which shall be obtained pursuant to the Work Letter) and shall promptly take all actions necessary to comply with all applicable statutes, ordinances, notes, regulations, orders, covenants, restrictions and requirements, including without limitation, the Occupational Safety and Health Act and the Americans With Disabilities Act of 1990 (49 U.S.C. Section 12101 et seq.) and regulations and guidelines promulgated thereunder, as all of the same may be amended from time to time (collectively, the “ADA”), with reference to the use, condition, configuration or occupancy of the Premises. Tenant further acknowledges and agrees that, except as may otherwise be specifically provided below, Tenant accepts the Premises and the Property in “as is” condition; provided, however, Landlord shall be responsible for compliance with the ADA in connection with the construction of the improvements by Landlord pursuant to Exhibit D. Landlord is making no representation or warranty as to whether the Premises or the Property as of the date of this Lease conform to the requirements of the ADA. Tenant has previously provided Landlord with the Manufacturer’s Safety Data Sheets (“MSDS”) for Hazardous Materials Tenant intends to use the Premises, and Landlord approves all such Hazardous Materials for which it has received a MSDS.

11

9.03 Hazardous Materials. Tenant covenants, represents and warrants that it will not use or store any Hazardous Materials on or about the Premises without obtaining Landlord’s prior written consent. If Tenant wishes to use or store any Hazardous Materials on or about the Premises, prior to doing so, Tenant shall also complete and deliver to Landlord Landlord’s form of Hazardous Materials Disclosure Certificate; provided that Tenant shall not be required to submit the Hazardous Materials Disclosure Certificate for Tenant’s storage and distribution of sealed batteries typically used in fire alarm panels, security panels and small computer UPS systems for which Tenant has provided a MSDS.

As used in this Lease, the term “Hazardous Material” shall mean any flammable items, explosives, radioactive materials, oil, hazardous or toxic substances, material or waste or related materials, including any substances defined as or included in the definition of “hazardous substances”, “hazardous wastes”, “hazardous materials” or “toxic substances” now or subsequently regulated under any applicable federal, state or local laws or regulations, including without limitation petroleum-based products, paints, solvents, lead, cyanide, DDT, printing inks, acids, pesticides, ammonia compounds and other chemical products, asbestos, PCBs and similar compounds, and including any different products and materials which are subsequently found to have adverse effects on the environment or the health and safety of persons. Tenant shall not cause or permit any Hazardous Material to be generated, produced, brought upon, used, stored, treated or disposed of in or about the Property by Tenant, its agents, employees, contractors, sublessees or invitees without (a) the prior written consent of Landlord, and (b) complying with all applicable Federal, State and Local laws or ordinances pertaining to the transportation, storage, use or disposal of such Hazardous Materials, including but not limited to obtaining proper permits. Landlord shall be entitled to take into account such other factors or facts as Landlord may reasonably determine to be relevant in determining whether to grant or withhold consent to Tenant’s proposed activity with respect to Hazardous Material. In no event, however, shall Landlord be required to consent to the installation or use of any storage tanks on the Property.

If Tenant’s transportation, storage, use or disposal of Hazardous Materials on the Premises results in the contamination of the soil or surface or ground water or loss or damage to person(s) or property, then Tenant agrees to: (a) notify Landlord immediately of any contamination, claim of contamination, loss or damage, (b) after consultation with the Landlord, clean up the contamination in full compliance with all applicable statutes, regulations and standards and (c) indemnify, defend and hold Landlord harmless from and against any claims, suits, causes of action, costs and fees, including attorney’s fees and costs, arising from or connected with any such contamination, claim of contamination, loss or damage. Tenant agrees to fully cooperate with Landlord and provide such documents, affidavits and information as may be requested by Landlord (i) to comply with any environmental law, (ii) to comply with the request of any lender, purchaser or tenant, and/or (iii) for any other reason deemed necessary by Landlord in its reasonable discretion. Tenant shall notify Landlord promptly in the event of any spill or other release of any Hazardous Material at, in, on, under or about the Premises which is required to be reported to a governmental authority under any environmental law, will promptly forward to Landlord copies of any notices received by Tenant relating to alleged violations of any environmental law and will promptly pay when due any fine or assessment against Landlord, Tenant or the Premises relating to any violation of an environmental law during the term of this Lease. If a lien is filed against the Premises by any governmental authority resulting from the need to expend or the actual expending of monies arising from an act or omission, whether intentional or unintentional, of Tenant, its agents, employees or invitees, or for which Tenant is responsible, resulting in the releasing, spilling, leaking, leaching, pumping, emitting, pouring, emptying or dumping of any Hazardous Material into the waters or onto land located within or without the State where the Premises is located, then Tenant shall, within thirty (30) days from the date that Tenant is first given notice that such lien has been placed against the Premises (or within such shorter period of time as may be specified by Landlord if such governmental authority has commenced steps to cause the Premises to be sold pursuant to such lien) either (i) pay the claim and remove the lien, or (ii) furnish a cash deposit, bond, or such other security with respect thereto as is satisfactory in all respects to Landlord and is sufficient to effect a complete discharge of such lien on the Premises. Landlord shall have the right, but not the obligation, without in any way limiting Landlord’s other rights and remedies under this Lease, to enter upon the Premises, or to take such other actions as it deems necessary or advisable, to investigate, clean up, remove or remediate any Hazardous Materials or contamination by Hazardous Materials present on, in, at, under or emanating from the Premises or the Property in violation of Tenant’s obligations under this Lease or under any laws regulating Hazardous Materials. Notwithstanding any other provision of this Lease, Landlord shall have the right, at its election, in its own name or as Tenant’s agent, to negotiate, defend, approve and appeal, at Tenant’s expense, any action taken or order issued by any governmental agency or authority with any governmental agency or authority against Tenant, Landlord or the Premises or Property relating to any Hazardous Materials or under any related law or the occurrence of any event or existence of any condition that would cause a breach of any of the covenants set forth in this Section 9.03. Prior to or promptly after the expiration or termination of this Lease, Landlord may require an environmental audit of the Premises by a qualified environmental consultant. If such audit discloses any contamination caused by Tenant or its agents, employees or contractors, Tenant shall pay the costs of such an environmental audit and shall, at it sole cost and expense, take all actions recommended in such audit to remediate any environmental conditions. The provisions of this Section 9.03 shall survive the expiration or earlier termination of this Lease.

12

9.04 Signs and Auctions. Tenant shall not place any signs on the Property without Landlord’s prior written consent, which consent shall not be unreasonably withheld. Tenant shall not conduct or permit any auctions or sheriff’s sales at the Property.

9.05 Landlord’s Access. Landlord or its agents may enter the Premises at all reasonable times to show the Premises to potential buyers, investors or tenants or other parties; to do any other act or to inspect and conduct tests in order to monitor Tenant’s compliance with all applicable environmental laws and all laws governing the presence and use of Hazardous Material; or for any other purpose Landlord deems necessary. Landlord shall give Tenant prior notice (which may be oral) of such entry, except in the case of an emergency, in which event Landlord shall make reasonable efforts to notify Tenant. Landlord will use commercially reasonable efforts to minimize any interference with Tenant’s business operations in connection with such entry. Landlord may place customary “For Sale” or “For Lease” signs on the Premises.

ARTICLE TEN - CONDITION AND MAINTENANCE OF PREMISES

10.01 Existing Conditions. Except as provided in the Work Letter attached hereto as Exhibit D, if applicable, Tenant shall accept the Property and the Premises in their condition as of the execution of the Lease, subject to all recorded matters, laws, ordinances, and governmental regulations and orders. Except as provided herein, Tenant acknowledges that neither Landlord nor any agent of Landlord has made any representation as to the condition of the Property or the suitability of the Property for Tenant’s intended use. Tenant represents and warrants that Tenant has made its own inspection of and inquiry regarding the condition of the Property and is not relying on any representations of Landlord or any Broker with respect thereto.

10.02 Exemption of Landlord from Liability. Tenant shall insure its personal property under a causes of loss – special form full replacement cost property insurance policy as provided in Section 7.04. Landlord shall not be liable for any damage or injury to the person, business (or any loss of income therefrom), goods, wares, merchandise or other property of Tenant, Tenant’s employees, invitees, customers or any other person or about the Property, whether such damage or injury is caused by or results from: (a) fire, steam, electricity, water, gas or rain; (b) the breakage, leakage, obstruction or other defects of pipes, sprinklers, wires, appliances, plumbing, air conditioning or lighting fixtures or any other cause; (c) conditions arising in or about Property, or from other sources or places; or (d) any act or omission of any other tenant of the Property. Tenant shall give Landlord prompt notice upon the occurrence of any accident or casualty at the Premises.

13

10.03 Landlord’s Obligations. Subject to the provisions of Article Eleven (Damage or Destruction) and Article Twelve (Condemnation), and except for damage caused by any act or omission of Tenant, or Tenant’s employees, agents, contractors or invitees, Landlord shall, as a component of Outside Maintenance Expenses (not to exceed $2,500.00 per calendar year), keep the foundation, roof, electric and plumbing lines up to the point of connection with the Building, Building sprinkler system, structural components and exterior walls of the improvements on the Property in good order, condition and repair; provided that the cost of any roof replacement and/or structural repairs shall be paid by Landlord and shall not be included in Outside Maintenance Expenses. However, Landlord shall not be obligated to maintain or repair windows, doors, plate glass or the surfaces of walls. Tenant shall promptly report in writing to Landlord any defective condition known to it which Landlord is required to repair. Further, Landlord shall at its expense make all necessary repairs and replacements to any portion of the Initial Improvements performed pursuant to Exhibit D arising from defects in materials and/or workmanship so long as Tenant gives Landlord written notice thereof on or before the first anniversary of the Lease Commencement Date. Tenant hereby waives the benefit of any present or future law which provides Tenant the right to repair the Premises or Property at Landlord’s expense or to terminate this Lease because of the condition of the Property or Premises.

10.04 Tenant’s Obligations.

10.04 (a) Repair and Maintenance. Except as provided in Section 10.03, Article Eleven (Damage or Destruction) and Article Twelve (Condemnation), Tenant shall keep all portions of the Premises, including, without limitation, plumbing, restrooms, lighting, man doors, dock doors, levelers, shelters, seals and bumpers (if any), windows, floors, fire/life safety systems, air rotation equipment and electrical items, in a clean and orderly condition and good repair. Tenant shall arrange and pay for its own janitorial service, trash removal, security system, telecommunication systems, and any and all other services that Tenant desires. Tenant shall enter into a preventative maintenance contract with a reputable HVAC service company, such contract and contractor to be approved by Landlord, to provide for routine maintenance of the HVAC systems serving the Premises. If any portion of the Premises or any system or equipment in the Premises which Tenant shall be obligated to repair cannot be fully repaired or restored, Tenant shall promptly replace such portion of the Premises or system or equipment, regardless of whether the benefit of such replacement extends beyond the Lease Term. Landlord shall have the right, upon written notice to Tenant, to undertake the responsibility for maintenance of the heating and air conditioning system at Tenant’s expense. Landlord shall, at Tenant’s expense, repair any damage to the portions of the Property Landlord shall be required to maintain caused by Tenant’s acts or omissions. Notwithstanding the foregoing, provided that Tenant maintains the required maintenance service contract for the HVAC systems serving the Premises as required herein, and except for any repairs or replacements necessitated by any action or inaction of Tenant or its agents, employees, invitees, licensees, or visitors, Landlord and Tenant agree that Tenant’s obligations for repairs or replacements to the HVAC units existing and serving the Premises as of the date of this Lease shall not exceed $1,000.00, per unit per occurrence, during the initial Lease Term (it being agreed that the cap on Tenant’s obligations for repair and maintenance shall not apply to any HVAC units installed by Tenant or any replacement HVAC units installed in replacement of any HVAC unit existing on the date of this Lease). In the event such repair or replacement cost for a particular unit exceeds $1,000.00 per any one occurrence, Landlord shall, at its sole discretion, elect to repair or replace such unit(s). If Tenant fails to maintain the required maintenance service contract in effect at any time during the Lease Term, Landlord’s obligation to pay for any repair or replacement of any HVAC unit shall terminate and be of no force or effect. Upon request by Landlord, Tenant shall provide Landlord with copies of invoices and evidence of payment of all repair costs for the HVAC systems serving the Premises.

14

10.04 (b) Tenant’s Expense. Tenant shall fulfill all of Tenant’s obligations under this Section 10.04 at Tenant’s sole expense. If Tenant shall fail to maintain, repair or replace the Premises as required by this Section 10.04, Landlord may, upon ten (10) days’ prior notice to Tenant (except that no notice shall be required in the case of an emergency), enter the Premises and perform such maintenance or repair (including replacement, as needed) on behalf of Tenant. In such case, Tenant shall reimburse Landlord for all costs reasonably incurred in performing such maintenance, repair or replacement immediately upon demand.

10.05 Alterations, Additions, and Improvements.

10.05 (a) Tenant’s Work. Tenant shall not make any installations, alterations, additions, or improvements in or to the Premises, including, without limitation, any apertures in the walls, partitions, ceilings or floors, without on each occasion obtaining the prior written consent of Landlord. Any such work so approved by Landlord shall be performed only in accordance with plans and specifications therefor reasonably approved by Landlord. However, Landlord’s consent shall not be required for any proposed installations, alterations, additions, or improvements that satisfy all of the following criteria (“Permitted Alterations”): (1) is not visible from the exterior of the Premises or Building; (2) will not affect the systems or structure of the Building; (3) does not require a building permit; and (4) will not, in the aggregate, cost more than $10,000.00. Further, installation and reconfiguration of racking in the Premises shall not require Landlord’s consent. Except for the requirement of obtaining Landlord’s prior written consent and the requirement of delivering plans to the Landlord, Permitted Alterations shall otherwise be subject to all the other provisions of this Section 10.05. Tenant shall procure at Tenant’s sole expense all necessary permits and licenses before undertaking any work on the Premises and shall perform all such work in a good and workmanlike manner employing materials of good quality and so as to conform with all applicable zoning, building, fire, health and other codes, regulations, ordinances and laws and with all applicable insurance requirements. If requested by Landlord, Tenant shall furnish to Landlord prior to commencement of any such work a bond or other security acceptable to Landlord assuring that any work by Tenant will be completed in accordance with the approved plans and specifications and that all subcontractors will be paid. Tenant shall employ for such work only contractors reasonably approved by Landlord and shall require all contractors employed by Tenant to carry worker’s compensation insurance in accordance with statutory requirements and commercial general liability insurance covering such contractors on or about the Premises with a combined single limit not less than $3,000,000 and shall submit certificates evidencing such coverage to Landlord prior to the commencement of such work. Tenant shall indemnify and hold harmless Landlord from all injury, loss, claims or damage to any person or property occasioned by or growing out of such work. Landlord may inspect the work of Tenant at reasonable times and given notice of observed defects. Upon completion of any such work, Tenant shall provide Landlord with “as built” plans, copies of all construction contracts and proof of payment for all labor and materials.

10.05 (b) No Liens. Tenant shall pay when due all claims for labor and material furnished to the Premises and shall at all times keep the Property free from liens for labor and materials. Tenant shall give Landlord at least twenty (20) days’ prior written notice of the commencement of any work on the Premises, regardless of whether Landlord’s consent to such work is required. Landlord may record and post notices of non-responsibility on the Premises.

15

10.06 Condition upon Termination. Upon the expiration or termination of this Lease, Tenant shall surrender the Premises to Landlord broom clean and in the condition which Tenant shall have been required to maintain the Premises under this Lease with the heating, ventilation, air-conditioning, plumbing, electrical systems, lighting, man doors, dock doors, levelers, shelters, seals and bumpers (if any), windows, floors, fire/life safety systems, air rotation equipment and electrical items serving the Premises in operating condition. Tenant shall not be obligated to repair any damage which Landlord is required to repair under Article Eleven (Damage or Destruction). Landlord may require Tenant to remove any alterations, additions or improvements (whether or not made with Landlord’s consent) and all phone and data cabling installed by or on behalf of Tenant (whether such cabling is located within or outside of the Premises) prior to the expiration of the Lease and repair any damaged caused by such removal, all at Tenant’s expense; provided that Tenant shall not be required to remove the Initial Improvements installed pursuant to Exhibit D. With respect to any alterations, additions or improvements which require Landlord’s approval, at the time of such approval Landlord shall specify if Tenant shall not be required to remove the same, and such items shall become Landlord’s property and shall be surrendered to Landlord upon the expiration or earlier termination of the Lease, except that Tenant may remove any of Tenant’s machinery or equipment which can be removed without damage to the Property. Tenant shall repair, at Tenant’s expense, any damage to the Property caused by the removal of any such machinery or equipment. In no event, however, shall Tenant remove any of the following materials or equipment (which shall be deemed Landlord’s property), without Landlord’s prior written consent; unless the same shall have been installed by Tenant at its expense: any power wiring or power wiring panels; lighting or lighting fixtures; wall coverings; drapes, blinds or other window coverings; carpets or other floor coverings; heaters, air conditioners or any other heating or air conditioning equipment; fencing or security gates; or other similar building operating equipment.

ARTICLE ELEVEN - DAMAGE OR DESTRUCTION

11.01 Damage to Premises.

11.01 (a) If the Premises shall be destroyed or rendered untenantable, either wholly or in part, by fire or other casualty (“Casualty”), Tenant shall immediately notify Landlord in writing upon the occurrence of such Casualty. In the event of any Casualty, Landlord shall notify Tenant within 60 days after such damage as to the amount of time Landlord reasonably estimates it will take to restore the Premises (the “Repair Estimate”). If the restoration time is estimated to exceed 210 days, either Landlord or Tenant may elect to terminate this Lease upon written notice to the other party given no later than 30 days after Tenant’s receipt of the Repair Estimate. If neither party elects to terminate this Lease, Landlord shall repair the damage caused by such casualty and restore the Premises to its former condition (excluding Tenant’s fixtures, equipment and alterations made by Tenant after the Lease Commencement Date) within the time reasonably necessary to do so, in which case this Lease shall remain in full force and effect.

11.01 (b) If the casualty to the Premises shall occur during the last six (6) months of the Lease Term and the damage shall be estimated by Landlord to require more than thirty (30) days to repair, either Landlord or Tenant may elect to terminate this Lease as of the date the casualty shall have occurred, regardless of the sufficiency of any insurance proceeds. The party electing to terminate this Lease shall give written notification to the other party of such election within ten (10) days after Tenant’s notice to Landlord of the occurrence of the casualty.

16

11.02 Temporary Reduction of Rent. If the Property shall be destroyed or damaged by casualty and this Lease is not terminated pursuant to the provisions of this Article Eleven, any Rent payable during the period of such damage, repair and/or restoration shall be reduced according to the degree, if any, to which Tenant’s use of the Premises shall be impaired. Except for such possible reduction in Base Rent, insurance premiums and Taxes, Tenant shall not be entitled to any compensation, reduction or reimbursement from Landlord as a result of any damage, destruction, repair, or restoration of the Property.

11.03 Waiver. Tenant waives the protection of any statute, code or judicial decision which shall grant a tenant the right to terminate a lease in the event of the damage or destruction of the leased property and the provisions of this Article Eleven shall govern the rights and obligations of Landlord and Tenant in the event of any damage or destruction of or to the Property.

ARTICLE TWELVE - CONDEMNATION

12.01 Condemnation. If any portion of the floor area of the Premises or more than fifteen percent (15%) of the parking on the Property shall be taken by eminent domain such that Tenant is unable to conduct its business in a manner reasonably comparable to the manner it was conducted prior to such taking, either Landlord or Tenant may terminate this Lease as of the date the condemning authority takes title or possession, by delivering notice to the other within ten (10) days after receipt of written notice of such taking (or in the absence of such notice, within ten (10) days after the condemning authority shall take title or possession). If neither Landlord nor Tenant shall terminate this Lease, this Lease shall remain in effect as to the portion of the Premises not taken, except that the Base Rent shall be reduced in a fair and equitable manner. If this Lease shall be terminated, any condemnation award or payment shall be distributed to the Landlord. Tenant shall have no claim against Landlord for the value of the unexpired lease term or otherwise, but Tenant shall be entitled to make a claim with the condemning authority for its moving expenses.

ARTICLE THIRTEEN - ASSIGNMENT AND SUBLETTING

13.01 Landlord’s Consent Required. Except as provided in Section 13.04 below, no portion of the Premises or of Tenant’s interest in this Lease shall be acquired by any other person or entity, whether by sale, assignment, mortgage, sublease, transfer, operation of law, or act of Tenant, without Landlord’s prior written consent, which consent shall not be unreasonably withheld, conditioned or delayed. Landlord shall have the right to grant or withhold its consent as provided in Section 13.05 below. Any attempted transfer without consent shall be void and shall constitute a non curable breach of this Lease.

13.02 No Release of Tenant. No assignment or transfer shall release Tenant or change Tenant’s primary liability to pay the Rent and to perform all other obligations of Tenant under this Lease. Landlord’s acceptance of Rent from any other person shall not be a waiver of any provision of this Article Thirteen. Consent to one transfer shall not be deemed a consent to any subsequent transfer or a waiver of the obligation to obtain consent on subsequent occasions. If Tenant’s assignee or transferee shall default under this Lease, Landlord may proceed directly against Tenant without pursuing remedies against the assignee or transferee. Landlord may consent to subsequent assignments or modifications of this Lease by Tenant’s transferee without notifying Tenant or obtaining its consent, and such action shall not release Tenant from any of its obligations or liabilities under this Lease as so assigned or modified.

13.03 Offer to Terminate. Except with respect to a Permitted Transfer (defined below), if Tenant shall desire to assign this Lease or sublease all or any part of the Premises, Tenant shall offer to Landlord in writing, the right to terminate this Lease as of the date specified in the offer. If Landlord shall elect in writing to accept the offer to terminate within fifteen (15) days after receipt of notice of the offer, this Lease shall terminate as of the date specified in such offer and all the terms and provisions of this Lease governing termination shall apply. If Landlord shall not so elect, Tenant shall then comply with the provisions of this Article Thirteen applicable to such assignment of sublease.

17

13.04 Permitted Transfer. Notwithstanding the foregoing, Tenant may assign its entire interest under this Lease or sublet all or any portion of the Premises (i) to any entity controlling or controlled by or under common control with Tenant or (ii) to any successor to Tenant by purchase, merger, consolidation or reorganization (hereinafter, collectively, referred to as “Permitted Transfer”) without the consent of Landlord, provided: (1) Tenant is not in default under this Lease; (2) if such proposed transferee is a successor to Tenant by purchase, said proposed transferee shall acquire all or substantially all of the stock or assets of Tenant’s business or, if such proposed transferee is a successor to Tenant by merger, consolidation or reorganization, the continuing or surviving entity shall own all or substantially all of the assets of Tenant; (3) with respect to a Permitted Transfer to a proposed transferee described in clause (ii), such proposed transferee shall have a tangible net worth which is at least equal to the greater of Tenant’s tangible net worth at the date of this Lease or Tenant’s tangible net worth as of the day prior to the proposed purchase, merger, consolidation or reorganization as evidenced to Landlord’s reasonable satisfaction; and (4) Tenant shall give Landlord written notice at least ten (10) days prior to the effective date of the proposed purchase, merger, consolidation or reorganization.

13.05 Landlord’s Consent. Tenant’s request for consent under Section 13.01 shall set forth the details of the proposed sublease, assignment or transfer, including the name, business and financial condition of the prospective transferee, financial details of the proposed transaction (e.g., the term of and the rent and security deposit payable under any proposed assignment or sublease), and any other information Landlord deems relevant. Landlord shall have the right to withhold consent, reasonably exercised, or to grant consent, based on the following factors: (i) the business of the proposed assignee or subtenant and the proposed use of the Premises; (ii) the net worth and financial condition of the proposed assignee or subtenant; (iii) Tenant’s compliance with all of its obligations under this Lease; and (iv) such other factors as Landlord may reasonably deem relevant. If Tenant shall assign or sublease, other than pursuant to a Permitted Transfer, the following shall apply: Tenant shall pay to Landlord as Additional Rent fifty percent (50%) of the Proceeds (defined below) on such transaction (such amount being Landlord’s Share) as and when received by Tenant, unless Landlord shall give notice to Tenant and the assignee or subtenant that Landlord’s Share shall be paid by the assignee or subtenant to Landlord directly. Proceeds shall mean (a) all rent and all fees and other consideration paid for or in respect of the assignment or sublease, including fees under any collateral agreements less (b) the rent and other sums payable under this Lease (in the case of a sublease of less than all of the Premises, allocable to the subleased premises) and all costs and expenses directly incurred by Tenant in connection with the execution and performance of such assignment or sublease for reasonable real estate broker’s commissions and reasonable costs of renovation or construction of tenant improvements required under such assignment or sublease. Tenant shall be entitled to recover such reasonable costs and expenses before Tenant shall be obligated to pay Landlord’s Share to Landlord. Tenant shall provide Landlord a written statement certifying all amounts to be paid from any assignment or sublease of the Premises within thirty (30) days after the transaction shall be signed and from time to time thereafter on Landlord’s request, and Landlord may inspect Tenant’s books and records to verify the accuracy of such statement. On written request, Tenant shall promptly furnish to Landlord copies of all the transaction documentation, all of which shall be certified by Tenant to be complete, true and correct. Tenant shall promptly reimburse Landlord for all legal costs and expenses incurred by Landlord in connection with a request for a sublease or assignment of this Lease.

18

ARTICLE FOURTEEN - DEFAULTS AND REMEDIES

14.01 Covenants and Conditions. Tenant’s performance of each of Tenant’s obligations under this Lease is a condition as well as a covenant. Tenant’s right to continue in possession of the Premises is conditioned upon such performance. Time is of the essence in the performance by Tenant of all covenants and conditions.

14.02 Defaults. Each of the following shall be an event of default under this Lease:

14.02 (a) Intentionally omitted;

14.02 (b) Tenant shall fail to pay Rent or any other sum payable under this Lease within five (5) days after it is due; provided that the first two (2) such failures during any calendar year during the Lease Term shall not be an event of default if Tenant pays the amount due within five (5) days after Tenant’s receipt of written notice from Landlord that such payments were not made when due;

14.02 (c) Tenant shall fail to perform any of Tenant’s other obligations under this Lease and such failure shall continue for a period of fifteen (15) days after notice from Landlord; provided that if more than fifteen (15) days shall be required to complete such performance, Tenant shall not be in default if Tenant shall commence such performance within the fifteen (15) day period and shall thereafter diligently pursue its completion.

14.02 (d) (i) Tenant shall make a general assignment or general arrangement for the benefit of creditors; (ii) a petition for adjudication of bankruptcy or for reorganization or rearrangement shall be filed by or against Tenant and shall not be dismissed within sixty (60) days; (iii) a trustee or receiver shall be appointed to take possession of substantially all of Tenant’s assets located at the Premises or Tenant’s interest in this Lease and possession shall be subjected to attachment, execution or other judicial seizure which shall not be discharged within sixty (60) days. If a court of competent jurisdiction shall determine that any of the acts described in this subsection (d) is not a default under this Lease, and a trustee shall be appointed to take possession (or if Tenant shall remain a debtor in possession) and such trustee or Tenant shall assign, sublease, or transfer Tenant’s interest hereunder, then Landlord shall receive, as Additional Rent, the excess, if any, of the rent (or any other consideration) paid in connection with such assignment, transfer or sublease over the rent payable by Tenant under this Lease.