Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - STIFEL FINANCIAL CORP | d435200d8k.htm |

| EX-99.1 - PRESS RELEASE - STIFEL FINANCIAL CORP | d435200dex991.htm |

3

rd

Quarter

2012

Financial Results Presentation

November 5, 2012

Exhibit 99.2 |

1

Disclaimer

This presentation may contain “forward-looking statements” within the meaning of

the Private Securities Litigation Reform Act of 1995 that involve significant risks,

assumptions, and uncertainties, including statements relating to the market opportunity and future business

prospects of Stifel Financial Corp., as well as Stifel, Nicolaus & Company, Incorporated

and its subsidiaries (collectively, “SF” or the “Company”).

These statements can be identified by the use of the words “may,” “will,” “should,” “could,” “would,” “plan,” “potential,”

“estimate,” “project,” “believe,” “intend,”

“anticipate,” “expect,” and similar expressions. In particular, these statements may refer to our

goals, intentions, and expectations, our business plans and growth strategies, our ability to

integrate and manage our acquired businesses, estimates of our risks and future costs

and benefits, and forecasted demographic and economic trends relating to our industry.

You should not place undue reliance on any forward-looking statements, which speak only as

of the date they were made. We will not update these forward-looking

statements, even though our situation may change in the future, unless we are obligated to do so under federal

securities laws. Actual results

may differ materially and reported results should not be considered as an indication of future performance. Factors that could

cause actual results to differ are included in the Company’s annual and quarterly reports

and from time to time in other reports filed by the Company with the Securities and

Exchange Commission and include, among other things, changes in general economic and business

conditions, actions of competitors, regulatory and legal actions, changes in legislation, and

technology changes.

The company utilized non-GAAP calculations of presented net revenues, compensation and

benefits, non-compensation operating expenses, income before income taxes,

provision for income taxes, net income, compensation and non-compensation operating expense ratios, pre-tax

margin and diluted earnings per share as an additional measure to aid in understanding and

analyzing the company’s financial results for the nine months ended September 30,

2012. Specifically, the company believes that the non-GAAP measures provide useful information by

excluding certain items that may not be indicative of the company’s core operating

results and business outlook. The company believes that these non-GAAP measures

will allow for a better evaluation of the operating performance of the business and facilitate a meaningful

comparison of the company’s results in the current period to those in prior periods and

future periods. Reference to these non-GAAP measures should not be considered as a

substitute for results that are presented in a manner consistent with GAAP. These non-GAAP

measures are provided to enhance investors' overall understanding of the company’s

financial performance. Forward-Looking Statements

Use

of

Non-GAAP

Financial

Measures |

2

Chairman’s Comments

“I am pleased with our third quarter results, which included

record net revenues, as well as with our record net revenues and

net income for the first nine months of 2012. Our results highlight

the soundness of our balanced business model, particularly

against a challenging economic backdrop. In the quarter, both the

Global Wealth Management and Institutional Group segments

performed well. We continue to invest in businesses that expand

our client services, and which we believe will return shareholder

value. Opportunities drive our growth. Today’s announcement of

our merger with KBW furthers our goal of creating the premier

middle-market investment bank with a specialized focus on the

financial services industry.”

|

Financial

Financial

Results

Results |

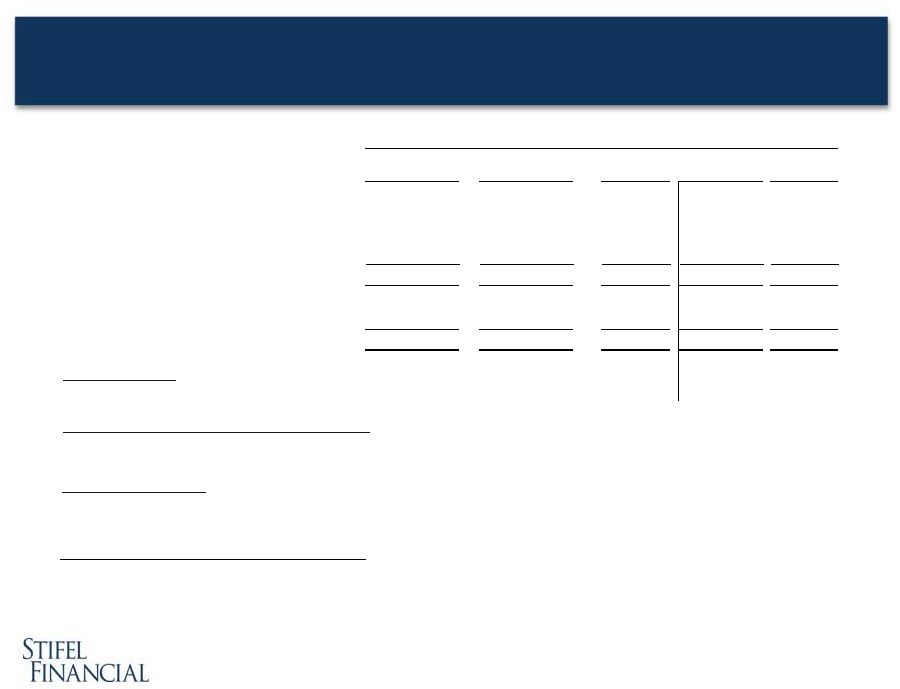

4

Stifel Financial Corp. Results

Three months ended September 30, 2012

($ in thousands, except per share amounts)

9/30/12

(1)

9/30/11

% Change

6/30/12

% Change

Net revenues

420,080

$

334,214

$

25.7%

374,407

$

12.2%

Compensation and benefits

267,652

210,573

27.1%

239,374

11.8%

Non-comp operating expenses

90,751

84,618

7.2%

91,159

(0.4%)

Total non-interest expenses

358,403

295,191

21.4%

330,533

8.4%

Income before income taxes

61,677

39,023

58.1%

43,874

40.6%

Provision for income taxes

23,967

16,719

43.4%

17,738

35.1%

Net income

37,710

$

22,304

$

69.1%

26,136

$

44.3%

Earnings per share:

Diluted

0.60

$

0.35

$

71.4%

0.42

$

42.9%

Weighted average number of shares outstanding:

Diluted

63,054

63,152

(0.2%)

62,678

0.6%

Ratios to net revenues:

Compensation and benefits

63.7%

63.0%

63.9%

Non-comp operating expenses

21.6%

25.3%

24.4%

Income before income taxes

14.7%

11.7%

11.7%

Three Months Ended

(1)

Results for the three months ended September 30, 2012 include realized and unrealized

gains on the Company's investment in Knight Capital Group Inc. of

$25.6 million. The after-tax impact was $0.09 per diluted share. |

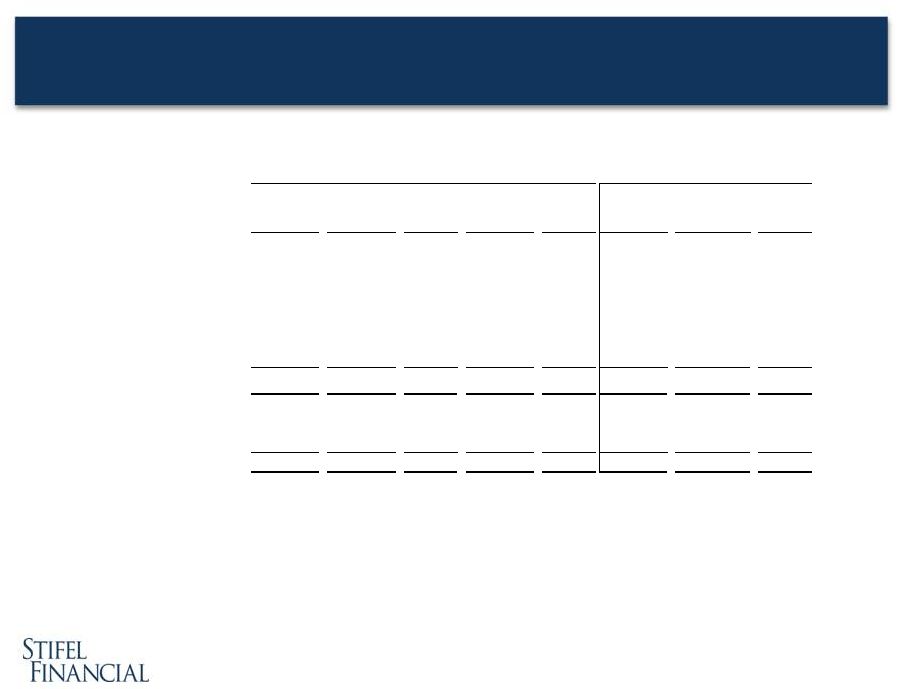

5

Stifel Financial Corp. Results

Nine months ended September 30, 2012

($ in thousands, except per share amounts)

9/30/12

(1)

9/30/11

% Change

Net revenues

1,194,820

$

1,059,684

$

12.8%

Compensation and benefits

761,730

671,678

13.4%

Non-comp operating expenses

268,285

294,424

(8.9%)

Total non-interest expenses

1,030,015

966,102

6.6%

Income before income taxes

164,805

93,582

76.1%

Provision for income taxes

66,186

36,464

81.5%

Net income

98,619

$

57,118

$

72.7%

Earnings per share

:

Diluted

(2)

1.57

$

0.90

$

74.4%

Weighted average number of shares outstanding:

Diluted

62,817

63,174

(0.6%)

Ratios to net revenues

:

Compensation and benefits

63.8%

63.4%

Non-comp operating expenses

22.4%

27.8%

Income before income taxes

13.8%

8.8%

Nine Months Ended

(1)

Results for the nine months ended September 30, 2012 include realized and unrealized gains on

the Company's investment in Knight Capital Group, Inc. of $25.6 million.

The after-tax impact was $0.09 per diluted share. (2)

Results for the nine months ended September 30, 2011 include previously

disclosed litigation-related charges and merger- related expenses of

$0.47 per diluted share after-tax. |

6

Source of Revenues

($ in thousands)

9/30/12

9/30/11

%

Change

6/30/12

% Change

9/30/12

9/30/11

%

Change

Commissions

127,966

$

143,243

$

(10.7%)

127,427

$

0.4%

378,696

$

437,344

$

(13.4%)

Principal transactions

102,979

76,650

34.3%

91,564

12.5%

310,776

249,250

24.7%

Capital raising

45,733

25,254

81.1%

40,733

12.3%

141,299

97,301

45.2%

Advisory

27,205

12,419

119.1%

26,630

2.2%

69,440

46,208

50.3%

Investment banking

72,938

37,673

93.6%

67,363

8.3%

210,739

143,509

46.8%

Asset mgt and service fees

62,881

58,253

7.9%

65,311

(3.7%)

189,010

172,914

9.3%

Other

(1)

31,922

540

*

5,418

489.2%

50,634

11,352

346.0%

Total operating revenues

398,686

316,359

26.0%

357,083

11.7%

1,139,855

1,014,369

12.4%

Interest revenue

27,306

24,161

13.0%

27,181

0.5%

79,744

64,246

24.1%

Total revenues

425,992

340,520

25.1%

384,264

10.9%

1,219,599

1,078,615

13.1%

Interest expense

5,912

6,306

(6.2%)

9,857

(40.0%)

24,779

18,931

30.9%

Net revenues

420,080

$

334,214

$

25.7%

374,407

$

12.2%

1,194,820

$

1,059,684

$

12.8%

* Percentage not meaningful.

Quarter Ended

Nine Months Ended

(1)

Results for the three and nine months ended September 30, 2012 include $25.6 million in

realized and unrealized gains on the Company's investment in Knight Capital Group,

Inc. |

7

Brokerage Revenues

($ in thousands)

9/30/12

9/30/11

%

Change

6/30/12

%

Change

9/30/12

9/30/11

%

Change

Principal transactions:

Taxable debt

55,908

$

41,871

$

33.5%

47,831

$

16.9%

165,172

$

136,310

$

21.2%

Municipal debt

24,412

19,335

26.3%

23,851

2.4%

70,089

57,722

21.4%

Equities

10,959

6,397

71.3%

8,463

29.5%

40,530

26,916

50.6%

Other

11,700

9,047

29.3%

11,419

2.5%

34,985

28,302

23.6%

Total principal transactions

102,979

$

76,650

$

34.3%

91,564

$

12.5%

310,776

$

249,250

$

24.7%

Commissions

127,966

143,243

(10.7%)

127,427

0.4%

378,696

437,344

(13.4%)

Total brokerage revenues

230,945

$

219,893

$

5.0%

218,991

$

5.5%

689,472

$

686,594

$

0.4%

Nine Months Ended

Quarter Ended |

8

Non-Interest Expenses

Three months ended September 30, 2012

($ in thousands)

9/30/12

9/30/11

% Change

6/30/12

% Change

9/30/12

9/30/11

6/30/12

Compensation and benefits

247,964

193,818

27.9%

219,004

13.2%

59.0%

58.0%

58.5%

Transitional pay

(1)

19,688

16,755

17.5%

20,370

(3.3%)

4.7%

5.0%

5.4%

Total compensation and benefits

267,652

210,573

27.1%

239,374

11.8%

63.7%

63.0%

63.9%

Occupancy and equipment rental

33,061

30,914

6.9%

32,320

2.3%

7.9%

9.2%

8.6%

Communication and office supplies

19,976

18,838

6.0%

20,797

(3.9%)

4.8%

5.6%

5.6%

Commissions and floor brokerage

8,031

7,400

8.5%

7,747

3.7%

1.9%

2.2%

2.1%

Other operating expenses

29,683

27,466

8.1%

30,295

(2.0%)

7.1%

8.1%

8.1%

Total non-comp operating expenses

90,751

84,618

7.2%

91,159

(0.4%)

21.7%

25.3%

24.3%

Total non-interest expense

358,403

295,191

21.4%

330,533

8.4%

85.3%

88.3%

88.3%

Quarter Ended

% of Net revenues

(1)

Transition pay includes amortization of upfront notes, signing bonuses and retention awards.

|

9

Non-Interest Expenses

Nine months ended September 30, 2012

($ in thousands)

9/30/12

9/30/11

% Change

9/30/12

9/30/11

Compensation and benefits

703,300

618,556

13.7%

58.9%

58.5%

Transitional pay

(1)

58,430

53,122

10.0%

4.9%

5.0%

Total compensation and benefits

761,730

671,678

13.4%

63.8%

63.4%

Occupancy and equipment rental

96,172

89,962

6.9%

8.0%

8.5%

Communication and office supplies

61,146

56,198

8.8%

5.1%

5.3%

Commissions and floor brokerage

23,390

20,943

11.7%

2.0%

2.0%

Other operating expenses

(2)

87,577

127,321

(31.2%)

7.3%

12.0%

Total non-comp operating expenses

268,285

294,424

(8.9%)

22.5%

27.8%

Total non-interest expense

1,030,015

966,102

6.6%

86.2%

91.2%

Nine Months Ended

% of Net revenues

(2)

Results for the nine months ended September 30, 2011 include litigation-related charges

and merger-related expenses of $29.4 million after-tax. (1)

Transition pay includes amortization of upfront notes, signing bonuses and retention awards.

|

10

Segment Comparison

($ in thousands)

9/30/12

9/30/11

%

Change

6/30/12

%

Change

9/30/12

9/30/11

%

Change

Net revenues:

Global Wealth Management

251,728

$

219,489

$

14.7%

240,029

$

4.9%

740,105

$

683,589

$

8.3%

Institutional Group

(1)

169,679

113,259

49.8%

135,297

25.4%

453,480

373,168

21.5%

Other

(1,327)

1,457

(191.1%)

(919)

(44.4%)

1,235

2,927

(57.8%)

420,080

$

334,205

$

25.7%

374,407

$

12.2%

1,194,820

$

1,059,684

$

12.8%

Operating contribution:

Global Wealth Management

68,370

$

55,612

$

22.9%

61,353

$

11.4%

198,901

$

172,510

$

15.3%

Institutional Group

(1)

33,427

9,152

265.2%

17,546

90.5%

74,677

52,496

42.3%

Other

(2)

(40,120)

(25,741)

55.9%

(35,025)

14.5%

(108,773)

(131,424)

(17.2%)

61,677

$

39,023

$

58.1%

43,874

$

40.6%

164,805

$

93,582

$

76.1%

Nine Months Ended

Quarter Ended

(2)

Results for the nine months ended September 30, 2011 include litigation-related charges

and merger-related expenses of $47.5 million pre-tax. (1)

Results for the three and nine months ended September 30, 2012 include $25.6 million in

realized and unrealized gains recognized on the Company's investment in Knight Capital

Group, Inc. |

11

Global Wealth Management

($ in thousands)

9/30/12

9/30/11

% Change

6/30/12

% Change

9/30/12

9/30/11

% Change

Commissions

89,393

$

92,029

$

(2.9%)

88,423

$

1.1%

268,839

$

287,384

$

(6.5%)

Principal transactions

58,801

48,836

20.4%

55,628

5.7%

173,474

156,262

11.0%

Asset management & service fees

62,871

58,007

8.4%

65,169

(3.5%)

188,626

172,354

9.4%

Net interest

22,283

15,016

48.4%

18,233

22.2%

58,163

39,586

46.9%

Investment banking

13,347

3,737

257.2%

8,531

56.5%

34,348

16,460

108.7%

Other income

5,033

1,873

168.7%

4,045

24.4%

16,655

11,543

44.3%

Net revenues

251,728

219,498

14.7%

240,029

4.9%

740,105

683,589

8.3%

Compensation and benefits

146,882

128,244

14.5%

140,984

4.2%

431,623

403,782

6.9%

Non-comp operating expenses

36,476

35,642

2.3%

37,692

(3.2%)

109,581

107,297

2.1%

Total non-interest expenses

183,358

163,886

11.9%

178,676

2.6%

541,204

511,079

5.9%

Income before income taxes

68,370

$

55,612

$

22.9%

61,353

$

11.4%

198,901

$

172,510

$

15.3%

Ratios to net revenues

:

Compensation and benefits

58.3%

58.4%

58.7%

58.3%

59.1%

Non-comp operating expenses

14.5%

16.3%

15.7%

14.8%

15.7%

Income before income taxes

27.2%

25.3%

25.6%

26.9%

25.2%

Quarter Ended

Nine Months Ended |

12

Stifel Bank & Trust

(an operating unit of GWM)

% Change

% Change

(in 000s, except percentages)

Net revenues

$

19,862

$

17,584

13.0

$

18,997

4.6

Income before income taxes

18,063

13,240

36.4

14,769

22.3

As of

9/30/12

9/30/11

% Change

6/30/12

% Change

Assets

$

3,228,021

$

2,311,371

39.7

$

3,058,971

5.5

Investment securities

2,133,494

1,470,812

45.1

1,849,622

15.3

Retained loans, net

746,120

567,341

31.5

709,079

5.2

Loans held for sale

209,358

114,452

82.9

117,166

78.7

Deposits

2,923,671

2,120,763

37.9

2,776,684

5.3

Allowance as a percentage of loans

0.85

%

0.67

%

0.88

%

Non-performing assets as a percentage of total

assets

0.07

%

0.08

%

0.08

%

As of

For the Three Months Ended

9/30/12

9/30/11

6/30/12 |

13

Institutional Group

($ in thousands)

9/30/12

9/30/11

% Change

6/30/12

% Change

9/30/12

9/30/11

% Change

Commissions

38,574

$

51,214

$

(24.7%)

39,004

$

(1.1%)

109,858

$

149,960

$

(26.7%)

Principal transactions

44,178

27,815

58.8%

35,936

22.9%

137,302

92,988

47.7%

Investment banking

59,591

33,936

75.6%

58,832

1.3%

176,391

127,049

38.8%

Other

(1)

27,336

294

*

1,525

*

29,929

3,171

*

Net revenues

169,679

113,259

49.8%

135,297

25.4%

453,480

373,168

21.5%

Compensation and benefits

104,913

74,813

40.2%

84,754

23.8%

283,691

234,006

21.2%

Non-comp operating expenses

31,339

29,294

7.0%

32,997

(5.0%)

95,112

86,666

9.7%

Total non-interest expenses

136,252

104,107

30.9%

117,751

15.7%

378,803

320,672

18.1%

Income before income taxes

33,427

$

9,152

$

265.2%

17,546

$

90.5%

74,677

$

52,496

$

42.3%

Ratios to net revenues

:

Compensation and benefits

61.8%

66.0%

62.6%

62.6%

62.7%

Non-comp operating expenses

18.5%

25.9%

24.4%

20.9%

23.2%

Income before income taxes

19.7%

8.1%

13.0%

16.5%

14.1%

* Percentage not meaningful.

Quarter Ended

Nine Months Ended

(1)

Includes net interest and other income. Other income for the three and nine months ended

September 30, 2012 includes $25.6 million pre-tax in realized and unrealized gains

recognized on the Company's investment in Knight Capital Group, Inc. |

14

Institutional Group Revenues

($ in thousands)

9/30/12

9/30/11

% Change

6/30/12

% Change

9/30/12

9/30/11

% Change

Institutional brokerage:

Equity

37,956

$

47,185

$

(19.6%)

38,466

$

(1.3%)

120,594

$

141,278

$

(14.6%)

Fixed income

44,796

31,844

40.7%

36,474

22.8%

126,566

101,670

24.5%

82,752

79,029

4.7%

74,940

10.4%

247,160

242,948

1.7%

Investment Banking:

Capital raising

Equity

17,527

16,382

7.0%

17,651

(0.7%)

66,728

67,386

(1.0%)

Fixed income

14,859

5,054

194.0%

14,551

2.1%

40,223

13,268

203.2%

32,386

21,436

51.1%

32,202

0.6%

106,951

80,654

32.6%

Advisory fees

27,205

12,500

117.6%

26,630

2.2%

69,440

46,395

49.7%

Investment banking

59,591

33,936

75.6%

58,832

1.3%

176,391

127,049

38.8%

Other

(1)

27,336

294

*

1,525

*

29,929

3,171

*

Total net revenue

169,679

$

113,259

$

49.8%

135,297

$

25.4%

453,480

$

373,168

$

21.5%

* Percentage not meaningful.

Nine Months Ended

Quarter Ended

(1)

Includes net interest and other income. Other income for the three and nine months ended

September 30, 2012 includes $25.6

million

pre-tax

in

realized

and

unrealized

gains

recognized

on

the

Company's

investment

in

Knight

Capital

Group,

Inc. |

Financial

Financial

Condition

Condition |

16

Capital Structure

As of September 30, 2012

(in thousands, except ratios)

($ in thousands)

Total Assets

6,139,530

$

Stockholders' Equity

1,427,124

$

Debentures to Stifel Financial Capital Trusts II, III, & IV

82,500

$

6.70% Senior Notes due 2022

175,000

$

Total Capitalization

1,684,624

$

Ratios:

Debt to Equity

(1)

18.0%

Leverage Ratio

(2)

3.6x

Equity Capitalization

(3)

4.3x

(1)

Debt to equity ratio includes the debentures to Stifel Financial Capital Trusts ($82.5m) and

Senior Notes ($175.0m) divided by stockholders’ equity.

(2)

Leverage ratio = total assets divided by total capitalization.

(3)

Equity capitalization = total assets divided by stockholders’ equity. |

17

Other Financial Data

Total assets (000s):

Stifel Nicolaus & Stifel Financial

Stifel Bank

Total assets

Total shareholders' equity (000s):

Stifel Nicolaus & Stifel Financial

Stifel Bank

Total shareholders' equity

Leverage ratio:

Stifel Nicolaus & Stifel Financial

Stifel Bank

Total leverage ratio

Book value per share

Financial advisors

(1)

Full-time associates

Locations

Total client assets (000s)

(2)

(1)

Includes 154, 160 and 156 independent contractors as of September 30, 2012 and 2011 and June

30, 2012, respectively. (2)

Includes money market and FDIC-insured balances. Prior period amounts have been adjusted

to conform to the current period presentation. As of

9/30/12

9/30/11

% Change

6/30/12

% Change

2,911,509

$

2,630,993

$

10.7%

3,079,564

$

(5.5%)

3,228,021

2,311,371

39.7%

3,058,971

5.5%

6,139,530

$

4,942,364

$

24.2%

6,138,535

$

0.0%

1,176,935

$

1,086,832

$

8.3%

1,140,188

$

3.2%

250,189

174,919

43.0%

231,657

8.0%

1,427,124

$

1,261,751

$

13.1%

1,371,845

$

4.0%

2.0

2.2

0.0%

2.2

10.0%

12.9

13.2

(2.5%)

13.2

0.0%

3.6

3.7

(0.8%)

3.8

11.8%

26.62

$

24.48

$

8.7%

25.63

$

3.9%

2,042

1,961

4.1%

2,028

0.7%

5,266

4,942

6.6%

5,196

1.3%

338

313

8.0%

332

1.8%

136,015,000

$

110,797,000

$

22.8%

131,026,000

$

3.8%

As of |

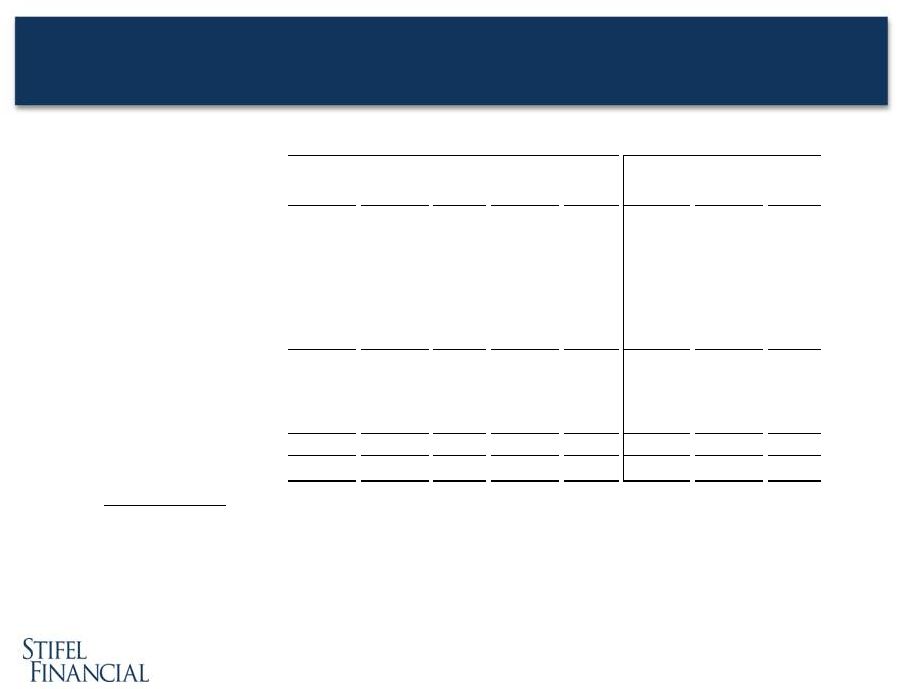

18

Level 3 Assets

($ in thousands)

9/30/12

12/31/11

Auction Rate Securities (ARS)

(1)

162,761

$

181,801

$

Stifel Bank & Trust Investments

11,529

12,000

Trading Securities

3,471

3,742

Other Investments

(2)

36,717

37,033

Level 3 assets (excluding ARS)

51,717

52,775

Total Level 3 assets

214,478

$

234,576

$

Percentage of Equity

15.0%

18.0%

Percentage of Equity (excluding ARS)

3.6%

4.1%

(1)

Includes $84.1 million and $66.9 million, respectively, of ARS held at Stifel Bank &

Trust. (2)

Includes $30.0 million and $30.2 million, respectively, of investments held by TWPG

subsidiaries. Carrying Value |

2012

2012

Investments

Investments |

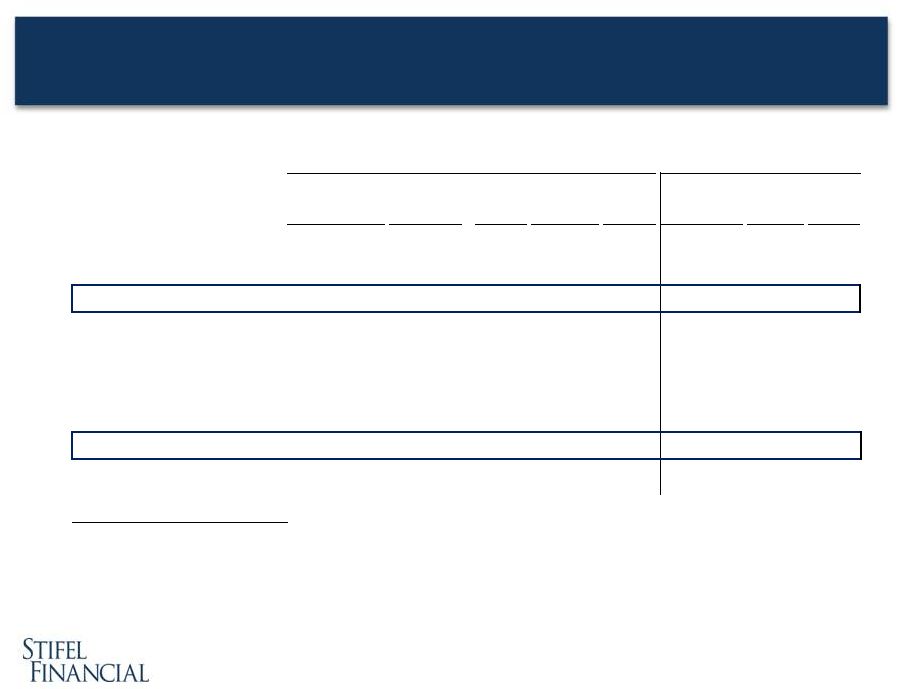

20

2012 Legacy Business vs. Investments

¹As of October 31, 2012.

2

Legacy revenues and expense s exclude new business and investments.

3

Legacy provision for income taxes is calculated using the tax rate for the nine month period

2012 of 40.2%. 2012 Investments include hiring 132 financial advisors and 65 fixed

income sales and trading professionals YTD .

($ in thousands, except per share amounts)

Legacy

2

Investments

Total

9m2012

Q3

Q2

Q1

Net revenues

1,165,461

29,359

1,194,820

29,359

15,131

9,227

5,001

Compensation and benefits

732,609

29,121

761,730

29,121

11,603

10,013

7,505

Non-compensation operating expenses

252,305

15,980

268,285

15,980

5,104

5,844

5,032

Total non-interest expenses

984,914

45,101

1,030,015

45,101

16,707

15,857

12,537

Income before income taxes

180,547

(15,742)

164,805

(15,742)

(1,576)

(6,630)

(7,536)

Provision

for

income

taxes

3

72,508

(6,322)

66,186

(6,322)

(523)

(2,685)

(3,114)

Net income

108,039

(9,420)

98,619

(9,420)

(1,053)

(3,945)

(4,422)

Earnings per share

1.72

$

(0.15)

$

1.57

$

(0.15)

$

(0.02)

$

(0.06)

$

(0.07)

$

Ratios to net revenues:

Compensation and benefits

62.9

63.8

Non-compensation operating expenses

21.6

22.5

Income before income taxes

15.5

13.8

As Reported

9M2012

Investments -

2012 Comparision

1 |

Q&A

Q&A |