Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Stagwell Inc | v327388_8-k.htm |

| EX-99.1 - EXHIBIT 99.1 - Stagwell Inc | v327388_ex99-1.htm |

Management Presentation November 5 , 2012 Third Quarter 2012 Results

This presentation, including our “ 2012 Financial Outlook”, contains forward - looking statements . The Company’s representatives may also make forward - looking statements orally from time to time . Statements in this presentation that are not historical facts, including statements about the Company’s beliefs and expectations, earnings guidance, recent business and economic trends, potential acquisitions, estimates of amounts for deferred acquisition consideration and “put” option rights, constitute forward - looking statements . These statements are based on current plans, estimates and projections, and are subject to change based on a number of factors, including those outlined in this section . Forward - looking statements speak only as of the date they are made, and the Company undertakes no obligation to update publicly any of them in light of new information or future events, if any . Forward - looking statements involve inherent risks and uncertainties . A number of important factors could cause actual results to differ materially from those contained in any forward - looking statements . Such risk factors include, but are not limited to, the following : • risks associated with severe effects of international, national and regional economic downturn ; • the Company’s ability to attract new clients and retain existing clients; • the spending patterns and financial success of the Company’s clients; • the Company’s ability to remain in compliance with its debt agreements and the Company’s ability to finance its contingent pa yme nt obligations when due and payable, including but not limited to those relating to “put” option rights and deferred acquisition consideration; • the successful completion and integration of acquisitions which compliment and expand the Company’s business capabilities; an d • foreign currency fluctuations. The Company’s business strategy includes ongoing efforts to engage in material acquisitions of ownership interests in entities in the marketing communications services industry . The Company intends to finance these acquisitions by using available cash from operations and through incurrence of bridge or other debt financing, either of which may increase the Company’s leverage ratios, or by issuing equity, which may have a dilutive impact on existing shareholders proportionate ownership . At any given time the Company may be engaged in a number of discussions that may result in one or more material acquisitions . These opportunities require confidentiality and may involve negotiations that require quick responses by the Company . Although there is uncertainty that any of these discussions will result in definitive agreements or the completion of any transactions, the announcement of any such transaction may lead to increased volatility in the trading price of the Company’s securities . Investors should carefully consider these risk factors and the additional risk factors outlined in more detail in the Annual Report on Form 10 - K under the caption “Risk Factors” and in the Company’s other SEC filings . FORWARD LOOKING STATEMENTS & OTHER INFORMATION

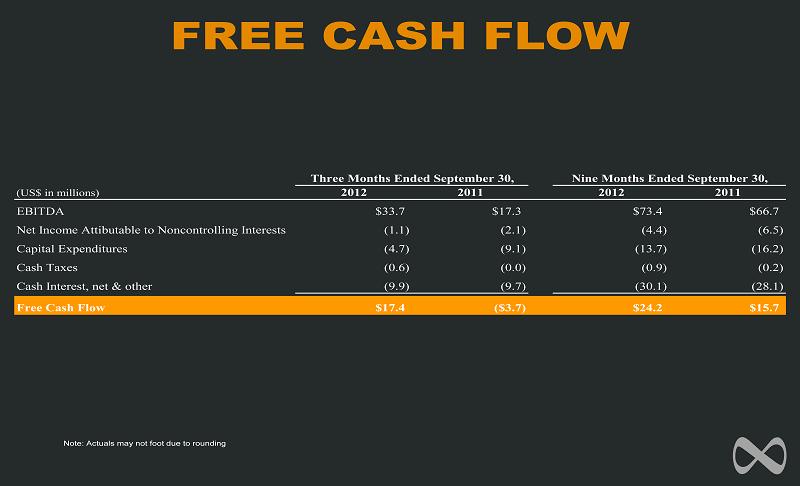

KEY HIGHLIGHTS • Organic revenue growth of 6.7% for Q3 2012 and 7.2% YTD • Q3 2012 revenue increased 13.6% • YTD revenue increased 13.2% • Q3 2012 EBITDA increased 94.7% • YTD EBITDA increased 10.0% • EBITDA margin expanded 530 basis points year over year to 12.6% in Q3 2012 • Net new business wins of $103.2 million YTD, an increase of 36.4% • Free Cash Flow increased 54.2% to $24.2 million YTD • On track to achieve full year financial guidance, including our target net - debt to EBITDA ratio of 3.0 to 3.5 times by year end

CONSOLIDATED REVENUE AND EARNINGS Note: Actuals may not foot due to rounding (US$ in millions, except percentages) 2012 2011 2012 2011 Revenue 267.8$ 235.7$ 13.6 % 777.3$ 686.3$ 13.2 % Operating Expenses Cost of services sold 180.9 173.5 4.2 % 546.1 489.2 11.6 % Office and general expenses 73.2 55.4 32.1 % 207.3 152.1 36.3 % Depreciation and amortization 12.4 9.8 27.2 % 36.1 29.6 21.7 % Operating profit (Loss) 1.3 (3.0) NM % (12.2) 15.4 NM % Other (expense), net (12.0) (13.9) (35.5) (33.2) Income tax expense 2.2 (0.0) 6.0 0.9 Equity in earnings of non-consolidated affiliates 0.1 (0.1) 0.4 0.2 Loss from Continuing Operations (12.7) (16.9) (53.3) (18.5) Loss from discontinued operations, net of taxes (0.6) (0.6) (3.2) (1.9) Net loss (13.4) (17.5) (56.5) (20.4) Net income attributable to the non- controlling interests (1.1) (2.1) (4.4) (6.5) Net loss attributable to MDC Partners Inc. (14.5)$ (19.6)$ (60.9)$ (26.9)$ % Change Three Months Ended September 30, Nine Months Ended September 30, % Change

SUMMARY OF SEGMENT RESULTS - REVENUE • Strategic Marketing Services delivered 12.5% organic growth, an acceleration of 180 basis points from 2Q 2012 • Strong new business wins year to date adds visibility to future revenue growth (US$ in millions, except percentages) 2012 2011 2012 2011 Revenue Strategic Marketing Services 176.7$ 146.1$ 20.9 % 520.5$ 442.6$ 17.6 % Performance Marketing Services 91.1 89.6 1.8 % 256.8 243.8 5.3 % Total Revenue 267.8$ 235.7$ 13.6 % 777.3$ 686.3$ 13.2 % % Change Three Months Ended September 30, Nine Months Ended September 30, % Change

THIRD QUARTER 2012 REVENUE GROWTH BY SEGMENT Strategic Performance Weighted Marketing Marketing Average Services Services Total Organic Growth 12.5% -2.9% 6.7% Acquisition Growth 8.7% 5.0% 7.3% Foreign Exchange Growth -0.3% -0.4% -0.4% Total 20.9% 1.7% 13.6%

YEAR TO DATE 2012 REVENUE GROWTH BY SEGMENT Strategic Performance Weighted Marketing Marketing Average Services Services Total Organic Growth 10.7% 1.1% 7.2% Acquisition Growth 7.5% 4.9% 6.6% Foreign Exchange Growth -0.6% -0.7% -0.6% Total 17.6% 5.3% 13.2%

THIRD QUARTER REVENUE BY CLIENT SECTOR Note: Actuals may not foot due to rounding Q3 2012 Q3 2011 Consumer Products, 32% Retail, 17% Communications, 12% Other, 12% Financials, 8% Technology, 8% Healthcare, 5% Auto, 6% Consumer Products, 32% Retail, 15% Communications, 13% Other, 12% Financials, 9% Technology, 10% Healthcare, 5% Auto, 4%

Outperformance Despite More Difficult Comparisons Note: *Peers include Omnicom, Publicis , Interpublic, WPP, and Havas *Due to timing of earnings, Havas is not included 3 Q12 ORGANIC GROWTH 3 Q12 +6.7% -10.0% -5.0% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% MDC Partners vs. Peers Trailing 12 Month Organic Revenue MDC Peers

SUMMARY OF SEGMENT RESULTS - EBITDA Note: Actuals may not foot due to rounding (US$ in millions, except percentages) 2012 2011 2012 2011 EBITDA Strategic Marketing Services 29.9$ 10.3$ 191.4 % 69.1$ 55.0$ 25.7 % margin 16.9% 7.0% 13.3% 12.4% Performance Marketing Services 8.9 11.8 (24.2) % 19.6 25.1 (21.9) % margin 9.8% 13.1% 7.6% 10.3% Marketing Communications 38.8 22.0 76.3 % 88.7 80.1 10.7 % margin 14.5% 9.3% 11.4% 11.7% Corporate Expenses (5.5) (4.8) 14.4 % (15.8) (13.9) 13.9 % Profit Distributions from Affiliates 0.4 0.1 0.5 0.5 Total EBITDA 33.7$ 17.3$ 94.7 % 73.4$ 66.7$ 10.0 % margin 12.6% 7.3% 9.4% 9.7% % Change Three Months Ended September 30, Nine Months Ended September 30, % Change

FREE CASH FLOW Note: Actuals may not foot due to rounding (US$ in millions) 2012 2011 2012 2011 EBITDA $33.7 $17.3 $73.4 $66.7 Net Income Attibutable to Noncontrolling Interests (1.1) (2.1) (4.4) (6.5) Capital Expenditures (4.7) (9.1) (13.7) (16.2) Cash Taxes (0.6) (0.0) (0.9) (0.2) Cash Interest, net & other (9.9) (9.7) (30.1) (28.1) Free Cash Flow $17.4 ($3.7) $24.2 $15.7 Three Months Ended September 30, Nine Months Ended September 30,

LIQUIDITY (US$ in millions) Commitment Under Facility 150.0$ Drawn 124.5 Letters of Credit 5.0 Total Cash 72.8 Available Liquidity at September 30, 2012

2012 FINANCIAL OUTLOOK Implied 2012 Year over Year Guidance Change Revenue $1,050 - $1,075 million +11.3% to +14.0% EBITDA $110 - $115 million +21.2% to +26.7% Free Cash Flow $35 - $40 million +50.8% to +72.3% + Change in Working Capital and Other +$25 million Total Free Cash Flow $60 - $65 million +10.6% to +19.8% Implied EBITDA Margin 10.5% - 10.7% +90 to +110 basis points Note: See appendix for definitions of non-GAAP measures

APPENDIX

TEMPORAL PUT OBLIGATIONS AND IMPACT ON EBITDA Note: Excludes put rights of $82.5 million exercisable pursuant to termination of employment or death. Incremental (US$ in millions) Cash Stock Total EBITDA in Period 2012 1.6 0.4 2.0 1.4 2013 1.8 0.5 2.3 0.3 2014 2.6 0.9 3.5 0.6 2015 3.3 0.5 3.8 1.2 Thereafter 6.0 0.4 6.4 0.6 Total $15.3 $2.7 $18.0 $4.1 Effective Multiple 4.4 Estimated Put Impact at September 30, 2012 Payment Consideration

SUMMARY OF CASH FLOW Note: Actuals may not foot due to rounding (US$ in millions) 2012 2011 Cash flows provided by (used in) continuing operating activities $18.1 ($3.8) Discontinued operations (2.3) (2.4) Net cash provided by (used in) operating activies $15.8 ($6.2) Cash flows provided by (used in) continuing investing activities $13.7 ($37.7) Discontinued operations 0.0 (0.3) Net cash provided by (used in) investing activities $13.8 ($37.9) Net cash provided by financing activities $35.1 $41.2 Effect of exchange rate changes on cash and cash equivalents ($0.0) ($0.7) Net increase (decrease) in cash and cash equivalents $64.7 ($3.6) Nine Months Ended September 30,

DEFINITION OF NON - GAAP MEASURES • EBITDA: EBITDA is a non - GAAP measure, that represents operating profit plus depreciation and amortization, stock - based compensation, acquisition deal costs, deferred acquisition consideration adjustments and profit distributions from affiliates . • Organic Growth: Organic revenue growth is a non - GAAP measure that refers to growth in revenues from sources other than acquisitions or foreign exchange impacts. • Free Cash Flow: Free cash flow is a non - GAAP measure that represents EBITDA less net income attributable to noncontrolling interests, less capital expenditures net of landlord reimbursements, less net cash interest (including interest paid and to be paid on the 11% Senior Notes), less cash taxes plus realized cash foreign exchange gains. • Total Free Cash Flow: Total free cash flow is a non - GAAP measure that represents free cash flow plus changes in working capital plus other changes in cash. • Net Bank Debt or Net Debt: Debt due pertaining to the revolving credit facility plus debt pertaining to the Senior Notes less total cash and cash equivalents. Note: A reconciliation of Non - GAAP to US GAAP reported results has been provided by the Company in the tables included in the earnings release issued on November 5, 2012.