Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - WARNACO GROUP INC /DE/ | d431395d8k.htm |

| EX-99.3 - TRANSCRIPT OF VIDEO PRESENTATION - WARNACO GROUP INC /DE/ | d431395dex993.htm |

| EX-99.1 - JOINT PRESS RELEASE - WARNACO GROUP INC /DE/ | d431395dex991.htm |

Growing Powerful Global Lifestyle Brands October 31, 2012

PVH Acquisition of Warnaco

Filed by The Warnaco Group, Inc.

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

of the Securities Exchange Act of 1934, as amended

Subject Company: The Warnaco Group, Inc.

(Commission File No. 001-10857)

EXHIBIT 99.2 |

2

Safe Harbor

We (PVH Corp.) obtained or created the market and competitive position data used

throughout this presentation from research, surveys or studies conducted by third

parties, information provided by customers, and industry or general publications.

Industry publications and surveys generally state that they have obtained information from

sources believed to be reliable but do not guarantee the accuracy and completeness of

such information. While we believe that each of these studies and publications

and the other information we receive or review is reliable, we have not independently

verified such data and we do not make any representation as to the accuracy of

such information.

This presentation contains forward-looking statements and information about our

current and future prospects and our operations and financial results, which are based on

currently available information. The forward looking statements include assumptions

about our operations, such as cost controls and market conditions, and our

proposed

acquisition

of

The

Warnaco

Group,

Inc.

(“Warnaco”)

through

a

merger

(including

its

benefits,

results,

effects

and

timing)

that

may

not

be

realized.

Risks and uncertainties related to the proposed merger include, among others: the

risk that Warnaco’s stockholders do not approve the merger; the risk that regulatory

approvals

required

for

the

merger

are

not

obtained

or

are

obtained

subject

to

conditions

that

are

not

anticipated;

the

risk

that

the

other

conditions

to

the

closing

of

the

merger

are

not

satisfied;

potential

adverse

reactions

or

changes

to

business

relationships

resulting

from

the

announcement

or

completion

of

the

merger;

uncertainties

as to

the timing of the merger; competitive responses to the proposed merger; costs and

difficulties related to the integration of Warnaco’s businesses and operations with

PVH’s

business

and

operations;

the

inability

to

obtain,

or

delays

in

obtaining,

cost

savings

and

synergies

from

the

merger;

unexpected

costs,

charges

or

expenses resulting

from the merger;

litigation relating to the merger; the inability

to retain key personnel; and any changes in general economic and/or industry

specific conditions.

Additional

factors

that

could

cause

future

results

or

events

to

differ

from

those

we

expect

are

those

risks

discussed

under

Item

1A,

”Risk

Factors,”

in

PVH’s Annual

Report on Form 10-K for the fiscal year ended January 29, 2012, Warnaco’s

Annual Report on Form 10-K for the fiscal year ended December 31, 2011, Warnaco’s Quarterly

Report on Form 10-Q for the quarter ended June 30, 2012, and other reports filed

by PVH and Warnaco with the Securities and Exchange Commission (SEC).

Please

read

our

“Risk

Factors”

and

other

cautionary

statements

contained

in

these

filings.

We

undertake

no

obligation

to

update

or

revise

any

forward-looking statements,

whether as a result of new information, the occurrence of certain events or

otherwise. As a result of these risks and others, actual results could vary significantly from those

anticipated in this presentation, and our financial condition and results of

operations could be materially adversely affected. This presentation also

includes non-GAAP financial measures, as defined under SEC rules. Reconciliations of these measures are included at the end of this presentation, as

well as in certain SEC filings as noted in this presentation,

which are available on our website at

www.pvh.com/investor_relations_press_releases.aspx and in our Current Reports

on Form 8-K furnished to the SEC in connection with our press releases, which are available on our website at www.pvh.com and the SEC’s website at www.sec.gov. |

3

Additional Information

In connection with the proposed merger, we will file with the SEC a Registration

Statement on Form S-4 that will include a Proxy Statement of Warnaco and a

Prospectus of PVH, as well as other relevant documents concerning the proposed transaction. WARNACO STOCKHOLDERS ARE

URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS REGARDING

THE MERGER WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED

WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE

THEY WILL CONTAIN IMPORTANT INFORMATION.

A free copy of the Proxy Statement/Prospectus, as well as other filings containing

information about PVH and Warnaco, may be obtained at the SEC’s Internet

site (http://www.sec.gov). You will also be able to obtain these documents, free of charge, from PVH at www.pvh.com under the

heading “Investors”

or from Warnaco by accessing Warnaco’s website at www.warnaco.com under the

heading “Investor Relations.” PVH and Warnaco and certain of their

directors and executive officers may be deemed to be participants in the solicitation of proxies from the

stockholders of Warnaco in connection with the merger. Information about the

directors and executive officers of PVH and their ownership of PVH common

stock is set forth in the proxy statement for PVH’s 2012 annual meeting of stockholders, as filed with the SEC on Schedule 14A on

May 10, 2012. Information about the directors and executive officers of Warnaco

and their ownership of Warnaco common stock is set forth in the proxy

statement for Warnaco’s 2012 annual meeting of stockholders, as filed with the SEC on Schedule 14A on April 11, 2012. Additional

information regarding the interests of those participants and other persons who may

be deemed participants in the transaction may be obtained

by

reading

the

Proxy

Statement/Prospectus

regarding

the

merger

when

it

becomes

available.

This

communication

shall

not

constitute

an offer to sell or the solicitation of an offer to sell or the solicitation of an

offer to buy any securities, nor shall there be any sale of securities in any

jurisdiction in which such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

jurisdiction. No offer of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the Securities Act of

1933, as amended. |

4

Compelling Strategic Rationale

•

Creates an over $8 BN global branded lifestyle apparel company with significant

growth prospects,

driven

by

two

powerful

designer

brands–Calvin

Klein

and

Tommy

Hilfiger

•

Reunites the “House of Calvin Klein”

to ensure single brand vision

•

PVH will have strong operations in all major consumer markets worldwide

•

Warnaco’s operations in high growth markets of Asia and Latin America complement

PVH’s strong operating platforms in North America and Europe

•

Enhances revenue and EPS growth, and improves operating margins

•

Approximately $100 MM in annual run rate synergies and accretive

to earnings in year one

(1)

•

Proven track record of successful acquisitions and achieving financial targets

(1) Excluding one-time costs in year one of $100 MM.

|

5

Transaction Overview

(1) Based off of non-GAAP EBITDA.

(2) Assumes $100 MM of annual run rate synergies less the earnings associated with the

potential loss of a license and excludes one-time costs in year one of $100 MM.

(3) Assumes year one synergies less the earnings associated with the potential loss of

a license and excludes one-time costs in year one of $100 MM. Terms

•

Warnaco

stockholders

will

receive

$51.75

per

share

in

cash

and

0.1822

PVH

common

stock

(fixed

ratio)

for

each

share

of

Warnaco

common

stock

•

Based

on

PVH’s

closing

stock

price

on

October

26

,

the

aggregate

value

of

the

consideration

is

$68.43

per

share

(value

at

signing)

•

Total

enterprise

value

of

approximately

$2.9

BN,

representing

9.0x

2012E

EBITDA

and

7.6x

2012E

EBITDA,

including

synergies

(1)(2)

Financing

•

$4.325 BN of committed financing

•

Anticipated financing consists of bank financing and a senior notes offering

Accretion

•

EPS

accretion

in

year

one

(FY

2013)

estimated

to

be

$0.35

,

excluding

one-time

costs

•

Approximately

$100

MM

of

annual

run

rate

synergies

achieved

over

three

years

•

One-time

integration

/

transaction

related

costs

of

approximately

$175

MM

over

three

years

Mgmt. / Board

•

PVH

existing

management

team

will

lead

company,

with

key

Warnaco

executives

expected

to

join

•

Helen

McCluskey

expected

to

join

PVH’s

Board

Target Closing

•

Early

2013,

subject

to

customary

closing

conditions,

including

Warnaco

stockholder

vote

and

regulatory

approvals

(1)

(3)

th |

6

Transaction Provides Significant Value to Warnaco Stockholders

Transaction delivers significant immediate value and upside potential to Warnaco

stockholders

Upon

closing,

Warnaco

stockholders

will

own

approximately

10%

of

the

outstanding

common

stock

of

PVH

Powerful

opportunity

to

accelerate

Warnaco’s

strategic

growth

initiatives

Calvin

Klein

brand

unification

to

enhance

growth

prospects

globally

Leverage

proven

successes

and

strong

momentum

-

Emerging

markets

development

-

Direct-to-consumer

expansion

Combined

brand

portfolio

will

benefit

from

a

truly

global

infrastructure

and

scale

Unlocks

additional

potential

of

our

brands

and

business

•

•

•

•

•

• |

7

With over $8 BN in pro forma revenues and over $1 BN in pro forma EBIT PVH will be one

of the largest and most profitable global apparel companies in the world

Source: FactSet except for PVH, WRC and PF PVH.

Note: PF PVH revenue assumes the elimination of the PVH royalty revenue and wholesale

revenues from PVH, as well as revenue associated with the potential loss of a license. PF PVH EBIT assumes $100 MM of annual run rate

synergies less the earnings associated with the potential loss of a license.

(1) Refer to Appendix for GAAP to non-GAAP reconciliation.

Creates an Over $8 BN Global Branded Lifestyle Apparel Company

|

8

Strong Operations in Every Major Consumer Market Worldwide

•

Strong operating platforms in

every major consumer market

around the world

•

Regional headquarters in key

geographies

-

US and Canada

-

Europe

-

Asia

-

Latin America

•

Presence in over 100 countries

-

Direct operations in over

40 countries |

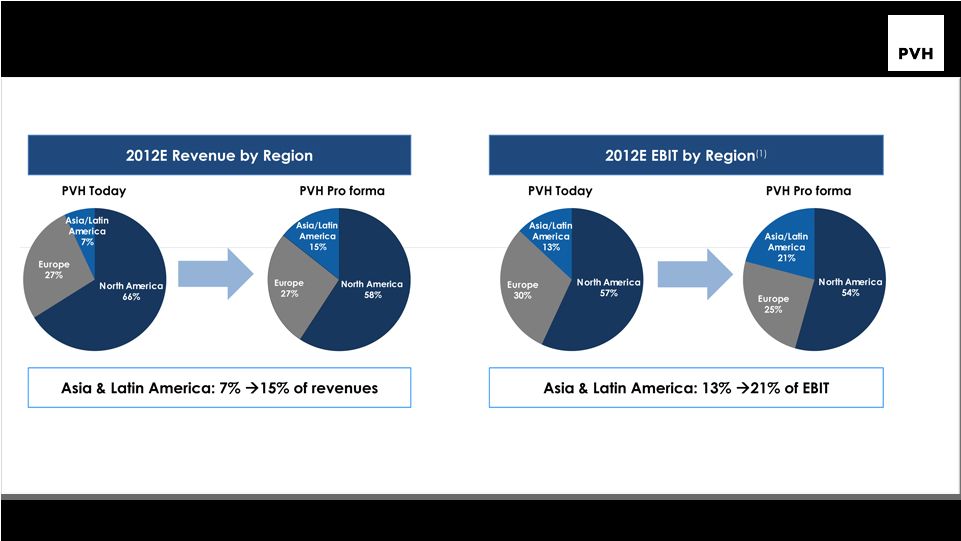

9

(1)

Excludes unallocated corporate expenses.

Note: Pro forma results exclude performance attributable to potential loss of a

license. Transaction increases PVH’s presence in emerging markets,

particularly Asia and Latin America Complementary Regional Platforms and

Operational Expertise |

10

Complementary Regional Platforms and Operational Expertise

ASIA

2012E CK Asia Revenue: >$525 MM

2009A-2012E Revenue CAGR: 19%

Key Growth Markets: China, India

LATIN AMERICA

2012E CK Latin America Revenue: >$200 MM

2009A-2012E Revenue CAGR: 30%

Key Growth Markets: Brazil, Mexico

Warnaco provides PVH significant scale and local operating platforms in high-growth

emerging markets where PVH is currently underpenetrated

Potential for PVH to leverage its supply chain, operations, processes and systems

expertise to drive further growth and margin improvement in these regions

PVH will leverage its expertise and infrastructure in North America and Europe to

restore growth and improve operating margins of the Calvin Klein Jeans and

Underwear businesses in these regions –

Opportunity

to

directly

operate

and

further

develop

Tommy

Hilfiger

in

these

regions

over

time

–

Enhance

product

design,

marketing

and

brand

presentation |

11

•

Calvin Klein is one of the most powerful global mega

brands with $7.6 BN in 2011 global retail sales

–

Calvin

Klein

named

one

of

TIME

magazine’s

“Top 100 Icons in Fashion, Style and Design”

–

Significant brand awareness in every major

market around the world

•

51% of global retail sales generated

outside of North America

–

Over

$300 MM of global marketing spend

across Calvin Klein

brands continues to support

global growth

–

Product innovation, category extensions and a

cohesive global brand marketing message

continue to drive the brand

Reunites the House of Calvin Klein to Ensure Single Brand Vision

|

12

Reunites the House of Calvin Klein to Ensure Single Brand Vision –

Global Retail Sales, 2003-2011

Transaction reinforces PVH

strategy to drive Calvin Klein

brand reach globally through new

customers, regions and channels

•

Since PVH acquired Calvin

Klein

in 2003, global retail

sales have grown 13%

compounded annually

•

Global retail sales expected

to grow 8%-10% annually at

retail over the next 5 years |

13

Reunites the House of Calvin Klein to Ensure Single Brand Vision

•

Complete

control

of

brand

image

and

commercial

decisions

for

the

two

largest

apparel

categories

of

Calvin

Klein

–

jeans

and

underwear

–

for

the

first

time

–

Global collaboration and coordination of product design, merchandising,

supply chain and retail distribution

•

Better product merchandising and execution alignment with global

brand positioning and marketing

–

Reposition full price / off-price and club channels mix over next two years

–

Optimize lifestyle product assortment across categories, channels and regions

–

Eliminates complexities, allowing for better communication and direction

•

Single brand vision –

strengthens the brand globally

–

Improve brand image, positioning and execution across markets

–

Consistency across sportswear, jeanswear and accessories collections and

marketing worldwide

•

Remaining royalty stream of over $170 MM (pro forma) will be strengthened by

the broader Calvin Klein brand initiatives |

14

PVH Positioned To Drive Long Term Revenue and EPS Growth

•

Fuel continued growth in

emerging markets

•

Focus on enhanced product

offering and execution

•

Continued direct-to-consumer

expansion

•

Increased brand support

•

Improved global coordination,

processes, systems and supply

chain

•

Strengthened momentum and

profitability in Europe and North

America

•

Leverage consistent profitability

and free cash flow from

Heritage Brands businesses

PVH Pro Forma Enhanced

Growth and Profitability

PVH Pro Forma Enhanced

Growth and Profitability

Drive Growth in

Warnaco’s Business

Drive Growth in

Warnaco’s Business

Synergies

Synergies

•

Expected pro forma revenue

growth of 6%-8% annually

•

Estimated accretion in year one

(anticipated

FY

2013)

of

$0.35

per share, excl. integration /

transaction related costs

–

Excludes earnings associated

with potential loss of license

•

Pro forma EPS growth in excess

of 15% annually

•

Continued strong cash flow

conversion

•

Ability to quickly de-lever

•

~$100 MM in annual run-rate

synergies

•

One-time integration /

transaction related costs of

approximately $175 MM to

achieve the synergies over 3

years

•

Primarily driven by domestic

business reduction of corporate

overhead / back office

•

Synergies realized over 3 years

(1) Reflects year one synergies, vs. $100 MM of annual run-rate synergies and

excludes one-time costs in year one of $100 MM. (1)

|

15

PVH in 5 Years –

Global Retail Sales |

16

History of Successful Acquisitions and Achieving Financial Targets

PVH has a proven track record of acquisitions

-

Calvin Klein (2003), Tommy Hilfiger (2010)

PVH will have repaid ~$1.0 BN of debt related to its Tommy Hilfiger acquisition by the

end of 2012E Tommy Hilfiger Acquisition

Tommy Hilfiger Acquisition

PVH Pro Forma For

Warnaco Transaction

PVH Pro Forma For

Warnaco Transaction

LTM EBITDA: ~$738 MM

(1)

Total Debt : $2.6 BN

Pro Forma Leverage: 3.6x

EBITDA: ~$870 MM

(1)

Total Debt: $1.6 BN

Leverage: 1.9x

Pro Forma PVH @

Closing –

May 2010

PVH Standalone

2012E

2012E EBITDA: ~$1.3 BN

(1)(2)

Total Debt: $4.3 BN

Pro Forma Leverage: 3.4x

(2)

(1)

Refer to Appendix for GAAP to non-GAAP reconciliation.

(2)

Including run-rate synergies less potential loss of license for pro forma

PVH. (3)

Excludes certain items. Reflects 2009 non-GAAP EPS of $2.83 (reconciled on

Form 8-K dated March 28, 2011) plus $0.30 of annualized accretion as estimated at the time of the Tommy Hilfiger acquisition.

(4)

Reflects the high end of the 2012E guidance. Excludes certain items. Reconciled

on Form 8-K dated 10/2/12. (5)

Reflects year one synergies vs. run-rate synergies of $100 MM and excludes

one-time costs in year one of $100 MM. EBITDA Growth:

+18%

De-Leveraging:

1.7x

Pro Forma EPS: $3.13

(3)

EPS: $6.37

(4)

Year 1 Accretion: $0.35 per

share, excl. one-time costs

(5)

EPS Growth:

+100% |

17

Future Opportunities Outside Plan

Significant Revenue and Profit Upside Following Strategic Initiatives To Elevate the

Calvin Klein Brand

Significant Revenue and Profit Upside Following Strategic Initiatives To Elevate the

Calvin Klein Brand

Re-Establish Calvin Klein Jeans Leadership in North America and Europe

Re-Establish Calvin Klein Jeans Leadership in North America and Europe

Directly develop Tommy Hilfiger in Markets Where Warnaco Has an Established

Operating Platform –

Asia, Latin America

Directly develop Tommy Hilfiger in Markets Where Warnaco Has an Established

Operating Platform –

Asia, Latin America

Expand the Calvin Klein Category Breadth in Jeans, Sportswear and Accessories

Expand the Calvin Klein Category Breadth in Jeans, Sportswear and Accessories

Develop Tommy Hilfiger and Calvin Klein in New Geographies, Underpenetrated

Markets and Categories

Develop Tommy Hilfiger and Calvin Klein in New Geographies, Underpenetrated

Markets and Categories |

18

Appendix |

19

Appendix: GAAP to Non-GAAP EBITDA Reconciliation

Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA)

(Amount in dollars and in millions)

Tommy Hilfiger

Transaction

Warnaco Transaction

PVH Standalone

Warnaco Standalone

Combined

2009 PF

(1)

2012E

2012E

2012E PF

(2)

GAAP earnings before interest and taxes (EBIT)

450

$

715

$

198

$

794

$

Pre-tax non-recurring and

one-time items (3)

65

15

60

175

EBIT excluding non-recurring and one-time items and run-rate synergies

515

$

730

$

258

$

969

$

Run-rate synergies

40

-

-

100

EBIT excluding non-recurring and one-time items

555

730

258

$

1,069

Depreciation and amortization

183

140

200

EBITDA as presented

738

$

870

$

1,269

$

(2)

Combined pro forma full year estimate based on management estimates assuming the transaction

was completed on the first day of PVH’s 2012 fiscal year. (3)

Adjustments represent the elimination of restructuring and other items in 2009 and

2012. Adjustments for combined 2012E PF also include one-time integration/

transaction costs.

(1)

Combined pro forma full year results assuming the transaction was completed on the first day

of PVH’s 2009 fiscal year. |

20

Growing Powerful Global Lifestyle Brands

|