Attached files

| file | filename |

|---|---|

| EX-21.1 - SUBSIDIARIES OF THE REGISTRANT - Artisan Partners Asset Management Inc. | d429881dex211.htm |

| EX-10.20 - INVESTMENT ADVISORY AGREEMENT - Artisan Partners Asset Management Inc. | d429881dex1020.htm |

| EX-10.19 - INVESTMENT ADVISORY AGREEMENT - Artisan Partners Asset Management Inc. | d429881dex1019.htm |

| EX-10.21 - INVESTMENT ADVISORY AGREEMENT - Artisan Partners Asset Management Inc. | d429881dex1021.htm |

| EX-23.3 - CONSENT OF MATTHEW R. BARGER - Artisan Partners Asset Management Inc. | d429881dex233.htm |

| EX-23.5 - CONSENT OF ALLEN R. THORPE - Artisan Partners Asset Management Inc. | d429881dex235.htm |

| EX-23.1 - CONSENT OF PRICEWATERHOUSECOOPERS LLP - Artisan Partners Asset Management Inc. | d429881dex231.htm |

| EX-23.4 - CONSENT OF TENCH COXE - Artisan Partners Asset Management Inc. | d429881dex234.htm |

Table of Contents

As filed with the Securities and Exchange Commission on November 1, 2012

Registration No.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Artisan Partners Asset Management Inc.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 6282 | 45-0969585 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(IRS Employer Identification Number) |

875 E. Wisconsin Avenue, Suite 800

Milwaukee, WI 53202

(414) 390-6100

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

JANET D. OLSEN

Chief Legal Officer

Artisan Partners Asset Management Inc.

875 E. Wisconsin Ave., Suite 800

Milwaukee, WI 53202

(414) 390-6100

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

| MARK J. MENTING CATHERINE M. CLARKIN Sullivan & Cromwell LLP 125 Broad Street New York, NY 10004 (212) 558-4000 |

VINCENT PAGANO JR. JOSHUA FORD BONNIE Simpson Thacher & Bartlett LLP 425 Lexington Avenue New York, NY 10017 (212) 455-2000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Securities Exchange Act of 1934. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of each class of securities to be registered | Proposed maximum offering price(1)(2) |

Amount of registration fee(3) | ||

| Class A common stock, par value $0.01 per share |

$250,000,000 | $34,100 | ||

|

| ||||

|

| ||||

| (1) | Includes additional shares of Class A common stock that the underwriters have the option to purchase. |

| (2) | Estimated solely for purposes of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933. |

| (3) | Pursuant to Rule 457(p) under the Securities Act of 1933, the registration fee is offset by $29,025 previously paid in connection with the Registrant’s Registration Statement on Form S-1 (File No. 333-173324, filed with the Commission on April 6, 2011 and subsequently withdrawn on December 29, 2011). |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The Information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion. Dated November 1, 2012.

Shares

Class A Common Stock

This is an initial public offering of shares of Class A common stock of Artisan Partners Asset Management Inc. All of the shares of Class A common stock included in this offering are being sold by Artisan Partners Asset Management Inc.

Prior to this offering, there has been no public market for our Class A common stock. We expect the initial public offering price per share to be between $ and $ . We have applied to list our Class A common stock on the New York Stock Exchange under the symbol “APAM”.

In connection with this offering and the related reorganization transactions, each of our employee-partners and our current general partner will enter into a stockholders agreement pursuant to which they will grant to a stockholders committee the right to vote all of their shares of our common stock they hold at such time or may acquire from us in the future. Following the consummation of this offering, Andrew A. Ziegler, our Executive Chairman, will have the sole right, in consultation with the other members of the stockholders committee, to determine how to vote all such shares. As a result, the stockholders committee, and initially solely Mr. Ziegler, will be able to elect all of the members of our board of directors (subject to the obligation of the stockholders committee under the terms of the stockholders agreement to vote in support of certain nominees) and thereby effectively control our management and affairs for so long as the stockholder group holds at least a majority of the combined voting power of our capital stock. The stockholders committee may control our management and affairs even if the shares subject to the stockholders agreement represent less than a majority of the number of outstanding shares of our capital stock. The purchasers of the shares of Class A common stock included in this offering will not be invited to enter and will never be a party to the stockholders agreement.

We are an “emerging growth company” under the federal securities laws and, as such, are eligible for reduced public company reporting and other requirements. See “Risk Factors” beginning on page 22 to read about factors you should consider before buying shares of the Class A common stock.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discount |

$ | $ | ||||||

|

|

|

|

|

|||||

| Proceeds, before expenses, to Artisan Partners Asset Management Inc. |

$ | $ | ||||||

|

|

|

|

|

|||||

To the extent that the underwriters sell more than shares of Class A common stock, the underwriters have the option to purchase up to an additional shares from Artisan Partners Asset Management Inc. at the initial public offering price less the underwriting discount.

The underwriters expect to deliver the shares of Class A common stock against payment in New York, New York on , 2013.

| Citigroup | Goldman, Sachs & Co. |

| BofA Merrill Lynch | Morgan Stanley | |||

| Scotiabank |

Prospectus dated , 2013.

Table of Contents

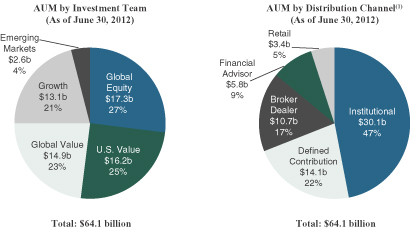

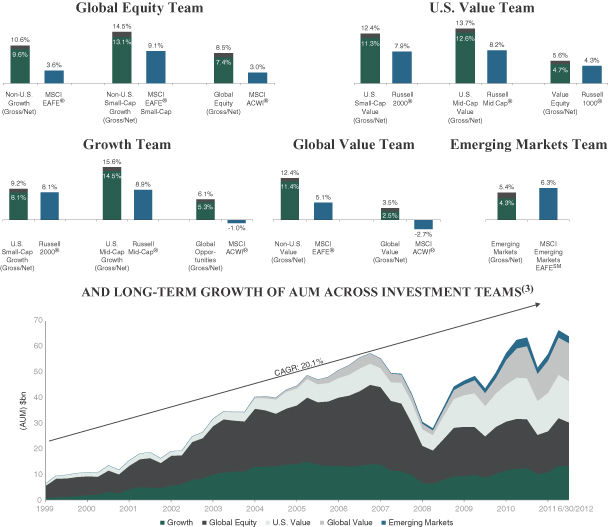

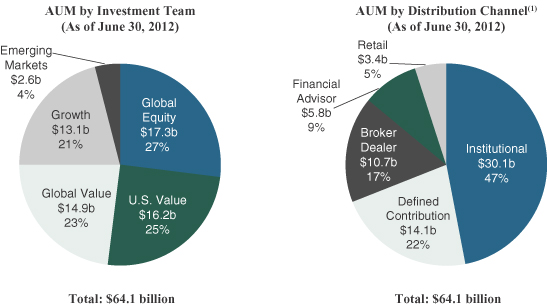

DIVERSIFIED BUSINESS BY INVESTMENT TEAM AND DISTRIBUTION CHANNEL

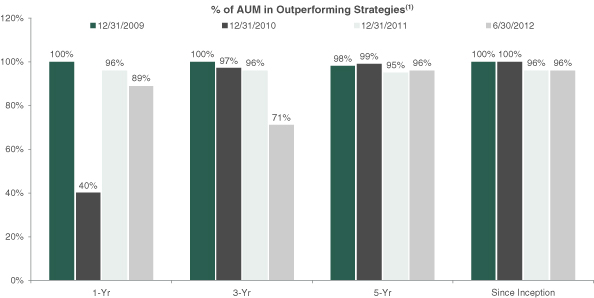

WITH STRONG LONG-TERM PERFORMANCE ACROSS ALL STRATEGIES(2)

| (1) | The allocation of assets under management, or AUM, by distribution channel involves the use of estimates and the exercise of judgment. See “Performance and Assets Under Management Information Used in this Prospectus” for more information. |

| (2) | Our average annual returns presented above are gross and net of our advisory fees, for the period from composite inception to June 30, 2012. Each MSCI Index and Russell Index presented above is the index we use in assessing the returns of our composites. Historical returns are not necessarily indicative of future performance of our current or future investment strategies. For additional details on investment performance, please see pages 136 to 149 of this prospectus. See also “Performance and Assets Under Management Information Used in this Prospectus”. |

| (3) | At December 31st of each year, unless otherwise specified. |

Table of Contents

| Page | ||||

| 1 | ||||

| 15 | ||||

| Summary Selected Historical and Pro Forma Consolidated Financial Data |

19 | |||

| 22 | ||||

| 47 | ||||

| 48 | ||||

| 75 | ||||

| 76 | ||||

| 78 | ||||

| 79 | ||||

| 81 | ||||

| 91 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

94 | |||

| 130 | ||||

| 154 | ||||

| 157 | ||||

| 179 | ||||

| 181 | ||||

| 184 | ||||

| 192 | ||||

| Material U.S. Federal Tax Considerations for Non-U.S. Holders of our Class A Common Stock |

195 | |||

| 198 | ||||

| 203 | ||||

| F-1 |

Through and including , 2013 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to unsold allotments or subscriptions.

We are responsible for the information contained in this prospectus and in any free writing prospectus we may authorize to be delivered to you. We have not authorized anyone to give you any other information, and take no responsibility for any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

Except where the context requires otherwise, in this prospectus:

| • | “AIC” refers to Artisan Investment Corporation, an entity controlled by Andrew A. Ziegler and Carlene M. Ziegler, who are married to each other, and through which Mr. Ziegler and Mrs. Ziegler maintain their ownership interests in Artisan Partners Holdings; |

| • | “Artisan Funds” refers to Artisan Partners Funds, Inc., a family of Securities and Exchange Commission registered mutual funds; |

| • | “Artisan Global Funds” refers to Artisan Partners Global Funds Public Limited Company, a family of Ireland-domiciled funds organized pursuant to the European Union’s Undertaking for Collective Investment in Transferable Securities; |

Table of Contents

| • | “Artisan Partners Asset Management Inc.”, “Artisan”, “Artisan Partners Asset Management”, the “company”, “we”, “us” and “our” refer to Artisan Partners Asset Management Inc., a Delaware corporation, and, unless the context otherwise requires, its direct and indirect subsidiaries, and, for periods prior to this offering, “Artisan,” the “company,” “we,” “us” and “our” refer to Artisan Partners Holdings LP and, unless the context otherwise requires, its direct and indirect subsidiaries; |

| • | “Artisan Partners Holdings” refers to Artisan Partners Holdings LP, a limited partnership organized under the laws of the State of Delaware, and, unless the context otherwise requires, its direct and indirect subsidiaries; |

| • | “client” and “clients” refer to investors who access our investment management services by engaging us to manage a separate account in one of our investment strategies or by investing in mutual funds, including the funds of Artisan Funds or Artisan Global Funds, collective investment trusts (which are pools of retirement plan assets maintained by a bank or trust company that we manage on a separate account basis), or other pooled investment vehicles for which we are investment adviser; and |

| • | “employee” includes members of Artisan Partners UK LLP and limited partners of Artisan Partners Holdings whose full-time professional efforts are devoted to providing services to us. |

-ii-

Table of Contents

Performance and Assets Under Management Information Used in this Prospectus

We manage investments primarily through mutual funds and separate accounts. We serve as investment adviser to Artisan Funds, a family of Securities and Exchange Commission, or the SEC, registered mutual funds, and as investment manager and promoter of Artisan Global Funds, a family of Ireland-domiciled funds organized pursuant to the European Union’s Undertaking for Collective Investment in Transferable Securities, or UCITS. We refer to funds and other accounts that are managed by us with a broadly common investment objective and substantially in accordance with a single model account as being part of the same “strategy”. We measure the results both of our individual funds and of our “composites”, which represent the aggregate performance of all discretionary client accounts, including mutual funds, invested in the same strategy, except those accounts with respect to which we believe client-imposed socially-based restrictions may have a material impact on portfolio construction and those accounts managed in a currency other than U.S. dollars (the results of these accounts, which represented approximately 7% of our assets under management at June 30, 2012, are maintained in separate composites, which are not presented in this prospectus).

Results for any investment strategy described herein, and for different investment products within a strategy, are affected by numerous factors, including: different material market or economic conditions; different investment management fee rates, brokerage commissions and other expenses; and the reinvestment of dividends or other earnings. The returns for any strategy may be positive or negative, and past performance does not guarantee future results.

Throughout this prospectus, we present the average annual returns and annual returns of our composites on a “gross” and “net” basis, which represent average annual returns and annual returns before and after payment of the highest fee payable to us by any portfolio in the composite, respectively, and in each case are net of commissions and transaction costs. In this prospectus, we also present the average annual returns and annual returns of certain market indices or “benchmarks” for the comparable period. Indices that are used for these performance comparisons are broad-based market indices that we believe are appropriate comparisons of our investment performance over a full market cycle and, for some of our strategies, style-based indices that we believe may be useful in evaluating our performance over shorter periods. The indices are unmanaged and have differing volatility, credit and other characteristics. You should not assume that there is any material overlap between the securities included in the portfolios of our investment strategies during these periods and those that comprise any MSCI Index or any Russell Index referred to in this prospectus. It is not possible to invest directly in any of the indices described above or listed below. The returns of these indices, as presented in this prospectus, have not been reduced by fees and expenses associated with investing in securities, but do include the reinvestment of dividends. In this prospectus, we refer to the date on which we began tracking the performance of an investment strategy as that strategy’s “inception date”.

The MSCI EAFE® Index, the MSCI EAFE® Growth Index, the MSCI EAFE® Small Cap Index, the MSCI EAFE® Value Index, the MSCI ACWI® Index and the MSCI Emerging Markets IndexSM are trademarks of MSCI Inc. MSCI Inc. is the owner of all copyrights relating to these indices and is the source of the performance statistics of these indices that are referred to in this prospectus.

The Russell 2000® Index, the Russell 2000® Value Index, the Russell Midcap® Index, the Russell Midcap® Value Index, the Russell 1000® Index, the Russell 1000® Value Index, the Russell Midcap® Growth Index, the Russell 1000® Growth Index and the Russell 2000® Growth Index are trademarks of Russell Investment Group. Russell Investment Group is the owner of all copyrights relating to these indices and is the source of the performance statistics that are referred to in this prospectus.

In this prospectus, we present Morningstar, Inc., or Morningstar, ratings for series of Artisan Funds. The Morningstar ratings refer to the ratings by Morningstar of the Investor Class and Advisor Class shares of the series of Artisan Funds and are based on a 5-star scale. Morningstar data contained herein (1) is proprietary to Morningstar and/or its content providers, (2) may not be copied or distributed and (3) is not warranted to be

-iii-

Table of Contents

accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. For each fund with at least a three-year history, Morningstar calculates a Morningstar Rating™, which is based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a fund’s monthly performance, including the effects of sales charges, loads, and redemption fees, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive 1 star. The Overall Morningstar RatingTM is derived from a weighted average of the performance figures associated with the rated fund’s three-, five- and 10-year Morningstar Rating metrics.

We also present Lipper rankings for series of Artisan Funds. Lipper rankings are based on total return, are historical and do not represent future results. The number of funds in a category may include multiple share classes of the same fund, which may have a material impact on a fund’s ranking within a category. Lipper, a Thomson Reuters company, is the owner of all trademarks and copyrights relating to Lipper rankings.

Throughout this prospectus, we present historical information about our assets under management, including information about changes in our assets under management due to gross client cash inflows and outflows, market appreciation and depreciation and transfers between investment vehicles (i.e., Artisan Funds and separate accounts). Gross client cash inflows and outflows represent client fundings, terminations and client initiated contributions and withdrawals (which could be in cash or in securities). Market appreciation (depreciation) represents realized gains and losses, the change in unrealized gains and losses, net income and certain miscellaneous items, immaterial in the aggregate, which may include payment of Artisan’s management fees or payment of custody expenses to the extent a client causes these fees to be paid from the account we manage. We also present information about our average assets under management for certain periods. We use our information management systems to track our assets under management, the components of market appreciation and depreciation, and client inflows and outflows, and we believe the information set forth in this prospectus regarding our assets under management, market appreciation and depreciation, and client inflows and outflows is accurate in all material respects. We also present in this prospectus information regarding the amount of our assets under management and client inflows and outflows sourced through particular investment vehicles and distribution channels. The allocation of assets under management and client flows sourced through particular distribution channels involves estimates because precise information on the sourcing of assets invested in Artisan Funds through intermediaries is not available on a complete or timely basis and involves the exercise of judgment because the same assets, in some cases, might fairly be said to have been sourced from more than one distribution channel. We have presented the information on our assets under management and client inflows and outflows sourced by distribution channel in the way in which we prepare and use that information in the management of our business. Data on our assets under management sourced by distribution channel and client inflows and outflows are not subject to our internal controls over financial reporting.

Any discrepancies included in this prospectus between totals and the sums of the amounts listed are due to rounding.

None of the information in this prospectus or the registration statement constitutes either an offer or a solicitation to buy or sell any fund securities, nor is any such information a recommendation for any fund security or investment service.

-iv-

Table of Contents

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider before deciding to invest in our Class A common stock. You should read this entire prospectus carefully, including the “Risk Factors” section, our historical consolidated financial statements and the notes thereto, and unaudited pro forma financial information, each included elsewhere in this prospectus.

Our Business

Founded in 1994, we are an independent investment management firm that provides a broad range of U.S., non-U.S. and global equity investment strategies and managed a total of $64.1 billion in assets as of June 30, 2012. We have established a record of investment excellence with attractive and consistent investment performance across multiple strategies and products. Through June 30, 2012, 11 of our 12 investment strategies (comprising 96% of our assets under management) had outperformed their respective benchmarks, on a gross and net basis, since inception, with inception dates ranging from April 1, 1995 for our U.S. Small-Cap Growth strategy to April 1, 2010 for our Global Equity strategy.

Since our founding, we have pursued a business model that is designed to maximize our ability to produce attractive investment results for our clients, and we believe this model has contributed to our success in doing so. We focus on attracting, retaining and developing talented investment professionals by creating an environment in which each investment team is provided ample resources and support, transparent, direct and predictable financial incentives, and a high degree of investment autonomy without imposing a centralized research function. We currently offer 12 actively-managed equity investment strategies, managed by five distinct investment teams. Each team is led by one or more experienced portfolio managers with a track record of investing success and is devoted to identifying long-term investment opportunities. We believe this autonomous structure promotes independent analysis and accountability among our investment professionals, which we believe promotes superior investment results.

Our 12 equity investment strategies span different market capitalization segments and investing styles in both U.S. and non-U.S. markets. Each strategy is designed to have a clearly articulated, consistent and replicable investment process that is well-understood by clients and managed to achieve superior long-term performance. Throughout our history, we have expanded our investment management capabilities in a disciplined manner that we believe is consistent with our overall philosophy of offering high value-added investment strategies in growing asset classes. Our business leaders work closely with each investment team to develop that team into an investment “franchise” with multiple investment decision-makers and the capacity to make a substantial contribution to our financial results. We have successfully expanded the range of strategies that we offer by launching new strategies managed by our existing investment teams as those teams have developed investment capacity, as well as by launching new strategies managed by new investment teams recruited to join Artisan.

In addition to our investment teams, we have a strong and seasoned management team that is focused on our business objectives of achieving profitable growth, expanding our investment capabilities, diversifying the source of our assets under management and delivering superior client service. Our management team supports our investment management capabilities and manages a centralized infrastructure, which allows our investment professionals to focus primarily on making investment decisions and generating attractive returns for our clients.

The combination of our superior investment performance and our strong business management has allowed us to attract and retain a diverse base of clients across a range of distribution channels and to increase our assets under management over time. Our assets under management have increased from $15.6 billion as of December 31, 2001 to $64.1 billion as of June 30, 2012, representing a compound annual growth rate, or CAGR, of 14.4%.

Table of Contents

We offer our investment management capabilities primarily to institutions and through intermediaries that operate with institutional-like decision-making processes and have longer-term investment horizons, by means of separate accounts and mutual funds. As of June 30, 2012, we managed separate accounts representing $29.1 billion, or 45%, of our assets under management in 173 separate accounts spanning 124 client relationships, including pension and profit sharing plans, trusts, endowments, foundations, charitable organizations, government entities, private funds and non-U.S. pooled investment vehicles that are generally comparable to U.S. mutual funds, as well as mutual funds, non-U.S. funds and collective trusts we sub-advise. We serve as the investment adviser to Artisan Funds, an SEC-registered family of mutual funds that offers shares in multiple classes designed to meet the needs of a range of institutional and other investors, and as investment manager and promoter of Artisan Global Funds, a family of Ireland-based UCITS funds that began operations in the first quarter of 2011 and offers shares to non-U.S. investors. Artisan Funds and Artisan Global Funds comprised $34.9 billion, or 55%, of our assets under management as of June 30, 2012.

We access traditional institutional clients primarily through relationships with investment consultants and access institutional-like investors primarily through consultants, alliances with major defined contribution/401(k) platforms and relationships with fee-based financial advisors and broker-dealers.

We derive essentially all of our revenues from investment management fees, which primarily are based on a specified percentage of clients’ average assets under management. Our growth in assets under management has resulted in an increase in our revenues from $101.5 million for the year ended December 31, 2001 to $462.4 million for the 12 months ended June 30, 2012. We believe our talent-focused business model, attractive range of high value-added equity investment strategies, track record of investment excellence and thoughtful approach to distribution and client service position us well for future growth.

As of June 30, 2012, we had 270 employees, including 47 employee-partners. Immediately following the completion of this offering, our investment professionals, senior management and other employees will collectively own approximately % of the economic interests in our company. Our culture of employee ownership strongly aligns our management’s and clients’ interests in our delivery of strong investment performance and growth.

Following the completion of this offering, we will conduct all of our business activities through operating subsidiaries of our direct subsidiary Artisan Partners Holdings, an intermediate holding company of which we are the general partner. Based on the ownership that will exist immediately after giving effect to the transactions described herein, net profits and net losses of Artisan Partners Holdings will be allocated, and distributions of profits will be made (subject to the H&F preference, as described under “Our Structure and Reorganization—Reorganization Transactions—Preferential Distributions to Holders of Preferred Units and Convertible Preferred Stock”), approximately % to us and % in the aggregate to Artisan Partners Holdings’ limited partners (or % and %, respectively, if the underwriters exercise their option to purchase additional shares in full). See “Our Structure and Reorganization”.

Competitive Strengths

We believe that our success as an investment manager is based on the following competitive strengths:

Talent-Focused Business Model. We believe that the success of an investment management firm depends on the talent of its professionals. As a result, we have implemented a business model that is designed to attract, develop and retain talented investment professionals by allowing them to focus on portfolio management in an environment conducive to producing their best work on a consistent, long-term basis. We have a strong philosophical belief in the autonomy of each investment team. We provide each investment team with ample resources and support, without imposing a centralized research function. We believe this structure differentiates us from those of our competitors who function with an integrated structure in which there is less investment team

-2-

Table of Contents

autonomy. At the same time, we have experienced business leadership that manages a team of dedicated client service professionals and a centralized infrastructure, and we work to reduce the demands on our investment professionals from responsibilities not directly related to managing client portfolios.

Our business leaders work closely with each Artisan investment team to develop that team into an investment franchise with multiple investment decision-makers and natural, internal succession, a solid, repeatable investment process, a strong long-term performance track record, a diversified client base, dedicated resources, and the capacity to make a significant contribution to our financial results. As a team grows into an investment franchise, the team develops the capacity to manage multiple strategies, growth opportunities for members of the team are created, and portfolio managers are encouraged by the potential evolution of their responsibilities over time to extend their careers and their contributions to our success. Developing an investment team into an investment franchise involves identifying, evaluating and developing investment professionals who are the right fit for our strategy and business model. Our rigorous standards are evidenced by the select number of senior investment professionals we have added over the years. Over our nearly 18-year history, we have had no significant turnover among our portfolio managers. Minimizing such turnover is a significant part of the responsibilities of our senior business management team.

Attractive Range of Diverse, High Value-Added Equity Investment Strategies. We have five distinct investment teams that currently manage a diverse array of 12 equity investment strategies. These U.S., non-U.S. and global equity investment strategies are diversified by market capitalization and investment style and are focused on areas that we believe provide opportunities to generate returns in excess of the relevant benchmarks. Each of our investment teams has its own dedicated research personnel and works independently from our other investment teams. We believe this investment autonomy increases the degree to which the investment performance of each of our teams is generated by independent ideas that are distinct from the investments pursued by our other teams. As of June 30, 2012, our largest strategy accounted for approximately 26% of our total assets under management and none of our investment teams managed more than approximately 27% of our total assets under management.

Track Record of Investment Excellence. Through June 30, 2012, 11 of our 12 investment strategies had outperformed their benchmarks, on a gross and net basis, since inception, with inception dates ranging from April 1, 1995 for our U.S. Small-Cap Growth strategy to April 1, 2010 for our Global Equity strategy. Nine of the 11 series of Artisan Funds eligible for Morningstar ratings, representing 95% of the assets of Artisan Funds and managed in strategies representing 94% of our total assets under management, had an Overall Morningstar Rating™ of 4 or 5 stars as of June 30, 2012. Investment performance highlights of our three largest strategies include:

| • | Non-U.S. Growth is our largest strategy and accounted for approximately 26% of our assets under management as of June 30, 2012. It is managed by our Global Equity investment team. Our Non-U.S. Growth composite has outperformed its benchmark by an average of 697 basis points annually from inception in 1996 through June 30, 2012 (calculated on an average annual gross basis before payment of fees). Artisan International Fund, which is managed in our Non-U.S. Growth strategy, is ranked as of June 30, 2012 #49 of 118 funds over the trailing 10 years, and #1 of 44 funds from inception (December 1995) in Lipper’s international large-cap growth category. See “Performance and Assets Under Management Information Used in this Prospectus”. |

| • | U.S. Mid-Cap Growth accounted for approximately 18% of our assets under management as of June 30, 2012. It is managed by our Growth investment team. Our U.S. Mid-Cap Growth composite has outperformed its benchmark by an average of 667 basis points annually from inception in 1997 through June 30, 2012 (calculated on an average annual gross basis before payment of fees). Artisan Mid Cap Fund, which is managed in our U.S. Mid-Cap Growth strategy, is ranked as of June 30, 2012 #32 of 245 funds over the trailing 10 years, and #1 of 108 funds from inception (June 1997) in Lipper’s multi-cap growth category. See “Performance and Assets Under Management Information Used in this Prospectus”. |

-3-

Table of Contents

| • | U.S. Mid-Cap Value accounted for approximately 17% of our assets under management as of June 30, 2012. It is managed by our U.S. Value investment team. Our U.S. Mid-Cap Value composite has outperformed its benchmark by an average of 629 basis points annually from inception in 1999 through June 30, 2012 (calculated on an average annual gross basis before payment of fees). Artisan Mid Cap Value Fund, which is managed in our U.S. Mid-Cap Value strategy, is ranked as of June 30, 2012 #7 of 107 funds over the trailing 10 years, and #7 of 87 funds from inception (March 2001) in Lipper’s mid-cap value category. See “Performance and Assets Under Management Information Used in this Prospectus”. |

We have been successful at generating attractive long-term investment performance on a consistent basis. Over the five-year period ended June 30, 2012, strategies representing approximately 96% of our total assets under management had outperformed their relevant benchmarks. A similar measure of trailing five-year investment performance relative to benchmarks taken at each of December 31, 2011, December 31, 2010 and December 31, 2009 indicates that strategies representing 95%, 99% and 99% of our total assets under management at each such date, respectively, were outperforming their relevant benchmarks.

Disciplined Growth—Balancing Investment Integrity, Investment Performance and Sustainable Demand. We manage our business with a long-term view. We launch a new strategy only when we believe it has the potential to achieve superior investment performance in an area that we believe will have sustained client demand at attractive fee rates over the long term. We strive to maintain the integrity of the investment process followed in each of our strategies by rigorous adherence to the investment parameters we have communicated to our clients. We also carefully monitor our investment capacity in each investment strategy. We believe that management of our investment capacity protects our ability to manage assets successfully, which protects the interests of our clients and, in the long term, protects our ability to retain client assets and maintain our fee schedules and profit margins. In order to better achieve our long-term goals, we are willing to close a strategy to new investors or otherwise take action to slow or restrict its growth when appropriate, even though our short-term results may be impacted. Currently, we have closed our Non-U.S. Small-Cap Growth, Non-U.S. Value, U.S. Mid-Cap Growth, U.S. Small-Cap Value and U.S. Mid-Cap Value strategies to most new investors and client relationships. Each of the strategies that we have offered to clients during our history continues in operation today.

Institutionally Oriented Client Base. We target discrete market segments that we believe offer attractive growth opportunities, which include institutions and intermediaries that operate with institutional-like decision-making processes and have longer-term investment horizons, and where we believe we have a well-recognized brand. Our original focus was on traditional institutional investors, including corporate and public pension plans, foundations and endowments. We believed these investors were often more focused on the integrity of the investment process and consistency of long-term investment performance than some other types of investors, which offered the potential for relationships of longer duration. As other market segments have evolved to have more institutional-like decision-making processes and longer-term investment horizons, we have expanded our distribution efforts into those areas, including defined contribution/401(k) administrators, broker-dealer fee-based programs and fee-based financial advisors. We have had significant success in attracting client assets from the defined contribution/401(k) market, and have experienced strong growth in assets through broker-dealers, where fee-based programs using centralized, institutional-like decision-making processes continue to grow.

As of June 30, 2012, we managed 173 separate accounts spanning 124 client relationships, including pension and profit sharing plans, trusts, endowments, foundations, charitable organizations, government entities, private funds and non-U.S. pooled investment vehicles that are generally comparable to U.S. mutual funds, as well as mutual funds, non-U.S. funds and collective trusts we sub-advise. Our largest client relationship, other than Artisan Funds, represented approximately 5% of our assets under management and no single consulting firm represented clients (including investors in Artisan Funds) having more than 6% of our assets under management.

-4-

Table of Contents

No single 401(k) platform, broker-dealer or financial advisor relationship represented more than 7%, 3% or 1%, respectively, of our assets under management.

Attractive Financial Model. We focus on high value-added strategies in asset classes that support fee rates that are above average for the asset management industry generally. We also have designed our expense structure to be flexible. The majority of our operating expenses, including incentive compensation and mutual fund intermediary fees, vary directly with our revenues and the amount of our assets under management. We believe that our model of relatively low fixed costs and relatively high variable costs is efficient and flexible, and historically has generated attractive adjusted operating margins and strong cash flow, even during challenging market conditions.

Ownership Culture That Aligns Interests. We believe that broad equity ownership of our business by our investment professionals and senior management is critical in aligning the interests of our clients, stockholders, investment professionals and management. Broad employee ownership helps us to attract talented investment professionals who have the ability to achieve attractive long-term investment performance. Attractive long-term investment performance benefits our clients and generally leads to growth in our assets under management. Growth in our assets under management enhances our financial results. Strong financial results drive the value of our equity, thereby helping us to attract and retain talented investment professionals. Immediately following the completion of this offering, our investment professionals, senior management and other employees will collectively own approximately % of the economic interests in our company. Following our transition to a public company, we intend to continue to promote broad and substantial equity ownership by our investment professionals and senior management through grants of equity interests and inclusion of equity interests as an element of compensation.

Strategy

Our strategy for continued success and future growth is guided by the following principles:

Execute Proven Business Model. The cornerstone of our strategy is to continue to promote our business model of attracting, developing and retaining talented investment professionals. We remain committed to investment team autonomy, to ensuring that our teams are able to focus on portfolio management and to fostering an environment that is attractive for our teams because they are able to do their best work on a consistent, long-term basis. We actively seek to identify new investment talent and teams both within and outside Artisan. Our business leaders will continue to work closely with each investment team to develop that team into an investment franchise with multiple decision-makers with natural, internal succession, a solid repeatable investment process, a strong long-term investment track record, a diversified client base, dedicated resources and the capacity to make a substantial contribution to our financial results. We are committed to the continuing development of our existing investment teams and we are open to the possibility of adding new investment teams, through hiring or acquisitions, when our rigorous standards have been met.

Deliver Profitable and Sustainable Financial Results. As a public company, we will continue to focus on delivering profitable and sustainable financial results. We are committed to managing high value-added strategies capable of supporting above-average fee rates. We intend to maintain our flexible financial profile through our highly variable expense structure with centralized infrastructure and investment team support.

Capitalize on our “Realizable Capacity” in Products with Strong Client Demand. We believe that growth in assets under management in an investment strategy requires investment capacity in the strategy (which is driven by the availability of attractive investment opportunities relative to the amount of assets under management in the strategy) at a time when the strategy has a competitive performance track record and there is stable or growing client demand for the strategy or asset class. When we believe that each of these factors is

-5-

Table of Contents

present with respect to an investment strategy, we say we have “realizable capacity” in that strategy. We believe that we currently have realizable capacity particularly in our non-U.S. and global strategies, where we believe we are well-positioned to take advantage of increasing client demand. We have leveraged our strength in these areas by launching new products from our Global Value team, which launched our Global Value strategy in July 2007, from our Growth Team, which launched our Global Opportunities strategy in February 2007, from our Emerging Markets team, which launched our Emerging Markets strategy in 2006, and from our Global Equity team, which launched our Global Equity strategy in March 2010. We also believe that we have realizable capacity in our Value Equity strategy, which is designed to appeal to client demand for strategies with greater investment flexibility. We intend to focus on attracting additional assets under management in these strategies from our current client base and through our existing intermediary relationships, as well as from the continued expansion of our distribution efforts.

Expand Distribution and Focus on Investment Strategies Generating Sustainable Demand. We will remain focused on institutional and institutional-like clients and intermediaries and will continue to offer high value-added investment strategies with market demand that we believe is sustainable, avoiding fad and niche products with limited long-term growth prospects. We expect to see growing interest among institutional investors in strategies focused on non-U.S. and global investments. We seek to further penetrate the defined contribution/401(k) market and the broker-dealer and the fee-based financial advisor markets with our style-oriented investment strategies, including our Value Equity strategy, which has an attractive performance track record and significant investment capacity. We are also expanding our distribution effort into non-U.S. markets, including the United Kingdom, other member countries of the European Union, Australia and certain Asian countries, among others, where we believe there is growing institutional demand for global and non-U.S. investment strategies, such as our Global Value, Global Equity and Global Opportunities strategies. As part of those efforts, we organized Artisan Global Funds, a family of Ireland-based UCITS funds that began operations during the first quarter of 2011 and offers shares to non-U.S. investors. We have seen strong results from these non-U.S. distribution efforts, as a significant part of our net client cash flows over the last three years through June 30, 2012 has come from clients domiciled outside the United States.

To support the consistent communication of our brand through our global distribution efforts and public relations activities, we are engaged in firm branding efforts that include the expansion and customization of our websites, increasing our use of digital media including video, targeted client events and conferences, and tactical marketing campaigns. Recent campaigns have focused on our investment culture, the experience of our investment teams, third-party awards received by the firm and our portfolio managers, and our global investment capabilities. Our branding efforts are improved by our marketing intelligence program, through which we analyze the effectiveness and reach of our branding efforts through various marketing channels. The program is designed to help us allocate marketing resources efficiently by identifying and prioritizing marketing efforts that successfully reach our target audience most efficiently.

Continue to Develop Artisan Leadership. We will continue to develop additional leaders for the company and for each investment team. We will also continue to work with each of our investment teams to develop its talent so that each team’s investment capabilities are expanded and natural internal succession continues to be developed. We believe that our culture of equity ownership has been instrumental in supporting the development of seasoned investment and business leaders. We intend to continue to promote broad and substantial equity ownership of our company by our employees.

Continue Disciplined Approach to Growth. We intend to continue to manage our business with a long-term view. We will launch a new strategy only when we believe it has the potential to achieve superior investment performance in an area that we believe will have sustained client demand at attractive fee rates over the long term. We intend to continue to actively manage our investment capacity to protect our ability to manage client assets successfully, which protects the interests of our clients and our own long-term interests, and we will seek to continue to diversify our client base to enhance the stability of our assets under management.

-6-

Table of Contents

Why We Are Going Public

We believe that becoming a public company is important to the evolution of our business for three principal reasons:

| • | to preserve our independence by establishing a process for existing owners to realize the value of their equity over a structured time frame (see “Our Structure and Reorganization—Offering Transactions—Resale and Registration Rights Agreement—Restrictions on Sale”); |

| • | to allow us to maintain our equity ownership culture and support our talent-focused business model by establishing a mechanism for sharing ownership among value-producing employees; and |

| • | to create additional financial flexibility, which we believe will allow us to continue to manage and grow our business in a disciplined way. |

Risk Factors

An investment in our Class A common stock involves substantial risks and uncertainties. These risks and uncertainties include, among others, the following:

| • | The loss of key members of our investment teams and senior management could have a material adverse effect on our business. Our ability to attract and retain qualified investment, management and marketing and client service professionals is critical to our success. |

| • | If our investment strategies perform poorly for any reason, including due to a declining stock market, general economic downturn or otherwise, clients could withdraw their funds and we could suffer a decline in our assets under management and/or become subject to litigation, which would reduce our earnings. |

| • | The historical returns of our existing investment strategies may not be indicative of their future results or of the results of investment strategies we may develop in the future. |

| • | Difficult market conditions can adversely affect our business in many ways, including by reducing the value of our assets under management and causing clients to withdraw funds, each of which could materially reduce our revenues and adversely affect our financial condition. |

| • | Several of our investment strategies invest principally in the securities of non-U.S. companies, which involve foreign currency exchange, tax, political, social and economic uncertainties and risks. |

| • | We derive a substantial portion of our revenues from a limited number of our investment strategies. |

| • | We may be unable to maintain our fee structure at current rates. |

| • | Control by AIC and our employee-partners of % of the combined voting power of our capital stock may give rise to conflicts of interest. |

| • | We must pay certain of our existing owners for certain tax benefits that we claim, and such amounts are expected to be substantial. |

The foregoing is not a comprehensive list of the risks and uncertainties we face. Investors should carefully consider all of the information in this prospectus, including information under “Risk Factors”, prior to making an investment in our Class A common stock.

-7-

Table of Contents

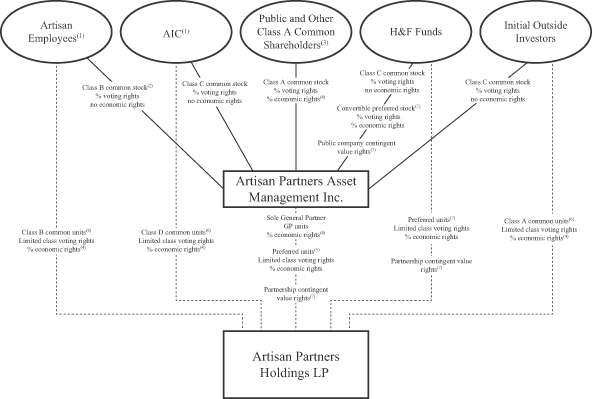

Our Structure and Reorganization

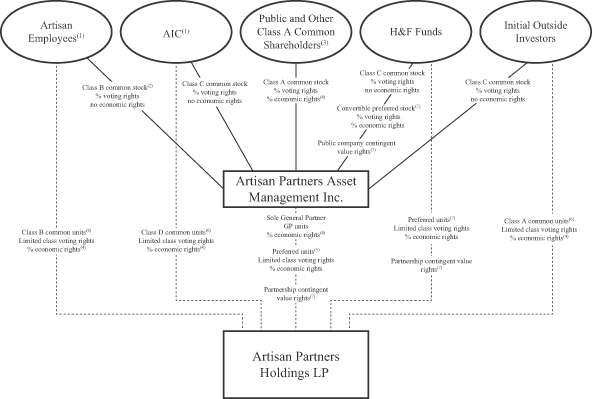

The diagram below depicts our organizational structure immediately after this offering and the related reorganization transactions.

| (1) | Each of our employee-partners and AIC will enter into a stockholders agreement with respect to all shares of our common stock they hold at such time or may acquire from us in the future, pursuant to which they will grant an irrevocable voting proxy to a stockholders committee, as described under “Our Structure and Reorganization—Stockholders Agreement”. |

| (2) | Each share of Class B common stock will initially entitle its holder to five votes per share. The stockholders committee will hold an irrevocable proxy to vote the shares of common stock of Artisan Partners Asset Management held by the Class B common stockholders until the stockholders agreement terminates. |

| (3) | Includes restricted shares of our Class A common stock, representing % of the voting rights in Artisan Partners Asset Management, that we intend to grant to our non-employee directors in connection with this offering. |

| (4) | Economic rights of the Class A common stock, the common units and the GP units are subject to the H&F preference as described under “Our Structure and Reorganization—Reorganization Transactions—Preferential Distributions to Holders of Preferred Units and Convertible Preferred Stock”. |

| (5) | We will be obligated to vote the preferred units we hold at the direction of our convertible preferred stockholders as described under “Our Structure and Reorganization—Offering Transactions—Amended and Restated Limited Partnership Agreement of Artisan Partners Holdings”. |

| (6) | Each class of common units generally will entitle its holders to the same economic and voting rights in Artisan Partners Holdings as each other class of common units, as described under “Our Structure and Reorganization—Offering Transactions—Amended and Restated Limited Partnership Agreement of Artisan Partners Holdings—Economic Rights of Partners” and “Our Structure and Reorganization—Offering Transactions—Amended and Restated Limited Partnership Agreement of Artisan Partners Holdings—Voting and Class Approval Rights”, respectively. |

-8-

Table of Contents

| (7) | The preferred units of Artisan Partners Holdings, as well as our convertible preferred stock and the contingent value rights, or CVRs, each as described below, are collectively intended to provide the H&F holders with economic and voting rights following the reorganization transactions similar (although not identical) to the economic and voting rights they possessed prior to the reorganization. The CVRs may require us to make a cash payment to the holders thereof on July 11, 2016, or, if earlier, five business days after the effective date of a change of control of Artisan, unless the average of the daily volume weighted average price, or VWAP, of our Class A common stock over any period of 60 consecutive trading days, beginning no earlier than (i) the 90th day after completion of the follow-on underwritten offering we plan to conduct as soon as possible after the first anniversary of this offering or (ii) the 15-month anniversary of this offering, if we do not conduct the follow-on offering by that date, is at least $ divided by the then-applicable conversion rate, in which case the contingent value rights will be terminated. The CVRs confer no voting rights or other rights of stockholders. Artisan Partners Asset Management will always hold one partnership CVR for each outstanding CVR of Artisan Partners Asset Management. See “Our Structure and Reorganization—Offering Transactions—Contingent Value Rights” for additional information about the CVRs. |

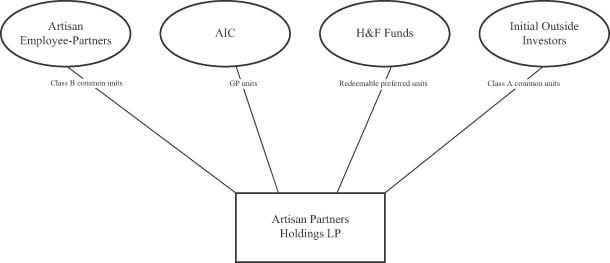

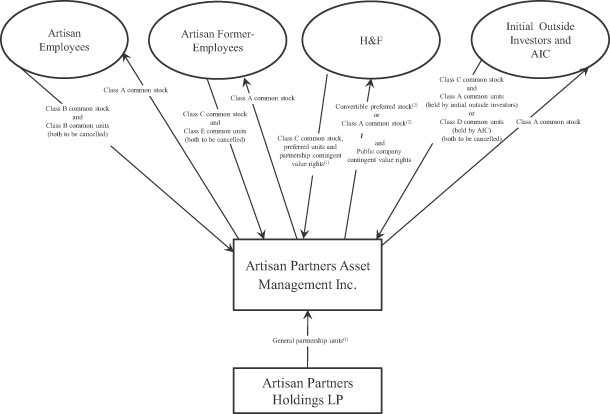

Following the transactions described below, we will conduct all of our business activities through operating subsidiaries of our direct subsidiary Artisan Partners Holdings, an intermediate holding company of which we are the general partner. Based on the ownership that will exist immediately after giving effect to the transactions described below, net profits and net losses of Artisan Partners Holdings will be allocated, and distributions of profits will be made (subject to the H&F preference, as described under “Our Structure and Reorganization—Reorganization Transactions—Preferential Distributions to Holders of Preferred Units and Convertible Preferred Stock”), approximately % to us and % in the aggregate to Artisan Partners Holdings’ limited partners (or % and %, respectively, if the underwriters exercise their option to purchase additional shares in full). See “Our Structure and Reorganization” for additional information, including a diagram that depicts the organizational structure of our subsidiary, Artisan Partners Holdings, before giving effect to this offering and the related reorganization transactions.

Reorganization Transactions

We were incorporated in Wisconsin on March 21, 2011 and converted to a Delaware corporation on October 29, 2012. We will enter into a series of transactions to reorganize our capital structure in connection with this offering. We refer throughout this prospectus to the transactions described below as the reorganization transactions or the reorganization. The reorganization transactions are designed to create a capital structure that preserves our ability to conduct our business through Artisan Partners Holdings (a partnership), while permitting us to raise additional capital and provide access to liquidity through a public company. Multiple classes of securities at the public company level are necessary to achieve these objectives and maintain a governance structure that resembles the current structure of Artisan Partners Holdings.

Revisions to our Organization and Capitalization Structure. The outstanding equity interests in Artisan Partners Holdings currently consist of GP units, Class A common units, Class B common units and redeemable preferred units. AIC, an entity controlled by Andrew A. Ziegler and Carlene M. Ziegler and through which Mr. Ziegler and Mrs. Ziegler maintain their ownership interests in Artisan Partners Holdings, holds the GP units. Thirty-three investors hold the Class A common units. The Class A investors, who were the initial outside investors in Artisan Partners Holdings and their successors, include current and former members of Hellman & Friedman LLC, or H&F, a private equity investment firm, investing in their individual capacities, and a venture capital fund managed by Sutter Hill Ventures, a venture capital firm, and related individuals. Fifty-five Artisan employees hold the Class B common units. The holders of preferred units, the H&F funds, are private equity funds controlled in each case by a sole general partner, each of which is, in turn, controlled by H&F.

Immediately prior to the consummation of this offering, the limited partnership agreement of Artisan Partners Holdings will be amended and restated to reclassify AIC’s GP units as Class D common units of Artisan

-9-

Table of Contents

Partners Holdings. We will become the sole general partner of Artisan Partners Holdings and will control Artisan Partners Holdings’ management, subject to certain voting rights of the limited partners. Upon the consummation of this offering, Artisan Partners Asset Management will contribute all of the net proceeds it receives to Artisan Partners Holdings, and Artisan Partners Holdings will issue to Artisan Partners Asset Management a number of GP units equal to the number of shares of Class A common stock that Artisan Partners Asset Management issues in this offering. In order to make a share of Class A common stock represent the same percentage economic interest, disregarding corporate-level taxes and payments with respect to the tax receivable agreements described under “Our Structure and Reorganization—Tax Receivable Agreements”, in Artisan Partners Holdings as a common unit of Artisan Partners Holdings, Artisan Partners Asset Management will always hold a number of GP units equal to the number of shares of Class A common stock issued and outstanding. Artisan Partners Holdings will apply the net proceeds it receives as described under “Use of Proceeds”. We describe the terms of the amended and restated limited partnership agreement of Artisan Partners Holdings under “Our Structure and Reorganization—Offering Transactions—Amended and Restated Limited Partnership Agreement of Artisan Partners Holdings”. We refer in this prospectus to the holders of the preferred units of Artisan Partners Holdings (other than us) and our convertible preferred stock upon completion of this offering as the H&F holders.

Following the first anniversary of this offering, the common units will be exchangeable for shares of our Class A common stock, and the preferred units will be exchangeable for shares of our Class A common stock or convertible preferred stock, subject to certain restrictions, as described under “Our Structure and Reorganization—Offering Transactions—Exchange Agreement”.

Capital Stock. Immediately prior to the consummation of this offering, we also will amend and restate our certificate of incorporation to authorize three classes of common stock, Class A common stock, Class B common stock and Class C common stock, as well as preferred stock, including a series of convertible preferred stock. Our common stock and convertible preferred stock will have the terms described below and, in more detail, under “Description of Capital Stock”:

| • | Class A Common Stock. We will issue shares of our Class A common stock to the public in this offering. In addition, we intend to grant equity awards of or with respect to shares of our Class A common stock to our non-employee directors in connection with this offering. Each share of Class A common stock will entitle its holder to one vote and economic rights in Artisan (including rights to dividends or distributions upon liquidation), subject to the H&F preference. See “Our Structure and Reorganization—Reorganization Transactions and Post-IPO Structure—Preferential Distributions to Holders of Preferred Units and Convertible Preferred Stock”. Following the first anniversary of this offering (i) subject to certain restrictions, each common unit held by a limited partner of Artisan Partners Holdings will be exchangeable for one share of our Class A common stock and each preferred unit held by a limited partner of Artisan Partners Holdings will be exchangeable for shares of our Class A common stock at the conversion rate and (ii) each share of convertible preferred stock will be convertible into our Class A common stock at the conversion rate. |

| • | Class B Common Stock. Immediately prior to the consummation of this offering, we will issue shares of our Class B common stock to our employee-partners in amounts equal to the number of Class B common units that such employee-partners hold at such time. Each share of our Class B common stock will initially entitle its holder to five votes per share but will have no economic rights in Artisan (including no rights to dividends or distributions upon liquidation). If and when the holders of our Class B common stock collectively hold less than 20% of the number of outstanding shares of our common stock and our convertible preferred stock, taken together, each share of Class B common stock will entitle its holder to only one vote per share. In connection with this offering, we plan to adopt the 2013 Omnibus Incentive Compensation Plan, pursuant to which we expect to grant equity awards of or with respect to shares of our Class A common stock or common units of Artisan Partners Holdings. To the extent that we cause Artisan Partners Holdings to issue additional common units to |

-10-

Table of Contents

| our employees, those employees would be entitled to receive an equal number of shares of our Class B common stock (including if the common units awarded are subject to vesting). As described more fully under “Our Structure and Reorganization—Reorganization Transactions and Post-IPO Structure—Class B Common Stock”, each share of our Class B common stock held by an employee-partner will automatically be exchanged for one share of Class C common stock upon termination of such employee-partner’s employment with us. |

| • | Class C Common Stock. Immediately prior to the consummation of this offering, we will issue shares of our Class C common stock to AIC, our initial outside investors and certain H&F holders that hold preferred units of Artisan Partners Holdings in amounts equal to the number of Class D common units, Class A common units and preferred units, respectively, that such holders hold at such time. Each share of Class C common stock will entitle its holder to one vote per share but will have no economic rights (including no rights to dividends or distributions upon liquidation). |

| • | Convertible Preferred Stock. One of the H&F private investment funds that is an investor in Artisan Partners Holdings holds its preferred units through a corporation, which we refer to as H&F Corp. Immediately prior to the consummation of this offering, H&F Corp will merge with and into us and the H&F private investment fund that was the sole stockholder of H&F Corp will receive, as consideration, shares of our convertible preferred stock, CVRs of Artisan Partners Asset Management and the right to receive an amount of cash equal to H&F Corp’s share of the distribution of Artisan Partners Holdings’ retained profits to its pre-offering partners. We will be the surviving corporation in the merger, which we refer to as the H&F Corp Merger. Each share of our convertible preferred stock will entitle its holder to one vote. In the case of distributions on the preferred units of Artisan Partners Holdings, each share of convertible preferred stock will entitle its holder to preferential distributions as described in “Our Structure and Reorganization—Reorganization Transactions and Post-IPO Structure—Preferential Distributions to Holders of Preferred Units and Convertible Preferred Stock”. We are issuing the convertible preferred stock in order to provide the initial holders of such stock with economic and voting rights similar (although not identical) to the economic and voting rights such holders currently possess with respect to Artisan Partners Holdings. |

Following the first anniversary of this offering, shares of our convertible preferred stock will be convertible at the election of the holder into shares of our Class A common stock at the conversion rate, which will initially be one-for-one subject to adjustment to reflect the payment of preferential distributions made to the holders of our convertible preferred stock. In no event will a share of convertible preferred stock be convertible into more than a single share of our Class A common stock. When the holders of our convertible preferred stock are no longer entitled to preferential distributions, all shares of convertible preferred stock will automatically convert into shares of our Class A common stock at the conversion rate plus cash in lieu of fractional shares (after aggregating all shares of our Class A common stock that would otherwise be received by such holder). See “Our Structure and Reorganization—Reorganization Transactions and Post-IPO Structure—Preferential Distributions to Holders of Preferred Units and Convertible Preferred Stock—Convertible Preferred Stock Conversion Rate”.

Preferential Distributions to Holders of Preferred Units and Convertible Preferred Stock. The holders of preferred units of Artisan Partners Holdings will be entitled to preferential distributions in the case of a partial capital event or upon dissolution of Artisan Partners Holdings in proportion to their respective number of units. A “partial capital event” would include a sale or disposition of greater than 1% of our consolidated assets. In the case of any distributions on the preferred units, each share of convertible preferred stock will entitle its holder to preferential distributions equal to the distribution made on a preferred unit, net of taxes, if any, payable by us on (without duplication) (i) allocations of taxable income related to such distributions and (ii) the distributions themselves, in each case in respect of the preferred units held by us. We refer to these preference rights as the H&F preference. See “Our Structure and Reorganization—Reorganization Transactions and Post-IPO Structure—Preferential Distributions to Holders of Preferred Units and Convertible Preferred Stock”.

-11-

Table of Contents

Stockholders Agreement. Each of our employee-partners and AIC will enter into a stockholders agreement pursuant to which they will grant an irrevocable voting proxy with respect to all shares of our common stock they hold at such time or may acquire from us in the future to a stockholders committee consisting initially of (i) a designee of AIC, who initially will be Andrew A. Ziegler, our Executive Chairman, (ii) Eric R. Colson, our President and Chief Executive Officer, and (iii) James C. Kieffer, a portfolio manager of our U.S. Value strategies. The members of the stockholders committee other than the AIC designee must be Artisan employees. At the close of the reorganization, the only shares of our capital stock subject to the stockholders agreement will be the shares of our common stock held by our employee-partners and AIC. Thereafter, any shares of our common stock that we issue to our employee-partners or other employees will be subject to the stockholders agreement so long as the agreement has not been terminated.

For so long as the parties whose shares are subject to the stockholders agreement hold at least a majority of the combined voting power of our capital stock, the stockholders committee will be able to elect all of the members of our board of directors (subject to the obligation of the stockholders committee under the terms of the stockholders agreement to vote in support of certain nominees consisting of one of our initial outside investors and of individuals designated by each of AIC and the H&F holders) and thereby control our management and affairs. Because each share of our Class B common stock will initially entitle its holder to five votes, the stockholders committee will control our management and affairs even if the shares subject to the stockholders agreement represent less than a majority of the number of outstanding shares of our capital stock as long as the stockholders committee has power to vote shares having a majority of the voting power of our outstanding common and preferred stock.

AIC will have the right to designate one member of the stockholders committee until the earliest to occur of (i) Mr. Ziegler’s death or disability, (ii) the voluntary termination of Mr. Ziegler’s employment with us, including by reason of the scheduled expiration of his employment on the first anniversary of this offering, and (iii) 180 days after the effective date of Mr. Ziegler’s involuntary termination of employment with us. So long as AIC has the right to designate one member of the stockholders committee, the AIC designee, initially Mr. Ziegler, will have the sole right, in consultation with the other members of the stockholders committee, to determine how to vote all shares subject to the stockholders agreement. AIC will have the right to withdraw its shares of common stock from the stockholders agreement when Mr. Ziegler is no longer a member of the stockholders committee. Although AIC may replace Mr. Ziegler as its stockholders committee designee, Mr. Ziegler indirectly holds 50% of the voting stock of AIC and therefore could not be replaced without his consent. When AIC no longer has the right to designate a member of the stockholders committee, assuming Mr. Colson remains our Chief Executive Officer and a member of the committee at that time, he and the other member of the committee will jointly select a third member of the stockholders committee, who must be an employee-partner. We describe the terms of the stockholders agreement in more detail under “Our Structure and Reorganization—Stockholders Agreement”.

Exchange Agreement. Immediately prior to the consummation of this offering, we will enter into an exchange agreement with the holders of limited partnership units of Artisan Partners Holdings. Following the first anniversary of this offering, subject to certain restrictions set forth in the exchange agreement (including those intended to ensure that Artisan Partners Holdings is not treated as a “publicly traded partnership” for U.S. federal income tax purposes), holders of Artisan Partners Holdings units (other than us) and certain permitted transferees will have the right to exchange common units (together with an equal number of shares of Class B or Class C common stock, as applicable) for shares of our Class A common stock on a one-for-one basis and to exchange preferred units (together with an equal number of shares of Class C common stock) either for shares of our convertible preferred stock on a one-for-one basis or for shares of our Class A common stock at the conversion rate as described in “Our Structure and Reorganization—Reorganization Transactions and Post-IPO Structure—Preferential Distributions to Holders of Preferred Units and Convertible Preferred Stock—Convertible Preferred Stock Conversion Rate”. Following the automatic conversion of our convertible preferred stock into Class A common stock, preferred units will be exchangeable only for Class A common stock at the conversion rate. Employee-partners who exchange common units that are unvested will receive restricted shares

-12-

Table of Contents

of our Class A common stock that are subject to the same vesting requirements that applied to the common units exchanged. As the holders of common units or preferred units exchange their units for Class A common stock, we will receive a number of GP units of Artisan Partners Holdings equal to the number of shares of our Class A common stock that they receive, and a number of common units or preferred units, and shares of our Class B or Class C common stock, as applicable, equal to the number of units so exchanged will be cancelled. We will retain any preferred units exchanged for shares of convertible preferred stock until the subsequent conversion of such shares into shares of our Class A common stock, although a number of shares of our Class C common stock equal to the number of units so exchanged will be cancelled. Upon conversion of shares of convertible preferred stock, we will exchange a number of preferred units we hold for GP units equal to the number of shares of our Class A common stock issued upon conversion. See “Our Structure and Reorganization—Offering Transactions—Exchange Agreement” for more detailed information concerning the exchange rights, including a diagram that illustrates the exchange of units of Artisan Partners Holdings for shares of our capital stock.

Transfer Restrictions Applicable to our Employee-Partners. Subject to certain restrictions, substantially all of the Class B common units held by our employee-partners, including all of our executive officers, will be exchangeable for shares of our Class A common stock (or restricted shares of our Class A common stock, in the case of exchange of unvested common units) following the first anniversary of this offering. Shares of our Class A common stock received by our employee-partners upon exchange of their Class B common units, will be subject to limitations on resale that are described in “Our Structure and Reorganization—Offering Transactions—Resale and Registration Rights Agreement—Restrictions on Sale”.

Resale and Registration Rights Agreement. As part of the reorganization transactions, we will enter into a resale and registration rights agreement with the holders of limited partnership units of Artisan Partners Holdings and shares of our convertible preferred stock, pursuant to which the shares of our Class A common stock issued upon exchange of their limited partnership units or conversion of their shares of convertible preferred stock will be eligible for resale. See “Our Structure and Reorganization—Offering Transactions—Resale and Registration Rights Agreement—Restrictions on Sale” for a description of the timing and manner limitations on resales of these shares.