Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - XTRA-GOLD RESOURCES CORP | form8k.htm |

Exhibit 99.1

NEWS RELEASE FOR IMMEDIATE RELEASE

Xtra-Gold Announces Initial NI 43-101 Resource

Estimate

at its Kibi Gold Project in Ghana, West Africa

278,000 oz. Au in Indicated Category and 147,000 oz. Au in Inferred Category

Toronto, Ontario – November 5, 2012 – Xtra-Gold Resources Corp. (“Xtra-Gold” or the “Company”) TSX: XTG; OTCBB: XTGR, is very pleased to announce the completion of an initial National Instrument 43-101 (“NI 43-101”) compliant Mineral Resource estimate on its wholly owned Kibi Gold Project, located in the Kibi–Winneba greenstone belt (“Kibi Gold Belt”), in Ghana, West Africa. The resource estimate encompasses the Big Bend, East Dyke, Mushroom, and South Ridge deposits in Zone 2 and the Double 19 deposit in Zone 3. All the above mineralized bodies remain open in several directions. In aggregate, these five gold deposits are estimated to contain an Indicated mineral resource of 278,000 ounces of gold and an additional Inferred mineral resource of 147,000 ounces of gold as tabulated below, with details presented in Table 2 in the Resource Estimate Summary section of this news release.

Table 1: Summary of Mineral Resources for Kibi Gold Project (October 26, 2012)

RESOURCE CATEGORY |

CUT-OFF GRADE (g/t Au) |

TONNAGE Tonnes (million) |

AVERAGE GRADE (g/t Au) |

CONTAINED GOLD (ounces) |

| Indicated | 0.5 | 3.38 | 2.56 | 278,000 |

| Inferred | 0.5 | 2.35 | 1.94 | 147,000 |

“This initial Mineral Resource estimate constitutes the first ever NI 43-101 compliant resource estimate generated on a lode gold project within the Kibi Gold Belt. We are very pleased to have been able to establish a significant indicated and inferred resource estimate on a totally Greenfields project within two years of our initial public offering at a ‘discovery cost’ of approximately $20 per ounce of gold.” remarked Paul Zyla, Xtra-Gold’s President and CEO. “We see this initial resource estimate as a significant starting position and, with all the mineralized bodies remaining open in several directions, we are extremely encouraged with the potential to expand their respective resources with further drilling. In particular, the robust grade and continuity of the mineralization together with the near surface setting, close proximity of the gold deposits to each other and the very positive preliminary metallurgical results which have previously been announced, augurs well for the development potential of the Kibi Gold Project,” added Mr. Zyla.

Mr. Zyla concluded by saying, “This initial resource estimate reflects work conducted on the Zone 2 and Zone 3 gold-in-soil anomalies, the first two targets where we have concentrated our efforts since commencing field work on the project. We believe there is excellent potential to discover entirely new deposits both within Zone 2 and Zone 3, as well as across the Kibi Gold Project. Considerable insight has been gained on the mineralization controls over the last two years and trenching efforts, focusing on the prioritization of additional gold showings yielded by our recently completed property-wide soil geochemical survey, geological modeling and VTEM targets, is continuing.”

- 2 –

Resource Estimate Summary

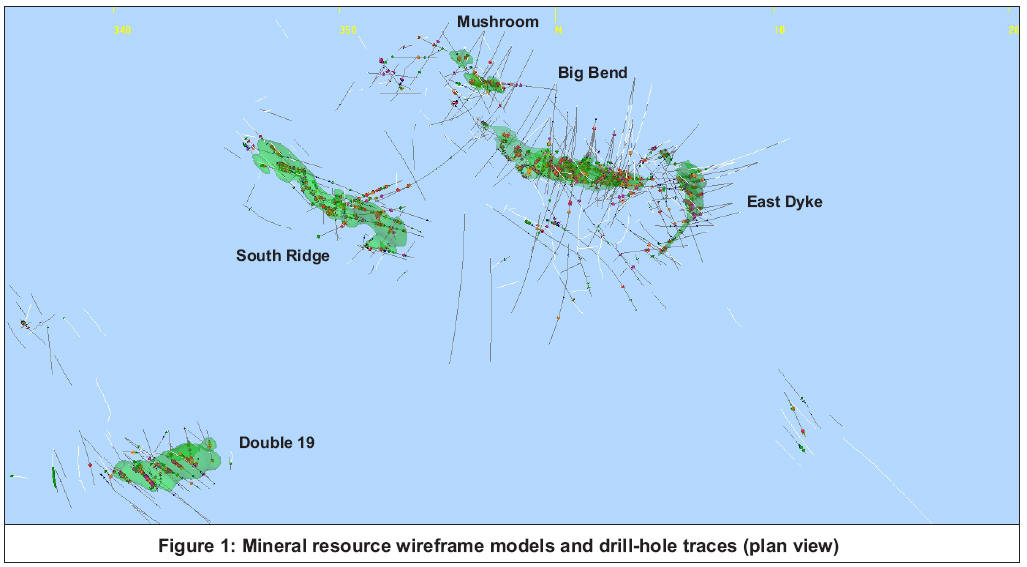

An independent mineral resource estimate for Xtra-Gold’s Kibi Gold Project has been prepared by SEMS Exploration Services Ltd (“SEMS”) of Accra, Ghana, in collaboration with Xtra-Gold personnel, in accordance with the Definition Standards for Mineral Resources and Mineral Reserves set out by the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”). The effective date of the mineral resource estimate is October 26, 2012. The independent NI 43-101 technical report supporting the resource estimate will be filed on www.sedar.com within 45 days of this news release. Details for the mineral resource estimate are outlined in the table below and a figure depicting the location of the deposits is appended to this news release as Figure 1.

The initial mineral resource estimate for the Kibi Gold Project has identified five deposits collectively hosting 278,000 ounces of gold at an average grade of 2.56 g/t in the Indicated category and 147,000 ounces of gold at an average grade of 1.94 g/t in the Inferred category. All mineral resources have been reported at a 0.5 g/t gold cut-off grade, taking into account current economic conditions and typical likely costs and parameters of open pit extraction. An assay top cut of 20 g/t gold was statistically determined for all mineralized zones. The resource estimate is based on some 190 diamond drill and reverse circulation (RC) boreholes totalling approximately 34,810 meters, of which 88% are diamond drill meters, drilled by Xtra-Gold from August 2008 to May 2012. The resource modelling incorporates 106 trenches including some un-sampled trenches utilized mainly for geological mapping or drill hole planning.

The five mineralized bodies cover a combined strike length of approximately 1.6 km within the Zone 2 and Zone 3 gold-in-soil anomalies. The Big Bend, East Dyke, Mushroom, and South Ridge deposits are located within Zone 2, with separations varying from almost contiguous to 200 meters. The Double 19 deposit lies approximately 500 meters southwest of Zone 2. Over 75% of the Indicated mineral resource occurs within the Big Bend deposit, with the remaining portion of the Indicated resource contained within the East Dyke deposit. Both of these deposits extend to 350 meters beneath the topography surface. The other three deposits are smaller, shallower and less advanced from an exploration perspective and their mineral resources have been classified as Inferred.

Gold mineralization within the mineral resource is predominantly characterized by mineralized quartz vein sets hosted in belt-type granitoids. Over 20 significant gold occurrences hosted by Belt (Dixcove) and Basin (Cape Coast) type granitoids are known in Ghana, with a number constituting significant deposits. These deposits represent a relatively new style of gold mineralization for orogenic gold deposits within the West African Birimian terrain. Belt-type intrusive hosted gold deposits include Newmont Mining’s Subika deposit at their Ahafo mine and Kinross Mining’s Chirano deposits within the Sefwi gold belt, as well as Golden Star Resources’ Hwini-Butre deposit at the southern extremity of the Ashanti gold belt.

- 3 –

Table 2: Mineral Resource Estimates by Deposit, Material Type, and Classification

| DEPOSIT | MATERIAL

TYPE |

RESOURCE

CATEGORY |

TONNAGE

Tonnes (million) |

AVERAGE

GRADE (Au g/t) |

CONTAINED GOLD (ounces) |

| Big Bend | Oxide | Indicated | 0.12 | 2.82 | 11,000 |

| Inferred | - | - | - | ||

| Transition | Indicated | 0.16 | 2.63 | 13,000 | |

| Inferred | - | - | - | ||

| Fresh | Indicated | 2.45 | 2.41 | 190,000 | |

| Inferred | 0.51 | 1.60 | 27,000 | ||

| East Dyke | Oxide | Indicated | 0.06 | 4.08 | 9,000 |

| Inferred | - | - | - | ||

| Transition | Indicated | 0.07 | 3.58 | 8,000 | |

| Inferred | - | - | - | ||

| Fresh | Indicated | 0.52 | 2.84 | 47,000 | |

| Inferred | 0.08 | 4.37 | 11,000 | ||

| Mushroom | Oxide | Inferred | 0.07 | 2.55 | 6,000 |

| Transition | Inferred | 0.01 | 1.88 | 1,000 | |

| Fresh | Inferred | 0.17 | 2.25 | 12,000 | |

| South Ridge | Oxide | Inferred | 0.17 | 1.60 | 9,000 |

| Transition | Inferred | 0.12 | 1.43 | 5,000 | |

| Fresh | Inferred | 0.61 | 1.46 | 28,000 | |

| Double 19 | Oxide | Inferred | 0.01 | 3.37 | 1,000 |

| Transition | Inferred | 0.13 | 3.11 | 13,000 | |

| Fresh | Inferred | 0.47 | 2.22 | 34,000 | |

| Total | All | Indicated | 3.38 | 2.56 | 278,000 |

| Total | All | Inferred | 2.35 | 1.94 | 147,000 |

Notes:

| 1) |

CIM Definition Standards were followed for the mineral resource estimate. |

| 2) |

All mineral resources have been reported at a 0.5 g/t gold cut-off grade, taking into account current economic conditions and typical likely costs and parameters of open pit extraction; and an assay top cut of 20 g/t gold was statistically determined for all mineralized zones. |

| 3) |

Resource estimation for main Big Bend and East Dyke deposits utilized a three-dimensional wireframe model defined on cross-sections ranging from 10 to 50 meter intervals (average 20 m). The remaining three minor deposits were modelled using an automated method (Leapfrog software). Grade interpolation for all resource models was undertaken using the inverse distance cube method in Datamine. |

| 4) |

Average specific gravity (SG) values of 1.6, 2.4, and 2.85 were used for Oxide, Transition, and Fresh (Sulphide) materials, respectively. |

| 5) |

Mineral resource tonnage and contained metal have been rounded to reflect the accuracy of the estimate, and numbers may not add due to rounding. |

| 6) |

Mineral resource tonnage and grade are reported as undiluted. |

| 7) |

The figures for contained gold are in-situ mineral resources. |

| 8) |

1 troy ounce equals 31.10348 grams. |

| 9) |

Mineral resources are not mineral reserves and by definition do not demonstrate economic viability. This mineral resource estimate includes inferred mineral resources that are normally considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves. There is also no certainty that these inferred mineral resources will be converted to the measured and indicated resource categories through further drilling, or into mineral reserves, once economic considerations are applied. |

- 4 –

Xtra-Gold supplied SEMS with a comprehensive drilling and trenching database together with “Leapfrog” mineralized models for each deposit, wireframe lithological model for the host diorite body, and wireframes of oxidation states for Regolith, Transition, and Fresh rock domains. This database, 3D models, and wireframes formed the basis of the resource presented here; with all work carried out by SEMS utilizing Datamine software.

Modelling of the five separate mineralized bodies was achieved in two different formats. The main Big Bend and East Dyke deposits were modelled by sectional digitising of mineralization outlines from 10 to 50 meter intervals (average 20m), dependent upon drill section spacing and continuity. The remaining three minor deposits were modelled using an automated method (Leapfrog software). Leapfrog models went through several iterations and refinements before being accepted. This involved visual checking of close spaced sections, comparison to manual interpretation, and elimination of excessive outliers.

Block models of the various zones were created within the mineralized solids using a parent cell block size of 5 x 5 x 5 meters (X,Y,Z), depleted to the topography, and densities set according to oxidation surfaces. Block grades were estimated using 1 meter down-hole composites utilizing an inverse distance cubed interpolation and classified as indicated or inferred dependent on drill section interval and sample proximity. Search ellipsoids for grade interpolation were created with 35 x 35 x 12 meter in the down dip, strike and minor width directions, respectively. The mineral resource has been constrained to several geological domains that limit the influence of grade interpolation. This is particularly relevant where secondary ore shoots parallel the main mineralized body. Individual search ellipsoids were assigned to each domain. Additionally, the mineral resource has been constrained to the diorite body, which is the predominant host rock of mineralization. The Indicated resource estimate is considered to have reasonable prospects for eventual economic viability, being constrained by a 0.5 g/t gold cut-off taking into account current economic conditions and typical likely costs and parameters of open pit extraction.

The Mineral Resource estimate for the Kibi Gold Project has been prepared by Mr. Andrew Netherwood, AusIMM, Mr. Joe Amanor, AusIMM, and Mr. Simon Meadows Smith, IOM3, all of SEMS Exploration Services Ltd (“SEMS”) of Accra, Ghana, and all independent Qualified Persons (“QP’s”) for the purpose of National Instrument 43-101 (“NI 43-101”). SEMS has conducted an audit of the sampling procedures and QA/QC data and is of the opinion that the data are of good quality and suitable for use in the resource estimates. An independent NI 43-101 technical report supporting the resource estimate is being prepared by SEMS and will be filed by Xtra-Gold on www.sedar.com within 45 days of this news release. All of the above QP's have reviewed and approved the contents of this news release with respect to the Mineral Resource estimate.

The scientific and technical information regarding exploration results contained herein is based on information prepared by or under the supervision of Mr. Yves P. Clement, P.Geo., Vice President, Exploration, Xtra-Gold Resources Corp, who is a "Qualified Person" for the purposes of NI 43-101. Mr. Clement has reviewed and approved the contents of this news release with respect to the scientific and technical information regarding exploration results.

- 5 –

About Xtra-Gold Resources Corp.

Xtra-Gold is a gold exploration company with a substantial land position in the Kibi greenstone belt (“Kibi Gold Belt”) located in Ghana, West Africa. The Kibi Gold Belt, which exhibits many similar geological features to Ghana’s main gold belt, the Ashanti Belt, has been the subject of very limited modern exploration activity targeting lode gold deposits as virtually all past gold mining activity and exploration efforts focused on the extensive alluvial gold occurrences in many river valleys throughout the Kibi area.

Xtra-Gold holds five (5) Mining Leases totaling approximately 226 sq km (22,600 ha) at the northern extremity of the Kibi Gold Belt. The Company’s exploration efforts to date have focused on the Kibi Project located on the Apapam Concession (33.65 sq. km), along the eastern flank of the Kibi Gold Belt. Xtra-Gold’s Kibi Project consists of an over 5.5 km long mineralized trend delineated from gold-in-soil anomalies, geophysical interpretations, trenching and drilling along the northwest margin of the Apapam Concession.

Forward-Looking Statements

The TSX does not accept responsibility for the adequacy or accuracy of this release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein. This news release includes certain “forward-looking statements”. These statements are based on information currently available to the Company and the Company provides no assurance that actual results will meet management’s expectations. Forward-looking statements include estimates and statements that describe the Company’s future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, or “plan”. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results relating to, among other things, results of exploration, project development, reclamation and capital costs of the Company’s mineral properties, and the Company’s financial condition and prospects, could differ materially from those currently anticipated in such statements for many reasons such as: changes in general economic conditions and conditions in the financial markets; changes in demand and prices for minerals; litigation, legislative, environmental and other judicial, regulatory, political and competitive developments; technological and operational difficulties encountered in connection with the activities of the Company; and other matters discussed in this news release. This list is not exhaustive of the factors that may affect any of the Company’s forward-looking statements. These and other factors should be considered carefully and readers should not place undue reliance on the Company’s forward-looking statements. The Company does not undertake to update any forward-looking statement that may be made from time to time by the Company or on its behalf, except in accordance with applicable securities laws.

Cautionary Note to United States Investors Concerning Estimates of Measured, Indicated and Inferred Mineral Resources

This news release makes use of the terms “Indicated” and “Inferred” Resources. United States investors are advised that while the terms “Measured”, “Indicated”, and “Inferred” Resources are recognized and required by Canadian regulations, the United States Securities and Exchange Commission does not recognize them. “Inferred Mineral Resources” have a great amount of uncertainty as to their existence, and as to their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Mineral Resource will ever be upgraded to a higher category. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of feasibility or other economic studies. United States investors are cautioned not to assume that all or any part of Measured or Indicated Mineral Resources will ever be converted into Mineral Reserves. United States investors are also cautioned not to assume that all or any part of an Inferred Mineral Resource exists, or is economically or legally mineable.

- 6 –

Contact Information

For further information please contact:

Paul Zyla, Chief Executive Officer

Telephone: 416 366-4227

E-mail: info@xtragold.com

Website: www.xtragold.com