Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FNB CORP/PA/ | d427572d8k.htm |

| EX-99.1 - EX-99.1 - FNB CORP/PA/ | d427572dex991.htm |

F.N.B. Corporation

Third Quarter 2012

Earnings Conference Call

October 23, 2012

Exhibit 99.2 |

Cautionary Statement Regarding Forward-Looking Information

and Non-GAAP Financial Information

2

This presentation and the reports F.N.B. Corporation files with the Securities and Exchange

Commission often contain “forward-looking statements” relating to present

or future trends or factors affecting the banking industry and, specifically, the financial operations, markets and products of F.N.B.

Corporation. These forward-looking statements involve certain risks and uncertainties.

There are a number of important factors that could cause F.N.B. Corporation’s

future results to differ materially from historical performance or projected performance. These factors include, but are not limited to: (1) a

significant increase in competitive pressures among financial institutions; (2) changes in the

interest rate environment that may reduce interest margins; (3) changes in prepayment

speeds, loan sale volumes, charge-offs and loan loss provisions; (4) general economic conditions; (5) various monetary and

fiscal policies and regulations of the U.S. government that may adversely affect the

businesses in which F.N.B. Corporation is engaged; (6) technological issues which may

adversely affect F.N.B. Corporation’s financial operations or customers; (7) changes in the securities markets; (8) risk factors mentioned

in the reports and registration statements F.N.B. Corporation files with the Securities and

Exchange Commission; (9) housing prices; (10) job market; (11) consumer confidence and

spending habits; (12) estimates of fair value of certain F.N.B. Corporation assets and liabilities; () 13) in connection with the

pending merger with Annapolis Bancorp, Inc., difficulties encountered in expanding into a new

market; or (14) the effects of current, pending and future legislation, regulation and

regulatory actions. F.N.B. Corporation undertakes no obligation to revise these forward-looking statements or to reflect events

or circumstances after the date of this presentation.

To supplement its consolidated financial statements presented in accordance with Generally

Accepted Accounting Principles (GAAP), the Corporation provides additional measures of

operating results, net income and earnings per share (EPS) adjusted to exclude certain costs, expenses, and gains and

losses. The Corporation believes that these non-GAAP financial measures are

appropriate to enhance the understanding of its past performance as well as prospects

for its future performance. In the event of such a disclosure or release, the Securities and Exchange Commission’s Regulation G requires: (i) the

presentation of the most directly comparable financial measure calculated and presented in

accordance with GAAP and (ii) a reconciliation of the differences between the

non-GAAP financial measure presented and the most directly comparable financial measure calculated and presented in

accordance with GAAP. The required presentations and reconciliations are contained

herein and can be found at our website, www.fnbcorporation.com, under “Shareholder

and Investor Relations” by clicking on “Non-GAAP Reconciliation.”

The Appendix to this presentation contains non-GAAP financial measures used by the

Corporation to provide information useful to investors in understanding the

Corporation's operating performance and trends, and facilitate comparisons with the performance of the Corporation's peers. While

the Corporation believes that these non-GAAP financial measures are useful in evaluating

the Corporation, the information should be considered supplemental in nature and not as

a substitute for or superior to the relevant financial information prepared in accordance with GAAP. The non-GAAP

financial measures used by the Corporation may differ from the non-GAAP financial measures

other financial institutions use to measure their results of operations. This

information should be reviewed in conjunction with the Corporation’s financial results disclosed on October 22, 2012 and in its periodic

filings with the Securities and Exchange Commission. |

Additional Information About the

Merger

3

ADDITIONAL INFORMATION ABOUT THE PENDING MERGER WITH ANNAPOLIS BANCORP, INC.

SHAREHOLDERS OF ANNAPOLIS BANCORP, INC. ARE ADVISED TO READ THE PROXY STATEMENT/PROSPECTUS

WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL

AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN

IMPORTANT INFORMATION. F.N.B. Corporation and Annapolis Bancorp, Inc. will file a proxy

statement/prospectus and other relevant documents with the SEC in connection with the

merger.

The proxy statement/prospectus and other relevant materials (when they become available), and

any other documents F.N.B. Corporation and Annapolis Bancorp, Inc. have filed with the

SEC, may be obtained free of charge at the SEC's website at www.sec.gov. In addition, investors and

security holders may obtain free copies of the documents F.N.B. Corporation has filed with the

SEC by contacting James Orie, F.N.B. Corporation, One F.N.B. Boulevard, Hermitage, PA

16148, telephone: (724) 983-3317 and free copies of the documents filed by Annapolis Bancorp, Inc. with the SEC by

contacting Edward Schneider, Treasurer and CFO, 1000 Bestgate Road, Suite 400, Annapolis, MD

21401, telephone: (410) 224-4455.

F.N.B. Corporation Annapolis Bancorp, Inc. and their directors and executive officers may be

deemed to be participants in the solicitation of proxies from Annapolis Bancorp, Inc.

shareholders in connection with the proposed merger. Information concerning such participants' ownership of

Annapolis Bancorp, Inc. common stock will be set forth in the proxy statement/prospectus

relating to the merger when it becomes available. This communication does not

constitute an offer of any securities for sale. |

3Q12

Highlights Strong Operating Results and Sustained Momentum

Net income of $30.7 million and diluted earnings per share of $0.22

Net interest margin of 3.70%

Strong

loan

growth

-

13

consecutive

quarter

of

organic

growth

for

total

loans

Strong transaction deposit and customer repurchase growth

Good asset quality results reflecting consistency and stability in core portfolio

Lower operating expenses

Acquisition Announcement: Annapolis Bancorp, Inc.

4

th |

3Q12

Operating Highlights 5

3Q12

2Q12

3Q11

Consistent

Earnings

Growth

Net income

$30,743

$29,130

$23,773

Earnings per diluted share

$0.22

$0.21

$0.19

Profitability

Performance

ROTE

19.10%

19.01%

16.23%

ROTA

1.03%

1.00%

0.95%

Net interest margin

3.70%

3.80%

3.79%

Efficiency ratio

56.8%

57.7%

59.0%

Strong

Organic

Balance Sheet

Growth

Trends

(1)

Total

loan

growth

(2)

6.9%

4.4%

8.1%

Commercial

loan

growth

(2)

8.9%

7.2%

8.7%

Consumer loan growth

12.0%

8.3%

9.1%

Transaction

deposits

and

customer

repo

growth

(3)

8.7%

14.3%

5.6%

(1)Average, annualized linked quarter organic growth results; (2)Excludes the Florida

commercial portfolio; (3)Excludes time deposits |

Sustained Loan Growth

6

(1)

Average, linked-quarter organic growth results

(2)

Year-over-year (Y-o-Y) organic growth results by portfolio, $ in

millions (3)

The Florida portfolio is an exit-strategy portfolio, the residential portfolio has

experienced accelerated pre-payment speeds and expected declines following the

Parkvale acquisition. Linked

Quarter

and

Y-o-Y

Loan

Growth

(%)

(1)

Y-o-Y

Loan

Growth

($)

(2)

Positive loan growth results despite

declines in the Florida portfolio and the

residential

mortgage

portfolio

(3)

Strong year-over-year results for FNB’s

commercial and consumer portfolios |

Positive Operating Trends: Pre-Provision Net Revenue Results

7

Pre-provision

net

revenue

(PPNR)

represents

net

interest

income

(FTE),

plus

non-interest

income

(excluding

securities

gains

and

losses

and

OTTI)

less

non-

interest expense. Non-interest income and non-interest expense have been

adjusted to exclude certain non-operating items, refer to appendix for

calculation.

9%

$147,993

$122,014

$

-

$20,000

$40,000

$60,000

$80,000

$100,000

$120,000

$140,000

$160,000

3Q12 YTD

3Q11 YTD

21%

Year-over-Year

PPNR

Growth

$1.05

$0.96

$0.90

$0.92

$0.94

$0.96

$0.98

$1.00

$1.02

$1.04

$1.06

$1.08

3Q12 YTD

3Q11 YTD

9%

Year-over-Year

PPNR EPS

Growth

21%

Pre-Provision Net Revenue EPS

Pre-Provision Net Revenue |

Natural

progression Consistent with stated expansion strategy

Market opportunity

Attractive demographics

Significant commercial banking opportunities

Excellent retail and wealth opportunities

Access to greater Baltimore and Washington

D.C. markets

Acquisition Announcement: Annapolis Bancorp, Inc.

8

Source:

Deposit

and

demographic

data

per

SNL

Financial;

deposits

as

of

June

30,

2012

(1) Includes branch opened October, 2012 in Waugh Chapel

County

Branches

Deposits in

Market ($000)

HH Income

($ -

2011)

Anne

Arundel,

MD

(1)

7

298,251

79,692

Queen Anne’s, MD

1

45,107

72,774

FNB Current Wtd Avg. by County

42,350

Attractive Market Entry Opportunity

F.N.B. (FNB) (266 branches)

Annapolis Bancorp (ANNB) (8 branches)

(1)

th

Attractive partner

ANNB is a relationship-focused bank with

strong community ties and presence

Execute FNB’s scalable, proven business

model and strong sales management culture

Establishes

a

5

FNB

region

Markets conducive to FNB’s model |

Asset Quality Results

(1)

9

$ in thousands

3Q12

2Q12

3Q11

3Q12 Highlights

NPL’s+OREO/Total loans+OREO

1.69%

1.93%

2.48%

Overall results reflect the consistent,

solid performance of the core portfolios

(Pennsylvania and Regency portfolios,

representing 99.1% of total loans)

Non-performing loans plus OREO

declined $13.3 million or 10.1%

Provision for loan losses

$6.2 million for the originated

portfolios

$2.2 million for the acquired

portfolios

Continued positive trends seen in

delinquency levels

NCO’s remain at good levels

Total delinquency

1.66%

1.78%

2.35%

Provision for loan losses

(2)

$8,429

$7,027

$8,573

Net charge-offs (NCO’s)

(2)

$7,362

$7,473

$8,984

NCO’s/Total average loans

(2)

0.37%

0.38%

0.53%

NCO’s/Total average originated loans

0.42%

0.45%

0.56%

Allowance for loan losses/

Total loans

1.43%

1.49%

1.69%

Allowance for loan losses/

Total non-performing loans

120.23%

104.89%

86.75%

(1)

Metrics shown are originated portfolio metrics unless noted as a total portfolio metric.

“Originated portfolio” or “Originated loans” excludes loans

acquired at fair value and accounted for in accordance with ASC 805 (effective January 1, 2009), as the risk of credit loss has been

considered by virtue of the Corporation’s estimate of fair value.

(2)

Total portfolio metric |

Balance Sheet Highlights

10

Average Balances, $ in millions

3Q12

3Q12-2Q12

Growth

(1)

3Q12 Highlights

Balance

$

%

Securities

$2,252

-$2.5

-0.4%

Strong overall loan and transaction

deposit growth

Sustained total loan growth

momentum:

13

th

consecutive

quarter

of total loan growth

Sustained commercial loan growth

momentum

:

14

th

consecutive

quarter

of PA commercial loan growth

Strong consumer loan growth

Attractive deposit mix: Lower cost,

relationship-focused transaction

deposits and customer repurchase

agreements = 74% of total deposits

and customer repurchase

agreements

(5)

Total loans

$7,928

$96.3

4.9%

Total PA loans

(2)

$7,850

$134.8

6.9%

PA Commercial loans

(2)

$4,194

$91.5

8.9%

Consumer loans

(3)

$2,460

$72.2

12.0%

Earning assets

$10,267

$103.2

4.0%

Total deposits and customer repos

$9,834

$83.3

3.4%

Transaction deposits and customer

repos

(4)

$7,182

$153.8

8.7%

Time Deposits

$2,653

-$70.5

-10.3%

1)% growth annualized; (2)Excludes the Florida portfolio; (3)Includes Direct Installment,

Indirect Installment and Consumer LOC portfolios;

(4)Excludes time deposits; (5) Period-end as of September 30, 2012

|

Net

Interest Margin 11

Net Interest Margin Trend

Parkvale

Acquisition

1/1/2012 |

Non-Interest Income

12

$ in thousands

3Q12

2Q12

3Q11

3Q12 Highlights

Service charges

$17,666

$17,588

$16,057

Consistent diverse fee revenue sources

and results

Insurance commissions and fees

benefited from seasonal commissions

Increase in other income reflects $1.4

million gain on the sale of a building

Insurance commissions and fees

4,578

3,882

4,002

Securities commissions

2,102

2,030

1,858

Trust income

3,783

3,842

3,565

Gain on sale of loans

1,176

711

657

Other

5,693

4,465

3,479

Total

non-interest

income

(1)

$34,998

$32,518

$29,618

(1) Excluding net securities gains/(losses) and OTTI of ($185), $260 and $12, respectively.

|

Non-Interest Expense

13

$ in thousands

3Q12

2Q12

3Q11

3Q12 Highlights

Salaries and employee benefits

$41,579

$41,070

$37,149

Positive efficiency ratio trends

OREO expenses trending favorably

Operating leverage from Parkvale

acquisition -

cost savings fully phased in

beginning 3Q12

Occupancy and equipment

11,568

11,862

10,263

Amortization of intangibles

2,242

2,369

1,808

Other real estate owned

796

1,467

1,065

Other

(1)

20,809

21,397

18,650

Non-interest expense,

excluding merger costs

$76,994

$78,165

$68,935

Merger and severance costs

88

317

282

Total non-interest expense

$77,082

$78,482

$69,217

Efficiency ratio

56.8%

57.7%

59.0%

(1) Excluding merger costs |

Capital Position

14

(1) September 30, 2012 Total Risk-Based and Tier One represent estimated ratios

12.0%

10.5%

8.1%

6.0%

12.3%

10.7%

8.2%

6.0%

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

Total Risk-Based

Tier One

Leverage

Tangible Common Equity

June 30, 2012

September 30, 2012

(1) |

Concluding Remarks

15

Strong third quarter and year-to-date results

FNB is well-positioned

Significant

achievements

and

progress

on

initiatives

through

the

first

nine

months

of

2012

Integrated the Parkvale acquisition

E-delivery platform strategy execution

Branch optimization/efficiency enhancement plan announced

Deployed scorecard management tools to additional business units

Announced acquisition of Annapolis Bancorp |

Appendix

16 |

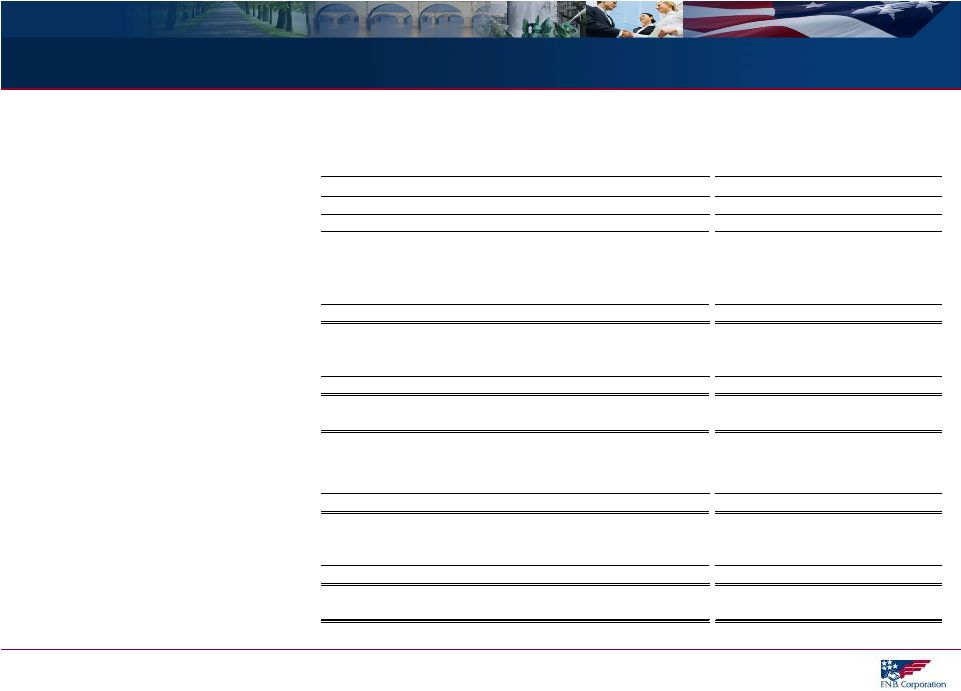

GAAP to Non-GAAP Reconciliation

17

Return on Average Tangible Equity

Return on Average Tangible Assets

September 30, 2012

June 30, 2012

September 30, 2011

2012

2011

Net income

$30,743

$29,130

$23,774

$81,455

$63,310

Return on average tangible equity

Net income, annualized

$122,304

$117,162

$94,319

$108,805

$84,646

Amortization of intangibles, net of tax, annualized

5,798

6,192

4,663

5,984

4,701

$128,102

$123,354

$98,982

$114,789

$89,347

Average shareholders' equity

$1,385,282

$1,367,333

$1,210,953

$1,368,457

$1,169,258

Less: Average intangible assets

714,501

718,507

601,010

717,390

600,020

Average tangible equity

$670,781

$648,826

$609,942

$651,066

$569,238

Return on average tangible equity

19.10%

19.01%

16.23%

17.63%

15.70%

Return on average tangible assets

Net income, annualized

$122,304

$117,162

$94,319

$108,805

$84,646

Amortization of intangibles, net of tax, annualized

5,798

6,192

4,663

5,984

4,701

$128,102

$123,354

$98,982

$114,789

$89,347

Average total assets

$11,842,204

$11,734,221

$9,971,847

$11,713,834

$9,845,310

Less: Average intangible assets

714,501

718,507

601,010

717,390

600,020

Average tangible assets

11,127,704

$

11,015,714

$

9,370,837

$

10,996,443

$

9,245,290

$

Return on average tangible assets

1.15%

1.12%

1.06%

1.04%

0.97%

For the Quarter Ended

September 30 Year-to-Date |

GAAP to Non-GAAP Reconciliation

18

(1)

Represents gain on sale of building, net gain/(loss) on securities and OTTI

(2)

Represents merger and severance costs

Pre-Provision Net Revenue

2012

2011

Pre-Provision Net Revenue (PPNR)

Net interest income (FTE)

$284,518

$242,353

Non-interest income

99,336

87,320

Non-interest expense

242,237

212,143

Pre-Provision Net Revenue (GAAP)

$141,617

$117,529

Less:

Non-operating

non-interest

income

(1)

1,633

105

Add:

Non-operating

non-interest

expense

(2)

8,009

4,589

Operating Pre-Provision Net Revenue

$147,993

$122,014

PPNR Earnings per Diluted Share

$1.05

$0.96

September 30 Year-to-Date |