Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Cooper-Standard Holdings Inc. | d436108d8k.htm |

Cooper Standard

Third Quarter 2012 Earnings Call

November 9, 2012

Exhibit 99.1 |

cooperstandard

2

Forward-Looking Statements

This presentation includes forward-looking statements as contemplated by the

1995 Private Securities Litigation Reform Act, reflecting management’s

current analysis and expectations, based on what are believed to be

reasonable assumptions. The words “estimates,”

“expects,”

“anticipates,”

“projects,”

“plans,”

“intends,”

“believes,”

“forecasts,”

or future or conditional verbs,

such as “will,”

“should,”

“could,”

or “may,”

and variations of such words or similar expressions

are intended to identify forward-looking statements. Forward-looking

statements are not guarantees of future results and may involve known and

unknown risks and uncertainties that may cause actual results to differ

materially from those projected, including, without limitation, the risks

and uncertainties set forth in the Company’s most recent Annual Report on the Form

10-K, subsequent Quarterly Reports on Form 10Q, and other Securities and

Exchange Commission filings.

The forward-looking statements in this presentation are made as of the

date hereof, and the Company does not assume any obligation to update, amend or

clarify them to reflect events, new information or circumstances occurring

after the date hereof. |

Jeff Edwards

President & CEO

Executive Overview

Third Quarter 2012 |

cooperstandard

4

Jeff Edwards Introduction

•

Joined Cooper Standard October 15, 2012

•

Twenty-eight plus years in automotive industry

•

Progression of key roles with Johnson Controls, Inc.

including lead automotive positions in Asia and North

America |

cooperstandard

5

First Hundred Day Plan

•

Global tour to uncover opportunities

•

Review technologies and innovation pipeline

•

Align organization structure

•

Prioritize and accelerate initiatives for growth

•

Grow Asian business

•

Accelerate European turnaround |

Financial Overview

Third Quarter 2012

Allen Campbell

Chief Financial Officer |

cooperstandard

Q3 and Year-to-Date 2012 Revenue

7

$ USD Millions

Q3 2011 Revenue: $708.5

Q3 2012 Revenue: $684.0

YTD 2011 Revenue: $2,157.8

YTD 2012 Revenue: $2,183.8

Note: Numbers subject to rounding |

cooperstandard

Q3 and Year-to-Date 2012 Performance

8

$ USD Millions, except per share amounts

Q3 2011

Q3 2012

YTD 2011

YTD 2012

Sales

708.5

684.0

2,157.8

2,183.8

Gross Profit

108.6

103.1

353.0

339.2

SGA

64.4

65.4

190.9

206.4

Operating Profit

33.7

23.6

102.3

105.4

Net Income

15.7

11.6

79.6

112.7

Fully Diluted EPS

$0.58

$0.44

$3.08

$4.63

Adjusted EBITDA

73.4

69.8

257.5

227.1

% Margin

10.4%

10.2%

11.9%

10.4% |

cooperstandard

9

Cooper Standard Non-consolidated Joint Venture Sales-

Q3 2012

34%

Joint Venture

Partner

Product

Country

Huayu-Cooper Sealing

SAIC/HASCO

Sealing

China

Nishikawa Cooper

Nishikawa Rubber

Sealing

U.S.

Nishikawa Tachaplalert Cooper

Nishikawa Rubber

Sealing

Thailand

Sujan CSF India

Magnum Elastomers

AVS

India

$0

$30

$60

$90

$120

Q3 2011

Q3 2012

$88

$118

Providing products to Japanese, Chinese and Indian OEMs

|

cooperstandard

10

Q3 and Year-to-Date 2012 Cash Flow

Note: Numbers subject to rounding

($ USD Millions)

Q3 2012

YTD Q3 2012

Cash from business

42.4

165.4

Pension

funding

-

US

(3.3)

(26.8)

Changes in operating assets & liabilities

(26.3)

(160.6)

Cash provided by / (used in) operations

12.8

(22.0)

Capital expenditures

(33.0)

(91.5)

Cash used in operations including CAPEX

(20.2)

(113.5)

Acquisition of business, net cash acquired

-

(1.1)

Proceeds from sale of assets

0.7

9.0

Dividends –

Preferred Stock

(1.7)

(5.1)

Financing activities

(4.6)

(7.1)

Repurchase of preferred stock

-

(4.9)

Repurchase of common stock

(7.0)

(20.6)

Foreign exchange/other

(1.5)

(0.6)

Net cash used

(34.3)

(143.9)

Cash balance as of 12/31/2011

361.7

Cash balance as of 9/30/2012

217.8

Board of Directors authorizes $25 million share repurchase program

|

cooperstandard

11

Liquidity as of September 30, 2012

Cash on Balance Sheet

$217.8

ABL Revolver

125.0

Letters of Credit

(27.6)

Total Liquidity

$315.2

Strong balance sheet and liquidity to support growth

•

ABL Revolver undrawn

•

Net leverage = $264.4 million

•

Net leverage ratio = 0.9

•

Interest coverage ratio = 6.8

•

No major debt maturity until 2018

($ USD Millions)

$0

$100

$200

$300

$400

$500

Debt

Cash

$482.2

$217.8 |

cooperstandard

12

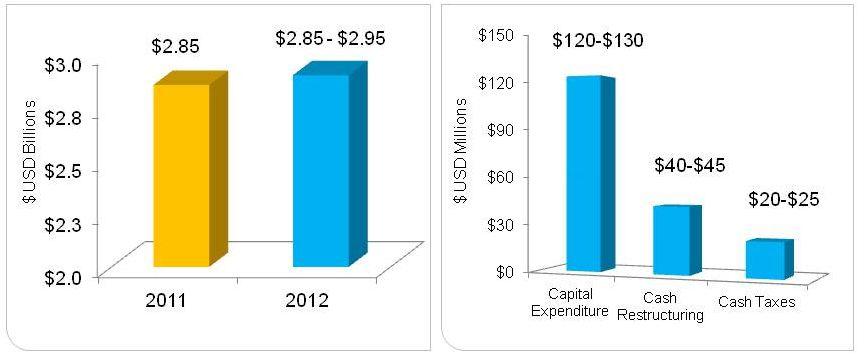

2012 Guidance

* Sales guidance is based on North American production of 15.1 million, and

Europe (including Russia) production of 19.0 million.

Revenue |

Questions & Answers |

Appendix |

cooperstandard

Non-GAAP Financial Measures

15

EBITDA and adjusted EBITDA are measures not recognized under Generally Accepted

Accounting Principles (GAAP) which exclude certain non-cash and

non-recurring items. When analyzing the company’s operating

performance, investors should use EBITDA and adjusted

EBITDA

in

addition

to,

and

not

as

alternatives

for,

net

income

(loss),

operating

income,

or any other performance measure derived in accordance with GAAP, or as an

alternative to cash flow from operating activities as a measure of the

company’s performance. EBITDA and adjusted EBITDA have limitations as

analytical tools and should not be considered in isolation or as substitutes

for analysis of the company’s results of operations as reported under GAAP.

Other companies may report EBITDA and adjusted EBITDA differently and therefore

Cooper Standard’s results may not be comparable to other similarly

titled measures of other companies. |

cooperstandard

EBITDA and Adjusted EBITDA Reconciliation

16

Note: Numbers subject to rounding

($ USD Millions)

2011

2012

2011

2012

Net income

$15.7

$11.6

$79.6

$112.7

Provision (benefit) for income tax expense

8.0

5.4

26.8

(32.8)

Interest expense, net of interest income

9.6

11.3

30.2

33.3

Depreciation and amortization

31.7

29.1

92.0

91.2

EBITDA

$65.0

$57.4

$228.6

$204.4

Restructuring

(1)

6.5

10.2

48.1

15.8

Noncontrolling

interest

restructuring

(2)

(1.3)

(0.2)

(19.0)

(0.5)

Net

gain

on

partial

sale

of

joint

venture

(3)

-

-

(11.4)

-

Stock-based

compensation

(4)

3.0

2.4

8.3

7.4

Inventory write-up

(5)

-

-

0.7

-

Acquisition costs

(6)

0.2

-

2.2

-

Adjusted EBITDA

$73.4

$69.8

$257.5

$227.1

Three Months

Ended September 30,

Nine Months

Ended September 30,

(1)

Includes non-cash restructuring.

(2)

Proportionate share of restructuring costs related to FMEA joint venture.

(3)

Net gain on partial sale of ownership percentage in joint venture.

(4)

Non-cash stock amortization expense and non-cash stock option expense for grants issued at

emergence from bankruptcy. (5)

Write-up

of

inventory

to

fair

value

for

the

USi,

Inc.

and

the

FMEA

joint

venture,

net

of

noncontrolling

interest.

(6)

Costs incurred in relation to the FMEA joint venture agreement. |

cooperstandard

17

Net Leverage Ratio as of Sep 30, 2012 -

LTM

(1)

Includes cash and noncash restructuring.

(2)

Proportionate share of restructuring costs related to Cooper Standard France joint

venture. (3)

Non-cash stock amortization expense and non-cash stock option expense for

grants issued at emergence from bankruptcy. (4)

Costs related to corporate development activities.

Note: Numbers subject to rounding

($ USD Millions)

Three Months Ended

Twelve

Months

Ended

Dec 31,

2011

Mar 31,

2012

Jun 30,

2012

Sep 30,

2012

Sep 30,

2012

Net income

$ 23.2

$ 23.8

$ 77.3

$ 11.6

$ 135.9

Provision (benefit) for income tax expense

(6.0)

8.1

(46.2)

5.4

(38.7)

Interest expense, net of interest income

10.3

11.2

10.8

11.3

43.6

Depreciation and amortization

32.1

31.6

30.5

29.1

123.3

EBITDA

$ 59.6

$ 74.7

$ 72.4

$ 57.4

$ 264.1

Restructuring

(1)

4.1

6.1

(0.5)

10.2

19.9

Noncontrolling interest restructuring

(2)

(0.9)

(0.3)

-

(0.2)

(1.4)

Stock-based compensation

(3)

2.5

2.7

2.2

2.4

9.8

Other

(4)

1.3

-

-

-

1.3

Adjusted EBITDA

$ 66.6

$ 83.2

$ 74.1

$ 69.8

$ 293.7

Net Leverage

Debt payable within one year

$ 30.2

Long-term debt

452.0

Less: cash and cash equivalents

(217.8)

Net Leverage

$ 264.4

Net Leverage Ratio

0.9 |

cooperstandard

18

Adjusted EBITDA as a percent of Sales -

LTM

Note: Numbers subject to rounding

(1)

Includes cash and noncash restructuring.

(2)

Proportionate share of restructuring costs related to Cooper Standard France joint

venture. (3)

Non-cash stock amortization expense and non-cash stock option expense for

grants issued at emergence from bankruptcy. (4)

Costs related to corporate development activities.

($ USD Millions)

Three Months Ended

Twelve

Months

Ended

Dec 31,

2011

Mar 31,

2012

Jun 30,

2012

Sep 30,

2012

Sep 30,

2012

Net income

$ 23.2

$ 23.8

$ 77.3

$ 11.6

$ 135.9

Provision (benefit)for income tax expense

(6.0)

8.1

(46.2)

5.4

(38.7)

Interest expense, net of interest income

10.3

11.2

10.8

11.3

43.6

Depreciation and amortization

32.1

31.6

30.5

29.1

123.3

EBITDA

$ 59.6

$ 74.7

$ 72.4

$ 57.4

$ 264.1

Restructuring

(1)

4.1

6.1

(0.5)

10.2

19.9

Noncontrolling interest restructuring

(2)

(0.9)

(0.3)

-

(0.2)

(1.4)

Stock-based compensation

(3)

2.5

2.7

2.2

2.4

9.8

Other

(4)

1.3

-

-

-

1.3

Adjusted EBITDA

$ 66.6

$ 83.2

$ 74.1

$ 69.8

$ 293.7

Sales

$ 695.7

$ 765.3

$ 734.5

$ 684.0

$ 2,879.5

Adjusted EBITDA as a percent of Sales

10.2% |