Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - AMERICAN CAMPUS COMMUNITIES INC | a50449688ex99-1.htm |

| 8-K - AMERICAN CAMPUS COMMUNITIES, INC. 8-K - AMERICAN CAMPUS COMMUNITIES INC | a50449688.htm |

Exhibit 99.2

Slide: 0 Title: lon (Gp:) BRINGING Supplemental Analyst Package | 3Q-2012 October 22, 2012 QUALITY TOGETHER

Slide: 1 Title: Table of Contents

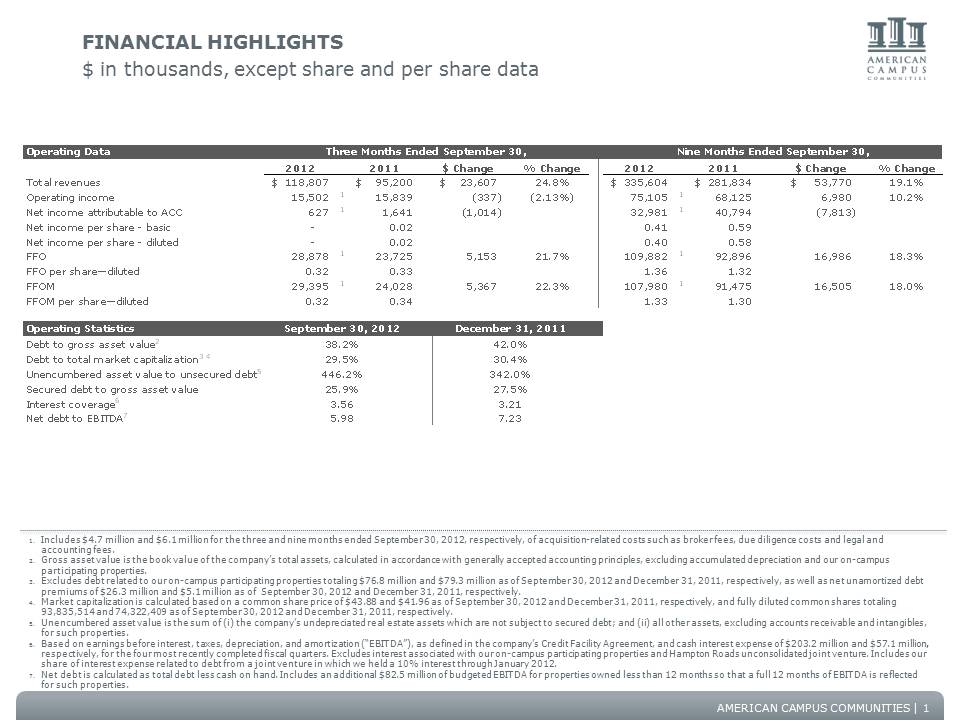

Slide: 2 Title: FINANCIAL highlights $ in thousands, except share and per share data Includes $4.7 million and $6.1 million for the three and nine months ended September 30, 2012, respectively, of acquisition-related costs such as broker fees, due diligence costs and legal and accounting fees. Gross asset value is the book value of the company’s total assets, calculated in accordance with generally accepted accounting principles, excluding accumulated depreciation and our on-campus participating properties. Excludes debt related to our on-campus participating properties totaling $76.8 million and $79.3 million as of September 30, 2012 and December 31, 2011, respectively, as well as net unamortized debt premiums of $26.3 million and $5.1 million as of September 30, 2012 and December 31, 2011, respectively. Market capitalization is calculated based on a common share price of $43.88 and $41.96 as of September 30, 2012 and December 31, 2011, respectively, and fully diluted common shares totaling 93,835,514 and 74,322,409 as of September 30, 2012 and December 31, 2011, respectively. Unencumbered asset value is the sum of (i) the company’s undepreciated real estate assets which are not subject to secured debt; and (ii) all other assets, excluding accounts receivable and intangibles, for such properties. Based on earnings before interest, taxes, depreciation, and amortization (“EBITDA”), as defined in the company’s Credit Facility Agreement, and cash interest expense of $203.2 million and $57.1 million, respectively, for the four most recently completed fiscal quarters. Excludes interest associated with our on-campus participating properties and Hampton Roads unconsolidated joint venture. Includes our share of interest expense related to debt from a joint venture in which we held a 10% interest through January 2012. Net debt is calculated as total debt less cash on hand. Includes an additional $82.5 million of budgeted EBITDA for properties owned less than 12 months so that a full 12 months of EBITDA is reflected for such properties. 1

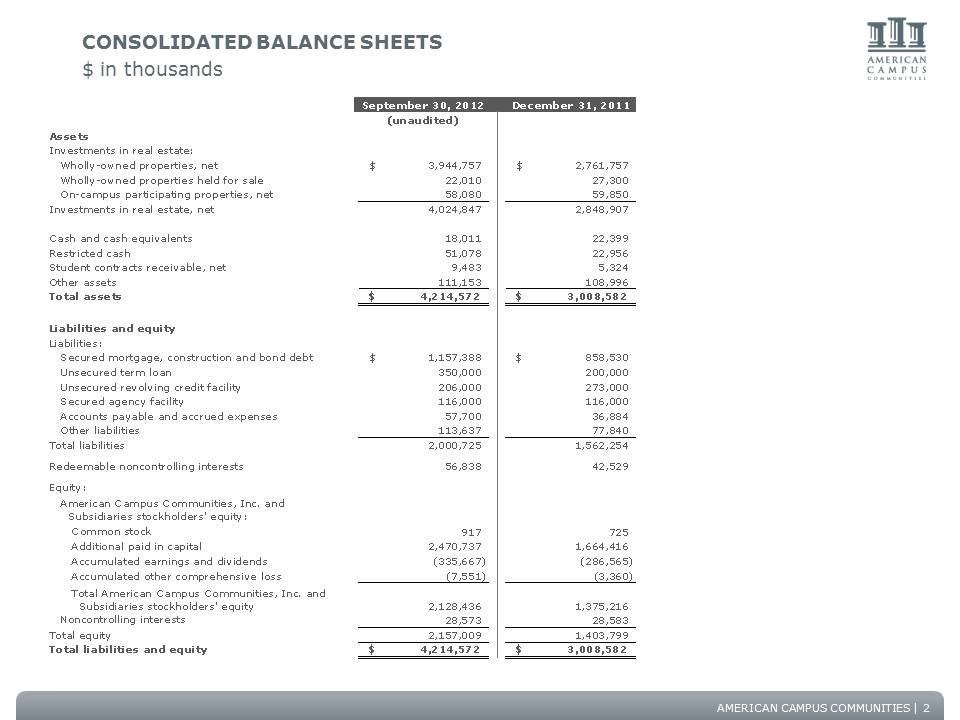

Slide: 3 Title: Consolidated balance sheets $ in thousands 2

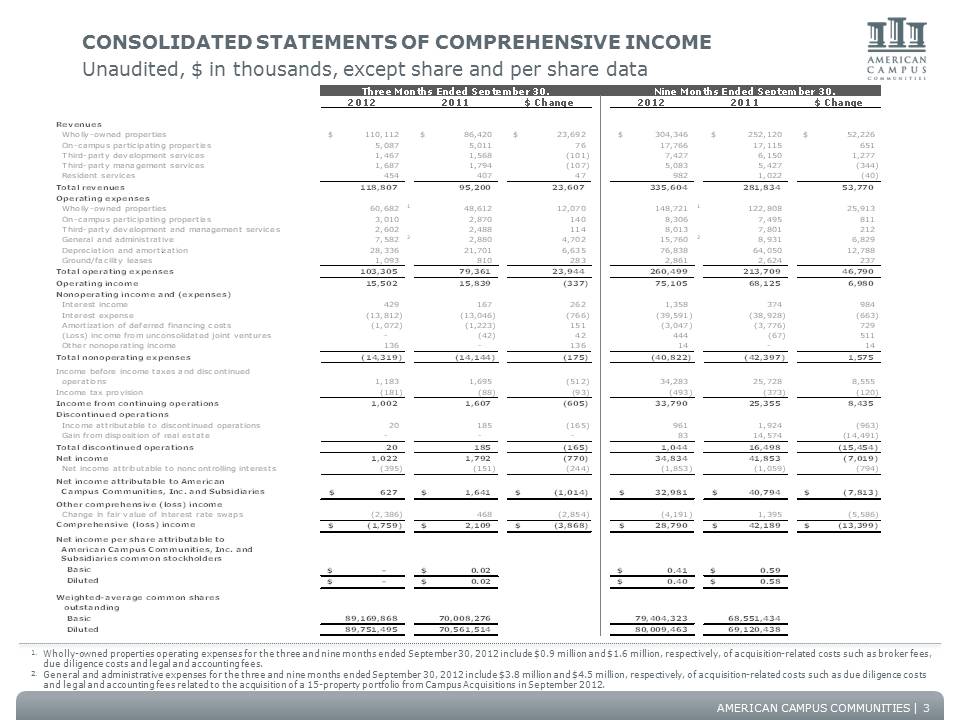

Slide: 4 Title: Consolidated statements of Comprehensive Income Unaudited, $ in thousands, except share and per share data 3 Wholly-owned properties operating expenses for the three and nine months ended September 30, 2012 include $0.9 million and $1.6 million, respectively, of acquisition-related costs such as broker fees, due diligence costs and legal and accounting fees. General and administrative expenses for the three and nine months ended September 30, 2012 include $3.8 million and $4.5 million, respectively, of acquisition-related costs such as due diligence costs and legal and accounting fees related to the acquisition of a 15-property portfolio from Campus Acquisitions in September 2012.

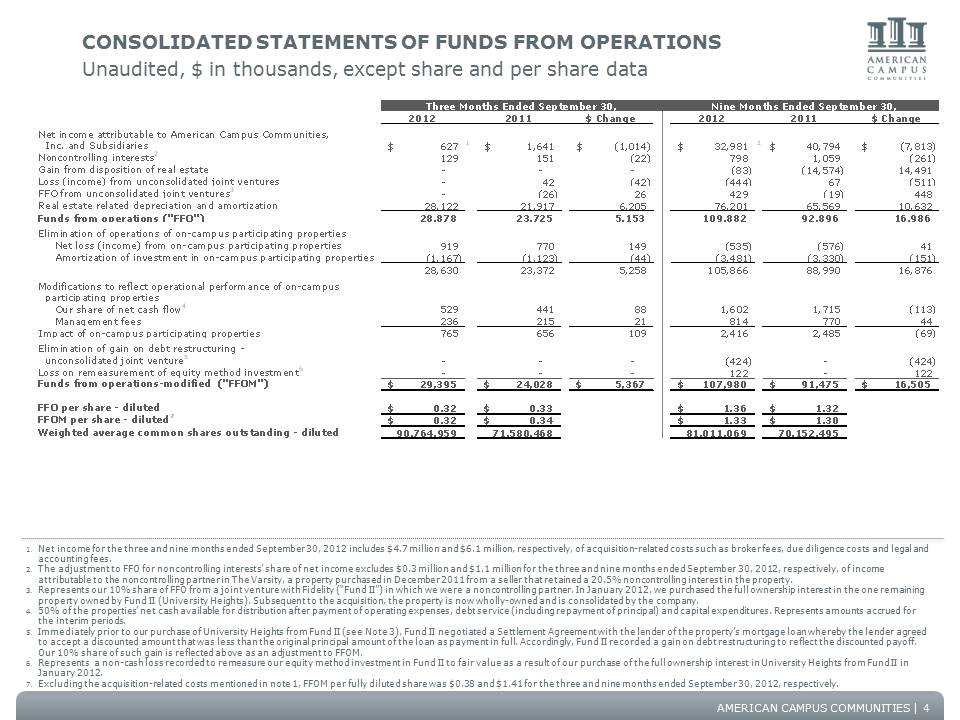

Slide: 5 Title: Consolidated statements of funds from operations Unaudited, $ in thousands, except share and per share data Net income for the three and nine months ended September 30, 2012 includes $4.7 million and $6.1 million, respectively, of acquisition-related costs such as broker fees, due diligence costs and legal and accounting fees. The adjustment to FFO for noncontrolling interests’ share of net income excludes $0.3 million and $1.1 million for the three and nine months ended September 30, 2012, respectively, of income attributable to the noncontrolling partner in The Varsity, a property purchased in December 2011 from a seller that retained a 20.5% noncontrolling interest in the property. Represents our 10% share of FFO from a joint venture with Fidelity (“Fund II”) in which we were a noncontrolling partner. In January 2012, we purchased the full ownership interest in the one remaining property owned by Fund II (University Heights). Subsequent to the acquisition, the property is now wholly-owned and is consolidated by the company. 50% of the properties’ net cash available for distribution after payment of operating expenses, debt service (including repayment of principal) and capital expenditures. Represents amounts accrued for the interim periods. Immediately prior to our purchase of University Heights from Fund II (see Note 3), Fund II negotiated a Settlement Agreement with the lender of the property’s mortgage loan whereby the lender agreed to accept a discounted amount that was less than the original principal amount of the loan as payment in full. Accordingly, Fund II recorded a gain on debt restructuring to reflect the discounted payoff. Our 10% share of such gain is reflected above as an adjustment to FFOM. Represents a non-cash loss recorded to remeasure our equity method investment in Fund II to fair value as a result of our purchase of the full ownership interest in University Heights from Fund II in January 2012. Excluding the acquisition-related costs mentioned in note 1, FFOM per fully diluted share was $0.38 and $1.41 for the three and nine months ended September 30, 2012, respectively. 4

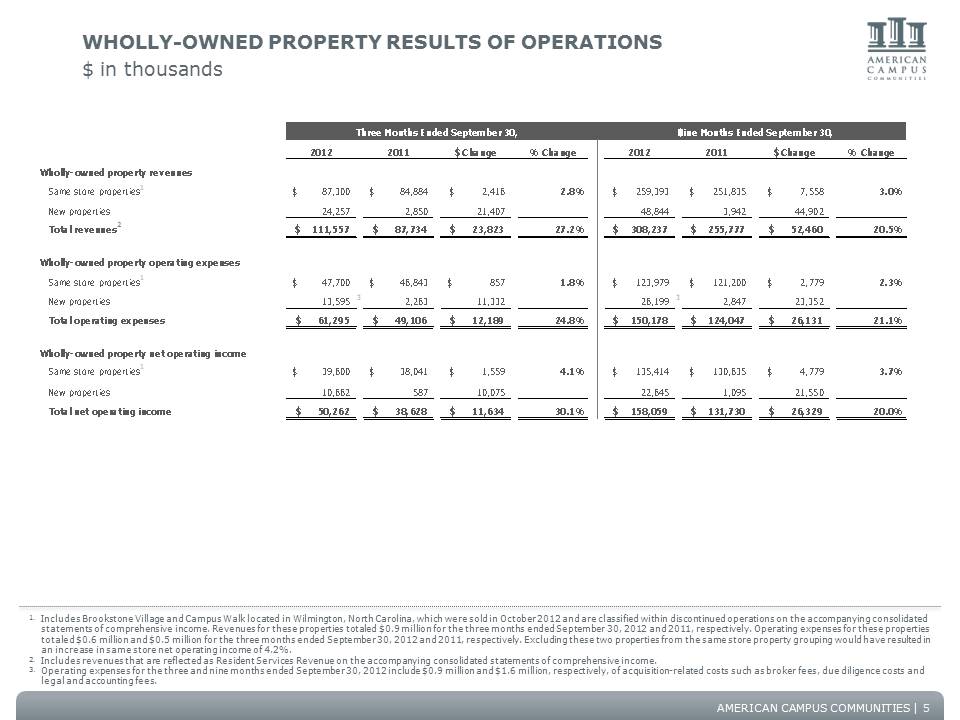

Slide: 6 Title: Wholly-owned property results of operations $ in thousands Includes Brookstone Village and Campus Walk located in Wilmington, North Carolina, which were sold in October 2012 and are classified within discontinued operations on the accompanying consolidated statements of comprehensive income. Revenues for these properties totaled $0.9 million for the three months ended September 30, 2012 and 2011, respectively. Operating expenses for these properties totaled $0.6 million and $0.5 million for the three months ended September 30, 2012 and 2011, respectively. Excluding these two properties from the same store property grouping would have resulted in an increase in same store net operating income of 4.2%. Includes revenues that are reflected as Resident Services Revenue on the accompanying consolidated statements of comprehensive income. Operating expenses for the three and nine months ended September 30, 2012 include $0.9 million and $1.6 million, respectively, of acquisition-related costs such as broker fees, due diligence costs and legal and accounting fees. 5

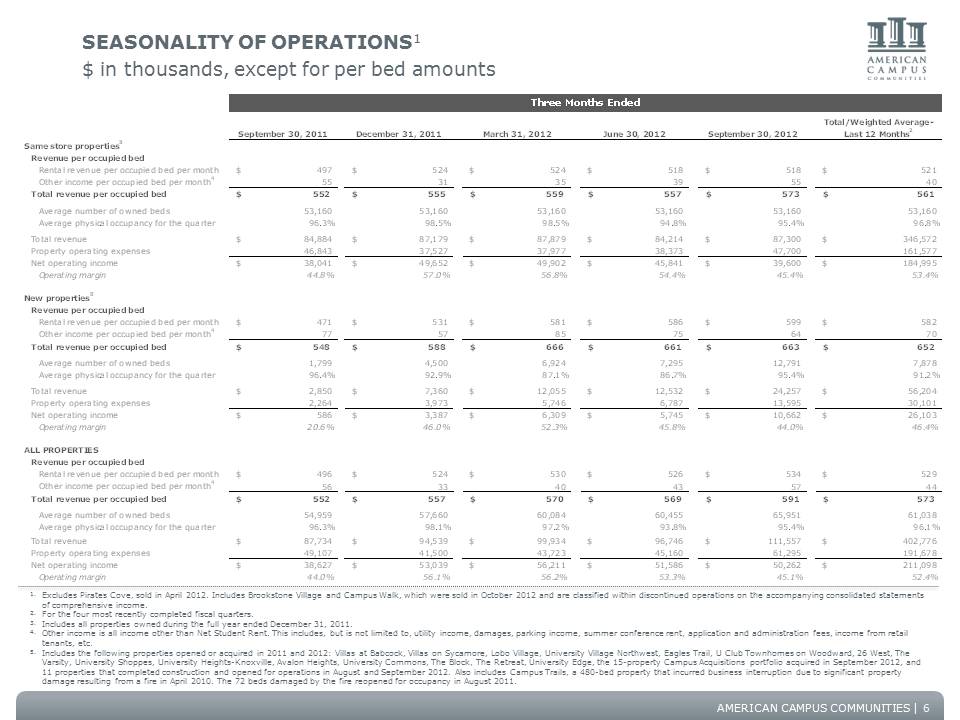

Slide: 7 Title: Seasonality of operations1 $ in thousands, except for per bed amounts Excludes Pirates Cove, sold in April 2012. Includes Brookstone Village and Campus Walk, which were sold in October 2012 and are classified within discontinued operations on the accompanying consolidated statements of comprehensive income. For the four most recently completed fiscal quarters. Includes all properties owned during the full year ended December 31, 2011. Other income is all income other than Net Student Rent. This includes, but is not limited to, utility income, damages, parking income, summer conference rent, application and administration fees, income from retail tenants, etc. Includes the following properties opened or acquired in 2011 and 2012: Villas at Babcock, Villas on Sycamore, Lobo Village, University Village Northwest, Eagles Trail, U Club Townhomes on Woodward, 26 West, The Varsity, University Shoppes, University Heights-Knoxville, Avalon Heights, University Commons, The Block, The Retreat, University Edge, the 15-property Campus Acquisitions portfolio acquired in September 2012, and 11 properties that completed construction and opened for operations in August and September 2012. Also includes Campus Trails, a 480-bed property that incurred business interruption due to significant property damage resulting from a fire in April 2010. The 72 beds damaged by the fire reopened for occupancy in August 2011. 6

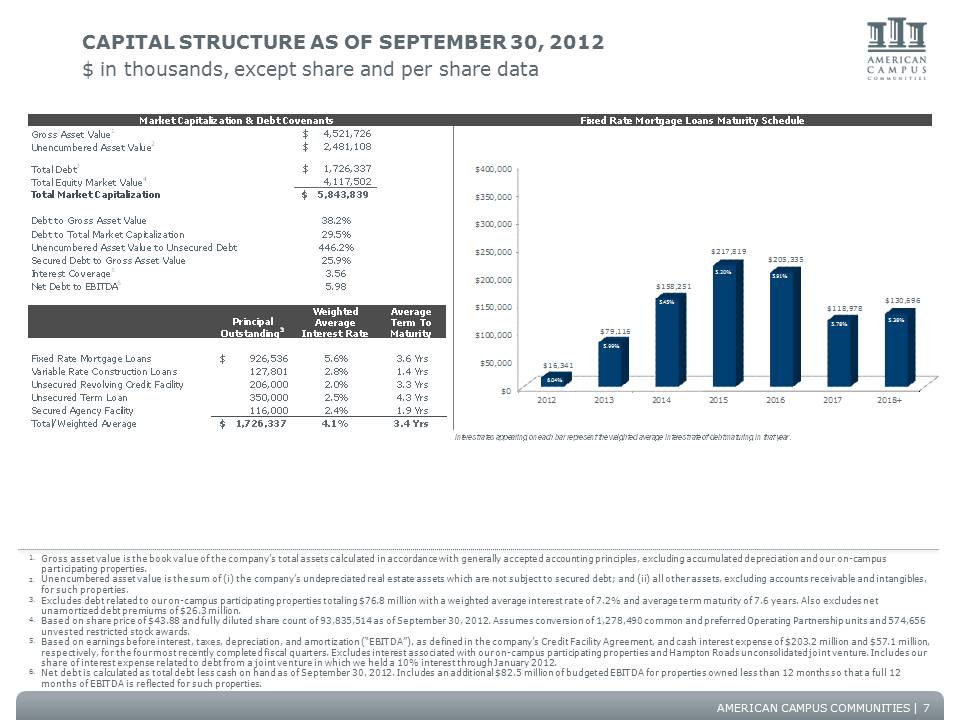

Slide: 8 Title: CAPITAL STRUCTURE AS OF September 30, 2012 $ in thousands, except share and per share data Gross asset value is the book value of the company’s total assets calculated in accordance with generally accepted accounting principles, excluding accumulated depreciation and our on-campus participating properties. Unencumbered asset value is the sum of (i) the company’s underappreciated real estate assets which are not subject to secured debt; and (ii) all other assets, excluding accounts receivable and intangibles, for such properties. Excludes debt related to our on-campus participating properties totaling $76.8 million with a weighted average interest rate of 7.2% and average term maturity of 7.6 years. Also excludes net unamortized debt premiums of $26.3 million. Based on share price of $43.88 and fully diluted share count of 93,835,514 as of September 30, 2012. Assumes conversion of 1,278,490 common and preferred Operating Partnership units and 574,656 unvested restricted stock awards. Based on earnings before interest, taxes, depreciation, and amortization (“EBITDA”), as defined in the company’s Credit Facility Agreement, and cash interest expense of $203.2 million and $57.1 million, respectively, for the four most recently completed fiscal quarters. Excludes interest associated with our on-campus participating properties and Hampton Roads unconsolidated joint venture. Includes our share of interest expense related to debt from a joint venture in which we held a 10% interest through January 2012. Net debt is calculated as total debt less cash on hand as of September 30, 2012. Includes an additional $82.5 million of budgeted EBITDA for properties owned less than 12 months so that a full 12 months of EBITDA is reflected for such properties. 7

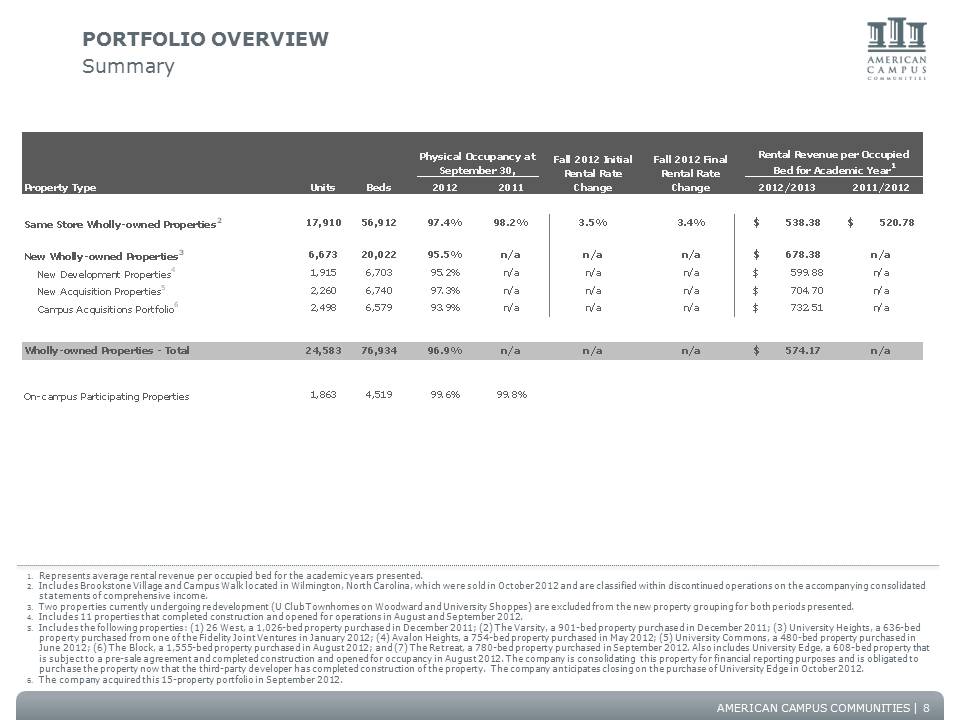

Slide: 9 Title: Portfolio overview Summary Represents average rental revenue per occupied bed for the academic years presented. Includes Brookstone Village and Campus Walk located in Wilmington, North Carolina, which were sold in October 2012 and are classified within discontinued operations on the accompanying consolidated statements of comprehensive income. Two properties currently undergoing redevelopment (U Club Townhomes on Woodward and University Shoppes) are excluded from the new property grouping for both periods presented. Includes 11 properties that completed construction and opened for operations in August and September 2012. Includes the following properties: (1) 26 West, a 1,026-bed property purchased in December 2011; (2) The Varsity, a 901-bed property purchased in December 2011; (3) University Heights, a 636-bed property purchased from one of the Fidelity Joint Ventures in January 2012; (4) Avalon Heights, a 754-bed property purchased in May 2012; (5) University Commons, a 480-bed property purchased in June 2012; (6) The Block, a 1,555-bed property purchased in August 2012; and (7) The Retreat, a 780-bed property purchased in September 2012. Also includes University Edge, a 608-bed property that is subject to a pre-sale agreement and completed construction and opened for occupancy in August 2012. The company is consolidating this property for financial reporting purposes and is obligated to purchase the property now that the third-party developer has completed construction of the property. The company anticipates closing on the purchase of University Edge in October 2012. The company acquired this 15-property portfolio in September 2012. 8

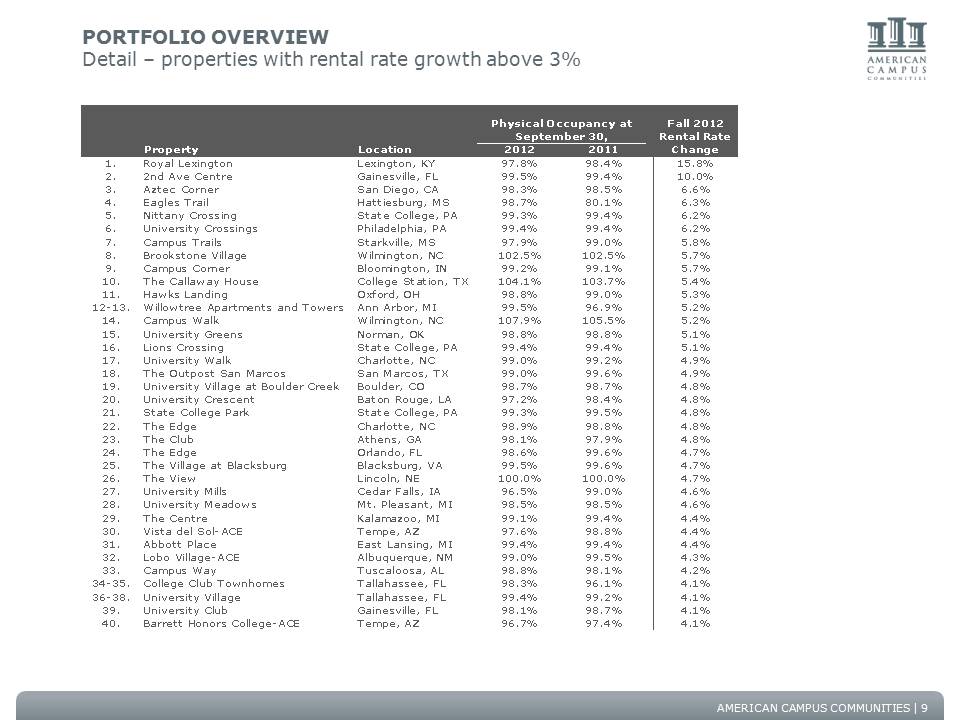

Slide: 10 Title: Portfolio overview Detail – properties with rental rate growth above 3% 9

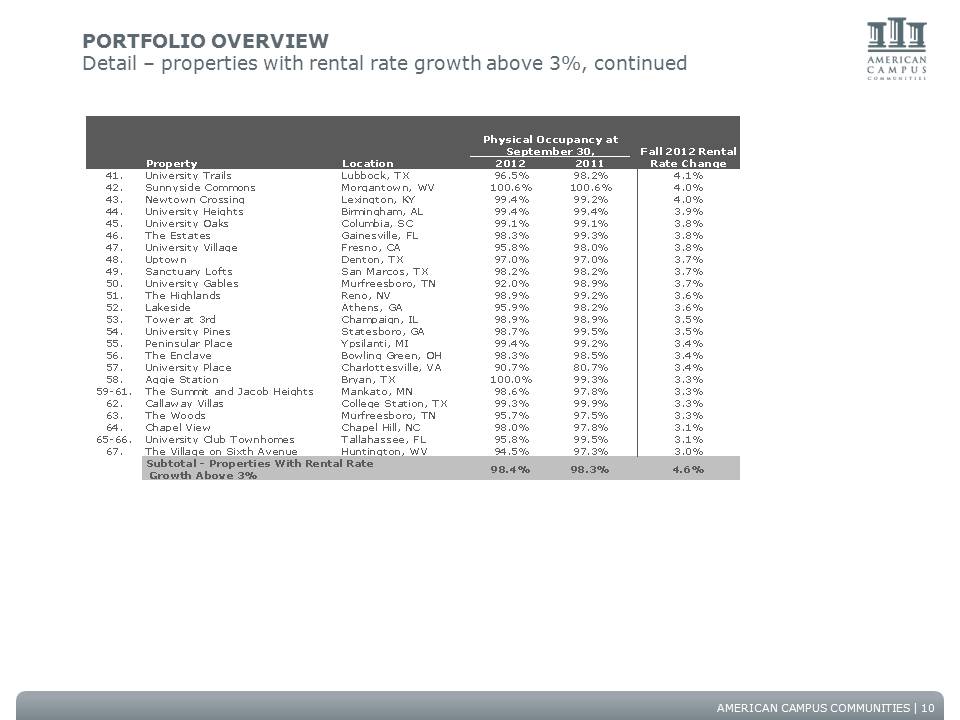

Slide: 11 Title: Portfolio overview Detail – properties with rental rate growth above 3%, continued 10

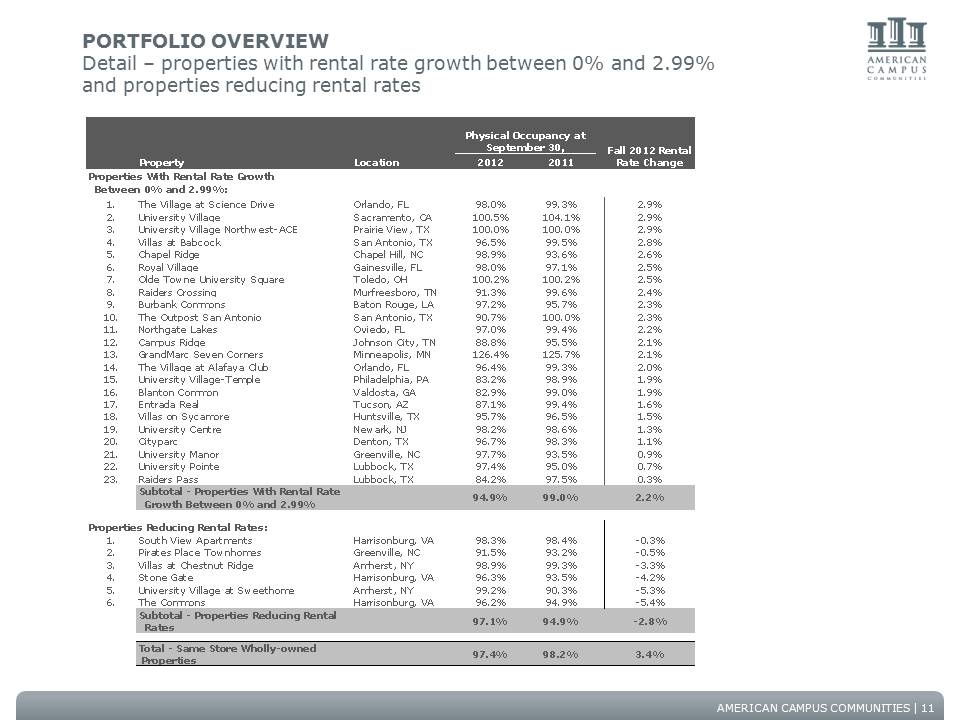

Slide: 12 Title: Portfolio overview Detail – properties with rental rate growth between 0% and 2.99% and properties reducing rental rates 11

Slide: 13 Title: Portfolio overview Detail – new wholly-owned properties 12 The company owns a 79.5% interest in this property.

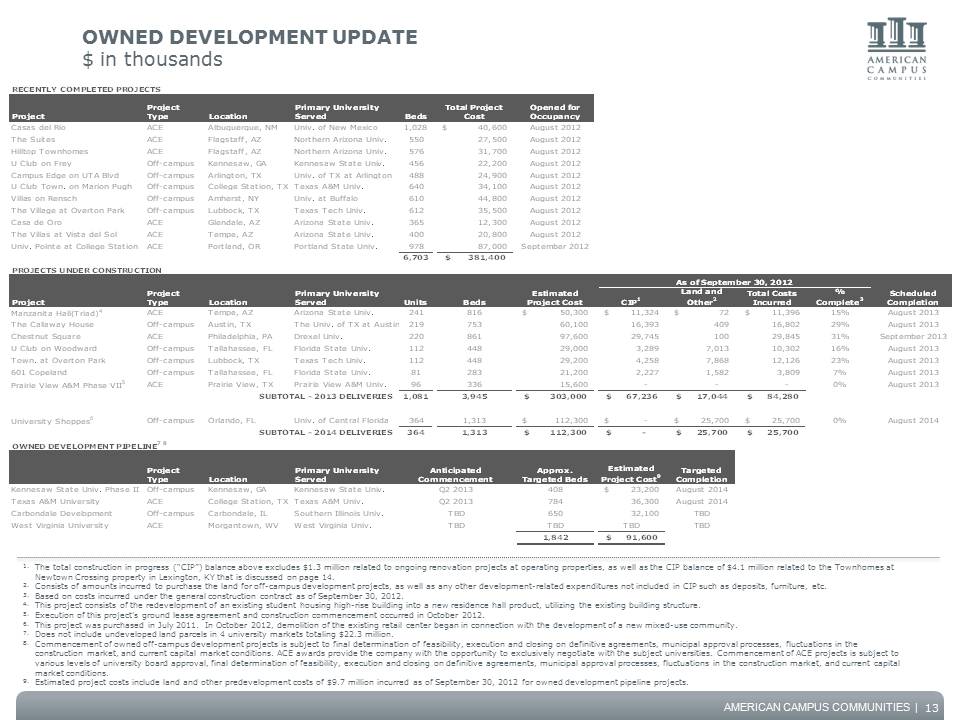

Slide: 14 Title: OWNED DEVELOPMENT UPDATE $ in thousands 13 The total construction in progress (“CIP”) balance above excludes $1.3 million related to ongoing renovation projects at operating properties, as well as the CIP balance of $4.1 million related to the Townhomes at Newtown Crossing property in Lexington, KY that is discussed on page 14. Consists of amounts incurred to purchase the land for off-campus development projects, as well as any other development-related expenditures not included in CIP such as deposits, furniture, etc. Based on costs incurred under the general construction contract as of September 30, 2012. This project consists of the redevelopment of an existing student housing high-rise building into a new residence hall product, utilizing the existing building structure. Execution of this project’s ground lease agreement and construction commencement occurred in October 2012. This project was purchased in July 2011. In October 2012, demolition of the existing retail center began in connection with the development of a new mixed-use community. Does not include undeveloped land parcels in 4 university markets totaling $22.3 million. Commencement of owned off-campus development projects is subject to final determination of feasibility, execution and closing on definitive agreements, municipal approval processes, fluctuations in the construction market, and current capital market conditions. ACE awards provide the company with the opportunity to exclusively negotiate with the subject universities. Commencement of ACE projects is subject to various levels of university board approval, final determination of feasibility, execution and closing on definitive agreements, municipal approval processes, fluctuations in the construction market, and current capital market conditions.Estimated project costs include land and other predevelopment costs of $9.7 million incurred as of September 30, 2012 for owned development pipeline projects.

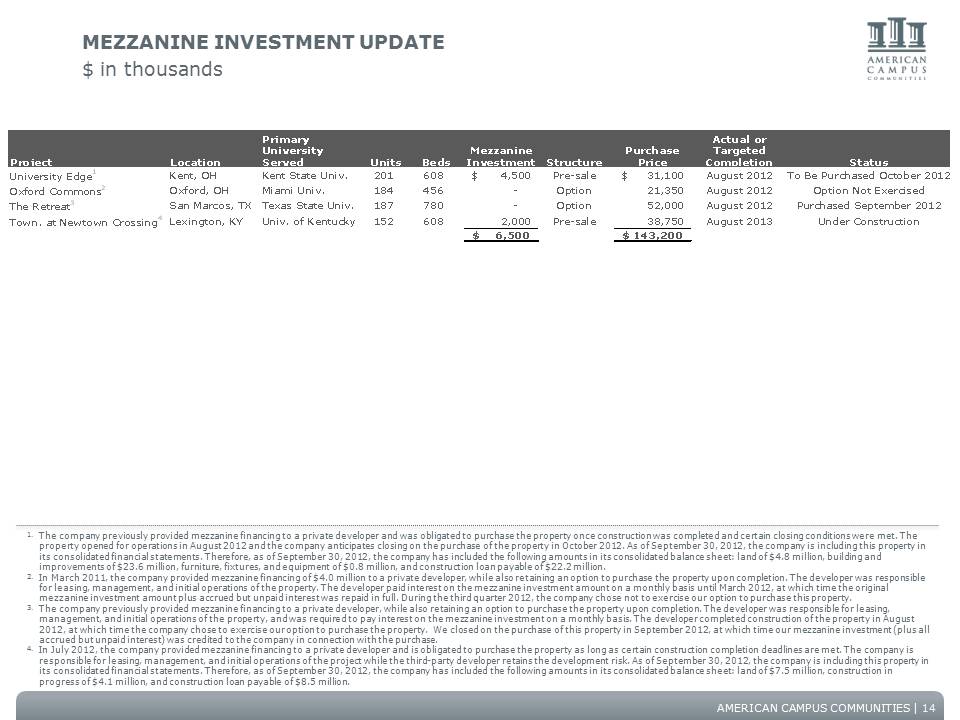

Slide: 15 Title: MEZZANINE INVESTMENT UPDATE $ in thousands The company previously provided mezzanine financing to a private developer and was obligated to purchase the property once construction was completed and certain closing conditions were met. The property opened for operations in August 2012 and the company anticipates closing on the purchase of the property in October 2012. As of September 30, 2012, the company is including this property in its consolidated financial statements. Therefore, as of September 30, 2012, the company has included the following amounts in its consolidated balance sheet: land of $4.8 million, building and improvements of $23.6 million, furniture, fixtures, and equipment of $0.8 million, and construction loan payable of $22.2 million. In March 2011, the company provided mezzanine financing of $4.0 million to a private developer, while also retaining an option to purchase the property upon completion. The developer was responsible for leasing, management, and initial operations of the property. The developer paid interest on the mezzanine investment amount on a monthly basis until March 2012, at which time the original mezzanine investment amount plus accrued but unpaid interest was repaid in full. During the third quarter 2012, the company chose not to exercise our option to purchase this property. The company previously provided mezzanine financing to a private developer, while also retaining an option to purchase the property upon completion. The developer was responsible for leasing, management, and initial operations of the property, and was required to pay interest on the mezzanine investment on a monthly basis. The developer completed construction of the property in August 2012, at which time the company chose to exercise our option to purchase the property. We closed on the purchase of this property in September 2012, at which time our mezzanine investment (plus all accrued but unpaid interest) was credited to the company in connection with the purchase. In July 2012, the company provided mezzanine financing to a private developer and is obligated to purchase the property as long as certain construction completion deadlines are met. The company is responsible for leasing, management, and initial operations of the project while the third-party developer retains the development risk. As of September 30, 2012, the company is including this property in its consolidated financial statements. Therefore, as of September 30, 2012, the company has included the following amounts in its consolidated balance sheet: land of $7.5 million, construction in progress of $4.1 million, and construction loan payable of $8.5 million. 14

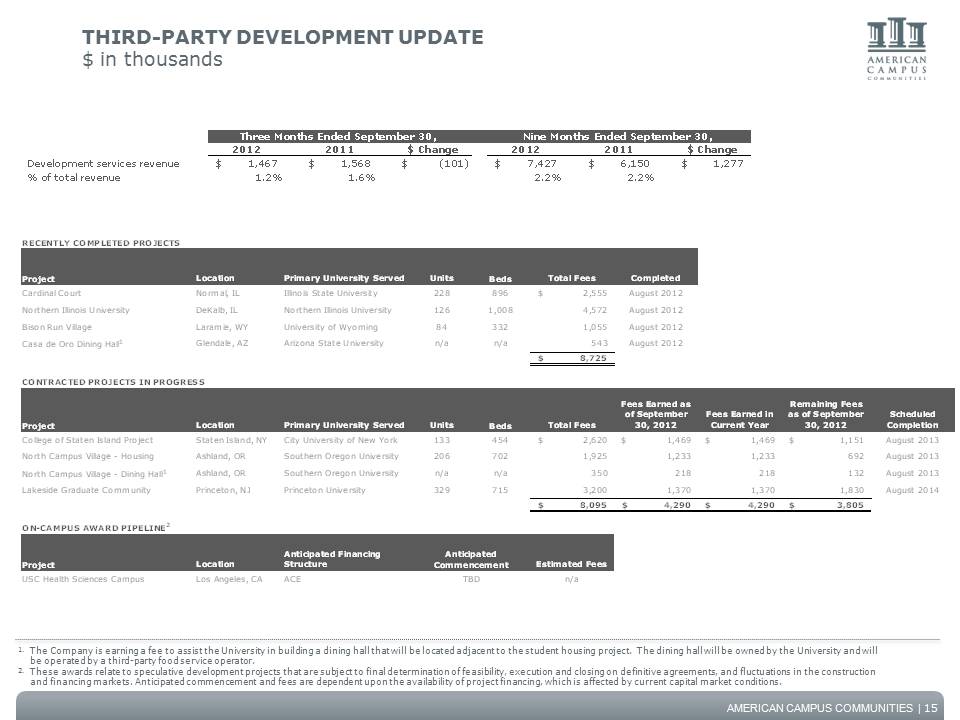

Slide: 16 Title: Third-party development update $ in thousands 15 The Company is earning a fee to assist the University in building a dining hall that will be located adjacent to the student housing project. The dining hall will be owned by the University and will be operated by a third-party food service operator. These awards relate to speculative development projects that are subject to final determination of feasibility, execution and closing on definitive agreements, and fluctuations in the construction and financing markets. Anticipated commencement and fees are dependent upon the availability of project financing, which is affected by current capital market conditions.

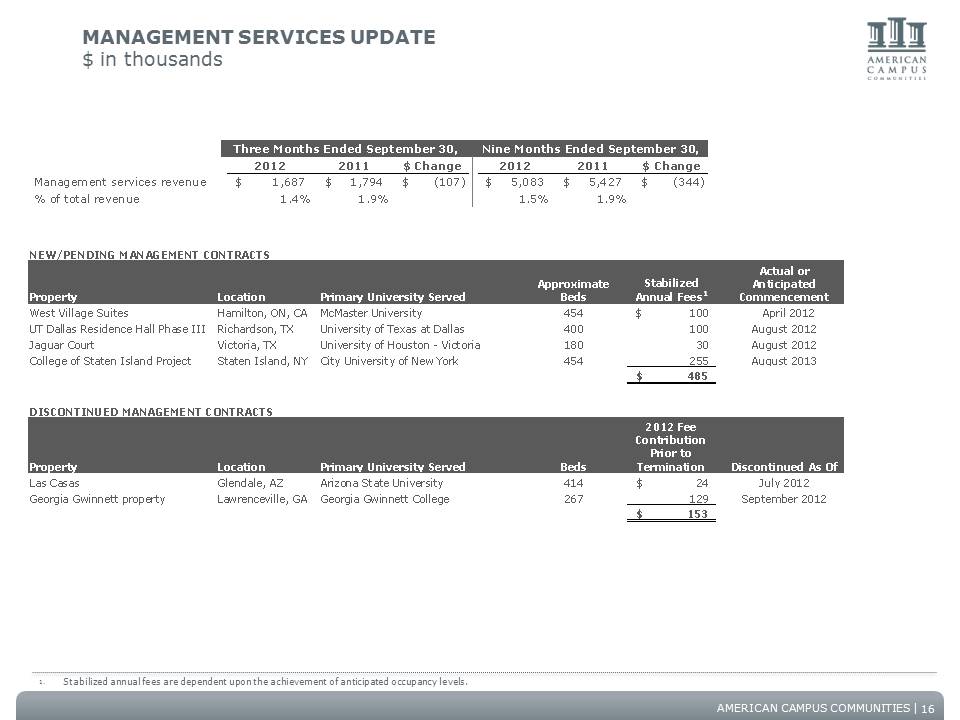

Slide: 17 Title: Management services update $ in thousands 16 Stabilized annual fees are dependent upon the achievement of anticipated occupancy levels.

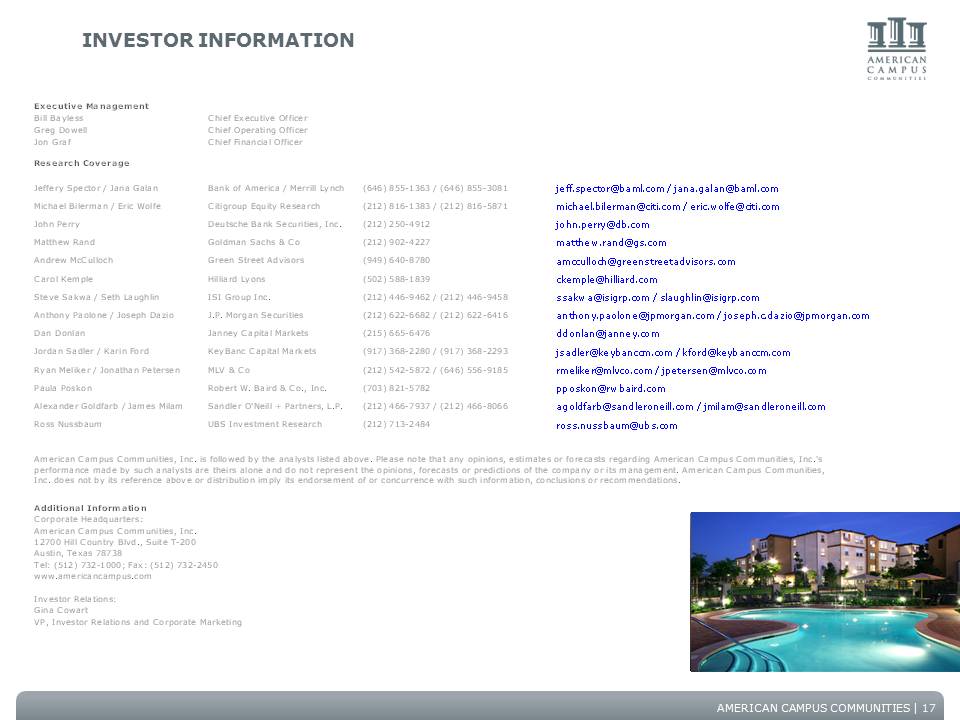

Slide: 18 Title: Investor information 17 Slide: 19 Title: Forward-looking statement Body: In addition to historical information, this supplemental package contains forward-looking statements under the federal securities law. These statements are based on current expectations, estimates and projections about the industry and markets in which American Campus operates, management's beliefs, and assumptions made by management. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict.