Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TWO HARBORS INVESTMENT CORP. | a8kq32012earningsrelease.htm |

| EX-99.1 - PRESS RELEASE, DATED NOVEMBER 6, 2012, ISSUED BY TWO HARBORS INVESTMENT CORP. ANNOUNCING THIRD QUARTER 2012 RESULTS. - TWO HARBORS INVESTMENT CORP. | q3-2012earningspressrelease.htm |

Two Harbors Investment Corp. Third Quarter 2012 Earnings Call November 7, 2012

2 Forward-Looking Statements This presentation includes “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Actual results may differ from expectations, estimates and projections and, consequently, readers should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “target,” “assume,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believe,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements. These forward- looking statements involve significant risks and uncertainties that could cause actual results to differ materially from expected results. Factors that could cause actual results to differ include, but are not limited to, higher than expected operating costs, changes in prepayment speeds of mortgages underlying our RMBS, the rates of default or decreased recovery on the mortgages underlying our non-Agency securities, failure to recover certain losses that are expected to be temporary, changes in interest rates or the availability of financing, the impact of new legislation or regulatory changes on our operations, the impact of any deficiencies in the servicing or foreclosure practices of third parties and related delays in the foreclosure process, the inability to acquire mortgage loans or securitize the mortgage loans we acquire, the inability to acquire residential real properties at attractive prices or lease such properties on a profitable basis, the impact of new or modified government mortgage refinance or principal reduction programs, and unanticipated changes in overall market and economic conditions. Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Two Harbors does not undertake or accept any obligation to release publicly any updates or revisions to any forward-looking statement to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Additional information concerning these and other risk factors is contained in Two Harbors’ most recent filings with the Securities and Exchange Commission. All subsequent written and oral forward looking statements concerning Two Harbors or matters attributable to Two Harbors or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above. Safe Harbor Statement

3 Executive Summary Delivered Exceptional Results Delivered comprehensive income of $524.4 million and total return on book value of 18.7%1. Book value increased 15.1% to $11.442 per diluted share, due primarily to strong appreciation in Agency and non-Agency holdings, net of hedges. Core Earnings3 of $0.31 were impacted primarily by timing of the capital deployment from the company's July 2012 capital raise and lower yields on the company's Agency RMBS securities acquired in recent months. Achieved total stockholder return of 89.7% since we commenced operations in October 2009, or 23.9% on an annualized basis4. Accretive public stock offering completed in July 2012, resulting in the issuance of 57.5 million shares for net proceeds of $592.4 million. Of the 33 million outstanding warrants, approximately 16 million have been exercised for proceeds of $176 million. (1) See Appendix, page 13 for calculation of Q3-2012 return on book value. (2) Diluted shares outstanding at end of period, which includes the effect of dilutive outstanding warrants determined using the treasury stock method, are used as the denominator for book value per share calculation. (3) Core Earnings is a non-GAAP measure that the company defines as GAAP net income, excluding impairment losses, gains or losses on sales of securities and termination of interest rate swaps, unrealized gains or losses on trading securities, interest rate swaps and swaptions and certain gains or losses on derivative instruments. As defined, Core Earnings includes interest income associated with the company's inverse interest-only securities (“Agency Derivatives”) and premium income on or loss on credit default swaps. (4) Source: Bloomberg. Data as of October 23, 2012.

4 Key Macroeconomic Update Key Macroeconomic Factors that Impact our Business Europe Dissolution of European Union or Euro is a significant risk to global markets. Home Prices CoreLogic Home Price Index increased 6.1%1 and we continue to find firming in certain regions. Interest Rates Interest rates could spike if the government doesn’t halt tax cuts and spending hikes and put a plan in place to lower national debt. Rates influence funding costs as well as Agency prepayment speeds. Low federal funds target rate should benefit funding costs for the next few years. Employment Trends are improving, but unemployment is still high. Meaningful determinant of probability of default on a mortgage loan. (1) Source: CoreLogic Home Price Index rolling 12-month change as of October 1, 2012.

5 Business Diversification Single Family Residential Properties As of October 31st, we had acquired a portfolio of approximately $240 million and over 2,000 homes. Represents an attractive asset class given long duration, current yield and potential home price appreciation. Securitization Continue to monitor the environment while maintaining an opportunistic approach. Increased commitments to acquire prime jumbo loans. Key Hires Nick Smith joined our team in September. Nick brings a skill set in residential loans and MSRs. Dan Koch joined Two Harbors in October. Dan has an extensive background in sourcing loan acquisitions and development of business diversification.

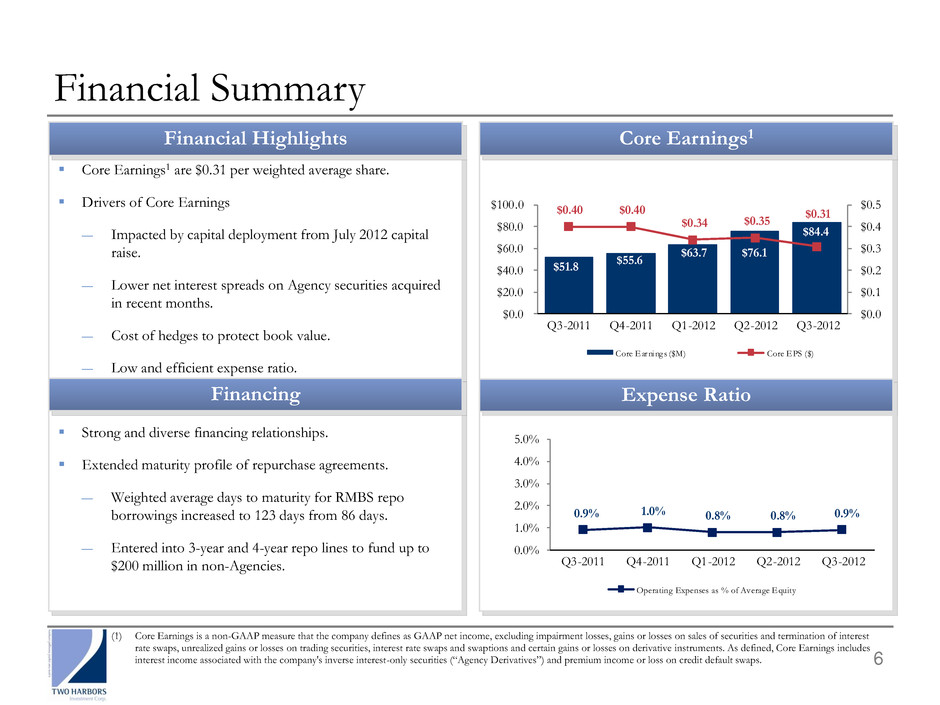

110 110 6 Financial Summary Financial Highlights Core Earnings1 Expense Ratio Core Earnings1 are $0.31 per weighted average share. Drivers of Core Earnings ― Impacted by capital deployment from July 2012 capital raise. ― Lower net interest spreads on Agency securities acquired in recent months. ― Cost of hedges to protect book value. ― Low and efficient expense ratio. Strong and diverse financing relationships. Extended maturity profile of repurchase agreements. ― Weighted average days to maturity for RMBS repo borrowings increased to 123 days from 86 days. ― Entered into 3-year and 4-year repo lines to fund up to $200 million in non-Agencies. $51.8 $55.6 $63.7 $76.1 $84.4 $0.40 $0.40 $0.34 $0.35 $0.31 $0.0 $0.1 $0.2 $0.3 $0.4 $0.5 $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 Q3-2011 Q4-2011 Q1-2012 Q2-2012 Q3-2012 Core Earnings ($M) Core EPS ($) 0.9% 1.0% 0.8% 0.8% 0.9% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% Q3-2011 Q4-2011 Q1-2012 Q2-2012 Q3-2012 Operating Expenses as % of Average Equity (1) Core Earnings is a non-GAAP measure that the company defines as GAAP net income, excluding impairment losses, gains or losses on sales of securities and termination of interest rate swaps, unrealized gains or losses on trading securities, interest rate swaps and swaptions and certain gains or losses on derivative instruments. As defined, Core Earnings includes interest income associated with the company's inverse interest-only securities (“Agency Derivatives”) and premium income or loss on credit default swaps. Financing

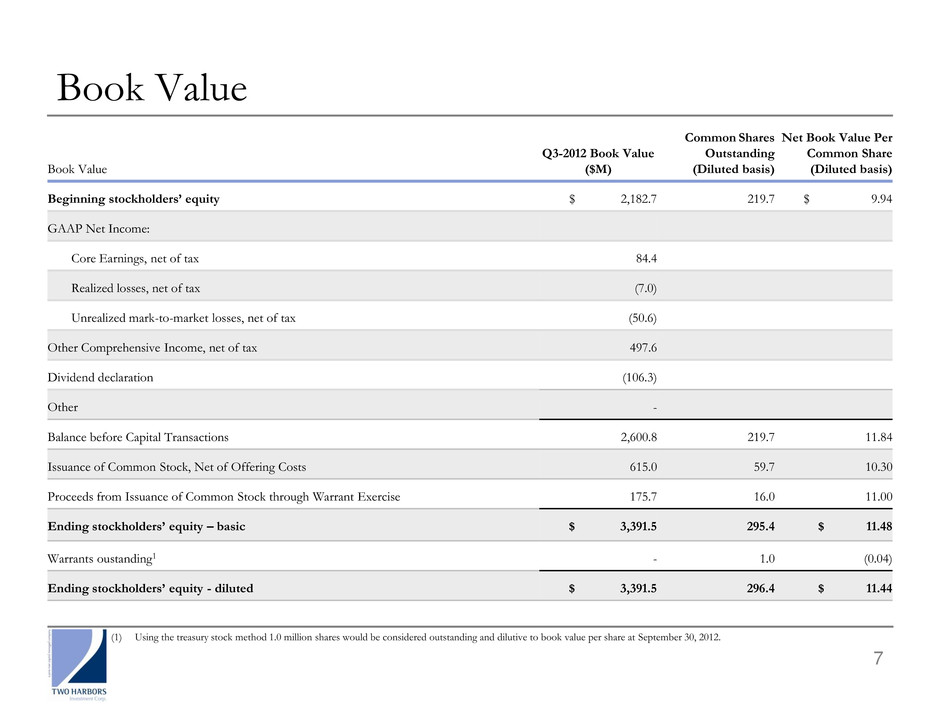

7 Book Value Book Value Q3-2012 Book Value ($M) Common Shares Outstanding (Diluted basis) Net Book Value Per Common Share (Diluted basis) Beginning stockholders’ equity $ 2,182.7 219.7 $ 9.94 GAAP Net Income: Core Earnings, net of tax 84.4 Realized losses, net of tax (7.0) Unrealized mark-to-market losses, net of tax (50.6) Other Comprehensive Income, net of tax 497.6 Dividend declaration (106.3) Other - Balance before Capital Transactions 2,600.8 219.7 11.84 Issuance of Common Stock, Net of Offering Costs 615.0 59.7 10.30 Proceeds from Issuance of Common Stock through Warrant Exercise 175.7 16.0 11.00 Ending stockholders’ equity – basic $ 3,391.5 295.4 $ 11.48 Warrants oustanding1 - 1.0 (0.04) Ending stockholders’ equity - diluted $ 3,391.5 296.4 $ 11.44 (1) Using the treasury stock method 1.0 million shares would be considered outstanding and dilutive to book value per share at September 30, 2012.

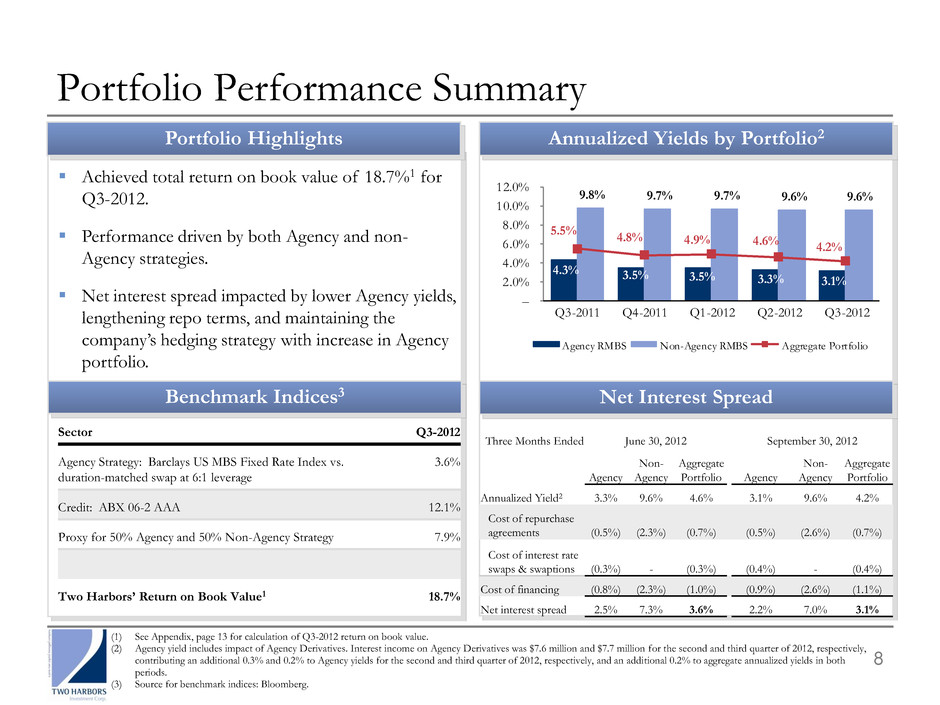

110 Achieved total return on book value of 18.7%1 for Q3-2012. Performance driven by both Agency and non- Agency strategies. Net interest spread impacted by lower Agency yields, lengthening repo terms, and maintaining the company’s hedging strategy with increase in Agency portfolio. Sector Q3-2012 Agency Strategy: Barclays US MBS Fixed Rate Index vs. duration-matched swap at 6:1 leverage 3.6% Credit: ABX 06-2 AAA 12.1% Proxy for 50% Agency and 50% Non-Agency Strategy 7.9% Two Harbors’ Return on Book Value1 18.7% Benchmark Indices3 Portfolio Performance Summary 8 110 4.3% 3.5% 3.5% 3.3% 3.1% 9.8% 9.7% 9.7% 9.6% 9.6% 5.5% 4.8% 4.9% 4.6% 4.2% – 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% Q3-2011 Q4-2011 Q1-2012 Q2-2012 Q3-2012 Agency RMBS Non-Agency RMBS Aggregate Portfolio (1) See Appendix, page 13 for calculation of Q3-2012 return on book value. (2) Agency yield includes impact of Agency Derivatives. Interest income on Agency Derivatives was $7.6 million and $7.7 million for the second and third quarter of 2012, respectively, contributing an additional 0.3% and 0.2% to Agency yields for the second and third quarter of 2012, respectively, and an additional 0.2% to aggregate annualized yields in both periods. (3) Source for benchmark indices: Bloomberg. Three Months Ended June 30, 2012 September 30, 2012 Agency Non- Agency Aggregate Portfolio Agency Non- Agency Aggregate Portfolio Annualized Yield2 3.3% 9.6% 4.6% 3.1% 9.6% 4.2% Cost of repurchase agreements (0.5%) (2.3%) (0.7%) (0.5%) (2.6%) (0.7%) Cost of interest rate swaps & swaptions (0.3%) - (0.3%) (0.4%) - (0.4%) Cost of financing (0.8%) (2.3%) (1.0%) (0.9%) (2.6%) (1.1%) Net interest spread 2.5% 7.3% 3.6% 2.2% 7.0% 3.1% Portfolio Highlights Annualized Yields by Portfolio2 Net Interest Spread

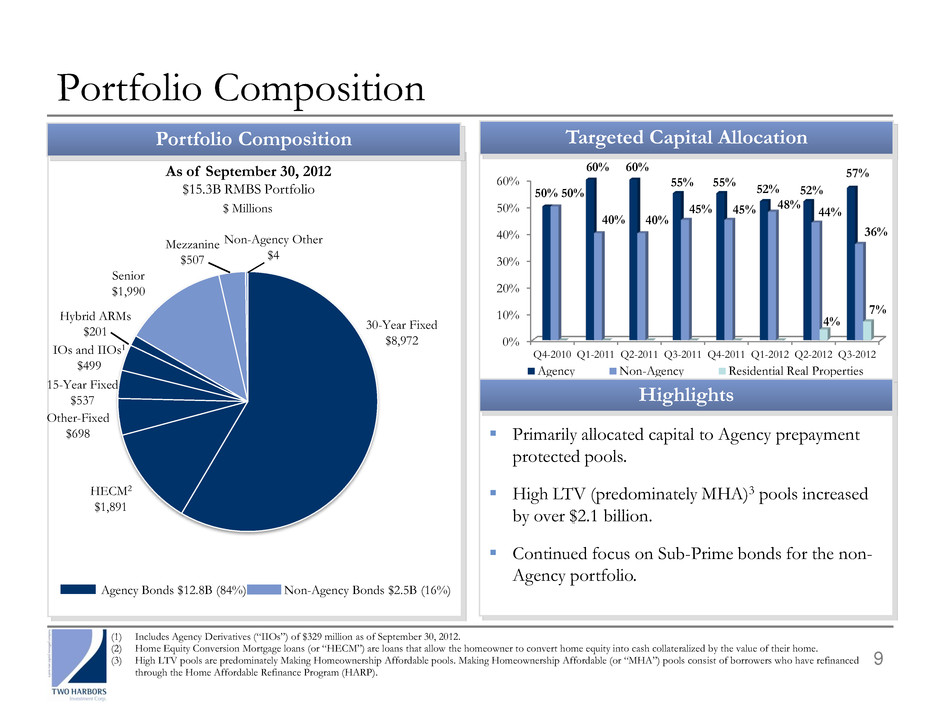

110 110 0% 10% 20% 30% 40% 50% 60% Q4-2010 Q1-2011 Q2-2011 Q3-2011 Q4-2011 Q1-2012 Q2-2012 Q3-2012 50% 60% 60% 55% 55% 52% 52% 57% 50% 40% 40% 45% 45% 48% 44% 36% 4% 7% Agency Non-Agency Residential Real Properties Portfolio Composition 9 (1) Includes Agency Derivatives (“IIOs”) of $329 million as of September 30, 2012. (2) Home Equity Conversion Mortgage loans (or “HECM”) are loans that allow the homeowner to convert home equity into cash collateralized by the value of their home. (3) High LTV pools are predominately Making Homeownership Affordable pools. Making Homeownership Affordable (or “MHA”) pools consist of borrowers who have refinanced through the Home Affordable Refinance Program (HARP). Highlights Targeted Capital Allocation Primarily allocated capital to Agency prepayment protected pools. High LTV (predominately MHA)3 pools increased by over $2.1 billion. Continued focus on Sub-Prime bonds for the non- Agency portfolio. As of September 30, 2012 $15.3B RMBS Portfolio $ Millions Agency Bonds $12.8B (84%) Non-Agency Bonds $2.5B (16%) 30-Year Fixed $8,972 15-Year Fixed $537 HECM2 $1,891 Other-Fixed $698 IOs and IIOs1 $499 Hybrid ARMs $201 Mezzanine $507 Senior $1,990 Non-Agency Other $4 Portfolio Composition

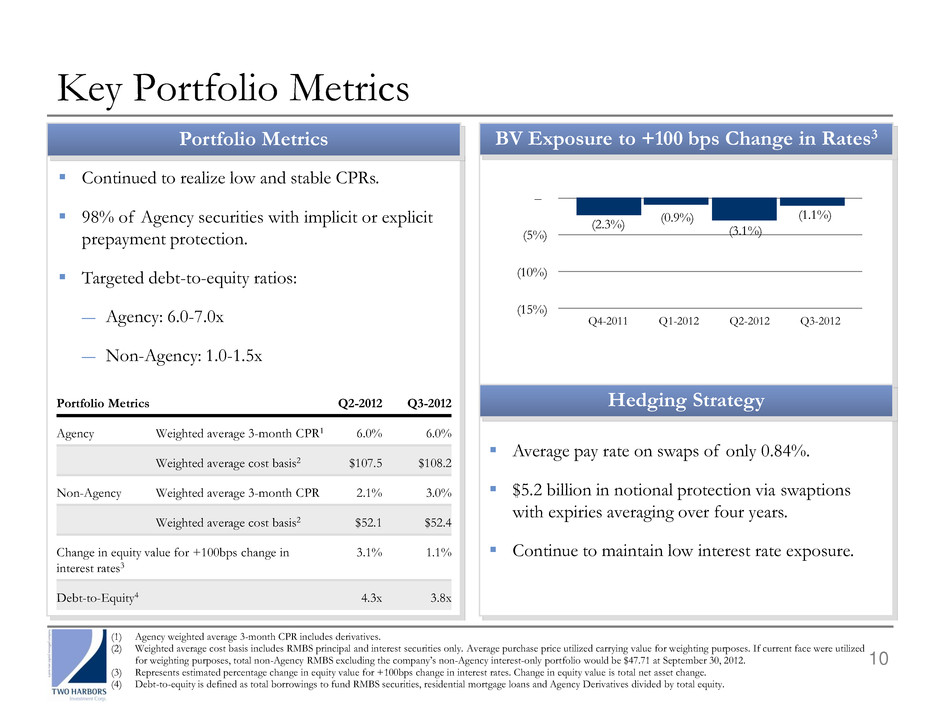

10 110 Key Portfolio Metrics 110 Continued to realize low and stable CPRs. 98% of Agency securities with implicit or explicit prepayment protection. Targeted debt-to-equity ratios: ― Agency: 6.0-7.0x ― Non-Agency: 1.0-1.5x (1) Agency weighted average 3-month CPR includes derivatives. (2) Weighted average cost basis includes RMBS principal and interest securities only. Average purchase price utilized carrying value for weighting purposes. If current face were utilized for weighting purposes, total non-Agency RMBS excluding the company’s non-Agency interest-only portfolio would be $47.71 at September 30, 2012. (3) Represents estimated percentage change in equity value for +100bps change in interest rates. Change in equity value is total net asset change. (4) Debt-to-equity is defined as total borrowings to fund RMBS securities, residential mortgage loans and Agency Derivatives divided by total equity. Average pay rate on swaps of only 0.84%. $5.2 billion in notional protection via swaptions with expiries averaging over four years. Continue to maintain low interest rate exposure. Portfolio Metrics Q2-2012 Q3-2012 Agency Weighted average 3-month CPR1 6.0% 6.0% Weighted average cost basis2 $107.5 $108.2 Non-Agency Weighted average 3-month CPR 2.1% 3.0% Weighted average cost basis2 $52.1 $52.4 Change in equity value for +100bps change in interest rates3 3.1% 1.1% Debt-to-Equity4 4.3x 3.8x Portfolio Metrics BV Exposure to +100 bps Change in Rates3 (2.3%) (0.9%) (3.1%) (1.1%) (15%) (10%) (5%) – Q3-2012 Hedging Strategy Q2-2012 Q1-2012 Q4-2011

11 Hybrid Model Provides Flexibility Agency Portfolio Today Focus on prepayment protected securities has generated low and stable prepayment experience. Low interest rate exposure. Non-Agency Portfolio Today Delinquencies are declining and performance is improving. Housing stable and improving, providing potential upside to non-Agency discount bonds. Hybrid Model Provides Flexibility – Broad Menu of Potential Opportunities Potential investment universe includes all residential real estate assets, including unsecuritized products. Recent hires bolster expertise and ability to explore opportunities for diversification. Securitization – credit bonds and IO creation math has improved. GSE Credit Investments – when, and if, the GSEs move to distribute credit risk. Mortgage Servicing Rights (MSRs). Other residential mortgage loans.

12 Appendix

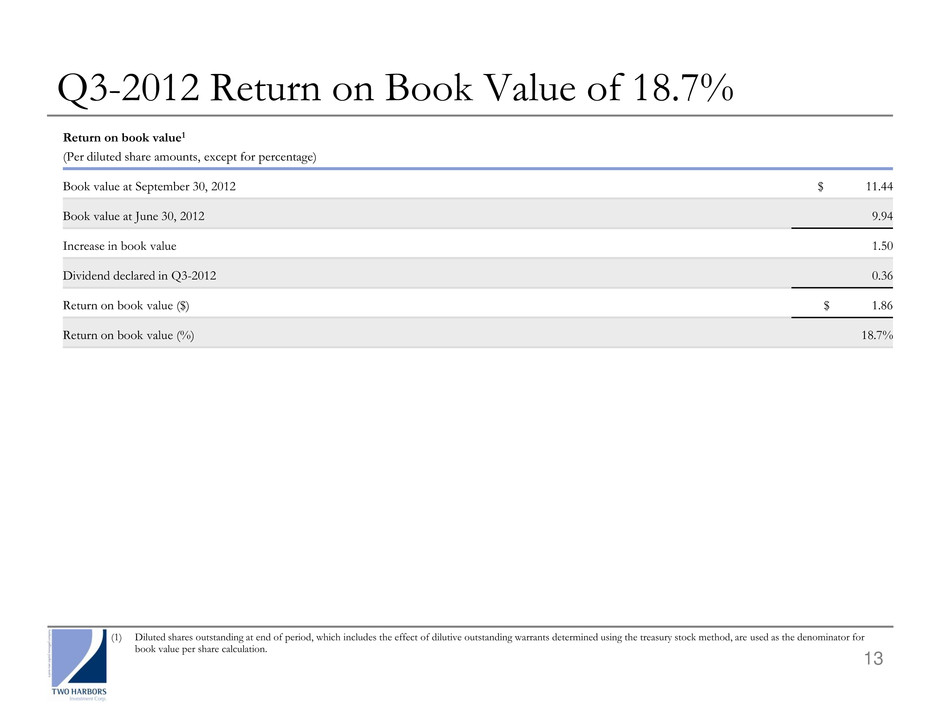

13 Q3-2012 Return on Book Value of 18.7% Return on book value1 (Per diluted share amounts, except for percentage) Book value at September 30, 2012 $ 11.44 Book value at June 30, 2012 9.94 Increase in book value 1.50 Dividend declared in Q3-2012 0.36 Return on book value ($) $ 1.86 Return on book value (%) 18.7% (1) Diluted shares outstanding at end of period, which includes the effect of dilutive outstanding warrants determined using the treasury stock method, are used as the denominator for book value per share calculation.

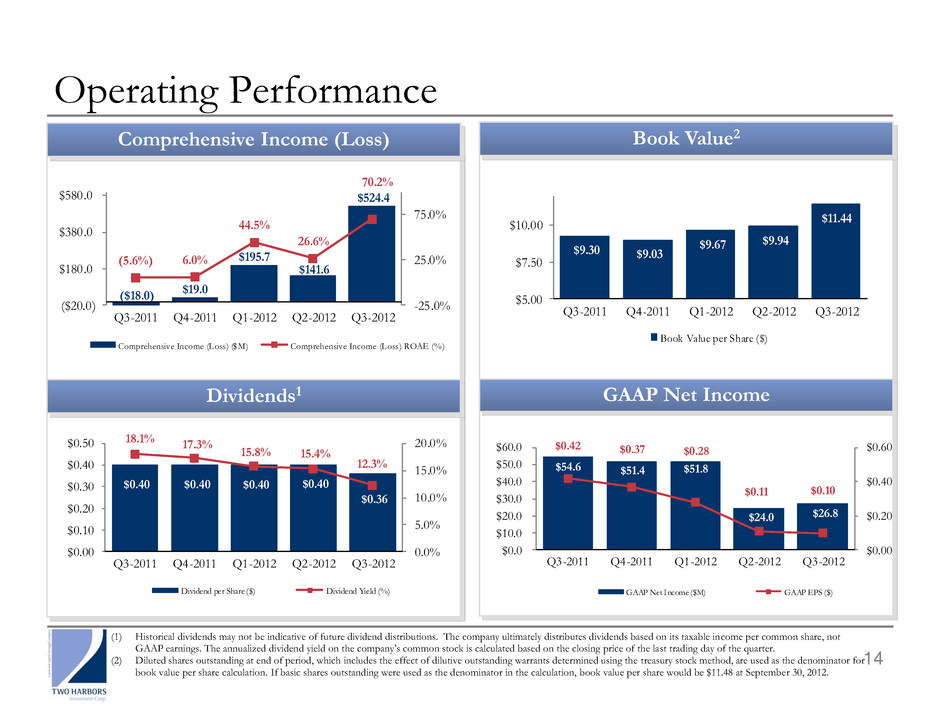

110 Operating Performance 110 $9.30 $9.03 $9.67 $9.94 $11.44 $5.00 $7.50 $10.00 Q3-2011 Q4-2011 Q1-2012 Q2-2012 Q3-2012 Book Value per Share ($) ($18.0) $19.0 $195.7 $141.6 $524.4 (5.6%) 6.0% 44.5% 26.6% 70.2% -25.0% 25.0% 75.0% ($20.0) $180.0 $380.0 $580.0 Q3-2011 Q4-2011 Q1-2012 Q2-2012 Q3-2012 Comprehensive Income (Loss) ($M) Comprehensive Income (Loss) ROAE (%) $0.40 $0.40 $0.40 $0.40 $0.36 18.1% 17.3% 15.8% 15.4% 12.3% 0.0% 5.0% 10.0% 15.0% 20.0% $0.00 $0.10 $0.20 $0.30 $0.40 $0.50 Q3-2011 Q4-2011 Q1-2012 Q2-2012 Q3-2012 Dividend per Share ($) Dividend Yield (%) (1) Historical dividends may not be indicative of future dividend distributions. The company ultimately distributes dividends based on its taxable income per common share, not GAAP earnings. The annualized dividend yield on the company’s common stock is calculated based on the closing price of the last trading day of the quarter. (2) Diluted shares outstanding at end of period, which includes the effect of dilutive outstanding warrants determined using the treasury stock method, are used as the denominator for book value per share calculation. If basic shares outstanding were used as the denominator in the calculation, book value per share would be $11.48 at September 30, 2012. 14 Book Value2 GAAP Net Income Comprehensive Income (Loss) Dividends1 $54.6 $51.4 $51.8 $24.0 $26.8 $0.4 $0.37 $0.28 $0.11 $0.10 $0.00 $0.20 $0.40 $0.60 $0.0 $10.0 $20.0 $30.0 $40. $50.0 $60.0 Q3-201 4-2011 Q1-2012 Q2-2012 Q3-2012 GAAP Net Income ($M) GAAP EPS ($)

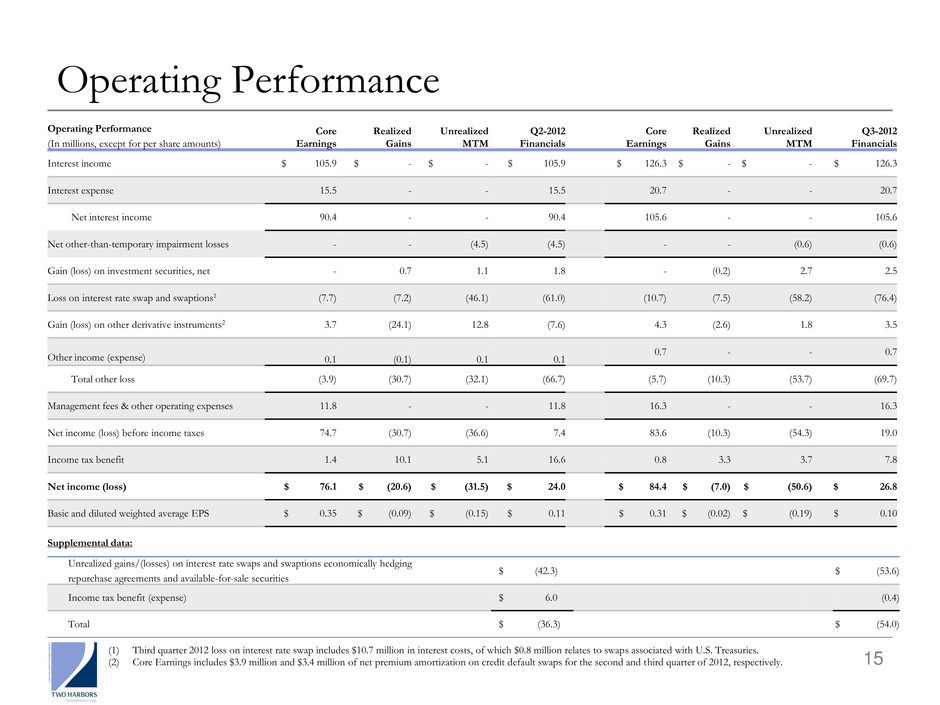

15 Operating Performance Operating Performance (In millions, except for per share amounts) Core Earnings Realized Gains Unrealized MTM Q2-2012 Financials Core Earnings Realized Gains Unrealized MTM Q3-2012 Financials Interest income $ 105.9 $ - $ - $ 105.9 $ 126.3 $ - $ - $ 126.3 Interest expense 15.5 - - 15.5 20.7 - - 20.7 Net interest income 90.4 - - 90.4 105.6 - - 105.6 Net other-than-temporary impairment losses - - (4.5) (4.5) - - (0.6) (0.6) Gain (loss) on investment securities, net - 0.7 1.1 1.8 - (0.2) 2.7 2.5 Loss on interest rate swap and swaptions1 (7.7) (7.2) (46.1) (61.0) (10.7) (7.5) (58.2) (76.4) Gain (loss) on other derivative instruments2 3.7 (24.1) 12.8 (7.6) 4.3 (2.6) 1.8 3.5 Other income (expense) 0.1 (0.1) 0.1 0.1 0.7 - - 0.7 Total other loss (3.9) (30.7) (32.1) (66.7) (5.7) (10.3) (53.7) (69.7) Management fees & other operating expenses 11.8 - - 11.8 16.3 - - 16.3 Net income (loss) before income taxes 74.7 (30.7) (36.6) 7.4 83.6 (10.3) (54.3) 19.0 Income tax benefit 1.4 10.1 5.1 16.6 0.8 3.3 3.7 7.8 Net income (loss) $ 76.1 $ (20.6) $ (31.5) $ 24.0 $ 84.4 $ (7.0) $ (50.6) $ 26.8 Basic and diluted weighted average EPS $ 0.35 $ (0.09) $ (0.15) $ 0.11 $ 0.31 $ (0.02) $ (0.19) $ 0.10 (1) Third quarter 2012 loss on interest rate swap includes $10.7 million in interest costs, of which $0.8 million relates to swaps associated with U.S. Treasuries. (2) Core Earnings includes $3.9 million and $3.4 million of net premium amortization on credit default swaps for the second and third quarter of 2012, respectively. Supplemental data: Unrealized gains/(losses) on interest rate swaps and swaptions economically hedging repurchase agreements and available-for-sale securities $ (42.3) $ (53.6) Income tax benefit (expense) $ 6.0 (0.4) Total $ (36.3) $ (54.0)

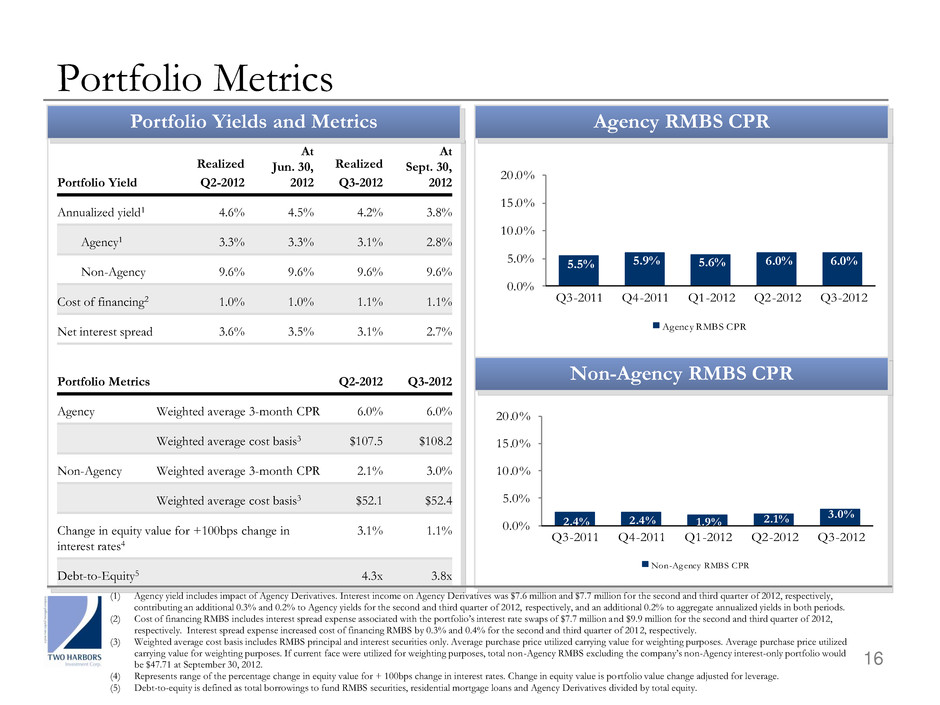

16 110 Portfolio Metrics Portfolio Yield Realized Q2-2012 At Jun. 30, 2012 Realized Q3-2012 At Sept. 30, 2012 Annualized yield1 4.6% 4.5% 4.2% 3.8% Agency1 3.3% 3.3% 3.1% 2.8% Non-Agency 9.6% 9.6% 9.6% 9.6% Cost of financing2 1.0% 1.0% 1.1% 1.1% Net interest spread 3.6% 3.5% 3.1% 2.7% Portfolio Metrics Q2-2012 Q3-2012 Agency Weighted average 3-month CPR 6.0% 6.0% Weighted average cost basis3 $107.5 $108.2 Non-Agency Weighted average 3-month CPR 2.1% 3.0% Weighted average cost basis3 $52.1 $52.4 Change in equity value for +100bps change in interest rates4 3.1% 1.1% Debt-to-Equity5 4.3x 3.8x Portfolio Yields and Metrics 110 Agency RMBS CPR Non-Agency RMBS CPR 2.4% 2.4% 1.9% 2.1% 3.0% 0.0% 5.0% 10.0% 15.0% 20.0% Q3-2011 Q4-2011 Q1-2012 Q2-2012 Q3-2012 Non-Agency RMBS CPR 5.5% 5.9% 5.6% 6.0% 6.0% . 5.0% 10.0% 15.0% 20.0% Q3-2011 Q4-2011 Q1-2012 Q2-2012 Q3-2012 Agency RMBS CPR (1) Agency yield includes impact of Agency Derivatives. Interest income on Agency Derivatives was $7.6 million and $7.7 million for the second and third quarter of 2012, respectively, contributing an additional 0.3% and 0.2% to Agency yields for the second and third quarter of 2012, respectively, and an additional 0.2% to aggregate annualized yields in both periods. (2) Cost of financing RMBS includes interest spread expense associated with the portfolio’s interest rate swaps of $7.7 million and $9.9 million for the second and third quarter of 2012, respectively. Interest spread expense increased cost of financing RMBS by 0.3% and 0.4% for the second and third quarter of 2012, respectively. (3) Weighted average cost basis includes RMBS principal and interest securities only. Average purchase price utilized carrying value for weighting purposes. Average purchase price utilized carrying value for weighting purposes. If current face were utilized for weighting purposes, total non-Agency RMBS excluding the company’s non-Agency interest-only portfolio would be $47.71 at September 30, 2012. (4) Represents range of the percentage change in equity value for + 100bps change in interest rates. Change in equity value is portfolio value change adjusted for leverage. (5) Debt-to-equity is defined as total borrowings to fund RMBS securities, residential mortgage loans and Agency Derivatives divided by total equity.

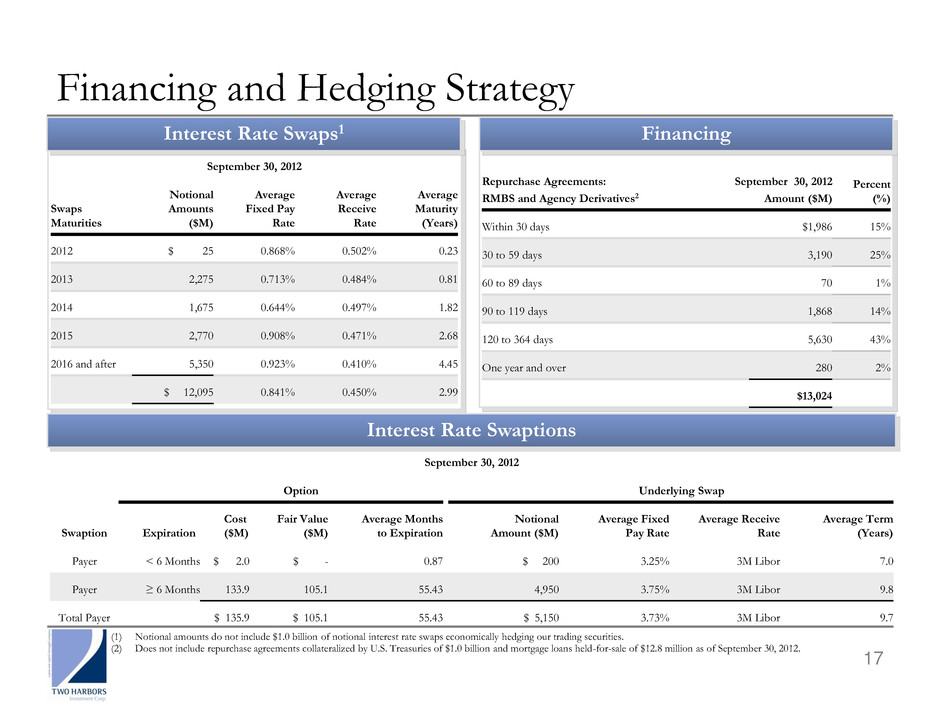

110 110 September 30, 2012 Swaps Maturities Notional Amounts ($M) Average Fixed Pay Rate Average Receive Rate Average Maturity (Years) 2012 $ 25 0.868% 0.502% 0.23 2013 2,275 0.713% 0.484% 0.81 2014 1,675 0.644% 0.497% 1.82 2015 2,770 0.908% 0.471% 2.68 2016 and after 5,350 0.923% 0.410% 4.45 $ 12,095 0.841% 0.450% 2.99 17 Financing and Hedging Strategy (1) Notional amounts do not include $1.0 billion of notional interest rate swaps economically hedging our trading securities. (2) Does not include repurchase agreements collateralized by U.S. Treasuries of $1.0 billion and mortgage loans held-for-sale of $12.8 million as of September 30, 2012. Repurchase Agreements: RMBS and Agency Derivatives2 September 30, 2012 Amount ($M) Percent (%) Within 30 days $1,986 15% 30 to 59 days 3,190 25% 60 to 89 days 70 1% 90 to 119 days 1,868 14% 120 to 364 days 5,630 43% One year and over 280 2% $13,024 Interest Rate Swaps1 Financing Interest Rate Swaptions September 30, 2012 Option Underlying Swap Swaption Expiration Cost ($M) Fair Value ($M) Average Months to Expiration Notional Amount ($M) Average Fixed Pay Rate Average Receive Rate Average Term (Years) Payer < 6 Months $ 2.0 $ - 0.87 $ 200 3.25% 3M Libor 7.0 Payer ≥ 6 Months 133.9 105.1 55.43 4,950 3.75% 3M Libor 9.8 Total Payer $ 135.9 $ 105.1 55.43 $ 5,150 3.73% 3M Libor 9.7

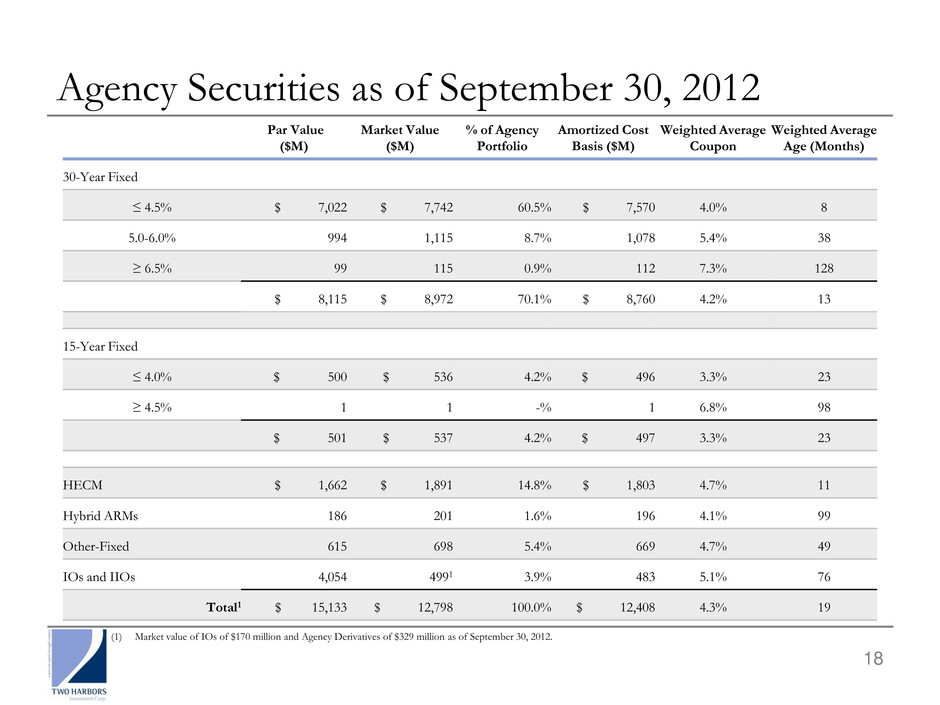

18 Agency Securities as of September 30, 2012 Par Value ($M) Market Value ($M) % of Agency Portfolio Amortized Cost Basis ($M) Weighted Average Coupon Weighted Average Age (Months) 30-Year Fixed ≤ 4.5% $ 7,022 $ 7,742 60.5% $ 7,570 4.0% 8 5.0-6.0% 994 1,115 8.7% 1,078 5.4% 38 ≥ 6.5% 99 115 0.9% 112 7.3% 128 $ 8,115 $ 8,972 70.1% $ 8,760 4.2% 13 15-Year Fixed ≤ 4.0% $ 500 $ 536 4.2% $ 496 3.3% 23 ≥ 4.5% 1 1 -% 1 6.8% 98 $ 501 $ 537 4.2% $ 497 3.3% 23 HECM $ 1,662 $ 1,891 14.8% $ 1,803 4.7% 11 Hybrid ARMs 186 201 1.6% 196 4.1% 99 Other-Fixed 615 698 5.4% 669 4.7% 49 IOs and IIOs 4,054 4991 3.9% 483 5.1% 76 Total1 $ 15,133 $ 12,798 100.0% $ 12,408 4.3% 19 (1) Market value of IOs of $170 million and Agency Derivatives of $329 million as of September 30, 2012.

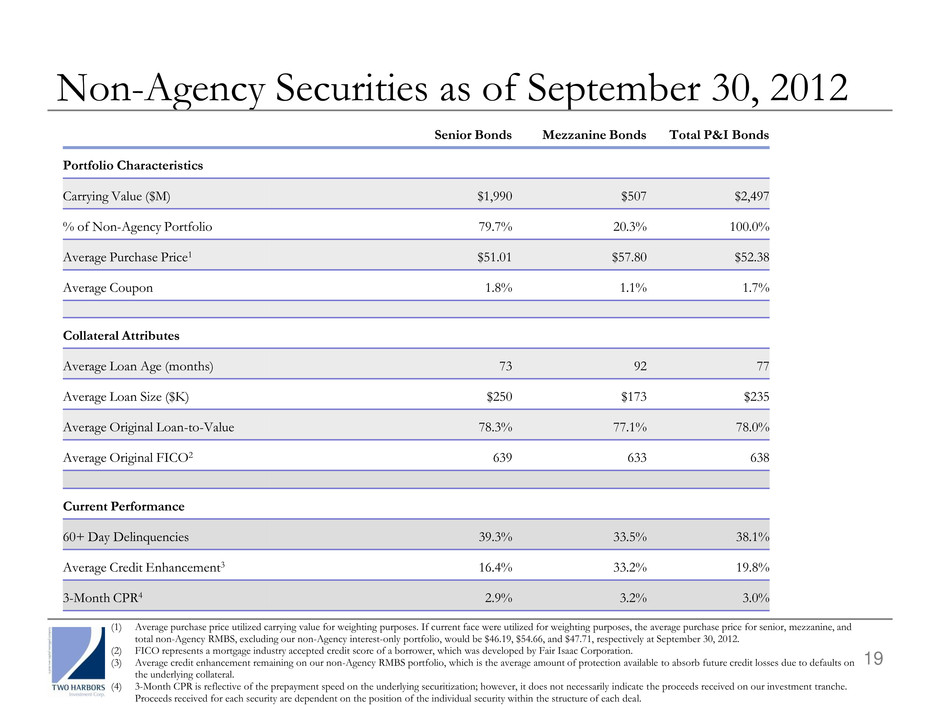

19 Non-Agency Securities as of September 30, 2012 Senior Bonds Mezzanine Bonds Total P&I Bonds Portfolio Characteristics Carrying Value ($M) $1,990 $507 $2,497 % of Non-Agency Portfolio 79.7% 20.3% 100.0% Average Purchase Price1 $51.01 $57.80 $52.38 Average Coupon 1.8% 1.1% 1.7% Collateral Attributes Average Loan Age (months) 73 92 77 Average Loan Size ($K) $250 $173 $235 Average Original Loan-to-Value 78.3% 77.1% 78.0% Average Original FICO2 639 633 638 Current Performance 60+ Day Delinquencies 39.3% 33.5% 38.1% Average Credit Enhancement3 16.4% 33.2% 19.8% 3-Month CPR4 2.9% 3.2% 3.0% (1) Average purchase price utilized carrying value for weighting purposes. If current face were utilized for weighting purposes, the average purchase price for senior, mezzanine, and total non-Agency RMBS, excluding our non-Agency interest-only portfolio, would be $46.19, $54.66, and $47.71, respectively at September 30, 2012. (2) FICO represents a mortgage industry accepted credit score of a borrower, which was developed by Fair Isaac Corporation. (3) Average credit enhancement remaining on our non-Agency RMBS portfolio, which is the average amount of protection available to absorb future credit losses due to defaults on the underlying collateral. (4) 3-Month CPR is reflective of the prepayment speed on the underlying securitization; however, it does not necessarily indicate the proceeds received on our investment tranche. Proceeds received for each security are dependent on the position of the individual security within the structure of each deal.

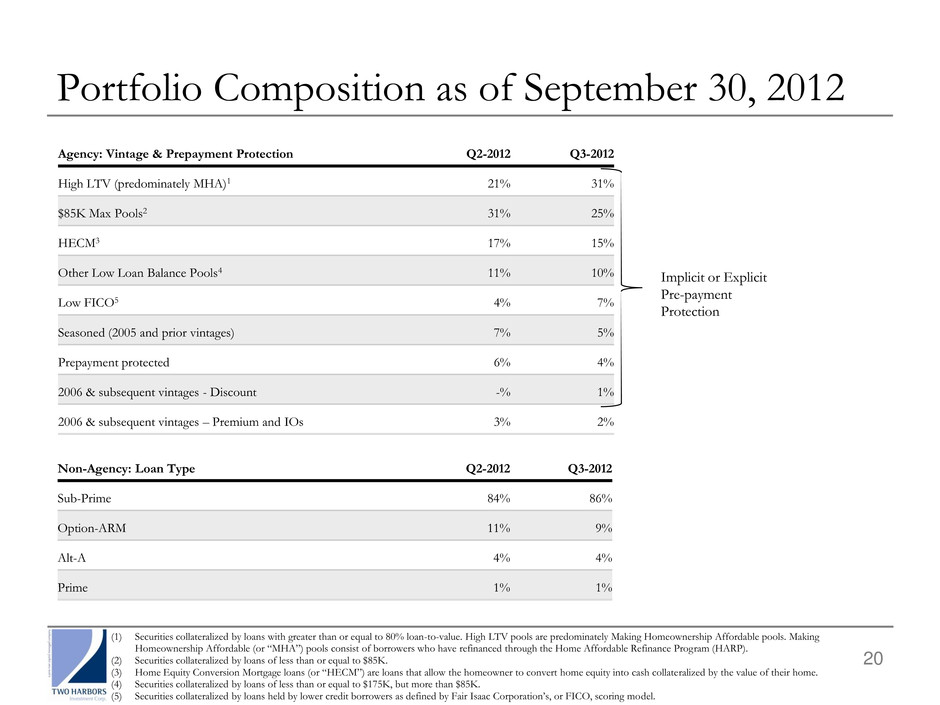

Agency: Vintage & Prepayment Protection Q2-2012 Q3-2012 High LTV (predominately MHA)1 21% 31% $85K Max Pools2 31% 25% HECM3 17% 15% Other Low Loan Balance Pools4 11% 10% Low FICO5 4% 7% Seasoned (2005 and prior vintages) 7% 5% Prepayment protected 6% 4% 2006 & subsequent vintages - Discount -% 1% 2006 & subsequent vintages – Premium and IOs 3% 2% 20 Portfolio Composition as of September 30, 2012 Implicit or Explicit Pre-payment Protection Non-Agency: Loan Type Q2-2012 Q3-2012 Sub-Prime 84% 86% Option-ARM 11% 9% Alt-A 4% 4% Prime 1% 1% (1) Securities collateralized by loans with greater than or equal to 80% loan-to-value. High LTV pools are predominately Making Homeownership Affordable pools. Making Homeownership Affordable (or “MHA”) pools consist of borrowers who have refinanced through the Home Affordable Refinance Program (HARP). (2) Securities collateralized by loans of less than or equal to $85K. (3) Home Equity Conversion Mortgage loans (or “HECM”) are loans that allow the homeowner to convert home equity into cash collateralized by the value of their home. (4) Securities collateralized by loans of less than or equal to $175K, but more than $85K. (5) Securities collateralized by loans held by lower credit borrowers as defined by Fair Isaac Corporation’s, or FICO, scoring model.