Attached files

| file | filename |

|---|---|

| EX-2.1 - EXHIBIT 2.1 - China Network Media, Inc. | v327031_ex2-1.htm |

| EX-99.2 - EXHIBIT 99.2 - China Network Media, Inc. | v327031_ex99-2.htm |

| EX-10.4 - EXHIBIT 10.4 - China Network Media, Inc. | v327031_ex10-4.htm |

| EX-99.1 - EXHIBIT 99.1 - China Network Media, Inc. | v327031_ex99-1.htm |

| EX-10.5 - EXHIBIT 10.5 - China Network Media, Inc. | v327031_ex10-5.htm |

| EX-10.3 - EXHIBIT 10.3 - China Network Media, Inc. | v327031_ex10-3.htm |

| EX-10.1 - EXHIBIT 10.1 - China Network Media, Inc. | v327031_ex10-1.htm |

| EX-16.1 - EXHIBIT 16.1 - China Network Media, Inc. | v327031_ex16-1.htm |

| EX-10.2 - EXHIBIT 10.2 - China Network Media, Inc. | v327031_ex10-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 29, 2012

METHA ENERGY SOLUTIONS INC.

(Exact name of registrant as specified in its charter)

| Delaware | 333-152539 | 32-0251358 | ||

| (State or other jurisdiction of | (Commission File Number) | (IRS Employer Identification No.) | ||

| incorporation) |

Room 205, Building A No. 1 Torch Road, High-Tech Zone Dalian, China |

116023 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: +86 (411) 3973-1515

| 410 Park Avenue, 15th Floor, New York, NY 10022 | ||

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c)) |

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This Current Report on Form 8-K (this “Report”) contains forward-looking statements. The forward-looking statements are contained principally in the sections entitled “Description of Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “seeks,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “would” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. These risks and uncertainties include, but are not limited to, the factors described in the section captioned “Risk Factors” below. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Such statements may include, but are not limited to, information related to: anticipated operating results; relationships with our merchants and subscribers; consumer demand; financial resources and condition; changes in revenues; changes in profitability; changes in accounting treatment; cost of sales; selling, general and administrative expenses; interest expense; the ability to produce the liquidity or enter into agreements to acquire the capital necessary to continue our operations and take advantage of opportunities; legal proceedings and claims.

Also, forward-looking statements represent our estimates and assumptions only as of the date of this Report. You should read this Report and the documents that we reference and file or furnish as exhibits to this Report completely and with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

USE OF CERTAIN DEFINED TERMS

Except as otherwise indicated by the context, references in this report to “we,” “us,” “our,” “our Company,” or “the Company” are to the combined business of Metha Energy Solutions, Inc. and its consolidated subsidiaries.

In addition, unless the context otherwise requires and for the purposes of this Report only:

| ● | “Closing Date” means October 29, 2012; | |

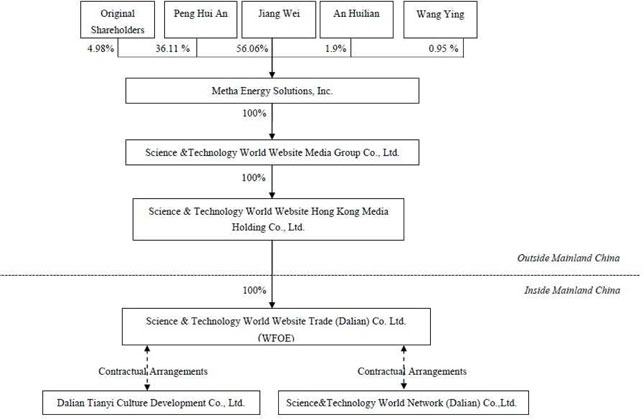

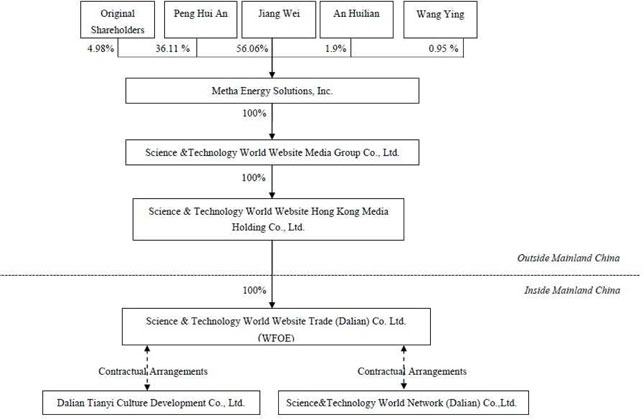

| ● | “Dalian Tianyi” refers to our variable interest entity Dalian Tianyi Culture Development Co., Ltd., a PRC limited company; | |

| ● | “Exchange Act” refers to the Securities Exchange Act of 1934, as amended; | |

| ● | “HK Science& Technology” refers to our subsidiary Science & Technology World Website Hong Kong MediaHolding Co., Ltd., a Hong Kong company; | |

| ● | “Hong Kong” refers to the Hong Kong Special Administrative Region of the People’s Republic of China; | |

| ● | “MGYS” refers to Metha Energy Solutions Inc., a Delaware corporation; | |

| ● | “PRC” and “China” refers to the People’s Republic of China, excluding, for the purpose of this prospectus, Taiwan and the special administrative regions of Hong Kong and Macau; | |

| ● | “PRC Operating Subsidiaries” and “PRC Operating Entities” refers to “Science & Technology (Dalian)” and “Dalian Tanyi”; | |

| ● | “Renminbi” and “RMB” refers to the legal currency of China; | |

| ● | “Science & Technology Media” refers to Science & Technology World Website Media Group Co., Ltd., a British Virgin Islands company; | |

| ● | “Science & Technology Holding” refers to Science & Technology World Website Media Holding Co., Ltd., a British Virgin Islands company; | |

| ● | “Science & Technology Trading” or “WFOE” refers to our indirect subsidiary of Science & Technology World Website Trade (Dalian) Co., Ltd., a PRC limited company; | |

| ● | “Science & Technology (Dalian)” refers to our variable interest entity Science & Technology World Network (Dalian) Co., Ltd., a PRC limited company; | |

| ● | “SEC” refers to the Securities and Exchange Commission; | |

| ● | “Securities Act” refers to the Securities Act of 1933, as amended; and | |

| ● | “U.S. dollars,” “dollars,” “US$,” “$” and “USD” refers to the legal currency of the United States. |

| Item 1.01 | Entry into a Material Definitive Agreement. |

Acquisition of Science & Technology Media

On the Closing Date, we entered into a Share Exchange Agreement (the “Exchange Agreement”) with (i) Science & Technology Holding, (ii) Science & Technology Media, (iii) the shareholders of Science & Technology Holding (the “Science & Technology Shareholders”) and (iv) our former principal shareholder pursuant to which we acquired all of the outstanding capital stock of Science & Technology Media from Science & Technology Holding in exchange for the issuance of 50,000,000 shares of our common stock to the Science & Technology Shareholders (the “Share Exchange”). The shares issued to the Science & Technology Shareholders in the Share Exchange constituted approximately 95% of our issued and outstanding shares of common stock as of and immediately after the consummation of the Share Exchange. In connection with the closing, 10,000,000 shares of our common stock held by our former principal shareholder have been cancelled. As a result of the Share Exchange, Science & Technology Media became our wholly owned subsidiary and Wei Jiang and HuiAn Peng became our principal stockholders.

The transaction was regarded as a reverse merger whereby Science & Technology Media was considered to be the accounting acquirer as it retained control of Metha Energy Solutions Inc. after the Share Exchange.

The foregoing description of the Share Exchange Agreement is qualified in its entirety by reference to the provisions of the Exchange Agreement filed as Exhibit 2.1 to this Report, which is incorporated by reference herein.

| Item 2.01 | Completion of Acquisition or Disposition of Assets. |

The disclosure in Item 1.01 of this Report regarding the Share Exchange is incorporated herein by reference in its entirety.

FORM 10 DISCLOSURE

As disclosed elsewhere in this Report, we acquired Science & Technology Media on the Closing Date pursuant to the Share Exchange, which was accounted for as a recapitalization effected by a share exchange. Item 2.01(f) of Form 8-K provides that if the Company was a shell company, other than a business combination related shell company (as those terms are defined in Rule 12b-2 under the Exchange Act) immediately before the Share Exchange, then the Company must disclose the information that would be required if the Company were filing a general form for registration of securities on Form 10 under the Exchange Act reflecting all classes of the Company’s securities subject to the reporting requirements of Section 13 of the Exchange Act upon consummation of the Share Exchange.

The transaction was regarded as a reverse merger whereby Science & Technology Media was considered to be the accounting acquirer as it retained control of Metha Energy Solutions Inc., after the Share Exchange.

To the extent that the Company might have been considered to be a shell company immediately before the Share Exchange, we are providing below the information that we would be required to disclose on Form 10 under the Exchange Act if we were to file such form. Please note that the information provided below relates to the Company after the acquisition of Science & Technology Media, except that information relating to periods prior to the date of the Share Exchange relate only to Science & Technology Media and its affiliates unless otherwise specifically indicated.

DESCRIPTION OF BUSINESS

Business Overview

Science & Technology Media is a multi-languages portal website that serves to the technology industry and provides advertising opportunities to the companies through our diverse business network in China; we well-positioned our business in the science and technology field and currently operate our website through three different versions in Chinese, English and Japanese. Right now, we have 34 domestic channels including every province, city, autonomous region, cities with independent planning status, Hong Kong, Macau and Tai Wan.

We mainly provide online platform to business entrepreneurs/corporations with a B2B marketplace that can help our customers:

| · | establish their brand image through online magazine, online corporate multimedia advertisement, executives interviews, institutional alliances and flexible membership package that tailor made based on what our customers need. |

| · | set up company online exhibition to introduce their products to the public, where they have our tailor-made corporate introduction and factory facilities online show room; |

| · | B2B product purchase platform for companies and end-users; |

| · | online job opportunity section for corporate clients; and |

| · | corporate blogs. |

We also offer a range of business management software, internet infrastructure services and export-related services, and provide educational services to incubate enterprise management and e-commerce professionals.

Besides our various service models that we provide to enterprises customers, we also provide “home-oriented” online experience to our technicians, science and technology professionals, where they can easily find information related to their work, job opportunities within the technology industry, moreover, they can also meet friends, professionals through our website. BBS is part of our service that users can upload and download software and data, read news and bulletins, and exchange messages with other users either through email or in public message board.

We currently derive a substantial portion of our revenues from online advertising services. Our advertising solutions present corporate users with attractive opportunities to combine the visual impact and engagement of traditional television-like multimedia advertisements and online magazines with the interactivity and precise targeting capabilities of the Internet. We strive to promote a novel and unique advertising environment on our website to attract technology enterprises.

We were mainly focus on the technology development, and clients marketing in 2010 and 2011. During the past two years, we have positioned ourselves in a fast growing industry – Internet. Despite said above, we also work closely with traditional media channels, such as magazine, TV channels. So far, we have built a steady relationship with four major Chinese magazines: 315online, China Brand, China High-Tech zone and Da Lian Machinery.

Moreover, we also work closely with WO 3G mobile TV, which is a new media channel through mobile that developed by Liaoning broadcast TV and China Unicom, which is the second largest mobile phone operator in China. With the new strategic cooperation with 3G, we will therefore, have a new platform for entrepreneurs, local government or any entities that have the needs to advertise their business and corporate cultures through a new channel.

We are a team combined with passionate employees and a perceiving management team, since the beginning of our business, our company has spent great effort on the website and market development in 2010 and 2011.

During the past two years, we have attracted clients from different industries: governments, academic institutions, OEM, Environmental technology firms, and other high-tech companies.

Our mission is to develop a worldwide online platform for science and technology companies. Our company believes the network can change the world, bring people, corporate from miles away into one online world to share, to work, to communicate.

Our Corporate History and Background

Science & Technology World Website Media Group Co., Ltd was organized under the laws of the British Virgin Islands on February 15, 2011 to serve as a holding company for our PRC operations. On September 16, 2011, Science & Technology Media established HK Science and Technology in Hong Kong to serve as an intermediate holding company.

On January 20, 2012, HK Science and Technology established WFOE in the PRC. On January 21, 2012, the WFOE respectively entered into a series of agreements with Dalian Tianyi, Science & Technology (Dalian) and their respective shareholders (the “Contractual Arrangements”). The relationship with Dalian Tianyi, Science & Technology (Dalian) and their respective shareholders are governed by the Contractual Arrangements. The Contractual Arrangements is comprised of a series of agreements, including Exclusive Technical Consulting Service Agreements and Operating Agreements, through which WFOE has the right to advise, consult, manage and operate Dalian Tianyi and Science & Technology (Dalian), and collect 85% of their respective net profits. In order to further reinforce the WFOE’s rights to control and operate Dalian Tianyi and Science & Technology (Dalian), the shareholders of Dalian Tianyi and Science & Technology (Dalian) have granted WFOE, under the Exclusive Equity Interest Purchase Agreement, the exclusive right and option to acquire all of their equity interests respectively in Dalian Tianyi and Science & Technology (Dalian). Furthermore, the shareholders of Dalian Tianyi and Science & Technology (Dalian) is under the procedure of pledging all of their equity interests respectively in Dalian Tianyi and Science & Technology (Dalian) to WFOE under the Exclusive Equity Interest Pledge Agreement, and through the Exclusive Equity Interest Pledge Agreement, WFOE can collect the remaining 15% of Dalian Tianyi and Science & Technology (Dalian)’s respective net profits. According to the Power of Attorney executed by the shareholders of Dalian Tianyi and Science & Technology (Dalian), they exclusively authorized WFOE to perform and exercise any and all of the shareholder’s rights in Dalian Tianyi and Science & Technology (Dalian).

HK Science and Technology and WFOE are considered foreign investor and foreign invested enterprise respectively under PRC law. As a result, HK Science and Technology and WFOE are subject to limitations under PRC law on foreign ownership of Chinese companies. According to the Catalogue of Industries for Guiding Foreign Investment (2011 Revision) (the “Catalogue”), there are four kinds of industries which are encouraged, permitted, restricted and prohibited for foreign investment. The primary business of Dalian Tianyi and Science & Technology (Dalian) are within the category in which foreign investment is currently restricted. The Contractual Arrangements with Dalian Tianyi and Science & Technology (Dalian) allow the Company to substantially control Dalian Tianyi and Science & Technology (Dalian) through WFOE without any equity relationship.

According to the Power of Attorney executed by the shareholders of Dalian Tianyi and Science & Technology (Dalian), they exclusively authorized WFOE to perform and exercise any and all of the shareholder’s rights in Dalian Tianyi and Science & Technology (Dalian).

As a result of the Contractual Arrangements, under generally accepted accounting principles in the United States, or U.S. GAAP, Science & Technology Media is considered the primary beneficiary of Dalian Tianyi and Science & Technology (Dalian) and thus consolidates their results in its consolidated financial statements.

On the Closing Date, we entered into the Share Exchange Agreement with (i) Science & Technology Holding (ii) Science & Technology Media, (iii) the Science & Technology Holding Shareholders and (iv) our former principal shareholder pursuant to which we acquired all of the outstanding capital stock of Science & Technology Media from Science & Technology Holding in exchange for the issuance of 50,000,000 shares of our common stock to the Science & Technology Shareholders. The shares issued to the Science & Technology Shareholders in the Share Exchange constituted approximately 95% of our issued and outstanding shares of common stock as of and immediately after the consummation of the Share Exchange. In connection with the closing, 10,000,000 shares of our common stock held by our former principal shareholder have been cancelled. As a result of the Share Exchange, Science & Technology Media became our wholly owned subsidiary and Wei Jiang and HuiAn Peng became our principal stockholders. The Share Exchange was accounted for as a recapitalization effected by a share exchange, wherein Science & Technology is considered the acquirer for accounting and financial reporting purposes. The assets and liabilities of Science & Technology have been brought forward at their book value and no goodwill has been recognized.

Corporate Information

Our principal executive offices are located at Room 205, Building A, No. 1, Torch Road, Hi-tech Zone, Dalian, China, 116023, the People’s Republic of China. Our telephone number at this address is +86 (411) 39731515.

Our Competitive Strengths

We believe that the following strengths contribute to our success and differentiate us from our competitors:

We are well positioned in a highly fragmented and competitive market. Our China-based website for technology allow us to utilize cost-competitive domestic labor and resources to manage costs, provides a close proximity to our customers to better understand and service their needs and allows us to have real time updates on prevailing market conditions in China.

We run our business with an attractive and various business models. We provide a broad range of services to entrepreneurs and corporations that include online exhibition, online magazine, online corporate multimedia advertisement, Executives interviews, institutional alliances and flexible membership package that tailor made based on what our customers need.

We have development strong business relationship with local enterprises throughout China, and business professionals, we also work closely with main media press. We work closely with major scientifically magazines, local governments, major media channels, and high-tech enterprises throughout China from different industry. So far, we have built a steady relationship with four major Chinese magazines: 315online, China Brand, China High-Tech Zone and Da lian Machinery. We also work closely with WO (UMTS/3G network service brand by China Unicom) 3G mobile TV, which is a new mobile media that developed by Liaoning broadcast TV and China Unicom (China Unicom is the second largest mobile phone operator in the country).

We also undertake big events to spread out our brand name. And therefore, earn the opportunities with other major media companies and enterprises. For example, in 2012, June to July, we have worked on the events called “China Brand image spokesman competition”

During the 21st century, Chinese brands are about to step into a new age. To set up a well-known brand, a company would need a high quality image spokesman to represent its product besides the high quality of its product. The aim of this contest is to select high quality image spokesman for emerging national brand, the advisory institutions for this contest include General Administration of Quality Supervision, Inspection and Quarantine of PRC, China Enterprise Confederation, China Enterprise Directors Association, China Radio and Television Association and China Council for the Promotion of Famous Brand Strategy. After local selection and final contest, a hundred brand image spokesmen will be chosen as winners of this contest. We have set up a team to deal with the work of contest design, operation, promotion and sponsorship. Local contest will be held by different local enterprises who have related qualifications and our authorization. The income of this event is mainly from the sponsorship of the final contest, endowment of co-organizers, sponsor from exclusive product enterprise, and 500,000 RMB from each enterprise who undertake the local contest.

We have an experienced management and operational teams with extensive market knowledge. Our management team and key operations and technical personnel have extensive management skills, relevant operational experience and industry knowledge. We have created and maintained a stable management team and have been able to retain our core management and key technical personnel since our inception. We believe that our management team’s experience, longstanding customer relationships and in depth knowledge of the Chinese market will enable us to continue our successful execution of expansion strategies and take advantage of market opportunities that may arise.

Multi-language website provides potential opportunities to attract clients from all over the world. We have currently operated our website through 3 languages: Chinese, English and Japanese. We believe with our multi-language portal website, more audience from the world will be able to learn, to communicate, and share information through our website.

Our Growth Strategy

Our mission is to become the primary source of technology information, knowledge, products platform for the Chinese population across any Internet-enabled device and moreover, we hope we can attract international technology professionals and enterprises through our multi-languages website. We intend to achieve our mission by expanding our content library and user base, enhancing our brand and improving our business model. More specifically, we plan to implement the following strategies:

| · | Increase the breadth and depth of our online technology content library. We have more than 25 in-house editors to collect and translate the most updated news through the world. However, we believe the long-term strategy of having a global growth is by improving the strength and capability to collect prompt information in time, and therefore, turning ourselves into one of the Chinese top online news channel. |

| · | Further enhance our brand recognition. We have a limited history that have not yet build adequate exposure in our business, as that said, we will dedicate more effort on company brand management through a cost effective way. Such as promote our brand through our strategic cooperation partners, high-technology product representative agent, carry out important social events with famous media channels and brands. |

| · | Expand and diversify our revenue sources. Our current revenue is mainly generated from online advertising for our customers through membership sales model. With the increase of our market share, brand recognition, and technology development, we will be able to work with most high-tech companies to develop a stable and active online trading platform , therefore, we will derive a new revenue stream from the trading platform (please refer to “our business and service” section for more information). |

| · | New stream to generate revenue through 3G Mobile TV. As the 2008 Olympic competition was rebroadcasted on mobile TV at the first time, the new media such as mobile TV created a new space for advertising business. This new opportunity is critical with the development of mobile, moreover, smart phone users. |

The 12th Five-Year Plan issued by China’s Ministry of Industry and Information Technology (MIIT) established aggressive development targets for the China telecommunications industry from 2011 to 2015. During this time, China’s mobile communications user base will reach more than 1.1 billion with total Internet users climbing to 600 million, representing a 40% penetration rate (www.iresearchchina.com).

Therefore, as analyzed above, we have targeted this market as a new potential platform for our service to our clients, that will create a new location to advertise their business on a smart phone. We are working closely with WO 3G mobile TV, which is a new mobile media that developed by Liaoning broadcast TV and China Unicom, the second largest mobile phone operator in the country.

| · | Expand our online network infrastructure and optimize our services. In order to improve website hits, we have revised our website from time to time to provide the most user-oriented set up for our web page to make it more in line with general practice for a website, but also exaggerate our advantages and diversity of the website. |

| · | Recruit additional qualified employees and enhance our research and development capabilities. In connection with the expansion of our business, we plan to continue recruiting more highly qualified individuals to conduct our operations of our website while maintaining the consistency and quality of the services that we deliver. We also plan to recruit more high profile personnel in our research and development department and invest in enhancing our research and development capabilities to be more competitive. Where appropriate, we will also endeavor to partner with domestic and international companies in order to expand our technological capabilities. |

Our Services

We currently generate our revenue through our diverse advertisement package to our business clients. To be our customers, the companies need to have the three distinct criteria:

| • | The member companies need to have its own technology created and have innovative project or have had significant success in the technology industry; |

| • | The member companies are reputable in their industry, and can influence the whole industry with their reputation; |

| • | The member companies have fine product quality and recognized brand in the industry. |

We have classified our service package as follow (Service fee in RMB):

| Executive vice president | Vice president | Executive director | Director | |||||

| Fee/ year | 500,000 | 300,000 | 150,000 | 80,000 | ||||

| Service Item | ||||||||

| Front page ad | 3 years,20MM* 50mm | 2 years,20MM* 50MM | 2 years,20MM* 50MM | 1 year,20MM* 50MM | ||||

| Online exhibition display | 3 years | 2 years | 2 years | 1 year | ||||

| multilanguage online profile | 3 years | 2 years | 2 years | 1 year | ||||

| setup trading platfrom | 3 years | 2 years | 2 years | 1 year | ||||

| Job recruiting | 3 years | 2 years | 2 years | 1 year | ||||

| online magazine advertisement | 3 years | 2 years | 1 year | 1 year | ||||

| annual conference,submit | at least once a year | at least once a year | at least once a year | Twice a year | ||||

| Make special subject | Yes | Yes | Yes | Yes | ||||

| Keyword for searching engine | 1 year | 1 year | 1 year | 6 months | ||||

| design website | Yes | Yes | Yes | NO | ||||

| referal business | first year | first year | first year | Yes | ||||

| Discount on subsidiary for S&T | Yes | Yes | Yes | Yes | ||||

| articles on tradtional magazine | 2 to 3 | 2 | 1( within 5000 words) | 1(within 2500 words) |

Detailed explanation for our service items:

Front page ad: front page advertisement for our membership companies on our website;

Online exhibition display: display our membership companies’ products and corporate profile on our website;

Multilanguage online profile: develop the membership company’s corporate profile with more than one language. They can choose to develop their corporate profile in English, Japanese or other languages;

Setup trading platform: help our membership company to setup an online trading section on our website under the online trading section;

Job recruiting: setup a corporate recruiting section on our website for our membership companies, to help them recruit new employees from our website resources;

Online magazine advertisement: we help our membership companies to design and display their own corporate magazine on our website;

Annual conference/submit: we organize conferences for more than one time in a year; the topic for each conference can vary. The membership companies will be invited to join the conference we organize;

Make special subject: our firm can compose an article based on a specific topic for our membership company that related to their corporate business, such as CEO interview; corporate interview;

Keyword for searching engine: we can set the name of our membership client’s firm as the keyword in the our search engine, so when any individual or corporate wants to search any information on our website, the keyword will show up immediately;

Design website: we provide website design service to our membership company;

Referral business: we introduce business for our membership company within our website

Discount on subsidiary for S&T: if our membership company wants to be an alliance of Science and Technology (Dalian), we can give discount to them for being an alliance;

Articles on traditional magazine: we can write one or more articles related to our membership client to introduce their corporate culture, corporate information or the CEO stories;

Our innovative business model that differentiate us from other advertising companies:

Online Exhibition

The “Online-Expo” of the Company is a brand-new mode of product exhibition. We put our members product information on the internet through this window based on actual exhibition locations; it is a percept complement to the “International High-tech product exhibition of Dalian”. Each exhibiter has its own web page, and all information about the exhibiter and its products are available to internet users on the page. According to actual exhibition, we divide the “Internet Expo” into 14 sections, including software, electronics, internet, cartoon, manufacture, biology, medicine, communications, automobile, energy, environmental protection, aerospace, new material and agriculture.

We have set up an integral database for every single exhibiter on the “Internet Expo”, all the data such as exhibition information; daily turnover and the attention rate of the product are available on their respective web page.

Business Mode of Software and Information Service

The Company has established a team to deal with software R&D and outsource services; these groups realize our website’s daily technique upgrade and also support related R&D of “The Internet of things” industry. At the meanwhile the company is seeking for cooperation with other companies, we take on all kinds of software outsource services. These services shall add extra profit to our company.

Online Trading Platform

The Company has a self-contained online transaction platform for technology products. It caters for the needs of most of the internet users who are likely to make technology product deals on the internet. But, some of the new products cannot be shown on the internet because of its own characteristics. We also have a professional team to deal with the promotion of these kinds of product, and we will knit a distribution net all over the Chinese mainland and main cities overseas.

Our Company has a strict product selecting procedure. Before we introduce a product to customers, we will verify the qualification of the manufacturing enterprise and make a series test of the products’ function and performance. Furthermore, we work directly with enterprises to cut down the number of intermediate links, so as to enhance the price advantage of the products.

In the near future, we plan to work together with our clients on marketing their products, and derive a new channel to make profit of our business.

There are two main operating procedures that we will consider: one is exclusive distribution of technology product and the other one is equity participation program. When we adopt the first strategy, we will buy out all the distribution right of a product in a specific area from a company; on top of that we will put this product on our promotion network. Our revenue comes from the price difference of the product.

When it comes to the second procedure, we will select a product which is likely to have a vigorous momentum in the future. We will cooperate with the manufacturing enterprise through cash investment, technology investment or other cooperative mode. As stated, we will act as a shareholder of the company we invested in and participant the business operation of this enterprise. Our revenue comes from the profit distribution of the enterprise.

Our Customers

We started generate revenue in 2010. We target companies that:

a. need to have its own technology created and have innovative project or have had significant success in the technology industry;

b. are reputable in their industry, and can influence the whole industry with their reputation;

c. have fine product quality and recognized brand in the industry.

We have various customers that come from different industries, such as: logistics, energy, social society, healthcare, construction, machinery, clothing, food and retailing and so forth. Our revenue increased approximately 15 times in 2011, in comparison with 2010, attributed to our aggressive marketing strategy.

Sales and Marketing

Sales to customers in China account for all of our revenue. We target our sales efforts primarily in major leading companies in China; however, we tend to focus on the local companies in Dalian for the beginning of our business, and then start to get in touch with companies throughout all China. We have developed and strive to maintain a diversified sales network that allows us to effectively market products and services to our customers. Our sales and marketing team currently consists of 19 employees. Our executive management team is also actively involved in business development and in managing our key client relationships.

Research and Development

Because of the nature of our business, we are required to improve our technology ability in a high frequency in order to compete with other business competitors in the business.

Since the beginning of our operation in 2010, we have striven to work on our website by increase the input of our database, develop new channels and functions on our website, create new platform for job recruitment, trading through different industries, and design, edit, and publish online journals and carried out other activities to dramatically enlarge our service capability.

We have upgraded our website three times in the past a year and half, made great effort of each time:

End of 2010 to January 2011, we managed to setup and create the Science & Technology website; In 7 months later, we upgraded our website with the development of network construction and database; from the beginning of 2012, we have setup clear strategy and timeline on what we will develop and how we will upgrade our website in order to improve our existing services and further broaden our product offering. We will also recruit more highly qualified experts to enhance its capability.

Competition

Our business model is to provide our B2B platform to technology enterprises, and our revenue is generated from advertisement business through our membership payment model. We believe that we have the unique business model; however, we still acknowledge the competition from the advertising market in china. Our competitor includes companies that provide the same advertising portal website to B2B customers and also the portal website that provide services to individuals, the large internet companies such as : Sohu.com, Sina.com, Baidu.com and others. We also face competition from large online video advertisers such as.Youku.com, Tudou.com and 56.com and others.

Traditional media channel (magazine, newspapers, and radio), telecommunications, street showcase, billboard, frame and public transport advertising companies are also our competitors.

Intellectual Property

We have recognized the material impact on how to protect our intellectual property.

Trademarks

We are registering the following trademark with the Trademark Office, State Administration for Industry and Commerce in the PRC:

| No. | Registration(Application) No. | Trademark | Applicant | Item Category | Application Date | |||||

| 1 | 10494489 and 10494470 |  |

Science & Technology (Dalian) | 35* 42* |

16th,February, 2012 | |||||

| 2 | 10494453 and 10494499 | TWWTN | Science &Technology (Dalian) | 35* 42* |

16th February ,2012 |

*35: Product/service category:

1. Advertising; 2 advertising agency; 3 Advertising space for rent;4 Online advertising on the data communication network; 5 advertising planning; 6 advertising design; 7 advertising publication; 8 Rental for advertising time on communication media; 9 direct email advertising;10 provide models for advertising or promotion purpose

*42: Product/service category:

1. Computer software design; 2 transfer data and document into electronic media;3 help the others to create or maintain website; 4 packaging design; 5 Exterior design for industrial product;6 Fashion design; 7 artwork appraisal; 8.Written graphic arts design; 9 Computer programming; 10 Managing computer stations.

Domain Names

Dalian Tianyi owns five domain names, which are www.twwtn.com, www.twwtn.cn, www.twwtn.net, www.twwtn.com.cn and www.twwtn.org.

Governmental Approval and Regulation

Patent

In accordance with the PRC Patent Law, the State Intellectual Property Office is responsible for administering patents in the PRC. The patent administration departments of provincial, autonomous region or municipal governments are responsible for administering patents within their respective jurisdictions.

The Chinese patent system adopts a "first to file" principle, which means that, where more than one person files a patent application for the same invention, a patent will be granted to the person who filed the application first. To be patentable, invention or utility models must meet three conditions: novelty, inventiveness and practical applicability. A patent is valid for 20 years in the case of an invention and 10 years in the case of utility models and designs. A third-party user must obtain consent or a proper license from the patent owner to use the patent. Otherwise, the use constitutes an infringement upon patent rights.

Trademarks

Registered trademarks in the PRC are protected by the Trademark Law of the PRC which came into effect in 1982 and was revised in 1993 and 2001 and the Regulations for the Implementation of Trademark Law of PRC which came into effect in 2002. A trademark can be registered in the PRC with the Trademark Office under the State Administration for Industry and Commerce, or the SAIC. The protection period for a registered trademark in the PRC is ten years starting from the date of registration and may be renewed if an application for renewal is filed within six months prior to expiration.

Copyright

Copyright in the PRC is protected by the Copyright Law of the PRC which was promulgated in 1990 and revised in 2001 and February 2010 and the Regulation for the Implementation of the Copyright Law of the PRC which came into effect in September 2002. Under the revised Copyright Law, copyright protections have been extended to information network and products transmitted on information network. Copyrights are reserved by the author, unless specified otherwise by the laws. According to Article 16 of the Copyright Law, if a work constitutes “work for hire”, the employer, instead of the employee, is considered the legal author of the work and will enjoy the copyrights of such “work for hire” other than rights of authorship. “Works for hire” include, (1) drawings of engineering designs and product designs, maps, computer software and other works for hire, which are created mainly with the materials and technical resources of the legal entity or organization with responsibilities being assumed by such legal entity or organization; (2) those works the copyrights of which are, in accordance with the laws or administrative regulations or under contractual arrangements, enjoyed by a legal entity or organization. The actual creator may enjoy the rights of authorship of such “work for hire.”

A copyright owner may transfer its copyrights to others or permit others to use its copyrighted works. Use of copyrighted works of others generally requires a licensing contract with the copyright owner. The protection period for copyrights in the PRC varies, with 50 years as the minimum. The protection period for a “work for hire” where a legal entity or organization owns the copyright (except for the right of authorship) is 50 years, expiring on December 31 of the fiftieth year after the first publication of such work.

Facilities

We currently operate in the following facility under a lease agreement. The aggregate monthly payment under these leases is RMB 43,828 (approximately $6,929), as set forth on the table below:

| Facility | Address | Lessor | Space (Square Meters) | Monthly Rent | Lease Period | |||||||||||

| Dalian (headquarters) | Room 205, Building A, No. 1, Torch Road, Hi-tech Zone, Dalian, China | DaLian Hi-Tech Enterprises Service Center | 1440.92 | $ | 6,929 | May 1, 2012 to April 30, 2013 | ||||||||||

Employees

As of October 2012, we had a total of 77 employees. We have paid the social insurance coverage for our full time employees for certain pension benefits, medical care, unemployment insurance, employee housing fund and other welfare benefits are provided to employees, which are carried out under PRC law. The following table shows the number of our employees by function.

| Function | Number Of Employees | |||

| Management | 7 | |||

| Technicians and Engineers | 13 | |||

| Editorials | 30 | |||

| Sales and Marketing | 16 | |||

| Accounting | 2 | |||

| Administration | 9 | |||

| Total | 77 | |||

We believe that we maintain a satisfactory working relationship with our employees, and we have not experienced any significant labor disputes or any difficulty in recruiting staff for our operations. None of our employees is represented by a labor union.

Our employees in China participate in a state pension plan organized by Chinese municipal and provincial governments. We are required to make monthly contributions to the plan for each employee at the rate of 20% of his or her average assessable salary. In addition, we are required by Chinese law to cover employees in China with various types of social insurance. We believe that we are in material compliance with the relevant PRC laws.

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this Report, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our shares of common stock could decline and you may lose all or part of your investment. See “Cautionary Note Regarding Forward Looking Statements” above for a discussion of forward-looking statements and the significance of such statements in the context of this Report.

Risks Related to Our Business

We have a history of operating losses and there can be no assurance that we can achieve or maintain profitability.

We have a history of operating losses and may not achieve or sustain profitability. We cannot guarantee that we will become profitable. Even if we achieve profitability, given the competitive and evolving nature of the industry in which we operate, we may be unable to sustain or increase profitability and our failure to do so would adversely affect the Company’s business, including our ability to raise additional funds.

We face intense competition. If we do not continue to innovate and provide products and services that are useful to users, we may not remain competitive, and our revenues and operating results could be adversely affected.

Our business is rapidly evolving and intensely competitive, and is subject to changing technology, shifting user needs, and frequent introductions of new products and services. We have many competitors in different industries, including Sohu, Youku, Sina and other industry players. Our current and potential competitors range from large and established companies to emerging start-ups. Established companies have longer operating histories and more established relationships with customers and users, and they can use their experience and resources in ways that could affect our competitive position, including by making acquisitions, investing aggressively in research and development, aggressively initiating intellectual property claims (whether or not meritorious) and competing aggressively for advertisers and websites. Emerging start-ups may be able to innovate and provide products and services faster than we can.

Our competitors are constantly developing innovations in web search, online advertising, and web-based products and services. As a result, we must continue to invest significant resources in research and development, including through acquisitions, in order to enhance our web search technology and our existing products and services, and introduce new products and services that people can easily and effectively use. If we are unable to provide quality products and services, then our users may become dissatisfied and move to a competitor’s products and services.

Our business depends substantially on the continuing efforts of our senior management and other key personnel, and our business may be severely disrupted if we lost their services.

Our future success heavily depends on the continued service of our senior management and other key employees. If one or more of our senior executives are unable or unwilling to continue to work for us in their present positions, we may have to spend a considerable amount of time and resources searching, recruiting, and integrating the replacements into our operations, which would substantially divert management’s attention from our business and severely disrupt our business. This may also adversely affect our ability to execute our business strategy. Moreover, if any of our senior executives joins a competitor or forms a competing company, we may lose customers, suppliers, know-how, and key employees.

Our senior management’s limited experience managing a publicly traded company may divert management’s attention from operations and harm our business.

Our senior management team has no experience managing a publicly traded company and complying with federal securities laws, including compliance with recently adopted disclosure requirements on a timely basis. Our management will be required to design and implement appropriate programs and policies in responding to increased legal, regulatory compliance and reporting requirements, and any failure to do so could lead to the imposition of fines and penalties and harm our business.

We may be unable to attract and retain qualified, experienced, highly skilled personnel, which could adversely affect the implementation of our business plan.

Our success depends to a significant degree upon our ability to attract, retain and motivate skilled and qualified personnel. As we become a more mature company in the future, we may find recruiting and retention efforts more challenging. If we do not succeed in attracting, hiring and integrating excellent personnel, or retaining and motivating existing personnel, we may be unable to grow effectively. The loss of any key employee, including members of our senior management team, and our inability to attract highly skilled personnel with sufficient experience in our industries could harm our business.

Our products may infringe the intellectual property rights of third parties, and third parties may infringe our proprietary rights, either of which may result in lawsuits, distraction of management and the impairment of our business.

As the number of patents, copyrights, trademarks and other intellectual property rights in our industry increases, products based on our technology may increasingly become the subject of infringement claims. Third parties could assert infringement claims against us in the future. Infringement claims with or without merit could be time consuming, result in costly litigation, cause product shipment delays or require us to enter into royalty or licensing agreements. Royalty or licensing agreements, if required, might not be available on terms acceptable to us, or at all. We may initiate claims or litigation against third parties for infringement of our proprietary rights or to establish the validity of our proprietary rights. Litigation to determine the validity of any claims, whether or not the litigation is resolved in our favor, could result in significant expense to us and divert the efforts of our technical and management personnel from productive tasks. If there is an adverse ruling against us in any litigation, we may be required to pay substantial damages, discontinue the use and sale of infringing products, and expend significant resources to develop non-infringing technology or obtain licenses to infringing technology. Our failure to develop or license a substitute technology could prevent us from selling our products.

We will incur increased costs as a result of being a public company.

We will face increased legal, accounting, administrative and other costs and expenses as a public company that we did not incur as a private company. The Sarbanes-Oxley Act of 2002, including the requirements of Section 404, as well as new rules and regulations subsequently implemented by the SEC, the Public Company Accounting Oversight Board (the “PCAOB”), impose additional reporting and other obligations on public companies. We expect that compliance with these public company requirements will increase our costs and make some activities more time-consuming. A number of those requirements will require us to carry out activities we have not done previously. For example, we will adopt new internal controls and disclosure controls and procedures. In addition, we will incur additional expenses associated with our SEC reporting requirements. Furthermore, if we identify any issues in complying with those requirements (for example, if we or our accountants identify a material weakness or significant deficiency in our internal control over financial reporting), we could incur additional costs rectifying those issues, and the existence of those issues could adversely affect us, our reputation or investor perceptions of us. We also expect that it will be difficult and expensive to obtain director and officer liability insurance, and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified persons to serve on the Company’s board of directors or as executive officers. Advocacy efforts by stockholders and third parties may also prompt even more changes in corporate governance and reporting requirements. We expect that the additional reporting and other obligations imposed on us by these rules and regulations will increase our legal and financial compliance costs and administrative fees significantly. These increased costs will require us to divert a significant amount of money that we could otherwise use to expand our business and achieve our strategic objectives.

Failure to comply with the United States Foreign Corrupt Practices Act could subject us to penalties and other adverse consequences.

As a Delaware corporation, we are subject to the United States Foreign Corrupt Practices Act, which generally prohibits United States companies from engaging in bribery or other prohibited payments to foreign officials for the purpose of obtaining or retaining business. Some foreign companies, including some that may compete with our company, may not be subject to these prohibitions. Corruption, extortion, bribery, pay-offs, theft and other fraudulent practices may occur from time-to-time in the Angola or any other countries in which we conduct our business. However, our employees or other agents may engage in conduct for which we might be held responsible. If our employees or other agents are found to have engaged in such practices, we could suffer severe penalties and other consequences that may have a material adverse effect on our business, financial condition and results of operations.

Risks Related to Our Corporate Structure

If the PRC government finds that the agreements that establish the structure for operating our businesses in China do not comply with PRC governmental restrictions on foreign investment in telecommunication business, or if these regulations or the interpretation of existing regulations change in the future, we could be subject to severe penalties or be forced to relinquish our interests in those operations.

Current PRC laws and regulations place certain restrictions on foreign ownership of companies that engage in telecommunication business. Specifically, foreign investors are not allowed to own more than a 50% equity interest in any PRC company engaging in value-added telecommunications businesses. We conduct our operations in China principally through the Contractual Arrangements among our WFOE, PRC Operating Entities and their shareholders. Our Contractual Arrangements enable us to exercise effective control over PRC Operating Entities and treat them as our consolidated affiliated entity.

The Circular regarding Strengthening the Administration of Foreign Investment in and Operation of Value added Telecommunications Business, or the Circular, issued by the Ministry of Industry and Information Technology, or the MIIT, in July 2006, reiterated the regulations on foreign investment in telecommunications businesses, which require foreign investors to set up foreign-invested enterprises and obtain a business operating license to conduct any value-added telecommunications business in China. Under the Circular, a domestic company that holds a telecommunications value-added services operation license is prohibited from leasing, transferring or selling the license to foreign investors in any form, and from providing any assistance, including providing resources, websites or facilities, to foreign investors that conduct value added telecommunications business illegally in China. Furthermore, the relevant trademarks and domain names that are used in the value-added telecommunications business must be owned by the local license holder. The Circular further requires each telecommunications value-added services operation license holder to have the necessary facilities for its approved business operations and to maintain such facilities in the regions covered by its license. In addition, all value-added telecommunications mobile payment service providers are required to maintain network and information security in accordance with the standards set forth under relevant PRC regulations. Due to a lack of interpretative materials from the regulator, it is unclear what impact the Circular will have on us or the other Chinese telecommunications and Internet companies that have adopted the same or similar corporate and contractual structures as ours.

We cannot assure you, however, that we will be able to enforce these agreements. Although we believe we are in compliance with current PRC regulations, we cannot assure you that the PRC government would agree that these Contractual Arrangements comply with PRC licensing, registration or other regulatory requirements, with existing policies or with requirements or policies that may be adopted in the future. PRC laws and regulations governing the validity of these Contractual Arrangements are uncertain and the relevant government authorities have broad discretion in interpreting these laws and regulations. If the PRC government determines that we do not comply with applicable laws and regulations, it could revoke our business and operating licenses, require us to discontinue or restrict our operations, restrict our right to collect revenues, block our websites, impose additional conditions or requirements with which we may not be able to comply, or take other regulatory or enforcement actions against us that could be harmful to our business. The imposition of any of these penalties would result in a material and adverse effect on our ability to conduct our business. The PRC government may also require us to restructure our operations entirely if it comes to find that our contractual arrangements do not comply with applicable laws and regulations. It is unclear how such mandatory restructuring could impact our business and operating results, as the PRC government has not yet found such contractual arrangements to be in non-compliance. However, any such restructuring may cause significant disruption to our business operations.

The relevant regulatory authorities would have broad discretion in dealing with such violations. If a relevant authority determines that we do not fully comply with applicable laws and regulations, it could revoke our business and operating licenses, require us to discontinue or restrict our operations, restrict our right to collect revenues, impose additional conditions or requirements with which we may not be able to comply, or take other regulatory or enforcement actions against us that could be harmful to our business. The relevant regulatory authorities may also require us to restructure our operations entirely if it finds that our Contractual Arrangements do not comply with applicable laws and regulations. It is unclear how a restructuring could impact our business and operating results, as no PRC authorities have yet found any such Contractual Arrangements to be in non-compliance. However, any such restructuring may cause significant disruption to our business operations.

Our contractual arrangements with PRC Operating Entities and their shareholders may not be as effective in providing control over these entities as direct ownership.

We have no equity ownership interest in PRC Operating Entities and rely on the Contractual Arrangements to control and operate PRC Operating Entities. The Contractual Arrangements may not be as effective in providing control over PRC Operating Entities as direct ownership. For example, PRC Operating Entities could fail to take actions required for our business or fail to pay dividends to WFOE despite its contractual obligation to do so. If PRC Operating Entities fails to perform its obligation under the Contractual Arrangements, we may have to rely on legal remedies under PRC law, which may not be effective. In addition, we cannot assure you that PRC Operating Entities’ stockholders will always act in our best interests.

Our Contractual Arrangements with PRC Operating Entities may result in adverse tax consequences to us.

As a result of our corporate structure and contractual arrangements between WFOE and PRC Operating Entities, WFOE is effectively subject to the 5% PRC business tax on revenues derived from PRC Operating Entities pursuant to the Contractual Arrangements. WFOE is subject to the business tax, while PRC Operating Entities, as a manufacturer, instead of a service provider, is not subject to the business tax. Moreover, we would be subject to adverse tax consequences if the PRC tax authorities were to determine that the Contractual Arrangements between WFOE and PRC Operating Entities were not on an arm’s length basis and therefore constitute a favorable transfer pricing. As a result, the PRC tax authorities could request that we adjust its taxable income upward for PRC tax purposes. Such a pricing adjustment could adversely affect us by:

| · | increasing PRC Operating Entities’s tax expenses without reducing WFOE’s tax expenses, which could subject PRC Operating Entities to late payment fees and other penalties for under-payment of taxes; and/or |

| · | resulting in WFOE’s loss of its preferential tax treatment. |

Perfection of the pledges in our Equity Interest Pledge Agreements with PRC Operating Entities and their registered shareholders may be adversely affected due to failure to register these Equity Interest Pledge Agreements.

Under our Equity Interest Pledge Agreements with the PRC Operating Entities and their registered shareholders, these registered shareholders have pledged all of their respective equity interests in the PRC Operating Entities to us. According to the PRC Property Rights Law, which became effective on October 1, 2007, a pledge is not deemed to be validly created without registration with the relevant local administration for industry and commerce. We are applying to register the equity pledges by the shareholders of the PRC Operating Entities with the relevant offices of the administration for industry and commerce. Although under PRC laws and regulations, the administration for industry and commerce should register a pledge immediately upon receiving a complete application, the registration process could take longer in practice. If the equity pledges are not successfully registered, they would not be deemed as validly created security interests under the PRC Property Rights Law. If the PRC Operating Entities breached their obligations under the agreements with us, there is a risk that we may not be able to successfully enforce the pledges if the Equity Interest Pledge Agreements have not been registered with the relevant administration for industry and commerce.

Risks Related to Doing Business in China

Adverse changes in political and economic policies of the PRC government could have a material adverse effect on the overall economic growth of China, which could reduce the demand for our products and materially and adversely affect our competitive position.

Substantially all of our business operations are conducted in China. Accordingly, our business, results of operations, financial condition and prospects are subject to economic, political and legal developments in China. Although the Chinese economy is no longer a planned economy, the PRC government continues to exercise significant control over China’s economic growth through direct allocation of resources, monetary and tax policies, and a host of other government policies such as those that encourage or restrict investment in certain industries by foreign investors, control the exchange between RMB and foreign currencies, and regulate the growth of the general or specific market. These government involvements have been instrumental in China’s significant growth in the past 30 years. In response to the recent global and Chinese economic downturn, the PRC government has adopted policy measures aimed at stimulating the economic growth in China. If the PRC government’s current or future policies fail to help the Chinese economy achieve further growth or if any aspect of the PRC government’s policies limits the growth of our industry or otherwise negatively affects our business, our growth rate or strategy, our results of operations could be adversely affected as a result.

New labor laws in the PRC may adversely affect our results of operations.

On June 29, 2007, the PRC government promulgated a new labor law, namely, the Labor Contract Law of the PRC, or the New Labor Contract Law, which became effective on January 1, 2008. The New Labor Contract Law imposes greater liabilities on employers and significantly affects the cost of an employer’s decision to reduce its workforce. Further, it requires certain terminations be based upon seniority and not merit. In the event we decide to significantly change or decrease our workforce, the New Labor Contract Law could adversely affect our ability to enact such changes in a manner that is most advantageous to our business or in a timely and cost-effective manner, thus materially and adversely affecting our financial condition and results of operations.

Our failure to fully comply with PRC labor laws exposes us to potential liability.

Companies operating in China must comply with a variety of labor laws, including certain social insurance, housing fund and other staff welfare-oriented payment obligations. There exist uncertainties as to the interpretation, implementation and enforcement of such obligations. If relevant governmental authorities determine that we have not complied fully with such obligations, we may be in violation of applicable PRC labor laws and we cannot assure you that PRC governmental authorities will not impose penalties on us for any failure to comply. In addition, in the event that any current or former employee files a complaint with relevant governmental authorities, we may be subject to making up such staff-welfare oriented obligations as well as paying administrative fines. Our failure to comply with PRC labor laws could expose us to potential liability.

Imposition of trade barriers and taxes may reduce our ability to do business internationally, and the resulting loss of revenue could harm our profitability.

We may experience barriers to conducting business and trade in our targeted emerging markets in the form of delayed customs clearances, customs duties and tariffs. In addition, we may be subject to repatriation taxes levied upon the exchange of income from local currency into foreign currency, substantial taxes on profits, revenues, assets and payroll, as well as value-added tax. The markets in which we plan to operate may impose onerous and unpredictable duties, tariffs and taxes on our business and products, and there can be no assurance that this will not reduce the level of sales that we achieve in such markets, which would reduce our revenues and profits.

Under the Enterprise Income Tax Law, we may be classified as a “Resident Enterprise” of China. Such classification will likely result in unfavorable tax consequences to us and our non-PRC stockholders.

China passed a new Enterprise Income Tax Law, or the EIT Law, and it is implementing rules, both of which became effective on January 1, 2008. Under the EIT Law, an enterprise established outside of China with “de facto management bodies” within China is considered a “resident enterprise,” meaning that it can be treated in a manner similar to a Chinese enterprise for enterprise income tax purposes. The implementing rules of the EIT Law define de facto management as “substantial and overall management and control over the production and operations, personnel, accounting, and properties” of the enterprise.

On April 22, 2009, the State Administration of Taxation of China issued the Notice Concerning Relevant Issues Regarding Cognizance of Chinese Investment Controlled Enterprises Incorporated Offshore as Resident Enterprises pursuant to Criteria of de facto Management Bodies, or the Notice, further interpreting the application of the EIT Law and its implementation to offshore entities controlled by a Chinese enterprise or group. Pursuant to the Notice, an enterprise incorporated in an offshore jurisdiction and controlled by a Chinese enterprise or group will be classified as a “non-domestically incorporated resident enterprise” if (i) its senior management in charge of daily operations reside or perform their duties mainly in China; (ii) its financial or personnel decisions are made or approved by bodies or persons in China; (iii) its substantial assets and properties, accounting books, corporate stamps, board and stockholder minutes are kept in China; and (iv) at least half of its directors with voting rights or senior management often resident in China. A resident enterprise would be subject to an enterprise income tax rate of 25% on its worldwide income and must pay a withholding tax at a rate of 10% when paying dividends to its non-PRC stockholders. However, it remains unclear as to whether the Notice is applicable to an offshore enterprise controlled by a Chinese natural person. Therefore, it is unclear how tax authorities will determine tax residency based on the facts of each case.

If the PRC tax authorities determine that we are a “resident enterprise” for PRC enterprise income tax purposes, a number of unfavorable PRC tax consequences could follow. First, we may be subject to the enterprise income tax at a rate of 25% on our worldwide taxable income as well as PRC enterprise income tax reporting obligations. In our case, this would mean that income such as non-China source income would be subject to PRC enterprise income tax at a rate of 25%. Currently, we do not have any non-China source income. Second, under the EIT Law and its implementing rules, dividends paid to us from our PRC subsidiaries would qualify as “tax-exempt income.” Finally, it is possible that future guidance issued with respect to the new “resident enterprise” classification could result in a situation in which a 10% withholding tax is imposed on dividends we pay to our non-PRC stockholders and with respect to gains derived by our non-PRC stockholders from transferring our shares.

If we were treated as a “resident enterprise” by PRC tax authorities, we would be subject to taxation in both the U.S. and China, and our PRC tax may not be creditable against our U.S. tax.

Uncertainties with respect to the PRC legal system could adversely affect us.

We conduct all of our business through our subsidiaries in China. Our operations in China are governed by PRC laws and regulations. Our PRC subsidiaries are generally subject to laws and regulations applicable to foreign investments in China and, in particular, laws and regulations applicable to wholly foreign-owned enterprises. The PRC legal system is based on statutes. Prior court decisions may be cited for reference but have limited precedential value.

Since 1979, PRC legislation and regulations have significantly enhanced the protections afforded to various forms of foreign investments in China. However, China has not developed a fully integrated legal system and recently enacted laws and regulations may not sufficiently cover all aspects of economic activities in China. In particular, because these laws and regulations are relatively new, and because of the limited volume of published decisions and their nonbinding nature, the interpretation and enforcement of these laws and regulations involve uncertainties. In addition, the PRC legal system is based in part on government policies and internal rules (some of which are not published on a timely basis or at all) that may have a retroactive effect. As a result, we may not be aware of our violation of these policies and rules until sometime after the violation. In addition, any litigation in China may be protracted and result in substantial costs and diversion of resources and management attention.

PRC regulation of loans and direct investment by offshore holding companies to PRC entities may delay or prevent us from using the proceeds of this offering to make loans or additional capital contributions to our PRC operating subsidiaries, which could materially and adversely affect our liquidity and our ability to fund and expand our business.

In utilizing the proceeds of this offering in the manner described in “Use of Proceeds,” as an offshore holding company of our PRC operating subsidiaries, we may make loans to our PRC subsidiaries, or we may make additional capital contributions to our PRC subsidiaries. Any loans to our PRC subsidiaries are subject to PRC regulations. For example, loans by us to our subsidiaries in China, which are FIEs, to finance their activities cannot exceed statutory limits and must be registered with the State Administration of Foreign Exchange, or SAFE. On August 29, 2008, SAFE promulgated Circular 142, a notice regulating the conversion by a foreign-invested company of foreign currency into RMB by restricting how the converted RMB may be used. The notice requires that RMB converted from the foreign currency-denominated capital of a foreign-invested company may only be used for purposes within the business scope approved by the applicable governmental authority and may not be used for equity investments within the PRC unless such investments are otherwise provided for in the business scope. The foreign currency-denominated capital shall be verified by an accounting firm before converting into RMB. In addition, SAFE strengthened its oversight over the flow and use of RMB funds converted from the foreign currency-denominated capital of a foreign-invested company. To convert such capital into RMB, the foreign-invested company must report the use of such RMB to the bank, and the RMB must be used to the reported purposes. According to Circular 142, change of the use of such RMB without approval is prohibited. In addition, such RMB may not be used to repay RMB loans if the proceeds of such loans have not yet been used. Violations of Circular 142 may result in severe penalties, including substantial fines as set forth in the Foreign Exchange Administration Rules.

We may also decide to finance our subsidiaries by means of capital contributions. These capital contributions must be approved by the Ministry of Commerce of China, or MOFCOM, or its local counterpart. We may not be able to obtain these government approvals on a timely basis, if at all, with respect to future capital contributions by us to our PRC subsidiaries. If we fail to receive such approvals, we will not be able to use the proceeds of this offering and capitalize our PRC operations, which could adversely affect our liquidity and our ability to fund and expand our business.

Governmental control of currency conversion may affect the value of your investment.

The PRC government imposes controls on the convertibility of the RMB into foreign currencies and, in certain cases, the remittance of currency out of China. We receive substantially all of our revenues in RMB. Under our current corporate structure, our income is primarily derived from dividend payments from our PRC subsidiaries. Shortages in the availability of foreign currency may restrict the ability of our PRC subsidiaries to remit sufficient foreign currency to pay dividends or other payments to us, or otherwise satisfy their foreign currency denominated obligations. Under existing PRC foreign exchange regulations, payments of current account items, including profit distributions, interest payments and expenditures from trade-related transactions can be made in foreign currencies without prior approval from SAFE by complying with certain procedural requirements. However, approval from appropriate government authorities is required where RMB is to be converted into foreign currency and remitted out of China to pay capital expenses such as the repayment of loans denominated in foreign currencies. The PRC government may also at its discretion restrict access in the future to foreign currencies for current account transactions. If the foreign exchange control system prevents us from obtaining sufficient foreign currency to satisfy our currency demands, we may not be able to pay dividends in foreign currencies to our security-holders.

Fluctuation in the value of the RMB may have a material adverse effect on the value of your investment.