Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HYSTER-YALE MATERIALS HANDLING, INC. | d433220d8k.htm |

BAIRD

INDUSTRIAL

CONFERENCE

November

6,

2012

Exhibit 99.1 |

1

Safe Harbor Statement

The following information includes forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933, as amended,

and

Section

21E

of

the

Securities

Exchange

Act

of

1934,

as

amended.

Any

and

all

statements

regarding

the

Company’s

expected future financial position, results of operations, cash flows, business

strategy, budgets, projected costs, capital expenditures, products, competitive

positions, growth opportunities, plans, goals and objectives of management for future operations, as well as

statements

that

include

words

such

as

“anticipate,”

“if,”

“believe,”

“plan,”

“estimate,”

“expect,”

“intend,”

“may,”

“could,”

“should,”

“will,”

and

other similar expressions are forward-looking statements. Such forward-looking

statements are inherently uncertain, and readers must recognize that actual

results may differ materially from the expectations of the Company’s management. The Company does not

undertake a duty to update such forward-looking statements. Factors that may cause

actual results to differ materially from those in the forward-looking

statements

include,

without

limitation,

reduction

in

demand

for

lift

trucks

and

related

aftermarket

parts

and

service

on

a

global basis; the ability of our dealers, suppliers and end-users to obtain

financing at reasonable rates, or at all, as a result of current economic and

market conditions; customer acceptance of pricing; delays in delivery or increases in costs, including transportation costs,

of

raw

materials

or

sourced

products

and

labor

or

changes

in

or

unavailability

of

quality

suppliers;

exchange

rate

fluctuations,

changes

in

foreign import tariffs and monetary policies and other changes in the regulatory

climate in the foreign countries in which we operate and/or sell products;

delays in manufacturing and delivery schedules; bankruptcy of or loss of major dealers, retail customers or suppliers;

customer acceptance of, changes in the costs of, or delays in the development of new

products; introduction of new products by, or more favorable product pricing

offered by, our competitors; product liability or other litigation, warranty claims or returns of products; the

effectiveness of the cost reduction programs implemented globally, including the

successful implementation of procurement and sourcing initiatives;

changes

mandated

by

federal,

state

and

other

regulation,

including

health,

safety

or

environmental

legislation;

and

other

risks

identified

in

the

Company’s

Registration

Statement

on

Form

S-1

and

other

filings

with

the

Securities

and

Exchange

Commission.

Many

of

these factors are outside of the Company’s control. |

2

Hyster-Yale Snapshot

Hyster-Yale Materials Handling, Inc. (NYSE:HY)

Leading global designer, manufacturer and marketer of lift

trucks and provider of aftermarket parts and support

Headquartered in Cleveland, Ohio

Over 5,300 employees in 13 countries

LTM

9/30/12

revenue

–

$2.5

billion

LTM

9/30/12

net

income

-

$89.2

million

LTM 9/30/12 EBITDA

(1)

–

$145.5 million

9/30/12

net

debt

–

$0.3

million

cash

LTM 9/30/12 ROTCE

(1)

of 27.5% (Net Debt Basis)

_____________________

(1)

EBITDA and ROTCE are non-GAAP measures and should not be considered in isolation or

as a substitute for GAAP measures. For discussion of non-GAAP items and the related

reconciliations to GAAP measures, see pages starting on 35.

|

3

Economic Engine is Driven by Unit Volume

Volume

Economies

of Scale

Geographic

and Product

Balance

Worldwide

Distribution

Strength to Drive

Market Share

Parts and Service

Volume

Large Lift Truck

Population in Service

Design

Component Commonality

Supply Chain

Manufacturing

Quality

Marketing

Parts

Infrastructure

Capital Requirements

A large lift truck population base drives parts and service volume resulting in enhanced

profitability for dealers and Hyster-Yale Hyster-Yale’s model yields

competitive advantages Basic Business Areas |

4

Parts and Service Contribution to

Hyster-Yale’s and Dealers’

Profitability

Average truck life of about 10 years

Hyster-Yale realizes significant additional parts margin over the life of an

average truck, in some cases, up to 85% of the new unit margin

–

Parts margin realization varies due to

Product life

Application / duty cycle

Product category

Focus on increasing parts margin realization

–

Lock in parts (for H-Y and dealer) and service (for dealer) with full service

contracts and/or fleet management

–

Understand needs of customer |

5

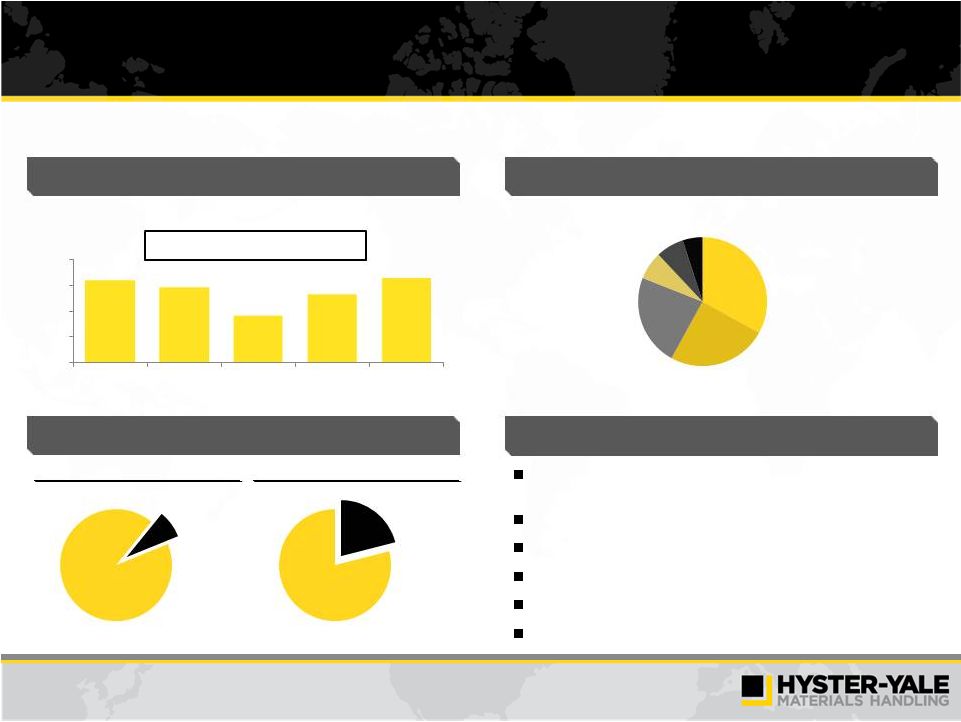

Industry and Hyster-Yale Overview

Industry Overview

–

2001-2011 long-term unit market growth rate 5.7%

–

975,000 unit market globally in 2011 with Europe, Middle East and Africa at 38%,

Americas at 23% and Asia/Pacific at 39%

–

Hyster-Yale 2011 unit market share at 8% of global market and 21% of the Americas

market

Hyster-Yale Overview

–

#3 in units globally in 2011

–

Large installed base of 785,000 units worldwide

–

Serves broad set of markets

–

Internal

Combustion

Engine

(ICE)

units

at

57%,

Electric

units

at

26%,

Parts

and

Other at 17%

–

Global footprint |

6

Growth near GDP levels in developed markets with emerging markets

driving expansion, particularly China

Strong demand for warehouse and distribution industry applications

Increasing focus on battery technology development

Integration of automated technology in products and processes

Importance of total lifecycle cost of ownership

Ongoing consolidation opportunities

Key Themes

Industry Overview

(units in thousands)

Global Lift Truck Industry Size

_____________________

Source: WITS. Represents order intake.

Global Lift Truck Industry Breakdown

Lift Truck Market Share Overview

_____________________

Source: WITS and Company data. Represents order intake.

Global

Americas

_____________________

Source: WITS. Represents order intake.

Europe

33%

China

25%

Americas

23%

Japan

7%

Asia Pacific

7%

Middle East

5%

Hyster

-Yale

21%

Hyster

-Yale

8%

951

872

547

794

975

0

300

600

900

1,200

2007

2008

2009

2010

2011

Long-term CAGR (2001 –

2011) = 5.7% |

7

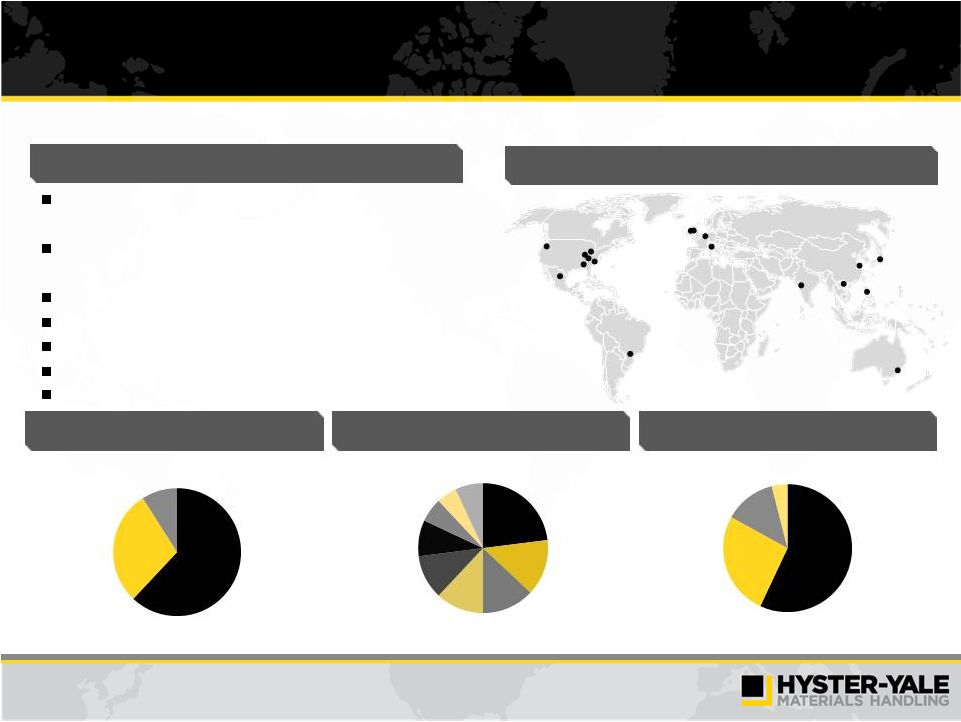

Hyster-Yale Overview

Leading global lift truck brands in terms of units sold

–

#3 globally

Large installed base that drives parts sales

–

Over 785,000 units worldwide

Diverse customer and application base

Global independent dealer network

Comprehensive, updated global product line

Globally integrated operations with economies of scale

Experienced management team

_____________________

(1)

Represents Hyster-Yale North American unit shipments by industry.

(2)

Includes Big Truck sales that represent 9% of total sales.

Key Highlights

Global Footprint

2011 Sales by Geography

2011 Retail Shipments by End Market

(1)

2011 Worldwide Sales by Product

Electric Units

26%

Internal

Combustion

Engine

(“ICE”)

Units

(2)

57%

Parts

13

%

Other

4%

Manufacturing

23%

Wholesale

Distribution

14%

Home Centers /

Retail

13%

Rental

12%

Food & Beverage

11%

Freight & Logistics

9%

Paper

6%

Auto

5%

Other

7%

Americas

62%

Europe, Africa &

Middle East

29%

-

Asia-Pacific

9% |

8

Global Distribution Network and Diverse Global

Customer Base

Global Distribution Network

–

Established brand strength

–

Independent dealer network

–

Complimented by a large national accounts program

Diverse Global Customer Base

–

Blue chip customer base

–

No industry or customer concentration |

9

Global Distribution Network

with Large Installed Base

Two brand network strategy optimizes local presence

and customer reach

–

Presence in over 130 countries worldwide

–

Increasing use of dual brand representation

Key differentiating factors:

–

Long-term relationships with dealers

–

Territorial exclusivity encourages strong, long-

term relationships with customers

–

Brand exclusivity ensures dealers’

selling efforts

focused on Hyster-Yale products

Hyster-Yale supports its dealer network purchases

through strong financing services with concentration on

a long-standing partnership with GE Capital primarily

with NMHG Financial Services, Inc., (“NFS”) in North

America, and with established financing relationships in

other regions

Hyster and Yale brands supported by strength of Hyster and Yale’s global independent

dealer network Sales of more than 79,500 units in 2011

–

Sales of more than 4,500 units at Sumitomo

NACCO JV in 2011 in Japan

Installed base of approximately 785,000 lift trucks

Utilized in more than 700 industries

No industry or customer concentration

Hyster-Yale primarily markets lift trucks and

aftermarket parts under two well-recognized and

respected brand names that resonate performance

and quality

Hyster

–

manufacturer

of

lift

trucks

since

1934

Yale

–

manufacturer

of

lift

trucks

since

1920

Large Installed Base Across Diverse Markets

Established Brand Strength

Independent Dealer Network |

10

Diverse Global Customer Base and Served Markets

National Accounts

Worldwide Channel Mix

Blue Chip Customer Base

Focused on strategic customers with centralized

purchasing and geographically dispersed operations

across dealer territories

Fleet Management Program provides customers with

value-added services that include service,

aftermarket parts and comprehensive management

of materials handling needs

National

Accounts

15%

Independent

Dealers

85% |

11

Key Highlights

Current strong position with significant improvement plans in

–

Products

–

Manufacturing

–

Supply Chain

–

Quality

–

Dealer Network

–

Operating Expenses

–

People |

12

Key Highlights

Comprehensive, updated global product line

Product development for 2013

2014 focuses on:

Completing

introduction

of

full

line

of

next

generation

electric

rider

products

including

some

with

“ICE

like”

capabilities

Updating narrow aisle products with latest technology for increased productivity and

robustness Enhancing

the

motorized

hand

riders

for

the

most

demanding,

high

hour

usage

Adding a range of utility and standard models to the core premium line for the ICE

products Globally integrated, lean operations with economies of scale

Assemble in market of sale

Focus on continuous improvement in lean processes, quality and cost control

Highly flexible low cost supply chain

Substantial

sourcing from low cost countries

Continuing to reduce number of suppliers

Extend supplier quality program

Focus on continuous improvement

-

Manufacturing

Supply Chain

Products |

13

Key Highlights (continued)

Quality

Reliability engineering and lean manufacturing focus have led to low warranty costs

and increased customer satisfaction

Focus on continuous improvement

Dealer Network

Global independent, exclusive dealer network

Increasing use of dual brand representation

Strengthen networks by attracting new dealers and building on stronger dealers

Enhance services to make dealers more profitable and productive

Operating

Expenses

Efficient operating structure

Focus on continuous improvement in dealer performance, sales coverage and productivity

and pricing processes

People

Experienced management team

Focus on continuous improvement in:

Recruiting

Talent Management

Training

|

14

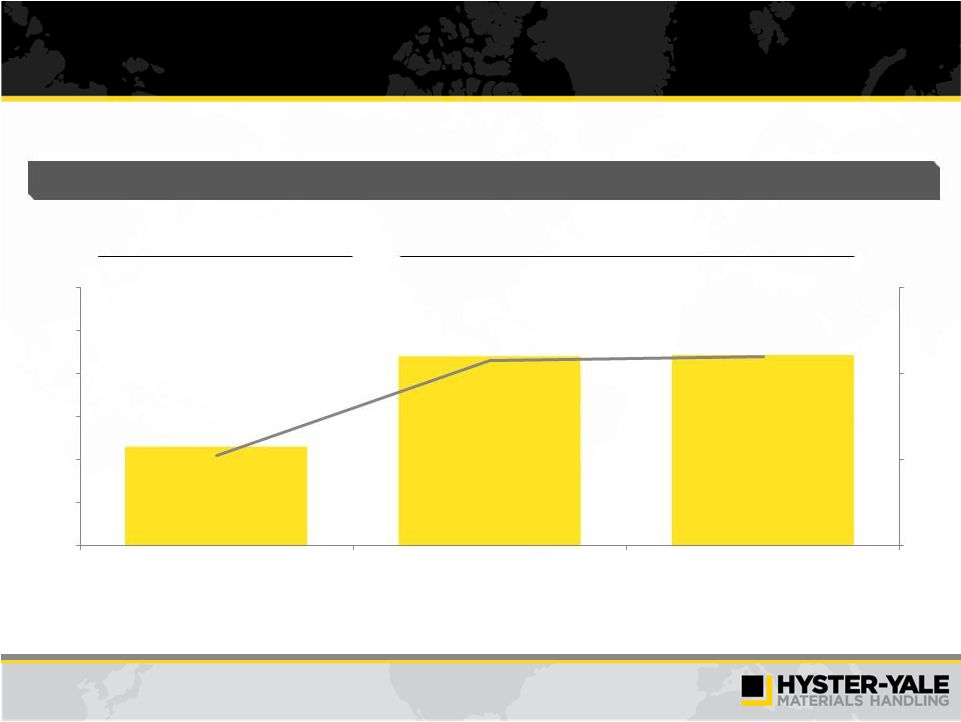

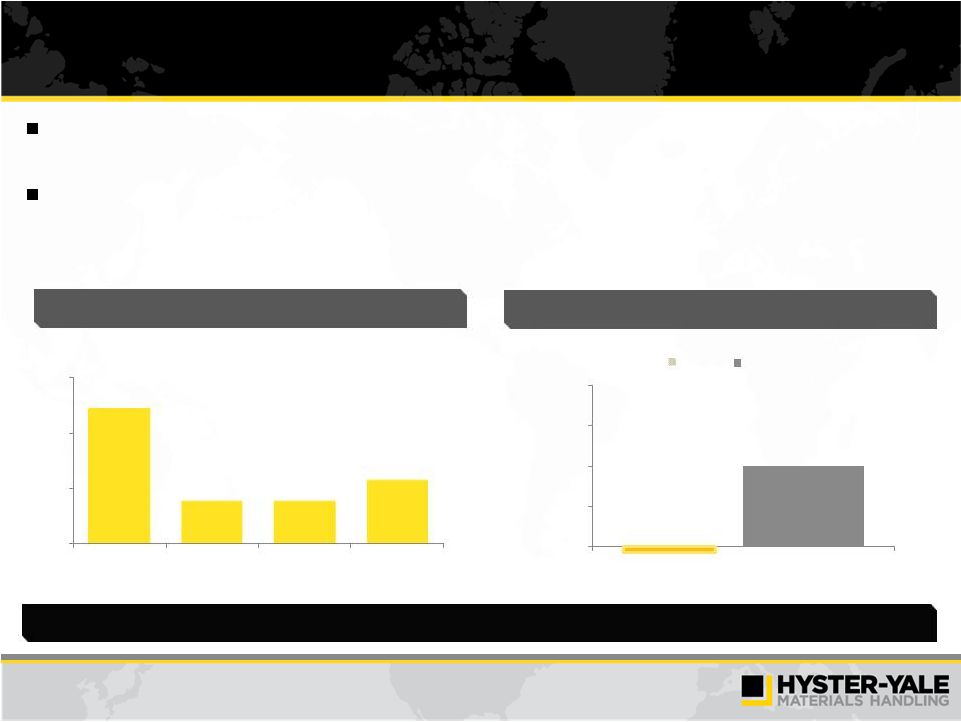

Operating Profit Margins

have Substantially Improved

Prior Cycle Market Peak

Mid-cycle Market

Operating Profit $ and % of Sales

($ in millions)

$57.3

$110.0

$110.7

2.1%

4.3%

4.4%

0.0%

2.0%

4.0%

6.0%

$0

$25

$50

$75

$100

$125

$150

2007

2011

2012 LTM |

15

Gap to Target Economics

Goal

of

achieving

minimum

operating

margin

of

7%

at

mid-cycle

over

the

next

3

–

5

years

2012 LTM Gap to Target Economics

Gap equals: (2.6% ) / $63m

Margin Variances:

Target economics Gap Closure

can be achieved by:

1.

Increased margin on ICE trucks

-

Segmentation

-

Low Cost of Ownership

2.

Unit volume

-

Share Growth

-

Stronger Industry

-

Achieve Operating Leverage

–

–

Volume Variances:

–

–

Unit Margins

(1.1%)

Other

0.9%

Manufacturing Variances

(1.4%)

Operating Expenses

(1.0%) |

16

Five Key Strategic Initiatives to Drive Margins and

Market

Share

Over

the

Next

3

-

5

Years

Unit Margin

Unit Share

Masters of the World of Low Cost Ownership

Significantly Improve Warehouse Business

Position

Enhance Independent Distribution

Succeed in Asian Markets

Enhanced Understanding of Customer Needs to

Drive Tailored Solutions

|

17

Masters of the World of Low Cost of Ownership

Strategic Objectives

Key Elements

Key Deliverables and Timing

Strategic Advantages |

18

Opportunity for a holistic approach:

–

Operator / Truck / Energy

–

Service / Safety / Rejuvenation / End of Life

Strategic Advantages

Strategic Objectives

Key Elements

Key Deliverables and Timing

Masters of the World of Low Cost of Ownership

Sell More Trucks

Sell More Parts

Sell More Services

Understand Major Cost Drivers:

Short Term (2013)

–

LCO metrics vs. competition/convert into

marketing materials for salesforce

Medium / Long Term

–

Expand fleet management to offer LCO-

based services

By Delivering Lowest Cost of Ownership

(LCO) in all target applications

And develop solutions that constantly

lower cost of ownership and create

differentiated competitive position

To create sustainable customer benefit

and competitive differentiation

Indirect (safety, litigation, pollution)

Direct (truck price, fuel, service, operator) |

Significantly Improve Warehouse Business Position

Strategic Objectives

Key Deliverables and Timing

Strategic Advantages

19

Key Elements |

20

Meets needs of specialist market while leveraging

economies of scale

Focus on the sales/ consultancy process while

leveraging its distribution network after-sales

support

Two brands covering entire market opportunity,

focused on different customer segments

Strategic Advantages

Strategic Objectives

Key Elements

Key Deliverables and Timing

Focused approach to gain share against

specialized market leaders

Improve dealer value proposition

Engage dealers to develop warehouse focus

Develop product gap closure plans

Direct support for dealer sales

Identify, qualify, assign and track performance of

key customers

Performance guarantees and protection of

residual values

Detailed project plans 2012

Dedicated warehouse specialist teams in place

–

US: Q1 2013

Product enhancements complete Q2 2013

Dealer engagement program Q2 2013

Significantly Improve Warehouse Business Position |

21

Enhanced Independent Distribution

Strategic Objectives

Key Elements

Key Deliverables and Timing

Strategic Advantages |

22

Exclusive, independent distribution

Two brands covering entire industry opportunity,

focused on different market segments with a

comprehensive product range

Strategic Advantages

Strategic Objectives

Key Elements

Key Deliverables and Timing

Recruit/develop strongest dealers in each territory

Ensure opportunities for dealers to make strong

returns on investment

Combine dealer entrepreneurship and performance

excellence with OEM support

Dual brand strategy

Sales specialization

Dedicated dealer development team

Identify, qualify, assign and track performance of

key customers

Dealer restructuring ongoing

–

2013 -

2016

Dealer excellence

–

Ongoing

Customer / market intelligence

–

Teams formed and deliverables defined

Enhanced Independent Distribution |

23

Succeed in Asian Markets

Strategic Objectives

Key Elements

Key Deliverables and Timing

Strategic Advantages |

24

Strong Partners

Restructured Product Offerings

Improved / New Dealer Organization

Strengthened Customer Facing Organization

Better dealer management

Enhanced support structure

Strategic Advantages

Strategic Objectives

Key Elements

Key Deliverables and Timing

Enhanced Dealer Organization and Structure

Develop Strategic Partners

Sales/engineering/manufacturing/sourcing

Local presence in Asia and India

Add New Products tailored to market opportunity

Strategic Alliances for New Products/Components

Build on Sumitomo Strength with Japanese

Customers

Strong local partners in China, India & Japan

Greater

“Fit

for

Market”

Product

Offering

Increased

Asian

presence –

2013

Strengthen

Dealer

Organization –

2013

Develop partners / alliances through 2014

Succeed in Asian Markets |

25

Enhanced Understanding of Customer

Needs to Drive Tailored Solutions

Strategic Objectives

Key Elements

Key Deliverables and Timing

Strategic Advantages |

26

Deep understanding of the market place and

dynamics

Build relationships with key customers in target

industries

Tailored solution for any application with the right

truck

Development of a culture that understands the

market and what it takes to win

Best product fit for customer application

Related services to maximize customer

satisfaction

Understand customer needs at a detailed level

Create differentiated product/service solutions and

more effective selling materials describing our

benefits vs. competition

Tailored Application Solutions

–

Develop industry strategies and application

guides

Product Positioning

–

New models focus on cost effectively serving

the

utility

and

standard

market

needs

and

relieve price pressure on premium products by

refocusing on the premium segments

Enhanced Understanding of Customer

Needs to Drive Tailored Solutions

Results

in:

–

Market

Share

Growth

–

Achievement

of

Target

Margin

Key Deliverables and Timing

Strategic Advantages

Strategic Objectives

Key Elements |

27

Positive Environment for Hyster-Yale to Gain Share

and

Margin

Performance

Over

Next

3

-

5

Years

Product gaps filled to position H-Y in most application segments and improve

margins

Favorable cost structure relative to Japanese-centric and German-centric

competitors

Second-tier competitors in the ICE segment more vulnerable due to their

weakened economy of scale position and currency

Key warehouse segment competitors are regional

Key Big Truck segment competitors are niche |

28

Share Gain Focus Varies by Market

Region

Focus

North America

Improve warehouse business position by enhancing product and non-product services

Continue to implement dual brand dealer network strategy

Europe and Other

Developed Markets

Strengthen dealer networks by attracting new dealers and building upon our stronger

dealers Leverage international customers to penetrate large accounts

Improve warehouse business position by enhancing product and non-product services

Enhance ICE share by focusing on standard and utility products

Developing Markets

Leverage ICE strength by supplementing current premium offering with utility and

standard products Strengthen dealer organization

|

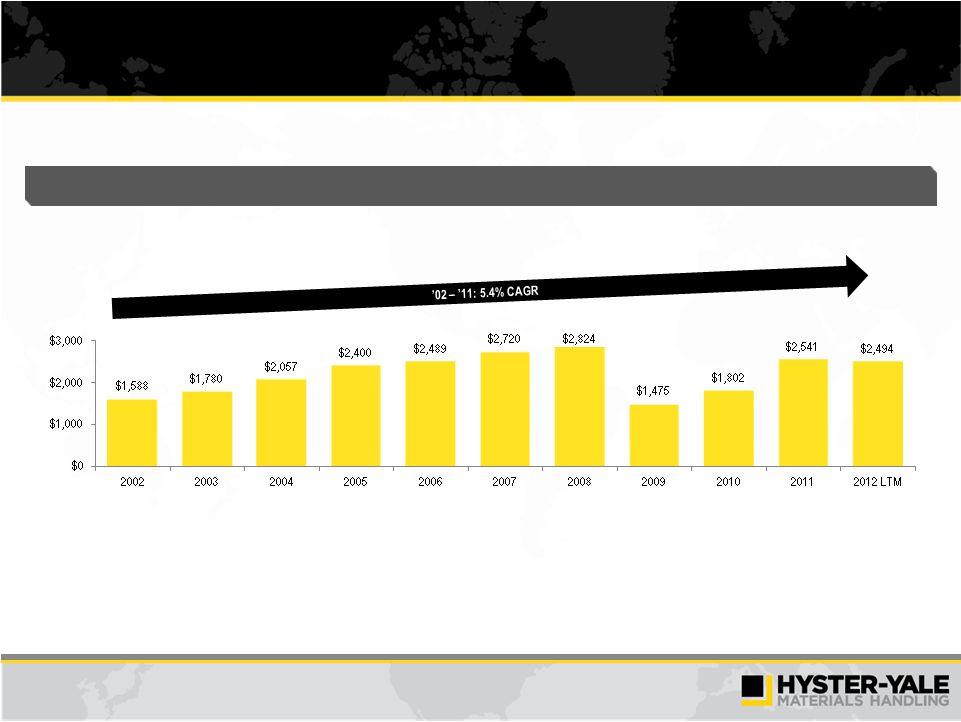

29

Historical Revenue

______________________________

Note: 2012 LTM as of September 30, 2012.

Revenue

($ in millions) |

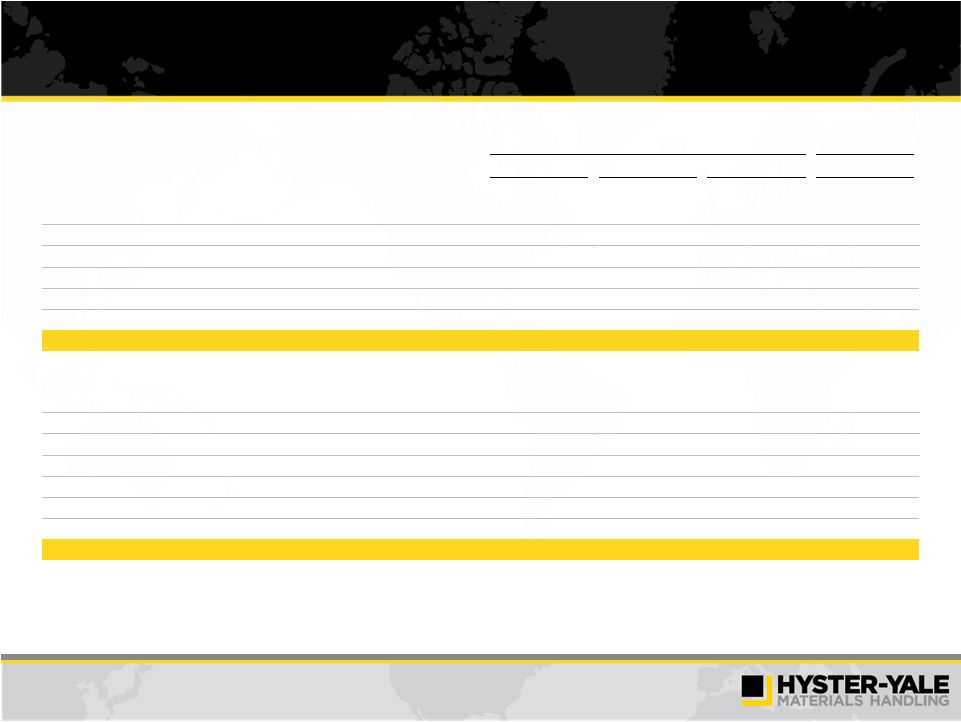

30

Q3 2012 and LTM Highlights

2012 Third Quarter

9/30/12 LTM

$

%

$

%

Revenue

$585.6

100.0%

$2,494.5

100.0%

Operating Profit

28.3

4.8%

110.7

4.4%

Net Income

24.9

4.3%

89.2

3.6%

EBITDA

(1)

$37.8

6.5%

$145.5

5.8%

Debt

$144.7

Cash

145.0

Net Debt

($0.3)

_____________________

(1)

EBITDA

is

a

non-GAAP

measure

and

should

not

be

considered

in

isolation

or

as

a

substitute

for

GAAP

measures.

For

discussion

of

non-GAAP

items

and

the

related

reconciliations

to

GAAP

measures,

see

pages

starting

on

35. |

31

2012

Third

Quarter

9/30/12

LTM

$

%

$

%

Revenue

$585.6

100.0%

$2,

494.

5

100.0%

Operating Profit

28.3

4.8%

110.7

4.4%

Net Income

24.9

4.3

%

89.2

3.6%

EBITDA

$37.

8

6.5

%

$14

5.5

5.8%

Debt

$144.7

Cash

145.0

Net Debt

Q3 2012 Highlights

Q3 2012 Results

Hyster-Yale

Outlook

–

Long

Term

Revenue pressure from unfavorable foreign currency

movements due to the weakening euro and Brazilian real

and lower year-over-year unit shipments.

Net income favorable to the third quarter of 2011 due to

improved unit price, unit mix movement towards higher

value/margin products and favorable impact of FX

contracts.

Fourth quarter global lift truck market expected to continue

to moderate, with global volumes down slightly from the prior

year. Weakness in Western Europe, Japan and Latin

America offset by small improvements in other markets.

Backlog of almost 25,600 units represents 16 weeks of

production

and

supports

4

quarter

production

plan.

($ in millions)

Hyster-Yale

Outlook

–

Short

Term

Hyster-Yale is focused on increasing operating profit

margins by increasing market share and improving product

margins to target levels

–

Focus on the 5 strategic initiatives

–

Selective new product introductions

_____________________

(1)

EBITDA

is

a

non-GAAP

measure

and

should

not

be

considered

in

isolation

or

as

a

substitute

for

GAAP

measures.

For

discussion

of

non-GAAP

items

and

the

related

reconciliations

to

GAAP

measures,

see

pages

starting

on

35.

th

(1)

($0.3) |

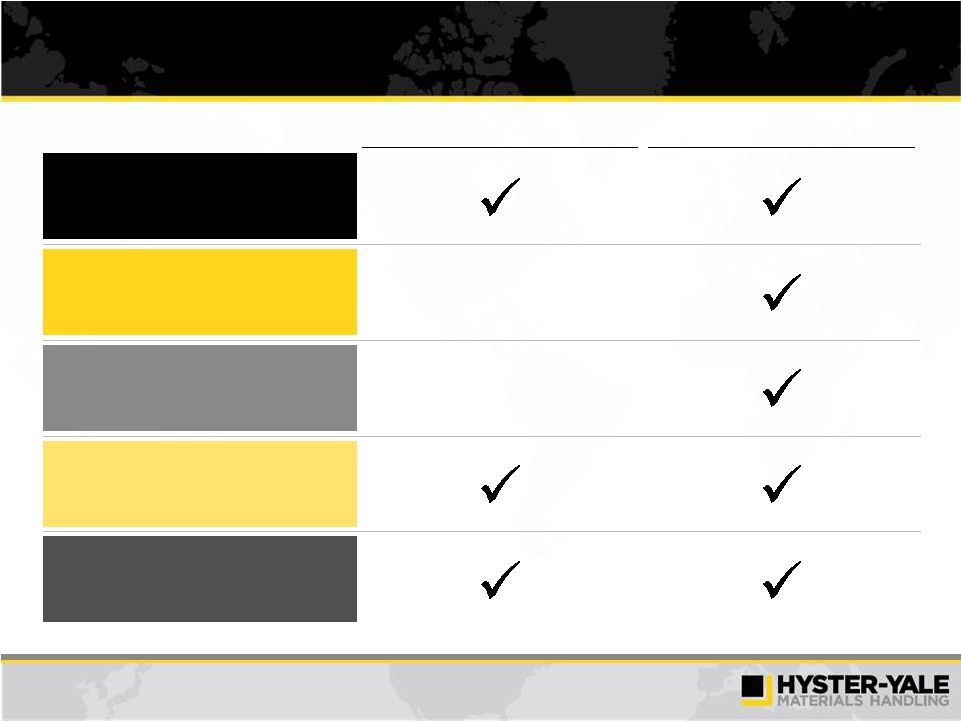

32

Strong Free Cash Generation and Conservative

Capital Structure

Hyster-Yale has had strong cash flow, generating $258 million cumulative cash flow

before financing from 2009 to 2012 YTD –

$145 million cash on 9/30/12

Hyster-Yale has a conservative capital structure

–

Gross debt leverage is 1.0x EBITDA

–

Net debt leverage is 0.0x EBITDA

Debt / LTM EBITDA

(2)

Stability to weather market changes with significant flexibility

for growth

Cash Flow before Financing

(1)

($ in millions)

0.0x

Net Debt

Gross Debt

_____________________

.(1)

Cash Flow before Financing is defined as cash from operating activities less cash from

investing activities. (2) EBITDA

is

a

non-GAAP

measure

and

should

not

be

considered

in

isolation

or

as

a

substitute

for

GAAP

measures.

For

discussion

of

non-GAAP

items

and

the

related

reconciliations

to

GAAP

measures,

see

pages

starting

on

35.

$122

$39

$39

$58

$0

$50

$100

$150

2009

2010

2011

2012 YTD

1.0x

0.0x

0.5x

1.0x

1.5x

2.0x

9/30/12

(1) |

33

Why Invest in Hyster-Yale?

1)

Leading position in growing industry benefiting from globalization and worldwide

economic recovery and development

2)

Premier brands, comprehensive global product line and exclusive,

global independent distribution

network

3)

Strong economic engine driven by volume economies of scale

4)

Focused

strategic

initiatives

to

gain

market

share

and

enhance

margins

over

next

3

–

5

years

5)

High potential for partnership and consolidation opportunities

6)

Strong balance sheet, financial flexibility and attractive returns on capital

employed 7)

Focused investment in capital goods sector with growth opportunity:

a)

In developed countries from exposure to goods movement, distribution and warehousing

b)

In

developing

countries

(Brazil,

Eastern

Europe,

India

and

Asia)

from

exposure

to

industrialization |

Appendix |

35

Non-GAAP Disclosure

EBITDA

and

return

on

total

capital

employed

are

not

measurements

under

U.S.

GAAP,

should

not

be

considered

in

isolation or as a substitute for GAAP measures, and are not necessarily comparable with

similarly titled measures of other companies. Hyster-Yale defines each

as the following: For reconciliations from GAAP measurements to non-GAAP

measurements, see pages 36 and 37. EBITDA is defined as income before income

taxes and non-controlling interest (income) expense plus net interest

expense and depreciation and amortization expense; Return on total capital

employed (“ROTCE”) is defined as net income before interest expense, after

tax, divided by LTM average capital employed. LTM average capital employed is

defined as LTM average equity plus LTM average debt less LTM average

cash. |

36

Non-GAAP Reconciliation

Year Ended December 31

LTM

2009

2010

2011

9/30/2012

Reconciliation of EBITDA

Net income (loss) attributable to stockholders

($43.1)

$32.4

$82.6

$89.2

Noncontrolling interest (income) loss

(0.1)

(0.1)

–

0.1

Income taxes provision (benefit)

(3.6)

1.8

18.9

15.9

Interest expense

19.0

16.6

15.8

13.6

Interest income

(2.8)

(2.3)

(1.8)

(1.5)

Depreciation and amortization expense

36.2

33.9

31.3

28.2

EBITDA

$5.6

$82.3

$146.8

$145.5

Reconciliation of cash flow from operations to EBITDA

Cash flow provided by operations

$115.9

$47.5

$54.6

$134.3

Change in working capital items

(113.7)

(6.6)

73.1

(21.5)

Gain (loss) on sale of assets and businesses

1.4

(6.1)

(0.2)

(0.1)

Restructuring (charges) reversals

(9.3)

1.9

–

–

Difference between deferred income taxes and total tax provision (benefit)

(32.1)

1.0

5.2

14.4

Other non-cash items

27.2

30.3

0.1

6.3

Interest expense, net

16.2

14.3

14.0

12.1

EBITDA

$5.6

$82.3

$146.8

$145.5

($ in millions)

_____________________

Note: *EBITDA is provided solely as a supplemental disclosure. EBITDA does not represent

net income or cash flow from operations, as defined by U.S. GAAP and should not be considered as a substitute for net income or net loss, or as an indicator of operating

performance or whether cash flows will be sufficient to fund cash needs. Hyster-Yale

defines EBITDA as income before income taxes and non-controlling interest income plus net interest expense and depreciation and amortization expense. EBITDA is not a

measurement under U.S. GAAP and is not necessarily comparable with similarly titled

measures of other companies. |

37

Non-GAAP Reconciliation (continued)

($ in millions)

Reconciliation of Return on Total Capital Employed (ROTCE)

9/30/12 LTM

LTM Average Equity (9/30/12, 6/30/12, 3/31/12, 12/31/11 and 9/30/11)

$323.2

LTM Average Debt (9/30/12, 6/30/12, 3/31/12, 12/31/11 and 9/30/11)

192.7

LTM Average Cash (9/30/12, 6/30/12, 3/31/12, 12/31/11 and 9/30/11)

(160.8)

LTM average capital employed

$355.1

LTM Net income

$89.2

Plus: LTM Interest expense

13.6

Less: Income taxes on LTM interest expense at 38%

(5.2)

Actual return on capital employed = actual net income before interest expense, after tax

$97.6

Actual return on capital employed percentage

27.5%

_____________________

Note: Return on capital employed is provided solely as a supplemental disclosure with

respect to income generation because management believes it provides useful information with respect to earnings in a form that is comparable to the Company’s cost of capital

employed,

which

includes

both

equity

and

debt

securities,

net

of

cash. |

38

Cash Flow before Financing Calculation

($ in millions)

Year Ended December 31

Trailing 12 Months

2009

2010

2011

9/30/2012

Reconciliation of Cash Flow before Financing

Net cash provided by (used for) operations

$115.9

$47.5

$54.6

$134.3

Net cash provided by (used for) investing activities

5.8

(8.5)

(15.9)

(15.9)

Cash Flow before Financing

$121.7

$39.0

$38.7

$118.4

|

Supplemental Perspective |

40

Mission Statement

Be a leading globally integrated designer,

manufacturer and marketer of a complete range of

high quality,

application-tailored lift trucks, offering

the lowest cost of ownership, outstanding parts

and service support and the best overall value |

41

Experienced Management Team

Alfred M. Rankin Jr.

Chairman, President and

Chief Executive Officer

Chairman, President and CEO of NACCO Industries since 1994

Former Vice Chairman, Chief Operating Officer and Director of Eaton

Corporation

Michael Brogan

President and CEO, NACCO Materials

Handling Group (“NMHG”)

Former Executive Vice President, International Operations of NMHG

Joined NMHG in 1983

Former President, NMHG Americas

Joined NMHG in 1988

Colin Wilson

Vice President and COO

Previously Divisional President at Villeroy and Boch

AG and VP of Group Marketing at Linde AG

Joined NMHG in 2006

Ralf Mock

Managing Director, Europe,

Africa and Middle East

Former VP, Chief Marketing Officer of NMHG

Formerly, SVP Strategy & Product Development,

Case Corporation

Joined NMHG in 1995

Victoria Rickey

Vice President, Asia-Pacific

Rajiv Prasad

Vice President, Global

Product Development and

Manufacturing

Former VP, Global Product Development of NMHG

VP Global Product Development for International

Truck, Navistar

Joined NMHG in 2007

Charles Bittenbender

Vice President, General

Counsel and Secretary

Previously Deputy General Counsel of G.D. Searle &

Co.

Joined NACCO in 1990

Kenneth Schilling

Vice President and CFO

Previously CFO of NMHG and Vice President and

Controller of NACCO

Joined NACCO in 1991

Hyster-Yale’s Executive Leadership |

42

Class

Capacity Range

Description / Illustrative Application

Class I

1 ton – 5.5 tons

Electric counterbalanced trucks used in warehousing and manufacturing operations

where noise or fuel emissions are undesirable

A distribution center customer uses a Class I truck to move pallets from one trailer

to another

Class II

1.5 tons – 6 tons

Electric narrow aisle trucks used indoors to handle high-density storage of

materials in narrow-aisled buildings

Retail and warehouse customers rely on Class II trucks to pick orders off their

shelves Class III

1.5 tons – 8 tons

Electric hand trucks used indoors and outdoors for applications requiring the user to

select and transport materials

Retail customers use Class III trucks to move pallets of goods to their store aisles

Class IV

1 ton – 7 tons

Internal combustion engine counterbalanced trucks with cushion tires used indoors in

warehousing and manufacturing operations and outdoors on smooth surfaces.

Utility, standard and premium models for different customer applications.

A customer relies on Class IV trucks to move heavy parts on a pallet from the

machining area in a factory to assembly

Class V

1 ton – 8 tons

Internal combustion engine counterbalanced trucks with pneumatic tires used indoors

and outdoors in warehousing and manufacturing operations. Utility, standard and

premium models to address different customer applications.

A warehouse or manufacturer relies on Class V trucks to move coils of steel from the

mill to a storage area

Class V Big

Trucks

8

ton – 52 tons

Internal combustion engine counterbalanced trucks with pneumatic tires used indoors

and outdoors in ports and heavy manufacturing operations

A port relies on Class V Big Trucks to move containers from the port to a rail area

Comprehensive Updated Global Product Line |

43

Key Investment Highlights

Leading Market

Share in Materials

Handling

Comprehensive

Global Product Line

Large Installed

Base Worldwide

Established

Brand Strength

Global

Independent Dealer

Network

Long-Term

Relationships

with Diverse

Customer Base

Experienced

Management Team

Modest Leverage

& Strong

Cash Flow

High-Impact

Strategic Initiatives

Continuous Focus on

Product Development

and Innovation

Worldwide

Economies

of Scale

Highly Flexible,

Low Cost Supply Chain

and Efficient Operating

Structure

Global Scope of

Manufacturing |