Attached files

| file | filename |

|---|---|

| 8-K/A - AMENDMENT NO. 1 TO FORM 8-K - Tower Group International, Ltd. | d436321d8ka.htm |

1.

Third Quarter 2012

Earnings Call Presentation

Exhibit 99.1 |

1

Forward-Looking Statements

The Private Securities Litigation Reform Act of 1995 provides a "safe

harbor" for forward-looking statements. This presentation and any

other written or oral statements made by or on behalf of Tower may

include forward-looking statements that reflect Tower's current

views with respect to future events and financial performance. All statements

other than statements of historical fact included in this presentation are

forward-looking statements. Forward-looking statements can

generally be identified by the use of forward-looking terminology such as "may," "will," "plan," "expect,"

"project," "intend," "estimate," "anticipate,"

"believe" and "continue" or their negative or variations or similar terminology.

All forward-looking statements address matters that involve risks and

uncertainties. Accordingly, there are or will be important factors that

could cause the actual results of Tower to differ materially from those indicated in these

statements. Please refer to Tower’s filings with the SEC, including

among others Tower’s Annual Report on Form 10-K for the year

ended December 31, 2011 and subsequent filings on Form 10-Q, for a description of the important factors that

could cause the actual results of Tower to differ materially from those

indicated in these statements. Forward-looking statements

speak only as of the date on which they are made, and Tower undertakes

no obligation to update publicly or revise any forward-looking

statement, whether as a result of new information, future developments or otherwise.

Notes on Non-GAAP Financial Measures

Operating income excludes realized gains and losses, acquisition-related

transaction costs and the results of the reciprocal business, net of

tax. This is a common measurement for property and casualty insurance companies. We

believe this presentation enhances the understanding of our results of

operations by highlighting the underlying profitability of our insurance

business. Additionally, these measures are a key internal management performance

standard. Operating earnings per share is operating income divided by diluted

weighted average shares outstanding. Operating return on equity is

annualized operating income divided by average common stockholders' equity.

Total premiums include gross premiums written through our insurance

subsidiaries and produced as managing general agent on behalf of other

insurance companies, including the reciprocal exchanges. |

2

Overview of the Operating Results |

3

Third Quarter Snapshot -

Strong Operating Results

Net Operating Income

•

Net

operating

income

of

$23.8

million

or

$0.62

per

diluted

share

compared

with

operating

loss

of

$15.3 million, or ($0.38) per diluted share same period last year

•

Previously disclosed litigation settlement of $2.9 million after-tax

($0.08 per share) charge was recorded against 3Q operating

results. »

Excluding

the

litigation

charge,

net

operating

income

would

have

been

$26.7

million

or

($0.70)

per diluted share

Gross premiums written and managed

•

$484.8

million,

representing

a

decrease

of

6.6%

primarily

due

to

the

termination

of

two

programs

($51.7

million

from

program

cancelled

in

3Q12

and

$23.3

million

of

assumed

reinsurance business, which was commuted in 4Q11)

•

Excluded these 2 programs, 3Q12 GWP and managed increased by 8.2%

Net loss ratio and combined ratio

•

The net loss ratio excluding the reciprocal exchanges improved to 60.8% from

77.6% •

Excluding the business that Tower manages on behalf of the reciprocal

exchanges, the net combined ratio improved to 96.3% from 112.0%

Continued positive market and pricing trends

•

4.3% premium increase on renewed business (4.0% increase for commercial

excluding programs; 4.5% for personal) |

4

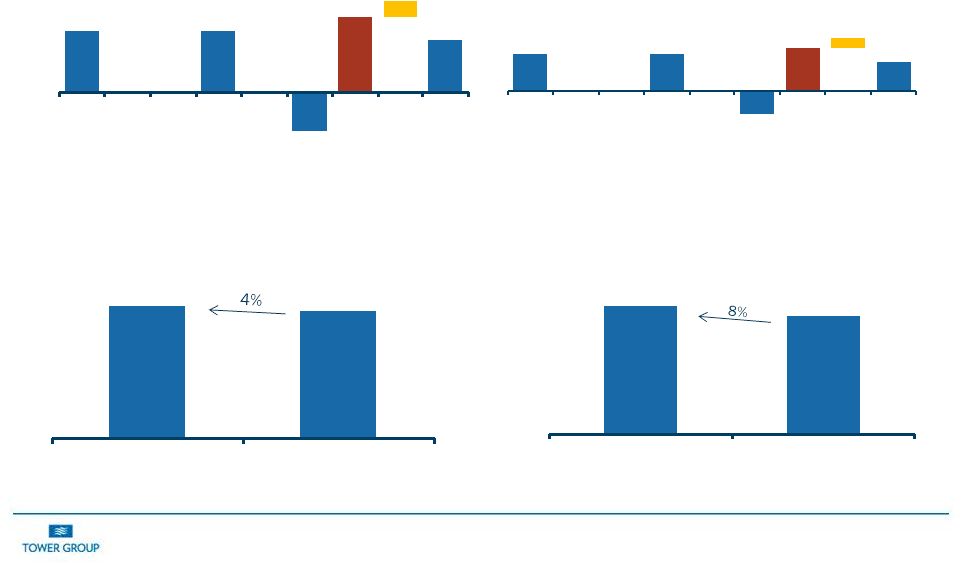

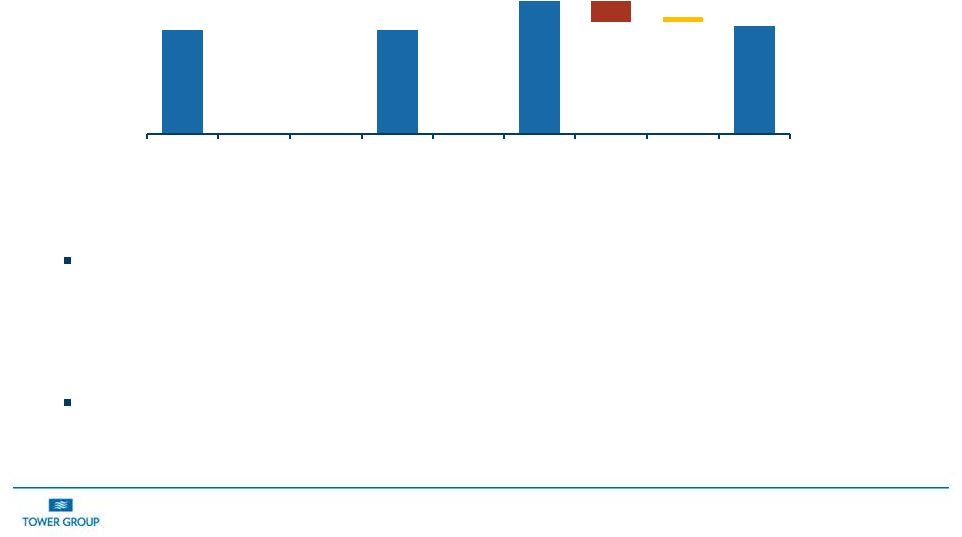

Third Quarter 2012 Highlights

*Stockholders equity reduced by $64.5 million from stock repurchases and

dividends since 3Q11 0.62

0.62

(0.38)

0.72

0.49

0.72

0.15

3Q12

Storms

Dev.

Pro -

Forma

3Q12

3Q11

Storms

Dev.

Pro -

Forma

3Q11

Operating EPS (Loss)

3Q12

3Q11

1,055

1,014

3Q12

3Q11

Stockholders' Equity ($ millions)*

27.49

25.42

3Q12

3Q11

Book Value per Share ($)*

23.8

23.8

(15.3)

29.2

20.2

29.2

6.3

3Q12

Storms

Dev.

Pro -

Forma

3Q12

3Q11

Storms

Dev.

Pro -

Forma

3Q11

Operating Earnings ($ millions)

3Q12

3Q11 |

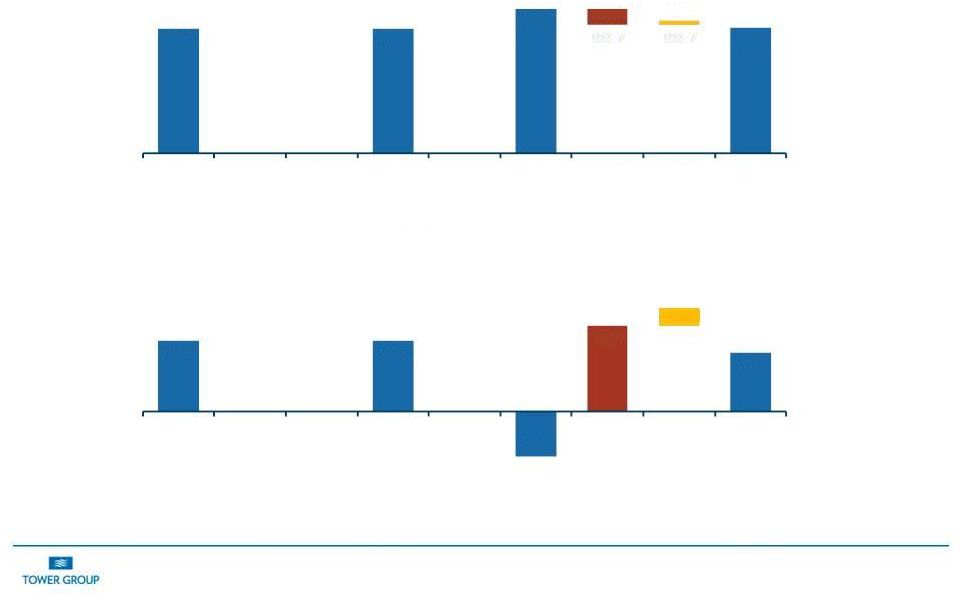

5

Third Quarter Highlights

96.3

96.3

112.0

97.1

-

12.3

-2.6

3Q12

Storms

Dev.

Pro

-

Forma

3Q12

3Q11

Storms

Dev.

Pro

-

Forma

3Q11

Combined Ratio (%)

3Q12

3Q11

9.2

9.2

(5.9)

7.7

11.2

2.4

3Q12

Storms

Dev.

Pro

-

Forma

3Q12

3Q11

Storms

Dev.

Pro

-

Forma

3Q11

Operating ROE (%)

3Q12

3Q11 |

6

Organic Growth Initiative

Excluding the effects of terminated program and commutation of an assumed

reinsurance treaty GPW were up $40.7 million or 8.2% due to organic

growth initiatives. •

Continued

production

from

newly

created

businesses

including

Assumed

Reinsurance

($39

million of GWP in the third quarter), Customized Solutions and National

Commercial Property business units

•

Forming strategic alliances with Lloyd's syndicates to provide expertise and

to support customized solutions

•

Evaluating industries and customer groups such as construction and affluent

home owners •

Improving product manufacturing capabilities for core products

The Organic Growth Initiative is building momentum by investing in Product,

People and Process

•

Product: Identifying product opportunities from internal research and

customized solutions clients while forming strategic alliances with

companies with specialty product expertise •

People: Recruiting franchise leaders to expand our product offering.

Decentralizing and implementing franchise concept

•

Process: Investing in business development to deliver customized

solutions and in business intelligence

to

conduct

research.

Strengthening cross functional committees and practices.

Investing our processes and practices to improve and drive customer

experience |

7

Business Segment Results

Commercial

Personal**

Insurance

General

Specialty

Services

Business Units / Products

Small Business;

Middle Market

National Programs, E&S,

Customized Solutions,

Transportation and

Assumed Reinsurance

Homeowners and

Private Passenger

Auto

3Q12 GPW* ($ millions)

$170

$142

$173

$9***

3Q11 GPW* ($ millions)

199

168

152

8***

3Q12 % of total GPW

35%

29%

36%

n/a

Commercial Consolidated

Loss Ratio

60.7%

60.9%

n/a

Expense Ratio

34.6%

38.3%

n/a

Combined Ratio

95.3%

99.2%

n/a

Retention

84%

89%

n/a

Renewal Premium Change

4.0%

4.5%

n/a

Segment

Summary

* Gross premiums written and managed

** Loss, Expense and Combined ratios exclude

reciprocal business ***Total revenue for the segment

Accelerated

focus

on

small

premium size segment

across all lines of business

Focus on eliminating or

improving

pricing

on

unprofitable middle market

business.

Plan

to

reduce

CA WC implemented

Termination of

unprofitable program

business with focus

on profitable

specialty programs

Growth driven

primarily by

assumed

reinsurance

business

Developing products

for affluent personal

lines market

Focus on

emphasizing

homeowners and

package policies and

deemphasizing

monoline auto

Expanding licensing

to expand writings

in other states and

thereby increasing

fee income |

8

Net Loss and Loss Expense Ratio, Excluding Reciprocals

The net loss ratio was 60.8% for the third quarter of 2012 compared to 77.6%

for the third quarter of 2011.

•

Included in the third quarter 2011 loss ratio was 12.3 points associated with

Hurricane Irene and 2.6 points associated with reserve development.

Excluding

the

impact

of

severe

weather

and

reserve

development the

net

loss

ratio improved to 60.8% in 3Q12 compared to 62.7% in 3Q11.

60.8

60.8

77.6

65.3

65.3

62.7

-12.3

-2.6

3Q12

Storms

Dev.

Pro -

Forma

3Q12

3Q11

Storms

Dev.

Pro -

Forma

3Q11

Loss Ratio (%)

3Q12

3Q11 |

9

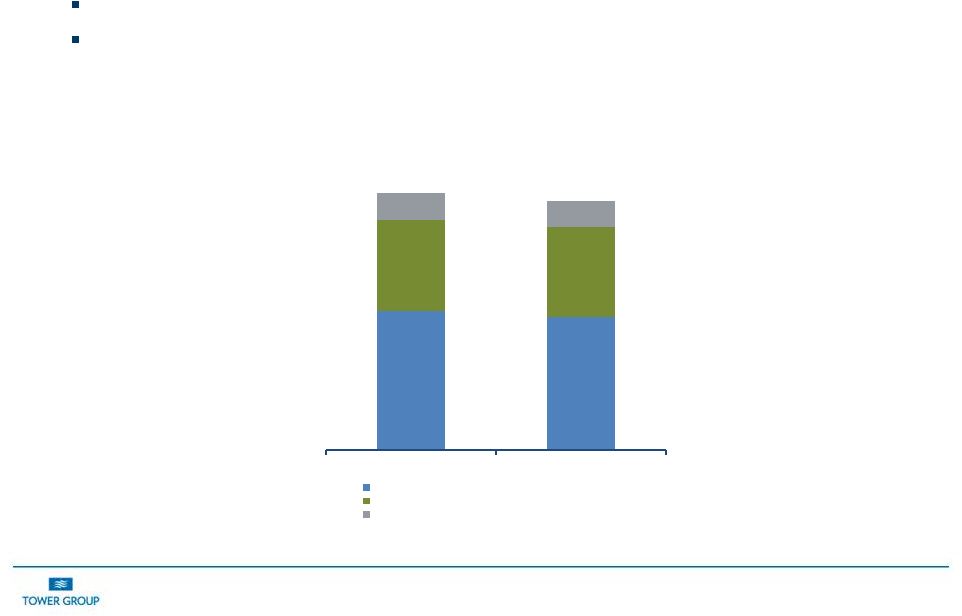

Expense Ratio Excluding Reciprocals

Commission rate higher year over year due to assumed reinsurance.

As

systems

initiatives

relating

to

personal

lines

are

completed,

we

expect

scale

advantage to drive expense ratio down

Note: Excludes reciprocals

19.2%

18.5%

12.5%

12.3%

3.8%

3.6%

35.5%

34.4%

3Q12

3Q11

Commissions, net of ceding commissions

OUE, net of fees

BB&T expenses |

10

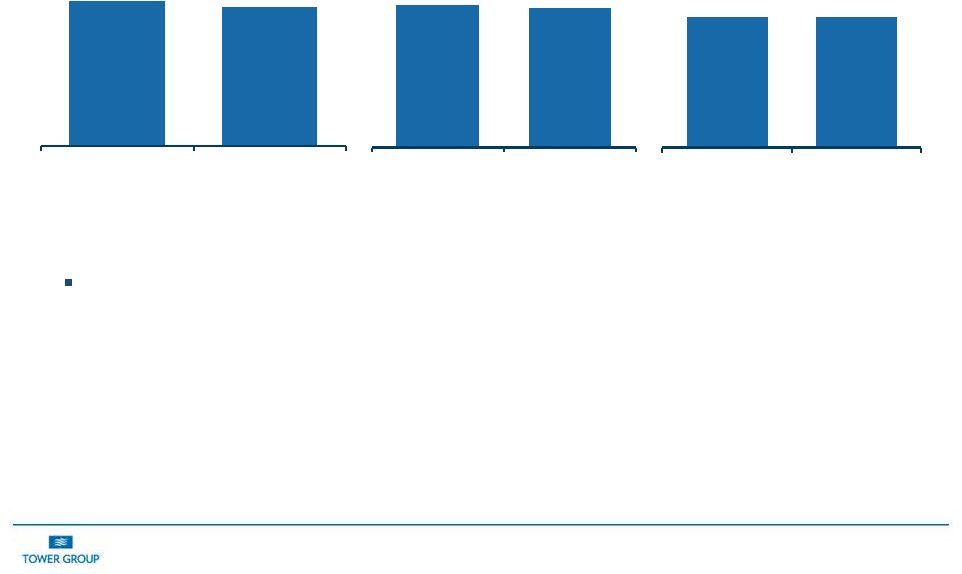

Improving Investment Performance

Note: Cash & Invested Assets, Tax–Equivalent Fixed Income Yield and

Net Investment Income exclude reciprocals $2,562

$2,436

9-30-2012

9-30-2011

Cash and Invested Assets ($millions)

4.6

4.5

9-30-2012

9-30-2011

Tax-

Equivalent Fixed Income

Yield (%)

$30

$30

9-30-2012

9-30-2011

Net Investment Income

($millions)

Alternative investment commitment remains modest but assets are

generating positive returns in 3Q12 and should provide higher yield and

diversification from interest rate risk inherent in fixed-income

investments, and reduce capital markets volatility |

11

Superstorm Sandy Impact to be Limited due to Tower’s

Catastrophe Reinsurance Program

Tower’s current after-tax estimate of loss ranges from $55 million to

$68 million •

Tower has exposure to Superstorm Sandy through direct insurance operations,

reinsurance assumed businesses and two alternative investments

Tower

expects

its

direct

insurance

loss

to

be

contained

in

its

first

reinsurance

layer

•

Tower expects pre-tax net loss from direct insurance business to be $90 to

$95 million, including reinstatement premiums

•

Direct losses in excess of $75 million pre-tax are ceded to reinsurers as

shown in table below Assumed reinsurance pre-tax losses expected to

be between $15 and $20 million Tower expects to recover $10 million if

industry losses exceed $10 billion and an additional $10 million if

industry losses exceed $15 billion through industry loss warranties that it put

in place in July 2012 to manage risk associated with exposure in

the Northeast

Tower believes its alternative investments will not be materially affected by

the losses associated with Superstorm Sandy

Range of Loss

Retention

Tower Net Loss

$0 - $75 million

Retained by Tower

$75 million

$75 - $150 million

100% reinsured

$75 million

$150 - $225 million

70% reinsured

$75 - $97.5 million

$225 - $400 million

100% reinsured

$75 - $97.5 million |

12

Update on Proposed Merger Transaction

Merger agreement announced July 30, 2012.

S-4 process is progressing with the SEC. Regulatory approval process is

progressing as well. We hope to be in a position to close the transaction

before year-end. |