Attached files

| file | filename |

|---|---|

| EX-10.3 - Seaniemac International, Ltd. | v327068_ex10-3.htm |

| EX-10.1 - Seaniemac International, Ltd. | v327068_ex10-1.htm |

| EX-10.2 - Seaniemac International, Ltd. | v327068_ex10-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 30, 2012

| Compliance Systems Corporation |

| (Exact name of registrant as specified in its charter) |

| Nevada | 000-54007 | 20-4292198 |

| (State or other jurisdiction | (Commission | (IRS Employer |

| of incorporation) | File Number) | Identification No.) |

| 780 New York Avenue, Suite A, Huntington, New York | 11743 |

| (Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code: (386) 409-0200

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Preliminary Statement: Unless the context requires otherwise, all references in this current report on Form 8-k to “us,” “we,” “our,” “Company” or “Compliance Systems Corporation” is to the Registrant and, unless the context otherwise indicates, its wholly and majority owned subsidiaries.

Item 2.01 Completion of Disposition or Acquisition of Assets.

The Securities Exchange/Agreement

On June 7, 2012, we entered into a Securities Exchange Agreement (the “Exchange Agreement”) with RDRD II Holding LLC, a Delaware limited liability company (“RDRD”). The Exchange Agreement was amended on October 29, 2012. In this Form 8-K, all references to the Exchange Agreement are to the Exchange Agreement as amended. The Exchange Agreement contemplated the acquisition(the “Acquisition”) by Compliance Systems Corporation from RDRD of RDRD’s 70% equity ownership interest (the “Seaniemac Equity Interest”) in Seaniemac Limited, an Ireland corporation (“Seaniemac”). The Exchange Agreement further contemplated that, in exchange for the Seaniemac Equity Interest, we would issue to RDRD an amount of shares of our common stock (the “RDRD Exchange Shares”) which, following such issuance, would equal approximately 71% of our then outstanding shares of Common Stock(on a fully diluted basis), after taking into account the 10 million post reverse split shares we were ordered by a court in Florida to issue to certain of our creditors in exchange for $500,000 of debt owed to such creditors(the “RDRD Percentage”). Seaniemac is in the business of operating a sports gaming website.

The RDRD Agreement also requires that, immediately following the issuance of the RDRD Exchange Shares, we shall have outstanding no more than 41,850,000 shares of Common Stock on a fully diluted basis (the “RDRD Share Limit”) and that we shall have outstanding no more than $350,000 of debt (the “RDRD Debt Limit”).

Pursuant to the Exchange Agreement, the number of shares outstanding on a fully diluted basis means the number of shares of common stock that would be, as of the applicable date, outstanding if all of our derivative securities, including, without limitation, warrants, options, rights, convertible debt, convertible securities and exchange securities, then outstanding were exercised, converted or exchanged for shares of Common Stock in accordance with the terms of such derivative securities. The Exchange Agreement requires that all preferred stock be converted or otherwise cancelled within 60 days of the closing of the Exchange Agreement.

The Exchange Agreement further provided that our directors and officers immediately prior to consummation of the Acquisition resign and RDRD was granted the right to designate a new board of directors for our Company with such board appointing new officers to manage the post Acquisition Company.

The Exchange Agreement also contemplated that we conduct, prior to the consummation of the Acquisition, a 1:994.488567392 reverse stock split of our common stock, whereby every 994.488567392 pre-split shares would be converted into one post-split share of common stock. The reverse stock split was made effective as of the opening of business on October 3, 2012.

| 2 |

The original Exchange Agreement is included as Exhibit 10.1 to this current report and the amendment is included as Exhibit 10.2 to this current report. The Exchange Agreement; as amended constitutes The legal document that governs the terms of the Acquisition and the other transactions contemplated thereby. The discussion of the Exchange Agreement set forth herein is qualified in its entirety by reference to Exhibits 10.1 and 10.2.

Item 2.01 Completion of Disposition or Acquisition of Assets.

On October 30, 2012 the Acquisition was consummated (the “Closing”). In addition, immediately following the Closing we issued 10,000,000 shares of our common stock in accordance with a court order, in exchange for the cancellation of $500,000 of our debt (“Debt Exchange Shares”) (See Item 3.02 Unregistered Sales of Equity Securities of this current report on Form 8-K) . As a result of the Acquisition and the issuance of our Debt Exchange Shares, there are now 41,810,476 shares of our common stock outstanding, on a fully diluted basis, of which approximately 71% are held by RDRD. We have been advised that RDRD has a total of five Equity Owners, each of whom would qualify as an Accredited Investor under Regulation D. Prior to the Acquisition, we were a shell company with no business operations. As a result of the Acquisition, we are no longer considered a shell company.

On October 30, 2012, RDRD designated the following persons to our Board of Directors and such board appointed the following individuals to serve as our officers: Barry M. Brookstein, Director, Chief Executive Officer, Chief Financial Officer, Secretary; Sean McEniff, Director, Chairman and President; Shane O’Driscoll, Director; and Jon M. Garfield, Director.

The issuance of the shares of our common stock pursuant to the Acquisition was made in reliance upon an exemption from registration under the Securities Act of 1933, as amended (the “Securities Act”), pursuant to Regulation D promulgated thereunder. As such, the shares of our common stock issued to RDRD in connection with the Acquisition may not be offered or sold unless they are registered under the Securities Act or an exemption from the registration requirements of the Securities Act is available.

Pursuant to Item 2.01(f) of Form 8-K, the information that would be required if we were filing a general form for registration of securities on Form 10 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), we have set forth below. The information below corresponds to the item numbers of Form 10 under the Exchange Act.

Forward Looking Statements

The statements contained in this current report that are not historical facts are forward-looking statements that represent management’s beliefs and assumptions based on currently available information. Forward-looking statements include all statements that are not historical facts and can be identified by the use of forward-looking terminology such as the words “believes,” “intends,” “may,” “will,” “should,” “anticipates,” “expects,” “could,” “plans,” or comparable terminology or by discussions of strategy or trends. Although management believes that the expectations reflected in such forward-looking statements are reasonable, we cannot give any assurances that these expectations will prove to be correct. Such statements by their nature involve risks and uncertainties that could significantly affect expected results, and actual future results could differ materially from those described in such forward-looking statements.

| 3 |

Among the factors that could cause actual future results to differ materially are the risks and uncertainties discussed in this current report. While it is not possible to identify all factors, management continues to face many risks and uncertainties including, but not limited to, our ability or a target entity to meet the requirements to close any potential acquisition, the results of operations and our profitability following the acquisition of a new business venture, the acceptance in the market of the products or services we offer following an acquisition. Should one or more of these risks materialize, or should the underlying assumptions prove incorrect, actual results could differ materially from those expected. We disclaim any intention or obligation to update publicly or revise such statements whether as a result of new information, future events or otherwise.

Except as otherwise indicated by the context, references in this Current Report on Form 8-K to “we,” “us” and “our” are to the consolidated business of the Registrant and Seaniemac.

ITEM 1. BUSINESS

Background/Description of Compliance Systems Corporation’s Business Prior to the Acquisition.

We were incorporated in Nevada on November 17, 2003 under the name GSA Publications, Inc. In conjunction with a reorganization in February 2006, we changed our name to our current name, Compliance Systems Corporation.

In February 2010, one of our wholly-owned subsidiaries merged with Execuserve Corp. (“Execuserve”) pursuant to which we entered the business then operated by Execuserve. The business of Execuserve provided organizations, who are hiring employees, with tests and other evaluation tools and services to assess and compare job candidates.

From May 2008 through July 2010, we raised capital through the sale to Agile Opportunity Fund, LLC of secured convertible debentures. Subsequent thereto, we breached certain of the terms of such debentures in December 2010 and transferred to Agile all of our operating assets in exchange for a release of our obligations under the debentures and other obligations owed to Agile. At that time, we became a non-operating shell company and began seeking to acquire or merge with an operating entity.

Acquisition of Interest in Seaniemac

On October 30, 2012 the Acquisition was consummated. As a result of the Acquisition and the issuance of certain Debt Exchange Shares, there are now 41,810,476 shares of our common stock outstanding, on a fully diluted basis, of which approximately 71% are held by RDRD. We have been advised that RDRD has a total of five Equity Owners, each of whom would qualify as an Accredited Investor under Regulation D. Prior to the Acquisition, we were a shell company with no business operations. As a result of the Acquisition, we are no longer considered a shell company.

On October 30, 2012, RDRD designated the following persons to our Board of Directors and such board appointed the following individuals to serve as our officers: Barry M. Brookstein, Director, Chief Executive Officer, Chief Financial Officer, Secretary; Sean McEniff, Director, Chairman and President; Shane O’Driscoll, Director; Jon M. Garfield, Director.

| 4 |

Description of RDRD’s Business

RDRD II Holding LLC, a Delaware limited liability company (“RDRD”) was formed on May 22, 2012 as a Delaware limited liability company. It is a privately owned, development stage company. Two of its primary business purposes are: (i) to own, acquire, manage, redeem, sell, dispose of and otherwise deal with an interest in Seaniemac and (ii) to own, acquire, manage, redeem, sell, dispose of and otherwise deal with an interest in Compliance Systems Corporation.

RDRD’s internal operations are governed by Delaware law and that certain Limited Liability Company Agreement of RDRD II Holding LLC dated May 22, 2012 by and among Rina Chernaya, Diana Chernaya, Robert Kessler, David Gentile, and Greg Trautman (i.e, the Members of the RDRD). The Members have elected the following as Managers of RDRD: Robert Kessler, David Gentile, Greg Trautman, and Rina Chernaya.

As of June 30, 2012, RDRD has loaned Seaniemac $46,389, inclusive of interest, payable on demand. Interest is accruing at 4 percent per annum. Accrued and unpaid interest at June 30, 2012 was $511.

On February 17, 2012, Seaniemac issued to RDRD 70 shares of its common stock, which shares currently represent approximately 70% all issued and outstanding shares (70 out of 100).

The principal business office of RDRD is 220 West 42nd St., 6th Floor, New York, NY 10036.

Description of Seaniemac’s Business

For purposes of this section entitled “Description of Seaniemac’s Business” only, all references to “we,” “us,” or “our” “Company” or “Seaniemac” refers to Seaniemac Limited prior to the effectiveness of the Acquisition.

General

Seaniemac Limited, a development stage company, is an Irish company that was incorporated on December 11, 2011. Its corporate charter authorizes 100,000 shares of one class of stock being “ordinary shares” which is analogous to common stock. Seaniemac has issued 100 of those shares, 70 of which have been issued to RDRD. It has no recognized revenue and is still devoting substantially all of its efforts on establishing the business and commencing its planned principal operations. All losses accumulated since inception have been considered as part of the Company’s development stage activities.

Seaniemac is an online sports and casino (traditional casino, live casino, poker, bingo and interactive skilled games) wagering web-based platform serving gamblers directly under the brand name Seaniemac.com. While the site offers wagering for many categories outside of sports, Seaniemac intends initially to capture the Irish market by initially focusing on the Gaelic Athletics Association (GAA) or Gaelic Games as well as Irish horse racing and soccer.

Seaniemac’s mission is to offer a market-leading, user-friendly website for online gambling, including sports betting and casino gaming (traditional casino, live casino, poker, bingo and interactive skilled games).

| 5 |

Industry

The online gambling industry encompasses a wide range of sites, including online casinos, sportsbooks, poker rooms, wagering, bingo parlors, lotteries, horse racing sites and more. The industry is comprised of four primary market players:

· Software vendors

· Online gambling business operators

· End customers (or players)

· Trade Associations

Online sports gambling (also referred to as online sports betting and interactive gambling) is a sub-segment of the online gambling industry and is currently the largest market share holder in terms of revenues for the online gambling industry.

The following table depicts the size of the gambling industry broken down by type of gambling on a global, Irish and British scale. Industry size, or gross revenue, is the total amount wagered by customers minus the total amount paid out to customers as winnings, but before the payment of any applicable taxes or expenses. The information in the table is from Casinos & Gaming in the UK, Datamonitor; Global Casinos & Gaming, Datamonitor; Global Online Gambling, Datamonitor; UK Territory Plans 2011, Richard Hogg; Mobile Gaming Report, Morgan Stanley; OnlineCasino.ie; Preliminary Results 2011, H2 Gambling Capital.

| Global | Ireland | United Kingdom | ||||||||||

| Total Gambling | $ | 411.6 billion | $ | 18.7 billion | $ | 48.9 billion | ||||||

| Online Gambling | $ | 32.0 billion | $ | 1.7 billion | $ | 8.8 billion | ||||||

| Online Sports Betting | $ | 12.2 billion | $ | 314.9 million | $ | 3.8 billion | ||||||

| Online Casino | $ | 7.5 billion | $ | 175.8 million | $ | 2.1 billion | ||||||

| Online Lottery | $ | 2.5 billion | $ | 80.6 million | $ | 792 million | ||||||

| Online Poker | $ | 6.2 billion | $ | 95.2 million | $ | 1.1 billion | ||||||

| Online Bingo/Other | $ | 3.5 billion | $ | 65.9 million | $ | 968 million | ||||||

| Mobile Gambling | $ | 2.7 billion | n/a | $ | 41 million | |||||||

Government Regulations and Political Factors

Gambling in Ireland is principally regulated by the Betting Act of 1931 and the Gaming and Lotteries Act of 1956. This legislation pre-dates many of the new developments in the industry. There are other gaming and gambling acts that regulate the industry such as The Horse and Greyhound Racing Act 2001, which falls under overall gaming and gambling regulations but no specific act has been passed in the country for online gambling as of now.

In Europe, there is no EU legislation that regulates the gambling sector yet. However, a number of EU consumer protection directives cover specific aspects of the activity. These include regulations surrounding distance selling, unfair commercial practices and data protection directives. In addition, all EU licensed and regulated gaming and gambling operators are subject to the regulations and laws that govern business in the EU.

| 6 |

Location

Seaniemac’s corporate headquarters are located in Dublin, Ireland and JB is located in Isle of Man. These locations have been strategically chosen as they provide a local environment with what we believe are relatively predictable legal and government constraints.

Payment Methods

Customers are able to pay through Moneybookers, debit cards, credit cards, Neteller, Western Union Quick Pay and bank transfer.

Technology/Marketing Agreement

On March 13, 2012, the Company entered into a marketing agreement with Jenningsbet Ltd (“Jenningsbet”), an Isle of Man company. Jenningsbet is responsible for developing and operating the Company’s gaming site. The Company has been charged an initial set-up fee of GBP 35,000 that covers the first year of operations. After the initial twelve month period, the Company will be charged a monthly license fee of 2% of Gross Revenue. In addition, Jenningsbet will retain 30 percent of Monthly Gross Revenue (“MGR”) if MGR is GBP 100,000 or less and 25 percent if MGR exceeds GPB 100,000 for three consecutive months. MGR is comprised of revenue less chargebacks for credit card fraud, gaming taxes and licensing fees.

Customer Service

One of Seaniemac’s main marketing objectives is to retain active players keeping the attrition rates low. The Company will attempt to do this through its guarantee policies and customer service support outlined below.

Each gambling product has strict guidelines and rules to be followed and carried out in order to achieve consistent service standards. Seaniemac guarantees that the site will operate with 99.9% up time and will operate within the requirements of the company’s Isle of Man Gambling Supervision Commission License. Seaniemac offers email support within a 1 hour response time from 9am - 5pm, a 2 hour response time from 5pm - 9.30 pm and a 10 hour response time and from 9.30pm - 9am.

Licenses and Permits

Seaniemac operates under Jenningsbet license which is a license from the Isle of Man Gambling Supervision Commission . This license is a white, United Kingdom regulated license which allows for gambling operations in Ireland and the United Kingdom.

Foreign Financial Considerations

Seaniemac’s income is subject to income taxes based upon the laws of Ireland.

For the Registrant’s financial reporting, Seaniemac’s assets and liabilities, whose functional currency is the Euro, are translated into U.S dollars at period-end exchange rates. Income and expense items are translated at the average rates of exchange prevailing during the period. The adjustments resulting from translating the Company’s financial statements are included in Accumulated other comprehensive loss (OCL), a component of Stockholders’ Equity. Foreign currency transaction gains and losses are recognized in net earnings based on differences between foreign exchange rates on the transaction date and settlement date.

| 7 |

Consulting Fees

A significant portion of Seaniemac’s consulting fees expense, are paid to its shareholders. Such consulting expenses incurred during the three months and six months ending June 30, 2012 totaled $59,724 and $87,221, respectively. The amount payable to shareholders for consulting services was $84,526 at June 30, 2012.

Competition

Generally, we compete with a number of public and private companies, which provide electronic commerce and/or Internet gaming. In addition to known current competitors, traditional land-based casino operators and other entities, many of which have significant financial resources, and occupy entrenched position in the market and name-brand recognition, may provide Internet gaming services in the future, and thus become our competitors.

We believe the principal competitive factors in our industry that create certain barriers to entry include but are not limited to reputation, technology, financial stability and resources, proven track record of successful operations, critical mass (particularly relating to online poker), regulatory compliance, independent oversight and transparency of business practices. While these barriers will limit those able to enter or compete effectively in the market, it is likely that new competitors as well as laws and regulations of governmental authority will be established in the future..

Particularly, Seaniemac faces direct competition from established online gambling sites like PaddyPower, LadBrokes, Betfair Group and others. However, the Company has several advantages at its side, primarily, services that are tailored to GAA enthusiasts, an underserved market niche. Most notably, Seaniemac: is the only Irish- and GAA-focused site; is the only site offering in-game betting during live-streaming of GAA games; utilizes industry leading software; and has procured several Irish celebrity partners.

Increased competition from current and future competitors may in the future materially adversely affect our business, revenues, operating results and financial condition.

Market & Economic Factors

The online gambling industry was revolutionized by the development of the World Wide Web in the mid-1990s. The evolution of technology is what led to the growth of this market making it possible to gamble anywhere, anytime. A solid infrastructure of broadband Internet connectivity, easy access to mobile applications, and safe and secure payments through a native banking system are three of the key market factors that support growth in this industry.

The industry is in the stage of market consolidation where the big players are looking to fill out their capabilities or reach into new markets through acquisitions. New rounds of merger and acquisition activity are predicted in this sector, both among traditional gaming and gambling companies reaching into virtual markets and existing virtual leaders taking over smaller niche competitors.

| 8 |

The Global Online Gambling market is somewhat fragmented with some nations totally prohibiting online gambling while others have specific restrictions with only eight nations making online gambling legal in all forms. Based on our independent research, in 2010 only 70 jurisdictions worldwide allowed online gambling to be operated from their shores. The varying gaming options available eases rivalry somewhat although high fixed costs of online gambling are not favorable to new entrants. Some market players within the online gambling market include a variety of retailers from private operators to monopolies. Monopolies exist in several countries such as Sweden where state run lottery operators offer the chance to purchase online tickets. The monopolies cover approximately 25% of the European online gambling market with a higher rate of 40% throughout Scandinavia. Government regulation is very stringent in some places with countries and particular states around the globe outlawing online gambling whilst many others place particular restrictions. Due to the nature of the internet, policing of particular laws are not always possible. Brand strength is powerful in some countries where major players are promoted through heavy advertising and sponsorship campaigns, although varying regulations and differentiated products means that dominance is never absolute. Based on our research there has been a rapid expansion of the online gambling market from 350 online gambling sites in 1998 to 2332 in 2010. Many countries such as France are easing their online gambling regulations thus opening the market up to new players. Overall the likelihood of new entrants is moderate.

The cost of switching is relatively low in many places where licensed betting shops or casinos are present. This may be a problem in some areas of the world such as the U.S. states of Tennessee and South Carolina and the Indian state of Maharashtra where State laws prohibit casinos, betting shops or private games. Cheaper alternatives may or may not be available depending on the location or particular rewards on offer; although, online service charges via credit cards, etc. may deem the online market as more expensive. The threat of substitutes to the online gaming market is moderate overall.

Rivalry in the online gaming industry is moderate overall, increased by some factors while decreased by others. The market is made up of various sectors competing for customers which eases rivalry somewhat. These include casinos, poker rooms, sports/race books, bingo, skill games, lottery, betting exchange and backgammon. The global reach of the internet and the plentiful supply of varying games means switching costs for the consumer are virtually nonexistent which increases rivalry. Differing regulations worldwide make it harder for expansion and the easing of regulations in some markets have led to consolidation from monopoly entities which weakens rivalry overall. Yet the opening of new markets such as France will also allow for more players to enter the market place offsetting the balance somewhat.

| 9 |

The following table, which we prepared based on our own independent research, portrays the major online gambling industry participants and their role in the industry:

| Industry Overview | Primary Focus | |

| Trade Organizations: | ||

| eCogra | eCogra is an internationally accredited testing agency and player protection and standards organization that provides an international framework for best operational practice requirements, with particular emphasis on fair and responsible gambling. | |

| EGBA - European Gaming and Betting Association | EGBA promotes implementation of a fair, competitive and regulated market for online gaming and gambling operators throughout Europe in line with EU law. | |

| Major Operators: | ||

| Betfair | Internet betting exchange that also operates a poker product and game arcade. | |

| bwin | Largest online gaming and gambling company focused primarily on sports betting, as well as Internet casino and poker | |

| GTECH (Lottomatica) | Focused on providing software and services in the Internet and sports betting market. | |

| Ladbrokes | Online casino sites offering sportbooks, poker, casino games, bingo and backgammon | |

| Rank Group | Operates bingo services and casinos in the U.K., with complementary online gaming and gambling services. | |

| Major Software Vendors: | ||

| Jenningsbet | JenningsBet.com is the online arm of one of the most established and progressive Bookmakers in the United Kingdom. | |

| Fremonte | Fremonte provides clients with the management of their online marketing services. We specialize in the complete customer journey, from acquisition to active promotions. | |

| GBGC - Global Betting & Gaming Consultants | GBGC has developed a wide range of gambling and business services that it can provide to its clients to help them operate successfully in the gambling field. | |

| Major Customers: | ||

| Men in the age range of 25 and 35 years | Men play more frequently at higher stakes but shorter sessions | |

| Women |

Women generally play for longer but at lower stakes 43% of all online players in 2009 were women |

Research and Development

We do not currently have a budget specifically allocated for research and development purposes.

Company Website

Our business website is www.seaniemac.com.

Employees

As of October 30, 2012, we have 3 employees.

Source of Revenue

Seaniemac’s gross revenue will be derived by subtracting total winnings from total wagers. As a result, Seaniemac cannot directly control revenue from sports wagering. However, the Company can indirectly control revenue from casino games by setting the odds high or low as compared to other companies. Seaniemac sets its odds slightly lower than its competitors in order to gain market share. Nonetheless, the Company does not have direct control over the actual percentage of winnings for any of its revenue sources. In regard to poker, Seaniemac determines its fees based on industry standards.

| 10 |

In addition, revenue is driven by the number of users (bettors), who we are assuming will bet an average of $200 per month. Based on industry averages, Seaniemac estimates that from each dollar bet, the Company will receive net revenue of 8% in the sports segment and 4% in the casino segment. Jenningsbet, which performs all administration directly related to gaming, will remit the net revenue on the 15th of the subsequent month.

Starting with an estimated 1,500 users in the first month, the total users at the end of years 1, 2, and 3, respectively are 12,000, 17,000, and 18,000. The tapering-off is a conservative assumption. Gross margins are projected to remain constant at 75%.

Market Size and Potential

Global Market Size

According to a report generated by Datamonitor in 2011, a global market research firm, global revenue from gambling reached $411.6 billion. Gross revenues from online gambling in particular reached $32.03 billion in 2011.

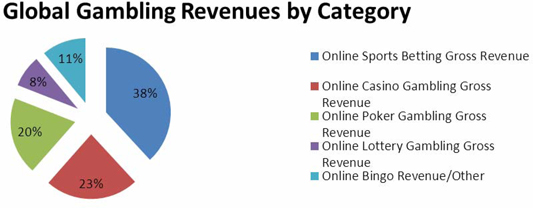

The chart and graph below show the global market shares of the different forms of online gambling in 2011:

| Global Gambling 2011 | $ | 411.6 billion | ||

| Global Online Gambling | $ | 32.0 billion | ||

| Online Sports Betting | $ | 12.2 billion | ||

| Online Casino | $ | 7.5 billion | ||

| Online Lottery | $ | 2.5 billion | ||

| Online Poker | $ | 6.2 billion | ||

| Online Bingo/Other | $ | 3.5 billion |

| 11 |

Irish Market Size

The total gambling industry in Ireland is estimated at $18.7 billion in gross revenue in 2011. Gross revenues from online gambling in particular reached $1.7 billion in 2011.

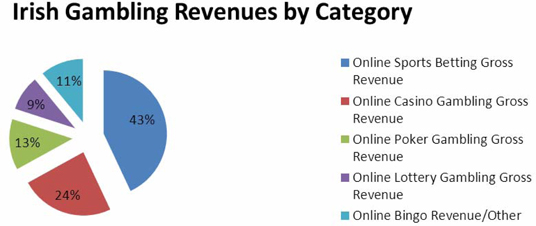

The chart and graph below show the Irish market shares of the different forms of online gambling in 2011:

| Irish Gambling | $ | 18.7 billion | ||

| Irish Online Gambling | $ | 1.7 billion | ||

| Online Sports Betting | $ | 314.9 million | ||

| Online Casino | $ | 175.8 million | ||

| Online Lottery | $ | 80.6 million | ||

| Online Poker | $ | 95.2 million | ||

| Online Bingo/Other | $ | 65.9 million |

| 12 |

British Market Size

The total gambling industry in the United Kingdom is estimated at $48.9 billion in gross revenue in 2010. Gross revenues from online gambling in particular reached $8.8 billion in 2011.

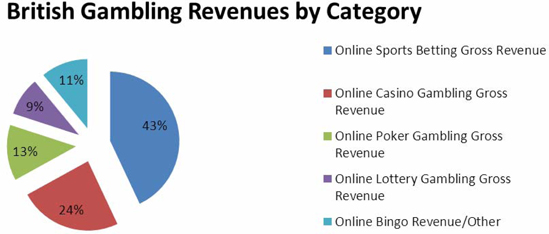

The chart and graph below show the British market shares of the different forms of online gambling in 2011:

| British Gambling | $ | 48.9 billion | ||

| British Online Gambling | $ | 8.8 billion | ||

| Online Sports Betting | $ | 3.8 billion | ||

| Online Casino | $ | 2.1 billion | ||

| Online Lottery | $ | 792 million | ||

| Online Poker | $ | 1.1 billion | ||

| Online Bingo/Other | $ | 968 million |

| 13 |

Industry Trends & Growth

Global Industry Trends & Growth Patterns

Global online gambling is an industry with strong potential for growth. According to online research firm Data Monitor, global online gambling revenues currently total $32 billion USD.1 Online gambling is expected to grow 52% to total $46.1 billion by the end of 2015.2 Globally, the potential for growth in the online gambling sector is strong.

Online gambling is quickly becoming a key driver in the gambling industry as a whole. Since 2003, the market has grown by an annual average of 23%. The gambling industry as a whole grew an average of 15% during the same time period. Online sports betting is the strongest category of online gambling, representing 41% of the market's overall value. It is clear that online gambling is becoming a significant segment of the gambling industry.

Although Europe represents the largest geographic market for online gambling, growth is expected to come from Asia and Latin America, according to a report by the gambling consulting firm H2 Gambling Capital. Europe, which currently comprises 44% of the online gambling market, is expected to grow more slowly as it focuses on deregulating the market within the European Common Market, according to KPMG.3

Legislative and regulatory considerations will likely be the single most substantial factor for growth in online gambling. As previously indicated, legal and regulatory restrictions prohibit or constrain the online gambling industry in several key markets (including the United States).4 Globally, governments and jurisdictions are still struggling to determine the place of online gambling in the regulatory and legal spectrum. Legalization and/or deregulation can open up or expand national markets significantly if legislative bodies become more comfortable with and receptive to online gambling.

In regards to online gambling activities, sport betting remains the most popular form of online gambling, representing 41% of all online gambling. Casino and poker games are the next most popular activities, representing 25% and 21% of online gaming activities. Other activities such as lotteries and bingo comprise the remaining 13% of the market.

In conclusion, online gaming represents a growing market that is constrained mostly by legal and regulatory instability and uncertainties. The greatest geographic market for growth will be Asia and Latin America, with Europe continuing to serve as a steady, mature market with growth opportunities.

1 Casinos & Gaming in the UK, Datamonitor; Global Casinos & Gaming, Datamonitor; Global Online Gambling, Datamonitor

2 2011 Global Online Gambling Market Expectations, Casinoman.net

3 Online Gambling, KPMG.com

4 www.GAO.gov

| 14 |

British Industry Trends & Growth Patterns

Gambling in the United Kingdom has grown steadily in the last decade. According to the United Kingdom Gambling Commission’s annual Gambling Prevalence Survey, 56% of adults participated in some form of gambling in 2010, up from 46% in 1999 and 48% in 2007, excluding those who participated only in the United Kingdom’s national lottery.5

The United Kingdom is the world’s largest online gambling market and is continuing to grow.6 Of those who participated in some form of gambling in 2010 (excluding national lottery participants), 5% did so online, up from 3% in 2007. In 2012, online gambling revenues are expected to reach $13.25 billion USD. Global consultancy PriceWaterhouseCoopers projects that revenue to rise as other EU governments create regulatory frameworks for their citizens to participate on British gaming websites.7 While the largest growth in gambling worldwide is expected to come from Asia and Latin America, it is clear that the United Kingdom’s large and mature online gaming industry will continue to have the potential to grow.

One caveat to the United Kingdom’s expected continued growth in online gambling is taxation. Current tax levies on market players in the United Kingdom are high and may drive players to use sites outside of the United Kingdom as other nations legalize and/or liberalize their online gambling laws. Furthermore, In January 2009, the government announced that the gambling sector will face a compulsory £5 million ($7.7 million) a year levy for research into problem gamblers unless it funds a voluntary scheme. Although online gambling in the United Kingdom will continue to grow, the effects of taxation must be considered.

In conclusion, the online gambling market in the United Kingdom is a mature market with the potential for modest, continued growth. The key factors to consider are taxation and regulation of the market.

Irish Industry Trends & Growth Patterns8

The Irish online gambling market has the potential to grow tremendously. Recent statistics estimate that the current market size for online gambling in Ireland is valued at $1.7 billion USD, representing approximately 5% of the global market. By extrapolating industry growth as a whole on the Irish market, online gambling is expected to reach $6.5 billion USD by 2015, and $9.8 billion USD by 2020. This represents growth rates of 124% (between today and 2015) and 50% (between 2015 and 2020). This assumes that Ireland’s 5% global market share and gambling prevalence remains constant.

The growth in the online gambling industry in Ireland is a trend that lends itself well to the launch of Seaniemac.

5 British Gambling Prevalence Survey, www.gamblingcommission.gov.uk

6 Global Gaming Outlook, www.PWC.com

7 Ibid, 39.

8 AtlanticCasinoConsultants.com

| 15 |

Trends in Mobile Gambling9

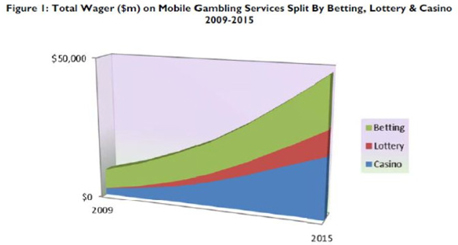

The proliferation of smartphones and the use of mobile broadband, combined with the growth of online gambling has resulted in the emergence and growth of mobile online gambling. As demonstrated in the following graph generated by Juniper Research, mobile gambling has seen steady growth since 2009 and is expected to continue to grow over the next several years reaching roughly $48 billion USD by 2015.

The majority of future growth is predicted to occur in mobile casino and lottery gambling. Casino gambling, which is currently producing a much smaller portion of total mobile wagering than betting, will grow to a roughly equal share of the total by 2015.

Furthermore, mobile lotteries, which today produce virtually no revenue, will substantially increase by 2015, although they will still represent a relatively small portion of the total. Juniper’s analysis suggests that the emergence of numerous mobile lotteries in the past 12 to 18 months, particularly in the Chinese, Latin American and African markets, will drive this future growth.

According to a Morgan Stanley report, six factors will influence the growth pattern of mobile online gambling: payment solutions, customer acceptance, battery life, regulation, branding, and substitution.

Market Trends & Growth Patterns: Global, United Kingdom and Ireland

Regulatory and legal uncertainties have the potential to skew the growth of online gambling worldwide. The most significant example is that of the United States, which outlawed online gambling in 2006.10 Stock values for Bwin.Party Digital Entertainment dropped 60% in 24 hours on that news.11 While the United States is an extreme case, it illustrates the potential effects changes in legal and regulatory practices on online gambling. In the case of Ireland, recent news indicates that the government is seeking to clarify gambling laws so as to account for online gaming, but may result in restrictions and constraints for the online gambling sector in particular.12 This is less of a concern in the United Kingdom, where online gambling is expressly allowed.13

9 Mobile Gambling White Paper, Juniper Research

10 www.ots.treas.gov

11 FTSE Stock Markets, www.guardian.co.uk

12 www.IrishExaminer.com

13 www.GAO.gov

| 16 |

A significant factor that will negatively affect the online gambling market in Ireland is emigration. According to Ireland’s Central Statistics Office, emigration is growing, from 65,300 Irish nationals emigrating in 2009, to over 76,000 in 2010.14 Although preliminary statistics are still being complied, the Economic and Social Research Institute estimates that over 120,000 Irish emigrated in 2011. The high unemployment rate and limited job prospects are the most significant factor in Irish emigration.15 The profile of the likeliest emigrants tracks closely with that of the typical Irish gambler: young, male, and with limited education. Although emigrants may retain close cultural ties to Ireland, they will naturally be far less likely to follow Irish-specific sports and gambling in their destination countries as they were in Ireland.

Although the growth potential for global and Irish online gambling is positive with moderate growth potential in the United Kingdom from a strictly economic standpoint, the above factors must be taken into careful consideration.

ITEM 1A. RISK FACTORS

YOU SHOULD CAREFULLY CONSIDER THE FOLLOWING FACTORS, IN ADDITION TO THE OTHER INFORMATION INCLUDED ELSEWHERE IN THIS CURRENT REPORT AND THE DOCUMENTS THAT WE HAVE FILED WITH THE SECURITIES AND EXCHANGE COMMISSION. UNLESS THE CONTEXT REQUIRES OTHERWISE, THE USE OF THE WORDS “COMPANY”, “COMPLIANCE SYSTEMS CORPORATION”, , “US,” OR “WE” REFERS TO THE COMBINED COMPANY AFTER GIVING EFFECT TO THE ACQUISITION. ADDITIONAL RISKS AND UNCERTAINTIES NOT PRESENTLY KNOWN TO US OR THAT ARE NOT CURRENTLY BELIEVED TO BE IMPORTANT TO YOU, IF THEY MATERIALIZE, ALSO MAY ADVERSELY AFFECT US AND OUR STOCK PRICE.

Our business is to offer a market-leading, user-friendly website for online gambling, including sports betting and casino gaming in Ireland under the brand name Seaniemac.com. We will initially focus on Gaelic Games as well as Irish horse racing and soccer. Gaelic Games, a series of popular Irish sports that include Hurling, Shinty and Gaelic Football, are gaining worldwide appeal.. An investment in our securities involves a high degree of risk. You should not invest in our securities if you cannot afford to lose your entire investment. In deciding whether you should invest in our securities, retain your equity interest in our company or dispose of your securities currently owned by you, you should carefully consider the following information together with all of the other information contained in this Current Report. Any of the following risk factors can cause our business, prospects, financial condition or results of operations to suffer and you to lose all or part of your investment.

14 2011 Population and Migration Estimates, www.CSO.ie

15 Leaving Ireland Emigration Looms Again, www.telegraph.co.uk

| 17 |

Risks Related to Our Business and Financial Condition

Because we have a limited operating history, we may not be able to successfully manage our business or achieve profitability.

Seaniemac was recently formed in December 2011 and our website only recently became operational. As a result, we have a limited operating history upon which you can evaluate our prospects and our potential value. The likelihood of our success must be considered in light of the expenses, complications and delays frequently encountered in connection with the establishment and expansion of new business and the competitive environment in which we will operate. We have little market penetration and successes to date, and may never reach profitability. No additional relevant operating history involving Seaniemac’s operations exists upon which an evaluation of our performance can be made. Our performance must be considered in light of the risks, expenses and difficulties frequently encountered in establishing new products and markets in the evolving, highly competitive online gambling industry. If we cannot successfully manage our business, we may not be able to generate future profits and may not be able to support our operations.

We have incurred substantial losses since our inception and may never be profitable.

We have incurred losses since inception and further losses are anticipated in the development of our business. As a development stage enterprise, there exists substantial doubt regarding our ability to continue as a going concern. The ability to continue as a going concern is dependent upon generating profitable operations in the future and/or to obtain the necessary financing to meet our obligations and repay our liabilities arising from normal business operations. Management intends to finance operating costs over the next twelve months with existing cash on hand, loans from stockholders and directors, and a possible private placement of our securities. No stockholder, director, or possible private placement participant has agreed to loan our company any funds nor agreed to purchase any of our securities. The failure to obtain necessary financing could result in our company ceasing all operations, which would likely result in a loss of all or a significant portion of your investment in our company.

Failure by us to respond to changes in consumer preferences could result in lack of sales revenues and may force us out of business.

Our online gambling website and online operations operate in an industry subject to:

| · | rapid technological change; |

| · | the proliferation of new and changing online gambling sites; |

| · | frequent new product introductions and updates; and |

| · | changes in customer demands. |

Any of the above changes that we fail to anticipate could reduce the demand for our online business, as well as any products we may introduce in the future. Failure to anticipate and respond to changes in consumer preferences and demands could lead to, among other things, customer dissatisfaction, failure to attract demand for our products and lower profit margins.

A decline in the popularity of our website will negatively impact our business.

Our primary source of revenues is dependent upon our ability to attract and retain new users and attracting existing users to increase their activity on our sites, among other things. If we are unable to maintain or extend web traffic to, and use of, our websites, our revenues may be adversely affected.

| 18 |

Intense competition in the online gambling industry may adversely affect our revenue and profitability.

We operate in a highly competitive environment and we compete for members, visitors and advertisers with numerous well established online gambling sites, as well as many smaller and/or newer sites. If we are unable to differentiate our products and generate sufficient appeal in the marketplace, our ability to achieve our business plan may be adversely affected. The effect of such competition may put pressure on profit margins and to involve us in vigorous competition to obtain and retain consumers and advertisers. As compared to us, many of our competitors have significantly longer operating histories and greater brand recognition as well as, greater financial, management, and other resources.

We currently depend on and may continue to be dependent on third parties to complete the development of our online gambling platform, and any increased costs associated with third party developers or any delay or interruption in production would negatively affect both our ability to develop the platform and our ability to continue our operations.

We currently depend on our agreement with Jenningsbet Ltd to develop the initial stages of and operate our online gambling platform. We anticipate that we will continue to need to rely on Jenningsbet Ltd and other third parties to complete the development of portions of the platform. The costs associated with relying on third parties may increase our development costs and negatively affect our ability to operate. Since we have less control over a third party because we cannot control the developer’s personnel, schedule or resources. We may experience delays in finalizing the platform. In addition, our reliance upon a third party developer exposes us to risks, including reduced control over quality assurance and costs of development. If this happens we could lose anticipated revenues from the platform and may not have the capital necessary to continue our operations. In addition, we may be required to rely on certain technology that we will license from third parties, including software that we integrate and use with our internally developed software. We cannot provide any assurances that these third party technology licenses will be available to us on commercially reasonable terms. The inability to establish any of these technology licenses, or the loss of such licenses if established, could result in delays in completing our platform until equivalent technology could be identified, licensed and integrated. Any such delays could materially adversely affect our business, operating results and financial condition.

Our success depends on the scope of our intellectual property rights and not infringing the intellectual property rights of others.

Our success depends in part on our ability to:

| · | obtain copyrights or trademarks or rights to copyrights or trademarks, where necessary, and to maintain their validity and enforceability; |

| · | operate without infringing upon the proprietary rights of others; and |

| · | prevent others from infringing on our proprietary rights. |

We will be able to protect our proprietary intellectual property rights from unauthorized use by third parties only to the extent that our proprietary rights are covered by valid and enforceable copyrights or trademarks. Our inability to protect our proprietary rights could materially adversely affect our business prospects and profitability. In addition, if litigation were to take place in connection with the enforcement of our intellectual property rights (or to defend third party claims of infringement against us), there can be no assurance that we would prevail. Legal proceedings could result in substantial costs and diversion of management time and resources and could materially adversely affect our operations and our financial condition. We currently own our operating url, www.seaniemac.com and the contents of such website, though we have not filed for formal copyright or trademark protection.

| 19 |

Our online website is subject to security and stability risks that could harm our business and reputation and expose us to litigation or liability.

Online commerce and communications depend on the ability to transmit confidential information and licensed intellectual property securely over private and public networks. Any compromise of our ability to transmit such information and data securely or reliably, and any costs associated with preventing or eliminating such problems, could harm our business. Online transmissions are subject to a number of security and stability risks, including:

| · | our encryption and authentication technology, and access and security procedures, may be compromised, breached or otherwise be insufficient to ensure the security of customer information; |

| · | we could experience unauthorized access, computer viruses, system interference or destruction, “denial of service” attacks and other disruptive problems, whether intentional or accidental, that may inhibit or prevent access to our websites or use of our products and services; |

| · | someone could circumvent our security measures and misappropriate our partners’ or our customers’ intellectual property, interrupt our operations, or jeopardize our licensing arrangements, which are contingent on our sustaining appropriate security protections; |

| · | our computer systems could fail and lead to service interruptions; |

| · | we may be unable to scale our infrastructure with increases in customer demand; or |

| · | our network of facilities may be affected by a natural disaster, terrorist attack or other catastrophic events. |

The occurrence of any of these or similar events could damage our business, hurt our ability to distribute products and services and collect revenue, threaten the proprietary or confidential nature of our technology, harm our reputation and expose us to litigation or liability. We may be required to expend significant capital or other resources to protect against the threat of security breaches, hacker attacks or system malfunctions or to alleviate problems caused by such breaches, attacks or failures.

We have limited experience competing in international markets. Any international expansion plans will expose us to greater political, intellectual property, regulatory, exchange rate fluctuation and other risks, which could harm our business.

Once our online gambling platform is developed, we may attempt to market such products in countries outside of our current operations in Ireland. The markets in which we may undertake international expansion may have technology and online industries that are less well developed than in Ireland. There are certain risks inherent in doing business in international markets, such as the following:

| · | Uncertainty of product acceptance by different cultures; |

| · | Unforeseen changes in regulatory requirements; |

| · | Difficulties in staffing and managing multinational operations; |

| · | State-imposed restrictions on the repatriation of funds; |

| · | Currency fluctuations; |

| · | Difficulties in finding appropriate foreign licensees or joint venture partners; |

| · | Laws and business practices that favor local competitors; |

| · | Expenses associated with localizing our products, including offering customers the ability to transact business in multiple currencies; |

| · | Potentially adverse tax consequences; and |

| 20 |

| · | Less stringent and/or narrower intellectual property protection. |

There is a risk that these factors will have an adverse effect on our ability successfully to operate internationally and on our results of operations and financial condition.

Changes to payment card networks or bank fees, rules, or practices could harm our business and, if we do not comply with the rules, could result in a termination of our ability to accept credit cards. If we are unable to accept credit cards, our competitive position would be seriously damaged.

We expect to belong to or directly access payment card networks, such as Visa, MasterCard and the National Automated Clearing House Association (“NACHA”), in order to accept or facilitate the processing of credit cards and debit cards (including some types of prepaid cards). We also expect to rely on banks or other payment processors to process transactions, and must pay fees for these services. From time to time, payment card networks have increased, and may increase in the future, the interchange fees and assessments that they charge for each transaction using one of their cards. Generally, payment card processors have the right to pass any increases in interchange fees and assessments on to payment systems like ours as well as increase their own fees for processing. Changes in interchange fees and assessments could increase our operating costs and reduce profit margins, if any. In addition, in some markets, governments have required Visa and MasterCard to reduce interchange fees, or have opened investigations as to whether Visa or MasterCard's interchange fees and practices violate antitrust law. The financial reform law enacted in 2010 authorizes the Federal Reserve Board to regulate debit card interchange rates and debit card network exclusivity provisions, and the Federal Reserve Board has proposed rules that include caps on debit card interchange fees at significantly lower rates than Visa or MasterCard currently charge. We expect to be required by our processors to comply with payment card network operating rules, which generally include the obligation to reimburse processors for any fines they are assessed by payment card networks as a result of any rule violations by users . The payment card networks set and interpret the card rules which could be more difficult or expensive to comply with. We also expect to be required to comply with payment card networks' special operating rules for Internet payment services. Some of these rules may be difficult or even impossible for us to comply with. If we are unable to comply with these rules, we may be subject to fines for any failure to comply with such rules or we may lose our ability to gain access to the credit card associations or NACHA.

Changes in government laws could materially adversely affect our business, financial condition and results of operations.

Our business is regulated by diverse and evolving laws and governmental authorities in Ireland and the Isle of Man and other countries in which we intend to operate in the future. Such laws relate to, among other things, online gambling, gambling in general, internet, licensing, copyrights, commercial advertising, subscription rates, foreign investment, use of confidential customer information and content. Promulgation of new laws, changes in current laws, changes in interpretations by courts and other government officials of existing laws, our inability or failure to comply with current or future laws or strict enforcement by current or future government officers of current or future laws could adversely affect us by reducing our revenue, increasing our operating expenses and/or exposing us to significant liabilities.

| 21 |

We may require significant additional capital to fund our business plan.

We will be required to expend significant funds to develop our online gambling operations. Our ability to obtain necessary funding for these purposes, in turn, depends upon a number of factors, including the status of the national and worldwide economy. . Capital markets worldwide have been adversely affected by substantial losses by financial institutions, in turn caused by investments in asset-backed securities. We may not be successful in obtaining the required financing, or if we can obtain such financing, such financing may not be on terms that are favorable to us. Failure to obtain such additional financing could result in delay or indefinite postponement of operations.

We depend upon a limited number of personnel and the loss of any of these individuals could adversely affect our business.

If any of our current executive employees were to die, become disabled or leave our company, we would be forced to identify and retain individuals to replace them. They are critical employees at this time. In addition to the executives, we rely heavily on a several people that have extensive knowledge of our industry. There is no assurance that we can find suitable individuals to replace them or to add to our employee base if that becomes necessary. We are entirely dependent on these individuals as our critical personnel at this time. We have no life insurance on any of our employees, and we may be unable to hire a suitable replacement for them on favorable terms, should that become necessary.

Risks Related to Our Common Stock

There currently is only a minimal public market for our common stock. Failure to develop or maintain a trading market could negatively affect the value of our common stock and make it difficult or impossible for you to sell your shares.

There currently is only a minimal public market for shares of our common stock and an active market may never develop. Our common stock is quoted on the OTCQB operated by the OTC Market’s Group, Inc. under the symbol “COPI”. We may not ever be able to satisfy the listing requirements for our common stock to be listed on any stock exchange, including the trading platforms of NASDAQ Stock Market which are often more widely-traded and liquid markets. Some, but not all, of the factors which may delay or prevent the listing of our common stock on a more widely-traded and liquid market include the following: our stockholders’ equity may be insufficient; the market value of our outstanding securities may be too low; our net income from operations may be too low; our common stock may not be sufficiently widely held; we may not be able to secure market makers for our common stock; and we may fail to meet the rules and requirements mandated by, any of the several exchanges and markets to have our common stock listed.

We cannot assure you that our common stock will become liquid or that it will be listed on a securities exchange.

Until our common stock is listed on a national securities exchange such as the New York Stock Exchange or the Nasdaq Stock Market, we expect our common stock to remain eligible for quotation on the OTCQB, or on another over-the-counter quotation system. In those venues, however, an investor may find it difficult to obtain accurate quotations as to the market value of our common stock. In addition, if we fail to meet the criteria set forth in SEC regulations, various requirements would be imposed by law on broker-dealers who sell our securities to persons other than established customers and accredited investors. Consequently, such regulations may deter broker-dealers from recommending or selling our common stock, which may further affect the liquidity of our common stock. This would also make it more difficult for us to raise capital.

| 22 |

The application of the “penny stock” rules could adversely affect the market price of our common shares and increase your transaction costs to sell those shares.

The Securities and Exchange Commission (the “SEC”) has adopted Rule 3a51-1 which establishes the definition of a “penny stock,” for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, SEC Rule 15g-9 requires:

| · | that a broker or dealer approve a person’s account for transactions in penny stocks, and |

| · | the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased. |

In order to approve a person’s account for transactions in penny stocks, the broker or dealer must:

| · | obtain financial information and investment experience objectives of the person, and |

| · | make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks. |

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the SEC relating to the penny stock market, which, in highlight form:

| · | sets forth the basis on which the broker or dealer made the suitability determination and |

| · | that the broker or dealer received a signed, written agreement from the investor prior to the transaction. |

Generally, brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult for investors to dispose of our common stock and cause a decline in the market value of our stock.

The market price for our common shares is particularly volatile given our status as a relatively unknown company with a small and thinly traded public float, limited operating history and lack of profits which could lead to wide fluctuations in our share price. You may be unable to sell your common stock at or above your purchase price, which may result in substantial losses to you.

The market for our common stock is characterized by significant price volatility when compared to seasoned issuers, and we expect that our share price will continue to be more volatile than a seasoned issuer for the indefinite future. The volatility in our share price is attributable to a number of factors. First, as noted above, our common stock is sporadically and thinly traded. As a consequence of this lack of liquidity, the trading of relatively small quantities of shares by our stockholders may disproportionately influence the price of those shares in either direction. The price for our common stock could, for example, decline precipitously in the event that a large number of shares are sold on the market without commensurate demand, as compared to the market for securities or a seasoned issuer which could better absorb those sales without adverse impact on its share price. Secondly, we are a speculative or “risky” investment due to our limited operating history and lack of profits to date, and uncertainty of future market acceptance for our potential products and services. As a consequence of this enhanced risk, more risk-adverse investors may, under the fear of losing all or most of their investment in the event of negative news or lack of progress, be more inclined to sell their shares on the market more quickly and at greater discounts than would be the case with the stock of a seasoned issuer. Many of these factors are beyond our control and may decrease the market price of our common shares, regardless of our operating performance. We cannot make any predictions or projections as to what the prevailing market price for our common stock will be at any time, including as to whether our common shares will sustain their current market prices, or as to what effect that the sale of shares or the availability of shares for sale at any time will have on the prevailing market price.

| 23 |

We do not pay dividends on our common stock.

We have not paid any dividends on our common stock and do not anticipate paying dividends in the foreseeable future. We plan to retain earnings, if any, to finance the development and expansion of our business.

Failure to achieve and maintain effective internal controls in accordance with Section 404 of the Sarbanes-Oxley Act of 2002 could have a material adverse effect on our business and stock price.

Section 404 of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”) requires that we establish and maintain an adequate internal control structure and procedures for financial reporting and include a report of management on our internal control over financial reporting in our annual report on Form 10-K. That report must contain an assessment by management of the effectiveness of our internal control over financial reporting and must include disclosure of any material weaknesses in internal control over financial reporting that we have identified.

Restrictions on the reliance of Rule 144 by Shell Companies or former Shell Companies.

Historically, the SEC staff has taken the position that Rule 144 is not available for the resale of securities initially issued by companies that are, or previously were, blank check companies. The SEC has codified and expanded this position in the amendments discussed above by prohibiting the use of Rule 144 for resale of securities issued by any shell companies (other than business combination related shell companies) or any issuer that has been at any time a “shell company”. The SEC has provided an important exception to this prohibition, however, if the following conditions are met:

| · | The issuer of the securities that was formerly a shell company has ceased to be a shell company, |

| · | The issuer of the securities is subject to the reporting requirements of Section 14 or 15(d) of the Exchange Act, |

| · | The issuer of the securities has filed all Exchange Act reports and material required to be filed, as applicable, during the preceding 12 months (or such shorter period that the issuer was required to file such reports and materials), other than Current Reports on Form 8-K; and |

| · | At least one year has elapsed from the time that the issuer filed current comprehensive disclosure with the SEC reflecting its status as an entity that is not a shell company. |

| 24 |

As a result, it is likely that pursuant to Rule 144, stockholders who hold restricted securities by our company including the 29,719,952 shares issued to RDRD in connection with the Acquisition or through any means other than a public offering will not be able to sell our shares without registration under the securities act until one year after we have completed our initial business combination and filed this current report on Form 8-K containing the information required in a Form 10.

Beginning one year after the filing of this current report on Form 8-K, and as long as we remain an operating business and current in our reporting requirements under the Exchange Act, our stockholders will be able to utilize Rule 144.

A summary of Rule 144 is as follows:

The SEC adopted amendments to Rule 144 which became effective on February 15, 2008 that apply to securities acquired both before and after that date. Under these amendments, a person who has beneficially owned restricted shares of our common stock for at least six months would be entitled to sell their securities provided that: (i) such person is not deemed to have been one of our affiliates at the time of, or at any time during the three months preceding a sale, (ii) we are subject to the Exchange Act periodic reporting requirements for at least 90 days before the sale and (iii) if the sale occurs prior to satisfaction of a one-year holding period, we provide current information at the time of sale.

Persons who have beneficially owned restricted shares of our common stock for at least six months but who are our affiliates at the time of, or at any time during the three months preceding, a sale would be subject to additional restrictions, by which such person would be entitled to sell within any three-month period only a number of securities that does not exceed the greater of either of the following:

| · | 1% of the total number of securities of the same class then outstanding; or |

| · | the average weekly trading volume of such securities during the four calendar weeks preceding the filing of a notice on Form 144 with respect to the sale; |

provided, in each case, that we are subject to the Exchange Act periodic reporting requirements for at least three months before the sale. Such sales by affiliates must also comply with the manner of sale, current public information and notice provisions of Rule 144.

ITEM 2. FINANCIAL INFORMATION

Management's Discussion And Analysis Of Financial Condition And Results Of Operations

The following management’s discussion and analysis should be read in conjunction with our and Seaniemac’s historical combined financial statements and the related notes. The following management’s discussion and analysis contains forward-looking statements that involve risks and uncertainties, such as statements of our plans, objectives, expectations and intentions. Any statements that are not statements of historical fact are forward-looking statements. When used, the words “believe,” “plan,” “intend,” “anticipate,” “target,” “estimate,” “expect” and the like, and/or future tense or conditional constructions (“will,” “may,” “could,” “should,” etc.), or similar expressions, identify certain of these forward-looking statements. These forward-looking statements are subject to risks and uncertainties that could cause actual results or events to differ materially from those expressed or implied by the forward-looking statements in this Current Report. Our actual results and the timing of events could differ materially from those anticipated in these forward-looking statements as a result of several factors. We do not undertake any obligation to update forward-looking statements to reflect events or circumstances occurring after the date of this Current Report. Please see “Forward-Looking Statements” and “Risk Factors” for a discussion of the uncertainties, risks and assumptions associated with these forward-looking statements.

| 25 |

Compliance Systems Corporation

Overview and Recent Developments

We were incorporated in Nevada on November 17, 2003 under the name GSA Publications, Inc. In conjunction with a reorganization in February 2006, we changed our name to our current name, Compliance Systems Corporation.

In February 2010, we merged with Execuserve pursuant to which we entered the business then operated by Execuserve.

From May 2008 through July 2010, we raised capital through the sale to Agile Opportunity Fund, LLC of secured convertible debentures. Subsequent thereto, we breached certain on the terms of such debentures in December 2010 and transferred to Agile all of our operating assets in exchange for a release of our obligations under the debentures and other obligations owed to Agile. At that time, we became a non-operating shell company and began seeking to acquire or merge with an operating entity.

On September 11, 2012, we filed with the SEC a definitive Information Statement on Schedule 14C in which we reported that our Board of Directors and the requisite number of our stockholders have authorized a 1 for 994.488567392 reverse split (the “Reverse Split”) of our common stock and a corresponding amendment to our Articles of Incorporation. The Reverse Split was necessary in order to effectuate the Acquisition as contemplated in the Exchange Agreement. In accordance with the definitive Information Statement, we filed an amendment to our Articles of Incorporation and the reverse split was declared effective on October 3, 2012. The effect of the Reverse Split is to decrease the number of our shares of Common Stock issued and outstanding from 1,441,770,097 pre-Reverse Split shares to approximately 1,449,760 post-Reverse Split shares.

Acquisition of Interest in Seaniemac

On June 12, 2012 we filed a Form 8-K in which we reported that on June 7, 2012 we entered into the Exchange Agreement with RDRD in connection with the Acquisition as described above.

On October 30, 2012, RDRD designated the following persons to our Board of Directors and such board appointed the following individuals to serve as our officers: Barry M. Brookstein, Director, Chief Executive Officer, Chief Financial Officer and Secretary; Sean McEniff, Director, Chairman and President; Shane O’Driscoll, Director; Jon M. Garfield, Director.

Critical Accounting Policies

The Company’s consolidated financial statements and related public information are based on the application of generally accepted accounting principles in the United States (“GAAP”). The Company’s significant accounting policies are summarized in Note 2 to its annual consolidated financial statements. While all of these significant accounting policies impact its financial condition and results of operations, the Company views certain of these policies as critical. Policies determined to be critical are those policies that have the most significant impact on our consolidated financial statements. The Company’s critical accounting policies are discussed below.

| 26 |

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Stock Based Compensation Arrangements

The Company accounts for stock-based compensation arrangements in accordance with guidance provided by the Financial Accounting Standards Board Accounting Standards Codification (“ASC”). This guidance addresses all forms of share-based payment awards including shares issued under employee stock purchase plans, stock options, restricted stock and stock appreciation rights, as well as share grants and other awards issued to employees and non-employees under free-standing arrangements. These awards are recorded at costs that are measured at fair value on the awards’ grant dates, based on the estimated number of awards that are expected to vest and will result in charges to operations.

From time to time, the Company’s shares of common stock and warrants have been issued as payment to employees and non-employees for services. These are non-cash transactions that require management to make judgments related to the fair value of the shares issued, which affects the amounts reported in the Company’s consolidated financial statements for certain of its assets and expenses.

Income Taxes

The Company accounts for income taxes under the provisions of Financial Accounting Standards Board's ("FASB") Accounting Standard Codification ("ASC") 740 "Income Tax". ASC 740 requires the recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the financial statements or tax returns. Under this method, deferred tax assets and liabilities are determined based on the differences between the financial statement carrying amounts and tax bases of assets and liabilities using enacted tax rates in effect in the years in which the differences are expected to reverse. Valuation allowances are established when necessary to reduce deferred tax assets to the amount expected to be realized.

The Company has adopted the provisions of FASB ASC 740-10-05 “Accounting for Uncertainty in Income Taxes.” The ASC clarifies the accounting for uncertainty in income taxes recognized in an enterprise’s financial statements. The ASC prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. The ASC provides guidance on de-recognition, classification, interest and penalties, accounting in interim periods, disclosure and transition.

Results of Operations for Year Ended December 31, 2011 Compared to the Year Ended December 31, 2010

This discussion of results of operations for the year ended December 31, 2012, should be read in conjunction with the discussion on Events Subsequent to June 30, 2012 beginning on page 31.

| 27 |

Going Concern