UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): October 19, 2012 (October 16, 2012)

SCI Engineered Materials, Inc.

(Exact Name of Registrant as specified in its charter)

| Ohio | 0-31641 | 31-1210318 | ||

| (State or other | (Commission File No.) | (IRS Employer | ||

| jurisdiction of | Identification | |||

| incorporation or | Number) | |||

| organization) |

2839 Charter Street

Columbus, Ohio 43228

(614) 486-0261

(Address, including zip code, and telephone number

including area code of Registrant's

principal executive offices)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01. Entry into a Material Definitive Agreement.

The disclosure contained in "Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant" of this Current Report on Form 8-K is incorporated in this Item 1.01 by reference.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

On October 16, 2012, SCI Engineered Materials, Inc. (the “Company”) received a signed resolution (“Resolution 12A18”) to the Ohio Air Quality Development Authority (“OAQDA”) 166 Direct Loan (“Loan”). On September 11, 2012 the OAQDA adopted Resolution 12A18 authorizing the Interim Executive Director pursuant to the request of SCI Engineered Materials, Inc. to: 1) accept the return of $998,159.50 from Huntington Bank as Escrow Agent under the SCI Engineered Materials, Inc. Escrow Agreement; 2) amend Section 4.3(g) of the Loan Agreement to provide for the disposal of non-project equipment in the ordinary course of business; 3) amend the debt service coverage ratio to .01 and include non-cash compensation expense in the debt service coverage formula.

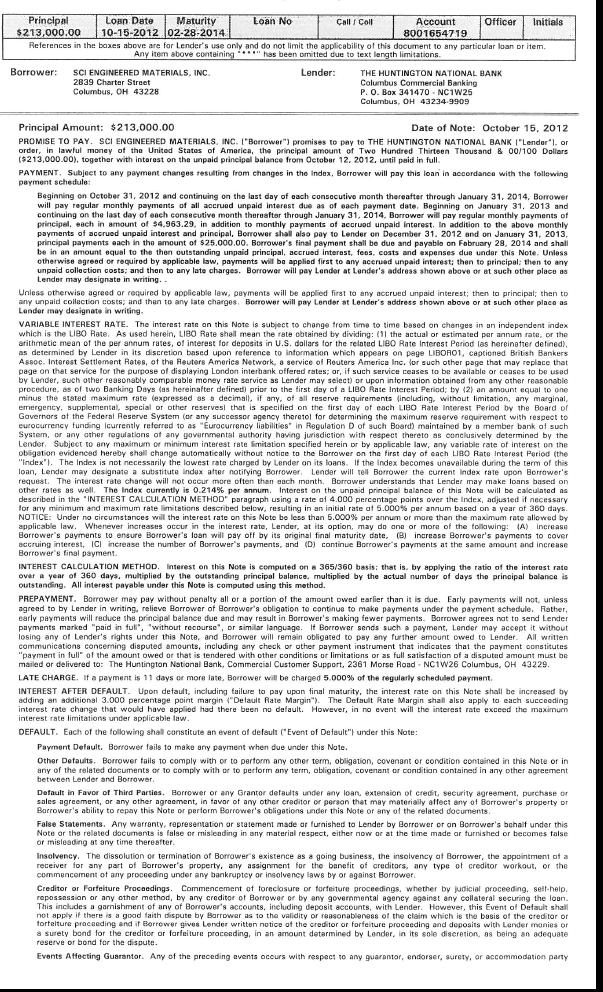

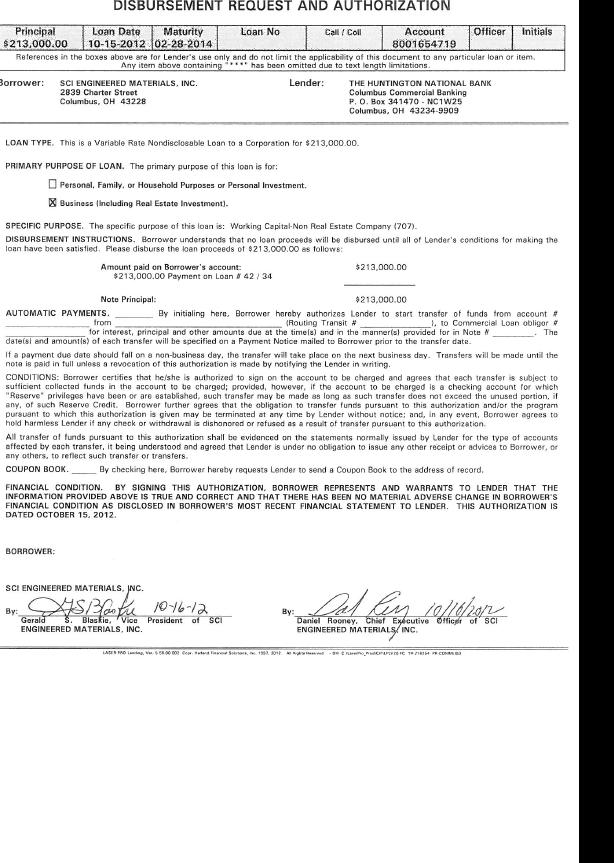

Also, on October 16, 2012, the Company issued a new Promissory Note (the “Note”) in the amount of $213,000 to The Huntington National Bank, as Lender, with a maturity date of February 28, 2014. This Note replaced an existing promissory note to the Huntington National Bank which had a balance of $213,000 at September 30, 2012 and an original maturity date of December 31, 2012. Among other items, the Note provides for interest only payments through December 31, 2012, with a $25,000 principal payment due December 31, 2012 and $25,000 due January 31, 2013. Beginning in January 2013, monthly payments of approximately $5,000, including interest, are due, with remaining principal due at maturity in February 2014.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| SCI ENGINEERED MATERIALS, INC | ||

| Date: October 19, 2012 | By: | /s/Daniel Rooney |

| Chairman of the Board, President

and Chief Executive Officer | ||

| 2 |

RESOLUTION 12A18

A Resolution authorizing the Interim Executive Director pursuant to the request of SCI Engineered Materials, Inc. to: 1) accept the return of $998,159.50 from Huntington Bank as Escrow Agent under the SCI Engineered Materials, Inc. Escrow Agreement; 2) amend Section 4.3(g) of the Loan Agreement to provide for the disposal of non-project equipment in the ordinary course of business; 3) amend the debt service coverage ratios to .01 and include non-cash compensation expense in the debt service coverage formula.

By:/s/ Gayle Channing Tannenbaum

CHAIR

Adopted: September 11, 2012

By:/s/ Jeff Jacobson

SECRETARY-TREASURER

| 3 |

|

| 4 |

|

| 5 |

|

| 6 |

|

| 7 |

|

| 8 |