Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DORAL FINANCIAL CORP | d435005d8k.htm |

| EX-99.1 - PRESS RELEASE DATED NOVEMBER 9, 2012 - DORAL FINANCIAL CORP | d435005dex991.htm |

Doral Financial Corporation

Q3 2012 Investor Presentation

November 9, 2012

Exhibit 99.2 |

Disclaimer

2

This presentation may include forward-looking statements as defined in the

Private Securities Litigation Reform Act of 1995 (the

“PSLRA”). These include comments with respect to our objectives and

strategies, and the results of our operations and our business.

Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts.

They

often

include

words

such

as

“expects,”

“anticipates,”

“intends,”

“plans,”

“believes,”

“seeks,”

“estimates,”

or

words

of

similar

meaning,

or

future

or

conditional

verbs

such

as

“will,”

“would,”

“should,”

“could”

or

“may.”

We

intend

these

forward-looking

statements to be covered by the safe harbor provisions of the PSLRA.

Forward-looking statements provide our expectations or predictions of future

conditions, events or results. They are, by their nature, subject to risks

and uncertainties. They are not guarantees of future performance, and actual results may differ materially.

By their nature, these forward-looking statements involve numerous assumptions

and uncertainties, both general and specific, including those discussed in

Doral Financial Corporation’s 2011 Annual Report on Form 10-K and other filings we make with the

Securities and Exchange Commission. Risk factors and uncertainties that could cause

the Company's actual results to differ materially from those described in

forward-looking statements can be found in the Company's 2011 Annual Report on Form 10-K,

which

is

available

in

the

Company's

website

at

www.doralfinancial.com,

as

they

may

be

updated

from

time

to

time

in

the

Company’s periodic and other reports filed with the Securities and Exchange

Commission. The statements in this presentation speak only as of the date

they are made. We do not undertake to update forward-looking

statements

to

reflect

the

impact

of

circumstances

or

events

that

arise

after

the

date

the

forward-looking

statements

were

made,

other than as required by law, including requirements of applicable securities

laws.. |

Q3

Highlights 3

H

21% quarter over quarter growth in Puerto Rico mortgage originations

o

94% of originations are sold to the secondary market

Asset substitution continues to drive strong US growth

o

$12.4 MM of pre-tax income in Q3

o

Net Income

$(32.5) mm

o

Pre-Tax, Pre-Provision Income

$2.4mm

o

Provisions

$34.4 mm

o

Net Interest Margin

291Bps

o

Book Value per Share

$3.57

o

Tier-1 Leverage Ratio

9.32%

Higher credit costs and provisions overshadowed revenue gains in the quarter. |

Doral

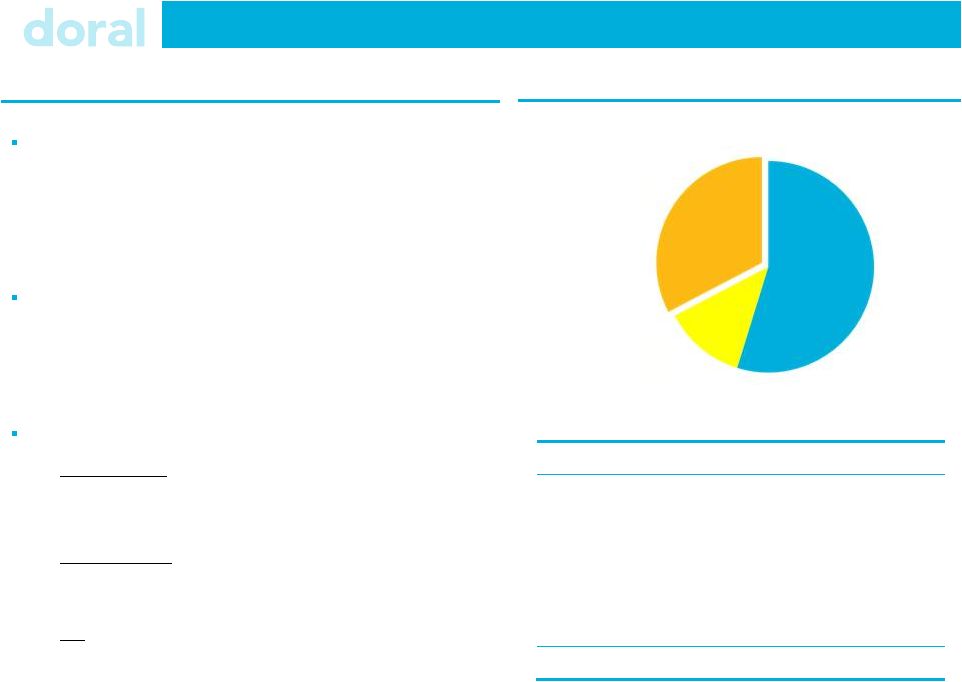

Financial Corporation Profile 4

Company Overview

Capital Ratios continue to exceed required levels:

o

Tier-1 Leverage Ratio: 9.3%

o

Total Risk-Based Capital Ratio: 13.3%

Book Value of $3.57 per share

o

A valuation allowance against Doral’s remaining deferred tax

asset represents an additional $2.61 per share ($335.7MM)

Business Segment Highlights:

1.

PR Residential:

A leading mortgage originator and servicer.

o

$254MM of mortgage origination, an increase of 21% versus

last quarter. Highest quarterly volume in the past 5-years.

2.

PR Commercial:

A shrinking $837MM portfolio.

o

41% modified coverage ratio against NPLs

3.

US:

A growing 2.5% ROAA business.

o

Net Interest Margin of 416 bps

o

Deposits grew $136 MM to $719 MM

o

NPAs currently at 26 bps

Loan Portfolio Composition ($6.2B)

Loan Portfolio by Geography

$ mm

Loan Category

PR

USA

Total

Residential

$3,602

$12

$3,614

CRE

542

586

1,128

C&I

146

1,431

1,577

Construction &

Development

149

116

265

Consumer / Other

27

-

27

Total

$4,466

$2,145

$6,611

PR Residential

(55%)

US

(33%)

PR Commercial

(12%) |

Q3

Results Pro forma Income ($MM)

1

3Q ‘12

Net Interest Income

$55.6

Non Interest Income

20.6

Non-Credit, Non Interest Expense

58.2

Pre-Tax, Pre-Credit Income

18.0

Credit Expenses

50.0

Non-Interest Expense

15.6

Provision

34.4

Pre-Tax Income

$(32.0)

Tax

0.5

Reported Net Income

$(32.5)

$32.5MM Net Loss impacted by $50MM of credit

expenses

o

$22MM of provision on TDR residential mortgages

Net Revenue grew by $1.5MM over Q2 driven by

increased yield from asset substitution and lower

deposit costs.

o

Maintained 291 bps Net Interest Margin

o

Total revenue grew to $76.2MM

o

Mortgage loan originations totaled $254MM a 21%

increase over Q2

Non-credit, non-interest expenses include $5MM of

elevated compliance costs.

$50MM of credit expenses include provisions, OREO

and foreclosure expenses.

Credit costs on residential mortgages offset improvements in revenues

5

1

Non-GAAP presentation of financial results

Credit Costs

($ MM)

Provision

$34.4

OREO

7.3

Foreclosure & Legal

5.2

Appraisal, Inspections & Other Loan Costs

3.1

Total

$50.0 |

Provisions & Credit Ratios

6

Coverage and Modified Coverage Ratios:

$ MM

Loan Balance

Coverage Ratio

1,2

NPL

1

Modified Coverage Ratio

1,3

Residential Mortgage

$3,614

3.2%

$453

40.1 %

Consumer

27

11.4%

-

825.6%

CRE

$1,128

1.9%

191

28.8%

C&I

$1,577

0.7%

2

576.0%

C&D

265

3.3%

107

52.0%

Total

$6,611

2.3%

$753

39.9%

1 Excludes Loans Held for Sale & FHA / VA Loans

2 Coverage Ratio: Reserves / Loan Receivable Balance

3 Modified Coverage Ratio : (Reserves + Partial Charge-offs) / (NPLs + Partial

Charge-offs) Increased provision providing strong coverage and modified

coverage ratios for the portfolio. Credit Provision Distribution by

Portfolio ($ MM)

Portfolio

New Volume

Valuation

Delinquency

Additional Reserve

Total

Residential Mortgage

-

$12.0

$9.8

$7.0

$28.8

Consumer

-

-

0.4

-

$0.4

PR Commercial

-

(0.9)

4.1

-

$3.2

US

$2.0

-

-

-

$2.0

Total

$2.0

$11.1

$14.3

$7.0

$34.4 |

PR

Residential Mortgage Credit Provisions 7

Puerto Rico Mortgage Portfolio Distribution

($ MM)

Performing

Non-Performing

Total

Core

1

$2,396

$142

$2,538

TDR

1

$362

$267

$629

Total

$2,758

$409

$3,167

Mortgage Provision Distribution

($ MM)

Valuation

Delinquency

Additional

Reserve

Total

Core

$5.6

$1.2

-

$6.8

TDR

$6.4

$8.6

$7.0

$22.0

Total

$12.0

$9.8

$7.0

$28.8

Valuation: $12.0MM

1,181 appraisals processed for $141MM

91% of residential NPLs have received an updated

valuation in the past year.

81% of appraisals received in Q3 updated collateral

values that were greater than 1-year.

Delinquency: $9.8MM

$8.1MM provision driven by performance of $374MM of

Troubled Debt Restructure (TDR) loans that have reached

the payment reset.

$162MM of TDR loans have not yet reached the payment

reset.

Additional Reserve: $7.0MM

$7.0MM additional reserve to address potential future

defaults on $96MM of reset TDR loans that have not yet

reached 6-months post-reset.

Residential

mortgage

provision

driven

by

appraisals

and

TDR

loan

performance.

1

Excludes FHA/VA guaranteed loans and loans held for sale

|

8

US Growth Platform

Income ($MM)

3Q ’12

Net Interest Income

$21.8

Non Interest Income

1.5

Non Interest Expense

8.9

Provision

2.0

Pre-Tax Income

$12.4

ROAA

2.4%

Net Interest Margin (bps)

416

NPA %

0.26%

Efficiency Ratio

38%

Doral operates a growing, high margin, low delinquency commercial platform in the

US Doral re-established its US operations in 2008

Since the merger of the US entity into Doral Bank in Q4 2011,

Doral’s US business has generated $43.8 MM in pre-tax income

During the past year Doral:

o

Grew loans from $1.4B to $2.1B

o

Grew deposits from $196MM to $719MM

o

Increased quarterly Net Interest Income by $8MM to $22MM

o

Maintained NPAs at $6MM (26 bps)

Loans now yield over 5.25%

Building scale by adding assets and profitability while lowering

the

US division’s efficiency ratio to below 40%

Doral Levered Asset Management (DLAM) has entered into a

partnership agreement to create a new Asset Management

company –

Redan Park Asset Management:

o

Redan Park to act as sub-adviser on over $1B of existing DLAM loans

o

DLAM retains all of its existing loans

o

New partnership creates a growing asset management company that

provides future earnings without significant investment by Doral

|

9

Executive Summary

TDR residential mortgages drove credit cost volatility

Solid growth in affordable residential mortgage originations

Asset Substitution strategy continues to grow earnings power

Tier-1 Capital exceeds leverage ratio requirements by over $100MM

Additional upside in Book Value per Share through potential future recognition of

Deferred Tax Asset |

Investor Relations Contact and Conference Replay Details

10

Investor Relations:

Christopher Poulton

212 / 329-3794

christopher.poulton@doralfinancial.com

Conference Call:

10.00 AM EDT November 10, 2012

(800)-230-1093 or (612) 288-0340

Conference Call Replay:

November 9, 2012 –

December 9, 2012

(800) 475-6701 or (320) 365-3844

Replay Code: 270528 |

Exhibit A

Summary Financials |

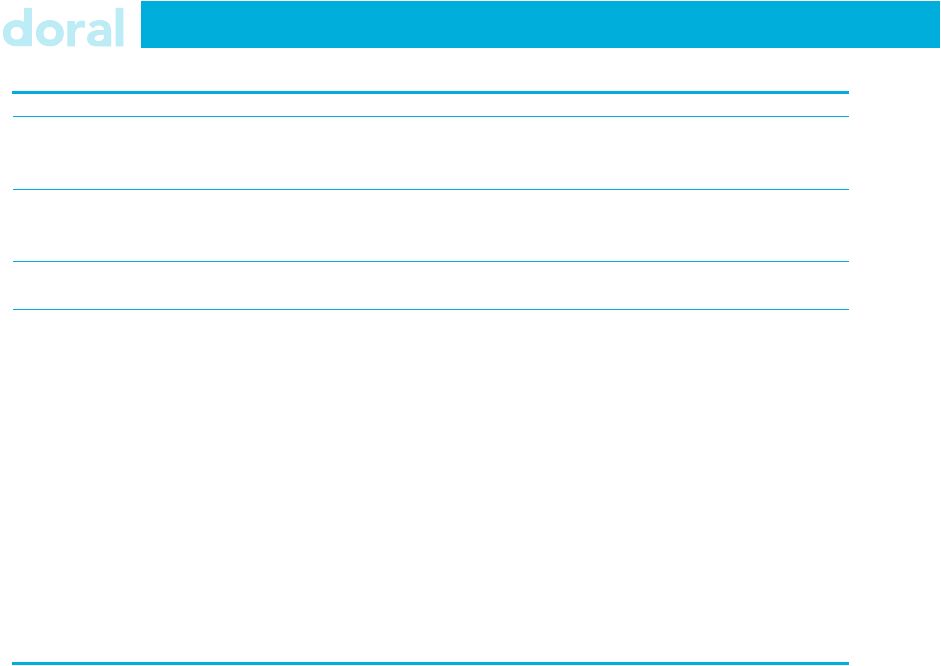

Summary Financials

12

($ mm)

30-Sep-12

30-Jun-12

31-Mar-12

31-

Dec –

11

30-Sep-11

Income Statement

Net Interest Income

55.6

54.1

52.1

49.4

$48.2

Provision for Credit Losses

34.4

5.2

115.2

9.9

41.7

NII After Provisions

21.2

48.9

(63.1)

39.4

6.5

Non-Interest Income

20.6

21.3

16.6

25.3

29.6

Non-Interest Expense

73.8

71.0

63.5

61.7

64.0

Pre-Tax Income

(32.0)

(0.8)

(110.0)

3.1

(27.8)

Taxes

0.5

0.8

(112.6)

(8.6)

2.3

Net Income

(32.5)

(1.6)

2.6

11.7

(30.2)

Pre-Tax Pre-Provision Income

2.4

4.4

5.2

13.0

13.9

Balance Sheet

Total Gross Loans (incl. HFS)

$6,611

$6,487

$6,355

$6,241

$6,111

Loan Loss Reserves

146

153

167

103

118

Total Deposits

4,614

4,538

4,560

4,395

4,349

Total Assets

8,371

8,345

8,093

7,975

8,014

Profitability Metrics

Net Interest Margin

2.91%

2.91%

2.85%

2.67%

2.60%

Capital & Credit Ratios

NPL / Loans

1

11.5%

11.4%

12.1%

9.8%

9.8%

Leverage Ratio

9.32%

9.92%

10.19%

9.13%

8.98%

1 Excludes Residential loans guaranteed by FHA / VA; NPL definition adjusted in Q1

2012 |