Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NEVADA POWER CO | d429197d8k.htm |

| EX-99.1 - PRESS RELEASE - NEVADA POWER CO | d429197dex991.htm |

Third

Quarter 2012 Financial Results

November 2, 2012

Exhibit 99.2 |

2

Safe Harbor Statement

This presentation may contain forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995 regarding the future

performance of NV Energy, Inc. and its subsidiaries, Nevada Power Company and Sierra

Pacific Power Company both d/b/a NV Energy. Forward-looking statements include

earnings guidance and estimates or forecasts

of

operating

and

financial

metrics.These

statements

reflect

current

expectations

of

future

conditions

and

events

and

as

such

are

subject

to

a

variety

of

risks,

uncertainties

and

assumptions

that

could

cause

actual

results

to

differ

materially

from

current

expectations.

These

risks,

uncertainties

and

assumptions

include,

but

are

not

limited

to,

NV

Energy

Inc.'s ability to maintain access to the capital markets, NV Energy Inc.'s ability

to receive dividends from its subsidiaries, the financial performance of NV

Energy Inc.'s subsidiaries, particularly Nevada Power Company and Sierra Pacific Power

Company both d/b/a NV Energy, and the discretion of NV Energy Inc.'s Board of

Directors with respect to the payment of future dividends based on its

periodic review of factors that ordinarily affect dividend policy, such as current and prospective

financial condition, earnings and liquidity, prospective business conditions,

regulatory factors, and dividend restrictions in NV Energy Inc.'s and its

subsidiaries' financing agreements. For Nevada Power Company and Sierra Pacific Power Company

both

d/b/a

NV

Energy,

these

risks

and

uncertainties

include,

but

are

not

limited

to,

future

economic

conditions

both

nationally and regionally, changes in the rate of industrial, commercial and

residential growth in their service territories, their ability to procure

sufficient renewable energy sources in each compliance year to satisfy the Nevada Renewable Energy

Portfolio Standard, changes in environmental laws and regulations, construction

risks, including but not limited to those associated with the ON Line

project, their ability to maintain access to the capital markets for general corporate purposes

and to finance construction projects, employee workforce factors, unseasonable

weather, drought, wildfire and other natural phenomena, explosions, fires,

accidents, mechanical breakdowns that may occur while operating and maintaining an

electric

and

natural

gas

system,

their

ability

to

purchase

sufficient

fuel,

natural

gas

and

power

to

meet

their

power

demands

and natural gas demands for Sierra Pacific Power Company d/b/a NV Energy, financial

market conditions, and unfavorable rulings in their pending and future

regulatory filings. Further risks, uncertainties and assumptions that may cause actual

results to differ from current expectations pertain to weather conditions, customer

and sales growth, plant outages, operations

and

maintenance

expense,

depreciation

and

allowance

for

funds

used

during

construction,

interest

rates

and

expense,

cash

flow

and

regulatory

matters.

Additional

cautionary

statements

regarding

other

risk

factors

that

could

have

an

effect on the future performance of NV Energy, Inc., Nevada Power Company and

Sierra Pacific Power Company both d/b/a NV Energy are contained in their

Annual Reports on Form 10-K for the year ended December 31, 2011, and quarterly

reports on Form 10-Q for the periods ended March 31, 2012, June 30, 2012, each

filed with the Securities and Exchange Commission. NV Energy Inc., Nevada

Power Company and Sierra Pacific Power Company both d/b/a NV Energy undertake

no

obligation

to

release

publicly

the

result

of

any

revisions

to

these

forward-looking

statements

that

may

be

made

to

reflect

events or circumstances after the date hereof or to reflect the occurrence of

unanticipated events. IR Contacts

Max Kuniansky

Britta Carlson

Executive, Investor Relations

Manager, Investor and Shareholder Relations

(702) 402-5627

(702) 402-5624

mkuniansky@nvenergy.com

bcarlson@nvenergy.com |

Third

Quarter Financial Results Major Drivers

Q3 2012 vs. Q3 2011

NV Energy Consolidated

Pre-Tax Total

After Tax

Gross Margin:

($ millions)

EPS Impact

Rate increase, NVE-South

48.2

$

0.13

$

Usage and customer growth

13.3

0.03

Weather

3.7

0.01

Other:

O&M expense excluding reversal

4.9

0.01

Termination cost reversal (O&M, 2011)

(8.0)

(0.02)

Interest expense

5.5

0.02

Gain on asset sale

5.5

0.02

Trust investments

4.9

0.01 |

Customer

and Usage Trends Low-use accounts, a proxy for vacant homes, have

decreased to levels not seen since 2008.

NV Energy South

4 |

5

Customer and Usage Trends

NV Energy North

Change in Average Customers

(% change, quarter vs. prior year; retail)

Low-Use Customer Accounts

(% of Residential Customers)

The trend in low-use accounts remains favorable.

|

EPS

Impact of Weather: Actual vs. Normal* 2011

Weather benefited earnings by $0.04 in Q3 2012 compared to

historically normal conditions.

* Estimates. Normal = 20-year average.

2012

No

Impact

$(0.04)

$0.03

$(0.01)

Q1

Q2

Q3

Q4

$(0.02)

$0.07

$0.04

Q1

Q2

Q3

6 |

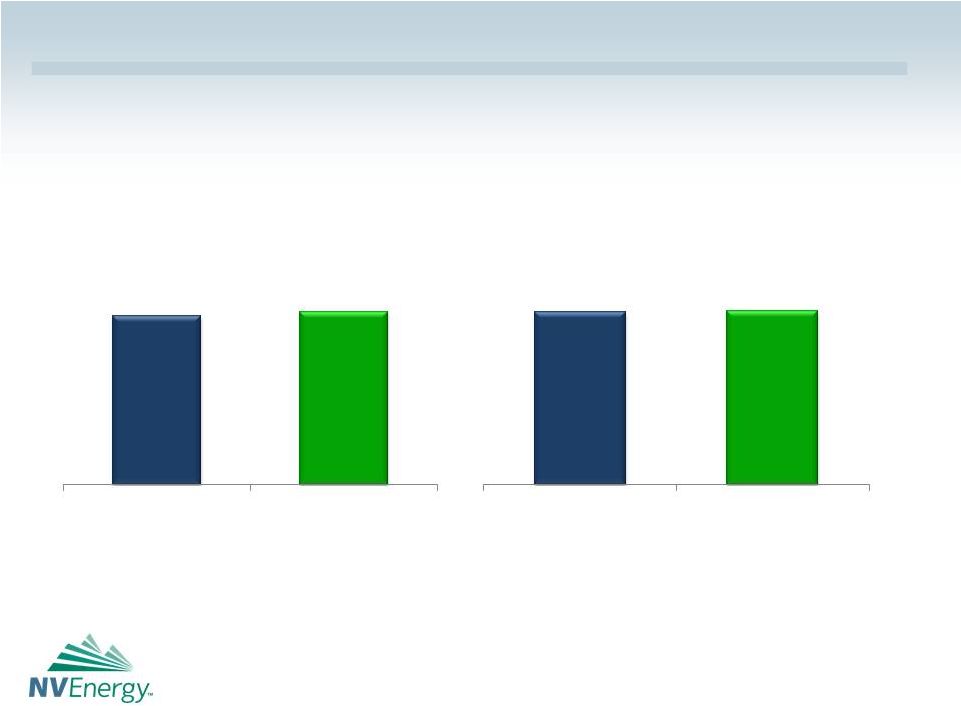

Cost

Control O&M virtually unchanged year-over-year

Periods ended September 30

$ millions

* Includes $8.0 million benefit from termination cost reversal

$116.0 *

$119.1

2011

2012

Three Months

$381.4 *

$383.3

2011

2012

Nine Months

7 |

8

Outlook: 2012

Guidance is based on ongoing, normalized EPS for the fourth

quarter of 2012, excluding unexpected events such as plant

outages, required regulatory accounting adjustments, etc.

For further information see forward –looking statements and risk factors in

2011 SEC Form 10-K and Form 10-Q for periods ended March 31,

2012 and June 30, 2012. Assumptions

Weather

Actual for first 9 months, normal for Q4

Gross margin

Actual for first 9 months, ~1% increase* for

Q4 from customer growth

O&M expense

Flat

Depreciation, AFUDC

Harry Allen plant, capital expenditures

Interest expense

Decrease due to 2011 refinancings, debt

reduction

* Excludes NVE-S rate increase effective January 1

2012 Earnings Guidance: $1.30 -

$1.40 / share |

9

Increase in 2012 Earnings Guidance

Since inception; per diluted share

* Estimate. Normal = 20-year average.

Guidance

Change

May 8, 2012

$1.15 - $1.25

Weather vs. normal*

0.09

$

Usage

0.04

All other

0.02

$

November 2, 2012

$1.30 - $1.40

|

10

EPS Impact: Adjustments & Other Items

Favorable (Unfavorable)

1

Estimates. Normal = 20-year average.

2

Energy efficiency implementation rate

12 Months Ended

9 Months Ended

Dec. 31, 2011

Sept. 30, 2012

Weather vs. normal

(0.02)

$

0.09

$

EEIR adjustment (Q2)

(0.03)

Termination cost reversal (Q3)

0.02

Regulatory adjustment/reserves (Q4)

(0.05)

Settlement (Q2)

0.01

Gain on asset sale (Q3)

0.02

1

2 |

Decreasing Capital Expenditures

$1,536

$1,166

A Key Driver of Free Cash Flow

* Gross expenditures, including contributions in aid of construction, debt AFUDC,

and net salvage. Forecast includes environmental expenditures for which the

company plans to seek PUCN approval. $843

$629

$621

$490

$490

$420

$445

$440

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

$ millions*

Base

Environmental

All Other

11 |

Third Quarter is Key to 12-Month Results

Earnings Per Share (diluted)

$0.01

$0.05

$0.73

$(0.11)

$0.05

$0.29

$0.94

Q1

Q2

Q3

Q4

2011

2012

Q1

Q2

Q3

Q4

Year

2007

$0.07

$0.12

$0.69

$0.02

$0.89

2008

0.10

0.15

0.64

(0.01)

0.89

2009

(0.09)

0.08

0.78

0.02

0.78

2010

(0.01)

0.16

0.75

0.06

0.96

2011

0.01

0.05

0.73

(0.11)

0.69

2012

0.05

0.29

0.94

Summer weather in southern Nevada

can

significantly affect financial results.

12 |

13

Key Expected Regulatory Filings and

Decisions through 2014

NVE-S

IRP

In merger filing, NVE will request that the resulting merged company general rate

filing follow the NVE-S schedule. Merger

Filing

Decision expected by year-end 2012

To be filed approximately 6 months before completion of ON Line

Current statutory schedule: NVE-N, June 2013; NVE-S, June 2014

General

Rate Filings |