Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FNB CORP/PA/ | d433221d8k.htm |

Vincent J. Delie,

Jr. President and Chief Executive Officer

Vincent J. Calabrese, Jr.

Chief Financial Officer

F.N.B. Corporation

Investor Presentation

Third Quarter 2012

Dated: November 5, 2012

Exhibit 99.1 |

Cautionary Statement Regarding Forward-Looking Information

and Non-GAAP Financial Information

2

This presentation and the reports F.N.B. Corporation files with the Securities and Exchange

Commission often contain “forward-looking statements” relating to

present or future trends or factors affecting the banking industry and, specifically, the financial operations, markets and products of F.N.B.

Corporation. These forward-looking statements involve certain risks and uncertainties.

There are a number of important factors that could cause F.N.B. Corporation’s

future results to differ materially from historical performance or projected performance. These factors include, but are not limited to: (1) a

significant increase in competitive pressures among financial institutions; (2) changes in the

interest rate environment that may reduce interest margins; (3) changes in prepayment

speeds, loan sale volumes, charge-offs and loan loss provisions; (4) general economic conditions; (5) various monetary and

fiscal policies and regulations of the U.S. government that may adversely affect the

businesses in which F.N.B. Corporation is engaged; (6) technological issues which may

adversely affect F.N.B. Corporation’s financial operations or customers; (7) changes in the securities markets; (8) risk factors

mentioned in the reports and registration statements F.N.B. Corporation files with the

Securities and Exchange Commission; (9) housing prices; (10) job market; (11) consumer

confidence and spending habits; (12) estimates of fair value of certain F.N.B. Corporation assets and liabilities; (13) in connection

with the pending merger with Annapolis Bancorp, Inc., difficulties encountered in expanding

into a new market; or (14) the effects of current, pending and future legislation,

regulation and regulatory actions. F.N.B. Corporation undertakes no obligation to revise these forward-looking statements or to

reflect events or circumstances after the date of this presentation. To

supplement its consolidated financial statements presented in accordance with Generally Accepted Accounting Principles (GAAP), the Corporation

provides additional measures of operating results, net income and earnings per share (EPS)

adjusted to exclude certain costs, expenses, and gains and losses. The

Corporation believes that these non-GAAP financial measures are appropriate to enhance the understanding of its past performance

as well as prospects for its future performance. In the event of such a disclosure or

release, the Securities and Exchange Commission’s Regulation G requires: (i)

the presentation of the most directly comparable financial measure calculated and presented in accordance with GAAP and (ii) a

reconciliation of the differences between the non-GAAP financial measure presented and the

most directly comparable financial measure calculated and presented in accordance with

GAAP. The required presentations and reconciliations are contained herein and can be found at our website,

www.fnbcorporation.com, under “Shareholder and Investor Relations” by clicking on

“Non-GAAP Reconciliation.”

The Appendix to this presentation contains non-GAAP financial measures used by the

Corporation to provide information useful to investors in understanding the

Corporation's operating performance and trends, and facilitate comparisons with the performance of the Corporation's peers. While

the Corporation believes that these non-GAAP financial measures are useful in evaluating

the Corporation, the information should be considered supplemental in nature and not as

a substitute for or superior to the relevant financial information prepared in accordance with GAAP. The non-GAAP

financial measures used by the Corporation may differ from the non-GAAP financial measures

other financial institutions use to measure their results of operations. This

information should be reviewed in conjunction with the Corporation’s financial results disclosed on October 22, 2012 and in its

periodic filings with the Securities and Exchange Commission. |

Additional Information About the Merger

3

ADDITIONAL INFORMATION ABOUT THE MERGER

F.N.B.

Corporation

and

Annapolis

Bancorp,

Inc.

will

file

a

proxy

statement/prospectus

and

other

relevant

documents

with

the

SEC

in

connection

with

the

merger.

SHAREHOLDERS OF ANNAPOLIS BANCORP, INC. ARE ADVISED TO READ THE PROXY STATEMENT/PROSPECTUS

WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL

AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION.

The proxy statement/prospectus and other relevant materials (when they become available), and

any other documents F.N.B. Corporation has filed with the SEC, may be obtained

free

of

charge

at

the

SEC's

website

at

www.sec.gov.

In

addition,

investors

and

security

holders

may

obtain

free

copies

of

the

documents

F.N.B.

Corporation

has

filed with the SEC by contacting James Orie, Chief Legal Officer, F.N.B. Corporation,

One F.N.B. Boulevard, Hermitage, PA 16148, telephone: (724) 983-3317; and free

copies of the documents Annapolis Bancorp, Inc. has filed with the SEC by contacting Edward

Schneider , Treasurer and CFO, Annapolis Bancorp, Inc., 1000 Bestgate Road, Suite

400, Annapolis, MD 21401, telephone: (410) 224-4455. F.N.B. Corporation and

Annapolis Bancorp, Inc. and certain of their directors and executive officers may be deemed to be participants in the solicitation of proxies from its

shareholders

in

connection

with

the

proposed

merger.

Information

concerning

such

participants'

ownership

of

Annapolis

Bancorp,

Inc.

common

stock

will

be

set

forth

in the

proxy

statement/prospectus

relating

to

the

merger

when

it

becomes

available.

This

communication

does

not

constitute

an

offer

of

any

securities

for

sale. |

4

F.N.B. Corporation |

Key

Facts 5

Attractive Footprint

–

#3 Market Share in the Pittsburgh MSA

–

Banking locations network spanning 45 counties

NYSE Listed

–

Market Cap of $1.5 Billion

–

Member S&P SmallCap 600 Index

Fourth Largest Pennsylvania-Based Bank

–

Assets

$12.0 Billion

–

Loans

$8.0 Billion

–

Deposits

$10.0 Billion

–

Banking Locations

266

–

Consumer Finance Locations

71

–

Headquarters

Hermitage, PA

Diverse Fee Income Sources with

Complementary Business Lines

–

Business and Personal Banking

–

Wealth Management

–

Insurance

–

Commercial Equipment Leasing

–

Merchant Banking

Diversified Financial Institution with a Network of Banking Locations

Spanning 45 Counties in Pennsylvania, Northeastern Ohio and West

Virginia

•

First National Bank Location

Ohio

Pennsylvania |

Key

Investment Considerations 6

Strong Performance

Positioning for Sustained Growth

1.

Experienced leadership, compelling core competencies and a sustainable business model

2.

Clear market position strategy

3.

Consistent, strong operating results

4.

Ongoing reposition and reinvest focus

5.

Proven and disciplined acquisition strategy

6.

Investment thesis and high quality earnings creates P/E expansion opportunity

|

Years of

Banking

Experience

Joined FNB

Prior Experience

President and CEO

Vincent J. Delie, Jr.

25

2005

National City

President, First National Bank

John C. Williams, Jr.

41

2008

National City, Mellon Bank

Chief Financial Officer

Vincent J. Calabrese, Jr.

24

2007

People’s United

Chief Credit Officer

Gary L. Guerrieri

26

2002

FNB, Promistar

Leadership

7

Experienced and respected executive management team |

Core

Competencies 8

Proven success and solid foundation for sustainable growth opportunities

Core

Competency

Proven

Sustainable

Commercial

Bank -

Strong

C&I Focus

3Q12 marks fourteen consecutive quarters of organic commercial

loan

growth

(1)

C&I

loan

portfolio

comprises

34%

of

the

total

loan

portfolio

(2)(3)

People: Experienced team

of bankers built over the

past several years

Process: Proprietary, cross-

functional and enterprise-

wide sales management

process

Positioning: Attractively

positioned in markets with

growth potential

Products: Unique ability to

deliver a sophisticated

product set while

maintaining a local,

community bank culture

Consumer

Product

Distribution

Strong cross-functional and cross-sell focus

Customer-based funding comprises 98% of total deposits and

borrowings

(2)

Low Risk Profile

Operating

Strategy

Balance growth strategy with a low risk profile

Consistent, better-than-peers asset quality results

Proven,

Disciplined,

Strategic

Acquirer

Nine bank acquisitions completed since 2002 with two completed

since the beginning of 2011

Acquisition of Annapolis Bancorp, Inc. announced 10/22/2012

Acquisition evaluation guided by disciplined capital recoupment

and operating EPS accretion hurdles

Well-positioned in strategically important markets

(1)

Organic,

linked-quarter

growth

for

the

Pennsylvania

commercial

portfolio;

(2)

As

of

September

30,

2012;

(3)

Represents

C&I

and

owner-occupied

CRE |

Sustainable Business Model

9

Sustainable Business Model

Disciplined Risk

Management

Maintain low risk

profile

Target neutral interest

rate risk position

Fund loan growth with

deposits

Adhere to consistent

underwriting and

pricing standards

Maintain rigid

expense control

Efficient capital

management

Growth

Oriented

Organic growth driven

by:

Investments in

people, product

development, high-

growth potential

market segments

Acquisition-related

growth:

FNB

Culture

Attract, retain and

develop top talent

Foster a strong cross-

sell environment

Holistic incentive

compensation

structure supports

cross-functional focus

Regularly monitor

external and internal

service excellence,

quality and

satisfaction

Recognize

accomplishments and

innovation

Shareholder

Value

Disciplined, growth

oriented focus guided

by commitment to

shareholder value

Long-term investment

thesis centered on:

Best-in-class,

enterprise-wide

sales management

Deep product set

Disciplined,

strategic, accretive

Targeted EPS

growth

Strong dividend |

4.30%

3.20%

10.00%

6.70%

5.20%

1.20%

3.40%

11.60%

9.20%

8.70%

6.80%

5.93%

7.21%

8.90%

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

14.00%

Pennyslvania Commercial Portfolio

Industry Leading Loan Growth

10

13

th

consecutive quarter of total loan growth

14

th

consecutive quarter of Pennsylvania commercial portfolio growth

(1)

Reflects linked-quarter average organic loan growth results on an annualized basis,

excluding reductions in the Florida commercial portfolio Total Loans

(1)

(1)

Over three years of consecutive quarterly organic loan growth accomplished

1.50%

5.60%

2.10%

3.90%

5.20%

4.40%

6.60%

5.70%

8.00%

6.00%

2.64%

4.36%

6.90%

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

7.00%

8.00%

9.00%

FNB Excl Non-Core Florida Portfolio

(1)

PA Commercial Loans

(1) |

Strong Profitability Trends

11

Return on Average Tangible Equity

(1)

Return on Average Tangible Assets

(1)

Peer data per SNL Financial, refer to Appendix for peer listing

(1) Operating ROTE and ROTA for FNB, excludes merger and severance costs and certain other

one-time items, refer to Non-GAAP Reconciliation included under Supplemental

Information 18.51%

16.32%

14.71%

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

14.00%

16.00%

18.00%

20.00%

3Q12 YTD

2011

2010

FNB

Peer Group Median

1.10%

1.02%

0.87%

0.00%

0.20%

0.40%

0.60%

0.80%

1.00%

1.20%

3Q12 YTD

2011

2010

FNB

Peer Group Median |

12

Market Position and Opportunity |

Top

Overall Market Position 13

Source: SNL Financial, deposit data as of June 30, 2012, pro-forma as of October 26,

2012, excludes custodian bank FNB Counties of Operation

Rank

Institution

Branch

Count

Total Market Deposits

($ 000)

Total Market Share

(%)

1

PNC Financial Services Group

367

53,477,806

30.3

2

Royal Bank of Scotland Group, PLC

227

10,728,368

6.1

3

F.N.B. Corporation

274

9,437,811

5.3

4

M&T Bank Corp.

152

8,603,725

4.9

5

Huntington Bancshares, Inc.

127

6,172,157

3.5

6

Wells Fargo & Co.

76

5,575,216

3.2

7

First Commonwealth Financial

101

3,957,651

2.2

8

Banco Santander

75

3,854,650

2.2

9

Dollar Bank Federal Savings Bank

40

3,665,400

2.1

10

Susquehanna Bancshares

84

3,172,621

1.8

Total (1-188)

3,035

176,528,069

100.0

FNB

holds

the

#3

overall

retail

market

position

for

all

counties

of

operation

–

with

significant

opportunities present for continued market share gains |

Top

Position in a Major Metropolitan Market 14

Source: MSA population per U.S. Census Bureau 2010 data; Deposit market share per SNL

Financial as of June 30, 2012, pro-forma as of October 8, 2012 (1) Excludes

custodian bank Population

Rank

MSA

(000's)

#1

#2

#3

1

New York

(1)

18,897

JPM

BofA

Citi

2

Los Angeles

12,829

BofA

Wells Fargo

Mitsubishi UFJ

3

Chicago

9,461

JPM

BMO

BofA

4

Dallas

6,372

BofA

JPM

Wells Fargo

5

Philadelphia

5,965

TD

Wells Fargo

HSBC

6

Houston

5,947

JPM

Wells Fargo

BofA

7

Washington

5,582

Capital One

Wells Fargo

BofA

8

Miami

5,565

Wells Fargo

BofA

Citi

9

Atlanta

5,269

SunTrust

Wells Fargo

BofA

10

Boston

4,552

BofA

RBS

Banco Santander

11

San Francisco

4,335

BofA

Wells Fargo

Citi

12

Detroit

4,296

JPM

Comerica

BofA

13

Riverside

4,225

BofA

Wells Fargo

JPM

14

Phoenix

4,193

Wells Fargo

JPM

BofA

15

Seattle

3,440

BofA

Wells Fargo

U.S. Bancorp

16

Minneapolis

(1)

3,280

Wells Fargo

U.S. Bancorp

TCF

17

San Diego

3,095

Wells Fargo

Mitsubishi UFJ

BofA

18

St. Louis

2,813

U.S. Bancorp

BofA

Commerce

19

Tampa

2,783

BofA

Wells Fargo

SunTrust

20

Baltimore

2,710

BofA

M&T

PNC

21

Denver

2,543

Wells Fargo

FirstBank

U.S. Bancorp

22

Pittsburgh

(1)

2,356

PNC

RBS

23

Portland

2,226

BofA

U.S. Bancorp

Wells Fargo

24

Sacramento

2,149

Wells Fargo

BofA

U.S. Bancorp

25

San Antonio

2,143

Cullen/Frost

BofA

Wells Fargo

Top 3 Banks in MSA by Deposit Market Share

FNB is uniquely

positioned as

one of only very

few community

banks to hold a

Top 3 deposit

market rank in

one of the

nation’s 25

largest

metropolitan

statistical areas.

F.N.B. Corporation |

Pittsburgh Market Opportunity

15

Pittsburgh, PA

FNB Presence

Strong FNB Presence

Pittsburgh MSA Market

Deposits

(1)

$3.5 billion

% of FNB Total Deposits

(1)

39%

Deposit Market Share

(1) (2)/

Rank

4.5% / #3

Market

Deposits

(2)

$96.7 billion

Population

(2)

2.4 million

Households

(2)

1.0 million

(1) As of June 30, 2012; Market Share Rank excludes custodian bank; (2) Data per SNL; (3)

Source: PittsburghToday.org 4-Year % Change in Jobs

Sept. 2008 –

Sept. 2012

(3)

1-Year Housing

Appreciation

Unemployment Rate

(3)

1

Quarter 2012

st

–

22

nd

largest

based

on

population

–

16

th

largest

based

on

deposits

–

Favorable economic trends that have

outperformed much of nation

(3)

–

#3 market retail rank

–

Regional headquarters accommodating all

lines of business |

Pittsburgh Market Position Timeline

16

Successful execution of an organic and acquisition growth strategy in the Pittsburgh

market 2004

2008

2009

2011

2003

2002

2005

2006

2007

2010

Iron &

Glass

Bancorp

Deposits:

$0.2 bn

Parkvale

Financial

Deposits:

$1.5 bn

Promistar

Financial

(Market

Entry)

Deposits:

$0.6 bn

Slippery

Rock

Deposits:

$0.2 bn

NSD

Bancorp

Deposits:

$0.4 bn

Invest in

Downtown Pittsburgh

Regional Headquarters

Relocate Wealth

Management and Insurance

to Downtown Pittsburgh

Lift-out of

Asset-Based

Lending

Group from

RBS Citizens

Bank

Acquisitions:

Other

Actions:

Lift-out of

Commercial

Banking Team

from

National City

12/31/2001:

Market Rank #34

Deposits

(1)

: $161 mm

Employees (FTE): 40

9/30/2012:

Market Rank #3

Deposits

(1)

: $3.5 bn

Employees (FTE): 592

2012

(1) Source: SNL Financial as of June 30 of each respective year |

Market Opportunity

17

Note: Above metrics at the MSA level

(1)

Data per Hoover’s as of October 29, 2012

(2)

Data per SNL Financial

1,000,755

852,488

223,760

230,329

227,644

1,042,841

200,000

400,000

600,000

800,000

1,000,000

1,200,000

# of Households

$45,359

$46,212

$53,289

$41,077

$39,404

$62,687

$0

$10,000

$20,000

$30,000

$40,000

$50,000

$60,000

$70,000

Median Household Income

2,356,285

2,077,240

549,745

563,631

565,773

2,710,489

-

500,000

1,000,000

1,500,000

2,000,000

2,500,000

3,000,000

Population

9,699

9,142

2,160

2,016

1,939

10,690

-

2,000

4,000

6,000

8,000

10,000

12,000

# of Companies with Revenue Greater Than $1 Million

(2)

(2)

(1)

(2)

- |

Marcellus and Utica Shale Exposure

18

(1) Sources: www.marcellus.psu.edu, retrieved May 31, 2012; (2) www.dnr.state.oh.us, retrieved

May 31, 2012; (3) Sterne Agee June 7, 2010 and FBR Capital Markets, March 2,

2011. FNB is well-positioned in the Marcellus Shale and Utica

Shale regions with a Pennsylvania footprint that closely

aligns with the Marcellus Shale concentration and

exposure to the Utica Shale region in Ohio.

FNB has been noted by analysts as being one of the

best geographically positioned banks to benefit from

the Marcellus Shale.

(3)

This presents opportunity for FNB given the expected

positive economic lift across much of FNB’s footprint.

FNB Banking Locations

Pennsylvania

Ohio

Ohio Utica Shale Well Locations

(2)

(1) |

Marcellus and Utica Shale FNB Strategic Focus

19

Opportunity for FNB relates to potential indirect and induced economic benefits across

footprint Direct Effect:

Oil and Gas

Directly associated with the extraction, processing and

delivery of the gas

Drilling, extraction and support activities

Indirect Effect:

Supply Chain

Provides goods and services to the energy industry

e.g.: Iron and steel, transportation, commodity traders,

heavy equipment, surveyors, utilities, rig parts,

attorneys, real estate, machinery manufacturers, etc.

Induced Benefit:

Consumption

Resulting benefit to industries and individuals from

positive direct and indirect effects

e.g.: Higher education, travel, housing, food and drink,

entertainment, utilities, etc.

FNB

Strategic Focus:

Supply Chain and

Consumption |

20

Strong Operating Results |

3Q12 Operating Highlights

21

3Q12

2Q12

3Q11

Consistent

Earnings

Growth

Net income

$30,743

$29,130

$23,773

Earnings per diluted share

$0.22

$0.21

$0.19

Profitability

Performance

ROTE

(1)

19.10%

19.01%

16.23%

ROTA

(1)

1.03%

1.00%

0.95%

Net interest margin

3.70%

3.80%

3.79%

Efficiency ratio

56.8%

57.7%

59.0%

Strong

Organic

Balance Sheet

Growth

Trends

(2)

Total loan growth

(3)

6.9%

4.4%

8.1%

Commercial loan growth

(3)

8.9%

7.2%

8.7%

Consumer loan growth

12.0%

8.3%

9.1%

Transaction

deposits

and

customer

repo

growth

(4)

8.7%

14.3%

5.6%

(1) ROTE and ROTA are non-GAAP measures, refer to Non-GAAP Reconciliation included

under Supplemental Information; (2)Average, annualized linked quarter organic growth

results; (3)Excludes the Florida commercial portfolio; (4)Excludes time deposits |

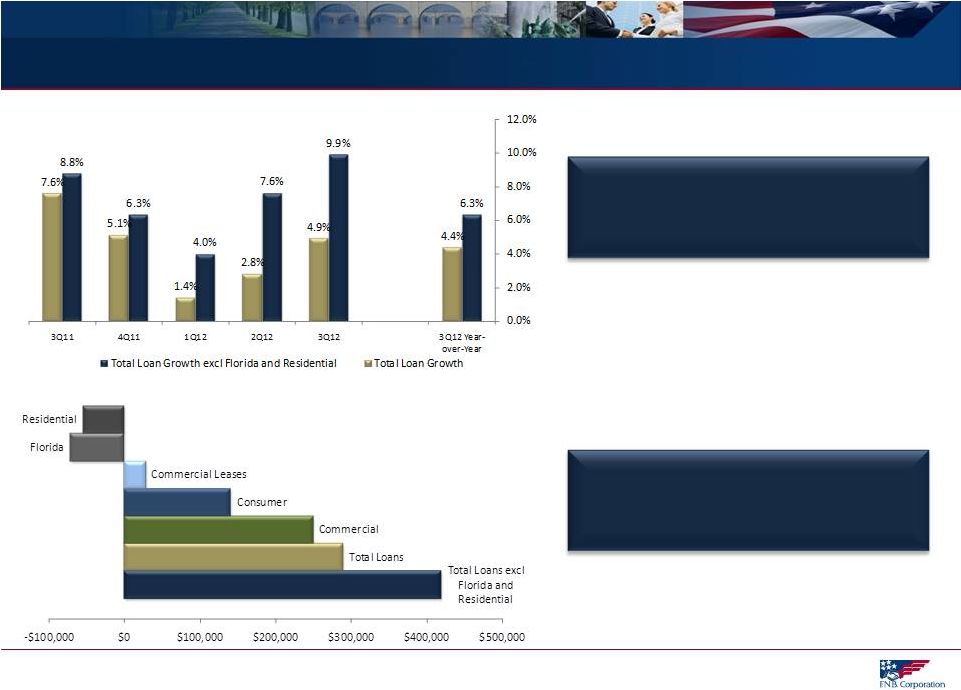

Sustained Loan Growth Momentum

22

(1)

Average, linked-quarter organic growth results

(2)

Year-over-year (Y-o-Y) organic growth results by portfolio, $ in

millions (3)

The Florida portfolio is an exit-strategy portfolio, the residential portfolio has

experienced accelerated pre-payment speeds and expected declines following the

Parkvale acquisition. Positive loan growth results despite

declines in the Florida portfolio and the

residential

mortgage

portfolio

(3)

Strong year-over-year results for FNB’s

commercial and consumer portfolios

Linked

Quarter

and

Y-o-Y

Loan

Growth

(%)

(1)

Y-o-Y

Loan

Growth

($)

(2) |

Positive Operating

Trends: Pre-Provision Net Revenue Results 23

21%

Year-over-Year

PPNR

Growth

9%

$147,993

$122,014

$

-

$20,000

$40,000

$60,000

$80,000

$100,000

$120,000

$140,000

$160,000

3Q12

YTD

3Q11 YTD

$1.05

$0.96

$0.90

$0.92

$0.94

$0.96

$0.98

$1.00

$1.02

$1.04

$1.06

$1.08

3Q12 YTD

3Q11 YTD

Pre-Provision Net Revenue EPS

Pre-Provision Net Revenue

9%

Year-over-Year

PPNR EPS

Growth

21%

Pre-provision net revenue (PPNR) represents net interest income (FTE), plus

non-interest income (excluding securities gains and losses and OTTI) less non-

interest expense. Non-interest income and non-interest expense have been

adjusted to exclude certain non-operating items, refer to appendix for calculation. |

Net

Interest Margin 24

Net Interest Margin Trend

Parkvale

Acquisition

1/1/2012

Net interest margin results reflects effective interest rate risk management

Consistent loan and transaction deposit growth contributes to stability in the net interest

margin 3Q12 and 2Q12 margin included the benefit of $1.4 million and $2.5 million,

respectively, in accretable yield on acquired loans.

Total

variable

and

adjustable-rate

loans

total

59.6%

of

total

loans

at

both

September

30,

2012

and

December 31, 2011

3.65%

3.70%

0.05%

0.10%

3.70%

3.80%

3.74%

3.79%

3.79%

3.00%

3.20%

3.40%

3.60%

3.80%

4.00%

3Q12

2Q12

1Q12

4Q11

3Q11

Core Net Interest Margin

Accretable Yield |

Asset Quality Results

(1)

25

$ in thousands

3Q12

2Q12

3Q11

3Q12 Highlights

NPL’s+OREO/Total loans+OREO

1.69%

1.93%

2.48%

Overall results reflect the consistent,

solid performance of the core portfolios

(Pennsylvania and Regency portfolios,

representing 99.1% of total loans)

Non-performing loans plus OREO

declined $13.3 million or 10.1%

Provision for loan losses

$6.2 million for the originated

portfolios

$2.2 million for the acquired

portfolios

Continued positive trends seen in

delinquency levels

NCO’s remain at good levels

Total delinquency

1.66%

1.78%

2.35%

Provision for loan losses

(2)

$8,429

$7,027

$8,573

Net charge-offs (NCO’s)

(2)

$7,362

$7,473

$8,984

NCO’s/Total average loans

(2)

0.37%

0.38%

0.53%

NCO’s/Total average originated loans

0.42%

0.45%

0.56%

Allowance for loan losses/

Total loans

1.43%

1.49%

1.69%

Allowance for loan losses/

Total non-performing loans

120.23%

104.89%

86.75%

(1) Metrics shown are originated portfolio metrics unless noted as a total

portfolio metric. “Originated portfolio” or “Originated loans” excludes loans

acquired at fair value and accounted for in accordance with ASC 805 (effective January 1,

2009), as the risk of credit loss has been considered by virtue of the

Corporation’s estimate of fair value.

(2) Total portfolio metric

|

Positive Asset Quality Trends

26

Peer data per SNL Financial, refer to Appendix for peer listing;

(1) Based on balances at year-end and quarter-end for each period presented.

“Originated Loans”

excludes loans acquired at fair value and accounted for in accordance with ASC 805 (effective

January 1, 2009), as the risk of credit loss has been considered by virtue of the

Corporation’s estimate of fair value; (2) Florida-related NCO’s 3Q12 YTD included in total metric

NPL’s+OREO to Originated Loans+OREO

(1)

NCO’s to Average Originated Loans

(1)

0.77%

0.62%

0.39%

0.00%

0.20%

0.40%

0.60%

0.80%

1.00%

1.20%

1.40%

2010

2011

3Q12 YTD

FNB excluding Florida

Florida

Peer

Group

Median

(2)

2.74%

2.15%

1.69%

1.56%

1.28%

1.22%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

4.00%

2010

2011

3Q12

FNB

FNB Excluding Florida Portfolio

Peer Group Median |

Diversified Loan Portfolio

27

Note: Balance, CAGR and % of Portfolio based on period-end balances

9/30/12

CAGR

% of Portfolio

($ in millions)

Balance

12/08-

9/12

12/31/08

9/30/12

C&I

$1,532

13.7%

16%

19%

CRE: Non-Owner Occupied

1,368

10.7%

16%

17%

CRE: Owner Occupied

1,229

5.6%

17%

15%

Commercial Leases

127

38.9%

1%

2%

Total Commercial

$4,256

10.6%

50%

53%

Consumer Home Equity

1,670

8.9%

21%

21%

Residential Mortgage

1,074

18.0%

10%

14%

Indirect

570

3.1%

9%

7%

Other

173

2.8%

3%

2%

Regency

164

1.0%

3%

2%

Florida

72

-31.3%

5%

1%

Total Loan Portfolio

$7,979

8.8%

100%

100%

Well diversified portfolio

Strong growth results driven by commercial loan growth

$8.0 Billion Loan Portfolio

September 30, 2012

Commercial &

Industrial 19%

Consumer

Home Equity

21%

Residential

Mortgage 14%

Indirect

7%

Other 2%

Regency 2%

Florida 1%

Commercial

Leases 2%

CRE: Owner

Occupied 15%

CRE: Non-

Owner

Occupied 17% |

Deposits and Customer Repurchase Agreements

28

Note: Balance, CAGR and % of Portfolio based on period-end balances; (1) Transaction

deposits include savings, NOW, MMDA and non-interest bearing deposits; (2) December

31, 2008 through September 30, 2012; (3) Transaction-based deposits represent all deposits and customer

repos other than time deposits

9/30/12

CAGR

Mix %

($ in millions)

Balance

12/08-

9/12

12/31/08

9/30/12

Savings, NOW, MMDA

$4,539

13.6%

44%

45%

Time Deposits

2,626

3.4%

36%

26%

Non-Interest Bearing

1,736

18.5%

14%

17%

Customer Repos

1,111

30.0%

6%

11%

Total Deposits and

Customer Repo Agreements

$10,012

12.3%

100%

100%

Transaction Deposits

(1)

and

Customer Repo Agreements

$7,386

16.6%

64%

74%

Loans to Deposits and Customer Repo Agreements Ratio =

80% at September 30, 2012

Focus on new client acquisition and growing lower cost relationship-based deposits

–

16.6%

average

growth

for

transaction

deposits

and

customer

repo

agreements

(2)

–

74%

of

total

deposits

and

customer

repo

agreements

are

transaction-based

deposits

(3)

$10.0 Billion Deposits and

Customer Repo Agreements

September 30, 2012

Non-Interest

Bearing 17%

Savings, NOW,

MMDA 45%

Customer

Repos 11%

Time Deposits

26% |

%

Ratings

($ in millions

(1)

)

Portfolio

Investment %

Agency MBS

$1,160

48%

AAA

100%

Highly Rated $2.4 Billion Investment Portfolio

September 30, 2012

CMO Agency

513

21%

AAA

100%

Agency Senior Notes

342

14%

AAA

100%

Municipals

183

7%

AAA

AA

A

2%

90%

8%

Short-Term

164

7%

AAA

100%

Trust Preferred

(2)

29

1%

A

BBB

BB

B

CCC

C

3%

5%

25%

10%

7%

50%

CMO Private Label

19

1%

AAA

AA

A

BBB

BB

CCC

19%

8%

14%

23%

15%

21%

Corporate

17

1%

AA

A

BBB

12%

61%

27%

Bank Stocks

2

-

Non-Rated

Commercial MBS

1

-

AAA

100%

Total Investment Portfolio

$2,430

100%

Investment Portfolio

29

(1) Amounts reflect GAAP; (2) Original cost of $107 million, adjusted cost of $44 million,

fair value of $29 million 2%

AAA, 89.4%

AA, 7.4%

A, 1.2%

BBB,BB,B

CCC,CC,C

Non

Rated

-

98% of total portfolio rated AA or better

Relatively low duration of 2.8

Municipal bond portfolio

–

Highly rated with an average rating of AA and 100%

of the portfolio rated A or better

–

General obligation bonds = 99.5% of portfolio

–

77.9% from municipalities located throughout

Pennsylvania |

Well Capitalized

30

Consistent capital management strategy focused on the efficient use of capital

Regulatory “Well-Capitalized”

Dividend Payout Ratio

3Q12 YTD

2011

2010

FNB

62.3%

69.7%

74.0%

Regional Peer Group Median

37.1%

31.1%

40.0%

12.0%

10.5%

8.1%

6.0%

12.2%

10.6%

8.2%

6.0%

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

Total Risk-Based

Tier One

Leverage

Tangible Common Equity

June 30, 2012

September 30, 2012 |

31

Acquisition Strategy |

Strategy

Focus on strategically important markets with growth potential.

Acquisition-related expansion has historically been focused on enhancing presence in the

Pittsburgh market and eastern and central Pennsylvania.

Consideration also given to contiguous attractive markets with concentrated commercial and

industrial business prospect opportunities.

Acquisition Criteria/Evaluation

Proficient due diligence and integration team in place

Disciplined approach to identifying and selecting targets

Targeted financial hurdles taken into consideration

Accretive to operating earnings per share the first full year following close.

Recoup diminution of capital within a relatively short time-period (target 12-18

months). Superior post-acquisition execution

Acquisition Strategy

32 |

Acquisition-Related Expansion

33

FNB Banking Location (pro-forma, including 8 ANNB branches in Maryland)

Erie

Pre-2002

Presence

Additional

Acquisition-Related Expansion

Pittsburgh

MSA Acquisition Expansion

Pending

ANNB Acquisition

Nine bank

acquisitions

completed since

2002, totaling $7.9

billion in assets

Pending acquisition

of ANNB announced

on October 22, 2012 |

34

Investment Thesis |

Long-Term Investment Thesis

35

FNB’s long-term investment thesis reflects a commitment to efficient capital management

and creating value for our shareholders

Long

-Term Investment Thesis:

Targeted EPS Growth

5-6%

Expected Dividend Yield

(Targeted Payout Ratio 60-70%)

4-6%

Total Shareholder Return

9-12% |

Relative Valuation Multiples

36

FNB

Regional Peer

Group Median

National Peer

Group Median

(1)

Price/Earnings Ratio

(2)

FY13 Consensus EPS (FNB=$0.88)

12.1x

12.8x

12.8x

Price/Tangible Book Value

(2)

2.2x

1.4x

1.4x

Price/Book Value

(2)

1.1x

1.1x

1.1x

Dividend Yield

(2)

4.5%

2.9%

2.3%

FNB has a modest P/E valuation relative to peers given its higher-quality earnings stream,

stronger dividend yield and future growth potential

Data per SNL Financial: Price/Earnings Ratio based on analyst consensus estimates for FNB and

peers; (1) National peer group consists of banks with assets between $5 and $25

billion; (2) As of October 26, 2012 closing prices (FNB=$10.69) |

FNB

Among Top Performing Banks 37

Assets

($ billions)

ROTCE (%)

Efficiency

Ratio (%)

Net Charge

Offs (%)

Net

Interest

Margin

Price/TBV (x)

Price/ 2013E

EPS (x)

Dividend

Yield (%)

Total Return

3 Yr (%)

Peer Median Results

Regional Peer Group

$9.5

11.45

58.0

0.57

3.73

1.36

12.8

2.89

27.86

Top 100 Banks/Thrifts Based on Asset Size

$13.3

11.23

62.2

0.46

3.62

1.37

12.6

2.35

23.04

Top 100 Trading at > 2.0x Tangible Book

$13.7

18.12

56.8

0.46

3.58

2.31

12.6

2.71

67.83

F.N.B. Corporation

$12.0

18.51

58.3

0.34

3.75

2.20

12.1

4.49

81.28

Year-to-Date Performance

Relative Valuation/Total Return

Notes: Data per SNL Financial and FNB. Year-to-date performance represents

the first nine months of 2012. Relative valuation metrics and total return as of

October 26, 2012. FNB ROTCE represents operating ROTCE – refer to Supplemental

Information. |

Relative Valuation Analysis

Where a bank trades relative to tangible book value is highly correlated with its projected

return on tangible capital

Source: SNL Financial as of 10/30/12; Note: Data set above includes FNB’s regional peer

group; (1)R-squared represents the percentage of the variation in price to tangible

book value (P/TBV) that can be explained by variation in 2013E projected return on average tangible equity (ROATE); (2)Based on

consensus mean estimates for FY2013.

38

FNB

currently

trades at a

discount to

its peers

based on its

projected

ROATE of

18.3%

(2)

6%

8%

10%

12%

14%

16%

18%

20%

0.50x

0.75x

1.00x

1.25x

1.50x

1.75x

2.00x

2.25x

2.50x

2.75x

Price/Tangible Book Value

R-squared

=

78%

(1) |

39

Supplemental Information |

40

Supplemental Information Index

Acquisition Announcement Presentation: Annapolis Bancorp, Inc., October 22, 2012

Loan Risk Profile (September 30, 2012)

Regency Finance Company Profile

Regional Peer Group Listing

Board of Directors

GAAP to Non-GAAP Reconciliation

Third Quarter 2012 Earnings Release (October 22, 2012) |

F.N.B. Corporation

Announces Agreement to Acquire

Annapolis Bancorp, Inc.

October 22, 2012 |

Natural

progression Consistent with stated expansion strategy

Market opportunity

Attractive demographics

Significant commercial banking opportunities

Excellent retail and wealth opportunities

Access to greater Baltimore and Washington

D.C. markets

Execute FNB’s scalable, proven business

model and strong sales management culture

Establishes

a

5

th

FNB

region

(refer

to

page

5)

Attractive partner

ANNB is a relationship-focused bank with

strong community ties and presence

Opportunity Overview

42

Source:

Deposit

and

demographic

data

per

SNL

Financial;

deposits

as

of

June

30,

2012

(1) Includes branch opened October, 2012 in Waugh Chapel

County

Branches

Deposits in

Market ($000)

HH Income

($ -

2011)

Anne

Arundel,

MD

(1)

7

298,251

79,692

Queen Anne’s, MD

1

45,107

72,774

FNB Current Wtd Avg. by County

42,350

Attractive Market Entry Opportunity

Markets conducive to FNB’s model

Annapolis Bancorp (ANNB) (8 branches)

(1)

F.N.B. (FNB) (266 branches) |

Market Opportunity

43

Leverage FNB’s core competencies and proven business model in a high growth market

Execute FNB’s scalable, cross-functional sales management process

Regional model with local decision making, market leaders, credit authority and functional

support Competitive environment : Similar to FNB’s larger markets

Future

opportunity

for

expansion:

25

identified

banks

in

close

proximity

(1)

Attractive markets present commercial and retail opportunities

Strong demographics present retail, wealth management, private banking and insurance

opportunities Strong commercial opportunities with access to more than 35,000 companies

within 50-mile radius (1)

Source: SNL Financial; Includes banks with assets between $200 million and $5 billion with

NPA’s/assets<4%; Excludes MHC’s, merger targets and banks with 5 or fewer

branches (2)

Source: Hoover’s; Includes companies within a 50-mile radius of ANNB headquarters

with revenue >$5 million, between $1 and $5 million and total companies with

revenue >$1 million Number

of

Commercial

Companies

Within

50-Mile

Radius

of

ANNB

(2)

9,693

25,379

35,072

0

5,000

10,000

15,000

20,000

25,000

30,000

35,000

40,000

>$5 million

$1-$5 million

Total

Revenue |

44

FNB’s Regional Model

Northwest Region

Pittsburgh Region

Central Region

Capital Region

Newly Created

Maryland Region

The ANNB transaction will

create

a

5

th

FNB

region

Benefits of a regional model

Local established

management team with

strong ties to region

Local decision making

Leverage newly created

regional hub to integrate

future acquisitions

Regional Model

FNB Regions |

(1)

Based on FNB stock price as of Friday, October 19, 2012

(2)

Subject to incremental cash pay-out for potential credit -related adjustment

(3)

Dependent upon credit related adjustment

(4)

Excluding one-time costs

Transaction Overview

45

Consideration

$12.09

(1)

per Annapolis Bancorp share

Fixed 1.143x exchange ratio

100%

stock

(2)

Price/TBV of 1.56x

Credit Related

Adjustment

Maximum additional cash consideration of up to $0.36 per share in cash based

on Annapolis Bancorp’s ability to resolve an agreed upon credit

matter Gross Credit Mark

5%

-

6%

of

loans

(3)

Detailed Due Diligence

Completed

Required Approvals

Customary regulatory and Annapolis Bancorp shareholders

Expected Closing

April 2013

TARP Repayment

Annapolis Bancorp intends to redeem its $4 million of remaining TARP prior to

closing, subject to Treasury approval

Financial Impact

Neutral to tangible book value per share

Highly accretive on a marginal basis to earnings per share

Slightly

accretive

to

total

FNB

earnings

per

share

in

the

first

full

year

(4) |

46

Source: SNL Financial and public filings as of June 30, 2012.

Annapolis Bancorp, Inc. Financial Overview

Consumer

3%

C&D

13%

CRE

41%

C&I

16%

Home Equity

12%

1-4 Family

16%

5.66%

Yield:

Savings

38%

Time

Deposits

21%

NOW

10%

Money

Market

15%

Noninterest

Bearing

16%

0.47%

Cost:

$297 Million Loan Portfolio

$343 Million of Deposits

Annapolis Bancorp (8 branches) |

Annapolis Bancorp, Inc. Financial Highlights

47

Source: SNL Financial and public filings.

($ in millions, except EPS)

Year Ended December 31

Quarter Ended

2008

2009

2010

2011

03/31/12

06/30/12

Balance Sheet

Total Assets

$395

$444

$432

$442

$441

$437

Gross Loans

268

282

280

290

301

297

Total Deposits

301

350

341

350

347

343

Loans / Deposits

89%

80%

82%

83%

87%

87%

Capital

TARP

$0

$8

$8

$8

$8

$4

Common Equity

27

25

27

29

30

31

TCE / TA

6.8%

5.5%

6.2%

6.6%

6.8%

7.0%

Tier 1 Ratio

11.4

12.5

12.8

12.8

12.7

11.8

Total Capital Ratio

12.6

13.7

14.1

14.0

14.0

13.1

Leverage Ratio

8.4

8.6

9.1

9.4

9.6

8.8

Income Statement

Net Income

$1.4

($1.7)

$1.6

$2.2

$0.8

$0.9

ROAA

0.38%

(0.38%)

0.37%

0.50%

0.75%

0.83%

ROAE

5.4

(5.2)

4.7

6.1

8.7

10.4

Net Interest Margin

3.6

3.3

3.7

3.9

3.8

3.9

Efficiency Ratio

70

76

72

69

67

65

Fee Income / Revenue

12

12

11

10

10

10

EPS

$0.35

($0.56)

$0.29

$0.39

$0.18

$0.21

Asset Quality

Reserves / Loans

1.54%

2.81%

2.45%

2.47%

2.25%

2.32%

NPAs / Assets

1.64

4.35

2.35

1.88

1.94

1.97

NCOs / Avg. Loans

0.21

1.00

1.16

0.64

0.79

(0.04) |

48

Additional Supplemental Information |

49

Loan Risk Profile

$ in millions

Balance 9/30/12

% of Loans

NPL's/Loans

(1)

YTD Net Charge-

Offs/Loans

(1)

Total Past

Due/Loans

(1)

Commercial and Industrial

$1,532,366

19.2%

0.45%

0.56%

0.65%

CRE: Non-Owner Occupied

1,368,038

17.1%

1.33%

0.10%

1.63%

CRE: Owner Occupied

1,228,991

15.4%

2.02%

0.29%

2.55%

Home Equity and Other Consumer

1,806,577

22.6%

0.37%

0.25%

0.79%

Residential Mortgage

1,073,596

13.5%

0.96%

0.02%

2.52%

Indirect Consumer

569,514

7.1%

0.19%

0.36%

0.97%

Regency Finance

163,954

2.1%

4.20%

3.50%

3.55%

Commercial Leases

127,065

1.6%

0.90%

0.37%

1.74%

Florida

71,887

0.9%

19.44%

-0.32%

19.44%

Other

37,462

0.5%

9.34%

2.66%

9.39%

Total

$7,979,450

100.0%

1.19%

0.39%

1.66%

(1)

Originated portfolio metric |

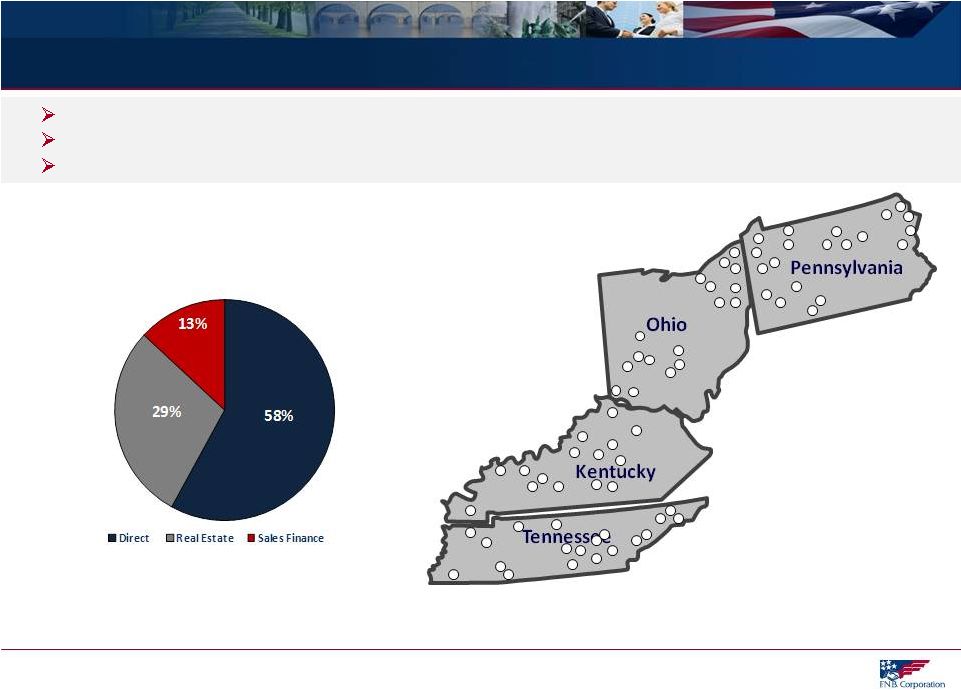

Conservatively run consumer finance business with over 80 years of consumer lending

experience Good credit quality: Year-to-date net charge-offs to average

loans of 3.50% Strong returns: First nine months of 2012: ROA 3.19%, ROE 33.66%, ROTE

37.92% Regency Finance Company Profile

(1)

Return on average tangible common equity (ROTCE) is calculated by dividing net

income less amortization of intangibles by average common equity less

average intangibles. 50

71 Locations

Spanning Four

States

Regency Finance Company

$164 Million Loan Portfolio

87% of Real Estate Loans are First Mortgages |

Regional Peer Group Listing

51

ASBC

Associated Bancorp

NPBC

National Penn Bancshares, Inc.

CBSH

Commerce Bancshares, Inc.

ONB

Old National Bancorp

CBU

Community Bank Systems, Inc.

PRK

Park National Corp

CHFC

Chemical Financial Corp.

PVTB

Private Bancorp, Inc.

CRBC

Citizens Republic Bancorp, Inc.

SBNY

Signature Bank

CSE

CapitalSource, Inc.

SUSQ

Susquehanna Bancshares, Inc.

FCF

First Commonwealth Financial

TCB

TCF Financial Corp.

FFBC

First Financial Bancorp, Inc.

UBSI

United Bankshares, Inc.

FMBI

First Midwest Bancorp, Inc.

UMBF

UMB Financial Corp.

FMER

First Merit Corp.

VLY

Valley National Bancorp

FULT

Fulton Financial

WSBC

WesBanco, Inc.

MBFI

MB Financial, Inc.

WTFC

Wintrust Financial Corp.

NBTB

NBT Bancorp, Inc. |

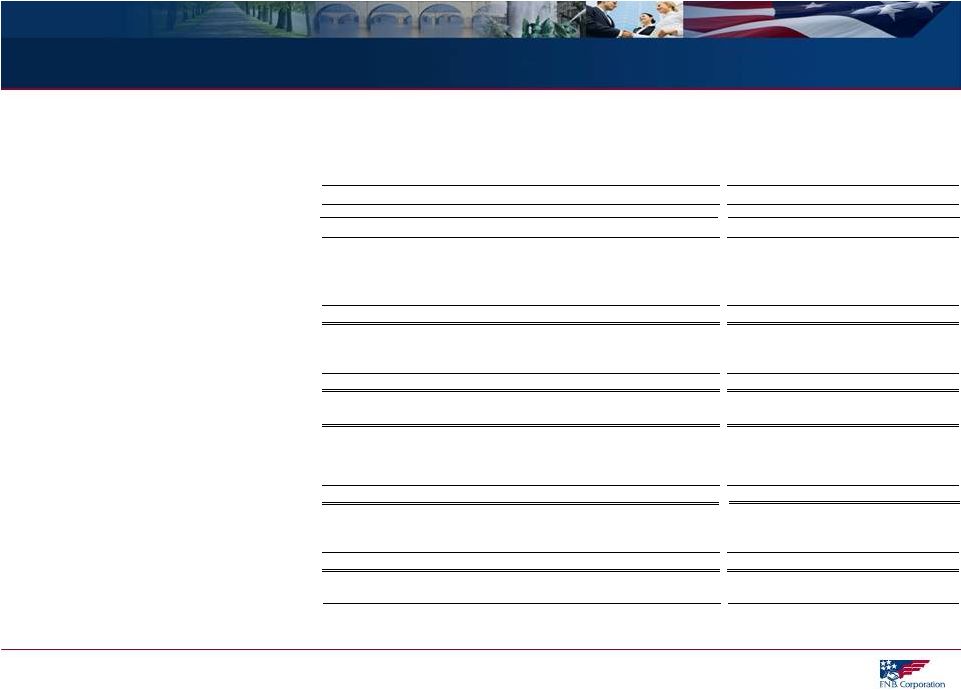

Board of Directors

52

Name

Age

Director

Since

Biography

Stephen J. Gurgovits

69

1981

Chairman of the Board effective January 2012; former Chief Executive Officer of F.N.B.

Corporation Vincent J. Delie, Jr.

48

2012

President and Chief Executive Officer effective January 2012

William B. Campbell

74

1975

Former Chairman of the Board; More than 30 years executive experience in the manufacturing,

steel, commercial development and construction industries.

James D. Chiafullo

54

2012

Partner, Cohen & Grigsby, PC

Philip E. Gingerich

75

2008

Director of Omega Financial Corporation from 1994 to 2008; retired real estate appraiser,

broker and consultant.

Robert R. Goldstein

72

2003

Over 46 years experience in the financial services industry; principal of CapGen Financial

Advisors LLC since 2007; Former Chairman of Bay View Capital Corporation.

Dawne S. Hickton

54

2006

Vice Chairman, president and chief executive officer of RTI International Metals, Inc. based

in Pittsburgh, Pennsylvania.

David J. Malone

58

2005

President and Chief Executive Officer of Gateway Financial Group, Inc., a financial services

firm located in Pittsburgh, Pennsylvania.

D. Stephen Martz

70

2008

Over 45 years experience in the banking and financial services industry; former director,

president and chief operating officer of Omega Financial Corporation.

Robert J. McCarthy

69

2012

Previously President and CEO of Parkvale Bank and Parkvale Financial Corporation and Vice

Chairman of Parkvale Financial Corporation’s Board of Directors.

Harry F. Radcliffe

61

2002

Investment manager with extensive prior experience in the financial services industry.

Arthur J. Rooney, II

60

2006

President of Pittsburgh Steelers Sports, Inc.; of counsel with Buchanan, Ingersoll &

Rooney, P.C. John W. Rose

63

2003

Has served on the boards of 25 separate banks or bank holding companies; currently principal

of CapGen Financial Advisors LLC.

Stanton R. Sheetz

57

2008

Co-owner and Chief Executive Officer of Sheetz, Inc.; director of Omega Financial

Corporation from 1994 to 2008.

William J. Strimbu

51

1995

President of Nick Strimbu, Inc. since 1994, a trucking company with common carrier authority.

Earl K. Wahl

71

2002

Over 36 years executive experience, owning and operating various businesses involving mining,

drilling, industrial contracting, restaurant, municipal and environmental services.

|

GAAP to Non-GAAP Reconciliation

53

Return on Average Tangible Equity

Return on Average Tangible Assets

September 30, 2012

June 30, 2012

September 30, 2011

2012

2011

Net income

$30,743

$29,130

$23,774

$81,455

$63,310

Return on average tangible equity

Net income, annualized

$122,304

$117,162

$94,319

$108,805

$84,646

Amortization of intangibles, net of tax, annualized

5,798

6,192

4,663

5,984

4,701

$128,102

$123,354

$98,982

$114,789

$89,347

Average shareholders' equity

$1,385,282

$1,367,333

$1,210,953

$1,368,457

$1,169,258

Less: Average intangible assets

714,501

718,507

601,010

717,390

600,020

Average tangible equity

$670,781

$648,826

$609,942

$651,066

$569,238

Return on average tangible equity

19.10%

19.01%

16.23%

17.63%

15.70%

Return on average tangible assets

Net income, annualized

$122,304

$117,162

$94,319

$108,805

$84,646

Amortization of intangibles, net of tax, annualized

5,798

6,192

4,663

5,984

4,701

$128,102

$123,354

$98,982

$114,789

$89,347

Average total assets

$11,842,204

$11,734,221

$9,971,847

$11,713,834

$9,845,310

Less: Average intangible assets

714,501

718,507

601,010

717,390

600,020

Average tangible assets

11,127,704

$

11,015,714

$

9,370,837

$

10,996,443

$

9,245,290

$

Return on average tangible assets

1.15%

1.12%

1.06%

1.04%

0.97%

For the Quarter Ended

September 30 Year-to-Date |

GAAP to Non-GAAP Reconciliation

54

Year-to-Date and Full Year

Operating Return on Average Tangible Equity

Operating Return on Average Tangible Assets

2012

2011

2011

2010

Operating net income

Net income

$81,455

$63,310

$87,047

$74,652

Add: Merger and severance costs, net of tax

5,206

2,983

3,238

402

Less: Gain on sale of building, net of tax

942

Less: One-time pension credit

6,853

Operating net income

$85,719

$66,294

$90,285

$68,201

Operating return on average tangible equity

Operating net income (annualized)

$114,500

$88,634

$90,285

$68,201

Amortization of intangibles, net of tax (annualized)

5,984

4,701

4,698

4,364

$120,484

$93,335

$94,983

$72,565

Average shareholders' equity

$1,368,457

$1,169,258

$1,181,941

$1,057,732

Less: Average intangible assets

717,390

600,020

599,851

564,448

Average tangible equity

$651,066

$569,238

$582,090

$493,284

Operating return on average tangible equity

18.51%

16.40%

16.32%

14.71%

Operating return on average tangible assets

Operating net income (annualized)

$114,500

$88,634

$90,285

$68,201

Amortization of intangibles, net of tax (annualized)

5,984

4,701

4,698

4,364

$120,484

$93,335

$94,983

$72,565

Average total assets

$11,713,834

$9,845,310

$9,871,164

$8,906,734

Less: Average intangible assets

717,390

600,020

599,851

564,448

Average tangible assets

10,996,443

$

9,245,290

$

9,271,313

$

8,342,286

$

Operating return on average tangible assets

1.10%

1.01%

1.02%

0.87%

September 30 Year-to-Date

Year Ended |

GAAP to Non-GAAP Reconciliation

55

(1)

Represents gain on sale of building, net gain/(loss) on securities and OTTI

(2)

Represents merger and severance costs

Pre-Provision Net Revenue

2012

2011

Pre-Provision Net Revenue (PPNR)

Net interest income (FTE)

$284,518

$242,353

Non-interest income

99,336

87,320

Non-interest expense

242,237

212,143

Pre-Provision Net Revenue (GAAP)

$141,617

$117,529

Less: Non-operating

non-interest

income

(1)

1,633

105

Add: Non-operating

non-interest

expense

(2)

8,009

4,589

Operating Pre-Provision Net Revenue

$147,993

$122,014

PPNR Earnings per Diluted Share

$1.05

$0.96

September 30 Year-to-Date |